North America Tissue Paper Market

Размер рынка в млрд долларов США

CAGR :

%

USD

14.31 Billion

USD

20.51 Billion

2025

2033

USD

14.31 Billion

USD

20.51 Billion

2025

2033

| 2026 –2033 | |

| USD 14.31 Billion | |

| USD 20.51 Billion | |

|

|

|

|

North America Tissue Paper Market, By Product Type (Toilet Paper, Tissue Towel, Paper Napkin, Facial Tissue, Wipes, And Others) Distribution Channel (Retail Stores, E-Commerce, Direct Sales, And Others) End Use (Home Care, Commercial, Personal Care, Healthcare, Hospitality, And Others) By Country (U.S., Canada, Mexico) Industry Trends and Forecast to 2028.

Market Analysis and Insights: North America Tissue Paper Market

Market Analysis and Insights: North America Tissue Paper Market

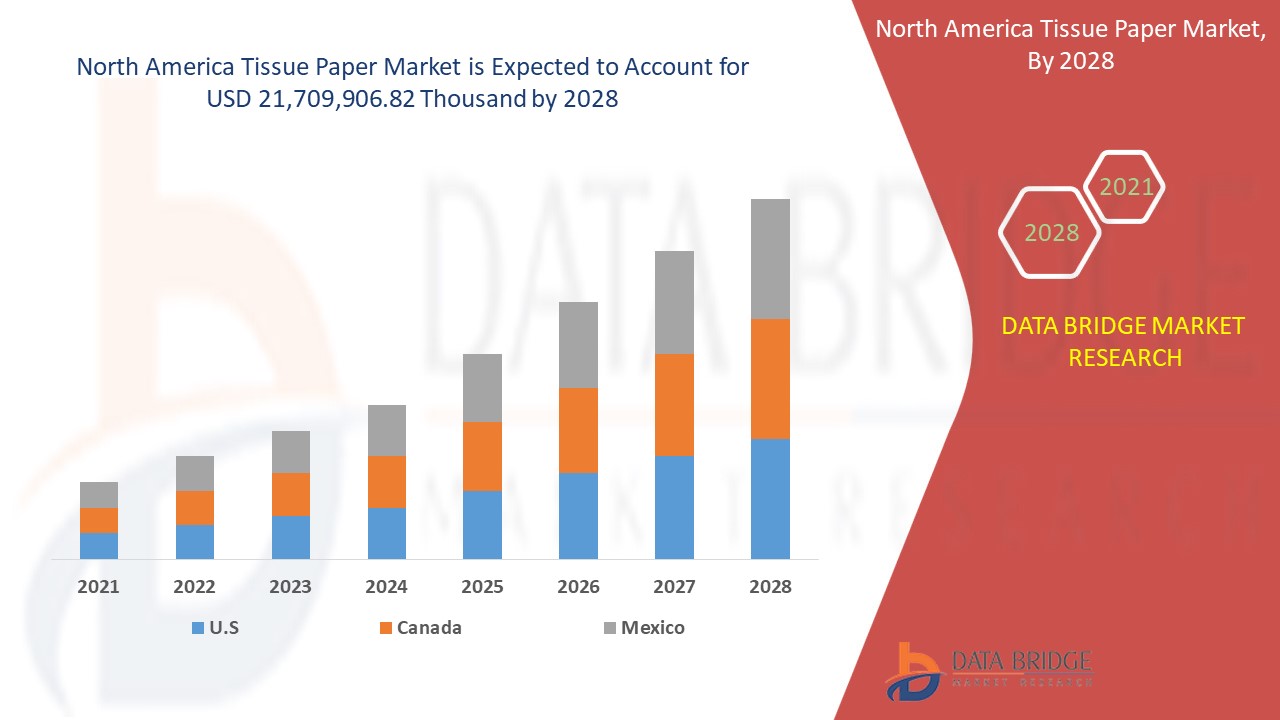

North America tissue paper market is expected to reach USD 21,709,906.82 thousand by 2028 from USD 16,387,472.49 thousand in 2020, growing at a steady CAGR of 3.4% in the forecast period of 2021 to 2028.

Tissue is a broad term that refers to a type of paper with a gauzy texture, can be glazed, unglazed, or creped and serve several functions. It can be made by turning trees into wood chips and then cooking them to separate the fiber (cellulose) from the glue that holds the tree together. This fiber is subsequently fashioned into a sheet and, eventually, tissue. Tissue goods are diverse and ubiquitous, and they assist in improving the quality of life worldwide on a daily basis.

Tissue paper is a lightweight paper with various properties such as absorbency, basic weight, thickness, bulk, brightness stretch, appearance, and comfort. It can be used for various purposes, majorly for maintaining hygiene. The factors expected to drive the market's growth are changes in priorities from hand dryers to hand towels due to COVID-19, an increase in health and hygiene awareness, and a rise in demand for facial tissue. The factors expected to restrain the market’s growth are the fluctuating raw materials prices and strengthened regulations towards deforestation.

This tissue paper market report provides details of market share, new developments, and product pipeline analysis, impact of domestic and localised market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, product approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario contact us for an Analyst Brief, our team will help you create a revenue impact solution to achieve your desired goal.

North America Tissue Paper Market Scope and Market Size

North America Tissue Paper Market Scope and Market Size

North America tissue paper market is segmented into three notable segments based on product type, distribution channel, and end-use.

- Based on product type, the North America tissue paper market is segmented into toilet paper, tissue towel, paper napkin, facial tissue, wipes, and others. In 2021, the toilet paper segment is expected to dominate the market due to the easy disposing property of toilet paper.

- On the basis of distribution channel, the North America tissue paper market is segmented into retail stores, e-commerce, direct sales, and others. In 2021, the retail stores segment is expected to dominate the market due to the high sales potential and benefit of service offered to customers.

- On the basis of end-use, the North America tissue paper market is segmented into home care, commercial, personal care, healthcare, hospitality, and others. In 2021, the home care segment is expected to dominate the market due to increasing awareness regarding home hygiene and the availability of increased varieties of tissue paper.

North America Tissue Paper Market Country Level Analysis

North America Tissue Paper Market Country Level Analysis

North America tissue paper market is segmented into three notable segments based on product type, distribution channel, and end-use.

The countries covered in the North America tissue paper market report are U.S., Canada and Mexico.

The U.S. is expected to dominate the market due to rise in demand for facial tissue in the country. Canada is expected to dominate the market due to the increasing awareness about personal hygiene due to COVID 19. Mexico is expected to dominate the market due to rise in need for personal care and sanitary items

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, presence and availability of Europe brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of sales channels are considered while providing forecast analysis of the country data.

Rising Demand of Tissue Papers

North America tissue paper market also provides you with detailed market analysis for every country growth in industry with sales, components sales, impact of technological development in Tissue paper, and changes in regulatory scenarios with their support for the North America Tissue Paper Market. The data is available for historic period 2010 to 2019.

Competitive Landscape and North America Tissue Paper Market Share Analysis

North America tissue paper market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the companies’ focus related to the North America tissue paper market.

Some of the major players operating in the tissue paper market are Procter & Gamble, KCWW, KP Tissue Inc., Cascades Inc., Irving Consumer Products Limited., Asaleo Care Limited, Lucart S.p.A., Georgia-Pacific, METSÄ TISSUE, SOFIDEL, von Drehle Corporation., First Quality Enterprises, Inc., Clearwater Paper Corporation, Gorham Paper & Tissue., Nova Tissue Company Ltd, Flower City Tissue Mills Co., Paloma, Global Tissue Group, Inc., Essity Aktiebolag (publ)., WEPA Hygieneprodukte GmbH among others.

North America tissue paper market is fragmented, and the major players have used various strategies such as collaboration, recognition, agreements, product launch and others to increase their footprints in the tissue paper market.

For instance,

- In July 2021, KCWW completed the acquisition of S-K Corporation of Taiwan. S-K corporation holds the trademark and distribution rights in Taiwan for KCWW global brands such as Kleenex. This acquisition helped acquire the distribution rights increasing their market share.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.