North America Third Party Risk Management Market, By Component (Solutions and Services), Deployment Model (On-Premise and Cloud), Organization Size (Small and Medium-Sized Enterprise and Large Enterprise), End User (Banking, Financial Services and Insurance, IT and Telecom, Healthcare and Life Sciences, Government, Aerospace and Defence, Retail and Consumer Goods, Manufacturing, Energy and Utilities and Others), Country (U.S., Canada, Mexico) Industry Trends and Forecast to 2028.

Market Analysis and Insights:

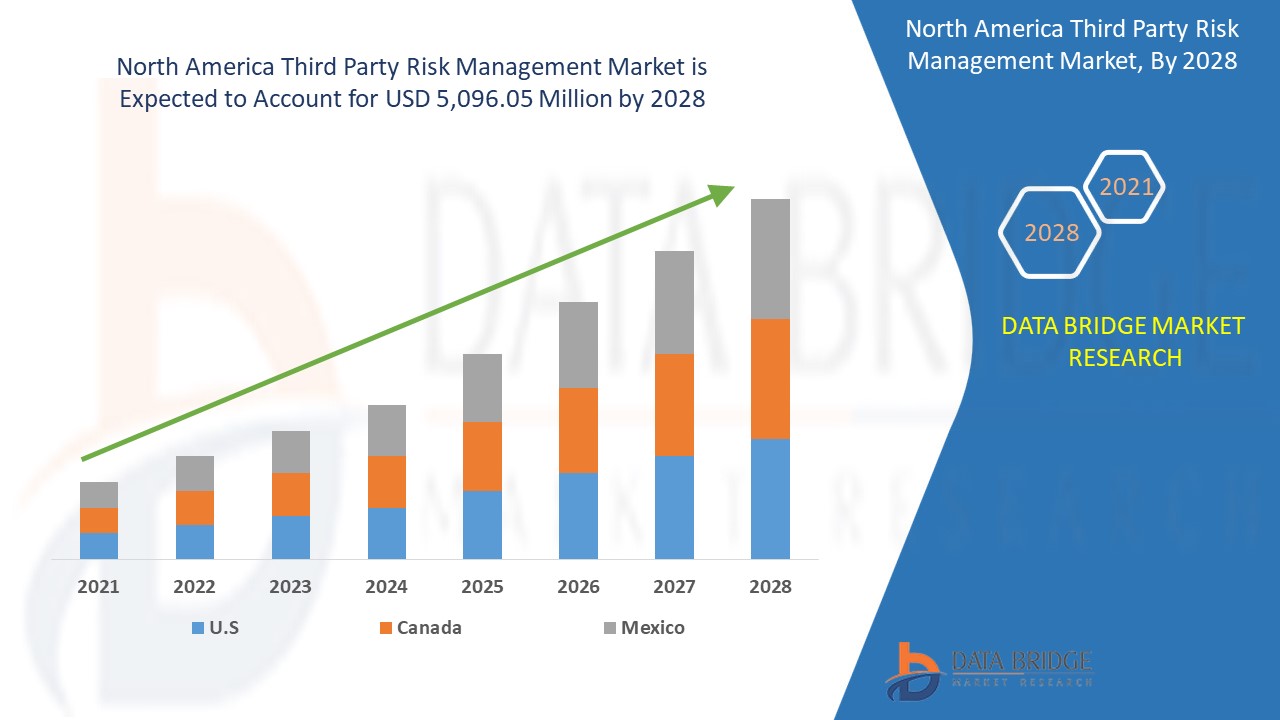

North America third party risk management market is expected to gain market growth in the forecast period of 2021 to 2028. Data Bridge Market Research analyses that the market is growing with a CAGR of 18.1% in the forecast period of 2021 to 2028 and is expected to reach USD 5,096.05 million by 2028. A surge in cyberattacks and ransomware is acting as major factors for the growth of the North America third party risk management market.

Third party risk management refers to risk management concerned with identifying and reducing risks relating to the use of third parties. The discipline is designed to give organizations an understanding of the third parties they use, how they use them, and what safeguards their third parties have in place. Organizations are increasing their dependence on third parties for improved profitability, faster time to market, competitive advantage, and decreased costs. However, third-party relationships come with multiple risks that include strategic risks, operational risks, reputational risks, financial risks, transaction risks, compliance risks, and information security risks, among others. TPRM is the process of identifying, assessing, and controlling these and other risks presented throughout the lifecycle of your relationships with third parties. The third party risk management lifecycle refers to a series of steps that outlines a typical relationship with a third party, such as vendor identification, evaluation and selection, risk assessment, risk mitigation, and monitoring.

The increasing dependence of various organizations on third party vendors acts as a major factor for the North America third party risk management market growth. Increasing emphasis on data governance and privacy by regulatory bodies has boosted the growth of the market. However, lack of awareness and dependence on conventional and manual risk management processes can act as a major restraint for the market's growth. The North American region has witnessed the increasing application of AI and ML technologies for third party due diligence, which opens up opportunities in the market. High initial investment costs can act as a major challenge for the growth of the market.

This North America third party risk management market report provides details of market share, new developments, and product pipeline analysis, the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, product approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario, contact us for an Analyst Brief; our team will help you create a revenue impact solution to achieve your desired goal.

North America Third Party Risk Management Market Scope and Market Size

North America Third Party Risk Management Market Scope and Market Size

North America third party risk management market is segmented based on component, deployment model, organization size, and end user. The growth among segments helps you analyse niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

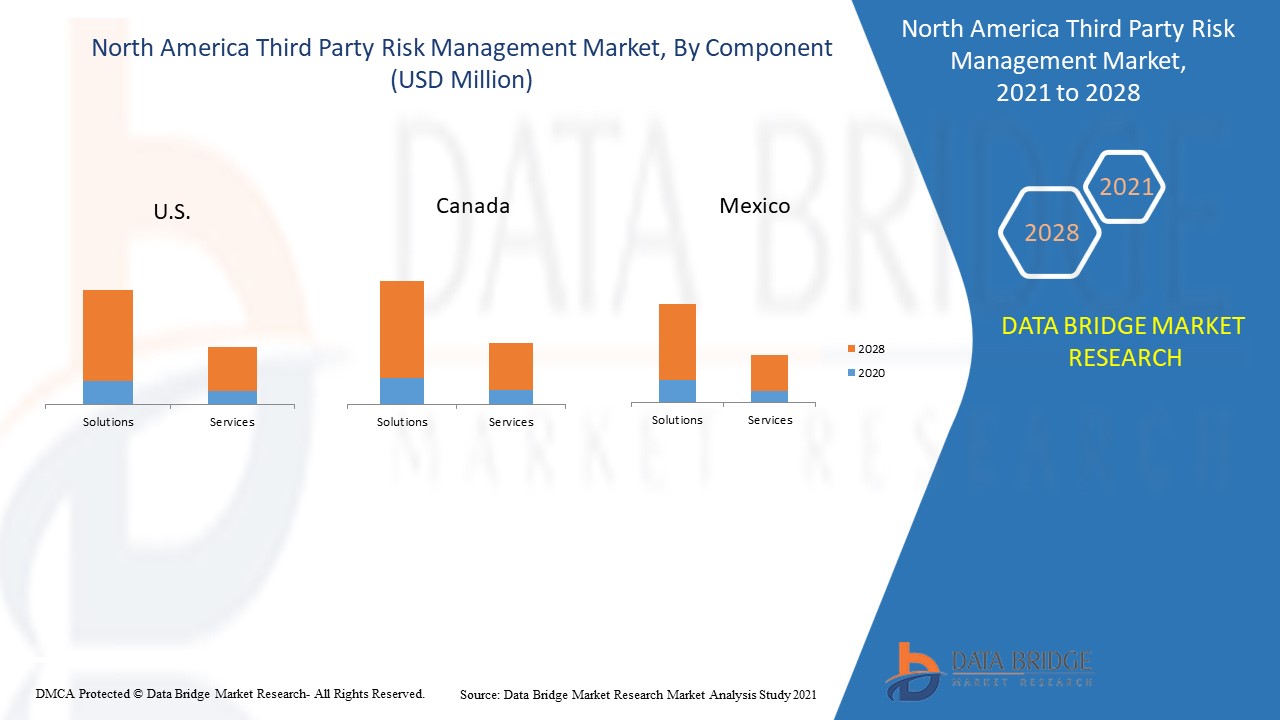

- On the basis of component, North America third party risk management market is segmented into solutions and services. In 2021, solutions segment is expected to dominate the market, as third party risk management solutions helps to reduce the risk of data breaches and increase the efficiency of cybersecurity scaling initiatives, in the countries such as U.S. and Canada.

- On the basis of deployment model, North America third party risk management market is segmented into computer on premise and cloud. In 2021, on premises segment is expected to dominate the market, due to the increased presence of on premises third party management solutions in the regions.

- On the basis of organization size, North America third party risk management market is segmented into small and medium-sized enterprises and large enterprises. In 2021, large enterprise segment is expected to dominate the market owing to factors, large enterprises in the North America region majorly relies on third parties and has huge adoption amongst the large enterprises.

- On the basis of end user, North America third party risk management market is segmented into banking, financial services and insurance, IT and telecom, healthcare and life sciences, government aerospace and defense, retail and consumer goods, manufacturing, energy and utilities and others. In 2021, government, aerospace, and defense is expected to dominate the market as effective risk management is essential for North America government, aerospace, and defense agencies and has crucial important data.

North America Third Party Risk Management Market Country Level Analysis

North America Third Party Risk Management Market Country Level Analysis

North America third party risk management market is analysed, and market size information is provided by the country, component, deployment model, organization size, and end user.

The countries covered in the North America third party risk management market report are the U.S., Canada and Mexico.

The U.S. accounted for maximum share in the third party risk management market due to presence of large number of dominating and local players in the country and growing adoption of technological innovations regarding third-party risk management solutions.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, the presence and availability of North American brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of sales channels are considered while providing forecast analysis of the country data.

Rising Demand of Third Party Risk Management

The North America third party risk management market also provides you with detailed market analysis for every country's growth in the industry with sales, components sales, the impact of technological development in third party risk management, and changes in regulatory scenarios with their support for the North America third party risk management market. The data is available for the historical period 2011 to 2019.

Competitive Landscape and North America Third Party Risk Management Market Share Analysis

The North America Third party risk management market competitive landscape provides details by the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, North America presence, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points are only related to the companies’ focus on the North America third party risk management market.

The major players covered in the North America third party risk management report are RSA Security LLC, KPMG International, Deloitte Touche Tohmatsu Limited, BitSight Technologies, ProcessUnity, Inc., Genpact, Venminder, Inc., Resolver Inc., NAVEX Global, Inc., SAI Global Compliance, Inc., Rapid Ratings International Inc., Optiv Security Inc., PwC, Aravo Soutions, Inc., OneTrust, LLC, Prevalent, Inc., Alyne GmbH, Ernst & Young Global Limited, IBM Corporation, and others. DBMR analysts understand competitive strengths and provide competitive analysis for each competitor separately.

Many product developments are also initiated by the companies worldwide, which are also accelerating the growth of the North America third party risk management market.

For instances,

- In September 2021, Venminder, Inc. announced the launch of new SIG Lite 2022 and SIG Core 2022 into their third party risk management platform. 2022 SIG was being updated to align with the evolving regulatory and threat environment. This enabled the company to streamline the questionnaire process for both third-party risk professionals and the vendors completing them. This enhanced the company’s offering of standardized assurance to its customers

- In November 2020, Rapid Ratings International Inc. announced the expansion and enhancement of the FHR Network. This innovative and secure membership platform gives private company suppliers the ability to share their financial health ratings. Through the FHR network, the third party suppliers were enabled to communicate and collaborate effectively, consistently, and transparently. The FHR Network gave them expanded capabilities that help suppliers communicate their exposures and opportunities discretely and securely. This enhanced the company’s risk management platform

Partnership, joint ventures, and other strategies enhance the company's market share with increased coverage and presence. It also benefits the organization to improve their offering for third party risk management through an expanded range of sizes.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Содержание

- introduction

- OBJECTIVES OF THE STUDY

- MARKET DEFINITION

- OVERVIEW of North America third party risk management market

- Currency and Pricing

- LIMITATIONS

- MARKETS COVERED

- MARKET SEGMENTATION

- MARKETS COVERED

- geographicAL scope

- years considered for the study

- DBMR TRIPOD DATA VALIDATION MODEL

- primary interviews with key opinion leaders

- DBMR MARKET POSITION GRID

- vendor share analysis

- End user COVERAGE GRID

- Multivariate Modeling

- PRODUCTS timeline curve

- secondary sourcEs

- assumptions

- EXECUTIVE SUMMARY

- premium insights

- market overview

- drivers

- Surge in cyberattacks and ransomware

- Increasing dependence of various organizations on third party vendors

- Increasing emphasis on data governance and privacy by regulatory bodies

- Increasing pace of digitalization in businesses

- Surge in the third party supply chain breaches

- RESTRAINTS

- COnstant Changes in compliance laws and regulations

- Lack of awareness and Dependence on conventional and manual risk management processes

- opportunities

- ESG-related third party risk is an emerging concern for many organizations

- Increasing application of AI and ML technologies for third party due TO diligence

- Third party risk management using blockchain

- Increasing use of cloud environment for business application

- challenges

- High initial investment cost

- Lack of skilled employees to perform and manage risk assessments

- Companies are inconsistent in their approach to TPRM

- COVID-19 IMPACT ON NORTH AMERICA THIRD PARTY RISK MANAGEMENT MARKET

- ANALYSIS ON IMPACT OF COVID-19 ON THE MARKET

- AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOSt THE MARKET

- STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

- IMPACT ON DEMAND

- IMPACT ON SUPPLY CHAIN

- PRICE IMPACT

- CONCLUSION

- NORTH AMERICA THIRD PARTY RISK MANAGEMENT MARKET, BY component

- overview

- solutions

- compliance management

- financial control management

- operation risk management

- contract management

- audit management

- others

- services

- professional services

- CONSULTING

- INTEGRATION AND DESIGN

- SUPPORT AND MAINTENANCE

- managed services

- North America THIRD PARTY RISK MANAGEMENT MARKET, BY deployment model

- overview

- on-premise

- cloud

- North America THIRD PARTY RISK MANAGEMENT MARKET, BY ORGANIZATION SIZE

- overview

- large enterprises

- small and medium-sized enterprises

- North America THIRD PARTY RISK MANAGEMENT MARKET, BY end user

- overview

- GOVERNMENT, AEROSPACE, AND DEFENSE

- large enterprises

- small and medium-sized enterprises

- banking, financial services and insurance

- large enterprises

- small and medium-sized enterprises

- IT AND TELECOM

- large enterprises

- small and medium-sized enterprises

- HEALTHCARE AND LIFE SCIENCES

- large enterprises

- small and medium-sized enterprises

- RETAIL AND CONSUMER GOODS

- large enterprises

- small and medium-sized enterprises

- MANUFACTURING

- large enterprises

- small and medium-sized enterprises

- ENERGY AND UTILITIES

- large enterprises

- small and medium-sized enterprises

- others

- large enterprises

- small and medium-sized enterprises

- North America third party risk management market, by region

- overview

- North America

- u.s.

- canada

- mexico

- NORTH AMERICA Third party risk management market: COMPANY landscape

- company share analysis: NORTH AMERICA

- Swot analysis

- COMPANY PROFILE

- ERNST & YOUNG GLOBAL LIMITED

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- ONETRUST, LLC

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- DELOITTE TOUCHE TOHMATSU LIMITED

- COMPANY SNAPSHOT

- . PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- KPMG INTERNATIONAL

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- GENPACT

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- ALYNE GMBH

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- ARAVO SOLUTIONS, INC.

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- BITSIGHT TECHNOLOGIES

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- IBM CORPORATION

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- METRICSTREAM

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- . RECENT DEVELOPMENTS

- NAVEX NORTH AMERICA, INC.

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- . RECENT DEVELOPMENTS

- OPTIV SECURITY INC.

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- PREVALENT, INC.

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- PROCESSUNITY, INC.

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- PWC

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- RAPID RATINGS INTERNATIONAL INC.

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- RESOLVER INC.

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- RSA SECURITY LLC

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- SAI GLOBAL COMPLIANCE, INC.

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- VENMINDER, INC.

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- questionnaire

- related reports

Список таблиц

TABLE 1 North America THIRD PARTY RISK MANAGEMENT Market, By Component, 2019-2028 (USD Million)

TABLE 2 North America solutions in THIRD PARTY RISK MANAGEMENT MARKET, By type, 2019-2028 (USD MILLION)

TABLE 3 North America Services in THIRD PARTY RISK MANAGEMENT Market, By type, 2019-2028 (USD MILLION)

TABLE 4 North America Professional services in THIRD PARTY RISK MANAGEMENT Market, By type, 2019-2028 (USD MILLION)

TABLE 5 North America THIRD PARTY RISK MANAGEMENT Market, By deployment model, 2019-2028 (USD Million)

TABLE 6 North America on-premise in THIRD PARTY RISK MANAGEMENT Market, By Region ,2019-2028 (USD Million)

TABLE 7 North America THIRD PARTY RISK MANAGEMENT Market, By organization size, 2019-2028 (USD Million)

TABLE 8 North America THIRD PARTY RISK MANAGEMENT Market, By end user, 2019-2028 (USD Million)

TABLE 9 North America Government, aerospace, and defense in THIRD PARTY RISK MANAGEMENT Market, By Organization Size, 2019-2028 (USD MILLION)

TABLE 10 North America Banking, financial services and insurance in THIRD PARTY RISK MANAGEMENT Market, By Organization Size, 2019-2028 (USD MILLION)

TABLE 11 North America IT and telecom in THIRD PARTY RISK MANAGEMENT MARKET, By Organization Size, 2019-2028 (USD MILLION)

TABLE 12 North America Healthcare and life sciences in THIRD PARTY RISK MANAGEMENT Market, By Organization Size, 2019-2028 (USD MILLION)

TABLE 13 North America Retail and consumer goods in THIRD PARTY RISK MANAGEMENT Market, By Organization Size, 2019-2028 (USD MILLION)

TABLE 14 North America Manufacturing in THIRD PARTY RISK MANAGEMENT Market, By Organization Size, 2019-2028 (USD MILLION)

TABLE 15 North America Energy and utilities in THIRD PARTY RISK MANAGEMENT Market, By Organization Size, 2019-2028 (USD MILLION)

TABLE 16 North America Others in THIRD PARTY RISK MANAGEMENT Market, By Organization Size, 2019-2028 (USD MILLION)

TABLE 17 NORTH AMERICA THIRD PARTY RISK MANAGEMENT MARKET, By Country, 2019-2028 (USD Million)

TABLE 18 U.S. Third party risk management market, By Component, 2019-2028 (USD Million)

TABLE 19 U.S. solutions in Third party risk management market, By Type, 2019-2028 (USD Million)

TABLE 20 U.S. services in Third party risk management market, By Type, 2019-2028 (USD Million)

TABLE 21 U.S. Professional Services in Third party risk management market, By Type, 2019-2028 (USD Million)

TABLE 22 U.S. Third party risk management market, By deployment model, 2019-2028 (USD Million)

TABLE 23 U.S. Third party risk management market, By organization size, 2019-2028 (USD Million)

TABLE 24 U.S. Third party risk management market, By end user, 2019-2028 (USD Million)

TABLE 25 U.S. government, Aerospace, and Defense in Third party risk management market, By organization size, 2019-2028 (USD Million)

TABLE 26 U.S. Banking, Financial Services, and Insurance in Third party risk management market, By organization size, 2019-2028 (USD Million)

TABLE 27 U.S. Healthcare and Life Sciences in Third party risk management market, By organization size, 2019-2028 (USD Million)

TABLE 28 U.S. IT and Telecom in Third party risk management market, By organization size, 2019-2028 (USD Million)

TABLE 29 U.S. Manufacturing in Third party risk management market, By organization size, 2019-2028 (USD Million)

TABLE 30 U.S. Energy and Utilities in Third party risk management market, By organization size, 2019-2028 (USD Million)

TABLE 31 U.S. Retail and Consumer Goods in Third party risk management market, By organization size, 2019-2028 (USD Million)

TABLE 32 U.S. Others in Third party risk management market, By organization size, 2019-2028 (USD Million)

TABLE 33 CANADA Third party risk management market, By Component, 2019-2028 (USD Million)

TABLE 34 CANADA solutions in Third party risk management market, By Type, 2019-2028 (USD Million)

TABLE 35 CANADA services in Third party risk management market, By Type, 2019-2028 (USD Million)

TABLE 36 CANADA Professional Services in Third party risk management market, By Type, 2019-2028 (USD Million)

TABLE 37 CANADA Third party risk management market, By deployment model, 2019-2028 (USD Million)

TABLE 38 CANADA Third party risk management market, By organization size, 2019-2028 (USD Million)

TABLE 39 CANADA Third party risk management market, By end user, 2019-2028 (USD Million)

TABLE 40 CANADA government, Aerospace, and Defense in Third party risk management market, By organization size, 2019-2028 (USD Million)

TABLE 41 CANADA Banking, Financial Services, and Insurance in Third party risk management market, By organization size, 2019-2028 (USD Million)

TABLE 42 CANADA Healthcare and Life Sciences in Third party risk management market, By organization size, 2019-2028 (USD Million)

TABLE 43 CANADA IT and Telecom in Third party risk management market, By organization size, 2019-2028 (USD Million)

TABLE 44 CANADA Manufacturing in Third party risk management market, By organization size, 2019-2028 (USD Million)

TABLE 45 CANADA Energy and Utilities in Third party risk management market, By organization size, 2019-2028 (USD Million)

TABLE 46 CANADA Retail and Consumer Goods in Third party risk management market, By organization size, 2019-2028 (USD Million)

TABLE 47 CANADA Others in Third party risk management market, By organization size, 2019-2028 (USD Million)

TABLE 48 MEXICO Third party risk management market, By Component, 2019-2028 (USD Million)

TABLE 49 MEXICO solutions in Third party risk management market, By Type, 2019-2028 (USD Million)

TABLE 50 MEXICO services in Third party risk management market, By Type, 2019-2028 (USD Million)

TABLE 51 MEXICO Professional Services in Third party risk management market, By Type, 2019-2028 (USD Million)

TABLE 52 MEXICO Third party risk management market, By deployment model, 2019-2028 (USD Million)

TABLE 53 MEXICO Third party risk management market, By organization size, 2019-2028 (USD Million)

TABLE 54 MEXICO Third party risk management market, By end user, 2019-2028 (USD Million)

TABLE 55 MEXICO government, Aerospace, and Defense in Third party risk management market, By organization size, 2019-2028 (USD Million)

TABLE 56 MEXICO Banking, Financial Services, and Insurance in Third party risk management market, By organization size, 2019-2028 (USD Million)

TABLE 57 MEXICO Healthcare and Life Sciences in Third party risk management market, By organization size, 2019-2028 (USD Million)

TABLE 58 MEXICO IT and Telecom in Third party risk management market, By organization size, 2019-2028 (USD Million)

TABLE 59 MEXICO Manufacturing in Third party risk management market, By organization size, 2019-2028 (USD Million)

TABLE 60 MEXICO Energy and Utilities in Third party risk management market, By organization size, 2019-2028 (USD Million)

TABLE 61 MEXICO Retail and Consumer Goods in Third party risk management market, By organization size, 2019-2028 (USD Million)

TABLE 62 MEXICO Others in Third party risk management market, By organization size, 2019-2028 (USD Million)

Список рисунков

FIGURE 1 North America third party risk MANAGEMENT MARKET: segmentation

FIGURE 2 North America third party risk management market: data triangulation

FIGURE 3 North America third party risk management market: DROC ANALYSIS

FIGURE 4 North America third party risk MANAGEMENT MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 North America third party risk MANAGEMENT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 North America third party risk MANAGEMENT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 North America third party risk management market: DBMR MARKET POSITION GRID

FIGURE 8 North America third party risk MANAGEMENT MARKET: vendor share analysis

FIGURE 9 NORTH AMERICA third party risk management market: APPLICATION COVERAGE GRID

FIGURE 10 North America third party risk management market: SEGMENTATION

FIGURE 11 Increasing dependence of various organizations on third party vendors is EXPECTED TO DRIVE THE North America third party risk management market IN THE FORECAST PERIOD OF 2021 to 2028

FIGURE 12 solutions segment is expected to account for the largest share of THE North America third party risk management market in 2021 & 2028

FIGURE 13 DRIVERS, RESTRaINT, OPPORTUNITIES, AND CHALLENGEs OF NORTH AMERICA THIRD PARTY RISK MANAGEMENT MARKET

FIGURE 14 North America THIRD PARTY RISK MANAGEMENT MARKET, BY component, 2020

FIGURE 15 North America THIRD PARTY RISK MANAGEMENT MARKET, BY deployment model, 2020

FIGURE 16 North America THIRD PARTY RISK MANAGEMENT MARKET, BY organization size, 2020

FIGURE 17 North America THIRD PARTY RISK MANAGEMENT MARKET, BY end user, 2020

FIGURE 18 NORTH AMERICA THIRD PARTY RISK MANAGEMENT MARKET: SNAPSHOT (2020)

FIGURE 19 NORTH AMERICA THIRD PARTY RISK MANAGEMENT MARKET: by Country (2020)

FIGURE 20 NORTH AMERICA THIRD PARTY RISK MANAGEMENT MARKET: by Country (2021 & 2028)

FIGURE 21 NORTH AMERICA THIRD PARTY RISK MANAGEMENT MARKET: by Country (2020 & 2028)

FIGURE 22 NORTH AMERICA THIRD PARTY RISK MANAGEMENT MARKET: by Component (2021-2028)

FIGURE 23 NORTH AMERICA Third party risk management Market: company share 2020 (%)

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.