Рынок управления расходами на телекоммуникации в Северной Америке, по предложению (решение, услуга), способу предоставления услуг (лицензионное программное обеспечение, управляемые услуги и полный аутсорсинг, хостинг), размеру предприятия (крупные предприятия, малые и средние предприятия), конечному использованию (ИТ и телекоммуникации, BFSI, производство, здравоохранение, транспорт и логистика, потребительские товары и розничная торговля, энергетика и электроэнергия, медиа и развлечения, другие) и стране (США, Канада и Мексика) Тенденции отрасли и прогноз до 2028 г.

Анализ рынка и аналитика: рынок управления расходами на телекоммуникации в Северной Америке

Анализ рынка и аналитика: рынок управления расходами на телекоммуникации в Северной Америке

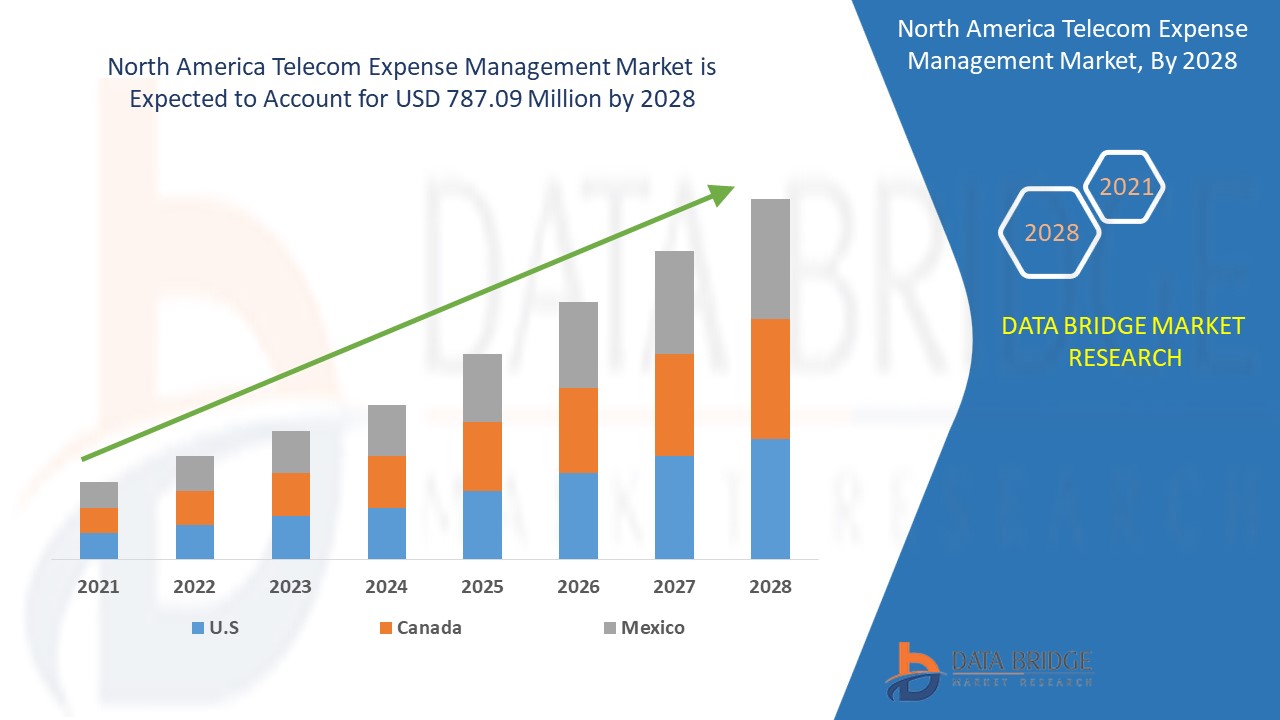

Ожидается, что рынок управления расходами на телекоммуникации в Северной Америке будет расти в прогнозируемый период с 2021 по 2028 год. По данным Data Bridge Market Research, среднегодовой темп роста рынка составит 5,1% в прогнозируемый период с 2021 по 2028 год, и ожидается, что к 2028 году он достигнет 787,09 млн долларов США. Рост спроса на TEM из-за Интернета вещей и облачных приложений стимулирует рынок.

Telecom Expense Management (TEM) — это подход к управлению всеми расходами на телекоммуникационные услуги, такими как голосовая связь, данные и беспроводная связь, с помощью комбинации программных инструментов и ручного аудита. При управлении всеми этими услугами и связанными с ними процессами его главная цель — минимизировать затраты и максимизировать эффективность процесса. Для небольшой компании это может быть просто ежемесячная проверка вашего телефонного счета, чтобы убедиться, что вам не выставляют счет за услуги, которые вам не нужны. Для более крупных компаний это более формальная программа по оптимизации расходов на телекоммуникационные услуги. Большая часть внимания уделяется аудиту счетов и получению возмещений за ошибки в счетах, но эффективная программа TEM может сделать больше.

Рост спроса на управление расходами на телекоммуникации из-за IoT и облачных приложений является основным движущим фактором на рынке. Прогнозирование будущих расходов может оказаться сложной задачей, однако низкая стоимость развертывания и растущий спрос на экономически эффективные решения TEM оказываются возможностью. Ограничения, связанные с отсутствием взаимодействия между решениями и различными поставщиками, являются сдерживающими факторами.

Отчет о рынке управления расходами на телекоммуникации содержит подробную информацию о доле рынка, новых разработках и анализе продуктового портфеля, влиянии внутренних и локализованных игроков рынка, анализирует возможности с точки зрения новых источников дохода, изменений в рыночных правилах, одобрений продуктов, стратегических решений, запусков продуктов, географических расширений и технологических инноваций на рынке. Чтобы понять анализ и сценарий рынка управления расходами на телекоммуникации, свяжитесь с Data Bridge Market Research для получения аналитического обзора, наша команда поможет вам создать решение по влиянию на доход для достижения желаемой цели.

Масштаб и размер рынка управления расходами на телекоммуникации в Северной Америке

Масштаб и размер рынка управления расходами на телекоммуникации в Северной Америке

Рынок управления расходами на телекоммуникации в Северной Америке сегментирован на основе предложения, способа предоставления услуг, размера предприятия и конечного использования. Рост среди сегментов помогает вам анализировать нишевые карманы роста и стратегии для подхода к рынку и определять ваши основные области применения и разницу в ваших целевых рынках.

- На основе предложения глобальный рынок управления расходами на телекоммуникации сегментируется на решения и услуги . Ожидается, что в 2021 году сегмент решений будет доминировать на мировом рынке управления расходами на телекоммуникации, поскольку он помогает сократить ненужные затраты и оптимизировать расходы на телекоммуникации.

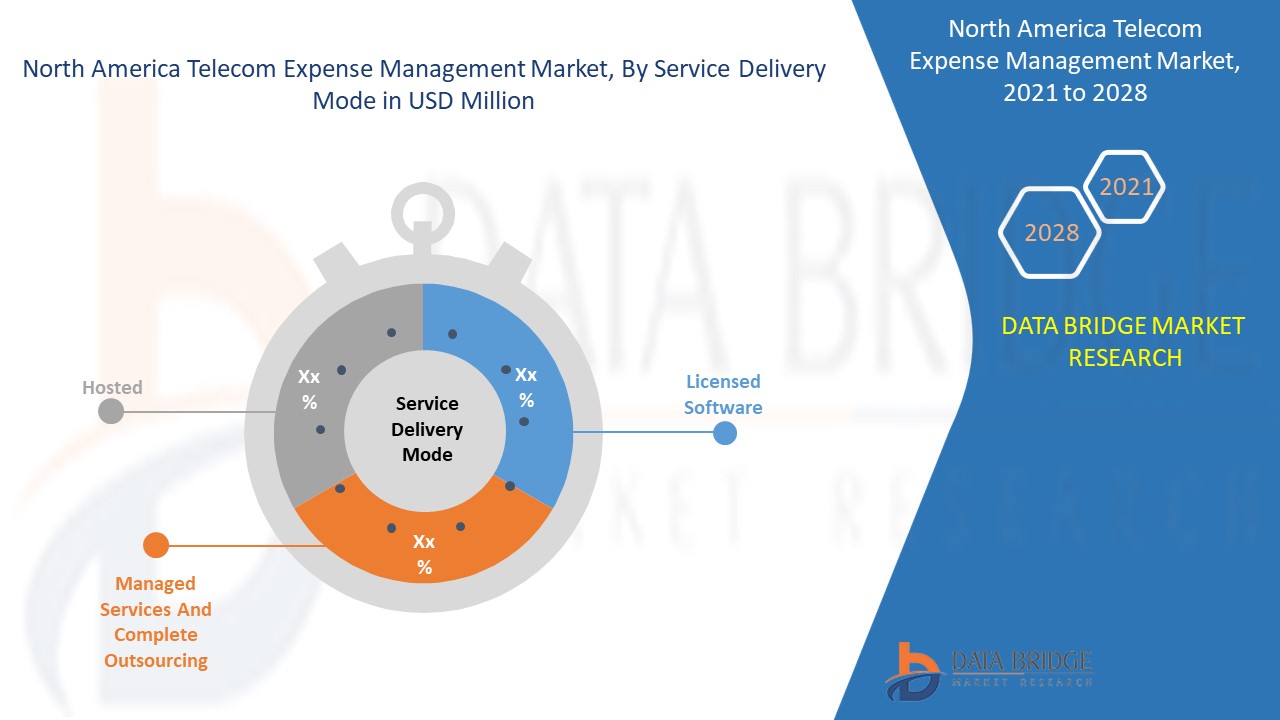

- На основе режима предоставления услуг глобальный рынок управления расходами в сфере телекоммуникаций был сегментирован на лицензионное программное обеспечение, управляемые услуги и полный аутсорсинг и хостинг. Ожидается, что в 2021 году сегмент лицензионного программного обеспечения будет доминировать на мировом рынке управления расходами в сфере телекоммуникаций, поскольку все операции выполняются самим клиентом, что обеспечивает прозрачность всех осуществляемых расходов.

- На основе размера предприятия глобальный рынок управления расходами на телекоммуникации был сегментирован на крупные предприятия и малые и средние предприятия. Ожидается, что в 2021 году сегмент крупных предприятий будет доминировать на мировом рынке управления расходами на телекоммуникации, поскольку большая часть работы многих крупных фирм выполняется через телекоммуникации, что увеличивает спрос на решение TEM для сокращения расходов на телекоммуникации.

- На основе конечного использования глобальный рынок управления расходами на телекоммуникации был сегментирован на ИТ и телекоммуникации, BFSI , производство, здравоохранение, транспорт и логистику, потребительские товары и розничную торговлю, энергетику и электроэнергию, медиа и развлечения и другие. Ожидается, что в 2021 году сегмент ИТ и телекоммуникаций будет доминировать на мировом рынке управления расходами на телекоммуникации, поскольку использование мобильных телефонов для целей связи значительно возросло, а потребность в решении TEM на рынке также растет.

Анализ рынка управления расходами на телекоммуникации в Северной Америке на уровне страны

Рынок управления расходами на телекоммуникации в Северной Америке сегментирован по типу предложения, способу предоставления услуг, размеру предприятия и конечному использованию.

Страны, охваченные отчетом по рынку управления расходами на телекоммуникации, — это США, Канада и Мексика. США доминируют на рынке из-за высокого спроса и крупных игроков, присутствующих на рынке управления расходами на телекоммуникации.

Раздел отчета по странам также содержит отдельные факторы, влияющие на рынок, и изменения в регулировании на внутреннем рынке, которые влияют на текущие и будущие тенденции рынка. Такие данные, как новые продажи, заменяющие продажи, демографические данные страны, нормативные акты и импортно-экспортные тарифы, являются одними из основных указателей, используемых для прогнозирования рыночного сценария для отдельных стран. Кроме того, при предоставлении прогнозного анализа данных по стране учитываются наличие и доступность брендов Северной Америки и их проблемы из-за большой или малой конкуренции со стороны местных и отечественных брендов, влияние каналов продаж.

Растущее использование биометрии в государственных целях безопасности и наблюдения стимулирует рост рынка управления расходами на телекоммуникации в Северной Америке

Рынок управления расходами на телекоммуникации в Северной Америке также предоставляет вам подробный анализ рынка для роста каждой страны на определенном рынке. Кроме того, он предоставляет подробную информацию о стратегии участников рынка и их географическом присутствии. Данные доступны за исторический период с 2010 по 2019 год.

Конкурентная среда и анализ доли рынка управления расходами на телекоммуникации в Северной Америке

Конкурентная среда рынка управления расходами на телекоммуникации содержит сведения по конкурентам. Включены сведения о компании, финансы компании, полученный доход, рыночный потенциал, инвестиции в исследования и разработки, новые рыночные инициативы, производственные площадки и объекты, сильные и слабые стороны компании, запуск продукта, конвейеры испытаний продукта, одобрения продукта, патенты, ширина и широта продукта, доминирование приложений, кривая жизненного цикла технологии. Приведенные выше точки данных связаны только с фокусом компании на рынке управления расходами на телекоммуникации.

Основными компаниями, которые занимаются управлением телекоммуникационными расходами, являются Vodafone Group, CGI Inc., Dimension Data, Accenture, Econocom, Asignet. Technology DNA, AVOTUS, Calero-MDSL, Cass Information Systems, Inc., Network Control, One Source, RadiusPoint, Saaswedo, Sakon, Tangoe, Tellennium, Upland Software, Inc., VALICOM, vMOX, LLC., WidePoint Corporation и другие отечественные игроки. Аналитики DBMR понимают конкурентные преимущества и предоставляют конкурентный анализ для каждого конкурента отдельно.

Многие контракты и соглашения также инициируются компаниями по всему миру, что также ускоряет развитие рынка управления телекоммуникационными расходами.

Например,

- В апреле 2021 года американская компания Calero-MDSL объявила о приобретении MetaPort, американской компании, которая является ведущей компанией по разработке программного обеспечения для картографирования телекоммуникационных сетей. Благодаря этому приобретению компания сможет предоставить организациям CIO и CTO уникальную визуализацию инвентаря, которая обеспечит новый уровень видимости их телекоммуникационных активов. Таким образом, компания сможет расширить свой бизнес в сфере программного обеспечения для управления расходами на технологии.

- В июле 2020 года американская компания WidePoint Corporation объявила о заключении нового контракта с Управлением по контролю за оборотом алкогольных напитков Вирджинии (Virginia ABC) на предоставление услуг по управлению расходами на телекоммуникации. Контракт заключен на один год и содержит четыре дополнительных периода продления сроком на один год. Таким образом, компания поможет Virginia ABC справиться с трудностями пандемии, управляя расходами компаний на телекоммуникации.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Содержание

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA TELECOM EXPENSE MANAGEMENT MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 OFFERING TIMELINE CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 USE CASE ANALYSIS

4.1.1 CASE STUDY 1:

4.1.2 CASE STUDY 2:

4.2 PORTERS FIVE FORCES ANALYSIS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 SIGNIFICANT COST REDUCTION

5.1.2 INCREASE IN ADOPTION OF MOBILE PHONES AND OTHER PORTABLE DEVICES

5.1.3 PROVIDING EXPENSE TRANSPARENCY

5.1.4 INCREASE IN DEMAND FOR TEM DUE TO IOT AND CLOUD-BASED APPLICATION

5.1.5 RISE IN DEMAND OF TEM IN THE HEALTHCARE SECTOR

5.1.6 RISE IN DEMAND FOR TEM MARKET FOR MID-SIZED BUSINESSES

5.2 RESTRAINT

5.2.1 LACK OF INTEROPERABILITY BETWEEN SOLUTIONS AND DIFFERENT VENDORS

5.3 OPPORTUNITIES

5.3.1 AUTOMATION TECHNOLOGY FOR TEM

5.3.2 OUTSOURCING OF TEM MARKET

5.3.3 LOW DEPLOYMENT COST AND GROWING DEMAND FOR COST-EFFICIENT TEM SOLUTIONS

5.4 CHALLENGES

5.4.1 FORECASTING FUTURE SPEND

5.4.2 TRACKING INVENTORY ON BILLS

6 IMPACT OF COVID-19 ON THE NORTH AMERICA TELECOM EXPENSE MNAGEMENT MARKET

6.1 ANALYSIS ON IMPACT OF COVID-19 ON THE MARKET

6.2 AFTERMATH OF COVID-19

6.3 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.4 IMPACT ON DEMAND

6.5 CONCLUSION

7 NORTH AMERICA TELECOM EXPENSE MANAGEMENT MARKET, BY OFFERING

7.1 OVERVIEW

7.2 SOLUTION

7.2.1 ORDERING & PROVISIONING MANAGEMENT

7.2.2 SOURCING MANAGEMENT

7.2.3 REPORTING & BUSINESS MANAGEMENT

7.2.4 INVOICE MANAGEMENT

7.2.5 USAGE MANAGEMENT

7.2.6 DISPUTE MANAGEMENT

7.2.7 OTHERS

7.3 SERVICES

7.3.1 IMPLEMENTATION & INTEGRATION

7.3.2 TRAINING & CONSULTING

7.3.3 SUPPORT & MAINTENANCE

8 NORTH AMERICA TELECOM EXPENSE MANAGEMENT MARKET, BY SERVICE DELIVERY MODE

8.1 OVERVIEW

8.2 LICENSED SOFTWARE

8.3 MANAGED SERVICES AND COMPLETE OUTSOURCING

8.4 HOSTED

9 NORTH AMERICA TELECOM EXPENSE MANAGEMENT MARKET, BY ENTERPRISE SIZE

9.1 OVERVIEW

9.2 LARGE ENTERPRISES

9.3 SMALL & MEDIUM ENTERPRISES

10 NORTH AMERICA TELECOM EXPENSE MANAGEMENT MARKET, BY END USE

10.1 OVERVIEW

10.2 IT & TELECOM

10.2.1 SOLUTION

10.2.2 SERVICES

10.3 BFSI

10.3.1 SOLUTION

10.3.2 SERVICES

10.4 MANUFACTURING

10.4.1 SOLUTION

10.4.2 SERVICES

10.5 HEALTHCARE

10.5.1 SOLUTION

10.5.2 SERVICES

10.6 TRANSPORTATION & LOGISTICS

10.6.1 SOLUTION

10.6.2 SERVICES

10.7 CONSUMER GOODS & RETAIL

10.7.1 SOLUTION

10.7.2 SERVICES

10.8 ENERGY & POWER

10.8.1 SOLUTION

10.8.2 SERVICES

10.9 MEDIA & ENTERTAINMENT

10.9.1 SOLUTION

10.9.2 SERVICES

10.1 OTHERS

10.10.1 SOLUTION

10.10.2 SERVICES

11 NORTH AMERICA TELECOM EXPENSE MANAGEMENT MARKET, BY REGION

11.1 NORTH AMERICA

11.1.1 U.S.

11.1.2 CANADA

11.1.3 MEXICO

12 NORTH AMERICA TELECOM EXPENSE MANAGEMENT MARKET, COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 VODAFONE GROUP

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENTS

14.2 CGI INC.

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENTS

14.3 DIMENSION DATA

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENTS

14.4 ACCENTURE

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT DEVELOPMENT

14.5 ECONOCOM

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT DEVELOPMENTS

14.6 ASIGNET. TECHNOLOGY DNA

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT DEVELOPMENTS

14.7 AVOTUS

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENT

14.8 CALERO-MDSL

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENTS

14.9 CASS INFORMATION SYSTEMS, INC.

14.9.1 COMPANY SNAPSHOT

14.9.2 REVENUE ANALYSIS

14.9.3 PRODUCT PORTFOLIO

14.9.4 RECENT DEVELOPMENTS

14.1 NETWORK CONTROL

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENTS

14.11 ONE SOURCE

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENTS

14.12 RADIUSPOINT

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENTS

14.13 SAASWEDO

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT DEVELOPMENTS

14.14 SAKON

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT DEVELOPMENTS

14.15 TANGOE

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT DEVELOPMENTS

14.16 TELLENNIUM

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT DEVELOPMENTS

14.17 UPLAND SOFTWARE, INC.

14.17.1 COMPANY SNAPSHOT

14.17.2 REVENUE ANALYSIS

14.17.3 PRODUCT PORTFOLIO

14.17.4 RECENT DEVELOPMENT

14.18 VALICOM

14.18.1 COMPANY SNAPSHOT

14.18.2 PRODUCT PORTFOLIO

14.18.3 RECENT DEVELOPMENT

14.19 VMOX, LLC

14.19.1 COMPANY SNAPSHOT

14.19.2 PRODUCT PORTFOLIO

14.19.3 RECENT DEVELOPMENTS

14.2 WIDEPOINT CORPORATION

14.20.1 COMPANY SNAPSHOT

14.20.2 REVENUE ANALYSIS

14.20.3 PRODUCT PORTFOLIO

14.20.4 RECENT DEVELOPMENTS

15 QUESTIONNAIRE

16 RELATED REPORTS

Список таблиц

TABLE 1 NORTH AMERICA TELECOM EXPENSE MANAGEMENT MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 2 NORTH AMERICA SOLUTION IN TELECOM EXPENSE MANAGEMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 3 NORTH AMERICA SOLUTION IN TELECOM EXPENSE MANAGEMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 4 NORTH AMERICA SERVICES IN TELECOM EXPENSE MANAGEMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 5 NORTH AMERICA SERVICES IN TELECOM EXPENSE MANAGEMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 6 NORTH AMERICA TELECOM EXPENSE MANAGEMENT MARKET, BY SERVICE DELIVERY MODE, 2019-2028 (USD MILLION)

TABLE 7 NORTH AMERICA LICENSED SOFTWARE IN TELECOM EXPENSE MANAGEMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 8 NORTH AMERICA MANAGED SERVICES AND COMPLETE OUTSOURCING IN TELECOM EXPENSE MANAGEMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 9 NORTH AMERICA HOSTED IN TELECOM EXPENSE MANAGEMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 10 NORTH AMERICA TELECOM EXPENSE MANAGEMENT MARKET, BY ENTERPRISE SIZE, 2019-2028 (USD MILLION)

TABLE 11 NORTH AMERICA LARGE ENTERPRISES IN TELECOM EXPENSE MANAGEMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 12 NORTH AMERICA SMALL & MEDIUM ENTERPRISES IN TELECOM EXPENSE MANAGEMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 13 NORTH AMERICA TELECOM EXPENSE MANAGEMENT MARKET, BY END USER, 2019-2028 (USD MILLION)

TABLE 14 NORTH AMERICA IT & TELECOM IN TELECOM EXPENSE MANAGEMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 15 NORTH AMERICA IT & TELECOM IN TELECOM EXPENSE MANAGEMENT MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 16 NORTH AMERICA BFSI IN TELECOM EXPENSE MANAGEMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 17 NORTH AMERICA BFSI IN TELECOM EXPENSE MANAGEMENT MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 18 NORTH AMERICA MANUFACTURING IN TELECOM EXPENSE MANAGEMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 19 NORTH AMERICA MANUFACTURING IN TELECOM EXPENSE MANAGEMENT MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 20 NORTH AMERICA HEALTHCARE IN TELECOM EXPENSE MANAGEMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 21 NORTH AMERICA HEALTHCARE IN TELECOM EXPENSE MANAGEMENT MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 22 NORTH AMERICA TRANSPORTATION & LOGISTICS IN TELECOM EXPENSE MANAGEMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 23 NORTH AMERICA TRANSPORTATION & LOGISTICS IN TELECOM EXPENSE MANAGEMENT MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 24 NORTH AMERICA CONSUMER GOODS & RETAIL IN TELECOM EXPENSE MANAGEMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 25 NORTH AMERICA CONSUMER GOODS & RETAIL IN TELECOM EXPENSE MANAGEMENT MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 26 NORTH AMERICA ENERGY & POWER IN TELECOM EXPENSE MANAGEMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 27 NORTH AMERICA ENERGY & POWER IN TELECOM EXPENSE MANAGEMENT MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 28 NORTH AMERICA MEDIA & ENTERTAINMENT IN TELECOM EXPENSE MANAGEMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 29 NORTH AMERICA MEDIA & ENTERTAINMENT IN TELECOM EXPENSE MANAGEMENT MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 30 NORTH AMERICA OTHERS IN TELECOM EXPENSE MANAGEMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 31 NORTH AMERICA OTHERS IN TELECOM EXPENSE MANAGEMENT MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 32 NORTH AMERICA TELECOM EXPENSE MANAGEMENT MARKET, BY COUNTRY, 2019-2028 (USD MILLION)

TABLE 33 NORTH AMERICA TELECOM EXPENSE MANAGEMENT MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 34 NORTH AMERICA SOLUTION IN TELECOM EXPENSE MANAGEMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 35 NORTH AMERICA SERVICES IN TELECOM EXPENSE MANAGEMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 36 NORTH AMERICA TELECOM EXPENSE MANAGEMENT MARKET, BY SERVICE DELIVERY MODE, 2019-2028 (USD MILLION)

TABLE 37 NORTH AMERICA TELECOM EXPENSE MANAGEMENT MARKET, BY ENTERPRISE SIZE, 2019-2028 (USD MILLION)

TABLE 38 NORTH AMERICA TELECOM EXPENSE MANAGEMENT MARKET, BY END USE, 2019-2028 (USD MILLION)

TABLE 39 NORTH AMERICA IT & TELECOM IN TELECOM EXPENSE MANAGEMENT MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 40 NORTH AMERICA BFSI IN TELECOM EXPENSE MANAGEMENT MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 41 NORTH AMERICA MANUFACTURING IN TELECOM EXPENSE MANAGEMENT MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 42 NORTH AMERICA HEALTHCARE IN TELECOM EXPENSE MANAGEMENT MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 43 NORTH AMERICA TRANSPORTATION & LOGISTICS IN TELECOM EXPENSE MANAGEMENT MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 44 NORTH AMERICA CONSUMER GOODS & RETAIL IN TELECOM EXPENSE MANAGEMENT MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 45 NORTH AMERICA ENERGY & POWER IN TELECOM EXPENSE MANAGEMENT MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 46 NORTH AMERICA MEDIA & ENTERTAINMENT IN TELECOM EXPENSE MANAGEMENT MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 47 NORTH AMERICA OTHERS IN TELECOM EXPENSE MANAGEMENT MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 48 U.S. TELECOM EXPENSE MANAGEMENT MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 49 U.S. SOLUTION IN TELECOM EXPENSE MANAGEMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 50 U.S. SERVICES IN TELECOM EXPENSE MANAGEMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 51 U.S. TELECOM EXPENSE MANAGEMENT MARKET, BY SERVICE DELIVERY MODE, 2019-2028 (USD MILLION)

TABLE 52 U.S. TELECOM EXPENSE MANAGEMENT MARKET, BY ENTERPRISE SIZE, 2019-2028 (USD MILLION)

TABLE 53 U.S. TELECOM EXPENSE MANAGEMENT MARKET, BY END USE, 2019-2028 (USD MILLION)

TABLE 54 U.S. IT & TELECOM IN TELECOM EXPENSE MANAGEMENT MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 55 U.S. BFSI IN TELECOM EXPENSE MANAGEMENT MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 56 U.S. MANUFACTURING IN TELECOM EXPENSE MANAGEMENT MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 57 U.S. HEALTHCARE IN TELECOM EXPENSE MANAGEMENT MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 58 U.S. TRANSPORTATION & LOGISTICS IN TELECOM EXPENSE MANAGEMENT MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 59 U.S. CONSUMER GOODS & RETAIL IN TELECOM EXPENSE MANAGEMENT MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 60 U.S. ENERGY & POWER IN TELECOM EXPENSE MANAGEMENT MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 61 U.S. MEDIA & ENTERTAINMENT IN TELECOM EXPENSE MANAGEMENT MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 62 U.S. OTHERS IN TELECOM EXPENSE MANAGEMENT MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 63 CANADA TELECOM EXPENSE MANAGEMENT MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 64 CANADA SOLUTION IN TELECOM EXPENSE MANAGEMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 65 CANADA SERVICES IN TELECOM EXPENSE MANAGEMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 66 CANADA TELECOM EXPENSE MANAGEMENT MARKET, BY SERVICE DELIVERY MODE, 2019-2028 (USD MILLION)

TABLE 67 CANADA TELECOM EXPENSE MANAGEMENT MARKET, BY ENTERPRISE SIZE, 2019-2028 (USD MILLION)

TABLE 68 CANADA TELECOM EXPENSE MANAGEMENT MARKET, BY END USE, 2019-2028 (USD MILLION)

TABLE 69 CANADA IT & TELECOM IN TELECOM EXPENSE MANAGEMENT MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 70 CANADA BFSI IN TELECOM EXPENSE MANAGEMENT MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 71 CANADA MANUFACTURING IN TELECOM EXPENSE MANAGEMENT MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 72 CANADA HEALTHCARE IN TELECOM EXPENSE MANAGEMENT MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 73 CANADA TRANSPORTATION & LOGISTICS IN TELECOM EXPENSE MANAGEMENT MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 74 CANADA CONSUMER GOODS & RETAIL IN TELECOM EXPENSE MANAGEMENT MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 75 CANADA ENERGY & POWER IN TELECOM EXPENSE MANAGEMENT MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 76 CANADA MEDIA & ENTERTAINMENT IN TELECOM EXPENSE MANAGEMENT MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 77 CANADA OTHERS IN TELECOM EXPENSE MANAGEMENT MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 78 MEXICO TELECOM EXPENSE MANAGEMENT MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 79 MEXICO SOLUTION IN TELECOM EXPENSE MANAGEMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 80 MEXICO SERVICES IN TELECOM EXPENSE MANAGEMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 81 MEXICO TELECOM EXPENSE MANAGEMENT MARKET, BY SERVICE DELIVERY MODE, 2019-2028 (USD MILLION)

TABLE 82 MEXICO TELECOM EXPENSE MANAGEMENT MARKET, BY ENTERPRISE SIZE, 2019-2028 (USD MILLION)

TABLE 83 MEXICO TELECOM EXPENSE MANAGEMENT MARKET, BY END USE, 2019-2028 (USD MILLION)

TABLE 84 MEXICO IT & TELECOM IN TELECOM EXPENSE MANAGEMENT MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 85 MEXICO BFSI IN TELECOM EXPENSE MANAGEMENT MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 86 MEXICO MANUFACTURING IN TELECOM EXPENSE MANAGEMENT MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 87 MEXICO HEALTHCARE IN TELECOM EXPENSE MANAGEMENT MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 88 MEXICO TRANSPORTATION & LOGISTICS IN TELECOM EXPENSE MANAGEMENT MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 89 MEXICO CONSUMER GOODS & RETAIL IN TELECOM EXPENSE MANAGEMENT MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 90 MEXICO ENERGY & POWER IN TELECOM EXPENSE MANAGEMENT MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 91 MEXICO MEDIA & ENTERTAINMENT IN TELECOM EXPENSE MANAGEMENT MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 92 MEXICO OTHERS IN TELECOM EXPENSE MANAGEMENT MARKET, BY OFFERING, 2019-2028 (USD MILLION)

Список рисунков

FIGURE 1 NORTH AMERICA TELECOM EXPENSE MANAGEMENT MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA TELECOM EXPENSE MANAGEMENT MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA TELECOM EXPENSE MANAGEMENT MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA TELECOM EXPENSE MANAGEMENT MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA TELECOM EXPENSE MANAGEMENT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA TELECOM EXPENSE MANAGEMENT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA TELECOM EXPENSE MANAGEMENT MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA TELECOM EXPENSE MANAGEMENT MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA TELECOM EXPENSE MANAGEMENT MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 NORTH AMERICA TELECOM EXPENSE MANAGEMENT MARKET: SEGMENTATION

FIGURE 11 SIGNIFICANT COST REDUCTION IS EXPECTED TO DRIVE THE NORTH AMERICA TELECOM EXPENSE MANAGEMENT MARKET IN THE FORECAST PERIOD OF 2021 TO 2028

FIGURE 12 SERVICES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF NORTH AMERICA TELECOM EXPENSE MANAGEMENT MARKET IN 2021 & 2028

FIGURE 13 DRIVERS, RESTRAINT, OPPORTUNITIES, AND CHALLENGES OF NORTH AMERICA TELECOM EXPENSE MANAGEMENT MARKET

FIGURE 14 NORTH AMERICA TELECOM EXPENSE MANAGEMENT MARKET, BY OFFERING, 2020

FIGURE 15 NORTH AMERICA TELECOM EXPENSE MANAGEMENT MARKET, BY SERVICE DELIVERY MODE, 2020

FIGURE 16 NORTH AMERICA TELECOM EXPENSE MANAGEMENT MARKET, BY ENTERPRISE SIZE, 2020

FIGURE 17 NORTH AMERICA TELECOM EXPENSE MANAGEMENT MARKET, BY END USER, 2020

FIGURE 18 NORTH AMERICA TELECOM EXPENSE MANAGEMENT MARKET: SNAPSHOT (2020)

FIGURE 19 NORTH AMERICA TELECOM EXPENSE MANAGEMENT MARKET: BY COUNTRY (2020)

FIGURE 20 NORTH AMERICA TELECOM EXPENSE MANAGEMENT MARKET: BY COUNTRY (2021 & 2028)

FIGURE 21 NORTH AMERICA TELECOM EXPENSE MANAGEMENT MARKET: BY COUNTRY (2020 & 2028)

FIGURE 22 NORTH AMERICA TELECOM EXPENSE MANAGEMENT MARKET: BY OFFERING (2021-2028)

FIGURE 23 NORTH AMERICA TELECOM EXPENSE MANAGEMENT MARKET: COMPANY SHARE 2020 (%)

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.