Рынок грибов шиитаке в Северной Америке по типу (дикий и культивируемый), категории (органический и неорганический), способу выращивания (выращивание на бревнах и грядках), типу продукта (свежий и обработанный), форме (цельный/цветы, части), типу упаковки (консервированный, пластиковые пакеты, лотки и другие), конечному пользователю (поставщики услуг общественного питания, домохозяйства, другие), каналу сбыта (розничная торговля в магазине и онлайн-розничная торговля), стране (США, Канада и Мексика) — тенденции отрасли и прогноз до 2029 года.

Анализ рынка и аналитика : рынок грибов шиитаке в Северной Америке

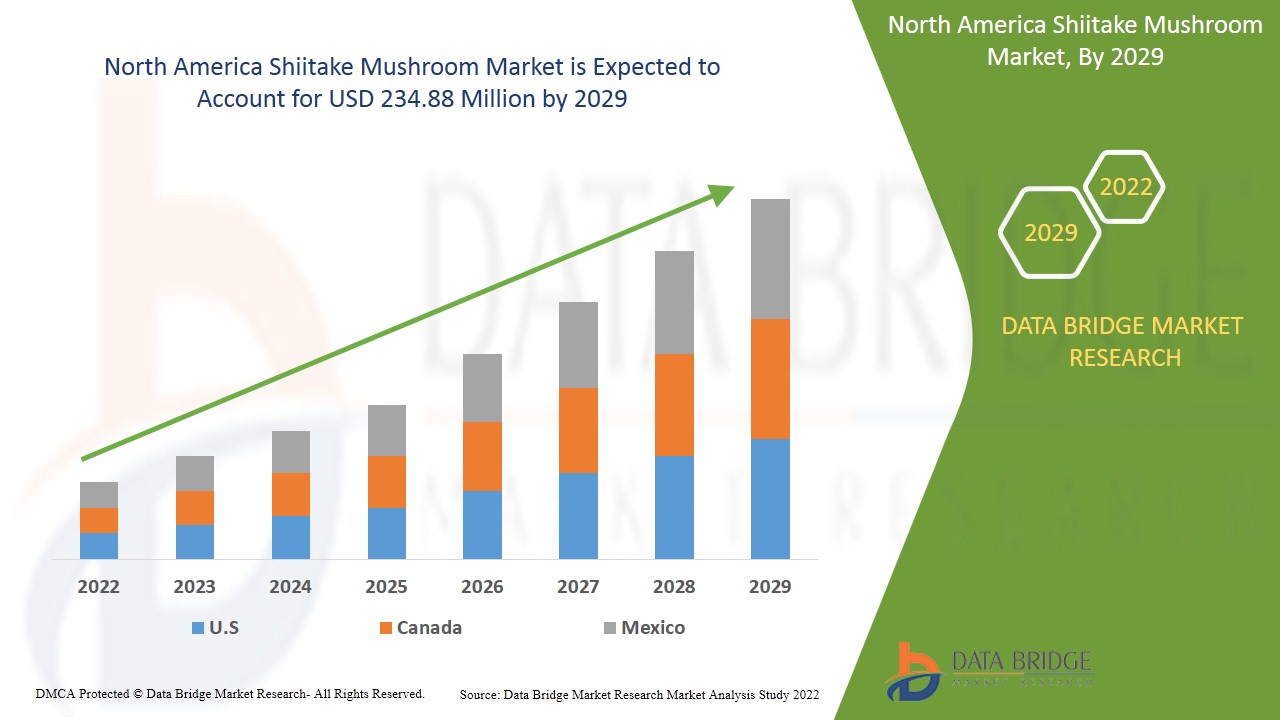

Ожидается, что рынок грибов шиитаке будет расти в прогнозируемый период с 2022 по 2029 год. По данным Data Bridge Market Research, среднегодовой темп роста рынка составит 7,7% в прогнозируемый период с 2022 по 2029 год, и ожидается, что к 2029 году его объем достигнет 234,88 млн долларов США. Высокий спрос на грибы шиитаке и развивающаяся экономика ускоряют рост рынка грибов шиитаке.

Грибы шиитаке — это тип съедобных грибов, которые богаты питательными веществами и имеют различные полезные свойства для здоровья. Шиитаке — это особый или экзотический гриб, который выращивается двумя способами: на бревнах и на грядках. Большинство производителей предпочитают грядки, поскольку они требуют меньше времени на производство и могут выращиваться в любое время года. Этот тип грибов имеет много полезных свойств для здоровья, таких как низкая калорийность и высокое содержание белка, а также приносит пользу здоровью потребителя, повышая иммунитет и снижая риск сердечных заболеваний и рака.

Известно, что гриб шиитаке содержит соединения, которые оказывают антибактериальное, противогрибковое и противовирусное действие на потребителей. Таким образом, при таком количестве преимуществ для здоровья потребление шиитаке растет и, следовательно, стимулирует рынок грибов шиитаке. Погодные колебания и особые температурные требования к выращиванию шиитаке стали причиной снижения производства шиитаке в регионе, что создало серьезное ограничение для роста рынка грибов шиитаке. Развитие и растущая осведомленность потребителей, а также производителей о пользе грибов шиитаке для здоровья откроют новые и предстоящие возможности с ростом функциональной пищи и диетических добавок на рынке грибов шиитаке. Кроме того, грибы шиитаке требуют длительных обязательств для любой окупаемости любых инвестиций, из-за чего многие производители не решаются выйти на рынок грибов шиитаке и выбирают грибы шиитаке только в качестве побочного бизнеса, тем самым бросая вызов росту грибов шиитаке в регионе.

В этом отчете о рынке грибов шиитаке содержатся сведения о доле рынка, новых разработках и анализе продуктового портфеля, влиянии игроков внутреннего и локального рынка, анализируются возможности с точки зрения новых источников дохода, изменений в рыночных правилах, одобрений продуктов, стратегических решений, запусков продуктов, географических расширений и технологических инноваций на рынке. Чтобы понять анализ и сценарий рынка грибов шиитаке, свяжитесь с Data Bridge Market Research для получения аналитического обзора, наша команда поможет вам создать решение по влиянию на доход для достижения желаемой цели.

Масштаб и размер рынка грибов шиитаке в Северной Америке

Рынок грибов шиитаке сегментирован на основе типа, категории, метода выращивания, типа продукта, формы, типа упаковки, конечного пользователя и канала сбыта. Рост среди сегментов помогает вам анализировать нишевые карманы роста и стратегии выхода на рынок и определять основные области применения и разницу в ваших целевых рынках.

- На основе типа рынок грибов шиитаке делится на дикий тип и культивируемый тип. Ожидается, что в 2022 году сегмент культивируемого типа будет доминировать на рынке грибов шиитаке из-за их удобства и экономичной себестоимости производства для производителей.

- На основе категории рынок грибов шиитаке делится на органический и неорганический. Ожидается, что в 2022 году неорганический сегмент будет доминировать на рынке грибов шиитаке из-за их удобства и экономичной себестоимости для производителей.

- На основе метода выращивания рынок грибов шиитаке делится на выращивание на бревнах и выращивание на грядках. Ожидается, что в 2022 году сегмент выращивания на грядках будет доминировать на рынке грибов шиитаке из-за более короткого времени производства и возможности выращивания в течение всего года.

- По типу продукта рынок грибов шиитаке делится на свежий и переработанный . Ожидается, что в 2022 году свежий сегмент будет доминировать на рынке грибов шиитаке из-за их удобства и широкого использования в нескольких секторах.

- На основе формы рынок грибов шиитаке делится на целые/цветки и части. Ожидается, что в 2022 году сегмент целые/цветки будет доминировать на рынке грибов шиитаке, поскольку многие производители поставляют эту продукцию, поэтому она легко доступна на рынке.

- По типу упаковки рынок грибов шиитаке делится на консервы , пластиковые пакеты, лотки и др. Ожидается, что в 2022 году сегмент пластиковых пакетов будет доминировать на рынке грибов шиитаке из-за растущего спроса на удобную еду в небольшой и практичной упаковке.

- На основе конечного потребителя рынок грибов шиитаке делится на поставщиков услуг общественного питания, домохозяйства и др. Ожидается, что в 2022 году сегмент домохозяйств будет доминировать на рынке грибов шиитаке из-за растущей осведомленности потребителей о различных преимуществах грибов шиитаке для здоровья.

- На основе канала сбыта рынок грибов шиитаке делится на розничных продавцов, работающих в магазинах, и онлайн-продавцов. В 2022 году сегмент розничных продавцов, работающих в магазинах, будет доминировать на рынке грибов шиитаке благодаря своей обширной сети распространения и легкой доступности в каждом уголке страны.

Анализ рынка грибов шиитаке в Северной Америке на уровне страны

Проведен анализ рынка грибов шиитаке в Северной Америке и предоставлена информация о размере рынка по стране, типу, категории, методу выращивания, типу продукта, форме, типу упаковки, конечному пользователю и каналу сбыта, как указано выше.

В отчете о рынке грибов шиитаке рассматриваются такие страны, как США, Канада и Мексика.

США доминируют на североамериканском рынке грибов шиитаке и демонстрируют значительный среднегодовой темп роста благодаря новым возможностям в сфере вегетарианского питания, а также росту производства и потребления обработанных пищевых продуктов из-за предпочтений потребителей, что способствовало развитию рынка в европейском регионе.

Раздел отчета по странам также содержит отдельные факторы, влияющие на рынок, и изменения в регулировании на внутреннем рынке, которые влияют на текущие и будущие тенденции рынка. Такие данные, как новые продажи, заменяющие продажи, демографические данные страны, нормативные акты и импортно-экспортные тарифы, являются одними из основных указателей, используемых для прогнозирования рыночного сценария для отдельных стран. Кроме того, при предоставлении прогнозного анализа данных по стране учитываются наличие и доступность брендов Северной Америки и их проблемы из-за большой или малой конкуренции со стороны местных и отечественных брендов, влияние каналов продаж.

Расширение бизнеса для будущего роста, создающее новые возможности для североамериканского рынка грибов шиитаке

Рынок грибов шиитаке также предоставляет вам подробный анализ рынка для каждой страны, рост в определенной отрасли с продажами грибов шиитаке, влияние расширения бизнеса в грибах шиитаке и изменения в сценариях регулирования с их поддержкой рынка грибов шиитаке. Данные доступны за исторический период с 2011 по 2019 год.

Анализ конкурентной среды и доли рынка грибов шиитаке

Конкурентная среда рынка грибов шиитаке содержит данные по конкурентам. Включены сведения о компании, финансы компании, полученный доход, рыночный потенциал, инвестиции в исследования и разработки, новые рыночные инициативы, производственные площадки и объекты, сильные и слабые стороны компании, запуск продукта, линии испытаний продукта, одобрения продукта, патенты, ширина продукта и кривая жизненного цикла источника. Приведенные выше данные относятся только к фокусу компании на рынке грибов шиитаке.

Основными игроками, охваченными отчетом о рынке грибов шиитаке в Северной Америке, являются Monterey Mushrooms, Inc., Giorgio Fresh Co., Monterey Mushrooms, Inc., Wuling (Fuzhou) Biotechnology Co., Ltd., Shandong Qihe Bio Technology Co., Ltd., Lianfeng (Suizhou) Food Co., Ltd., Hirano Mushroom LLC, mycopolitan mushroom company llc и другие. Аналитики DBMR понимают конкурентные преимущества и предоставляют конкурентный анализ для каждого конкурента отдельно.

Многие компании по всему миру инициируют запуск новых продуктов и заключение соглашений, что также ускоряет развитие рынка грибов шиитаке.

Например,

- В октябре 2018 года компания Monterey Mushrooms продемонстрировала свою продукцию на Техасском фестивале грибов. Компания угостила посетителей мероприятия грибными тако и продемонстрировала настоящие подносы с растущими грибами.

Выставки, партнерства, совместные предприятия и другие стратегии участников рынка расширяют возможности компании на рынке грибов шиитаке, что также дает организациям возможность улучшить свое предложение в сфере грибов шиитаке.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Содержание

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA SHIITAKE MUSHROOM MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 COMPARATIVE ANALYSIS OF DIFFERENT GROWTH MEDIUMS OF MUSHROOM

4.2 IMPORT-EXPORT ANALYSIS

4.3 NORTH AMERICA SHIITAKE MUSHROOM MARKET: REGULATORY FRAMEWORK

5 SUPPLY CHAIN OF NORTH AMERICA SHIITAKE MUSHROOM MARKET

5.1 RAW MATERIAL PROCUREMENT

5.2 MANUFACTURING AND DISTRIBUTION

5.3 END USERS

6 VALUE CHAIN

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 RISING HEALTH CONSCIOUSNESS AMONG CONSUMERS

7.1.2 NUTRIENT-RICH PROFILE OF SHIITAKE MUSHROOM

7.1.3 INCREASING PRODUCTION & MANUFACTURERS OF SHIITAKE MUSHROOM IN THE ASIAN REGION

7.1.4 GROWING MARKET OF MEAT ALTERNATIVES ACROSS THE WORLD

7.1.5 GROWING USE OF SHIITAKE MUSHROOM IN VARIOUS APPLICATION

7.2 RESTRAINTS

7.2.1 HIGH PRICES OF SHIITAKE MUSHROOM IN COMPARISON TO OTHER MUSHROOMS

7.2.2 FLUCTUATION IN SHIITAKE MUSHROOMS PRODUCTION DUE TO DEPENDENCE ON WEATHER

7.2.3 HIGH EXPENDITURE IN LOG CULTIVATION METHOD OF SHIITAKE

7.2.4 ALLERGIC REACTION OF SHIITAKE MUSHROOMS

7.3 OPPORTUNITIES

7.3.1 INCREASING CONSUMPTION & PRODUCTION OF MUSHROOMS ACROSS REGIONS

7.3.2 GROWING MARKET OF SPECIALTY & EXOTIC MUSHROOMS

7.3.3 INCREASE IN THE VEGAN FOOD MARKET

7.3.4 GROWING DEMAND FOR FUNCTIONAL FOOD & DIETARY SUPPLEMENTS

7.4 CHALLENGES

7.4.1 DIFFICULTY IN SHIITAKE CULTIVATION PROCESS AND CONDITIONS

7.4.2 GROWING MARKET DEVELOPMENTS FOR OTHER MUSHROOM CATEGORIES

7.4.3 CHALLENGES ASSOCIATED WITH BRAND EQUITY OF THE PRODUCT

7.4.4 SHIITAKE MUSHROOM REQUIRE SPECIAL ATTENTION WHILE TRANSPORTATION

8 NORTH AMERICA SHIITAKE MUSHROOM MARKET, BY TYPE

8.1 OVERVIEW

8.2 CULTIVATED TYPE

8.3 WILD TYPE

9 NORTH AMERICA SHIITAKE MUSHROOM MARKET, BY CATEGORY

9.1 OVERVIEW

9.2 INORGANIC

9.3 ORGANIC

10 NORTH AMERICA SHIITAKE MUSHROOM MARKET, BY CULTIVATION METHOD

10.1 OVERVIEW

10.2 BED CULTIVATION

10.3 LOG CULTIVATION

11 NORTH AMERICA SHIITAKE MUSHROOM MARKET, BY FORM

11.1 OVERVIEW

11.2 WHOLE /FLOWER

11.3 PARTS

11.3.1 SLICED

11.3.2 CAPS

11.3.3 CAPS

11.3.4 OTHERS

12 NORTH AMERICA SHIITAKE MUSHROOM MARKET, BY PRODUCT TYPE

12.1 OVERVIEW

12.2 FRESH

12.3 PROCESSED

12.3.1 DRIED

12.3.2 FROZEN

12.3.3 CANNED

12.3.4 OTHERS

13 NORTH AMERICA SHIITAKE MUSHROOM MARKET, BY PACKAGING TYPE

13.1 OVERVIEW

13.2 PLASTIC BAGS

13.3 TRAY

13.3.1 TOPSEAL TRAY

13.3.2 CARDBOARD TRAY

13.3.3 WOODEN TRAY

13.4 CANNED

13.5 OTHERS

14 NORTH AMERICA SHIITAKE MUSHROOM MARKET, BY END USER

14.1 OVERVIEW

14.2 HOUSEHOLD

14.3 FOOD SERVICE PROVIDERS

14.3.1 RESTAURANTS

14.3.2 HOTELS & BARS

14.3.3 CAFE

14.3.4 CATERING

14.3.5 OTHERS

14.4 OTHERS

15 NORTH AMERICA SHIITAKE MUSHROOM MARKET, BY DISTRIBUTION CHANNEL

15.1 OVERVIEW

15.2 STORE BASED RETAILER

15.2.1 WHOLESALE SELLER

15.2.2 SUPERMARKETS/HYPERMARKETS

15.2.3 CONVENIENCE STORES

15.2.4 VEGETABLE SHOPS

15.2.5 OTHERS

15.3 ONLINE BASED RETAILER

16 NORTH AMERICA SHIITAKE MUSHROOM MARKET, BY REGION

16.1 NORTH AMERICA

16.1.1 U.S.

16.1.2 CANADA

16.1.3 MEXICO

17 NORTH AMERICA SHIITAKE MUSHROOM MARKET: COMPANY LANDSCAPE

17.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

18 SWOT

19 COMPANY PROFILE

19.1 MONTEREY MUSHROOMS, INC.

19.1.1 COMPANY SNAPSHOT

19.1.2 COMPANY SHARE ANALYSIS

19.1.3 PRODUCT PORTFOLIO

19.1.4 RECENT DEVELOPMENTS

19.2 GIORGIO FRESH CO.

19.2.1 COMPANY SNAPSHOT

19.2.2 COMPANY SHARE ANALYSIS

19.2.3 PRODUCT PORTFOLIO

19.2.4 RECENT DEVELOPMENTS

19.3 FUJISHUKIN CO., LTD.

19.3.1 COMPANY SNAPSHOT

19.3.2 COMPANY SHARE ANALYSIS

19.3.3 PRODUCT PORTFOLIO

19.3.4 RECENT DEVELOPMENT

19.4 HIRANO MUSHROOM LLC

19.4.1 COMPANY SNAPSHOT

19.4.2 COMPANY SHARE ANALYSIS

19.4.3 PRODUCT PORTFOLIO

19.4.4 RECENT DEVELOPMENT

19.5 LIANFENG (SUIZHOU) FOOD CO., LTD.

19.5.1 COMPANY SNAPSHOT

19.5.2 COMPANY SHARE ANALYSIS

19.5.3 PRODUCT PORTFOLIO

19.5.4 RECENT DEVELOPMENT

19.6 BANKEN CHAMPIGNONS B.V.

19.6.1 COMPANY SNAPSHOT

19.6.2 PRODUCT PORTFOLIO

19.6.3 RECENT DEVELOPMENT

19.7 FUNGO NETHERLANDS B.V.

19.7.1 COMPANY SNAPSHOT

19.7.2 PRODUCT PORTFOLIO

19.7.3 RECENT DEVELOPMENT

19.8 MEADOW MUSHROOMS

19.8.1 COMPANY SNAPSHOT

19.8.2 PRODUCT PORTFOLIO

19.8.3 RECENT DEVELOPMENTS

19.9 MYCOMEDICA D.O.O.

19.9.1 COMPANY SNAPSHOT

19.9.2 PRODUCT PORTFOLIO

19.9.3 RECENT DEVELOPMENT

19.1 MYCOPOLITAN MUSHROOM COMPANY LLC

19.10.1 COMPANY SNAPSHOT

19.10.2 PRODUCT PORTFOLIO

19.10.3 RECENT DEVELOPMENT

19.11 SHANDONG QIHE BIO TECHNOLOGY CO., LTD.

19.11.1 COMPANY SNAPSHOT

19.11.2 PRODUCT PORTFOLIO

19.11.3 RECENT DEVELOPMENTS

19.12 THAR FOOD

19.12.1 COMPANY SNAPSHOT

19.12.2 PRODUCT PORTFOLIO

19.12.3 RECENT DEVELOPMENT

20 QUESTIONNAIRE

21 RELATED REPORTS

Список таблиц

TABLE 1 IMPORT OF FRESH OR CHILLED EDIBLE MUSHROOMS AND TRUFFLES (EXCLUDING MUSHROOMS OF THE GENUS "AGARICUS") IN TONNES

TABLE 2 IMPORT OF FRESH OR CHILLED EDIBLE MUSHROOMS AND TRUFFLES (EXCLUDING MUSHROOMS OF THE GENUS "AGARICUS") IN USD THOUSANDS

TABLE 3 EXPORT OF FRESH OR CHILLED EDIBLE MUSHROOMS AND TRUFFLES (EXCLUDING MUSHROOMS OF THE GENUS "AGARICUS") IN TONNES

TABLE 4 EXPORT OF FRESH OR CHILLED EDIBLE MUSHROOMS AND TRUFFLES (EXCLUDING MUSHROOMS OF THE GENUS "AGARICUS") IN USD THOUSANDS

TABLE 5 IN THE U.S., THE MUSHROOM GRADES AND STANDARD, WHERE THE TOLERANCE IN INSPECTION IS AS FOLLOWS,

TABLE 6 NUTRITIENTS IN 100G OF RAW AND DRIED SHIITAKE MUSHROOM IN COMPARISON WITH OTHER MUSHROOM

TABLE 7 PRICE OF VARIOUS SHIITAKE MUSHROOM PRODUCTS

TABLE 8 PRICE OF VARIOUS OTHER MUSHROOM PRODUCTS

TABLE 9 TEMPERATURE REQUIREMENT IN SHIITAKE CULTIVATION

TABLE 10 ACTIVITIES AND COST ASSOCIATED WITH LOG CULTIVATION WITH 400 TO 800 LOGS PER YEAR

TABLE 11 PRODUCTION OF MUSHROOM AND TRUFFLES ACROSS REGION IN THE YEARS 2017, 2018, AND 2019 IN TONS

TABLE 12 PER CAPITA CONSUMPTION OF MUSHROOMS IN VARIOUS COUNTRIES IN METRIC TONNES

TABLE 13 FUNCTIONAL FOOD AND DIETARY SUPPLEMENT PRODUCTS OF SHIITAKE MUSHROOM

TABLE 14 MOISTURE AND HUMIDITY REQUIREMENTS FOR SHIITAKE

TABLE 15 NORTH AMERICA SHIITAKE MUSHROOM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA CULTIVATED TYPE IN SHIITAKE MUSHROOM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA WILD TYPE IN SHIITAKE MUSHROOM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA SHIITAKE MUSHROOM MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA INORGANIC IN SHIITAKE MUSHROOM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA ORGANIC IN SHIITAKE MUSHROOM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA SHIITAKE MUSHROOM MARKET, BY CULTIVATION METHOD, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA BED CULTIVATION IN SHIITAKE MUSHROOM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA LOG CULTIVATION IN SHIITAKE MUSHROOM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA SHIITAKE MUSHROOM MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA WHOLE/FLOWER IN SHIITAKE MUSHROOM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA PARTS IN SHIITAKE MUSHROOM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA PARTS IN SHIITAKE MUSHROOM MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA SHIITAKE MUSHROOM MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 29 COMPANIES PROVIDING FRESH SHIITAKE MUSHROOM

TABLE 30 NORTH AMERICA FRESH IN SHIITAKE MUSHROOM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA PROCESSED IN SHIITAKE MUSHROOM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA PROCESSED IN SHIITAKE MUSHROOM MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA SHIITAKE MUSHROOM MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA PLASTIC BAGS IN SHIITAKE MUSHROOM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA TRAY IN SHIITAKE MUSHROOM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA TRAY IN SHIITAKE MUSHROOM MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA CANNED IN SHIITAKE MUSHROOM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA OTHERS IN SHIITAKE MUSHROOM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA SHIITAKE MUSHROOM MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA HOUSEHOLD IN SHIITAKE MUSHROOM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA FOOD SERVICE PROVIDERS IN SHIITAKE MUSHROOM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA FOOD SERVICE PROVIDERS IN SHIITAKE MUSHROOM MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA OTHERS IN SHIITAKE MUSHROOM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA SHIITAKE MUSHROOM MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 45 NORTH AMERICA STORE BASED RETAILER IN SHIITAKE MUSHROOM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 46 NORTH AMERICA STORE BASED RETAILER IN SHIITAKE MUSHROOM MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 47 NORTH AMERICA ONLINE BASED RETAILER IN SHIITAKE MUSHROOM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 48 NORTH AMERICA SHIITAKE MUSHROOM MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 49 NORTH AMERICA SHIITAKE MUSHROOM MARKET, BY COUNTRY, 2020-2029 (TONS)

TABLE 50 NORTH AMERICA SHIITAKE MUSHROOM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 51 NORTH AMERICA SHIITAKE MUSHROOM MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 52 NORTH AMERICA SHIITAKE MUSHROOM MARKET, BY CULTIVATION METHOD, 2020-2029 (USD MILLION)

TABLE 53 NORTH AMERICA SHIITAKE MUSHROOM MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 54 NORTH AMERICA PARTS IN SHIITAKE MUSHROOM MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 55 NORTH AMERICA SHIITAKE MUSHROOM MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 56 NORTH AMERICA PROCESSED IN SHIITAKE MUSHROOM MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 57 NORTH AMERICA SHIITAKE MUSHROOM MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 58 NORTH AMERICA TRAY IN SHIITAKE MUSHROOM MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 59 NORTH AMERICA SHIITAKE MUSHROOM MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 60 NORTH AMERICA FOOD SERVICE PROVIDERS IN SHIITAKE MUSHROOM MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 61 NORTH AMERICA SHIITAKE MUSHROOM MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 62 NORTH AMERICA STORE BASED RETAILERS IN SHIITAKE MUSHROOM MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 63 U.S. SHIITAKE MUSHROOM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 64 U.S. SHIITAKE MUSHROOM MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 65 U.S. SHIITAKE MUSHROOM MARKET, BY CULTIVATION METHOD, 2020-2029 (USD MILLION)

TABLE 66 U.S. SHIITAKE MUSHROOM MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 67 U.S. PARTS IN SHIITAKE MUSHROOM MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 68 U.S. SHIITAKE MUSHROOM MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 69 U.S. PROCESSED IN SHIITAKE MUSHROOM MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 70 U.S. SHIITAKE MUSHROOM MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 71 U.S. TRAY IN SHIITAKE MUSHROOM MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 72 U.S. SHIITAKE MUSHROOM MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 73 U.S. FOOD SERVICE PROVIDE IN SHIITAKE MUSHROOM MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 74 U.S. SHIITAKE MUSHROOM MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 75 U.S. STORE BASED RETAILERS IN SHIITAKE MUSHROOM MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 76 CANADA SHIITAKE MUSHROOM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 77 CANADA SHIITAKE MUSHROOM MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 78 CANADA SHIITAKE MUSHROOM MARKET, BY CULTIVATION METHOD, 2020-2029 (USD MILLION)

TABLE 79 CANADA SHIITAKE MUSHROOM MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 80 CANADA PARTS IN SHIITAKE MUSHROOM MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 81 CANADA SHIITAKE MUSHROOM MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 82 CANADA PROCESSED IN SHIITAKE MUSHROOM MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 83 CANADA SHIITAKE MUSHROOM MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 84 CANADA TRAY IN SHIITAKE MUSHROOM MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 85 CANADA SHIITAKE MUSHROOM MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 86 CANADA FOOD SERVICE PROVIDERS IN SHIITAKE MUSHROOM MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 87 CANADA SHIITAKE MUSHROOM MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 88 CANADA STORE BASED RETAILER IN SHIITAKE MUSHROOM MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 89 MEXICO SHIITAKE MUSHROOM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 90 MEXICO SHIITAKE MUSHROOM MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 91 MEXICO SHIITAKE MUSHROOM MARKET, BY CULTIVATION METHOD, 2020-2029 (USD MILLION)

TABLE 92 MEXICO SHIITAKE MUSHROOM MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 93 MEXICO PARTS IN SHIITAKE MUSHROOM MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 94 MEXICO SHIITAKE MUSHROOM MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 95 MEXICO PROCESSED IN SHIITAKE MUSHROOM MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 96 MEXICO SHIITAKE MUSHROOM MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 97 MEXICO TRAY IN SHIITAKE MUSHROOM MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 98 MEXICO SHIITAKE MUSHROOM MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 99 MEXICO FOOD SERVICE PROVIDERS IN SHIITAKE MUSHROOM MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 100 MEXICO SHIITAKE MUSHROOM MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 101 MEXICO STORE BASED RETAILER IN SHIITAKE MUSHROOM MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

Список рисунков

FIGURE 1 NORTH AMERICA SHIITAKE MUSHROOM MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA SHIITAKE MUSHROOM MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA SHIITAKE MUSHROOM MARKET : DROC ANALYSIS

FIGURE 4 NORTH AMERICA SHIITAKE MUSHROOM MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA SHIITAKE MUSHROOM MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA SHIITAKE MUSHROOM MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA SHIITAKE MUSHROOM MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA SHIITAKE MUSHROOM MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA SHIITAKE MUSHROOM MARKET: SEGMENTATION

FIGURE 10 ASIA-PACIFIC IS EXPECTED TO DOMINATE THE NORTH AMERICA SHIITAKE MUSHROOM MARKET AND GROWING WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 11 NUTRIENT RICH PROFILE OF SHIITAKE MUSHROOM IS LEADING THE GROWTH OF THE NORTH AMERICA SHIITAKE MUSHROOM MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 CULTIVATED TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA SHIITAKE MUSHROOM MARKET IN 2022 & 2029

FIGURE 13 SUPPLY CHAIN OF NORTH AMERICA SHIITAKE MUSHROOM

FIGURE 14 VALUE CHAIN OF SHIITAKE MUSHROOM

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF SHIITAKE MUSHROOM MARKET

FIGURE 16 NORTH AMERICA SHIITAKE MUSHROOM MARKET, BY TYPE, 2021

FIGURE 17 NORTH AMERICA SHIITAKE MUSHROOM MARKET, BY CATEGORY, 2021

FIGURE 18 NORTH AMERICA SHIITAKE MUSHROOM MARKET, BY CULTIVATION METHOD, 2021

FIGURE 19 NORTH AMERICA SHIITAKE MUSHROOM MARKET, BY FORM, 2021

FIGURE 20 NORTH AMERICA SHIITAKE MUSHROOM MARKET, BY PRODUCT TYPE, 2021

FIGURE 21 NORTH AMERICA SHIITAKE MUSHROOM MARKET, BY PACKAGING TYPE, 2021

FIGURE 22 NORTH AMERICA SHIITAKE MUSHROOM MARKET, BY END USER, 2021

FIGURE 23 NORTH AMERICA SHIITAKE MUSHROOM MARKET, BY DISTRIBUTION CHANNEL, 2021

FIGURE 24 NORTH AMERICA SHIITAKE MUSHROOM MARKET: SNAPSHOT (2021)

FIGURE 25 NORTH AMERICA SHIITAKE MUSHROOM MARKET: BY COUNTRY (2021)

FIGURE 26 NORTH AMERICA SHIITAKE MUSHROOM MARKET: BY COUNTRY (2022 & 2029)

FIGURE 27 NORTH AMERICA SHIITAKE MUSHROOM MARKET: BY COUNTRY (2021 & 2029)

FIGURE 28 NORTH AMERICA SHIITAKE MUSHROOM MARKET: BY TYPE (2022 & 2029)

FIGURE 29 NORTH AMERICA SHIITAKE MUSHROOM MARKET: COMPANY SHARE 2021 (%)

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.