North America Ocular Pain Market

Размер рынка в млрд долларов США

CAGR :

%

USD

541.88 Million

USD

1,048.43 Million

2025

2033

USD

541.88 Million

USD

1,048.43 Million

2025

2033

| 2026 –2033 | |

| USD 541.88 Million | |

| USD 1,048.43 Million | |

|

|

|

|

Сегментация рынка препаратов для лечения глазной боли в Северной Америке по типу заболевания (глазная боль при заболеваниях глаз и глазная боль без первичных заболеваний глаз), типу (диагностика и лечение), применению (конъюнктивит, повреждение роговицы, блефарит, ячмень, ирит, синусит, мигрень, глаукома и другие), способу применения (местный, периорбитальный, внутриглазной, пероральный), типу лекарственного средства (рецептурное и безрецептурное), типу населения (взрослые и пожилые люди), конечным пользователям (больницы, специализированные клиники, учреждения по уходу на дому, офтальмологические центры, амбулаторные хирургические центры и другие), каналам сбыта (прямые закупки, больничные аптеки, розничные аптеки, онлайн-аптеки и другие) — тенденции отрасли и прогноз до 2033 года.

Размер рынка глазной боли в Северной Америке

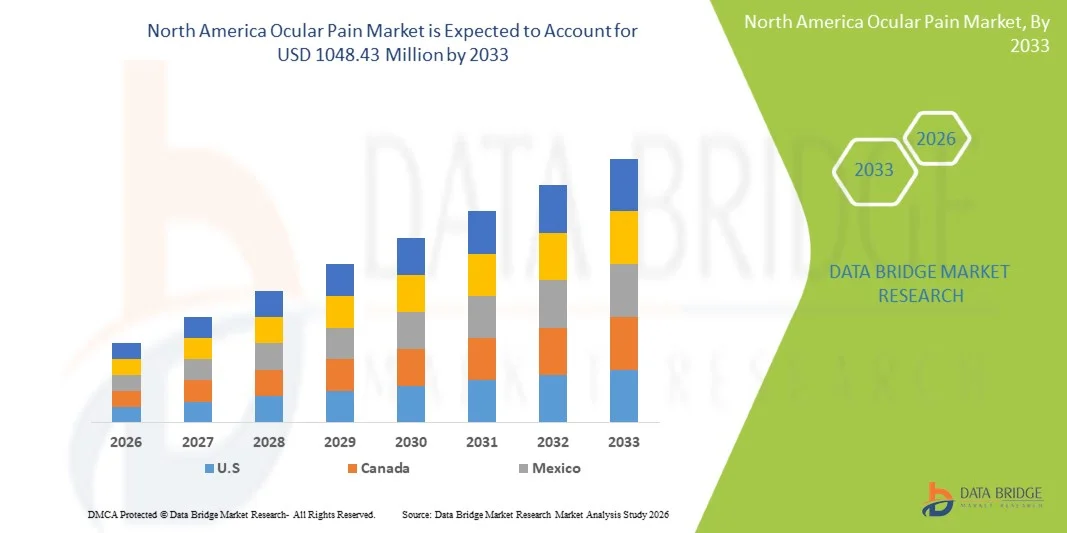

- Объем рынка препаратов для лечения глазной боли в Северной Америке в 2025 году оценивался в 541,88 млн долларов США и, как ожидается, достигнет 1048,43 млн долларов США к 2033 году , демонстрируя среднегодовой темп роста в 8,60% в течение прогнозируемого периода.

- Рост рынка в значительной степени обусловлен увеличением распространенности заболеваний глаз, ростом времени, проводимого за экраном, загрязнением окружающей среды и старением населения, что в совокупности приводит к увеличению частоты возникновения глазной боли как в развитых, так и в развивающихся странах.

- Кроме того, растущая осведомленность о здоровье глаз, улучшенный доступ к офтальмологической помощи и постоянное совершенствование диагностических и терапевтических технологий стимулируют спрос на эффективные решения для лечения глазной боли, что значительно способствует общему росту отрасли.

Анализ рынка глазной боли в Северной Америке

- Глазная боль, подразумевающая дискомфорт, болезненность или раздражение в области глаз и вокруг них, вызванные такими состояниями, как синдром сухого глаза, инфекции, воспаление, мигрень и неврологические расстройства, становится все более актуальной проблемой как в клинической практике, так и в домашних условиях из-за повышенного воздействия цифровых экранов, загрязнения окружающей среды и напряжения глаз, связанного с образом жизни.

- Растущий спрос на средства для лечения глазной боли в первую очередь обусловлен увеличением распространенности хронических заболеваний глаз, длительным использованием цифровых устройств, ростом численности пожилого населения и повышением осведомленности потребителей во всем мире о важности ухода за здоровьем глаз.

- США доминировали на североамериканском рынке лечения глазной боли, занимая наибольшую долю выручки в 37,6% в 2025 году, чему способствовали развитая инфраструктура здравоохранения, высокая осведомленность пациентов, широкий доступ к офтальмологам и сильное присутствие ключевых фармацевтических компаний и производителей медицинских изделий, разрабатывающих инновационные офтальмологические препараты.

- Ожидается, что Канада станет самым быстрорастущим регионом на рынке лечения глазной боли в Северной Америке, демонстрируя среднегодовой темп роста в 8,9% в течение прогнозируемого периода. Это обусловлено ростом инвестиций в здравоохранение, увеличением численности пожилого населения, улучшением доступа к услугам по уходу за зрением и растущим внедрением передовых методов лечения.

- В 2025 году сегмент лечения занимал наибольшую долю рынка по выручке, составляющую 68,9%, поскольку большинство пациентов, испытывающих боль в глазах, ищут облегчения непосредственно с помощью медикаментов или терапевтического вмешательства.

Обзор отчета и сегментация рынка глазной боли в Северной Америке

|

Атрибуты |

Ключевые тенденции рынка лечения глазной боли в Северной Америке. |

|

Охваченные сегменты |

|

|

Охваченные страны |

Северная Америка

|

|

Ключевые игроки рынка |

|

|

Рыночные возможности |

|

|

Информационные наборы данных, представляющие добавленную стоимость |

Помимо анализа рыночных сценариев, таких как рыночная стоимость, темпы роста, сегментация, географический охват и основные игроки, отчеты о рынке, подготовленные Data Bridge Market Research, также включают углубленный экспертный анализ, эпидемиологию пациентов, анализ перспективных разработок, анализ ценообразования и нормативно-правовую базу. |

Тенденции рынка лечения глазной боли в Северной Америке

« Достижения в области таргетной офтальмологической терапии и персонализированного лечения боли »

- Значительная и быстро набирающая обороты тенденция на рынке лечения глазной боли в Северной Америке — это растущее внимание к таргетной офтальмологической терапии и персонализированным подходам к лечению, разработанным для более эффективного купирования хронической и острой боли в глазах. Улучшение понимания основных воспалительных и нейропатических механизмов, связанных с глазной болью, привело к разработке более специализированных лекарственных препаратов и схем лечения.

- Например, глазные капли, содержащие противовоспалительные средства, кортикостероиды и циклоспорин, все чаще используются для лечения боли, связанной с синдромом сухого глаза, послеоперационным раздражением и повреждением роговицы. Аналогичным образом, внедрение биологических методов лечения аутоиммунных воспалительных заболеваний глаз обеспечивает улучшение результатов лечения пациентов, страдающих от постоянной боли в глазах, вызванной такими состояниями, как увеит и склерит.

- Применение комбинированной терапии, включающей увлажняющие глазные капли, пероральные НПВП и иммуномодулирующие препараты, набирает популярность, поскольку позволяет одновременно устранять множество причин боли. Эти методы лечения подбираются индивидуально в зависимости от тяжести симптомов, продолжительности дискомфорта и основного клинического состояния, что позволяет врачам разрабатывать более персонализированные планы лечения для пациентов.

- Кроме того, внедрение передовых диагностических технологий, таких как визуализация роговицы и анализ слезной пленки, позволяет офтальмологам более точно определять конкретный источник боли. Это помогает сократить количество проб и ошибок при назначении лекарств и повышает общую эффективность лечения, особенно у пациентов с хроническими заболеваниями поверхности глаза.

- Растущий спрос на неинвазивные и длительно действующие обезболивающие средства также привел к резкому увеличению разработки офтальмологических препаратов с пролонгированным высвобождением и глазных капель без консервантов, которые уменьшают раздражение и повышают комфорт пациента.

- Тенденция к индивидуализированным, научно обоснованным и ориентированным на пациента подходам к лечению коренным образом меняет методы лечения глазной боли. В результате фармацевтические компании вкладывают значительные средства в исследования и разработки для внедрения инновационных методов лечения, обеспечивающих более быстрое облегчение боли, более длительное действие и меньшее количество побочных эффектов.

- В условиях увеличения времени, проводимого за экраном, загрязнения окружающей среды и роста распространенности заболеваний глаз, ожидается, что спрос на передовые решения для купирования боли в глазах будет неуклонно расти как в клинических условиях, так и в условиях домашнего ухода в Северной Америке.

Динамика рынка глазной боли в Северной Америке

Водитель

«Растущая распространенность заболеваний глаз и повышение осведомленности о методах лечения»

- Растущая распространенность таких заболеваний глаз, как синдром сухого глаза, конъюнктивит, глаукома, диабетическая ретинопатия и послеоперационное воспаление, является основной причиной роста спроса на лечение глазной боли в Северной Америке. Длительное воздействие цифровых экранов, загрязняющих веществ окружающей среды и старение населения в значительной степени способствуют хроническому дискомфорту и раздражению глаз.

- Например, в мае 2024 года несколько офтальмологических ассоциаций Северной Америки активизировали кампании по повышению осведомленности общественности о рисках длительного воздействия цифровых экранов и его связи с повреждением поверхности глаза, призывая к ранней диагностике и лечению дискомфорта и боли в глазах. Ожидается, что подобные инициативы ускорят рост рынка в течение прогнозируемого периода.

- По мере того как пациенты все больше осознают последствия нелеченной боли в глазах, возрастает их готовность обращаться за медицинской помощью и приобретать рецептурные и безрецептурные средства для ухода за глазами. Эта возросшая осведомленность стимулирует спрос на обезболивающие глазные капли, противовоспалительные препараты и увлажняющие средства.

- Кроме того, растущее число офтальмологических операций, включая LASIK и операции по удалению катаракты, увеличило потребность в послеоперационном обезболивании, что привело к увеличению потребления обезболивающих средств для глаз. Больницы и клиники постоянно совершенствуют свои протоколы лечения, чтобы внедрить более эффективные методы обезболивания.

- Расширение доступности современных фармацевтических препаратов, улучшение доступа к специалистам по офтальмологии и увеличение расходов на здравоохранение в регионе также способствуют росту рынка лечения глазной боли в Северной Америке в стационарных, клинических и стационарных условиях.

Сдержанность/Вызов

« Побочные эффекты, ограниченные возможности длительного применения и высокая стоимость современных методов лечения »

- Несмотря на растущий спрос, рынок лечения глазной боли в Северной Америке сталкивается со значительными проблемами из-за потенциальных побочных эффектов, связанных с длительным применением кортикостероидов и НПВП, включая повышение внутриглазного давления, образование катаракты и осложнения со стороны роговицы. Эти риски часто ограничивают возможность длительного лечения, особенно в хронических случаях.

- Кроме того, у некоторых пациентов развивается толерантность или снижается эффективность часто назначаемых препаратов, что значительно затрудняет купирование боли. Это создает потребность в более сложных и дорогостоящих комбинированных методах лечения, которые могут быть недоступны для всех групп пациентов.

- Например, пациенты, длительное время использующие кортикостероидные глазные капли, часто нуждаются в постоянном наблюдении из-за риска развития вторичной глаукомы, что увеличивает как клиническую нагрузку, так и общие затраты на лечение. Это ограничивает широкое применение препарата в течение длительного времени.

- Высокая стоимость современных биологических препаратов и новых лекарственных форм также ограничивает их доступность, особенно для пациентов без медицинской страховки или с недостаточной страховкой. Хотя эти методы лечения обеспечивают лучшие результаты, их высокая стоимость может значительно ограничить их применение среди групп населения, чувствительных к стоимости лечения.

- Кроме того, недостаточная осведомленность в некоторых сельских и малообеспеченных регионах приводит к задержке диагностики и неправильному лечению, усугублению симптомов и снижению эффективности доступных методов терапии.

- Для преодоления этих проблем потребуется разработка более безопасных долгосрочных альтернатив, экономически эффективных генериков и улучшение программ обучения пациентов, чтобы обеспечить устойчивый рост рынка лечения глазной боли.

Обзор рынка лечения глазной боли в Северной Америке

Рынок сегментирован по типу заболевания, типу продукции, применению, способу введения, типу лекарственного препарата, типу населения, конечному пользователю и каналу сбыта.

• По типу заболевания

В зависимости от типа заболевания, рынок лечения глазной боли в Северной Америке сегментируется на глазную боль, связанную с заболеваниями глаз, и глазную боль, не связанную с первичными заболеваниями глаз. Сегмент глазной боли, связанной с заболеваниями глаз, занимал наибольшую долю рынка, составляющую 62,4% в 2025 году, что обусловлено высокой распространенностью таких состояний, как конъюнктивит, повреждения роговицы, глаукома, увеит, синдром сухого глаза и инфекции, непосредственно вызывающие дискомфорт и боль в глазах. Эти состояния часто требуют немедленной медицинской помощи и постоянного терапевтического вмешательства для уменьшения воспаления, облегчения боли и предотвращения потери зрения. Рост численности пожилого населения, увеличение времени, проводимого за экраном, рост заболеваемости глазными инфекциями и хроническими заболеваниями, такими как глаукома, вносят значительный вклад в рост этого сегмента. Пациенты, испытывающие нарушения зрения или воспаление глаз, чаще обращаются за профессиональной помощью, что увеличивает спрос на диагностические процедуры и лекарственные препараты. Усовершенствованные диагностические технологии в офтальмологии способствуют раннему выявлению причин боли, связанных с глазами, что еще больше увеличивает доступность лечения. Растущее число госпитализаций, связанных с травмами глаз, повреждением роговицы и послеоперационной болью после офтальмологических процедур, также укрепляет этот сегмент. Повышение доступности офтальмологических услуг в городских районах и информационные кампании о здоровье глаз способствуют росту. Кроме того, расширение офтальмологических отделений в больницах способствует увеличению числа пациентов, получающих лечение. Совокупность этих факторов прочно закрепляет за этим сегментом лидирующие позиции на рынке.

Ожидается, что сегмент «Офтальмологическая боль без первичных заболеваний глаз» продемонстрирует самый быстрый среднегодовой темп роста в 8,6% в период с 2026 по 2033 год, чему способствует увеличение числа диагностированных случаев иррадиационной боли, вызванной мигренью, синуситом, неврологическими расстройствами и системными воспалительными заболеваниями. Этот тип боли не возникает непосредственно из-за заболевания глаз, но значительно влияет на комфорт глаз, побуждая пациентов обращаться за консультацией к офтальмологам и неврологам. Растущая осведомленность о нейропатической и иррадиационной глазной боли способствует более целенаправленной диагностике и специализированным методам лечения. Поскольку распространенность головных болей, мигрени и осложнений, связанных с синусами, продолжает расти во всем мире, этот сегмент приобретает значительную популярность. Технологические достижения в области визуализации и диагностики боли позволяют улучшить дифференциацию между первичной и иррадиационной глазной болью. Расширение сотрудничества между неврологами, ЛОР-специалистами и офтальмологами улучшает общее управление болью. Расширение доступа к медицинской помощи и лучшее распознавание неглазных причин глазной боли ускоряют рост. Увеличение количества назначений неопиоидных анальгетиков и нейрологических препаратов способствует расширению рынка. Кроме того, повышение осведомленности пациентов и улучшение информированности о симптомах будут и дальше стимулировать рост в течение прогнозируемого периода.

• По типу

В зависимости от типа, рынок лечения глазной боли в Северной Америке сегментирован на диагностику и лечение. Сегмент лечения занимал наибольшую долю рынка, составляющую 68,9% выручки в 2025 году, поскольку большинство пациентов, испытывающих глазную боль, напрямую ищут облегчения с помощью медикаментов или терапевтического вмешательства. Это включает использование противовоспалительных препаратов, увлажняющих глазных капель, антибиотиков, противовирусных препаратов, анальгетиков и кортикостероидов, которые эффективно устраняют основные причины. Растущая распространенность хронических заболеваний, таких как синдром сухого глаза, глаукома и увеит, значительно стимулирует спрос на непрерывное лечение. Увеличение числа случаев глазной аллергии из-за загрязнения окружающей среды также способствует росту зависимости от фармацевтического лечения. Облегчение послеоперационной офтальмологической боли является еще одним ключевым фактором, расширяющим этот сегмент. Фармацевтические компании продолжают выпускать улучшенные лекарственные формы с большей эффективностью и меньшим количеством побочных эффектов. Расширение розничной и онлайн-аптек сделало лечение более доступным. Увеличение доли врачей, использующих медикаментозное лечение, а не только наблюдение, является еще одним поддерживающим фактором. Повышение осведомленности о важности раннего купирования симптомов также приводит к увеличению спроса на лечение.

Ожидается, что сегмент диагностики продемонстрирует самый быстрый среднегодовой темп роста в 9,3% в период с 2026 по 2033 год благодаря быстрому развитию офтальмологических диагностических технологий, таких как оптическая когерентная томография, осмотр с помощью щелевой лампы и передовые системы визуализации. Ранняя и точная диагностика становится все более важной для предотвращения осложнений, таких как потеря зрения. Повышение осведомленности о профилактическом уходе за глазами побуждает все больше людей проходить регулярные обследования и диагностические оценки. Инициативы правительства и НПО, направленные на популяризацию профилактических осмотров глаз, ускоряют внедрение этой практики. Создание специализированных офтальмологических клиник и диагностических центров расширяет доступ к услугам тестирования. Постоянное совершенствование диагностических инструментов на основе искусственного интеллекта (только для анализа изображений, не упомянутых в интеграции) повышает показатели выявления заболеваний. Увеличение инвестиций в офтальмологические исследования способствует разработке более точных диагностических устройств. Рост численности пожилого населения, более восприимчивого к заболеваниям глаз, еще больше увеличивает спрос на регулярные диагностические обследования.

• По заявлению

В зависимости от области применения, рынок лечения глазной боли в Северной Америке сегментирован на конъюнктивит, повреждение роговицы, блефарит, ячмень, ирит, синусит, мигрень, глаукому и другие заболевания. Сегмент конъюнктивита занимал наибольшую долю рынка (35,7%) в 2025 году благодаря чрезвычайно высокой распространенности заболевания во всех возрастных группах и тесной связи с глазной болью, раздражением, покраснением и дискомфортом. Как бактериальный, так и вирусный конъюнктивит вносят значительный вклад в амбулаторные посещения больниц и клиник. Сезонная аллергия и загрязнение окружающей среды еще больше увеличивают заболеваемость, что приводит к росту спроса на антибиотики, антигистаминные и противовоспалительные препараты. Особенно страдают дети школьного возраста и работающие взрослые, что приводит к увеличению объемов лечения. Заразный характер конъюнктивита требует раннего медицинского вмешательства, что усиливает спрос на фармацевтические препараты. Повышение осведомленности о гигиене глаз и инфекционном контроле увеличивает число диагностированных случаев. Системы здравоохранения в развивающихся и развитых регионах сообщают о неуклонном росте числа обращений по поводу конъюнктивита. Доступность безрецептурных лекарств также способствует доминированию этого сегмента. Кроме того, улучшенные методы диагностики помогают быстрее выявлять конъюнктивит, что приводит к более быстрому началу лечения и сохранению лидерства на рынке.

Ожидается, что сегмент лечения мигрени продемонстрирует самый быстрый среднегодовой темп роста в 9,8% в период с 2026 по 2033 год, обусловленный растущим глобальным бременем неврологических расстройств и состояний, связанных со стрессом. Боль в глазах является частым симптомом, связанным с приступами мигрени, что побуждает многих пациентов обращаться за целенаправленным лечением. Изменения образа жизни, повышенное воздействие экранов, нерегулярный режим сна и растущий стресс на работе способствуют росту распространенности мигрени во всем мире. Улучшенное распознавание симптомов мигрени, связанных с глазами, медицинскими работниками ускоряет диагностику. Интеграция междисциплинарного подхода к лечению с участием неврологов и офтальмологов приводит к более эффективному лечению боли при мигрени в глазах. Повышенный спрос на профилактические методы лечения мигрени и обезболивающие препараты поддерживает расширение этого сегмента. Повышение осведомленности посредством медицинских кампаний также побуждает пациентов обращаться за надлежащим лечением. Постоянные фармацевтические инновации, направленные на неврологические пути, еще больше способствуют высокому прогнозируемому росту.

• Путем введения

В зависимости от способа применения, рынок средств от глазной боли в Северной Америке сегментирован на местное, периорбитальное, внутриглазное и пероральное применение. Сегмент местного применения занимал наибольшую долю рынка, составляющую 48,5% в 2025 году, благодаря широкому использованию глазных капель, гелей и мазей для непосредственного лечения местной глазной боли. Местные лекарственные формы пользуются большим спросом благодаря быстрому действию, простоте применения и минимальным системным побочным эффектам. Их часто назначают при таких состояниях, как конъюнктивит, синдром сухого глаза, повреждения роговицы и блефарит. Расширение доступности препаратов без консервантов и длительного действия способствует их более широкому применению. Пациенты предпочитают местные препараты, поскольку они неинвазивны и могут применяться самостоятельно дома. Технологические достижения в системах доставки лекарственных средств улучшили абсорбцию и эффективность. Повышение осведомленности о раннем лечении глазных заболеваний увеличивает зависимость от местной терапии. Медицинские работники часто выбирают этот способ лечения в качестве первой линии, что делает его доминирующим сегментом. Увеличение производства лекарственных препаратов для наружного применения фармацевтическими компаниями еще больше укрепляет их рыночные позиции.

Ожидается, что сегмент пероральных препаратов продемонстрирует самый быстрый среднегодовой темп роста в 8,9% в период с 2026 по 2033 год, в основном из-за увеличения частоты возникновения глазной боли, вызванной системными и неврологическими заболеваниями, такими как синусит и мигрень. Пероральные анальгетики, противовоспалительные средства и антибиотики играют решающую роль в лечении иррадиационной или распространенной боли. Пациенты с хроническими заболеваниями часто нуждаются в длительном приеме пероральных препаратов, что увеличивает общий спрос. Растущая предпочтительность для пациентов неинвазивных и удобных методов лечения также способствует этому росту. Увеличение количества назначений препаратов от нейропатической боли стимулирует рост сегмента. Пероральные препараты легко доступны как по рецепту, так и без рецепта, что способствует их более широкому применению. Улучшение профилей безопасности лекарственных средств побуждает врачей чаще рекомендовать пероральные препараты. Расширение услуг телемедицины и электронного выписывания рецептов еще больше упрощает доступ к пероральным препаратам.

• По типу препарата

В зависимости от типа лекарственного препарата, рынок офтальмологических препаратов в Северной Америке сегментирован на рецептурные и безрецептурные (OTC) препараты. Рецептурный сегмент занимал наибольшую долю рынка (64,3%) в 2025 году благодаря важной роли антибиотиков, кортикостероидов и специализированных противовоспалительных препаратов, используемых при заболеваниях глаз средней и тяжелой степени. Сложные заболевания глаз, такие как глаукома, ирит, повреждение роговицы и инфекции, требуют профессиональной диагностики и лечения по рецепту. Пациенты, перенесшие хирургические вмешательства или страдающие хроническими заболеваниями глаз, в большей степени зависят от лечения под наблюдением врача. Рост числа офтальмологических операций и современных методов лечения поддерживает высокий спрос на рецептурные препараты. Внедрение новых фирменных офтальмологических препаратов с улучшенной эффективностью еще больше укрепляет этот сегмент. Рецептурные препараты также необходимы для контроля осложнений и предотвращения потери зрения. Больницы и специализированные клиники регулярно используют рецептурные препараты, что увеличивает общий объем рынка. Строгий регуляторный контроль обеспечивает доверие и авторитет, способствуя более высоким темпам внедрения. Расширение охвата медицинского страхования для приобретения рецептурных лекарств также способствует доминированию на рынке.

Ожидается, что сегмент безрецептурных лекарств продемонстрирует самый быстрый среднегодовой темп роста в 10,1% в период с 2026 по 2033 год, чему способствует растущая популярность самолечения и раннего купирования симптомов. Легкая боль, раздражение и сухость глаз все чаще лечатся безрецептурными увлажняющими средствами, антигистаминными препаратами и обезболивающими каплями. Рост осведомленности потребителей о здоровье глаз и легкая доступность продукции в розничных и онлайн-аптеках способствуют этому росту. Напряженный образ жизни и ограниченный доступ к немедленной консультации стимулируют использование безрецептурных препаратов. Усиление брендинга и маркетинга средств по уходу за глазами также повышает доверие потребителей. Улучшенное качество рецептуры сделало безрецептурные препараты более эффективными и безопасными для частого использования. Рост цифровой информации о здоровье и тенденции к самодиагностике еще больше способствуют распространению. Этот сегмент также выигрывает от снижения стоимости консультаций и удобства, что делает его очень привлекательным, особенно в развивающихся регионах.

• По типу населения

В зависимости от типа населения, рынок средств от глазной боли в Северной Америке сегментирован на взрослых и пожилых людей. Сегмент взрослых занимал наибольшую долю рынка, составляющую 57,8% выручки в 2025 году, в основном из-за более интенсивного использования цифровых экранов, загрязнения окружающей среды, перенапряжения глаз на рабочем месте и заболеваний глаз, связанных с образом жизни. Среди работающего населения наблюдается рост распространенности синдрома сухого глаза, аллергии, травм роговицы и инфекций. Длительное время, проведенное за экраном, и цифровая усталость значительно способствуют дискомфорту в глазах. Более активное обращение за медицинской помощью среди взрослых также увеличивает показатели диагностики и лечения. Рост использования контактных линз является еще одним ключевым фактором, увеличивающим количество осложнений со стороны глаз. Взрослое население чаще обращается за лечением для быстрого восстановления из-за опасений по поводу производительности труда. Лучший доступ к медицинским услугам и более высокая осведомленность о здоровье глаз дополнительно поддерживают лидерство сегмента. Взрослые также более склонны к мигрени и глазной боли, связанной с синуситом. Эти факторы в совокупности делают эту группу доминирующим потребителем средств от глазной боли.

Ожидается, что сегмент гериатрической помощи продемонстрирует самый быстрый среднегодовой темп роста в 9,4% в период с 2026 по 2033 год, обусловленный быстрым старением населения планеты и растущей распространенностью возрастных заболеваний глаз. Такие заболевания, как глаукома, катаракта (послеоперационная боль), дегенерация макулы и хронический синдром сухого глаза, широко распространены среди пожилых людей. Снижение иммунной функции делает пожилых людей более восприимчивыми к инфекциям и воспалениям. Частая необходимость в офтальмологических операциях у пожилых людей увеличивает потребность в обезболивании после операций. Растущие инвестиции в здравоохранение для пожилых людей еще больше усиливают спрос. Правительства во всем мире внедряют программы гериатрической офтальмологической помощи, поддерживая эту тенденцию. Увеличение продолжительности жизни также расширяет целевую базу для непрерывного лечения. Члены семьи и лица, осуществляющие уход, все чаще обращаются за специализированным лечением для пожилых пациентов, что способствует устойчивому росту рынка.

• Конечным пользователем

В зависимости от конечного пользователя, рынок лечения глазной боли в Северной Америке сегментирован на больницы, специализированные клиники, учреждения по оказанию медицинской помощи на дому, офтальмологические центры, амбулаторные хирургические центры и другие. Сегмент больниц занимал наибольшую долю рынка, составляющую 41,6% выручки в 2025 году, благодаря наличию современных диагностических и лечебных учреждений под одной крышей. Тяжелые случаи глазной боли, травмы глаз и послеоперационные состояния в основном лечатся в больницах. Наличие специализированных офтальмологов, неврологов и хирургических бригад приводит к увеличению потока пациентов. Экстренная офтальмологическая помощь более доступна в больницах, что повышает зависимость пациентов от этих учреждений. Развитая инфраструктура обеспечивает точную диагностику и своевременное лечение. Больницы также обслуживают большинство пациентов, получающих государственное финансирование и медицинскую страховку, что увеличивает их финансовую долю. Растущая урбанизация и развитие инфраструктуры в секторе здравоохранения еще больше повышают доступность больниц. Увеличение числа офтальмологических процедур также укрепляет этот сегмент. Высокое доверие пациентов обеспечивает сохранение лидирующих позиций.

Ожидается, что сегмент офтальмологических центров продемонстрирует самый быстрый среднегодовой темп роста в 10,3% в период с 2026 по 2033 год, что обусловлено растущим спросом на специализированные и целенаправленные услуги по уходу за глазами. Эти центры оснащены высококвалифицированными специалистами и передовыми технологиями для более эффективной диагностики и лечения глазной боли. Растущая популярность специализированной помощи по сравнению с общими больницами ускоряет приток пациентов в такие учреждения. Более быстрая запись на прием и более короткие периоды ожидания также способствуют их растущей популярности. Расширение частных офтальмологических сетей и франчайзинговых моделей дополнительно стимулирует рост. Увеличение инвестиций в современное диагностическое оборудование улучшает результаты лечения пациентов. Медицинский туризм для получения офтальмологической помощи также приносит пользу специализированным центрам. Индивидуальные планы лечения в таких учреждениях делают их очень привлекательными для долгосрочного лечения хронических заболеваний глаз.

• По каналам сбыта

В зависимости от канала сбыта, рынок лекарств от глазной боли в Северной Америке сегментирован на прямые тендеры, больничные аптеки, розничные аптеки, онлайн-аптеки и другие. Сегмент больничных аптек занимал наибольшую долю рынка, составляющую 39,2% выручки в 2025 году, поскольку большинство рецептурных препаратов от глазной боли отпускаются непосредственно в больницах. Это особенно характерно для хирургических пациентов и тех, кто нуждается в неотложной помощи. Тесная интеграция между диагностикой и лечением обеспечивает немедленный доступ к необходимым лекарствам. Больничные аптеки предлагают широкий ассортимент специализированных офтальмологических препаратов, включая инъекционные и современные лекарственные формы. Контролируемое распределение и профессиональный надзор гарантируют правильное использование. Увеличение числа госпитализаций по поводу заболеваний глаз укрепляет этот канал. Институциональные закупки через тендеры также обеспечивают стабильные поставки продукции. Врачи часто рекомендуют лекарства, доступные непосредственно в больничных аптеках, что увеличивает объемы продаж. Это удобство и надежность позволяют больничным аптекам оставаться доминирующим каналом сбыта.

Ожидается, что сегмент онлайн-аптек продемонстрирует самый быстрый среднегодовой темп роста в 11,5% в период с 2026 по 2033 год, чему способствуют быстрая цифровизация и растущая популярность доставки лекарств на дом. Рост использования смартфонов и проникновения интернета облегчает пациентам заказ глазных лекарств онлайн. Пациенты с хроническими заболеваниями, нуждающиеся в повторном приеме лекарств, предпочитают онлайн-варианты пополнения запасов. Конкурентоспособные цены, скидки и доставка на дом делают онлайн-каналы очень привлекательными. Развитие систем электронных рецептов также способствует использованию цифровых платформ. Повышение доверия к онлайн-фармацевтическим услугам еще больше стимулирует спрос. Расширение сети проверенных и регулируемых онлайн-аптек повышает безопасность и признание. Ожидается, что этот переход к цифровым решениям в сфере здравоохранения обеспечит устойчивый долгосрочный рост в этом сегменте.

Региональный анализ рынка глазной боли в Северной Америке

- Северная Америка доминировала на североамериканском рынке лечения глазной боли, занимая наибольшую долю выручки в 2025 году.

- Развитие системы здравоохранения, высокая осведомленность пациентов о здоровье глаз, широкая доступность диагностических учреждений и сильное присутствие ведущих фармацевтических компаний и производителей офтальмологических изделий являются движущей силой этого процесса.

- Увеличение распространенности таких заболеваний глаз, как синдром сухого глаза, глаукома и послеоперационные боли в глазах, еще больше ускорило спрос на эффективные методы лечения в регионе.

Анализ рынка глазной боли в США и Северной Америке

Рынок лечения глазной боли в Северной Америке доминировал на этом рынке, занимая 37,6% выручки в 2025 году. Этому способствовали хорошо развитая инфраструктура здравоохранения, широкий доступ к квалифицированным офтальмологам, высокие расходы на здравоохранение и присутствие крупных компаний, занимающихся разработкой инновационных офтальмологических препаратов и передовых решений для купирования боли. Рост числа случаев цифрового напряжения глаз, возрастных заболеваний глаз и послеоперационной глазной боли также вносит значительный вклад в рост рынка в стране.

Анализ рынка глазной боли в Канаде и Северной Америке

Ожидается, что рынок лечения глазной боли в Канаде станет самым быстрорастущим на североамериканском рынке, демонстрируя среднегодовой темп роста в 8,9% в течение прогнозируемого периода. Этот рост обусловлен увеличением инвестиций в инфраструктуру здравоохранения, ростом численности пожилого населения, подверженного хроническим заболеваниям глаз, улучшением доступа к услугам по уходу за зрением и повышением осведомленности о ранней диагностике и современных методах лечения глазной боли.

Доля рынка обезболивающих средств для глаз в Северной Америке

В отрасли лечения глазной боли лидируют преимущественно хорошо зарекомендовавшие себя компании, в том числе:

- Alcon Inc. (Швейцария)

- Santen Pharmaceutical Co., Ltd. (Япония)

- Sun Pharmaceutical Industries Ltd. (Индия)

- Teva Pharmaceutical Industries Ltd. (Израиль)

- Bayer AG (Германия)

- Otsuka Pharmaceutical Co., Ltd. (Япония)

- Merck & Co., Inc. (США)

- AbbVie Inc. (США)

- Aurobindo Pharma Ltd. (Индия)

- Cipla Ltd. (Индия)

- Компания Perrigo plc (Ирландия)

- Regeneron Pharmaceuticals, Inc. (США)

- Horizon Therapeutics (Ирландия)

- Лаборатории доктора Редди (Индия)

- Hikma Pharmaceuticals PLC (Великобритания)

Последние тенденции на рынке лечения глазной боли в Северной Америке

- В октябре 2021 года Управление по санитарному надзору за качеством пищевых продуктов и медикаментов США (FDA) одобрило назальный спрей TYRVAYA™ (раствор варениклина) для лечения признаков и симптомов синдрома сухого глаза, представив первую одобренную FDA назальную терапию для лечения этого состояния и предложив важную альтернативу для пациентов, испытывающих трудности с традиционным применением глазных капель, тем самым расширив возможности лечения дискомфорта в глазах.

- В октябре 2021 года FDA одобрило дополнительное показание для применения препарата DEXTENZA® (интраканальный имплантат дексаметазона), включающее лечение зуда в глазах, связанного с аллергическим конъюнктивитом, в дополнение к его существующему применению при послеоперационной боли и воспалении глаз, что усиливает роль систем доставки лекарственных средств пролонгированного действия в лечении дискомфорта, связанного с глазами.

- В ноябре 2022 года (сделка была завершена в январе 2023 года) компания Viatris объявила и завершила приобретение Oyster Point Pharma, разработчика препарата TYRVAYA, создав специализированное подразделение по уходу за глазами, направленное на расширение присутствия на североамериканском рынке офтальмологии и улучшение коммерческого охвата инновационных методов лечения боли и дискомфорта на поверхности глаза.

- В ноябре 2024 года компания Aldeyra Therapeutics объявила о том, что FDA приняло ее заявку на регистрацию нового лекарственного препарата репроксалап, новой местной терапии, разрабатываемой для лечения синдрома сухого глаза, и установило сроки рассмотрения заявки, что подчеркивает важность одной из наиболее пристально отслеживаемых разработок на поздних стадиях лечения глазной боли, вызванной воспалением.

- В апреле 2025 года FDA направило компании Reproxalap письмо с полным отказом в предоставлении информации, в котором указывалось на необходимость дополнительных клинических доказательств для подтверждения достаточной эффективности препарата. Это побудило компанию изложить планы дальнейших испытаний и повторной подачи заявки, что отражает строгие нормативные стандарты, применяемые к новым методам лечения в сегменте лечения глазной боли и сухости глаз.

- В мае 2025 года компания Alcon получила одобрение FDA на препарат TRYPTYR (офтальмологический раствор аколтремона) 0,003% для лечения признаков и симптомов синдрома сухого глаза, что укрепило ее портфель офтальмологических препаратов и подчеркнуло продолжающиеся инновации в терапии, направленной на устранение раздражения, дискомфорта и воспалительных компонентов глазной боли.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.