Рынок аутсорсинга нормативно-правовых актов IVD в Северной Америке по услугам (нормативная документация и подача документов, нормативная регистрация и заявки на клинические испытания, нормативный консалтинг, юридическое представительство, услуги по управлению данными, услуги по производству и контролю химии (CMC) и другие), показания (онкология, неврология, кардиология, клиническая химия и иммуноанализы, прецизионная медицина, инфекционные заболевания, диабет, генетическое тестирование, ВИЧ/СПИД, гематология , тестирование лекарств/фармакогеномика, переливание крови, точка оказания медицинской помощи и другие), режим развертывания (облачный и локальный), размер организации (малые и средние предприятия (SMES) и крупные предприятия), стадия (клиническая, доклиническая и PMA (пострегистрационная авторизация)), класс (класс I, класс II и класс III), конечный пользователь (фармацевтические компании, компании по производству медицинских приборов , биотехнологические компании и другие), страна (США, Канада, Мексика) Тенденции отрасли и прогноз до 2029 года.

Анализ рынка и идеи : рынок аутсорсинга нормативно-правового регулирования IVD в Северной Америке

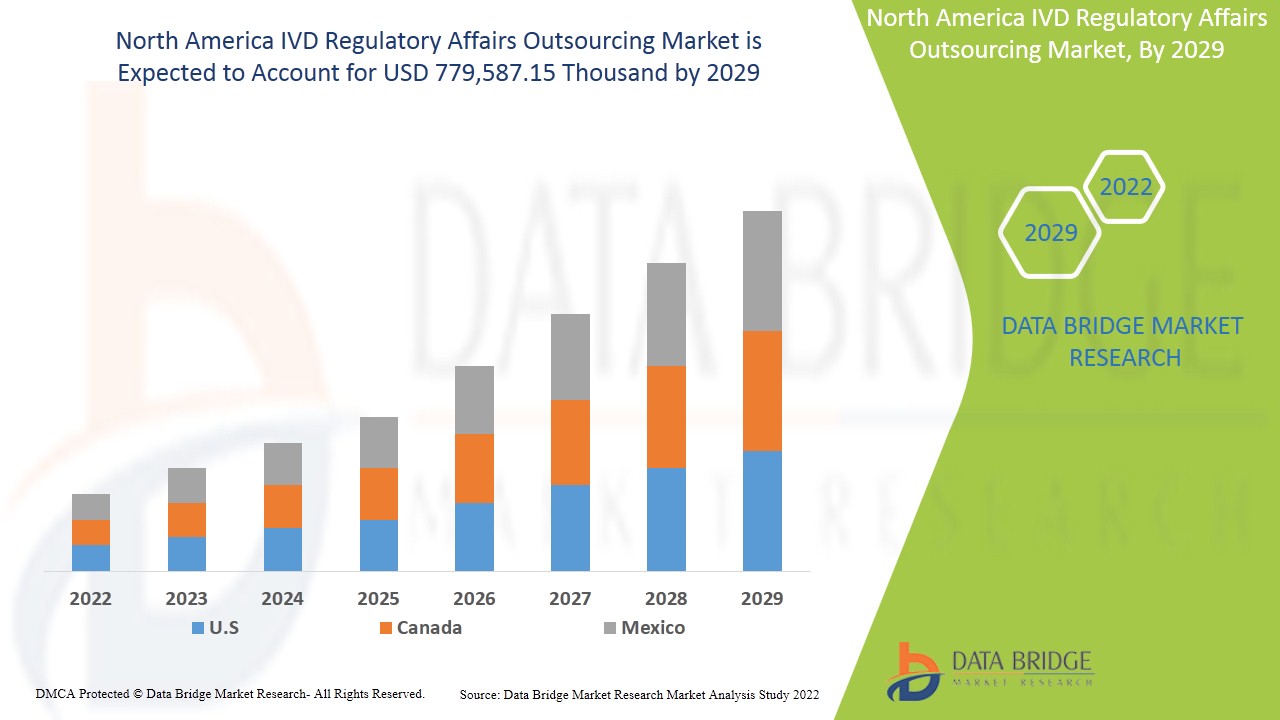

Ожидается, что рынок аутсорсинга регуляторных вопросов IVD в Северной Америке будет расти в прогнозируемый период с 2022 по 2029 год. По данным Data Bridge Market Research, среднегодовой темп роста рынка составит 13,4% в прогнозируемый период с 2022 по 2029 год, и ожидается, что к 2029 году он достигнет 779 587,15 тыс. долларов США.

- Продукция для диагностики in vitro — это реагенты, устройства и системы, используемые для диагностики заболеваний или других состояний, включая определение состояния здоровья для лечения, смягчения, лечения или профилактики заболеваний. Эти продукты предназначены для использования при сборе, подготовке и исследовании образцов человеческого тела. Нормативные вопросы играют важную роль в индустрии диагностических устройств in vitro (IVD) и медицинских устройств. Услуги аутсорсинга нормативно-правовых вопросов включают в себя написание и публикацию медицинской нормативной документации специалистами, которые вносят вклад в создание высококачественных документов для проектов клинических исследований. Спрос на аутсорсинг нормативно-правовых услуг существенно растет в клинических исследованиях, проводимых в странах с развивающейся экономикой, что обеспечивает здоровую платформу для роста этой отрасли.

Основными факторами, способствующими росту рынка аутсорсинга регуляторных вопросов IVD, являются развитие поддержки на основе проектов, что приводит к долгосрочному соглашению об аутсорсинге между организациями и технологическому прогрессу в различных диагностических устройствах in vitro. Увеличение деятельности по НИОКР компаниями по всему региону создает возможности для роста рынка. Более высокие затраты, связанные с обслуживанием и аутсорсингом IVD, являются основным сдерживающим фактором для рынка аутсорсинга регуляторных вопросов IVD. Нехватка квалифицированного персонала для работы с диагностическими устройствами in vitro является основным препятствием для роста рынка.

В этом отчете IVD по аутсорсингу рынка регуляторных вопросов содержатся сведения о доле рынка, новых разработках и анализе продуктового портфеля, влиянии внутренних и локальных игроков рынка, анализируются возможности с точки зрения новых источников дохода, изменений в рыночных правилах, одобрений продуктов, стратегических решений, запусков продуктов, географических расширений и технологических инноваций на рынке. Чтобы понять анализ и рыночный сценарий, свяжитесь с нами для получения аналитического обзора , наша команда поможет вам создать решение по влиянию на доход для достижения желаемой цели.

Масштаб и размер рынка аутсорсинга нормативно-правового регулирования IVD в Северной Америке

Рынок аутсорсинга нормативно-правового регулирования IVD в Северной Америке разделен на семь основных сегментов, которые основаны на услугах, показаниях, режиме развертывания, размере организации, этапе, классе и конечном пользователе.

- На основе услуг рынок аутсорсинга регуляторных вопросов IVD в Северной Америке сегментирован на написание и подачу нормативных документов, регистрацию нормативных документов и заявки на клинические испытания, консалтинг по нормативным вопросам, юридическое представительство, услуги по управлению данными, услуги по производству и контролю химии (CMC) и другие. Ожидается, что в 2022 году на рынке будут доминировать написание и подача нормативных документов, поскольку отрасль реагирует на несколько широко распространенных разработок, которые привели к инновациям и расширению технологий IVD. К этим масштабным тенденциям относятся старение населения, рост числа инфекционных заболеваний, влияние крупных технологических новаторов и принятие персонализированного ухода, а также стремление к простоте использования.

- На основе показаний рынок аутсорсинга вопросов регулирования IVD в Северной Америке сегментирован на онкологию, неврологию, кардиологию, клиническую химию и иммуноанализы, точную медицину, инфекционные заболевания, диабет, генетическое тестирование, ВИЧ/СПИД, гематологию, тестирование лекарств/фармакогеномику, переливание крови , пункт оказания медицинской помощи и др. Ожидается, что в 2022 году сегмент онкологии будет доминировать, поскольку он улучшает предсказуемость процесса разработки онкологических препаратов и становится полезным инструментом для онкологов при принятии решения о плане лечения пациента.

- На основе режима развертывания североамериканский рынок аутсорсинга регуляторных вопросов IVD сегментирован на облачный и локальный. Ожидается, что в 2022 году облачный сегмент будет доминировать, поскольку технология облачных вычислений в регулировании IVD обеспечивает стабильную инфраструктуру с максимальной производительностью для фирм, занимающихся системами IVD, благодаря своим экономически эффективным и гибким в плане решений свойствам.

- На основе размера организации рынок аутсорсинга регуляторных вопросов IVD в Северной Америке сегментируется на малые и средние предприятия (SMES) и крупные предприятия. Ожидается, что в 2022 году сегмент крупных предприятий будет доминировать, поскольку он вовлекает в себя высококачественные технологии и портфель услуг, связанных с регуляторными вопросами IVD.

- На основе стадии рынок аутсорсинга регуляторных вопросов IVD в Северной Америке сегментирован на клинический, доклинический и PMA (пострегистрационное разрешение). Ожидается, что в 2022 году клинический сегмент будет доминировать на рынке, поскольку клинические испытания требуют одобрения со стороны органов власти, каждый результат должен быть подан и тщательно зарегистрирован перед подачей заявок, услуги регуляторных вопросов пользуются большим спросом в этой области.

- На основе класса рынок аутсорсинга регуляторных вопросов IVD в Северной Америке сегментирован на класс I, класс II и класс III. Ожидается, что в 2022 году сегмент класса I будет доминировать на рынке, поскольку он не несет риска для общественного здоровья или имеет низкий личный риск с минимальными правилами. Они пользуются большим спросом, и 47% медицинских устройств попадают в эту категорию.

- На основе конечного пользователя североамериканский рынок аутсорсинга регуляторных вопросов IVD сегментирован на фармацевтические компании, компании по производству медицинских приборов, биотехнологические компании и т. д. Ожидается, что в 2022 году компании по производству медицинских приборов будут доминировать на рынке, внедряя различные эффективные технологические услуги и стандарты.

Анализ рынка аутсорсинга IVD-регулирования в Северной Америке на уровне страны

Проведен анализ рынка аутсорсинга нормативно-правового регулирования IVD в Северной Америке, а также предоставлена информация о размере рынка по стране, услугам, показаниям, режиму развертывания, размеру организации, этапу, классу и конечному пользователю.

В отчете о рынке аутсорсинга вопросов регулирования IVD в Северной Америке рассматриваются следующие страны: США, Мексика и Канада.

США доминируют на рынке Северной Америки благодаря растущему развитию новых технологий в секторе здравоохранения, а также стратегическим приобретениям и партнерствам между организациями.

Раздел отчета по странам также содержит отдельные факторы, влияющие на рынок, и изменения в регулировании на внутреннем рынке, которые влияют на текущие и будущие тенденции рынка. Такие данные, как новые продажи, замещающие продажи, демографические данные страны, нормативные акты и импортно-экспортные тарифы, являются одними из основных указателей, используемых для прогнозирования рыночного сценария для отдельных стран. Кроме того, при предоставлении прогнозного анализа данных по стране учитываются наличие и доступность глобальных брендов и их проблемы из-за большой или малой конкуренции со стороны местных и отечественных брендов, влияние каналов продаж.

Растущий спрос на аутсорсинг вопросов регулирования IVD

Рынок аутсорсинга регуляторных вопросов IVD в Северной Америке также предоставляет вам подробный анализ рынка для каждой страны, рост в отрасли с продажами, продажами компонентов, влиянием технологического развития на аутсорсинг регуляторных вопросов IVD и изменениями в сценариях регулирования с их поддержкой рынка аутсорсинга регуляторных вопросов IVD. Данные доступны за исторический период с 2012 по 2020 год.

Конкурентная среда и анализ доли рынка аутсорсинга нормативно-правового регулирования IVD в Северной Америке

Конкурентная среда рынка аутсорсинга регуляторных вопросов IVD в Северной Америке содержит сведения по конкурентам. Включены сведения о компании, финансы компании, полученный доход, рыночный потенциал, инвестиции в исследования и разработки, новые рыночные инициативы, глобальное присутствие, производственные площадки и объекты, сильные и слабые стороны компании, запуск продукта, конвейеры испытаний продукта, одобрения продукта, патенты, ширина и широта продукта, доминирование приложений, кривая жизненной линии технологии. Приведенные выше точки данных связаны только с фокусом компаний, связанным с рынком аутсорсинга регуляторных вопросов IVD в Северной Америке.

Некоторые из основных игроков, работающих в отчете, на рынке аутсорсинга регуляторных вопросов IVD: Freyr Solutions, AXSource, LORENZ Life Sciences Group, PPD Inc. (дочерняя компания Thremofisher Scientific Inc.), Promedica International, калифорнийская корпорация, Assent Compliance Inc., MakroCare, EMERGO, ICON, Parexel International Corporation, CRITERIUM, INC., Groupe ProductLife SA, Propharma Group, VCLS, Labcorp Drug Development, WuXi AppTec, Charles River Laboratories, Genpact, Medpace, Regulatory Compliance Associates Inc., RQM+, Saraca Solutions Private Limited, PBC BioMed, Dor Pharmaceutical Services, Qserve, mdiConsultants, Inc. и другие. Аналитики DBMR понимают конкурентные преимущества и предоставляют конкурентный анализ для каждого конкурента отдельно.

Многие разработки продуктов также инициируются компаниями по всему миру, что также ускоряет рост рынка аутсорсинга нормативно-правового регулирования IVD в Северной Америке.

Например,

- В сентябре 2021 года Tánaiste объявляет о многомиллионном финансировании НИОКР ICON plc для ускорения технологии децентрализованных клинических испытаний. Tánaiste и министр предпринимательства, торговли и занятости Лео Варадкар TD объявили, что ICON plc (NASDAQ: ICLR), базирующийся в Дублине глобальный поставщик услуг по разработке и коммерциализации лекарственных препаратов для фармацевтической, биотехнологической и медицинской промышленности, получил 4 миллиона долларов США на финансирование НИОКР, администрируемое Enterprise Ireland, для дальнейшего совершенствования своих решений в области данных и технологии децентрализованных клинических испытаний. Это помогло компании улучшить свои позиции на рынке.

- В октябре 2021 года группа Propharma приобрела Pharmica Consulting. ProPharma Group, портфельная компания Odyssey Investment Partners, приобрела Pharmica Consulting, консалтинговую компанию в области естественных наук, которая предоставляет консалтинговые решения по управлению проектами (PM) и фирменное программное обеспечение для операций фармацевтическим и биотехнологическим компаниям для проведения клинических испытаний. Это помогло компании расширить свой бизнес на глобальном рынке.

Партнерство, совместные предприятия и другие стратегии увеличивают долю рынка компании за счет увеличения охвата и присутствия. Это также дает преимущество организациям в улучшении их предложения по аутсорсингу регуляторных вопросов IVD за счет расширения диапазона размеров.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Содержание

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 SERVICE TIMELINE CURVE

2.1 MARKET END USER COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, REGULATORY SCENARIO

4.1.1 THE U.S.

4.1.2 REGULATIONS IN EUROPE

4.1.3 REGULATIONS IN ASIA

4.1.3.1 CHINA

4.1.3.2 SOUTH KOREA

4.1.3.3 MALAYSIA

4.1.3.4 THAILAND

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISE IN PREVALENCE OF CHRONIC DISEASES ACROSS THE REGION

5.1.2 TECHNOLOGICAL ADVANCEMENT IN DEVELOPING VARIOUS IN VITRO DIAGNOSTIC DEVICES

5.1.3 DEVELOPMENT OF PROJECT-BASED SUPPORT LEADS TO LONG TERM OUTSOURCING AGREEMENT AMONG ORGANIZATION

5.1.4 INCREASE IN PRODUCT REGISTRATION NUMBERS AND CLINICAL TRIAL APPROVALS ACROSS THE REGION

5.2 RESTRAINTS

5.2.1 STRINGENT REGULATIONS REGARDING MEDICAL DEVICES IN DIFFERENT REGIONS

5.2.2 HIGHER COST RELATED TO MAINTENANCE AND OUTSOURCING OF IVD

5.3 OPPORTUNITIES

5.3.1 RISE IN STRATEGIC ACQUISITION & PARTNERSHIP AMONG ORGANIZATION

5.3.2 EMERGENCE OF VARIOUS EFFICIENT TECHNOLOGICAL SERVICES AND STANDARDS

5.3.3 INCREASE IN R&D ACTIVITIES BY COMPANIES ACROSS THE REGION

5.4 CHALLENGES

5.4.1 LACK OF INFRASTRUCTURE IN HEALTHCARE SERVICE

5.4.2 SHORTAGE OF SKILLED PERSONNEL FOR HANDLING IN VITRO DIAGNOSTIC DEVICES

6 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE

6.1 OVERVIEW

6.2 REGULATORY WRITING & SUBMISSIONS

6.3 LEGAL REPRESENTATION

6.4 REGULATORY CONSULTING

6.5 REGULATORY REGISTRATION & CLINICAL TRIAL APPLICATIONS

6.6 CHEMISTRY MANUFACTURING AND CONTROLS (CMC) SERVICES

6.7 DATA MANAGEMENT SERVICES

6.8 OTHERS

7 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY INDICATION

7.1 OVERVIEW

7.2 CLINICAL CHEMISTRY AND IMMUNOASSAYS

7.3 INFECTIOUS DISEASES

7.3.1 VIROLOGY

7.3.2 MICROBIOLOGY AND MYCOLOGY

7.3.3 BACTERIOLOGY

7.3.4 SEPSIS

7.3.5 HEPATITIS B

7.3.6 HEPATITIS C

7.3.7 MALARIA

7.3.8 TUBERCULOSIS

7.3.9 SYPHILIS

7.3.10 HUMAN PAPILLOMAVIRUS (HPV) INFECTION

7.3.11 OTHERS

7.4 HAEMATOLOGY

7.5 DRUG TESTING/PHARMACOGENOMICS

7.6 PRECISION MEDICINE

7.7 DIABETES

7.8 BLOOD TRANSFUSION

7.9 CARDIOLOGY

7.1 POINT OF CARE

7.10.1 WAIVED TEST

7.10.2 AT HOME TESTS

7.11 ONCOLOGY

7.12 NEUROLOGY

7.13 HIV/AIDS

7.14 GENETIC TESTING

7.15 OTHERS

8 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY CLASS

8.1 OVERVIEW

8.2 CLASS I

8.3 CLASS III

8.4 CLASS II

9 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY DEPLOYMENT MODE

9.1 OVERVIEW

9.2 CLOUD

9.3 ON-PREMISES

10 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE

10.1 OVERVIEW

10.2 LARGE ENTERPRISES

10.3 SMALL & MEDIUM ENTERPRISES (SMES)

11 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY STAGE

11.1 OVERVIEW

11.2 CLINICAL

11.3 PRECLINICAL

11.4 PMA (POST MARKET AUTHORIZATION)

12 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY END USER

12.1 OVERVIEW

12.2 MEDICAL DEVICE COMPANIES

12.2.1 BY ORGANIZATION SIZE

12.2.1.1 LARGE ENTERPRISES

12.2.1.2 SMALL & MEDIUM ENTERPRISES (SMES)

12.2.2 BY SERVICE

12.2.2.1 REGULATORY WRITING & SUBMISSIONS

12.2.2.2 LEGAL REPRESENTATION

12.2.2.3 REGULATORY CONSULTING

12.2.2.4 REGULATORY REGISTRATION & CLINICAL TRIAL APPLICATIONS

12.2.2.5 CHEMISTRY MANUFACTURING AND CONTROLS (CMC) SERVICES

12.2.2.6 DATA MANAGEMENT SERVICES

12.2.2.7 OTHERS

12.3 PHARMACEUTICAL COMPANIES

12.3.1 BY ORGANIZATION SIZE

12.3.1.1 LARGE ENTERPRISES

12.3.1.2 SMALL & MEDIUM ENTERPRISES (SMES)

12.3.2 BY SERVICE

12.3.2.1 REGULATORY WRITING & SUBMISSIONS

12.3.2.2 LEGAL REPRESENTATION

12.3.2.3 REGULATORY CONSULTING

12.3.2.4 REGULATORY REGISTRATION & CLINICAL TRIAL APPLICATIONS

12.3.2.5 CHEMISTRY MANUFACTURING AND CONTROLS (CMC) SERVICES

12.3.2.6 DATA MANAGEMENT SERVICES

12.3.2.7 OTHERS

12.4 BIOTECHNOLOGY COMPANIES

12.4.1 BY ORGANIZATION SIZE

12.4.1.1 LARGE ENTERPRISES

12.4.1.2 SMALL & MEDIUM ENTERPRISES (SMES)

12.4.2 BY SERVICE

12.4.2.1 REGULATORY WRITING & SUBMISSIONS

12.4.2.2 LEGAL REPRESENTATION

12.4.2.3 REGULATORY CONSULTING

12.4.2.4 REGULATORY REGISTRATION & CLINICAL TRIAL APPLICATIONS

12.4.2.5 CHEMISTRY MANUFACTURING AND CONTROLS (CMC) SERVICES

12.4.2.6 DATA MANAGEMENT SERVICES

12.4.2.7 OTHERS

12.5 OTHERS

13 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION

13.1 NORTH AMERICA

13.1.1 U.S.

13.1.2 CANADA

13.1.3 MEXICO

14 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 ICON PLC

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENTS

16.2 MEDPACE

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENTS

16.3 PAREXEL INTERNATIONAL CORPORATION

16.3.1 COMPANY SNAPSHOT

16.3.2 COMPANY SHARE ANALYSIS

16.3.3 PRODUCT PORTFOLIO

16.3.4 RECENT DEVELOPMENTS

16.4 LABCORP DRUG DEVELOPMENT

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENT

16.5 PPD INC. (A SUBSIDIARY OF THERMOFISHER SCIENTIFIC INC.)

16.5.1 COMPANY SNAPSHOT

16.5.2 COMPANY SHARE ANALYSIS

16.5.3 PRODUCT PORTFOLIO

16.5.4 RECENT DEVELOPMENTS

16.6 CHARLES RIVER LABORATORIES

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 PRODUCT PORTFOLIO

16.6.4 RECENT DEVELOPMENTS

16.7 FREYR

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENTS

16.8 ASSENT COMPLIANCE INC.

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENT

16.9 ANDAMAN MEDICAL

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENT

16.1 ASIA ACTUAL

16.10.1 COMPANY SNAPSHOT

16.10.2 SERVICE PORTFOLIO

16.10.3 RECENT DEVELOPMENTS

16.11 AXSOURCE

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENTS

16.12 CRITERIUM, INC.

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENT

16.13 DOR PHARMACEUTICAL SERVICES

16.13.1 COMPANY SNAPSHOT

16.13.2 SERVICE PORTFOLIO

16.13.3 RECENT DEVELOPMENTS

16.14 EMERGO BY UL

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENTS

16.15 GENPACT

16.15.1 COMPANY SNAPSHOT

16.15.2 REVENUE ANALYSIS

16.15.3 PRODUCT PORTFOLIO

16.15.4 RECENT DEVELOPMENTS

16.16 GROUPE PRODUCTLIFE S.A.

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENTS

16.17 LORENZ LIFE SCIENCES GROUP

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENTS

16.18 MAKROCARE

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENTS

16.19 MARACA INTERNATIONAL BVBA

16.19.1 COMPANY SNAPSHOT

16.19.2 SERVICE PORTFOLIO

16.19.3 RECENT DEVELOPMENTS

16.2 MDICONSULTANTS, INC.

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENTS

16.21 PBC BIOMED

16.21.1 COMPANY SNAPSHOT

16.21.2 PRODUCT PORTFOLIO

16.21.3 RECENT DEVELOPMENT

16.22 PROMEDICA INTERNATIONAL, A CALIFORNIA CORPORATION

16.22.1 COMPANY SNAPSHOT

16.22.2 PRODUCT PORTFOLIO

16.22.3 RECENT DEVELOPMENT

16.23 PROPHARMA GROUP

16.23.1 COMPANY SNAPSHOT

16.23.2 PRODUCT PORTFOLIO

16.23.3 RECENT DEVELOPMENTS

16.24 QSERVE

16.24.1 COMPANY SNAPSHOT

16.24.2 SERVICE PORTFOLIO

16.24.3 RECENT DEVELOPMENTS

16.25 REGULATORY COMPLIANCE ASSOCIATES INC.

16.25.1 COMPANY SNAPSHOT

16.25.2 PRODUCT PORTFOLIO

16.25.3 RECENT DEVELOPMENT

16.26 RMQ+

16.26.1 COMPANY SNAPSHOT

16.26.2 PRODUCT PORTFOLIO

16.26.3 RECENT DEVELOPMENT

16.27 SARACA SOLUTIONS PRIVATE LIMITED

16.27.1 COMPANY SNAPSHOT

16.27.2 PRODUCT PORTFOLIO

16.27.3 RECENT DEVELOPMENT

16.28 VCLS

16.28.1 COMPANY SNAPSHOT

16.28.2 PRODUCT PORTFOLIO

16.28.3 RECENT DEVELOPMENTS

16.29 WUXI APPTEC

16.29.1 COMPANY SNAPSHOT

16.29.2 REVENUE ANALYSIS

16.29.3 PRODUCT PORTFOLIO

16.29.4 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

Список таблиц

TABLE 1 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 2 NORTH AMERICA REGULATORY WRITING & SUBMISSIONS IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 3 NORTH AMERICA LEGAL REPRESENTATION IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 4 NORTH AMERICA REGULATORY CONSULTING IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 5 NORTH AMERICA REGULATORY REGISTRATION & CLINICAL TRIAL APPLICATIONS IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 6 NORTH AMERICA CHEMISTRY MANUFACTURING AND CONTROLS (CMC) SERVICES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 7 NORTH AMERICA DATA MANAGEMENT SERVICES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 8 NORTH AMERICA OTHERS IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 9 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY INDICATION, 2020-2029 (USD THOUSAND)

TABLE 10 NORTH AMERICA CLINICAL CHEMISTRY AND IMMUNOASSAYS IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 11 NORTH AMERICA INFECTIOUS DISEASES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION,2020-2029 (THOUSAND)

TABLE 12 NORTH AMERICA INFECTIOUS DISEASES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 13 NORTH AMERICA HAEMATOLOGY IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 14 NORTH AMERICA DRUG TESTING/PHARMACOGENOMICS IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (THOUSAND)

TABLE 15 NORTH AMERICA PRECISION MEDICINE IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (THOUSAND)

TABLE 16 NORTH AMERICA DIABETES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (THOUSAND)

TABLE 17 NORTH AMERICA BLOOD TRANSFUSION IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (THOUSAND)

TABLE 18 NORTH AMERICA CARDIOLOGY IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (THOUSAND)

TABLE 19 NORTH AMERICA POINT OF CARE IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (THOUSAND)

TABLE 20 NORTH AMERICA POINT OF CARE IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 21 NORTH AMERICA ONCOLOGY IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (THOUSAND)

TABLE 22 NORTH AMERICA NEUROLOGY IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (THOUSAND)

TABLE 23 NORTH AMERICA HIV/AIDS IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (THOUSAND)

TABLE 24 NORTH AMERICA GENETIC TESTING IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (THOUSAND)

TABLE 25 NORTH AMERICA OTHERS IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (THOUSAND)

TABLE 26 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY CLASS, 2020-2029 (USD THOUSAND)

TABLE 27 NORTH AMERICA CLASS I IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 28 NORTH AMERICA CLASS III IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (THOUSAND)

TABLE 29 NORTH AMERICA CLASS II IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 30 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD THOUSAND)

TABLE 31 NORTH AMERICA CLOUD IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 32 NORTH AMERICA ON-PREMISES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 33 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD THOUSAND)

TABLE 34 NORTH AMERICA LARGE ENTERPRISES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 35 NORTH AMERICA SMALL & MEDIUM ENTERPRISES (SMES) IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 36 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY STAGE, 2020-2029 (USD THOUSAND)

TABLE 37 NORTH AMERICA CLINICAL IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 38 NORTH AMERICA PRECLINICAL IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 39 NORTH AMERICA PMA (POST MARKET AUTHORIZATION) IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 40 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 41 NORTH AMERICA MEDICAL DEVICE COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 42 NORTH AMERICA MEDICAL DEVICE COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 43 NORTH AMERICA MEDICAL DEVICE COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 44 NORTH AMERICA PHARMACEUTICAL COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 45 NORTH AMERICA PHARMACEUTICAL COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 46 NORTH AMERICA PHARMACEUTICAL COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 47 NORTH AMERICA BIOTECHNOLOGY COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 48 NORTH AMERICA BIOTECHNOLOGY COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 49 NORTH AMERICA BIOTECHNOLOGY COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 50 NORTH AMERICA OTHERS IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 51 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 52 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 53 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY INDICATION, 2020-2029 (USD THOUSAND)

TABLE 54 NORTH AMERICA INFECTIOUS DISEASES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 55 NORTH AMERICA POINT OF CARE IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 56 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD THOUSAND)

TABLE 57 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 58 NORTH AMERICA REGULATORY AFFAIRS OUTSOURCING MARKET, BY STAGE, 2020-2029 (USD THOUSAND)

TABLE 59 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY CLASS, 2020-2029 (USD THOUSAND)

TABLE 60 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 61 NORTH AMERICA MEDICAL DEVICE COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 62 NORTH AMERICA MEDICAL DEVICE COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 63 NORTH AMERICA PHARMACEUTICAL COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 64 NORTH AMERICA PHARMACEUTICAL COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 65 NORTH AMERICA BIOTECHNOLOGY COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 66 NORTH AMERICA BIOTECHNOLOGY COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 67 U.S. IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 68 U.S. IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY INDICATION, 2020-2029 (USD THOUSAND)

TABLE 69 U.S. INFECTIOUS DISEASES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 70 U.S. POINT OF CARE IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 71 U.S. IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD THOUSAND)

TABLE 72 U.S. IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 73 U.S. REGULATORY AFFAIRS OUTSOURCING MARKET, BY STAGE, 2020-2029 (USD THOUSAND)

TABLE 74 U.S. IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY CLASS, 2020-2029 (USD THOUSAND)

TABLE 75 U.S. IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 76 U.S. MEDICAL DEVICE COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 77 U.S. MEDICAL DEVICE COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 78 U.S. PHARMACEUTICAL COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 79 U.S. PHARMACEUTICAL COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 80 U.S. BIOTECHNOLOGY COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 81 U.S. BIOTECHNOLOGY COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 82 CANADA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 83 CANADA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY INDICATION, 2020-2029 (USD THOUSAND)

TABLE 84 CANADA INFECTIOUS DISEASES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 85 CANADA POINT OF CARE IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 86 CANADA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD THOUSAND)

TABLE 87 CANADA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 88 CANADA REGULATORY AFFAIRS OUTSOURCING MARKET, BY STAGE, 2020-2029 (USD THOUSAND)

TABLE 89 CANADA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY CLASS, 2020-2029 (USD THOUSAND)

TABLE 90 CANADA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 91 CANADA MEDICAL DEVICE COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 92 CANADA MEDICAL DEVICE COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 93 CANADA PHARMACEUTICAL COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 94 CANADA PHARMACEUTICAL COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 95 CANADA BIOTECHNOLOGY COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 96 CANADA BIOTECHNOLOGY COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 97 MEXICO IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 98 MEXICO IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY INDICATION, 2020-2029 (USD THOUSAND)

TABLE 99 MEXICO INFECTIOUS DISEASES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 100 MEXICO POINT OF CARE IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 101 MEXICO IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD THOUSAND)

TABLE 102 MEXICO IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 103 MEXICO REGULATORY AFFAIRS OUTSOURCING MARKET, BY STAGE, 2020-2029 (USD THOUSAND)

TABLE 104 MEXICO IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY CLASS, 2020-2029 (USD THOUSAND)

TABLE 105 MEXICO IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 106 MEXICO MEDICAL DEVICE COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 107 MEXICO MEDICAL DEVICE COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 108 MEXICO PHARMACEUTICAL COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 109 MEXICO PHARMACEUTICAL COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 110 MEXICO BIOTECHNOLOGY COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 111 MEXICO BIOTECHNOLOGY COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

Список рисунков

FIGURE 1 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET: END USER COVERAGE GRID

FIGURE 10 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET: SEGMENTATION

FIGURE 11 RISE IN THE PREVALENCE OF CHRONIC DISEASES ACROSS IS EXPECTED TO DRIVE NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 SERVICE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET IN 2022 & 2029

FIGURE 13 ASIA-PACIFIC IS EXPECTED TO DOMINATE AND IS THE FASTEST GROWING REGION IN THE NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES FOR NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET

FIGURE 15 MULTIPLE CHRONIC CONDITIONS AMONG PEOPLE AGED 65 AND ABOVE IN EUROPEAN REGION (2017)

FIGURE 16 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET: BY SERVICE, 2021

FIGURE 17 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET: BY INDICATION, 2021

FIGURE 18 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET: BY CLASS, 2021

FIGURE 19 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET: BY DEPLOYMENT MODE, 2021

FIGURE 20 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET: BY ORGANIZATION SIZE, 2021

FIGURE 21 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET: BY STAGE, 2021

FIGURE 22 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET: BY END USER, 2021

FIGURE 23 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET: SNAPSHOT (2021)

FIGURE 24 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET: BY COUNTRY (2021)

FIGURE 25 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET: BY COUNTRY (2022 & 2029)

FIGURE 26 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET: BY COUNTRY (2021 & 2029)

FIGURE 27 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET: BY SERVICE (2022-2029)

FIGURE 28 NORTH AMERICA IVD REGULATORY AFFAIRS OUTSOURCING MARKET: COMPANY SHARE 2021 (%)

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.