Рынок наследственных заболеваний сетчатки в Северной Америке по типу заболевания (пигментный ретинит, болезнь Штаргардта, ахроматопсия , дистрофия колбочек и палочек, хоридеремия, врожденный амавроз Лебера, отек желтого пятна и другие), по типу (диагностика и терапия), конечные пользователи (больницы, специализированные клиники, амбулаторные хирургические центры, уход на дому и другие), канал сбыта (розничные продажи и прямые торги), тенденции отрасли и прогноз до 2029 года.

Анализ рынка и идеи: рынок наследственных заболеваний сетчатки в Северной Америке

Наследственные заболевания сетчатки (IRD) — это группа заболеваний, которые могут привести к серьезной потере зрения или даже слепоте. Каждое IRD вызвано как минимум одним геном, который не работает должным образом. IRD могут поражать людей всех возрастов, могут прогрессировать с разной скоростью и встречаются редко. Однако многие из них являются дегенеративными, что означает, что симптомы заболевания со временем будут ухудшаться. Распространенные типы IRD включают врожденный амавроз Лебера (LCA), пигментный ретинит, хоридеремию, болезнь Штаргардта и ахроматопсию. Цель генной терапии — исправить или компенсировать дефектный ген. IRD являются особенно сильными кандидатами на лечение генной терапией из-за уникального физического строения сетчатки . По сравнению с другими органами тела глаз мал и легко доступен для введения лечения. Однако некоторые области тела являются иммунно-привилегированными, что означает, что нормальный иммунный ответ не так активен. Обычно это происходит в областях нашего тела, которые очень важны и могут быть повреждены, если возникает отек или воспаление. Это означает, что все, что имплантируется в глаз — например, клетка с исправленным геном — с меньшей вероятностью будет отторгнуто.

Диагностика и лечение наследственных заболеваний сетчатки состоят из различных методов, которые позволяют диагностировать наследственные заболевания сетчатки после одобрения продукта. Лечение заболевания недавно одобрено, что поддерживает рост рынка.

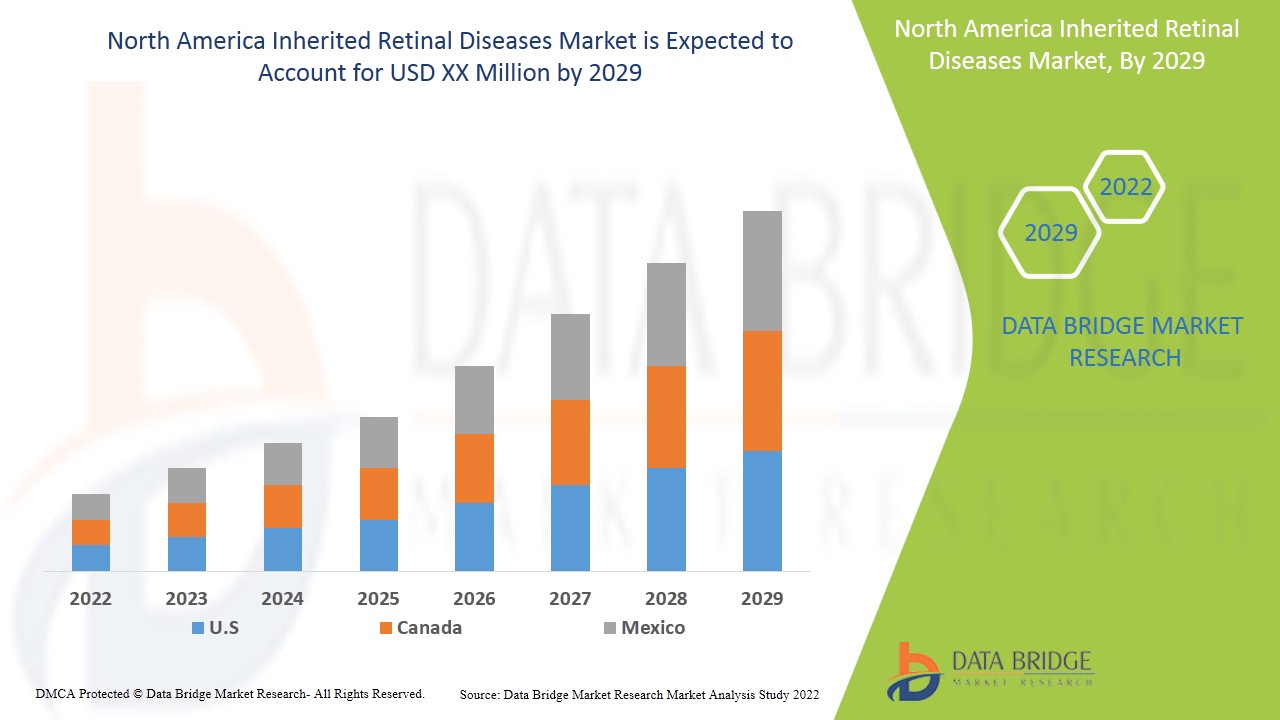

Наследственные заболевания сетчатки являются поддерживающими и направлены на замедление прогрессирования заболевания. Data Bridge Market Research анализирует, что рынок наследственных заболеваний сетчатки будет расти в среднем на 7,6% в течение прогнозируемого периода с 2022 по 2029 год.

|

Отчет Метрика |

Подробности |

|

Прогнозируемый период |

2022-2029 |

|

Базовый год |

2021 |

|

Исторические годы |

2020 (Можно настроить на 2019 - 2014) |

|

Количественные единицы |

Доход в млн. долл. США, объемы в единицах, цены в долл. США |

|

Охваченные сегменты |

Тип заболевания (пигментный ретинит, болезнь Штаргардта, ахроматопсия, дистрофия колбочек и палочек, хориоидеремия, врожденный амавроз Лебера, отек желтого пятна и другие), по типу (диагностика и терапия), конечные пользователи (больницы, специализированные клиники, амбулаторные хирургические центры, домашняя медицинская помощь и другие), канал сбыта (розничные продажи и прямые торги) |

|

Страны, охваченные |

США, Канада и Мексика в Северной Америке |

|

Охваченные участники рынка |

Spark Therapeutics, Novartis AG, Okuvision, Nidek Co. Ltd., Invitae Corporation, Carl Zeiss Meditech AG, Optos (дочерняя компания Nikon Corporation), Neurosoft, PIXIUM VISION, LKC TECHNOLOGIES, INC., Renurone, Astellas Pharma, REGENXBIO Inc., Ionis Pharmaceutics, Sparing Vision, Ocugen Inc, Johnson & Johnson, IVERIC bio, Second Sight, Coave Therapeutics, MeiraGTx Limited, Gensight Biologics, ProQR Therapeutics, Bionic Vision Technologies |

Динамика рынка наследственных заболеваний сетчатки

Драйверы

- Рост распространенности наследственных заболеваний сетчатки

Ожидается, что растущая распространенность и постоянное открытие новых мутагенных участков, которые передаются генетически, станут движущей силой роста рынка. Распространенность моногенных IRD составляет примерно 1 на 2000, затрагивая два миллиона человек в сети.

- Увеличение поставок продукции на рынок

Поскольку активность клинических испытаний поднимается на новый уровень, эта область, по-видимому, готова к быстрым и важным достижениям в исследованиях IRD и уходе за пациентами. Это всего лишь несколько обычных испытаний, поэтому компании, работающие на этом рынке, постоянно проводят клинические испытания и подвергают своих кандидатов клиническим испытаниям. Ожидается, что это создаст возможность и подстегнет рынок наследственных заболеваний сетчатки в Северной Америке. Высокая распространенность генетических заболеваний

Кроме того, рост распространенности некоторых генетических заболеваний, таких как синдром Миллера-Дикера и синдром Уокера-Варбурга, будет способствовать дальнейшему росту рынка наследственных заболеваний сетчатки.

Кроме того, рост стратегических инициатив ключевых игроков, прогресс в области медицинских технологий, увеличение одобрения продукции для IRD, растущие инициативы государственных и частных организаций по распространению информации и растущее государственное финансирование являются факторами, которые расширят рынок наследственных заболеваний сетчатки. Другие факторы, такие как рост спроса на эффективные методы лечения и рост внедрения раннего генетического консультирования, окажут положительное влияние на темпы роста рынка наследственных заболеваний сетчатки. Кроме того, высокий располагаемый доход, рост числа случаев различных заболеваний сетчатки приведут к расширению рынка наследственных заболеваний сетчатки.

Возможности

- Увеличение государственных инициатив в отношении наследственных заболеваний сетчатки.

Более того, рост осведомленности и обращаемости за лечением, а также появление политики возмещения расходов на лечение откроют новые возможности для темпов роста рынка.

Кроме того, запуск эффективных методов лечения и непрерывные клинические испытания предоставят благоприятные возможности для рынка наследственных заболеваний сетчатки в прогнозируемый период 2022-2029 гг. Кроме того, высокая неудовлетворенная потребность в текущем лечении и разработках в области медицинских технологий ускорит темпы роста рынка наследственных заболеваний сетчатки в будущем.

Ограничения/Проблемы

Однако высокая стоимость доступного лечения и отсутствие инфраструктуры в странах с низким уровнем дохода будут сдерживать темпы роста рынка наследственных заболеваний сетчатки. Кроме того, нехватка квалифицированных специалистов и осложнения, связанные с заболеванием, будут сдерживать рост рынка наследственных заболеваний сетчатки.

В этом отчете о рынке наследственных заболеваний сетчатки содержатся сведения о последних новых разработках, правилах торговли, анализе импорта-экспорта, анализе производства, оптимизации цепочки создания стоимости, доле рынка, влиянии внутренних и локальных игроков рынка, анализируются возможности с точки зрения новых источников дохода, изменений в правилах рынка, анализ стратегического роста рынка, размер рынка, рост рынка категорий, ниши приложений и доминирование, одобрения продуктов, запуски продуктов, географические расширения, технологические инновации на рынке. Чтобы получить больше информации о рынке наследственных заболеваний сетчатки, свяжитесь с Data Bridge Market Research для получения аналитического обзора , наша команда поможет вам принять обоснованное рыночное решение для достижения роста рынка.

Анализ эпидемиологии пациентов

Наследственное заболевание сетчатки — это генетическое заболевание, которое встречается относительно редко и частота которого неизвестна. Согласно исследованию наследственных заболеваний сетчатки, распространенность IRD составляет 1 на 3000.

Пигментный ретинит является наиболее распространенным заболеванием среди других заболеваний. Пигментный ретинит представляет собой группу связанных заболеваний глаз, вызванных вариациями в 60 генах, которые влияют на сетчатку. IRD представляют собой гетерогенную группу сиротских заболеваний глаз с распространенностью, оцениваемой в 0,06% и 0,2%, с нагрузкой IRD в Северной Америке в диапазоне 5–10 миллионов человек.

Рынок наследственных заболеваний сетчатки также предоставляет вам подробный анализ рынка для анализа пациента, прогноза и лечения. Распространенность, заболеваемость, смертность, показатели соблюдения — вот некоторые из переменных данных, которые доступны в отчете. Анализируется прямое или косвенное влияние эпидемиологии на рост рынка для создания более надежной и когортной многомерной статистической модели для прогнозирования рынка в период роста.

Влияние COVID-19 на рынок наследственных заболеваний сетчатки

COVID-19 негативно повлиял на рынок. Блокировки и изоляция во время пандемий усложняют лечение заболеваний и соблюдение режима приема лекарств. Отсутствие доступа к медицинским учреждениям для планового лечения и приема лекарств еще больше повлияет на рынок. Социальная изоляция усиливает стресс, отчаяние и социальную поддержку, что может привести к снижению соблюдения режима приема противосудорожных препаратов во время пандемии.

Недавнее развитие

- В январе 2022 года ведущая мировая организация, занимающаяся поиском методов лечения и излечения заболеваний сетчатки, приводящих к слепоте, объявила о запуске Расширенной программы ускорения трансляционных исследований Фонда Дианы Дэвис Спенсер.

Объем рынка наследственных заболеваний сетчатки в Северной Америке

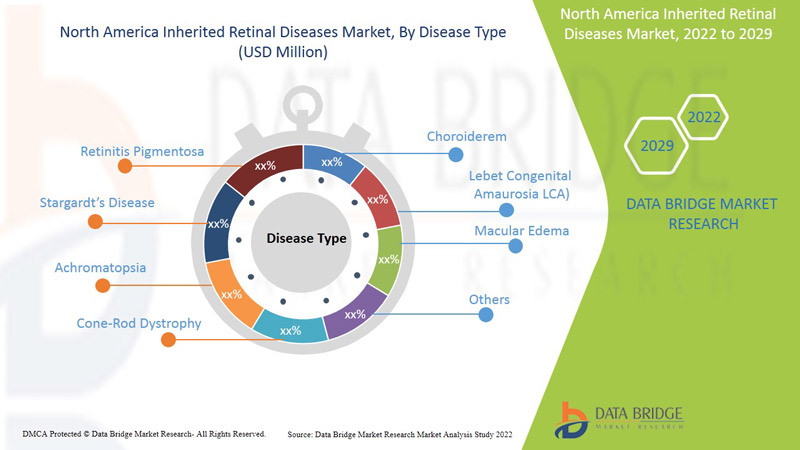

Рынок наследственных заболеваний сетчатки сегментирован по типу заболевания, типу, конечному пользователю и каналу сбыта. Рост среди этих сегментов поможет вам проанализировать сегменты с незначительным ростом в отраслях и предоставить пользователям ценный обзор рынка и рыночные идеи для принятия стратегических решений по определению основных рыночных приложений.

Тип заболевания

- Пигментный ретинит

- Болезнь Штаргардта

- Ахроматопсия

- Дистрофия палочек и колбочек

- Хороидеремия

- Врожденный амавроз Лебера (LCA)

- Отек макулы

- Другие

На основе типа рынок наследственных заболеваний сетчатки сегментируется по типу заболевания (пигментный ретинит, болезнь Штаргардта, ахроматопсия, дистрофия колбочек и палочек, хороидеремия, врожденный амавроз Лебера, отек желтого пятна и др.)

Тип

- Диагноз

- Терапия

На основе типа рынок наследственных заболеваний сетчатки сегментируется на диагностику и терапию. Сегмент диагностики подразделяется на генную терапию, протезирование сетчатки, нейропротекторы и другие. Нейропротекторы далее подразделяются на пальмитат витамина А, докозагексаеновую кислоту (ДГК), лютеин и другие. Сегмент диагностики сегментируется на клиническую диагностику и генетическую диагностику. Клиническая диагностика далее подразделяется на визуализацию сетчатки, электрофизиологические тесты, проверку поля зрения и клиническое обследование глаз. Визуализация сетчатки далее подразделяется на оптическую когерентную томографию (ОКТ), аутофлуоресцентную визуализацию глазного дна (ФАФ), сканирующую лазерную офтальмоскопию (СЛО), адаптивную оптику (АО) и обычную цветную визуализацию глазного дна. Электрофизиологические тесты далее подразделяются на полномасштабную электроретинограмму (ЭРГ) и темную адаптометрию (ДА). Проверка поля зрения далее подразделяется на компьютерные проверки поля зрения и ручную проверку поля зрения. Клиническое обследование глаз подразделяется на щелевую лампу, непрямую офтальмоскопию, рефракционный тест, дилатационное обследование.

Конечный пользователь

- Больницы

- Специализированные клиники

- Амбулаторный хирургический центр

- Домашнее здравоохранение

- Другие

На основе конечных пользователей рынок наследственных заболеваний сетчатки сегментируется на больницы, специализированные клиники, амбулаторные хирургические центры, учреждения здравоохранения на дому и другие.

Канал распространения

- Розничные продажи

- Прямой тендер

Рынок наследственных заболеваний сетчатки также сегментирован по каналу сбыта на розничные продажи и прямые торги.

Анализ трубопровода

Анализ перспективных лекарственных препаратов для лечения наследственных заболеваний сетчатки включает различные перспективные методы лечения, такие как NCT05244304, NCT00999609, NCT05176717, NCT05158296, NCT04850118. Belite Bio, Inc, Spark Therapeutics, ProQR Therapeutics, Applied Genetic Technologies Corp, Biogen, MeiraGTx Ltd участвуют в разработке потенциальных лекарственных препаратов для улучшения лечения приступов.

Региональный анализ/информация о рынке наследственных заболеваний сетчатки

Проанализирован рынок наследственных заболеваний сетчатки, а также предоставлены сведения о размерах рынка и тенденциях по странам, типу заболевания, типу, конечному пользователю и каналу сбыта, как указано выше.

The countries covered in the inherited retinal diseases market report are U.S., Canada and Mexico in North America.

U.S. dominates the inherited retinal diseases market in terms of market share and market revenue and will continue to flourish its dominance during the forecast period. This is due to the presence of major key players and well-developed healthcare infrastructure in this region.

The country section of the report also provides individual market impacting factors and changes in regulations in the market that impact the current and future trends of the market. Data points, such as new and replacement sales, country demographics, disease epidemiology, and import-export tariffs, are some of the major pointers used to forecast the market scenario for individual countries. In addition, the presence and availability of North America brands and their challenges faced due to high competition from local and domestic brands, and impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Inherited Retinal Diseases Market Share Analysis

The inherited retinal diseases market competitive landscape provides details by the competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, North America presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points provided are only related to the companies' focus on inherited retinal diseases market.

Some of the major players operating in the inherited retinal diseases market are Spark Therapeutics, Novartis AG, Okuvision, Nidek Co. Ltd., Invitae Corporation, Carl Zeiss Meditech AG, Optos (A Subdidiary of Nikon Corporation, Neurosoft, PIXIUM VISION, LKC TECHNOLOGIES, INC., Renurone, Astellas Pharma, REGENXBIO Inc., Ionis Pharmaceutics, Sparing Vision, Ocugen Inc, Johnson & Johnson, IVERIC bio, Second Sight, Coave Therapeutics, MeiraGTx Limited, Gensight Biologics, ProQR Therapeutics, Bionic Vision Technologies among others.

Research Methodology: North America Inherited Retinal Diseases Market

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Рыночные данные анализируются и оцениваются с использованием рыночных статистических и когерентных моделей. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в рыночном отчете. Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Помимо этого, модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, анализ доли рынка компании, стандарты измерения, анализ Северной Америки и регионов и доли поставщиков. Пожалуйста, запросите звонок аналитика в случае дальнейшего запроса.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Содержание

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA INHERITED RETINAL DISEASES MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END USER COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PIPELINE ANALYSIS FOR NORTH AMERICA INHERITED RETINAL DISEASES MARKET

5 REGULATORY FRAMEWORK

6 PREMIUM INSIGHTS

6.1 PESTEL ANALYSIS

6.2 POTER’S FIVE FORCES MODEL

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 INCREASE IN THE PREVALENCE OF INHERITED RETINAL DISEASES

7.1.2 INCREASE IN PIPELINE PRODUCTS

7.1.3 INCREASING PRODUCT APPROVAL FOR INHERITED RETINAL DISEASES

7.1.4 INCREASE IN STRATEGIC INITIATIVE BY KEY PLAYER

7.2 RESTRAINTS

7.2.1 HIGH COST OF TREATMENT AND PROCEDURES

7.2.2 LACK OF ENOUGH QUALIFIED PROFESSIONALS

7.3 OPPORTUNITIES

7.3.1 INCREASE IN GOVERNMENT INITIATIVES TOWARDS INHERITED RETINAL DISEASES(IRDS)

7.3.2 INCREASE IN AWARENESS AND TREATMENT-SEEKING RATE

7.3.3 EMERGING REIMBURSEMENT POLICIES FOR THE TREATMENT

7.4 CHALLENGES

7.4.1 RISKS ASSOCIATED WITH IRD SPECIFIC GENE THERAPY

7.4.2 LIMITED ACCESS TO TREATMENT

8 NORTH AMERICA INHERITED RETINAL DISEASES MARKET, BY DISEASE TYPE

8.1 OVERVIEW

8.2 RETINITIS PIGMENTOSA

8.3 STARGARDT’S DISEASE

8.4 ACHROMATOPSIA

8.5 CONE-ROD DYSTROPHY

8.6 CHOROIDEREMIA

8.7 LEBER CONGENITAL AMAUROSIS (LCA)

8.8 MACULAR EDEMA

8.9 OTHERS

9 NORTH AMERICA INHERITED RETINAL DISEASES MARKET, BY TYPE

9.1 OVERVIEW

9.2 DIAGNOSIS

9.2.1 CLINICAL DIAGNOSIS

9.2.1.1 RETINAL IMAGING

9.2.1.1.1 OPTICAL COHERENCE TOMOGRAPHY (OCT)

9.2.1.1.2 FUNDUS AUTOFLUORESCENCE IMAGING (FAF)

9.2.1.1.3 SCANNING LASER OPHTHALMOSCOPY (SLO)

9.2.1.1.4 ADAPTIVE OPTICS (AO) IMAGING

9.2.1.1.5 CONVENTIONAL COLOR FUNDUS IMAGING

9.2.1.2 ELECTROPHYSIOLOGICAL TESTS

9.2.1.2.1 FULL-FIELD ELECTRORETINOGRAM (ERG)

9.2.1.2.2 DARK ADAPTOMETRY (DA)

9.2.1.3 VISUAL FIELD TEST

9.2.1.3.1 COMPUTERIZED VISUAL FIELD TESTS

9.2.1.3.2 MANUAL FIELD TEST

9.2.1.4 CLINICAL EYE EXAMINATION

9.2.1.4.1 SLIT LAMP

9.2.1.4.2 INDIRECT OPHTHALMOSCOPY

9.2.1.4.3 REFRACTION TEST

9.2.1.4.4 DILATION EXAM

9.2.1.5 OTHERS

9.2.2 GENETIC DIAGNOSIS

9.3 THERAPY

9.3.1 GENE THERAPY

9.3.2 RETINAL PROSTHETIC

9.3.3 NEUROPROTECTIVE AGENTS

9.3.3.1 VITAMIN A PALMITATE

9.3.3.2 DOCOSAHEXAENOIC ACID

9.3.3.3 LUTEIN

9.3.3.4 OTHERS

9.3.4 OTHERS

10 NORTH AMERICA INHERITED RETINAL DISEASES MARKET, BY END USER

10.1 OVERVIEW

10.2 HOSPITALS

10.3 SPECIALTY CLINICS

10.4 AMBULATORY SURGICAL CENTERS

10.5 HOME HEALTHCARE

10.6 OTHERS

11 NORTH AMERICA INHERITED RETINAL DISEASES MARKET, BY DISTRIBUTION CHANNEL

11.1 OVERVIEW

11.2 RETAIL SALES

11.2.1 HOSPITAL PHARMACIES

11.2.2 RETAIL PHARMACIES

11.2.3 OTHERS

11.3 DIRECT TENDER

12 NORTH AMERICA INHERITED RETINAL DISEASES MARKET, BY REGION

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

13 NORTH AMERICA INHERITED RETINAL DISEASES MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 SPARK THERAPEUTICS, INC.

15.1.1 COMPANY SNAPSHOT

15.1.2 COMPANY SHARE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT DEVELOPMENTS

15.1.4.1 PROGRAM LAUNCH

15.1.4.2 ACQUISITIONS

15.2 NOVARTIS AG

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENT

15.2.5.1 AGREEMENT

15.3 OKUVISION

15.3.1 COMPANY SNAPSHOT

15.3.2 COMPANY SHARE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENTS

15.3.4.1 EXPANSION

15.3.4.2 EVENTS

15.3.4.3 APPROVAL

15.4 NIDEK CO., LTD

15.4.1 COMPANY SNAPSHOT

15.4.2 COMPANY SHARE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENTS

15.4.4.1 PRODUCT LAUNCH

15.4.4.2 PRODUCT LAUNCH

15.5 INVITAE CORPORATION

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENTS

15.5.5.1 PROGRAM LAUNCH

15.5.5.2 ACQUISITION

15.6 ZEISS INTERNATIONAL

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENTS

15.6.4.1 EVENTS

15.6.4.2 SOCIAL INVOLVEMENT

15.7 OPTOS (A SUBSIDIARY OF NIKON CORPORATION)

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENTS

15.8 NEUROSOFT

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENTS

15.9 ASTELLAS PHARMA INC.

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT DEVELOPMENTS

15.1 BIONIC VISION TECHNOLOGIES

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.10.3.1 AWARD

15.11 COAVE THERAPEUTICS

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENT

15.11.3.1 AGREEMENT

15.12 GENSIGHT BIOLOGICS

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 PRODUCT PORTFOLIO

15.12.4 RECENT DEVELOPMENTS

15.12.4.1 EVENT

15.12.4.2 AWARD

15.13 IONIS PHARMACEUTICALS

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 PRODUCT PORTFOLIO

15.13.4 RECENT DEVELOPMENT

15.13.4.1 EVENT

15.14 IVERIC BIO

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENTS

15.15 JOHNSON &JOHNSON SERVICES, INC.

15.15.1 COMPANY SNAPSHOT

15.15.2 REVENUE ANALYSIS

15.15.3 PRODUCT PORTFOLIO

15.15.4 RECENT DEVELOPMENT

15.15.4.1 COLLABORATION

15.16 LKC TECHNOLOGIES, INC.

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENT

15.16.3.1 PRODUCT LAUNCH

15.17 MEIRAGTX LIMITED

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENTS

15.17.3.1 EVENTS

15.17.3.2 AWARD

15.17.3.3 COLLABORATION

15.18 OCUGEN INC.

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENTS

15.18.3.1 INVESTMENT

15.18.3.2 CLINICAL TRIAL

15.19 PIXIUM VISION

15.19.1 COMPANY SNAPSHOT

15.19.2 REVENUE ANALYSIS

15.19.3 PRODUCT PORTFOLIO

15.19.4 RECENT DEVELOPMENT

15.19.4.1 AWARD

15.2 PROQR THERAPEUTICS

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENT

15.20.3.1 EVENT

15.21 SECOND SIGHT

15.21.1 COMPANY SNAPSHOT

15.21.2 PRODUCT PORTFOLIO

15.21.3 RECENT DEVELOPMENT

15.21.3.1 PRODUCT LAUNCH

15.22 SPARING VISION

15.22.1 COMPANY SNAPSHOT

15.22.2 PRODUCT PORTFOLIO

15.22.3 RECENT DEVELOPMENT

15.22.3.1 ACQUISITION

15.23 REGENXBIO INC.

15.23.1 COMPANY SNAPSHOT

15.23.2 PRODUCT PORTFOLIO

15.23.3 RECENT DEVELOPMENTS

15.23.3.1 EVENT

15.23.3.2 COLLABORATION

15.23.3.3 CERTIFICATION

15.24 RENEURON GROUP PLC

15.24.1 COMPANY SNAPSHOT

15.24.2 PRODUCT PORTFOLIO

15.24.3 RECENT DEVELOPMENT

15.24.3.1 STRATEGIC INITIATIVE

16 QUESTIONNAIRE

17 RELATED REPORTS

Список таблиц

TABLE 1 PIPELINE ANALYSIS FOR INHERITED RETINAL DISEASES:

TABLE 2 NORTH AMERICA INHERITED RETINAL DISEASES MARKET, BY DISEASE TYPE, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA RETINITIS PIGMENTOSA IN INHERITED RETINAL DISEASES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA STARGARDT’S DISEASE IN INHERITED RETINAL DISEASES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA ACHROMATOPSIA IN INHERITED RETINAL DISEASES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA CONE-ROD DYSTROPHY IN INHERITED RETINAL DISEASES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA CHOROIDERMIA IN INHERITED RETINAL DISEASES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA LEBER CONGENITAL AMAUROSIS (LCA) IN INHERITED RETINAL DISEASES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA MACULAR EDEMA IN INHERITED RETINAL DISEASES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA OTHERS IN INHERITED RETINAL DISEASES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA DIAGNOSIS IN INHERITED RETINAL DISEASES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA DIAGNOSIS IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA CLINICAL DIAGNOSIS IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA RETINAL IMAGING IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA ELECTROPHYSIOLOGICAL TETS IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA VISUAL FIELD TEST IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA CLINICAL EYE EXAMINATION IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA THERAPY IN INHERITED RETINAL DISEASES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA THERAPY IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA NEUROPROTECTIVE AGENTS IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA INHERITED RETINAL DISEASES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA HOSPITALS IN INHERITED RETINAL DISEASES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA SPECIALTY CLINICS IN INHERITED RETINAL DISEASES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA AMBULATORY SURGICAL CENTERS IN INHERITED RETINAL DISEASES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA HOME HEALTHCARE IN INHERITED RETINAL DISEASES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA OTHERS IN INHERITED RETINAL DISEASES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA INHERITED RETINAL DISEASES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA RETAIL SALES IN INHERITED RETINAL DISEASES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA RETAIL SALES IN INHERITED RETINAL DISEASES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA DIRECT TENDER IN INHERITED RETINAL DISEASES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA INHERITED RETINAL DISEASES MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA INHERITED RETINAL DISEASES MARKET, BY DISEASE TYPE, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA THERAPY IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA NEUROPROTECTIVE AGENTS IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA DIAGNOSIS IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA CLINICAL DIAGNOSIS IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA RETINAL IMAGING IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA ELECTROPHYSIOLOGICAL TESTS IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA VISUAL FIELD TEST IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA CLINICAL EYE EXAMINATION IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA INHERITED RETINAL DISEASES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA INHERITED RETINAL DISEASES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 45 NORTH AMERICA RETAIL SALES IN INHERITED RETINAL DISEASES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 46 U.S. INHERITED RETINAL DISEASES MARKET, BY DISEASE TYPE, 2020-2029 (USD MILLION)

TABLE 47 U.S. INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 48 U.S. THERAPY IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 49 U.S. NEUROPROTECTIVE AGENTS IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 50 U.S. DIAGNOSIS IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 51 U.S. CLINICAL DIAGNOSIS IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 52 U.S. RETINAL IMAGING IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 53 U.S. ELECTROPHYSIOLOGICAL TESTS IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 54 U.S. VISUAL FIELD TEST IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 55 U.S. CLINICAL EYE EXAMINATION IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 56 U.S. INHERITED RETINAL DISEASES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 57 U.S. INHERITED RETINAL DISEASES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 58 U.S. RETAIL SALES IN INHERITED RETINAL DISEASES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 59 CANADA INHERITED RETINAL DISEASES MARKET, BY DISEASE TYPE, 2020-2029 (USD MILLION)

TABLE 60 CANADA INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 61 CANADA THERAPY IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 62 CANADA NEUROPROTECTIVE AGENTS IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 63 CANADA DIAGNOSIS IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 64 CANADA CLINICAL DIAGNOSIS IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 65 CANADA RETINAL IMAGING IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 66 CANADA ELECTROPHYSIOLOGICAL TESTS IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 67 CANADA VISUAL FIELD TEST IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 68 CANADA CLINICAL EYE EXAMINATION IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 69 CANADA INHERITED RETINAL DISEASES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 70 CANADA INHERITED RETINAL DISEASES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 71 CANADA RETAIL SALES IN INHERITED RETINAL DISEASES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 72 MEXICO INHERITED RETINAL DISEASES MARKET, BY DISEASE TYPE, 2020-2029 (USD MILLION)

TABLE 73 MEXICO INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 74 MEXICO THERAPY IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 75 MEXICO NEUROPROTECTIVE AGENTS IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 76 MEXICO DIAGNOSIS IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 77 MEXICO CLINICAL DIAGNOSIS IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 78 MEXICO RETINAL IMAGING IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 79 MEXICO ELECTROPHYSIOLOGICAL TESTS IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 80 MEXICO VISUAL FIELD TEST IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 81 MEXICO CLINICAL EYE EXAMINATION IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 82 MEXICO INHERITED RETINAL DISEASES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 83 MEXICO INHERITED RETINAL DISEASES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 84 MEXICO RETAIL SALES IN INHERITED RETINAL DISEASES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

Список рисунков

FIGURE 1 NORTH AMERICA INHERITED RETINAL DISEASES MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA INHERITED RETINAL DISEASES MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA INHERITED RETINAL DISEASES MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA INHERITED RETINAL DISEASES MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA INHERITED RETINAL DISEASES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA INHERITED RETINAL DISEASES MARKET: MULTIVARIATE MODELLING

FIGURE 7 NORTH AMERICA INHERITED RETINAL DISEASES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 NORTH AMERICA INHERITED RETINAL DISEASES MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA INHERITED RETINAL DISEASES MARKET: MARKET END USER COVERAGE GRID

FIGURE 10 NORTH AMERICA INHERITED RETINAL DISEASES MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 NORTH AMERICA INHERITED RETINAL DISEASES MARKET: SEGMENTATION

FIGURE 12 NORTH AMERICA IS EXPECTED TO DOMINATE AND EUROPE IS GROWING AT THE FASTEST PACE IN NORTH AMERICA INHERITED RETINAL DISEASES MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 13 INCREASE IN THE PREVALENCE OF INHERITED RETINAL DISEASES AND INCREASE IN PIPELINE PRODUCTS ARE DRIVING THE NORTH AMERICA INHERITED RETINAL DISEASES MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 RETINITIS PIGMENTOSA SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA INHERITED RETINAL DISEASES MARKET IN 2022 & 2029

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF NORTH AMERICA INHERITED RETINAL DISEASES MARKET

FIGURE 16 NORTH AMERICA INHERITED RETINAL DISEASES MARKET: BY DISEASE TYPE, 2021

FIGURE 17 NORTH AMERICA INHERITED RETINAL DISEASES MARKET: BY DISEASE TYPE, 2020-2029 (USD MILLION)

FIGURE 18 NORTH AMERICA INHERITED RETINAL DISEASES MARKET: BY DISEASE TYPE, CAGR (2022-2029)

FIGURE 19 NORTH AMERICA INHERITED RETINAL DISEASES MARKET: BY DISEASE TYPE, LIFELINE CURVE

FIGURE 20 NORTH AMERICA INHERITED RETINAL DISEASES MARKET: BY TYPE, 2021

FIGURE 21 NORTH AMERICA INHERITED RETINAL DISEASES MARKET: BY TYPE, 2020-2029 (USD MILLION)

FIGURE 22 NORTH AMERICA INHERITED RETINAL DISEASES MARKET: BY TYPE, CAGR (2022-2029)

FIGURE 23 NORTH AMERICA INHERITED RETINAL DISEASES MARKET: BY TYPE, LIFELINE CURVE

FIGURE 24 NORTH AMERICA INHERITED RETINAL DISEASES MARKET: BY END USER, 2021

FIGURE 25 NORTH AMERICA INHERITED RETINAL DISEASES MARKET: BY END USER, 2020-2029 (USD MILLION)

FIGURE 26 NORTH AMERICA INHERITED RETINAL DISEASES MARKET: BY END USER, CAGR (2022-2029)

FIGURE 27 NORTH AMERICA INHERITED RETINAL DISEASES MARKET: BY END USER, LIFELINE CURVE

FIGURE 28 NORTH AMERICA INHERITED RETINAL DISEASES MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 29 NORTH AMERICA INHERITED RETINAL DISEASES MARKET: BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

FIGURE 30 NORTH AMERICA INHERITED RETINAL DISEASES MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 31 NORTH AMERICA INHERITED RETINAL DISEASES MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 32 NORTH AMERICA INHERITED RETINAL DISEASES MARKET: SNAPSHOT (2021)

FIGURE 33 NORTH AMERICA INHERITED RETINAL DISEASES MARKET: BY COUNTRY (2021)

FIGURE 34 NORTH AMERICA INHERITED RETINAL DISEASES MARKET: BY COUNTRY (2022 & 2029)

FIGURE 35 NORTH AMERICA INHERITED RETINAL DISEASES MARKET: BY COUNTRY (2021 & 2029)

FIGURE 36 NORTH AMERICA INHERITED RETINAL DISEASES MARKET: BY DISEASE TYPE (2022-2029)

FIGURE 37 NORTH AMERICA INHERITED RETINAL DISEASES MARKET: COMPANY SHARE 2021 (%)

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.