Рынок промышленных котлов в Северной Америке , по методам труб (водотрубные котлы с несущей трубой, водотрубные котлы), давлению пара (котлы высокого давления, котлы среднего давления, котлы низкого давления), использованию пара (технологические котлы, коммунальные котлы, судовые котлы), положению топки (котлы с внешним нагревом, котлы с внутренним нагревом), по оси оболочки (горизонтальные котлы, вертикальные котлы), по трубам в котлах (многотрубные котлы, отдельные котлы), по циркуляции воды и пара в котлах (котлы с принудительной циркуляцией, котлы с естественной циркуляцией), по типу топлива (угольные котлы, котлы на мазуте, газовые котлы, котлы на биомассе и другие), по типу продукта (конденсационный водогрейный котел, интегрированный конденсационный водогрейный котел, интегрированный конденсационный паровой котел, конденсационный паровой котел с раздельным контуром) Котел, электрический паровой котел, электрические водогрейные котлы, другие), мощность котла (10-150 л.с., 151 -300 л.с., 301 - 600 л.с.), промышленность (пищевая промышленность, пивоваренные заводы, прачечные и клининговые компании, строительство, фармацевтика, автомобилестроение, целлюлозно-бумажная промышленность, больницы, сельское хозяйство, упаковка, другие) – тенденции в отрасли и прогноз до 2029 г.

Анализ и размер рынка

Рост потребности в производстве электроэнергии наблюдается по всему миру из-за быстрого роста населения. Промышленные котлы широко используются в различных секторах, таких как металлургическая и горнодобывающая промышленность, химическая, нефтеперерабатывающая и пищевая промышленность и т. д.

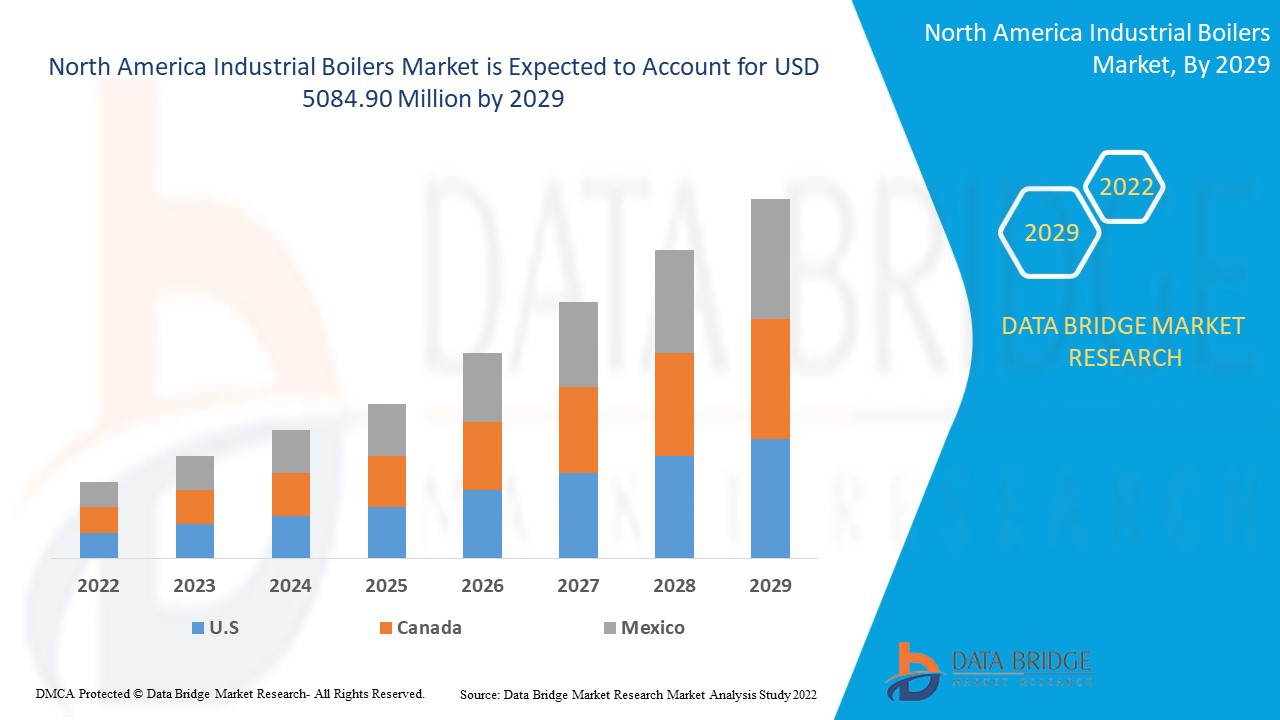

Рынок промышленных котлов в Северной Америке оценивался в 2962,22 млн долларов США в 2021 году и, как ожидается, достигнет 5084,90 млн долларов США к 2029 году, регистрируя среднегодовой темп роста в 5,90% в прогнозируемый период 2022-2029 годов. Пищевая промышленность занимает крупнейшие сегменты сектора конечного использования на соответствующем рынке из-за потребления хлебобулочных изделий и фаст-фудов. Отчет о рынке, подготовленный командой Data Bridge Market Research, включает в себя углубленный экспертный анализ, анализ импорта/экспорта, анализ цен, анализ производства и потребления, а также анализ пестиков.

Определение рынка

Промышленный котел — это паровой или высокотемпературный водогрейный котел, использующий в качестве топлива горючий газ, биомассу, нефть или уголь. Современные котлы нагревают или охлаждают воду внутри и распределяют ее по линейным структурам потребителям.

Область отчета и сегментация рынка

|

Отчет Метрика |

Подробности |

|

Прогнозируемый период |

2022-2029 |

|

Базовый год |

2021 |

|

Исторические годы |

2020 (Можно настроить на 2019 - 2014) |

|

Количественные единицы |

Доход в млн. долл. США, объемы в единицах, цены в долл. США |

|

Охваченные сегменты |

Методы прокладки труб (водотрубные котлы Carrier, водотрубные котлы), давление пара (котлы высокого давления, котлы среднего давления, котлы низкого давления), использование пара (технологические котлы, коммунальные котлы, судовые котлы), положение печи (котлы с внешним нагревом, котлы с внутренним нагревом), ось оболочки (горизонтальные котлы, вертикальные котлы), трубы в котлах (многотрубные котлы, одиночные котлы), циркуляция воды и пара в котлах (котлы с принудительной циркуляцией, котлы с естественной циркуляцией), тип топлива (угольные котлы, котлы на мазуте, газовые котлы, котлы на биомассе и другие), тип продукта (конденсационный водогрейный котел, интегрированный конденсационный водогрейный котел, интегрированный конденсационный паровой котел, сплит-конденсационный паровой котел, паровой котел с электрическим нагревом, Электрические водогрейные котлы, прочее), мощность котла (10-150 л.с., 151 -300 л.с., 301 - 600 л.с.), промышленность (пищевая промышленность, пивоваренные заводы, прачечные и клининговые компании, строительство, фармацевтика, автомобилестроение, целлюлозно-бумажная промышленность, больницы, сельское хозяйство, упаковка и прочее) |

|

Страны, охваченные |

США, Канада и Мексика в Северной Америке. |

|

Охваченные участники рынка |

Babcock & Wilcox Enterprises, Inc. (США), John Wood Group PLC (Великобритания), Bharat Heavy Electricals Limited (Индия), IHI Corporation (Япония), Mitsubishi Hitachi Power Systems, Ltd. (Европа), Thermax Limited (Индия), ANDRITZ (Австрия), Siemens (Германия), ALFA LAVAL (Швеция), General Electric Company (США), Hurst Boiler & Welding Co, Inc. (США), Bryan Steam (США), Superior Boiler Works, Inc. (США), Vapor Power (США), Sofinter Spa (Италия), Cleaver-Brooks, Inc (США) и ZOZEN boiler Co., Ltd. (Китай) и другие |

|

Возможности рынка |

|

Динамика рынка промышленных котлов в Северной Америке

В этом разделе рассматривается понимание движущих сил рынка, преимуществ, возможностей, ограничений и проблем. Все это подробно обсуждается ниже:

Драйверы

- Технологические достижения

Рынок будет стимулироваться активным ростом промышленных предприятий в соответствии с программами расширения, реализуемыми государством и федеральным правительством.

- Строгие государственные постановления

Строгие государственные правила, направленные на сокращение выбросов парниковых газов, а также растущее внимание к сокращению потребления топлива будут способствовать развитию рынка.

- Растущее внедрение эффективных единиц

Растущее признание эффективных установок в химической промышленности благодаря их безопасной эксплуатации, высокой эффективности и низким эксплуатационным расходам будет способствовать внедрению продукции, что окажет дальнейшее влияние на рост рынка.

Возможности

Кроме того, растущее внедрение новых технологий интеллектуальных котлов в работу предприятий и постоянное развитие со стороны поставщиков расширяют возможности получения прибыли для участников рынка в прогнозируемый период с 2022 по 2029 год.

Ограничения/Проблемы

С другой стороны, ожидается, что увеличение первоначальных инвестиций будет препятствовать росту рынка. Кроме того, коррозия, невозможность достижения требуемого срока службы и другие технологические проблемы потребуют дополнительных исследований и инвестиций в научно-исследовательские и опытно-конструкторские работы, что, как ожидается, бросит вызов рынку центральных пылесосов в прогнозируемый период 2022-2029 гг.

В этом отчете о рынке промышленных котлов Северной Америки содержатся сведения о новых последних разработках, правилах торговли, анализе импорта-экспорта, анализе производства, оптимизации цепочки создания стоимости, доле рынка, влиянии внутренних и локальных игроков рынка, анализируются возможности с точки зрения новых источников дохода, изменений в правилах рынка, анализ стратегического роста рынка, размер рынка, рост рынка категорий, ниши приложений и доминирование, одобрения продуктов, запуски продуктов, географические расширения, технологические инновации на рынке. Чтобы получить больше информации о рынке промышленных котлов Северной Америки, свяжитесь с Data Bridge Market Research для получения аналитического обзора, наша команда поможет вам принять обоснованное рыночное решение для достижения роста рынка.

Влияние COVID-19 на рынок промышленных котлов в Северной Америке

COVID-19 оказал негативное влияние на рынок промышленных котлов. Эпидемия COVID-19 привела к отсрочке ряда инициатив, включая строительство инфраструктуры, реорганизацию и реконструкцию. Повышенное внимание правительства к чрезмерной компенсации последствий путем улучшения операций при появлении возможностей ускорит рост отрасли. С другой стороны, действия правительства по возобновлению работы основных отраслей промышленности, производственных предприятий и инфраструктурных проектов будут способствовать росту корпораций.

Последние события

В январе 2020 года новый контракт на сумму около 5,00 млн долларов США был предоставлен компании Babcock & Wilcox Enterprises, Inc. на установку модернизированного котельного оборудования. Инновационная технология используется для модернизации котельного оборудования на американских угольных электростанциях. Этот контракт помог организации расширить свое присутствие на рынке и клиентскую базу в Соединенных Штатах.

Масштаб и размер рынка промышленных котлов в Северной Америке

Рынок промышленных котлов Северной Америки сегментирован на основе методов труб, давления пара, использования пара, положения печи, оси оболочки, труб в котлах, циркуляции воды и пара в котлах, типа топлива, типа продукта, мощности котла и отрасли. Рост среди этих сегментов поможет вам проанализировать сегменты с незначительным ростом в отраслях и предоставить пользователям ценный обзор рынка и рыночные идеи, которые помогут им принимать стратегические решения для определения основных рыночных приложений.

Методы трубок

- Котлы Carrier Firetube

- Водотрубные котлы

Давление пара

- Котлы высокого давления

- Котлы среднего давления

- Котлы низкого давления

Использование Steam

- Технологические котлы

- Котлы коммунального назначения

- Судовые котлы

Положение печи

- Котлы с внешним нагревом

- Котлы с внутренним нагревом

Ось оболочки

- Горизонтальные котлы

- Вертикальные котлы

Трубы в котлах

- Многотрубные котлы

- Отдельные котлы

Циркуляция воды и пара в котлах

- Котлы с принудительной циркуляцией

- Котлы с естественной циркуляцией

Тип топлива

- Угольные котлы

- Котлы на мазуте

- Газовые котлы

- Котлы на биомассе

- Другие

Тип продукта

- Конденсационный водогрейный котел

- Интегрированный конденсационный водогрейный котел

- Интегрированный конденсационный паровой котел

- Конденсационный паровой котел сплит-системы

- Электрический паровой котел

- Электрические водогрейные котлы

- Другие

Мощность котла

- 10-150 л.с.

- 151 -300 л.с.

- 301 - 600 л.с.

Промышленность

- Пищевая промышленность

- Пивоварни

- Прачечные и клининговые компании

- Строительство

- Фармацевтическая

- Автомобильный

- Целлюлозно-бумажная промышленность

- Больницы

- Сельское хозяйство

- Упаковка

- Другие

Региональный анализ/информация о рынке промышленных котлов в Северной Америке

Проведен анализ рынка промышленных котлов Северной Америки, а также предоставлены сведения о размерах рынка и тенденциях по странам, методам прокладки труб, давлению пара, использованию пара, положению печи, оси кожуха, трубам в котлах, циркуляции воды и пара в котлах, типу топлива, типу продукта, мощности котла и отраслям, как указано выше.

В отчете о рынке промышленных котлов Северной Америки рассматриваются следующие страны: США, Канада и Мексика.

США доминируют на североамериканском рынке промышленных котлов благодаря устойчивой финансовой устойчивости, позволяющей принимать новые технологии или технологии с повышенными капитальными потребностями.

Раздел отчета по странам также содержит отдельные факторы, влияющие на рынок, и изменения в регулировании на внутреннем рынке, которые влияют на текущие и будущие тенденции рынка. Такие данные, как анализ цепочки создания стоимости вверх и вниз по течению, технические тенденции и анализ пяти сил Портера, тематические исследования, являются некоторыми из указателей, используемых для прогнозирования рыночного сценария для отдельных стран. Кроме того, при предоставлении прогнозного анализа данных по странам учитываются наличие и доступность глобальных брендов и их проблемы, связанные с большой или малой конкуренцией со стороны местных и отечественных брендов, влияние внутренних тарифов и торговых путей.

Конкурентная среда и рынок промышленных котлов в Северной Америке

Конкурентная среда рынка промышленных котлов Северной Америки содержит сведения по конкурентам. Включены сведения о компании, финансы компании, полученный доход, рыночный потенциал, инвестиции в исследования и разработки, новые рыночные инициативы, глобальное присутствие, производственные площадки и объекты, производственные мощности, сильные и слабые стороны компании, запуск продукта, широта и широта продукта, доминирование в применении. Приведенные выше данные относятся только к фокусу компаний, связанному с рынком промышленных котлов Северной Америки.

Некоторые из основных игроков, работающих на рынке промышленных котлов в Северной Америке, это:

- Babcock & Wilcox Enterprises, Inc. (США)

- John Wood Group PLC (Великобритания)

- Bharat Heavy Electricals Limited (Индия)

- Корпорация IHI (Япония)

- Mitsubishi Hitachi Power Systems, Ltd. (Европа)

- Thermax Limited (Индия)

- АНДРИТЦ (Австрия)

- Сименс (Германия)

- АЛЬФА ЛАВАЛЬ (Швеция)

- General Electric Company (США)

- Hurst Boiler & Welding Co, Inc. (США)

- Брайан Стим (США)

- Superior Boiler Works, Inc. (США)

- Мощность пара (США)

- Sofinter Spa (Италия)

- Cleaver-Brooks, Inc (США)

- ZOZEN boiler Co., Ltd. (Китай)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Содержание

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA INDUSTRIAL BOILERS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 TUBING METHODS TIMELINE CURVE

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING DEMAND FOR LOW EMISSION INDUSTRIAL BOILERS

5.1.2 GROWING DEMAND FOR ADVANCED BOILER SOLUTION FROM INDUSTRIAL VERTICALS

5.1.3 RISING DEMAND FROM THE FOOD AND BEVERAGES INDUSTRY

5.1.4 RAPID ADOPTION OF INDUSTRIAL BOILER FROM ASIAN COUNTRIES

5.2 RESTRAINT

5.2.1 HIGH INVESTMENT COST

5.3 OPPORTUNITIES

5.3.1 DIGITALISATION OF THE INDUSTRIAL BOILER FOR IMPROVING EFFICIENCY

5.3.2 GROWING DEMAND FOR THE BIOMASS BOILERS

5.3.3 ADVENT OF PORTABLE, RENTAL AND TEMPORARY INDUSTRIAL BOILERS

5.4 CHALLENGES

5.4.1 TECHNICAL CHALLENGES TO IMPROVE THE PERFORMANCE AND LIFE

5.4.2 UNCERTAINTY AMONGST CUSTOMERS ABOUT INDUSTRIAL BOILER SAFETY AT PLANT

6 IMPACT ANALYSIS OF COVID-19 ON THE MARKET

6.1 IMPACT ON THE MANUFACTURING INDUSTRY AND GOVERNMENT INITIATIVE TO BOOST THE MARKET

6.2 STRATEGIC DECISIONS FOR MARKET PLAYERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.3 IMPACT ON DEMAND

6.4 CONSLUSION

7 NORTH AMERICA INDUSTRIAL BOILERS MARKET, BY TUBING METHODS

7.1 OVERVIEW

7.2 WATER TUBE BOILERS

7.3 FIRE TUBE BOILERS

8 NORTH AMERICA INDUSTRIAL BOILERS MARKET, BY STEAM PRESSURE

8.1 OVERVIEW

8.2 HIGH PRESSURE BOILERS

8.3 MEDIUM PRESSURE BOILERS

8.4 LOW PRESSURE BOILERS

9 NORTH AMERICA INDUSTRIAL BOILERS MARKET, BY STEAM USAGE

9.1 OVERVIEW

9.2 PROCESS BOILERS

9.3 UTILITY BOILERS

9.4 MARINE BOILERS

10 NORTH AMERICA INDUSTRIAL BOILERS MARKET, BY FURNACE POSITION

10.1 OVERVIEW

10.2 EXTERNALLY FIRED BOILERS

10.3 INTERNALLY FIRED BOILERS

11 NORTH AMERICA INDUSTRIAL BOILERS MARKET, BY SHELL AXIS

11.1 OVERVIEW

11.2 HORIZONTAL BOILERS

11.3 VERTICAL BOILERS

12 NORTH AMERICA INDUSTRIAL BOILERS MARKET, BY TUBES IN BOILERS

12.1 OVERVIEW

12.2 MULTI TUBE BOILERS

12.3 SINGLE TUBE BOILERS

13 NORTH AMERICA INDUSTRIAL BOILERS MARKET, BY WATER AND STEAM CIRCULATION IN BOILERS

13.1 OVERVIEW

13.2 FORCED CIRCULATION BOILERS

13.3 NATURAL CIRCULATION BOILERS

14 NORTH AMERICA INDUSTRIAL BOILERS MARKET, BYFUEL TYPE

14.1 OVERVIEW

14.2 GAS FIRED BOILERS

14.3 COAL FIRED BOILERS

14.4 BIOMASS BOILERS

14.5 OIL FIRED BOILERS

14.6 OTHERS

15 NORTH AMERICA INDUSTRIAL BOILERS MARKET, BY PRODUCT TYPE

15.1 OVERVIEW

15.2 CONDENSING HOT WATER BOILER

15.3 INTEGRATED CONDENSING HOT WATER BOILER

15.4 INTEGRATED CONDENSING STEAM BOILER

15.5 SPLIT CONDENSING STEAM BOILER

15.6 ELECTRIC HEATED STEAM BOILER

15.7 ELECTRIC HOT WATER BOILERS

15.8 OTHERS

16 NORTH AMERICA INDUSTRIAL BOILERS MARKET, BY BOILER HORSEPOWER

16.1 OVERVIEW

16.2-150 BHP

16.3 -300 BHP

16.4 - 600 BHP

17 NORTH AMERICA INDUSTRIAL BOILERS MARKET, BY INDUSTRY

17.1 OVERVIEW

17.2 FOOD INDUSTRY

17.2.1 CONDENSING HOT WATER BOILER

17.2.2 INTEGRATED CONDENSING HOT WATER BOILER

17.2.3 SPLIT CONDENSING STEAM BOILER

17.2.4 INTEGRATED CONDENSING STEAM BOILER

17.2.5 ELECTRIC HEATED STEAM BOILER

17.2.6 ELECTRIC HOT WATER BOILERS

17.2.7 OTHERS

17.3 BREWERIES

17.3.1 CONDENSING HOT WATER BOILER

17.3.2 INTEGRATED CONDENSING HOT WATER BOILER

17.3.3 SPLIT CONDENSING STEAM BOILER

17.3.4 INTEGRATED CONDENSING STEAM BOILER

17.3.5 ELECTRIC HEATED STEAM BOILER

17.3.6 ELECTRIC HOT WATER BOILERS

17.3.7 OTHERS

17.4 LAUNDRIES AND CLEANING FIRM

17.4.1 SPLIT CONDENSING STEAM BOILER

17.4.2 INTEGRATED CONDENSING STEAM BOILER

17.4.3 CONDENSING HOT WATER BOILER

17.4.4 INTEGRATED CONDENSING HOT WATER BOILER

17.4.5 ELECTRIC HEATED STEAM BOILER

17.4.6 ELECTRIC HOT WATER BOILERS

17.4.7 OTHERS

17.5 PHARMACEUTICAL

17.5.1 INTEGRATED CONDENSING HOT WATER BOILER

17.5.2 CONDENSING HOT WATER BOILER

17.5.3 INTEGRATED CONDENSING STEAM BOILER

17.5.4 ELECTRIC HOT WATER BOILERS

17.5.5 ELECTRIC HEATED STEAM BOILER

17.5.6 SPLIT CONDENSING STEAM BOILER

17.5.7 OTHERS

17.6 HOSPITALS

17.6.1 INTEGRATED CONDENSING STEAM BOILER

17.6.2 CONDENSING HOT WATER BOILER

17.6.3 INTEGRATED CONDENSING HOT WATER BOILER

17.6.4 ELECTRIC HOT WATER BOILERS

17.6.5 ELECTRIC HEATED STEAM BOILER

17.6.6 SPLIT CONDENSING STEAM BOILER

17.6.7 OTHERS

17.7 CONSTRUCTION

17.7.1 INTEGRATED CONDENSING STEAM BOILER

17.7.2 CONDENSING HOT WATER BOILER

17.7.3 INTEGRATED CONDENSING HOT WATER BOILER

17.7.4 ELECTRIC HEATED STEAM BOILER

17.7.5 SPLIT CONDENSING STEAM BOILER

17.7.6 ELECTRIC HOT WATER BOILERS

17.7.7 OTHERS

17.8 PULP AND PAPER

17.8.1 CONDENSING HOT WATER BOILER

17.8.2 SPLIT CONDENSING STEAM BOILER

17.8.3 INTEGRATED CONDENSING HOT WATER BOILER

17.8.4 ELECTRIC HOT WATER BOILERS

17.8.5 ELECTRIC HEATED STEAM BOILER

17.8.6 INTEGRATED CONDENSING STEAM BOILER

17.8.7 OTHERS

17.9 AUTOMOTIVE

17.9.1 CONDENSING HOT WATER BOILER

17.9.2 INTEGRATED CONDENSING HOT WATER BOILER

17.9.3 INTEGRATED CONDENSING STEAM BOILER

17.9.4 ELECTRIC HOT WATER BOILERS

17.9.5 ELECTRIC HEATED STEAM BOILER

17.9.6 SPLIT CONDENSING STEAM BOILER

17.9.7 OTHERS

17.1 AGRICULTURE

17.10.1 SPLIT CONDENSING STEAM BOILER

17.10.2 INTEGRATED CONDENSING HOT WATER BOILER

17.10.3 CONDENSING HOT WATER BOILER

17.10.4 INTEGRATED CONDENSING STEAM BOILER

17.10.5 ELECTRIC HEATED STEAM BOILER

17.10.6 ELECTRIC HOT WATER BOILERS

17.10.7 OTHERS

17.11 PACKAGING

17.11.1 ELECTRIC HEATED STEAM BOILER

17.11.2 INTEGRATED CONDENSING STEAM BOILER

17.11.3 SPLIT CONDENSING STEAM BOILER

17.11.4 INTEGRATED CONDENSING HOT WATER BOILER

17.11.5 CONDENSING HOT WATER BOILER

17.11.6 ELECTRIC HOT WATER BOILERS

17.11.7 OTHERS

17.12 OTHERS

18 NORTH AMERICA INDUSTRIAL BOILERS MARKET, BY GEOGRAPHY

18.1 NORTH AMERICA

18.1.1 U.S.

18.1.2 CANADA

18.1.3 MEXICO

19 NORTH AMERICA INDUSTRIAL BOILERS MARKET, COMPANY LANDSCAPE

19.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

20 NORTH AMERICA INDUSTRIAL BOILERS MARKET, SWOT

21 COMPANY PROFILE

21.1 GENERAL ELECTRIC

21.1.1 COMPANY SNAPSHOT

21.1.2 REVENUE ANALYSIS

21.1.3 COMPANY SHARE ANALYSIS

21.1.4 PRODUCT PORTFOLIO

21.1.5 RECENT DEVELOPMENTS

21.2 MITSUBISHI HITACHI POWER SYSTEMS, LTD.

21.2.1 COMPANY SNAPSHOT

21.2.2 COMPANY PROFILE

21.2.3 PRODUCT PORTFOLIO

21.2.4 RECENT DEVELOPMENTS

21.3 ANDRITZ

21.3.1 COMPANY SNAPSHOT

21.3.2 REVENUE ANALYSIS

21.3.3 COMPANY SHARE ANALYSIS

21.3.4 PRODUCT PORTFOLIO

21.3.5 RECENT DEVELOPMENTS

21.4 ALFA LAVAL

21.4.1 COMPANY SNAPSHOT

21.4.2 REVENUE ANALYSIS

21.4.3 COMPANY SHARE ANALYSIS

21.4.4 PRODUCT PORTFOLIO

21.4.5 RECENT DEVELOPMENTS

21.5 IHI CORPORATION

21.5.1 COMPANY SNAPSHOT

21.5.2 REVENUE ANALYSIS

21.5.3 COMPANY SHARE ANALYSIS

21.5.4 PRODUCT PORTFOLIO

21.5.5 RECENT DEVELOPMENTS

21.6 THERMAX LIMITED

21.6.1 COMPANY SNAPSHOT

21.6.2 REVENUE ANALYSIS

21.6.3 PRODUCT PORTFOLIO

21.6.4 RECENT DEVELOPMENTS

21.7 AB&CO GROUP

21.7.1 COMPANY SNAPSHOT

21.7.2 PRODUCT PORTFOLIO

21.7.3 RECENT DEVELOPMENT

21.8 BABCOCK & WILCOX ENTERPRISES, INC.

21.8.1 COMPANY SNAPSHOT

21.8.2 REVENUE ANALYSIS

21.8.3 PRODUCT PORTFOLIO

21.8.4 RECENT DEVELOPMENTS

21.9 BHARAT HEAVY ELECTRICALS LIMITED

21.9.1 COMPANY SNAPSHOT

21.9.2 REVENUE ANALYSIS

21.9.3 PRODUCT PORTFOLIO

21.9.4 RECENT DEVELOPMENTS

21.1 BRYAN STEAM

21.10.1 COMPANY SNAPSHOT

21.10.2 PRODUCT PORTFOLIO

21.10.3 RECENT DEVELOPMENTS

21.11 CLEAVER-BROOKS, INC

21.11.1 COMPANY SNAPSHOT

21.11.2 PRODUCT PORTFOLIO

21.11.3 RECENT DEVELOPMENTS

21.12 DEC

21.12.1 COMPANY SNAPSHOT

21.12.2 REVENUE ANALYSIS

21.12.3 PRODUCT PORTFOLIO

21.12.4 RECENT DEVELOPMENTS

21.13 HURST BOILER & WELDING CO, INC.

21.13.1 COMPANY SNAPSHOT

21.13.2 PRODUCT PORTFOLIO

21.13.3 RECENT DEVELOPMENTS

21.14 JOHN WOOD GROUP PLC

21.14.1 COMPANY SNAPSHOT

21.14.2 REVENUE ANALYSIS

21.14.3 PRODUCT PORTFOLIO

21.14.4 RECENT DEVELOPMENTS

21.15 SIEMENS

21.15.1 COMPANY SNAPSHOT

21.15.2 REVENUE ANALYSIS

21.15.3 PRODUCT PORTFOLIO

21.15.4 RECENT DEVELOPMENT

21.16 SOFINTER S.P.A

21.16.1 COMPANY SNAPSHOT

21.16.2 PRODUCT PORTFOLIO

21.16.3 RECENT DEVELOPMENTS

21.17 SUPERIOR BOILER WORKS, INC.

21.17.1 COMPANY SNAPSHOT

21.17.2 PRODUCT PORTFOLIO

21.17.3 RECENT DEVELOPMENTS

21.18 SUZHOU HAILU HEAVY INDUSTRY CO., LTD

21.18.1 COMPANY SNAPSHOT

21.18.2 PRODUCT PORTFOLIO

21.18.3 RECENT DEVELOPMENTS

21.19 VAPOR POWER

21.19.1 COMPANY SNAPSHOT

21.19.2 PRODUCT PORTFOLIO

21.19.3 RECENT DEVELOPMENT

21.2 ZOZEN BOILER CO., LTD.

21.20.1 COMPANY SNAPSHOT

21.20.2 PRODUCT PORTFOLIO

21.20.3 RECENT DEVELOPMENTS

22 QUESTIONNAIRE

23 RELATED REPORTS

Список таблиц

LIST OF TABLES

TABLE 1 NORTH AMERICA INDUSTRIAL BOILERS MARKET, BY TUBING METHODS, 2018-2027 (USD MILLION)

TABLE 2 NORTH AMERICA WATER TUBE BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 3 NORTH AMERICA FIRE TUBE BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 4 NORTH AMERICA INDUSTRIAL BOILERS MARKET, BY STEAM PRESSURE, 2018-2027 (USD MILLION)

TABLE 5 NORTH AMERICA HIGH PRESSURE BOILERS IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 6 NORTH AMERICA MEDIUM PRESSURE BOILERS IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 7 NORTH AMERICA MEDIUM PRESSURE BOILERS IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 8 NORTH AMERICA INDUSTRIAL BOILERS MARKET, BY STEAM USAGE, 2018-2027 (USD MILLION)

TABLE 9 NORTH AMERICA PROCESS BOILERS IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 10 NORTH AMERICA UTILITY BOILERS IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 11 NORTH AMERICA MARINE BOILERS IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 12 NORTH AMERICA INDUSTRIAL BOILERS MARKET, BY FURNACE POSITION, 2018-2027 (USD MILLION)

TABLE 13 NORTH AMERICA EXTERNALLY FIRED BOILERS IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 14 NORTH AMERICA INTERNALLY FIRED BOILERS IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 15 NORTH AMERICA INDUSTRIAL BOILERS MARKET, BY SHELL AXIS, 2018-2027 (USD MILLION)

TABLE 16 NORTH AMERICA HORIZONTAL BOILERS IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 17 NORTH AMERICA VERTICAL BOILERS IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 18 NORTH AMERICA INDUSTRIAL BOILERS MARKET, BY TUBES IN BOILERS, 2018-2027 (USD MILLION)

TABLE 19 NORTH AMERICA MULTI TUBE BOILERS IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 20 NORTH AMERICA SINGLE TUBE BOILERS IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 21 NORTH AMERICA INDUSTRIAL BOILERS MARKET, BY WATER AND STEAM CIRCULATION IN BOILERS, 2018-2027 (USD MILLION)

TABLE 22 NORTH AMERICA FORCED CIRCULATION BOILERS IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 23 NORTH AMERICA NATURAL CIRCULATION BOILERS IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 24 NORTH AMERICA INDUSTRIAL BOILERS MARKET, BY FUEL TYPE, 2018-2027 (USD MILLION)

TABLE 25 NORTH AMERICA GAS FIRED BOILERS IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 26 NORTH AMERICA COAL FIRED BOILERS IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 27 NORTH AMERICA BIOMASS BOILERS IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 28 NORTH AMERICA OIL FIRED BOILERS IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 29 NORTH AMERICA OTHERS IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 30 NORTH AMERICA INDUSTRIAL BOILERS MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 31 NORTH AMERICA CONDENSING HOT WATER BOILER IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 32 NORTH AMERICA INTEGRATED CONDENSING HOT WATER BOILER IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 33 NORTH AMERICA INTEGRATED CONDENSING STEAM BOILER IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 34 NORTH AMERICA SPLIT CONDENSING STEAM BOILERIN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 35 NORTH AMERICA ELECTRIC HEATED STEAM BOILER IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 36 NORTH AMERICA ELECTRIC HOT WATER BOILERS IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 37 NORTH AMERICA OTHERS IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 38 NORTH AMERICA INDUSTRIAL BOILERS MARKET, BY BOILER HORSEPOWER, 2018-2027 (USD MILLION)

TABLE 39 NORTH AMERICA 10-150 BHP IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 40 NORTH AMERICA 151 -300 BHPIN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 41 NORTH AMERICA 301 - 600 BHPIN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 42 NORTH AMERICA INDUSTRIAL BOILERS MARKET, BY INDUSTRY, 2018-2027 (USD MILLION)

TABLE 43 NORTH AMERICA FOOD INDUSTRY IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 44 NORTH AMERICA FOOD INDUSTRY IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 45 NORTH AMERICA BREWERIES IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 46 NORTH AMERICA BREWERIES IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 47 NORTH AMERICA LAUNDRIES AND CLEANING FIRM IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 48 NORTH AMERICA LAUNDRIES AND CLEANING FIRM IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 49 NORTH AMERICA PHARMACEUTICAL IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 50 NORTH AMERICA PHARMACEUTICAL IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 51 NORTH AMERICA HOSPITALS IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 52 NORTH AMERICA HOSPITALS IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 53 NORTH AMERICA CONSTRUCTION IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 54 NORTH AMERICA CONSTRUCTION IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 55 NORTH AMERICA PULP AND PAPER IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 56 NORTH AMERICA PULP AND PAPER IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 57 NORTH AMERICA AUTOMOTIVE IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 58 NORTH AMERICA AUTOMOTIVE IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 59 NORTH AMERICA AGRICULTURE IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 60 NORTH AMERICA AGRICULTURE IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 61 NORTH AMERICA PACKAGING IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 62 NORTH AMERICA PACKAGING IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 63 NORTH AMERICA FOOD INDUSTRY IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 64 NORTH AMERICAINDUSTRIAL BOILERS MARKET,BY COUNTRY, 2018-2027 (USD MILLION)

TABLE 65 NORTH AMERICA INDUSTRIAL BOILERS MARKET,BY TUBING METHODS, 2018-2027 (USD MILLION)

TABLE 66 NORTH AMERICA INDUSTRIAL BOILERS MARKET,BY STEAM PRESSURE, 2018-2027 (USD MILLION)

TABLE 67 NORTH AMERICA INDUSTRIAL BOILERS MARKET,BY STEAM USAGE, 2018-2027 (USD MILLION)

TABLE 68 NORTH AMERICA INDUSTRIAL BOILERS MARKET,BY FURNACE POSITION, 2018-2027 (USD MILLION)

TABLE 69 NORTH AMERICA INDUSTRIAL BOILERS MARKET,BY SHELL AXIS, 2018-2027 (USD MILLION)

TABLE 70 NORTH AMERICA INDUSTRIAL BOILERS MARKET,BY TUBES IN BOILERS, 2018-2027 (USD MILLION)

TABLE 71 NORTH AMERICA INDUSTRIAL BOILERS MARKET,BY WATER AND STEAM CIRCULATION IN BOILERS, 2018-2027 (USD MILLION)

TABLE 72 NORTH AMERICA INDUSTRIAL BOILERS MARKET,BY FUEL TYPE, 2018-2027 (USD MILLION)

TABLE 73 NORTH AMERICA INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 74 NORTH AMERICA INDUSTRIAL BOILERS MARKET,BY BOILER HORSEPOWER, 2018-2027 (USD MILLION)

TABLE 75 NORTH AMERICA INDUSTRIAL BOILERS MARKET,BY INDUSTRY, 2018-2027 (USD MILLION)

TABLE 76 NORTH AMERICA FOOD INDUSTRY IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 77 NORTH AMERICA BREWERIES IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 78 NORTH AMERICA LAUNDRIES AND CLEANING FIRM IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 79 NORTH AMERICA PHARMACEUTICAL IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 80 NORTH AMERICA HOSPITALS IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 81 NORTH AMERICA CONSTRUCTION IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 82 NORTH AMERICA PULP AND PAPER IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 83 NORTH AMERICA AUTOMOTIVE IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 84 NORTH AMERICA AGRICULTURE IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 85 NORTH AMERICA PACKAGING IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 86 U.S. INDUSTRIAL BOILERS MARKET,BY TUBING METHODS, 2018-2027 (USD MILLION)

TABLE 87 U.S. INDUSTRIAL BOILERS MARKET,BY STEAM PRESSURE, 2018-2027 (USD MILLION)

TABLE 88 U.S. INDUSTRIAL BOILERS MARKET,BY STEAM USAGE, 2018-2027 (USD MILLION)

TABLE 89 U.S. INDUSTRIAL BOILERS MARKET,BY FURNACE POSITION, 2018-2027 (USD MILLION)

TABLE 90 U.S. INDUSTRIAL BOILERS MARKET,BY SHELL AXIS, 2018-2027 (USD MILLION)

TABLE 91 U.S. INDUSTRIAL BOILERS MARKET,BY TUBES IN BOILERS, 2018-2027 (USD MILLION)

TABLE 92 U.S. INDUSTRIAL BOILERS MARKET,BY WATER AND STEAM CIRCULATION IN BOILERS, 2018-2027 (USD MILLION)

TABLE 93 U.S. INDUSTRIAL BOILERS MARKET,BY FUEL TYPE, 2018-2027 (USD MILLION)

TABLE 94 U.S. INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 95 U.S. INDUSTRIAL BOILERS MARKET,BY BOILER HORSEPOWER, 2018-2027 (USD MILLION)

TABLE 96 U.S. INDUSTRIAL BOILERS MARKET,BY INDUSTRY, 2018-2027 (USD MILLION)

TABLE 97 U.S. FOOD INDUSTRY IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 98 U.S. BREWERIES IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 99 U.S. LAUNDRIES AND CLEANING FIRM IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 100 U.S. PHARMACEUTICAL IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 101 U.S. HOSPITALS IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 102 U.S. CONSTRUCTION IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 103 U.S. PULP AND PAPER IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 104 U.S. AUTOMOTIVE IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 105 U.S. AGRICULTURE IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 106 U.S. PACKAGING IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 107 CANADA INDUSTRIAL BOILERS MARKET,BY TUBING METHODS, 2018-2027 (USD MILLION)

TABLE 108 CANADA INDUSTRIAL BOILERS MARKET,BY STEAM PRESSURE, 2018-2027 (USD MILLION)

TABLE 109 CANADA INDUSTRIAL BOILERS MARKET,BY STEAM USAGE, 2018-2027 (USD MILLION)

TABLE 110 CANADA INDUSTRIAL BOILERS MARKET,BY FURNACE POSITION, 2018-2027 (USD MILLION)

TABLE 111 CANADA INDUSTRIAL BOILERS MARKET,BY SHELL AXIS, 2018-2027 (USD MILLION)

TABLE 112 CANADA INDUSTRIAL BOILERS MARKET,BY TUBES IN BOILERS, 2018-2027 (USD MILLION)

TABLE 113 CANADA INDUSTRIAL BOILERS MARKET,BY WATER AND STEAM CIRCULATION IN BOILERS, 2018-2027 (USD MILLION)

TABLE 114 CANADA INDUSTRIAL BOILERS MARKET,BY FUEL TYPE, 2018-2027 (USD MILLION)

TABLE 115 CANADA INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 116 CANADA INDUSTRIAL BOILERS MARKET,BY BOILER HORSEPOWER, 2018-2027 (USD MILLION)

TABLE 117 CANADA INDUSTRIAL BOILERS MARKET,BY INDUSTRY, 2018-2027 (USD MILLION)

TABLE 118 CANADA FOOD INDUSTRY IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 119 CANADA BREWERIES IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 120 CANADA LAUNDRIES AND CLEANING FIRM IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 121 CANADA PHARMACEUTICAL IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 122 CANADA HOSPITALS IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 123 CANADA CONSTRUCTION IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 124 CANADA PULP AND PAPER IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 125 CANADA AUTOMOTIVE IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 126 CANADA AGRICULTURE IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 127 CANADA PACKAGING IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 128 MEXICO INDUSTRIAL BOILERS MARKET,BY TUBING METHODS, 2018-2027 (USD MILLION)

TABLE 129 MEXICO INDUSTRIAL BOILERS MARKET,BY STEAM PRESSURE, 2018-2027 (USD MILLION)

TABLE 130 MEXICO INDUSTRIAL BOILERS MARKET,BY STEAM USAGE, 2018-2027 (USD MILLION)

TABLE 131 MEXICO INDUSTRIAL BOILERS MARKET,BY FURNACE POSITION, 2018-2027 (USD MILLION)

TABLE 132 MEXICO INDUSTRIAL BOILERS MARKET,BY SHELL AXIS, 2018-2027 (USD MILLION)

TABLE 133 MEXICO INDUSTRIAL BOILERS MARKET,BY TUBES IN BOILERS, 2018-2027 (USD MILLION)

TABLE 134 MEXICO INDUSTRIAL BOILERS MARKET,BY WATER AND STEAM CIRCULATION IN BOILERS, 2018-2027 (USD MILLION)

TABLE 135 MEXICO INDUSTRIAL BOILERS MARKET,BY FUEL TYPE, 2018-2027 (USD MILLION)

TABLE 136 MEXICO INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 137 MEXICO INDUSTRIAL BOILERS MARKET,BY BOILER HORSEPOWER, 2018-2027 (USD MILLION)

TABLE 138 MEXICO INDUSTRIAL BOILERS MARKET,BY INDUSTRY, 2018-2027 (USD MILLION)

TABLE 139 MEXICO FOOD INDUSTRY IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 140 MEXICO BREWERIES IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 141 MEXICO LAUNDRIES AND CLEANING FIRM IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 142 MEXICO PHARMACEUTICAL IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 143 MEXICO HOSPITALS IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 144 MEXICO CONSTRUCTION IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 145 MEXICO PULP AND PAPER IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 146 MEXICO AUTOMOTIVE IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 147 MEXICO AGRICULTURE IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 148 MEXICO PACKAGING IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

Список рисунков

LIST OF FIGURES

FIGURE 1 NORTH AMERICA INDUSTRIAL BOILERS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA INDUSTRIAL BOILERS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA INDUSTRIAL BOILERS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA INDUSTRIAL BOILERS MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA INDUSTRIAL BOILERS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA INDUSTRIAL BOILERS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA INDUSTRIAL BOILERS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA INDUSTRIAL BOILERS MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA INDUSTRIAL BOILERS MARKET: SEGMENTATION

FIGURE 10 INCREASING DEMAND FOR LOW EMISSION INDUSTRIAL BOILERS AND GROWING DEMAND FOR ADVANCED BOILER SOLUTION FROM INDUSTRIAL VERTICALS ARE DRIVING THE NORTH AMERICA INDUSTRIAL BOILERS MARKET IN THE FORECAST PERIOD OF 2020 TO 2027

FIGURE 11 WATER TUBE BOILERS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF NORTH AMERICA INDUSTRIAL BOILERS MARKET IN 2020 & 2027

FIGURE 12 DRIVERS, RESTRAINT, OPPORTUNITIES AND CHALLENGES OF NORTH AMERICA INDUSTRIAL BOILERS MARKET

FIGURE 13 THERMODYNE MARKET SHARE OF FOOD INDUSTRY BOILERS

FIGURE 14 FUEL LOSS IN BOILER WITH SCALE BUILD UP

FIGURE 15 NORTH AMERICA INDUSTRIAL BOILERS MARKET: BY TUBING METHODS, 2019

FIGURE 16 NORTH AMERICA INDUSTRIAL BOILERS MARKET: BYSTEAM PRESSURE, 2019

FIGURE 17 NORTH AMERICA INDUSTRIAL BOILERS MARKET: BY STEAM USAGE, 2019

FIGURE 18 NORTH AMERICA INDUSTRIAL BOILERS MARKET: BY FURNACE POSITION, 2019

FIGURE 19 NORTH AMERICA INDUSTRIAL BOILERS MARKET: BY SHELL AXIS, 2019

FIGURE 20 NORTH AMERICA INDUSTRIAL BOILERS MARKET: BY TUBES IN BOILERS, 2019

FIGURE 21 NORTH AMERICA INDUSTRIAL BOILERS MARKET: BY WATER AND STEAM CIRCULATION IN BOILERS, 2019

FIGURE 22 NORTH AMERICA INDUSTRIAL BOILERS MARKET: BYFUEL TYPE, 2019

FIGURE 23 NORTH AMERICA INDUSTRIAL BOILERS MARKET: BY PRODUCT TYPE, 2019

FIGURE 24 NORTH AMERICA INDUSTRIAL BOILERS MARKET: BY BOILER HORSEPOWER, 2019

FIGURE 25 NORTH AMERICA INDUSTRIAL BOILERS MARKET: BY INDUSTRY, 2019

FIGURE 26 NORTH AMERICAINDUSTRIAL BOILERS MARKET: SNAPSHOT (2019)

FIGURE 27 NORTH AMERICAINDUSTRIAL BOILERS MARKET: BY COUNTRY(2019)

FIGURE 28 NORTH AMERICAINDUSTRIAL BOILERS MARKET: BY COUNTRY(2020& 2027)

FIGURE 29 NORTH AMERICA INDUSTRIAL BOILERS MARKET: BY COUNTRY (2019& 2027)

FIGURE 30 NORTH AMERICA INDUSTRIAL BOILERS MARKET: BY TUBING METHODS (2020-2027)

FIGURE 31 NORTH AMERICA INDUSTRIAL BOILERS MARKET: COMPANY SHARE 2019 (%)

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.