North America Flow Cytometry Market

Размер рынка в млрд долларов США

CAGR :

%

USD

3.40 Billion

USD

7.77 Billion

2024

2032

USD

3.40 Billion

USD

7.77 Billion

2024

2032

| 2025 –2032 | |

| USD 3.40 Billion | |

| USD 7.77 Billion | |

|

|

|

|

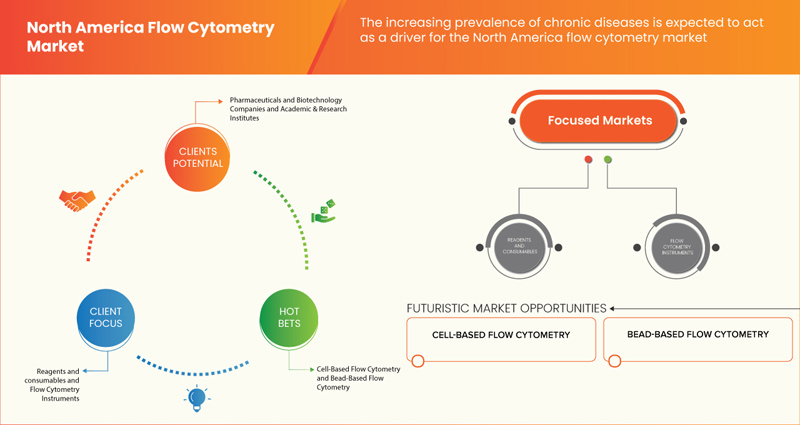

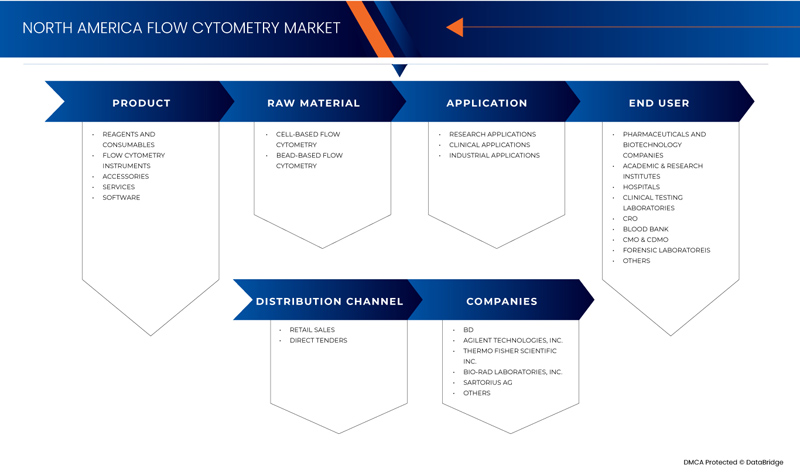

Сегментация рынка проточной цитометрии в Северной Америке по продукту (реагенты и расходные материалы, приборы для проточной цитометрии, аксессуары, услуги и программное обеспечение), технология (клеточная проточная цитометрия и проточная цитометрия на основе шариков), применение (исследовательские приложения, клинические приложения и промышленные приложения), конечный пользователь (фармацевтические и биотехнологические компании, академические и научно-исследовательские институты, больницы, клинические испытательные лаборатории, CRO, банки крови, CMO и CDMO, судебно-медицинские лаборатории и другие), канал сбыта (розничные продажи и прямые тендеры) — отраслевые тенденции и прогноз до 2032 г.

Анализ рынка проточной цитометрии в Северной Америке

Проточная цитометрия — это метод обнаружения и количественной оценки физических и химических свойств популяции клеток или частиц. Образец, содержащий клетки или частицы, суспендируется в жидкости и вводится в оборудование проточного цитометра в этом процессе. Проточная цитометрия — это хорошо зарекомендовавшая себя технология идентификации клеток в растворе, которая чаще всего используется для оценки периферической крови, костного мозга и других жидкостей организма. Иммунные клетки идентифицируются и количественно определяются с помощью проточной цитометрии, которая также используется для описания гематологических злокачественных новообразований. Оценка клеток с помощью этого метода играет ключевую роль в диагностике многих хронических заболеваний. Он анализирует биологическую активность внутри клеток, апоптоз, некроз, клеточный цикл, клеточную мембрану, пролиферацию клеток и измерение ДНК на клетку.

Основные диагностические приложения включают доброкачественные гематологические процессы, рак, СПИД, иммунодефицит, доброкачественные гематологические заболевания и обнаружение этих заболеваний с помощью флуоресценции. В этом процессе клетки окрашиваются флуорофорами для обнаружения испускаемого света, чтобы получить интенсивность путем маркировки определенных белков (иммунофенотипирование) для диагностики лейкемии и лимфом.

Размер рынка проточной цитометрии в Северной Америке

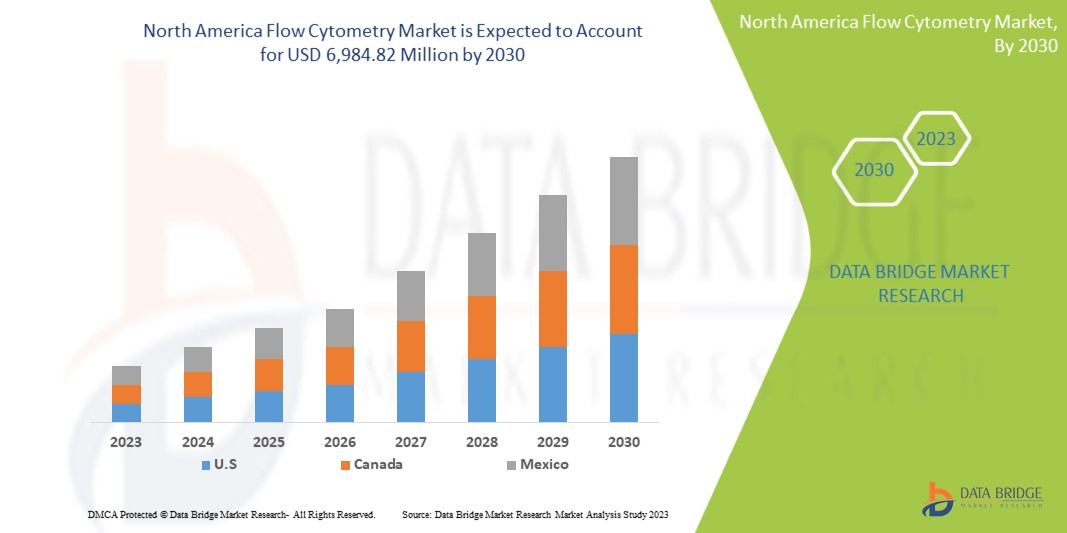

Объем рынка проточной цитометрии в Северной Америке оценивался в 3,40 млрд долларов США в 2024 году и, по прогнозам, достигнет 7,77 млрд долларов США к 2032 году со среднегодовым темпом роста 10,8% в прогнозируемый период с 2025 по 2032 год. Помимо информации о рыночных сценариях, таких как рыночная стоимость, темпы роста, сегментация, географический охват и основные игроки, рыночные отчеты, подготовленные Data Bridge Market Research, также включают анализ импорта и экспорта, обзор производственных мощностей, анализ потребления продукции, анализ ценовых тенденций, сценарий изменения климата, анализ цепочки поставок, анализ цепочки создания стоимости, обзор сырья/расходных материалов, критерии выбора поставщиков, анализ PESTLE, анализ Портера и нормативную базу.

Тенденции рынка проточной цитометрии в Северной Америке

«Растущее внедрение возможностей многопараметрического анализа»

Одной из важных тенденций на рынке проточной цитометрии в Северной Америке является растущее внедрение возможностей многопараметрического анализа, обусловленное достижениями в области технологий, которые позволяют одновременно измерять многочисленные клеточные маркеры. Эта тенденция в значительной степени подпитывается растущим спросом на подробную клеточную характеристику в таких областях, как исследования рака, иммунология и персонализированная медицина, где необходимо понимать сложные клеточные взаимодействия. Инновации в лазерных системах, детекторах и программном обеспечении позволяют анализировать больше параметров с большей чувствительностью и разрешением, что позволяет исследователям и врачам глубже проникать в биологические процессы и повышать точность диагностики. Этот сдвиг в сторону более сложных систем проточной цитометрии трансформирует исследовательские методологии и расширяет применимость проточной цитометрии в различных областях.

Область применения отчета и сегментация рынка проточной цитометрии в Северной Америке

|

Атрибуты |

Обзор рынка проточной цитометрии в Северной Америке |

|

Охваченные сегменты |

|

|

Охваченный регион |

США, Канада, Мексика, Германия, Франция, Великобритания, Италия, Испания, Россия, Нидерланды, Швейцария, Турция, Бельгия, Австрия, Ирландия, Норвегия, Польша, Остальные страны Европы, Япония, Китай, Индия, Южная Корея, Австралия, Сингапур, Таиланд, Малайзия, Индонезия, Вьетнам, Филиппины, Остальные страны Азиатско-Тихоокеанского региона, Бразилия, Аргентина, Перу, Остальные страны Южной Америки, Южная Африка, Саудовская Аравия, ОАЭ, Египет, Кувейт, Израиль и Остальные страны Ближнего Востока и Африки |

|

Ключевые игроки рынка |

BD (США), Agilent Technologies, Inc. (США), Thermo Fisher Scientific Inc. (США), Bio-Rad Laboratories, Inc. (США), Sartorius AG (Германия), Bennubio Inc. (США), Enzo Biochem Inc. (США), Apogee Flow Systems Ltd. (Великобритания), Beckman Coulter, Inc. (США), Coherent Corp. (США), Cell Signaling Technology, Inc. (США), Cytek Biosciences (США), Biomérieux. (Франция), Cytonome/ST LLC (США) и другие |

|

Возможности рынка |

|

|

Информационные наборы данных с добавленной стоимостью |

Помимо информации о рыночных сценариях, таких как рыночная стоимость, темпы роста, сегментация, географический охват и основные игроки, рыночные отчеты, подготовленные Data Bridge Market Research, также включают анализ импорта и экспорта, обзор производственных мощностей, анализ потребления продукции, анализ ценовых тенденций, сценарий изменения климата, анализ цепочки поставок, анализ цепочки создания стоимости, обзор сырья/расходных материалов, критерии выбора поставщиков, анализ PESTLE, анализ Портера и нормативную базу. |

Определение рынка проточной цитометрии в Северной Америке

Рынок проточной цитометрии в Северной Америке относится к отрасли, которая охватывает разработку, производство и распространение оборудования для проточной цитометрии, реагентов, программного обеспечения и услуг, используемых для анализа и сортировки клеток и других частиц, взвешенных в потоке жидкости. Проточная цитометрия — это мощный метод, позволяющий одновременно измерять множество физических и химических характеристик отдельных клеток, таких как размер, сложность и экспрессия белка. Эта технология широко используется в различных приложениях, включая иммунологию, онкологию, микробиологию и разработку лекарств, что делает ее важным инструментом как в клинической диагностике, так и в исследовательских целях.

Динамика рынка проточной цитометрии в Северной Америке

Драйверы

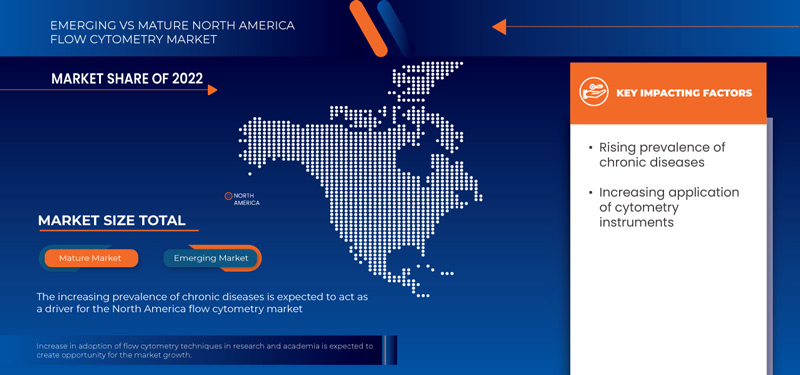

- Рост распространенности хронических заболеваний

Проточная цитометрия — это метод обнаружения и количественной оценки физических и химических свойств популяции клеток или частиц. Образец, содержащий клетки или частицы, суспендируется в жидкости и вводится в оборудование проточного цитометра в этом процессе. Проточная цитометрия — это хорошо зарекомендовавшая себя технология идентификации клеток в растворе, которая чаще всего используется для оценки периферической крови, костного мозга и других жидкостей организма. Иммунные клетки идентифицируются и количественно определяются с помощью проточной цитометрии, которая также используется для описания гематологических злокачественных новообразований. Оценка клеток с помощью этого метода играет ключевую роль в диагностике многих хронических заболеваний. Он анализирует биологическую активность внутри клеток, апоптоз, некроз, клеточный цикл, клеточную мембрану, пролиферацию клеток и измерение ДНК на клетку.

Основные диагностические приложения включают доброкачественные гематологические процессы, рак, СПИД, иммунодефицит, доброкачественные гематологические заболевания и обнаружение этих заболеваний с помощью флуоресценции. В этом процессе клетки окрашиваются флуорофорами для обнаружения испускаемого света, чтобы получить интенсивность путем маркировки определенных белков (иммунофенотипирование) для диагностики лейкемии и лимфом.

Растущая распространенность хронических заболеваний обусловила растущий спрос на методы проточной цитометрии, которые могут помочь исследователям и врачам лучше понять основные механизмы этих заболеваний и разработать более эффективные методы лечения.

- Растущее применение цитометрических приборов

Проточная цитометрия — это мощный аналитический инструмент, используемый для анализа и количественной оценки отдельных клеток или частиц в гетерогенной смеси. Он использует лазеры и оптику для обнаружения и измерения клеток или частиц, таких как размер, форма и интенсивность флуоресценции. Этот метод включает маркировку клеток или частиц флуоресцентными красителями или антителами, которые связываются со специфическими маркерами клеточной поверхности или внутриклеточными молекулами. Затем маркированные клетки или частицы пропускаются через проточный цитометр, который обнаруживает и измеряет флуоресценцию, испускаемую каждой клеткой или частицей. Проточная цитометрия широко используется во многих областях исследований, включая иммунологию, микробиологию, исследования стволовых клеток, исследования рака, открытие и разработку лекарственных препаратов и клиническую диагностику. Метод постоянно развивается с новыми приложениями и усовершенствованиями аппаратного и программного обеспечения, что делает его важным инструментом в изучении биологических систем.

Например,

- В июле 2023 года, согласно статье, опубликованной NCBI, растущее применение проточной цитометрии в различных областях, включая иммунофенотипирование, анализы жизнеспособности, анализ клеточного цикла и идентификацию редких клеток, стимулирует рынок проточной цитометрии в Северной Америке. Его способность анализировать отдельные клетки на уровне отдельных клеток и сортировать определенные популяции для передовых исследований подпитывает спрос. Эта универсальность ускоряет рост как академических, так и клинических исследований, стимулируя расширение рынка.

- В июне 2020 года, согласно статье, опубликованной в онлайн-библиотеке Wiley, проточная цитометрия может использоваться для идентификации и характеристики различных подмножеств иммунных клеток у пациентов с аутоиммунными заболеваниями, такими как системная красная волчанка (СКВ). Исследование пришло к выводу, что проточная цитометрия может предоставить ценную информацию о патогенезе этих заболеваний и помочь в разработке более целенаправленных методов лечения. Это ускоряет рост как академических, так и клинических исследований, стимулируя расширение рынка.

Растущее использование проточной цитометрии в разработке лекарств

- Расширение исследовательской деятельности, как прогнозируется, будет стимулировать рост проточной цитометрии. Она стала основным ключом к исследованию процессов открытия и разработки лекарств. Благодаря своей выдающейся способности анализировать гетерогенные популяции клеток, проточная цитометрия представляет собой заманчивую перспективу для путей открытия и разработки лекарств. Она обеспечивает более высокое разрешение понимания многопараметрической функциональной и биологической информации отдельной клетки. Более того, продолжающийся прогресс в подходах проточной цитометрии, таких как высокопроизводительный многофакторный анализ, улучшение сортировки клеток и быстрое обнаружение и разрешение событий, обеспечивает повышенную эффективность в поиске и характеристике новых биоактивных лекарств.

- Например;-

- В марте 2024 года, согласно статье, опубликованной NCBI, растущее использование проточной цитометрии в разработке лекарств, особенно для модуляции биомаркеров в ранних клинических испытаниях, стимулирует рынок проточной цитометрии в Северной Америке. Его способность предоставлять ценную информацию о прогрессии молекул и обратной трансляции данных пациентов ускоряет открытия в терапевтических разработках. Это растущее применение в разработке лекарств стимулирует спрос на передовые технологии проточной цитометрии в секторах здравоохранения и фармацевтики.

- В ноябре 2021 года, согласно статье, опубликованной News Medical Life Sciences, возросшее использование проточной цитометрии в разработке лекарств, от идентификации мишеней до разработки лидов, является движущей силой рынка Северной Америки. Она позволяет анализировать различные биомолекулярные структуры, включая клеточные мембраны, белки, ДНК и мРНК, что позволяет точно нацеливаться при разработке лекарств. Эта широкая применимость в понимании сложных биологических процессов ускоряет спрос на технологии проточной цитометрии в фармацевтических исследованиях.

Возможности

- Рост внедрения методов проточной цитометрии в исследованиях и академических кругах

Проточная цитометрия — это сложная технология измерения отдельных клеток и других частиц в суспензии со скоростью тысяч клеток в секунду. Проточная цитометрия была распространена на исследования окружающей среды, анализ внеклеточных везикул и возможность использования более 30 различных параметров для более обширного анализа. Чаще всего она используется в условиях иммунологии. Проточные цитометры обеспечивают исключительные возможности, высококачественные данные и простую в использовании платформу, которая экономит время исследователей при сборе и оценке данных.

Рост распространенности и заболеваемости хроническими заболеваниями и инфекционными заболеваниями открыл широкие возможности для масштабных исследований и разработок в области новых диагностических и терапевтических приложений.

Например,

В феврале 2021 года, согласно исследованию, опубликованному в PLOS ONE, исследователи использовали проточную цитометрию для анализа иммунного ответа пациентов с COVID-19. Исследование показало, что проточная цитометрия является надежным и эффективным инструментом для характеристики иммунного ответа на вирус, что может помочь в определении стратегий лечения

В апреле 2021 года, согласно исследованию, опубликованному в Frontiers in Immunology, исследователи использовали проточную цитометрию для изучения иммунного ответа на ВИЧ-инфекцию. Исследование показало, что проточная цитометрия является эффективным инструментом для характеристики иммунного ответа на вирус, что может привести к разработке новых методов лечения и вакцин.

- Растущее развитие фармацевтической и биотехнологической промышленности

Инструменты для проточной цитометрии стали неотъемлемой частью открытия и разработки лекарств в фармацевтической и биотехнологической промышленности. Разработка нового оборудования для проточной цитометрии помогла исследователям анализировать и сортировать клетки быстрее, точнее и эффективнее, что помогло ускорить сроки разработки лекарств. Например, Beckman Coulter, ведущий производитель оборудования для проточной цитометрии, разработал проточный цитометр CytoFLEX LX с быстрым обнаружением, повышенной чувствительностью и малыми габаритами. CytoFLEX LX разработан, чтобы помочь исследователям анализировать редкие популяции клеток быстрее и эффективнее.

В целом, разработка новых устройств проточной цитометрии помогает фармацевтическим и биотехнологическим компаниям ускорить сроки разработки лекарств, позволяя проводить более быстрый и точный анализ сложных популяций клеток. С ростом гериатрического населения и случаев хронических заболеваний также увеличивается рост биотехнологических и фармацевтических компаний. Во всем мире деятельность по исследованиям и разработкам растет из-за расходов на здравоохранение с учетом экономических показателей.

Например,

- В октябре 2024 года Ardena объявила о существенном расширении своего биоаналитического подразделения в Нидерландах. Кроме того, она сосредоточилась на расширении своих возможностей в области иммунохимии, проточной цитометрии и платформ qPCR, увеличении своей мощности LC-MS/MS и добавлении новых автоматизированных систем Hamilton для повышения эффективности и решения развивающихся биоаналитических задач.

- В апреле 2021 года, согласно данным, предоставленным CBO (Бюджетным управлением Конгресса), фармацевтический сектор потратил 83 миллиарда долларов США на исследования и разработки. Эти расходы были понесены в связи с рядом операций, включая открытие и тестирование новых лекарств, разработку дополнительных усовершенствований, таких как расширение продуктов, и клинические испытания для мониторинга безопасности и маркетинга.

Ограничения/Проблемы

- Высокая стоимость приборов для проточной цитометрии

Значительные первоначальные инвестиции, необходимые для приборов проточной цитометрии, в сочетании с текущими расходами на реагенты, красители и техническое обслуживание создают финансовые барьеры, особенно для небольших лабораторий или тех, которые находятся в условиях ограниченных ресурсов. Кроме того, техническая сложность проточной цитометрии требует квалифицированного персонала для работы, а также специальной подготовки, необходимой для надлежащего использования технологии. Это ограничивает ее доступность в регионах, где не хватает опыта, что снижает скорость ее внедрения. Более того, системы проточной цитометрии требуют регулярного обслуживания, калибровки и устранения неполадок, что увеличивает эксплуатационные расходы и может привести к простоям, еще больше влияя на эффективность лаборатории. Строгие нормативные требования к одобрению этих медицинских приборов также создают задержки в выходе на рынок и дополнительные расходы на соблюдение требований. Эти факторы в совокупности препятствуют широкому внедрению проточной цитометрии, особенно на развивающихся рынках, где финансовые ограничения, нехватка обученных специалистов и медленные процессы регулирования выступают в качестве существенных барьеров для роста, в конечном итоге сдерживая потенциальное расширение рынка.

Например

- Согласно статье, опубликованной Excedr, в январе 2024 года высокая стоимость инструментов для проточной цитометрии, которая варьируется от 100 000 до 1,5 млн долл. США, выступает существенным сдерживающим фактором для рынка Северной Америки. Эти расходы ограничивают доступ к небольшим лабораториям и учреждениям, что затрудняет для них внедрение передовых технологий. В результате высокие первоначальные инвестиции и расходы на техническое обслуживание препятствуют широкому использованию и замедляют рост рынка, особенно в условиях ограниченных ресурсов.

- Согласно статье, опубликованной NCBI, в ноябре 2023 года высокая стоимость инструментов для проточной цитометрии, от 50 000 до 750 000 долларов США и более, выступает в качестве существенного ограничения на рынке Северной Америки. Эти существенные финансовые инвестиции, необходимые для расширенных функций и спецификаций, ограничивают доступность, особенно для небольших исследовательских лабораторий и учреждений с ограниченным бюджетом. Следовательно, высокая стоимость замедляет внедрение и сдерживает рост рынка, особенно в условиях ограниченных ресурсов.

Первоначальные инвестиции в приборы и текущие расходы на реагенты и обслуживание создают финансовые проблемы для небольших лабораторий и лабораторий в регионах с ограниченными ресурсами. Сложность технологии также требует обученного персонала, что ограничивает ее использование в регионах с недостатком опыта. Кроме того, необходимость регулярного обслуживания и калибровки увеличивает эксплуатационные расходы и приводит к потенциальному простою. Строгие нормативные требования еще больше задерживают одобрение продукта и выход на рынок. Эти факторы ограничивают внедрение проточной цитометрии, особенно на развивающихся рынках, сдерживая общий рост рынка.

- Ограничения проточной цитометрии

Проточная цитометрия имеет неотъемлемые ограничения, такие как ее неспособность анализировать фиксированные формалином ткани, что ограничивает ее использование в определенных исследовательских и клинических приложениях. Метод разработан для свежих или замороженных образцов, а фиксация формалином может изменить структуру клеток и экспрессию маркеров, сделав их непригодными для анализа. Кроме того, проточная цитометрия с трудом может полностью захватить сложные клеточные взаимодействия или многослойные сигнальные пути. Эти ограничения ограничивают сферу ее использования в различных областях и действуют как сдерживающий фактор на рынке проточной цитометрии в Северной Америке, сужая ее применимость, особенно в клинических и патологических условиях.

Например-

- В июне 2021 года, согласно статье, опубликованной LearnHaem, проточная цитометрия требует обработки свежих образцов сразу после сбора, поскольку неправильное хранение или длительное хранение приводит к естественному апоптозу, что снижает точность результатов. Кроме того, проточную цитометрию нельзя использовать на тканях, фиксированных формалином, что ограничивает ее применение в определенных клинических и исследовательских средах. Эти ограничения сдерживают рынок проточной цитометрии в Северной Америке, снижая ее универсальность и применимость в некоторых областях.

- В марте 2020 года, согласно статье, опубликованной NCBI, проточная цитометрия столкнулась с ограничениями из-за оптической размытости, вызванной высоким движением клеток, что влияет на четкость изображения. Кроме того, обнаружение редких и атипичных объектов, таких как циркулирующие опухолевые клетки (ЦОК), представляет собой проблему, несмотря на их прогностическое значение. Эти проблемы ограничивают возможность точного захвата и анализа критических биомаркеров, сдерживая рост и применение проточной цитометрии в определенных диагностических и исследовательских областях.

Проточная цитометрия сталкивается с ограничениями, такими как невозможность анализа тканей, зафиксированных формалином, которые обычно используются в патологии и клинической диагностике. Для этого процесса требуются свежие или замороженные образцы, а процесс химической фиксации изменяет клеточные маркеры, делая их несовместимыми с проточной цитометрией. Кроме того, методу трудно полностью охватить сложные клеточные взаимодействия или сложные сигнальные пути. Эти ограничения ограничивают более широкое применение технологии, выступая сдерживающим фактором на рынке проточной цитометрии в Северной Америке, снижая ее универсальность в клинических и исследовательских условиях.

Масштаб рынка проточной цитометрии в Северной Америке

Рынок сегментирован на основе продукта, приложения, технологии, канала сбыта и конечного пользователя. Рост среди этих сегментов поможет вам проанализировать сегменты с незначительным ростом в отраслях и предоставить пользователям ценный обзор рынка и рыночные идеи, которые помогут им принимать стратегические решения для определения основных рыночных приложений.

Продукт

- Реагенты и расходные материалы

- Краситель

- Антитела

- Бусины

- Другие

- Приборы для проточной цитометрии

- Анализаторы клеток

- По типу

- Проточные цитометры для визуализации

- Проточные цитометры без визуализации

- По диапазону

- Высокопроизводительные клеточные анализаторы

- Анализаторы клеток среднего класса

- Анализаторы клеток низкого диапазона

- По модальности

- Настольный

- Автономный

- По типу

- Сортировщики клеток

- По модальности

- Настольный

- Автономный

- По диапазону

- Высокопроизводительные клеточные анализаторы

- Анализаторы клеток среднего класса

- Анализаторы клеток низкого диапазона

- По модальности

- Анализаторы клеток

- Аксессуары

- Фильтры

- Детекторы

- Другие

- Услуги

- Программное обеспечение

Технологии

- Проточная цитометрия на основе клеток

- Приборы для проточной цитометрии

- Реагенты и расходные материалы

- Аксессуары

- Проточная цитометрия на основе шариков

- Приборы для проточной цитометрии

- Реагенты и расходные материалы

- Аксессуары

Приложение

- Исследовательские приложения

- Анализ клеточного цикла

- Сортировка/скрининг клеток

- Трансфекция/Жизнеспособность клеток

- Фармацевтика и биотехнологии

- Открытие лекарств

- Исследования стволовых клеток

- Тестирование токсичности in vitro

- Иммунология

- Апоптоз

- Подсчет клеток

- Другие

- Клинические применения

- Гематология

- Рак

- Иммунодефицитные заболевания

- Трансплантация органов

- Другое клиническое применение

- Промышленное применение

Конечный пользователь

- Фармацевтические и биотехнологические компании

- Академические и научно-исследовательские институты

- Больницы

- Лаборатории клинических испытаний

- Кро

- Банк крови

- Cmo и Cdmo

- Судебно-медицинская лаборатория

- Другие

Канал распространения

- Розничные продажи

- Оффлайн

- Онлайн

- Прямые тендеры

Региональный анализ рынка проточной цитометрии в Северной Америке

Проводится анализ рынка и предоставляются сведения о его размерах и тенденциях по странам, продуктам, областям применения, технологиям, каналам сбыта и конечным пользователям, как указано выше.

Страны, охваченные рынком: США, Канада, Мексика, Германия, Франция, Великобритания, Италия, Испания, Россия, Нидерланды, Швейцария, Турция, Бельгия, Австрия, Ирландия, Норвегия, Польша, остальные страны Европы, Япония, Китай, Индия, Южная Корея, Австралия, Сингапур, Таиланд, Малайзия, Индонезия, Вьетнам, Филиппины, остальные страны Азиатско-Тихоокеанского региона, Бразилия, Аргентина, Перу, остальные страны Южной Америки, Южная Африка, Саудовская Аравия, ОАЭ, Египет, Кувейт, Израиль и остальные страны Ближнего Востока и Африки.

США доминируют на рынке проточной цитометрии благодаря своему сильному сектору исследований и разработок, присутствию ведущих компаний, таких как BD Biosciences и Beckman Coulter, и существенному государственному финансированию. Кроме того, их передовые отрасли здравоохранения и биотехнологий стимулируют широкое использование проточной цитометрии в исследовательских и клинических приложениях.

Канада является самой быстрорастущей страной в проточной цитометрии благодаря расширяющимся секторам биотехнологий и фармацевтики, увеличивающемуся финансированию исследований и прочному академическому сотрудничеству. Сосредоточение страны на инновациях в здравоохранении в сочетании с растущим спросом на передовые диагностические инструменты стимулирует внедрение технологий проточной цитометрии в исследования и клинические приложения.

Раздел отчета по странам также содержит отдельные факторы, влияющие на рынок, и изменения в регулировании на внутреннем рынке, которые влияют на текущие и будущие тенденции рынка. Такие данные, как анализ цепочки создания стоимости вверх и вниз по течению, технические тенденции и анализ пяти сил Портера, тематические исследования — вот некоторые из указателей, используемых для прогнозирования рыночного сценария для отдельных стран. Кроме того, при предоставлении прогнозного анализа данных по странам учитываются наличие и доступность брендов Северной Америки и их проблемы из-за большой или малой конкуренции со стороны местных и отечественных брендов, влияние внутренних тарифов и торговых путей.

Доля рынка проточной цитометрии в Северной Америке

Конкурентная среда рынка содержит сведения о конкурентах. Включены сведения о компании, ее финансах, полученном доходе, рыночном потенциале, инвестициях в исследования и разработки, новых рыночных инициативах, присутствии в Северной Америке, производственных площадках и объектах, производственных мощностях, сильных и слабых сторонах компании, запуске продукта, широте и широте продукта, доминировании приложений. Приведенные выше данные касаются только фокуса компаний на рынке.

Лидерами рынка проточной цитометрии в Северной Америке являются:

- БД (США)

- Agilent Technologies, Inc. (США)

- Thermo Fisher Scientific Inc. (США)

- Bio-Rad Laboratories, Inc. (США)

- Sartorius AG(США)

- CytoBuoy(США)

- ORLFO Technologies(США)

- Bennubio Inc. (США)

- Enzo Biochem Inc. (США)

- Merck KGaA(США)

- Apogee Flow Systems Ltd. (США)

- Beckman Coulter, Inc. (США)

- Coherent Corp. (США)

- Лаборатории NeoGenomics (США)

- Корпорация Sysmex (США)

- Корпорация Luminex (США)

- Elabscience Bionovation Inc. (США)

- Милтени Биотек

- Takara Bio Inc. (США)

- Cell Signaling Technology, Inc. (США)

- Sony Biotechnology Inc. (США)

- Cytek Biosciences (США)

- Биомерье (США).

- Корпорация On-chip Biotechnologies Co., Ltd. (США)

- NanoCellect Biomedical (США)

- Stratedigm, Inc(США)

- Cytonome/ST LLC (США)

- Union Biometrica, Inc. (США)

Последние разработки на рынке проточной цитометрии в Северной Америке

- В июле 2024 года компания Agilent Technologies объявила о приобретении канадской компании по предоставлению лекарственных услуг BioVectra за 925 миллионов долларов США. Этот шаг расширяет возможности Agilent в области редактирования генов, в частности, в производстве олигонуклеотидов и пептидов, усиливая ее роль в РНК-терапии и технологиях редактирования генов, таких как CRISPR-Cas.

- В июне 2024 года компания Thermo Fisher отпраздновала открытие расширения площадью 72 500 квадратных футов в своем кампусе в Миддлтоне, которое будет служить лабораторией для фармацевтических испытаний. Проект создаст 350 рабочих мест в течение следующих двух лет, а государственные налоговые льготы поддержат инициативу

- В ноябре 2024 года Sartorius Stedim Biotech открыла новый Центр инноваций в области биопроцессов в Мальборо, штат Массачусетс, нацеленный на продвижение разработки терапевтических средств следующего поколения. Объект площадью 63 000 квадратных футов обеспечит оптимизацию процесса, обучение и GMP-комплексы для клинического производства, начиная с 2025 года.

- В марте 2024 года компания Beckman Coulter Life Sciences выпустила нанопроточный цитометр CytoFLEX, прорыв в анализе наночастиц, позволяющий обнаруживать частицы размером до 40 нм. Эта система повышает чувствительность, предлагая на 50% больше данных для исследования внеклеточных везикул и менее распространенных мишеней

- В марте 2024 года компания Beckman Coulter Life Sciences получила разрешение FDA 510(k) на распространение своего клинического проточного цитометра DxFLEX в США. Это упрощает проведение сложных испытаний за счет повышенной чувствительности и автоматизированной компенсации, делая многоцветную проточную цитометрию более доступной и эффективной для лабораторий.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Содержание

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA FLOW CYTOMETRY MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 DBMR MARKET POSITION GRID

2.8 VENDOR SHARE ANALYSIS

2.9 MARKET END USER COVERAGE GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 PESTEL ANALYSIS

5 NORTH AMERICA FLOW CYTOMETRY MARKET: REGULATIONS

5.1 NORTH AMERICA (U.S. AND CANADA)

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING PREVALENCE OF CHRONIC DISEASES

6.1.2 INCREASING APPLICATION OF CYTOMETRY INSTRUMENTS

6.1.3 GROWING USE OF FLOW CYTOMETRY IN DRUG DISCOVERY

6.1.4 GROWING RESEARCH FUNDING

6.2 RESTRAINTS

6.2.1 HIGH COST OF FLOW CYTOMETRY INSTRUMENTS

6.2.2 LIMITATIONS OF FLOW CYTOMETRY

6.3 OPPORTUNITIES

6.3.1 INCREASE IN ADOPTION OF FLOW CYTOMETRY TECHNIQUES IN RESEARCH AND ACADEMIA

6.3.2 RISING DEVELOPMENT OF PHARMACEUTICAL AND BIOTECHNOLOGY INDUSTRIES

6.3.3 STRATEGIC INITIATIVES BY KEY MARKET PLAYERS

6.4 CHALLENGES

6.4.1 DIFFICULTY IN THE DEVELOPMENT AND VALIDATION OF FLOW CYTOMETRY ASSAYS

6.4.2 COMPLEXITIES RELATED TO REAGENT DEVELOPMENT

7 NORTH AMERICA FLOW CYTOMETRY MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 REAGENTS AND CONSUMABLES

7.2.1 DYE

7.2.2 ANTIBODIES

7.2.3 BEADS

7.2.4 OTHERS

7.3 FLOW CYTOMETRY INSTRUMENTS

7.3.1 CELL ANALYZERS

7.3.1.1 CELL ANALYZERS, BY TYPE

7.3.1.1.1 IMAGING FLOW CYTOMETERS

7.3.1.1.2 NON-IMAGING FLOW CYTOMETERS

7.3.1.2 CELL ANALYZERS, BY RANGE

7.3.1.2.1 HIGH-RANGE CELL ANALYZERS

7.3.1.2.2 MID-RANGE CELL ANALYZERS

7.3.1.2.3 LOW-RANGE CELL ANALYZERS

7.3.1.3 CELL ANALYZERS, BY MODALITY

7.3.1.3.1 BENCHTOP

7.3.1.3.2 STANDALONE

7.3.2 CELL SORTERS

7.3.2.1 BENCHTOP

7.3.2.2 STANDALONE

7.3.3 CELL SORTERS

7.3.3.1 HIGH-RANGE CELL ANALYZERS

7.3.3.2 MID-RANGE CELL ANALYZERS

7.3.3.3 LOW-RANGE CELL ANALYZERS

7.4 ACCESSORIES

7.4.1 FILTERS

7.4.2 DETECTORS

7.4.3 OTHERS

7.5 SERVICES

7.6 SOFTWARE

8 NORTH AMERICA FLOW CYTOMETRY MARKET, BY TECHNOLOGY

8.1 OVERVIEW

8.2 CELL-BASED FLOW CYTOMETRY

8.2.1 FLOW CYTOMETRY INSTRUMENTS

8.2.2 REAGENTS & CONSUMABLES

8.2.3 ACCESSORIES

8.3 BEAD-BASED FLOW CYTOMETRY

8.3.1 FLOW CYTOMETRY INSTRUMENTS

8.3.2 REAGENTS & CONSUMABLES

8.3.3 ACCESSORIES

9 NORTH AMERICA FLOW CYTOMETRY MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 RESEARCH APPLICATIONS

9.2.1 CELL CYCLE ANALYSIS

9.2.2 CELL SORTING/SCREENING

9.2.3 CELL TRANSFECTION/VIABILITY

9.2.4 PHARMACEUTICAL AND BIOTECHNOLOGY

9.2.4.1 DRUG DISCOVERY

9.2.4.2 STEM CELL RESEARCH

9.2.4.3 IN VITRO TOXICITY TESTING

9.2.5 IMMUNOLOGY

9.2.6 APOPTOSIS

9.2.7 CELL COUNTING

9.2.8 OTHERS

9.3 CLINICAL APPLICATIONS

9.3.1 HAEMATOLOGY

9.3.2 CANCER

9.3.3 IMMUNODEFICIENCY DISEASES

9.3.4 ORGAN TRANSPLANTATION

9.3.5 OTHER CLINICAL APPLICATION

9.4 INDUSTRIAL APPLICATIONS

10 NORTH AMERICA FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL

10.1 OVERVIEW

10.2 RETAIL SALES

10.2.1 OFFLINE

10.2.2 ONLINE

10.3 DIRECT TENDERS

11 NORTH AMERICA FLOW CYTOMETRY MARKET, BY END USER

11.1 OVERVIEW

11.2 PHARMACEUTICALS AND BIOTECHNOLOGY COMPANIES

11.3 ACADEMIC & RESEARCH INSTITUTES

11.4 HOSPITALS

11.5 CLINICAL TESTING LABORATORIES

11.6 CRO

11.7 BLOOD BANK

11.8 CMO & CDMO

11.9 FORENSIC LABORATORIES

11.1 OTHERS

12 NORTH AMERICA FLOW CYTOMETRY MARKET, BY COUNTRY

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

13 NORTH AMERICA FLOW CYTOMETRY MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 BD

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT DEVELOPMENT

15.2 AGILENT TECHNOLOGIES, INC.

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT DEVELOPMENT

15.3 THERMO FISHER SCIENTIFIC INC.

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENT

15.4 BIO-RAD LABORATORIES, INC.

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENT

15.5 SARTORIUS AG

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT DEVELOPMENT

15.6 APOGEE FLOW SYSTEMS LTD.

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 BECKMAN COULTER, INC. (A SUBSIDIARY OF DANAHER CORPORATION)

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENT

15.8 BIOMÉRIEUX

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT DEVELOPMENT

15.9 BIOLEGEND, INC.

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 BENNUBIO INC.

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 COHERENT CORP.

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 PRODUCT PORTFOLIO

15.11.4 RECENT DEVELOPMENT

15.12 CYTONOME/ST, LLC

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENTS

15.13 CELL SIGNALING TECHNOLOGY, INC

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENT

15.14 CYTEK BIOSCIENCES

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 DIASORIN S.P.A.

15.15.1 COMPANY SNAPSHOT

15.15.2 REVENUE ANALYSIS

15.15.3 PRODUCT PORTFOLIO

15.15.4 RECENT DEVELOPMENT

15.16 ELABSCIENCE BIONOVATION INC.

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENT

15.17 ENZO BIOCHEM, INC

15.17.1 COMPANY SNAPSHOT

15.17.2 REVENUE ANALYSIS

15.17.3 PRODUCT PORTFOLIO

15.17.4 RECENT DEVELOPMENT

15.18 MILTENYI BIOTEC

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENT

15.19 MERCK KGAA

15.19.1 COMPANY SNAPSHOT

15.19.2 REVENUE ANALYSIS

15.19.3 PRODUCT PORTFOLIO

15.19.4 RECENT DEVELOPMENT

15.2 NANOCELLECT BIOMEDICAL

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENTS

15.21 NEOGENOMICS LABORATORIES

15.21.1 COMPANY SNAPSHOT

15.21.2 REVENUE ANALYSIS

15.21.3 PRODUCT PORTFOLIO

15.21.4 RECENT DEVELOPMENT

15.22 ON-CHIP BIOTECHNOLOGIES CO., LTD. CORPORATION

15.22.1 COMPANY SNAPSHOT

15.22.2 PRODUCT PORTFOLIO

15.22.3 RECENT DEVELOPMENTS

15.23 ORLFO TECHNOLOGIES

15.23.1 COMPANY SNAPSHOT

15.23.2 PRODUCT PORTFOLIO

15.23.3 RECENT DEVELOPMENT

15.24 STRATEDIGM, INC

15.24.1 COMPANY SNAPSHOT

15.24.2 PRODUCT PORTFOLIO

15.24.3 RECENT DEVELOPMENTS

15.25 SONY BIOTECHNOLOGY INC.

15.25.1 COMPANY SNAPSHOT

15.25.2 PRODUCT PORTFOLIO

15.25.3 RECENT DEVELOPMENT

15.26 SYSMEX ASIA PACIFIC PTE LTD (PART OF SYSMEX CORPORATION)

15.26.1 COMPANY SNAPSHOT

15.26.2 REVENUE ANALYSIS

15.26.3 PRODUCT PORTFOLIO

15.26.4 RECENT DEVELOPMENT

15.27 UNION BIOMETRICA, INC.

15.27.1 COMPANY SNAPSHOT

15.27.2 PRODUCT PORTFOLIO

15.27.3 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

Список таблиц

TABLE 1 NORTH AMERICA FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 2 NORTH AMERICA REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 3 NORTH AMERICA REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 4 NORTH AMERICA FLOW CYTOMETRY INSTRUMENTS IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 5 NORTH AMERICA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 6 NORTH AMERICA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (VOLUME)

TABLE 7 NORTH AMERICA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 8 NORTH AMERICA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 9 NORTH AMERICA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 10 NORTH AMERICA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 11 NORTH AMERICA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 12 NORTH AMERICA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 13 NORTH AMERICA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 14 NORTH AMERICA ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 15 NORTH AMERICA ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 16 NORTH AMERICA FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 17 NORTH AMERICA CELL-BASED IN FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 18 NORTH AMERICA BEAD-BASED IN FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 19 NORTH AMERICA FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 20 NORTH AMERICA RESEARCH APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 21 NORTH AMERICA PHARMACEUTICAL AND BIOTECHNOLOGY IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 22 NORTH AMERICA CLINICAL APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 23 NORTH AMERICA FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 24 NORTH AMERICA RETAIL SALES IN FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 25 NORTH AMERICA FLOW CYTOMETRY MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 26 NORTH AMERICA FLOW CYTOMETRY MARKET, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 27 U.S. FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 28 U.S. REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 29 U.S. REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 30 U.S. REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 31 U.S. FLOW CYTOMETRY INSTRUMENTS IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 32 U.S. CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 33 U.S. CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (VOLUME)

TABLE 34 U.S. CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (ASP)

TABLE 35 U.S. CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 36 U.S. CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 37 U.S. CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 38 U.S. CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 39 U.S. CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 40 U.S. CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 41 U.S. CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 42 U.S. CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 43 U.S. CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (VOLUME)

TABLE 44 U.S. CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (ASP)

TABLE 45 U.S. ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 46 U.S. ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 47 U.S. ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 48 U.S. FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 49 U.S. CELL-BASED FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 50 U.S. BEAD-BASED IN FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 51 U.S. FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 52 U.S. RESEARCH APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 53 U.S. PHARMACEUTICAL AND BIOTECHNOLOGY IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 54 U.S. CLINICAL APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 55 U.S. FLOW CYTOMETRY MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 56 U.S. FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 57 U.S. RETAIL SALES IN FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 58 CANADA FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 59 CANADA REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 60 CANADA REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 61 CANADA REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 62 CANADA FLOW CYTOMETRY INSTRUMENTS IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 63 CANADA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 64 CANADA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (VOLUME)

TABLE 65 CANADA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (ASP)

TABLE 66 CANADA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 67 CANADA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 68 CANADA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 69 CANADA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 70 CANADA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 71 CANADA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 72 CANADA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 73 CANADA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 74 CANADA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (VOLUME)

TABLE 75 CANADA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (ASP)

TABLE 76 CANADA ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 77 CANADA ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 78 CANADA ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 79 CANADA FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 80 CANADA CELL-BASED FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 81 CANADA BEAD-BASED IN FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 82 CANADA FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 83 CANADA RESEARCH APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 84 CANADA PHARMACEUTICAL AND BIOTECHNOLOGY IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 85 CANADA CLINICAL APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 86 CANADA FLOW CYTOMETRY MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 87 CANADA FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 88 CANADA RETAIL SALES IN FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 89 MEXICO FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 90 MEXICO REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 91 MEXICO REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 92 MEXICO REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 93 MEXICO FLOW CYTOMETRY INSTRUMENTS IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 94 MEXICO CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 95 MEXICO CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (VOLUME)

TABLE 96 MEXICO CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (ASP)

TABLE 97 MEXICO CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 98 MEXICO CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 99 MEXICO CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 100 MEXICO CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 101 MEXICO CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 102 MEXICO CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 103 MEXICO CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 104 MEXICO CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 105 MEXICO CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (VOLUME)

TABLE 106 MEXICO CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (ASP)

TABLE 107 MEXICO ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 108 MEXICO ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 109 MEXICO ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 110 MEXICO FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 111 MEXICO CELL-BASED FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 112 MEXICO BEAD-BASED IN FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 113 MEXICO FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 114 MEXICO RESEARCH APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 115 MEXICO PHARMACEUTICAL AND BIOTECHNOLOGY IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 116 MEXICO CLINICAL APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 117 MEXICO FLOW CYTOMETRY MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 118 MEXICO FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 119 MEXICO RETAIL SALES IN FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

Список рисунков

FIGURE 1 NORTH AMERICA FLOW CYTOMETRY MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA FLOW CYTOMETRY MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA FLOW CYTOMETRY MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA FLOW CYTOMETRY MARKET: COUNTRY-WISE MARKET ANALYSIS

FIGURE 5 NORTH AMERICA FLOW CYTOMETRY MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA FLOW CYTOMETRY MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA FLOW CYTOMETRY MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA FLOW CYTOMETRY MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MARKET END USER COVERAGE GRID

FIGURE 10 NORTH AMERICA FLOW CYTOMETRY MARKET: SEGMENTATION

FIGURE 11 FIVE SEGMENTS COMPRISE THE NORTH AMERICA FLOW CYTOMETRY MARKET, BY PRODUCT

FIGURE 12 NORTH AMERICA FLOW CYTOMETRY MARKET EXECUTIVE SUMMARY

FIGURE 13 STRATEGIC DECISIONS

FIGURE 14 RISING PREVALENCE OF CHRONIC DISEASES IS DRIVING THE GROWTH OF THE NORTH AMERICA FLOW CYTOMETRY MARKET FROM 2025 TO 2032

FIGURE 15 THE REAGENTS AND CONSUMABLES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA FLOW CYTOMETRY MARKET IN 2025 AND 2032

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA FLOW CYTOMETRY MARKET

FIGURE 17 NORTH AMERICA FLOW CYTOMETRY MARKET: BY PRODUCT, 2024

FIGURE 18 NORTH AMERICA FLOW CYTOMETRY MARKET: BY PRODUCT, 2025-2032 (USD MILLION)

FIGURE 19 NORTH AMERICA FLOW CYTOMETRY MARKET: BY PRODUCT, CAGR (2025-2032)

FIGURE 20 NORTH AMERICA FLOW CYTOMETRY MARKET: BY PRODUCT, LIFELINE CURVE

FIGURE 21 NORTH AMERICA FLOW CYTOMETRY MARKET: BY TECHNOLOGY, 2024

FIGURE 22 NORTH AMERICA FLOW CYTOMETRY MARKET: BY TECHNOLOGY, 2025-2032 (USD MILLION)

FIGURE 23 NORTH AMERICA FLOW CYTOMETRY MARKET: BY TECHNOLOGY, CAGR (2025-2032)

FIGURE 24 NORTH AMERICA FLOW CYTOMETRY MARKET: BY TECHNOLOGY, LIFELINE CURVE

FIGURE 25 NORTH AMERICA FLOW CYTOMETRY MARKET: BY APPLICATION, 2024

FIGURE 26 NORTH AMERICA FLOW CYTOMETRY MARKET: BY APPLICATION, 2025-2032 (USD MILLION)

FIGURE 27 NORTH AMERICA FLOW CYTOMETRY MARKET: BY APPLICATION, CAGR (2025-2032)

FIGURE 28 NORTH AMERICA FLOW CYTOMETRY MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 29 NORTH AMERICA FLOW CYTOMETRY MARKET: BY DISTRIBUTION CHANNEL, 2024

FIGURE 30 NORTH AMERICA FLOW CYTOMETRY MARKET: BY DISTRIBUTION CHANNEL, 2025-2032 (USD MILLION)

FIGURE 31 NORTH AMERICA FLOW CYTOMETRY MARKET: BY DISTRIBUTION CHANNEL, CAGR (2025-2032)

FIGURE 32 NORTH AMERICA FLOW CYTOMETRY MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 33 NORTH AMERICA FLOW CYTOMETRY MARKET: BY END USER, 2024

FIGURE 34 NORTH AMERICA FLOW CYTOMETRY MARKET: BY END USER, 2025-2032 (USD MILLION)

FIGURE 35 NORTH AMERICA FLOW CYTOMETRY MARKET: BY END USER, CAGR (2025-2032)

FIGURE 36 NORTH AMERICA FLOW CYTOMETRY MARKET: BY END USER, LIFELINE CURVE

FIGURE 37 NORTH AMERICA FLOW CYTOMETRY MARKET: SNAPSHOT

FIGURE 38 NORTH AMERICA FLOW CYTOMETRY MARKET: COMPANY SHARE 2024 (%)

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.