North America E Commerce Packaging Market

Размер рынка в млрд долларов США

CAGR :

%

USD

18.98 Billion

USD

37.53 Billion

2025

2033

USD

18.98 Billion

USD

37.53 Billion

2025

2033

| 2026 –2033 | |

| USD 18.98 Billion | |

| USD 37.53 Billion | |

|

|

|

|

Рынок упаковки для электронной коммерции в Северной Америке: по типу упаковки (гофрированные коробки, пакеты, почтовые конверты, этикетки, защитная упаковка, паллетные коробки, ленты, почтовая упаковка, термоусадочная пленка), по материалу (на основе волокна, с добавлением переработанного материала и вторично переработанного пластика, биоматериалы, обычный пластик, другие), по конечным пользователям (одежда и аксессуары, электроника и электротехника, текстиль, товары для дома, средства личной гигиены, продукты питания и напитки, фармацевтика, автомобильная промышленность, изделия из металла, химическая продукция, сельское хозяйство, мебель, древесина и изделия из дерева, кожа и изделия из кожи, строительные материалы, табачные изделия, другие), по каналам сбыта (прямые, косвенные) — тенденции отрасли и прогноз до 2033 года.

Размер рынка упаковки для электронной коммерции в Северной Америке

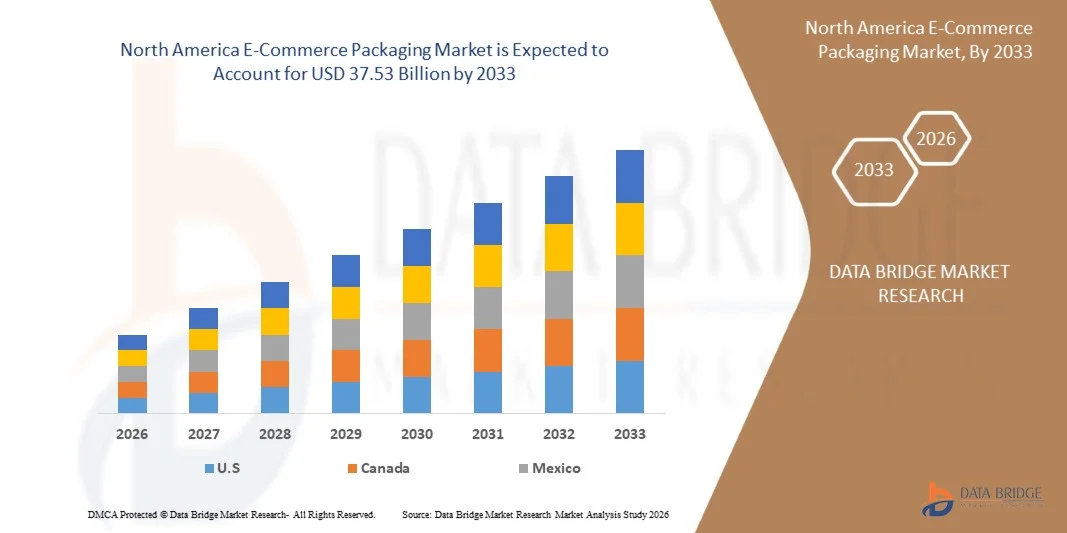

- Объем рынка упаковки для электронной коммерции в Северной Америке в 2025 году оценивался в 18,98 млрд долларов США и, как ожидается, достигнет 37,53 млрд долларов США к 2033 году.

- В прогнозируемый период с 2026 по 2033 год рынок, вероятно, будет расти со среднегодовым темпом роста в 8,9%, в основном за счет растущей вовлеченности потребителей в развлекательные, социальные и семейные мероприятия, что значительно увеличило спрос на стратегические и образовательные настольные игры — ключевые категории, которые часто требуют специализированной, прочной и эстетически привлекательной упаковки.

- Кроме того, расширение производственной и транспортной инфраструктуры Северной Америки в сочетании с ростом объемов торговли как на внутреннем, так и на международном рынках ускоряет внедрение передовых упаковочных решений. Сильный акцент региона на современной логистике, инициативах в области устойчивого развития и удобстве для потребителей дополнительно поддерживает устойчивую динамику рынка.

Анализ рынка упаковки для электронной коммерции в Северной Америке

- Рынок упаковки для электронной коммерции в Северной Америке стремительно развивается, поскольку бренды внедряют передовые технологии для повышения эффективности, экологичности и вовлеченности потребителей. Хотя автоматизация традиционно ассоциируется с логистикой и портовыми операциями, аналогичные тенденции — такие как цифровизация, аналитика на основе ИИ, автоматизированные механизмы штабелирования и интеллектуальное управление запасами — все чаще влияют на упаковочные операции в различных секторах, включая химическую промышленность, пищевую промышленность и производство напитков, фармацевтику, сельское хозяйство, строительство, горнодобывающую промышленность и добычу полезных ископаемых, переработку отходов и потребительские товары.

- Эти технологии укрепляют цепочку поставок в регионе, сокращая ручные процессы, ускоряя сроки доставки, оптимизируя складские площади и поддерживая обширные сети онлайн-розничной торговли. Автоматизированные штабелирующие краны (ASC), системы с управлением на основе искусственного интеллекта и передовые инструменты мониторинга позволяют оптимизировать хранение, сократить время обработки и обеспечить постоянный контроль уровня запасов, помогая производителям, дистрибьюторам и платформам электронной коммерции поддерживать стабильность поставок и снижать операционные издержки.

- Внедрение интеллектуальных платформ распределения и прогнозного планирования спроса еще больше повышает эффективность циклов пополнения запасов, особенно в периоды пиковых продаж, запуска новых продуктов и проведения рекламных акций.

- Ожидается, что США будут доминировать на североамериканском рынке упаковки для электронной коммерции, занимая наибольшую долю выручки в 75,23% в 2026 году, благодаря значительным инвестициям в автоматизацию логистики, цифровую инфраструктуру и инициативы по повышению устойчивости цепочки поставок. Крупные порты, такие как Лос-Анджелес, Лонг-Бич и Нью-Йорк/Нью-Джерси, уже внедрили автоматизированные центры обработки грузов (ASC), автоматизированные транспортные средства (AGV) и передовые системы управления терминалами (TOS) для повышения пропускной способности и снижения заторов, в то время как ключевые операторы, такие как APM Terminals, SSA Marine и DP World, продолжают модернизировать погрузочно-разгрузочное оборудование и операции.

- Ожидается, что Мексика станет самым быстрорастущим регионом на рынке упаковки для электронной коммерции в Северной Америке в течение прогнозируемого периода с темпом роста в 9,6%, чему способствуют рост контейнерных перевозок, модернизация логистических центров, а также внедрение систем отслеживания запасов с использованием искусственного интеллекта, беспилотных автомобилей и дистанционно управляемых кранов.

- В 2026 году сегмент гофрированных коробок, как ожидается, будет доминировать на рынке с долей в 36,63%, поскольку эти упаковочные решения предлагают идеальный баланс доступности, долговечности, масштабируемости и операционной гибкости. Их способность удовлетворять высокие объемы спроса в электронной коммерции при сохранении экономической эффективности делает их предпочтительным выбором для производителей, дистрибьюторов и компаний, занимающихся доставкой «последней мили» в регионе.

Обзор отчета и сегментация рынка упаковки для электронной коммерции в Северной Америке

|

Атрибуты |

Ключевые тенденции рынка упаковки для электронной коммерции в Северной Америке. |

|

Охваченные сегменты |

|

|

Охваченные страны |

Северная Америка

|

|

Ключевые игроки рынка |

|

|

Рыночные возможности |

|

|

Информационные наборы данных, представляющие добавленную стоимость |

Помимо анализа рыночных сценариев, таких как рыночная стоимость, темпы роста, сегментация, географический охват и основные игроки, отчеты о рынке, подготовленные Data Bridge Market Research, также включают углубленный экспертный анализ, анализ ценообразования, анализ доли брендов, опросы потребителей, демографический анализ, анализ цепочки поставок, анализ цепочки создания стоимости, обзор сырья/расходных материалов, критерии выбора поставщиков, PESTLE-анализ, анализ Портера и нормативно-правовую базу. |

Тенденции рынка упаковки для электронной коммерции в Северной Америке

«Внедрение автоматизации и оптимизация систем в сфере выполнения заказов»

- Внедрение автоматизации и оптимизация систем в сфере выполнения заказов стали значительной возможностью для глобального рынка упаковки для электронной коммерции в Северной Америке. По мере роста объемов заказов и увеличения разнообразия товарных позиций ручные процессы упаковки и выполнения заказов становятся более дорогостоящими, медленными и подверженными ошибкам. Автоматизация с помощью робототехники, систем комплектации/упаковки на основе искусственного интеллекта и оптимизированного упаковочного оборудования обеспечивает повышение эффективности, снижение зависимости от рабочей силы, стабильную производительность и оптимизированное использование материалов, что тесно соответствует потребностям электронной коммерции и целям устойчивого развития. Этот сдвиг позиционирует автоматизацию упаковки как инструмент повышения добавленной стоимости для компаний, позволяющий снизить логистические затраты, повысить скорость выполнения заказов и обеспечить масштабируемый рост.

- В январе 2025 года компания Smart-Robotics.io сообщила, что к 2025 году, по оценкам, на 50 000 складах по всему миру будет установлено около четырех миллионов складских роботов, а уровень автоматизации вырастет с 18% на конец 2021 года до 26% к 2027 году.

- В сентябре 2024 года в пресс-релизе отмечалось, что глобальный рынок автоматизации упаковки (включая автоматизированные системы упаковки, запечатывания и маркировки) прогнозируется к росту с 64,70 млрд долларов США в 2022 году до 136,47 млрд долларов США к 2032 году.

- В июле 2025 года в блоге eShipz, посвященном автоматизации складских операций, было отмечено, что автоматизация складских операций может снизить затраты до 30 % и увеличить производительность более чем на 40 %, что делает автоматизацию стратегической необходимостью на динамичных рынках с большими объемами товаров, таких как Индия.

- Растущее внедрение автоматизации и оптимизации систем в сфере выполнения заказов электронной коммерции создает структурные возможности для поставщиков упаковки и технологических компаний. Автоматизация снижает стоимость упаковки, ускоряет обработку заказов, повышает точность и обеспечивает масштабируемость. По мере того, как центры выполнения заказов инвестируют в робототехнику и технологии оптимизации, ожидается существенный рост спроса на автоматизированные упаковочные линии, модульные упаковочные системы и интеллектуальные упаковочные решения, что будет способствовать росту и инновациям на мировом рынке упаковки для электронной коммерции в Северной Америке.

Динамика рынка упаковки для электронной коммерции в Северной Америке

Водитель

«Региональный уровень проникновения интернета и смартфонов на развивающихся рынках»

- Рост проникновения интернета и смартфонов в развивающихся странах стал ключевым фактором роста мирового рынка упаковки для электронной коммерции в Северной Америке. По мере того, как все больше потребителей получают надежный доступ к мобильному интернету, а смартфоны становятся основным средством онлайн-покупок, проникновение онлайн-торговли быстро растет, что приводит к увеличению спроса на упаковку в различных регионах. Это цифровое проникновение стимулирует увеличение объемов отправлений мелких посылок, частые циклы заказов и расширение трансграничной торговли, что повышает потребность в разнообразных, масштабируемых упаковочных решениях, соответствующих требованиям логистики электронной коммерции.

- В октябре 2023 года Международный союз электросвязи (МСЭ) сообщил, что 78 процентов населения мира в возрасте 10 лет и старше владеют мобильными телефонами, что на 11 процентных пунктов выше, чем уровень проникновения интернета в мире.

- В октябре 2024 года в отчете GSMA о состоянии мобильного интернет-соединения было указано, что 4,6 миллиарда человек — примерно 57 процентов населения мира — использовали мобильный интернет на личных устройствах, что свидетельствует об ускоренном проникновении цифровых технологий в развивающихся регионах.

- В июле 2025 года отчет Всемирного банка Global Findex Digital Connectivity Tracker показал, что в странах с низким и средним уровнем дохода значительно вырос уровень распространения смартфонов и использования цифровых платежей, что отражает расширение возможностей цифровой коммерции и способствует росту электронной коммерции за пределами регионов с высоким уровнем дохода.

- По оценкам, в октябре 2025 года около 6,04 миллиарда человек — примерно 73 процента населения мира — пользовались Интернетом, что подчеркивает расширение базы цифровых потребителей, определяющее спрос на упаковку для электронной коммерции.

- Растущее проникновение интернета и смартфонов на развивающихся рынках расширяет целевую базу для онлайн-торговли, что, в свою очередь, приводит к росту спроса на упаковку для электронной коммерции. По мере расширения доступа к цифровым технологиям поставщики упаковки могут ожидать устойчивого роста объемов продаж и диверсификации форматов упаковки, что усиливает роль расширения объемов производства упаковки как структурного фактора роста для глобального рынка упаковки для электронной коммерции в Северной Америке.

Сдержанность/Вызов

« Нормы обращения с упаковочными отходами и затраты на их соблюдение»

- Нормативы по обращению с упаковочными отходами и связанные с этим затраты стали существенным сдерживающим фактором для мирового рынка упаковки для электронной коммерции в Северной Америке. По мере того, как регулирующие органы по всему миру ужесточают правила в отношении дизайна упаковки, состава материалов, возможности вторичной переработки и ответственности за отходы, компании электронной коммерции сталкиваются с растущим давлением: от перепроектирования упаковки в соответствии с новыми стандартами и увеличения использования переработанных материалов до сокращения пустого пространства и расширения ответственности производителя (EPR). Эти нормативные требования повышают затраты на соблюдение нормативных требований, усложняют трансграничные перевозки и могут вынудить компании перестраивать цепочки поставок или перекладывать затраты на потребителей. Для рынка, ориентированного на скорость, удобство и низкую стоимость доставки, более строгие законы об обращении с упаковочными отходами могут замедлить рост или ограничить расширение маржи.

- В декабре 2024 года Министерство окружающей среды Индии представило проект Правил по защите окружающей среды (расширенная ответственность производителя за упаковку) 2024 года, которые после вступления в силу в апреле 2026 года потребуют от производителей, импортеров и владельцев брендов управлять полным жизненным циклом упаковки.

- В апреле 2024 года Европейский парламент достиг предварительного соглашения о принятии более жестких правил в отношении упаковки, включая целевые показатели по сокращению отходов упаковки на 5% к 2030 году (10% к 2035 году, 15% к 2040 году), запрет на многие виды одноразовой пластиковой упаковки и требования о том, чтобы вся упаковка была пригодна для вторичной переработки.

- В марте 2024 года Совет Европейского союза и Европейский парламент достигли предварительного соглашения о пересмотре правил в отношении упаковки и упаковочных отходов, ужесточив стандарты дизайна, возможности вторичной переработки и маркировки для всей упаковки, включая упаковку для электронной коммерции.

- В декабре 2024 года Совет официально принял новое Положение об упаковке и упаковочных отходах 2025/40 (PPWR), устанавливающее обязательные целевые показатели по повторному использованию и содержанию переработанных материалов, ограничивающее использование одноразового пластика и требующее минимизации веса/объема упаковки.

- 11 февраля 2025 года вступил в силу Регламент о маркировке и упаковке упаковочных материалов (PPWR), который установил гармонизированную правовую основу на всей территории ЕС для всей упаковки, поступающей на рынок, включая упаковку для электронной коммерции, и ознаменовал сдвиг в сторону ужесточения требований в рамках экономики замкнутого цикла для онлайн-ритейлеров.

- В крупнейших экономиках мира ужесточаются правила обращения с упаковочными отходами, ужесточаются обязательные требования к возможности вторичной переработки, повторного использования, отчетности и сокращению расхода материалов. Эти меры повышают затраты на соблюдение требований для производителей упаковки для электронной коммерции за счет более строгих стандартов проектирования, обязательств по отслеживаемости, требований к содержанию переработанных материалов и расширения ответственности производителей. По мере повышения нормативных порогов компании сталкиваются с увеличением операционных расходов, расходов на аудит и перепроектирование, что приводит к сужению маржи и усложняет выход на рынок для небольших поставщиков. Следовательно, ожидается, что растущие требования к соблюдению нормативных требований будут выступать в качестве структурного сдерживающего фактора для мирового рынка упаковки для электронной коммерции в Северной Америке, увеличивая издержки и ограничивая гибкость в выборе материалов и форматов.

Обзор рынка упаковки для электронной коммерции в Северной Америке

Глобальный рынок упаковки для электронной коммерции в Северной Америке сегментирован на четыре категории по типу упаковки, материалу, конечному пользователю и каналу сбыта.

- По упаковке

В зависимости от типа упаковки, рынок упаковки для электронной коммерции в Северной Америке сегментируется на гофрированные коробки, пакеты, почтовые конверты, этикетки, защитную упаковку, паллетные коробки, ленты, почтовую упаковку и термоусадочную пленку. Ожидается, что в 2026 году сегмент гофрированных коробок будет доминировать на рынке с долей 36,63%, чему способствуют рост объемов онлайн-покупок, растущий спрос на прочную и экономичную упаковку, а также быстрое расширение многоканальных розничных сетей. Гофрированные коробки остаются предпочтительным выбором благодаря своей высокой прочности, возможности вторичной переработки, гибкости персонализации и пригодности для широкого спектра товаров — от электроники и товаров для дома до одежды, косметики и товаров первой необходимости. Кроме того, рост моделей электронной коммерции на основе подписки, усовершенствованные технологии печати и ужесточение требований к экологичности укрепляют лидерство этого сегмента.

Сегмент гофрированных коробок является самым быстрорастущим на рынке упаковки для электронной коммерции в Северной Америке, демонстрируя среднегодовой темп роста в 9,5%. Это обусловлено резким увеличением количества посылочных отправлений, растущим внедрением экологичных и легких упаковочных решений, а также повышением ожиданий потребителей в отношении безопасной доставки без повреждений. Расширение центров выполнения заказов, усовершенствование автоматизированных систем изготовления коробок и переход к упаковке оптимального размера еще больше ускоряют рост спроса. Кроме того, ожидается, что повышенное внимание к перерабатываемым материалам, требования к экологически чистой упаковке и растущее присутствие крупных игроков электронной коммерции в США, Канаде и Мексике укрепят доминирование гофрированной упаковки в ближайшие годы.

- По материалу

В зависимости от материала, рынок упаковки для электронной коммерции в Северной Америке сегментируется на волокнистую, переработанную и вторично переработанную (PCR) пластиковую, биоразлагаемую, обычную пластиковую (первичную) и другие. Ожидается, что к 2026 году сегмент волокнистой упаковки будет доминировать с долей рынка в 50,22%, чему будет способствовать высокий спрос на экологичные, перерабатываемые и легкие упаковочные решения в основных категориях электронной коммерции. Переход к экологически чистой упаковке, растущая осведомленность потребителей об экологических проблемах и внедрение более строгих правил устойчивого развития в США и Канаде ускоряют внедрение волокнистых материалов. Кроме того, расширение производства гофрированной упаковки, достижения в технологиях повышения прочности и снижения веса бумаги, а также растущая популярность упаковки без пластика среди брендов и розничных продавцов еще больше укрепляют лидерство этого сегмента.

Сегмент биоразлагаемых материалов является самым быстрорастущим сегментом на рынке упаковки для электронной коммерции в Северной Америке, демонстрируя среднегодовой темп роста в 9,8%. Это обусловлено увеличением инвестиций в биоразлагаемую и компостируемую упаковку, усилением корпоративных обязательств в области устойчивого развития и предпочтением потребителей к экологически чистым альтернативам. Биоразлагаемые почтовые конверты, пленки, амортизирующие материалы и формованные волоконные решения набирают популярность, поскольку компании стремятся сократить выбросы углекислого газа и достичь целей в области ESG (экологическое, социальное и корпоративное управление). Кроме того, инновации в области полимеров на растительной основе, поддерживаемые государством экологические инициативы и быстрое расширение экологически сознательных брендов, ориентированных на прямые продажи потребителям, ускоряют внедрение этих технологий на рынке региона.

- По каналам сбыта

В зависимости от канала сбыта, глобальный рынок упаковки для электронной коммерции в Северной Америке сегментируется на прямые и непрямые каналы. В 2026 году ожидается, что сегмент прямых каналов будет доминировать на рынке с долей 68,61%, чему способствуют высокие объемы закупок со стороны крупных компаний электронной коммерции, сторонних логистических компаний (3PL) и крупных розничных организаций, которые предпочитают закупать упаковочные материалы напрямую у производителей. Прямые каналы предлагают такие преимущества, как оптовые цены, индивидуальные решения по упаковке, более короткие сроки выполнения заказов и долгосрочные партнерские отношения с поставщиками, которые все чаще выбирают операторы электронной коммерции с большими объемами продаж. Кроме того, растущая тенденция к вертикально интегрированным цепочкам поставок, закупкам упаковки по подписке и автоматизированным упаковочным линиям еще больше укрепляет доминирование прямого канала сбыта.

Прямые закупки являются самым быстрорастущим сегментом на рынке упаковки для электронной коммерции в Северной Америке с среднегодовым темпом роста 9,1%. Это обусловлено растущим предпочтением компаний электронной коммерции, центров выполнения заказов и поставщиков 3PL закупать упаковочные материалы напрямую у производителей для повышения экономической эффективности, обеспечения стабильного качества и надежности поставок. Прямые закупки позволяют крупным покупателям получать оптовые заказы, пользоваться преимуществами согласованных цен, получать доступ к индивидуальным упаковочным решениям и оптимизировать управление запасами — критически важные преимущества на рынке, где объемы заказов и частота отгрузок продолжают расти.

- Конечным пользователем

В зависимости от конечного пользователя, глобальный рынок упаковки для электронной коммерции в Северной Америке сегментирован на следующие категории: одежда и аксессуары (за исключением изделий из кожи), электроника и электротехника, текстиль, товары для дома, средства личной гигиены, продукты питания и напитки, фармацевтика, автомобильная промышленность, изделия из металла, химическая продукция, сельское хозяйство, мебель, древесина и изделия из дерева (за исключением мебели), кожа и кожаные изделия, строительные материалы, табачные изделия и другие. Ожидается, что к 2026 году сегмент одежды и аксессуаров (за исключением изделий из кожи) будет доминировать на рынке с долей 14,51%, чему будет способствовать быстрый рост онлайн-торговли модной одеждой, брендов быстрой моды и компаний, работающих по модели D2C (прямые продажи потребителям). Растущая потребительская предпочтение удобного возврата товаров, персонализированных подписок на модную одежду и сезонных запусков товаров стимулирует спрос на прочные и легкие упаковочные решения. Развитие социальной коммерции, рекламных акций одежды с участием инфлюенсеров и большие объемы доставки еще больше укрепляют лидерство этого сегмента в мировой индустрии упаковки для электронной коммерции.

Сегмент электроники и электротехники является самым быстрорастущим сегментом на рынке упаковки для электронной коммерции в Северной Америке с среднегодовым темпом роста в 10,0%, чему способствует рост онлайн-продаж бытовой электроники, умных устройств, товаров для домашней автоматизации и мелкой бытовой техники. Поскольку эти товары требуют защитной, ударопрочной и защищенной от вскрытия упаковки, спрос на специализированные материалы, такие как защитные почтовые конверты, формованные волокнистые вставки, гофрированные коробки и многослойная упаковка, продолжает расти. Кроме того, быстрое внедрение инноваций в продукцию, частые обновления устройств и растущее использование платформ электронной коммерции для дорогостоящей электроники, в сочетании с расширением рынков восстановленной электроники, ускоряют потребность в передовых и экологичных упаковочных решениях в регионе.

Региональный анализ рынка упаковки для электронной коммерции в Северной Америке

- Ожидается, что США будут доминировать на североамериканском рынке упаковки для электронной коммерции, занимая наибольшую долю выручки в 75,23% к 2026 году. Этому способствуют развитая розничная торговля и экосистема электронной коммерции страны, высокая покупательная способность потребителей, а также присутствие крупных онлайн-ритейлеров, логистических компаний и производителей упаковки. Масштабные операции таких компаний, как Amazon, Walmart, Target, UPS и FedEx, стимулируют значительный спрос на гофрированные коробки, почтовые конверты, защитную упаковку и экологически чистые материалы. Кроме того, США продолжают активно инвестировать в автоматизацию, оптимизацию складских помещений, цифровизацию цепочек поставок и экологически ответственную упаковку, еще больше укрепляя свои доминирующие позиции в регионе.

- Ожидается, что Мексика станет самым быстрорастущим регионом на рынке упаковки для электронной коммерции в Северной Америке в течение прогнозируемого периода с темпом роста в 9,6%, чему способствуют быстрое расширение проникновения электронной коммерции, рост трансграничной торговли, растущее внедрение цифровых платежных систем и улучшение инфраструктуры доставки «последней мили». Инвестиции в современные логистические центры, предприятия по производству упаковки и государственные инициативы, поддерживающие конкурентоспособность производства, еще больше ускоряют развитие рынка. Кроме того, рост малых и средних предприятий и брендов, работающих по модели «от потребителя к потребителю» (D2C), в Мексике способствует увеличению потребления гибких почтовых конвертов, гофрированных коробок и защитной упаковки.

- В целом, растущее внедрение цифровых технологий в розничной торговле, развитие трансграничной электронной коммерции, инновации в продуктах, ориентированные на устойчивое развитие, и постоянные инвестиции в логистические и логистические технологии в совокупности укрепляют североамериканский рынок упаковки для электронной коммерции в США, Мексике и Канаде.

Анализ рынка упаковки для электронной коммерции в Канаде и Северной Америке

Канадский рынок упаковки для электронной коммерции в Северной Америке занимает важное место в североамериканской отрасли, чему способствуют рост проникновения онлайн-торговли, сильные предпочтения потребителей в отношении экологичной упаковки и увеличение инвестиций в развитую логистическую и производственную инфраструктуру. Строгие экологические нормы страны и растущий акцент на возможности вторичной переработки и практике циклической экономики ускоряют внедрение решений в области упаковки на основе волокна и экологически чистых материалов. Кроме того, быстрое расширение внутренней и трансграничной электронной коммерции, рост брендов, работающих по подписке, и растущее присутствие глобальных ритейлеров повысили спрос на гофрированные коробки, защитную упаковку и легкие почтовые конверты. Устойчивый рост складских мощностей Канады, улучшение сетей доставки «последней мили» и продолжающаяся цифровая трансформация в розничной торговле еще больше укрепляют ее роль как важного участника североамериканского рынка упаковки для электронной коммерции.

Анализ рынка упаковки для электронной коммерции в Мексике и Северной Америке

Ожидается, что рынок упаковки для электронной коммерции в Северной Америке (Мексика) будет стабильно расти, чему способствуют быстрое расширение онлайн-торговли, увеличение проникновения интернета и смартфонов, а также развитие внутренних и трансграничных платформ электронной коммерции. Растущее участие малых и средних предприятий и брендов, работающих по модели «от потребителя к потребителю», в онлайн-розничной торговле стимулирует спрос на экономичные форматы упаковки, такие как гибкие почтовые конверты, гофрированные коробки и защитная упаковка. Кроме того, значительные инвестиции в модернизацию логистики, включая автоматизированные склады, улучшенные транспортные сети и расширенные возможности доставки «последней мили», укрепляют экосистему электронной коммерции страны. Поддерживающие государственные инициативы по повышению конкурентоспособности производства в сочетании с растущими ожиданиями потребителей в отношении более быстрой доставки и надежной упаковки дополнительно способствуют устойчивой траектории роста рынка.

Крупнейшими лидерами рынка, работающими на данной платформе, являются:

- Международная бумажная компания (США)

- Amcor PLC (Швейцария)

- DS Smith PLC (Великобритания)

- Smurfit WestRock (США)

- Packaging Corporation of America (PCA) (США)

- Mondi PLC (Великобритания)

- Klabin SA (Бразилия)

- Корпорация Oji Holdings (Япония)

- Корпорация Sealed Air (США)

- Nine Dragons Paper Holdings Ltd. (Гонконг)

- Компания 3M (США)

- Корпорация Эйвери Деннисон (США)

- Компания Green Bay Packaging Inc. (США)

- Cosmo Films (Индия)

- Georgia-Pacific LLC (США)

- Ranpak Holdings Corp. (США)

- Boxon Group AB (Швеция)

- Stora Enso (Финляндия)

- Pratt Industries (США)

- Prem Industries India Limited (Индия)

- Pregis LLC (США)

- Packtek (Индия)

- Packman Packaging Private Limited (Индия)

- Packhelp (Польша)

- IPG (США)

- Группа компаний Filmar (Польша)

- ЕЦБ (США)

- Ecom Packaging (Индия)

- Упаковка в синей коробке (США)

- Альтпак (Индия)

Последние разработки в сфере упаковки для электронной коммерции в Северной Америке.

- В июле 2022 года Packhelp запустила «углеродную маркировку» для своей упаковочной продукции, позволяющую клиентам видеть приблизительный углеродный след заказов на упаковку. Это соответствует растущему спросу на экологичную упаковку в электронной коммерции. Packhelp продолжает позиционировать себя как площадку для заказа индивидуальной упаковки с низкими минимальными объемами заказа, что остается привлекательным для продавцов электронной коммерции, стартапов и небольших D2C-брендов, которым нужна индивидуальная упаковка, но которые не заказывают большие объемы.

- В апреле 2025 года компания Pratt Industries, Inc. объявила о своем намерении инвестировать 5 миллиардов долларов США в переработку отходов, инфраструктуру чистой энергетики и создание рабочих мест в обрабатывающей промышленности США, поддерживая тем самым масштабную программу реиндустриализации.

- В сентябре 2025 года компания Pregis открыла новый центр по переработке бумаги площадью 477 000 квадратных футов в городе Элгин, штат Иллинойс. Предприятие обеспечит более 500 рабочих мест в производственном секторе и сможет выпускать более 1 миллиарда упаковок из бумаги, пригодных для вторичной переработки, ежегодно.

- В августе 2025 года компания Ranpak Holdings Corp. объявила о значительном расширении своего существующего сотрудничества с Walmart. В соответствии с условиями этого стратегического соглашения, Walmart установит множество систем Ranpak AutoFill в своих пяти центрах выполнения заказов нового поколения, что позволит оптимизировать процесс выполнения заказов, сократить количество отходов упаковки и упростить работу сотрудников.

- В сентябре 2025 года компания Sealed Air Corporation продвигает свою стратегию по предоставлению комплексных услуг в сфере выполнения заказов, представив гибридную упаковочную машину AUTOBAG 850HB — новую автоматизированную систему упаковки, предназначенную для работы как с полиэтиленовыми, так и с бумажными почтовыми пакетами.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Содержание

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 COMPANY EVALUATION QUADRANT

4.3 PATENT ANALYSIS

4.3.1 PATENT FILING DISTRIBUTION BY COUNTRY

4.3.2 KEY APPLICANTS (TOP INNOVATORS)

4.3.3 TECHNOLOGY SEGMENTATION BY IPC CODES

4.3.4 PATENT TREND OVER TIME (2016–2025)

4.4 PRICING ANALYSIS

4.5 PRODUCTION CAPACITY OF KEY MANUFACTURERS

4.6 BRAND OUTLOOK

4.7 CLIMATE CHANGE SCENARIO

4.7.1 ENVIRONMENTAL CONCERNS

4.7.1.1 Packaging waste volumes and landfill pressure

4.7.1.2 Plastic pollution & microplastics

4.7.1.3 Deforestation and pulp supply stress

4.7.1.4 Greenhouse gas (GHG) emissions across the lifecycle

4.7.1.5 Water and chemical pollution

4.7.1.6 Supply chain vulnerability to extreme weather

4.7.1.7 Regulatory and consumer pressure

4.7.2 INDUSTRY RESPONSE

4.7.2.1 Material substitution and lightweighting

4.7.2.2 Design for recycling & circularity

4.7.2.3 Adoption of recycled and bio-based feedstocks

4.7.2.4 Investment in recycling & recovery partnerships

4.7.2.5 Supply-chain optimization & right-sizing

4.7.2.6 Process & energy efficiency at converters

4.7.2.7 Certification & eco-labeling

4.7.2.8 Innovation in protective solutions

4.7.3 GOVERNMENT’S ROLE

4.7.3.1 Regulation & mandates

4.7.3.2 Standards, labelling & transparency

4.7.3.3 Fiscal instruments & incentives

4.7.3.4 Infrastructure investment

4.7.3.5 Public procurement leadership

4.7.3.6 R&D & standards support

4.7.4 ANALYST RECOMMENDATIONS

4.8 CONSUMER BUYING BEHAVIOR

4.8.1 DEMAND FOR SUSTAINABLE AND ECO-FRIENDLY PACKAGING

4.8.2 PREFERENCE FOR SECURE AND DAMAGE-RESISTANT PACKAGING

4.8.3 RISING IMPORTANCE OF CONVENIENCE AND EASE OF UNBOXING

4.8.4 INFLUENCE OF AESTHETIC APPEAL AND BRAND IDENTITY

4.8.5 INCREASING CONSUMER NEED FOR TRANSPARENCY AND INFORMATION

4.8.6 SHIFT TOWARD PERSONALIZED PACKAGING EXPERIENCES

4.8.7 CONCERNS ABOUT PACKAGING WASTE AND RECYCLING CONVENIENCE

4.8.8 WILLINGNESS TO PAY FOR PREMIUM PACKAGING IN CERTAIN CATEGORIES

4.8.9 CONCLUSION

4.9 COST ANALYSIS BREAKDOWN

4.9.1 TOP-LEVEL COST BUCKETS

4.9.1.1 Raw Materials

4.9.1.2 Manufacturing & Converting

4.9.1.3 Protective Inserts & Cushioning

4.9.1.4 Labour & Fulfilment Handling

4.9.1.5 Packaging Design / Customization / Printing

4.9.1.6 Logistics & Dimensional Weight Impact

4.9.1.7 Returns & Reverse Logistics

4.9.1.8 Sustainability Premium & Compliance Costs

4.9.1.9 Overheads & CAPEX Amortization

4.9.1.10 Supplier Margin / Distributor Markup

4.9.2 TYPICAL COST SHARES

4.9.2.1 Raw Materials + Converting: 50-65% of Total Packaging Cost

4.9.2.2 Labour & Fulfilment Handling: 10-20%

4.9.2.3 Protective Inserts & Void Fill: 5-15%

4.9.2.4 Design / Printing / Customization: 3-10%

4.9.2.5 Sustainability Premium / Compliance: 5-15%

4.9.2.6 Packaging as % of Fulfilment Cost: 15-20%

4.1 INDUSTRY ECOSYSTEM ANALYSIS

4.10.1 PROMINENT COMPANIES

4.10.2 SMALL & MEDIUM-SIZED COMPANIES

4.10.3 END USERS

4.11 INNOVATION TRACKER AND STRATEGIC ANALYSIS

4.11.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

4.11.2 NUMBER OF PRODUCTS IN DEVELOPMENT

4.11.3 STAGE OF DEVELOPMENT

4.11.4 TIMELINES AND MILESTONES

4.11.5 INNOVATION STRATEGIES AND METHODOLOGIES

4.11.6 17.6 RISK ASSESSMENT AND MITIGATION

4.11.7 FUTURE OUTLOOK

4.12 PROFIT MARGIN OUTLOOK AND SCENARIO ASSESSMENT

4.12.1 INTRODUCTION

4.12.2 EXPECTED MARGIN PERFORMANCE (BASE CASE)

4.12.3 MARGIN UPSIDE POTENTIAL (FAVOURABLE MARKET ENVIRONMENT)

4.12.4 MARGIN COMPRESSION RISKS (ADVERSE MARKET CONDITIONS)

4.12.5 EXPOSURE TO RAW MATERIAL PRICE VOLATILITY

4.12.6 MARGIN VARIATION BY PRODUCT CATEGORY

4.12.7 INFLUENCE OF SCALE AND AUTOMATION ON COST EFFICIENCY

4.12.8 SENSITIVITY TO DEMAND CYCLICALITY AND PRICING DYNAMICS

4.12.9 FINANCIAL IMPACT OF SUSTAINABILITY REQUIREMENTS

4.12.10 COMPETITIVE INTENSITY AND ITS EFFECT ON MARGIN STRUCTURE

4.12.11 STRATEGIC MARGIN ENHANCEMENT OPPORTUNITIES

4.12.12 CONCLUSION

4.13 RAW MATERIAL COVERAGE

4.13.1 PAPER AND PAPERBOARD: THE DOMINANT RAW MATERIAL

4.13.2 PLASTICS: FLEXIBLE, PROTECTIVE, AND LIGHTWEIGHT

4.13.3 BIODEGRADABLE AND COMPOSTABLE MATERIALS

4.13.4 MOLDED FIBER AND PULP-BASED MATERIALS

4.13.5 FOAMS AND CUSHIONING MATERIALS

4.13.6 ADHESIVES, COATINGS, AND INKS

4.13.7 EMERGING RAW MATERIALS FOR SMARTER PACKAGING

4.13.8 CONCLUSION

4.14 SUPPLY CHAIN ANALYSIS

4.14.1 OVERVIEW

4.14.2 LOGISTIC COST SCENARIO

4.14.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.15 TECHNOLOGICAL ADVANCEMENTS

4.15.1 SMART PACKAGING AND IOT INTEGRATION

4.15.2 AUTOMATION AND ROBOTICS IN FULFILMENT CENTRES

4.15.3 RIGHT-SIZING AND ON-DEMAND PACKAGING TECHNOLOGIES

4.15.4 SUSTAINABLE AND ADVANCED MATERIAL INNOVATIONS

4.15.5 ARTIFICIAL INTELLIGENCE AND DATA-DRIVEN DESIGN

4.15.6 ANTI-COUNTERFEIT AND SECURITY TECHNOLOGIES

4.15.7 ENHANCED CUSTOMIZATION AND DIGITAL PRINTING

4.15.8 CONCLUSION

4.16 VALUE CHAIN ANALYSIS

4.16.1 OVERVIEW

4.16.2 RAW MATERIAL SUPPLY

4.16.3 COMPONENT MANUFACTURING AND PROCESSING

4.16.4 EQUIPMENT & TECHNOLOGY PROVIDERS

4.16.5 DISTRIBUTION AND LOGISTICS

4.16.6 END-USERS

4.16.7 CONCLUSION

4.17 VENDOR SELECTION CRITERIA

4.17.1 PRODUCT QUALITY, DURABILITY, AND COMPLIANCE

4.17.2 SUSTAINABILITY AND ENVIRONMENTAL CERTIFICATIONS

4.17.3 TECHNOLOGICAL CAPABILITIES AND INNOVATION

4.17.4 CUSTOMIZATION, BRANDING, AND CONSUMER EXPERIENCE

4.17.5 COST EFFICIENCY AND TOTAL COST OF OWNERSHIP (TCO)

4.17.6 SUPPLY CHAIN STRENGTH AND NORTH AMERICA REACH

4.17.7 CERTIFICATIONS, SAFETY STANDARDS, AND INDUSTRY EXPERTISE

4.17.8 AFTER-SALES SUPPORT AND TECHNICAL ASSISTANCE

4.17.9 CONCLUSION

5 TARIFFS AND IMPACT ANALYSIS

5.1 CURRENT TARIFF RATE(S) IN TOP-5 COUNTRY MARKETS

5.2 OUTLOOK: LOCAL PRODUCTION VS IMPORT RELIANCE

5.3 VENDOR SELECTION CRITERIA DYNAMICS

5.4 IMPACT ON SUPPLY CHAIN

5.4.1 RAW MATERIAL PROCUREMENT

5.4.2 MANUFACTURING AND PRODUCTION

5.4.3 LOGISTICS AND DISTRIBUTION

5.4.4 PRICE PITCHING AND POSITION OF MARKET

5.5 INDUSTRY PARTICIPANTS: PROACTIVE MOVES

5.5.1 SUPPLY CHAIN OPTIMIZATION

5.5.2 JOINT VENTURE ESTABLISHMENTS

5.6 IMPACT ON PRICES

5.7 REGULATORY INCLINATION

5.7.1 GEOPOLITICAL SITUATION

5.7.2 TRADE PARTNERSHIPS BETWEEN COUNTRIES

5.7.2.1 FREE TRADE AGREEMENTS

5.7.2.2 ALLIANCES ESTABLISHMENTS

5.7.3 STATUS ACCREDITATION (INCLUDING MFN)

5.7.4 DOMESTIC COURSE OF CORRECTION

5.7.4.1 INCENTIVE SCHEMES TO BOOST PRODUCTION OUTPUTS

5.7.4.2 ESTABLISHMENT OF SEZs/INDUSTRIAL PARKS

6 REGULATORY COVERAGE

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 REGIONAL INTERNET & SMARTPHONE PENETRATION IN EMERGING MARKETS

7.1.2 RISING CONSUMER EXPECTATIONS FOR PRODUCT PROTECTION AND DELIVERY EXPERIENCE

7.1.3 RAPID GROWTH OF ONLINE RETAIL AND FULFILLMENT NETWORKS

7.1.4 SUSTAINABILITY SHIFT TOWARD RECYCLABLE AND FIBER-BASED FORMATS

7.2 RESTRAINS

7.2.1 VOLATILITY IN RAW MATERIAL PRICES (PAPER, RESINS, ADHESIVES)

7.2.2 PACKAGING WASTE REGULATIONS AND COMPLIANCE COSTS

7.3 OPPORTUNITY

7.3.1 ADOPTION OF AUTOMATION AND RIGHT-SIZING SYSTEMS IN FULFILLMENT

7.3.2 PREMIUMIZATION VIA DIGITAL PRINTING AND BRAND PERSONALIZATION

7.4 CHALLENGES

7.4.1 BALANCING PROTECTION WITH MATERIAL REDUCTION TARGETS

7.4.2 REVERSE LOGISTICS AND RETURNS PACKAGING OPTIMIZATION

8 NORTH AMERICA E-COMMERCE PACKAGING MARKET, BY PACKAGING.

8.1 OVERVIEW

8.2 NORTH AMERICA E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

8.2.1 CORRUGATED BOXES

8.2.2 BAGS

8.2.3 MAILER

8.2.4 LABELS

8.2.5 PROTECTIVE PACKAGING

8.2.6 PALLET BOXES

8.2.7 TAPES

8.2.8 POSTAL PACKAGING

8.2.9 SHRINK FILM

8.3 NORTH AMERICA E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (THOUSAND UNITS)

8.3.1 CORRUGATED BOXES

8.3.2 BAGS

8.3.3 MAILER

8.3.4 LABELS

8.3.5 PROTECTIVE PACKAGING

8.3.6 PALLET BOXES

8.3.7 TAPES

8.3.8 POSTAL PACKAGING

8.3.9 SHRINK FILM

8.4 NORTH AMERICA CORRUGATED BOXES IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.4.1 ASIA-PACIFIC

8.4.2 NORTH AMERICA

8.4.3 EUROPE

8.4.4 SOUTH AMERICA

8.4.5 MIDDLE EAST & AFRICA

8.5 NORTH AMERICA CORRUGATED BOXES IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (THOUSAND UNITS)

8.5.1 ASIA-PACIFIC

8.5.2 NORTH AMERICA

8.5.3 EUROPE

8.5.4 SOUTH AMERICA

8.5.5 MIDDLE EAST & AFRICA

8.6 NORTH AMERICA BAGS IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.6.1 POLYTHENE BAGS

8.6.2 COURIER BAGS

8.6.3 WOVEN SACK BAGS

8.6.4 FOAM BAGS

8.6.5 TEMPER PROOF BAGS

8.6.6 LOCK BAGS

8.6.7 OTHERS

8.7 NORTH AMERICA BAGS IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (THOUSAND UNITS)

8.7.1 POLYTHENE BAGS

8.7.2 COURIER BAGS

8.7.3 WOVEN SACK BAGS

8.7.4 FOAM BAGS

8.7.5 TEMPER PROOF BAGS

8.7.6 LOCK BAGS

8.7.7 OTHERS

8.8 NORTH AMERICA BAGS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.8.1 ASIA-PACIFIC

8.8.2 NORTH AMERICA

8.8.3 EUROPE

8.8.4 SOUTH AMERICA

8.8.5 MIDDLE EAST & AFRICA

8.9 NORTH AMERICA BAGS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (THOUSAND UNITS)

8.9.1 ASIA-PACIFIC

8.9.2 NORTH AMERICA

8.9.3 EUROPE

8.9.4 SOUTH AMERICA

8.9.5 MIDDLE EAST & AFRICA

8.1 NORTH AMERICA MAILER IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.10.1 ASIA-PACIFIC

8.10.2 NORTH AMERICA

8.10.3 EUROPE

8.10.4 SOUTH AMERICA

8.10.5 MIDDLE EAST & AFRICA

8.11 NORTH AMERICA MAILER IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (THOUSAND UNITS)

8.11.1 ASIA-PACIFIC

8.11.2 NORTH AMERICA

8.11.3 EUROPE

8.11.4 SOUTH AMERICA

8.11.5 MIDDLE EAST & AFRICA

8.12 NORTH AMERICA LABELS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.12.1 ASIA-PACIFIC

8.12.2 NORTH AMERICA

8.12.3 EUROPE

8.12.4 SOUTH AMERICA

8.12.5 MIDDLE EAST & AFRICA

8.13 NORTH AMERICA LABELS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (THOUSAND UNITS)

8.13.1 ASIA-PACIFIC

8.13.2 NORTH AMERICA

8.13.3 EUROPE

8.13.4 SOUTH AMERICA

8.13.5 MIDDLE EAST & AFRICA

8.14 NORTH AMERICA TAPES IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.14.1 SELF-ADHESIVE BOPP TAPES

8.14.2 PRINTED TAPES

8.14.3 REINFORCED PAPER TAPES

8.14.4 PVC PACKING TAPES

8.14.5 PACKAGING SEALING ADHESIVE TAPES

8.14.6 RESEALABLE BAG SEALING TAPES

8.14.7 OTHERS

8.15 NORTH AMERICA TAPES IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (THOUSAND UNITS)

8.15.1 SELF-ADHESIVE BOPP TAPES

8.15.2 PRINTED TAPES

8.15.3 REINFORCED PAPER TAPES

8.15.4 PVC PACKING TAPES

8.15.5 PACKAGING SEALING ADHESIVE TAPES

8.15.6 RESEALABLE BAG SEALING TAPES

8.15.7 OTHERS

8.16 NORTH AMERICA TAPES IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.16.1 ASIA-PACIFIC

8.16.2 NORTH AMERICA

8.16.3 EUROPE

8.16.4 SOUTH AMERICA

8.16.5 MIDDLE EAST & AFRICA

8.17 NORTH AMERICA TAPES IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (THOUSAND UNITS)

8.17.1 ASIA-PACIFIC

8.17.2 NORTH AMERICA

8.17.3 EUROPE

8.17.4 SOUTH AMERICA

8.17.5 MIDDLE EAST & AFRICA

8.18 NORTH AMERICA PROTECTIVE PACKAGING IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.18.1 AIR BUBBLE ROLLS

8.18.2 CORRUGATED ROLLS

8.18.3 OTHERS

8.19 NORTH AMERICA PROTECTIVE PACKAGING IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (THOUSAND UNITS )

8.19.1 AIR BUBBLE ROLLS

8.19.2 CORRUGATED ROLLS

8.19.3 OTHERS

8.2 NORTH AMERICA PROTECTIVE PACKAGING IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.20.1 ASIA-PACIFIC

8.20.2 NORTH AMERICA

8.20.3 EUROPE

8.20.4 SOUTH AMERICA

8.20.5 MIDDLE EAST & AFRICA

8.21 NORTH AMERICA PROTECTIVE PACKAGING IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (THOUSAND UNITS)

8.21.1 ASIA-PACIFIC

8.21.2 NORTH AMERICA

8.21.3 EUROPE

8.21.4 SOUTH AMERICA

8.21.5 MIDDLE EAST & AFRICA

8.22 NORTH AMERICA PALLET BOXES IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.22.1 ASIA-PACIFIC

8.22.2 NORTH AMERICA

8.22.3 EUROPE

8.22.4 SOUTH AMERICA

8.22.5 MIDDLE EAST & AFRICA

8.23 NORTH AMERICA PALLET BOXES IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (THOUSAND UNITS)

8.23.1 ASIA-PACIFIC

8.23.2 NORTH AMERICA

8.23.3 EUROPE

8.23.4 SOUTH AMERICA

8.23.5 MIDDLE EAST & AFRICA

8.24 NORTH AMERICA POSTAL PACKAGING IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.24.1 ASIA-PACIFIC

8.24.2 NORTH AMERICA

8.24.3 EUROPE

8.24.4 SOUTH AMERICA

8.24.5 MIDDLE EAST & AFRICA

8.25 NORTH AMERICA POSTAL PACKAGING IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (THOUSAND UNITS)

8.25.1 ASIA-PACIFIC

8.25.2 NORTH AMERICA

8.25.3 EUROPE

8.25.4 SOUTH AMERICA

8.25.5 MIDDLE EAST & AFRICA

8.26 NORTH AMERICA SHRINK FILM IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.26.1 ASIA-PACIFIC

8.26.2 NORTH AMERICA

8.26.3 EUROPE

8.26.4 SOUTH AMERICA

8.26.5 MIDDLE EAST & AFRICA

8.27 NORTH AMERICA SHRINK FILMING E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (THOUSAND UNITS)

8.27.1 ASIA-PACIFIC

8.27.2 NORTH AMERICA

8.27.3 EUROPE

8.27.4 SOUTH AMERICA

8.27.5 MIDDLE EAST & AFRICA

9 NORTH AMERICA E-COMMERCE PACKAGING MARKET, BY MATERIAL.

9.1 OVERVIEW

9.2 NORTH AMERICA E-COMMERCE PACKAGING MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

9.2.1 FIBER-BASED

9.2.2 RECYCLED CONTENT & POST-CONSUMER RECYCLED (PCR) PLASTICS

9.2.3 BIO-BASED MATERIALS

9.2.4 CONVENTIONAL PLASTICS (VIRGIN PLASTICS)

9.2.5 OTHERS

9.3 NORTH AMERICA FIBER-BASED IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

9.3.1 CORRUGATED BOARD

9.3.2 PAPER & PAPERBOARD

9.4 NORTH AMERICA CORRUGATED BOARD IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

9.4.1 SINGLE WALL

9.4.2 DOUBLE WALL

9.4.3 SINGLE FACE

9.4.4 TRIPLE WALL

9.4.5 OTHERS

9.5 NORTH AMERICA FIBER-BASED IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.5.1 ASIA-PACIFIC

9.5.2 NORTH AMERICA

9.5.3 EUROPE

9.5.4 SOUTH AMERICA

9.5.5 MIDDLE EAST & AFRICA

9.6 NORTH AMERICA RECYCLED CONTENT & POST-CONSUMER RECYCLED (PCR) PLASTICS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.6.1 ASIA-PACIFIC

9.6.2 NORTH AMERICA

9.6.3 EUROPE

9.6.4 SOUTH AMERICA

9.6.5 MIDDLE EAST & AFRICA

9.7 NORTH AMERICA BIO-BASED MATERIALS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.7.1 ASIA-PACIFIC

9.7.2 NORTH AMERICA

9.7.3 EUROPE

9.7.4 SOUTH AMERICA

9.7.5 MIDDLE EAST & AFRICA

9.8 NORTH AMERICA CONVENTIONAL PLASTICS (VIRGIN PLASTICS) IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.8.1 ASIA-PACIFIC

9.8.2 NORTH AMERICA

9.8.3 EUROPE

9.8.4 SOUTH AMERICA

9.8.5 MIDDLE EAST & AFRICA

9.9 NORTH AMERICA OTHERS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.9.1 ASIA-PACIFIC

9.9.2 NORTH AMERICA

9.9.3 EUROPE

9.9.4 SOUTH AMERICA

9.9.5 MIDDLE EAST & AFRICA

10 NORTH AMERICA E-COMMERCE PACKAGING MARKET, BY END-USER.

10.1 OVERVIEW

10.2 NORTH AMERICA E-COMMERCE PACKAGING MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

10.2.1 APPARELS AND ACCESSORIES (EX. LEATHER BASED) (0001)

10.2.2 ELECTRONICS & ELECTRICAL (2500)

10.2.3 TEXTILE (0001)

10.2.4 HOUSEHOLD (2000,0001)

10.2.5 PERSONAL CARE (2000,0001)

10.2.6 FOOD AND BEVERAGES (1000,1100)

10.2.7 PHARMACEUTICALS (2100)

10.2.8 AUTOMOTIVE (4600)

10.2.9 FABRICATED METAL PRODUCTS (2500)

10.2.10 CHEMICAL PRODUCTS (2000)

10.2.11 AGRICULTURE (0100)

10.2.12 FURNITURE (0001)

10.2.13 WOOD AND WOOD PRODUCTS (EX. FURNITURE) (0001)

10.2.14 LEATHER AND LEATHER GOODS (0001)

10.2.15 CONSTRUCTION MATERIALS (2000,0001)

10.2.16 TOBACCO PRODUCTS (0001)

10.3 NORTH AMERICA APPAREL & ACCESSORIES IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

10.3.1 RETAIL

10.3.2 WHOLESALE

10.4 NORTH AMERICA APPAREL & ACCESSORIES IN E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

10.4.1 CORRUGATED BOXES

10.4.2 BAGS

10.4.3 MAILER

10.4.4 LABELS

10.4.5 PROTECTIVE PACKAGING

10.4.6 PALLET BOXES

10.4.7 TAPES

10.4.8 POSTAL PACKAGING

10.4.9 SHRINK FILM

10.5 NORTH AMERICA APPAREL & ACCESSORIES IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.5.1 ASIA-PACIFIC

10.5.2 NORTH AMERICA

10.5.3 EUROPE

10.5.4 SOUTH AMERICA

10.5.5 MIDDLE EAST & AFRICA

10.6 NORTH AMERICA ELECTRONICS & ELECTRICAL IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

10.6.1 RETAIL

10.6.2 WHOLESALE

10.7 NORTH AMERICA ELECTRONICS & ELECTRICAL IN E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

10.7.1 CORRUGATED BOXES

10.7.2 BAGS

10.7.3 MAILER

10.7.4 LABELS

10.7.5 PROTECTIVE PACKAGING

10.7.6 PALLET BOXES

10.7.7 TAPES

10.7.8 POSTAL PACKAGING

10.7.9 SHRINK FILM

10.8 NORTH AMERICA ELECTRONICS & ELECTRICAL IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

10.8.1 COMPUTERS, ELECTRONIC AND OPTICAL PRODUCTS

10.8.2 ELECTRICAL EQUIPMENT

10.8.3 OTHERS

10.9 NORTH AMERICA ELECTRONICS & ELECTRICAL IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.9.1 ASIA-PACIFIC

10.9.2 NORTH AMERICA

10.9.3 EUROPE

10.9.4 SOUTH AMERICA

10.9.5 MIDDLE EAST & AFRICA

10.1 NORTH AMERICA TEXTILE IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

10.10.1 RETAIL

10.10.2 WHOLESALE

10.11 NORTH AMERICA TEXTILE IN E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

10.11.1 CORRUGATED BOXES

10.11.2 BAGS

10.11.3 MAILER

10.11.4 LABELS

10.11.5 PROTECTIVE PACKAGING

10.11.6 PALLET BOXES

10.11.7 TAPES

10.11.8 POSTAL PACKAGING

10.11.9 SHRINK FILM

10.12 NORTH AMERICA TEXTILE IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.12.1 ASIA-PACIFIC

10.12.2 NORTH AMERICA

10.12.3 EUROPE

10.12.4 SOUTH AMERICA

10.12.5 MIDDLE EAST & AFRICA

10.13 NORTH AMERICA HOUSEHOLD IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

10.13.1 RETAIL

10.13.2 WHOLESALE

10.14 NORTH AMERICA HOUSEHOLD IN E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

10.14.1 CORRUGATED BOXES

10.14.2 BAGS

10.14.3 MAILER

10.14.4 LABELS

10.14.5 PROTECTIVE PACKAGING

10.14.6 PALLET BOXES

10.14.7 TAPES

10.14.8 POSTAL PACKAGING

10.14.9 SHRINK FILM

10.15 NORTH AMERICA HOUSEHOLD IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.15.1 ASIA-PACIFIC

10.15.2 NORTH AMERICA

10.15.3 EUROPE

10.15.4 SOUTH AMERICA

10.15.5 MIDDLE EAST & AFRICA

10.16 NORTH AMERICA PERSONAL CARE IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

10.16.1 RETAIL

10.16.2 WHOLESALE

10.17 NORTH AMERICA PERSONAL CARE IN E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

10.17.1 CORRUGATED BOXES

10.17.2 BAGS

10.17.3 MAILER

10.17.4 LABELS

10.17.5 PROTECTIVE PACKAGING

10.17.6 PALLET BOXES

10.17.7 TAPES

10.17.8 POSTAL PACKAGING

10.17.9 SHRINK FILM

10.18 NORTH AMERICA PERSONAL CARE IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.18.1 ASIA-PACIFIC

10.18.2 NORTH AMERICA

10.18.3 EUROPE

10.18.4 SOUTH AMERICA

10.18.5 MIDDLE EAST & AFRICA

10.19 NORTH AMERICA FOOD AND BEVERAGES IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

10.19.1 RETAIL

10.19.2 WHOLESALE

10.2 NORTH AMERICA FOOD AND BEVERAGES IN E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

10.20.1 CORRUGATED BOXES

10.20.2 BAGS

10.20.3 MAILER

10.20.4 LABELS

10.20.5 PROTECTIVE PACKAGING

10.20.6 PALLET BOXES

10.20.7 TAPES

10.20.8 POSTAL PACKAGING

10.20.9 SHRINK FILM

10.21 NORTH AMERICA FOOD AND BEVERAGES IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

10.21.1 FOOD

10.21.2 BEVERAGES

10.22 NORTH AMERICA FOOD AND BEVERAGES IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.22.1 ASIA-PACIFIC

10.22.2 NORTH AMERICA

10.22.3 EUROPE

10.22.4 SOUTH AMERICA

10.22.5 MIDDLE EAST & AFRICA

10.23 NORTH AMERICA PHARMACEUTICALS IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

10.23.1 RETAIL

10.23.2 WHOLESALE

10.24 NORTH AMERICA PHARMACEUTICALS IN E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

10.24.1 CORRUGATED BOXES

10.24.2 BAGS

10.24.3 MAILER

10.24.4 LABELS

10.24.5 PROTECTIVE PACKAGING

10.24.6 PALLET BOXES

10.24.7 TAPES

10.24.8 POSTAL PACKAGING

10.24.9 SHRINK FILM

10.25 NORTH AMERICA PHARMACEUTICALS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.25.1 ASIA-PACIFIC

10.25.2 NORTH AMERICA

10.25.3 EUROPE

10.25.4 SOUTH AMERICA

10.25.5 MIDDLE EAST & AFRICA

10.26 NORTH AMERICA AUTOMOTIVE IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

10.26.1 RETAIL

10.26.2 WHOLESALE

10.27 NORTH AMERICA AUTOMOTIVE IN E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

10.27.1 CORRUGATED BOXES

10.27.2 BAGS

10.27.3 MAILER

10.27.4 LABELS

10.27.5 PROTECTIVE PACKAGING

10.27.6 PALLET BOXES

10.27.7 TAPES

10.27.8 POSTAL PACKAGING

10.27.9 SHRINK FILM

10.28 NORTH AMERICA AUTOMOTIVE IN E-COMMERCE PACKAGING MARKET, BY COMMODITY TYPE, 2018-2033 (USD THOUSAND)

10.28.1 SPARE PARTS

10.28.2 VEHICLE MODIFICATION PARTS

10.29 NORTH AMERICA AUTOMOTIVE IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.29.1 ASIA-PACIFIC

10.29.2 NORTH AMERICA

10.29.3 EUROPE

10.29.4 SOUTH AMERICA

10.29.5 MIDDLE EAST & AFRICA

10.3 NORTH AMERICA FABRICATED METAL PRODUCTS IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

10.30.1 RETAIL

10.30.2 WHOLESALE

10.31 NORTH AMERICA FABRICATED METAL PRODUCTS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.32 ASIA-PACIFIC

10.32.1 NORTH AMERICA

10.32.2 EUROPE

10.32.3 SOUTH AMERICA

10.32.4 MIDDLE EAST & AFRICA

10.33 NORTH AMERICA CHEMICAL PRODUCTS IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

10.33.1 RETAIL

10.33.2 WHOLESALE

10.34 NORTH AMERICA CHEMICAL PRODUCTS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.34.1 ASIA-PACIFIC

10.34.2 NORTH AMERICA

10.34.3 EUROPE

10.34.4 SOUTH AMERICA

10.34.5 MIDDLE EAST & AFRICA

10.35 NORTH AMERICA AGRICULTURE IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

10.35.1 RETAIL

10.35.2 WHOLESALE

10.36 NORTH AMERICA AGRICULTURE IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

10.36.1 FERTILIZERS

10.36.2 FISHING AND AQUACULTURE PRODUCTS

10.36.3 PLANTS

10.36.4 SEEDS

10.36.5 OTHERS

10.37 NORTH AMERICA AGRICULTURE IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.37.1 ASIA-PACIFIC

10.37.2 NORTH AMERICA

10.37.3 EUROPE

10.37.4 SOUTH AMERICA

10.37.5 MIDDLE EAST & AFRICA

10.38 NORTH AMERICA FURNITURE IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

10.38.1 RETAIL

10.38.2 WHOLESALE

10.39 NORTH AMERICA FURNITURE IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.39.1 ASIA-PACIFIC

10.39.2 NORTH AMERICA

10.39.3 EUROPE

10.39.4 SOUTH AMERICA

10.39.5 MIDDLE EAST & AFRICA

10.4 NORTH AMERICA WOOD AND WOOD PRODUCTS (EX. FURNITURE) IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

10.40.1 RETAIL

10.40.2 WHOLESALE

10.41 NORTH AMERICA WOOD AND WOOD PRODUCTS (EX. FURNITURE) IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.41.1 ASIA-PACIFIC

10.41.2 NORTH AMERICA

10.41.3 EUROPE

10.41.4 SOUTH AMERICA

10.41.5 MIDDLE EAST & AFRICA

10.42 NORTH AMERICA LEATHER AND LEATHER GOODS PRODUCTS IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

10.42.1 RETAIL

10.42.2 WHOLESALE

10.43 NORTH AMERICA LEATHER AND LEATHER GOODS PRODUCTS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.43.1 ASIA-PACIFIC

10.43.2 NORTH AMERICA

10.43.3 EUROPE

10.43.4 SOUTH AMERICA

10.43.5 MIDDLE EAST & AFRICA

10.44 NORTH AMERICA CONSTRUCTION MATERIALS IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

10.44.1 RETAIL

10.44.2 WHOLESALE

10.45 NORTH AMERICA CONSTRUCTION MATERIALS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.45.1 ASIA-PACIFIC

10.45.2 NORTH AMERICA

10.45.3 EUROPE

10.45.4 SOUTH AMERICA

10.45.5 MIDDLE EAST & AFRICA

10.46 NORTH AMERICA TOBACCO PRODUCTS IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

10.46.1 RETAIL

10.46.2 WHOLESALE

10.47 NORTH AMERICA TOBACCO PRODUCTS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.47.1 ASIA-PACIFIC

10.47.2 NORTH AMERICA

10.47.3 EUROPE

10.47.4 SOUTH AMERICA

10.47.5 MIDDLE EAST & AFRICA

10.48 NORTH AMERICA OTHERS IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

10.48.1 CORRUGATED BOXES

10.48.2 BAGS

10.48.3 MAILER

10.48.4 LABELS

10.48.5 PROTECTIVE PACKAGING

10.48.6 PALLET BOXES

10.48.7 TAPES

10.48.8 POSTAL PACKAGING

10.48.9 SHRINK FILM

10.49 NORTH AMERICA OTHERS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.49.1 ASIA-PACIFIC

10.49.2 NORTH AMERICA

10.49.3 EUROPE

10.49.4 SOUTH AMERICA

10.49.5 MIDDLE EAST & AFRICA

11 NORTH AMERICA E-COMMERCE PACKAGING MARKET, BY DISTRIBUTION CHANNEL.

11.1 OVERVIEW

11.2 NORTH AMERICA E-COMMERCE PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

11.2.1 DIRECT

11.2.2 INDIRECT

11.3 NORTH AMERICA DIRECT SALES IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.3.1 COMPANY OWNED WEBSITES

11.3.2 FIELD AGENTS

11.3.3 DIRECT CONTRACTS

11.4 NORTH AMERICA INDIRECT SALES IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.4.1 DISTRIBUTORS / WHOLESALERS

11.4.2 VALUE-ADDED RESELLERS (VARS)

11.4.3 THIRD-PARTY ONLINE MARKETPLACES

11.5 NORTH AMERICA DIRECT SALE IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.5.1 ASIA-PACIFIC

11.5.2 NORTH AMERICA

11.5.3 EUROPE

11.5.4 SOUTH AMERICA

11.5.5 MIDDLE EAST & AFRICA

11.6 NORTH AMERICA INDIRECT SALE IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.6.1 ASIA-PACIFIC

11.6.2 NORTH AMERICA

11.6.3 EUROPE

11.6.4 SOUTH AMERICA

11.6.5 MIDDLE EAST & AFRICA

12 NORTH AMERICA E-COMMERCE PACKAGING MARKET, BY GEOGRAPHY

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

13 NORTH AMERICA E-COMMERCE PACKAGING MARKET: COMPANY LANDSCAPE

13.1 MANUFACTURER COMPANY SHARE ANALYSIS: GLOBAL

14 SWOT ANALYSIS

15 MANUFACTURERS COMPANY PROFILE

15.1 INTERNATIONAL PAPER

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENT

15.2 AMCOR PLC

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENT

15.3 DS SMITH

15.3.1 COMPANY SNAPSHOT

15.3.2 COMPANY SHARE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENT

15.4 SMURFIT WESTROCK

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENT

15.5 PACKAGING CORPORATION OF AMERICA.

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENT

15.6 3M

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENT

15.7 ALTPAC

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 AVERY DENNISON CORPORATION

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT DEVELOPMENT

15.9 BLUE BOX PACKAGING

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 BOXON AB

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVEOPMENT

15.11 COSMO FILMS

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 PRODUCT PORTFOLIO

15.11.4 RECENT DEVELOPMENT

15.12 ECOM PACKAGING

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENT

15.13 ECB

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENT

15.14 FILMAR GROUP

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 GEORGIA-PACIFIC LLC

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.16 GREEN BAY PACKAGING INC

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENT

15.17 IPG

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENT

15.18 KLABIN S.A

15.18.1 COMPANY SNAPSHOT

15.18.2 REVENUE ANALYSIS

15.18.3 PRODUCT PORTFOLIO

15.18.4 RECENT DEVELOPMENT

15.19 MONDI

15.19.1 COMPANY SNAPSHOT

15.19.2 REVENUE ANALYSIS

15.19.3 PRODUCT PORTFOLIO

15.19.4 RECENT DEVELOPMENT

15.2 NINE DRAGONS WORLDWIDE (CHINA) INVESTMENT GROUP CO., LTD.

15.20.1 COMPANY SNAPSHOT

15.20.2 REVENUE ANALYSIS

15.20.3 PRODUCT PORTFOLIO

15.20.4 RECENT DEVELOPMENT

15.21 OJI HOLDINGS CORPORATION.

15.21.1 COMPANY SNAPSHOT

15.21.2 REVENUE ANALYSIS

15.21.3 PRODUCT PORTFOLIO

15.21.4 RECENT DEVELOPMENT

15.22 PACKHELP

15.22.1 COMPANY SNAPSHOT

15.22.2 PRODUCT PORTFOLIO

15.22.3 RECENT DEVELOPMENT

15.23 PACKMAN PACKAGING PRIVATE LIMITED.

15.23.1 COMPANY SNAPSHOT

15.23.2 PRODUCT PORTFOLIO

15.23.3 RECENT DEVELOPMENT

15.24 PACKTEK

15.24.1 COMPANY SNAPSHOT

15.24.2 PRODUCT PORTFOLIO

15.24.3 RECENT DEVELOPMENT

15.25 PRATT INDUSTRIES INC.

15.25.1 COMPANY SNAPSHOT

15.25.2 PRODUCT PORTFOLIO

15.25.3 RECENT DEVELOPMENT

15.26 PREGIS LLC

15.26.1 COMPANY SNAPSHOT

15.26.2 PRODUCT PORTFOLIO

15.26.3 RECENT DEVELOPMENT

15.27 PREM INDUSTRIES INDIA LIMITED

15.27.1 COMPANY SNAPSHOT

15.27.2 PRODUCT PORTFOLIO

15.27.3 RECENT DEVELOPMENT

15.28 RANPAK

15.28.1 COMPANY SNAPSHOT

15.28.2 REVENUE ANALYSIS

15.28.3 PRODUCT PORTFOLIO

15.28.4 RECENT DEVELOPMENT

15.29 SEALED AIR

15.29.1 COMPANY SNAPSHOT

15.29.2 REVENUE ANALYSIS

15.29.3 PRODUCT PORTFOLIO

15.29.4 RECENT DEVELOPMENT

15.3 STORA ENSO

15.30.1 COMPANY SNAPSHOT

15.30.2 REVENUE ANALYSIS

15.30.3 PRODUCT PORTFOLIO

15.30.4 RECENT DEVELOPMENT

16 DISTRIBUTOR COMPANY PROFILE

16.1 BUNZL PLC

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 PRODUCT PORTFOLIO

16.1.4 RECENT DEVELOPMENT

16.2 MACFARLANE PACKAGING (A SUBSIDIARY COMPANY OF MACFARLANE GROUP PLC)

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 PRODUCT PORTFOLIO

16.2.4 RECENT DEVELOPMENT

16.3 RAJAPACK LTD

16.3.1 COMPANY SNAPSHOT

16.3.2 PRODUCT PORTFOLIO

16.3.3 RECENT DEVELOPMENT

16.4 ULINE

16.4.1 COMPANY SNAPSHOT

16.4.2 PRODUCT PORTFOLIO

16.4.3 RECENT DEVELOPMENT

16.5 VERITIV OPERATING COMPANY

16.5.1 COMPANY SNAPSHOT

16.5.2 PRODUCT PORTFOLIO

16.5.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

Список таблиц

TABLE 1 PRODUCTION CAPACITY OF KEY MANUFACTURERS

TABLE 2 BRAND COMPARATIVE ANALYSIS

TABLE 3 CONSUMER PREFERENCE MATRIX

TABLE 4 REGULATORY COVERAGE

TABLE 5 NORTH AMERICA E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 6 NORTH AMERICA E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (THOUSAND UNITS)

TABLE 7 NORTH AMERICA CORRUGATED BOXES IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 8 NORTH AMERICA CORRUGATED BOXES IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (THOUSAND UNITS)

TABLE 9 NORTH AMERICA BAGS IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 10 NORTH AMERICA BAGS IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (THOUSAND UNITS)

TABLE 11 NORTH AMERICA BAGS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 12 NORTH AMERICA BAGS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (THOUSAND UNITS)

TABLE 13 NORTH AMERICA MAILER IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 14 NORTH AMERICA MAILER IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (THOUSAND UNITS)

TABLE 15 NORTH AMERICA LABELS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 16 NORTH AMERICA LABELS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (THOUSAND UNITS)

TABLE 17 NORTH AMERICA TAPES IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 18 NORTH AMERICA TAPES IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (THOUSAND UNITS)

TABLE 19 NORTH AMERICA TAPES IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 20 NORTH AMERICA TAPES IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (THOUSAND UNITS)

TABLE 21 NORTH AMERICA PROTECTIVE PACKAGING IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 22 NORTH AMERICA PROTECTIVE PACKAGING IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (THOUSAND UNITS )

TABLE 23 NORTH AMERICA PROTECTIVE PACKAGING IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 24 NORTH AMERICA PROTECTIVE PACKAGING IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (THOUSAND UNITS)

TABLE 25 NORTH AMERICA PALLET BOXES IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 26 NORTH AMERICA PALLET BOXES IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (THOUSAND UNITS)

TABLE 27 NORTH AMERICA POSTAL PACKAGING IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 28 NORTH AMERICA POSTAL PACKAGING IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (THOUSAND UNITS)

TABLE 29 NORTH AMERICA SHRINK FILM IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 30 NORTH AMERICA SHRINK FILMING E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (THOUSAND UNITS)

TABLE 31 NORTH AMERICA E-COMMERCE PACKAGING MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 32 NORTH AMERICA FIBER-BASED IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 33 NORTH AMERICA CORRUGATED BOARD IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 34 NORTH AMERICA FIBER-BASED IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 35 NORTH AMERICA RECYCLED CONTENT & POST-CONSUMER RECYCLED (PCR) PLASTICS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 36 NORTH AMERICA BIO-BASED MATERIALS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 37 NORTH AMERICA CONVENTIONAL PLASTICS (VIRGIN PLASTICS) IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 38 NORTH AMERICA OTHERS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 39 NORTH AMERICA E-COMMERCE PACKAGING MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 40 NORTH AMERICA APPAREL & ACCESSORIES IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 41 NORTH AMERICA APPAREL & ACCESSORIES IN E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 42 NORTH AMERICA APPAREL & ACCESSORIES IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 43 NORTH AMERICA ELECTRONICS & ELECTRICAL IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 44 NORTH AMERICA ELECTRONICS & ELECTRICAL IN E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 45 NORTH AMERICA ELECTRONICS & ELECTRICAL IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 46 NORTH AMERICA ELECTRONICS & ELECTRICAL IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 47 NORTH AMERICA TEXTILE IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 48 NORTH AMERICA TEXTILE IN E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 49 NORTH AMERICA TEXTILE IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 50 NORTH AMERICA HOUSEHOLD IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 51 NORTH AMERICA HOUSEHOLD IN E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 52 NORTH AMERICA HOUSEHOLD IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 53 NORTH AMERICA PERSONAL CARE IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 54 NORTH AMERICA PERSONAL CARE IN E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 55 NORTH AMERICA PERSONAL CARE IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 56 NORTH AMERICA FOOD AND BEVERAGES IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 57 NORTH AMERICA FOOD AND BEVERAGES IN E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 58 NORTH AMERICA FOOD AND BEVERAGES IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 59 NORTH AMERICA FOOD AND BEVERAGES IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 60 NORTH AMERICA PHARMACEUTICALS IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 61 NORTH AMERICA PHARMACEUTICALS IN E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 62 NORTH AMERICA PHARMACEUTICALS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 63 NORTH AMERICA AUTOMOTIVE IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 64 NORTH AMERICA AUTOMOTIVE IN E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 65 NORTH AMERICA AUTOMOTIVE IN E-COMMERCE PACKAGING MARKET, BY COMMODITY TYPE, 2018-2033 (USD THOUSAND)

TABLE 66 NORTH AMERICA AUTOMOTIVE IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 67 NORTH AMERICA FABRICATED METAL PRODUCTS IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 68 NORTH AMERICA FABRICATED METAL PRODUCTS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 69 NORTH AMERICA CHEMICAL PRODUCTS IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 70 NORTH AMERICA CHEMICAL PRODUCTS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 71 NORTH AMERICA AGRICULTURE IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 72 NORTH AMERICA AGRICULTURE IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 73 NORTH AMERICA AGRICULTURE IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 74 NORTH AMERICA FURNITURE IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 75 NORTH AMERICA FURNITURE IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 76 NORTH AMERICA WOOD AND WOOD PRODUCTS (EX. FURNITURE) IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 77 NORTH AMERICA WOOD AND WOOD PRODUCTS (EX. FURNITURE) IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 78 NORTH AMERICA LEATHER AND LEATHER GOODS PRODUCTS IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 79 NORTH AMERICA LEATHER AND LEATHER GOODS PRODUCTS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 80 NORTH AMERICA CONSTRUCTION MATERIALS IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 81 NORTH AMERICA CONSTRUCTION MATERIALS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 82 NORTH AMERICA TOBACCO PRODUCTS IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 83 NORTH AMERICA TOBACCO PRODUCTS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 84 NORTH AMERICA OTHERS IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 85 NORTH AMERICA OTHERS IN E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 86 NORTH AMERICA OTHERS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 87 NORTH AMERICA E-COMMERCE PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 88 NORTH AMERICA DIRECT SALES IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 89 NORTH AMERICA INDIRECT SALES IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 90 NORTH AMERICA DIRECT SALE IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 91 NORTH AMERICA INDIRECT SALE IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 92 NORTH AMERICA

TABLE 93 NORTH AMERICA E-COMMERCE PACKAGING MARKET, BY COUNTRY, 2018-2033 (USD THOUSAND)

TABLE 94 NORTH AMERICA

TABLE 95 NORTH AMERICA E-COMMERCE PACKAGING MARKET, BY COUNTRY, 2018-2033 (THOUSAND UNITS)

TABLE 96 THOUSAND

TABLE 97 NORTH AMERICA E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 98 NORTH AMERICA E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (THOUSAND UNITS)

TABLE 99 NORTH AMERICA BAGS IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 100 NORTH AMERICA BAGS IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (THOUSAND UNITS)

TABLE 101 NORTH AMERICA TAPES IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 102 NORTH AMERICA TAPES IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (THOUSAND UNITS)

TABLE 103 NORTH AMERICA PROTECTIVE PACKAGING IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 104 NORTH AMERICA PROTECTIVE PACKAGING IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (THOUSAND UNITS )

TABLE 105 NORTH AMERICA E-COMMERCE PACKAGING MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 106 NORTH AMERICA FIBER-BASED IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 107 NORTH AMERICA CORRUGATED BOARD IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 108 NORTH AMERICA E-COMMERCE PACKAGING MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 109 NORTH AMERICA APPAREL & ACCESSORIES IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 110 NORTH AMERICA APPAREL & ACCESSORIES IN E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 111 NORTH AMERICA ELECTRONICS & ELECTRICAL IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 112 NORTH AMERICA ELECTRONICS & ELECTRICAL IN E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 113 NORTH AMERICA ELECTRONICS & ELECTRICAL IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 114 NORTH AMERICA TEXTILE IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 115 NORTH AMERICA TEXTILE IN E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 116 NORTH AMERICA HOUSEHOLD IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)