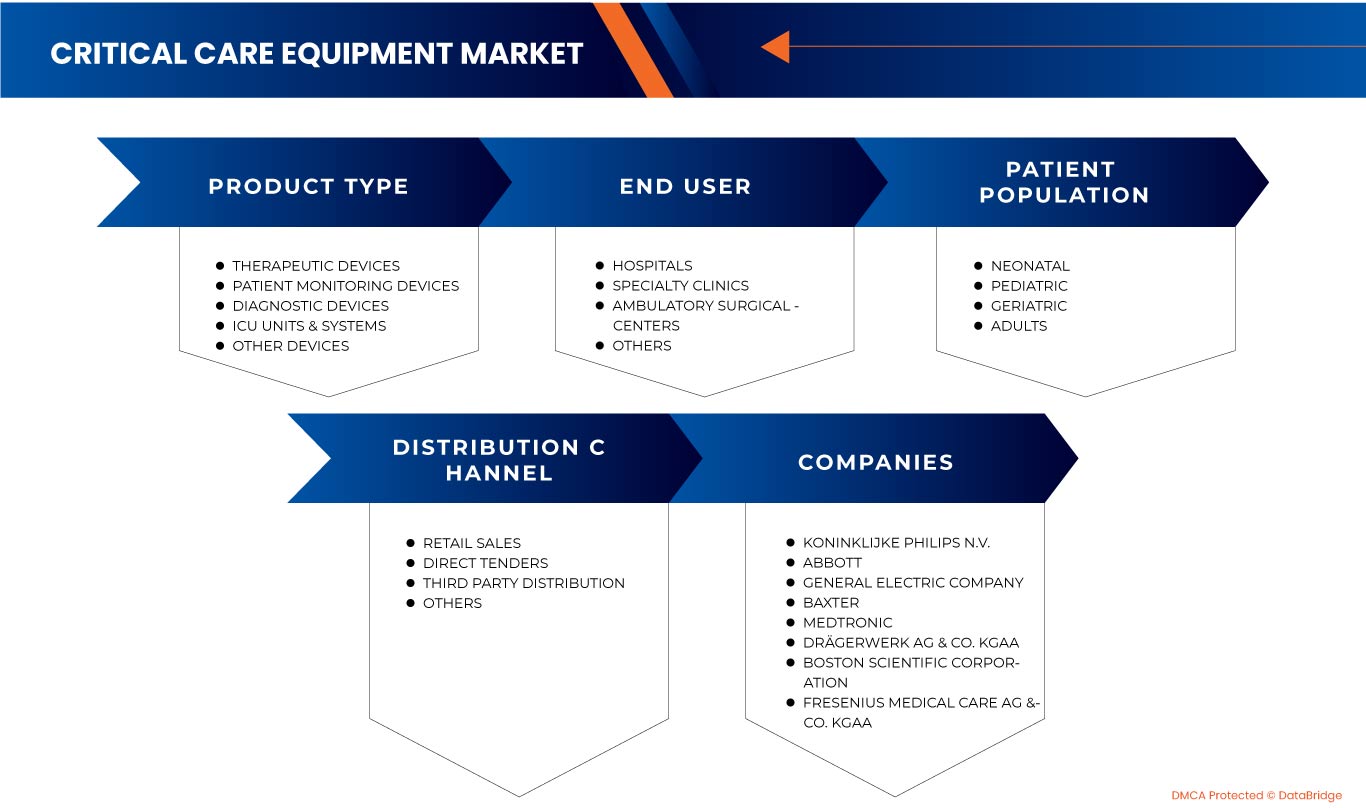

North America Critical Care Equipment Market, By Product Type (Therapeutic Devices, Patient Monitoring Devices, Diagnostic Devices, ICU Units & System, and Other Devices), Patient Population (Neonatal, Pediatric, Adults, and Geriatric), End User (Hospitals, Specialty Clinics, Ambulatory Surgical Centers, and Others), Distribution Channel (Direct Tenders, Retail Sales, Third Party Distribution, and Others) Industry Trends and Forecast to 2030.

North America Critical Care Equipment Market Analysis and Insights

Patients admitted to an ICU may be there for varying reasons, but what they all have in common is that they need close attention and monitoring, and they need advanced equipment, often life and respiratory support.

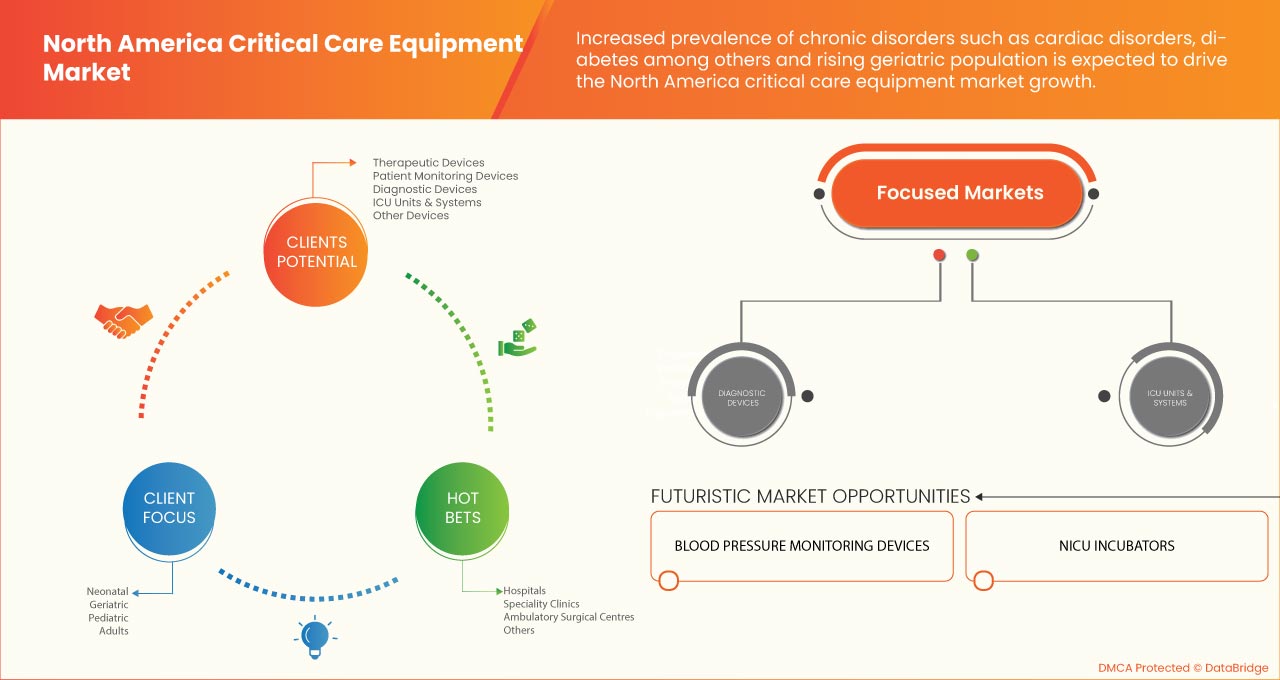

The North America critical care equipment market is growing tremendously in North America due to a rise in chronic disorders such as diabetes, cardiovascular disorders, and kidney disorders among others, which is leading to an increase in the number of patients in critical care. However, stringent regulations and poor reimbursement policies may restrain the market during the forecast period. Moreover, the high cost of critical care equipment is one of the most significant factors which may hamper the market's growth in the long run.

The development of technology is an opportunity for key players during the forecast period. On the other hand, the lack of proper staffing and training is acting as a challenge for the market's growth.

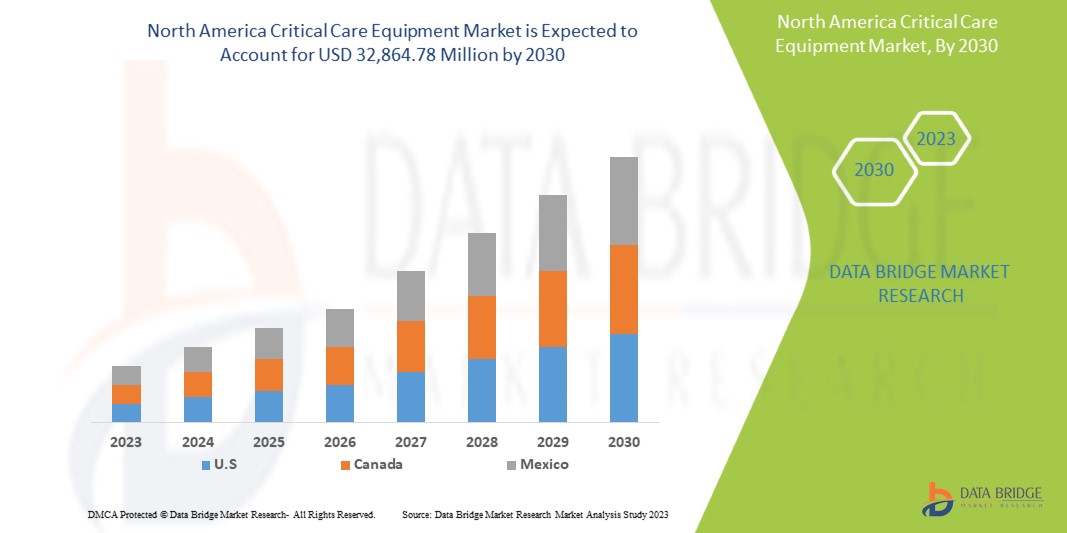

Data Bridge Market Research analyzes that the North America critical care equipment market is expected to reach the value of USD 32,864.78 million by 2030, at a CAGR of 8.8% during the forecast period. Product type accounts for the largest type segment in the market due to the rapid demand for critical care equipment in North America. This market report also covers pricing analysis, patent analysis, and technological advancements in depth.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2020-2016) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

By Product Type (Therapeutic Devices, Patient Monitoring Devices, Diagnostic Devices, ICU Units & System, and Other Devices), Patient Population (Neonatal, Pediatric, Adults, and Geriatric), End User (Hospitals, Specialty Clinics, Ambulatory Surgical Centers, and Others), Distribution Channel (Direct Tenders, Retail Sales, Third Party Distribution, and Others). |

|

Countries Covered |

U.S., Canada, and Mexico. |

|

Market Players Covered |

Koninklijke Philips N.V.,General Electric Company, COOK MEDICAL LLC, Abbott, Medtronic, Getinge AB, heyer medical AG, Drägerwerk AG & Co. KGaA, ICU Medical, Inc., NIHON KOHDEN CORPORATION., Fresenius Medical Care AG & Co. KGaA, Skanray Technologies Ltd., Boston Scientific Corporation, STERIS, Advin Health Care, Baxter, SS TECHNOMED (P) LTD., SCHILLER, Shenzhen Mindray Bio-Medical Electronics Co., Ltd., Nonin, Dixion distribution of medical devices GmbH, Masimo, and Compumedics Limited among others. |

Market Definition

Critical equipment is essential for patient care under normal operating conditions and whose failure could cause imminent serious injury or death to patients or users. Critical care is also referred to as intensive care. It is a type of care that involves treating and managing injuries and illnesses that are very serious and may be life-threatening. Surgical complications, accident injuries, severe infections, and serious respiratory issues are a few examples of conditions that may require critical care.

Patients receiving this level of care may get better, and transition to other types of care, but many people die in critical care. The equipment used for critical care is known as critical care equipment, which includes patient monitoring devices, ICU units & systems, and therapeutic devices among others. The critical care unit or intensive care unit (ICU) is a highly specialized & dedicated unit of the hospital for patients requiring intensive monitoring of medical, surgical & patient care services. Critical care is administered in an intensive care unit, which in some places is called the critical care unit.

North America Critical Care Equipment Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail below:

Drivers

- Rise in the prevalence of chronic disorders

The change in lifestyle habits, such as smoking tobacco, drinking liquor, stationary way of life, and numerous others, have raised the instances of patients experiencing constant ailment. The rising prevalence of chronic disorders is boosting the market and positively influencing the critical care equipment market.

- Rise in the geriatric population

Expanding illness trouble alongside a quickly developing geriatric populace will significantly affect the critical care equipment market. Besides, the geriatric populace is vulnerable and possesses few irresistible and constant sicknesses. The rise in the geriatric population will positively influence the market and act as a driver in the growth of the critical care equipment market.

Restraint

- Lack of skilled professionals

The lack of capable laboratory professionals is not a new story in diagnosis and healthcare. As with the increased burden of chronic diseases, the aging population and the development of healthcare insurance have increased the demand for healthcare laboratory professionals. Another reason is the lack of training sessions for the professionals.

Factors such as the retention rate, workload, and lack of certification are reasons for the lack of trained laboratory human resources, lack of education, and a relevant degree. These factors hamper the growth of the North America critical care equipment market.

- High cost of equipment

Equipment is needed for medical purposes in every department, such as surgery, orthopedics, chest medicines, and others. Mechanical equipment such as ventilators is required for external breathing support for the patients. Also, the major cost of the equipment depends upon its maintenance.

According to the Supervasi Foundation, one-day expenditure of the price of an ICU unit in India is around USD 67.17 per day, including highly-trained medical professionals. Moreover, ideally, the ICU department should comprise around 2 to 5 pieces of critical care equipment in each hospital, but due to the high cost of the equipment systems and high maintenance cost of the units in poor economic countries or rural areas hampers the growth

Opportunity

-

Growth in healthcare expenditure

Growing healthcare infrastructure helps provide better critical care, leading to faster recovery and rehabilitation into normal life. Also, as an investment in healthcare increases, more people are getting aware and desire advanced critical care equipment and diagnosing their health for precaution and cure.

Increasing healthcare expenditure for critical care treatment also helps patients to take hassle-free advanced treatment for better diagnosis and fast recovery. The spending on health is made up of self-pay or the combination of government expenditure by welfare schemes and sources, including health insurance and activities by non-governmental organizations, due to which faster recovery and rehabilitation into normal life is acting as an opportunity for growing the demand of the market.

An increase in healthcare expenditure leads to the implementation of advanced technologies equipment & products, and better treatment for critical care patients, leading to faster recovery. For this reason, faster recovery and rehabilitation into a normal life are expected to act as an opportunity for growing the demand for the North America critical care equipment market.

-

Rise in technical developments in equipments

Critical care has always been a technology- and data-dependent field. As big data and technology potentially revolutionize critical care practice, professional societies are well-positioned to partner with patients, families, practitioners, researchers, industry leaders, policymakers, and administrators to ensure that humanistic, high-value, ever-improving patient care remains the central goal for the future of critical care medicine.

Recent technological innovations are the predicted speculation about the future of critical care. The rising technical developments in critical care will continue to be multi-professional, with diverse generalists, therapists, specialists, and subspecialists seamlessly collaborating toward the common goal of optimal and humanistic patient care in a learning healthcare system. The wearable technology will optimize staffing patterns by tracking and mitigating excessive workloads while monitoring for mental and physical fatigue and distraction that could worsen patient care

Challenge

- Healthcare staff shortages

Maintaining appropriate staffing in healthcare facilities is essential for providing a safe work environment for patient care. When staffing shortages are anticipated, healthcare facilities and employers, in collaboration with human resources and occupational health services, use contingency capacity strategies to plan and prepare for mitigating the problems, such as adjusting staff schedules, hiring additional skilled staff, and rotating positions that support patient care activities.

The healthcare staff and nursing profession continue to face shortages due to a lack of potential educators, high turnover, and inequitable workforce distribution. The causes of the nursing shortage are numerous, and issues of concern are that some regions have a surplus of nurses and lower growth potential while others struggle to fulfill the local population's basic needs.

Post-COVID-19 Impact on North America Critical Care Equipment Market

Growth in the incidence of COVID-19 patients anticipated to propel the demand for medical devices such as ventilators, spirometers, oxygen concentrators, anesthesia machines, CPAP/BIPAP, and others. Moreover, advancement in technology acts as a driver for its growth in the market. However, the high cost of the devices and the risk associated with the use of ventilators act as a restraint to its growth in the market.

Manufacturers are making various strategic decisions to bounce back post-COVID-19. The players are conducting multiple R&D activities and product launches, and strategic partnerships to improve the technology and test results involved in the North America critical care equipment market.

Recent Developments

- In September 2021, SensaCore announced the launch of ST-200 CC Blood Gas Analyzer-Ultra Smart, which is the highly advanced blood gas model of Sensacore, and it is a fully automated, microprocessor-controlled electrolyte system that uses current direct measurement with ION selective electrode (ISE), impedance (Hct), and amperometry (pO2) technology to make arterial blood gas analysis and electrolyte measurements.

- In August 2021, Dixion distribution of medical devices GMBH announced that they had successfully completed registration by the FDA. The first series of equipment, namely Operating Tables Surgery and Surgical Lights Convelar had received FDA certifications in addition to the already existing CE certification.

North America Critical Care Equipment Market Scope

The North America critical care equipment market is segmented into product type, patient population, end user, and distribution channel. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

BY PRODUCT TYPE

- Therapeutic devices

- Patient monitoring devices

- Diagnostic devices

- ICU units & systems

- Other devices

On the basis of product type, the North America critical care equipment market is segmented into therapeutic devices, patient monitoring devices, diagnostic devices, ICU systems & units, and other devices.

BY PATIENT POPULATION

- Neonatal

- Pediatric

- Adults

- Geriatric

On the basis of the patient population, the North America critical care equipment market is segmented into neonatal, pediatric, adults, and geriatric.

BY END USER

- Hospitals

- Specialty clinics

- Ambulatory surgical centers

- Others

On the basis of end user, the North America critical care equipment market is segmented into hospitals, specialty clinics, ambulatory surgical centers, and others.

BY DISTRIBUTION CHANNEL

- Direct tender

- Retail sales

- Third party distribution

- Others

On the basis of distribution channel, the North America critical care equipment market is segmented into direct tender, retail sales, third party distribution, and others.

North America Critical Care Equipment Market Regional Analysis/Insights

The North America critical care equipment market is analyzed, and market size information is provided product type, patient population, end user, and distribution channel.

The countries covered in this market report are the U.S., Canada, and Mexico.

- In 2023, U.S is expected to dominate the North America critical care equipment market due to the presence of key market players in the largest consumer market with high GDP. It is expected to grow due to novel technological advancements in the critical care equipment market.

The country section of the report also provides individual market-impacting factors and changes in regulation in the market domestically that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, the presence and availability of North America brands and their challenges faced due to large or scarce competition from local and domestic brands, and the impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and North America Critical Care Equipment Market Share Analysis

North America critical care equipment market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in R&D, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product approvals, patents, product width and breadth, application dominance, and technology lifeline curve. The above data points provided are only related to the company's focus on the North America critical care equipment market.

Some of the major players operating in the North America critical care equipment market are Koninklijke Philips N.V., General Electric Company, COOK MEDICAL LLC, Abbott, Medtronic, Getinge AB, heyer medical AG, Drägerwerk AG & Co. KGaA, ICU Medical, Inc., NIHON KOHDEN CORPORATION., Fresenius Medical Care AG & Co. KGaA, Skanray Technologies Ltd., Boston Scientific Corporation, STERIS, Advin Health Care, Baxter, SS TECHNOMED (P) LTD., SCHILLER, Shenzhen Mindray Bio-Medical Electronics Co., Ltd., Nonin, Dixion distribution of medical devices GmbH, Masimo, and Compumedics Limited among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Содержание

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 MULTIVARIATE MODELING

2.6 PRODUCT TYPE LIFELINE CURVE

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 VENDOR SHARE ANALYSIS

2.1 MARKET END USER COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHT

4.1 PESTEL ANALYSIS

4.2 PORTER’S FIVE FORCES

5 INDUSTRY INSIGHTS

5.1 CONCLUSION:

6 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET: REGULATORY SCENARIO

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 RISE IN THE PREVALENCE OF CHRONIC DISORDERS

7.1.2 INCREASED NUMBER OF PATIENTS TREATED IN EMERGENCY CARE AND INTENSIVE CARE UNITS

7.1.3 INCREASE IN THE NUMBER OF PRODUCT LAUNCHES AND ADVANCE IN TECHNOLOGY.

7.1.4 RISE IN THE GERIATRIC POPULATION

7.2 RESTRAINTS

7.2.1 LACK OF SKILLED PROFESSIONALS

7.2.2 STRINGENT REGULATION FOR PRODUCT APPROVAL

7.2.3 HIGH COST OF EQUIPMENT

7.3 OPPORTUNITIES

7.3.1 GROWTH IN HEALTHCARE EXPENDITURE

7.3.2 RISE IN TECHNICAL DEVELOPMENTS IN EQUIPMENTS

7.3.3 STRATEGIC INITIATIVES BY KEY PLAYERS

7.4 CHALLENGES

7.4.1 HEALTHCARE STAFF SHORTAGES

7.4.2 LACK OF TRAINING AND IMPROPER CARE BY STAFF

8 IMPACT OF COVID-19 ON THE NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET

8.1 AFTERMATH OF COVID-19 AND THE GOVERNMENT ROLE

8.2 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

8.3 PRICE IMPACT

8.4 IMPACT ON SUPPLY CHAIN

8.5 IMPACT ON DEMAND

8.6 CONCLUSION

9 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE

9.1 OVERVIEW

9.2 THERAPEUTIC DEVICES

9.2.1 VENTILATOR

9.2.1.1 VENTILATOR, BY TYPE

9.2.1.1.1 INVASIVE

9.2.1.1.1.1 VOLUME-CYCLED VENTILATORS

9.2.1.1.1.2 PRESSURE-CYCLED VENTILATORS

9.2.1.1.1.3 CONTINUOUS POSITIVE AIRWAY PRESSURE VENTILATORS

9.2.1.1.1.4 BI-LEVEL POSITIVE AIRWAY PRESSURE VENTILATORS

9.2.1.1.1.5 FLOW-CYCLED VENTILATORS

9.2.1.1.1.6 TIME-CYCLED VENTILATORS

9.2.1.1.2 NON-INVASIVE

9.2.1.1.2.1 CONTINUOUS POSITIVE AIRWAY PRESSURE (CPAP)

9.2.1.1.2.2 AUTOTITRATING (ADJUSTABLE) POSITIVE AIRWAY PRESSURE (APAP)

9.2.1.1.2.3 BILEVEL POSITIVE AIRWAY PRESSURE (BIPAP)

9.2.1.2 VENTILATOR, BY PRODUCT

9.2.1.2.1 HIGH-END VENTILATORS

9.2.1.2.2 BASIC VENTILATORS

9.2.1.2.3 MID-END VENTILATORS

9.2.2 DEFIBRILLATOR & SUCTION PUMP

9.2.3 PHOTOTHERAPY EQUIPMENT

9.2.4 SYRINGE PUMPS

9.3 PATIENT MONITORING DEVICES

9.3.1 CARDIAC MONITORING DEVICES

9.3.1.1 EVENT MONITORS

9.3.1.2 ECG DEVICES

9.3.1.3 IMPLANTABLE LOOP RECORDERS

9.3.2 RESPIRATORY MONITORING DEVICES

9.3.2.1 PULSE OXIMETERS

9.3.2.2 SPIROMETERS

9.3.2.3 CAPNOGRAPHS

9.3.2.4 PEAK FLOW METERS

9.3.3 NEUROMONITORING DEVICES

9.3.3.1 ELECTROENCEPHALOGRAPH MACHINES

9.3.3.2 ELECTROMYOGRAPHY MACHINE

9.3.3.3 MAGNETOENCEPHALOGRAPH MACHINES

9.3.3.4 CEREBRAL OXIMETERS

9.3.3.5 INTRACRANIAL PRESSURE MONITORS

9.3.3.6 TRANSCRANIAL DOPPLER MACHINES

9.3.4 TEMPERATURE MONITORING DEVICES

9.3.4.1 HANDHELD TEMPERATURE MONITORING DEVICES

9.3.4.2 TABLE-TOP TEMPERATURE MONITORING DEVICES

9.3.4.3 INVASIVE TEMPERATURE MONITORING DEVICES

9.3.5 HEMODYNAMIC/PRESSURE MONITORING DEVICES

9.3.5.1 HEMODYNAMIC MONITORS

9.3.5.2 BLOOD PRESSURE MONITORING DEVICES

9.3.5.3 DISPOSABLES

9.3.6 MULTI-PARAMETER MONITORING DEVICES

9.3.6.1 HIGH-ACUITY MONITORING DEVICES

9.3.6.2 LOW-ACUITY MONITORING DEVICES

9.3.6.3 MID-ACUITY MONITORING DEVICES

9.4 DIAGNOSTIC DEVICES

9.4.1 ELECTROCARDIOGRAM (ECG) MACHINE

9.4.2 MOBILE X-RAY MACHINE

9.4.3 ULTRASONOGRAPHY MACHINE

9.4.4 ABG MACHINE

9.5 ICU UNITS & SYSTEMS

9.5.1 MEDICAL SUPPLY SYSTEMS

9.5.1.1 CEILING SUPPLY UNITS

9.5.1.2 WALL-MOUNT SUPPLY UNITS

9.5.2 SURGICAL AND EXAMINATION LIGHTS

9.5.2.1 SURGICAL LIGHT

9.5.2.2 EXAMINATION LIGHT

9.5.3 OTHERS

9.6 OTHER DEVICES

9.6.1 MEDICAL ACCESSORIES AND CONSUMABLES

9.6.1.1 CATHETERS

9.6.1.2 ECG LEADS

9.6.1.3 BABYFLOW PLUS

9.6.1.4 ANESTHESIA CIRCUIT KITS

9.6.1.5 POSITIVE AIRWAYS PRESSURE (PAP) SYSTEM

9.6.1.6 OTHERS

9.6.2 INFANT WARMERS & INCUBATORS

9.6.2.1 NICU WARMERS

9.6.2.2 TRANSPORT INCUBATOR

9.6.2.3 LABOR AND DELIVERY WARMER

9.6.3 INFUSION PUMP

9.6.4 ANESTHESIA MACHINE

9.6.5 BLOOD WARMER

9.6.6 SLEEP APNEA DEVICES

9.6.7 OTHERS

10 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET, BY PATIENT POPULATION

10.1 OVERVIEW

10.2 NEONATAL

10.3 PEDIATRIC

10.4 GERIATRIC

10.5 ADULTS

11 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET, BY END USER

11.1 OVERVIEW

11.2 HOSPITALS

11.2.1 ACUTE CARE HOSPITALS

11.2.2 LONG TERM CARE HOSPITALS

11.3 SPECIALTY CLINICS

11.4 AMBULATORY SURGICAL CENTRES

11.5 OTHERS

12 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 RETAIL SALES

12.3 DIRECT TENDER

12.4 THIRD PARTY DISTRIBUTION

12.5 OTHERS

13 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET, BY REGION

13.1 NORTH AMERICA

13.1.1 U.S.

13.1.2 CANADA

13.1.3 MEXICO

14 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 KONINKLIJKE PHILIPS N.V.

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENTS

16.2 ABBOTT

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENTS

16.3 GENERAL ELECTRIC COMPANY

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENTS

16.4 BAXTER

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENTS

16.5 MEDTRONIC

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENTS

16.6 ADVIN HEALTH CARE

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENTS

16.7 BOSTON SCIENTIFIC CORPORATION

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 PRODUCT PORTFOLIO

16.7.4 RECENT DEVELOPMENTS

16.8 COMPUMEDICS LIMITED

16.8.1 COMPANY SNAPSHOT

16.8.2 REVENUE ANALYSIS

16.8.3 PRODUCT PORTFOLIO

16.8.4 RECENT DEVELOPMENTS

16.9 COOK

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENTS

16.1 DRÄGERWERK AG & CO. KGAA.

16.10.1 COMPANY SNAPSHOT

16.10.2 REVENUE ANALYSIS

16.10.3 PRODUCT PORTFOLIO

16.10.4 RECENT DEVELOPMENTS

16.11 DIXION DISTRIBUTION OF MEDICAL DEVICES GMBH

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENTS

16.12 FRESENIUS SE & CO. KGAA

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 PRODUCT PORTFOLIO

16.12.4 RECENT DEVELOPMENT

16.13 GETING AB

16.13.1 COMPANY SNAPSHOT

16.13.2 REVENUE ANALYSIS

16.13.3 PRODUCT PORTFOLIO

16.13.4 RECENT DEVELOPMENTS

16.14 HEYER MEDICAL AG

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENT

16.15 ICU MEDICAL

16.15.1 COMPANY SNAPSHOT

16.15.2 REVENUE ANALYSIS

16.15.3 PRODUCT PORTFOLIO

16.15.4 RECENT DEVELOPMENTS

16.16 MASIMO

16.16.1 COMPANY SNAPSHOT

16.16.2 REVENUE ANALYSIS.

16.16.3 PRODUCT PORTFOLIO

16.16.4 RECENT DEVELOPMENTS

16.17 NIHON KOHDEN CORPORATION

16.17.1 COMPANY SNAPSHOT

16.17.2 REVENUE ANALYSIS

16.17.3 PRODUCT PORTFOLIO

16.17.4 RECENT DEVELOPMENT

16.18 NONIN

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENT

16.19 STERIS

16.19.1 COMPANY SNAPSHOT

16.19.2 REVENUE ANALYSIS

16.19.3 PRODUCT PORTFOLIO

16.19.4 RECENT DEVELOPMENTS

16.2 SKANRAY TECHNOLOGIES INC

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENTS

16.21 SS TECHNOMED (P) LTD.

16.21.1 COMPANY SNAPSHOT

16.21.2 PRODUCT PORTFOLIO

16.21.3 RECENT DEVELOPMENTS

16.22 SCHILLER

16.22.1 COMPANY SNAPSHOT

16.22.2 PRODUCT PORTFOLIO

16.22.3 RECENT DEVELOPMENTS

16.23 SHENZHEN MINDRAY BIO-MEDICAL ELECTRONICS CO., LTD.

16.23.1 COMPANY SNAPSHOT

16.23.2 PRODUCT PORTFOLIO

16.23.3 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

Список таблиц

TABLE 1 RESPIRATORY DISEASES WORLDWIDE HEALTH BURDEN IN 2019

TABLE 2 PRICES OF A FEW VENTILATORS

TABLE 3 AVERAGE DAILY COST FOR STAY IN ICU BY HOSPITAL TYPE, 2013–2014

TABLE 4 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 5 NORTH AMERICA THERAPEUTIC DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 6 NORTH AMERICA THERAPEUTIC DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 7 NORTH AMERICA VENTILATOR IN CRITICAL CARE EQUIPMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 8 NORTH AMERICA INVASIVE IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 9 NORTH AMERICA NON-INVASIVE IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 10 NORTH AMERICA VENTILATOR IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 11 NORTH AMERICA PATIENT MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 12 NORTH AMERICA PATIENT MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 13 NORTH AMERICA CARDIAC MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 14 NORTH AMERICA RESPIRATORY MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 15 NORTH AMERICA NEUROMONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 16 NORTH AMERICA TEMPERATURE MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 17 NORTH AMERICA HEMODYNAMIC/PRESSURE MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 18 NORTH AMERICA MULTI-PARAMETER MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 19 NORTH AMERICA DIAGNOSTIC DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 20 NORTH AMERICA DIAGNOSTIC DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 21 NORTH AMERICA ICU UNITS & SYSTEMS IN CRITICAL CARE EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 22 NORTH AMERICA ICU UNITS & SYSTEMS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 23 NORTH AMERICA MEDICAL SUPPLY SYSTEMS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 24 NORTH AMERICA SURGICAL AND EXAMINATION LIGHTS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 25 NORTH AMERICA OTHER DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 26 NORTH AMERICA OTHER DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 27 NORTH AMERICA MEDICAL ACCESSORIES AND CONSUMABLES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 28 NORTH AMERICA INFANT WARMERS & INCUBATORS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 29 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET, BY PATIENT POPULATION, 2021-2030 (USD MILLION)

TABLE 30 NORTH AMERICA NEONATAL IN CRITICAL CARE EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 31 NORTH AMERICA PEDIATRIC IN CRITICAL CARE EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 32 NORTH AMERICA GERIATRIC IN CRITICAL CARE EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 33 NORTH AMERICA ADULTS IN CRITICAL CARE EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 34 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 35 NORTH AMERICA HOSPITALS IN CRITICAL CARE EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 36 NORTH AMERICA HOSPITALS IN CRITICAL CARE EQUIPMENT MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 37 NORTH AMERICA SPECIALTY CLINICS IN CRITICAL CARE EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 38 NORTH AMERICA AMBULATORY SURGICAL CENTRES IN CRITICAL CARE EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 39 NORTH AMERICA OTHERS IN CRITICAL CARE EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 40 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 41 NORTH AMERICA RETAIL SALES IN CRITICAL CARE EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 42 NORTH AMERICA DIRECT TENDER IN CRITICAL CARE EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 43 NORTH AMERICA THIRD PARTY DISTRIBUTION IN CRITICAL CARE EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 44 NORTH AMERICA OTHERS IN CRITICAL CARE EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 45 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 46 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 47 NORTH AMERICA THERAPEUTIC DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 48 NORTH AMERICA THERAPEUTIC DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 49 NORTH AMERICA THERAPEUTIC DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 50 NORTH AMERICA VENTILATOR IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 51 NORTH AMERICA VENTILATOR IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT, 2021-2030 (UNIT)

TABLE 52 NORTH AMERICA VENTILATOR IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT, 2021-2030 (ASP)

TABLE 53 NORTH AMERICA VENTILATOR IN CRITICAL CARE EQUIPMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 54 NORTH AMERICA INVASIVE IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 55 NORTH AMERICA NON-INVASIVE IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 56 NORTH AMERICA PATIENT MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 57 NORTH AMERICA CARDIAC MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 58 NORTH AMERICA CARDIAC MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 59 NORTH AMERICA CARDIAC MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 60 NORTH AMERICA RESPIRATORY MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 61 NORTH AMERICA RESPIRATORY MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 62 NORTH AMERICA RESPIRATORY MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 63 NORTH AMERICA NEUROMONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 64 NORTH AMERICA NEUROMONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 65 NORTH AMERICA NEUROMONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 66 NORTH AMERICA TEMPERATURE MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 67 NORTH AMERICA TEMPERATURE MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 68 NORTH AMERICA TEMPERATURE MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 69 NORTH AMERICA HEMODYNAMIC/PRESSURE MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 70 NORTH AMERICA HEMODYNAMIC/PRESSURE MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 71 NORTH AMERICA HEMODYNAMIC/PRESSURE MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 72 NORTH AMERICA MULTI-PARAMETER MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 73 NORTH AMERICA MULTI-PARAMETER MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 74 NORTH AMERICA MULTI-PARAMETER MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 75 NORTH AMERICA DIAGNOSTIC DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 76 NORTH AMERICA DIAGNOSTIC DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 77 NORTH AMERICA DIAGNOSTIC DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 78 NORTH AMERICA ICU UNITS & SYSTEMS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 79 NORTH AMERICA MEDICAL SUPPLY SYSTEMS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 80 NORTH AMERICA MEDICAL SUPPLY SYSTEMS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 81 NORTH AMERICA MEDICAL SUPPLY SYSTEMS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 82 NORTH AMERICA SURGICAL AND EXAMINATION LIGHTS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 83 NORTH AMERICA SURGICAL AND EXAMINATION LIGHTS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 84 NORTH AMERICA SURGICAL AND EXAMINATION LIGHTS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 85 NORTH AMERICA OTHER DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 86 NORTH AMERICA OTHER DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 87 NORTH AMERICA OTHER DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 88 NORTH AMERICA MEDICAL ACCESSORIES AND CONSUMABLES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 89 NORTH AMERICA MEDICAL ACCESSORIES AND CONSUMABLES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 90 NORTH AMERICA MEDICAL ACCESSORIES AND CONSUMABLES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 91 NORTH AMERICA INFANT WARMERS & INCUBATORS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 92 NORTH AMERICA INFANT WARMERS & INCUBATORS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 93 NORTH AMERICA INFANT WARMERS & INCUBATORS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 94 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET, BY PATIENT POPULATION, 2021-2030 (USD MILLION)

TABLE 95 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 96 NORTH AMERICA HOSPITALS IN CRITICAL CARE EQUIPMENT MARKET, BY END USER 2021-2030 (USD MILLION)

TABLE 97 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 98 U.S. CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 99 U.S. THERAPEUTIC DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 100 U.S. THERAPEUTIC DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 101 U.S. THERAPEUTIC DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 102 U.S. VENTILATOR IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 103 U.S. VENTILATOR IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT, 2021-2030 (UNIT)

TABLE 104 U.S. VENTILATOR IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT, 2021-2030 (ASP)

TABLE 105 U.S. VENTILATOR IN CRITICAL CARE EQUIPMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 106 U.S. INVASIVE IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 107 U.S. NON-INVASIVE IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 108 U.S. PATIENT MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 109 U.S. CARDIAC MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 110 U.S. CARDIAC MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 111 U.S. CARDIAC MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 112 U.S. RESPIRATORY MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 113 U.S. RESPIRATORY MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 114 U.S. RESPIRATORY MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 115 U.S. NEUROMONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 116 U.S. NEUROMONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 117 U.S. NEUROMONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 118 U.S. TEMPERATURE MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 119 U.S. TEMPERATURE MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 120 U.S. TEMPERATURE MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 121 U.S. HEMODYNAMIC/PRESSURE MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 122 U.S. HEMODYNAMIC/PRESSURE MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 123 U.S. HEMODYNAMIC/PRESSURE MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 124 U.S. HEMODYNAMIC/PRESSURE MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 125 U.S. MULTI-PARAMETER MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 126 U.S. MULTI-PARAMETER MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 127 U.S. MULTI-PARAMETER MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 128 U.S. DIAGNOSTIC DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 129 U.S. DIAGNOSTIC DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 130 U.S. DIAGNOSTIC DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 131 U.S. ICU UNITS & SYSTEMS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 132 U.S. MEDICAL SUPPLY SYSTEMS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 133 U.S. MEDICAL SUPPLY SYSTEMS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 134 U.S. MEDICAL SUPPLY SYSTEMS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 135 U.S. SURGICAL AND EXAMINATION LIGHTS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 136 U.S. SURGICAL AND EXAMINATION LIGHTS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 137 U.S. SURGICAL AND EXAMINATION LIGHTS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 138 U.S. OTHER DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 139 U.S. OTHER DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 140 U.S. OTHER DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 141 U.S. MEDICAL ACCESSORIES AND CONSUMABLES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 142 U.S. MEDICAL ACCESSORIES AND CONSUMABLES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 143 U.S. MEDICAL ACCESSORIES AND CONSUMABLES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 144 U.S. INFANT WARMERS & INCUBATORS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 145 U.S. INFANT WARMERS & INCUBATORS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 146 U.S. INFANT WARMERS & INCUBATORS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 147 U.S. CRITICAL CARE EQUIPMENT MARKET, BY PATIENT POPULATION, 2021-2030 (USD MILLION)

TABLE 148 U.S. CRITICAL CARE EQUIPMENT MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 149 U.S. HOSPITALS IN CRITICAL CARE EQUIPMENT MARKET, BY END USER 2021-2030 (USD MILLION)

TABLE 150 U.S. CRITICAL CARE EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 151 CANADA CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 152 CANADA THERAPEUTIC DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 153 CANADA THERAPEUTIC DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 154 CANADA THERAPEUTIC DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 155 U.S. VENTILATOR IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 156 CANADA VENTILATOR IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT, 2021-2030 (UNIT)

TABLE 157 CANADA VENTILATOR IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT, 2021-2030 (ASP)

TABLE 158 CANADA VENTILATOR IN CRITICAL CARE EQUIPMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 159 CANADA INVASIVE IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 160 CANADA NON-INVASIVE IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 161 CANADA PATIENT MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 162 CANADA CARDIAC MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 163 CANADA CARDIAC MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 164 CANADA CARDIAC MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 165 CANADA RESPIRATORY MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 166 CANADA RESPIRATORY MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 167 CANADA RESPIRATORY MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 168 CANADA NEUROMONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 169 CANADA NEUROMONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 170 CANADA NEUROMONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 171 CANADA TEMPERATURE MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 172 CANADA TEMPERATURE MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 173 CANADA TEMPERATURE MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 174 CANADA HEMODYNAMIC/PRESSURE MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 175 CANADA HEMODYNAMIC/PRESSURE MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 176 CANADA HEMODYNAMIC/PRESSURE MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 177 CANADA MULTI-PARAMETER MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 178 CANADA MULTI-PARAMETER MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 179 CANADA MULTI-PARAMETER MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 180 CANADA DIAGNOSTIC DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 181 CANADA DIAGNOSTIC DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 182 CANADA DIAGNOSTIC DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 183 CANADA ICU UNITS & SYSTEMS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 184 CANADA MEDICAL SUPPLY SYSTEMS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 185 CANADA MEDICAL SUPPLY SYSTEMS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 186 CANADA MEDICAL SUPPLY SYSTEMS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 187 CANADA SURGICAL AND EXAMINATION LIGHTS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 188 CANADA SURGICAL AND EXAMINATION LIGHTS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 189 CANADA SURGICAL AND EXAMINATION LIGHTS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 190 CANADA OTHER DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 191 CANADA OTHER DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 192 CANADA OTHER DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 193 CANADA MEDICAL ACCESSORIES AND CONSUMABLES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 194 CANADA MEDICAL ACCESSORIES AND CONSUMABLES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 195 CANADA MEDICAL ACCESSORIES AND CONSUMABLES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 196 CANADA INFANT WARMERS & INCUBATORS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 197 CANADA INFANT WARMERS & INCUBATORS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 198 CANADA INFANT WARMERS & INCUBATORS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 199 CANADA CRITICAL CARE EQUIPMENT MARKET, BY PATIENT POPULATION, 2021-2030 (USD MILLION)

TABLE 200 CANADA CRITICAL CARE EQUIPMENT MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 201 CANADA HOSPITALS IN CRITICAL CARE EQUIPMENT MARKET, BY END USER 2021-2030 (USD MILLION)

TABLE 202 CANADA CRITICAL CARE EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 203 MEXICO CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 204 MEXICO THERAPEUTIC DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 205 MEXICO THERAPEUTIC DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 206 MEXICO THERAPEUTIC DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 207 MEXICO VENTILATOR IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 208 MEXICO VENTILATOR IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT, 2021-2030 (UNIT)

TABLE 209 MEXICO VENTILATOR IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT, 2021-2030 (ASP)

TABLE 210 MEXICO VENTILATOR IN CRITICAL CARE EQUIPMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 211 MEXICO INVASIVE IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 212 MEXICO NON-INVASIVE IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 213 MEXICO PATIENT MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 214 MEXICO CARDIAC MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 215 MEXICO CARDIAC MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 216 MEXICO CARDIAC MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 217 MEXICO RESPIRATORY MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 218 MEXICO RESPIRATORY MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 219 MEXICO RESPIRATORY MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 220 MEXICO NEUROMONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 221 MEXICO NEUROMONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 222 MEXICO NEUROMONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 223 MEXICO TEMPERATURE MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 224 MEXICO TEMPERATURE MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 225 MEXICO TEMPERATURE MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 226 MEXICO HEMODYNAMIC/PRESSURE MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 227 MEXICO HEMODYNAMIC/PRESSURE MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 228 MEXICO HEMODYNAMIC/PRESSURE MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 229 MEXICO MULTI-PARAMETER MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 230 MEXICO MULTI-PARAMETER MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 231 MEXICO MULTI-PARAMETER MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 232 MEXICO DIAGNOSTIC DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 233 MEXICO DIAGNOSTIC DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 234 MEXICO DIAGNOSTIC DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 235 MEXICO ICU UNITS & SYSTEMS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 236 MEXICO MEDICAL SUPPLY SYSTEMS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 237 MEXICO MEDICAL SUPPLY SYSTEMS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 238 MEXICO MEDICAL SUPPLY SYSTEMS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 239 MEXICO SURGICAL AND EXAMINATION LIGHTS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 240 MEXICO SURGICAL AND EXAMINATION LIGHTS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 241 MEXICO SURGICAL AND EXAMINATION LIGHTS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 242 MEXICO OTHER DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 243 MEXICO OTHER DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 244 MEXICO OTHER DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 245 MEXICO MEDICAL ACCESSORIES AND CONSUMABLES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 246 MEXICO MEDICAL ACCESSORIES AND CONSUMABLES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 247 MEXICO MEDICAL ACCESSORIES AND CONSUMABLES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 248 MEXICO INFANT WARMERS & INCUBATORS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 249 MEXICO INFANT WARMERS & INCUBATORS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 250 MEXICO INFANT WARMERS & INCUBATORS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 251 MEXICO CRITICAL CARE EQUIPMENT MARKET, BY PATIENT POPULATION, 2021-2030 (USD MILLION)

TABLE 252 MEXICO CRITICAL CARE EQUIPMENT MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 253 MEXICO HOSPITALS IN CRITICAL CARE EQUIPMENT MARKET, BY END USER 2021-2030 (USD MILLION)

TABLE 254 MEXICO CRITICAL CARE EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

Список рисунков

FIGURE 1 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET: NORTH AMERICA VS. REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET: MULTIVARIATE MODELLING

FIGURE 7 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET: SEGMENTATION

FIGURE 12 INCREASING CHRONIC DISORDERS AND THE NUMBER OF PATIENT IN ICU AND NICU IS EXPECTED TO DRIVE THE NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 13 THERAPEUTIC DEVICES IS EXPECTED TO HAVE THE LARGEST SHARE OF NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET FROM 2023 TO 2030

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET

FIGURE 15 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET: BY PRODUCT TYPE, 2022

FIGURE 16 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET: BY PRODUCT TYPE, 2023-2030 (USD MILLION)

FIGURE 17 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET: BY PRODUCT TYPE, CAGR (2023-2030)

FIGURE 18 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 19 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET: BY PATIENT POPULATION, 2022

FIGURE 20 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET: BY PATIENT POPULATION, 2023-2030 (USD MILLION)

FIGURE 21 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET: BY PATIENT POPULATION, CAGR (2023-2030)

FIGURE 22 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET: BY PATIENT POPULATION, LIFELINE CURVE

FIGURE 23 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET: BY END USER, 2022

FIGURE 24 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET: BY END USER, 2023-2030 (USD MILLION)

FIGURE 25 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET: BY END USER, CAGR (2023-2030)

FIGURE 26 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET: BY END USER, LIFELINE CURVE

FIGURE 27 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET: BY DISTRIBUTION CHANNEL, 2022

FIGURE 28 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET: BY DISTRIBUTION CHANNEL, 2023-2030 (USD MILLION)

FIGURE 29 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET: BY DISTRIBUTION CHANNEL, CAGR (2023-2030)

FIGURE 30 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET : BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 31 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET: SNAPSHOT (2022)

FIGURE 32 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET: BY COUNTRY (2022)

FIGURE 33 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET: BY COUNTRY (2023 & 2030)

FIGURE 34 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET: BY COUNTRY (2022 & 2030)

FIGURE 35 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET: PRODUCT TYPE (2023-2030)

FIGURE 36 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET: COMPANY SHARE 2022 (%)

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.