Коммерческий рынок морских водорослей в Северной Америке по видам продукции (красные морские водоросли, зеленые морские водоросли и бурые морские водоросли), форме (жидкость , порошок и хлопья), выращиванию (выращивание на суше, выращивание в открытом море, выращивание вблизи берега, выращивание в IMTA, солевая аквакультура), конечному потребителю (продукты питания и напитки , фармацевтика, сельское хозяйство, корма для животных , косметика и средства личной гигиены, биотопливо и другие), стране (США, Канада и Мексика) Тенденции отрасли и прогноз до 2029 года

Анализ рынка и аналитика: рынок коммерческих морских водорослей в Северной Америке

Анализ рынка и аналитика: рынок коммерческих морских водорослей в Северной Америке

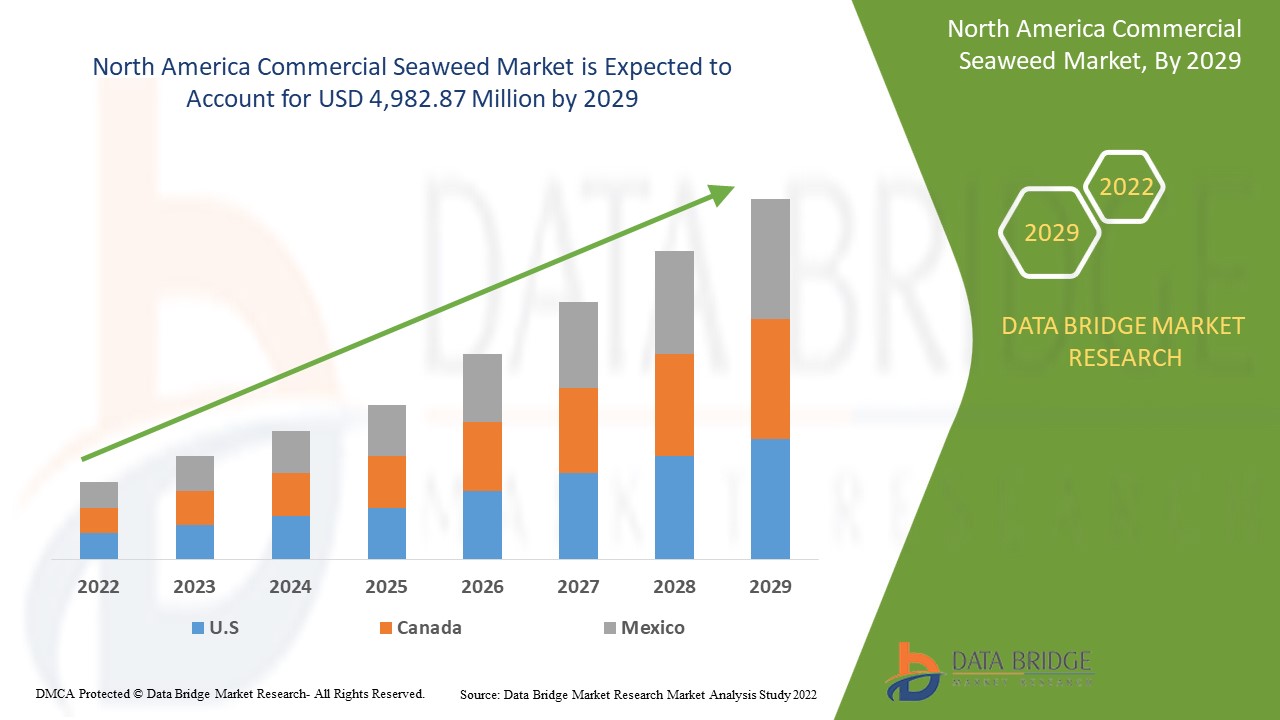

Ожидается, что рынок коммерческих морских водорослей в Северной Америке будет расти в прогнозируемый период с 2022 по 2029 год. По данным Data Bridge Market Research, среднегодовой темп роста рынка составит 7,0% в прогнозируемый период с 2022 по 2029 год, и ожидается, что к 2029 году он достигнет 4 982,87 млн долларов США. Спрос на коммерческие морские водоросли высок, следовательно, и получение доходов также будет высоким, что может способствовать росту рынка в регионе.

Коммерческие водоросли — это микроводоросли, которые растут в море, независимо от того, морская вода это или пресная. Они являются источником пищи для жизни в океане и могут быть трех цветов: красные водоросли, зеленые водоросли и бурые водоросли в зависимости от присутствующих пигментов. Водоросли растут в основном вдоль скалистых береговых линий по всему миру. Коммерческие водоросли — это обогащенный источник белков, витаминов, минералов, волокон, йода и антиоксидантов. Кроме того, коммерческие водоросли известны своей пользой для здоровья, такой как снижение риска сердечных заболеваний, диабета и зоба, а также улучшение здоровья кишечника.

Ожидается, что рынок коммерческих водорослей значительно вырастет в североамериканском регионе, поскольку коммерческие водоросли в основном известны своими гидроколлоидами и широко применяются в различных отраслях промышленности, таких как производство продуктов питания и напитков, сельского хозяйства, кормов для животных, косметики и средств личной гигиены, а также фармацевтики. Однако ожидается, что экологический риск, связанный с водорослями, и высокое содержание йода и тяжелых металлов в них будут сдерживать рост рынка. Новые области применения водорослей в различных отраслях промышленности могут создать возможности на рынке, а высокие цены на водоросли могут помешать росту рынка.

В этом отчете о рынке коммерческих морских водорослей Северной Америки содержатся сведения о доле рынка, новых разработках и анализе продуктового портфеля, влиянии внутренних и локальных игроков рынка, анализируются возможности с точки зрения новых источников дохода, изменений в рыночных правилах, одобрений продуктов, стратегических решений, запусков продуктов, географических расширений и технологических инноваций на рынке. Чтобы понять анализ и рыночный сценарий, свяжитесь с нами для получения аналитического обзора, наша команда поможет вам создать решение по влиянию на доход для достижения желаемой цели.

Масштаб и размер рынка коммерческих морских водорослей в Северной Америке

Масштаб и размер рынка коммерческих морских водорослей в Северной Америке

Коммерческий рынок морских водорослей в Северной Америке сегментирован на четыре заметных сегмента, которые разветвляются на основе продукта, формы, выращивания, конечного пользователя. Рост среди сегментов помогает вам анализировать нишевые карманы роста и стратегии подхода к рынку и определять ваши основные области применения и разницу в ваших целевых рынках.

- На основе продукта рынок коммерческих водорослей Северной Америки сегментирован на красные водоросли, зеленые водоросли и бурые водоросли. В 2022 году бурые водоросли будут иметь самую большую долю рынка из-за таких факторов, как рост спроса на более натуральные и органические продукты.

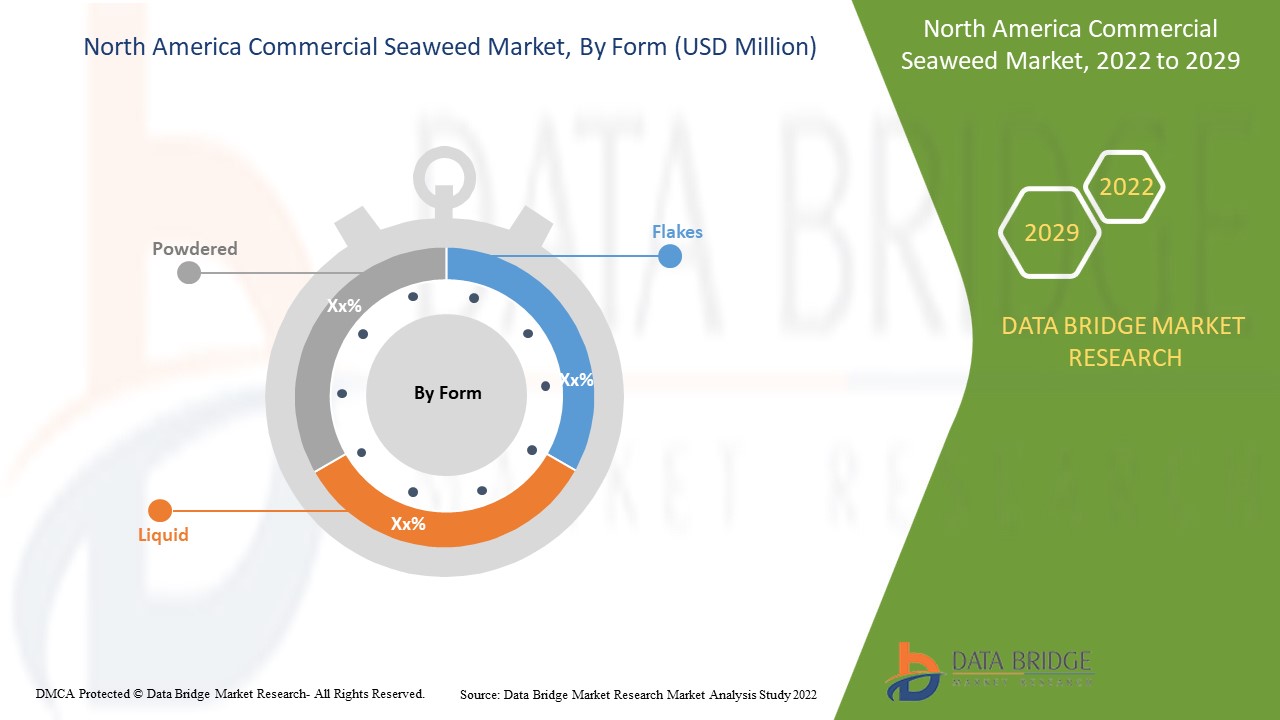

- На основе формы рынок коммерческих морских водорослей Северной Америки сегментируется на жидкие, порошкообразные и хлопья. В 2022 году сегмент порошка будет иметь наибольшую долю рынка из-за таких факторов, как увеличение преимуществ сегмента порошка.

- На основе выращивания рынок коммерческих водорослей Северной Америки сегментируется на выращивание на суше, выращивание в открытом море, выращивание в прибрежной зоне, выращивание в IMTA, соляную аквакультуру. В 2022 году сегмент выращивания в открытом море будет иметь наибольшую долю рынка из-за таких факторов, как растущий спрос на коммерческие водоросли и возросший интерес к выращиванию водорослей в больших масштабах.

- На основе конечного потребителя рынок коммерческих морских водорослей в Северной Америке сегментируется на продукты питания и напитки, фармацевтику, сельское хозяйство, корма для животных, косметику и средства личной гигиены, биотопливо и др. В 2022 году сегмент продуктов питания и напитков будет иметь наибольшую долю рынка из-за таких факторов, как рост осведомленности о питательных свойствах и пользе для здоровья, предлагаемых морскими водорослями, а также рост спроса на более натуральные и органические продукты питания и напитки.

Анализ рынка коммерческих морских водорослей в Северной Америке на уровне страны

Проведен анализ рынка коммерческих морских водорослей в Северной Америке и предоставлена информация о размерах рынка по странам, продуктам, формам, выращиванию и конечным пользователям.

В отчете о рынке коммерческих морских водорослей Северной Америки рассматриваются следующие страны: США, Канада и Мексика.

- В Северной Америке США занимают самую большую долю рынка, поскольку в стране растет выращивание морских водорослей. Канада растет, поскольку увеличение спроса на морские водоросли среди конечных потребителей подпитывает рост рынка морских водорослей, а Мексика увеличивает свою долю рынка из-за растущей популярности коммерческих морских водорослей в стране.

Раздел отчета по странам о рынке коммерческих морских водорослей в Северной Америке также содержит индивидуальные факторы, влияющие на рынок, и изменения в регулировании на внутреннем рынке, которые влияют на текущие и будущие тенденции рынка. Такие данные, как новые продажи, заменяющие продажи, демографические данные страны, нормативные акты и импортно-экспортные тарифы, являются одними из основных указателей, используемых для прогнозирования рыночного сценария для отдельных стран. Кроме того, при предоставлении прогнозного анализа данных по стране учитываются наличие и доступность брендов и их проблемы из-за большой или малой конкуренции со стороны местных и отечественных брендов, влияние каналов продаж.

Растущее применение коммерческих водорослей в различных отраслях промышленности

Коммерческий рынок водорослей Северной Америки также предоставляет вам подробный анализ рынка для каждой страны, рост в отрасли с продажами, продажами компонентов, влиянием технологического развития в материале подошвы обуви и изменениями в сценариях регулирования с их поддержкой для коммерческого рынка водорослей. Данные доступны за исторический период с 2011 по 2019 год.

Анализ конкурентной среды и доли рынка коммерческих морских водорослей в Северной Америке

Конкурентная среда рынка коммерческих морских водорослей в Северной Америке содержит сведения по конкурентам. Включены сведения о компании, финансы компании, полученный доход, рыночный потенциал, инвестиции в исследования и разработки, новые рыночные инициативы, присутствие в Северной Америке, производственные площадки и объекты, сильные и слабые стороны компании, запуск продукта, испытания продуктов, одобрения продуктов, патенты, широта и широта продукта, доминирование приложений, кривая жизненной линии технологий. Приведенные выше данные относятся только к фокусу компаний, связанному с рынком коммерческих морских водорослей.

Некоторые из основных игроков, рассмотренных в отчете, включают Cargill, Incorporated, DuPont, Marcel Carrageenan, Beijing Leili Agricultural Co., Ltd, Ocean Rainforest, Indigrow Ltd, Maine Coast Sea Vegetables, Nantong Xinlang Seaweed & Foods Co., Ltd., Cascadia Seaweed и другие. Аналитики DBMR понимают конкурентные преимущества и предоставляют конкурентный анализ для каждого конкурента отдельно.

Например,

- В ноябре 2021 года компания Acadian SeaPlus выпустила новый продукт из водорослей Chondracanthus chamissoi для клиентов по всему рынку. Это вид красных водорослей, который применяется в различных продуктах, начиная от функционального питания, нутрицевтики, косметики, фармацевтики и заканчивая пивоварением. Это помогло компании расширить свой продуктовый портфель

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Содержание

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA COMMERCIAL SEAWEED MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 NORTH AMERICA COMMERCIAL SEAWEED MARKET: GOVERNMENT REGULATIONS

5.1 U.S.

5.2 EUROPE

5.3 CANADA

5.4 CHINA

6 NORTH AMERICA COMMERCIAL SEAWEED MARKET: PRICING ANALYSIS

7 NORTH AMERICA COMMERCIAL SEAWEED: PRODUCTION

7.1 NORTH AMERICA COMMERCIAL SEAWEED: PRODUCTION VALUE

7.2 ASIA PACIFIC

7.2.1 CHINA

7.2.2 INDONESIA

7.2.3 SOUTH KOREA

7.2.4 PHILLIPINES

7.2.5 JAPAN

7.2.6 MALAYSIA

7.2.7 INDIA

7.2.8 SINGAPORE

7.2.9 AUSTRALIA

7.2.10 THAILAND

7.2.11 REST OF ASIA-PACIFIC

7.3 MIDDLE EAST AND AFRICA

7.3.1 SOUTH AFRICA

7.3.2 U.A.E.

7.3.3 SAUDI ARABIA

7.3.4 KUWAIT

7.3.5 REST OF MIDDLE EAST AND AFRICA

7.4 EUROPE

7.4.1 NORWAY

7.4.2 FRANCE

7.4.3 RUSSIA

7.4.4 U.K.

7.4.5 GERMANY

7.4.6 ITALY

7.4.7 SWITZERLAND

7.4.8 SPAIN

7.4.9 NETHERLANDS

7.4.10 TURKEY

7.4.11 BELGIUM

7.4.12 REST OF EUROPE

7.5 SOUTH AMERICA

7.5.1 BRAZIL

7.5.2 ARGENTINA

7.5.3 REST OF SOUTH AMERICA

7.6 NORTH AMERICA

7.6.1 CANADA

7.6.2 MEXICO

7.6.3 U.S.

8 NORTH AMERICA COMMERCIAL SEAWEED MARKET: SUPPLY CHAIN ANALYSIS

8.1 RAW MATERIAL PROCUREMENT

8.2 MANUFACTURING

8.3 DISTRIBUTION

8.4 END USERS

9 NORTH AMERICA COMMERCIAL SEAWEED MARKET, PORTER’S FIVE FORCES ANALYSIS

9.1 BUYER POWER

9.2 SUPPLIER POWER

9.3 THE THREAT OF NEW ENTRANTS

9.4 THREAT OF SUBSTITUTES

9.5 RIVALRY AMONG EXISTING COMPETITORS

10 IMPORT EXPORT DATA

11 NORTH AMERICA COMMERCIAL SEAWEED MARKET, MARKETING AND BUSINESS STRATEGIES

12 MARKET OVERVIEW

12.1 DRIVERS

12.1.1 INCREASE IN APPLICATION OF COMMERCIAL SEAWEED IN PHARMACEUTICAL AND PERSONAL CARE

12.1.2 HIGH NUTRITIONAL VALUE AND HEALTH BENEFITS AID IN COMBATING VARIOUS DISEASES

12.1.3 INCREASING ADOPTION OF SEAWEED FOR HYDROCOLLOIDS

12.1.4 RISE IN FARMING PRACTICES OF SEAWEED WITH THE GROWING DEMAND

12.1.5 INCREASING DEMAND FOR SEAWEED IN FOOD & BEVERAGE PRODUCTS

12.2 RESTRAINTS

12.2.1 ENVIRONMENTAL RISK ASSOCIATED WITH SEAWEED FARMING

12.2.2 A HIGH AMOUNT OF IODINE AND HEAVY METAL HAVE POTENTIAL OF HEALTH RISKS

12.2.3 LACK OF AWARENESS ABOUT THE HEALTH BENEFITS OF SEAWEED

12.3 OPPORTUNITIES

12.3.1 INCREASE IN AWARENESS AMONG THE CONSUMERS FOR THE HEALTH BENEFITS OF NATURALLY AVAILABLE PRODUCTS

12.3.2 EMERGING APPLICATIONS OF SEAWEEDS IN VARIOUS INDUSTRIES

12.3.3 AWARENESS OF POSITIVE EFFECTS OF SEAWEEDS ON HUMAN HEALTH DURING COVID-19

12.4 CHALLENGES

12.4.1 TOXICITY ASSOCIATED WITH THE CONSUMPTION OF SEAWEEDS

12.4.2 HIGHER PRICES OF SEAWEED PRODUCTS

13 COVID-19 IMPACT ON THE NORTH AMERICA COMMERCIAL SEAWEED MARKET

13.1 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVES TO BOOST THE NORTH AMERICA COMMERCIAL SEAWEED MARKET

13.2 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

13.3 IMPACT ON PRICE

13.4 IMPACT ON DEMAND

13.5 IMPACT ON SUPPLY CHAIN

13.6 CONCLUSION

14 NORTH AMERICA COMMERCIAL SEAWEED MARKET, BY PRODUCT

14.1 OVERVIEW

14.2 RED SEAWEED

14.2.1 EUCHEUMA SPP

14.2.2 GRACILARIA GRACILIS/VERRUCOSA

14.2.3 PORPHYRA UMBILICALIS

14.2.4 KAPPAPHYCUS SPP

14.2.5 CHONDRIA SPP

14.2.6 PORPHYRA LACINIATA

14.2.7 PYROPIA YEZOENSIS

14.2.8 PYROPIA TENERA

14.2.9 PORPHYRA DIOICA

14.2.10 PORPHYRA PURPUREA

14.2.11 PYROPIA LEUCOSTICTA

14.2.12 PALMARIA PALMATA

14.2.13 FURCELLARIA SPP

14.2.14 VERTEBRATA LANOSA/POLYSIPHONIA LANOSA

14.2.15 OTHERS

14.3 BROWN SEAWEED

14.3.1 SACCHARINA JAPONICA

14.3.2 LAMINARIA LONGICRURIS

14.3.3 UNDARIA PINNATIFIDA

14.3.4 SACCHARINA LATISSIMA

14.3.5 LAMINARIA HYPERBOREA

14.3.6 LAMINARIA DIGITATA

14.3.7 LAMINARIA OCHROLEUCA

14.3.8 FUCUS VESICULOSUS

14.3.9 FUCUS EVANESCENS

14.3.10 ASCOPHYLLUM NODOSUM

14.3.11 FUCUS SPIRALIS

14.3.12 CLADOSIPHON OKAMURANUS

14.3.13 FUCUS SERRATUS

14.3.14 SARGASSUM FUSIFORME

14.3.15 EISENIA BICYCLIS

14.3.16 ALARIA ESCULENTA

14.3.17 DURVILLAEA ANTARCTICA

14.3.18 HIMANTHALIA ELONGATA

14.3.19 LITHOTHAMNIUM CALCAREUM

14.3.20 OTHERS

14.4 GREEN SEAWEED

14.4.1 ENTEROMORPHA SP

14.4.2 CAULERPA LENTILLIFERA

14.4.3 ULVA SP

14.4.4 CODIUM TOMENTOSUM

14.4.5 MONOSTROMA SPP

14.4.6 OTHERS

15 NORTH AMERICA COMMERCIAL SEAWEED MARKET, BY FORM

15.1 OVERVIEW

15.2 POWDERED

15.3 FLAKES

15.4 LIQUID

16 NORTH AMERICA COMMERCIAL SEAWEED MARKET, BY CULTIVATION

16.1 OVERVIEW

16.2 OFFSHORE CULTIVATION

16.3 ONSHORE CULTIVATION

16.4 IMTA CULTIVATION

16.5 NEARSHORE CULTURE

16.6 SALINE AQUACULTURE

17 NORTH AMERICA COMMERCIAL SEAWEED MARKET, BY END USER

17.1 OVERVIEW

17.2 FOOD & BEVERAGES

17.2.1 BAKERY PRODUCTS

17.2.1.1 Cakes & Muffins

17.2.1.2 Biscuits & Cookies

17.2.1.3 Breads & Rolls

17.2.1.4 Doughnuts

17.2.1.5 Others

17.2.2 CONFECTIONERY

17.2.2.1 Jam & jellies

17.2.2.2 Jelly

17.2.2.3 Candy Bars

17.2.2.4 Fruit Jelly Desserts

17.2.2.5 Marmalades

17.2.2.6 Meringues

17.2.2.7 Others

17.2.3 PROCESSED FOOD

17.2.3.1 Soups & Sauces

17.2.3.2 Rte Meals

17.2.3.3 Noodles & pasta

17.2.3.4 SnackS

17.2.3.5 Dressing & condiments

17.2.3.6 Others

17.2.4 DAIRY PRODUCTS

17.2.4.1 Ice cream

17.2.4.2 Processed Cheese

17.2.4.3 Milk Dessert

17.2.4.4 Pudding

17.2.4.5 YOGURT

17.2.4.6 Others

17.2.5 BEVERAGES

17.2.5.1 Wines

17.2.5.2 Beers

17.2.5.3 Juices

17.2.5.4 Others

17.2.6 BREAKFAST CEREALS & NUTRITION BARS

17.2.7 SPORTS NUTRITION

17.2.8 INFANT FORMULA/BABY FORMULA

17.2.9 OTHERS

17.2.9.1 Bread Dough

17.2.9.2 Pie Filling

17.2.9.3 Chiffon Pies

17.2.9.4 Sugar Icing

17.2.9.5 Cake Glaze

17.2.9.6 Others

17.2.10 FOOD & BEVERAGES, BY PRODUCT

17.2.10.1 Red Seaweed

17.2.10.1.1 Eucheuma SPP

17.2.10.1.2 Gracilaria Gracilis/Verrucosa

17.2.10.1.3 Porphyra umbilicalis

17.2.10.1.4 Kappaphycus SPP

17.2.10.1.5 Chondria SPP

17.2.10.1.6 Porphyra laciniata

17.2.10.1.7 Pyropia yezoensis

17.2.10.1.8 Pyropia tenera

17.2.10.1.9 Porphyra dioica

17.2.10.1.10 Porphyra purpurea

17.2.10.1.11 Pyropia leucosticta

17.2.10.1.12 Palmaria Palmata

17.2.10.1.13 Furcellaria SPP

17.2.10.1.14 Vertebrata lanosa/polysiphonia lanosa

17.2.10.1.15 Others

17.2.10.2 Brown Seaweed

17.2.10.2.1 Saccharina Japonica

17.2.10.2.2 Laminaria Longicruris

17.2.10.2.3 Undaria Pinnatifida

17.2.10.2.4 Saccharina Latissima

17.2.10.2.5 Laminaria Hyperborea

17.2.10.2.6 Laminaria Digitata

17.2.10.2.7 Laminaria Ochroleuca

17.2.10.2.8 Fucus Vesiculosus

17.2.10.2.9 Fucus Evanescens

17.2.10.2.10 Ascophyllum Nodosum

17.2.10.2.11 Fucus Spiralis

17.2.10.2.12 Cladosiphon Okamuranus

17.2.10.2.13 Fucus Serratus

17.2.10.2.14 Sargassum Fusiforme

17.2.10.2.15 Eisenia Bicyclis

17.2.10.2.16 Alaria Esculenta

17.2.10.2.17 Durvillaea Antarctica

17.2.10.2.18 Himanthalia Elongata

17.2.10.2.19 Lithothamnium Calcareum

17.2.10.2.20 Others

17.2.10.3 Green Seaweed

17.2.10.3.1 Enteromorpha SP

17.2.10.3.2 Caulerpa Lentillifera

17.2.10.3.3 Ulva SP

17.2.10.3.4 Codium Tomentosum

17.2.10.3.5 Monostroma SPP

17.2.10.3.6 Others

17.3 PHARMACEUTICALS

17.3.1 PLANT BIOTECHNOLOGY

17.3.2 ELECTROPHORESIS

17.3.3 IMPRESSION MATERIAL

17.3.4 DENTAL PROSTHETICS

17.3.5 CHROMATOGRAPHY

17.3.6 OTHERS

17.3.7 PHARMACEUTICALS, BY PRODUCT

17.3.7.1 Red Seaweed

17.3.7.1.1 Eucheuma SPP

17.3.7.1.2 Gracilaria Gracilis/Verrucosa

17.3.7.1.3 Porphyra umbilicalis

17.3.7.1.4 Kappaphycus SPP

17.3.7.1.5 Chondria SPP

17.3.7.1.6 Porphyra laciniata

17.3.7.1.7 Pyropia yezoensis

17.3.7.1.8 Pyropia tenera

17.3.7.1.9 Porphyra dioica

17.3.7.1.10 Porphyra purpurea

17.3.7.1.11 Pyropia leucosticta

17.3.7.1.12 Palmaria Palmata

17.3.7.1.13 Furcellaria SPP

17.3.7.1.14 Vertebrata lanosa/polysiphonia lanosa

17.3.7.1.15 Others

17.3.7.2 Brown Seaweed

17.3.7.2.1 Saccharina Japonica

17.3.7.2.2 Laminaria Longicruris

17.3.7.2.3 Undaria Pinnatifida

17.3.7.2.4 Saccharina Latissima

17.3.7.2.5 Laminaria Hyperborea

17.3.7.2.6 Laminaria Digitata

17.3.7.2.7 Laminaria Ochroleuca

17.3.7.2.8 Fucus Vesiculosus

17.3.7.2.9 Fucus Evanescens

17.3.7.2.10 Ascophyllum Nodosum

17.3.7.2.11 Fucus Spiralis

17.3.7.2.12 Cladosiphon Okamuranus

17.3.7.2.13 Fucus Serratus

17.3.7.2.14 Sargassum Fusiforme

17.3.7.2.15 Eisenia Bicyclis

17.3.7.2.16 Alaria Esculenta

17.3.7.2.17 Durvillaea Antarctica

17.3.7.2.18 Himanthalia Elongata

17.3.7.2.19 Lithothamnium Calcareum

17.3.7.2.20 Others

17.3.7.3 Green Seaweed

17.3.7.3.1 Enteromorpha SP

17.3.7.3.2 Caulerpa Lentillifera

17.3.7.3.3 Ulva SP

17.3.7.3.4 Codium Tomentosum

17.3.7.3.5 Monostroma SPP

17.3.7.3.6 Others

17.4 ANIMAL FEED

17.4.1 PETS

17.4.2 POULTRY

17.4.3 SWINE

17.4.4 RUMINANT

17.4.5 OTHERS

17.4.6 ANIMAL FEED, BY PRODUCT

17.4.6.1 RED SEAWEED

17.4.6.1.1 EUCHEUMA SPP

17.4.6.1.2 GRACILARIA Gracilis/Verrucosa

17.4.6.1.3 Porphyra umbilicalis

17.4.6.1.4 Kappaphycus SPP

17.4.6.1.5 Chondria SPP

17.4.6.1.6 Porphyra laciniata

17.4.6.1.7 Pyropia yezoensis

17.4.6.1.8 Pyropia tenera

17.4.6.1.9 Porphyra dioica

17.4.6.1.10 Porphyra purpurea

17.4.6.1.11 Pyropia leucosticta

17.4.6.1.12 Palmaria Palmata

17.4.6.1.13 Furcellaria SPP

17.4.6.1.14 Vertebrata lanosa/polysiphonia lanosa

17.4.6.1.15 OTHERS

17.4.6.2 Brown Seaweed

17.4.6.2.1 Saccharina Japonica

17.4.6.2.2 Laminaria Longicruris

17.4.6.2.3 Undaria Pinnatifida

17.4.6.2.4 Saccharina Latissima

17.4.6.2.5 Laminaria Hyperborea

17.4.6.2.6 Laminaria Digitata

17.4.6.2.7 Laminaria Ochroleuca

17.4.6.2.8 Fucus Vesiculosus

17.4.6.2.9 Fucus Evanescens

17.4.6.2.10 Ascophyllum Nodosum

17.4.6.2.11 Fucus Spiralis

17.4.6.2.12 Cladosiphon Okamuranus

17.4.6.2.13 Fucus Serratus

17.4.6.2.14 Sargassum Fusiforme

17.4.6.2.15 Eisenia Bicyclis

17.4.6.2.16 Alaria Esculenta

17.4.6.2.17 Durvillaea Antarctica

17.4.6.2.18 Himanthalia Elongata

17.4.6.2.19 Lithothamnium Calcareum

17.4.6.2.20 Others

17.4.6.3 Green Seaweed

17.4.6.3.1 Enteromorpha SP

17.4.6.3.2 Caulerpa Lentillifera

17.4.6.3.3 Ulva SP

17.4.6.3.4 Codium Tomentosum

17.4.6.3.5 Monostroma SPP

17.4.6.3.6 Others

17.5 COSMETICS & PERSONAL CARE

17.5.1 HAIR CARE

17.5.2 SKIN CARE

17.5.3 COSMETICS & PERSONAL CARE, BY PRODUCT

17.5.3.1 Red Seaweed

17.5.3.1.1 Eucheuma SPP

17.5.3.1.2 Gracilaria Gracilis/Verrucosa

17.5.3.1.3 Porphyra umbilicalis

17.5.3.1.4 Kappaphycus SPP

17.5.3.1.5 Chondria SPP

17.5.3.1.6 Porphyra laciniata

17.5.3.1.7 Pyropia yezoensis

17.5.3.1.8 Pyropia tenera

17.5.3.1.9 Porphyra dioica

17.5.3.1.10 Porphyra purpurea

17.5.3.1.11 Pyropia leucosticta

17.5.3.1.12 Palmaria Palmata

17.5.3.1.13 Furcellaria SPP

17.5.3.1.14 Vertebrata lanosa/polysiphonia lanosa

17.5.3.1.15 Others

17.5.3.2 Brown Seaweed

17.5.3.2.1 Saccharina Japonica

17.5.3.2.2 Laminaria Longicruris

17.5.3.2.3 Undaria Pinnatifida

17.5.3.2.4 Saccharina Latissima

17.5.3.2.5 Laminaria Hyperborea

17.5.3.2.6 Laminaria Digitata

17.5.3.2.7 Laminaria Ochroleuca

17.5.3.2.8 Fucus Vesiculosus

17.5.3.2.9 Fucus Evanescens

17.5.3.2.10 Ascophyllum Nodosum

17.5.3.2.11 Fucus Spiralis

17.5.3.2.12 Cladosiphon Okamuranus

17.5.3.2.13 Fucus Serratus

17.5.3.2.14 Sargassum Fusiforme

17.5.3.2.15 Eisenia Bicyclis

17.5.3.2.16 Alaria Esculenta

17.5.3.2.17 Durvillaea Antarctica

17.5.3.2.18 Himanthalia Elongata

17.5.3.2.19 Lithothamnium Calcareum

17.5.3.2.20 Others

17.5.3.3 Green Seaweed

17.5.3.3.1 Enteromorpha SP

17.5.3.3.2 Caulerpa Lentillifera

17.5.3.3.3 Ulva SP

17.5.3.3.4 Codium Tomentosum

17.5.3.3.5 Monostroma SPP

17.5.3.3.6 Others

17.6 AGRICULTURE

17.6.1 BIOSTIMULANT

17.6.2 BIOCONTROLS

17.6.3 BIOFERTILIZERS

17.6.4 AGRICULTURE, BY PRODUCT

17.6.4.1 Red Seaweed

17.6.4.1.1 Eucheuma SPP

17.6.4.1.2 Gracilaria Gracilis/Verrucosa

17.6.4.1.3 Porphyra umbilicalis

17.6.4.1.4 Kappaphycus SPP

17.6.4.1.5 Chondria SPP

17.6.4.1.6 Porphyra laciniata

17.6.4.1.7 Pyropia yezoensis

17.6.4.1.8 Pyropia tenera

17.6.4.1.9 Porphyra dioica

17.6.4.1.10 Porphyra purpurea

17.6.4.1.11 Pyropia leucosticta

17.6.4.1.12 Palmaria Palmata

17.6.4.1.13 Furcellaria SPP

17.6.4.1.14 Vertebrata lanosa/polysiphonia lanosa

17.6.4.1.15 Others

17.6.4.2 Brown Seaweed

17.6.4.2.1 Saccharina Japonica

17.6.4.2.2 Laminaria Longicruris

17.6.4.2.3 Undaria Pinnatifida

17.6.4.2.4 Saccharina Latissima

17.6.4.2.5 Laminaria Hyperborea

17.6.4.2.6 Laminaria Digitata

17.6.4.2.7 Laminaria Ochroleuca

17.6.4.2.8 Fucus Vesiculosus

17.6.4.2.9 Fucus Evanescens

17.6.4.2.10 Ascophyllum Nodosum

17.6.4.2.11 Fucus Spiralis

17.6.4.2.12 Cladosiphon Okamuranus

17.6.4.2.13 Fucus Serratus

17.6.4.2.14 Sargassum Fusiforme

17.6.4.2.15 Eisenia Bicyclis

17.6.4.2.16 Alaria Esculenta

17.6.4.2.17 Durvillaea Antarctica

17.6.4.2.18 Himanthalia Elongata

17.6.4.2.19 Lithothamnium Calcareum

17.6.4.2.20 Others

17.6.4.3 Green Seaweed

17.6.4.3.1 Enteromorpha SP

17.6.4.3.2 Caulerpa Lentillifera

17.6.4.3.3 Ulva SP

17.6.4.3.4 Codium Tomentosum

17.6.4.3.5 Monostroma SPP

17.6.4.3.6 Others

17.7 BIOFUELS

17.7.1 BIOFUELS, BY PRODUCT

17.7.2 RED SEAWEED

17.7.2.1 Eucheuma SPP

17.7.2.2 Gracilaria Gracilis/Verrucosa

17.7.2.3 Porphyra umbilicalis

17.7.2.4 Kappaphycus SPP

17.7.2.5 Chondria SPP

17.7.2.6 Porphyra laciniata

17.7.2.7 Pyropia yezoensis

17.7.2.8 Pyropia tenera

17.7.2.9 Porphyra dioica

17.7.2.10 Porphyra purpurea

17.7.2.11 Pyropia leucosticta

17.7.2.12 Palmaria Palmata

17.7.2.13 Furcellaria SPP

17.7.2.14 Vertebrata lanosa/polysiphonia lanosa

17.7.2.15 Others

17.7.3 BROWN SEAWEED

17.7.3.1 Saccharina Japonica

17.7.3.2 Laminaria Longicruris

17.7.3.3 Undaria Pinnatifida

17.7.3.4 Saccharina Latissima

17.7.3.5 Laminaria Hyperborea

17.7.3.6 Laminaria Digitata

17.7.3.7 Laminaria Ochroleuca

17.7.3.8 Fucus Vesiculosus

17.7.3.9 Fucus Evanescens

17.7.3.10 Ascophyllum Nodosum

17.7.3.11 Fucus Spiralis

17.7.3.12 Cladosiphon Okamuranus

17.7.3.13 Fucus Serratus

17.7.3.14 Sargassum Fusiforme

17.7.3.15 Eisenia Bicyclis

17.7.3.16 Alaria Esculenta

17.7.3.17 Durvillaea Antarctica

17.7.3.18 Himanthalia Elongata

17.7.3.19 Lithothamnium Calcareum

17.7.3.20 Others

17.7.4 GREEN SEAWEED

17.7.4.1 Enteromorpha SP

17.7.4.2 Caulerpa Lentillifera

17.7.4.3 Ulva SP

17.7.4.4 Codium Tomentosum

17.7.4.5 Monostroma SPP

17.7.4.6 Others

17.8 OTHERS

17.8.1 OTHERS, BY PRODUCT

17.8.2 RED SEAWEED

17.8.2.1 Eucheuma SPP

17.8.2.2 Gracilaria Gracilis/Verrucosa

17.8.2.3 Porphyra umbilicalis

17.8.2.4 Kappaphycus SPP

17.8.2.5 Chondria SPP

17.8.2.6 Porphyra laciniata

17.8.2.7 Pyropia yezoensis

17.8.2.8 Pyropia tenera

17.8.2.9 Porphyra dioica

17.8.2.10 Porphyra purpurea

17.8.2.11 Pyropia leucosticta

17.8.2.12 Palmaria Palmata

17.8.2.13 Furcellaria SPP

17.8.2.14 Vertebrata lanosa/polysiphonia lanosa

17.8.2.15 Others

17.8.3 BROWN SEAWEED

17.8.3.1 Saccharina Japonica

17.8.3.2 Laminaria Longicruris

17.8.3.3 Undaria Pinnatifida

17.8.3.4 Saccharina Latissima

17.8.3.5 Laminaria Hyperborea

17.8.3.6 Laminaria Digitata

17.8.3.7 Laminaria Ochroleuca

17.8.3.8 Fucus Vesiculosus

17.8.3.9 Fucus Evanescens

17.8.3.10 Ascophyllum Nodosum

17.8.3.11 Fucus Spiralis

17.8.3.12 Cladosiphon Okamuranus

17.8.3.13 Fucus Serratus

17.8.3.14 Sargassum Fusiforme

17.8.3.15 Eisenia Bicyclis

17.8.3.16 Alaria Esculenta

17.8.3.17 Durvillaea Antarctica

17.8.3.18 Himanthalia Elongata

17.8.3.19 Lithothamnium Calcareum

17.8.3.20 Others

17.8.4 GREEN SEAWEED

17.8.4.1 Enteromorpha SP

17.8.4.2 Caulerpa Lentillifera

17.8.4.3 Ulva SP

17.8.4.4 Codium Tomentosum

17.8.4.5 Monostroma SPP

17.8.4.6 Others

18 NORTH AMERICA COMMERCIAL SEAWEED MARKET, BY REGION

18.1 NORTH AMERICA

18.1.1 U.S.

18.1.2 CANADA

18.1.3 MEXICO

19 NORTH AMERICA COMMERCIAL SEAWEED MARKET: COMPANY LANDSCAPE

19.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

20 SWOT ANALYSIS

21 COMPANY PROFILE

21.1 CARGILL, INCORPORATED

21.1.1 COMPANY SNAPSHOT

21.1.2 REVENUE ANALYSIS

21.1.3 COMPANY SHARE ANALYSIS

21.1.4 PRODUCT PORTFOLIO

21.1.5 RECENT DEVELOPMENTS

21.2 KWANGCHEONKIM

21.2.1 COMPANY SNAPSHOT

21.2.2 COMPANY SHARE ANALYSIS

21.2.3 PRODUCT PORTFOLIO

21.2.4 RECENT DEVELOPMENTS

21.3 ACADIAN SEAPLUS

21.3.1 COMPANY SNAPSHOT

21.3.2 COMPANY SHARE ANALYSIS

21.3.3 PRODUCT PORTFOLIO

21.3.4 RECENT DEVELOPMENTS

21.4 CASCADIA SEAWEED

21.4.1 COMPANY SNAPSHOT

21.4.2 COMPANY SHARE ANALYSIS

21.4.3 PRODUCT PORTFOLIO

21.4.4 RECENT DEVELOPMENTS

21.5 KAI HO "OCEANS TREASURE"

21.5.1 COMPANY SNAPSHOT

21.5.2 COMPANY SHARE ANALYSIS

21.5.3 PRODUCT PORTFOLIO

21.5.4 RECENT DEVELOPMENTS

21.6 RAW SEAWEEDS

21.6.1 COMPANY SNAPSHOT

21.6.2 PRODUCT PORTFOLIO

21.6.3 RECENT DEVELOPMENTS

21.7 MARCEL CARRAGEENAN

21.7.1 COMPANY SNAPSHOT

21.7.2 PRODUCT PORTFOLIO

21.7.3 RECENT DEVELOPMENT

21.8 MAINE COAST SEA VEGETABLES

21.8.1 COMPANY SNAPSHOT

21.8.2 PRODUCT PORTFOLIO

21.8.3 RECENT DEVELOPMENT

21.9 OCEAN RAINFOREST

21.9.1 COMPANY SNAPSHOT

21.9.2 PRODUCT PORTFOLIO

21.9.3 RECENT DEVELOPMENTS

21.1 IRISH SEAWEEDS

21.10.1 COMPANY SNAPSHOT

21.10.2 PRODUCT PORTFOLIO

21.10.3 RECENT DEVELOPMENT

21.11 ALGOLESKO

21.11.1 COMPANY SNAPSHOT

21.11.2 PRODUCT PORTFOLIO

21.11.3 RECENT DEVELOPMENT

21.12 ATSEANOVA

21.12.1 COMPANY SNAPSHOT

21.12.2 PRODUCT PORTFOLIO

21.12.3 RECENT DEVELOPMENT

21.13 AUSHADH LIMITED.

21.13.1 COMPANY SNAPSHOT

21.13.2 PRODUCT PORTFOLIO

21.13.3 RECENT DEVELOPMENTS

21.14 BLUE EVOLUTION

21.14.1 COMPANY SNAPSHOT

21.14.2 PRODUCT PORTFOLIO

21.14.3 RECENT DEVELOPMENT

21.15 BY VIET DELTA.

21.15.1 COMPANY SNAPSHOT

21.15.2 PRODUCT PORTFOLIO

21.15.3 RECENT DEVELOPMENT

21.16 EARAYBIO

21.16.1 COMPANY SNAPSHOT

21.16.2 PRODUCT PORTFOLIO

21.16.3 RECENT DEVELOPMENTS

21.17 KELP INDUSTRIES PTY, LTD.

21.17.1 COMPANY SNAPSHOT

21.17.2 PRODUCT PORTFOLIO

21.17.3 RECENT DEVELOPMENT

21.18 MARA SEAWEED

21.18.1 COMPANY SNAPSHOT

21.18.2 PRODUCT PORTFOLIO

21.18.3 RECENT DEVELOPMENTS

21.19 ORGANIC IRISH SEAWEED-EMERALD ISLE

21.19.1 COMPANY SNAPSHOT

21.19.2 PRODUCT PORTFOLIO

21.19.3 RECENT DEVELOPMENTS

21.2 PACIFIC HARVEST

21.20.1 COMPANY SNAPSHOT

21.20.2 PRODUCT PORTFOLIO

21.20.3 RECENT DEVELOPMENT

21.21 SEAWEED SOLUTIONS AS

21.21.1 COMPANY SNAPSHOT

21.21.2 PRODUCT PORTFOLIO

21.21.3 RECENT DEVELOPMENTS

21.22 SHORE SEAWEED

21.22.1 COMPANY SNAPSHOT

21.22.2 PRODUCT PORTFOLIO

21.22.3 RECENT DEVELOPMENT

21.23 SPRINGTIDE SEAWEED, LLC

21.23.1 COMPANY SNAPSHOT

21.23.2 PRODUCT PORTFOLIO

21.23.3 RECENT DEVELOPMENTS

21.24 THE SEAWEED COMPANY

21.24.1 COMPANY SNAPSHOT

21.24.2 PRODUCT PORTFOLIO

21.24.3 RECENT DEVELOPMENTS

21.25 WILD IRISH SEAWEEDS

21.25.1 COMPANY SNAPSHOT

21.25.2 PRODUCT PORTFOLIO

21.25.3 RECENT DEVELOPMENT

22 QUESTIONNAIRE

23 RELATED REPORTS

Список таблиц

TABLE 1 THE PRICES OF SEAWEEDS IN EUROPEAN COUNTRIES IS AS FOLLOWS:

TABLE 2 NORTH AMERICA COMMERCIAL SEAWEED MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 4 ASIA-PACIFIC COMMERCIAL SEAWEED MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 5 ASIA PACIFIC COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 6 CHINA COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 7 INDONESIA COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 8 SOUTH KOREA COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 9 PHILIPPINES COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 10 JAPAN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 11 MALAYSIA COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 12 INDIA COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 13 SINGAPORE COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 14 AUSTRALIA COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 15 THAILAND COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 16 REST OF ASIA PACIFIC COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA COMMERCIAL SEAWEED MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 19 SOUTH AFRICA COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 20 U.A.E. COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 21 SAUDI ARABIA COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 22 KUWAIT COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 23 REST OF MIDDLE EAST AND AFRICA COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 24 EUROPE COMMERCIAL SEAWEED MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 25 EUROPE COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 26 NORWAY COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 27 FRANCE COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 28 RUSSIA COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 29 U.K COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 30 GERMANY COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 31 ITALY COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 32 SWITZERLAND COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 33 SPAIN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 34 NETHERLANDS COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 35 TURKEY COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 36 BELGIUM COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 37 REST OF EUROPE COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 38 SOUTH AMERICA COMMERCIAL SEAWEED MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 39 SOUTH AMERICA COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 40 BRAZIL COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 41 ARGENTINA COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 42 REST OF SOUTH AMERICA COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA COMMERCIAL SEAWEED MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 45 CANADA COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 46 MEXICO COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 47 U.S. COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 48 IMPORT DATA OF SEAWEEDS AND OTHER ALGAE, FRESH, CHILLED, FRESH OR DRIED, WHETHER OR NOT GROUND, FIT FOR HUMAN CONSUMPTION (TONS) HS CODE: 121221

TABLE 49 EXPORT DATA OF SEAWEEDS AND OTHER ALGAE, FRESH, CHILLED, FRESH OR DRIED, WHETHER OR NOT GROUND, FIT FOR HUMAN CONSUMPTION (TONS) HS CODE: 121221

TABLE 50 IMPORT DATA OF SEAWEEDS AND OTHER ALGAE, FRESH, CHILLED, FRESH OR DRIED, WHETHER OR NOT GROUND, UNFIT FOR HUMAN CONSUMPTION (TONS) HS CODE: 121229

TABLE 51 EXPORT DATA OF SEAWEEDS AND OTHER ALGAE, FRESH, CHILLED, FRESH OR DRIED, WHETHER OR NOT GROUND, UNFIT FOR HUMAN CONSUMPTION (TONS) HS CODE: 121229

TABLE 52 THE IODINE CONTENT OF A FEW TYPES OF SEAWEED ARE AS FOLLOWS:

TABLE 53 THE BELOW TABLE DESCRIBES THE PRICE OF SEAWEED/KG IN VARIOUS EUROPEAN COUNTRIES:

TABLE 54 NORTH AMERICA COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 55 NORTH AMERICA RED SEAWEED IN COMMERCIAL SEAWEED MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 56 NORTH AMERICA RED SEAWEED IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 57 NORTH AMERICA BROWN SEAWEED IN COMMERCIAL SEAWEED MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 58 NORTH AMERICA BROWN SEAWEED IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 59 NORTH AMERICA GREEN SEAWEED IN COMMERCIAL SEAWEED MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 60 NORTH AMERICA GREEN SEAWEED IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 61 NORTH AMERICA COMMERCIAL SEAWEED MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 62 NORTH AMERICA POWDERED IN COMMERCIAL SEAWEED MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 63 NORTH AMERICA FLAKES IN COMMERCIAL SEAWEED MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 64 NORTH AMERICA LIQUID IN COMMERCIAL SEAWEED MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 65 NORTH AMERICA COMMERCIAL SEAWEED MARKET, BY CULTIVATION, 2020-2029 (USD MILLION)

TABLE 66 NORTH AMERICA OFFSHORE CULTIVATION IN COMMERCIAL SEAWEED MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 67 NORTH AMERICA ONSHORE CULTIVATION IN COMMERCIAL SEAWEED MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 68 NORTH AMERICA IMTA CULTIVATION IN COMMERCIAL SEAWEED MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 69 NORTH AMERICA NEARSHORE CULTIVATION IN COMMERCIAL SEAWEED MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 70 NORTH AMERICA SALINE AQUACULTURE IN COMMERCIAL SEAWEED MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 71 NORTH AMERICA COMMERCIAL SEAWEED MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 72 NORTH AMERICA FOOD & BEVERAGES IN COMMERCIAL SEAWEED MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 73 NORTH AMERICA FOOD & BEVERAGES IN COMMERCIAL SEAWEED MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 74 NORTH AMERICA BAKERY PRODUCTS IN COMMERCIAL SEAWEED MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 75 NORTH AMERICA CONFECTIONERY IN COMMERCIAL SEAWEED MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 76 NORTH AMERICA PROCESSED FOOD IN COMMERCIAL SEAWEED MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 77 NORTH AMERICA DAIRY PRODUCTS IN COMMERCIAL SEAWEED MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 78 NORTH AMERICA BEVERAGES IN COMMERCIAL SEAWEED MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 79 NORTH AMERICA OTHERS IN COMMERCIAL SEAWEED MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 80 NORTH AMERICA FOOD & BEVERAGES IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 81 NORTH AMERICA RED SEAWEED IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 82 NORTH AMERICA BROWN SEAWEED IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 83 NORTH AMERICA GREEN SEAWEED IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 84 NORTH AMERICA PHARMACEUTICALS IN COMMERCIAL SEAWEED MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 85 NORTH AMERICA PHARMACEUTICALS IN COMMERCIAL SEAWEED MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 86 NORTH AMERICA PHARMACEUTICALS IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 87 NORTH AMERICA RED SEAWEED IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 88 NORTH AMERICA BROWN SEAWEED IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 89 NORTH AMERICA GREEN SEAWEED IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 90 NORTH AMERICA ANIMAL FEED IN COMMERCIAL SEAWEED MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 91 NORTH AMERICA ANIMAL FEED IN COMMERCIAL SEAWEED MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 92 NORTH AMERICA ANIMAL FEED IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 93 NORTH AMERICA RED SEAWEED IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 94 NORTH AMERICA BROWN SEAWEED IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 95 NORTH AMERICA GREEN SEAWEED IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 96 NORTH AMERICA COSMETICS & PERSONAL CARE IN COMMERCIAL SEAWEED MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 97 NORTH AMERICA COSMETICS & PERSONAL CARE IN COMMERCIAL SEAWEED MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 98 NORTH AMERICA COSMETICS & PERSONAL CARE IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 99 NORTH AMERICA RED SEAWEED IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 100 NORTH AMERICA BROWN SEAWEED IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 101 NORTH AMERICA GREEN SEAWEED IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 102 NORTH AMERICA AGRICULTURE IN COMMERCIAL SEAWEED MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 103 NORTH AMERICA AGRICULTURE IN COMMERCIAL SEAWEED MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 104 NORTH AMERICA AGRICULTURE IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 105 NORTH AMERICA RED SEAWEED IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 106 NORTH AMERICA BROWN SEAWEED IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 107 NORTH AMERICA GREEN SEAWEED IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 108 NORTH AMERICA BIOFUELS IN COMMERCIAL SEAWEED MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 109 NORTH AMERICA BIOFUELS IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 110 NORTH AMERICA RED SEAWEED IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 111 NORTH AMERICA BROWN SEAWEED IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 112 NORTH AMERICA GREEN SEAWEED IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 113 NORTH AMERICA OTHERS IN COMMERCIAL SEAWEED MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 114 NORTH AMERICA OTHERS IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 115 NORTH AMERICA RED SEAWEED IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 116 NORTH AMERICA BROWN SEAWEED IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 117 NORTH AMERICA GREEN SEAWEED IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 118 NORTH AMERICA COMMERCIAL SEAWEED MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 119 NORTH AMERICA COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 120 NORTH AMERICA RED SEAWEED IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 121 NORTH AMERICA BROWN SEAWEED IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 122 NORTH AMERICA GREEN SEAWEED IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 123 NORTH AMERICA COMMERCIAL SEAWEED MARKET, BY FORM, 2020-2029 (USD MILLION

TABLE 124 NORTH AMERICA COMMERCIAL SEAWEED MARKET, BY CULTIVATION, 2020-2029 (USD MILLION)

TABLE 125 NORTH AMERICA COMMERCIAL SEAWEED MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 126 NORTH AMERICA FOOD & BEVERAGES IN COMMERCIAL SEAWEED MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 127 NORTH AMERICA BAKERY PRODUCTS IN COMMERCIAL SEAWEED MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 128 NORTH AMERICA CONFECTIONERY IN COMMERCIAL SEAWEED MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 129 NORTH AMERICA PROCESSED FOOD IN COMMERCIAL SEAWEED MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 130 NORTH AMERICA DAIRY PRODUCTS IN COMMERCIAL SEAWEED MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 131 NORTH AMERICA BEVERAGES IN COMMERCIAL SEAWEED MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 132 NORTH AMERICA OTHERS IN COMMERCIAL SEAWEED MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 133 NORTH AMERICA FOOD & BEEVRAGES IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 134 NORTH AMERICA RED SEAWEED IN FOOD & BEVERAGES IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 135 NORTH AMERICA BROWN SEAWEED IN FOOD & BEVERAGES IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 136 NORTH AMERICA GREEN SEAWEED IN FOOD & BEVERAGES IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 137 NORTH AMERICA PHARMACEUTICALS IN COMMERCIAL SEAWEED MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 138 NORTH AMERICA PHARMACEUTICALS IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 139 NORTH AMERICA RED SEAWEED IN PHARMACEUTICALS IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 140 NORTH AMERICA BROWN SEAWEED IN PHARMACEUTICALS IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 141 NORTH AMERICA GREEN SEAWEED IN PHARMACEUTICALS IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 142 NORTH AMERICA AGRICULTURE IN COMMERCIAL SEAWEED MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 143 NORTH AMERICA AGRICULTURE IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 144 NORTH AMERICA RED SEAWEED IN AGRICULTURE IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 145 NORTH AMERICA BROWN SEAWEED IN AGRICULTURE IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 146 NORTH AMERICA GREEN SEAWEED IN AGRICULTURE IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 147 NORTH AMERICA ANIMAL FEED IN COMMERCIAL SEAWEED MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 148 NORTH AMERICA ANIMAL FEED IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 149 NORTH AMERICA RED SEAWEED IN ANIMAL FEED IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 150 NORTH AMERICA BROWN SEAWEED IN ANIMAL FEED IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 151 NORTH AMERICA GREEN SEAWEED IN ANIMAL FEED IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 152 NORTH AMERICA COSMETICS & PERSONAL CARE IN COMMERCIAL SEAWEED MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 153 NORTH AMERICA COSMETICS & PERSONAL CARE IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 154 NORTH AMERICA RED SEAWEED IN COSMETICS & PERSONAL CARE IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 155 NORTH AMERICA BROWN SEAWEED IN COSMETICS & PERSONAL CARE IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 156 NORTH AMERICA GREEN SEAWEED IN COSMETICS & PERSONAL CARE IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 157 NORTH AMERICA BIOFUEL IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 158 NORTH AMERICA RED SEAWEED IN BIOFUEL IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 159 NORTH AMERICA BROWN SEAWEED IN BIOFUEL IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 160 NORTH AMERICA GREEN SEAWEED IN BIOFUEL IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 161 NORTH AMERICA OTHERS IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 162 NORTH AMERICA RED SEAWEED IN OTHERS IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 163 NORTH AMERICA BROWN SEAWEED IN OTHERS IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 164 NORTH AMERICA GREEN SEAWEED IN OTHERS IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 165 U.S. COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 166 U.S. RED SEAWEED IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 167 U.S. BROWN SEAWEED IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 168 U.S. GREEN SEAWEED IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 169 U.S. COMMERCIAL SEAWEED MARKET, BY FORM, 2020-2029 (USD MILLION

TABLE 170 U.S. COMMERCIAL SEAWEED MARKET, BY CULTIVATION, 2020-2029 (USD MILLION)

TABLE 171 U.S. COMMERCIAL SEAWEED MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 172 U.S. FOOD & BEVERAGES IN COMMERCIAL SEAWEED MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 173 U.S. BAKERY PRODUCTS IN COMMERCIAL SEAWEED MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 174 U.S. CONFECTIONERY IN COMMERCIAL SEAWEED MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 175 U.S. PROCESSED FOOD IN COMMERCIAL SEAWEED MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 176 U.S. DAIRY PRODUCTS IN COMMERCIAL SEAWEED MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 177 U.S. BEVERAGES IN COMMERCIAL SEAWEED MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 178 U.S. OTHERS IN COMMERCIAL SEAWEED MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 179 U.S. FOOD & BEEVRAGES IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 180 U.S. RED SEAWEED IN FOOD & BEVERAGES IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 181 U.S. BROWN SEAWEED IN FOOD & BEVERAGES IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 182 U.S. GREEN SEAWEED IN FOOD & BEVERAGES IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 183 U.S. PHARMACEUTICALS IN COMMERCIAL SEAWEED MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 184 U.S. PHARMACEUTICALS IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 185 U.S. RED SEAWEED IN PHARMACEUTICALS IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 186 U.S. BROWN SEAWEED IN PHARMACEUTICALS IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 187 U.S. GREEN SEAWEED IN PHARMACEUTICALS IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 188 U.S. AGRICULTURE IN COMMERCIAL SEAWEED MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 189 U.S. AGRICULTURE IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 190 U.S. RED SEAWEED IN AGRICULTURE IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 191 U.S. BROWN SEAWEED IN AGRICULTURE IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 192 U.S. GREEN SEAWEED IN AGRICULTURE IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 193 U.S. ANIMAL FEED IN COMMERCIAL SEAWEED MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 194 U.S. ANIMAL FEED IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 195 U.S. RED SEAWEED IN ANIMAL FEED IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 196 U.S. BROWN SEAWEED IN ANIMAL FEED IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 197 U.S. GREEN SEAWEED IN ANIMAL FEED IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 198 U.S. COSMETICS & PERSONAL CARE IN COMMERCIAL SEAWEED MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 199 U.S. COSMETICS & PERSONAL CARE IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 200 U.S. RED SEAWEED IN COSMETICS & PERSONAL CARE IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 201 U.S. BROWN SEAWEED IN COSMETICS & PERSONAL CARE IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 202 U.S. GREEN SEAWEED IN COSMETICS & PERSONAL CARE IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 203 U.S. BIOFUEL IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 204 U.S. RED SEAWEED IN BIOFUEL IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 205 U.S. BROWN SEAWEED IN BIOFUEL IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 206 U.S. GREEN SEAWEED IN BIOFUEL IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 207 U.S. OTHERS IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 208 U.S. RED SEAWEED IN OTHERS IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 209 U.S. BROWN SEAWEED IN OTHERS IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 210 U.S. GREEN SEAWEED IN OTHERS IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 211 CANADA COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 212 CANADA RED SEAWEED IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 213 CANADA BROWN SEAWEED IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 214 CANADA GREEN SEAWEED IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 215 CANADA COMMERCIAL SEAWEED MARKET, BY FORM, 2020-2029 (USD MILLION

TABLE 216 CANADA COMMERCIAL SEAWEED MARKET, BY CULTIVATION, 2020-2029 (USD MILLION)

TABLE 217 CANADA COMMERCIAL SEAWEED MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 218 CANADA FOOD & BEVERAGES IN COMMERCIAL SEAWEED MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 219 CANADA BAKERY PRODUCTS IN COMMERCIAL SEAWEED MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 220 CANADA CONFECTIONERY IN COMMERCIAL SEAWEED MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 221 CANADA PROCESSED FOOD IN COMMERCIAL SEAWEED MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 222 CANADA DAIRY PRODUCTS IN COMMERCIAL SEAWEED MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 223 CANADA BEVERAGES IN COMMERCIAL SEAWEED MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 224 CANADA OTHERS IN COMMERCIAL SEAWEED MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 225 CANADA FOOD & BEEVRAGES IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 226 CANADA RED SEAWEED IN FOOD & BEVERAGES IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 227 CANADA BROWN SEAWEED IN FOOD & BEVERAGES IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 228 CANADA GREEN SEAWEED IN FOOD & BEVERAGES IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 229 CANADA PHARMACEUTICALS IN COMMERCIAL SEAWEED MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 230 CANADA PHARMACEUTICALS IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 231 CANADA RED SEAWEED IN PHARMACEUTICALS IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 232 CANADA BROWN SEAWEED IN PHARMACEUTICALS IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 233 CANADA GREEN SEAWEED IN PHARMACEUTICALS IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 234 CANADA AGRICULTURE IN COMMERCIAL SEAWEED MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 235 CANADA AGRICULTURE IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 236 CANADA RED SEAWEED IN AGRICULTURE IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 237 CANADA BROWN SEAWEED IN AGRICULTURE IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 238 CANADA GREEN SEAWEED IN AGRICULTURE IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 239 CANADA ANIMAL FEED IN COMMERCIAL SEAWEED MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 240 CANADA ANIMAL FEED IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 241 CANADA RED SEAWEED IN ANIMAL FEED IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 242 CANADA BROWN SEAWEED IN ANIMAL FEED IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 243 CANADA GREEN SEAWEED IN ANIMAL FEED IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 244 CANADA COSMETICS & PERSONAL CARE IN COMMERCIAL SEAWEED MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 245 CANADA COSMETICS & PERSONAL CARE IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 246 CANADA RED SEAWEED IN COSMETICS & PERSONAL CARE IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 247 CANADA BROWN SEAWEED IN COSMETICS & PERSONAL CARE IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 248 CANADA GREEN SEAWEED IN COSMETICS & PERSONAL CARE IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 249 CANADA BIOFUEL IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 250 CANADA RED SEAWEED IN BIOFUEL IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 251 CANADA BROWN SEAWEED IN BIOFUEL IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 252 CANADA GREEN SEAWEED IN BIOFUEL IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 253 CANADA OTHERS IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 254 CANADA RED SEAWEED IN OTHERS IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 255 CANADA BROWN SEAWEED IN OTHERS IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 256 CANADA GREEN SEAWEED IN OTHERS IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 257 MEXICO COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 258 MEXICO RED SEAWEED IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 259 MEXICO BROWN SEAWEED IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 260 MEXICO GREEN SEAWEED IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 261 MEXICO COMMERCIAL SEAWEED MARKET, BY FORM, 2020-2029 (USD MILLION

TABLE 262 MEXICO COMMERCIAL SEAWEED MARKET, BY CULTIVATION, 2020-2029 (USD MILLION)

TABLE 263 MEXICO COMMERCIAL SEAWEED MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 264 MEXICO FOOD & BEVERAGES IN COMMERCIAL SEAWEED MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 265 MEXICO BAKERY PRODUCTS IN COMMERCIAL SEAWEED MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 266 MEXICO CONFECTIONERY IN COMMERCIAL SEAWEED MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 267 MEXICO PROCESSED FOOD IN COMMERCIAL SEAWEED MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 268 MEXICO DAIRY PRODUCTS IN COMMERCIAL SEAWEED MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 269 MEXICO BEVERAGES IN COMMERCIAL SEAWEED MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 270 MEXICO OTHERS IN COMMERCIAL SEAWEED MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 271 MEXICO FOOD & BEEVRAGES IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 272 MEXICO RED SEAWEED IN FOOD & BEVERAGES IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 273 MEXICO BROWN SEAWEED IN FOOD & BEVERAGES IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 274 MEXICO GREEN SEAWEED IN FOOD & BEVERAGES IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 275 MEXICO PHARMACEUTICALS IN COMMERCIAL SEAWEED MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 276 MEXICO PHARMACEUTICALS IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 277 MEXICO RED SEAWEED IN PHARMACEUTICALS IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 278 MEXICO BROWN SEAWEED IN PHARMACEUTICALS IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 279 MEXICO GREEN SEAWEED IN PHARMACEUTICALS IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 280 MEXICO AGRICULTURE IN COMMERCIAL SEAWEED MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 281 MEXICO AGRICULTURE IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 282 MEXICO RED SEAWEED IN AGRICULTURE IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 283 MEXICO BROWN SEAWEED IN AGRICULTURE IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 284 MEXICO GREEN SEAWEED IN AGRICULTURE IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 285 MEXICO ANIMAL FEED IN COMMERCIAL SEAWEED MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 286 MEXICO ANIMAL FEED IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 287 MEXICO RED SEAWEED IN ANIMAL FEED IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 288 MEXICO BROWN SEAWEED IN ANIMAL FEED IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 289 MEXICO GREEN SEAWEED IN ANIMAL FEED IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 290 MEXICO COSMETICS & PERSONAL CARE IN COMMERCIAL SEAWEED MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 291 MEXICO COSMETICS & PERSONAL CARE IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 292 MEXICO RED SEAWEED IN COSMETICS & PERSONAL CARE IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 293 MEXICO BROWN SEAWEED IN COSMETICS & PERSONAL CARE IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 294 MEXICO GREEN SEAWEED IN COSMETICS & PERSONAL CARE IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 295 MEXICO BIOFUEL IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 296 MEXICO RED SEAWEED IN BIOFUEL IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 297 MEXICO BROWN SEAWEED IN BIOFUEL IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 298 MEXICO GREEN SEAWEED IN BIOFUEL IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 299 MEXICO OTHERS IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 300 MEXICO RED SEAWEED IN OTHERS IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 301 MEXICO BROWN SEAWEED IN OTHERS IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 302 MEXICO GREEN SEAWEED IN OTHERS IN COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

Список рисунков

FIGURE 1 NORTH AMERICA COMMERCIAL SEAWEED MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA COMMERCIAL SEAWEED MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA COMMERCIAL SEAWEED MARKET : DROC ANALYSIS

FIGURE 4 NORTH AMERICA COMMERCIAL SEAWEED MARKET: NORTH AMERICA VS REGIONAL ANALYSIS

FIGURE 5 NORTH AMERICA COMMERCIAL SEAWEED MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA COMMERCIAL SEAWEED MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA COMMERCIAL SEAWEED MARKET: DBMR POSITION GRID

FIGURE 8 NORTH AMERICA COMMERCIAL SEAWEED MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA COMMERCIAL SEAWEED MARKET: SEGMENTATION

FIGURE 10 INCREASING APPLICATION OF COMMERICAL SEAWEED IN PHARMACEUTICAL AND PERSONAL CARE IS DRIVING THE GROWTH OF NORTH AMERICA COMMERCIAL SEAWEED MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 11 PRODUCT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA COMMERCIAL SEAWEED MARKET IN 2022 & 2029

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF NORTH AMERICA COMMERCIAL SEAWEED MARKET

FIGURE 13 NORTH AMERICA COMMERCIAL SEAWEED MARKET, BY PRODUCT, 2021

FIGURE 14 NORTH AMERICA COMMERCIAL SEAWEED MARKET, BY FORM, 2021

FIGURE 15 NORTH AMERICA COMMERCIAL SEAWEED MARKET, BY CULTIVATION, 2021

FIGURE 16 NORTH AMERICA COMMERCIAL SEAWEED MARKET: BY END USER, 2021

FIGURE 17 NORTH AMERICA COMMERCIAL SEAWEED MARKET: SNAPSHOT (2021)

FIGURE 18 NORTH AMERICA COMMERCIAL SEAWEED MARKET: BY COUNTRY (2021)

FIGURE 19 NORTH AMERICA COMMERCIAL SEAWEED MARKET: BY COUNTRY (2022 & 2029)

FIGURE 20 NORTH AMERICA COMMERCIAL SEAWEED MARKET: BY COUNTRY (2021 & 2029)

FIGURE 21 NORTH AMERICA COMMERCIAL SEAWEED MARKET: BY PRODUCT (2022 & 2029)

FIGURE 22 NORTH AMERICA COMMERCIAL SEAWEED MARKET: COMPANY SHARE 2021 (%)

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.