Биометрия на государственном рынке Северной Америки по режиму (распознавание отпечатков пальцев, распознавание лиц, распознавание радужной оболочки глаза, распознавание отпечатков ладоней, распознавание вен, распознавание подписи, распознавание голоса и другие), компонентам (аппаратное и программное обеспечение), типу (бесконтактная, контактная и гибридная/мультимодальная), аутентификации (однофакторная и многофакторная аутентификация), применению (гражданской, военной, правоохранительной, электронных паспортов, электронных виз, коммерческой и других), стране (Германия, Франция, Великобритания, Италия, Испания, Нидерланды, Швейцария, Россия, Турция, Бельгия и остальная часть Северной Америки). Тенденции отрасли и прогноз до 2028 года.

Анализ рынка и идеи: биометрия на государственном рынке Северной Америки

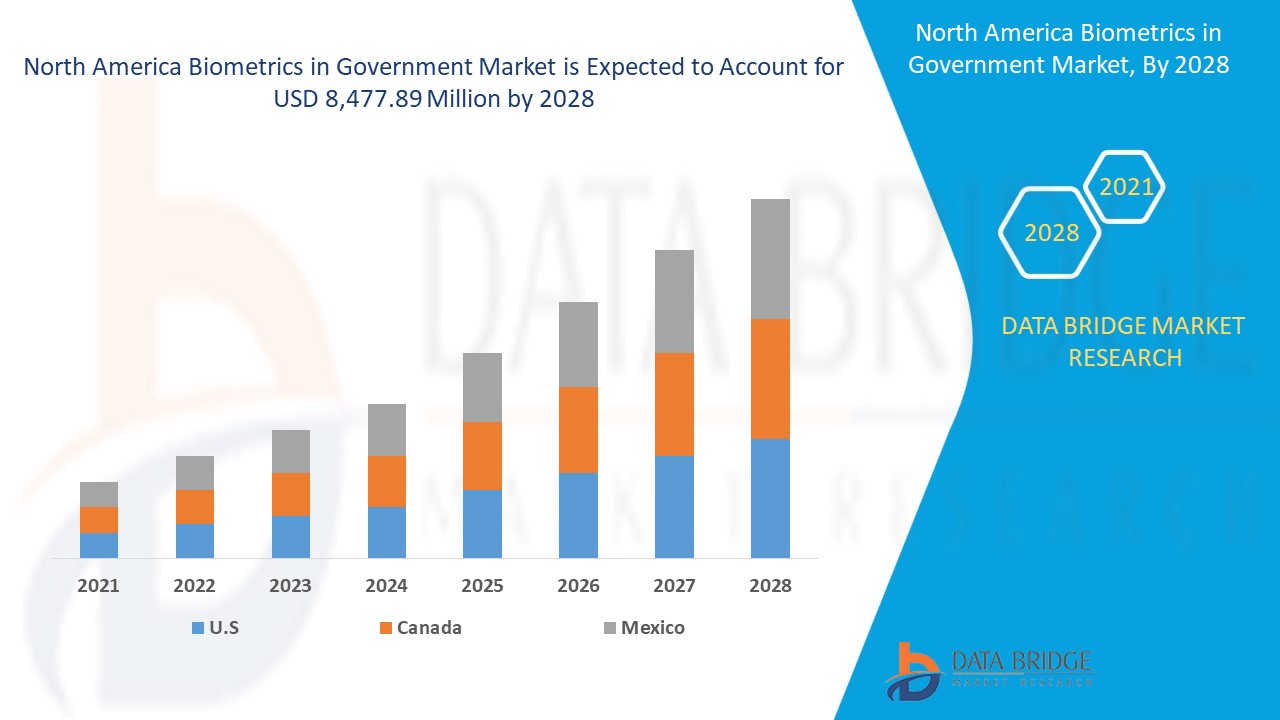

Ожидается, что рынок биометрии в государственном секторе Северной Америки будет расти в прогнозируемый период с 2021 по 2028 год. По данным Data Bridge Market Research, среднегодовой темп роста рынка составит 15,2% в прогнозируемый период с 2021 по 2028 год, и ожидается, что к 2028 году он достигнет 8 477,89 млн долларов США. Растущая потребность в обеспечении безопасности и наблюдения в сочетании с возросшей угрозой террористических атак является движущей силой роста рынка биометрии в государственном секторе.

Биометрия — это измерение и статистический анализ уникальных физических и поведенческих характеристик человека. Термин «биометрия» происходит от греческих слов bio — жизнь и metric — измерять. Для идентификации и контроля доступа человека используются различные технологии. При биометрической аутентификации будут точно идентифицированы внутренние физические или поведенческие черты каждого человека. Биометрия используется в каждой отрасли, такой как здравоохранение, автомобилестроение, бытовая электроника , военная промышленность и другие, для контроля доступа и идентификации и распознавания человека, находящегося под наблюдением. Система используется государственными органами для обеспечения безопасности своих граждан, использующих биометрию. Биометрию трудно подделать или украсть (в отличие от паролей), она проста и удобна в использовании, непередаваема и эффективна, поскольку шаблоны занимают меньше места.

Растущее использование биометрии в правительстве для ведения центральной базы данных граждан для национальной идентификации является основным движущим фактором на рынке. Риск нарушения безопасности из-за утечки данных может оказаться проблемой, а прогресс в технологиях и системах для применения биометрии в правительстве оказывается возможностью. Однако высокая стоимость развертывания и проблемы, возникающие из-за воздействия COVID-19 на цепочку поставок сырья, являются сдерживающими факторами.

Отчет о рынке биометрии в государственном секторе содержит подробную информацию о доле рынка, новых разработках и анализе продуктового портфеля, влиянии внутренних и локальных игроков рынка, анализирует возможности с точки зрения новых источников дохода, изменений в рыночных правилах, одобрений продуктов, стратегических решений, запусков продуктов, географических расширений и технологических инноваций на рынке. Чтобы понять анализ и сценарий рынка биометрии в государственном секторе, свяжитесь с Data Bridge Market Research для получения аналитического обзора, наша команда поможет вам создать решение по влиянию на доход для достижения желаемой цели.

Объем и размер рынка биометрии в государственном секторе Северной Америки

Североамериканский рынок биометрии в государственном секторе сегментирован на основе режима, компонентов, типа, аутентификации и применения. Рост среди сегментов помогает вам анализировать нишевые карманы роста и стратегии подхода к рынку и определять ваши основные области применения и разницу в ваших целевых рынках.

- На основе режима биометрия на государственном рынке сегментируется на распознавание отпечатков пальцев, распознавание лиц, распознавание радужной оболочки глаза, распознавание отпечатков ладоней, распознавание вен, распознавание подписи, распознавание голоса и т. д. В 2021 году распознавание отпечатков пальцев будет доминировать среди биометрических данных на государственном рынке из-за высокой скорости обнаружения.

- На основе компонентов биометрия на государственном рынке сегментируется на аппаратное и программное обеспечение. В 2021 году сегмент оборудования доминирует на рынке биометрии на государственном рынке из-за его более высокой стоимости.

- На основе типа биометрия на государственном рынке сегментируется на бесконтактную, контактную и гибридную/мультимодальную. В 2021 году бесконтактный сегмент доминирует на государственном рынке биометрии из-за опасений потребителей по поводу безопасности высоких технологий.

- На основе аутентификации биометрия на государственном рынке сегментируется на однофакторную аутентификацию и многофакторную аутентификацию. В 2021 году сегмент однофакторной аутентификации доминирует на государственном рынке биометрии, поскольку система быстрее и проще в развертывании.

- На основе сферы применения биометрия на государственном рынке сегментируется на гражданскую, военную, правоохранительную, электронные паспорта, электронные визы, коммерческую и др. В 2021 году гражданский сегмент доминирует над биометрией на государственном рынке из-за возросшего принятия биометрии для национальных удостоверений личности.

Анализ биометрии на государственном рынке Северной Америки на уровне страны

Проведен анализ биометрических данных на государственном рынке, а также предоставлена информация о размере рынка по стране, режиму, компонентам, типу, аутентификации и применению, как указано выше.

Страны, охваченные отчетом о рынке биометрии в правительстве, — это США, Канада и Мексика. США доминируют на рынке из-за более высоких производителей и спроса на биометрию в правительстве.

Раздел отчета по странам также содержит отдельные факторы, влияющие на рынок, и изменения в регулировании на внутреннем рынке, которые влияют на текущие и будущие тенденции рынка. Такие данные, как новые продажи, заменяющие продажи, демографические данные страны, нормативные акты и импортно-экспортные тарифы, являются одними из основных указателей, используемых для прогнозирования рыночного сценария для отдельных стран. Кроме того, при предоставлении прогнозного анализа данных по стране учитываются наличие и доступность брендов Северной Америки и их проблемы из-за большой или малой конкуренции со стороны местных и отечественных брендов, влияние каналов продаж.

Растущее использование биометрии в государственных целях для обеспечения безопасности и наблюдения стимулирует рост рынка биометрии в Северной Америке на государственном рынке

Биометрия Северной Америки на государственном рынке также предоставляет вам подробный анализ рынка для роста каждой страны на конкретном рынке. Кроме того, он предоставляет подробную информацию о стратегии участников рынка и их географическом присутствии. Данные доступны за исторический период с 2010 по 2019 год.

Конкурентная среда и анализ доли рынка биометрических данных в государственном секторе в Северной Америке

Биометрия на государственном рынке конкурентной среды предоставляет детали по конкурентам. Включены сведения о компании, финансы компании, полученный доход, рыночный потенциал, инвестиции в исследования и разработки, новые рыночные инициативы, производственные площадки и объекты, сильные и слабые стороны компании, запуск продукта, испытания продуктов конвейеров, одобрения продуктов, патенты, ширина продукта и широта, доминирование приложений, кривая жизненной линии технологий. Приведенные выше точки данных связаны только с фокусом компании, связанным с биометрией на государственном рынке.

Основными компаниями, которые занимаются биометрией в правительстве Северной Америки, являются Thales Group, NEC Corporation, HID Global Corporation, IDEMIA, Shenzhen Goodix Technology Co., Aratek, Aware, Inc., Paravision, SecuGen Corporation, BioID, Cognitec Systems GmbH, FUJITSU, id3 Technologies, Innovatrics, Integrated Biometrics, Jenetric GmbH и BIO-key International среди других отечественных игроков. Аналитики DBMR понимают конкурентные преимущества и предоставляют конкурентный анализ для каждого конкурента отдельно.

Множество контрактов и соглашений также инициируются компаниями по всему миру, которые также ускоряют внедрение биометрии на государственном рынке.

Например,

- В январе 2021 года Jenetric GmbH представляет антимикробное покрытие для сканеров отпечатков пальцев, чтобы защитить пользователя от любого вида инфекции. Покрытие предотвращает передачу микроорганизмов и вносит ценный вклад в профилактику инфекций. Самое важное в покрытии то, что оно не влияет на качество отпечатков пальцев сканера. Благодаря этому компания сможет предоставить своему пользователю постоянное решение для защиты от инфекций.

- В июне 2021 года компания Aware, Inc. объявила о партнерстве с Iris ID Systems Inc., мировым лидером в области технологий распознавания радужной оболочки глаза и аутентификации личности. Благодаря этому партнерству компании будут разрабатывать быструю и точную идентификацию на основе радужной оболочки глаза для различных случаев использования в уголовном правосудии. Объединив программное обеспечение AwareABIS и Nexa|Iris от Aware с оборудованием Iris ID, компании будут производить систему. Это поможет компании расширить свой продуктовый портфель.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Содержание

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA BIOMETRICS IN GOVERNMENT MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MARKET APPLICATION COVERAGE GRID

2.9 MULTIVARIATE MODELING

2.1 MODE TIMELINE CURVE

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING USE OF BIOMETRICS IN CONSUMER ELECTRONIC DEVICES FOR AUTHENTICATION AND IDENTIFICATION

5.1.2 GROWING NEED FOR SECURITY AND SURVEILLANCE WITH THE HEIGHTENED THREAT OF TERRORIST ATTACK

5.1.3 UPSURGE IN THE USAGE OF BIOMETRIC IN E-PASSPORT, E-VISAS AND NATIONAL ID CARDS

5.1.4 GROWING UTILIZATION OF ADVANCED BIOMETRICS FOR SAFE AND SECURED CROSS-BORDER MOBILITY

5.1.5 GOVERNMENT INITIATIVES SUPPORTING THE ADOPTION OF BIOMETRICS

5.1.6 INCREASING USE OF BIOMETRIC SYSTEMS IN THE ORGANIZATION FOR TIME AND ATTENDANCE

5.2 RESTRAINT

5.2.1 HIGH DEPLOYMENT COST OF BIOMETRIC SYSTEM

5.3 OPPORTUNITIES

5.3.1 IMPLICATION OF CONTACTLESS BIOMETRIC AUTHENTICATION

5.3.2 GROWING ADVANCEMENT IN BIOMETRIC IDENTIFICATION TECHNOLOGY

5.3.3 EXPANSION IN DEMAND FOR STRENGTHENING OF SYSTEMS AND MONITORING SERVICES

5.4 CHALLENGES

5.4.1 SECURITY CONCERNS REGARDING DATA BREACH

5.4.2 LACK OF TECHNICAL KNOW-HOW AND AWARENESS AMONG THE PEOPLE

6 IMPACT OF COVID-19 ON THE NORTH AMERICA BIOMETRICS IN GOVERNMENT MARKET

6.1 ANALYSIS ON IMPACT OF COVID-19 ON THE MARKET

6.2 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE MARKET

6.3 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.4 IMPACT ON DEMAND

6.5 IMPACT ON SUPPLY CHAIN

6.6 CONCLUSION

7 NORTH AMERICA BIOMETRICS IN GOVERNMENT MARKET, BY MODE

7.1 OVERVIEW

7.2 FINGERPRINT RECOGNITION

7.2.1 BY TECHNOLOGY

7.2.1.1 Optical

7.2.1.2 Capacitive

7.2.1.3 Ultrasonic

7.2.1.4 Thermal

7.3 FACE RECOGNITION

7.3.1 BY APPLICATION

7.3.1.1 Access Control

7.3.1.2 Security and Surveillance

7.3.1.3 Attendance tracking and Monitoring

7.3.1.4 Emotion recognition

7.4 IRIS RECOGNITION

7.4.1 BY APPLICATION

7.4.1.1 identity management and access control

7.4.1.2 time monitoring

7.4.1.3 E-payment

7.5 PALMPRINT RECOGNITION

7.6 VEIN RECOGNITION

7.6.1 BY TYPE

7.6.1.1 Finger vein recognition

7.6.1.2 palm vein recognition

7.6.1.3 eye vein recognition

7.7 SIGNATURE RECOGNITION

7.8 VOICE RECOGNITION

7.8.1 BY TYPE

7.8.1.1 Artificial intelligence

7.8.1.2 non-Artificial intelligence

7.9 OTHERS

8 NORTH AMERICA BIOMETRICS IN GOVERNMENT MARKET, BY COMPONENTS

8.1 OVERVIEW

8.2 HARDWARE

8.2.1 BY TYPE

8.2.1.1 Microcontroller

8.2.1.2 cameras

8.2.1.3 scanners

8.2.1.4 Finger print readers

8.2.1.5 others

8.3 SOFTWARE

9 NORTH AMERICA BIOMETRICS IN GOVERNMENT MARKET, BY TYPE

9.1 OVERVIEW

9.2 CONTACTLESS

9.3 CONTACT-BASED

9.4 HYBRID/MULTIMODAL

10 NORTH AMERICA BIOMETRICS IN GOVERNMENT MARKET, BY AUTHENTICATION

10.1 OVERVIEW

10.2 SINGLE FACTOR AUTHENTICATION

10.3 MULTIPLE FACTOR AUTHENTICATION

11 NORTH AMERICA BIOMETRICS IN GOVERNMENT MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 CIVIL

11.2.1 CIVIL, BY TYPE

11.2.1.1 national id

11.2.1.2 Civil boarder immigration/ border control

11.2.1.3 voter registration and voting

11.2.1.4 employee background checks

11.2.2 CIVIL, BY COMPONENTS

11.2.2.1 Hardware

11.2.2.1.1 Microcontroller

11.2.2.1.2 cameras

11.2.2.1.3 scanners

11.2.2.1.4 Fingerprint Readers

11.2.2.1.5 Others

11.2.2.2 Software

11.3 MILITARY

11.3.1 MILITARY, BY TYPE

11.3.1.1 protection of military bases

11.3.1.2 illegal border crossing/asylum application processing

11.3.2 BY COMPONENTS

11.3.2.1 Hardware

11.3.2.1.1 Microcontroller

11.3.2.1.2 cameras

11.3.2.1.3 scanners

11.3.2.1.4 Fingerprint Readers

11.3.2.1.5 Others

11.3.2.2 Software

11.4 LAW ENFORCEMENT

11.4.1 LAW ENFORCEMENT, BY PRODUCT TYPE

11.4.1.1 police booking systems

11.4.1.2 latent fingerprint machine

11.4.1.3 public safety

11.4.1.4 rapid id products

11.4.2 LAW ENFORCEMENT, BY COMPONENTS

11.4.2.1 Hardware

11.4.2.1.1 Microcontroller

11.4.2.1.2 cameras

11.4.2.1.3 scanners

11.4.2.1.4 Fingerprint Readers

11.4.2.1.5 Others

11.4.2.2 Software

11.5 E-PASSPORT

11.5.1 E-PASSPORT, BY COMPONENTS

11.5.1.1 Hardware

11.5.1.1.1 Microcontroller

11.5.1.1.2 cameras

11.5.1.1.3 scanners

11.5.1.1.4 Fingerprint Readers

11.5.1.1.5 Others

11.5.1.2 Software

11.6 E-VISAS

11.6.1 E-VISAS, BY COMPONENTS

11.6.1.1 Hardware

11.6.1.1.1 Microcontroller

11.6.1.1.2 cameras

11.6.1.1.3 scanners

11.6.1.1.4 Fingerprint Readers

11.6.1.1.5 Others

11.6.1.2 Software

11.7 COMMERCIAL

11.7.1 COMMERCIAL, BY TYPE

11.7.1.1 banking with biometrics

11.7.1.2 healthcare and welfare

11.7.1.3 Biometrics in restaurant point-of-sale

11.7.2 COMMERCIAL, BY COMPONENTS

11.7.2.1 Hardware

11.7.2.1.1 Microcontroller

11.7.2.1.2 cameras

11.7.2.1.3 scanners

11.7.2.1.4 Fingerprint Readers

11.7.2.1.5 Others

11.7.2.2 Software

11.8 OTHER

12 NORTH AMERICA BIOMETRICS IN GOVERNMENT MARKET, BY REGION

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

13 NORTH AMERICA BIOMETRICS IN GOVERNMENT MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 THALES GROUP

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 SOLUTION PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.2 NEC CORPORATION

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 SOLUTION & SERVICE PORTFOLIO

15.2.5 RECENT DEVELOPMENTS

15.3 HID NORTH AMERICA CORPORATION

15.3.1 COMPANY SNAPSHOT

15.3.2 COMPANY SHARE ANALYSIS

15.3.3 SOLUTION PORTFOLIO

15.3.4 RECENT DEVELOPMENTS

15.4 IDEMIA

15.4.1 COMPANY SNAPSHOT

15.4.2 COMPANY SHARE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENTS

15.5 SHENZHEN GOODIX TECHNOLOGY CO., LTD.

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENTS

15.6 ARATEK

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENTS

15.7 AWARE, INC.

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENTS

15.8 BEIJING KUANGSHI TECHNOLOGY CO.,LTD.

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENTS

15.9 BIOENABLE TECHNOLOGIES PVT. LTD.

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENTS

15.1 BIOID

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENTS

15.11 BIO-KEY INTERNATIONAL

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 PRODUCT PORTFOLIO

15.11.4 RECENT DEVELOPMENTS

15.12 COGNITEC SYSTEMS GMBH

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENTS

15.13 FUJITSU

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 PRODUCT PORTFOLIO

15.13.4 RECENT DEVELOPMENTS

15.14 ID3 TECHOLOGIES

15.14.1 COMPANY SNAPSHOT

15.14.2 SOLUTION & PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENTS

15.15 INNOVATRICS

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENTS

15.16 INTEGRATED BIOMETRICS

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENTS

15.17 JENETRIC GMBH

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENTS

15.18 PARAVISION

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENTS

15.19 SECUGEN CORPORATION

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENTS

15.2 SENSETIME

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

Список таблиц

LIST OF TABLES

TABLE 1 HIGH DEPLOYMENT COST OF BIOMETRIC SYSTEM

TABLE 2 COST OF DIFFERENT TYPES OF BIOMETRIC SYSTEM

TABLE 3 EFFECT OF SECURITY AWARENESS TRAINING ON THE USE OF BIOMETRIC AUTHENTICATION

TABLE 4 NORTH AMERICA BIOMETRICS IN GOVERNMENT MARKET, BY MODE, 2019-2028 (USD MILLION)

TABLE 5 NORTH AMERICA FINGERPRINT RECOGNITION IN BIOMETRICS IN GOVERNMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 6 NORTH AMERICA FINGERPRINT RECOGNITION IN BIOMETRICS IN GOVERNMENT MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 7 NORTH AMERICA FACE RECOGNITION IN BIOMETRICS IN GOVERNMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 8 NORTH AMERICA FACE RECOGNITION IN BIOMETRICS IN GOVERNMENT MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 9 NORTH AMERICA IRIS RECOGNITION IN BIOMETRICS IN GOVERNMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 10 NORTH AMERICA IRIS RECOGNITION IN BIOMETRICS IN GOVERNMENT MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 11 NORTH AMERICA PALMPRINT RECOGNITION IN BIOMETRICS IN GOVERNMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 12 NORTH AMERICA VEIN RECOGNITION IN BIOMETRICS IN GOVERNMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 13 NORTH AMERICA VEIN RECOGNITION IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 14 NORTH AMERICA SIGNATURE RECOGNITION IN BIOMETRICS IN GOVERNMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 15 NORTH AMERICA VOICE RECOGNITION IN BIOMETRICS IN GOVERNMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 16 NORTH AMERICA VOICE RECOGNITION IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 17 NORTH AMERICA OTHERS IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 18 NORTH AMERICA BIOMETRICS IN GOVERNMENT MARKET, BY COMPONENTS, 2019-2028 (USD MILLION)

TABLE 19 NORTH AMERICA HARDWARE IN BIOMETRICS IN GOVERNMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 20 NORTH AMERICA HARDWARE IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 21 NORTH AMERICA SOFTWARE IN BIOMETRICS IN GOVERNMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 22 NORTH AMERICA BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 23 NORTH AMERICA CONTACTLESS IN BIOMETRICS IN GOVERNMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 24 NORTH AMERICA CONTACT-BASED IN BIOMETRICS IN GOVERNMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 25 NORTH AMERICA HYBRID/MULTIMODAL IN BIOMETRICS IN GOVERNMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 26 NORTH AMERICA BIOMETRICS IN GOVERNMENT MARKET, BY AUTHENTICATION, 2019-2028 (USD MILLION)

TABLE 27 NORTH AMERICA SINGLE FACTOR AUTHENTICATION IN BIOMETRICS IN GOVERNMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 28 NORTH AMERICA MULTIPLE FACTOR AUTHENTICATION IN BIOMETRICS IN GOVERNMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 29 NORTH AMERICA BIOMETRICS IN GOVERNMENT MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 30 NORTH AMERICA CIVIL IN BIOMETRICS IN GOVERNMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 31 NORTH AMERICA CIVIL IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 32 NORTH AMERICA CIVIL IN BIOMETRICS IN GOVERNMENT MARKET, BY COMPONENTS, 2019-2028 (USD MILLION)

TABLE 33 NORTH AMERICA HARDWARE IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 34 NORTH AMERICA MILITARY IN BIOMETRICS IN GOVERNMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 35 NORTH AMERICA MILITARY IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 36 NORTH AMERICA MILITARY IN BIOMETRICS IN GOVERNMENT MARKET, BY COMPONENTS, 2019-2028 (USD MILLION)

TABLE 37 NORTH AMERICA HARDWARE IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 38 NORTH AMERICA LAW ENFORCEMENT IN BIOMETRICS IN GOVERNMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 39 NORTH AMERICA LAW ENFORCEMENT IN BIOMETRICS IN GOVERNMENT MARKET, BY PRODUCT TYPE, 2019-2028 (USD MILLION)

TABLE 40 NORTH AMERICA LAW ENFORCEMENT IN BIOMETRICS IN GOVERNMENT MARKET, BY COMPONENTS, 2019-2028 (USD MILLION)

TABLE 41 NORTH AMERICA HARDWARE IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 42 NORTH AMERICA E-PASSPORT IN BIOMETRICS IN GOVERNMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 43 NORTH AMERICA E-PASSPORT IN BIOMETRICS IN GOVERNMENT MARKET, BY COMPONENTS, 2019-2028 (USD MILLION)

TABLE 44 NORTH AMERICA HARDWARE IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 45 NORTH AMERICA E-VISAS IN BIOMETRICS IN GOVERNMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 46 NORTH AMERICA E-VISAS IN BIOMETRICS IN GOVERNMENT MARKET, BY COMPONENTS, 2019-2028 (USD MILLION)

TABLE 47 NORTH AMERICA HARDWARE IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 48 NORTH AMERICA COMMERCIAL IN BIOMETRICS IN GOVERNMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 49 NORTH AMERICA COMMERCIAL IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 50 NORTH AMERICA COMMERCIAL IN BIOMETRICS IN GOVERNMENT MARKET, BY COMPONENTS, 2019-2028 (USD MILLION)

TABLE 51 NORTH AMERICA HARDWARE IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 52 NORTH AMERICA OTHER IN BIOMETRICS IN GOVERNMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 53 NORTH AMERICA BIOMETRICS IN GOVERNMENT MARKET, BY COUNTRY, 2019-2028 (USD MILLION)

TABLE 54 NORTH AMERICA BIOMETRICS IN GOVERNMENT MARKET, BY MODE, 2019-2028 (USD MILLION)

TABLE 55 NORTH AMERICA FINGERPRINT RECOGNITION IN BIOMETRICS IN GOVERNMENT MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 56 NORTH AMERICA FACE RECOGNITION IN BIOMETRICS IN GOVERNMENT MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 57 NORTH AMERICA IRIS RECOGNITION IN BIOMETRICS IN GOVERNMENT MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 58 NORTH AMERICA VEIN RECOGNITION IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 59 NORTH AMERICA VOICE RECOGNITION IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 60 NORTH AMERICA BIOMETRICS IN GOVERNMENT MARKET, BY COMPONENTS, 2019-2028 (USD MILLION)

TABLE 61 NORTH AMERICA HARDWARE IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 62 NORTH AMERICA BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 63 NORTH AMERICA BIOMETRICS IN GOVERNMENT MARKET, BY AUTHENTICATION, 2019-2028 (USD MILLION)

TABLE 64 NORTH AMERICA BIOMETRICS IN GOVERNMENT MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 65 NORTH AMERICA CIVIL IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 66 NORTH AMERICA CIVIL IN BIOMETRICS IN GOVERNMENT MARKET, BY COMPONENTS, 2019-2028 (USD MILLION)

TABLE 67 NORTH AMERICA HARDWARE IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 68 NORTH AMERICA MILITARY IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 69 NORTH AMERICA MILITARY IN BIOMETRICS IN GOVERNMENT MARKET, BY COMPONENTS, 2019-2028 (USD MILLION)

TABLE 70 NORTH AMERICA HARDWARE IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 71 NORTH AMERICA LAW ENFORCEMENT IN BIOMETRICS IN GOVERNMENT MARKET, BY PRODUCT TYPE, 2019-2028 (USD MILLION)

TABLE 72 NORTH AMERICA LAW ENFORCEMENT IN BIOMETRICS IN GOVERNMENT MARKET, BY COMPONENTS, 2019-2028 (USD MILLION)

TABLE 73 NORTH AMERICA HARDWARE IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 74 NORTH AMERICA E-PASSPORT IN BIOMETRICS IN GOVERNMENT MARKET, BY COMPONENTS, 2019-2028 (USD MILLION)

TABLE 75 NORTH AMERICA HARDWARE IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 76 NORTH AMERICA E-VISAS IN BIOMETRICS IN GOVERNMENT MARKET, BY COMPONENTS, 2019-2028 (USD MILLION)

TABLE 77 NORTH AMERICA HARDWARE IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 78 NORTH AMERICA COMMERCIAL IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 79 NORTH AMERICA COMMERCIAL IN BIOMETRICS IN GOVERNMENT MARKET, BY COMPONENTS, 2019-2028 (USD MILLION)

TABLE 80 NORTH AMERICA HARDWARE IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 81 U.S. BIOMETRICS IN GOVERNMENT MARKET, BY MODE, 2019-2028 (USD MILLION)

TABLE 82 U.S. FINGERPRINT RECOGNITION IN BIOMETRICS IN GOVERNMENT MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 83 U.S. FACE RECOGNITION IN BIOMETRICS IN GOVERNMENT MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 84 U.S. IRIS RECOGNITION IN BIOMETRICS IN GOVERNMENT MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 85 U.S. VEIN RECOGNITION IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 86 U.S. VOICE RECOGNITION IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 87 U.S. BIOMETRICS IN GOVERNMENT MARKET, BY COMPONENTS, 2019-2028 (USD MILLION)

TABLE 88 U.S. HARDWARE IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 89 U.S. BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 90 U.S. BIOMETRICS IN GOVERNMENT MARKET, BY AUTHENTICATION, 2019-2028 (USD MILLION)

TABLE 91 U.S. BIOMETRICS IN GOVERNMENT MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 92 U.S. CIVIL IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 93 U.S. CIVIL IN BIOMETRICS IN GOVERNMENT MARKET, BY COMPONENTS, 2019-2028 (USD MILLION)

TABLE 94 U.S. HARDWARE IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 95 U.S. MILITARY IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 96 U.S. MILITARY IN BIOMETRICS IN GOVERNMENT MARKET, BY COMPONENTS, 2019-2028 (USD MILLION)

TABLE 97 U.S. HARDWARE IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 98 U.S. LAW ENFORCEMENT IN BIOMETRICS IN GOVERNMENT MARKET, BY PRODUCT TYPE, 2019-2028 (USD MILLION)

TABLE 99 U.S. LAW ENFORCEMENT IN BIOMETRICS IN GOVERNMENT MARKET, BY COMPONENTS, 2019-2028 (USD MILLION)

TABLE 100 U.S. HARDWARE IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 101 U.S. E-PASSPORT IN BIOMETRICS IN GOVERNMENT MARKET, BY COMPONENTS, 2019-2028 (USD MILLION)

TABLE 102 U.S. HARDWARE IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 103 U.S. E-VISAS IN BIOMETRICS IN GOVERNMENT MARKET, BY COMPONENTS, 2019-2028 (USD MILLION)

TABLE 104 U.S. HARDWARE IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 105 U.S. COMMERCIAL IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 106 U.S. COMMERCIAL IN BIOMETRICS IN GOVERNMENT MARKET, BY COMPONENTS, 2019-2028 (USD MILLION)

TABLE 107 U.S. HARDWARE IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 108 CANADA BIOMETRICS IN GOVERNMENT MARKET, BY MODE, 2019-2028 (USD MILLION)

TABLE 109 CANADA FINGERPRINT RECOGNITION IN BIOMETRICS IN GOVERNMENT MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 110 CANADA FACE RECOGNITION IN BIOMETRICS IN GOVERNMENT MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 111 CANADA IRIS RECOGNITION IN BIOMETRICS IN GOVERNMENT MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 112 CANADA VEIN RECOGNITION IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 113 CANADA VOICE RECOGNITION IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 114 CANADA BIOMETRICS IN GOVERNMENT MARKET, BY COMPONENTS, 2019-2028 (USD MILLION)

TABLE 115 CANADA HARDWARE IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 116 CANADA BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 117 CANADA BIOMETRICS IN GOVERNMENT MARKET, BY AUTHENTICATION, 2019-2028 (USD MILLION)

TABLE 118 CANADA BIOMETRICS IN GOVERNMENT MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 119 CANADA CIVIL IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 120 CANADA CIVIL IN BIOMETRICS IN GOVERNMENT MARKET, BY COMPONENTS, 2019-2028 (USD MILLION)

TABLE 121 CANADA HARDWARE IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 122 CANADA MILITARY IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 123 CANADA MILITARY IN BIOMETRICS IN GOVERNMENT MARKET, BY COMPONENTS, 2019-2028 (USD MILLION)

TABLE 124 CANADA HARDWARE IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 125 CANADA LAW ENFORCEMENT IN BIOMETRICS IN GOVERNMENT MARKET, BY PRODUCT TYPE, 2019-2028 (USD MILLION)

TABLE 126 CANADA LAW ENFORCEMENT IN BIOMETRICS IN GOVERNMENT MARKET, BY COMPONENTS, 2019-2028 (USD MILLION)

TABLE 127 CANADA HARDWARE IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 128 CANADA E-PASSPORT IN BIOMETRICS IN GOVERNMENT MARKET, BY COMPONENTS, 2019-2028 (USD MILLION)

TABLE 129 CANADA HARDWARE IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 130 CANADA E-VISAS IN BIOMETRICS IN GOVERNMENT MARKET, BY COMPONENTS, 2019-2028 (USD MILLION)

TABLE 131 CANADA HARDWARE IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 132 CANADA COMMERCIAL IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 133 CANADA COMMERCIAL IN BIOMETRICS IN GOVERNMENT MARKET, BY COMPONENTS, 2019-2028 (USD MILLION)

TABLE 134 CANADA HARDWARE IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 135 MEXICO BIOMETRICS IN GOVERNMENT MARKET, BY MODE, 2019-2028 (USD MILLION)

TABLE 136 MEXICO FINGERPRINT RECOGNITION IN BIOMETRICS IN GOVERNMENT MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 137 MEXICO FACE RECOGNITION IN BIOMETRICS IN GOVERNMENT MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 138 MEXICO IRIS RECOGNITION IN BIOMETRICS IN GOVERNMENT MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 139 MEXICO VEIN RECOGNITION IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 140 MEXICO VOICE RECOGNITION IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 141 MEXICO BIOMETRICS IN GOVERNMENT MARKET, BY COMPONENTS, 2019-2028 (USD MILLION)

TABLE 142 MEXICO HARDWARE IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 143 MEXICO BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 144 MEXICO BIOMETRICS IN GOVERNMENT MARKET, BY AUTHENTICATION, 2019-2028 (USD MILLION)

TABLE 145 MEXICO BIOMETRICS IN GOVERNMENT MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 146 MEXICO CIVIL IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 147 MEXICO CIVIL IN BIOMETRICS IN GOVERNMENT MARKET, BY COMPONENTS, 2019-2028 (USD MILLION)

TABLE 148 MEXICO HARDWARE IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 149 MEXICO MILITARY IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 150 MEXICO MILITARY IN BIOMETRICS IN GOVERNMENT MARKET, BY COMPONENTS, 2019-2028 (USD MILLION)

TABLE 151 MEXICO HARDWARE IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 152 MEXICO LAW ENFORCEMENT IN BIOMETRICS IN GOVERNMENT MARKET, BY PRODUCT TYPE, 2019-2028 (USD MILLION)

TABLE 153 MEXICO LAW ENFORCEMENT IN BIOMETRICS IN GOVERNMENT MARKET, BY COMPONENTS, 2019-2028 (USD MILLION)

TABLE 154 MEXICO HARDWARE IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 155 MEXICO E-PASSPORT IN BIOMETRICS IN GOVERNMENT MARKET, BY COMPONENTS, 2019-2028 (USD MILLION)

TABLE 156 MEXICO HARDWARE IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 157 MEXICO E-VISAS IN BIOMETRICS IN GOVERNMENT MARKET, BY COMPONENTS, 2019-2028 (USD MILLION)

TABLE 158 MEXICO HARDWARE IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 159 MEXICO COMMERCIAL IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 160 MEXICO COMMERCIAL IN BIOMETRICS IN GOVERNMENT MARKET, BY COMPONENTS, 2019-2028 (USD MILLION)

TABLE 161 MEXICO HARDWARE IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

Список рисунков

LIST OF FIGURES

FIGURE 1 NORTH AMERICA BIOMETRICS IN GOVERNMENT MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA BIOMETRICS IN GOVERNMENT MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA BIOMETRICS IN GOVERNMENT MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA BIOMETRICS IN GOVERNMENT MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA BIOMETRICS IN GOVERNMENT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA BIOMETRICS IN GOVERNMENT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA BIOMETRICS IN GOVERNMENT MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA BIOMETRICS IN GOVERNMENT MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA BIOMETRICS IN GOVERNMENT MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 NORTH AMERICA BIOMETRICS IN GOVERNMENT MARKET: SEGMENTATION

FIGURE 11 INCREASE USE OF BIOMETRICS IN CONSUMER ELECTRONIC DEVICES FOR AUTHENTICATION AND IDENTIFICATION IS EXPECTED TO DRIVE NORTH AMERICA BIOMETRICS IN GOVERNMENT MARKET IN THE FORECAST PERIOD OF 2021 TO 2028

FIGURE 12 FINGERPRINT RECOGNITION SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF NORTH AMERICA BIOMETRICS IN GOVERNMENT MARKET IN 2021 & 2028

FIGURE 13 DRIVERS, RESTRAINT, OPPORTUNITIES AND CHALLENGES OF NORTH AMERICA BIOMETRICS IN GOVERNMENT MARKET

FIGURE 14 NORTH AMERICA BIOMETRICS IN GOVERNMENT MARKET, BY MODE, 2020

FIGURE 15 NORTH AMERICA BIOMETRICS IN GOVERNMENT MARKET, BY COMPONENTS, 2020

FIGURE 16 NORTH AMERICA BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2020

FIGURE 17 NORTH AMERICA BIOMETRICS IN GOVERNMENT MARKET, BY AUTHENTICATION, 2020

FIGURE 18 NORTH AMERICA BIOMETRICS IN GOVERNMENT MARKET, BY APPLICATION, 2020

FIGURE 19 NORTH AMERICA BIOMETRICS IN GOVERNMENT MARKET: SNAPSHOT (2020)

FIGURE 20 NORTH AMERICA BIOMETRICS IN GOVERNMENT MARKET: BY COUNTRY (2020)

FIGURE 21 NORTH AMERICA BIOMETRICS IN GOVERNMENT MARKET: BY COUNTRY (2021 & 2028)

FIGURE 22 NORTH AMERICA BIOMETRICS IN GOVERNMENT MARKET: BY COUNTRY (2020 & 2028)

FIGURE 23 NORTH AMERICA BIOMETRICS IN GOVERNMENT MARKET: BY MODE (2021-2028)

FIGURE 24 NORTH AMERICA BIOMETRICS IN GOVERNMENT MARKET: COMPANY SHARE 2020 (%)

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.