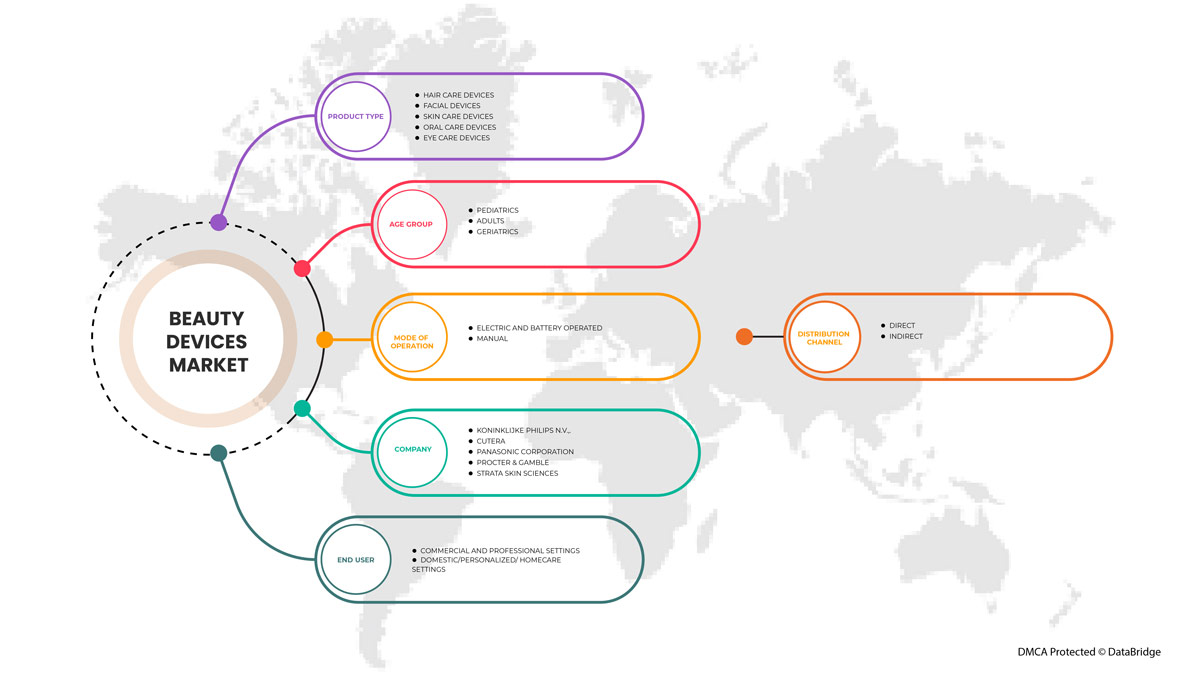

Рынок косметических устройств Северной Америки по типу продукта (устройства для ухода за волосами, устройства для лица, устройства для ухода за кожей, устройства для ухода за полостью рта и устройства для ухода за глазами), возрастной группе (дети, взрослые и гериатрии), режиму работы (электрический, с батарейным питанием и ручной) ), Конечный пользователь (коммерческие и профессиональные настройки и домашние/персонализированные настройки/настройки для ухода на дому), Канал распространения (прямой и косвенный), Тенденции отрасли и прогноз до 2029 года.

Анализ и аналитика рынка косметических устройств в Северной Америке

Растущая осведомленность о коже как среди мужчин, так и среди женщин увеличила спрос на косметические устройства. Проблемы, связанные с кожей, такие как складки, прыщи, пигментация, морщины, а также шрамы от ожогов в результате несчастных случаев, чрезвычайно распространены среди людей, которые требуют соответствующего лечения для улучшения внешнего вида кожи.

Рынок косметических устройств в прогнозируемом году будет расти по нескольким причинам, таким как растущая осведомленность потребителей о своей красивой внешности и улучшение образа жизни потребителей. Наряду с этим производители занимаются исследованиями и разработками для вывода на рынок косметических устройств передовых продуктов, основанных на новых технологиях.

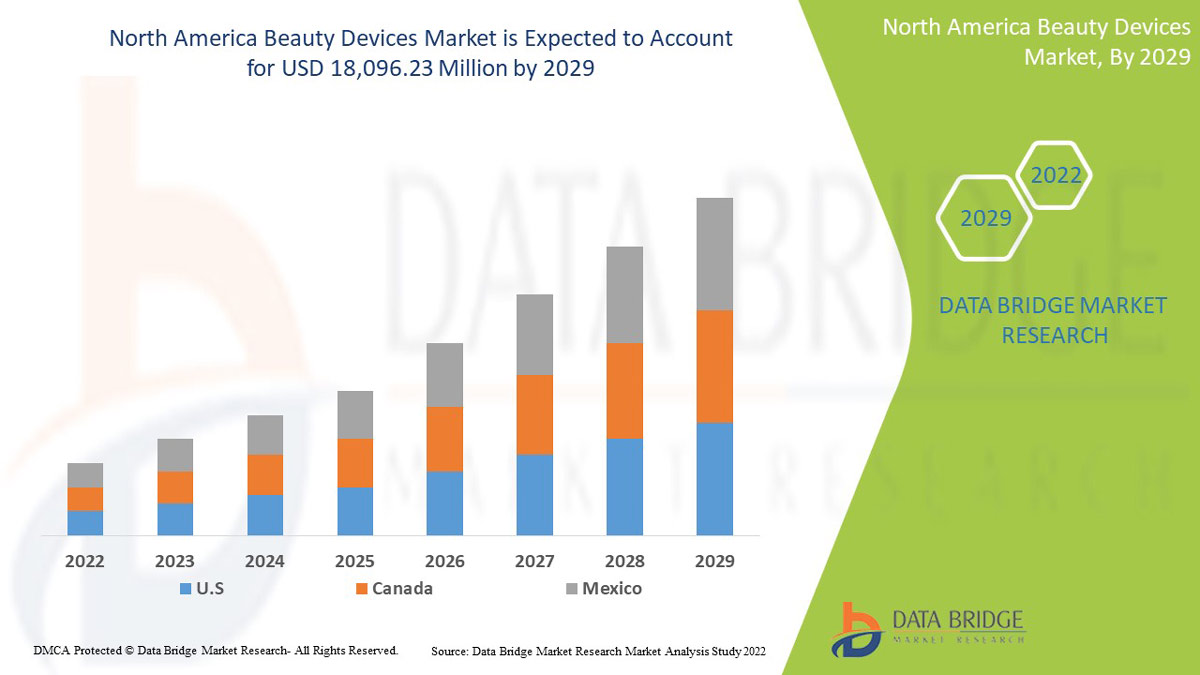

Ожидается, что рынок косметических устройств в Северной Америке будет расти в прогнозируемом периоде с 2022 по 2029 год. Исследование Data Bridge Market Research анализирует, что рынок растет со среднегодовым темпом 13,5% в прогнозируемый период с 2022 по 2029 год и, как ожидается, достигнет доллара США. 18 096,23 миллиона к 2029 году.

|

Отчет по метрике |

Подробности |

|

Прогнозный период |

2022–2029 гг. |

|

Базисный год |

2021 год |

|

Исторические годы |

2020 г. (настраивается на 2019–2014 гг.) |

|

Количественные единицы |

Выручка в миллионах долларов США, объемы в единицах, цены в долларах США. |

|

Охваченные сегменты |

Тип продукта (устройства для ухода за волосами, устройства для лица, устройства для ухода за кожей, устройства для ухода за полостью рта и устройства для ухода за глазами), возрастная группа (дети, взрослые и гериатрии), режим работы (электрический, с батарейным питанием и ручной), конечный пользователь (коммерческий). и «Профессиональные настройки» и «Домашние/персонализированные/услуги по уходу на дому»), Канал распространения (прямой и косвенный). |

|

Охваченные страны |

США, Канада, Мексика |

|

Охваченные игроки рынка |

Nu Skin, CANDELA CORPORATION, Curallux LLC, FOREO, Koninklijke Philips NV, Conair Corporation, Lumenis Be Ltd, Cynosure, Sciton, Inc., Fotona, Procter & Gamble, LUTRONIC, STRATA Skin Sciences, NuFACE, Spectrum Brands, Inc., Cutera , Merz North America, Inc., Panasonic Corporation, Procter & Gamble и другие. |

Определение рынка косметических устройств в Северной Америке

Красота является неотъемлемой характеристикой как женщин, так и мужчин. Косметические устройства используются для решения различных проблем, связанных с внешним видом, включая волосы, лицо, кожу, ротовую полость и глаза. Косметические устройства чрезвычайно полезны для решения проблем, связанных с красотой. На рынке продаются различные типы косметических устройств, таких как устройства для ухода за волосами, устройства для лица, устройства для ухода за кожей, устройства для ухода за полостью рта и устройства для ухода за глазами, которые используются для улучшения внешнего вида.

Устройства для терапии светом / светодиодами и фотоомоложением — это форма косметической системы, которая использует узкополосную и нетепловую энергию светодиодного света для активации естественных клеточных процессов в организме, способствуя омоложению и восстановлению кожи. Борьба со старением является одной из самых серьезных проблем в сфере красоты. Случаи борьбы со старением растут очень быстро, а косметические устройства нацелены на многочисленные признаки борьбы со старением и уменьшают появление широкого спектра признаков старения, включая морщины. или тонкие линии. Индустрия красоты фрагментирована из-за появления на рынке продуктов, основанных на передовых технологиях, которые получили широкое распространение среди конечных пользователей.

Динамика рынка косметических устройств в Северной Америке

В этом разделе рассматривается понимание движущих сил рынка, возможностей, ограничений и проблем. Все это подробно рассмотрено ниже:

ВОДИТЕЛИ

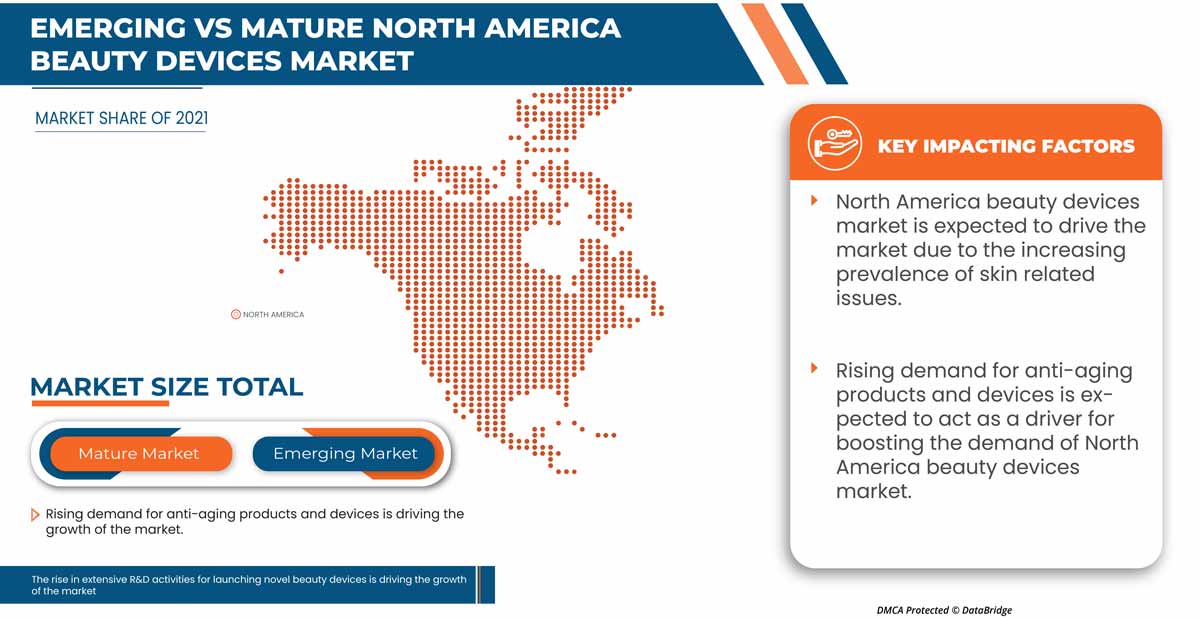

Растущий спрос на антивозрастные продукты и устройства

Антистарение — это тип сложного биологического процесса, на который влияет сочетание экзогенных или внешних факторов и эндогенных или внутренних факторов. Борьба со старением населения является одной из самых серьезных проблем, с которыми сталкиваются такие проблемы, связанные с красотой, как упругость кожи, выпадение волос, морщины против старения и проблемы ухода за полостью рта, среди других. На рынке представлен широкий спектр косметических устройств, которые используются для минимизации воздействия антивозрастных средств на красоту стареющего населения.

Число пожилых людей увеличивается очень быстро, а косметические устройства нацелены на многочисленные признаки омоложения и уменьшают появление широкого спектра признаков старения, включая морщины и тонкие линии, из-за чего растет спрос на омолаживающие продукты и устройства. стимулирует спрос рынка.

Растущая распространенность проблем, связанных с кожей

Проблемы с кожей, как правило, являются одной из наиболее распространенных проблем, наблюдаемых в учреждениях первичной медико-санитарной помощи. Согласно исследованию Национального центра биотехнологической информации, в возрасте от 18 до 44 лет распространенность проблем, связанных с кожей, составила 34%, а среди людей в возрасте 65 лет и старше распространенность увеличилась до 49,4%. Акне — это тип универсального кожного заболевания, которым страдают от 79% до 95% подростков.

По данным Американской медицинской ассоциации, в США от 40 до 50 миллионов человек страдают от прыщей. Согласно отчету, женщины и мужчины в США старше 25 лет имеют некоторую степень прыщей на лице от 40 до 54 процентов, а клинические прыщи на лице у 12 процентов женщин и 3 процентов мужчин сохраняются и в среднем возрасте.

Использование устройств для косметического ухода за кожей обеспечивает дополнительную пользу для внешнего вида кожи. Косметические устройства используются для улучшения здоровья и внешнего вида кожи, поэтому растущая распространенность проблем, связанных с кожей, стимулирует спрос на рынке.

Проблемы с кожей, такие как складки, прыщи, пигментация, морщины, а также шрамы от ожогов, чрезвычайно распространены среди людей. По данным Ассоциации Американской академии дерматологии, прыщи — самое распространенное кожное заболевание в США. Ежегодно от прыщей страдают около 50 миллионов человек в США. Ежегодно около 5,1 миллиона человек обращаются за лечением от прыщей. Примерно в возрасте от 12 до 24 лет у 85% людей появляются небольшие прыщи.

Морщины на лице — один из наиболее заметных признаков проблем с кожей. Мужчины и женщины демонстрируют разные модели образования морщин в зависимости от образа жизни и физиологических факторов. По этой причине для улучшения внешнего вида кожи используется широкий спектр косметических устройств для ухода за кожей, таких как световые / светодиодные и фототерапевтические устройства для омоложения, устройства для уменьшения целлюлита, устройства для удаления прыщей, кислородные и паровые устройства, дермальные ролики, очищающие устройства и интеллектуальные устройства. Растущая распространенность проблем, связанных с кожей, является движущей силой увеличения спроса на рынке косметических устройств Северной Америки.

ВОЗМОЖНОСТИ

Увеличение расходов на красоту

По данным членов Aesthetic Society, в 2020 году американцы потратили более 6 миллиардов долларов США на эстетические хирургические процедуры и более 3 миллиардов долларов США на нехирургические эстетические процедуры. Рост расходов на красоту обусловлен несколькими причинами, такими как улучшение образа жизни людей и растущий спрос. косметических устройств для улучшения их внешнего вида.

Увеличение расходов на косметические услуги приведет к увеличению процесса внедрения передовых косметических устройств, что улучшит профиль продукта на лидирующих позициях на рынке, по этой причине увеличение расходов на косметические услуги является возможностью для увеличения спроса на рынке косметических устройств в Северной Америке.

ОГРАНИЧЕНИЯ/ ВЫЗОВЫ

Высокая стоимость косметических аппаратов

Косметические устройства, основанные на современных технологиях, помогают тонизировать и подтягивать мышцы лица, а также используются для уменьшения появления тонких линий и морщин. Потребители могут использовать косметическое устройство у себя дома.

Косметические устройства предлагают множество возможностей для решения различных проблем, связанных с красотой, таких как уход за кожей, уход за волосами и уход за полостью рта и другие. Но наряду с этим косметические устройства очень дороги в покупке, из-за чего высокая стоимость косметических устройств сдерживает спрос на рынке косметических устройств в Северной Америке.

Недавние улучшения

- В январе 2021 года Candela Corporation, ведущая мировая компания по производству медицинских эстетических устройств, объявила о выпуске системы Frax Pro, одобренного FDA неаблятивного фракционного устройства для шлифовки кожи с использованием Frax 1550 и новых аппликаторов Frax 1940. Это помогло компании расширить портфель эстетической продукции на рынке Северной Америки.

- В июне 2021 года Cutera объявила о выпуске секретного радиочастотного (РЧ) устройства для микронидлинга Secret PRO. Устройство предоставит практикующим многоуровневый подход к омоложению кожи с использованием приложения для шлифовки кожи CO2 «UltraLight», воздействующего на эпидермис. Это помогло компании расширить портфель продуктов.

Объем рынка косметических устройств Северной Америки

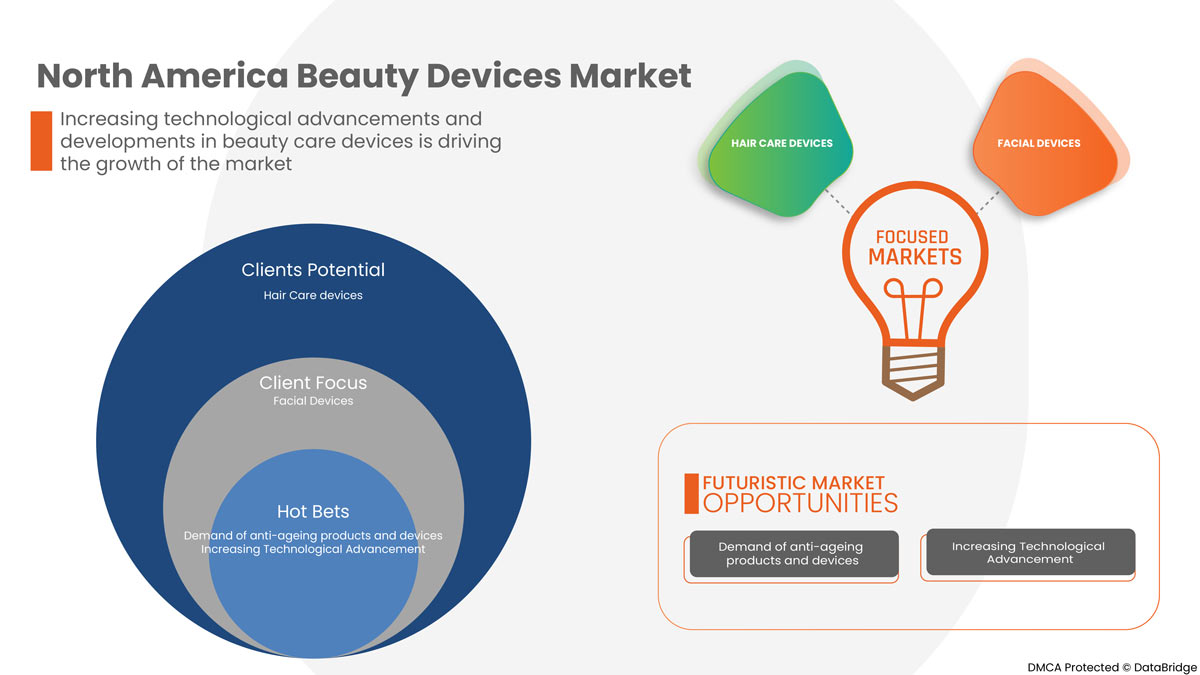

Рынок косметических устройств Северной Америки сегментирован по типу продукта, возрастной группе, режиму работы, конечному пользователю и каналу распространения. Рост среди сегментов поможет вам проанализировать ниши роста и стратегии выхода на рынок и определить свое ядро. приложение области и разницу в ваших целевых рынках.

РЫНОК КОСМЕТИЧЕСКИХ ПРИБОРОВ СЕВЕРНОЙ АМЕРИКИ ПО ТИПАМ ПРОДУКТА

- ПРИБОРЫ ДЛЯ УХОДА ЗА ВОЛОСАМИ

- ЛИЦЕВЫЕ УСТРОЙСТВА

- ПРИБОРЫ ДЛЯ УХОДА ЗА КОЖЕЙ

- УСТРОЙСТВА ДЛЯ УХОДА ЗА ПОЛОСТЬЮ РТА

- ПРИБОРЫ ДЛЯ УХОДА ЗА ГЛАЗАМИ

В зависимости от типа продукта рынок косметических устройств в Северной Америке сегментирован на устройства для ухода за волосами, устройства для лица, устройства для ухода за кожей, устройства для ухода за полостью рта и устройства для ухода за глазами.

РЫНОК КОСМЕТИЧЕСКИХ ПРИБОРОВ СЕВЕРНОЙ АМЕРИКИ ПО ВОЗРАСТНЫМ ГРУППАМ

- Педиатрия

- Взрослый

- Гериатрия

В зависимости от возрастной группы рынок косметических устройств в Северной Америке разделен на педиатрические, взрослые и гериатрические.

РЫНОК КОСМЕТИЧЕСКОЙ ПРИБОРЫ СЕВЕРНОЙ АМЕРИКИ ПО РЕЖИМАМ РАБОТЫ

- Электрический И на батарейках

- Руководство

В зависимости от режима работы рынок косметических устройств в Северной Америке разделен на электрические, аккумуляторные и ручные.

РЫНОК КОСМЕТИЧЕСКИХ ПРИБОРОВ СЕВЕРНОЙ АМЕРИКИ ПО КОНЕЧНЫМ ПОЛЬЗОВАТЕЛЯМ

- Коммерческие и профессиональные настройки

- Домашние/индивидуальные/домашние настройки

Рынок косметических устройств Северной Америки сегментирован на коммерческие и профессиональные, а также домашние/персонализированные/уходовые помещения.

РЫНОК КОСМЕТИЧЕСКИХ ПРИБОРОВ СЕВЕРНОЙ АМЕРИКИ ПО КАНАЛУ РАСПРЕДЕЛЕНИЯ

- Прямой

- Косвенный

В зависимости от канала сбыта рынок косметических устройств Северной Америки сегментирован на прямой и косвенный.

Конкурентная среда и анализ доли рынка косметических устройств в Северной Америке

Конкурентная среда на рынке косметических устройств Северной Америки предоставляет подробную информацию о конкурентах. Подробная информация включает обзор компании, финансовые показатели компании, полученный доход, рыночный потенциал, инвестиции в исследования и разработки, новые рыночные инициативы, производственные площадки и объекты, сильные и слабые стороны компании, запуск продукта, конвейеры испытаний продукта, утверждения продукта, патенты, широту и дыхание продукта, доминирование приложений, кривая жизненного пути технологии. Приведенные выше данные относятся только к ориентации компании на рынок косметических устройств Северной Америки.

Крупнейшими компаниями, работающими на рынке косметических устройств Северной Америки, являются Nu Skin, CANDELA CORPORATION, Curallux LLC, FOREO, Koninklijke Philips NV, Conair Corporation, Lumenis Be Ltd, Cynosure, Sciton, Inc., Fotona, Procter & Gamble, LUTRONIC. , STRATA Skin Sciences, NuFACE, Spectrum Brands, Inc., Cutera, Merz North America, Inc., Panasonic Corporation, Procter & Gamble и других.

Методология исследования: Рынок косметических устройств Северной Америки

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Рыночные данные анализируются и оцениваются с использованием рыночных статистических и последовательных моделей. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевыми экспертами) проверку. Помимо этого, модели данных включают сетку позиционирования поставщиков, анализ временных графиков рынка, обзор и руководство по рынку, сетку позиционирования компаний, анализ доли компании на рынке, стандарты измерения, сравнение Северной Америки и регионов и анализ доли поставщиков. Пожалуйста, запросите звонок аналитика в случае дальнейшего запроса.

Артикул-