North America Bacteriophages Therapy Market

Размер рынка в млрд долларов США

CAGR :

%

USD

21.34 Million

USD

32.75 Million

2025

2033

USD

21.34 Million

USD

32.75 Million

2025

2033

| 2026 –2033 | |

| USD 21.34 Million | |

| USD 32.75 Million | |

|

|

|

|

Сегментация рынка терапии бактериофагами в Северной Америке по целевому объекту (кишечная палочка, стафилококки, стрептококки, синегнойная палочка, сальмонелла и другие), типу (литический и лизогенный), основе (стерильная бульонная культура и водорастворимая желеобразная основа), применению (бактериальная дизентерия, инфекции кожи и слизистой оболочки носа, гнойные инфекции кожи, инфекции легких и плевры, послеоперационные раневые инфекции и другие), способу введения (перорально, парентерально, ректально, дермально и другие), конечному потребителю (больницы, специализированные клиники, научно-исследовательские институты и другие), каналу сбыта (прямой тендер и сторонние дистрибьюторы) — тенденции отрасли и прогноз до 2033 года

Размер рынка терапии бактериофагами в Северной Америке

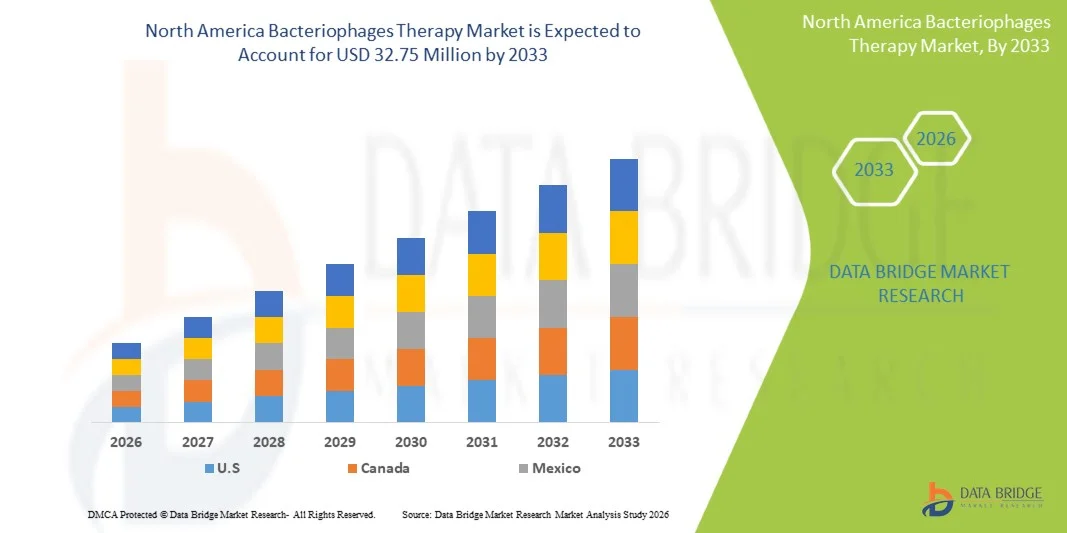

- Объем рынка терапии бактериофагами в Северной Америке в 2025 году оценивался в 21,34 млн долларов США и, как ожидается , достигнет 32,75 млн долларов США к 2033 году при среднегодовом темпе роста 5,50% в течение прогнозируемого периода.

- Рост рынка во многом обусловлен растущим глобальным бременем инфекций, устойчивых к антибиотикам, и стремительным прогрессом в исследованиях фагов, персонализированной медицине и геномной инженерии. Растущий переход от традиционных антибиотиков к прецизионной антимикробной терапии значительно ускоряет внедрение решений на основе бактериофагов в клинических, ветеринарных и сельскохозяйственных учреждениях.

- Более того, растущий спрос потребителей и медицинских работников на безопасные, эффективные и целенаправленные противомикробные альтернативы позиционирует бактериофаговую терапию как перспективный метод лечения нового поколения. Эти факторы ускоряют внедрение решений на основе бактериофаговой терапии, тем самым значительно стимулируя рост отрасли.

Анализ рынка бактериофаговой терапии в Северной Америке

- Терапия бактериофагами, обеспечивающая целенаправленное и точное противомикробное действие против конкретных бактериальных патогенов, становится важнейшим компонентом лечения инфекционных заболеваний нового поколения как в больницах, так и в клинических исследовательских учреждениях благодаря своей способности бороться с инфекциями, устойчивыми к антибиотикам, снижать побочные эффекты и сохранять здоровую микробиоту.

- Растущий спрос на бактериофаговую терапию обусловлен, главным образом, глобальным ростом устойчивости к противомикробным препаратам (AMR), увеличением инвестиций в фаговую биотехнологию и всё более широким внедрением подходов к персонализированной медицине. Кроме того, рост числа клинических испытаний, поддержка со стороны регулирующих органов и появление биотехнологических стартапов ускоряют внедрение решений для бактериофаговой терапии.

- США доминировали на североамериканском рынке бактериофаговой терапии, обеспечив наибольшую долю выручки в 32,6% в 2025 году благодаря значительным государственным инвестициям в передовые медицинские технологии, расширению возможностей для исследований инфекционных заболеваний и стратегическим инициативам по развитию биомедицинских инноваций. Растущее внедрение инновационных методов лечения в крупных больницах и исследовательских центрах страны ещё больше укрепляет её лидирующие позиции в Северной Америке.

- Ожидается, что Канада станет страной с самыми быстрыми темпами роста на североамериканском рынке бактериофаговой терапии в течение прогнозируемого периода, что обусловлено быстрой модернизацией здравоохранения, расширением инфраструктуры клинических исследований, ростом распространенности инфекций, устойчивых к антибиотикам, и сильным акцентом правительства на внедрении передовых биотерапевтических препаратов как в государственном, так и в частном секторах здравоохранения.

- Сегмент стерильных бульонных культур занял самую большую долю рынка в 62,1% в 2025 году благодаря стабильности, простоте производства и пригодности для клинического использования.

Область применения отчета и сегментация рынка терапии бактериофагами в Северной Америке

|

Атрибуты |

Ключевые аспекты рынка терапии бактериофагами |

|

Охваченные сегменты |

|

|

Охваченные страны |

Северная Америка

|

|

Ключевые игроки рынка |

|

|

Рыночные возможности |

|

|

Информационные наборы данных с добавленной стоимостью |

Помимо информации о рыночных сценариях, таких как рыночная стоимость, темпы роста, сегментация, географический охват и основные игроки, рыночные отчеты, подготовленные Data Bridge Market Research, также включают в себя углубленный экспертный анализ, эпидемиологию пациентов, анализ воронки продаж, анализ ценообразования и нормативную базу. |

Тенденции рынка бактериофаговой терапии в Северной Америке

« Растущая тенденция к точной, персонализированной и синтетической инженерии бактериофагов »

- Важной и быстро набирающей силу тенденцией на рынке бактериофаговой терапии в Северной Америке является переход от традиционных, выделенных естественным путем фагов к высокоточным, генетически оптимизированным и персонализированным фаговым методам. Этот сдвиг обусловлен ростом устойчивости к противомикробным препаратам (AMR), ограничениями антибиотиков широкого спектра действия и клинической потребностью в высокоточных антибактериальных решениях.

- Например, такие компании, как Adaptive Phage Therapeutics (APT), разрабатывают платформы персонализированной фаговой терапии, которые подбирают бактериальные штаммы, специфичные для пациента, к соответствующим фагам из постоянно расширяющихся фаговых библиотек. Аналогичным образом, BiomX использует синтетическую биологию и микробиом-таргетированные фаги для лечения хронических инфекций и воспалительных заболеваний.

- Сконструированные фаги обладают такими свойствами, как улучшенное расширение круга хозяев, повышенная эффективность уничтожения бактерий, способность обходить резистентность и удаление нежелательных генов, что значительно повышает терапевтическую надёжность и клинические результаты. Кроме того, возможность быстрого обновления фаговых коктейлей помогает поддерживать эффективность против эволюционирующих бактериальных мутаций.

- Растущее внедрение фагового дизайна с использованием CRISPR и биоинформатического отбора фагов способствует разработке высокоточных методов лечения инфекций, с которыми традиционные антибиотики не справляются. Стартапы и исследовательские институты всё активнее сотрудничают в создании автоматизированных платформ для сопоставления фагов, способных быстро идентифицировать бактерии и подбирать пары фагов.

- Интеграция инструментов синтетической биологии также позволяет производителям разрабатывать модульные, программируемые бактериофаги с предсказуемым поведением и улучшенными профилями безопасности. Например, компания Pherecydes Pharma разрабатывает специализированные фаговые коктейли, специально разработанные для борьбы с патогенами с множественной лекарственной устойчивостью (МЛУ), такими как Pseudomonas aeruginosa и Staphylococcus aureus.

- Эта растущая тенденция к персонализированной и разработанной терапии бактериофагами фундаментально меняет ожидания от лечения лекарственно-устойчивых инфекций. В результате компании в США, Европе и Азиатско-Тихоокеанском регионе всё больше инвестируют в разработку фагов, создание фаговых банков и автоматизированных платформ для производства фагов, чтобы удовлетворить растущий клинический спрос.

- Спрос на высокоточную терапию бактериофагами стремительно растет в больницах, исследовательских и биотехнологических учреждениях, поскольку поставщики медицинских услуг ищут более безопасные и эффективные альтернативы антибиотикам, особенно при хронических, рецидивирующих и устойчивых к антибиотикам инфекциях.

Динамика рынка терапии бактериофагами в Северной Америке

Водитель

«Растущая устойчивость к антибиотикам и растущее клиническое признание терапии на основе фагов»

- Глобальный рост устойчивости к противомикробным препаратам (УПП) и снижение эффективности традиционных антибиотиков являются ключевыми факторами, увеличивающими спрос на бактериофаговую терапию. Больницы и врачи всё чаще ищут альтернативные подходы к лечению опасных для жизни инфекций, которые больше не поддаются лечению доступными антибиотиками.

- Например, в январе 2024 года компания Adaptive Phage Therapeutics расширила свою программу клинических испытаний инфекций, вызванных MDR-Staphylococcus aureus, под надзором FDA, что свидетельствует о растущем институциональном и регулирующем признании терапевтических средств на основе фагов. Ожидается, что эти достижения будут способствовать значительному расширению рынка в ближайшие годы.

- По мере роста осведомленности о патогенах с множественной лекарственной устойчивостью, таких как кишечная палочка, клебсиелла пневмонии и синегнойная палочка, поставщики медицинских услуг быстро внедряют фаговую терапию для лечения тяжелых раневых инфекций, инфекций костей, диабетических язв стопы и хронических респираторных заболеваний.

- Терапия бактериофагами обладает такими важными преимуществами, как высокая специфичность, сниженная токсичность, минимальное воздействие на полезную микробиоту и способность размножаться в очагах инфекции, что делает ее более эффективной, чем антибиотики широкого спектра действия во многих клинических случаях.

- Рост числа внутрибольничных инфекций (ВБИ) и увеличение числа пациентов с иммунодефицитом ещё больше повышают потребность в высоконаправленных терапевтических стратегиях. Возможность сочетания фаговой терапии с традиционными антибиотиками для достижения синергетического эффекта повышает эффективность лечения и расширяет его применение.

- Более того, улучшение нормативной поддержки, получение разрешений на использование в гуманных целях и расширение портфеля клинических исследований способствуют глобальному признанию фаговой терапии, особенно в США, Европе и Южной Корее. Растущая доступность масштабируемых платформ для производства фагов, соответствующих требованиям GMP, продолжает повышать коммерческую привлекательность.

- В совокупности эти факторы значительно стимулируют рост рынка, побуждая больницы, государственные программы и биотехнологические компании включать решения на основе фагов в стандартные схемы лечения сложных бактериальных инфекций.

Сдержанность/Вызов

« Сложность регулирования, ограниченная стандартизация и высокие производственные ограничения »

- Несмотря на растущий интерес, рынок бактериофаговой терапии в Северной Америке сталкивается со значительными трудностями, обусловленными неопределенностью нормативно-правового регулирования, отсутствием глобальной стандартизации и сложностью разработки последовательных и масштабируемых процессов производства фагов. Эти проблемы продолжают препятствовать быстрому проникновению на рынок.

- Например, различные пути одобрения в разных регионах — США полагаются на исследовательские маршруты IND, а Европа переходит к адаптивным системам регулирования — приводят к задержкам и непоследовательности в клиническом внедрении и коммерциализации.

- Биологическое разнообразие и быстрая эволюция фагов затрудняют установление универсальных стандартов качества, методов проверки эффективности и стандартов долгосрочной стабильности. Эти научные трудности приводят к увеличению сроков разработки и увеличению производственных затрат для производителей.

- Кроме того, процесс выделения, секвенирования, очистки и производства высококачественных, свободных от загрязнений бактериофагов требует сложной биотехнологической инфраструктуры и квалифицированного персонала, что приводит к высоким расходам на производство и НИОКР.

- Осведомленность общественности остается ограниченной, и некоторые врачи по-прежнему не решаются применять фаговую терапию из-за недостатка долгосрочных клинических данных и опасений относительно ее принятия регулирующими органами.

- Кроме того, потребность в персонализированных фаговых коктейлях в некоторых случаях увеличивает логистическую сложность, поскольку сопоставление фагов в реальном времени, изоляция бактерий и индивидуальная формулировка требуют координации между лабораториями и клиническими центрами.

- Для преодоления этих трудностей отрасль должна уделять первоочередное внимание гармонизации нормативно-правовой базы, стандартизации производственных регламентов, совершенствованию методов испытаний стабильности и расширению данных клинических исследований. Достижение этих целей будет иметь решающее значение для обеспечения широкомасштабной коммерциализации и более широкого терапевтического применения методов лечения на основе бактериофагов.

Рынок бактериофаговой терапии в Северной Америке

Рынок терапии бактериофагами в Северной Америке сегментирован по признаку цели, типа, базы, применения, пути введения, конечного пользователя и канала сбыта.

• По цели

На основе цели рынок терапии бактериофагами в Северной Америке сегментирован на Escherichia coli, Staphylococcus, Streptococcus, Pseudomonas, Salmonella и другие. Сегмент Escherichia coli доминировал с самой большой долей выручки на рынке в 36,4% в 2025 году, что обусловлено высокой распространенностью желудочно-кишечных инфекций, связанных с E. coli, и растущей устойчивостью к антибиотикам. Больницы и специализированные клиники все чаще отдают предпочтение фаговой терапии из-за ее целенаправленного действия и минимальных побочных эффектов. Фаги E. coli поддерживаются текущими клиническими испытаниями, подтверждающими их безопасность и эффективность. Сегмент выигрывает от финансирования исследований и государственных инициатив, продвигающих альтернативные методы лечения. Растущая осведомленность среди пациентов и медицинских работников ускоряет принятие. Фаговая терапия инфекций E. coli снижает зависимость от антибиотиков широкого спектра действия. Коммерческая доступность хорошо охарактеризованных фагов E. coli обеспечивает надежное клиническое применение. Постоянный технологический прогресс в разработке фаговых формул повышает стабильность и срок годности. Рост заболеваемости штаммами с множественной лекарственной устойчивостью дополнительно усиливает спрос. Этот сегмент остаётся критически важным как в развитых, так и в развивающихся регионах.

Ожидается, что сегмент Staphylococcus будет демонстрировать самый быстрый среднегодовой темп роста на уровне 19,8% в период с 2026 по 2033 год, что обусловлено ростом случаев MRSA и других резистентных стафилококковых инфекций. Растущая потребность в эффективных альтернативах традиционным антибиотикам стимулирует исследовательский и коммерческий интерес. Больницы и специализированные клиники быстро внедряют фаги, нацеленные на стафилококки, для контроля инфекций. Научно-исследовательские институты активно разрабатывают модифицированные фаги для повышения терапевтической эффективности. Клинические испытания расширяют доказательную базу для безопасного и целенаправленного лечения. Фаготерапия обеспечивает быстрое уничтожение бактерий с минимальным нарушением нормальной микробиоты. Интеграция фаговой терапии со стандартным лечением улучшает результаты лечения хронических и послеоперационных инфекций. Растущая осведомленность врачей и пациентов увеличивает частоту назначений. Государственное и частное финансирование поддерживает разработку и коммерциализацию новых продуктов. Растущая распространенность инфекций кожи и мягких тканей усиливает рыночный спрос. Разрешения регулирующих органов на ключевых рынках усиливают внедрение и распространение. Выход на развивающиеся рынки открывает значительные возможности для роста.

• По типу

По типу рынок сегментирован на литические и лизогенные. Литический сегмент занимал наибольшую долю рынка в 58,7% в 2025 году благодаря своему быстрому бактерицидному действию и эффективности против множественных лекарственно-устойчивых штаммов. Больницы и клиники предпочитают литические фаги для лечения острых инфекций из-за их немедленного эффекта. Сегмент выигрывает от хорошо известного профиля безопасности и клинических данных. Литические фаги быстро снижают бактериальную нагрузку, минимизируя осложнения и продолжительность госпитализации. Их предсказуемая фармакокинетика позволяет точно дозировать и планировать лечение. Внедрение поддерживается ростом случаев желудочно-кишечных и кожных инфекций. Фармацевтические компании инвестируют в крупномасштабное производство для клинического использования. Интеграция со стандартной антибактериальной терапией улучшает терапевтические результаты. Исследования расширяют стабильность формул для более широкого применения. Соблюдение пациентами режима лечения улучшается благодаря более короткой продолжительности лечения. Литические фаги совместимы с различными форматами доставки, включая пероральное и дермальное применение. Их коммерческая доступность усиливает проникновение на рынок.

Ожидается, что сегмент лизогенных фагов будет демонстрировать самый быстрый среднегодовой темп роста в 16,3% в период с 2026 по 2033 год, что обусловлено исследованиями в области сконструированных лизогенных фагов и их потенциала в долгосрочном контроле инфекций. Академические и клинические исследования расширяются благодаря их способности интегрироваться в геном хозяина. Лизогенные фаги обладают пролонгированной антибактериальной активностью и модуляцией микробиома. Растущий интерес к лечению хронических инфекций стимулирует рост рынка. Технологические достижения обеспечивают более безопасное и предсказуемое терапевтическое применение. Клинические испытания подтверждают эффективность против резистентных штаммов бактерий. Сегмент выигрывает от финансирования и совместных проектов между научно-исследовательскими институтами и биотехнологическими компаниями. Лизогенные фаги привлекают внимание к приложениям персонализированной терапии. Регуляторное принятие постепенно улучшается благодаря положительным результатам испытаний. Их интеграция с другими методами лечения повышает универсальность. Изучаются специфичные для пациента составы для таргетной терапии. Расширение на развивающиеся рынки открывает значительные возможности. Растущая осведомленность среди поставщиков медицинских услуг способствует внедрению.

• По базе

На основе основы рынок сегментирован на стерильные бульонные культуры и водорастворимую желейную основу. Сегмент стерильных бульонных культур занял наибольшую долю рынка в 62,1% в 2025 году благодаря стабильности, простоте производства и пригодности для клинического использования. Больницы и исследовательские лаборатории широко используют бульонные культуры для получения надежных результатов. Сегмент выигрывает от стандартизированных производственных протоколов, обеспечивающих стабильное качество. Стерильная бульонная культура позволяет точно дозировать и сохраняет жизнеспособность фагов. Внедрение подкреплено клиническими данными и соблюдением нормативных требований. Формат подходит как для перорального, так и для парентерального применения. Фармацевтические компании предпочитают бульонные культуры для массового производства и коммерциализации. Интеграция с больничными протоколами обеспечивает безопасное введение. Сегмент широко используется при желудочно-кишечных и системных инфекциях. Постоянные НИОКР повышают эффективность и срок годности. Бульонные культуры совместимы с автоматизированными системами распределения. Растущая осведомленность и клиническое внедрение способствуют доминированию на рынке.

Ожидается, что сегмент водорастворимых желейных основ продемонстрирует самый быстрый среднегодовой темп роста в 18,5% в период с 2026 по 2033 год, что обусловлено спросом на средства местного применения, средства по уходу за ранами и удобные для пациента составы. Сегмент выигрывает от растущего использования при послеоперационных раневых инфекциях и лечении кожи. Желеобразные фаги позволяют проводить локальную терапию, минимизируя системные побочные эффекты. Растущее внедрение в больницах и специализированных клиниках поддерживает рост. Клинические исследования демонстрируют улучшение соблюдения пациентами режима местного применения. Технологические достижения повышают стабильность и срок годности желеобразных составов. Растущее предпочтение неинвазивным методам лечения ускоряет внедрение. Рост осведомленности среди врачей и пациентов усиливает рыночный потенциал. Электронная коммерция и каналы сбыта расширяют доступность. Интеграция с современными средствами по уходу за ранами повышает рыночное признание. Таргетная терапия в дерматологии повышает значимость сегмента. Правительственные инициативы в отношении альтернативных методов лечения способствуют расширению. Развивающиеся рынки предоставляют новые возможности для роста.

• По применению

На основе области применения рынок сегментируется на бактериальную дизентерию, инфекции кожи и слизистой оболочки носа, гнойные инфекции кожи, инфекции легких и плевры, послеоперационные раневые инфекции и другие. На сегмент бактериальной дизентерии пришлась наибольшая доля выручки рынка в 40,6% в 2025 году, что обусловлено высокой распространенностью в развивающихся регионах и устойчивостью к традиционным антибиотикам. Больницы и клиники предпочитают фаговую терапию из-за ее специфичности и быстрого действия. Исследования подтверждают эффективность фагов при желудочно-кишечных инфекциях. Государственные программы здравоохранения и неправительственные организации способствуют внедрению. Осведомленность пациентов и рекомендации врачей усиливают проникновение на рынок. Клинические испытания подтверждают профили безопасности и эффективности. Интеграция в стратегии общественного здравоохранения повышает доступность лечения. Коммерческая доступность стандартизированных фагов обеспечивает надежность. Технологический прогресс улучшает стабильность и хранение. Растущая распространенность случаев у детей стимулирует спрос. Поддерживающая политика возмещения расходов способствует внедрению. Постоянные НИОКР обеспечивают совершенствование формул.

Ожидается, что сегмент послеоперационных раневых инфекций будет демонстрировать самый быстрый среднегодовой темп роста на уровне 21,2% в период с 2026 по 2033 год, что обусловлено ростом числа хирургических операций и инфекций, устойчивых к антибиотикам. Больницы внедряют фаговую терапию для лечения ран и контроля инфекций. Все большую популярность приобретают местные и дермальные фаги. Клинические данные подтверждают более быстрое заживление и снижение рецидивов инфекций. Исследования сосредоточены на сочетании фагов с традиционными антибиотиками. Соблюдение пациентами режима лечения улучшается благодаря простоте применения. Государственные и частные программы здравоохранения стимулируют внедрение. Интеграция в протоколы больниц повышает эффективность работы. Технологические достижения позволяют улучшить формулу и стабильность. Рост осведомленности среди хирургов и медсестер стимулирует использование. Развивающиеся рынки демонстрируют растущее признание. Сотрудничество между биотехнологическими компаниями и больницами расширяет охват. Расширение в хирургических центрах предоставляет значительные возможности для роста.

• По способу введения

На основе пути введения рынок сегментирован на пероральный, парентеральный, ректальный, дермальный и другие. Пероральный сегмент занимал наибольшую долю рынка в 47,9% выручки в 2025 году благодаря удобству, эффективности при желудочно-кишечных инфекциях и соблюдению пациентами режима лечения. Пероральные фаги позволяют проводить таргетную терапию без инвазивных процедур. Больницы и клиники предпочитают пероральный прием для амбулаторного лечения. Клинические данные подтверждают безопасность и быстрое действие. Фармацевтические производители отдают предпочтение масштабируемым пероральным формулам. Интеграция с обычным лечением улучшает результаты. Повышение стабильности и увеличение срока годности усиливают внедрение. Коммерческая доступность обеспечивает надежные поставки. Исследования сосредоточены на методах инкапсуляции для лучшей биодоступности. Программы общественного здравоохранения продвигают пероральную фаговую терапию. Кампании по повышению осведомленности стимулируют внедрение среди пациентов и врачей. Пероральный прием способствует широкому использованию на развивающихся рынках. Разрешения регулирующих органов укрепляют доверие.

Ожидается, что сегмент дермальных препаратов продемонстрирует самый быстрый среднегодовой темп роста на уровне 20,5% в период с 2026 по 2033 год, что обусловлено спросом на кожных инфекциях, ожогах и послеоперационных ранах. Местная терапия обеспечивает локализованное лечение и снижает системное воздействие. Больницы и специализированные клиники внедряют дермальные фаги для ухода, удобного для пациентов. Клинические исследования демонстрируют быстрое заживление и контроль инфекций. Технологические достижения улучшают формулы гелей и кремов. Интеграция с раневыми повязками повышает терапевтическую эффективность. Научные исследования поддерживают новые системы доставки. Рост осведомленности среди дерматологов и хирургов стимулирует внедрение. Улучшение приверженности пациентов благодаря неинвазивному применению. Регуляторные разрешения способствуют расширению рынка. Электронная коммерция и дистрибьюторы повышают доступность. Развивающиеся рынки демонстрируют растущее предпочтение дермальной терапии. Частные и государственные программы здравоохранения стимулируют ее использование.

• Конечным пользователем

На основе конечного пользователя рынок сегментирован на больницы, специализированные клиники, академические исследования и институты и другие. На сегмент больниц пришлась наибольшая доля выручки рынка в 53,3% в 2025 году, что обусловлено высоким притоком пациентов, протоколами инфекционного контроля и доступом к клиническим фагам. Больницы предпочитают стандартизированные формулы фагов для надежности и безопасности. Интеграция в программы борьбы с инфекциями способствует внедрению. Коммерческая доступность и дистрибьюторские сети обеспечивают поставки. Непрерывные программы обучения и повышения осведомленности поддерживают использование. Больницы проводят внутренние исследования для подтверждения эффективности. Рост заболеваемости резистентными инфекциями увеличивает спрос. Технологические достижения обеспечивают эффективное управление. Внедрение больницами поддерживается государственными инициативами в области здравоохранения. Доверие пациентов к терапии, проводимой в больнице, укрепляет позиции на рынке. Соблюдение нормативных требований гарантирует качество и безопасность. Больницы предоставляют площадку для крупномасштабных клинических испытаний.

Ожидается, что сегмент академических исследований и институтов будет демонстрировать самый быстрый среднегодовой темп роста (CAGR) в 22,0% в период с 2026 по 2033 год, что обусловлено увеличением финансирования исследований, клинических испытаний и сотрудничества. Академические учреждения сосредоточены на разработке фагов для таргетной терапии. Исследования расширяются на хронические и редкие инфекции. Государственные гранты и частные инвестиции поддерживают инновации. Сотрудничество с биотехнологическими компаниями ускоряет коммерциализацию. Публикация клинических результатов повышает осведомленность и внедрение. Программы обучения готовят квалифицированных специалистов в области фаговой терапии. Научные исследования способствуют получению разрешений регулирующих органов и разработке руководств. Лабораторное производство обеспечивает возможность экспериментального применения. Конференции и семинары стимулируют обмен знаниями. Развивающиеся рынки демонстрируют рост исследовательской активности. Патентование фаговых продуктов повышает рыночную стоимость. Научные результаты влияют на внедрение в больницы.

• По каналу распространения

На основе канала сбыта рынок сегментирован на сегмент прямых тендеров и сторонних дистрибьюторов. Сегмент прямых тендеров занимал самую большую долю рынка в 61,5% в 2025 году благодаря оптовым закупкам больницами, государственными программами и научно-исследовательскими институтами. Прямые тендеры обеспечивают контроль качества, соблюдение нормативных требований и стабильные поставки. Больницы и учреждения предпочитают прямые закупки для критически важных методов лечения. Государственные инициативы в области здравоохранения поддерживают внедрение через тендеры. Стандартизированные цепочки поставок повышают надежность. Долгосрочные контракты обеспечивают постоянную доступность. Фармацевтические компании содержат команды прямых продаж для взаимодействия с больницами. Требования клинических исследований и исследований стимулируют оптовые закупки. Доминирование на рынке подкрепляется регулирующим надзором. Эффективность затрат и прозрачность способствуют принятию тендеров. Прямые тендеры облегчают доступ на развивающиеся рынки. Развитые дистрибьюторские сети гарантируют своевременную доставку.

Ожидается, что сегмент сторонних дистрибьюторов продемонстрирует самый быстрый среднегодовой темп роста в 19,4% в период с 2026 по 2033 год, что обусловлено ростом электронной коммерции, региональных дистрибьюторских сетей и расширением охвата медицинских учреждений в пригородах и сельской местности. Дистрибьюторы обеспечивают поставки в небольших объемах в клиники и исследовательские лаборатории. Гибкая логистика обеспечивает своевременную доставку и управление запасами. Платформы электронных аптек повышают доступность для конечных пользователей. Партнерство с местными дистрибьюторами способствует проникновению на рынок. Информационные кампании стимулируют внедрение в отдаленных регионах. Нормативно-правовое регулирование обеспечивает безопасную дистрибуцию. Дистрибьюторы поддерживают больницы, обеспечивая быстрое пополнение запасов. Маркетинговая и образовательная поддержка способствуют пониманию продукта. Рост числа специализированных клиник стимулирует спрос на распространяемую продукцию. Региональная кастомизация улучшает принятие. Расширение в развивающихся регионах обеспечивает высокий потенциал роста.

Региональный анализ рынка бактериофаговой терапии в Северной Америке

- Ожидается, что рынок бактериофаговой терапии в Северной Америке значительно вырастет в течение прогнозируемого периода, что обусловлено ростом распространенности инфекций, устойчивых к антибиотикам, повышением осведомленности о высокоточных антибактериальных методах лечения и увеличением инвестиций в передовые методы лечения инфекционных заболеваний. Внимание региона к инновационным биологическим препаратам и новым методам лечения дополнительно стимулирует их внедрение на рынке.

- Правительства по всей Северной Америке активно укрепляют инфраструктуру здравоохранения, расширяют клинические и исследовательские возможности и способствуют внедрению передовых биологических препаратов, что увеличивает спрос на терапию на основе бактериофагов.

- Кроме того, растущее сотрудничество между региональными поставщиками медицинских услуг, научно-исследовательскими институтами и глобальными биотехнологическими компаниями способствует внедрению и клиническому применению проверенных методов фаговой терапии как в больницах, так и в исследовательских учреждениях.

Обзор рынка терапии бактериофагами в США и Северной Америке

Рынок бактериофаготерапии в США и Северной Америке доминировал на североамериканском рынке бактериофаготерапии, достигнув наибольшей доли выручки в 32,6% в 2025 году благодаря значительным государственным инвестициям в передовые медицинские технологии, расширению возможностей для исследований инфекционных заболеваний и стратегическим инициативам по укреплению биомедицинских инноваций. Растущее внедрение инновационных методов лечения в крупных больницах и исследовательских центрах страны ещё больше укрепляет её лидирующие позиции в Северной Америке.

Обзор рынка бактериофаговой терапии в Канаде и Северной Америке

Ожидается, что рынок бактериофаговой терапии в Канаде и Северной Америке станет самым быстрорастущим в Северной Америке в течение прогнозируемого периода благодаря быстрой модернизации здравоохранения, расширению инфраструктуры клинических исследований, росту распространенности инфекций, устойчивых к антибиотикам, и активному вниманию правительства к внедрению передовых биотерапевтических препаратов. Расширение сотрудничества с международными биотехнологическими компаниями и растущее внедрение в больницах методов лечения нового поколения способствуют ускоренному росту рынка в Канаде.

Доля рынка бактериофаговой терапии в Северной Америке

Лидерами отрасли терапии бактериофагами являются, в первую очередь, хорошо зарекомендовавшие себя компании, в том числе:

- Intralytix Inc. (США)

- Armata Pharmaceuticals (США)

- PhagePro Inc. (США)

- Микроос (Нидерланды)

- Proteon Pharmaceuticals (Польша)

- Фагелюкс (Китай)

- Technophage (Португалия)

- Eligo Bioscience (Франция)

- Ферецид Фарма (Франция)

- PhageLab (Чили)

- Locus Biosciences (США)

- Genpharm (США)

- Phage International (США)

- Aptorum Group (Гонконг)

- Вираликс (Австралия)

- iNtRON Biotechnology (Южная Корея)

Последние разработки на рынке бактериофаговой терапии в Северной Америке

- В феврале 2021 года компания Locus Biosciences объявила об успешном завершении клинического испытания фазы 1b своей бактериофаговой терапии с использованием CRISPR-Cas3 (LBP-EC01), направленной на Escherichia coli. Испытание показало, что разработанный фаг безопасен, хорошо переносится и приводит к снижению уровня E. coli у пациентов, что стало важным подтверждением эффективности их платформы прецизионных фагов.

- В мае 2022 года компания Adaptive Phage Therapeutics (APT) сообщила о назначении препарата первому пациенту в рамках своего исследования фазы 1/2 «DANCE» при остеомиелите диабетической стопы (DFO) с использованием своего подхода PhageBank. Это стало важным клиническим достижением, поскольку APT использует библиотеку фагов, подобранных к инфекциям пациентов, для борьбы с устойчивыми к антибиотикам инфекциями.

- В январе 2024 года компания Locus Biosciences получила транш в размере 23,9 млн долларов США от BARDA (Управления передовых биомедицинских исследований и разработок США) на поддержку второй части исследования фазы 2 ELIMINATE препарата LBP-EC01 для лечения инфекций мочевыводящих путей, вызванных лекарственно-устойчивой кишечной палочкой (E. coli). Эта поддержка, не подлежащая разбавлению, подчеркивает твердую приверженность правительства передовым методам фаговой терапии.

- В августе 2024 года компания Locus Biosciences объявила о положительных результатах первой (открытой) части исследования LBP-EC01 фазы 2 ELIMINATE. Данные, опубликованные в журнале The Lancet Infectious Diseases, подтвердили безопасность и переносимость препарата у пациентов, что послужило прочным основанием для проведения второй части исследования (слепого, плацебо-контролируемого).

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.