North America Amino Acid In Dietary Supplements Market

Размер рынка в млрд долларов США

CAGR :

%

USD

826.78 Million

USD

1,268.85 Million

2024

2032

USD

826.78 Million

USD

1,268.85 Million

2024

2032

| 2025 –2032 | |

| USD 826.78 Million | |

| USD 1,268.85 Million | |

|

|

|

|

Рынок аминокислот в пищевых добавках Северной Америки по типу (глутаминовая кислота, лизин, триптофан, метионин, фенилаланин и другие), форме выпуска (таблетки, капсулы, мягкие гели, порошки, жевательные конфеты, жидкости и другие), применению (контроль энергии и веса, общее состояние здоровья, здоровье костей и суставов, здоровье желудочно-кишечного тракта, иммунитет, здоровье сердца, диабет, противораковые препараты и другие), конечному потребителю (взрослые, пожилые, беременные женщины, дети и младенцы) и каналу сбыта (безрецептурные и рецептурные препараты) – тенденции отрасли и прогноз до 2032 года

Размер рынка аминокислот в пищевых добавках в Северной Америке

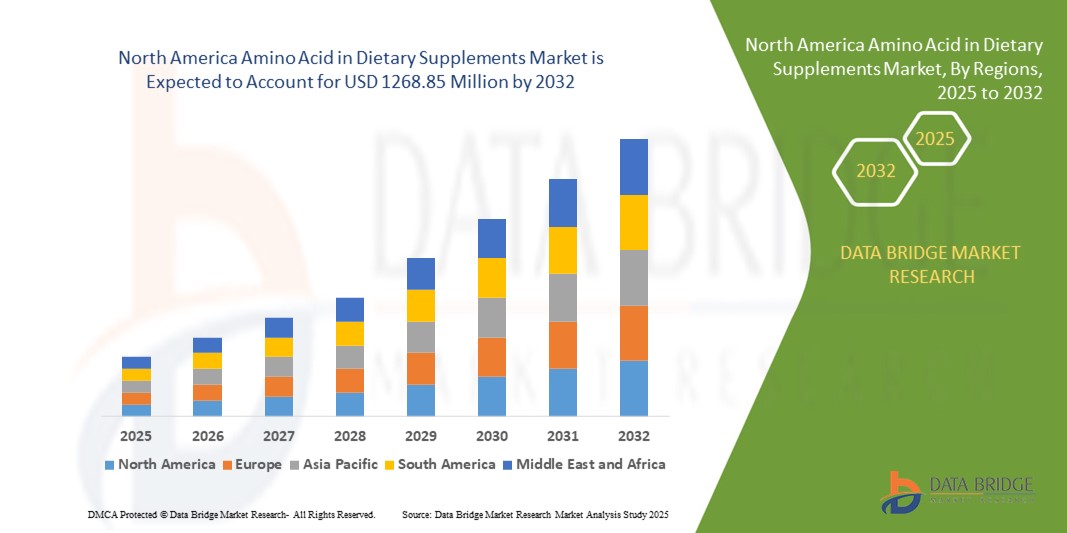

- Объем рынка аминокислот в пищевых добавках в Северной Америке в 2024 году оценивался в 826,78 млн долларов США и, как ожидается , достигнет 1268,85 млн долларов США к 2032 году при среднегодовом темпе роста 5,50% в течение прогнозируемого периода.

- Рост рынка обусловлен в первую очередь повышением осведомленности потребителей о здоровье и благополучии, ростом спроса на добавки для повышения физической формы и производительности, а также растущим использованием добавок с аминокислотами для профилактического здравоохранения.

- Резкий рост спроса на растительные и подходящие для веганов добавки с аминокислотами, а также рост осознанности здорового образа жизни среди стареющего населения еще больше стимулируют рост рынка как в розничной торговле, так и в электронной коммерции.

Анализ рынка аминокислот в пищевых добавках в Северной Америке

- Рынок аминокислот в составе пищевых добавок в Северной Америке переживает устойчивый рост из-за растущего внимания потребителей к фитнесу, иммунитету и общему благополучию, а также растущего спроса на персонализированные решения в области питания.

- Растущий интерес к спортивному питанию и контролю веса побуждает производителей разрабатывать инновационные формулы высококачественных, биодоступных аминокислот, адаптированные к различным потребностям потребителей.

- США доминируют на североамериканском рынке аминокислот в составе пищевых добавок с наибольшей долей выручки в 75,2% в 2024 году, что обусловлено хорошо развитой индустрией здравоохранения и оздоровления, а также высокими потребительскими расходами на пищевые добавки.

- Ожидается, что Канада станет страной с самыми быстрыми темпами роста на североамериканском рынке аминокислот в составе пищевых добавок в течение прогнозируемого периода, чему будет способствовать повышение осведомленности о здоровом образе жизни, развитие фитнес-трендов и растущее использование пищевых добавок среди миллениалов и представителей поколения Z.

- Сегмент глутаминовой кислоты занимал самую большую долю рынка в 43,4% в 2024 году, что обусловлено ее широким применением в качестве усилителя вкуса и ее ролью в поддержке синтеза нейромедиаторов и общего состояния здоровья.

Область применения отчета и сегментация рынка аминокислот в пищевых добавках в Северной Америке

|

Атрибуты |

Ключевые данные о рынке аминокислот в пищевых добавках в Северной Америке |

|

Охваченные сегменты |

|

|

Охваченные страны |

Северная Америка

|

|

Ключевые игроки рынка |

|

|

Рыночные возможности |

|

|

Информационные наборы данных с добавленной стоимостью |

Помимо информации о рыночных сценариях, таких как рыночная стоимость, темпы роста, сегментация, географический охват и основные игроки, отчеты о рынке, подготовленные Data Bridge Market Research, также включают в себя углубленный экспертный анализ, анализ цен, анализ доли бренда, опрос потребителей, демографический анализ, анализ цепочки поставок, анализ цепочки создания стоимости, обзор сырья/расходных материалов, критерии выбора поставщиков, анализ PESTLE, анализ Портера и нормативную базу. |

Тенденции рынка аминокислот в пищевых добавках в Северной Америке

Растущая интеграция персонализированного питания и аналитики данных

- На североамериканском рынке аминокислот в составе пищевых добавок наблюдается значительная тенденция к интеграции персонализированного питания и углубленной аналитики данных.

- Эти технологии позволяют разрабатывать индивидуальные рекомендации по приему добавок, анализируя индивидуальные данные о здоровье, привычках питания и генетических профилях для оптимизации результатов лечения.

- Разрабатываются платформы на базе искусственного интеллекта для предоставления персонализированных планов приема добавок с аминокислотами, например, ориентированных на конкретные фитнес-цели, поддержку иммунитета или когнитивное здоровье, на основе данных, характерных для конкретного пользователя.

- Например, компании используют аналитику данных, чтобы рекомендовать точные дозировки аминокислот, таких как лизин или метионин, для восстановления мышц или управления энергией, соответствующие индивидуальным потребностям потребителей.

- Эта тенденция повышает привлекательность добавок с аминокислотами, предлагая целевые решения, что делает их более привлекательными для потребителей, заботящихся о своем здоровье, спортсменов и людей пожилого возраста.

- Аналитика данных также отслеживает модели потребления пищевых добавок потребителями, позволяя производителям оптимизировать формулы продуктов и маркетинговые стратегии.

Динамика рынка аминокислот в пищевых добавках в Северной Америке

Водитель

Растущий спрос на товары для здоровья, хорошего самочувствия и профилактической медицины

- Растущая осведомленность потребителей о здоровье и благополучии, особенно в США и Канаде, является основным фактором роста рынка аминокислот в пищевых добавках в Северной Америке.

- Добавки с аминокислотами, такие как глутаминовая кислота для когнитивного здоровья и триптофан для регуляции настроения, пользуются все большим спросом из-за их роли в поддержании иммунитета, восстановлении мышц и общем благополучии.

- Рост популярности фитнес-культуры и спортивного питания, особенно среди взрослых и спортсменов, увеличивает спрос на аминокислоты, такие как метионин и фенилаланин, для роста мышц и повышения производительности.

- Правительственные инициативы и кампании в области здравоохранения, направленные на пропаганду профилактической помощи, особенно в США, которые доминируют на рынке, поощряют использование пищевых добавок для решения проблемы дефицита питательных веществ.

- Расширение платформ электронной коммерции и повышение доступности безрецептурных добавок являются дополнительными драйверами роста рынка, особенно в Канаде, самой быстрорастущей стране в регионе.

- Достижения в области форм выпуска пищевых добавок, таких как жевательные конфеты и жидкости, отвечают разнообразным предпочтениям потребителей, способствуя проникновению на рынок.

Сдержанность/Вызов

Высокие производственные затраты и проблемы с соблюдением нормативных требований

- Высокая стоимость производства и разработки добавок с аминокислотами, включая закупку сырья и усовершенствованные формы выпуска, такие как мягкие гели и порошки, может стать серьезным препятствием, особенно для небольших производителей на развивающихся рынках.

- Разработка специализированных рецептур, например, для младенцев или беременных женщин, требует значительных инвестиций в исследования и контроль качества, что увеличивает общие затраты.

- Соблюдение нормативных требований и вопросы безопасности представляют собой серьёзную проблему. Производство аминокислотных добавок подразумевает сбор и анализ данных о здоровье потребителей для персонализированного питания, что вызывает опасения по поводу конфиденциальности данных и соблюдения таких нормативных требований, как Закон США о переносимости и подотчётности медицинского страхования (HIPAA) и Закон Канады о защите персональной информации и электронных документов (PIPEDA).

- Сложная нормативно-правовая база в США и Канаде в отношении безопасности, маркировки и заявлений о пользе добавок может усложнить работу производителей и ограничить расширение рынка.

- Возможные побочные эффекты, такие как дискомфорт в желудочно-кишечном тракте из-за высоких доз определенных аминокислот, таких как глутаминовая кислота, могут отпугивать потребителей, особенно в регионах с высоким уровнем осведомленности о безопасности добавок.

Рынок аминокислот в пищевых добавках в Северной Америке. Область применения

Рынок сегментирован по типу, форме, применению, конечному пользователю и каналу сбыта.

- По типу

По типу аминокислот рынок пищевых добавок в Северной Америке сегментируется на глутаминовую кислоту, лизин, триптофан, метионин, фенилаланин и другие. Сегмент глутаминовой кислоты занимал наибольшую долю рынка – 43,4% – в 2024 году, что обусловлено её широким применением в качестве усилителя вкуса и её ролью в поддержании синтеза нейромедиаторов и общего здоровья. Высокий спрос на пищевые добавки обусловлен осведомлённостью потребителей о её пользе для восстановления мышц и улучшения когнитивных функций.

Ожидается, что сегмент лизина продемонстрирует самые высокие темпы роста – 8,7% – в период с 2025 по 2032 год, что обусловлено его растущим использованием в спортивном питании и его ролью в развитии мышц, функционировании иммунной системы и выработке гормонов. Растущий спрос на растительные добавки с лизином, особенно среди вегетарианцев и веганов, ещё больше ускоряет его внедрение.

- По форме

По форме выпуска рынок аминокислот в составе пищевых добавок в Северной Америке сегментируется на таблетки, капсулы, мягкие гели, порошки, жевательные конфеты, жидкости и другие. Наибольшая доля выручки рынка в 2024 году пришлась на сегмент порошков – 38,3%, что объясняется его универсальностью, простотой настройки дозировки и популярностью среди любителей фитнеса, поскольку их можно смешивать с коктейлями или смузи.

Ожидается, что сегмент жидких добавок продемонстрирует самые высокие темпы роста – 7,5% в период с 2025 по 2032 год. Это обусловлено быстрой усвояемостью и простотой использования, особенно для потребителей, ищущих удобные и быстродействующие добавки. Рост популярности липосомальных жидких формул повышает их биодоступность, стимулируя внедрение.

- По применению

По сфере применения рынок аминокислот в составе пищевых добавок в Северной Америке сегментируется на следующие категории: контроль энергии и веса, общее состояние здоровья, здоровье костей и суставов, здоровье желудочно-кишечного тракта, иммунитет, здоровье сердца, диабет, противораковые препараты и другие. Сегмент контроля энергии и веса доминировал с долей выручки 39,1% в 2024 году, что обусловлено растущим спросом на аминокислотные добавки среди спортсменов и любителей фитнеса для восстановления мышц, снижения утомляемости и повышения производительности.

Ожидается, что сегмент продуктов для поддержания иммунитета продемонстрирует устойчивый рост в период с 2025 по 2032 год, что обусловлено возросшим вниманием потребителей к профилактическим мерам здравоохранения после пандемии COVID-19. Аминокислоты, такие как глутамин и аргинин, пользуются всё большим спросом благодаря своей роли в поддержании иммунитета и общего благополучия.

- Конечным пользователем

По типу конечного потребителя рынок аминокислот в составе биологически активных добавок в Северной Америке сегментируется на следующие группы: взрослые, пожилые люди, беременные женщины, дети и младенцы. Сегмент взрослых обеспечил наибольшую долю рынка в 47,3% в 2024 году, что обусловлено растущей осведомлённостью о профилактической медицине, трендами в фитнесе и необходимостью восполнить дефицит питательных веществ среди взрослых потребителей.

Ожидается, что гериатрический сегмент продемонстрирует быстрый рост на 6,8% в период с 2025 по 2032 год, что обусловлено растущим спросом стареющего населения на добавки, направленные на здоровье костей, когнитивные функции и иммунитет. Производители разрабатывают специальные формулы аминокислот, отвечающие особым потребностям пожилых людей.

- По каналу распространения

По каналам сбыта рынок аминокислот в составе биологически активных добавок в Северной Америке сегментируется на безрецептурные (OTC) и рецептурные препараты. Сегмент OTC доминировал с долей выручки 62,7% в 2024 году благодаря широкой доступности аминокислотных добавок в розничных каналах, включая аптеки, супермаркеты и платформы электронной коммерции, ориентированных на потребителей, заботящихся о своем здоровье.

Ожидается, что сегмент рецептурных препаратов продемонстрирует значительный рост в период с 2025 по 2032 год, что будет обусловлено увеличением числа рекомендаций специалистов в области здравоохранения относительно добавок с аминокислотами для решения конкретных проблем со здоровьем, таких как потеря мышечной массы, укрепление иммунитета и контроль хронических заболеваний.

Региональный анализ рынка аминокислот в пищевых добавках в Северной Америке

- США доминируют на североамериканском рынке аминокислот в составе пищевых добавок с наибольшей долей выручки в 75,2% в 2024 году, что обусловлено хорошо развитой индустрией здравоохранения и оздоровления, а также высокими потребительскими расходами на пищевые добавки.

- Тенденция к фитнесу и профилактическому здравоохранению в сочетании с ужесточением правил, гарантирующих безопасность продукции, дополнительно стимулирует расширение рынка. Стремление производителей к инновационным формулам, таким как растительные и высокоэффективные аминокислоты, дополняет как розничные продажи, так и продажи по рецепту, создавая разнообразную экосистему продуктов.

Обзор рынка аминокислот в пищевых добавках в Канаде

Ожидается, что Канада станет свидетелем самых высоких темпов роста рынка аминокислот в составе биологически активных добавок в Северной Америке, что обусловлено растущим спросом на оздоровительные добавки в городах и пригородах. Потребители ищут аминокислоты для контроля энергии и веса, укрепления иммунитета и общего состояния здоровья. Повышение осведомленности о пользе для здоровья и развитие нормативных требований здравоохранения, направленных на баланс между эффективностью и безопасностью, влияют на выбор потребителей.

Доля рынка аминокислот в пищевых добавках в Северной Америке

Лидерами отрасли производства аминокислот в составе пищевых добавок являются в основном хорошо зарекомендовавшие себя компании, в том числе:

- MusclePharm (США)

- True Nutrition (США)

- Пищевые добавки Reliance Private Label (США)

- NOW Foods (США)

- Solgar Inc. (США)

- BIOVEA (США)

- Jarrow Formulas, Inc (США)

- Optimum Nutrition (США)

- Universal Nutrition (США)

- Evonik Industries AG (Германия)

- Целлюкор (США)

- КАГЕД (США)

- EVLUTION NUTRITION (США)

- ALLMAX (Канада)

- Ajinomoto Co., Inc. (Япония)

- GAT WHP (США)

- ProSupps USA, LLC (США)

- NutraBio Labs, Inc. (США)

- Five Percent Nutrition, LLC. (США)

Каковы последние тенденции на рынке аминокислот в пищевых добавках в Северной Америке?

- В мае 2025 года компания Arla Foods Ingredients (AFI) представила революционное решение для улучшения пероральных пищевых добавок (ПП) в форме сока для сектора медицинского питания. Используя Lacprodan® BLG-100, чистый бета-лактоглобулин, богатый незаменимыми аминокислотами, такими как лейцин, компания AFI успешно увеличила содержание белка до 7% без ущерба для вкуса, консистенции и стабильности. Эта обезжиренная формула предлагает приятную на вкус альтернативу традиционным молочным ПП, решая проблемы недоедания и потери мышечной массы. Инновация отражает приверженность AFI принципам «чистой этикетки» и высокоэффективного питания, а также отвечает растущему спросу на эффективные и удобные в употреблении пищевые добавки.

- В январе 2025 года корпорация Cizzle Brands запустила Spoken Nutrition — премиальный бренд нутрицевтиков, специально разработанный для спорта и фитнеса. Spoken Nutrition, сертифицированный NSF for Sport®, соответствует строгим стандартам безопасности и чистоты, предъявляемым профессиональными спортивными организациями. Линейка продукции, разработанная ведущими экспертами в области спортивной подготовки, включая тренеров звезд НБА и НФЛ, включает добавки для улучшения сна, здоровья кишечника и восстановления мышц. Spoken Nutrition, одобренный командами высшей лиги и делающий акцент на чистых и эффективных формулах, стремится изменить представление о спортивном питании для элитных спортсменов и любителей фитнеса, таких как

- В сентябре 2024 года корпорация Agape ATP Corporation выпустила ATP2 – современную оздоровительную добавку, разработанную для поддержания целостного здоровья и жизненного тонуса. Усовершенствованная формула включает 20 аминокислот, 76 незаменимых минералов и растительные ферменты, которые действуют синергетически с ацетатом водорода – научно обоснованным ингредиентом, улучшающим метаболизм, уменьшающим воспаление и борющимся со старением. ATP2 направлен на решение ключевых проблем со здоровьем, таких как хронические заболевания, выработка энергии и восстановление клеток, что отражает растущую тенденцию к комплексным решениям в области питания. Благодаря своей инновационной формуле, ATP2 представляет собой важный этап в приверженности Agape передовым научным разработкам в области оздоровления.

- В октябре 2023 года компания Vitaquest International стратегически приобрела завод по переработке порошков Pharmachem в Патерсоне, штат Нью-Джерси, что значительно расширило её производственные и технологические возможности. Этот завод, теперь известный как VQ Technologies, использует передовые технологии обработки в псевдоожиженном слое, что позволяет Vitaquest предлагать специализированные услуги, такие как грануляция, агломерация, микрокапсулирование, сушка и смешивание порошковых и жидких ингредиентов. Эти процессы повышают эффективность добавок за счёт улучшения текучести, вкуса, стабильности и точности дозирования. Это приобретение выводит Vitaquest на лидирующие позиции в области разработки порошков и частиц, поддерживая её миссию по предоставлению высококачественных инновационных решений для секторов нутрицевтики и функционального питания.

- В сентябре 2023 года компания VitaNatural Inc. расширила свой портфель и присутствие на рынке, приобретя Vitamin Bounty, хорошо зарекомендовавший себя бренд диетических добавок, известный своими высококачественными продуктами для здоровья и благополучия. Компания Vitamin Bounty, основанная в 2016 году, предлагает широкий ассортимент добавок — от средств для укрепления иммунитета до средств для контроля веса, — производимых на сертифицированных по стандарту GMP предприятиях и прошедших независимую проверку качества. Это стратегическое приобретение позволяет VitaNatural использовать сильное присутствие Vitamin Bounty в интернете и розничные партнёрства по всей Северной Америке, укрепляя её конкурентные преимущества на растущем рынке самостоятельного оздоровления. Этот шаг подчёркивает приверженность VitaNatural инновациям, развитию бренда и предоставлению надёжных решений для здоровья.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.