North America Advanced Wound Care Market, By Product Type (Dressing, Therapy Device, Biologics, Others), Wound Type (Primary Wound Care, Secondary Wound Care), Wound Class (Class I, Class II, Class III, Class IV), End User (Hospitals, Wound Care Centers, Ambulatory Centers, Home Healthcare, Clinics, Others), Distribution Channel (Direct Tenders, Retail), Country (U.S., Canada, Mexico) Industry Trends and Forecast to 2022.

Advanced Wound Care Market Size

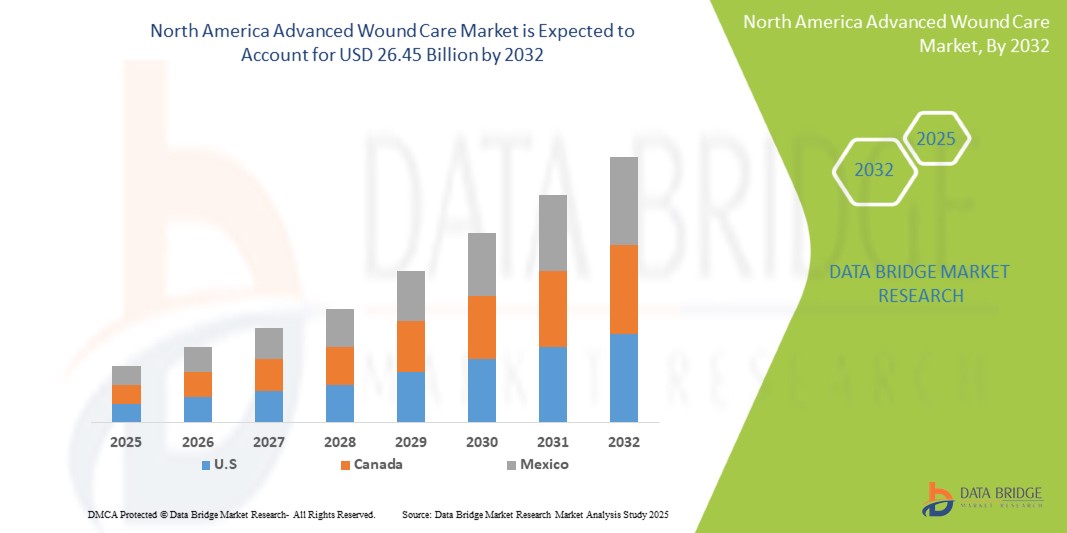

- The North America Advanced Wound Care Market size was valued atUSD 15.18 Billion in 2024and is expected to reachUSD 26.45 Billion by 2032, at aCAGR of 6.55%during the forecast period

- This growth is driven by factors such as the rising number of surgical procedures, increasing incidence of chronic wounds, and technological advancements in Advanced Wound Care.

Advanced Wound Care Market Analysis

- Active wound care products play a critical role in enhancing the wound healing process by supporting cellular activity and tissue regeneration, particularly in chronic and non-healing wounds

- The demand for these products is driven by the increasing prevalence of chronic wounds, growing geriatric population, and rising awareness about advanced wound management solutions

- U.S. is expected to dominate the Active and Advanced Wound Care market due to its strong healthcare infrastructure, high healthcare expenditure, and increasing adoption of innovative wound care therapies

- U.S. is also projected to be the fastest-growing market during the forecast period due to the surge in diabetic foot ulcers, supportive reimbursement policies, and growing investments in wound care R&D

- The Advanced Dressings segment is expected to lead the market with a significant share due to their effectiveness in moisture retention, infection prevention, and acceleration of the healing process in complex wounds

Report Scope andAdvanced Wound Care Market Segmentation

|

Attributes |

Advanced Wound Care KeyMarket Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Advanced Wound Care Market Trends

“Rising Prevalence of Chronic and Surgical Wounds”

- The increasing incidence of chronic wounds, such as diabetic foot ulcers and pressure ulcers, is driving demand for effective Advanced Wound Care devices to accelerate healing, minimize infection risk, and reduce hospital stays, especially among the aging population.

- Surgical procedures are rising due to a growing elderly population and lifestyle-related diseases. Post-surgical wound management is critical, and advanced Advanced Wound Care devices are essential to support quick recovery and minimize complications like infections and dehiscence.

- Patients suffering from obesity or compromised immune systems face more complications in wound healing. This necessitates innovative Advanced Wound Care solutions that offer superior sealing, minimal trauma, and improved outcomes, thereby fueling the adoption of advanced Advanced Wound Care.

For Instance,

- The rising prevalence of chronic wounds, including diabetic foot ulcers and pressure ulcers, increases demand for advanced wound care devices. These solutions are crucial for the aging population and surgical patients, as they enhance healing and reduce infection risk. Innovative options are particularly vital for patients with obesity or compromised immune systems.

Advanced Wound Care Market Dynamics

Driver

Technological Advancements in Advanced Wound Care Techniques

- Emerging technologies such as absorbable staples, bioengineered adhesives, and antimicrobial sutures provide efficient, less invasive wound Advanced Wound Care options. These innovations enhance clinical outcomes and patient comfort, encouraging wider use in both hospitals and outpatient settings.

- The integration of Advanced Wound Care with digital monitoring tools enables real-time assessment of healing progress. This improves treatment strategies, reduces readmissions, and supports better decision-making among healthcare professionals, promoting adoption across North America.

- Minimally invasive surgical procedures are increasingly popular, necessitating equally advanced Advanced Wound Care. These tools allow quicker recovery times, reduced scarring, and better cosmetic results, meeting rising patient and provider expectations for high-quality care.

For Instance

- Technological advancements in advanced wound care, such as absorbable staples and antimicrobial sutures, offer efficient and less invasive options that enhance patient comfort and clinical outcomes. The integration with digital monitoring tools supports real-time healing assessments, while minimally invasive surgeries necessitate advanced wound care solutions for quicker recovery and improved cosmetic results.

Opportunity

“Rising Ambulatory Surgical Centers (ASCs) and Homecare Trends”

- With the shift toward cost-effective healthcare, Ambulatory Surgical Centers are on the rise. These facilities favor wound Advanced Wound Care solutions that are quick to apply, easy to monitor, and adaptable to same-day procedures, offering growth potential for manufacturers.

- The expansion of home healthcare services allows for increased use of user-friendly Advanced Wound Care. Devices like skin adhesives and adhesive strips, which require minimal medical supervision, are in demand among homecare patients across North America.

- Remote patient monitoring combined with easy-to-use Advanced Wound Care technologies creates an opportunity for manufacturers to develop smart, self-applicable Advanced Wound Care systems. These innovations align with the growing preference for decentralized and patient-centric healthcare delivery models.

For Instance,

- The rise of Ambulatory Surgical Centers (ASCs) emphasizes the need for quick, adaptable advanced wound care solutions suitable for same-day procedures, providing growth opportunities for manufacturers. Additionally, the expansion of home healthcare services drives demand for user-friendly devices, while remote monitoring fosters innovation in self-applicable wound care systems, enhancing patient-centric care.

Restraint/Challenge

“Regulatory Hurdles and Reimbursement Constraints”

- Strict regulatory pathways for approval of Advanced Wound Care in the U.S. and Canada can delay market entry. Developers face rigorous testing and documentation requirements, increasing time-to-market and development costs.

- Reimbursement limitations for newer wound Advanced Wound Care technologies restrict hospital and clinic adoption. Without adequate insurance coverage, healthcare providers may be reluctant to switch from traditional methods, hindering widespread deployment of innovative solutions.

- Navigating varying state-level reimbursement rules in the U.S. adds complexity for manufacturers. Inconsistent policies between regions impact market penetration and create operational challenges, especially for small and mid-sized device developers.

For Instance,

- Strict regulatory pathways in the U.S. and Canada for advanced wound care can hinder market entry due to rigorous testing and documentation requirements. Additionally, reimbursement limitations discourage healthcare providers from adopting new technologies, while varying state-level rules in the U.S. complicate market penetration for small and mid-sized manufacturers.

Advanced Wound Care Market Scope

The market is segmented on the basis Product Type, Wound ,Wound Class, End User, Distribution Channel.

|

Segmentation |

Sub-Segmentation |

|

By Product Type |

|

|

Wound |

|

|

Wound Class |

|

|

End User |

|

|

Distribution Channel |

|

In 2025, theAdhesives is projected to dominate the market with a largest share in application segment

The Adhesives segment is expected to dominate the Advanced Wound Care market with the largest share of 48.38% in 2024 due to increasing demand for non-invasive, easy-to-use wound Advanced Wound Care solutions. As a critical component in both surgical and trauma care, advancements in adhesive strength, flexibility, and biocompatibility have significantly improved clinical outcomes and patient comfort. The rising volume of surgical procedures, growing preference for minimally invasive techniques, and increasing healthcare awareness further contribute to the segment’s market dominance.

TheStaples is expected to account for the largest share during the forecast period in technology market

In 2025, the Staples segment is expected to dominate the Advanced Wound Care market with the largest market share of 48.38% due to their efficiency, speed of application, and effectiveness in closing large or complex wounds. As a vital component in surgical wound management, advancements in stapler design, material safety, and precision delivery systems have improved procedural outcomes and reduced operative time. The increasing number of surgical interventions, rising demand for reliable Advanced Wound Care methods, and growing adoption of technology-driven surgical tools further contribute to the segment’s market dominance.

Advanced Wound Care Market Regional Analysis

“U.S Holds the Largest Share and highest CAGR in theAdvanced Wound CareMarket”

- U.S. dominates and highest CAGR the Advanced Wound Care market, driven by advanced healthcare infrastructure, high volume of surgical procedures, and strong presence of key market players

- The U.S. holds a significant share due to increased demand for minimally invasive wound Advanced Wound Care solutions, rising incidence of chronic wounds, and growing preference for faster recovery options

- The availability of well-established reimbursement policies and growing investments in surgical innovation by leading medical device companies further strengthen the market

- In addition, the increasing shift toward outpatient surgeries, integration of smart wound care technologies, and the rising elderly population are fueling market expansion across the region

Advanced Wound Care Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Johnson & Johnson Services, Inc. (U.S.)

- Medtronic (Ireland)

- 3M (U.S.)

- Smith+Nephew (U.K.)

- B. Braun SE (Germany)

- Stryker (U.S.)

- Baxter (U.S.)

- Boston Scientific Corporation (U.S.)

- Frankenman International Ltd. (China)

- CooperSurgical Inc. (U.S.)

- Intuitive Surgical (U.S.)

- MANI, INC. (Japan)

- Artivion, Inc. (U.S.)

- CP Medical (Riverpoint Medical) (U.S.)

- CONMED Corporation (U.S.)

- Genesis Medtech (Singapore)

- Cardinal Health, Inc. (U.S.)

- Essity AB (Sweden)

- Medline Industries, LP (U.S.)

Latest Developments in North America Advanced Wound Care Market

- In June 2021, Ethicon Plus sutures were the first to be approved for use in the NHS by NICE Medical Technologies Guidance as they have been demonstrated to lower the possibility of surgical site infections (SSIs) by over 30%.

- In November 2020, Trubarb, a knotless tissue Advanced Wound Care device launched by Healthium, is an efficacious triangular end stopper that removes the need for knotting as compared to a normal suture.

- In March 2020, LiquiBand Plus, developed by Advanced Medical Solutions Limited, was approved by the FDA to heal readily approximated skin margins of wounds after surgical incisions.

- In February 2020, Wego-Stainless Steel suture was approved by the FDA for applications such as abdominal wound Advanced Wound Care, hernia repair, and sternal Advanced Wound Care by Foosin Medical Supplies Inc., Ltd

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.