Рынок острого респираторного дистресс-синдрома (ОРДС) в Северной Америке по причине (коронавирусное заболевание 2019 г. (COVID-19), сепсис, вдыхание вредных веществ, тяжелая пневмония и другие), типу (диагностика и лечение), способу введения (перорально, парентерально и другие), конечному пользователю (больницы, специализированные клиники, уход на дому и другие), каналу сбыта (прямой тендер, больничная аптека, розничная аптека, интернет-аптека и другие), стране (США, Канада и Мексика). Тенденции отрасли и прогноз до 2029 г.

Анализ рынка и аналитика : рынок острого респираторного дистресс-синдрома (ОРДС) в Северной Америке

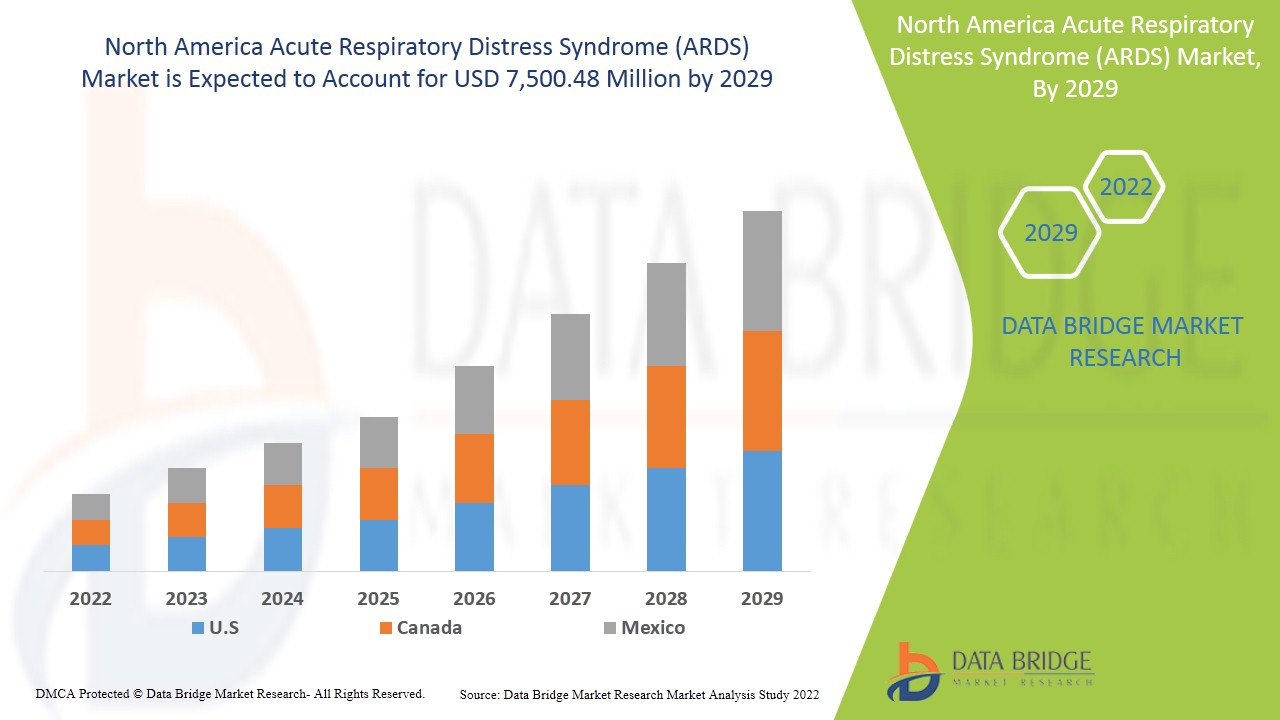

Ожидается, что рынок острого респираторного дистресс-синдрома (ОРДС) в Северной Америке будет расти в прогнозируемый период с 2022 по 2029 год. По данным Data Bridge Market Research, среднегодовой темп роста рынка составит 10,5% в прогнозируемый период с 2022 по 2029 год, и ожидается, что к 2029 году он достигнет 7 500,48 млн долларов США. Рост распространенности COVID-19 является движущей силой роста рынка острого респираторного дистресс-синдрома (ОРДС).

Острый респираторный дистресс-синдром (ОРДС) — это опасное для жизни повреждение легких, при котором жидкость просачивается в легкие. Большинство людей, у которых развивается ОРДС, уже находятся в больнице из-за травмы или заболевания, такого как COVID-19. Синдром обычно возникает, когда жидкость скапливается в крошечных эластичных воздушных мешочках, называемых альвеолами в легких. Это скопление жидкости приводит к тому, что в кровоток поступает меньше кислорода. Это лишает органы возможности получать достаточно кислорода для их нормального функционирования. У людей с другими заболеваниями ОРДС развивается в течение нескольких часов или дней после травмы или инфекции. Риск смерти увеличивается с возрастом, и в зависимости от тяжести заболевания пациентам становится тяжело пережить синдром. Тяжелая болезнь или травма, вызывающая повреждение мембранных мешочков легких, приводит к ОРДС. Наиболее распространенными основными причинами указанных заболеваний являются сепсис, вдыхание вредных веществ, тяжелая пневмония, травма головы, груди или другая серьезная травма, коронавирусная болезнь 2019 (COVID-19) и другие.

Рост распространенности и заболеваемости острым повреждением легких, широкий спектр факторов риска для ОРДС и ускорение в пуле пациентов с COVID-19 с ОРДС действуют как движущая сила для рынка острого респираторного дистресс-синдрома (ОРДС). Другие факторы, которые, как ожидается, будут способствовать росту рынка острого респираторного дистресс-синдрома (ОРДС) в Северной Америке, включают растущий уровень загрязнения воздуха и заболеваний, связанных с образом жизни, а также увеличение числа несчастных случаев и травм, вызывающих ОРДС.

Однако такие факторы, как осложнения, связанные с лечением, высокая стоимость устройств и методов лечения, сдерживают рост рынка острого респираторного дистресс-синдрома (ОРДС) в Северной Америке. С другой стороны, растущее гериатрическое население, растущие расходы на здравоохранение и стратегические инициативы участников рынка выступают в качестве возможности для роста рынка острого респираторного дистресс-синдрома (ОРДС) в Северной Америке. Строгие правила утверждения и многочисленные проблемы, с которыми сталкиваются медсестры отделений интенсивной терапии, являются ключевыми проблемами рынка острого респираторного дистресс-синдрома (ОРДС) в Северной Америке.

Отчет о рынке острого респираторного дистресс-синдрома (ОРДС) содержит подробную информацию о доле рынка, новых разработках и анализе продуктового портфеля, влиянии внутренних и локальных игроков рынка, анализирует возможности с точки зрения новых источников дохода, изменений в рыночных правилах, одобрений продуктов, стратегических решений, запусков продуктов, географических расширений и технологических инноваций на рынке. Чтобы понять анализ и сценарий рынка острого респираторного дистресс-синдрома (ОРДС), свяжитесь с Data Bridge Market Research для получения аналитического обзора, наша команда поможет вам создать решение по влиянию на доход для достижения желаемой цели.

Острый респираторный дистресс-синдром (ОРДС). Масштаб рынка и размер рынка

Рынок острого респираторного дистресс-синдрома (ОРДС) сегментирован на основе причины, типа, пути введения, конечных пользователей и канала сбыта. Рост среди сегментов помогает вам анализировать нишевые карманы роста и стратегии подхода к рынку и определять ваши основные области применения и разницу в ваших целевых рынках.

- На основе причины рынок острого респираторного дистресс-синдрома (ОРДС) в Северной Америке сегментируется на коронавирусное заболевание 2019 года (COVID-19), сепсис, вдыхание вредных веществ, тяжелую пневмонию и другие. Ожидается, что в 2022 году сегмент коронавирусного заболевания 2019 года (COVID-19) будет доминировать на рынке, поскольку заболевание распространилось по всему региону с огромными показателями смертности.

- На основе типа рынок острого респираторного дистресс-синдрома (ОРДС) в Северной Америке сегментируется на диагностику и лечение. Ожидается, что в 2022 году сегмент диагностики будет доминировать на рынке, поскольку люди стали более осведомленными о своевременной диагностике для надлежащего лечения смертельного расстройства.

- На основе пути введения рынок острого респираторного дистресс-синдрома (ОРДС) в Северной Америке сегментирован на пероральные, парентеральные и другие. Парентеральный сегмент далее сегментирован на внутримышечные и внутривенные. Ожидается, что в 2022 году парентеральный сегмент будет доминировать на рынке из-за большого ассортимента продуктов, одобренных FDA, и растущего числа продуктов, находящихся в разработке.

- На основе конечных пользователей рынок острого респираторного дистресс-синдрома (ОРДС) в Северной Америке сегментируется на больницы, специализированные клиники, домашнюю медицинскую помощь и т. д. Ожидается, что в 2022 году сегмент больниц будет доминировать на рынке из-за высоких технологических разработок в развитой части страны.

- На основе канала сбыта рынок острого респираторного дистресс-синдрома (ОРДС) в Северной Америке сегментируется на прямые торги, больничную аптеку, розничную аптеку, интернет-аптеку и др. Ожидается, что в 2022 году сегмент прямых торгов будет доминировать на рынке, поскольку игроки предпринимают стратегические инициативы по расширению своего канала сбыта для поставок по всему миру.

Анализ рынка острого респираторного дистресс-синдрома (ОРДС) на уровне страны

Проанализирован рынок острого респираторного дистресс-синдрома (ОРДС) и предоставлена информация о размере рынка по странам, пяти основным сегментам, таким как причина, тип, путь введения, конечные пользователи и канал сбыта, как указано выше.

В отчете о рынке острого респираторного дистресс-синдрома (ОРДС) рассматриваются следующие страны: США, Канада и Мексика.

Ожидается, что сегмент больниц в США будет расти самыми высокими темпами в прогнозируемый период с 2022 по 2029 год из-за увеличения государственной и организационной поддержки. Сегмент больниц в Канаде занимает второе место по доминированию на рынке из-за увеличения случаев хронических респираторных заболеваний и высокого уровня внедрения надлежащей диагностики. Мексика занимает третье место по росту рынка, а сегмент больниц доминирует в этой стране из-за увеличения числа новых больничных инфраструктур, открываемых из-за появления COVID-19.

Раздел отчета по странам также содержит отдельные факторы, влияющие на рынок, и изменения в регулировании на внутреннем рынке, которые влияют на текущие и будущие тенденции рынка. Такие данные, как новые продажи, заменяющие продажи, демографические данные страны, нормативные акты и импортно-экспортные тарифы, являются одними из основных указателей, используемых для прогнозирования рыночного сценария для отдельных стран. Кроме того, при предоставлении прогнозного анализа данных по стране учитываются наличие и доступность брендов Северной Америки и их проблемы из-за большой или малой конкуренции со стороны местных и отечественных брендов, влияние каналов продаж.

Расширение стратегической деятельности основных участников рынка по повышению осведомленности о лечении острого респираторного дистресс-синдрома (ОРДС) стимулирует рост рынка острого респираторного дистресс-синдрома (ОРДС)

Рынок острого респираторного дистресс-синдрома (ОРДС) также предоставляет вам подробный анализ рынка для роста каждой страны на определенном рынке. Кроме того, он предоставляет подробную информацию о стратегии участников рынка и их географическом присутствии. Данные доступны за исторический период с 2011 по 2020 год.

Анализ конкурентной среды и доли рынка острого респираторного дистресс-синдрома (ОРДС)

Конкурентная среда рынка острого респираторного дистресс-синдрома (ОРДС) содержит подробную информацию по конкурентам. Включены следующие сведения: обзор компании, финансовые показатели компании, полученный доход, рыночный потенциал, инвестиции в исследования и разработки, новые рыночные инициативы, производственные площадки и объекты, сильные и слабые стороны компании, запуск продукта, испытания продуктов, одобрения продуктов, патенты, широта и широта продукта, доминирование приложений, кривая жизненной линии технологий. Приведенные выше точки данных относятся только к фокусу компании, связанному с рынком острого респираторного дистресс-синдрома (ОРДС).

Основными компаниями, которые занимаются острым респираторным дистресс-синдромом (ОРДС), являются Drägerwerk AG & Co. KGaA, Fisher & Paykel Healthcare Limited., LivaNova PLC, Gilead Sciences, Inc., Fresenius SE & Co. KGaA, Armstrong Medical, Smiths Medical (часть ICU Medical, Inc.), ResMed, ALung Technologies, Inc., Medtronic, F. Hoffmann-La Roche Ltd, Hamilton Medical, nice Neotech Medical Systems Pvt. Ltd., Pfizer Inc., WEINMANN Emergency Medical Technology GmbH + Co. KG, NIPRO, Terumo Medical Corporation, Getinge AB., EUROSETS и другие отечественные игроки. Аналитики DBMR понимают конкурентные преимущества и предоставляют конкурентный анализ для каждого конкурента отдельно.

Многие контракты и соглашения также инициируются компаниями по всему миру, которые также ускоряют развитие рынка острого респираторного дистресс-синдрома (ОРДС).

Например,

- В мае 2021 года компания Medtronic объявила о запуске системы мониторинга дыхательных путей SonarMed. Система использует акустическую технологию для проверки обструкции эндотрахеальной трубки. Это помогло компании расширить свой ассортимент продукции.

- В июле 2020 года компания F. Hoffman-La Roche Ltd объявила о запуске экспресс-теста на антитела к SARS-CoV-2. Тест был запущен в партнерстве с SD Biosenseor, Inc. Это помогло компании расширить свой продуктовый портфель.

Сотрудничество, запуск продукции, расширение бизнеса, награды и признание, совместные предприятия и другие стратегии участников рынка расширяют присутствие компании на рынке лечения острого респираторного дистресс-синдрома, что также обеспечивает рост прибыли организации.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Содержание

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 CAUSE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END USER COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTERS FIVE FORCES

5 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: REGULATIONS

5.1 REGULATION IN U.S.:

5.2 REGULATION FOR VENTILATORS AND RESPIRATORY DEVICES AS PER FDA

5.3 REGULATION FOR THE USE OF VENTILATOR AND ANESTHESIA GAS MACHINE BREATHING CIRCUIT DEVICES

5.4 LABELING OF MODIFIED DEVICES

5.5 REGULATION IN EUROPE:

5.6 REGULATION IN INDIA:

5.7 REGULATION IN JAPAN:

6 REGIONAL SUMMARY

6.1 NORTH AMERICA REGION

6.2 EUROPE REGION

6.3 ASIA-PACIFIC

6.4 SOUTH AMERICA

6.5 MIDDLE EAST AND AFRICA

7 PIPELINE ANALYSIS

8 INSURANCE REIMBURSEMENT

8.1 CENTER FOR MEDICARE SERVICES (CMS)–ELSO (EXTRACORPOREAL LIFE SUPPORT ORGANIZATION)

8.2 HEALTH RESOURCES AND SERVICES ADMINISTRATION

8.3 ABBOTT CODING GUIDE FOR ECMO

8.4 CENTRAL GOVERNMENT HEALTH SCHEME (CGHS)

8.5 CERN HEALTH INSURANCE SCHEME

8.6 AMERICAN SOCIETY OF CLINICAL ONCOLOGY (ASCO) – (MEDICARE & MEDICAID)

8.7 AMERICAN HOSPITAL ASSOCIATION

8.8 CONCLUSION

9 MARKET OVERVIEW

9.1 DRIVERS

9.1.1 INCREASING PREVALENCE AND INCIDENCE OF ACUTE LUNG INJURY

9.1.2 WIDE RANGE OF RISK FACTORS FOR ARDS

9.1.3 ACCELERATION IN PATIENT POOL OF COVID-19 WITH ARDS

9.1.4 RISING RATE OF AIR POLLUTION AND LIFESTYLE-RELATED DISEASES

9.1.5 INCREASING ACCIDENT RATES AND TRAUMA CAUSING ARDS

9.2 RESTRAINTS

9.2.1 COMPLICATIONS ASSOCIATED WITH TREATMENTS

9.2.2 HIGH COST OF DEVICE AND TREATMENTS

9.2.3 LACK OF SKILLED WORKFORCE

9.3 OPPORTUNITIES

9.3.1 GROWING GERIATRIC POPULATION

9.3.2 RISING HEALTHCARE EXPENDITURE

9.3.3 STRATEGIC INITIATIVES BY MARKET PLAYERS

9.3.4 IMPROVING AWARENESS REGARDING ARD SYNDROME

9.4 CHALLENGES

9.4.1 STRINGENT RULES & REGULATIONS

9.4.2 MULTIPLE CHALLENGES FACED BY ICU NURSES

10 IMPACT OF COVID-19 PANDEMIC ON THE NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET

10.1 PRICE IMPACT

10.2 IMPACT ON DEMAND

10.3 IMPACT ON SUPPLY CHAIN

10.4 STRATEGIC DECISIONS FOR MANUFACTURERS

10.5 CONCLUSION

11 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY TYPE

11.1 OVERVIEW

11.2 DIAGNOSIS

11.2.1 IMAGING TESTS

11.2.1.1 CHEST X-RAY

11.2.1.2 CT SCAN

11.2.1.3 ULTRASOUND

11.2.1.4 OTHERS

11.2.2 BLOOD TEST

11.2.3 RESPIRATORY RATE

11.2.4 SPO2 TEST

11.2.5 OTHERS

11.3 TREATMENT

11.3.1 MECHANICAL VENTILATION

11.3.1.1 HIGH-FLOW NASAL O2

11.3.1.2 BI-LEVEL POSITIVE AIRWAY PRESSURE

11.3.1.3 CONTINOUS POSITIVE AIRWAY PRESSURE

11.3.1.4 PRONE POSITIVE VENTILATION

11.3.1.5 OTHERS

11.3.2 CORTICOSTEROIDS

11.3.2.1 METHYLPREDNISOLONE

11.3.2.2 DEXAMETHASONE

11.3.2.3 OTHERS

11.3.3 ANTIVIRAL MEDICATION

11.3.3.1 REMDESIVIR

11.3.3.2 COMBINATION DRUGS

11.3.3.3 OTHERS

11.3.4 EXTRACORPOREAL MEMBRANE OXYGENATION (ECMO)

11.3.5 TOCILIZUMAB

11.3.6 OTHERS

12 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY ROUTE OF ADMINISTRATION

12.1 OVERVIEW

12.2 PARENTERAL

12.2.1 INTRAVENOUS

12.2.2 INTRAMUSCULAR

12.3 ORAL

12.4 OTHERS

13 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY CAUSE

13.1 OVERVIEW

13.2 CORONAVIRUS DISEASE 2019 (COVID-19)

13.3 SEPSIS

13.4 INHALATION OF HARMFUL SUBSTANCES

13.5 SEVERE PNEUMONIA

13.6 OTHERS

14 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY END USER

14.1 OVERVIEW

14.2 HOSPITALS

14.3 SPECIALTY CLINICS

14.4 HOME HEALTHCARE

14.5 OTHERS

15 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY DISTRIBUTION CHANNEL

15.1 OVERVIEW

15.2 DIRECT TENDER

15.3 HOSPITAL PHARMACY

15.4 RETAIL PHARMACY

15.5 ONLINE PHARMACY

16 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY REGION

16.1 NORTH AMERICA

16.1.1 U.S.

16.1.2 CANADA

16.1.3 MEXICO

17 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: COMPANY LANDSCAPE

17.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

18 SWOT ANALYSIS

19 COMPANY PROFILE

19.1 GILEAD SCIENCES INC.

19.1.1 COMPANY SNAPSHOT

19.1.2 REVENUS ANALYSIS

19.1.3 COMPANY SHARE ANALYSIS

19.1.4 PRODUCT PORTFOLIO

19.1.5 RECENT DEVELOPMENT

19.2 TERUMO CORPORATION

19.2.1 COMPANY SNAPSHOT

19.2.2 REVENUS ANALYSIS

19.2.3 COMPANY SHARE ANALYSIS

19.2.4 PRODUCT PORTFOLIO

19.2.5 RECENT DEVELOPMENT

19.3 GETINGE AB

19.3.1 COMPANY SNAPSHOT

19.3.2 REVENUS ANALYSIS

19.3.3 COMPANY SHARE ANALYSIS

19.3.4 PRODUCT PORTFOLIO

19.3.5 RECENT DEVELOPMENT

19.4 LIVANOVA PLC

19.4.1 COMPANY SNAPSHOT

19.4.2 REVENUE ANALYSIS

19.4.3 COMPANY SHARE ANALYSIS

19.4.4 PRODUCT PORTFOLIO

19.4.5 RECENT DEVELOPMENTS

19.5 MEDTRONIC

19.5.1 COMPANY SNAPSHOT

19.5.2 REVENUE ANALYSIS

19.5.3 COMPANY SHARE ANALYSIS

19.5.4 PRODUCT PORTFOLIO

19.5.5 RECENT DEVELOPMENTS

19.6 ALUNG TECHNOLOGIES, INC

19.6.1 COMPANY SNAPSHOT

19.6.2 PRODUCT PORTFOLIO

19.6.3 RECENT DEVELOPMENT

19.7 ARMSTRONG MEDICAL

19.7.1 COMPANY SNAPSHOT

19.7.2 PRODUCT PORTFOLIO

19.7.3 RECENT DEVELOPMENT

19.8 BESMED HEALTH BUSINESS CORP.

19.8.1 COMPANY SNAPSHOT

19.8.2 PRODUCT PORTFOLIO

19.8.3 RECENT DEVELOPMENTS

19.9 DRÄGERWERK AG & CO. KGAA

19.9.1 COMPANY SNAPSHOT

19.9.2 REVENUE ANALYSIS

19.9.3 PRODUCT PORTFOLIO

19.9.4 RECENT DEVELOPMENTS

19.1 EUROSETS

19.10.1 COMPANY SNAPSHOT

19.10.2 PRODUCT PORTFOLIO

19.10.3 RECENT DEVELOPMENT

19.11 F. HOFFMANN-LA ROCHE LTD

19.11.1 COMPANY SNAPSHOT

19.11.2 RECENT ANALYSIS

19.11.3 PRODUCT PORTFOLIO

19.11.4 RECENT DEVELOPMENTS

19.12 FISHER & PAYKEL HEALTHCARE LIMITED

19.12.1 COMPANY SNAPSHOT

19.12.2 REVENUE ANALYSIS

19.12.3 PRODUCT PORTFOLIO

19.12.4 RECENT DEVELOPMENTS

19.13 FRESENIUS SE & CO. KGAA

19.13.1 COMPANY SNAPSHOT

19.13.2 REVENUS ANALYSIS

19.13.3 PRODUCT PORTFOLIO

19.13.4 RECENT DEVELOPMENTS

19.14 HAMILTON MEDICAL

19.14.1 COMPANY SNAPSHOT

19.14.2 PRODUCT PORTFOLIO

19.14.3 RECENT DEVELOPMENT

19.15 NICE NEOTECH MEDICAL SYSTEMS PVT.LTD.

19.15.1 COMPANY SNAPSHOT

19.15.2 PRODUCT PORTFOLIO

19.15.3 RECENT DEVELOPMENT

19.16 NIPRO

19.16.1 COMPANY SNAPSHOT

19.16.2 REVENUS ANALYSIS

19.16.3 PRODUCT PORTFOLIO

19.16.4 RECENT DEVELOPMENT

19.17 PFIZER INC.

19.17.1 COMPANY SNAPSHOT

19.17.2 REVENUS ANALYSIS

19.17.3 PRODUCT PORTFOLIO

19.17.4 RECENT DEVELOPMENT

19.18 RESMED

19.18.1 COMPANY SNAPSHOT

19.18.2 REVENUE ANALYSIS

19.18.3 PRODUCT PORTFOLIO

19.18.4 RECENT DEVELOPMENT

19.19 SMITHS MEDICAL

19.19.1 COMPANY SNAPSHOT

19.19.2 REVENUS ANALYSIS

19.19.3 PRODUCT PORTFOLIO

19.19.4 RECENT DEVELOPMENTS

19.2 WEINMANN EMERGENCY MEDICAL TECHNOLOGY GMBH + CO. KG

19.20.1 COMPANY SNAPSHOT

19.20.2 PRODUCT PORTFOLIO

19.20.3 RECENT DEVELOPMENT

20 QUESTIONNAIRE

21 RELATED REPORTS

Список таблиц

TABLE 1 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: PIPELINE ANALYSIS

TABLE 2 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA DIAGNOSIS IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA DIAGNOSIS IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA IMAGING TESTS IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA TREATMENT IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA TREATMENT IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA MECHANICAL VENTILATION IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA CORTICOSTEROIDS IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA ANTIVIRAL MEDICATION IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA PARENTERAL IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA PARENTERAL IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA ORAL IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA OTHERS IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY CAUSE, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA CORONAVIRUS DISEASE 2019 (COVID-19) IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA SEPSIS IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA INHALATION OF HARMFUL SUBSTANCES IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA SEVERE PNEUMONIA IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA OTHERS IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA HOSPITALS IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA SPECIALTY CLINICS IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA HOME HEALTHCARE IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA OTHERS IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA DIRECT TENDER IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA HOSPITAL PHARMACY IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA RETAIL PHARMACY IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA ONLINE PHARMACY IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY CAUSE, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA DIAGNOSIS IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA IMAGING TESTS IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA TREATMENT IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA ANTIVIRAL MEDICATION IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA CORTICOSTEROIDS IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA MECHANICAL VENTILATION IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA PARENTERAL IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 45 U.S. ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY CAUSE, 2020-2029 (USD MILLION)

TABLE 46 U.S. ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 47 U.S. DIAGNOSIS IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 48 U.S. IMAGING TESTS IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 49 U.S. TREATMENT IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 50 U.S. ANTIVIRAL MEDICATION IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 51 U.S. CORTICOSTEROIDS IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 52 U.S. MECHANICAL VENTILATION IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 53 U.S. ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 54 U.S. PARENTERAL IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 55 U.S. ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 56 U.S. ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 57 CANADA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY CAUSE, 2020-2029 (USD MILLION)

TABLE 58 CANADA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 59 CANADA DIAGNOSIS IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 60 CANADA IMAGING TESTS IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 61 CANADA TREATMENT IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 62 CANADA ANTIVIRAL MEDICATION IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 63 CANADA CORTICOSTEROIDS IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 64 CANADA MECHANICAL VENTILATION IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 65 CANADA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 66 CANADA PARENTERAL IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 67 CANADA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 68 CANADA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 69 MEXICO ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY CAUSE, 2020-2029 (USD MILLION)

TABLE 70 MEXICO ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 71 MEXICO DIAGNOSIS IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 72 MEXICO IMAGING TESTS IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 73 MEXICO TREATMENT IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 74 MEXICO ANTIVIRAL MEDICATION IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 75 MEXICO CORTICOSTEROIDS IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 76 MEXICO MECHANICAL VENTILATION IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 77 MEXICO ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 78 MEXICO PARENTERAL IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 79 MEXICO ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 80 MEXICO ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

Список рисунков

FIGURE 1 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: MARKET END USER COVERAGE GRID

FIGURE 9 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: SEGMENTATION

FIGURE 11 ACCELERATION IN PATIENT POOL OF COVID-19 WITH ARDS IS EXPECTED TO DRIVE THE NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 CORONAVIRUS DISEASE 2019 (COVID-19) SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET IN 2022 & 2029

FIGURE 13 NORTH AMERICA IS EXPECTED TO DOMINATE AND ASIA-PACIFIC IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET

FIGURE 15 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: BY TYPE, 2021

FIGURE 16 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: BY TYPE, 2020-2029 (USD MILLION)

FIGURE 17 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: BY TYPE, CAGR (2022-2029)

FIGURE 18 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: BY TYPE, LIFELINE CURVE

FIGURE 19 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: BY ROUTE OF ADMINISTRATION, 2021

FIGURE 20 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

FIGURE 21 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: BY ROUTE OF ADMINISTRATION, CAGR (2022-2029)

FIGURE 22 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: BY ROUTE OF ADMINISTRATION, LIFELINE CURVE

FIGURE 23 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: BY CAUSE, 2021

FIGURE 24 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: BY CAUSE, 2020-2029 (USD MILLION)

FIGURE 25 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: BY CAUSE, CAGR (2022-2029)

FIGURE 26 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: BY CAUSE, LIFELINE CURVE

FIGURE 27 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: BY END USER, 2021

FIGURE 28 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: BY END USER, 2020-2029 (USD MILLION)

FIGURE 29 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: BY END USER, CAGR (2022-2029)

FIGURE 30 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: BY END USER, LIFELINE CURVE

FIGURE 31 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: DISTRIBUTION CHANNEL, 2021

FIGURE 32 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

FIGURE 33 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 34 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 35 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: SNAPSHOT (2021)

FIGURE 36 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: BY COUNTRY (2021)

FIGURE 37 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: BY COUNTRY (2022 & 2029)

FIGURE 38 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: BY COUNTRY (2021 & 2029)

FIGURE 39 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: BY CAUSE (2022 & 2029)

FIGURE 40 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: COMPANY SHARE 2021 (%)

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.