Рынок серной кислоты на Ближнем Востоке и в Африке по сырью (металлоплавильные заводы, элементарная сера, колчеданная руда и другие), форме (концентрированная, серная кислота Боме 66 градусов, кислота Башни/Гловера, камерная/удобрительная кислота, аккумуляторная кислота и разбавленная серная кислота), процессу производства (контактный процесс, процесс в свинцовой камере, процесс получения мокрой серной кислоты, метабисульфитный процесс и другие), каналу сбыта (офлайн и онлайн), применению (удобрения, химическое производство, нефтепереработка , металлообработка, автомобилестроение, текстильная промышленность , производство лекарств, целлюлозно-бумажная промышленность, промышленность и другие). Тенденции и прогнозы в отрасли до 2029 года.

Анализ и размер рынка серной кислоты на Ближнем Востоке и в Африке

Серная кислота — бесцветная, не имеющая запаха и вязкая жидкость, растворимая в воде при любых концентрациях. Это сильная кислота, получаемая путем окисления растворов диоксида серы и используемая в больших количествах в качестве промышленного и лабораторного реагента. Серная кислота или серная кислота, также известная как купоросное масло, — это минеральная кислота, состоящая из серы, кислорода и водорода, с молекулярной формулой H2SO4 и температурой плавления 10 °C, температурой кипения 337 °C.

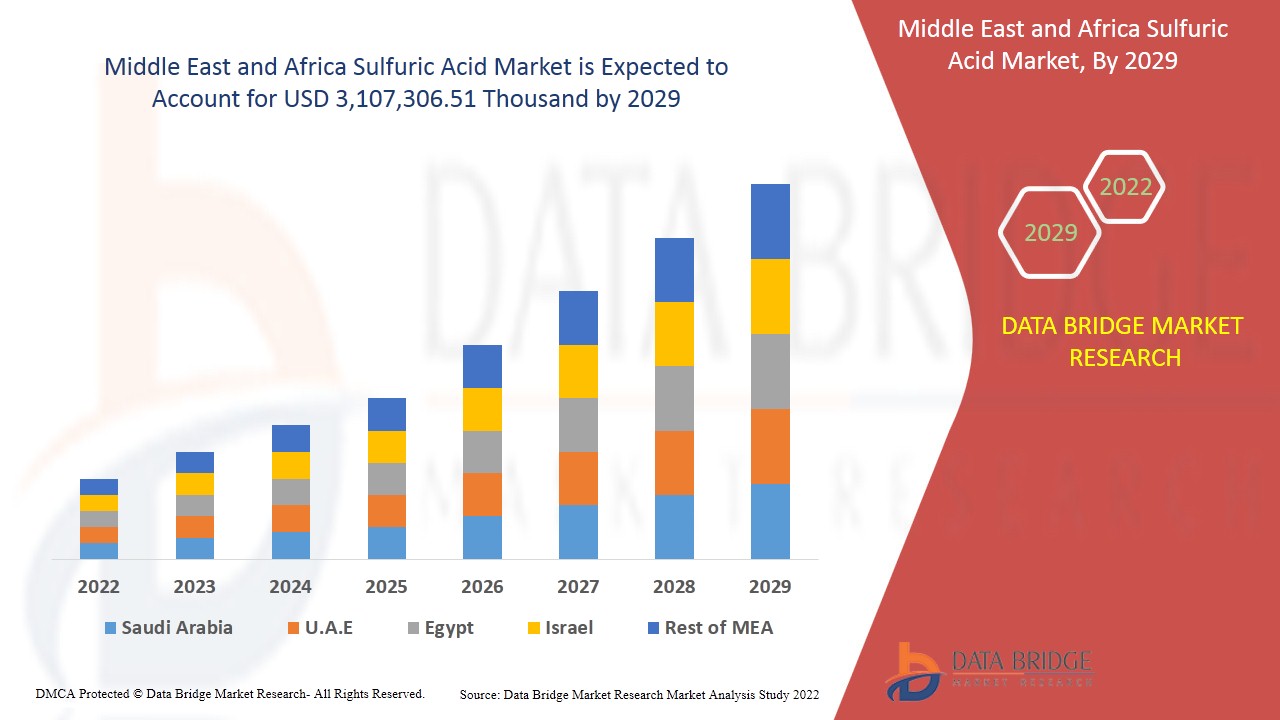

Растущий спрос на удобрения в сельскохозяйственной отрасли и растущий спрос на серную кислоту в различных отраслях промышленности являются одними из факторов, повышающих спрос на серную кислоту на рынке. Data Bridge Market Research анализирует, что рынок серной кислоты, как ожидается, достигнет значения 3 107 306,51 тыс. долларов США к 2029 году при среднегодовом темпе роста 3,1% в течение прогнозируемого периода. «Элементарная сера» составляет наиболее заметный сегмент сырья в соответствующем из-за обильной доступности серы по всему миру. Отчет о рынке, подготовленный командой Data Bridge Market Research, включает в себя углубленный экспертный анализ, анализ импорта/экспорта, анализ цен, анализ потребления производства и сценарий климатической цепочки.

|

Отчет Метрика |

Подробности |

|

Прогнозируемый период |

2022-2029 |

|

Базовый год |

2021 |

|

Исторические годы |

2020 (Можно настроить на 2019 - 2014) |

|

Количественные единицы |

Доход в тыс. долл. США, объемы в тыс. тонн, цены в долл. США |

|

Охваченные сегменты |

По сырью (металлоплавильные заводы, элементарная сера, колчеданная руда и другие), форме (концентрированная, 66-градусная серная кислота Боме, кислота Башни/Гловера, камерная/удобрительная кислота, аккумуляторная кислота и разбавленная серная кислота), процессу производства (контактный процесс, процесс свинцовой камеры, процесс получения влажной серной кислоты, метабисульфитный процесс и другие), каналу сбыта (офлайн и онлайн), применению (удобрения, химическое производство, нефтепереработка, металлообработка, автомобилестроение, текстиль, производство лекарств, целлюлозно-бумажная промышленность, промышленность и другие) |

|

Страна покрытия |

Южная Африка, Египет, Саудовская Аравия, Объединенные Арабские Эмираты, Израиль и остальной Ближний Восток и Африка на Ближнем Востоке и в Африке |

|

Охваченные участники рынка |

LANXESS (Кельн, Германия), Brenntag GmbH (дочерняя компания Brenntag SE) (Эссен, Германия), Boliden Group (Стокгольм, Швеция), Adisseo (Энтони, Франция), Veolia (Париж, Франция), Univar Solutions Inc (Иллинойс, США), NORAM Engineering & Construction Ltd. (Ванкувер, Канада), Nouryon (Амстердам, Нидерланды), International Raw Materials LTD (Пенсильвания, США), Eti Bakir (Кастамону, Турция), ACIDEKA SA (Бискайя, Испания), Airedale Chemical Company Limited. (Северный Йоркшир, Великобритания), BASF SE (Людвигсхафен, Германия), Aguachem Ltd (Рексем, Великобритания), Feralco AB (Виднес, Великобритания), Fluorsid (Милан, Италия), Aurubis AG (Гамбург, Германия), Nyrstar (Бюдель, Нидерланды), Merck KGaA (Дармштадт, Германия) и Shrieve (Техас, США) |

Определение рынка

Серная кислота — сильная кислота с гигроскопическими характеристиками и окислительными свойствами. Она используется в производстве удобрений, химической промышленности, синтетических тканей и пигментов. Другие области применения включают производство аккумуляторов, травление металла, а также другие промышленные производственные процессы. На рынке серная кислота доступна в различных концентрациях, таких как 98%, 96,5%, 76%, 70% и 38%. Большое количество серной кислоты используется для производства сульфатов калия и удобрений. Растущий спрос на удобрения в сельскохозяйственной отрасли и растущий спрос на серную кислоту в различных отраслях промышленности являются одними из движущих факторов, повышающих спрос на серную кислоту на рынке. С ростом потребления серной кислоты во всем мире основные игроки расширяют свои производственные мощности в разных странах, чтобы усилить свое присутствие на рынке.

Нормативная база

- DHHS (1994) и EPA не классифицировали триоксид серы или серную кислоту как канцерогенные вещества. IARC считает профессиональное воздействие сильных неорганических туманов, содержащих серную кислоту, канцерогенным для человека (Группа 1) (IARC 1992). ACGIH классифицировала серную кислоту как предполагаемый канцероген для человека (Группа A2) (ACGIH 1998).

Серная кислота входит в список химических веществ в разделе «Токсичные химические вещества, подпадающие под действие раздела 3 13 Закона о планировании действий в чрезвычайных ситуациях и праве общественности на информацию» (EPA 1998f).

Допустимый предел воздействия на рабочем месте (PEL) для серной кислоты составляет 1 мг/м3 (OSHA 1998). Рекомендуемый NIOSH предел воздействия (REL) также составляет 1 мг/м3 (NIOSH 1997). ACGIH рекомендует пороговое предельное значение средневзвешенной по времени концентрации (TLV-TWA) 1 мг/м3 и предел кратковременного воздействия (STEL) 3 мг/м3 (ACGIH 1998).

COVID-19 оказал минимальное влияние на рынок серной кислоты на Ближнем Востоке и в Африке

COVID-19 повлиял на различные производственные отрасли в 2020-2021 годах, поскольку он привел к закрытию рабочих мест, нарушению цепочек поставок и ограничениям на транспорт. Однако было отмечено значительное влияние на операции и цепочки поставок серной кислоты на Ближнем Востоке и в Африке, при этом несколько производственных предприятий все еще работали. Поставщики услуг продолжали предлагать серную кислоту после принятия мер санитарии и безопасности в пост-COVID-сценарии.

Динамика рынка серной кислоты на Ближнем Востоке и в Африке включает:

- Растущий спрос на удобрения в сельскохозяйственной отрасли

Растущий спрос на высококачественные удобрения для выращивания сельскохозяйственных культур стимулирует рынок серной кислоты на Ближнем Востоке и в Африке.

- Значительный рост в химической промышленности

Увеличение химического производства в европейском регионе с химической стратегией для устойчивости является важной частью Green Deal по укреплению роста химической промышленности, что позволяет легче избегать использования опасных химикатов и поощрять инновации для разработки безопасных и устойчивых альтернатив. Таким образом, стратегия устойчивости в химической промышленности может помочь сохранить значительный рост в химической промышленности и продвинуть рынок серной кислоты на Ближнем Востоке и в Африке в ближайшие годы.

- Растущий спрос на серную кислоту в различных отраслях промышленности

Ожидается, что спрос на серную кислоту в различных отраслях промышленности, таких как фармацевтическая, текстильная, бумажная и целлюлозно-бумажная, будет расти ускоренными темпами и, по прогнозам, будет стимулировать рынок серной кислоты на Ближнем Востоке и в Африке.

- Растущий спрос на аккумуляторы в автомобильной промышленности

Ожидается, что в связи с ростом спроса на утилизацию отходов печатных плат использование серной кислоты для извлечения различных металлов, таких как золото, серебро, железо и медь, будет стимулировать рынок серной кислоты на Ближнем Востоке и в Африке.

- Значительный рост в сфере здравоохранения

Растущие преимущества сернокислотных аккумуляторных батарей в автомобилях и других агрегатах электромобилей увеличивают спрос на серную кислоту, создавая возможность для рынка серной кислоты на Ближнем Востоке и в Африке выйти на него и продемонстрировать более высокие темпы роста в будущем.

- Обилие серы как сырья

Кроме того, сера в настоящее время также производится для промышленного использования в нефтяной и газовой промышленности по всему миру. Таким образом, обилие запасов серы по всему миру создает возможность для роста рынка серной кислоты на Ближнем Востоке и в Африке.

Ограничения/Проблемы, с которыми сталкивается рынок серной кислоты на Ближнем Востоке и в Африке

- Опасности для здоровья, связанные с серной кислотой

Растущая опасность для здоровья, связанная с воздействием серной кислоты на кожу, глаза и другие органы, вероятно, будет сдерживать спрос на серную кислоту на рынке Ближнего Востока и Африки.

- Снижение продаж из-за переизбытка серной кислоты

Недостаток серной кислоты на рынке серной кислоты Ближнего Востока и Африки является самой большой проблемой, с которой сталкиваются ключевые производители, работающие на рынке, что напрямую влияет на их продажи и маржу прибыли, поскольку переизбыток поставок со стороны других производителей привел к снижению цен. Это является самой большой проблемой в росте рынка серной кислоты Ближнего Востока и Африки.

В этом отчете о рынке серной кислоты содержатся сведения о последних новых разработках, правилах торговли, анализе импорта-экспорта, анализе производства, оптимизации цепочки создания стоимости, доле рынка, влиянии внутренних и локальных игроков рынка, анализируются возможности с точки зрения новых источников дохода, изменений в правилах рынка, анализ стратегического роста рынка, размер рынка, рост рынка категорий, ниши применения и доминирование, одобрения продуктов, запуски продуктов, географические расширения, технологические инновации на рынке. Чтобы получить больше информации о рынке серной кислоты, свяжитесь с Data Bridge Market Research для получения аналитического обзора . Наша команда поможет вам принять обоснованное рыночное решение для достижения роста рынка.

Последние события

- В ноябре 2020 года Airedale Chemical Company Limited приобрела Alutech, которая предлагает ряд решений по обработке металла, включая отбеливатели алюминия и очистители для предварительной обработки. Это развитие помогает компании увеличить спрос на серную кислоту, что увеличило ее прибыль

- В мае 2017 года BASF SE представила новый катализатор серной кислоты, предпочтительный из-за его уникальной геометрической формы. Это обновление помогает компании увеличить производственные мощности, что в будущем принесет доход

Масштаб рынка серной кислоты на Ближнем Востоке и в Африке

Рынок серной кислоты Ближнего Востока и Африки сегментирован на основе сырья, формы, производственного процесса, канала сбыта и применения. Рост среди этих сегментов поможет вам проанализировать сегменты с незначительным ростом в отраслях и предоставить пользователям ценный обзор рынка и рыночные идеи, которые помогут им принимать стратегические решения для определения основных рыночных приложений.

Сырье

- Плавильные заводы основных металлов

- Элементарная сера

- Пиритовая руда

- Другие

По сырью рынок сегментирован на плавильные заводы по производству цветных металлов, элементарной серы, пиритной руды и др. Ожидается, что в 2022 году сегмент элементарной серы будет доминировать из-за обильной доступности серы по всему миру.

Форма

- Концентрированный (98%)

- Кислота Тауэра/Гловера (77,67%)

- Камера/Удобрение Кислота (62,8%)

- Аккумуляторная кислота (33,5%)

- Серная кислота Боме 66 градусов (93%)

- Разбавленная серная кислота (10%)

По форме рынок сегментирован на концентрированную (98%), башенную/перчаточную кислоту (77,67%), камерную/удобрительную кислоту (62,8%), аккумуляторную кислоту (33,5%), серную кислоту Боме 66 градусов (93%) и разбавленную серную кислоту (10%).

Процесс производства

- Процесс контакта

- Процесс в свинцовой камере

- Процесс получения мокрой серной кислоты

- Процесс метабисульфита

- Другие

В зависимости от производственного процесса рынок сегментируется на контактный процесс, процесс в свинцовой камере, процесс с использованием мокрой серной кислоты, метабисульфитный процесс и другие.

Канал распространения

- Оффлайн

- Онлайн

По каналам сбыта рынок серной кислоты Ближнего Востока и Африки сегментируется на офлайн и онлайн.

Приложение

- Удобрение,

- Химическое производство

- Переработка нефти

- Обработка металла

- Автомобильный

- Текстиль

- Производство лекарств

- Целлюлозно-бумажная промышленность

- Промышленный

- Другие

На основе сферы применения рынок сегментирован на удобрения, химическое производство, нефтепереработку, металлообработку, автомобилестроение, текстиль, производство лекарств, целлюлозно-бумажную промышленность, промышленность и др. Ожидается, что удобрения будут доминировать в сегменте применения, поскольку спрос на серные удобрения растет для выращивания сельскохозяйственных культур и повышения плодородия почв.

Региональный анализ/идеи серной кислоты на Ближнем Востоке и в Африке

Проведен анализ рынка серной кислоты на Ближнем Востоке и в Африке, а также предоставлены сведения о размерах рынка и тенденциях по сырью, форме, производственному процессу, каналу сбыта и применению, как указано выше.

В отчете о рынке серной кислоты на Ближнем Востоке и в Африке рассматриваются следующие страны: Южная Африка, Египет, Саудовская Аравия, Объединенные Арабские Эмираты, Израиль, а также остальные страны Ближнего Востока и Африки.

На Ближнем Востоке и в Африке Объединенные Арабские Эмираты доминируют на рынке серной кислоты на Ближнем Востоке и в Африке из-за быстрорастущей индустрии удобрений в стране. Основное применение серной кислоты — производство основных видов удобрений, таких как суперфосфат извести и сульфат аммония.

Раздел отчета по странам также содержит отдельные факторы, влияющие на рынок, и изменения в регулировании рынка, которые влияют на текущие и будущие тенденции рынка. Такие данные, как анализ цепочки создания стоимости сверху и снизу, технические тенденции и анализ пяти сил Портера, тематические исследования, являются некоторыми из указателей, используемых для прогнозирования рыночного сценария для отдельных стран. Кроме того, при предоставлении прогнозного анализа данных по странам учитываются наличие и доступность глобальных брендов и их проблемы из-за большой или малой конкуренции со стороны местных и отечественных брендов, влияние внутренних тарифов и торговых путей.

Анализ конкурентной среды и доли рынка серной кислоты на Ближнем Востоке и в Африке

Конкурентная среда рынка серной кислоты на Ближнем Востоке и в Африке содержит подробную информацию по конкурентам. Включены следующие сведения: обзор компании, финансовые показатели компании, полученный доход, рыночный потенциал, инвестиции в исследования и разработки, новые рыночные инициативы, глобальное присутствие, производственные площадки и объекты, производственные мощности, сильные и слабые стороны компании, запуск продукта, широта и широта продукта, доминирование в применении. Приведенные выше данные относятся только к фокусу компаний, связанному с рынком серной кислоты на Ближнем Востоке и в Африке.

Среди основных игроков, работающих на рынке родентицидов, можно назвать LANXESS, Brenntag GmbH (дочерняя компания Brenntag SE), Boliden Group, Adisseo, Veolia, Univar Solutions Inc, NORAM Engineering & Construction Ltd., Nouryon, International Raw Materials LTD, Eti Bakir, ACIDEKA SA, Airedale Chemical Company Limited., BASF SE, Aguachem Ltd, Feralco AB, Fluorsid, Aurubis AG, Nyrstar, Merck KGaA и Shrieve.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Содержание

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA SULFURIC ACID MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 RAW MATERIAL LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 AVERAGE ESTIMATED PRICING ANALYSIS

4.2 PRICE TRENDS BY RAW MATERIALS IN NORTH AMERICA

4.3 PRICE TRENDS BY FORM IN NORTH AMERICA

4.4 PRICE TRENDS BY APPLICATION IN NORTH AMERICA

4.5 REGULATORY OVERVIEW:

4.6 VALUE CHAIN ANALYSIS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING DEMAND FOR FERTILIZERS IN AGRICULTURAL INDUSTRY

5.1.2 SIGNIFICANT GROWTH IN CHEMICAL INDUSTRY

5.1.3 GROWING DEMAND FOR SULFURIC ACID ACROSS A DIVERSE RANGE OF INDUSTRIES

5.1.4 RISING USE IN RECOVERY OF WASTE PRINTED CIRCUIT BOARDS

5.2 RESTRAINTS

5.2.1 HEALTH HAZARDS ASSOCIATED WITH SULFURIC ACID

5.2.2 STRINGENT GOVERNMENT REGULATIONS ON USAGE OF SULFURIC ACID

5.2.3 VOLATILITY IN RAW MATERIAL PRICES

5.3 OPPORTUNITIES

5.3.1 GROWING DEMAND FOR BATTERIES IN AUTOMOTIVE INDUSTRY

5.3.2 ABUNDANCE OF SULFUR AS A RAW MATERIAL

5.4 CHALLENGES

5.4.1 DECLINE IN SALES RESULTING FROM OVERSUPPLY OF SULFURIC ACID

5.4.2 DIFFICULTIES INVOLVED IN TRANSPORTATION AND HANDLING OF SULFURIC ACID

6 IMPACT OF COVID-19 ON THE MIDDLE EAST & AFRICA SULFURIC ACID MARKET

6.1 ANALYSIS ON IMPACT OF COVID-19 ON THE MIDDLE EAST & AFRICA SULFURIC ACID MARKET

6.2 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE MIDDLE EAST & AFRICA SULFURIC ACID MARKET

6.3 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.4 IMPACT ON PRICE

6.5 IMPACT ON DEMAND

6.6 IMPACT ON SUPPLY CHAIN

6.7 CONCLUSION

7 MIDDLE EAST & AFRICA SULFURIC ACID MARKET, BY RAW MATERIAL

7.1 OVERVIEW

7.2 ELEMENTAL SULFUR

7.3 BASE METAL SMELTERS

7.4 PYRITE ORE

7.5 OTHERS

8 MIDDLE EAST & AFRICA SULFURIC ACID MARKET, BY FORM

8.1 OVERVIEW

8.2 CHAMBER/FERTILIZER ACID (62.18%)

8.3 CONCENTRATED (98%)

8.4 TOWER/GLOVER ACID (77.67%)

8.5 BATTERY ACID (33.5%)

8.6 DILUTE SULFURIC ACID (10%)

8.7 66 DEGREE BAUME SULFURIC ACID (93%)

9 MIDDLE EAST & AFRICA SULFURIC ACID MARKET, BY MANUFACTURING PROCESS

9.1 OVERVIEW

9.2 CONTACT PROCESS

9.3 LEAD CHAMBER PROCESS

9.4 WET SULFURIC ACID PROCESS

9.5 METABISULFITE PROCESS

9.6 OTHERS

10 MIDDLE EAST & AFRICA SULFURIC ACID MARKET, BY DISTRIBUTION CHANNEL

10.1 OVERVIEW

10.2 OFFLINE

10.3 ONLINE

11 MIDDLE EAST & AFRICA SULFURIC ACID MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 FERTILIZERS

11.2.1 CHAMBER/FERTILIZER ACID (62.18%)

11.2.2 CONCENTRATED (98%)

11.2.3 TOWER/GLOVER ACID (77.67%)

11.2.4 BATTERY ACID (33.5%)

11.2.5 DILUTE SULFURIC ACID (10%)

11.2.6 66 DEGREE BAUME SULFURIC ACID (93%)

11.3 PETROLEUM REFINING

11.3.1 CHAMBER/FERTILIZER ACID (62.18%)

11.3.2 CONCENTRATED (98%)

11.3.3 TOWER/GLOVER ACID (77.67%)

11.3.4 BATTERY ACID (33.5%)

11.3.5 DILUTE SULFURIC ACID (10%)

11.3.6 66 DEGREE BAUME SULFURIC ACID (93%)

11.4 METAL PROCESSING

11.4.1 CHAMBER/FERTILIZER ACID (62.18%)

11.4.2 CONCENTRATED (98%)

11.4.3 TOWER/GLOVER ACID (77.67%)

11.4.4 BATTERY ACID (33.5%)

11.4.5 DILUTE SULFURIC ACID (10%)

11.4.6 66 DEGREE BAUME SULFURIC ACID (93%)

11.5 DRUG MANUFACTURING

11.5.1 CHAMBER/FERTILIZER ACID (62.18%)

11.5.2 CONCENTRATED (98%)

11.5.3 TOWER/GLOVER ACID (77.67%)

11.5.4 BATTERY ACID (33.5%)

11.5.5 DILUTE SULFURIC ACID (10%)

11.5.6 66 DEGREE BAUME SULFURIC ACID (93%)

11.6 CHEMICAL MANUFACTURING

11.6.1 BY FORM

11.6.1.1 CHAMBER/FERTILIZER ACID (62.18%)

11.6.1.2 CONCENTRATED (98%)

11.6.1.3 TOWER/GLOVER ACID (77.67%)

11.6.1.4 BATTERY ACID (33.5%)

11.6.1.5 DILUTE SULFURIC ACID (10%)

11.6.1.6 66 DEGREE BAUME SULFURIC ACID (93%)

11.6.2 BY APPLICATION

11.6.2.1 AGRICULTURE CHEMICALS

11.6.2.2 HYDROCHLORIC ACID

11.6.2.3 NITRIC ACID

11.6.2.4 DYES AND PIGMENTS

11.6.2.5 SULFATE SALTS

11.6.2.6 SYNTHETIC DETERGENTS

11.6.2.7 OTHERS

11.7 TEXTILE

11.7.1 CHAMBER/FERTILIZER ACID (62.18%)

11.7.2 CONCENTRATED (98%)

11.7.3 TOWER/GLOVER ACID (77.67%)

11.7.4 BATTERY ACID (33.5%)

11.7.5 DILUTE SULFURIC ACID (10%)

11.7.6 66 DEGREE BAUME SULFURIC ACID (93%)

11.8 INDUSTRIAL

11.8.1 CHAMBER/FERTILIZER ACID (62.18%)

11.8.2 CONCENTRATED (98%)

11.8.3 TOWER/GLOVER ACID (77.67%)

11.8.4 BATTERY ACID (33.5%)

11.8.5 DILUTE SULFURIC ACID (10%)

11.8.6 66 DEGREE BAUME SULFURIC ACID (93%)

11.9 AUTOMOTIVE

11.9.1 CHAMBER/FERTILIZER ACID (62.18%)

11.9.2 CONCENTRATED (98%)

11.9.3 TOWER/GLOVER ACID (77.67%)

11.9.4 BATTERY ACID (33.5%)

11.9.5 DILUTE SULFURIC ACID (10%)

11.9.6 66 DEGREE BAUME SULFURIC ACID (93%)

11.1 PULP & PAPER

11.10.1 CHAMBER/FERTILIZER ACID (62.18%)

11.10.2 CONCENTRATED (98%)

11.10.3 TOWER/GLOVER ACID (77.67%)

11.10.4 BATTERY ACID (33.5%)

11.10.5 DILUTE SULFURIC ACID (10%)

11.10.6 66 DEGREE BAUME SULFURIC ACID (93%)

11.11 OTHERS

11.11.1 CHAMBER/FERTILIZER ACID (62.18%)

11.11.2 CONCENTRATED (98%)

11.11.3 TOWER/GLOVER ACID (77.67%)

11.11.4 BATTERY ACID (33.5%)

11.11.5 DILUTE SULFURIC ACID (10%)

11.11.6 66 DEGREE BAUME SULFURIC ACID (93%)

12 MIDDLE EAST & AFRICA SULFURIC ACID MARKET, BY REGION

12.1 MIDDLE EAST & AFRICA

12.1.1 U.A.E.

12.1.2 SAUDI ARABIA

12.1.3 SOUTH AFRICA

12.1.4 ISRAEL

12.1.5 EGYPT

12.1.6 REST OF MIDDLE EAST & AFRICA

13 MIDDLE EAST & AFRICA SULFURIC ACID MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

13.2 MERGERS & ACQUISITIONS

13.3 EXPANSIONS

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 VEOLIA

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT UPDATES

15.2 AURUBIS AG

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT UPDATES

15.3 MERCK KGAA

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT UPDATE

15.4 UNIVAR SOLUTIONS INC.

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT UPDATE

15.5 BASF SE

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT UPDATES

15.6 ACIDEKA S.A.

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT UPDATE

15.7 ADISSEO

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT UPDATE

15.8 AGUACHEM LTD

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT UPDATE

15.9 AIREDALE CHEMICAL COMPANY LIMITED

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT UPDATE

15.1 BOLIDEN GROUP

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT UPDATE

15.11 BRENNTAG GMBH (A SUBSIDARY OF BRENNTAG SE)

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 PRODUCT PORTFOLIO

15.11.4 RECENT UPDATE

15.12 ETI BAKIR

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT UPDATE

15.13 FERALCO AB

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT UPDATES

15.14 FLUORSID

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT UPDATE

15.15 INTERNATIONAL RAW MATERIALS LTD

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT UPDATE

15.16 LANXESS

15.16.1 COMPANY SNAPSHOT

15.16.2 REVENUE ANALYSIS

15.16.3 PRODUCT PORTFOLIO

15.16.4 RECENT UPDATES

15.17 NORAM ENGINEERS AND CONSTRUCTORS LTD.

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT UPDATES

15.18 NOURYON

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT UPDATES

15.19 NYRSTAR

15.19.1 COMPANY SNAPSHOT

15.19.2 REVENUE ANALYSIS

15.19.3 PRODUCT PORTFOLIO

15.19.4 RECENT UPDATES

15.2 SHRIEVE

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT UPDATES

16 QUESTIONNAIRE

17 RELATED REPORTS

Список таблиц

TABLE 1 IMPORT DATA OF SULFURIC ACID; OLEUM; HS CODE - 2807 (USD THOUSAND)

TABLE 2 EXPORT DATA OF SULFURIC ACID; OLEUM; HS CODE - 2807 (USD THOUSAND)

TABLE 3 EMISSION STANDARDS SULFURIC ACID PLANT (CPCB- INDIA)

TABLE 4 DEMAND FOR FERTILIZER NUTRIENT USE IN THE WORLD, 2016-2022 (THOUSAND TONES)

TABLE 5 NEWLY LAUNCHED AND EXPECTED LAUNCH MODELS OF ELECTRICAL CARS

TABLE 6 MIDDLE EAST & AFRICA SULFURIC ACID MARKET, BY RAW MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 7 MIDDLE EAST & AFRICA SULFURIC ACID MARKET, BY RAW MATERIAL, 2020-2029 (THOUSAND TONNE)

TABLE 8 MIDDLE EAST & AFRICA ELEMENTAL SULFUR IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 9 MIDDLE EAST & AFRICA ELEMENTAL SULFUR IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (THOUSAND TONNE)

TABLE 10 MIDDLE EAST & AFRICA BASE METAL SMELTERS IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 11 MIDDLE EAST & AFRICA BASE METAL SMELTERS IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (THOUSAND TONNE)

TABLE 12 MIDDLE EAST & AFRICA PYRITE ORE IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 13 MIDDLE EAST & AFRICA PYRITE ORE IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (THOUSAND TONNE)

TABLE 14 MIDDLE EAST & AFRICA OTHERS IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 15 MIDDLE EAST & AFRICA OTHERS IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (THOUSAND TONNE)

TABLE 16 MIDDLE EAST & AFRICA SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 17 MIDDLE EAST & AFRICA CHAMBER/FERTILIZER ACID (62.18%) IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 18 MIDDLE EAST & AFRICA CONCENTRATED (98%) IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 19 MIDDLE EAST & AFRICA TOWER/GLOVER ACID (77.67%) IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 20 MIDDLE EAST & AFRICA BATTERY ACID (33.5%) IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 21 MIDDLE EAST & AFRICA DILUTE SULFURIC ACID (10%) IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 22 MIDDLE EAST & AFRICA 66 DEGREE BAUME SULFURIC ACID (93%) IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 23 MIDDLE EAST & AFRICA SULFURIC ACID MARKET, BY MANUFACTURING PROCESS, 2020-2029 (USD THOUSAND)

TABLE 24 MIDDLE EAST & AFRICA CONTACT PROCESS IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 25 MIDDLE EAST & AFRICA LEAD CHAMBER PROCESS IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 26 MIDDLE EAST & AFRICA WET SULFURIC ACID PROCESS IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 27 MIDDLE EAST & AFRICA METABISULFITE PROCESS IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 28 MIDDLE EAST & AFRICA OTHERS IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 29 MIDDLE EAST & AFRICA SULFURIC ACID MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 30 MIDDLE EAST & AFRICA OFFLINE IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 31 MIDDLE EAST & AFRICA ONLINE IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 32 MIDDLE EAST & AFRICA SULFURIC ACID MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 33 MIDDLE EAST & AFRICA FERTILIZERS IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 34 MIDDLE EAST & AFRICA FERTILIZERS IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 35 MIDDLE EAST & AFRICA PETROLEUM REFINING IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 36 MIDDLE EAST & AFRICA PETROLEUM REFINING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 37 MIDDLE EAST & AFRICA METAL PROCESSING IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 38 MIDDLE EAST & AFRICA METAL PROCESSING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 39 MIDDLE EAST & AFRICA DRUG MANUFACTURING IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 40 MIDDLE EAST & AFRICA DRUG MANUFACTURING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 41 MIDDLE EAST & AFRICA CHEMICAL MANUFACTURING IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 42 MIDDLE EAST & AFRICA CHEMICAL MANUFACTURING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 43 MIDDLE EAST & AFRICA CHEMICAL MANUFACTURING IN SULFURIC ACID MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 44 MIDDLE EAST & AFRICA TEXTILE IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 45 MIDDLE EAST & AFRICA TEXTILE IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 46 MIDDLE EAST & AFRICA INDUSTRIAL IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 47 MIDDLE EAST & AFRICA INDUSTRIAL IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 48 MIDDLE EAST & AFRICA AUTOMOTIVE IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 49 MIDDLE EAST & AFRICA AUTOMOTIVE IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 50 MIDDLE EAST & AFRICA PULP & PAPER IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 51 MIDDLE EAST & AFRICA PULP & PAPER IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 52 MIDDLE EAST & AFRICA OTHERS IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 53 MIDDLE EAST & AFRICA OTHERS IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 54 MIDDLE EAST & AFRICA SULFURIC ACID MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 55 MIDDLE EAST & AFRICA SULFURIC ACID MARKET, BY COUNTRY, 2020-2029 (THOUSAND TONNE)

TABLE 56 MIDDLE EAST & AFRICA SULFURIC ACID MARKET, BY RAW MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 57 MIDDLE EAST & AFRICA SULFURIC ACID MARKET, BY RAW MATERIAL, 2020-2029 (THOUSAND TONNE)

TABLE 58 MIDDLE EAST & AFRICA SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 59 MIDDLE EAST & AFRICA SULFURIC ACID MARKET, BY MANUFACTURING PROCESS, 2020-2029 (USD THOUSAND)

TABLE 60 MIDDLE EAST & AFRICA SULFURIC ACID MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 61 MIDDLE EAST & AFRICA SULFURIC ACID MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 62 MIDDLE EAST & AFRICA FERTILIZERS IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 63 MIDDLE EAST & AFRICA PETROLEUM REFINING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 64 MIDDLE EAST & AFRICA METAL PROCESSING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 65 MIDDLE EAST & AFRICA DRUG MANUFACTURING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 66 MIDDLE EAST & AFRICA CHEMICAL MANUFACTURING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 67 MIDDLE EAST & AFRICA CHEMICAL MANUFACTURING IN SULFURIC ACID MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 68 MIDDLE EAST & AFRICA TEXTILE IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 69 MIDDLE EAST & AFRICA INDUSTRIAL IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 70 MIDDLE EAST & AFRICA AUTOMOTIVE IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 71 MIDDLE EAST & AFRICA PULP & PAPER IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 72 MIDDLE EAST & AFRICA OTHERS IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 73 U.A.E. SULFURIC ACID MARKET, BY RAW MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 74 U.A.E. SULFURIC ACID MARKET, BY RAW MATERIAL, 2020-2029 (THOUSAND TONNE)

TABLE 75 U.A.E. SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 76 U.A.E. SULFURIC ACID MARKET, BY MANUFACTURING PROCESS, 2020-2029 (USD THOUSAND)

TABLE 77 U.A.E. SULFURIC ACID MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 78 U.A.E. SULFURIC ACID MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 79 U.A.E. FERTILIZERS IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 80 U.A.E. PETROLEUM REFINING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 81 U.A.E. METAL PROCESSING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 82 U.A.E. DRUG MANUFACTURING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 83 U.A.E. CHEMICAL MANUFACTURING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 84 U.A.E. CHEMICAL MANUFACTURING IN SULFURIC ACID MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 85 U.A.E. TEXTILE IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 86 U.A.E. INDUSTRIAL IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 87 U.A.E. AUTOMOTIVE IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 88 U.A.E. PULP & PAPER IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 89 U.A.E. OTHERS IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 90 SAUDI ARABIA SULFURIC ACID MARKET, BY RAW MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 91 SAUDI ARABIA SULFURIC ACID MARKET, BY RAW MATERIAL, 2020-2029 (THOUSAND TONNE)

TABLE 92 SAUDI ARABIA SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 93 SAUDI ARABIA SULFURIC ACID MARKET, BY MANUFACTURING PROCESS, 2020-2029 (USD THOUSAND)

TABLE 94 SAUDI ARABIA SULFURIC ACID MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 95 SAUDI ARABIA SULFURIC ACID MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 96 SAUDI ARABIA FERTILIZERS IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 97 SAUDI ARABIA PETROLEUM REFINING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 98 SAUDI ARABIA METAL PROCESSING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 99 SAUDI ARABIA DRUG MANUFACTURING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 100 SAUDI ARABIA CHEMICAL MANUFACTURING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 101 SAUDI ARABIA CHEMICAL MANUFACTURING IN SULFURIC ACID MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 102 SAUDI ARABIA TEXTILE IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 103 SAUDI ARABIA INDUSTRIAL IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 104 SAUDI ARABIA AUTOMOTIVE IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 105 SAUDI ARABIA PULP & PAPER IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 106 SAUDI ARABIA OTHERS IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 107 SOUTH AFRICA SULFURIC ACID MARKET, BY RAW MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 108 SOUTH AFRICA SULFURIC ACID MARKET, BY RAW MATERIAL, 2020-2029 (THOUSAND TONNE)

TABLE 109 SOUTH AFRICA SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 110 SOUTH AFRICA SULFURIC ACID MARKET, BY MANUFACTURING PROCESS, 2020-2029 (USD THOUSAND)

TABLE 111 SOUTH AFRICA SULFURIC ACID MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 112 SOUTH AFRICA SULFURIC ACID MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 113 SOUTH AFRICA FERTILIZERS IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 114 SOUTH AFRICA PETROLEUM REFINING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 115 SOUTH AFRICA METAL PROCESSING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 116 SOUTH AFRICA DRUG MANUFACTURING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 117 SOUTH AFRICA CHEMICAL MANUFACTURING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 118 SOUTH AFRICA CHEMICAL MANUFACTURING IN SULFURIC ACID MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 119 SOUTH AFRICA TEXTILE IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 120 SOUTH AFRICA INDUSTRIAL IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 121 SOUTH AFRICA AUTOMOTIVE IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 122 SOUTH AFRICA PULP & PAPER IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 123 SOUTH AFRICA OTHERS IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 124 ISRAEL SULFURIC ACID MARKET, BY RAW MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 125 ISRAEL SULFURIC ACID MARKET, BY RAW MATERIAL, 2020-2029 (THOUSAND TONNE)

TABLE 126 ISRAEL SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 127 ISRAEL SULFURIC ACID MARKET, BY MANUFACTURING PROCESS, 2020-2029 (USD THOUSAND)

TABLE 128 ISRAEL SULFURIC ACID MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 129 ISRAEL SULFURIC ACID MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 130 ISRAEL FERTILIZERS IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 131 ISRAEL PETROLEUM REFINING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 132 ISRAEL METAL PROCESSING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 133 ISRAEL DRUG MANUFACTURING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 134 ISRAEL CHEMICAL MANUFACTURING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 135 ISRAEL CHEMICAL MANUFACTURING IN SULFURIC ACID MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 136 ISRAEL TEXTILE IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 137 ISRAEL INDUSTRIAL IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 138 ISRAEL AUTOMOTIVE IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 139 ISRAEL PULP & PAPER IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 140 ISRAEL OTHERS IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 141 EGYPT SULFURIC ACID MARKET, BY RAW MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 142 EGYPT SULFURIC ACID MARKET, BY RAW MATERIAL, 2020-2029 (THOUSAND TONNE)

TABLE 143 EGYPT SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 144 EGYPT SULFURIC ACID MARKET, BY MANUFACTURING PROCESS, 2020-2029 (USD THOUSAND)

TABLE 145 EGYPT SULFURIC ACID MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 146 EGYPT SULFURIC ACID MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 147 EGYPT FERTILIZERS IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 148 EGYPT PETROLEUM REFINING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 149 EGYPT METAL PROCESSING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 150 EGYPT DRUG MANUFACTURING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 151 EGYPT CHEMICAL MANUFACTURING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 152 EGYPT CHEMICAL MANUFACTURING IN SULFURIC ACID MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 153 EGYPT TEXTILE IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 154 EGYPT INDUSTRIAL IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 155 EGYPT AUTOMOTIVE IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 156 EGYPT PULP & PAPER IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 157 EGYPT OTHERS IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 158 REST OF MIDDLE EAST & AFRICA SULFURIC ACID MARKET, BY RAW MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 159 REST OF MIDDLE EAST & AFRICA SULFURIC ACID MARKET, BY RAW MATERIAL, 2020-2029 (THOUSAND TONNE)

Список рисунков

FIGURE 1 MIDDLE EAST & AFRICA SULFURIC ACID MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA SULFURIC ACID MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA SULFURIC ACID MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA SULFURIC ACID MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA SULFURIC ACID MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA SULFURIC ACID MARKET: RAW MATERIAL LIFE LINE CURVE

FIGURE 7 MIDDLE EAST & AFRICA SULFURIC ACID MARKET: MULTIVARIATE MODELLING

FIGURE 8 MIDDLE EAST & AFRICA SULFURIC ACID MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 MIDDLE EAST & AFRICA SULFURIC ACID MARKET: DBMR MARKET POSITION GRID

FIGURE 10 MIDDLE EAST & AFRICA SULFURIC ACID MARKET: APPLICATION COVERAGE GRID

FIGURE 11 MIDDLE EAST & AFRICA SULFURIC ACID MARKET: CHALLENGE MATRIX

FIGURE 12 MIDDLE EAST & AFRICA SULFURIC ACID MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 MIDDLE EAST & AFRICA SULFURIC ACID MARKET: SEGMENTATION

FIGURE 14 ASIA-PACIFIC IS EXPECTED TO DOMINATE AND IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 15 SIGNIFICANT GROWTH IN THE CHEMICAL INDUSTRY IS EXPECTED TO DRIVE THE MIDDLE EAST & AFRICA SULFURIC ACID MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 16 ELEMENTAL SULFUR SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA SULFURIC ACID MARKET IN 2022 & 2029

FIGURE 17 AVERAGE ESTIMATED PRICING ANALYSIS OF SULFURIC ACID

FIGURE 18 PRICE OF 98% SULFURIC ACID

FIGURE 19 VALUE CHAIN ANALYSIS OF MIDDLE EAST & AFRICA SULFURIC ACID MARKET

FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF MIDDLE EAST & AFRICA SULFURIC ACID MARKET

FIGURE 21 FERTILIZER CONSUMPTION IN VARIOUS COUNTRIES (2019) (KILOGRAMS PER HECTARE OF LAND)

FIGURE 22 MIDDLE EAST & AFRICA SULFURIC ACID MARKET: BY RAW MATERIAL, 2021

FIGURE 23 MIDDLE EAST & AFRICA SULFURIC ACID MARKET: BY FORM, 2021

FIGURE 24 MIDDLE EAST & AFRICA SULFURIC ACID MARKET: BY MANUFACTURING PROCESS, 2021

FIGURE 25 MIDDLE EAST & AFRICA SULFURIC ACID MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 26 MIDDLE EAST & AFRICA SULFURIC ACID MARKET: BY APPLICATION, 2021

FIGURE 27 MIDDLE EAST & AFRICA SULFURIC ACID MARKET: SNAPSHOT (2021)

FIGURE 28 MIDDLE EAST & AFRICA SULFURIC ACID MARKET: BY COUNTRY (2021)

FIGURE 29 MIDDLE EAST & AFRICA SULFURIC ACID MARKET: BY COUNTRY (2022 & 2029)

FIGURE 30 MIDDLE EAST & AFRICA SULFURIC ACID MARKET: BY COUNTRY (2021 & 2029)

FIGURE 31 MIDDLE EAST & AFRICA SULFURIC ACID MARKET: BY RAW MATERIAL (2022-2029)

FIGURE 32 MIDDLE EAST & AFRICA SULFURIC ACID MARKET: COMPANY SHARE 2021 (%)

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.