Middle East And Africa Rubber Testing Equipment Market

Размер рынка в млрд долларов США

CAGR :

%

USD

11.47 Million

USD

15.81 Million

2024

2032

USD

11.47 Million

USD

15.81 Million

2024

2032

| 2025 –2032 | |

| USD 11.47 Million | |

| USD 15.81 Million | |

|

|

|

|

Сегментация рынка оборудования для испытаний резины на Ближнем Востоке и в Африке по типу испытаний (испытание вязкости, испытание плотности, испытание твердости, испытание на изгиб, испытание толщины, испытание механической стабильности, испытание на удар и испытание в печи старения), технологии (вискозиметр Муни, реометр с подвижной плашкой, автоматизированный тестер плотности, автоматизированный твердомер и анализатор процесса), типу резины (стирол-бутадиеновый каучук, EPDM-каучук, бутилкаучук, натуральный каучук, силиконовый каучук, неопреновый каучук, нитриловый каучук и другие), диапазону частот (более 4 Гц, от 1 до 4 Гц и менее 1 Гц), применению (шины и автомобильные детали, промышленные резинотехнические изделия, резиновые уплотнители и уплотнительные кольца, подошвы обуви, конвейерные ленты, ремни, резиновые коврики и ковры, спорт и фитнес) — тенденции отрасли и прогноз до 2032 года

Размер рынка оборудования для испытаний резины на Ближнем Востоке и в Африке

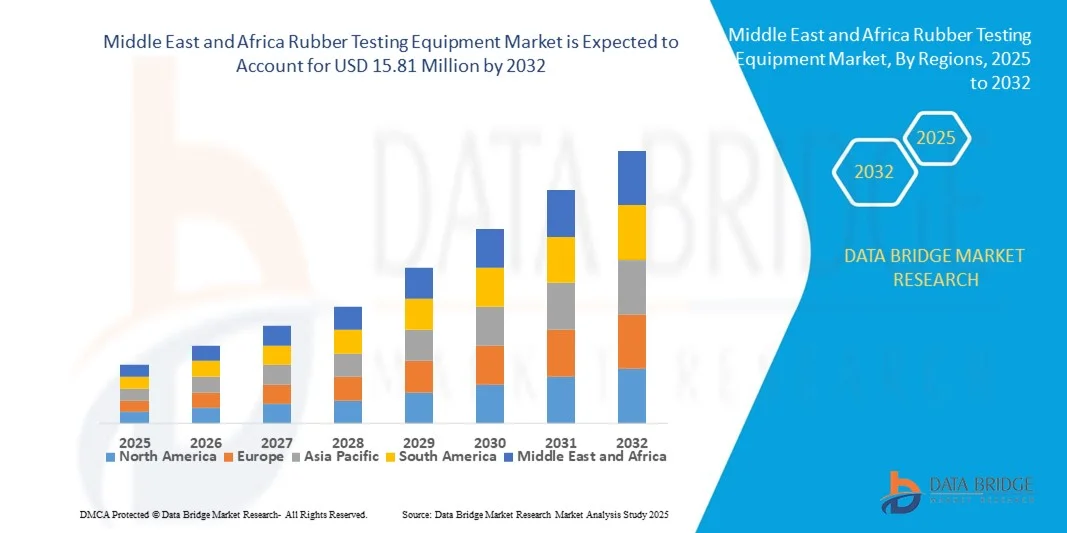

- Объем рынка оборудования для испытаний резины на Ближнем Востоке и в Африке в 2024 году оценивался в 11,47 млн долларов США, а к 2032 году , как ожидается, он достигнет 15,81 млн долларов США при среднегодовом темпе роста 4,1% в прогнозируемый период.

- Рост рынка во многом обусловлен растущим спросом на высококачественные резиновые компоненты в автомобильной, аэрокосмической и промышленной отраслях, а также строгими нормами качества и безопасности, способствующими внедрению передовых испытательных решений.

- Кроме того, технологические достижения в области испытательного оборудования, такие как автоматизация, аналитика данных в реальном времени и интеграция с цифровыми платформами, повышают точность и эффективность тестирования, что дополнительно способствует расширению рынка.

Анализ рынка оборудования для испытаний резины на Ближнем Востоке и в Африке

- Рынок оборудования для испытаний резины демонстрирует устойчивый рост, поскольку производители уделяют все больше внимания обеспечению качества для соответствия стандартам производительности в промышленных приложениях.

- Растущее внимание к стабильности и безопасности продукции в таких секторах, как автомобилестроение и производство, стимулирует использование точных и автоматизированных решений для испытаний резины.

- Рынок Южной Африки получил наибольшую долю выручки в 2024 году, в первую очередь благодаря устойчивой автомобильной промышленности и расширению производства промышленной резины.

- Ожидается, что в ОАЭ будут наблюдаться самые высокие среднегодовые темпы роста (CAGR) на рынке оборудования для испытаний резины на Ближнем Востоке и в Африке благодаря быстрой индустриализации, повышению спроса на автомобильные и строительные резиновые изделия, а также растущему внедрению автоматизированных и точных испытательных технологий.

- Сегмент испытаний на вязкость обеспечил наибольшую долю выручки рынка в 2024 году, что обусловлено его важнейшей ролью в оценке технологичности и текучести резиновых смесей. Производители активно используют испытания на вязкость для обеспечения стабильности производства и соответствия эксплуатационным требованиям конечных потребителей.

Область применения отчета и сегментация рынка оборудования для испытаний резины на Ближнем Востоке и в Африке

|

Атрибуты |

Ключевые данные о рынке оборудования для испытаний резины на Ближнем Востоке и в Африке |

|

Охваченные сегменты |

|

|

Охваченные страны |

Ближний Восток и Африка

|

|

Ключевые игроки рынка |

|

|

Рыночные возможности |

|

|

Информационные наборы данных с добавленной стоимостью |

Помимо информации о рыночных сценариях, таких как рыночная стоимость, темпы роста, сегментация, географический охват и основные игроки, рыночные отчеты, подготовленные Data Bridge Market Research, также включают в себя углубленный экспертный анализ, географически представленные данные о производстве и мощностях компаний, схемы сетей дистрибьюторов и партнеров, подробный и обновленный анализ ценовых тенденций и анализ дефицита цепочки поставок и спроса. |

Тенденции рынка оборудования для испытаний резины на Ближнем Востоке и в Африке

Растет применение передовых решений по испытанию резины

- Растущее использование современного оборудования для испытаний резины меняет подход к контролю качества, позволяя точно и надежно оценивать такие свойства резины, как прочность на разрыв, твердость и эластичность. Эти системы позволяют производителям обеспечивать стабильные эксплуатационные характеристики продукции и соответствие отраслевым стандартам, сокращая количество дефектов и повышая общее качество продукции. Кроме того, интеграция с цифровыми системами отчетности и аналитики данных помогает производителям отслеживать производственные тенденции и принимать обоснованные решения по улучшению продукции.

- Растущий спрос на резиновые изделия в автомобильной, промышленной и потребительской отраслях ускоряет внедрение автоматизированных и портативных испытательных устройств. Эти решения особенно эффективны для выявления несоответствий материалов и обеспечения соответствия резиновых компонентов требованиям безопасности и долговечности. Эта тенденция усиливается ужесточением международных требований к качеству и необходимостью сертификации на экспортных рынках.

- Простота использования, точность и универсальность современных приборов для испытаний резины делают их привлекательными для регулярных проверок качества, помогая производителям поддерживать эффективность производства и сокращать потери материалов. Кроме того, эти системы часто имеют модульную конструкцию и возможности удалённого мониторинга, что обеспечивает гибкое применение на различных производственных линиях и объектах. Внедрение этих систем также способствует достижению целей устойчивого развития, сводя к минимуму количество бракованной продукции и потери ресурсов.

- Например, в 2023 году несколько производителей шин и резинотехнических изделий в регионе сообщили об улучшении стабильности качества продукции и снижении количества производственных дефектов после внедрения автоматизированных испытательных машин на растяжение и твердость. Эти улучшения укрепили репутацию бренда и повысили удовлетворенность клиентов, а также снизили количество отзывов и гарантийных случаев. Интеграция интеллектуальных датчиков и обратная связь в режиме реального времени позволила производителям оптимизировать свои процессы и поддерживать стабильное качество продукции.

- Несмотря на то, что современное оборудование для испытаний резины набирает популярность, его эффективность зависит от постоянных технологических инноваций, обучения операторов и доступности. Производителям необходимо сосредоточиться на разработке модульных, масштабируемых и надежных систем, чтобы в полной мере воспользоваться преимуществами роста рынка. Постоянное обновление программного обеспечения и совместимость с новыми решениями Интернета вещей также критически важны для поддержания эксплуатационной эффективности и соответствия меняющимся отраслевым стандартам.

Динамика рынка оборудования для испытаний резины на Ближнем Востоке и в Африке

Водитель

Растущее внимание к качеству, безопасности и стандартизации продукции

- Растущее внимание к безопасности продукции и соблюдению международных стандартов стимулирует внедрение оборудования для испытаний резины. Компании всё чаще отдают предпочтение испытательным решениям, обеспечивающим долговечность, производительность и соответствие нормативным требованиям в автомобильном, промышленном и потребительском сегментах. Растущее понимание важности безопасности конечного пользователя и ответственности бренда также побуждает производителей внедрять высокоточные испытательные системы.

- Производители всё чаще ищут автоматизированные, точные и надёжные системы тестирования для оптимизации производственных процессов, сокращения отходов и поддержания стабильного качества продукции от партии к партии. Современное испытательное оборудование позволяет детально характеризовать материалы, способствуя улучшению конструкции и эксплуатационных характеристик продукции. Использование подключённых устройств и аналитики обеспечивает прослеживаемость процесса, что способствует проведению регулирующих аудитов и реализации внутренних инициатив по контролю качества.

- Развитие резиновой промышленности, особенно в производстве автомобильных шин, промышленных уплотнителей и потребительских товаров, дополнительно стимулирует рыночный спрос. Решения для испытаний предоставляют критически важную информацию о свойствах материалов, гарантируя соответствие конечной продукции ожидаемым характеристикам и требованиям клиентов. Кроме того, рост экспорта в регионы со строгими стандартами безопасности побуждает компании внедрять передовые протоколы испытаний для сохранения доступа к рынку.

- Например, в 2022 году несколько производителей резиновых изделий в регионе интегрировали автоматизированные системы испытаний на твёрдость и растяжение в свои производственные линии, что привело к повышению однородности продукции и снижению уровня отказов. Внедрение этих систем также повысило эффективность производства за счёт сокращения ручного вмешательства и минимизации человеческого фактора, что привело к повышению производительности и снижению затрат.

- Хотя качество продукции и стандартизация являются ключевыми факторами роста, внедрение зависит от экономической эффективности, простоты использования и наличия обученного персонала для работы со сложным испытательным оборудованием. Программы непрерывного обучения и службы технической поддержки становятся необходимыми для обеспечения оптимальной загрузки и предотвращения простоев, что в конечном итоге способствует долгосрочному расширению рынка.

Сдержанность/Вызов

Высокая стоимость современного испытательного оборудования и ограниченная доступность при мелкомасштабных операциях

- Высокая стоимость современных приборов для испытаний резины, включая универсальные испытательные машины, твердомеры и реометры, ограничивает их внедрение среди малых и средних производителей. Ценовые ограничения ограничивают доступ к передовым технологиям, повышающим качество контроля. Более того, дорогостоящие контракты на техническое обслуживание и требования к калибровке увеличивают эксплуатационные расходы, что удерживает мелких производителей от инвестирования.

- Во многих регионах наблюдается нехватка квалифицированного персонала, способного эксплуатировать и обслуживать сложное испытательное оборудование. Недостаток обучения и технических знаний препятствует эффективному использованию, снижая преимущества передовых систем. Эта проблема особенно остро стоит на развивающихся рынках, где возможности профессионального обучения работе с современным лабораторным оборудованием ограничены.

- Проблемы с цепочками поставок и ограниченная доступность специализированных испытательных приборов в развивающихся регионах еще больше ограничивают выход на рынок. Небольшие производители часто используют ручные или устаревшие методы испытаний, что может привести к нестабильному качеству. Задержки с импортом высокотехнологичного оборудования и запасных частей могут нарушить производственные графики, что скажется на общей эффективности производства.

- Например, в 2023 году несколько производителей резиновых компонентов в регионе сообщили о задержках в переходе на автоматизированное испытательное оборудование из-за бюджетных и логистических ограничений, что повлияло на эффективность производства и надежность продукции. Эти задержки привели к срыву сроков и ограничили их способность соответствовать стандартам качества экспортной продукции, что негативно отразилось на выручке и конкурентоспособности на рынке.

- Несмотря на продолжающееся развитие технологий испытаний, решение проблем стоимости, доступности и квалификации специалистов имеет решающее значение для более широкого внедрения и устойчивого роста рынка оборудования для испытаний резины. Сотрудничество с представителями отрасли, государственная поддержка и гибкие варианты финансирования могут дополнительно помочь небольшим компаниям внедрить передовые системы испытаний и повысить общие стандарты рынка.

Рынок оборудования для испытаний резины на Ближнем Востоке и в Африке

Рынок оборудования для испытаний резины на Ближнем Востоке и в Африке сегментирован по типу испытаний, технологии, типу резины, диапазону частот и области применения.

- По типу тестирования

По типу испытаний рынок сегментируется на следующие категории: испытания на вязкость, плотность, твердость, изгиб, толщину, механическую стабильность, ударную вязкость и испытания в печи старения. Сегмент испытаний на вязкость обеспечил наибольшую долю рынка в 2024 году благодаря своей важнейшей роли в оценке технологичности и текучести резиновых смесей. Производители активно используют испытания на вязкость для обеспечения стабильности производства и соответствия эксплуатационным требованиям конечных потребителей.

Ожидается, что сегмент испытаний на твёрдость будет демонстрировать самые высокие темпы роста в период с 2025 по 2032 год, что обусловлено растущим спросом на высокопроизводительные резиновые компоненты в таких отраслях, как автомобилестроение, строительство и аэрокосмическая промышленность. Испытания на твёрдость позволяют точно оценить сопротивление материала давлению, гарантируя долговечность и надёжность резиновых деталей, используемых в экстремальных условиях.

- По технологии

В зависимости от технологии рынок сегментирован на вискозиметры Муни, реометры с подвижной фильерой, автоматические плотномеры, автоматические твердомеры и анализаторы процессов. Сегмент вискозиметров Муни занимал наибольшую долю в 2024 году, поскольку они остаются общепризнанным стандартом для измерения вязкости каучука и резиновых смесей. Простота эксплуатации и широкая область применения делают их основополагающим инструментом в процессах контроля качества резины.

Ожидается, что сегмент анализаторов технологических процессов будет демонстрировать самые высокие темпы роста в период с 2025 по 2032 год, что обусловлено растущим спросом на мониторинг производственных параметров в режиме реального времени. Анализаторы технологических процессов повышают эффективность работы, сокращая время простоя и обеспечивая принятие решений на основе данных, что становится критически важным в автоматизированных и крупномасштабных производственных средах.

- По типу резины

В зависимости от типа каучука рынок сегментирован на бутадиен-стирольный каучук, этиленпропиленовый каучук (EPDM), бутилкаучук, натуральный каучук, силиконовый каучук, неопреновый каучук, нитрильный каучук и другие. Натуральный каучук доминировал на рынке в 2024 году благодаря своему широкому применению в автомобильной, промышленной и потребительской отраслях благодаря своей эластичности и механической прочности. Его совместимость с различными методами испытаний и доступность на мировых рынках также способствуют доминированию в этом сегменте.

Ожидается, что сегмент силиконового каучука будет демонстрировать самые высокие темпы роста в период с 2025 по 2032 год, что обусловлено его превосходной термостойкостью, электроизоляционными свойствами и растущим использованием в электронике и здравоохранении. Этот материал требует тщательного тестирования для соответствия строгим стандартам качества, что стимулирует спрос на специализированное оборудование для испытаний резины.

- По диапазону частот

По диапазону частот рынок сегментирован на диапазоны более 4 Гц, от 1 до 4 Гц и менее 1 Гц. Сегмент от 1 до 4 Гц занимал наибольшую долю рынка в 2024 году благодаря широкому применению в стандартном динамическом механическом анализе и испытаниях на усталость. Этот диапазон оптимален для оценки характеристик в условиях повторяющихся нагрузок в таких отраслях, как автомобилестроение и обувная промышленность.

Ожидается, что сегмент частот более 4 Гц будет демонстрировать самые высокие темпы роста в период с 2025 по 2032 год, что обусловлено его растущим использованием в сложных испытаниях на усталость и ударную прочность. Оборудование, работающее в этом диапазоне, обеспечивает более короткие циклы испытаний и более высокую точность, что критически важно для высокопроизводительных промышленных сред.

- По применению

По областям применения рынок сегментирован на следующие сегменты: шины и автомобильные детали, резинотехнические изделия, резиновые уплотнители и уплотнительные кольца, подошвы для обуви, конвейерные ленты, ремни, резиновые коврики и ковровые покрытия, а также товары для спорта и фитнеса. Сегмент шин и автомобильных деталей занимал наибольшую долю в 2024 году, что обусловлено строгими требованиями к качеству и безопасности в автомобильной отрасли. Испытания гарантируют соответствие таких компонентов, как шины и втулки, эксплуатационным требованиям по износу, давлению и температуре.

Ожидается, что сегмент конвейерных лент будет демонстрировать самые высокие темпы роста в период с 2025 по 2032 год, чему будет способствовать растущая индустриализация и потребность в прочных материалах в логистике и горнодобывающей промышленности. Тщательные испытания механических свойств и устойчивости к старению имеют решающее значение для обеспечения долговечности в условиях непрерывной эксплуатации и абразивных сред.

Региональный анализ рынка оборудования для испытаний резины на Ближнем Востоке и в Африке

- Рынок Южной Африки получил наибольшую долю выручки в 2024 году, в первую очередь благодаря устойчивой автомобильной промышленности и расширению производства промышленной резины.

- Производители все чаще используют автоматизированные системы испытаний на растяжение, твердость и реологические свойства, чтобы гарантировать однородность материалов и соответствие строгим нормативным стандартам.

- Правительственные инициативы, направленные на модернизацию промышленности, и акцент на высококачественные резиновые компоненты дополнительно поддерживают рост рынка и инвестиции в передовые технологии испытаний.

Обзор рынка оборудования для испытаний резины в ОАЭ

Ожидается, что рынок ОАЭ будет демонстрировать самые высокие темпы роста в период с 2025 по 2032 год, чему будут способствовать быстрая индустриализация и растущий спрос на автомобильную, строительную и потребительскую резинотехническую продукцию. Внедрение передовых испытательных решений, включая автоматизированные и модульные системы, повышает точность и эффективность производства. Производители уделяют первостепенное внимание соблюдению международных стандартов и обеспечению надёжных характеристик материалов. Кроме того, государственные инициативы по поддержке качества и инноваций в промышленности способствуют ускорению роста рынка оборудования для испытаний резины в ОАЭ.

Доля рынка оборудования для испытаний резины на Ближнем Востоке и в Африке

Лидерами отрасли оборудования для испытаний резины на Ближнем Востоке и в Африке являются в основном хорошо зарекомендовавшие себя компании, в том числе:

- Saudi Aramco (Саудовская Аравия)

- Группа Эмирейтс (ОАЭ)

- SABIC (Саудовская Аравия)

- Qatar Petroleum (Катар)

- Первый банк Абу-Даби (ОАЭ)

- Emaar Properties (ОАЭ)

- DP World (ОАЭ)

- Al Rajhi Bank (Саудовская Аравия)

- Группа Etisalat (ОАЭ)

- Группа Ooredoo (Катар)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.