Рынок гидролизатов протеина на Ближнем Востоке и в Африке по типу (молоко, мясо, морепродукты, растения, яйца и другие), источнику (животные, растения и микробы), форме (жидкость и порошок), процессу (ферментативный гидролиз и кислотный гидролиз), применению ( корма для животных , детское питание, лечебное питание, спортивное питание, диетические добавки и другие), стране (Южная Африка, Египет, Саудовская Аравия, Объединенные Арабские Эмираты, Израиль и остальные страны Ближнего Востока и Африки). Тенденции отрасли и прогноз до 2029 года.

Анализ рынка и аналитика : рынок гидролизатов белка на Ближнем Востоке и в Африке

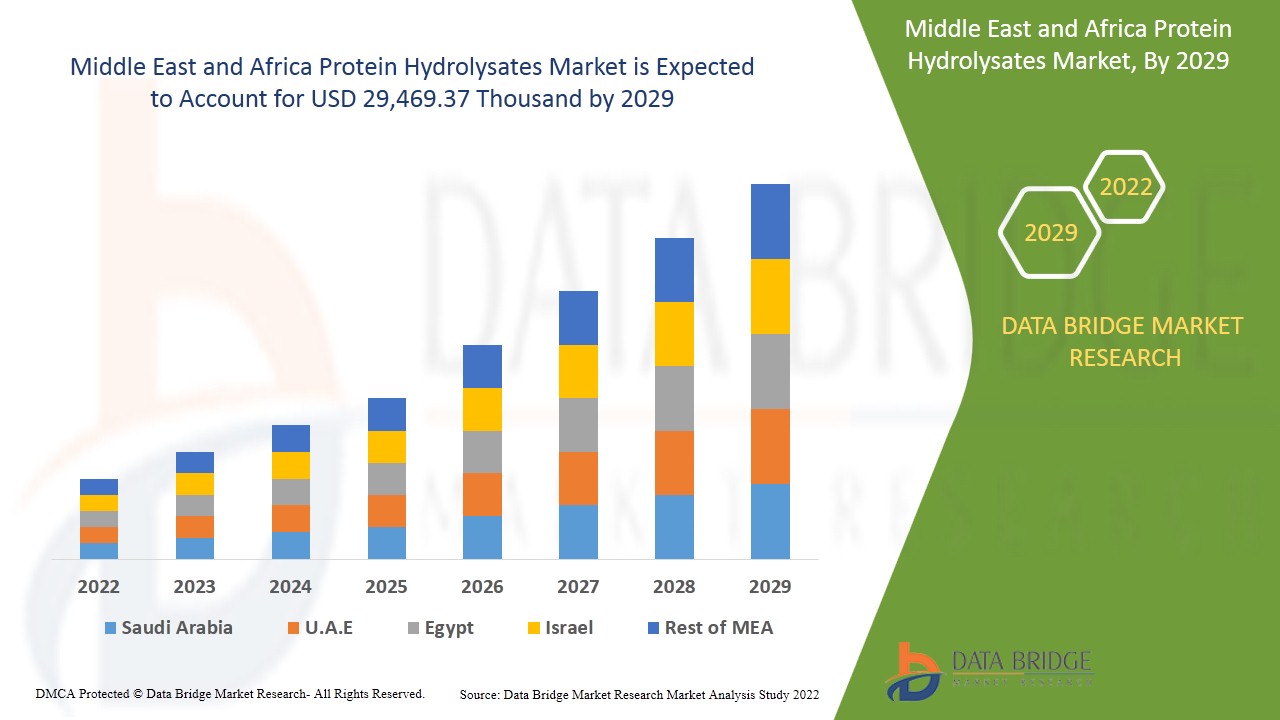

Ожидается, что рынок гидролизатов белка на Ближнем Востоке и в Африке будет расти в прогнозируемый период с 2022 по 2029 год. По данным Data Bridge Market Research, среднегодовой темп роста рынка составит 3,0% в прогнозируемый период с 2022 по 2029 год, и ожидается, что к 2029 году он достигнет 29 469,37 тыс. долларов США.

Гидролизаты белка производятся из очищенных источников белка путем добавления протеолитических ферментов с последующими процедурами очистки. Каждый гидролизат белка представляет собой сложную смесь пептидов с различной длиной цепи и свободных аминокислот, которая может быть определена значением на Ближнем Востоке и в Африке, известным как степень гидролиза, которая представляет собой долю пептидных связей, которые были расщеплены в исходном белке. Такие препараты обеспечивают пищевой эквивалент исходного материала в его составляющих аминокислотах и используются в качестве питательных веществ и восполнения жидкости в специальных диетах или для пациентов, которые не могут принимать обычные пищевые белки. Он обеспечивает многочисленные преимущества для здоровья, такие как он помогает организму усваивать аминокислоты быстрее, чем цельный белок, тем самым максимизируя доставку питательных веществ и имея различные применения в пищевой промышленности и производстве напитков. Применение гидролизатов белка имеет особое применение в спортивной медицине, поскольку аминокислоты, присутствующие в гидролизатах белка, легче усваиваются организмом, чем цельные белки, что увеличивает доставку питательных веществ в мышцы. Он также используется в биотехнологической промышленности для дополнения клеточных культур.

Рост спроса на детские смеси в различных регионах подстегнул рост рынка белковых гидролизатов. Потребление смесей, состоящих из белкового гидролизата, считается более полезным, чем смеси на основе коровьего молока, поскольку белковые гидролизаты легко усваиваются младенцами, в отличие от продуктов на основе молока, которые, как ожидается, в значительной степени будут способствовать росту рынка белковых гидролизатов на Ближнем Востоке и в Африке.

Значительный спрос на продукты для контроля веса для детского и спортивного питания и растущая осведомленность потребителей о здоровье, что приводит к потреблению функциональных и питательных продуктов, являются движущими силами рынка гидролизатов белка на Ближнем Востоке и в Африке. Однако ожидается, что доступность альтернатив, таких как изоляты, будет сдерживать рост рынка.

Рост численности веганов по всему миру может создать возможности для роста рынка гидролизатов белка на Ближнем Востоке и в Африке в будущем.

Ожидается, что высокая стоимость переработки гидролизованного белка в ближайшем будущем станет препятствием для роста рынка гидролизатов белка на Ближнем Востоке и в Африке.

В этом отчете о рынке гидролизатов белка на Ближнем Востоке и в Африке содержатся сведения о доле рынка, новых разработках и анализе продуктового портфеля, влиянии внутренних и локальных игроков рынка, анализируются возможности с точки зрения новых источников дохода, изменений в рыночных правилах, одобрений продуктов, стратегических решений, запусков продуктов, географических расширений и технологических инноваций на рынке. Чтобы понять анализ и рыночный сценарий, свяжитесь с нами для получения аналитического обзора; наша команда поможет вам создать решение по влиянию на доход для достижения желаемой цели.

Масштаб и размер рынка гидролизатов белка на Ближнем Востоке и в Африке

Рынок гидролизатов протеина на Ближнем Востоке и в Африке сегментирован на пять сегментов по типу, источнику, форме, процессу и применению. Рост среди сегментов помогает вам анализировать нишевые карманы роста и стратегии подхода к рынку и определять основные области применения и разницу в ваших целевых рынках.

- По типу рынок гидролизатов белка на Ближнем Востоке и в Африке сегментируется на молочные, мясные, морские, растительные, яичные и др. Ожидается, что в 2022 году сегмент гидролизатов молочного белка будет доминировать на рынке гидролизатов белка на Ближнем Востоке и в Африке, поскольку он обладает заметными антигипертензивными, антиоксидантными, противовоспалительными и гипохолестеринемическими эффектами.

- Рынок гидролизатов белка на Ближнем Востоке и в Африке сегментируется по источнику на животных, растительных и микробных. Ожидается, что в 2022 году сегмент животного происхождения будет доминировать на рынке гидролизатов белка на Ближнем Востоке и в Африке из-за высокого содержания белка в источниках животного происхождения по сравнению с аналогами.

- По форме рынок гидролизатов протеина на Ближнем Востоке и в Африке сегментируется на жидкие и порошковые. Ожидается, что в 2022 году сегмент гидролизатов протеина в порошке будет доминировать на рынке гидролизатов протеина на Ближнем Востоке и в Африке, поскольку он легче усваивается и используется организмом, делая восстановление после тренировки более эффективным и быстрым. Кроме того, гидролизованные протеиновые порошки с меньшей вероятностью вызывают боли в животе и проблемы с кишечником и обеспечивают разнообразные преимущества для здоровья, что способствует повышению спроса на него в прогнозируемом году.

- На основе процесса рынок гидролизатов белка на Ближнем Востоке и в Африке сегментируется на ферментативный гидролиз и кислотный гидролиз. Ожидается, что в 2022 году ферментативный гидролиз будет доминировать на рынке гидролизатов белка на Ближнем Востоке и в Африке, поскольку степень обработки можно контролировать благодаря присущей ей специфичности различных протеаз.

- В зависимости от сферы применения рынок гидролизатов белка на Ближнем Востоке и в Африке сегментируется на корма для животных, детское питание, лечебное питание, спортивное питание , диетические добавки и др. Ожидается, что в 2022 году сегмент диетических добавок будет доминировать на рынке гидролизатов белка на Ближнем Востоке и в Африке, поскольку они обеспечивают полное или частичное питание для людей, которые не могут потреблять достаточное количество пищи в обычной форме.

Анализ рынка гидролизатов протеина на уровне стран Ближнего Востока и Африки

Проведен анализ рынка Ближнего Востока и Африки, а также предоставлена информация о размере рынка по типу, источнику, форме, процессу и применению.

Страны, рассматриваемые в отчете о рынке гидролизатов белка на Ближнем Востоке и в Африке, сегментированы следующим образом: Южная Африка, Египет, Саудовская Аравия, Объединенные Арабские Эмираты, Израиль и остальные страны Ближнего Востока и Африки.

- Ожидается, что в 2022 году Объединенные Арабские Эмираты будут доминировать на рынке гидролизатов белка на Ближнем Востоке и в Африке из-за высокого располагаемого дохода потребителей.

Раздел отчета по странам также содержит отдельные факторы, влияющие на рынок, и изменения в регулировании рынка, которые влияют на текущие и будущие тенденции рынка. Такие данные, как новые продажи, замещающие продажи, демографические данные страны, нормативные акты и импортно-экспортные тарифы, являются одними из основных указателей, используемых для прогнозирования рыночного сценария для отдельных стран. Кроме того, при предоставлении прогнозного анализа данных по странам учитываются наличие и доступность брендов Ближнего Востока и Африки и их проблемы из-за большой или малой конкуренции со стороны местных и отечественных брендов, влияние каналов продаж.

Ближний Восток и Африка на рынке гидролизатов протеина на Ближнем Востоке и в Африке

Рынок гидролизатов протеина Ближнего Востока и Африки также предоставляет вам подробный анализ рынка для роста каждой страны в установленной базе различных видов продуктов для рынка, влияние технологий с использованием кривых жизненного цикла и изменений в сценариях регулирования гидролизатов протеина, а также их влияние на рынок гидролизатов протеина. Данные доступны за исторический период с 2010 по 2020 год.

Конкурентная среда и анализ доли рынка гидролизатов белка на Ближнем Востоке и в Африке

Конкурентная среда рынка гидролизатов белка на Ближнем Востоке и в Африке содержит подробную информацию по конкурентам. Включены следующие сведения: обзор компании, финансовые показатели компании, полученный доход, рыночный потенциал, инвестиции в исследования и разработки, новые рыночные инициативы, присутствие на Ближнем Востоке и в Африке, производственные площадки и объекты, сильные и слабые стороны компании, запуск продукта, клинические испытания, анализ бренда, одобрение продукта, патенты, широта продукта, доминирование применения, кривая жизненной линии технологии. Приведенные выше данные относятся только к фокусу компании на рынке гидролизатов белка на Ближнем Востоке и в Африке.

В число основных игроков, охваченных отчетом, входят BRF Middle East and Africa, Novozymes, Azelis, Scanbio Marine Group AS, Bioiberica SAU, Kemin Industries Inc., Copalis, Bio-marine Ingredients Ireland, Titan Biotech, ZXCHEM USA INC., SUBONEYO Chemicals Pharmaceuticals P Limited, New Alliance Dye Chem Pvt. Ltd., Janatha Fish Meals & Oil Products, NAN Group и SAMPI, а также другие.

Аналитики DBMR понимают конкурентные преимущества и проводят конкурентный анализ для каждого конкурента в отдельности.

Например,

- В октябре 2021 года Институт BRF, частная ассоциация, которая стратегически управляет социальными инвестициями компании, завершил третий раунд отбора для публичного уведомления Our Part For The Whole Fund. На инициативу было получено более 370 заявок, из которых было отобрано 50 инициатив на общую сумму 1,8 млн бразильских реалов в виде инвестиций по различным направлениям, ориентированным на создание рабочих мест и доходов, здравоохранение и чрезвычайные ситуации, безопасность пищевых продуктов и социальную защиту.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Содержание

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 SIGNIFICANT DEMAND IN WEIGHT MANAGEMENT PRODUCTS FOR INFANT AND SPORTS NUTRITION

5.1.2 INCREASING HEALTH AWARENESS AMONG CONSUMERS LEADING TO CONSUMPTION OF FUNCTIONAL AND NUTRITIONAL FOODS

5.1.3 RISING DEMAND ACROSS A DIVERSE RANGE OF APPLICATIONS

5.1.4 INCREASED USAGE OF FISH PROTEIN HYDROLYSATE IN AQUAFEED

5.2 RESTRAINTS

5.2.1 HEALTH ISSUES RELATED TO HIGH AND LONG TERM CONSUMPTION OF PROTEIN-BASED DIET

5.2.2 STRINGENT GOVERNMENT REGULATIONS

5.2.3 AVAILABILITY OF ALTERNATIVES SUCH AS ISOLATES AND CONCENTRATES

5.3 OPPORTUNITIES

5.3.1 INCREASING VEGAN POPULATION ACROSS THE GLOBE

5.3.2 HIGH DEMAND FOR ORGANIC FOOD INGREDIENTS

5.4 CHALLENGES

5.4.1 HIGH PRODUCTION COST OF HYDROLYZED PROTEIN

5.4.2 LACK OF AWARENESS IN DEVELOPING COUNTRIES

6 COVID-19 IMPACT ON MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES MARKET

6.1 ANALYSIS ON IMPACT OF COVID-19 ON MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES MARKET

6.2 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES MARKET

6.3 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.4 PRICE IMPACT

6.5 IMPACT ON DEMAND

6.6 IMPACT ON SUPPLY CHAIN

6.7 CONCLUSION

7 MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES MARKET, BY TYPE

7.1 OVERVIEW

7.2 MILK

7.2.1 MILK, BY TYPE

7.2.1.1 WHEY

7.2.1.2 CASEIN

7.3 MEAT

7.3.1 MEAT, BY TYPE

7.3.1.1 BOVINE

7.3.1.2 POULTRY

7.3.1.3 SWINE

7.4 PLANT

7.4.1 PLANT, BY TYPE

7.4.1.1 SOY

7.4.1.2 WHEAT

7.4.1.3 OTHERS

7.5 EGGS

7.6 MARINE

7.6.1 MARINE, BY TYPE

7.6.1.1 FISH

7.6.1.1.1 FISH, BY TYPE

7.6.1.1.1.1 TUNA

7.6.1.1.1.2 SALMON

7.6.1.1.1.3 OTHERS

7.6.1.2 ALGAE

7.7 OTHERS

8 MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES MARKET, BY SOURCE

8.1 OVERVIEW

8.2 ANIMALS

8.3 PLANTS

8.4 MICROBES

9 MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES MARKET, BY FORM

9.1 OVERVIEW

9.2 POWDER

9.3 LIQUID

10 MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES MARKET, BY PROCESS

10.1 OVERVIEW

10.2 ENZYMATIC HYDROLYSIS

10.3 ACID HYDROLYSIS

11 MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 DIETARY SUPPLEMENTS

11.3 INFANT NUTRITION

11.4 SPORTS NUTRITION

11.5 ANIMAL FEED

11.6 CLINICAL NUTRITION

11.7 OTHERS

12 MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES MARKET, BY REGION

12.1 MIDDLE EAST AND AFRICA

12.1.1 U.A.E.

12.1.2 SAUDI ARABIA

12.1.3 SOUTH AFRICA

12.1.4 EGYPT

12.1.5 ISRAEL

12.1.6 REST OF MIDDLE EAST AND AFRICA

13 MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

13.2 MERGERS & ACQUISITIONS

13.3 EXPANSIONS

13.4 NEW PRODUCT DEVELOPMENTS

13.5 PARTNERSHIPS

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 BRF MIDDLE EAST & AFRICA

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT UPDATES

15.2 NOVOZYMES

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT UPDATES

15.3 AZELIS

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT UPDATES

15.4 SCANBIO MARINE GROUP AS

15.4.1 COMPANY SNAPSHOT

15.4.2 COMPANY SHARE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT UPDATE

15.5 BIOIBERICA S.A.U

15.5.1 COMPANY SNAPSHOT

15.5.2 PRODUCT PORTFOLIO

15.5.3 RECENT UPDATES

15.6 KEMIN INDUSTRIES, INC.

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT UPDATES

15.7 COPALIS

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT UPDATES

15.8 BIO-MARINE INGREDIENTS IRELAND

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT UPDATES

15.9 JANATHA FISH MEAL & OIL PRODUCTS

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT UPDATE

15.1 NAN GROUP

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT UPDATE

15.11 NEW ALLIANCE DYE CHEM PVT. LTD.

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT UPDATE

15.12 SAMPI

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT UPDATE

15.13 SUBONEYO CHEMICAL PHARMACEUTICALS P LIMITED

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT UPDATE

15.14 TITAN BIOTECH

15.14.1 COMPANY SNAPSHOT

15.14.2 REVENUE ANALYSIS

15.14.3 PRODUCT PORTFOLIO

15.14.4 RECENT UPDATES

15.15 ZXCHEM USA INC.

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT UPDATES

16 QUESTIONNAIRE

17 RELATED REPORTS

Список таблиц

TABLE 1 IMPORT DATA OF PEPTONES AND THEIR DERIVATIVES; OTHER ALBUMINOUS SUBSTANCES AND THEIR DERIVATIVES; HS CODE - 350400 (USD THOUSAND)

TABLE 2 EXPORT DATA OF PEPTONES AND THEIR DERIVATIVES; OTHER ALBUMINOUS SUBSTANCES AND THEIR DERIVATIVES; HS CODE – 350400 (USD THOUSAND)

TABLE 3 MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 4 MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (TONNE)

TABLE 5 MIDDLE EAST & AFRICA MILK IN PROTEIN HYDROLYSATES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 6 MIDDLE EAST & AFRICA MILK IN PROTEIN HYDROLYSATES MARKET, BY REGION, 2020-2029 (TONNE)

TABLE 7 MIDDLE EAST & AFRICA MILK IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 8 MIDDLE EAST & AFRICA MEAT IN PROTEIN HYDROLYSATES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 9 MIDDLE EAST & AFRICA MEAT IN PROTEIN HYDROLYSATES MARKET, BY REGION, 2020-2029 (TONNE)

TABLE 10 MIDDLE EAST & AFRICA MEAT IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 11 MIDDLE EAST & AFRICA PLANT IN PROTEIN HYDROLYSATES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 12 MIDDLE EAST & AFRICA PLANT IN PROTEIN HYDROLYSATES MARKET, BY REGION, 2020-2029 (TONNE)

TABLE 13 MIDDLE EAST & AFRICA PLANT IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 14 MIDDLE EAST & AFRICA EGGS IN PROTEIN HYDROLYSATES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 15 MIDDLE EAST & AFRICA EGGS IN PROTEIN HYDROLYSATES MARKET, BY REGION, 2020-2029 (TONNE)

TABLE 16 MIDDLE EAST & AFRICA MARINE IN PROTEIN HYDROLYSATES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 17 MIDDLE EAST & AFRICA MARINE IN PROTEIN HYDROLYSATES MARKET, BY REGION, 2020-2029 (TONNE)

TABLE 18 MIDDLE EAST & AFRICA MARINE IN PROTEIN HYDROLYSATESMARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 19 MIDDLE EAST & AFRICA FISH IN PROTEIN HYDROLYSATESMARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 20 MIDDLE EAST & AFRICA OTHERS IN PROTEIN HYDROLYSATESMARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 21 MIDDLE EAST & AFRICA OTHERS IN PROTEIN HYDROLYSATESMARKET, BY REGION, 2020-2029 (TONNE)

TABLE 22 MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES MARKET, BY SOURCE, 2020-2029 (USD THOUSAND)

TABLE 23 MIDDLE EAST & AFRICA ANIMALS IN PROTEIN HYDROLYSATES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 24 MIDDLE EAST & AFRICA PLANTS IN PROTEIN HYDROLYSATES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 25 MIDDLE EAST & AFRICA MICROBES IN PROTEIN HYDROLYSATES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 26 MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 27 MIDDLE EAST & AFRICA POWDER IN PROTEIN HYDROLYSATES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 28 MIDDLE EAST & AFRICA LIQUID IN PROTEIN HYDROLYSATES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 29 MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES MARKET, BY PROCESS, 2020-2029 (USD THOUSAND)

TABLE 30 MIDDLE EAST & AFRICA ENZYMATIC HYDROLYSIS IN PROTEIN HYDROLYSATES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 31 MIDDLE EAST & AFRICA ACID HYDROLYSIS IN PROTEIN HYDROLYSATES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 32 MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 33 MIDDLE EAST & AFRICA DIETARY SUPPLEMENTS IN PROTEIN HYDROLYSATES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 34 MIDDLE EAST & AFRICA INFANT NUTRITION IN PROTEIN HYDROLYSATES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 35 MIDDLE EAST & AFRICA SPORTS NUTRITION IN PROTEIN HYDROLYSATES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 36 MIDDLE EAST & AFRICA ANIMAL FEED IN PROTEIN HYDROLYSATES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 37 MIDDLE EAST & AFRICA CLINICAL NUTRITION IN PROTEIN HYDROLYSATES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 38 MIDDLE EAST & AFRICA CLINICAL NUTRITION IN PROTEIN HYDROLYSATES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 39 MIDDLE EAST AND AFRICA PROTEIN HYDROLYSATES MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 40 MIDDLE EAST AND AFRICA PROTEIN HYDROLYSATES MARKET, BY COUNTRY, 2020-2029 (TONNE)

TABLE 41 MIDDLE EAST AND AFRICA PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 42 MIDDLE EAST AND AFRICA PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (TONNE)

TABLE 43 MIDDLE EAST AND AFRICA MILK IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 44 MIDDLE EAST AND AFRICA MEAT IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 45 MIDDLE EAST AND AFRICA MARINE IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 46 MIDDLE EAST AND AFRICA FISH IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 47 MIDDLE EAST AND AFRICA PLANT IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 48 MIDDLE EAST AND AFRICA PROTEIN HYDROLYSATES MARKET, BY SOURCE, 2020-2029 (USD THOUSAND)

TABLE 49 MIDDLE EAST AND AFRICA PROTEIN HYDROLYSATES MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 50 MIDDLE EAST AND AFRICA PROTEIN HYDROLYSATES MARKET, BY PROCESS, 2020-2029 (USD THOUSAND)

TABLE 51 MIDDLE EAST AND AFRICA PROTEIN HYDROLYSATES MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 52 U.A.E. PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 53 U.A.E. PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (TONNE)

TABLE 54 U.A.E. MILK IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 55 U.A.E. MEAT IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 56 U.A.E. MARINE IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 57 U.A.E. FISH IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 58 U.A.E. PLANT IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 59 U.A.E. PROTEIN HYDROLYSATES MARKET, BY SOURCE, 2020-2029 (USD THOUSAND)

TABLE 60 U.A.E. PROTEIN HYDROLYSATES MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 61 U.A.E. PROTEIN HYDROLYSATES MARKET, BY PROCESS, 2020-2029 (USD THOUSAND)

TABLE 62 U.A.E. PROTEIN HYDROLYSATES MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 63 SAUDI ARABIA PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 64 SAUDI ARABIA PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (TONNE)

TABLE 65 SAUDI ARABIA MILK IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 66 SAUDI ARABIA MEAT IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 67 SAUDI ARABIA MARINE IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 68 SAUDI ARABIA FISH IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 69 SAUDI ARABIA PLANT IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 70 SAUDI ARABIA PROTEIN HYDROLYSATES MARKET, BY SOURCE, 2020-2029 (USD THOUSAND)

TABLE 71 SAUDI ARABIA PROTEIN HYDROLYSATES MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 72 SAUDI ARABIA PROTEIN HYDROLYSATES MARKET, BY PROCESS, 2020-2029 (USD THOUSAND)

TABLE 73 SAUDI ARABIA PROTEIN HYDROLYSATES MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 74 SOUTH AFRICA PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 75 SOUTH AFRICA PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (TONNE)

TABLE 76 SOUTH AFRICA MILK IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 77 SOUTH AFRICA MEAT IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 78 SOUTH AFRICA MARINE IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 79 SOUTH AFRICA FISH IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 80 SOUTH AFRICA PLANT IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 81 SOUTH AFRICA PROTEIN HYDROLYSATES MARKET, BY SOURCE, 2020-2029 (USD THOUSAND)

TABLE 82 SOUTH AFRICA PROTEIN HYDROLYSATES MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 83 SOUTH AFRICA PROTEIN HYDROLYSATES MARKET, BY PROCESS, 2020-2029 (USD THOUSAND)

TABLE 84 SOUTH AFRICA PROTEIN HYDROLYSATES MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 85 EGYPT PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 86 EGYPT PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (TONNE)

TABLE 87 EGYPT MILK IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 88 EGYPT MEAT IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 89 EGYPT MARINE IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 90 EGYPT FISH IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 91 EGYPT PLANT IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 92 EGYPT PROTEIN HYDROLYSATES MARKET, BY SOURCE, 2020-2029 (USD THOUSAND)

TABLE 93 EGYPT PROTEIN HYDROLYSATES MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 94 EGYPT PROTEIN HYDROLYSATES MARKET, BY PROCESS, 2020-2029 (USD THOUSAND)

TABLE 95 EGYPT PROTEIN HYDROLYSATES MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 96 ISRAEL PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 97 ISRAEL PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (TONNE)

TABLE 98 ISRAEL MILK IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 99 ISRAEL MEAT IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 100 ISRAEL MARINE IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 101 ISRAEL FISH IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 102 ISRAEL PLANT IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 103 ISRAEL PROTEIN HYDROLYSATES MARKET, BY SOURCE, 2020-2029 (USD THOUSAND)

TABLE 104 ISRAEL PROTEIN HYDROLYSATES MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 105 ISRAEL PROTEIN HYDROLYSATES MARKET, BY PROCESS, 2020-2029 (USD THOUSAND)

TABLE 106 ISRAEL PROTEIN HYDROLYSATES MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 107 REST OF MIDDLE EAST AND AFRICA PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 108 REST OF MIDDLE EAST AND AFRICA PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (TONNE)

Список рисунков

FIGURE 1 MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES MARKET: TYPE LIFE LINE CURVE

FIGURE 7 MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES MARKET: MULTIVARIATE MODELLING

FIGURE 8 MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES MARKET: DBMR MARKET POSITION GRID

FIGURE 10 MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES MARKET: APPLICATION COVERAGE GRID

FIGURE 11 MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES MARKET: CHALLENGE MATRIX

FIGURE 12 MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES MARKET: SEGMENTATION

FIGURE 14 NORTH AMERICA IS EXPECTED TO DOMINATE THE MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES MARKET, WHILE ASIA-PACIFIC IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 15 INCREASED DEMAND FOR INFANT NUTRITION AND SPORTS NUTRITION IS EXPECTED TO DRIVE THE MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 16 MILK SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES MARKET IN 2022 & 2029

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES MARKET

FIGURE 18 WORLD CAPTURE FISHERIES FROM 1950 TO 2018

FIGURE 19 MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES, BY TYPE, 2021

FIGURE 20 MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES, BY SOURCE, 2021

FIGURE 21 MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES, BY FORM, 2021

FIGURE 22 MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES, BY PROCESS, 2021

FIGURE 23 MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES, BY APPLICATION, 2021

FIGURE 24 MIDDLE EAST AND AFRICA PROTEIN HYDROLYSATES MARKET: SNAPSHOT (2021)

FIGURE 25 MIDDLE EAST AND AFRICA PROTEIN HYDROLYSATES MARKET: BY COUNTRY (2021)

FIGURE 26 MIDDLE EAST AND AFRICA PROTEIN HYDROLYSATES MARKET: BY COUNTRY (2022 & 2029)

FIGURE 27 MIDDLE EAST AND AFRICA PROTEIN HYDROLYSATES MARKET: BY COUNTRY (2021 & 2029)

FIGURE 28 MIDDLE EAST AND AFRICA PROTEIN HYDROLYSATES MARKET: BY TYPE (2022-2029)

FIGURE 29 MIDDLE EAST & AFRICA PROTEIN HYDROLYSATES MARKET: COMPANY SHARE 2021 (%)

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.