Middle East And Africa Foundry Chemicals Market

Размер рынка в млрд долларов США

CAGR :

%

USD

218.69 Million

USD

285.76 Million

2025

2033

USD

218.69 Million

USD

285.76 Million

2025

2033

| 2026 –2033 | |

| USD 218.69 Million | |

| USD 285.76 Million | |

|

|

|

|

Сегментация рынка литейных химикатов на Ближнем Востоке и в Африке по типу (бензол, формальдегид, нафталин, фенол, ксилол и другие), типу продукции (связующие вещества, добавки, покрытия, флюсы и другие), типу литейного производства (черные и цветные металлы), типу литейного инструмента (шпатели, кельмы, подъемники, ручные шпатели, вентиляционная проволока, трамбовки, тампоны, штифты и кусачки для литников и другие), типу литейного процесса (термическое цинкование и химическое никелирование), типу литейной системы (системы литья в песчаные формы и системы литья в песчаные формы с химическим связыванием), применению (чугун, сталь, алюминий и другие), каналам сбыта (электронная коммерция, специализированные магазины, B2B/сторонние дистрибьюторы и другие) - Тенденции отрасли и прогноз до 2033 года.

Каковы размеры и темпы роста рынка химикатов для литейного производства на Ближнем Востоке и в Африке?

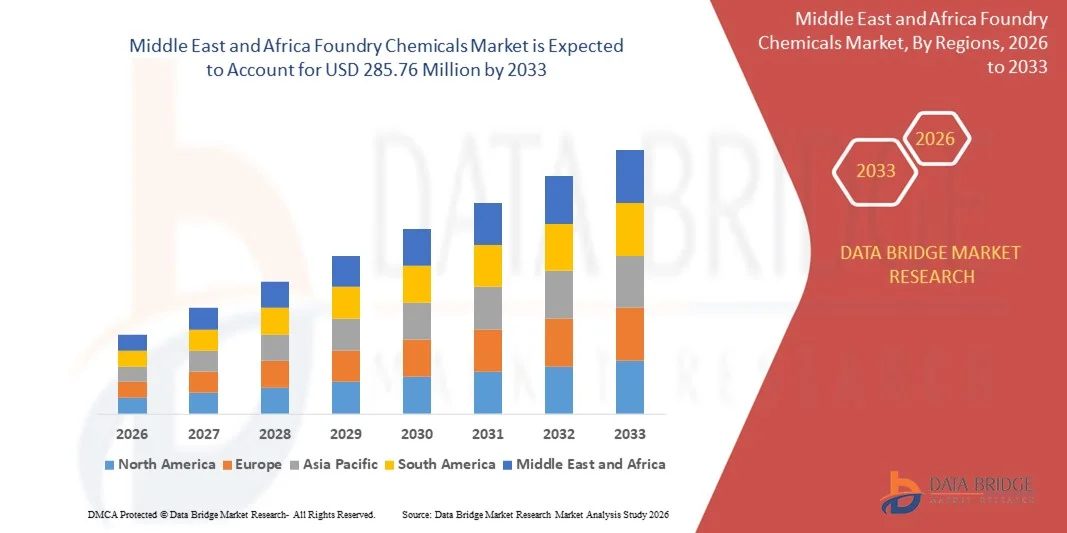

- Объем рынка химикатов для литейного производства на Ближнем Востоке и в Африке в 2025 году оценивался в 218,69 млн долларов США и, как ожидается, достигнет 285,76 млн долларов США к 2033 году , демонстрируя среднегодовой темп роста в 3,4% в течение прогнозируемого периода.

- Растущий спрос на литье металлов в производстве тяжелого машиностроения стимулирует рост рынка литейных химикатов.

- Коррозионная активность черных металлов в условиях окружающей среды снижает спрос на рынке литейных химикатов.

Основные выводы по рынку химикатов для литейного производства?

- Растущий спрос на сталь на рынке создает возможности для рынка химикатов для литейного производства. Однако жесткие экологические нормы в отношении химических веществ, выбрасываемых литейными предприятиями, создают препятствия для роста спроса на рынке химикатов для литейного производства.

- Саудовская Аравия доминировала на рынке химикатов для литейного производства на Ближнем Востоке и в Африке, занимая, по оценкам, 39,7% выручки в 2025 году. Это обусловлено крупными промышленными проектами, автомобильной и машиностроительной промышленностью, а также широким применением в строительстве, возобновляемой энергетике и производстве тяжелого оборудования.

- По прогнозам, Южная Африка продемонстрирует самый быстрый среднегодовой темп роста в 10,8% в период с 2026 по 2033 год, что обусловлено ростом использования в автомобильной, горнодобывающей и промышленной отраслях.

- Сегмент формальдегида доминировал на рынке, занимая, по оценкам, 41,2% доли к 2025 году, благодаря его высокой реакционной способности, превосходным связующим свойствам и широкому применению в литейной промышленности черных и цветных металлов.

Обзор отчета и сегментация рынка химикатов для литейного производства

|

Атрибуты |

Ключевые рыночные тенденции в сфере литейной химии. |

|

Охваченные сегменты |

|

|

Охваченные страны |

Ближний Восток и Африка

|

|

Ключевые игроки рынка |

|

|

Рыночные возможности |

|

|

Информационные наборы данных, представляющие добавленную стоимость |

Помимо анализа рыночных сценариев, таких как рыночная стоимость, темпы роста, сегментация, географический охват и основные игроки, отчеты о рынке, подготовленные Data Bridge Market Research, также включают углубленный экспертный анализ, анализ ценообразования, анализ доли брендов, опросы потребителей, демографический анализ, анализ цепочки поставок, анализ цепочки создания стоимости, обзор сырья/расходных материалов, критерии выбора поставщиков, PESTLE-анализ, анализ Портера и нормативно-правовую базу. |

Какова ключевая тенденция на рынке химикатов для литейного производства?

Растущее внедрение передовых, легких и высокопрочных химикатов для литейного производства.

- На рынке химикатов для литейного производства наблюдается растущий спрос на легкие, коррозионностойкие и высокоэффективные материалы, используемые в автомобильной, аэрокосмической, машиностроительной и возобновляемой энергетике.

- Производители все чаще внедряют полимерные композиты, сплавы с покрытием из ПТФЭ и армированные волокнами металлокерамические решения для повышения износостойкости, несущей способности и эксплуатационной надежности.

- Акцент на энергоэффективности, снижении затрат на техническое обслуживание и увеличении срока службы стимулирует внедрение таких решений в условиях высоких нагрузок и непрерывной эксплуатации.

- Например, такие компании, как SKF, Schaeffler, Trelleborg, GGB и RBC Bearings, расширяют свой ассортимент современных композитных подшипников и покрытий, снижающих трение, для электромобилей, ветряных турбин, промышленной автоматизации и тяжелого оборудования.

- Высокий уровень использования литейных химикатов в электромобилях, промышленной робототехнике, системах обработки жидкостей и аэрокосмических компонентах поддерживает рост рынка.

- Поскольку промышленность уделяет особое внимание долговечности, оптимизации веса и снижению затрат на протяжении всего жизненного цикла, ожидается, что химические реактивы для литейного производства останутся критически важными в механических и промышленных системах следующего поколения.

Каковы основные факторы, влияющие на рынок химикатов для литейного производства?

- Растущий спрос на подшипники, не требующие технического обслуживания, смазки и способные выдерживать высокие нагрузки, значительно стимулирует использование химических реагентов в литейном производстве в автомобильной, аэрокосмической и промышленной отраслях.

- Например, в 2024–2025 годах компании SKF, Schaeffler и Trelleborg представили передовые решения на основе композитных и полимерных материалов, предназначенные для работы в экстремальных температурах, при больших нагрузках и с увеличенным сроком службы.

- Растущее внедрение электромобилей, ветроэнергетических систем, автоматизированного оборудования и промышленных роботов увеличивает потребность в легких, прочных и энергоэффективных подшипниках.

- Достижения в области полимерной инженерии, композитных материалов и высокоточного производства повышают сопротивление трению, износостойкость и несущую способность.

- Усиление внимания к вопросам устойчивого развития и энергосбережения способствует замене традиционных металлических подшипников на композитные или полимерные аналоги.

- Благодаря промышленной автоматизации, расширению использования возобновляемых источников энергии и развитию инфраструктуры, рынок химикатов для литейного производства готов к устойчивому долгосрочному росту.

Какой фактор препятствует росту рынка химикатов для литейного производства?

- Более высокая стоимость современных полимеров, волокон и материалов, изготовленных с высокой точностью, ограничивает их применение в областях, чувствительных к цене.

- Нестабильность цен на сырье и сбои в цепочках поставок в 2024–2025 годах привели к увеличению операционных издержек для ключевых производителей.

- Ограничения в работе при экстремальных ударных нагрузках или несоосности могут ограничивать применение в некоторых тяжелых промышленных системах.

- Низкая осведомленность мелких производителей о преимуществах на протяжении всего жизненного цикла продукции и долгосрочной экономической эффективности замедляет проникновение на рынок.

- Конкуренция со стороны традиционных металлических подшипников и недорогих заменителей оказывает ценовое давление и снижает дифференциацию.

- Для преодоления этих проблем компании сосредотачиваются на экономически эффективных конструкциях, целевых областях применения и обучении клиентов, чтобы стимулировать более широкое внедрение химикатов для литейного производства.

Как сегментируется рынок химикатов для литейного производства?

Рынок сегментирован по типу, типу продукции, типу литейного производства, типу литейного инструмента, типу литейного процесса, типу литейной системы, каналу сбыта и применению.

- По типу

Рынок литейных химикатов сегментирован на бензол, формальдегид, нафталин, фенол, ксилол и другие. Сегмент формальдегида доминировал на рынке с предполагаемой долей в 41,2% в 2025 году, что обусловлено его высокой реакционной способностью, превосходными связующими свойствами и широким применением в литейной промышленности черных и цветных металлов. Химические вещества на основе формальдегида широко используются в рецептурах смол, покрытиях и связующих веществах для стержней, обеспечивая прочность и долговечность при высокотемпературных операциях.

Прогнозируется, что сегмент фенола будет расти самыми быстрыми темпами в период с 2026 по 2033 год, чему способствует растущий спрос на фенольные смолы в современных процессах литья, аэрокосмической и автомобильной промышленности. Превосходная термостойкость, химическая стабильность и возможность производства стержней с низким уровнем выбросов ускоряют внедрение фенола. Усиление внимания к устойчивому производству и улучшению качества литья еще больше расширяет возможности роста для производителей литейной химии на основе фенола во всем мире.

- По типу продукции

По типу продукции рынок сегментируется на связующие вещества, добавки, покрытия, флюсы и прочие. Сегмент связующих веществ доминировал с долей 38,5% в 2025 году, чему способствовал высокий спрос в литье в песчаные формы, изготовлении стержней и системах с химически связанным песком. Связующие вещества повышают прочность форм, уменьшают количество дефектов и улучшают качество поверхности в автомобильной, строительной и промышленной отраслях.

Ожидается, что сегмент покрытий продемонстрирует самый быстрый среднегодовой темп роста в период с 2026 по 2033 год, чему способствует растущее внедрение термостойких и защитных покрытий в высокоточном литье, аэрокосмической отрасли и промышленном оборудовании. Технологические достижения в рецептурах покрытий, улучшающие теплоизоляцию, износостойкость и уменьшающие количество дефектов, еще больше способствуют расширению рынка в глобальном масштабе.

- По типу литейного производства

В зависимости от типа литейного производства рынок сегментируется на черные и цветные металлы. Сегмент черных металлов доминировал на рынке с долей 56,7% в 2025 году, что объясняется их широким применением в литье из стали, чугуна и сплавов для автомобильной, строительной и машиностроительной отраслей. Литейные предприятия, работающие с черными металлами, нуждаются в надежных химических растворах для высокотемпературного формования, обеспечения свойств связующих веществ и качества поверхности.

Прогнозируется, что сегмент цветных металлов будет расти самыми быстрыми темпами в период с 2026 по 2033 год, чему способствует рост использования алюминия, меди и специальных сплавов в литье для электроники, аэрокосмической отрасли и автомобилестроения. Растущая индустриализация и спрос на высокоточные, легкие компоненты дополнительно способствуют внедрению химических реактивов для литейного производства цветных металлов.

- По типу литейного инструмента

В зависимости от типа инструмента рынок сегментируется на лопаты, кельмы, подъемники, ручные уплотнители, вентиляционную проволоку, трамбовки, тампоны, штифты и кусачки для литников, а также другие инструменты. Сегмент трамбовок доминировал с долей 33,4% в 2025 году и широко используется для уплотнения форм и стержней в высококачественных литейных операциях. Трамбовки обеспечивают равномерную плотность, снижение дефектов и повышение прочности форм, особенно в тяжелой промышленности и автомобильном литейном производстве.

Прогнозируется, что сегмент тампонов будет расти самыми быстрыми темпами в период с 2026 по 2033 год благодаря расширению их использования для нанесения покрытий на стержни, прецизионной очистки и подготовки форм без дефектов при литье из черных и цветных металлов. Повышение уровня автоматизации и спрос на высококачественное литье ускоряют внедрение тампонов.

- По типу литейного процесса

В зависимости от типа процесса рынок сегментируется на термическое цинкование и химическое никелирование. Сегмент термического цинкования доминировал с долей 59,1% в 2025 году, чему способствовало широкое применение в защите от коррозии, упрочнении поверхности и повышении термостойкости промышленных компонентов.

Ожидается, что сегмент электрохимического никелирования будет расти самыми быстрыми темпами в период с 2026 по 2033 год благодаря равномерному нанесению покрытия, повышенной износостойкости и широкому применению в аэрокосмической, автомобильной и высокоточной литьевой промышленности. Регуляторные меры, направленные на обеспечение устойчивого развития и совершенствование технологий нанесения покрытий, также способствуют росту.

- По типу литейной системы

Рынок сегментирован на системы литья в песчаные формы и системы литья в песчаные формы с химическим соединением. Сегмент систем литья в песчаные формы доминировал с долей 52,6% в 2025 году благодаря широкому применению в литье черных и цветных металлов, экономичности и совместимости с традиционными литейными производствами.

Прогнозируется, что сегмент систем литья в песчаные формы с химическим связующим будет расти самыми быстрыми темпами в период с 2026 по 2033 год, чему способствует растущий спрос на высокоточные отливки с низким уровнем дефектов в автомобильной, аэрокосмической и промышленной отраслях. Передовые технологии связующих веществ и высокоэффективные химические вещества ускоряют внедрение этих технологий.

- По заявлению

В зависимости от области применения рынок сегментирован на чугун, сталь, алюминий и другие материалы. Сегмент чугуна доминировал с долей 44,3% в 2025 году, чему способствовало широкое использование в автомобильных двигателях, промышленном оборудовании и тяжелой технике. Литейные заводы, производящие чугун, нуждаются в высокоэффективных связующих, покрытиях и флюсах для обеспечения точности, термической стабильности и отсутствия дефектов в продукции.

Ожидается, что сегмент алюминия будет расти самыми быстрыми темпами в период с 2026 по 2033 год благодаря увеличению производства легких автомобильных и аэрокосмических компонентов, росту промышленной автоматизации и спросу на экологически чистые высокоточные отливки.

- По каналам сбыта

По каналам сбыта рынок сегментируется на электронную коммерцию, специализированные магазины, B2B/сторонних дистрибьюторов и другие. Сегмент B2B/сторонних дистрибьюторов доминировал с долей 61,8% в 2025 году благодаря прочным отношениям с поставщиками, оптовым закупкам промышленными потребителями и индивидуальным решениям для крупных литейных предприятий.

Ожидается, что сегмент электронной коммерции будет расти самыми быстрыми темпами в период с 2026 по 2033 год, чему способствуют растущая цифровизация, онлайн-доступ к стандартным и специализированным химическим веществам, а также внедрение этой технологии малыми и средними литейными предприятиями. Более быстрая доставка, конкурентоспособные цены и более широкая доступность продукции способствуют расширению рынка в глобальном масштабе.

Какой регион занимает наибольшую долю рынка химикатов для литейного производства?

- Саудовская Аравия доминировала на рынке химикатов для литейного производства на Ближнем Востоке и в Африке, занимая, по оценкам, 39,7% выручки в 2025 году. Это обусловлено крупными промышленными проектами, автомобильной и машиностроительной промышленностью, а также широким применением в строительстве, возобновляемой энергетике и производстве тяжелого оборудования.

- Растущий спрос на высокоэффективные, долговечные и не требующие сложного обслуживания химические реактивы для литейного производства укрепляет лидерство Саудовской Аравии на рынке. Тесное сотрудничество с производителями оригинального оборудования, передовые производственные возможности и постоянные инвестиции в НИОКР еще больше укрепляют долгосрочные перспективы роста.

Анализ рынка химикатов для литейного производства в ОАЭ

В ОАЭ рост рынка обусловлен проектами в строительстве, нефтегазовой отрасли и сфере возобновляемой энергетики. Химические вещества для литейного производства все чаще используются в тяжелой технике, прецизионном литье и промышленном оборудовании благодаря низкому коэффициенту трения, высокой износостойкости и необслуживаемости. Акцент на энергоэффективности, устойчивом производстве и прочные партнерские отношения с производителями оригинального оборудования способствуют стабильному внедрению и обеспечивают долгосрочное расширение рынка в ключевых отраслях промышленности.

Анализ рынка химикатов для литейного производства в Южной Африке

По прогнозам, Южная Африка продемонстрирует самый быстрый среднегодовой темп роста в 10,8% в период с 2026 по 2033 год, обусловленный ростом использования в автомобильной, горнодобывающей и промышленной отраслях. Расширение внедрения энергоэффективных методов производства, инициатив в области возобновляемой энергии и передовой промышленной автоматизации ускоряет спрос на химические вещества для литейного производства волокон и металлических матриц. Расширение внутренних производственных центров и ориентированный на экспорт промышленный рост дополнительно способствуют долгосрочному развитию рынка.

Анализ рынка химикатов для литейного производства в Египте

В Египте рост обеспечивается инвестициями в автомобильную, строительную и промышленную отрасли, где химические реактивы для литейного производства предпочтительны для применения в условиях высоких нагрузок, износостойкости и низких затрат на техническое обслуживание. Благодаря программам модернизации и государственным стимулам растет внедрение технологий в возобновляемые источники энергии, инфраструктурные проекты и производство тяжелой техники. Сотрудничество между местными производителями, OEM-партнерами и научно-исследовательскими институтами способствует инновациям и повышению конкурентоспособности на региональном рынке.

Анализ рынка литейной химии в Марокко

Марокко демонстрирует устойчивый рост, обусловленный проектами в строительстве, автомобилестроении и производстве промышленного оборудования. Химические вещества для литейного производства все чаще используются в тяжелой технике, литье и возобновляемой энергетике для повышения долговечности, эффективности работы и срока службы. Поддержка со стороны правительства в области модернизации промышленности, инициативы по повышению энергоэффективности и расширение местных производственных мощностей способствуют внедрению этих технологий. Рост экспорта и региональное промышленное сотрудничество еще больше укрепляют долгосрочное развитие рынка.

Какие компании занимают лидирующие позиции на рынке химикатов для литейного производства?

В отрасли производства литейной химии литейное производство литейные химикаты в основном возглавляют хорошо зарекомендовавшие себя компании, в том числе:

- Везувий (Великобритания)

- Имерис (Франция)

- Saint Gobain Performance Ceramics & Refractories (Франция)

- Компания Georgia Pacific Chemicals (США)

- DuPont (США)

- ASK Chemicals (США)

- Шаньдун Краунчем Индастри Коль (Китай)

- Компания Compax Industrial Systems Pvt. Ltd (Индия)

- CS ADDITIVE GMBH (Германия)

- CAGroup (ОАЭ)

- Ultraseal India Pvt. Ltd. (Индия)

- Хюттенес Альбертус (Германия)

- CERAFLUX INDIA PVT.LTD. (Индия)

- Forace Polymers (P) Ltd. (Индия)

- Шотландская химическая компания (Великобритания)

Какие последние тенденции наблюдаются на мировом рынке химикатов для литейного производства?

- В августе 2025 года компания Vesuvius приобрела подразделение Molten Metal Systems компании Morgan Advanced, чтобы увеличить свою выручку от производства цветных металлов до 27%, сосредоточившись на расширении производства в Индии. Ожидается, что синергия затрат обеспечит рост EBITDA более чем на 50%, что укрепит позиции компании на мировом рынке.

- В марте 2025 года компания ASK Chemicals выпустила новую линейку низкоэмиссионных связующих для холодного формования, снижающих выбросы летучих органических соединений на 30%, что способствует устойчивому развитию литейного производства в автомобильной промышленности и поддерживает экологически ответственные методы производства.

- В январе 2024 года компания Hüttenes-Albertus International разработала биоразлагаемые разделительные составы в соответствии с экологическими директивами ЕС, ориентируясь на рост в строительном секторе и еще больше укрепляя приверженность компании к устойчивым и экологически чистым решениям.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.