Рынок коммерческих посудомоечных машин на Ближнем Востоке и в Африке по области применения ( гостиницырестораны и другие), продукту (встраиваемые, с дверцей или вытяжкой, с конвейером и стаканомоечные машины), категории (отдельно стоящие и встраиваемые), каналу сбыта (офлайн и онлайн), стране (Южная Африка, Египет, Саудовская Аравия, ОАЭ, Израиль и остальные страны Ближнего Востока и Африки). Тенденции отрасли и прогноз до 2029 года.

Анализ рынка и аналитика: рынок коммерческих посудомоечных машин на Ближнем Востоке и в Африке

Анализ рынка и аналитика: рынок коммерческих посудомоечных машин на Ближнем Востоке и в Африке

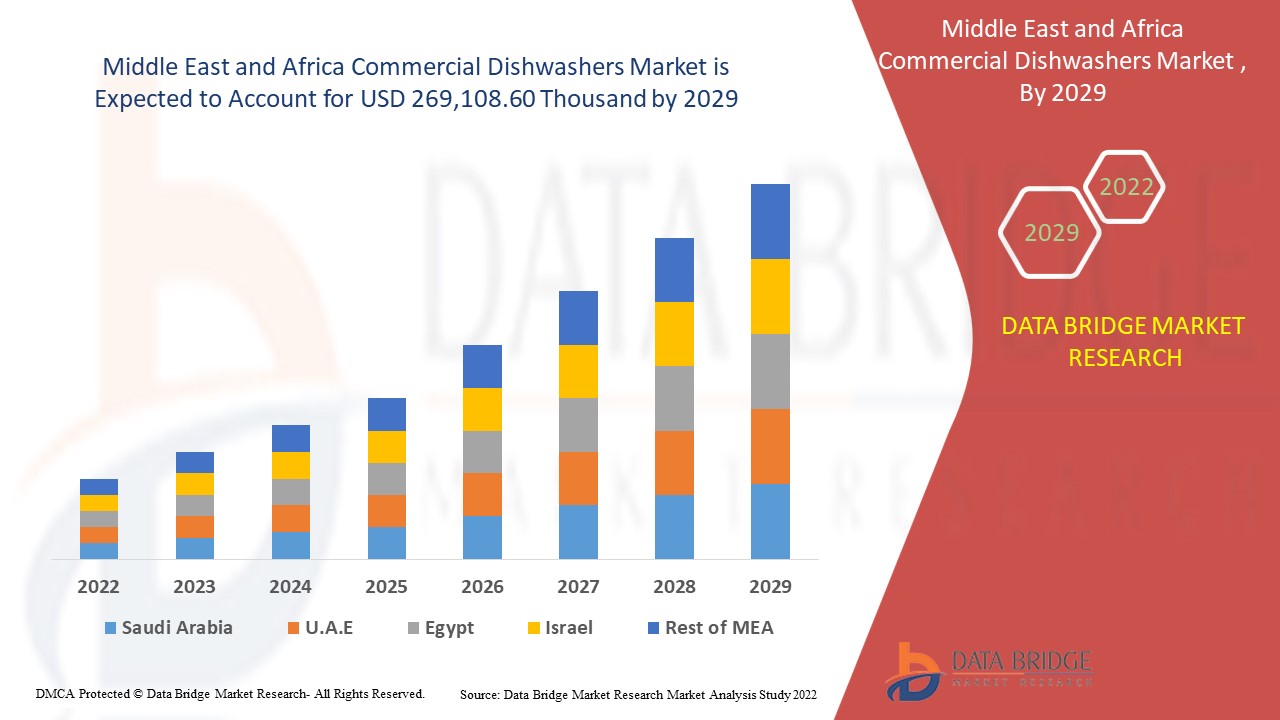

Ожидается, что рынок коммерческих посудомоечных машин на Ближнем Востоке и в Африке будет расти в прогнозируемый период с 2022 по 2029 год. По данным Data Bridge Market Research, среднегодовой темп роста рынка составит 3,6% в прогнозируемый период с 2022 по 2029 год, и ожидается, что к 2029 году его объем достигнет 269 108,60 тыс. долларов США.

Посудомоечные машины широко используются для мытья посуды в отелях, ресторанах и других коммерческих кухнях . Коммерческие посудомоечные машины более эффективны, чем бытовые, и обеспечивают другие функции, такие как стерилизация посуды.

Растущее влияние западного образа жизни является важнейшим фактором, обусловливающим рост рынка, а также растущая потребность бизнесменов экономить время и выполнять задачи как можно быстрее, растущее число ресторанов, кафе, небольших предприятий общественного питания и т. д., занятый образ жизни людей, растущее предпочтение продукции, сертифицированной Energy Star, поскольку она предлагает многочисленные преимущества, такие как экономия на эксплуатационных расходах, потребление меньшего количества энергии и сокращение потребления химических средств, используемых для чистки, являются одними из основных факторов, среди прочих, движущих рынок коммерческих посудомоечных машин.

Большинство коммерческих кухонь используют коммерческие посудомоечные машины, которые сделаны из нержавеющей стали, потому что нержавеющая сталь долговечна и устойчива практически ко всему. Она не только эстетически приятна, но и устойчива к воде, теплу и всему, что может быть суровым на кухне ресторана. Более того, растущий располагаемый доход людей также является одним из основных факторов, которые подпитывают спрос на коммерческие посудомоечные машины среди населения. Основным сдерживающим фактором для рынка является высокая стоимость коммерческой посудомоечной машины, которая может повлиять на карман потребителя. Поэтому производители постоянно фокусируются на инновационных технологиях, чтобы разрабатывать инновационные продукты, которые предлагают ключевые преимущества по более низким ценам.

В этом отчете о рынке коммерческих посудомоечных машин на Ближнем Востоке и в Африке содержатся сведения о доле рынка, новых разработках и анализе продуктового портфеля, влиянии внутренних и локальных игроков рынка, анализируются возможности с точки зрения новых источников дохода, изменений в рыночных правилах, одобрений продуктов, стратегических решений, запусков продуктов, географических расширений и технологических инноваций на рынке. Чтобы понять анализ и рыночный сценарий, свяжитесь с нами для получения аналитического обзора; наша команда поможет вам создать решение по влиянию на доход для достижения желаемой цели.

Масштаб и размер рынка коммерческих посудомоечных машин на Ближнем Востоке и в Африке

Масштаб и размер рынка коммерческих посудомоечных машин на Ближнем Востоке и в Африке

Рынок коммерческих посудомоечных машин Ближнего Востока и Африки сегментирован на основе применения, категории, продукта и канала сбыта. Рост среди сегментов помогает вам анализировать нишевые карманы роста и стратегии подхода к рынку и определять ваши основные области применения и разницу в ваших целевых рынках.

- На основе сферы применения рынок коммерческих посудомоечных машин Ближнего Востока и Африки сегментируется на рестораны, отели и др. Ожидается, что в 2022 году сегмент отелей будет доминировать на рынке коммерческих посудомоечных машин Ближнего Востока и Африки из-за появления в регионе миллениалов-путешественников.

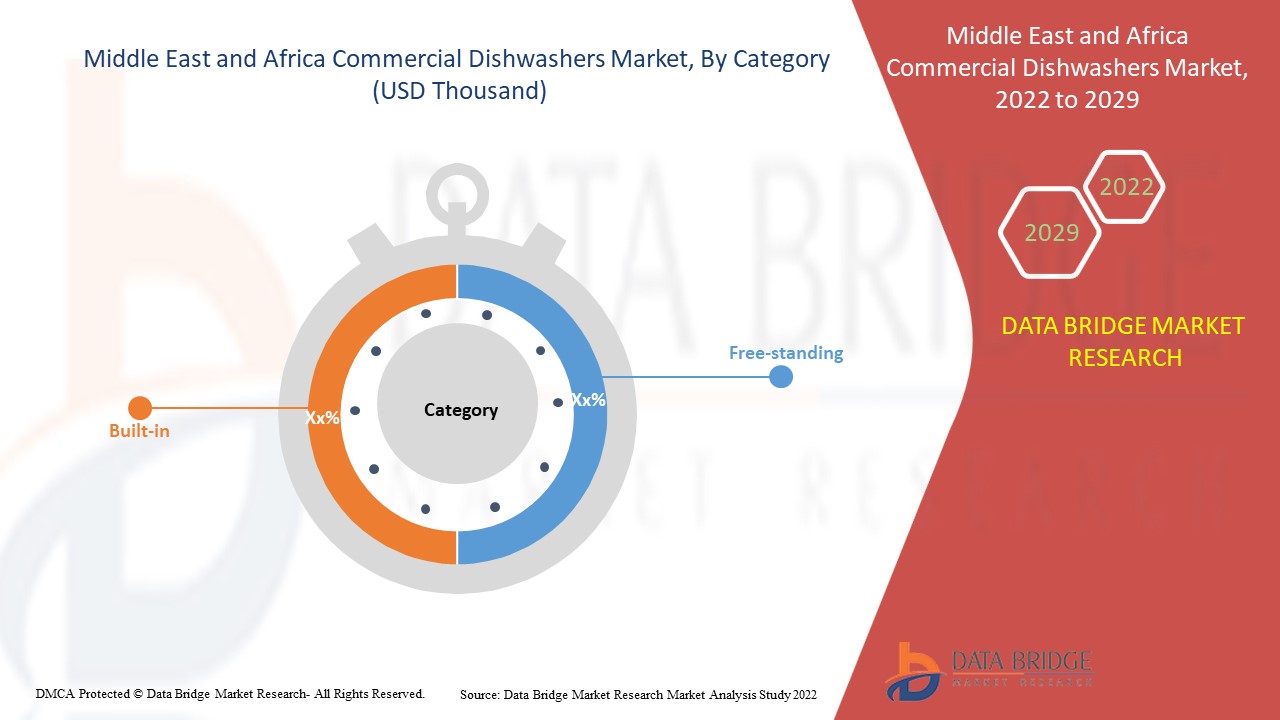

- На основе категории рынок коммерческих посудомоечных машин Ближнего Востока и Африки сегментируется на отдельно стоящие и встраиваемые. Ожидается, что в 2022 году сегмент отдельно стоящих машин будет доминировать на рынке коммерческих посудомоечных машин Ближнего Востока и Африки из-за увеличения располагаемого дохода.

- На основе продукта рынок коммерческих посудомоечных машин Ближнего Востока и Африки сегментируется на подстольные, дверные или капотные, стеллажные/конвейерные и стаканомоечные машины. Ожидается, что в 2022 году сегмент подстольных посудомоечных машин будет доминировать на рынке коммерческих посудомоечных машин Ближнего Востока и Африки, поскольку спрос на подстольные посудомоечные машины растет очень быстро из-за увеличения располагаемого дохода.

- На основе канала дистрибуции рынок коммерческих посудомоечных машин Ближнего Востока и Африки сегментируется на офлайн и онлайн. Ожидается, что в 2022 году офлайн-сегмент будет доминировать на рынке коммерческих посудомоечных машин Ближнего Востока и Африки из-за легкой доступности магазинов в регионе.

Анализ рынка коммерческих посудомоечных машин на уровне страны на Ближнем Востоке и в Африке

Проведен анализ рынка Ближнего Востока и Африки, а также предоставлена информация о размере рынка по странам, областям применения, категориям, продуктам и каналам сбыта.

Страны, охваченные отчетом о рынке коммерческих посудомоечных машин на Ближнем Востоке и в Африке, включают Объединенные Арабские Эмираты, Саудовскую Аравию, Южную Африку, Египет, Израиль и остальные страны Ближнего Востока и Африки. Объединенные Арабские Эмираты доминируют на рынке коммерческих посудомоечных машин на Ближнем Востоке и в Африке из-за растущей склонности к технологиям умной кухни в регионе. Саудовская Аравия доминирует на рынке коммерческих посудомоечных машин на Ближнем Востоке и в Африке из-за большого использования коммерческих посудомоечных машин в ресторанах и барах. Южная Африка доминирует на рынке коммерческих посудомоечных машин на Ближнем Востоке и в Африке из-за растущей склонности к туристическим турам и путешествиям в регионе.

Раздел отчета по странам также содержит отдельные факторы, влияющие на рынок, и изменения в регулировании рынка, которые влияют на текущие и будущие тенденции рынка. Такие данные, как новые продажи, замещающие продажи, демографические данные страны, нормативные акты и импортно-экспортные тарифы, являются одними из основных указателей, используемых для прогнозирования рыночного сценария для отдельных стран. Кроме того, при предоставлении прогнозного анализа данных по странам учитываются наличие и доступность брендов Ближнего Востока и Африки и их проблемы из-за большой или малой конкуренции со стороны местных и отечественных брендов, влияние каналов продаж.

Рост рынка коммерческих посудомоечных машин на Ближнем Востоке и в Африке

Рынок коммерческих посудомоечных машин Ближнего Востока и Африки также предоставляет вам подробный анализ рынка для роста установленной базы различных видов продукции для рынка в каждой стране, влияние технологий с использованием кривых жизненного цикла и изменений в сценариях регулирования детской смеси, а также их влияние на рынок коммерческих посудомоечных машин. Данные доступны за исторический период с 2012 по 2020 год.

Конкурентная среда и анализ доли рынка коммерческих посудомоечных машин на Ближнем Востоке и в Африке

Конкурентная среда рынка коммерческих посудомоечных машин на Ближнем Востоке и в Африке содержит данные по конкурентам. Включены следующие данные: обзор компании, финансовые показатели компании, полученный доход, рыночный потенциал, инвестиции в исследования и разработки, новые рыночные инициативы, глобальное присутствие, производственные площадки и объекты, сильные и слабые стороны компании, запуск продукта, клинические испытания, анализ бренда, одобрение продукта, патенты, широта продукта, доминирование приложений, кривая жизненной линии технологий. Приведенные выше данные относятся только к фокусу компании, связанному с рынком коммерческих посудомоечных машин на Ближнем Востоке и в Африке.

Основными игроками, охваченными отчетом, являются Robert Bosch GmbH, LG Electronics, Whirlpool Corporation и другие.

Аналитики DBMR понимают конкурентные преимущества и проводят конкурентный анализ для каждого конкурента в отдельности.

Например,

- В феврале Robert Bosch GmbH совместно с BSH Household Appliances планировали начать производство прибора в Индии. Они планировали инвестировать 100 миллионов евро (более 870 крор рупий) в свой сегмент бытовой техники в течение следующих 3-4 лет в персонализированные решения, создание бренда, укрепление технологического центра и исследования пользовательского опыта. Это расширение поможет компании укрепить свои позиции на рынке.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Содержание

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA COMMERCIAL DISHWASHERS MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELLING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 CONSUMER BUYING PREFERENCES

4.2 FACTORS INFLUENCING BUYING DECISION

4.3 PORTER’S FIVE FORCES:

4.3.1 THE THREAT OF NEW ENTRANTS

4.3.2 THE THREAT OF SUBSTITUTES

4.3.3 CUSTOMER BARGAINING POWER

4.3.4 SUPPLIER BARGAINING POWER

4.3.5 INTERNAL COMPETITION (RIVALRY)

4.4 PRODUCT ADOPTION SCENARIO

4.5 VENDOR SELECTION CRITERIA

4.6 REGULATORY COVERAGE

5 SUPPLY CHAIN ANALYSIS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 EXPANSION OF FOOD-SERVICE INDUSTRY IN EMERGING COUNTRIES

6.1.2 INCREASING INFLUENCE OF WESTERN LIFESTYLE

6.1.3 SURGE IN AWARENESS REGARDING HEALTH & HYGIENE

6.1.4 INCREASING DEMAND FOR SUSTAINABLE CLEANING TECHNOLOGIES

6.2 RESTRAINTS

6.2.1 HIGH COST OF COMMERCIAL DISHWASHER

6.2.2 HIGH ENERGY CONSUMPTION

6.2.3 VOLATILITY OF RAW MATERIALS SUCH AS STAINLESS STEEL

6.3 OPPORTUNITIES

6.3.1 GROWING PREFERENCE FOR KITCHEN APPLIANCES COUPLED WITH CONSUMER SHIFT TOWARDS SMART TECHNOLOGY

6.3.2 RISING NUMBER OF HOTEL AND RESTAURANT CHAINS ACROSS THE GLOBE

6.4 CHALLENGES

6.4.1 HIGH COST OF MAINTENANCE AND OVERALL OPERATION OF DISHWASHERS

6.4.2 STRONG PRESENCE OF LABOUR FORCE OR HOUSE-HELPS IN MAJORITY OF EMERGING COUNTRIES

6.4.3 EMPLOYMENT OF PEOPLE IN DISHWASHING JOBS (U.S.)

7 MIDDLE EAST & AFRICA COMMERCIAL DISHWASHERS MARKET, BY APPLICATION

7.1 OVERVIEW

7.2 HOTELS

7.2.1 HOTEL, BY PRODUCT

7.2.1.1 UNDERCOUNTER

7.2.1.2 DOOR OR HOOD TYPE

7.2.1.3 RACK/CONVEYOR

7.2.1.4 GLASSWASHER

7.2.2 HOTEL, BY CATEGORY

7.2.2.1 FREE-STANDING

7.2.2.2 BUILT-IN

7.3 RESTAURANTS

7.3.1 RESTAURANTS, BY PRODUCT

7.3.1.1 UNDERCOUNTER

7.3.1.2 DOOR OR HOOD TYPE

7.3.1.3 RACK/CONVEYOR

7.3.1.4 GLASSWASHER

7.3.2 RESTAURANTS, BY CATEGORY

7.3.2.1 FREE-STANDING

7.3.2.2 BUILT-IN

7.3.3 RESTAURANTS, BY TYPE

7.3.3.1 FINE DINING

7.3.3.2 CASUAL DINING

7.3.3.3 QUICK SERVICE RESTAURANT

7.3.3.4 CAFÉ

7.3.3.5 OTHERS

7.4 OTHERS

7.4.1 OTHERS, BY PRODUCT

7.4.1.1 UNDERCOUNTER

7.4.1.2 DOOR OR HOOD TYPE

7.4.1.3 RACK/CONVEYOR

7.4.1.4 GLASSWASHER

7.4.2 OTHERS, BY CATEGORY

7.4.2.1 FREE-STANDING

7.4.2.2 BUILT-IN

8 MIDDLE EAST & AFRICA COMMERCIAL DISHWASHERS MARKET, BY PRODUCT

8.1 OVERVIEW

8.2 UNDERCOUNTER

8.3 DOOR OR HOOD TYPE

8.4 RACK/CONVEYOR

8.5 GLASSWASHER

9 MIDDLE EAST & AFRICA COMMERCIAL DISHWASHERS MARKET, BY CATEGORY

9.1 OVERVIEW

9.2 FREE-STANDING

9.3 BUILT-IN

10 MIDDLE EAST & AFRICA COMMERCIAL DISHWASHERS MARKET, BY DISTRIBUTION CHANNEL

10.1 OVERVIEW

10.2 OFFLINE

10.2.1 OFFLINE, BY TYPE

10.2.1.1 SPECIALTY STORES

10.2.1.2 SUPERMARKETS/HYPERMARKETS

10.2.1.3 OTHERS

10.3 ONLINE

10.3.1 ONLINE, BY TYPE

10.3.1.1 COMPANY-OWNED

10.3.1.2 THIRD PARTY WEBSITES

11 MIDDLE EAST & AFRICA COMMERCIAL DISHWASHERS MARKET, BY GEOGRAPHY

11.1 MIDDLE EAST & AFRICA

11.1.1 UNITED ARAB EMIRATES

11.1.2 SAUDI ARABIA

11.1.3 SOUTH AFRICA

11.1.4 EGYPT

11.1.5 ISRAEL

11.1.6 REST OF MIDDLE EAST & AFRICA

12 MIDDLE EAST & AFRICA COMMERCIAL DISHWASHERS MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

12.2 EXPANSIONS

12.3 NEW PRODUCT DEVELOPMENTS

12.4 PARTNERSHIP

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 ROBERT BOSCH GMBH

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT UPDATES

14.2 LG ELECTRONICS

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT UPDATES

14.3 WHIRLPOOL CORPORATION

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT UPDATE

14.4 ELECTROLUX PROFESSIONAL

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT UPDATE

14.5 SAMSUNG

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT UPDATE

14.6 FAGOR PROFESSIONAL

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT UPDATE

14.7 WINTERHALTER GASTRONOM GMBH

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT UPDATE

14.8 BLAKESLEE INC.

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT UPDATE

14.9 AGA RANGEMASTER LIMITED

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT UPDATE

14.1 ASKO APPLIANCES

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT UPDATE

14.11 CHAMPION INDUSTRIES

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT UPDATE

14.12 COMENDA-ALI GROUP

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT UPDATE

14.13 HAIER GROUP

14.13.1 COMPANY SNAPSHOT

14.13.2 REVENUE ANALYSIS

14.13.3 PRODUCT PORTFOLIO

14.13.4 RECENT UPDATE

14.14 INSINGER MACHINE COMPANY

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT UPDATE

14.15 JLA

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT UPDATE

14.16 KAFF APPLIANCES

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT UPDATE

14.17 MIELE

14.17.1 COMPANY SNAPSHOT

14.17.2 REVENUE ANALYSIS

14.17.3 PRODUCT PORTFOLIO

14.17.4 RECENT UPDATE

14.18 MVP GROUP CORP

14.18.1 COMPANY SNAPSHOT

14.18.2 PRODUCT PORTFOLIO

14.18.3 RECENT UPDATE

14.19 VEETSAN

14.19.1 COMPANY SNAPSHOT

14.19.2 PRODUCT PORTFOLIO

14.19.3 RECENT UPDATE

14.2 WASHTECH GROUP

14.20.1 COMPANY SNAPSHOT

14.20.2 PRODUCT PORTFOLIO

14.20.3 RECENT UPDATES

15 QUESTIONNAIRE

16 RELATED REPORTS

Список таблиц

TABLE 1 IMPORT DATA OF DISHWASHING MACHINES (EXCLUDING THOSE OF THE HOUSEHOLD TYPE)…..; HS CODE - 842219 (USD THOUSAND)

TABLE 2 EXPORT DATA OF DISHWASHING MACHINES (EXCLUDING THOSE OF THE HOUSEHOLD TYPE)…..; HS CODE - 842219 (USD THOUSAND)

TABLE 3 MIDDLE EAST & AFRICA COMMERCIAL DISHWASHERS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 4 MIDDLE EAST & AFRICA COMMERCIAL DISHWASHERS MARKET, BY APPLICATION, 2020-2029 (THOUSAND UNITS)

TABLE 5 MIDDLE EAST & AFRICA HOTELS IN COMMERCIAL DISHWASHERS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 6 MIDDLE EAST & AFRICA HOTELS IN COMMERCIAL DISHWASHERS MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 7 MIDDLE EAST & AFRICA HOTELS IN COMMERCIAL DISHWASHERS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 8 MIDDLE EAST & AFRICA HOTELS IN COMMERCIAL DISHWASHERS MARKET, BY CATEGORY, 2020-2029 (USD THOUSAND)

TABLE 9 MIDDLE EAST & AFRICA RESTAURANTS IN COMMERCIAL DISHWASHERS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 10 MIDDLE EAST & AFRICA RESTAURANTS IN COMMERCIAL DISHWASHERS MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 11 MIDDLE EAST & AFRICA RESTAURANTS IN COMMERCIAL DISHWASHERS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 12 MIDDLE EAST & AFRICA RESTAURANTS IN COMMERCIAL DISHWASHERS MARKET, BY CATEGORY, 2020-2029 (USD THOUSAND)

TABLE 13 MIDDLE EAST & AFRICA RESTAURANTS IN COMMERCIAL DISHWASHERS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 14 MIDDLE EAST & AFRICA OTHERS IN COMMERCIAL DISHWASHERS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 15 MIDDLE EAST & AFRICA OTHERS IN COMMERCIAL DISHWASHERS MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 16 MIDDLE EAST & AFRICA OTHERS IN COMMERCIAL DISHWASHERS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 17 MIDDLE EAST & AFRICA OTHERS IN COMMERCIAL DISHWASHERS MARKET, BY CATEGORY, 2020-2029 (USD THOUSAND)

TABLE 18 MIDDLE EAST & AFRICA COMMERCIAL DISHWASHERS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 19 MIDDLE EAST & AFRICA UNDERCOUNTER IN COMMERCIAL DISHWASHERS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 20 MIDDLE EAST & AFRICA DOOR OR HOOD TYPE IN COMMERCIAL DISHWASHERS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 21 MIDDLE EAST & AFRICA RACK/CONVEYOR IN COMMERCIAL DISHWASHERS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 22 MIDDLE EAST & AFRICA GLASSWASHER IN COMMERCIAL DISHWASHERS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 23 MIDDLE EAST & AFRICA COMMERCIAL DISHWASHERS MARKET, BY CATEGORY, 2020-2029 (USD THOUSAND)

TABLE 24 MIDDLE EAST & AFRICA FREE-STANDING IN COMMERCIAL DISHWASHERS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 25 MIDDLE EAST & AFRICA BUILT-IN IN COMMERCIAL DISHWASHERS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 26 MIDDLE EAST & AFRICA COMMERCIAL DISHWASHERS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 27 MIDDLE EAST & AFRICA OFFLINE IN COMMERCIAL DISHWASHERS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 28 MIDDLE EAST & AFRICA OFFLINE IN COMMERCIAL DISHWASHERS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 29 MIDDLE EAST & AFRICA ONLINE IN COMMERCIAL DISHWASHERS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 30 MIDDLE EAST & AFRICA ONLINE IN COMMERCIAL DISHWASHERS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 31 MIDDLE EAST & AFRICA COMMERCIAL DISHWASHERS MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 32 MIDDLE EAST & AFRICA COMMERCIAL DISHWASHERS MARKET, BY COUNTRY, 2020-2029 (THOUSAND UNITS)

TABLE 33 MIDDLE EAST & AFRICA COMMERCIAL DISHWASHERS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 34 MIDDLE EAST & AFRICA COMMERCIAL DISHWASHERS MARKET, BY APPLICATION, 2020-2029 (THOUSAND UNITS)

TABLE 35 MIDDLE EAST AND AFRICA HOTELS IN COMMERCIAL DISHWASHERS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 36 MIDDLE EAST AND AFRICA HOTELS IN COMMERCIAL DISHWASHERS MARKET, BY CATEGORY, 2020-2029 (USD THOUSAND)

TABLE 37 MIDDLE EAST AND AFRICA RESTAURANTS IN COMMERCIAL DISHWASHERS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND))

TABLE 38 MIDDLE EAST AND AFRICA RESTAURANTS IN COMMERCIAL DISHWASHERS MARKET, BY CATEGORY, 2020-2029 (USD THOUSAND)

TABLE 39 MIDDLE EAST AND AFRICA RESTAURANTS IN COMMERCIAL DISHWASHERS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 40 MIDDLE EAST AND AFRICA OTHERS IN COMMERCIAL DISHWASHERS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 41 MIDDLE EAST AND AFRICA OTHERS IN COMMERCIAL DISHWASHERS MARKET, BY CATEGORY, 2020-2029 (USD THOUSAND)

TABLE 42 MIDDLE EAST & AFRICA COMMERCIAL DISHWASHERS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 43 MIDDLE EAST & AFRICA COMMERCIAL DISHWASHERS MARKET, BY CATEGORY, 2020-2029 (USD THOUSAND)

TABLE 44 MIDDLE EAST & AFRICA COMMERCIAL DISHWASHERS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 45 MIDDLE EAST & AFRICA OFFLINE IN COMMERCIAL DISHWASHERS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 46 MIDDLE EAST & AFRICA ONLINE IN COMMERCIAL DISHWASHERS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 47 UNITED ARAB EMIRATES COMMERCIAL DISHWASHERS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 48 UNITED ARAB EMIRATES COMMERCIAL DISHWASHERS MARKET, BY APPLICATION, 2020-2029 (THOUSAND UNITS)

TABLE 49 UNITED ARAB EMIRATE HOTELS IN COMMERCIAL DISHWASHERS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 50 UNITED ARAB EMIRATE HOTELS IN COMMERCIAL DISHWASHERS MARKET, BY CATEGORY, 2020-2029 (USD THOUSAND)

TABLE 51 UNITED ARAB EMIRATE RESTAURANTS IN COMMERCIAL DISHWASHERS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 52 UNITED ARAB EMIRATE RESTAURANTS IN COMMERCIAL DISHWASHERS MARKET, BY CATEGORY, 2020-2029 (USD THOUSAND)

TABLE 53 UNITED ARAB EMIRATE RESTAURANTS IN COMMERCIAL DISHWASHERS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 54 UNITED ARAB EMIRATE OTHERS IN COMMERCIAL DISHWASHERS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 55 UNITED ARAB EMIRATE OTHERS IN COMMERCIAL DISHWASHERS MARKET, BY CATEGORY, 2020-2029 (USD THOUSAND)

TABLE 56 UNITED ARAB EMIRATES COMMERCIAL DISHWASHERS MARKET, BY PRODUCT, 2020-2029(USD THOUSAND)

TABLE 57 UNITED ARAB EMIRATES COMMERCIAL DISHWASHERS MARKET, BY CATEGORY, 2020-2029(USD THOUSAND)

TABLE 58 UNITED ARAB EMIRATES COMMERCIAL DISHWASHERS MARKET, BY DISTRIBUTION CHANNEL, (USD THOUSAND)

TABLE 59 UNITED ARAB EMIRATES OFFLINE IN COMMERCIAL DISHWASHERS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 60 UNITED ARAB EMIRATES ONLINE IN COMMERCIAL DISHWASHERS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 61 SAUDI ARABIA COMMERCIAL DISHWASHERS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 62 SAUDI ARABIA COMMERCIAL DISHWASHERS MARKET, BY APPLICATION, 2020-2029 (THOUSAND UNITS))

TABLE 63 SAUDI ARABIA HOTELS IN COMMERCIAL DISHWASHERS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 64 SAUDI ARABIA HOTELS IN COMMERCIAL DISHWASHERS MARKET, BY CATEGORY, 2020-2029 (USD THOUSAND)

TABLE 65 SAUDI ARABIA RESTAURANTS IN COMMERCIAL DISHWASHERS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 66 SAUDI ARABIA RESTAURANTS IN COMMERCIAL DISHWASHERS MARKET, BY CATEGORY, 2020-2029 (USD THOUSAND)

TABLE 67 SAUDI ARABIA RESTAURANTS IN COMMERCIAL DISHWASHERS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 68 SAUDI ARABIA OTHERS IN COMMERCIAL DISHWASHERS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 69 SAUDI ARABIA OTHERS IN COMMERCIAL DISHWASHERS MARKET, BY CATEGORY, 2020-2029 (USD THOUSAND)

TABLE 70 SAUDI ARABIA COMMERCIAL DISHWASHERS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 71 SAUDI ARABIA COMMERCIAL DISHWASHERS MARKET, BY CATEGORY, 2020-2029 (USD THOUSAND)

TABLE 72 SAUDI ARABIA COMMERCIAL DISHWASHERS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 73 SAUDI ARABIA OFFLINE IN COMMERCIAL DISHWASHERS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 74 SAUDI ARABIA OFFLINE IN COMMERCIAL DISHWASHERS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 75 SOUTH AFRICA COMMERCIAL DISHWASHERS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 76 SOUTH AFRICA COMMERCIAL DISHWASHERS MARKET, BY APPLICATION, 2020-2029 (THOUSAND UNITS))

TABLE 77 SOUTH AFRICA HOTELS IN COMMERCIAL DISHWASHERS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 78 SOUTH AFRICA HOTELS IN COMMERCIAL DISHWASHERS MARKET, BY CATEGORY, 2020-2029 (USD THOUSAND)

TABLE 79 SOUTH AFRICA RESTAURANTS IN COMMERCIAL DISHWASHERS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 80 SOUTH AFRICA RESTAURANTS IN COMMERCIAL DISHWASHERS MARKET, BY CATEGORY, 2020-2029 (USD THOUSAND)

TABLE 81 SOUTH AFRICA RESTAURANTS IN COMMERCIAL DISHWASHERS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 82 SOUTH AFRICA OTHERS IN COMMERCIAL DISHWASHERS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 83 SOUTH AFRICA OTHERS IN COMMERCIAL DISHWASHERS MARKET, BY CATEGORY, 2020-2029 (USD THOUSAND)

TABLE 84 SOUTH AFRICA COMMERCIAL DISHWASHERS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 85 SOUTH AFRICA COMMERCIAL DISHWASHERS MARKET, BYCATEGORY, 2020-2029 (USD THOUSAND)

TABLE 86 SOUTH AFRICA COMMERCIAL DISHWASHERS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 87 SOUTH AFRICA IN OFFLINE IN COMMERCIAL DISHWASHERS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 88 SOUTH AFRICA ONLINE IN COMMERCIAL DISHWASHERS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 89 EGYPT COMMERCIAL DISHWASHERS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 90 EGYPT COMMERCIAL DISHWASHERS MARKET, BY APPLICATION, 2020-2029 (THOUSAND UNITS)

TABLE 91 EGYPT HOTELS IN COMMERCIAL DISHWASHERS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 92 EGYPT HOTELS IN COMMERCIAL DISHWASHERS MARKET, BY CATEGORY, 2020-2029 (USD THOUSAND)

TABLE 93 EGYPT RESTAURANTS IN COMMERCIAL DISHWASHERS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 94 EGYPT RESTAURANTS IN COMMERCIAL DISHWASHERS MARKET, BY CATEGORY, 2020-2029 (USD THOUSAND)

TABLE 95 EGYPT RESTAURANTS IN COMMERCIAL DISHWASHERS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 96 EGYPT OTHERS IN COMMERCIAL DISHWASHERS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 97 EGYPT OTHERS IN COMMERCIAL DISHWASHERS MARKET, BY CATEGORY, 2020-2029 (USD THOUSAND)

TABLE 98 EGYPT COMMERCIAL DISHWASHERS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 99 EGYPT COMMERCIAL DISHWASHERS MARKET, BY CATEGORY, 2020-2029 (USD THOUSAND)

TABLE 100 EGYPT COMMERCIAL DISHWASHERS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 101 EGYPT OFFLINE IN COMMERCIAL DISHWASHERS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 102 EGYPT ONLINE IN COMMERCIAL DISHWASHERS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 103 ISRAEL COMMERCIAL DISHWASHERS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 104 ISRAEL COMMERCIAL DISHWASHERS MARKET, BY APPLICATION, 2020-2029 (THOUSAND UNITS))

TABLE 105 ISRAEL HOTELS IN COMMERCIAL DISHWASHERS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 106 ISRAEL HOTELS IN COMMERCIAL DISHWASHERS MARKET, BY CATEGORY, 2020-2029 (USD THOUSAND)

TABLE 107 ISRAEL RESTAURANTS IN COMMERCIAL DISHWASHERS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 108 ISRAEL RESTAURANTS IN COMMERCIAL DISHWASHERS MARKET, BY CATEGORY, 2020-2029 (USD THOUSAND)

TABLE 109 ISRAEL RESTAURANTS IN COMMERCIAL DISHWASHERS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 110 ISRAEL OTHERS IN COMMERCIAL DISHWASHERS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 111 ISRAEL OTHERS IN COMMERCIAL DISHWASHERS MARKET, BY CATEGORY, 2020-2029 (USD THOUSAND)

TABLE 112 ISRAEL COMMERCIAL DISHWASHERS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 113 ISRAEL COMMERCIAL DISHWASHERS MARKET, BY CATEGORY, 2020-2029 (USD THOUSAND)

TABLE 114 ISRAEL COMMERCIAL DISHWASHERS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 115 ISRAEL OFFLINE IN COMMERCIAL DISHWASHERS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 116 ISRAEL ONLINE IN COMMERCIAL DISHWASHERS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 117 REST OF MIDDLE EAST & AFRICA COMMERCIAL DISHWASHERS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 118 REST OF MIDDLE EAST & AFRICA COMMERCIAL DISHWASHERS MARKET, BY APPLICATION, 2020-2029 (THOUSAND UNITS)

Список рисунков

FIGURE 1 MIDDLE EAST & AFRICA COMMERCIAL DISHWASHERS MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA COMMERCIAL DISHWASHERS MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA COMMERCIAL DISHWASHERS MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA COMMERCIAL DISHWASHERS MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA COMMERCIAL DISHWASHERS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA COMMERCIAL DISHWASHERS MARKET: THE TYPE LIFE LINE CURVE

FIGURE 7 MIDDLE EAST & AFRICA COMMERCIAL DISHWASHERS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 MIDDLE EAST & AFRICA COMMERCIAL DISHWASHERS MARKET: DBMR MARKET POSITION GRID

FIGURE 9 MIDDLE EAST & AFRICA COMMERCIAL DISHWASHERS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 MIDDLE EAST & AFRICA COMMERCIAL DISHWASHERS MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 11 MIDDLE EAST & AFRICA COMMERCIAL DISHWASHERS MARKET: SEGMENTATION

FIGURE 12 EUROPE IS EXPECTED TO DOMINATE THE MIDDLE EAST & AFRICA COMMERCIAL DISHWASHERS MARKET AND IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 13 EXPANSION OF FOOD-SERVICE INDUSTRY IN EMERGING COUNTRIES IS EXPECTED TO DRIVE THE MIDDLE EAST & AFRICA COMMERCIAL DISHWASHERS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 HOTELS HOODS IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA COMMERCIAL DISHWASHERS MARKET IN 2022 & 2029

FIGURE 15 VENDOR SELECTION CRITERIA

FIGURE 16 SUPPLY CHAIN FLOW FOR COMMERCIAL DISHWASHERS:

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF MIDDLE EAST & AFRICA COMMERCIAL DISHWASHERS MARKET

FIGURE 18 NUMBER OF RESTAURANTS IN THE U.S.

FIGURE 19 MIDDLE EAST & AFRICA COMMERCIAL DISHWASHERS MARKET, BY APPLICATION, 2021

FIGURE 20 MIDDLE EAST & AFRICA COMMERCIAL DISHWASHERS MARKET, BY PRODUCT, 2021

FIGURE 21 MIDDLE EAST & AFRICA COMMERCIAL DISHWASHERS MARKET, BY CATEGORY, 2021

FIGURE 22 MIDDLE EAST & AFRICA COMMERCIAL DISHWASHERS MARKET, BY DISTRIBUTION CHANNEL, 2021

FIGURE 23 MIDDLE EAST & AFRICA COMMERCIAL DISHWASHERS MARKET: SNAPSHOT (2021)

FIGURE 24 MIDDLE EAST & AFRICA COMMERCIAL DISHWASHERS MARKET: BY COUNTRY (2021)

FIGURE 25 MIDDLE EAST & AFRICA COMMERCIAL DISHWASHERS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 26 MIDDLE EAST & AFRICA COMMERCIAL DISHWASHERS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 27 MIDDLE EAST & AFRICA COMMERCIAL DISHWASHERS MARKET: BY APPLICATION (2022-2029)

FIGURE 28 MIDDLE EAST & AFRICA COMMERCIAL DISHWASHERS MARKET: COMPANY SHARE 2021 (%)

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.