Middle East And Africa Api Intermediates Market

Размер рынка в млрд долларов США

CAGR :

%

USD

966.78 Million

USD

1,461.35 Million

2024

2032

USD

966.78 Million

USD

1,461.35 Million

2024

2032

| 2025 –2032 | |

| USD 966.78 Million | |

| USD 1,461.35 Million | |

|

|

|

|

Сегментация рынка промежуточных фармацевтических ингредиентов на Ближнем Востоке и в Африке по типу (промежуточные фармацевтические продукты для ветеринарных препаратов и промежуточные продукты для оптовых партий лекарственных средств), продукту (бромсоединение, O-бензилсальбутамол, гемисульфат, оксиран, основание бисопролола, хиральный PCBHP, основание фенирамина, основание хлорфенирамина, основание бромфенирамина, основание мепирамина/пириламина, 6-амино-1,3-диметилурацил, теофиллин, ацефиллин, ксантин, нитрилы и другие), терапевтическому типу (аутоиммунные заболевания, онкология, метаболические заболевания, офтальмология, сердечно-сосудистые заболевания, инфекционные заболевания, неврология, респираторные заболевания, дерматология, урология и другие), клиентам (прямые пользователи/фармацевтические компании, трейдеры/оптовики/дистрибьюторы и Ассоциации/государственные учреждения/частные учреждения), конечный пользователь (производитель АФИ и производитель готовой продукции), канал сбыта (прямой тендер, розничные продажи и другие) – тенденции отрасли и прогноз до 2032 года

Размер рынка промежуточных API на Ближнем Востоке и в Африке

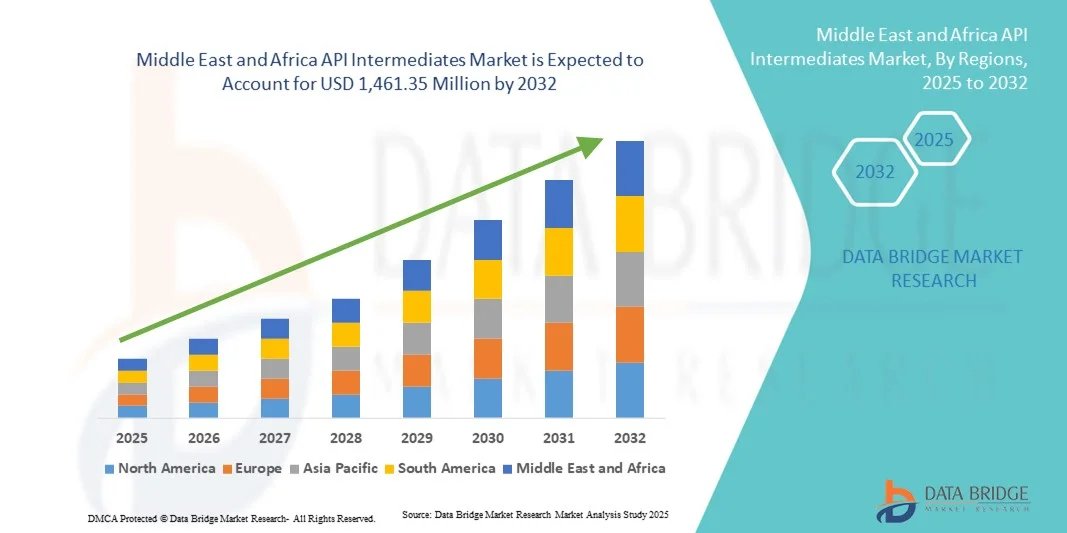

- Объем рынка промежуточных АФИ на Ближнем Востоке и в Африке оценивался в 966,78 млн долларов США в 2024 году и, как ожидается, достигнет 1 461,35 млн долларов США к 2032 году при среднегодовом темпе роста 5,3% в течение прогнозируемого периода.

- Рост рынка во многом обусловлен растущим спросом как на общие, так и на инновационные АФИ, что обусловлено ростом распространенности хронических заболеваний, таких как диабет, сердечно-сосудистые заболевания и рак, в регионе.

- Более того, расширение инфраструктуры здравоохранения, стратегические инициативы местных производителей по наращиванию производственных мощностей и благоприятная нормативно-правовая среда превращают регион Ближнего Востока и Африки в растущий центр производства активных фармацевтических ингредиентов (АФИ). Сочетание этих факторов ускоряет внедрение передовых промежуточных продуктов для АФИ, тем самым значительно стимулируя рост отрасли.

Анализ рынка промежуточных API-продуктов на Ближнем Востоке и в Африке

- Промежуточные продукты АФИ, выступающие в качестве ключевых строительных блоков в производстве активных фармацевтических ингредиентов, становятся все более важными компонентами фармацевтического производства как в сегментах дженериков, так и инновационных препаратов на Ближнем Востоке и в Африке из-за их роли в обеспечении высококачественного, экономически эффективного и масштабируемого синтеза лекарств.

- Растущий спрос на промежуточные АФИ обусловлен, прежде всего, ростом распространенности хронических заболеваний и заболеваний, связанных с образом жизни, ростом производственных мощностей фармацевтической промышленности и переходом на промежуточные продукты местного производства для снижения зависимости от импорта.

- Египет доминировал на рынке промежуточных фармацевтических ингредиентов на Ближнем Востоке и в Африке, имея наибольшую долю выручки в 38% в 2024 году, что характеризовалось расширением фармацевтической производственной инфраструктуры, государственными инициативами по поддержке местного производства и наличием устоявшихся организаций по контрактному производству, а также значительным ростом в сфере ветеринарных и фармацевтических промежуточных продуктов, особенно для лечения сердечно-сосудистых и метаболических заболеваний.

- Ожидается, что Южная Африка станет самой быстрорастущей страной на рынке промежуточных фармацевтических ингредиентов Ближнего Востока и Африки в течение прогнозируемого периода благодаря увеличению инвестиций в здравоохранение, повышению доступа к современным медицинским учреждениям и растущему внедрению современных промежуточных продуктов, таких как бромсодержащие соединения, оксиран и основание фенирамина.

- На рынке промежуточных фармацевтических ингредиентов (АФИ) на Ближнем Востоке и в Африке доминировали оптовые партии промежуточных фармацевтических ингредиентов с долей рынка 48,2% в 2024 году, что было обусловлено высоким спросом со стороны производителей АФИ и производителей готовой продукции, а также распространением через прямые тендеры и каналы розничных продаж.

Область применения отчета и сегментация рынка промежуточных API на Ближнем Востоке и в Африке

|

Атрибуты |

Ключевые данные о рынке промежуточных API-продуктов на Ближнем Востоке и в Африке |

|

Охваченные сегменты |

|

|

Охваченные страны |

Ближний Восток и Африка

|

|

Ключевые игроки рынка |

|

|

Рыночные возможности |

|

|

Информационные наборы данных с добавленной стоимостью |

Помимо информации о рыночных сценариях, таких как рыночная стоимость, темпы роста, сегментация, географический охват и основные игроки, рыночные отчеты, подготовленные Data Bridge Market Research, также включают в себя углубленный экспертный анализ, эпидемиологию пациентов, анализ воронки продаж, анализ ценообразования и нормативно-правовую базу. |

Тенденции рынка промежуточных API на Ближнем Востоке и в Африке

Растущий спрос на специализированные и высокоэффективные промежуточные продукты

- Значительной и набирающей силу тенденцией на рынке промежуточных продуктов фармацевтических субстанций для стран Ближнего Востока и Африки является рост производства и внедрения специализированных промежуточных продуктов для высокоэффективной и целевой терапии, что повышает эффективность и безопасность лекарственных средств.

- Например, компании в Египте разрабатывают передовые промежуточные продукты для онкологических и сердечно-сосудистых препаратов, чтобы удовлетворить растущий местный и региональный спрос, обеспечивая более высокое качество и соблюдение нормативных требований.

- Внедрение передовых технологий синтеза, включая хиральные промежуточные соединения и сложные химические соединения, позволяет производителям удовлетворять потребности как дженериков, так и инновационных фармацевтических секторов.

- Интеграция услуг контрактного производства с производством АФИ позволяет централизованно контролировать качество, цепочку поставок и экономическую эффективность, создавая более оптимизированный производственный процесс.

- Эта тенденция к производству высококачественных специализированных промежуточных продуктов стимулирует инвестиции в НИОКР, модернизацию предприятий и сотрудничество с глобальными фармацевтическими игроками для сохранения конкурентоспособности.

- Спрос на передовые промежуточные АФИ растет как в фармацевтическом, так и в ветеринарном сегменте, поскольку производители отдают предпочтение высокоэффективным, экономически эффективным и соответствующим нормативным требованиям решениям.

- Расширение цифровых инструментов для мониторинга процессов, контроля качества и предиктивного обслуживания повышает эффективность производства и снижает эксплуатационные риски на производственных предприятиях.

- Расширение партнерских отношений между производителями стран Ближнего Востока и Африки и международными фармацевтическими компаниями способствует передаче технологий, наращиванию потенциала и выходу на новые рынки.

Динамика рынка промежуточных API на Ближнем Востоке и в Африке

Водитель

Рост фармацевтического производства и распространенности хронических заболеваний

- Растущая распространенность хронических заболеваний, таких как сердечно-сосудистые, метаболические и инфекционные заболевания , в сочетании с расширением производственных мощностей фармацевтической промышленности является ключевым фактором спроса на промежуточные АФИ.

- Например, в Южной Африке наблюдается рост внутреннего производства активных фармацевтических ингредиентов для удовлетворения потребностей местного здравоохранения, что снижает зависимость от импорта и поддерживает региональные цепочки поставок фармацевтической продукции.

- Правительства и частные компании инвестируют в современные производственные мощности и внедряют процессы, соответствующие требованиям GMP, чтобы гарантировать стабильное качество и соответствие международным стандартам.

- Растущая осведомленность среди поставщиков медицинских услуг и пациентов увеличивает спрос на высококачественные лекарственные средства, что, в свою очередь, обуславливает потребность в надежных и масштабируемых промежуточных АФИ.

- Расширение местной фармацевтической инфраструктуры и рост инвестиций в биотехнологии и контрактное производство расширяют производственные возможности региона. Сочетание распространённости хронических заболеваний, развитой производственной инфраструктуры и государственных стимулов значительно ускоряет рост рынка.

- Растущие правительственные инициативы по продвижению местного производства АФИ и снижению зависимости от импорта создают дополнительные стимулы для инвестиций в производственные мощности.

- Повышенное внимание к устойчивому развитию и зеленой химии при синтезе активных фармацевтических ингредиентов побуждает производителей внедрять экологически безопасные процессы, повышая конкурентоспособность и соответствие нормативным требованиям.

Сдержанность/Вызов

Сложность регулирования и зависимость от сырья

- Соблюдение нормативных требований и строгих международных стандартов качества представляет собой серьёзную проблему для производителей промежуточных фармацевтических ингредиентов в регионе Ближнего Востока и Африки. Например, задержки в выдаче разрешений от органов здравоохранения Египта и Марокко могут нарушить производственные графики и ограничить доступ новых промежуточных ингредиентов на рынок.

- Зависимость от импортного сырья, особенно из Азии, подвергает производителей сбоям в цепочке поставок и колебаниям цен, что влияет на непрерывность производства.

- Небольшие производители могут столкнуться с трудностями в выполнении капиталоемких требований современных объектов АФИ, что ограничивает их возможности по масштабированию или внедрению передовых технологий синтеза.

- Хотя региональные инициативы направлены на поддержку местного производства, необходимость соблюдать многострановые правила и гармонизировать стандарты остается сложной и ресурсоемкой задачей.

- Преодоление этих проблем посредством гармонизации нормативно-правового регулирования, поиска местных источников сырья и стратегического партнерства будет иметь решающее значение для устойчивого расширения рынка.

- Изменчивость региональной инфраструктуры, включая логистику и возможности хранения, может препятствовать своевременной доставке промежуточных продуктов конечным пользователям.

- Нехватка квалифицированной рабочей силы в области современного химического синтеза и контроля качества сдерживает эффективность производства и инновации в некоторых странах Ближнего Востока и Африки.

Рынок промежуточных API-продуктов на Ближнем Востоке и в Африке

Рынок сегментирован по типу, продукту, терапевтическому типу, клиентам, конечному пользователю и каналу сбыта.

- По типу

По типу рынок промежуточных фармацевтических продуктов (АФИ) на Ближнем Востоке и в Африке сегментируется на ветеринарные, фармацевтические и нерасфасованные лекарственные препараты. Сегмент нерасфасованных лекарственных препаратов (БЛП) доминировал на рынке с наибольшей долей выручки в 48,2% в 2024 году. Это доминирование обусловлено высоким спросом на дженерики и специализированные АФИ, используемые для лечения хронических заболеваний, включая сердечно-сосудистые, метаболические и инфекционные заболевания. Производители предпочитают нерасфасованные промежуточные продукты из-за их экономической эффективности и простоты интеграции в готовые лекарственные формы. Такие страны, как Египет и ЮАР, расширяют производственные мощности для удовлетворения как внутреннего, так и экспортного спроса. Государственное стимулирование, соблюдение нормативных требований и налаженные цепочки поставок укрепляют позиции компании на рынке. Продолжающаяся распространенность хронических заболеваний обеспечивает устойчивый спрос на эти промежуточные продукты в течение прогнозируемого периода.

Ожидается, что сегмент полупродуктов для ветеринарных препаратов продемонстрирует самый быстрый среднегодовой темп роста – 22% в период с 2025 по 2032 год. Рост обусловлен увеличением поголовья скота и повышением осведомленности о здоровье животных. Местные органы власти и частные компании увеличивают производство ветеринарных препаратов, чтобы гарантировать безопасность и эффективность продукции. Возможности экспорта в соседние регионы дополнительно способствуют росту. Растет внедрение высококачественных полупродуктов для ветеринарных препаратов отечественными производителями, что соответствует нормативным требованиям и стандартам безопасности. В целом, сегмент выигрывает от роста инвестиций в региональную инфраструктуру ветеринарии.

- По продукту

На основе продукта рынок сегментирован на бромсодержащие соединения, О-бензилсальбутамол, гемисульфат, оксиран, основание бисопролола, хиральный PCBHP, основание фенирамина, основание хлорфенирамина, основание бромфенирамина, основание мепирамина/пириламина, 6-амино-1,3-диметилурацил, теофиллин, ацефиллин, ксантин, нитрилы и другие. Сегмент бромсодержащих соединений доминировал на рынке в 2024 году благодаря своему широкому использованию в синтезе сердечно-сосудистых, респираторных и противовирусных препаратов. Его высокий спрос обусловлен совместимостью как с производством массовых лекарств, так и с фармацевтическими промежуточными продуктами. Производители в Египте и Южной Африке сосредоточены на производстве высокочистых бромсодержащих соединений, соответствующих стандартам GMP. Сегмент выигрывает от масштабируемого синтеза, экономической эффективности и строгого соблюдения нормативных требований. Долгосрочные контракты с фармацевтическими компаниями укрепляют его рыночные позиции. Постоянные инвестиции в НИОКР обеспечивают непрерывные инновации и повышение качества.

Ожидается, что сегмент оксиранов продемонстрирует самые высокие темпы роста в прогнозируемый период. Его рост обусловлен растущим использованием в синтезе специализированных лекарственных препаратов, особенно в метаболической и онкологической терапии. Промежуточные продукты оксиранов обеспечивают химическую универсальность для производства сложных активных фармацевтических ингредиентов. Стратегическое партнерство с международными фармацевтическими компаниями ускоряет внедрение в производственных центрах на Ближнем Востоке и в Африке. Местные инвестиции в передовые производственные технологии повышают выход и качество продукции. Развитие инфраструктуры здравоохранения и спрос на таргетную терапию являются ключевыми факторами роста этого сегмента.

- По терапевтическому типу

По терапевтическому типу рынок сегментирован на аутоиммунные заболевания, онкологию, метаболические заболевания, офтальмологию, сердечно-сосудистые заболевания, инфекционные заболевания, неврологию, респираторные заболевания, дерматологию, урологию и другие. Сегмент сердечно-сосудистых заболеваний доминировал на рынке с долей 35% в 2024 году. Это доминирование обусловлено высокой распространенностью сердечно-сосудистых заболеваний в странах Ближнего Востока и Африки. Промежуточные фармацевтические субстанции (АФИ) для сердечно-сосудистых препаратов пользуются высоким спросом в связи с растущими потребностями пациентов и производством дженериков. Высокоочищенные промежуточные продукты обеспечивают безопасность, эффективность и соответствие нормативным требованиям. Сотрудничество местных производителей с международными фармацевтическими компаниями укрепляет присутствие на рынке. Государственные инициативы, поддерживающие лечение хронических заболеваний, еще больше усиливают доминирование.

Ожидается, что сегмент онкологии будет демонстрировать самый быстрый среднегодовой темп роста – 20% в период с 2025 по 2032 год. Рост заболеваемости раком и спрос на таргетную терапию стимулируют этот рост. Промежуточные препараты для онкологии отличаются высокой специализацией, включая высокоактивные АФИ и хиральные соединения. Инвестиции в производственные технологии и инфраструктуру способствуют расширению. Партнерство с международными компаниями способствует трансферу технологий. Региональные инициативы по развитию здравоохранения также способствуют внедрению на рынок промежуточных препаратов для онкологии.

- Клиентами

По типу потребителей рынок сегментируется на прямых потребителей/фармацевтические компании, трейдеров/оптовиков/дистрибьюторов и ассоциации/государственные учреждения/частные организации. Сегмент прямых потребителей/фармацевтических компаний доминировал на рынке в 2024 году благодаря устойчивому спросу на высококачественные промежуточные продукты для собственного производства лекарств. Оптовые закупки обеспечивают бесперебойное производство и экономическую эффективность. Местные фармацевтические компании в Египте, Марокко и ЮАР обеспечивают надежные цепочки поставок благодаря долгосрочным соглашениям. Соблюдение нормативных требований и контроль качества являются ключевыми приоритетами. Этот сегмент выигрывает от прочных отношений с производителями активных фармацевтических ингредиентов. Постоянная распространенность хронических заболеваний обеспечивает постоянный спрос.

Ожидается, что сегмент трейдеров/оптовиков/дистрибьюторов будет демонстрировать самые быстрые темпы роста в период с 2025 по 2032 год. Рост обусловлен деятельностью посредников, которые обеспечивают баланс спроса и предложения в регионе. Малые и средние фармацевтические компании полагаются на них для доступа к качественным промежуточным продуктам. Они помогают управлять логистикой, документацией и контролем качества. Расширение возможностей экспорта в соседние страны дополнительно усиливает их роль. Сегмент выигрывает от расширения регионального доступа и спроса на специализированные промежуточные продукты.

- Конечным пользователем

По принципу конечного потребителя рынок сегментирован на производителей АФИ и производителей готовой продукции. Сегмент производителей АФИ доминировал на рынке с долей выручки 55% в 2024 году. Высокий спрос на промежуточные продукты для крупномасштабного синтеза АФИ обеспечивает стабильный рост. Производители фокусируются на производстве нефасованных лекарственных средств и специализированных АФИ, соблюдая требования GMP и нормативные требования. Инвестиции в высокопроизводительные заводы и НИОКР укрепляют доминирующее положение. Партнерство с глобальными фармацевтическими компаниями расширяет технологические возможности. Региональный спрос на промежуточные продукты для сердечно-сосудистых и метаболических препаратов дополнительно поддерживает этот сегмент.

Ожидается, что сегмент производителей готовых лекарственных средств будет демонстрировать самые быстрые темпы роста в период с 2025 по 2032 год. Рост обусловлен отечественными фармацевтическими компаниями, производящими готовые лекарственные формы. Специализированные промежуточные продукты для онкологических, метаболических и респираторных препаратов всё чаще закупаются на местном уровне. Расширение инфраструктуры здравоохранения способствует производству. Региональные производители уделяют особое внимание качеству, стоимости и соблюдению нормативных требований. Сотрудничество с поставщиками активных фармацевтических ингредиентов (АФИ) расширяет доступ к высокоэффективным промежуточным продуктам.

- По каналу распространения

По каналам сбыта рынок сегментируется на прямые тендеры, розничные продажи и другие. Сегмент прямых тендеров доминировал на рынке с долей 50% в 2024 году. Долгосрочные контракты с фармацевтическими и ветеринарными компаниями обеспечивают бесперебойность поставок. Тендеры обеспечивают экономическую эффективность, предсказуемость поставок и гарантию качества. Крупные покупатели предпочитают этот канал для оптовых закупок. Государственные закупки укрепляют доминирующее положение на рынке. Высокодоходные промежуточные поставщики получают выгоду от прямых тендерных соглашений для поддержания стабильности цепочки поставок.

Ожидается, что сегмент розничных продаж будет демонстрировать самые быстрые темпы роста в период с 2025 по 2032 год. Небольшие фармацевтические компании, производители ветеринарной продукции и частные больницы всё чаще закупают промежуточные продукты через розничные каналы. Простота транзакций и доступ к специализированным промежуточным продуктам стимулируют рост. Региональные дистрибьюторы играют ключевую роль в обеспечении доступности. Расширение экспортных возможностей способствует росту розничных продаж. Растущий спрос на нишевые препараты ускоряет освоение сегмента. Выход дистрибьюторов на местный рынок дополнительно стимулирует этот сегмент.

Региональный анализ рынка промежуточных API-продуктов на Ближнем Востоке и в Африке

- Египет доминировал на рынке промежуточных фармацевтических ингредиентов на Ближнем Востоке и в Африке, имея наибольшую долю выручки в 38% в 2024 году, что характеризовалось расширением фармацевтической производственной инфраструктуры, государственными инициативами по поддержке местного производства и наличием устоявшихся организаций по контрактному производству, а также значительным ростом в сфере ветеринарных и фармацевтических промежуточных продуктов, особенно для лечения сердечно-сосудистых и метаболических заболеваний.

- Производители в Египте отдают приоритет высококачественным промежуточным АФИ для лечения сердечно-сосудистых, метаболических и инфекционных заболеваний, обеспечивая соответствие международным стандартам и поддерживая как внутреннее потребление, так и экспортные рынки.

- Широкое внедрение промежуточных продуктов местного производства поддерживается стратегическими инвестициями в передовые производственные мощности, партнерствами по контрактному производству и развитием квалифицированной рабочей силы, что превращает Египет в ключевой центр синтеза АФИ в регионе Ближнего Востока и Африки.

Обзор рынка промежуточных продуктов API в Египте

Рынок промежуточных фармацевтических ингредиентов Египта (АФИ) в 2024 году занял наибольшую долю выручки в 38% в регионе Ближнего Востока и Африки, чему способствовало расширение фармацевтической производственной инфраструктуры и государственные инициативы по стимулированию местного производства. Производители всё чаще отдают приоритет высококачественным промежуточным продуктам для лечения сердечно-сосудистых, метаболических и инфекционных заболеваний. Растущий спрос на промежуточные продукты как для дженериков, так и для специализированных лекарственных средств стимулирует инвестиции в передовые производственные технологии. Кроме того, партнёрство с многонациональными фармацевтическими компаниями способствует передаче технологий и наращиванию потенциала. Регуляторная поддержка Египта, квалифицированная рабочая сила и стратегическое экспортное положение дополнительно стимулируют рост рынка. Рост расходов на здравоохранение и распространённость хронических заболеваний продолжают поддерживать высокий спрос на промежуточные АФИ.

Обзор рынка полупродуктов API в Южной Африке

Ожидается, что рынок промежуточных фармацевтических ингредиентов (АФИ) в Южной Африке будет расти самыми быстрыми темпами в 21% в год в прогнозируемый период с 2025 по 2032 год, что обусловлено увеличением инвестиций в инфраструктуру здравоохранения и ростом спроса на высококачественные промежуточные фармацевтические продукты. Местные производители сосредоточены на расширении производственных мощностей для промежуточных фармацевтических продуктов для онкологии, метаболизма и ветеринарии. Государственные инициативы, направленные на снижение импортозависимости и поддержку внутреннего фармацевтического производства, дополнительно стимулируют рост. Внедрение передовых технологий синтеза и услуг контрактного производства повышает качество и масштабируемость. Южная Африка также становится региональным центром поставок АФИ в соседние страны. Растущая распространенность хронических заболеваний и заболеваний, связанных с образом жизни, подчеркивает сохраняющуюся потребность в надежных промежуточных продуктах.

Обзор рынка промежуточных продуктов API в Саудовской Аравии

Рынок промежуточных фармацевтических ингредиентов (АФИ) в Саудовской Аравии набирает обороты благодаря увеличению инвестиций в инфраструктуру здравоохранения и фармацевтическое производство. Правительственная инициатива «Vision 2030» стимулирует местное производство АФИ и снижает зависимость от импорта. Производители концентрируются на производстве промежуточных ингредиентов для препаратов для лечения метаболических заболеваний, инфекций и сердечно-сосудистых заболеваний. Внедрение современных методов синтеза и систем контроля качества обеспечивает соответствие международным стандартам. Расширение партнерских отношений с транснациональными фармацевтическими компаниями способствует передаче технологий и наращиванию потенциала. Кроме того, рост распространенности хронических заболеваний и расширение сети медицинских учреждений в стране способствуют устойчивому росту рынка.

Обзор рынка промежуточных API в Нигерии

В 2024 году рынок промежуточных фармацевтических субстанций Нигерии занимал значительную долю в регионе Африки к югу от Сахары, что обусловлено растущим спросом на доступные и высококачественные промежуточные фармацевтические субстанции. Местные производители концентрируются на производстве фармацевтических и ветеринарных промежуточных субстанций для удовлетворения внутренних и региональных потребностей. Инвестиции в производственные мощности, соблюдение нормативных требований и обучение персонала расширяют производственные возможности. Стратегическое положение Нигерии в Западной Африке способствует экспорту в соседние страны. Государственная поддержка местного фармацевтического производства также способствует росту. Рост распространенности инфекционных и хронических заболеваний продолжает стимулировать спрос на надежные промежуточные фармацевтические субстанции.

Доля рынка промежуточных API на Ближнем Востоке и в Африке

Лидерами отрасли промежуточных API на Ближнем Востоке и в Африке являются в основном хорошо зарекомендовавшие себя компании, в том числе:

- Hikma Pharmaceuticals (Иордания)

- Julphar Gulf Pharmaceutical Industries (ОАЭ)

- Dr. Reddy's Laboratories Ltd. (Индия)

- Aurobindo Pharma Limited (Индия)

- EVA Pharma (Египет)

- Aspen Pharmacare (Южная Африка)

- Cadila Pharmaceuticals Ltd. (Индия)

- Сандоз (США)

- Teva Pharmaceutical Industries Ltd. (Израиль)

- Sun Pharmaceutical Industries Ltd. (Индия)

- Cipla Ltd. (Индия)

- AbbVie Inc. (США)

- Санофи (Франция)

- Компания Bristol-Myers Squibb (США)

- Merck & Co., Inc. (США)

- Pfizer Inc. (США)

- Johnson & Johnson Services, Inc. (США)

- Eli Lilly and Company (США)

- GSK plc (Великобритания)

Каковы последние события на рынке промежуточных продуктов API на Ближнем Востоке и в Африке?

- В октябре 2025 года в отчёте отмечалось расширение рынка пиридина в ОАЭ, обусловленное ростом спроса в фармацевтической отрасли, производстве пищевых ароматизаторов и каучука. Также существуют возможности в секторе электроники, чему способствуют растущая промышленная база страны и инвестиции в высокотехнологичные отрасли. Это развитие свидетельствует о растущей роли ОАЭ в производстве ключевых химических промежуточных продуктов, необходимых для различных фармацевтических применений.

- В августе 2025 года корпорация Marubeni завершила инвестиции в компанию Phillips Healthcare Corporation (Phillips Pharma), которая теперь является дочерней компанией Marubeni, финансируемой по методу долевого участия. Этот шаг является частью стратегии Marubeni по расширению фармацевтического бизнеса в Африке, внося вклад в разработку новой программы по разработке противомалярийных препаратов и присоединяясь к фонду AAIC, который специализируется на инвестировании и поддержке роста компаний в сфере здравоохранения.

- В июле 2025 года Hikma Pharmaceuticals и Международная финансовая корпорация (IFC) подписали соглашение на сумму 250 миллионов долларов США, ознаменовав 40-летнее партнерство, направленное на расширение доступа к качественным лекарственным средствам в регионе Ближнего Востока и Северной Африки. Это партнерство подчеркивает стремление к улучшению цепочки поставок фармацевтической продукции и улучшению доступа к основным лекарственным средствам на Ближнем Востоке и в Северной Африке.

- В июле 2025 года правительство Египта объявило о планах создания в Александрии современного фармацевтического производственного предприятия, предназначенного для производства широкого спектра промежуточных продуктов активных фармацевтических ингредиентов (АФИ). Эта инициатива является частью более широкой стратегии Египта по расширению местных производственных возможностей и снижению зависимости от импорта АФИ.

- В июне 2025 года компании EVA Pharma и CHICO Pharmaceutical подписали стратегический Меморандум о взаимопонимании (МОВ) по локализации производства активных фармацевтических ингредиентов (АФИ) для онкологических препаратов на Ближнем Востоке и в Африке. Целью этого сотрудничества является улучшение региональных цепочек поставок и повышение доступности высокоэффективных противораковых препаратов.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.