Ksa Cold Chain Logistics Market

Размер рынка в млрд долларов США

CAGR :

%

USD

4.33 Million

USD

13.81 Million

2024

2032

USD

4.33 Million

USD

13.81 Million

2024

2032

| 2025 –2032 | |

| USD 4.33 Million | |

| USD 13.81 Million | |

|

|

|

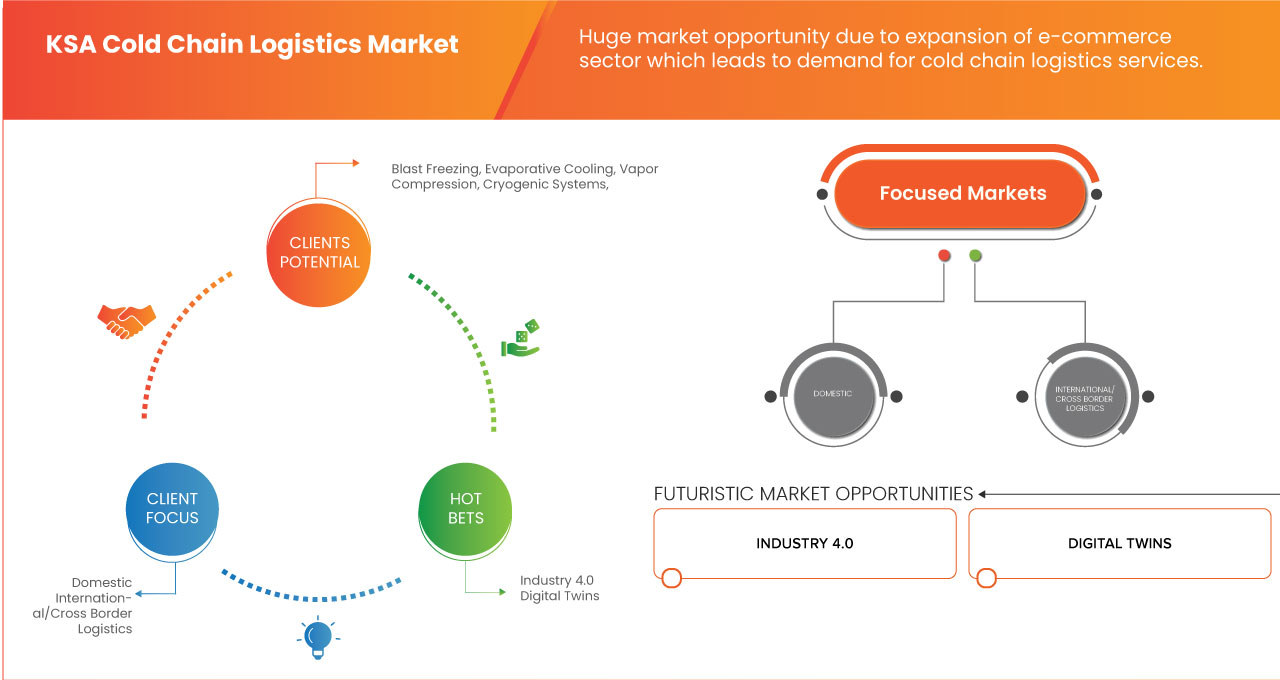

KSA Cold Chain Logistics Market, By Type (Warehousing/Storage, Logistics (Road), Logistics (Sea), Logistics (Railway), Logistics (Air), Fulfilment & Last Mile Delivery), By Type of Goods/Critical Attribute (Foodstuffs, General Goods (Including Medical Supplies), Dangerous Goods (Including Hazardous Chemicals)), Technology (Blast Freezing, Evaporative Cooling, Vapor Compression, Cryogenic Systems, Programmable Logic Controller), By Temperature Type, (Ambient, Chilled, Frozen), By Payload Size (Large, Medium, Small, X-Small, Petite), By Operation (Domestic, International/Cross Border Logistics), By Customer Type (B2B,B2C, E-commerce & Last Miles Delivery), By Business Model (Asset-Based Carriers, Brokerage & Third-Party Logistics (3PL), Fourth Party Logistics (4PL)), Distance (More than 500 Miles, 201 Miles to 500 Miles, 101 Miles–200 Miles, 50 Miles–100 Miles, Less than 50 Miles), Country (KSA) - Industry Trends and Forecast to 2031.

KSA Cold Chain Logistics Market Analysis and Size

Increased consumption of foods, pharmaceuticals, and other temperature-sensitive products, government initiatives and investments in logistics infrastructure, the expansion of e-commerce drives the growth of cold chain logistics, and transporting perishable goods requires stringent health and safety measures, are the factors which are driving the growth of KSA cold chain logistics market. However, High operational costs, and navigating regulatory standards in logistics are expected to restrain the growth of KSA cold chain logistics market. Additionally, adopting technologies such as automated storage and retrieval systems, Saudi Arabia’s strategic location create trade hub between Asia, Africa, and Europe, and implementation of IoT, AI, for improving tracking and efficiency is expected as an opportunity for the growth of KSA cold chain logistics market. However, managing temperature variability during extreme weather conditions is expected as a challenge for the growth of KSA cold chain logistics market.

Data Bridge Market Research analyses that the KSA cold chain logistics market is expected to reach a value of USD 11,947.06 million by 2031 from 3,848.92 million in 2023, growing at a CAGR of 15.6% during the forecast period 2024 to 2031.

|

Report Metric |

Details |

|

Forecast Period |

2024 to 2031 |

|

Base Year |

2023 |

|

Historic Years |

2022 (Customizable to 2016-2021) |

|

Quantitative Units |

Revenue in USD Million |

|

Segments Covered |

Тип (Складирование/Хранение, Логистика (Автомобильная), Логистика (Морская), Логистика (Железнодорожная), Логистика (Воздушная), Фулфилмент и Доставка последней мили), Тип товара/Критический атрибут (Продукты питания, Товары общего назначения (Включая Медицинские принадлежности), Опасные грузы (Включая Опасные Химические вещества)), Технология (Шоковая заморозка, Испарительное охлаждение, Паровая компрессия, Криогенные системы, Программируемый Логистический Контроллер), Тип температуры (Окружающей Среды, Охлажденный, Замороженный), Размер полезной нагрузки (Большой, Средний, Маленький, Очень Маленький, Маленький), Операция (Внутренняя, Международная/Трансграничная Логистика), Тип клиента (B2B, B2C, Электронная коммерция и Доставка последней мили), Бизнес-модель (Перевозчики на основе активов, Посредничество и логистика третьей стороны (3PL), Логистика четвертой стороны (4PL)), Расстояние (Более 500 миль, 201–500 миль, 101–200 миль, 50–100 миль, менее 50 миль) |

|

Страны, охваченные |

Саудовская Аравия |

|

Охваченные участники рынка |

AP Moller–Maersk, CGS, Mosanada Logistics Services (часть Naghi & Sons.), Wared Logistics., NAQEL Company, Agility, IFFCO, Almajdouie Logistics, Advanced Storage Co, United Group, Four Winds, Jones International Transportation, SMSA Express Transportation Company Ltd., Transcorp, Tamer Logistics, Flow, Starlinks, Binzagr, Mubarrad, Etmam Logistics (дочерняя компания Almarai), Aman Logistics и Logexa, среди прочих |

Определение рынка

Рынок логистики холодовой цепи KSA охватывает комплексное управление и транспортировку чувствительных к температуре продуктов, включая скоропортящиеся продукты питания, напитки, фармацевтические препараты и химикаты, посредством ряда холодильных производств, хранения и дистрибуции. Этот рынок включает специализированную инфраструктуру, такую как холодильные склады, транспортные средства с контролируемой температурой и передовые системы мониторинга для обеспечения целостности, безопасности и качества продукции по всей цепочке поставок. Основная цель — поддерживать требуемый температурный диапазон от точки отправления до конечного пункта назначения, придерживаясь строгих нормативных стандартов и используя инновационные технологии для удовлетворения растущего спроса на свежие и безопасные продукты как на внутреннем, так и на международном рынках.

Динамика рынка логистики холодовой цепи в Саудовской Аравии

В этом разделе рассматривается понимание движущих сил рынка, преимуществ, возможностей, ограничений и проблем. Все это подробно обсуждается ниже:

Драйверы

- Увеличение потребления продуктов питания, фармацевтических препаратов и других товаров, чувствительных к температуре

Рост потребления продуктов питания, фармацевтических препаратов и других чувствительных к температуре продуктов повысил спрос на эффективную логистику холодовой цепи. Этот сектор обеспечивает, чтобы эти скоропортящиеся товары оставались в требуемых температурных диапазонах на протяжении всей цепочки поставок, от производства до доставки, тем самым поддерживая их качество и безопасность. По мере роста потребности в таких продуктах роль логистики холодовой цепи в предотвращении порчи и обеспечении соответствия стандартам охраны труда и техники безопасности становится еще более важной.

- Рост государственных инициатив и инвестиций в логистическую инфраструктуру

Правительственные инициативы и инвестиции в логистическую инфраструктуру имеют решающее значение для развития сектора логистики холодовой цепи. Отдавая приоритет развитию современных складских помещений, совершенствуя транспортные сети и внедряя передовые системы отслеживания, эти усилия направлены на повышение эффективности и надежности обработки чувствительных к температуре продуктов. Такие инвестиции не только поддерживают рост отраслей, зависящих от логистики холодовой цепи, но и способствуют экономическому развитию и конкурентоспособности, обеспечивая бесперебойный поток товаров и снижая эксплуатационные расходы.

Возможности

- Рост внедрения автоматизированного хранения и извлечения

Внедрение таких технологий, как автоматизированные системы хранения и поиска, открывает значительные возможности для рынка логистики холодовой цепи. Эти системы повышают эффективность за счет автоматизации хранения, поиска и обработки чувствительных к температуре товаров, сокращая ручной труд и минимизируя человеческие ошибки. Это приводит к более точному управлению запасами и сокращению времени обработки, повышая общую эффективность работы. Кроме того, технологии автоматизации помогают оптимизировать использование пространства в холодильных складах, что может привести к экономии средств и увеличению производительности. Интегрируя передовые технологии, компании могут повысить уровень обслуживания и масштабируемость, позиционируя себя для удовлетворения растущего спроса на логистические решения с контролем температуры.

- Рост торговой активности с другими регионами

Рост торговой активности с другими регионами, такими как Азия, Африка и Европа, представляет собой значительную возможность для рынка логистики холодовой цепи Саудовской Аравии. Поскольку Саудовская Аравия расширяет свои мировые торговые связи, растет спрос на надежные и эффективные логистические решения с контролируемой температурой. Эта возросшая торговая активность требует технологий холодовой цепи для управления растущим объемом чувствительных к температуре товаров. Расширение торговли обуславливает необходимость в улучшенной инфраструктуре и инновационных решениях для обеспечения безопасной и эффективной доставки скоропортящихся и чувствительных продуктов. В результате сектор логистики холодовой цепи в Саудовской Аравии, вероятно, покажет существенный рост, что побудит инвестиции в современные технологии и повысит общую производительность цепочки поставок.

Ограничения/Проблемы

- Высокие инвестиционные затраты

Высокие инвестиционные затраты являются существенным ограничением в секторе логистики холодовой цепи. Поддержание необходимой температуры для скоропортящихся товаров требует существенных инвестиций в рефрижераторный транспорт, специализированные складские помещения и современные системы мониторинга. Кроме того, необходимость в непрерывном энергоснабжении и тщательном обслуживании еще больше увеличивает расходы. Эти высокие эксплуатационные расходы могут истощить бюджеты, особенно для небольших игроков на рынке, и требуют эффективных стратегий управления для обеспечения экономической эффективности при сохранении целостности и качества термочувствительных продуктов.

Последние события

- В июле 2024 года United Group продолжила свою приверженность этическому совершенству и инновациям, интегрировав передовые технологии ИИ в свою деятельность. Этот стратегический шаг автоматизировал повторяющиеся задачи и повысил эффективность в различных отделах, от ввода данных до управления цепочкой поставок. Внедрение ИИ не только оптимизировало процессы, но и дало возможность сотрудникам сосредоточиться на более творческих и приносящих удовлетворение задачах. Это достижение соответствовало стремлению компании оставаться лидером в отрасли и предоставлять превосходные услуги, в том числе в секторе холодовой цепи, где точное и эффективное управление температурно-чувствительными товарами имеет решающее значение.

- В январе 2024 года United Group добилась значительного прогресса в своей логистике холодовой цепи, внедрив самые современные системы контроля температуры на всех складских и транспортных операциях. Это обновление гарантировало, что термочувствительные продукты, такие как фармацевтические препараты и скоропортящиеся товары, будут поддерживаться в оптимальных условиях на протяжении всего пути. Улучшенная инфраструктура холодовой цепи повысила способность компании более эффективно управлять запасами, снизила показатели порчи и повысила удовлетворенность клиентов, гарантируя доставку высококачественной продукции. Это развитие подчеркнуло приверженность United Group операционному совершенству и ее стремление соответствовать строгим требованиям сектора холодовой цепи.

- В марте 2024 года StarLink расширила свое партнерство с F5, компанией, занимающейся многооблачными приложениями и безопасностью. Сотрудничество расширило сферу своего охвата, включив Королевство Саудовская Аравия (КСА) и Бахрейн. Это расширение позволило StarLink предложить портфель решений F5 в более широком спектре, охватывающем Саудовскую Аравию, Бахрейн, Кувейт, Оман, Катар, Иорданию и Ливан. Этот стратегический шаг дал возможность компаниям на Ближнем Востоке предоставлять улучшенные приложения и решения по безопасности. Партнерство было направлено на удовлетворение меняющихся потребностей клиентов в регионе, способствуя росту и эффективности обеих компаний в динамичной области облачных сервисов и безопасности.

- В марте 2023 года SMSA заключила стратегическое партнерство с China Mobile International Middle East во время конференции LEAP, направленное на содействие интеллектуальным решениям цифровой трансформации и улучшение саудовских технологий в логистической отрасли. Это сотрудничество не только расширило возможности SMSA, но и позволило ей предлагать передовые курьерские услуги, одновременно извлекая выгоду из опыта и международного охвата China Mobile International, что в конечном итоге способствовало росту SMSA и повышению ее конкурентоспособности в меняющемся ландшафте логистики.

- В ноябре 2023 года компания NAQEL достигла нового рубежа, поскольку Saudi Post (SPL) полностью приобрела ее. Это приобретение позиционировало NAQEL как национального оператора, укрепляя роль Саудовской Аравии как логистического шлюза в Европу, Азию и Африку. Оно также соответствовало целям Vision 2030, направленным на то, чтобы сделать Королевство региональным лидером в области логистики. Приобретение расширило операционные возможности NAQEL, а также расширило ее рыночное присутствие

Объем рынка логистики холодовой цепи в Саудовской Аравии

Рынок логистики холодовой цепи KSA разделен на девять основных сегментов, которые основаны на типе, типе товара/критическом атрибуте, технологии, типе температуры, размере полезной нагрузки, операции, типе клиента, бизнес-модели и расстоянии.

Тип

- Складирование/Хранение

- Логистика (Дорожная)

- Логистика (море)

- Логистика (железная дорога)

- Логистика (воздушная)

- Выполнение заказов и доставка последней мили

По типу рынок логистики холодовой цепи Саудовской Аравии сегментируется на складирование/хранение, логистику (автомобильную), логистику (морскую), логистику (железнодорожную), логистику (воздушную), а также фулфилмент и доставку последней мили.

Тип товара/критический атрибут

- Продукты питания

- Товары общего назначения (включая медицинские принадлежности)

- Опасные грузы (включая опасные химические вещества)

- Другие

На основе типа товара/критического атрибута рынок логистики холодовой цепи Саудовской Аравии сегментируется на продукты питания, товары общего назначения (включая медицинские принадлежности), опасные грузы (включая опасные химикаты) и другие.

Технологии

- Шоковая заморозка

- Испарительное охлаждение

- Сжатие пара

- Криогенные системы

- Программируемый логический контроллер

- Другие

По технологическому признаку рынок логистики холодильной цепи Саудовской Аравии сегментируется на системы шоковой заморозки, испарительного охлаждения, компрессии пара, криогенные системы, программируемые логические контроллеры и другие.

Тип температуры

- Окружающий

- Охлажденный

- Замороженный

- Другие

В зависимости от типа температуры рынок логистики холодильной цепи Саудовской Аравии сегментируется на следующие категории: транспортировка при комнатной температуре, охлажденная, замороженная и другие.

Размер полезной нагрузки

- Большой

- Середина

- Маленький

- X-маленький

- Маленький

В зависимости от размера полезной нагрузки рынок логистики холодильной цепи Саудовской Аравии сегментируется на крупные, средние, мелкие, очень мелкие и мелкие.

Операция

- Одомашненный

- Международная/трансграничная логистика

По принципу работы рынок логистики холодовой цепи Саудовской Аравии сегментируется на внутреннюю и международную/трансграничную логистику.

Тип клиента

- В2В

- B2C

- Электронная коммерция

- Доставка на последних милях

В зависимости от типа клиента рынок логистики холодовой цепи Саудовской Аравии сегментируется на B2B, B2C, а также электронную коммерцию и доставку на последних милях.

Бизнес-модель

- Перевозчики на основе активов

- Брокерские услуги и сторонняя логистика (3PL)

- Логистика четвертой стороны (4PL)

- Другие

На основе бизнес-модели рынок логистики холодовой цепи Саудовской Аравии сегментируется на перевозчиков, базирующихся на активах, брокерские услуги и стороннюю логистику (3PL), стороннюю логистику (4PL) и другие.

Расстояние

- Более 500 миль

- 201–500 миль

- 101-200 миль

- 50-100 миль

- Менее 50 миль

По расстоянию рынок логистики холодовой цепи Саудовской Аравии сегментируется на следующие сегменты: более 500 миль, от 201 мили до 500 миль, от 101 мили до 200 миль, от 50 миль до 100 миль и менее 50 миль.

Региональный анализ/информация о рынке логистики холодовой цепи в Саудовской Аравии

Проведен анализ рынка логистики холодильной цепи, а также предоставлены сведения о размерах рынка и тенденциях по типу, типу товара/критическому атрибуту, технологии, типу температуры, размеру полезной нагрузки, операции, типу клиента, бизнес-модели и расстоянию, как указано выше.

Раздел отчета по странам также содержит отдельные факторы, влияющие на рынок, и изменения в регулировании рынка, которые влияют на текущие и будущие тенденции рынка. Такие данные, как анализ цепочки создания стоимости вверх и вниз по течению, технические тенденции и анализ пяти сил Портера, тематические исследования — вот некоторые из указателей, используемых для прогнозирования рыночного сценария для отдельных стран. Кроме того, при предоставлении прогнозного анализа данных по странам учитываются наличие и доступность глобальных брендов и их проблемы, связанные с большой или малой конкуренцией со стороны местных и отечественных брендов, влияние внутренних тарифов и торговых путей .

Анализ конкурентной среды и доли рынка логистики холодовой цепи в Саудовской Аравии

Конкурентная среда рынка логистики холодной цепи KSA содержит сведения о конкуренте. Включены сведения о компании, финансы компании, полученный доход, рыночный потенциал, инвестиции в исследования и разработки, новые рыночные инициативы, производственные площадки и объекты, производственные мощности, сильные и слабые стороны компании, запуск продукта, широта и широта продукта, доминирование приложений. Приведенные выше данные относятся только к фокусу компаний, связанному с глобальным рынком промышленной автоматизации.

Некоторые из основных игроков, работающих на рынке логистики холодной цепи Саудовской Аравии, включают AP Moller–Maersk, CGS, Mosanada Logistics Services (часть Naghi & Sons.), Wared Logistics., NAQEL Company, Agility, IFFCO, Almajdouie Logistics, Advanced Storage Co, United Group, Four Winds, Jones International Transportation, SMSA Express Transportation Company Ltd., Transcorp, Tamer Logistics, Flow, Starlinks, Binzagr, Mubarrad, Etmam Logistics (дочерняя компания Almarai), Aman Logistics и Logexa и другие.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.