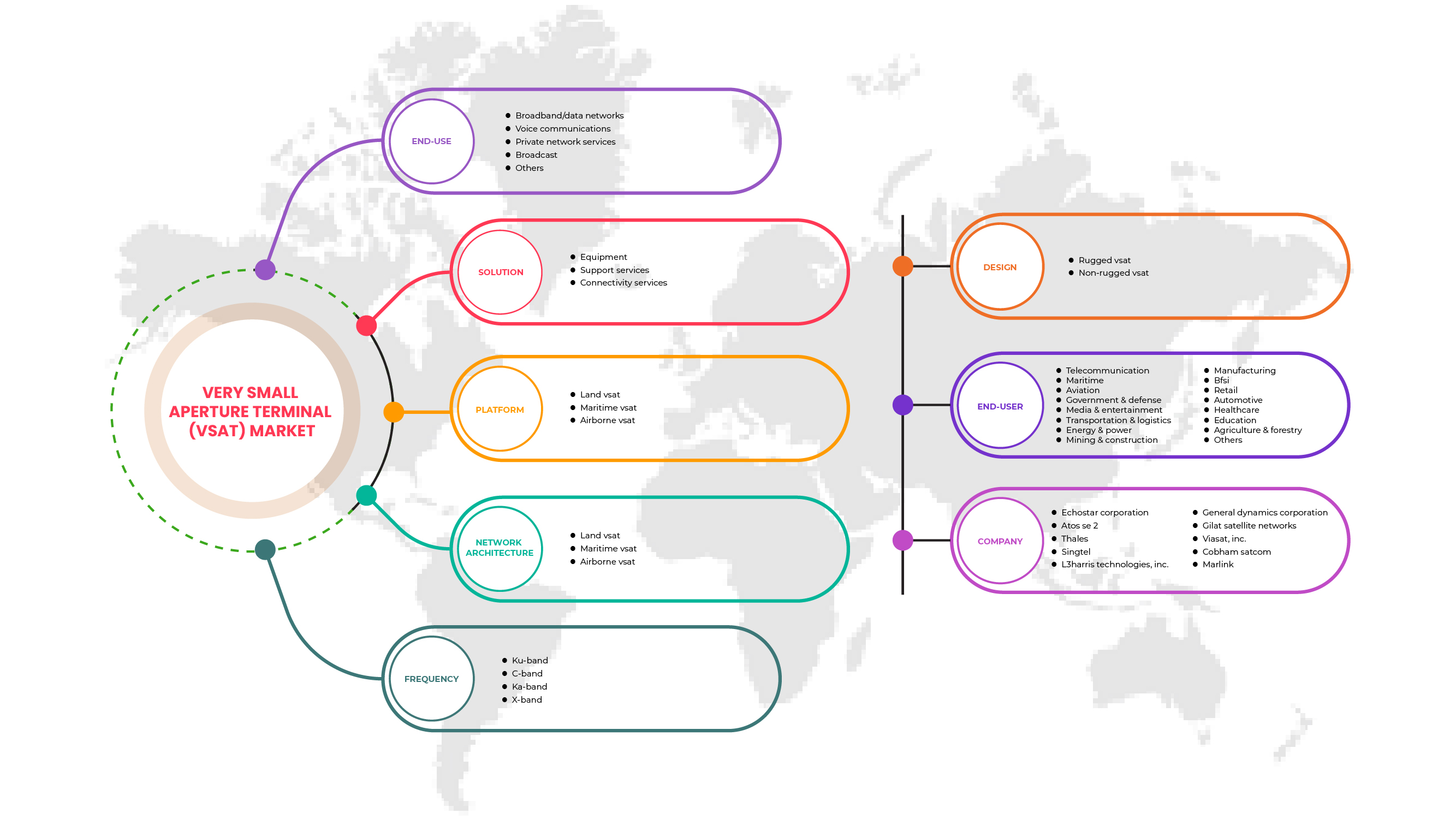

Глобальный рынок терминалов с очень малой апертурой (VSAT), по решению (оборудование, услуги поддержки, услуги подключения), платформе (наземный VSAT, морской VSAT, бортовой VSAT), частоте (Ku-диапазон, C-диапазон, Ka-диапазон, X-диапазон), сетевой архитектуре (топология «звезда», топология «сетка», гибридная топология, соединения «точка-точка»), конструкции (защищенный VSAT и незащищенный VSAT), вертикали (телекоммуникации, морское судоходство, авиация, правительство и оборона, медиа и развлечения, транспорт и логистика, энергетика и электроэнергия, горнодобывающая промышленность и строительство, производство, BFSI, розничная торговля, автомобилестроение, транспорт и логистика, здравоохранение, образование, сельское и лесное хозяйство и другие), конечному использованию (широкополосная связь/сеть передачи данных, голосовая связь, услуги частных сетей, вещание и другие) — отраслевые тенденции и прогноз до 2029 года.

Анализ рынка и размер терминала с очень малой апертурой (VSAT)

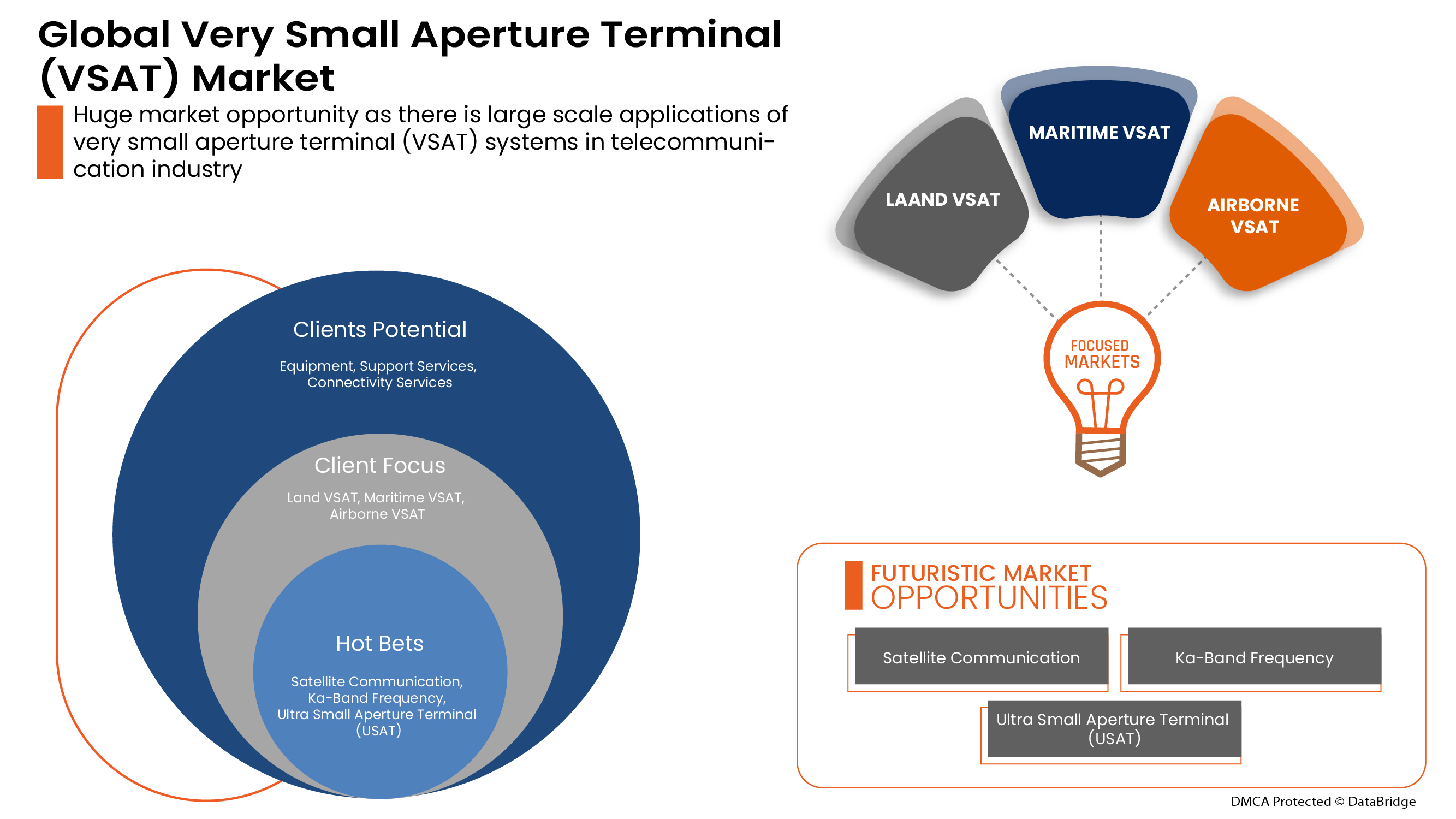

Массовый рост емкости спутников привел к значительному снижению цен, что впервые сделало терминалы с очень малой апертурой (VSAT) жизнеспособным решением для многих отраслей и регионов. Кроме того, возросло внедрение технологии VSAT в таких отраслях, как морское судоходство, нефтегазовая отрасль, авиация и т. д. Эти системы также обеспечивают необходимую связь между пользователями медицинских приложений, баз данных, видео и телефонов в удаленных местах и позволяют осуществлять связь с удаленными и мобильными объектами.

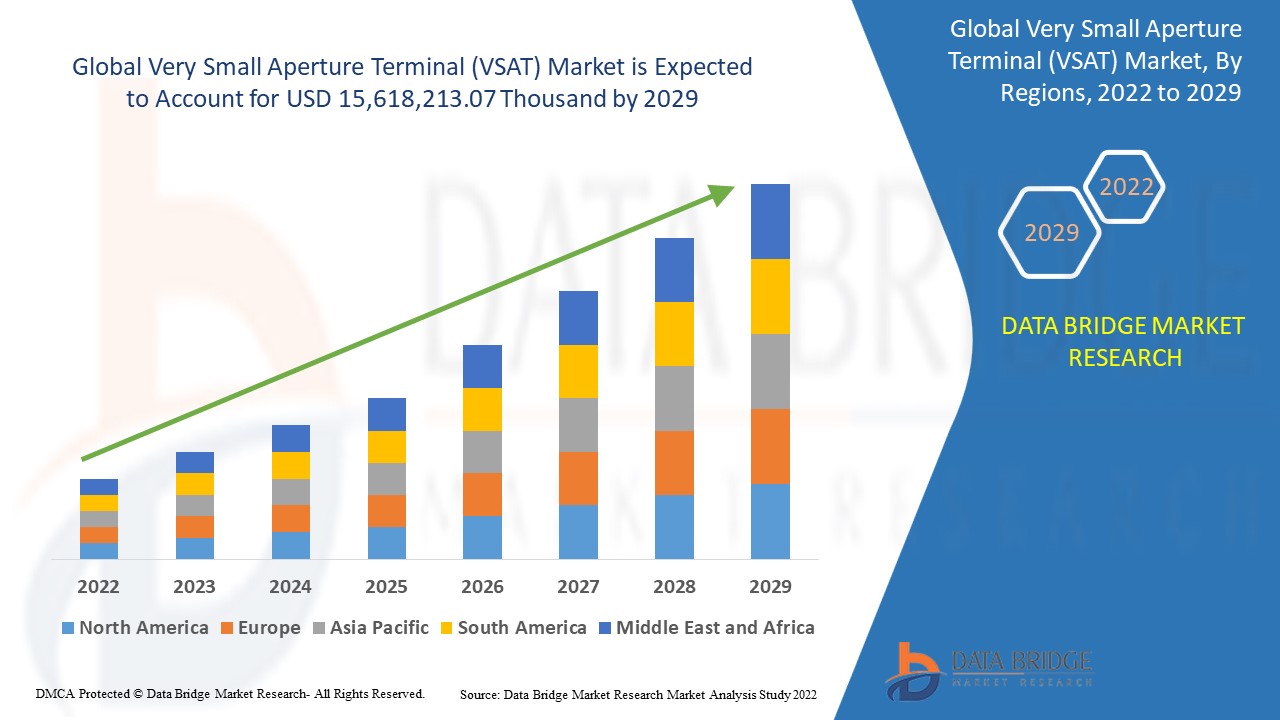

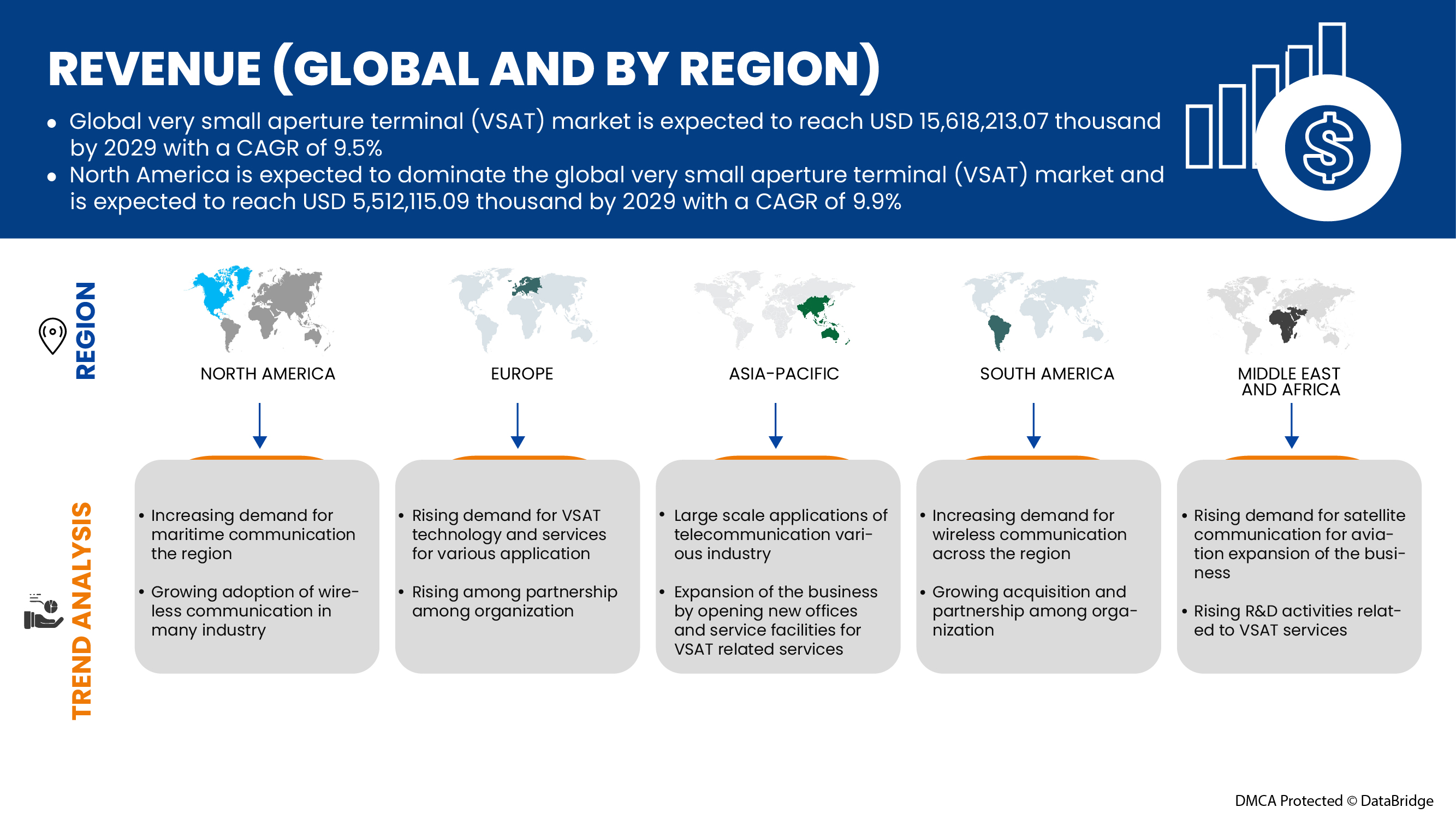

Data Bridge Market Research анализирует, что рынок терминалов с очень малой апертурой (VSAT) к 2029 году, как ожидается, достигнет значения 15 618 213,07 тыс. долларов США, при среднегодовом темпе роста 9,5% в течение прогнозируемого периода. Отчет о рынке терминалов с очень малой апертурой (VSAT) также охватывает анализ цен, патентный анализ и технологические достижения в деталях.

|

Отчет Метрика |

Подробности |

|

Прогнозируемый период |

2022-2029 |

|

Базовый год |

2021 |

|

Исторические годы |

2020 (Можно настроить на 2019-2014) |

|

Количественные единицы |

Доход в тыс. долл. США, цены в долл. США |

|

Охваченные сегменты |

По решению (оборудование, службы поддержки, службы подключения), платформа (наземный VSAT, морской VSAT, бортовой VSAT), частота (Ku-диапазон, C-диапазон, Ka-диапазон, X-диапазон), сетевая архитектура (топология «звезда», топология «сетка», гибридная топология, соединения «точка-точка»), конструкция (защищенный VSAT и незащищенный VSAT), вертикаль (телекоммуникации, морское судоходство, авиация, правительство и оборона, медиа и развлечения, транспорт и логистика, энергетика и электроэнергия, горнодобывающая промышленность и строительство, производство, BFSI, розничная торговля, автомобилестроение, транспорт и логистика, здравоохранение, образование, сельское хозяйство и лесное хозяйство и другие), конечное использование (широкополосная сеть/сеть передачи данных, голосовая связь, частная сетевая служба, вещание и другие) |

|

Страны, охваченные |

США, Канада и Мексика, Германия, Франция, Великобритания, Нидерланды, Швейцария, Бельгия, Россия, Италия, Испания, Турция, Швеция, остальные страны Европы, Китай, Япония, Индия, Южная Корея, Сингапур, Малайзия, Австралия и Новая Зеландия, Таиланд, Индонезия, Филиппины, остальные страны Азиатско-Тихоокеанского региона, Саудовская Аравия, ОАЭ, Южная Африка, Египет, Израиль, остальные страны Ближнего Востока и Африки, Бразилия, Аргентина и остальные страны Южной Америки. |

|

Охваченные участники рынка |

Singtel, Vizocom Company, x2nSat, C-COM Satellite Systems Inc, Marlink, Thuraya Telecommunications Company, Speedcast, NSSLGlobal, ST Engineering, Atos SE 2, Iridium Communications Inc., EchoStar Corporation, Orbit Communications Systems Ltd., Ultra, Nisshinbo Holdings Inc., General Dynamics Corporation, Honeywell International Inc., Cobham Satcom, Thales, GILAT SATELLITE NETWORKS, L3Harris Technologies, Inc., Viasat, Inc., KVH Industries, Inc., CPI International Inc., Global Invacom |

Определение рынка

Двусторонняя спутниковая система связи называется VSAT, или терминал с очень малой апертурой. Диаметр тарелки этой системы обычно составляет менее 3,8 метра. Эффективность системы VSAT может быть негативно затронута погодой. Кроме того, обычно используются три топологии сетей VSAT: звезда, сетка или гибрид. Таким образом, системы VSAT обеспечивают необходимую связь между пользователями медицинских приложений, баз данных, видео и телефонов в удаленных местах и позволяют осуществлять связь с удаленными и мобильными сайтами.

Динамика мирового рынка терминалов с очень малой апертурой (VSAT)

В этом разделе рассматривается понимание движущих сил рынка, преимуществ, возможностей, ограничений и проблем. Все это подробно обсуждается ниже:

Драйверы

- Растущий спрос на безопасную связь для морских приложений Интернета вещей

Технология VSAT стала важным делом для морской отрасли. Они используются для двусторонней спутниковой связи для интернета, данных и телефонии, как правило, в сельской местности и суровых условиях. В последние годы наблюдается прогрессивный сдвиг в морской экосистеме IoT. Эта экосистема обслуживается различными стандартными электронными частями, которые представляют собой аппаратное обеспечение, интегрированное с различным программным обеспечением. Услуги IoT через спутник позволяют компаниям получать доступ к данным с активов наиболее доступным способом. Поэтому корабли в море находятся в удалении, суда и другие отдельные объекты принимают цифровые системы как часть более крупных сетей IoT. Использование устройств IoT и сенсорных систем на судах/флоте помогает получить конкурентное преимущество, за счет использования таких технологий компании могут использовать весь потенциал данных для более эффективных операций и принятия решений.

- Более широкое внедрение технологии VSAT в нефтегазовой отрасли

В настоящее время нефтегазовый сектор претерпевает огромные изменения из-за различных цифровых инноваций. Существует множество требований, таких как безопасность, надежность, разведка новых месторождений нефти и повышение прозрачности между буровой установкой и штаб-квартирой, при этом контролируя эксплуатационные расходы. Поэтому операторы буровых установок постоянно подвергаются давлению, требующему принятия более быстрых решений и более эффективного выполнения операций. Кроме того, нефтегазовая отрасль работает в удаленных наземных и морских условиях, где использование наземных коммуникаций непрактично или ненадежно. Поэтому многие компании начали внедрять технологию VSAT, чтобы операторы буровых установок могли принимать быстрые и более обоснованные решения, что снизит эксплуатационные расходы, повысит производительность и обеспечит более безопасные условия труда для экипажа независимо от местоположения.

Возможности

- Расширение стратегического партнерства и приобретений среди различных организаций

Координация и инвестирование в проекты имеют важное значение для достижения устойчивых улучшений в секторе терминалов с очень малой апертурой (VSAT). Благодаря этому правительство и другие частные организации стремятся к партнерству и поглощениям, тем самым ускоряя рост отраслей. Это помогает повысить осведомленность и прибыль для организации и тем самым создает возможности для нового изобретения в отрасли. Кроме того, благодаря партнерству компания может больше инвестировать в передовые технологии для предоставления более безопасных и надежных услуг и решений терминалов с очень малой апертурой (VSAT). Кроме того, это помогает обеим компаниям получить признание на конкурентном рынке, тем самым генерируя прибыль в определенной степени.

Ограничения/Проблемы

- Растущие проблемы кибербезопасности и утечки данных

Киберпреступность/хакерство и проблемы кибербезопасности возросли на 600% во время пандемии во всех секторах. Недостатки в сетевой или программной безопасности — это уязвимость, которую используют хакеры для выполнения несанкционированных действий в системе.

Согласно недавнему отчету «Обследование морской кибербезопасности», опубликованному Safety at Sea и BIMCO, за 12 месяцев до февраля 2020 года 31% организаций стали жертвами кибератак, что на 9% больше, чем в 2019 году. Согласно другому отчету, опубликованному Робертом Ризикой, руководителем североамериканских операций в Naval Dome, количество кибератак на операционные технологии (OT) морской отрасли увеличилось на 900% с 50% в 2017 году до 120% и 310% в 2018 и 2019 годах соответственно.

- Проблемы, связанные с надежностью сети терминалов с очень малой апертурой (VSAT) в плохую погоду

Космическая погода мешает радиосвязи между Землей и спутниками, поскольку она может вызывать ионосферные возмущения, которые отражают, преломляют или поглощают радиоволны. Учитывая, что спутниковые сигналы должны проходить большие расстояния в воздухе, спутниковые интернет-услуги для сельских пользователей могут быть уязвимы к суровой погоде. Хотя ветер редко влияет на радиосигналы, он может колебаться, вибрировать или даже смещать оборудование, такое как спутниковые антенны. Задержка и затухание из-за дождя — два конкретных фактора, которые влияют на способность спутников отправлять сигналы. Дождь и атмосферная влажность являются основными причинами затухания из-за дождя, что может ослабить или ухудшить спутниковый сигнал на более высоких частотах Ku- и Ka-диапазона.

Влияние COVID-19 на глобальный рынок терминалов с очень малой апертурой (VSAT)

COVID-19 оказал негативное влияние на рынок терминалов с очень малой апертурой (VSAT) из-за мер изоляции и остановки производственных предприятий.

Пандемия COVID-19 оказала негативное влияние на рынок терминалов с очень малой апертурой (VSAT). Однако всплеск спроса на глобальную систему безопасности при бедствии на море по всему миру помог рынку вырасти после пандемии. Кроме того, рост был высоким после открытия рынка после COVID-19, и ожидается, что в секторе будет наблюдаться значительный рост из-за растущего распространения спутниковой связи в военном и оборонном секторе.

Поставщики решений принимают различные стратегические решения, чтобы восстановиться после COVID-19. Игроки проводят многочисленные исследования и разработки для улучшения технологии, задействованной в терминале с очень малой апертурой (VSAT). Благодаря этому компании выведут на рынок передовые технологии. Кроме того, правительственные инициативы по использованию технологий автоматизации привели к росту рынка

Последние события

- В июне 2022 года Cobham Satcom заключила партнерство с Mangata Networks. Основной целью этого партнерства было укрепление систем спутникового слежения и наземной инфраструктуры. В рамках этого партнерства Cobham Satcom согласилась развернуть несколько антенн шлюза Cobham Satcom 4.0M TRACKER по всему миру. Благодаря этому обе компании приобрели репутацию среди своих клиентов и расширили свое присутствие на рынке.

- В декабре 2021 года Orbit Communications Systems Ltd. приобрела Euclid Systems Engineering, компанию, специализирующуюся на разработке интеллектуальных, легких позиционеров и систем слежения для оборонной промышленности. Мотивом этого приобретения было укрепление возможностей компании в области морской и воздушной спутниковой связи с помощью Euclid Systems Engineering. Это развитие поможет компании расширить свой продуктовый портфель и глобальное присутствие на рынке.

Масштаб мирового рынка терминалов с очень малой апертурой (VSAT)

Глобальный рынок терминалов с очень малой апертурой (VSAT) сегментирован на основе решения, платформы, частоты, сетевой архитектуры, дизайна, вертикали, конечного использования. Рост среди этих сегментов поможет вам проанализировать сегменты с незначительным ростом в отраслях и предоставить пользователям ценный обзор рынка и рыночные идеи, которые помогут им принимать стратегические решения для определения основных рыночных приложений.

Решение

- Оборудование

- Службы поддержки

- Услуги связи

На основе решения глобальный рынок терминалов с очень малой апертурой (VSAT) сегментируется на оборудование, услуги поддержки и услуги связи.

Платформа

- Наземная VSAT-связь

- Морской VSAT

- Воздушный VSAT

На основе платформы глобальный рынок терминалов со сверхмалой апертурой (VSAT) сегментирован на наземный VSAT, морской VSAT и воздушный VSAT.

Частота

- Ku-диапазон

- C-диапазон

- Ka-диапазон

- X-Band

По частотному признаку глобальный рынок терминалов с очень малой апертурой (VSAT) сегментирован на Ku-диапазон, C-диапазон, Ka-диапазон и X-диапазон.

Сетевая архитектура

- Топология «звезда»

- Топология сетки

- Гибридная топология

- Связи точка-точка

На основе сетевой архитектуры глобальный рынок терминалов с очень малой апертурой (VSAT) сегментирован на топологию «звезда», топологию «сетка», гибридную топологию и соединения «точка-точка».

Дизайн

- Прочный VSAT

- Незащищенный VSAT

По конструктивному принципу глобальный рынок терминалов с очень малой апертурой (VSAT) сегментируется на защищенные VSAT и незащищенные VSAT.

Вертикальный

- Телекоммуникации

- Морской

- Авиация

- Правительство и оборона

- Медиа и развлечения

- Транспорт и логистика

- Энергия и мощность

- Горное дело и строительство

- Производство

- БФСИ

- Розничная торговля

- Автомобильный

- Транспорт и логистика

- Здравоохранение

- Образование

- Сельское и лесное хозяйство

- Другие

По вертикали глобальный рынок терминалов с очень малой апертурой (VSAT) сегментирован на телекоммуникации, судоходство, авиацию, государственное управление и оборону, СМИ и развлечения, транспорт и логистику, энергетику и электроэнергию, горнодобывающую промышленность и строительство, производство, BFSI, розничную торговлю, автомобилестроение, транспорт и логистику, здравоохранение, образование, сельское и лесное хозяйство и другие.

Конечное использование

- Широкополосная/сеть передачи данных

- Голосовая связь

- Частная сетевая служба

- Транслировать

- Другие

По признаку конечного использования глобальный рынок терминалов с очень малой апертурой (VSAT) сегментируется на широкополосные сети/сети передачи данных, голосовую связь, услуги частных сетей, вещание и другие.

Региональный анализ/информация о мировом рынке терминалов с очень малой апертурой (VSAT)

Проведен анализ мирового рынка терминалов с очень малой апертурой (VSAT), а также предоставлены сведения о размерах рынка и тенденциях по странам, типам материалов, производственным процессам и отраслям конечного использования, как указано выше.

The countries covered in the very small aperture terminal (VSAT) market report are U.S., Canada and Mexico, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Sweden, Rest of Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia & New Zealand, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa, Brazil, Argentina and Rest of South America.

North America dominates the very small aperture terminal (VSAT) market owing to rapid adoption of satellite communication technology and increasing research and development activities for reducing antenna size. U.S. dominates in the North America region owing to rising utilization of VSAT in government & defence applications. China dominates in the Asia-Pacific region as it is the world’s biggest manufacturing hub for technological products. Germany dominates in Europe region owing to growing demand for secure communication for maritime and airborne IoT applications.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Global Very Small Aperture Terminal (VSAT) Market Share Analysis

Global very small aperture terminal (VSAT) market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to very small aperture terminal (VSAT) market.

Some of the major players operating in the global very small aperture terminal (VSAT) market are Singtel, Vizocom Company, x2nSat, C-COM Satellite Systems Inc, Marlink , Thuraya Telecommunications Company, Speedcast, NSSLGlobal, ST Engineering, Atos SE 2, Iridium Communications Inc., EchoStar Corporation, Orbit Communications Systems Ltd., Ultra, Nisshinbo Holdings Inc., General Dynamics Corporation, Honeywell International Inc., Cobham Satcom, Thales, GILAT SATELLITE NETWORKS, L3Harris Technologies, Inc., Viasat, Inc., KVH Industries, Inc., CPI International Inc., Global Invacom among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Содержание

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 SOLUTION TIMELINE CURVE

2.1 MARKET CHALLENGE MATRIX

2.11 MARKET PLATFORM COVERAGE GRID

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER'S FIVE FORCES MODEL

4.2 TECHNOLOGY ANALYSIS

4.3 USE CASES

4.3.1 RELIABLE VSAT CONNECTIVITY IMPROVES OPERATIONAL STABILITY FOR SUN ENTERPRISES

4.3.2 CUSTOMER WINS MAJOR OIL AND GAS CONTRACT USING WINEGARD'S SECRET WEAPON

4.3.3 VIZOCOM'S SATELLITE SOLUTION PROVIDES THE DEPARTMENT OF DEFENSE EDUCATION ACTIVITY (DODEA) WITH INTERNET CONNECTIVITY TO PUERTO RICO AFTER HURRICANE MARIA IN 2017

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING DEMAND FOR SECURE COMMUNICATION FOR MARITIME IOT APPLICATIONS

5.1.2 INCREASED ADOPTION OF VSAT TECHNOLOGY IN THE OIL AND GAS INDUSTRY

5.1.3 PROLIFERATION OF SATELLITE-BASED COMMUNICATION IN THE MILITARY AND DEFENSE SECTOR

5.2 RESTRAINTS

5.2.1 RISING CYBER SECURITY CONCERNS AND DATA BREACHES

5.2.2 ISSUES RELATED TO DATA LATENCY IN VSAT TECHNOLOGY

5.3 OPPORTUNITIES

5.3.1 SURGE IN DEMAND FOR GLOBAL MARITIME DISTRESS SAFETY SYSTEM

5.3.2 INCREASING STRATEGIC PARTNERSHIP AND ACQUISITION AMONG VARIOUS ORGANIZATIONS

5.3.3 ADVENT OF VSAT SERVICE PROVIDERS IN VARIOUS ENTERPRISE SECTORS

5.4 CHALLENGES

5.4.1 HIGHER HARDWARE AND INSTALLATION COSTS OF VSAT SYSTEMS

5.4.2 ISSUES RELATED TO RELIABILITY OF VSAT NETWORK DURING BAD WEATHER

5.4.3 HIGHER CHANCES OF INTERFERENCE IN VERY SMALL APERTURE TERMINAL (VSAT) NETWORKS

6 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY SOLUTION

6.1 OVERVIEW

6.2 EQUIPMENT

6.2.1 OUT-DOOR UNITS

6.2.1.1 ANTENNAS

6.2.1.2 RF FREQUENCY CONVERTERS

6.2.1.3 AMPLIFIERS

6.2.1.4 DIPLEXERS

6.2.1.5 OTHERS

6.2.2 IN-DOOR UNITS

6.2.2.1 SATELLITE MODEM

6.2.2.2 SATELLITE ROUTER

6.2.3 MOUNTS

6.2.4 ANTENNA CONTROL UNITS

6.2.5 OTHERS

6.2.6 SUPPORT SERVICES

6.2.6.1 PROFESSIONAL SERVICES

6.2.6.1.1 MAINTENANCE & SUPPORT SERVICES

6.2.6.1.2 ENGINEERING & CONSULTATION

6.2.6.1.3 TRAINING

6.2.6.2 MANAGED SERVICES

6.2.6.2.1 INSTALLATION & SETUP

6.2.6.2.2 NETWORK DESIGN & OPTIMIZATION

6.2.6.2.3 NETWORK OPERATIONS

6.3 CONNECTIVITY SERVICES

7 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY PLATFORM

7.1 OVERVIEW

7.2 LAND VSAT

7.2.1 FIXED

7.2.1.1 EARTH STATION

7.2.1.2 COMMERCIAL BUILDINGS

7.2.1.3 COMMAND & CONTROL CENTERS

7.2.2 ON-THE-MOVE

7.2.2.1 COMMERCIAL VEHICLES

7.2.2.2 MILITARY VEHICLES

7.2.2.3 TRAINS

7.2.2.4 EMERGENCY VEHICLES

7.2.2.5 UNMANNED GROUND VEHICLES

7.2.3 PORTABLE/MANPACKS

7.3 MARITIME VSAT

7.3.1 COMMERCIAL SHIP

7.3.2 MILITARY SHIP

7.3.3 UNMANNED MARINE SHIP

7.4 AIRBORNE VSAT

7.4.1 COMMERCIAL AIRCRAFT

7.4.2 MILITARY AIRCRAFT

7.4.3 UNMANNED MARINE SHIP

8 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY NETWORK ARCHITECTURE

8.1 OVERVIEW

8.2 STAR TOPOLOGY

8.3 MESH TOPOLOGY

8.4 HYBRID TOPOLOGY

8.5 POINT-TO-POINT LINKS

9 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY FREQUENCY

9.1 OVERVIEW

9.2 KU-BAND

9.3 C-BAND

9.4 KA-BAND

9.5 X-BAND

10 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY DESIGN

10.1 OVERVIEW

10.2 RUGGED VSAT

10.3 NON- RUGGED VSAT

11 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY VERTICAL

11.1 OVERVIEW

11.2 TELECOMMUNICATION

11.2.1 EQUIPMENT

11.2.2 SUPPORT SERVICES

11.2.3 CONNECTIVITY SERVICES

11.3 MARITIME

11.3.1 EQUIPMENT

11.3.2 SUPPORT SERVICES

11.3.3 CONNECTIVITY SERVICES

11.4 AVIATION

11.4.1 EQUIPMENT

11.4.2 SUPPORT SERVICES

11.4.3 CONNECTIVITY SERVICES

11.5 GOVERNMENT & DEFENSE

11.5.1 EQUIPMENT

11.5.2 SUPPORT SERVICES

11.5.3 CONNECTIVITY SERVICES

11.6 MEDIA & ENTERTAINMENT

11.6.1 EQUIPMENT

11.6.2 SUPPORT SERVICES

11.6.3 CONNECTIVITY SERVICES

11.7 TRANSPORTATION & LOGISTICS

11.7.1 EQUIPMENT

11.7.2 SUPPORT SERVICES

11.7.3 CONNECTIVITY SERVICES

11.8 ENERGY & POWER

11.9 MINING & CONSTRUCTION

11.9.1 EQUIPMENT

11.9.2 SUPPORT SERVICES

11.9.3 CONNECTIVITY SERVICES

11.1 MANUFACTURING

11.10.1 EQUIPMENT

11.10.2 SUPPORT SERVICES

11.10.3 CONNECTIVITY SERVICES

11.11 BFSI

11.12 RETAIL

11.12.1 EQUIPMENT

11.12.2 SUPPORT SERVICES

11.12.3 CONNECTIVITY SERVICES

11.13 AUTOMOTIVE

11.13.1 EQUIPMENT

11.13.2 SUPPORT SERVICES

11.13.3 CONNECTIVITY SERVICES

11.14 HEALTHCARE

11.15 EDUCATION

11.16 AGRICULTURE & FORESTRY

11.16.1 EQUIPMENT

11.16.2 SUPPORT SERVICES

11.16.3 CONNECTIVITY SERVICES

11.17 OTHERS

12 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY END-USE

12.1 OVERVIEW

12.2 BROADBAND/DATA NETWORKS

12.3 VOICE COMMUNICATIONS

12.4 PRIVATE NETWORK SERVICES

12.5 BROADCAST

12.6 OTHERS

13 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION

13.1 OVERVIEW

13.2 NORTH AMERICA

13.2.1 U.S.

13.2.2 CANADA

13.2.3 MEXICO

13.3 ASIA-PACIFIC

13.3.1 CHINA

13.3.2 JAPAN

13.3.3 SOUTH KOREA

13.3.4 INDIA

13.3.5 AUSTRALIA & NEW ZEALAND

13.3.6 INDONESIA

13.3.7 THAILAND

13.3.8 SINGAPORE

13.3.9 MALAYSIA

13.3.10 PHILIPPINES

13.3.11 REST OF ASIA-PACIFIC

13.4 EUROPE

13.4.1 GERMANY

13.4.2 U.K.

13.4.3 FRANCE

13.4.4 SPAIN

13.4.5 ITALY

13.4.6 RUSSIA

13.4.7 NETHERLANDS

13.4.8 SWITZERLAND

13.4.9 SWEDEN

13.4.10 BELGIUM

13.4.11 TURKEY

13.4.12 REST OF EUROPE

13.5 SOUTH AMERICA

13.5.1 BRAZIL

13.5.2 ARGENTINA

13.5.3 REST OF SOUTH AMERICA

13.6 MIDDLE EAST & AFRICA

13.6.1 SAUDI ARABIA

13.6.2 U.A.E.

13.6.3 SOUTH AFRICA

13.6.4 ISRAEL

13.6.5 EGYPT

13.6.6 REST OF MIDDLE EAST & AFRICA

14 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

14.2 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

14.3 COMPANY SHARE ANALYSIS: EUROPE

15 SWOT ANLYSIS

16 COMPAMY PROFILE

16.1 ECHOSTAR CORPORATION

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENT

16.2 ATOS SE

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCTS PORTFOLIO

16.2.5 RECENT DEVELOPMENTS

16.3 THALES

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENT

16.4 SINGTEL

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENT

16.5 L3HARRIS TECHNOLOGIES, INC

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENTS

16.6 GENERAL DYNAMICS CORPORATION

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 PRODUCT PORTFOLIO

16.6.4 RECENT DEVELOPMENTS

16.7 GILAT SATELLITE NETWORKS

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 PRODUCT PORTFOLIO

16.7.4 RECENT DEVELOPMENTS

16.8 C-COM SATELLITE SYSTEMS INC.

16.8.1 COMPANY SNAPSHOT

16.8.2 REVENUE ANALYSIS

16.8.3 PRODUCT PORTFOLIO

16.8.4 RECENT DEVELOPMENTS

16.9 COBHAM SATCOM

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENTS

16.1 CPI INTERNATIONAL INC.

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENT

16.11 GLOBAL INVACOM

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 SERVICES PORTFOLIO

16.11.4 RECENT DEVELOPMENT

16.12 HONEYWELL INTERNATIONAL INC.

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 PRODUCT PORTFOLIO

16.12.4 RECENT DEVELOPMENTS

16.13 IRIDIUM COMMUNICATIONS INC.

16.13.1 COMPANY SNAPSHOT

16.13.2 REVENUE ANALYSIS

16.13.3 SERVICE PORTFOLIO

16.13.4 RECENT DEVELOPMENT

16.14 KVH INDUSTRIES, INC.

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 SOLUTION PORTFOLIO

16.14.4 RECENT DEVELOPMENT

16.15 MARLINK

16.15.1 COMPANY SNAPSHOT

16.15.2 SOLUTION PORTFOLIO

16.15.3 RECENT DEVELOPMENTS

16.16 NISSHINBO HOLDINGS INC.

16.16.1 COMPANY SNAPSHOT

16.16.2 REVENUE ANALYSIS

16.16.3 PRODUCT PORTFOLIO

16.16.4 RECENT DEVELOPMENTS

16.17 NSSL GLOBAL

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENT

16.18 ORBIT COMMUNICATIONS SYSTEMS LTD.

16.18.1 COMPANY SNAPSHOT

16.18.2 REVENUE ANALYSIS

16.18.3 PRODUCT PORTFOLIO

16.18.4 RECENT DEVELOPMENTS

16.19 SPEEDCAST

16.19.1 COMPANY SNAPSHOT

16.19.2 SOLUTION PORTFOLIO

16.19.3 RECENT DEVELOPMENTS

16.2 ST ENGINEERING

16.20.1 COMPANY SNAPSHOT

16.20.2 REVENUE ANALYSIS

16.20.3 PRODUCT PORTFOLIO

16.20.4 RECENT DEVELOPMENT

16.21 THURAYA TELECOMMUNICATIONS COMPANY

16.21.1 COMPANY SNAPSHOT

16.21.2 SERVICE PORTFOLIO

16.21.3 RECENT DEVELOPMENT

16.22 ULTRA

16.22.1 COMPANY SNAPSHOT

16.22.2 REVENUE ANALYSIS

16.22.3 PRODUCT PORTFOLIO

16.22.4 RECENT DEVELOPMENTS

16.23 VIASAT, INC.

16.23.1 COMPANY SNAPSHOT

16.23.2 REVENUE ANALYSIS

16.23.3 PRODUCT PORTFOLIO

16.23.4 RECENT DEVELOPMENTS

16.24 VIZOCOM COMPANY

16.24.1 COMPANY SNAPSHOT

16.24.2 SOLUTION PORTFOLIO

16.24.3 RECENT DEVELOPMENT

16.25 X2NSAT

16.25.1 COMPANY SNAPSHOT

16.25.2 SERVICE PORTFOLIO

16.25.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

Список таблиц

TABLE 1 CYBER-ATTACKS ON VESSELS/MARITIME INDUSTRY

TABLE 2 TYPICAL HARDWARE AND INSTALLATION COSTS

TABLE 3 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY SOLUTION, 2020-2029 (USD THOUSAND)

TABLE 4 GLOBAL EQUIPMENT IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 5 GLOBAL EQUIPMENT IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 6 GLOBAL OUT-DOOR UNITS IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 7 GLOBAL IN-DOOR UNITS IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 8 GLOBAL SUPPORT SERVICES IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 9 GLOBAL SUPPORT SERVICES IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 10 GLOBAL PROFESSIONAL SERVICES IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 11 GLOBAL MANAGED SERVICES IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 12 GLOBAL CONNECTIVITY SERVICES IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 13 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY PLATFORM, 2020-2029 (USD THOUSAND)

TABLE 14 GLOBAL LAND VSAT IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 15 GLOBAL LAND VSAT IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 16 GLOBAL FIXED IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 17 GLOBAL ON-THE-MOVE IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 18 GLOBAL MARITIME VSAT IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 19 GLOBAL MARITIME VSAT IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 20 GLOBAL AIRBORNE VSAT IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 21 GLOBAL AIRBORNE VSAT IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 22 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY NETWORK ARCHITECTURE, 2020-2029 (USD THOUSAND)

TABLE 23 GLOBAL STAR TOPOLOGY IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 24 GLOBAL MESH TOPOLOGY IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 25 GLOBAL HYBRID TOPOLOGY IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 26 GLOBAL POINT-TO-POINT LINKS IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 27 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY FREQUENCY, 2020-2029 (USD THOUSAND)

TABLE 28 GLOBAL KU-BAND IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 29 GLOBAL C-BAND IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 30 GLOBAL KA-BAND IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 31 GLOBAL X-BAND IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 32 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY DESIGN, 2020-2029 (USD THOUSAND)

TABLE 33 GLOBAL RUGGED VSAT IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 34 GLOBAL NON- RUGGED VSAT IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 35 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY VERTICAL, 2020-2029 (USD THOUSAND)

TABLE 36 GLOBAL TELECOMMUNICATION IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 37 GLOBAL TELECOMMUNICATION IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY SOLUTION, 2020-2029 (USD THOUSAND)

TABLE 38 GLOBAL MARITIME IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 39 GLOBAL MARITIME IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY SOLUTION, 2020-2029 (USD THOUSAND)

TABLE 40 GLOBAL AVIATION IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 41 GLOBAL AVIATION IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY SOLUTION, 2020-2029 (USD THOUSAND)

TABLE 42 GLOBAL GOVERNMENT & DEFENSE IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 43 GLOBAL GOVERNMENT & DEFENSE IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY SOLUTION, 2020-2029 (USD THOUSAND)

TABLE 44 GLOBAL MEDIA & ENTERTAINMENT IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 45 GLOBAL MEDIA & ENTERTAINMENT IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY SOLUTION, 2020-2029 (USD THOUSAND)

TABLE 46 GLOBAL TRANSPORTATION & LOGISTICS IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 47 GLOBAL TRANSPORTATION & LOGISTICS IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY SOLUTION, 2020-2029 (USD THOUSAND)

TABLE 48 GLOBAL ENERGY & POWER IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 49 GLOBAL MINING & CONSTRUCTION IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 50 GLOBAL MINING & CONSTRUCTION IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY SOLUTION, 2020-2029 (USD THOUSAND)

TABLE 51 GLOBAL MANUFACTURING IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 52 GLOBAL MANUFACTURING IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY SOLUTION, 2020-2029 (USD THOUSAND)

TABLE 53 GLOBAL BFSI IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 54 GLOBAL RETAIL IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 55 GLOBAL RETAIL IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY SOLUTION, 2020-2029 (USD THOUSAND)

TABLE 56 GLOBAL AUTOMOTIVE IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 57 GLOBAL AUTOMOTIVE IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY SOLUTION, 2020-2029 (USD THOUSAND)

TABLE 58 GLOBAL HEALTHCARE IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 59 GLOBAL EDUCATION IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 60 GLOBAL AGRICULTURE & FORESTRY IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 61 GLOBAL AGRICULTURE & FORESTRY IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY SOLUTION, 2020-2029 (USD THOUSAND)

TABLE 62 GLOBAL OTHERS IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 63 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 64 GLOBAL BROADBAND/DATA NETWORKS IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 65 GLOBAL VOICE COMMUNICATIONS NETWORKS IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 66 GLOBAL PRIVATE NETWORK SERVICES NETWORKS IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 67 GLOBAL BROADCAST IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 68 GLOBAL OTHERS IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 69 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 70 NORTH AMERICA VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 71 ASIA-PACIFIC VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 72 EUROPE VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 73 SOUTH AMERICA VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 74 MIDDLE EAST & AFRICA VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

Список рисунков

FIGURE 1 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET: SEGMENTATION

FIGURE 2 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET: DATA TRIANGULATION

FIGURE 3 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET: DROC ANALYSIS

FIGURE 4 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET: DBMR MARKET POSITION GRID

FIGURE 8 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET: MARKET PLATFORM COVERAGE GRID

FIGURE 10 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET: SEGMENTATION

FIGURE 11 NORTH AMERICA IS EXPECTED TO DOMINATE WHEREAS ASIA-PACIFIC IS THE FASTEST-GROWING REGION IN THE GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET IN THE FORECAST PERIOD

FIGURE 12 ASIA-PACIFIC IS THE FASTEST GROWING MARKET FOR GLOBAL VERY SMALL APERTURE TERMINAL MANUFACTURERS IN THE FORECAST PERIOD

FIGURE 13 PROLIFERATION OF SATELLITE-BASED COMMUNICATION IN THE MILITARY AND DEFENSE SECTOR IS EXPECTED TO DRIVE THE GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET IN THE FORECAST PERIOD 2022 TO 2029

FIGURE 14 EQUIPMENT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET IN 2022 & 2029

FIGURE 15 IMPACT OF VARIOUS SATELLITE TECHNOLOGY TRENDS AND INNOVATIONS IN 2022

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET

FIGURE 17 REGIONAL MARKET SHARE IN SERVICE ENTERPRISE FOR THE YEAR 2016

FIGURE 18 GLOBAL SHIPPING LOSSES BY THE NUMBER OF VESSELS OVER THE YEARS

FIGURE 19 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET, SOLUTION, 2021

FIGURE 20 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET, PLATFORM, 2021 (USD THOUSAND)

FIGURE 21 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET, NETWORK ARCHITECTURE, 2021 (USD THOUSAND)

FIGURE 22 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET, FREQUENCY, 2021 (USD THOUSAND)

FIGURE 23 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET, DESIGN, 2021 (USD THOUSAND)

FIGURE 24 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET, VERTICAL, 2021

FIGURE 25 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET, END-USE, 2021 (USD THOUSAND)

FIGURE 26 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET: SNAPSHOT (2021)

FIGURE 27 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET: BY COUNTRY (2021)

FIGURE 28 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET: BY COUNTRY (2022 & 2029)

FIGURE 29 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET: BY COUNTRY (2021 & 2029)

FIGURE 30 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET: BY SOLUTION (2022-2029)

FIGURE 31 NORTH AMERICA VERY SMALL APERTURE TERMINAL (VSAT) MARKET: SNAPSHOT (2021)

FIGURE 32 NORTH AMERICA VERY SMALL APERTURE TERMINAL (VSAT) MARKET: BY COUNTRY (2021)

FIGURE 33 NORTH AMERICA VERY SMALL APERTURE TERMINAL (VSAT) MARKET: BY COUNTRY (2022 & 2029)

FIGURE 34 NORTH AMERICA VERY SMALL APERTURE TERMINAL (VSAT) MARKET: BY COUNTRY (2021 & 2029)

FIGURE 35 NORTH AMERICA VERY SMALL APERTURE TERMINAL (VSAT) MARKET: BY SOLUTION (2022-2029)

FIGURE 36 ASIA-PACIFIC VERY SMALL APERTURE TERMINAL (VSAT) MARKET: SNAPSHOT (2021)

FIGURE 37 ASIA-PACIFIC VERY SMALL APERTURE TERMINAL (VSAT) MARKET: BY COUNTRY (2021)

FIGURE 38 ASIA-PACIFIC VERY SMALL APERTURE TERMINAL (VSAT) MARKET: BY COUNTRY (2022 & 2029)

FIGURE 39 ASIA-PACIFIC VERY SMALL APERTURE TERMINAL (VSAT) MARKET: BY COUNTRY (2021 & 2029)

FIGURE 40 ASIA-PACIFIC VERY SMALL APERTURE TERMINAL (VSAT) MARKET: BY SOLUTION (2022-2029)

FIGURE 41 EUROPE VERY SMALL APERTURE TERMINAL (VSAT) MARKET: SNAPSHOT (2021)

FIGURE 42 EUROPE VERY SMALL APERTURE TERMINAL (VSAT) MARKET: BY COUNTRY (2021)

FIGURE 43 EUROPE VERY SMALL APERTURE TERMINAL (VSAT) MARKET: BY COUNTRY (2022 & 2029)

FIGURE 44 EUROPE VERY SMALL APERTURE TERMINAL (VSAT) MARKET: BY COUNTRY (2021 & 2029)

FIGURE 45 EUROPE VERY SMALL APERTURE TERMINAL (VSAT) MARKET: BY SOLUTION (2022-2029)

FIGURE 46 SOUTH AMERICA VERY SMALL APERTURE TERMINAL (VSAT) MARKET: SNAPSHOT (2021)

FIGURE 47 SOUTH AMERICA VERY SMALL APERTURE TERMINAL (VSAT) MARKET: BY COUNTRY (2021)

FIGURE 48 SOUTH AMERICA VERY SMALL APERTURE TERMINAL (VSAT) MARKET: BY COUNTRY (2022 & 2029)

FIGURE 49 SOUTH AMERICA VERY SMALL APERTURE TERMINAL (VSAT) MARKET: BY COUNTRY (2021 & 2029)

FIGURE 50 SOUTH AMERICA VERY SMALL APERTURE TERMINAL (VSAT) MARKET: BY SOLUTION (2022-2029)

FIGURE 51 MIDDLE EAST & AFRICA VERY SMALL APERTURE TERMINAL (VSAT) MARKET: SNAPSHOT (2021)

FIGURE 52 MIDDLE EAST & AFRICA VERY SMALL APERTURE TERMINAL (VSAT) MARKET: BY COUNTRY (2021)

FIGURE 53 MIDDLE EAST & AFRICA VERY SMALL APERTURE TERMINAL (VSAT) MARKET: BY COUNTRY (2022 & 2029)

FIGURE 54 MIDDLE EAST & AFRICA VERY SMALL APERTURE TERMINAL (VSAT) MARKET: BY COUNTRY (2021 & 2029)

FIGURE 55 MIDDLE EAST & AFRICA VERY SMALL APERTURE TERMINAL (VSAT) MARKET: BY SOLUTION (2022-2029)

FIGURE 56 GLOBAL VERY SMALL APERTURE TERMINAL (VSAT) MARKET: COMPANY SHARE 2021 (%)

FIGURE 57 NORTH AMERICA VERY SMALL APERTURE TERMINAL (VSAT) MARKET: COMPANY SHARE 2021 (%)

FIGURE 58 ASIA-PACIFIC VERY SMALL APERTURE TERMINAL (VSAT) MARKET: COMPANY SHARE 2021 (%)

FIGURE 59 EUROPE VERY SMALL APERTURE TERMINAL (VSAT) MARKET: COMPANY SHARE 2021 (%)

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.