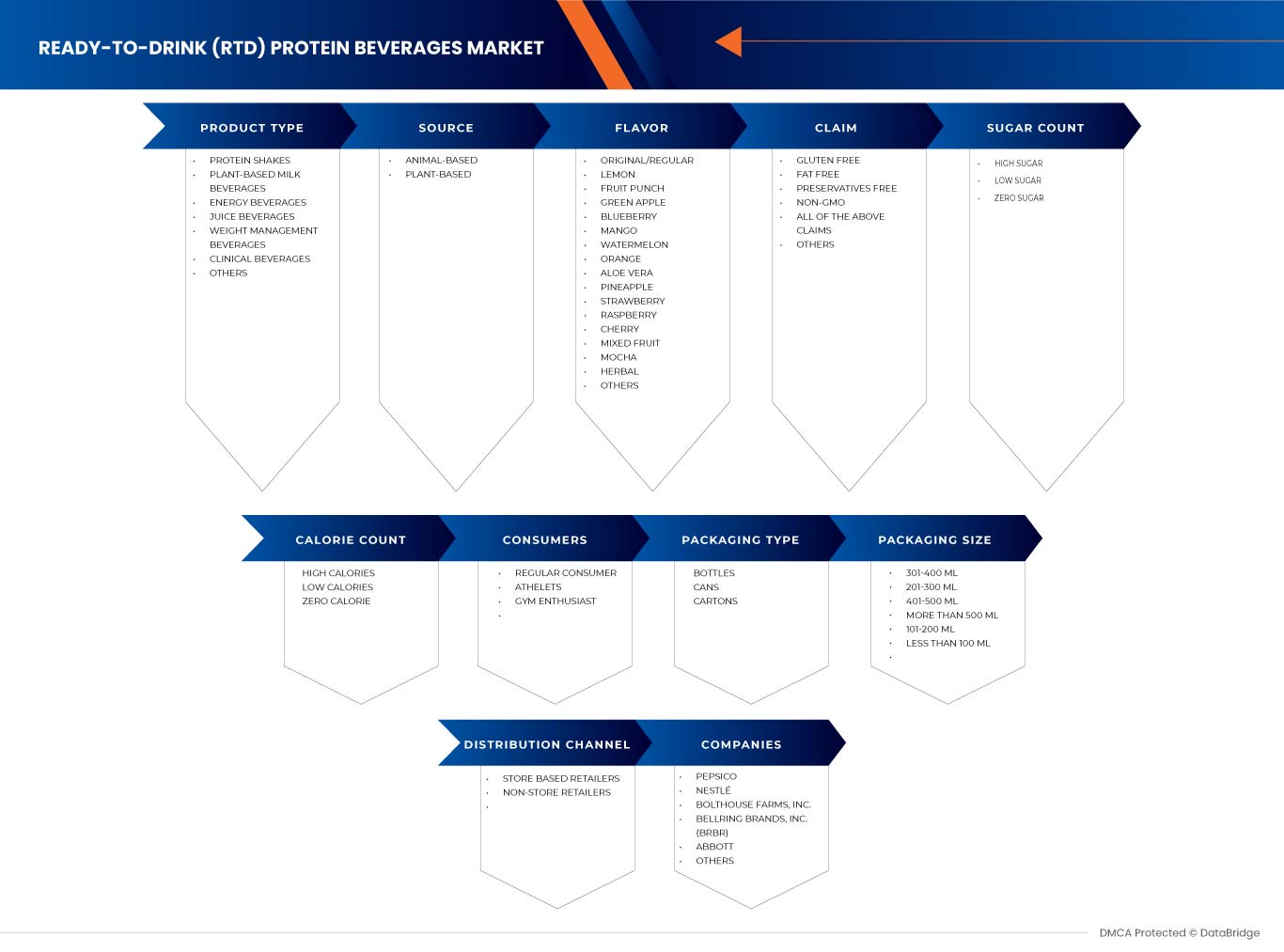

Global Ready-to-Drink (RTD) Protein Beverages Market, By Product Type (Energy Beverages, Juice Beverages, Protein Shakes, Plant-Based Milk Beverages, Weight Management Beverages, Clinical Beverages, and Others), Source (Animal-Based and Plant-Based), Flavor (Orange, Mango, Strawberry, Mixed Fruit, Pineapple, Lemon, Raspberry, Original/Regular, Watermelon, Blueberry, Fruit Punch, Mocha, Green Apple, Cherry, Herbal, Aloe Vera, and Others), Calorie Count (Low Calories, High Calories, and Zero Calorie), Consumers (Gym Enthusiast, Athletes, and Regular Consumer), Claim (Preservatives Free, Gluten Free, Non-GMO, Fat Free, All of the Above Claims, and Others), Sugar Count (Low Sugar, High Sugar, and Zero Sugar), Packaging Type (Bottles, Cans, and Cartons), Packaging Size (201-300 ml, 301-400 ml, 401-500 ml, More than 500 ml, 101-200 ml, and Less than 100 ml), Distribution Channel (Non-Store Retailers and Store Based Retailers) - Industry Trends and Forecast to 2030.

Ready-To-Drink (RTD) Protein Beverages Market Analysis and Insights

The key factor fueling the market expansion for Ready-to-Drink (RTD) protein beverages is the increasing demand for healthy and protein-rich diets across the globe. Rising trends of convenience and on-the-go lifestyles are other factors driving the market growth. In addition, rapid technological advancements and miniaturization in manufacturing RTD protein drinks are likely to fuel market growth. The increase in the R&D efforts and the modernization of released recently products on the market will open up more business potential for the market.

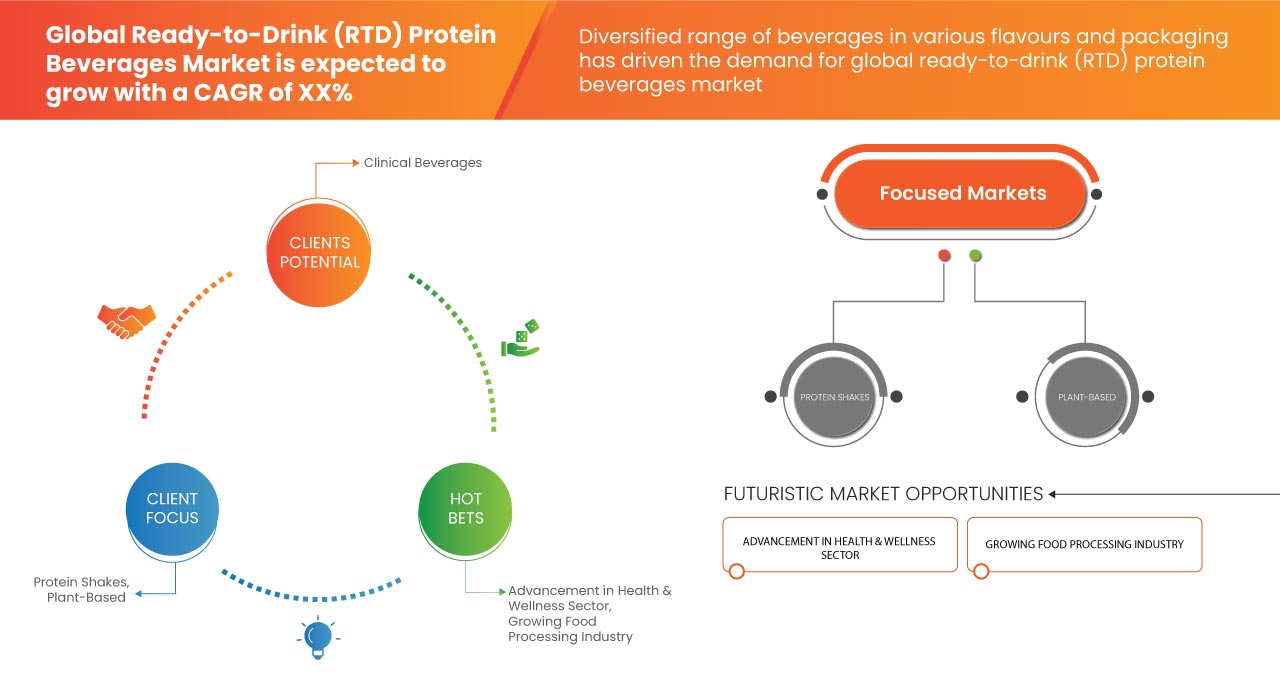

The major restraint impacting the market growth is uncertainty and volatility in the prices of RTD protein beverages. Further, the availability of other substitutes will also restrain the market growth. The diversified range of beverages in various flavors and packaging is providing opportunities for market growth. However, the stringent government rules and regulations related to RTD protein beverages and intense competition among market players are expected to pose a challenge to market growth.

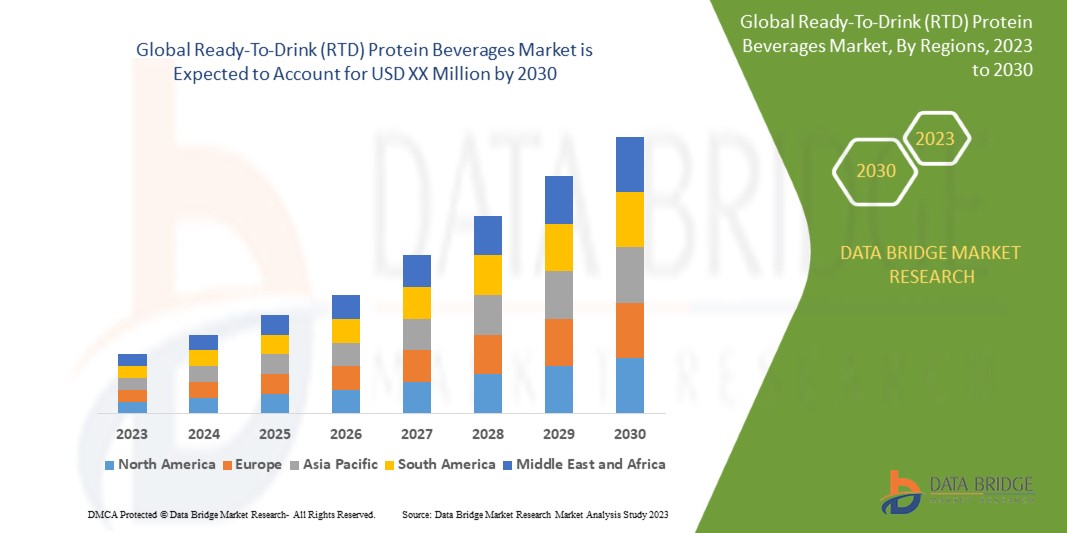

Data Bridge Market Research analyzes that the global ready-to-drink (RTD) protein beverages market will grow at a CAGR of 6.4% during the forecast period of 2023 to 2030.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015 - 2020) |

|

Quantitative Units |

Revenue in USD Million |

|

Segments Covered |

Product Type (Energy Beverages, Juice Beverages, Protein Shakes, Plant-Based Milk Beverages, Weight Management Beverages, Clinical Beverages, and Others), Source (Animal-Based and Plant-Based), Flavor (Orange, Mango, Strawberry, Mixed Fruit, Pineapple, Lemon, Raspberry, Original/Regular, Watermelon, Blueberry, Fruit Punch, Mocha, Green Apple, Cherry, Herbal, Aloe Vera, and Others), Calorie Count (Low Calories, High Calories, and Zero Calorie), Consumers (Gym Enthusiast, Athletes, and Regular Consumer), Claim (Preservatives Free, Gluten Free, Non-GMO, Fat Free, All of the Above Claims, and Others), Sugar Count (Low Sugar, High Sugar, and Zero Sugar), Packaging Type (Bottles, Cans, and Cartons), Packaging Size (201-300 ml, 301-400 ml, 401-500 ml, More than 500 ml, 101-200 ml, and Less than 100 ml), Distribution Channel (Non-Store Retailers and Store Based Retailers) |

|

Countries Covered |

U.S., Canada, Mexico, Germany, U.K., Italy, France, Spain, Switzerland, Netherlands, Belgium, Russia, Turkey, Rest of Europe, Japan, China, South Korea, India, Vietnam, Australia, Singapore, Thailand, Indonesia, Malaysia, Philippines, Rest of Asia-Pacific, Brazil, Argentina, Rest of South America, South Africa, Egypt, U.A.E., Saudi Arabia, Kuwait, and Rest of Middle East and Africa |

|

Market Players Covered |

USN - Ultimate Sports Nutrition, QNT SA, Bolthouse Farms, Inc., Huel Limited, Upbeat Drinks Ltd, UFIT High Protein Drinks, Shakes & Snacks, KRÜGER GROUP, GRENADE [UK] LIMITED, Nestlé, PepsiCo, Abbott, Optimum Nutrition, Danone S.A., BELLRING BRANDS, INC. (BRBR), Jake Nutritionals B.V., Amway Corp, Organicobeverages, AQUATEIN, Nutramino, and The Alternativive Company among others |

Market Definition

Ready-to-drink (RTD) protein beverages are pre-formulated, conveniently packaged liquid products which provide a sufficient and convenient source of protein intake. These beverages are typically designed for individuals who lead busy lifestyles, engage in physical activities, or require a convenient protein supplement. RTD protein beverages often come in various flavors and formulations, including whey, plant-based, and collagen-based proteins.

The global market for ready-to-drink (RTD) protein beverages market has witnessed substantial growth in recent years, driven by evolving consumer preferences toward healthier lifestyles and increased demand for convenient, on-the-go nutritional options. The RTD protein beverages segment has emerged as a key player in the functional beverage industry as health-conscious consumers increasingly prioritize protein consumption for muscle recovery, weight management, and overall well-being.

Global Ready-to-Drink (RTD) Protein Beverages Market Dynamics

Drivers

- Rising Trend of Convenience and on-the-Go Lifestyles

В последние годы заметный сдвиг в предпочтениях потребителей в сторону удобства и потребления на ходу стимулировал рост различных отраслей, включая мировой рынок готовых к употреблению (RTD) протеиновых напитков. Эта тенденция является ответом на быстрый темп современного образа жизни, когда потребители ищут питательные и богатые белком варианты, которые можно удобно употреблять в любое время. Готовые к употреблению протеиновые напитки предлагают решение, объединяя питательные преимущества белка с удобством портативных, предварительно упакованных напитков. Урбанизация, более плотный график, более длительные поездки на работу и возросшие требования к работе привели к значительному изменению поведения потребителей. В результате потребители все чаще ищут продукты, которые соответствуют их быстрому темпу жизни, делая удобство главным приоритетом. Более того, нехватка времени побудила потребителей искать быстрые и простые решения для удовлетворения своих потребностей в питании. Традиционные модели питания изменились, и перекусы и потребление на ходу стали более распространенными.

Готовые к употреблению протеиновые напитки предлагают удобный источник белка, не требующий приготовления. Эти напитки часто обогащаются другими необходимыми питательными веществами, витаминами и минералами, что делает их хорошо сбалансированной заменой еды или вариантом перекуса на ходу.

Готовые к употреблению протеиновые напитки предназначены для широкого круга потребителей: от любителей фитнеса и спортсменов до занятых профессионалов и людей, заботящихся о своем здоровье. Они могут использоваться в качестве пред- или посттренировочных вариантов, перекусов в середине дня или даже как часть сбалансированного приема пищи.

Глобальный рынок готовых к употреблению (RTD) протеиновых напитков переживает устойчивый рост из-за растущей популярности удобного и активного образа жизни. Готовые к употреблению протеиновые напитки стали удобным и питательным решением, поскольку потребители отдают предпочтение богатым питательными веществами портативным вариантам, которые соответствуют их плотному графику. Таким образом, ожидается, что рост потребления готовых к употреблению протеиновых напитков будет способствовать росту рынка во всем мире.

- Растущая тенденция к здоровому и богатому белком питанию

В последние годы наблюдается значительный сдвиг в предпочтениях потребителей в сторону более здорового образа жизни и осведомленности о питании. Этот сдвиг подстегнул тенденцию к росту потребления богатых белком диет, что впоследствии привело к росту рынка. Готовые к употреблению протеиновые напитки предлагают удобный и легкодоступный источник белка для потребителей, находящихся в движении, идеально вписываясь в их напряженный образ жизни и заботу о своем здоровье. Растущее внимание к здоровью и благополучию привело к тому, что потребители стали искать диетические варианты, которые поддерживают их цели в фитнесе и общее благополучие. Белок является важнейшим макроэлементом, который играет решающую роль в восстановлении мышц, поддержании их здоровья и общих функциях организма. Люди включают богатые белком диеты в свою повседневную жизнь, поскольку они становятся более активными в управлении своим здоровьем. Эта тенденция в значительной степени обусловлена энтузиастами фитнеса, спортсменами и теми, кто стремится достичь целей по контролю веса.

Растущая тенденция здорового и богатого белком питания является движущей силой роста рынка. Растущее внимание потребителей к здоровью и благополучию в сочетании с удобством и разнообразием, предлагаемыми этими напитками, привело к их широкому принятию. Таким образом, ожидается, что растущая тенденция здорового и богатого белком питания будет способствовать росту рынка.

Возможность

-

Разнообразный ассортимент напитков с различными вкусами и упаковками

Глобальный рынок готовых к употреблению (RTD) протеиновых напитков переживает значительный рост, обусловленный такими факторами, как возросшая осведомленность о здоровье и фитнесе, а также ориентированный на удобство образ жизни. Способность отрасли предлагать разнообразный ассортимент напитков с различными вкусами и вариантами упаковки создает дополнительные возможности для роста рынка. Предложение широкого спектра вкусов позволяет производителям удовлетворять разнообразные предпочтения потребителей. У разных людей разные вкусовые предпочтения, и наличие разнообразного ассортимента вкусов помогает гарантировать, что найдется что-то для каждого. Постоянные инновации в профилях вкусов привносят новизну и волнение на рынок, побуждая потребителей пробовать новые продукты. Уникальные и экзотические вкусы могут пробудить любопытство потребителей и стимулировать повторные покупки. Более того, адаптация вкусов к определенным демографическим группам, таким как дети, спортсмены или люди с ограничениями в питании, может расширить потребительскую базу. Вкусы, разработанные для определенных возрастных групп или образа жизни, могут привлечь новых клиентов и увеличить проникновение на рынок.

Кроме того, разнообразные форматы упаковки, такие как бутылки, банки, тетра-пакеты и пакеты , удовлетворяют различные потребности потребителей в удобстве и портативности. Различные варианты упаковки позволяют потребителям выбирать формат, который лучше всего подходит для их активного образа жизни. Инновации в упаковке могут помочь позиционировать готовые к употреблению протеиновые напитки для определенных случаев потребления, например, повторно закрывающиеся пакеты могут быть идеальными для потягивания в течение дня, в то время как банки или бутылки могут быть нацелены на восстановление после тренировки. Уникальный дизайн упаковки и маркировка способствуют визуальной привлекательности продукта и могут эффективно передавать индивидуальность и сообщение бренда. Привлекательная упаковка может привлечь потребителей и способствовать узнаваемости бренда.

Производители могут привлечь новых потребителей, которые ранее могли быть не заинтересованы в протеиновых напитках, обслуживая более широкий спектр вкусовых предпочтений и сценариев потребления. Уникальные вкусы и премиальная упаковка могут позиционировать продукты как премиальные предложения, позволяя производителям реализовывать более высокие ценовые стратегии и повышать прибыльность.

Разнообразный ассортимент напитков с различными вкусами и вариантами упаковки представляет значительные возможности для роста рынка. Производители могут завоевать интерес потребителей, расширить свою потребительскую базу и позиционировать себя как лидеров на этом процветающем и конкурентном рынке, постоянно внедряя инновации и предлагая уникальные вкусовые профили, а также универсальные упаковочные решения.

Сдержанность/Вызов

- Строгие правила со стороны различных органов власти

Глобальный рынок готовых к употреблению (RTD) протеиновых напитков значительно вырос из-за увеличения потребительского спроса на продукты для фитнеса и оздоровления. Однако этот рост сопровождался значительными проблемами, связанными с нормативными проблемами. Строгие правила, введенные различными органами власти, могут повлиять на расширение рынка.

Эти правила, направленные на обеспечение безопасности потребителей, качества продукции и точной маркировки, создают препятствия для производителей в секторе готовых к употреблению протеиновых напитков. Готовые к употреблению протеиновые напитки часто содержат различные ингредиенты, включая растительные белки, витамины и минералы. Надлежащий контроль аллергенов необходим для предотвращения перекрестного загрязнения и воздействия аллергенов. Правила требуют от производителей четко перечислять аллергены, присутствующие в продукте, и принимать меры для предотвращения непреднамеренного присутствия аллергенов.

Регулирующие органы устанавливают строгие стандарты безопасности и качества пищевых продуктов для защиты потребителей от потенциальных рисков для здоровья. Это включает в себя руководящие принципы по производственной практике, источникам ингредиентов и контролю качества. Производители готовых к употреблению протеиновых напитков должны придерживаться этих стандартов, чтобы гарантировать безопасность своей продукции. Более того, включение новых ингредиентов и добавок в готовые к употреблению протеиновые напитки, таких как растительные белки и функциональные ингредиенты, может потребовать одобрения регулирующих органов перед коммерческим использованием. Этот процесс может быть длительным и дорогостоящим, что может замедлить разработку продукта и выход на рынок.

Строгие правила могут замедлить инновации и разработку новых готовых к употреблению протеиновых напитков. Производители могут столкнуться с задержками в получении разрешений на новые ингредиенты и формулы, что повлияет на их способность удовлетворять меняющиеся требования потребителей.

Хотя строгие правила создают проблемы для роста рынка, они необходимы для обеспечения безопасности потребителей, качества продукции и точной информации. Производители должны уделять первостепенное внимание соблюдению требований, инвестировать в НИОКР и поддерживать прозрачность, чтобы успешно преодолевать эти нормативные препятствия.

Последние события

- В мае 2023 года компания Upbeat Drinks Ltd. выпустила новую готовую к употреблению смесь кофеина и белка Sour Berry Protein Energy. Негазированный, прозрачный напиток из сывороточного изолята в бутылках содержит все девять незаменимых аминокислот , 4000 мг BCAA и комплекс витаминов группы B. Он расширил продуктовый портфель компании.

- В марте 2023 года Premier Protein, являющийся брендом BELLRINGS BRANDS, INC. (BRBR), выпустив НОВЫЙ порошок растительного белка, вышел на рынок веганского белка с его популярным вкусом, разумной ценой и понятными питательными характеристиками. Такой запуск продукта привлечет новую потребительскую базу.

- В июне 2022 года Evolve анонсировала новую программу, направленную на сохранение окружающей среды, предлагая всем людям доступ к природе. Обязательство «Plant-Based for the Outdoors» состоит из трех основных направлений: обновление упаковки продукции с целью включения большего количества растительных материалов, закупка гороха, выращенного в экологически чистых условиях, для протеиновых коктейлей Evolve и сотрудничество с некоммерческой организацией One Tree Planted с целью сделать такие города, как Нью-Йорк, Лос-Анджелес и Чикаго, более зелеными. Кампания стартует 5 июня 2022 года, во Всемирный день окружающей среды. Такого рода инициативы помогли компании привлечь больше внимания потребителей и новую потребительскую базу.

Масштаб мирового рынка готовых к употреблению протеиновых напитков

Глобальный рынок готовых к употреблению (RTD) протеиновых напитков сегментирован на десять заметных сегментов на основе типа продукта, источника, вкуса, количества калорий, потребителей, претензий, количества сахара, типа упаковки, размера упаковки и канала сбыта. Рост среди этих сегментов поможет вам проанализировать основные сегменты роста в отраслях и предоставить пользователям ценный обзор рынка и рыночные идеи для принятия стратегических решений по определению основных рыночных приложений.

Тип продукта

- Энергетические напитки

- Сокосодержащие напитки

- Протеиновые коктейли

- Молочные напитки на растительной основе

- Напитки для контроля веса

- Клинические напитки

- Другие

По типу продукции рынок сегментируется на энергетические напитки, сокосодержащие напитки, протеиновые коктейли, напитки на растительной основе, напитки для контроля веса, клинические напитки и другие.

Источник

- На растительной основе

- На основе животных

По источнику рынок сегментируется на растительный и животный.

Вкус

- Апельсин

- манго

- Клубника

- Фруктовый микс

- Ананас

- Лимон

- Малина

- Оригинальный/Обычный

- Арбуз

- Черника

- Фруктовый пунш

- Мокко

- Зелёное яблоко

- вишня

- Травяной

- Алоэ Вера

- Другие

По вкусу рынок сегментирован на следующие виды: апельсин, манго, клубника, фруктовый микс, ананас, лимон, малина, оригинальный/обычный, арбуз, черника, фруктовый пунш, мокко, зеленое яблоко, вишня, травяной, алоэ вера и другие.

Количество калорий

- Высококалорийный

- Низкокалорийный

- Ноль калорий

По количеству калорий рынок сегментируется на высококалорийные, низкокалорийные и бескалорийные.

Потребители

- Постоянный потребитель

- Спортсмены

- Любитель спортзала

По типу потребителей рынок сегментируется на обычных потребителей, спортсменов и любителей тренажерных залов.

Требовать

- Без консервантов

- Не содержит глютен

- Не-ГМО

- Обезжиренный

- Все вышеуказанные утверждения

- Другие

На основе заявлений рынок сегментируется на продукты без консервантов, без глютена, без ГМО, без жиров, со всеми вышеперечисленными заявлениями и другие.

Количество сахара

- Низкое содержание сахара

- Высокий уровень сахара

- Без сахара

По содержанию сахара рынок сегментируется на продукты с низким содержанием сахара, с высоким содержанием сахара и без сахара.

Тип упаковки

- Бутылки

- Банки

- Cartons

On the basis of packaging type, the market is segmented into bottles, cans, and cartons.

Packaging Size

- 201-300 ml

- 301-400 ml

- 401-500 ml

- More than 500 ml

- 101-200 ml

- Less than 100 ml

On the basis of packaging size, the market is segmented into 201-300 ml, 301-400 ml, 401-500 ml, more than 500 ml, 101-200 ml, and less than 100 ml.

Distribution Channel

- Non-store Retailers

- Store Based Retailers

On the basis of distribution channel, the market is segmented into non-store retailers and store based retailers.

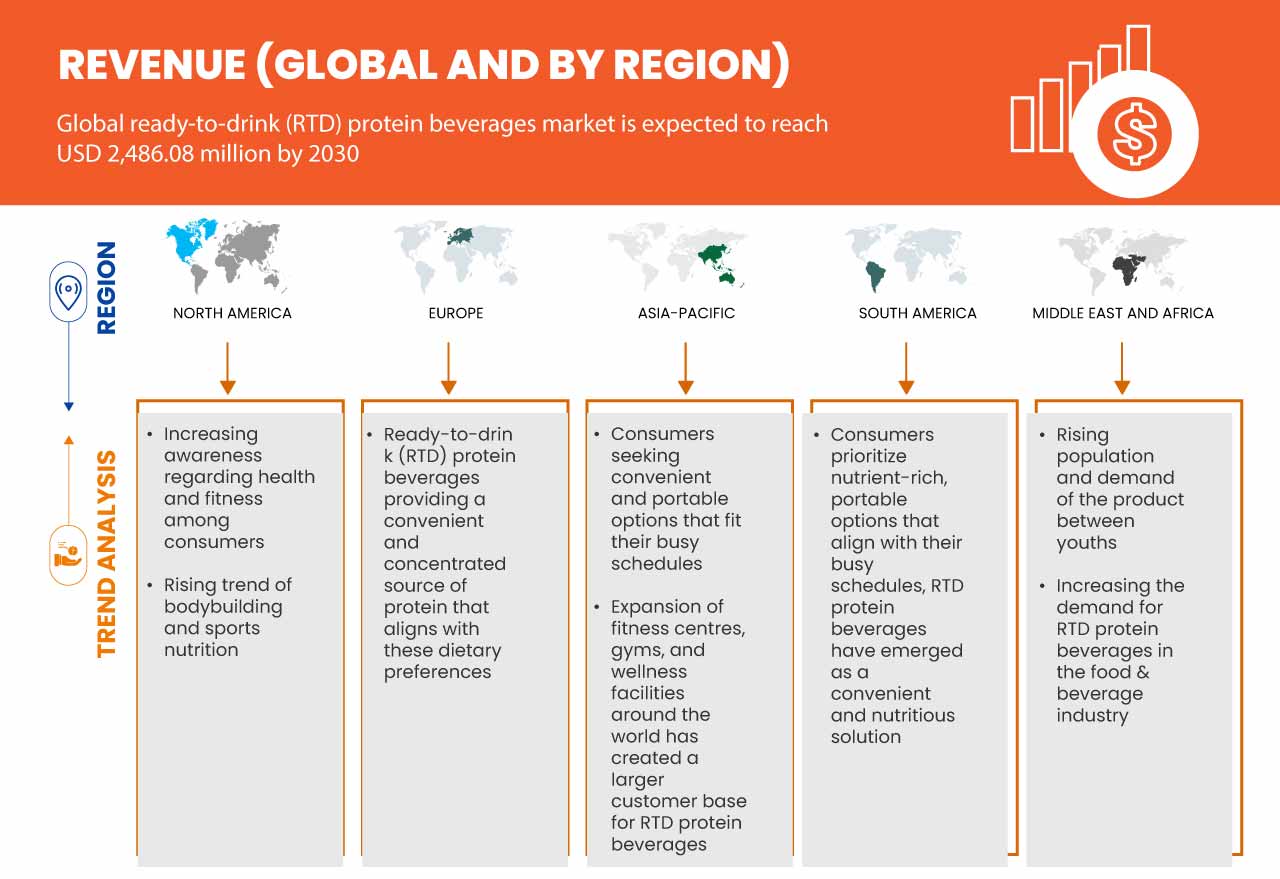

Global Ready-to-Drink (RTD) Protein Beverages Market Regional Analysis/Insights

The global ready-to-drink (RTD) protein beverages market is segmented into ten notable segments based on product type, source, flavor, calorie count, consumers, claim, sugar count, packaging type, packaging size, and distribution channel.

The countries covered in the global ready-to-drink (RTD) protein beverages market report are U.S., Canada, Mexico, Germany, U.K., Italy, France, Spain, Switzerland, Netherlands, Belgium, Russia, Turkey, Rest of Europe, Japan, China, South Korea, India, Vietnam, Australia, Singapore, Thailand, Indonesia, Malaysia, Philippines, Rest of Asia-Pacific, Brazil, Argentina, Rest of South America, South Africa, Egypt, U.A.E., Saudi Arabia, Kuwait, and Rest of Middle East and Africa.

North America is expected to dominate the global ready-to-drink (RTD) protein beverages market in terms of market share and market revenue. It is estimated to maintain its dominance during the forecast period due to the growing surge for RTD protein beverages in various industries and growing consumer demand from end users. U.S. is expected to dominate the market in the North America region due to the increasing number of users and manufacturers. China is expected to dominate the market in the Asia-Pacific region due to the increasing investments by manufacturers in terms of product manufacturing. Germany is expected to dominate the market in the Europe region due to the increasing awareness related to health.

The region section of the report also provides individual market-impacting factors and changes in regulations in the market that impact the current and future trends of the market. Data points, such as new and replacement sales, country demographics, disease epidemiology, and import-export tariffs, are some of the major pointers used to forecast the market scenario for individual countries. In addition, the presence and availability of global brands and their challenges faced due to high competition from local and domestic brands, and the impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Global Ready-to-Drink (RTD) Protein Beverages Market Share Analysis

Конкурентная среда мирового рынка готовых к употреблению (RTD) протеиновых напитков содержит сведения о конкурентах. Подробности включают обзор компании, финансовые показатели компании, полученный доход, рыночный потенциал, инвестиции в исследования и разработки, новые рыночные инициативы, глобальное присутствие, производственные площадки и объекты, производственные мощности, сильные и слабые стороны компании, запуск продукта, широту и широту продукта и доминирование в применении . Вышеуказанные пункты данных связаны только с фокусом компаний на рынке.

Некоторые из основных игроков, работающих на рынке готовых к употреблению (RTD) протеиновых напитков, включают USN - Ultimate Sports Nutrition, QNT SA, Bolthouse Farms, Inc., Huel Limited, Upbeat Drinks Ltd, UFIT High Protein Drinks, Shakes & Snacks, KRÜGER GROUP, GRENADE [UK] LIMITED, Nestlé, PepsiCo, Abbott, Optimum Nutrition, Danone SA, BELLRING BRANDS, INC. (BRBR), Jake Nutritionals BV, Amway Corp, Organicobeverages, AQUATEIN, Nutramino и The Alternativive Company и другие.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Содержание

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE GLOBAL READY-TO-DRINK (RTD) PROTEIN BEVERAGES MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.7 DBMR MARKET POSITION GRID

2.8 MULTIVARIATE MODELLING

2.9 TYPE LIFELINE CURVE

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 FACTORS INFLUENCING PURCHASING DECISION OF CUSTOMERS

4.1.1 PRODUCT PRICING

4.1.2 MARKETING CAMPAIGNS

4.1.3 ECONOMIC CONDITIONS

4.1.4 AUTHENTICITY OF PRODUCTS

4.1.5 NUTRITIONAL CONTENT

4.2 IMPORT-EXPORT ANALYSIS

4.3 PRICE INDEX

4.4 PRODUCTION CONSUMPTION ANALYSIS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISING TREND OF CONVENIENCE AND ON-THE-GO LIFESTYLES

5.1.2 INCREASING TREND OF HEALTHY AND PROTEIN-RICH DIETS

5.2 RESTRAINTS

5.2.1 PRICE SENSITIVITY OF VARIOUS PRODUCTS

5.2.2 AVAILABILITY OF OTHER PROTEIN SUBSTITUTES

5.3 OPPORTUNITIES

5.3.1 DIVERSIFIED RANGE OF BEVERAGES IN VARIOUS FLAVOURS AND PACKAGING

5.3.2 RISING DEMAND FOR VEGAN AND PLANT-BASED DIETS

5.4 CHALLENGES

5.4.1 STRINGENT REGULATIONS BY VARIOUS AUTHORITIES

5.4.2 STIFF COMPETITION AMONG KEY MARKET PLAYERS

6 GLOBAL READY-TO-DRINK (RTD) PROTEIN BEVERAGES MARKET, BY REGION

6.1 OVERVIEW

6.2 NORTH AMERICA

6.3 EUROPE

6.4 ASIA-PACIFIC

6.5 SOUTH AMERICA

6.6 MIDDLE EAST & AFRICA

7 COMPANY LANDSCAPE

7.1 COMPANY SHARE ANALYSIS: GLOBAL

7.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

7.3 COMPANY SHARE ANALYSIS: EUROPE

7.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

8 SWOT ANALYSIS

9 COMPANY PROFILES

9.1 PEPSICO

9.1.1 COMPANY SNAPSHOT

9.1.2 REVENUE ANALYSIS

9.1.3 COMPANY SHARE ANALYSIS

9.1.4 PRODUCT PORTFOLIO

9.1.5 RECENT DEVELOPMENT

9.2 NESTLÉ

9.2.1 COMPANY SNAPSHOT

9.2.2 REVENUE ANALYSIS

9.2.3 COMPANY SHARE ANALYSIS

9.2.4 PRODUCT PORTFOLIO

9.2.5 RECENT DEVELOPMENT

9.3 BOLTHOUSE FARMS, INC.

9.3.1 COMPANY SNAPSHOT

9.3.2 COMPANY SHARE ANALYSIS

9.3.3 PRODUCT PORTFOLIO

9.3.4 RECENT DEVELOPMENT

9.4 BELLRING BRANDS, INC. (BRBR)

9.4.1 COMPANY SNAPSHOT

9.4.2 REVENUE ANALYSIS

9.4.3 COMPANY SHARE ANALYSIS

9.4.4 PRODUCT PORTFOLIO

9.4.5 RECENT DEVELOPMENTS

9.5 ABBOTT

9.5.1 COMPANY SNAPSHOT

9.5.2 REVENUE ANALYSIS

9.5.3 COMPANY SHARE ANALYSIS

9.5.4 PRODUCT PORTFOLIO

9.5.5 RECENT DEVELOPMENTS

9.6 AMWAY CORP..

9.6.1 COMPANY SNAPSHOT

9.6.2 PRODUCT PORTFOLIO

9.6.3 RECENT DEVELOPMENT

9.7 AQUATEIN

9.7.1 COMPANY SNAPSHOT

9.7.2 PRODUCT PORTFOLIO

9.7.3 RECENT DEVELOPMENT

9.8 DANONE S.A.

9.8.1 COMPANY SNAPSHOT

9.8.2 REVENUE ANALYSIS

9.8.3 PRODUCT PORTFOLIO

9.8.4 RECENT DEVELOPMENT

9.9 GRENADE [UK] LIMITED

9.9.1 COMPANY SNAPSHOT

9.9.2 PRODUCT PORTFOLIO

9.9.3 RECENT DEVELOPMENTS

9.1 HUEL LIMITED

9.10.1 COMPANY SNAPSHOT

9.10.2 PRODUCT PORTFOLIO

9.10.3 RECENT DEVELOPMENT

9.11 JAKE NUTRITIONALS B.V.

9.11.1 COMPANY SNAPSHOT

9.11.2 PRODUCT PORTFOLIO

9.11.3 RECENT DEVELOPMENT

9.12 KRÜGER GROUP

9.12.1 COMPANY SNAPSHOT

9.12.2 PRODUCT PORTFOLIO

9.12.3 RECENT DEVELOPMENTS

9.13 NUTRAMINO

9.13.1 COMPANY SNAPSHOT

9.13.2 PRODUCT PORTFOLIO

9.13.3 RECENT DEVELOPMENT

9.14 OPTIMUM NUTRITION

9.14.1 COMPANY SNAPSHOT

9.14.2 PRODUCT PORTFOLIO

9.14.3 RECENT DEVELOPMENT

9.15 ORGANICOBEVERAGES

9.15.1 COMPANY SNAPSHOT

9.15.2 PRODUCT PORTFOLIO

9.15.3 RECENT DEVELOPMENT

9.16 QNT SA

9.16.1 COMPANY SNAPSHOT

9.16.2 PRODUCT PORTFOLIO

9.16.3 RECENT DEVELOPMENTS

9.17 THE ALTERNATIVIVE COMPANY

9.17.1 COMPANY SNAPSHOT

9.17.2 PRODUCT PORTFOLIO

9.17.3 RECENT DEVELOPMENT

9.18 UFIT HIGH PROTEIN DRINKS, SHAKES & SNACKS

9.18.1 COMPANY SNAPSHOT

9.18.2 PRODUCT PORTFOLIO

9.18.3 RECENT DEVELOPMENTS

9.19 UPBEAT DRINKS LTD

9.19.1 COMPANY SNAPSHOT

9.19.2 PRODUCT PORTFOLIO

9.19.3 RECENT DEVELOPMENT

9.2 USN - ULTIMATE SPORTS NUTRITION

9.20.1 COMPANY SNAPSHOT

9.20.2 PRODUCT PORTFOLIO

9.20.3 RECENT DEVELOPMENT

10 QUESTIONNAIRE

11 RELATED REPORTS

Список таблиц

TABLE 1 IMPORT DATA OF WORLD AND TOP 5 COUNTRIES (2022) FOR "PROTEIN CONCENTRATES AND TEXTURED PROTEIN SUBSTANCES"; HS CODE OF PRODUCT: 210610

TABLE 2 IMPORT DATA OF WORLD AND TOP 5 COUNTRIES (2022) FOR "PROTEIN CONCENTRATES AND TEXTURED PROTEIN SUBSTANCES"; HS CODE OF PRODUCT: 210610

TABLE 3 EXPORT DATA OF WORLD AND TOP 5 COUNTRIES (2022) FOR " PROTEIN CONCENTRATES AND TEXTURED PROTEIN SUBSTANCES"; HS CODE OF PRODUCT: 210610

TABLE 4 EXPORT DATA OF WORLD AND TOP 5 COUNTRIES (2022) FOR " PROTEIN CONCENTRATES AND TEXTURED PROTEIN SUBSTANCES"; HS CODE OF PRODUCT: 210610

TABLE 5 GLOBAL READY-TO-DRINK (RTD) PROTEIN BEVERAGES MARKET, BY REGION, 2021-2030, AVERAGE SELLING PRICE (USD/TONS)

Список рисунков

FIGURE 1 GLOBAL READY-TO-DRINK (RTD) PROTEIN BEVERAGES MARKET: SEGMENTATION

FIGURE 2 GLOBAL READY-TO-DRINK (RTD) PROTEIN BEVERAGES MARKET: DATA TRIANGULATION

FIGURE 3 GLOBAL READY-TO-DRINK (RTD) PROTEIN BEVERAGES MARKET: DROC ANALYSIS

FIGURE 4 GLOBAL READY-TO-DRINK (RTD) PROTEIN BEVERAGES MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 GLOBAL READY-TO-DRINK (RTD) PROTEIN BEVERAGES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 GLOBAL READY-TO-DRINK (RTD) PROTEIN BEVERAGES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 GLOBAL READY-TO-DRINK (RTD) PROTEIN BEVERAGES MARKET: DBMR MARKET POSITION GRID

FIGURE 8 GLOBAL READY-TO-DRINK (RTD) PROTEIN BEVERAGES MARKET: SEGMENTATION

FIGURE 9 NORTH AMERICA REGION IS EXPECTED TO DOMINATE THE GLOBAL READY-TO-DRINK (RTD) PROTEIN BEVERAGES MARKET AND ASIA-PACIFIC IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 10 THE RISING TREND OF CONVENIENCE AND ON-THE-GO LIFESTYLES IS DRIVING THE GROWTH OF THE GLOBAL READY-TO-DRINK (RTD) PROTEIN BEVERAGES MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 11 PROTEIN SHAKES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE GLOBAL READY-TO-DRINK (RTD) PROTEIN BEVERAGES MARKET IN 2023 AND 2030

FIGURE 12 ASIA-PACIFC IS THE FASTEST-GROWING MARKET FOR READY-TO-DRINK (RTD) PROTEIN BEVERAGES MANUFACTURERS IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE GLOBAL READY-TO-DRINK (RTD) PROTEIN BEVERAGES MARKET

FIGURE 14 GLOBAL READY-TO-DRINK (RTD) PROTEIN BEVERAGES MARKET: SNAPSHOT (2022)

FIGURE 15 NORTH AMERICA READY-TO-DRINK (RTD) PROTEIN BEVERAGES MARKET: SNAPSHOT (2022)

FIGURE 16 EUROPE READY-TO-DRINK (RTD) PROTEIN BEVERAGES MARKET: SNAPSHOT (2022)

FIGURE 17 ASIA-PACIFIC READY-TO-DRINK (RTD) PROTEIN BEVERAGES MARKET: SNAPSHOT (2022)

FIGURE 18 SOUTH AMERICA READY-TO-DRINK (RTD) PROTEIN BEVERAGES MARKET: SNAPSHOT (2022)

FIGURE 19 MIDDLE EAST & AFRICA READY-TO-DRINK (RTD) PROTEIN BEVERAGES MARKET: SNAPSHOT (2022)

FIGURE 20 GLOBAL READY-TO-DRINK (RTD) PROTEIN BEVERAGES MARKET: COMPANY SHARE 2022 (%)

FIGURE 21 NORTH AMERICA READY-TO-DRINK (RTD) PROTEIN BEVERAGES MARKET: COMPANY SHARE 2022 (%)

FIGURE 22 EUROPE READY-TO-DRINK (RTD) PROTEIN BEVERAGES MARKET: COMPANY SHARE 2022 (%)

FIGURE 23 ASIA-PACIFIC READY-TO-DRINK (RTD) PROTEIN BEVERAGES MARKET: COMPANY SHARE 2022 (%)

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.