Global Ready To Drink High Strength Premixes Market

Размер рынка в млрд долларов США

CAGR :

%

USD

39.85 Billion

USD

54.12 Billion

2024

2032

USD

39.85 Billion

USD

54.12 Billion

2024

2032

| 2025 –2032 | |

| USD 39.85 Billion | |

| USD 54.12 Billion | |

|

|

|

Глобальный рынок готовых к употреблению/крепких премиксов, сегментация по типу (напитки RTD на основе солода, RTD на основе спирта, RTD на основе вина и другие), типу обработки (однокомпонентные и смешанные), полу (мужские и женские), типу упаковки (бутылки, банки и другие), торговле (внешняя торговля, внутренняя торговля) — тенденции отрасли и прогноз до 2032 г.

Анализ рынка готовых к употреблению/высококачественных премиксов

Категория готовых к употреблению напитков (RTD) претерпела несколько критических изменений в ответ на меняющуюся динамику предпочтений и привычек потребителей в отношении употребления спиртных напитков во всем мире. Несмотря на значительную критику, большие успехи, достигнутые в спросе и маркетинге алкогольной продукции, заслужили почетное место в категории RTD. Импульс спроса не сильно потерял блеск из-за высокого уровня удобства, предоставляемого потребителям, которые сыграли важную роль в подпитке популярности простых в приготовлении алкогольных напитков.

Размер рынка готовых к употреблению/высококонцентрированных премиксов

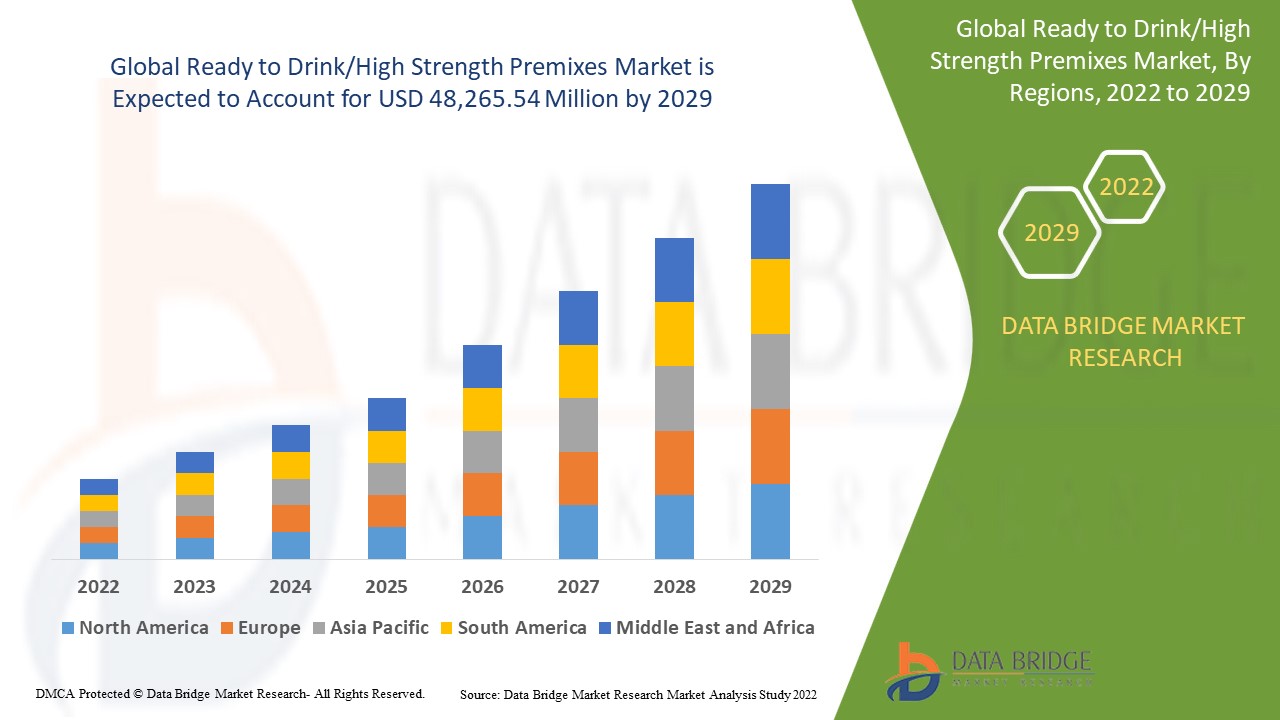

Объем мирового рынка готовых к употреблению/крепких премиксов в 2024 году оценивался в 39,85 млрд долларов США и, по прогнозам, достигнет 54,12 млрд долларов США к 2032 году, при этом среднегодовой темп роста составит 3,90% в прогнозируемый период с 2025 по 2032 год.

Область отчета и сегментация рынка

|

Атрибуты |

Ключевые сведения о рынке готовых к употреблению/высококачественных премиксов |

|

Сегментация |

|

|

Страны, охваченные |

США, Канада и Мексика в Северной Америке, Германия, Швеция, Польша, Дания, Италия, Франция, Великобритания, Нидерланды, Швейцария, Бельгия, Россия, Италия, Испания, Турция, Остальная Европа в Европе, Китай, Япония, Индия, Южная Корея, Сингапур, Малайзия, Австралия, Таиланд, Индонезия, Филиппины, Остальная часть Азиатско-Тихоокеанского региона (APAC) в Азиатско-Тихоокеанском регионе (APAC), Саудовская Аравия, ОАЭ, Южная Африка, Египет, Израиль, Остальной Ближний Восток и Африка (MEA) как часть Ближнего Востока и Африки (MEA), Бразилия, Аргентина и Остальная часть Южной Америки как часть Южной Америки |

|

Ключевые игроки рынка |

Davide Campari-Milano NV (Нидерланды), Diageo PLC (Великобритания), Halewood International Limited (Великобритания), Asahi Group Holdings, Ltd. (Япония), Accolade Wines (Австралия), Bacardi Limited (Бермудские острова), Mike's Hard Lemonade Co. (США), Castel Group (Франция), Suntory Holdings Limited (Япония), Anheuser-Busch InBev SA/NV (Бельгия), The Brown-Forman Corporation (США), United Brands Company, Inc. (США), PernodRicard SA (Франция), The Miller Brewing Company (США) |

|

Возможности рынка |

|

Определение рынка готовых к употреблению/высококонцентрированных премиксов

Готовые к употреблению (RTD) премиксы — это напитки, которые были предварительно смешаны и готовы к употреблению в любое время. Существует два вида готовых к употреблению премиксов: RTD и премиксы высокой крепости. Напитки RTD в основном состоят из алкогольных напитков на основе спирта, вина или солода . Высококрепкие премиксы включают предварительно смешанные напитки на основе алкоголя.

Динамика рынка готовых к употреблению/высококонцентрированных премиксов

Драйверы

- Растущая популярность слабоалкогольных ароматизированных напитков

Растущая популярность слабоалкогольных и ароматизированных напитков среди все большего числа молодых людей является основным драйвером рынка алкогольных RTD/крепких премиксов. Растущая популярность здоровых алкогольных напитков, особенно среди миллениалов, повышает спрос на алкогольные RTD/крепкие премиксы. Растущая склонность потребителей к замене крепких напитков на крепкие значительно подстегнула спрос.

- Инновационные маркетинговые стратегии для целевых потребителей

Изменение образа жизни клиентов, возросший спрос на готовые к употреблению премиксы со стороны молодежи, растущая значимость новых и этнических вкусов, а также инновационные достижения в маркетинге и рекламной деятельности — все это способствует росту мирового рынка готовых к употреблению премиксов. Проникновение электронной коммерции, низкие цены, легкий доступ, внедрение натуральных и полезных для здоровья ингредиентов в готовые к употреблению премиксы, растущие инвестиции в пабы и бары, а также разнообразие вкусов, доступных в готовых к употреблению премиксах, способствуют росту мирового рынка этого продукта.

Возможность

Развивающиеся экономики предоставляют многочисленные возможности для производителей готовых к употреблению премиксов для расширения своей деятельности. В прогнозируемый период ожидается, что рынок готовых к употреблению премиксов будет расти экспоненциально. Однако RTD на основе вина и RTD на основе спирта покажут самый устойчивый рост в категории продуктов на рынке готовых к употреблению премиксов. Потребительское стремление к удобству побуждает компании расширять свой бизнес по производству премиксов.

Ограничения

Однако такие факторы, как религиозные или культурные убеждения в ряде стран, высокие налоги и пошлины, а также негативное воздействие алкоголя на здоровье могут препятствовать росту рынка. Кроме того, строгие правила и положения о рекламе алкогольной продукции, а также увеличение числа антиалкогольных кампаний оказывают негативное влияние на рост рынка премиксов высокой крепости.

В этом отчете о рынке готовых к употреблению/крепких премиксов содержатся сведения о последних новых разработках, правилах торговли, анализе импорта-экспорта, анализе производства, оптимизации цепочки создания стоимости, доле рынка, влиянии отечественных и локальных игроков рынка, анализируются возможности с точки зрения новых источников дохода, изменений в правилах рынка, анализ стратегического роста рынка, размер рынка, рост рынка категорий, ниши применения и доминирование, одобрение продуктов, запуск продуктов, географическое расширение, технологические инновации на рынке. Чтобы получить больше информации о рынке готовых к употреблению/крепких премиксов, свяжитесь с Data Bridge Market Research для получения аналитического обзора, наша команда поможет вам принять обоснованное рыночное решение для достижения роста рынка.

Объем рынка готовых к употреблению/высококонцентрированных премиксов

Рынок готовых к употреблению/высококачественных премиксов сегментирован по типу, типу обработки, полу, типу упаковки и торговле. Рост среди этих сегментов поможет вам проанализировать сегменты со слабым ростом в отраслях и предоставить пользователям ценный обзор рынка и рыночные идеи, которые помогут им принимать стратегические решения для определения основных рыночных приложений.

Тип

- RTDS на основе солода

- Пиво

- Ароматизированные солодовые напитки (FMB)

- RTDS на основе спирта

- Водка

- Виски

- Ром

- Текила

- Другие

- RTDS на основе вина

- Другие

Тип обработки

- Одиночное соединение

- Смешанный

Пол

- Мужской

- Женский

Тип упаковки

- Бутылка

- Может

- Другие

Торговля

- О торговле

- Вне торговли

Региональный анализ рынка готовых к употреблению/высококачественных премиксов

Проведен анализ рынка готовых к употреблению/концентрированных премиксов, а также предоставлены сведения о размерах рынка и тенденциях по странам, типу, типу обработки, полу, типу упаковки и торговле, как указано выше.

Страны, охваченные отчетом о рынке готовых к употреблению/высококонцентрированных премиксов: США, Канада и Мексика в Северной Америке, Германия, Швеция, Польша, Дания, Италия, Франция, Великобритания, Нидерланды, Швейцария, Бельгия, Россия, Италия, Испания, Турция, остальные страны Европы в Европе, Китай, Япония, Индия, Южная Корея, Сингапур, Малайзия, Австралия, Таиланд, Индонезия, Филиппины, остальные страны Азиатско-Тихоокеанского региона (APAC) в Азиатско-Тихоокеанском регионе (APAC), Саудовская Аравия, ОАЭ, Южная Африка, Египет, Израиль, остальные страны Ближнего Востока и Африки (MEA) как часть Ближнего Востока и Африки (MEA), Бразилия, Аргентина и остальные страны Южной Америки как часть Южной Америки.

Китай является доминирующей страной в Азиатско-Тихоокеанском регионе из-за большого населения и высокого потребления алкогольных напитков. Поскольку это менее вредно для здоровья, люди или потребители в Китае тяготеют к нему, что приводит к получению высокого дохода от этого продукта. Поскольку люди в Соединенных Штатах хорошо осведомлены о пользе для здоровья слабоалкогольных напитков, производители начали продавать свою продукцию в этой стране. Кроме того, Соединенное Королевство доминирует в Европейском регионе из-за высокого потребления слабоалкогольных продуктов в регионе.

Раздел отчета по странам также содержит отдельные факторы, влияющие на рынок, и изменения в регулировании рынка, которые влияют на текущие и будущие тенденции рынка. Такие данные, как анализ цепочки создания стоимости вверх и вниз по течению, технические тенденции и анализ пяти сил Портера, тематические исследования — вот некоторые из указателей, используемых для прогнозирования рыночного сценария для отдельных стран. Кроме того, при предоставлении прогнозного анализа данных по странам учитываются наличие и доступность глобальных брендов и их проблемы из-за большой или малой конкуренции со стороны местных и отечественных брендов, влияние внутренних тарифов и торговых путей.

Доля рынка готовых к употреблению/высококонцентрированных премиксов

Конкурентная среда рынка готовых к употреблению/высокой крепости премиксов содержит сведения по конкурентам. Включены сведения о компании, финансы компании, полученный доход, рыночный потенциал, инвестиции в исследования и разработки, новые рыночные инициативы, глобальное присутствие, производственные площадки и объекты, производственные мощности, сильные и слабые стороны компании, запуск продукта, широта и широта продукта, доминирование в применении. Приведенные выше данные касаются только фокуса компаний, связанного с рынком готовых к употреблению/высокой крепости премиксов.

Лидерами рынка готовых к употреблению/концентрированных премиксов являются:

- Давиде Кампари-Милано Н.В. (Италия)

- Diageo PLC (Великобритания)

- Halewood International Limited (Великобритания)

- Asahi Group Holdings, Ltd. (Япония)

- Accolade Wines (Австралия)

- Bacardi Limited (Бермудские острова)

- Mike's Hard Lemonade Co. (США)

- Группа компаний Castel (Франция)

- Suntory Holdings Limited (Япония)

- Anheuser-Busch InBev SA/NV (Бельгия)

- Корпорация Brown-Forman (США)

- United Brands Company, Inc. (США)

- PernodRicard SA (Франция)

- Пивоваренная компания Miller (США)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.