Global Radio Frequency Identification Rfid Kanban Systems Market

Размер рынка в млрд долларов США

CAGR :

%

USD

2.46 Billion

USD

12.36 Billion

2024

2032

USD

2.46 Billion

USD

12.36 Billion

2024

2032

| 2025 –2032 | |

| USD 2.46 Billion | |

| USD 12.36 Billion | |

|

|

|

|

Глобальный рынок систем радиочастотной идентификации (RFID) Kanban по типу (односекционный, многосекционный), компоненту (коробка, основание, полка/шкаф, электронные полочные дисплеи, другое), применению (управление запасами цепочки поставок, идентификация оборудования, решения для отслеживания и контроля , другое) — отраслевые тенденции и прогноз до 2029 г.

Анализ рынка и размер систем Kanban для радиочастотной идентификации (RFID)

Системы Kanban с радиочастотной идентификацией (RFID) используются в отрасли для бережливого управления запасами, автоматического сопоставления идентичных заказов и раннего обнаружения колебаний спроса. Увеличение спроса на внутренние и международные логистические услуги из-за растущей популярности платформ электронной коммерции является одним из ключевых факторов роста рынка. Системы RFID Kanban помогают управлять большими объемами данных, генерируемых во время складирования и управления складом, сокращая общее время доставки.

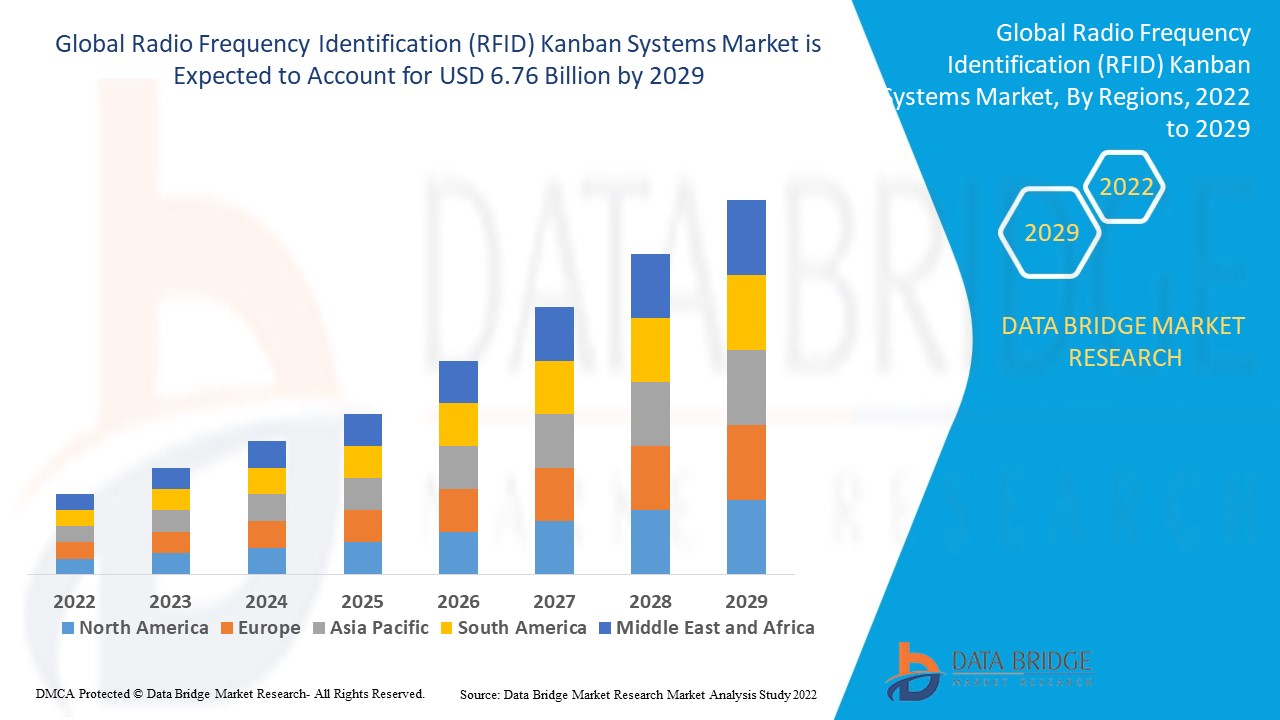

Data Bridge Market Research анализирует темпы роста рынка систем радиочастотной идентификации (RFID) kanban в прогнозируемом периоде 2022-2029 гг. Ожидаемый среднегодовой темп роста рынка систем радиочастотной идентификации (RFID) kanban составляет около 22,30% в указанный прогнозируемый период. Рынок был оценен в 1,35 млрд долларов США в 2021 году, и он вырастет до 6,76 млрд долларов США к 2029 году. Помимо рыночных данных, таких как рыночная стоимость, темпы роста, сегменты рынка, географический охват, участники рынка и рыночный сценарий, рыночный отчет, подготовленный командой Data Bridge Market Research, также включает в себя углубленный экспертный анализ, эпидемиологию пациентов, анализ воронки продаж, анализ цен и нормативную базу.

Масштаб и сегментация рынка систем Kanban с радиочастотной идентификацией (RFID)

|

Отчет Метрика |

Подробности |

|

Прогнозируемый период |

2022-2029 |

|

Базовый год |

2021 |

|

Исторические годы |

2020 (Можно настроить на 2014 - 2019) |

|

Количественные единицы |

Доход в млн. долл. США, объемы в единицах, цены в долл. США |

|

Охваченные сегменты |

По типу (одиночный контейнер, многоконтейнерный контейнер), компоненту (коробка, основание, полка/шкаф, электронные дисплеи для полок, другое), применению (управление запасами цепочки поставок, идентификация оборудования, решения для отслеживания и контроля, другое) |

|

Страны, охваченные |

США, Канада и Мексика в Северной Америке, Германия, Франция, Великобритания, Нидерланды, Швейцария, Бельгия, Россия, Италия, Испания, Турция, Остальная Европа в Европе, Китай, Япония, Индия, Южная Корея, Сингапур, Малайзия, Австралия, Таиланд, Индонезия, Филиппины, Остальная часть Азиатско-Тихоокеанского региона (APAC) в Азиатско-Тихоокеанском регионе (APAC), Саудовская Аравия, ОАЭ, Южная Африка, Египет, Израиль, Остальной Ближний Восток и Африка (MEA) как часть Ближнего Востока и Африки (MEA), Бразилия, Аргентина и Остальная часть Южной Америки как часть Южной Америки. |

|

Охваченные участники рынка |

BROOKS AUTOMATION (США), Adolf Würth GmbH & Co. KG (США), Wilhelm Böllhoff GmbH & Co. KG (Германия), Pepperl+Fuchs (Германия), Grifols, SA (Испания), Metra Tec GmbH (Германия), MATTTEO (Бельгия), AVERY DENNISON CORPORATION (США), Zebra Technologies (США), Honeywell International Inc. (США), NXP Semiconductors (Нидерланды) и Impinj, Inc. (США) |

|

Возможности рынка |

|

Определение рынка

RFID-метки или транспондеры с антеннами устанавливаются на полках канбан. Уникальный номер обычно может идентифицировать это для повышения безопасности данных. Это позволяет точно контролировать поток товаров, автоматизировать передачу данных, обмениваться информацией в режиме реального времени и сокращать ручной труд. Поэтому компании по всему миру полагаются на RFID-системы канбан, а не на традиционную обработку канбан, чтобы повысить безопасность поставок и эффективно управлять запасами.

Динамика мирового рынка систем радиочастотной идентификации (RFID) Kanban

Драйверы

- Увеличение распространенности решений по отслеживанию контактов из-за COVID-19

После снятия блокады COVID 19 многие компании и офисы по всему миру возобновили работу. Однако правительство поручило таким компаниям соблюдать социальную дистанцию и низкую численность персонала. Если критерии не соблюдаются, один случай COVID 19 может привести к закрытию всего объекта и может потребовать дезинфекции перед возобновлением работы. Крупные компании принимают различные меры предосторожности, чтобы избежать этой ситуации, включая решения по отслеживанию контактов. Многие поставщики решений RFID усовершенствовали новые или существующие продукты для удовлетворения потребностей клиентов во время пандемии COVID 19, чтобы воспользоваться растущей потребностью в решениях по отслеживанию контактов.

- Растущая дистрибуция электронной коммерции

По мере роста популярности платформ электронной коммерции , растущий спрос на внутренние и международные логистические услуги стимулирует рост рынка. Кроме того, ожидается, что рост рынка будет обусловлен ростом расходов на просроченные лекарства и процедурами управления запасами, необходимыми для развертывания систем RFID Kanban. Внедрение этих систем отвечает за более быструю доставку.

Возможности

- Технологические достижения

По мере развития технологий радиочастотная идентификация (RFID) становится все более распространенной и широко используется в различных приложениях. Кроме того, RFID имеет много преимуществ, таких как пакетное считывание, обработка информации, устойчивость к суровым условиям и хранение данных. Картирование потока создания ценности анализирует и улучшает текущее состояние процесса, а новые состояния процесса разрабатываются на основе понимания. Современные решения RFID могут снизить затраты и увеличить продажи, перестраивая экономику магазина.

- Растет число установок RFID-систем на производственных предприятиях

Производственным предприятиям необходимо контролировать состояние и производительность оборудования, сбои процессов и систем, а также обеспечивать предиктивное обслуживание оборудования и систем путем интеграции специализированных инструментов и внедрения методов контроля качества. Использование технологии RFID для управления имуществом предприятия помогает производителям достичь этой цели. Сочетание RFID-меток и сенсорных решений идеально подходит для различных точек производственного предприятия, включая конвейеры, камеры, котлы, резервуары, трубы и т. д., для контроля и поддержания качества и производительности производственного процесса.

Ограничения/Проблемы

- Нехватка квалифицированных специалистов

Нехватка квалифицированного персонала, который не сможет использовать эти устройства, может сдержать рост рынка систем радиочастотной идентификации (RFID) kanban в течение прогнозируемого периода.

- Высокая стоимость

Плата за установку RFID-гаджета может варьироваться от 2 до 5 миллионов долларов США для стандартной системы мониторинга в реальном времени. Эта плата может колебаться в зависимости от конечного предприятия и области установки. Высокая плата за установку является одним из основных сдерживающих элементов для внедрения технологии RFID. Внедрение структур RFID на любом предприятии требует чрезмерных инвестиций, таких как плата за приобретение RFID-меток, считывателей и программного обеспечения, а также расходы, связанные с заменяющими предложениями и электроэнергией.

Этот отчет о рынке систем kanban радиочастотной идентификации (RFID) содержит подробную информацию о новых последних разработках, правилах торговли, анализе импорта-экспорта, анализе производства, оптимизации цепочки создания стоимости, доле рынка, влиянии внутренних и локальных игроков рынка, анализирует возможности с точки зрения новых источников дохода, изменений в правилах рынка, анализе стратегического роста рынка, размере рынка, росте рынка категорий, нишах приложений и доминировании, одобрении продуктов, запуске продуктов, географическом расширении, технологических инновациях на рынке. Чтобы получить больше информации о рынке систем kanban радиочастотной идентификации (RFID), свяжитесь с Data Bridge Market Research для получения аналитического обзора, наша команда поможет вам принять обоснованное рыночное решение для достижения роста рынка.

Развитие рынка:

- В январе 2022 года Stafa представила новую услугу Kanban, чтобы держать клиентов на складе, когда это необходимо. Клиенты Stafa могут быстро заказывать новые продукты, используя современные сканеры RFID. Пустые контейнеры распознаются сканером RFID. Сроки доставки этих товаров будут согласованы. Клиенты будут уведомлены о процессе заказа на панели RFID. Заказы можно отслеживать на сенсорном экране от заказа до отправки, что обеспечивает дополнительную ценную информацию в цехе.

- В мае 2022 года HID Global объявила о приобретении Vizinex RFID для расширения своего портфеля продуктов высокопроизводительных пассивных RFID-меток. В результате приобретения Vizinex RFID компанией HID Global компания усилит свое присутствие на основных вертикальных рынках, таких как здравоохранение/медицина, производство, нефть и газ и центры обработки данных. Это также позволит добавить ключевые технологии в существующий известный в отрасли портфель RFID-меток компании.

- В августе 2021 года HID Global приобрела OmniID, чтобы расширить свои возможности RFID. С приобретением OmniID HID расширила свой портфель меток RAIN-RFID UHF и компонентов IoT, еще больше расширив возможности настройки RFID. Это приобретение не только расширяет лидирующие позиции на рынке в области технологии RFID, но и расширяет присутствие HID в Индии и Китае.

Глобальный рынок систем радиочастотной идентификации (RFID) Kanban

Рынок систем kanban радиочастотной идентификации (RFID) сегментирован на основе типа, компонента и применения. Рост среди этих сегментов поможет вам проанализировать сегменты со слабым ростом в отраслях и предоставить пользователям ценный обзор рынка и рыночные идеи, которые помогут им принимать стратегические решения для определения основных рыночных приложений.

Тип

- Одиночный контейнер

- Мульти-Бин

Компонент

- Коробка

- База

- Полка/Шкаф

- Электронные полочные дисплеи

- Другой

Приложение

- Управление запасами в цепочке поставок

- Идентификация оборудования

- Решения для отслеживания и контроля

- Другой

Региональный анализ/информация о рынке систем Kanban с радиочастотной идентификацией (RFID)

Проанализирован рынок систем радиочастотной идентификации (RFID) и даны сведения о размерах рынка и тенденциях по странам, типам, компонентам и областям применения, как указано выше.

Основные страны, охваченные отчетом о рынке систем радиочастотной идентификации (RFID) kanban , включают США, Канаду и Мексику в Северной Америке, Германию, Францию, Великобританию, Нидерланды, Швейцарию, Бельгию, Россию, Италию, Испанию, Турцию, остальные страны Европы в Европе, Китай, Японию, Индию, Южную Корею, Сингапур, Малайзию, Австралию, Таиланд, Индонезию, Филиппины, остальные страны Азиатско-Тихоокеанского региона (APAC) в Азиатско-Тихоокеанском регионе (APAC), Саудовскую Аравию, ОАЭ, ЮАР, Египет, Израиль, остальные страны Ближнего Востока и Африки (MEA) как часть Ближнего Востока и Африки (MEA), Бразилию, Аргентину и остальные страны Южной Америки как часть Южной Америки.

Северная Америка доминирует на рынке систем радиочастотной идентификации (RFID) канбан благодаря продолжающемуся экономическому развитию, высокому спросу на оптимизацию процессов, растущему интересу поставщиков медицинских услуг к системам RFID канбан и растущей осведомленности о преимуществах, связанных с технологией.

Азиатско-Тихоокеанский регион продемонстрировал значительный рост в прогнозируемый период с 2022 по 2029 год. Поскольку система Канбан изначально была разработана в Японии, с тех пор в стране произошел огромный прогресс в плане автоматизации двухъярусной системы Канбан.

Раздел отчета по странам также содержит отдельные факторы, влияющие на рынок, и изменения в регулировании на внутреннем рынке, которые влияют на текущие и будущие тенденции рынка. Кроме того, при предоставлении прогнозного анализа данных по странам рассматриваются наличие и доступность глобальных брендов и их проблемы, связанные с большой или малой конкуренцией со стороны местных и отечественных брендов, влияние внутренних тарифов и торговых путей.

Конкурентная среда и глобальный анализ доли рынка систем Kanban для радиочастотной идентификации (RFID)

Конкурентная среда рынка систем радиочастотной идентификации (RFID) kanban содержит сведения по конкурентам. Включены сведения о компании, финансы компании, полученный доход, рыночный потенциал, инвестиции в исследования и разработки, новые рыночные инициативы, глобальное присутствие, производственные площадки и объекты, производственные мощности, сильные и слабые стороны компании, запуск продукта, широта и широта продукта, доминирование приложений. Приведенные выше точки данных относятся только к фокусу компаний, связанному с рынком систем радиочастотной идентификации (RFID) kanban

Ключевые игроки, работающие на мировом рынке систем радиочастотной идентификации (RFID) Kanban, включают:

- BROOKS AUTOMATION (США)

- Adolf Würth GmbH & Co. KG (США)

- Wilhelm Böllhoff GmbH & Co. KG (Германия)

- Peperl+Fuchs (Германия)

- Grifols, SA (Испания)

- Metra Tec GmbH (Германия)

- МАТТЕО (Бельгия)

- КОРПОРАЦИЯ AVERY DENNISON (США)

- Zebra Technologies (США)

- Honeywell International Inc., (США)

- NXP Semiconductors (Нидерланды)

- Impinj, Inc., (США)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.