Global Polyglycerol Esters Market

Размер рынка в млрд долларов США

CAGR :

%

USD

595.78 Million

USD

725.50 Million

2024

2032

USD

595.78 Million

USD

725.50 Million

2024

2032

| 2025 –2032 | |

| USD 595.78 Million | |

| USD 725.50 Million | |

|

|

|

|

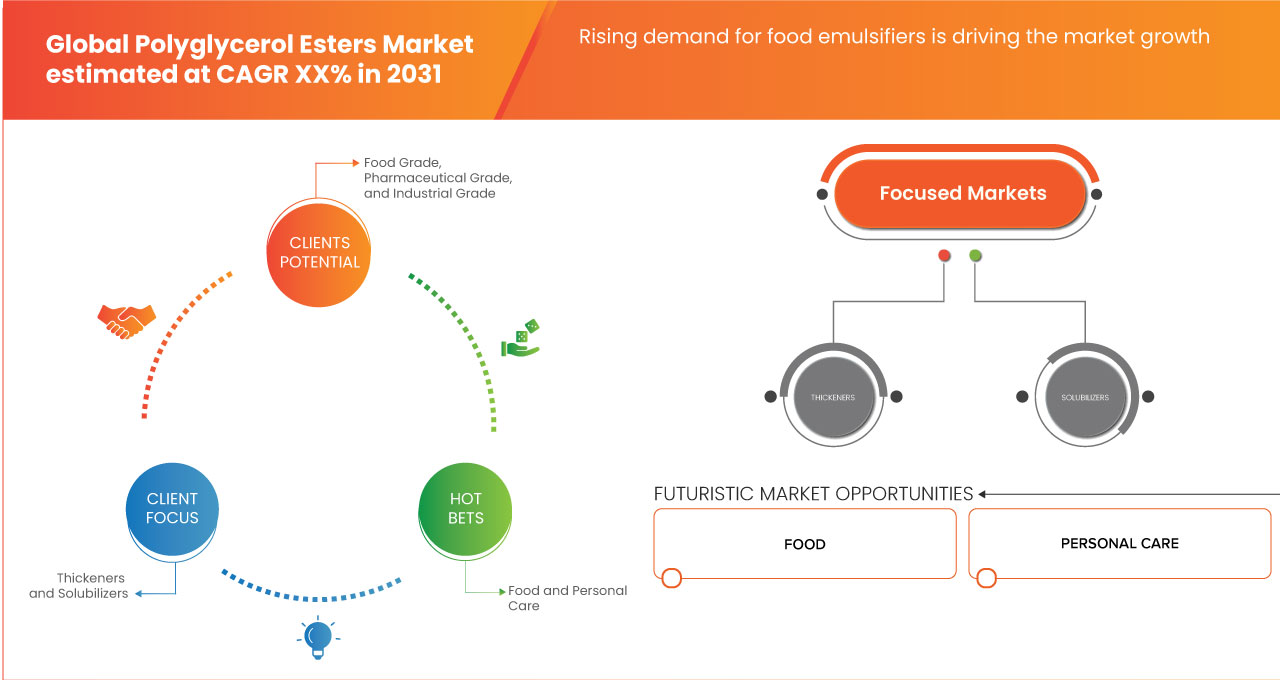

Global Polyglycerol Esters Market Segmentation, By Grade (Food Grade, Pharmaceutical Grade, and Industrial Grade), Form (Thickeners, Solubilizers, Spreading Agents, AdditivesWaxy Solids, and Inert Ingredients), Hydroxyl Value (50 to 150, 30 to 49, Less Than 30, and More Than 150), Color (Light Yellow, Amber, Light Tan, and Brown), Application (Food, Personal Care, Pharmaceuticals, Surfactants & Detergents, and Others) – Industry Trends and Forecast to 2031.

Polyglycerol Esters Market Analysis

The rising demand for food emulsifiers significantly drives the global polyglycerol esters market. As consumer preferences shift towards processed and convenience foods, the need for effective emulsification has become increasingly important. Polyglycerol esters, recognized for their superior emulsifying properties, play a crucial role in enhancing the quality and stability of a wide range of food products.

Food emulsifiers such as Polyglycerol Esters (PGE) are essential in maintaining the desired texture and consistency in processed foods. They help stabilize emulsions, prevent phase separation, and extend the shelf life of products. This is particularly relevant in the baking industry, where polyglycerol esters improve the texture and volume of bread, cakes, and pastries. In margarine and spreads, PGEs facilitate the formation of stable water-in-oil emulsions, ensuring product consistency. In addition, in dairy products and ice cream, polyglycerol esters contribute to a smooth, creamy texture and prevent ice crystal formation.

Polyglycerol Esters Market Size

Global polyglycerol esters market size was valued at USD 583.41 million in 2023 and is projected to reach USD 707.86 million by 2031, with a CAGR of 2.49% during the forecast period of 2024 to 2031. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

Polyglycerol Esters Market Trends

“Rising Demand for Food Emulsifiers”

The rising demand for food emulsifiers significantly drives the global polyglycerol esters market. As consumer preferences shift towards processed and convenience foods, the need for effective emulsification has become increasingly important. Polyglycerol esters, recognized for their superior emulsifying properties, play a crucial role in enhancing the quality and stability of a wide range of food products.

The trends towards healthier and more convenient food options further drives the demand for PGEs. As consumers increasingly seek products that offer extended freshness and enhanced quality without compromising on taste or texture, food manufacturers are turning to advanced emulsifiers like PGEs to meet these expectations. For instance, in the snack and confectionery sectors, PGEs are used to achieve a uniform texture and prevent crystallization, which is crucial for maintaining the product's appeal and quality.

Report Scope and Polyglycerol Esters Market Segmentation

|

Attributes |

Polyglycerol Esters Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada, Mexico, Germany, France, U.K., Italy, Russia, Spain, Turkey, Belgium, Netherlands, Switzerland, Rest of Europe, China, Japan, South Korea, India, Australia & New Zealand, Singapore, Thailand, Malaysia, Indonesia, Philippines, Rest of Asia-Pacific, Brazil, Argentina, Rest of South America, U.A.E., Saudi Arabia, South Africa, Egypt, Israel, and Rest of Middle East and Africa |

|

Key Market Players |

Taiyo Kagaku Co.,Ltd. (Japan), Olean NV (Belgium), Evonik Industries AG (Germany), Lonza (Switzerland), NIHON EMULSION Co., Ltd. (Japan), Guangzhou Cardlo biotechnology Co.,LTD (China), BASF SE (Germany), Sakamoto Yakuhin Kogyo Co., Ltd (Japan), Shandong BinZhou GIN&ING New Material Technology Co., Ltd. (China), Qingdao HuaYi Biological Technology Co., LTD. (China), Henan Chemsino Industry Co.,Ltd (China), Compass Foods Pte Ltd. (Singapore), ABITEC (U.S.), Foodchem International Corporation (China), Estelle Chemicals Pvt. Ltd. (India), and ATAMAN KIMYA (Turkey) among others |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Polyglycerol Esters Market Definition

The global polyglycerol esters market refers to the trade and production of a class of non-ionic surfactants derived from the esterification of polyglycerols with fatty acids. These esters are widely used in various industries, including food and beverages, cosmetics, pharmaceuticals, and industrial applications. In the food industry, PGEs act as emulsifiers, stabilizing oil-water mixtures in products such as baked goods, sauces, and margarine. Their application in cosmetics enhances the texture and stability of creams and lotions, while in pharmaceuticals, they improve solubility and bioavailability of active ingredients.

Polyglycerol Esters Market Dynamics

Drivers

- Rising Demand for Food Emulsifiers

The rising demand for food emulsifiers significantly drives the global polyglycerol esters market. As consumer preferences shift towards processed and convenience foods, the need for effective emulsification has become increasingly important. Polyglycerol esters, recognized for their superior emulsifying properties, play a crucial role in enhancing the quality and stability of a wide range of food products.

Food emulsifiers such as Polyglycerol Esters (PGE) are essential in maintaining the desired texture and consistency in processed foods. They help stabilize emulsions, prevent phase separation, and extend the shelf life of products. This is particularly relevant in the baking industry, where polyglycerol esters improve the texture and volume of bread, cakes, and pastries. In margarine and spreads, PGEs facilitate the formation of stable water-in-oil emulsions, ensuring product consistency.

For instance,

In December 2023, according to report by Henan Chemsino Industry Co.,Ltd, the growing demand for food emulsifiers like polyglycerol esters (PGEs), driven by their ability to enhance texture and stability in processed foods. PGEs are increasingly utilized in bakery items, dairy products, and sauces, aligning with consumer preferences for consistent, high-quality, and longer-lasting food products.

- Fast Expansion of Pharmaceutical Industry

The rapid expansion of the pharmaceutical industry is a key driver for the growth of the global polyglycerol esters market. Polyglycerol esters, known for their exceptional emulsifying, stabilizing, and solubilizing properties, are increasingly being adopted in pharmaceutical formulations, particularly in oral, topical, and injectable products. As the demand for advanced drug delivery systems and high-quality pharmaceutical products grows, PGEs are playing an essential role in meeting the industry's evolving needs.

PGEs are widely used in oral medications such as tablets, capsules, and suspensions, where they act as emulsifiers to ensure the even distribution of Active Pharmaceutical Ingredients (APIs). By improving the bioavailability and stability of these APIs, PGEs help enhance the efficacy of medications. In addition, they aid in the production of sustained-release formulations, which are becoming increasingly popular in the pharmaceutical industry for providing consistent, controlled delivery of drugs over time. This trend is expected to fuel the demand for PGEs as more pharmaceutical companies incorporate these advanced formulations into their product lines.

For instance,

In October 2020, according to a report by Germany Trade & Investment, Germany's pharmaceutical industry saw significant growth, driven by strong research and development (R&D) investments and innovation in biopharmaceuticals. With over 500 pharmaceutical companies operating in the country, the industry's rapid expansion fuels demand for advanced excipients such as Polyglycerol Esters (PGEs) to support the development of complex drug formulations.

Opportunities

- Expansion into Sustainable and Eco-Friendly Product Lines

As environmental awareness grows and consumers demand greener alternatives, industries are increasingly pivoting towards sustainable practices. PGEs, with their natural origins and environmentally friendly properties, are well-positioned to meet this shift in demand. Polyglycerol esters, derived from renewable sources like vegetable oils and fats, are biodegradable and non-toxic, making them an attractive choice for companies committed to reducing their environmental footprint. This aligns with the rising trend across various sectors, including food, cosmetics, and pharmaceuticals, where there is a strong push for natural and sustainable ingredients.

In the food industry, there is an increasing consumer preference for clean-label products, which are perceived as healthier and more environmentally friendly. PGEs serve as effective emulsifiers and stabilizers, providing a natural alternative to synthetic additives. This not only helps food manufacturers meet consumer expectations for transparency and sustainability but also enables them to comply with stricter regulations on food safety and environmental impact. As such, PGEs are becoming a key ingredient in clean-label and organic food products, driving their market growth.

For instance,

In November 2023, according to an article published by Elsevier B.V., this study explores the cost-effective synthesis of polyglycerol esters (PGEs) using distilled soya acid oil (DSAO) and glycerol, leveraging by-products from vegetable oil refineries. Base-catalyzed polymerization of glycerol at 250°C and acid-catalyzed esterification of DSAO at 210°C were employed to create PGEs with varying hydrophilic-lipophilic balance (HLB). The PGEs significantly reduced surface tension to 31.55 mNm−1 and interfacial tension to 4.81 mNm−1, with a critical micelle concentration between 15.8 and 69.7 mgL−1. PGEs exhibited excellent amplifiability in vegetable oils, and their performance in moisturizing creams was compared to commercial products, showcasing effective, cost-efficient, and renewable emulsification.

- Expansion in Emerging Markets

As developing economies experience rapid industrialization, urbanization, and rising consumer spending, the demand for PGEs is poised to grow, driven by several key factors. Firstly, emerging markets are witnessing substantial growth in the food and beverage sector, where PGEs are increasingly used as emulsifiers and stabilizers. In these regions, the rising middle class is fueling demand for processed and convenience foods, which often require PGEs to enhance texture, stability, and shelf life. As these markets continue to develop, there is a growing need for high-quality ingredients that can meet both consumer expectations and regulatory standards. PGEs, with their natural origins and effective functional properties, are well-positioned to meet this demand and support the growth of the food and beverage industry in emerging economies.

For instance,

In June 2024, according to an article published by Greengredients, polyglycerol esters have become essential in natural cosmetics for their versatile benefits. These plant-derived compounds, produced from polyglycerols and fatty acids, excel as emulsifiers, enhancing both oil-in-water and water-in-oil formulations. They improve texture, skin hydration, and overall sensory appeal while being biodegradable and skin-friendly. Greengredients offers high-quality polyglycerol esters like Oleamuls OW and Sesamuls OW, which are ideal for moisturizers, cleansers, hair care, and sun care products. These ingredients meet eco-friendly standards and support sustainable, effective beauty formulations. Explore Greengredients’ range to elevate your natural cosmetic products.

Restraints/Challenges

- Advanced Technology Complexity and Integration Issues

As PGEs are used in diverse applications—ranging from food and beverages to cosmetics and pharmaceuticals—the intricate technology involved in their production and application poses several issues. Firstly, the synthesis of PGEs requires sophisticated chemical processes. These esters are produced through the esterification of polyglycerols with fatty acids, a process that demands precise control over reaction conditions such as temperature, pressure, and catalyst concentration. This technical complexity necessitates advanced manufacturing facilities and skilled personnel. Companies must invest in cutting-edge technology and expertise to ensure consistent product quality and performance. For smaller firms or those new to the market, these technological demands can be a significant barrier to entry.

Moreover, the development and optimization of PGE formulations for specific applications add another layer of complexity. Each application—whether in food, cosmetics, or pharmaceuticals—has unique requirements for emulsification, stability, and compatibility. Developing PGEs that meet these specific needs often involves extensive research and development (R&D) efforts, including trials, testing, and formulation adjustments. This R&D process can be both time-consuming and costly, requiring substantial investment in technology and innovation.

For instance,

In October 2023, according to an article published by Walter de Gruyter GmbH, polyglycerol esters (PGEs) are non-ionic surfactants used as emulsifiers, wetting agents, and viscosity modifiers in the cosmetic, pharmaceutical, and food industries. They are seen as safer alternatives to ethoxylated glycol-based surfactants. Composed of a fatty acid (lipophilic) and polyglycerol (hydrophilic), PGEs can be synthesized through various methods, including direct esterification, chemical or enzymatic transesterification, and microwave irradiation. As they derive from renewable vegetable oils, PGEs are considered eco-friendly and versatile. Key challenges in their synthesis involve increasing yield, controlling esterification levels, and minimizing side reactions.

- Regulatory Compliance and Approval Issues

These challenges arise from stringent regulations, varying standards across regions, and the need for continual compliance with evolving guidelines. Firstly, regulatory requirements for PGEs can differ widely between countries and regions, creating complexities for manufacturers operating on a global scale. In the food and beverage industry, for instance, PGEs must meet specific safety and efficacy standards that vary from one jurisdiction to another. The approval process for food additives, including PGEs, involves rigorous testing and documentation to demonstrate safety and efficacy. Navigating these disparate regulations can be resource-intensive and time-consuming for companies, potentially delaying market entry and increasing costs.

Similarly, in the cosmetics and personal care sector, regulations on ingredient safety and labeling are becoming increasingly stringent. Different regions, such as the European Union and the United States, have distinct requirements for cosmetic ingredients, including PGEs. For instance, the EU has strict guidelines on the safety and permissible concentrations of cosmetic ingredients, while the U.S. Food and Drug Administration (FDA) has its own set of regulations. Compliance with these varying standards requires significant investment in regulatory affairs and quality control, which can be challenging for companies trying to streamline their operations globally.

For instance,

In December 2020, according to an article published by Elsevier B.V., this study presents a new method for creating extended-release matrix tablets with stable performance through direct compaction. Polyglycerol esters of fatty acids (PGFAs), known for their solid-state stability, were used as matrix agents. Metformin HCl, a highly soluble API, served as the model substance. Three PGFA compounds with HLB values of 1.8–4.5 were tested. Tablets with PGFAs exhibited reduced yield pressure and improved flow properties. Direct compression of these blends, without granulation, produced tablets with optimal tensile strength and friability. Varying PGFAs' HLB values allowed tailoring of the API release profile, with stable release linked to the stable solid-state of the lipids. No cytotoxic effects were detected.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions.

Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Polyglycerol Esters Market Scope

The market is segmented on the basis of grade, form, hydroxyl value, color, and application. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Grade

- Food Grade

- Pharmaceutical Grade

- Industrial Grade

Form

- Thickeners

- Solubilizers

- Spreading Agents

- Additives

- Waxy Solids

- Inert Ingredients

Hydroxyl Value

- 50 To 150

- 30 To 49

- Less Than 30

- More Than 150

Color

- Light Yellow

- Amber

- Light Tan

- Brown

Application

- Food

- Food, By Type

- Bakery

- Bread & Rolls

- Cakes, Pastries & Truffle

- Biscuit, Cookies & Crackers

- Tart & Pies

- Swiss Rolls

- Brownies

- Others

- Confectionery

- Candy Bars

- Jelly Candies

- Jams and Jellies

- Marmalades

- Fruit Jelly Dessert

- Toppings

- Others

- Oil Products

- Desserts

- Bakery

- Food, By Type

- Personal Care

- Personal Care, By Application

- Moisturizers

- Hair Conditioners

- Foundation

- Anti- Ageing Serums

- Lip Gloss

- Mascara

- Others

- Personal Care, By Application

- Pharmaceuticals

- Surfactants & Detergents

- Others

Polyglycerol Esters Market Regional Analysis

The market is analyzed and market size insights and trends are provided by grade, form, hydroxyl value, color, and application as referenced above.

The countries covered in the market are U.S., Canada, Mexico, Germany, France, U.K., Italy, Russia, Spain, Turkey, Belgium, Netherlands, Switzerland, Rest of Europe, China, Japan, South Korea, India, Australia & New Zealand, Singapore, Thailand, Malaysia, Indonesia, Philippines, Rest of Asia-Pacific, Brazil, Argentina, Rest of South America, U.A.E., Saudi Arabia, South Africa, Egypt, Israel, and Rest of Middle East and Africa.

Asia-Pacific is expected to dominate and the fastest growing region in the market due to rapidly expanding food processing sector, especially in countries such as China, India, and Southeast Asia. Polyglycerol esters are widely used as emulsifiers in baked goods, dairy products, and processed foods.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Polyglycerol Esters Market Share

The market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Polyglycerol Esters Market Leaders Operating in the Market Are:

- Taiyo Kagaku Co.,Ltd. (Japan)

- Olean NV (Belgium)

- Evonik Industries AG (Germany)

- Lonza (Switzerland)

- NIHON EMULSION Co., Ltd. (Japan)

- Guangzhou Cardlo biotechnology Co.,LTD (China)

- BASF SE (Germany)

- Sakamoto Yakuhin Kogyo Co., Ltd (Japan)

- Shandong BinZhou GIN&ING New Material Technology Co., Ltd. (China)

- Qingdao HuaYi Biological Technology Co., LTD. (China)

- Henan Chemsino Industry Co.,Ltd (China)

- Compass Foods Pte Ltd. (Singapore)

- ABITEC (U.S.)

- Foodchem International Corporation (China)

- Estelle Chemicals Pvt. Ltd. (India)

- ATAMAN KIMYA (Turkey)

Latest Developments in Polyglycerol Esters Market

- In March 2024, Lonza announced it acquired Roche's Genentech biologics site in Vacaville, California, for USD 1.2 billion. The acquisition, boosting Lonza’s manufacturing capacity, included plans to invest approximately USD 500 million to upgrade the facility and support growth

- In August 2024, Foodchem, a prominent player in the food ingredients industry, is thrilled to announce its participation in FISA 2024, in São Paulo, Brazil. Company booth D-95 to explore their latest innovations in food ingredient solutions. This event helps to increase the product presence in various regions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.