Global Pharmaceutical Packaging Market

Размер рынка в млрд долларов США

CAGR :

%

USD

118.43 Billion

USD

206.52 Billion

2024

2032

USD

118.43 Billion

USD

206.52 Billion

2024

2032

| 2025 –2032 | |

| USD 118.43 Billion | |

| USD 206.52 Billion | |

|

|

|

|

Глобальный рынок фармацевтической упаковки, по видам продукции (первичная упаковка, вторичная и третичная упаковка), материалам (пластик и полимеры, бумага и картон, стекло, металлы и другие), способам доставки лекарств (упаковка для перорального приема лекарств, упаковка для парентерального приема лекарств, упаковка для местного приема лекарств, упаковка для ингаляционного приема лекарств, упаковка для назального приема лекарств, упаковка для офтальмологического приема лекарств, упаковка для других видов доставки лекарств), конечным пользователям (компании по производству фармацевтических препаратов, компании по контрактной упаковке, аптеки и другие) — тенденции отрасли и прогноз до 2031 года.

Анализ и понимание рынка фармацевтической упаковки

Аутсорсинг услуг по упаковке по контракту стал критически важным для фармацевтических компаний, позволяя им сосредоточиться на основных компетенциях, соблюдая при этом высокие стандарты. Prespack предлагает многомерное партнерство, освобождая производителей лекарственных средств или медицинских приборов от многих процессов. Эта тенденция отражает растущий сектор фармацевтического аутсорсинга, в конечном итоге способствуя расширению рынка фармацевтической упаковки.

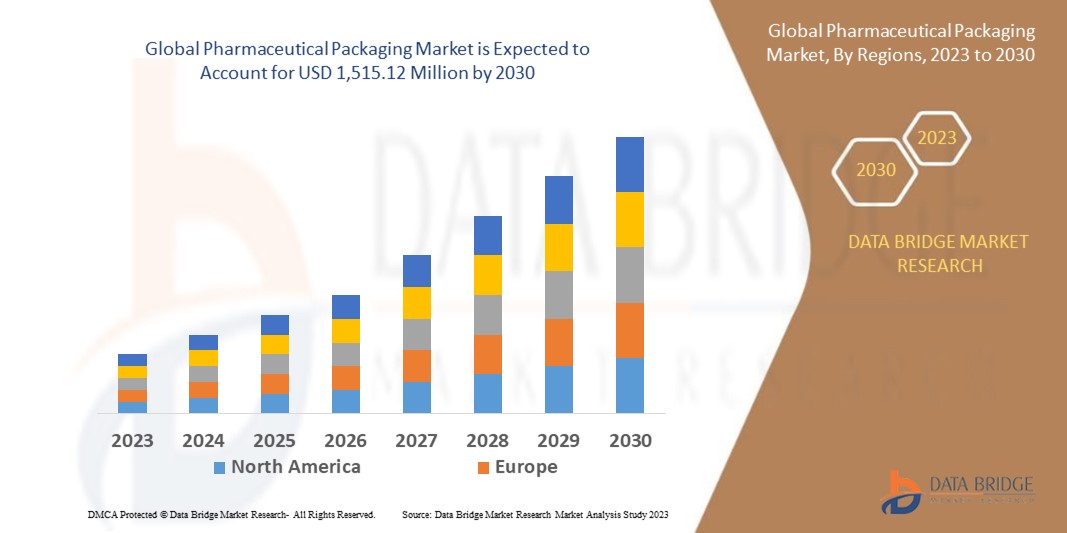

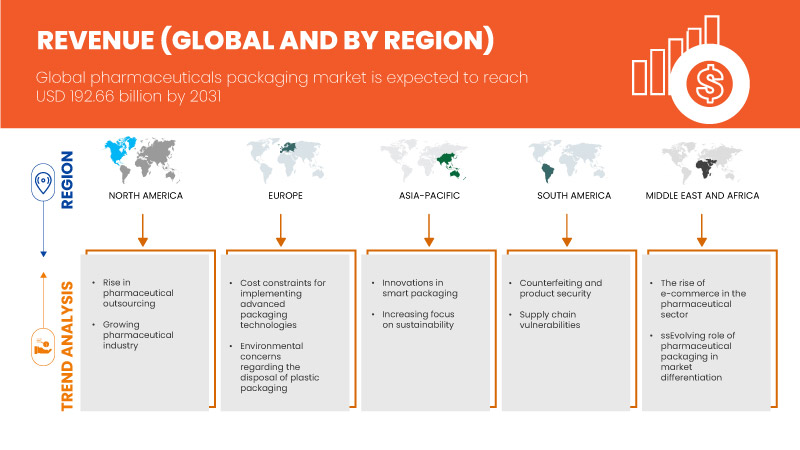

По данным исследования рынка Data Bridge, ожидается, что объем мирового рынка фармацевтической упаковки к 2031 году достигнет 192,66 млрд долларов США по сравнению с 111,52 млрд долларов США в 2023 году, а среднегодовой темп роста составит 7,2% в прогнозируемый период с 2024 по 2031 год.

|

Отчет Метрика |

Подробности |

|

Прогнозируемый период |

2024-2031 |

|

Базовый год |

2023 |

|

Исторические годы |

2022 (можно изменить на 2016–2021) |

|

Количественные единицы |

Доход в млрд долларов США |

|

Охваченные сегменты |

Продукт (первичная упаковка, вторичная и третичная упаковка), Материал (пластик и полимеры, бумага и картон, стекло, металлы и другие), Способ доставки лекарств (упаковка для перорального введения лекарств, упаковка для парентерального введения лекарств, упаковка для местного применения лекарств, упаковка для ингаляционного введения лекарств, упаковка для назального введения лекарств, упаковка для глазного введения лекарств, упаковка для доставки других лекарств), Конечный пользователь (компании по производству фармацевтических препаратов, компании по контрактной упаковке, аптеки и другие) |

|

Страны, охваченные |

США, Канада, Мексика, Германия, Великобритания, Франция, Италия, Нидерланды, Испания, Россия, Швейцария, Турция, Бельгия, Остальная Европа, Китай, Япония, Индия, Южная Корея, Австралия, Сингапур, Индонезия, Таиланд, Малайзия, Филиппины, Остальная часть Азиатско-Тихоокеанского региона, Бразилия, Аргентина, Остальная часть Южной Америки, Южная Африка, ОАЭ, Саудовская Аравия, Египет, Израиль, Остальной Ближний Восток и Африка |

|

Охваченные участники рынка |

WestRock Company, Amcor plc, BD, AptarGroup, Inc., West Pharmaceutical Services, Inc., Berry Global, Inc., CCL Industries, Gerresheimer AG, Schott AG, UFlex Limited, SGD Pharma, EPL Limited, Drug Plastics Group, Comar и Daikyo Seiko Co., Ltd., среди прочих |

Определение рынка

Фармацевтическая упаковка включает в себя процесс помещения лекарств и других фармацевтических продуктов в упаковочные материалы, которые обеспечивают их защиту, идентификацию и распространение информации. К этим материалам относятся пластик, стекло, алюминий , бумага и картон, каждый из которых выбирается по своим особым свойствам и применению. Эти материалы тщательно выбираются на основе их совместимости с фармацевтическим продуктом, их способности защищать от внешних факторов и нормативных требований.

Динамика мирового рынка фармацевтической упаковки

В этом разделе рассматривается понимание движущих сил рынка, возможностей, ограничений и проблем. Все это подробно обсуждается ниже:

Драйверы

- Растущий фармацевтический аутсорсинг

Фармацевтические компании все чаще предпочитают передавать производственные процессы на аутсорсинг специализированным контрактным упаковщикам. Этот стратегический сдвиг позволяет этим компаниям сосредоточиться на своих основных компетенциях, таких как исследования, разработки и маркетинг, оставляя сложности упаковки экспертам. Контрактные упаковщики предлагают ряд услуг, включая дизайн упаковки, выбор материалов и обеспечение соответствия строгим нормативным требованиям. Это особенно выгодно для фармацевтических компаний, ищущих инновационные и индивидуальные решения по упаковке для своей продукции.

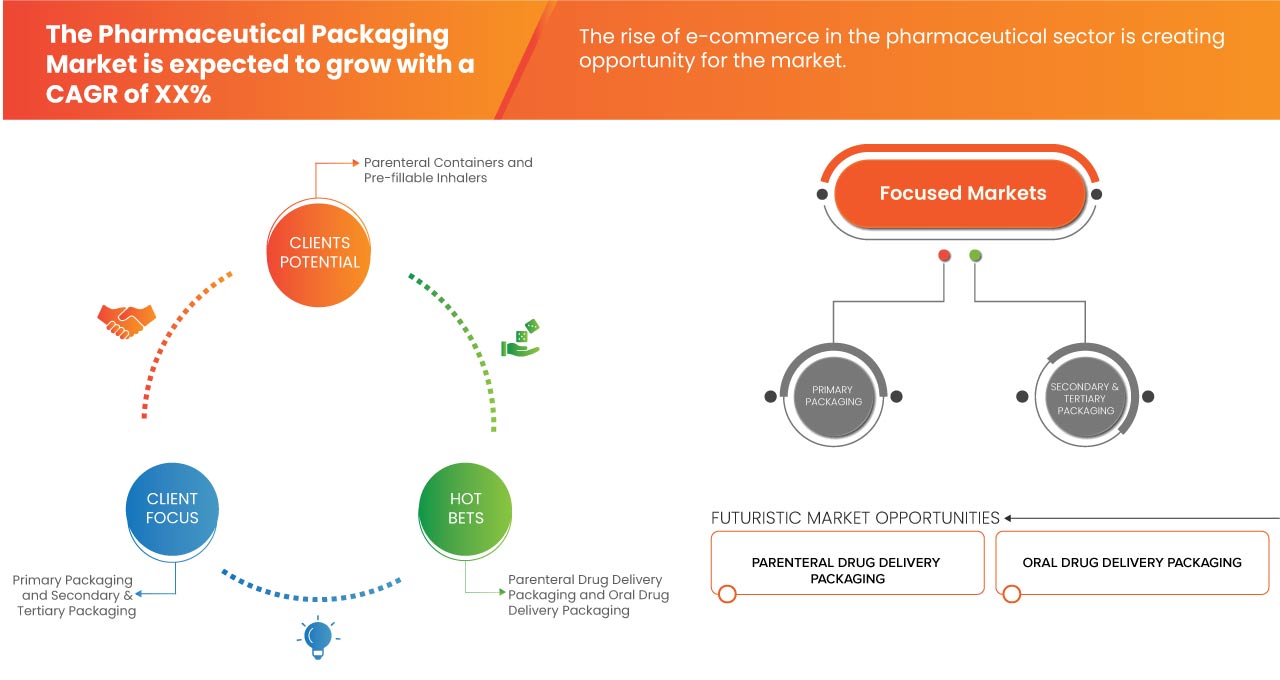

- Растущая роль фармацевтической упаковки в дифференциации рынка

Упаковка вышла за рамки своей традиционной роли простого хранения фармацевтических продуктов; теперь она является ключевым элементом в дифференциации этих продуктов на рынке. Этот сдвиг обусловлен усиливающейся конкуренцией в фармацевтической отрасли, где компании используют упаковку как инструмент для того, чтобы выделить свою продукцию среди конкурентов. Упаковка служит визуальной и информационной платформой, которая передает важные сведения о продукте, включая его качество, безопасность и эффективность. Кроме того, упаковка действует как маркетинговый носитель, помогая привлекать потребителей и влиять на их решения о покупке. В ответ на эту тенденцию произошел всплеск инновационных упаковочных решений. Например, интеллектуальная упаковка включает в себя цифровые функции, такие как RFID-метки или QR-коды, что позволяет потребителям получать доступ к дополнительной информации о продукте или отслеживать подлинность.

Использование экологически чистых материалов в упаковке набирает обороты, отражая растущую экологическую сознательность потребителей. Эти инновационные подходы не только отличают продукцию, но и способствуют устойчивым практикам, еще больше укрепляя репутацию бренда.

Сосредоточение внимания на дифференциации продукции посредством упаковки способствует значительному прогрессу в фармацевтической упаковочной отрасли, способствуя созданию рыночной среды, благоприятной для постоянных инноваций и улучшений.

Возможность

- Инновации в области интеллектуальной упаковки

Инновации в области интеллектуальной упаковки, такие как термочувствительные этикетки и отслеживание RFID, революционизируют мировой рынок фармацевтической упаковки. Эти достижения предлагают множество преимуществ, начиная с улучшенной видимости по всей цепочке поставок. Термочувствительные этикетки, например, обеспечивают мониторинг в режиме реального времени, гарантируя, что лекарства хранятся и транспортируются в оптимальных условиях. Эта возможность особенно важна для фармацевтических препаратов, поскольку поддержание правильной температуры имеет решающее значение для сохранения их эффективности и безопасности. Более того, отслеживание RFID позволяет компаниям отслеживать отдельные единицы продукции, гарантируя подлинность и предотвращая фальсификацию. Такой уровень прослеживаемости не только помогает соблюдать нормативные стандарты, но и повышает доверие потребителей. Кроме того, интеллектуальная упаковка способствует эффективным процессам отзыва, поскольку компании могут быстро идентифицировать и извлекать затронутые продукты.

Сдержанность / Проблемы

- Подделка и безопасность продукции

Подделка в фармацевтическом секторе представляет собой многогранную проблему, несмотря на достижения в области технологий упаковки. Распространение поддельных лекарств не только ставит под угрозу здоровье пациентов, но и подрывает доверие к фармацевтической продукции и отрасли. Эта незаконная деятельность часто подразумевает сложные тактики, включая копирование упаковки и маркировки для имитации подлинной продукции. Поскольку фальсификаторы постоянно совершенствуют свои методы, чтобы избежать обнаружения, фармацевтические компании должны сохранять бдительность и адаптировать свои стратегии упаковки, чтобы опережать эти угрозы. Эта продолжающаяся борьба с поддельными лекарствами подчеркивает критическую важность инновационных упаковочных решений и совместных усилий в рамках отрасли и регулирующих органов для обеспечения безопасности и целостности фармацевтической продукции.

- Ограничения по стоимости внедрения передовых технологий упаковки

Разработка и внедрение передовых технологий упаковки, таких как интеллектуальная упаковка и меры по борьбе с подделками, часто требуют существенных инвестиций в исследования, разработки и технологическую инфраструктуру. Для небольших компаний с ограниченными ресурсами эти затраты могут быть непомерными, что не позволяет им внедрять инновационные упаковочные решения. В результате эти компании могут оказаться в невыгодном положении по сравнению с более крупными конкурентами, которые могут позволить себе инвестировать в передовые упаковочные технологии. Это ограничение препятствует общему росту и инновационному потенциалу рынка фармацевтической упаковки, ограничивая доступность передовых упаковочных решений и потенциально препятствуя рыночной конкурентоспособности.

Последние события

- В сентябре 2023 года компании WestRock Company WRK и Smurfit Kappa Group Plc SMFKY договорились о слиянии и создании Smurfit WestRock, которая, как ожидается, станет одной из крупнейших в мире компаний по производству бумаги и упаковки с капитализацией около 20 миллиардов долларов.

- В июле 2023 года Constantia Flexibles анонсировала свое новейшее решение для фармацевтической упаковки — фольгу холодной формовки REGULA CIRC, передовую технологию, которая устанавливает новый стандарт устойчивости в блистерной упаковке. Разработанная с учетом цикличности, REGULA CIRC соответствует будущим нормам и законодательству, предлагая комплексное барьерное решение, которое соответствует самым высоким стандартам устойчивой упаковки.

- В июне 2022 года Berlin Packaging, один из крупнейших в мире поставщиков гибридной упаковки, объявила о приобретении Andler Packaging Group, дистрибьютора пластиковых, стеклянных и металлических контейнеров и укупорочных средств с добавленной стоимостью.

- В декабре 2021 года компания Comar, ведущий поставщик индивидуальных медицинских приборов и узлов, а также специализированных упаковочных решений, объявила о приобретении Omega Packaging, производителя литьевых и формованных под давлением изделий для фармацевтического, нутрицевтического, спортивного питания и рынка средств по уходу за кожей.

- В апреле 2022 года компания Amcor, лидер в разработке и производстве этичных упаковочных решений, объявила о добавлении нового, более экологичного ламината High Shield в свою линейку фармацевтической упаковки.

Масштаб мирового рынка фармацевтической упаковки

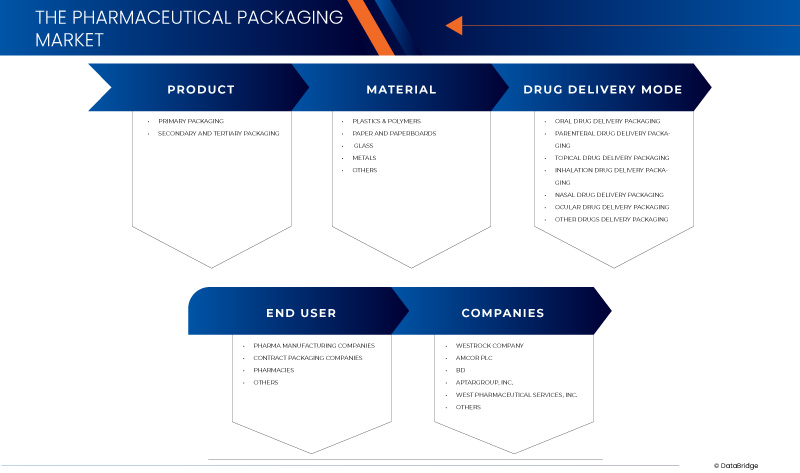

Глобальный рынок упаковки для фармацевтической продукции сегментирован на четыре заметных сегмента на основе продукта, материала, способа доставки лекарств и конечного пользователя. Рост среди сегментов помогает вам анализировать нишевые карманы роста и стратегии для выхода на рынок и определять ваши основные области применения и различия на ваших целевых рынках.

Продукт

- Первичная упаковка

- Вторичная и третичная упаковка

По видам продукции рынок сегментируется на первичную упаковку, вторичную и третичную упаковку.

Материал

- Пластмассы и полимеры

- Бумага и картон

- Стекло

- Металлы

- Другие

По материалу рынок сегментируется на пластмассы и полимеры, бумагу и картон, стекло, металлы и другие.

Режим доставки лекарств

- Упаковка для перорального приема лекарств

- Упаковка для парентеральной доставки лекарств

- Упаковка для доставки лекарств местного действия

- Упаковка для ингаляционной доставки лекарств

- Упаковка для назальной доставки лекарств

- Упаковка для глазной доставки лекарств

- Другие лекарственные препараты Упаковка для доставки

В зависимости от способа доставки лекарственных средств рынок сегментирован на упаковку для перорального приема лекарственных средств, упаковку для парентерального приема лекарственных средств, упаковку для местного применения, упаковку для ингаляционного приема лекарственных средств, упаковку для назального приема лекарственных средств, упаковку для глазного приема лекарственных средств и упаковку для других видов приема лекарственных средств.

Конечный пользователь

- Фармацевтические производственные компании

- Компании по контрактной упаковке

- Аптеки

- Другие

По признаку конечного потребителя рынок сегментируется на компании-производители фармацевтической продукции, компании по контрактной упаковке, аптеки и другие.

Региональный анализ/информация о мировом рынке фармацевтической упаковки

Мировой рынок фармацевтической упаковки подразделяется на четыре основных сегмента в зависимости от продукта, материала, способа доставки лекарств и конечного пользователя.

В данном отчете о рынке рассматриваются следующие страны: США, Канада, Мексика, Германия, Великобритания, Франция, Италия, Нидерланды, Испания, Россия, Швейцария, Турция, Бельгия, остальные страны Европы, Китай, Япония, Индия, Южная Корея, Австралия, Сингапур, Индонезия, Таиланд, Малайзия, Филиппины, остальные страны Азиатско-Тихоокеанского региона, Бразилия, Аргентина, остальные страны Южной Америки, Южная Африка, ОАЭ, Саудовская Аравия, Египет, Израиль, а также остальные страны Ближнего Востока и Африки.

Ожидается, что Северная Америка будет доминировать на мировом рынке фармацевтической упаковки благодаря своей развитой инфраструктуре здравоохранения, надежной нормативной базе и значительным инвестициям в исследования и разработки. Ожидается, что США будут доминировать в Северной Америке благодаря своей развитой инфраструктуре здравоохранения, крупной фармацевтической промышленности и высокому спросу на инновационные упаковочные решения. Ожидается, что Китай будет доминировать в Азиатско-Тихоокеанском регионе благодаря своей быстрорастущей фармацевтической промышленности, большой потребительской базе и растущим инвестициям в инфраструктуру здравоохранения и упаковочные технологии. Ожидается, что Германия будет доминировать в европейском регионе благодаря своему надежному фармацевтическому производственному сектору, сильной нормативной среде и акценту на высококачественные стандарты упаковки.

Раздел отчета по странам также содержит отдельные факторы, влияющие на рынок, и изменения в регулировании на внутреннем рынке, которые влияют на текущие и будущие тенденции рынка. Такие данные, как новые продажи, заменяющие продажи, демографические данные страны, нормативные акты и импортно-экспортные тарифы, являются одними из основных указателей, используемых для прогнозирования рыночного сценария для отдельных стран. Кроме того, при предоставлении прогнозного анализа данных по стране учитываются наличие и доступность глобальных брендов и их проблемы, связанные с большой или малой конкуренцией со стороны местных и внутренних брендов, а также влияние каналов продаж.

Анализ конкурентной среды и доли мирового рынка фармацевтической упаковки

Конкурентная среда мирового рынка фармацевтической упаковки содержит сведения о конкурентах. Включены сведения о компании, ее финансах, полученном доходе, рыночном потенциале, инвестициях в НИОКР, новых рыночных инициативах, производственных площадках и объектах, сильных и слабых сторонах компании, запуске продукта, одобрении продукта, широте и широте продукта, доминировании приложений и кривой жизненного цикла типа продукта. Приведенные выше данные относятся только к фокусу компании на рынке.

Некоторые из основных игроков рынка, работающих на рынке, включают WestRock Company, Amcor plc, BD, AptarGroup, Inc., West Pharmaceutical Services, Inc., Berry Global, Inc., CCL Industries, Gerresheimer AG, Schott AG, UFlex Limited, SGD Pharma, EPL Limited, Drug Plastics Group, Comar и Daikyo Seiko Co., Ltd., а также другие.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.