Мировой рынок напитков на основе молока, по видам продукции (животное молоко и растительное молоко), вкусам (ароматизированные и неароматизированные/обычные), природе (органические и традиционные), каналу сбыта (розничная торговля в магазинах и вне магазинов) — тенденции отрасли и прогноз до 2030 года.

Анализ и объем рынка напитков на основе молока

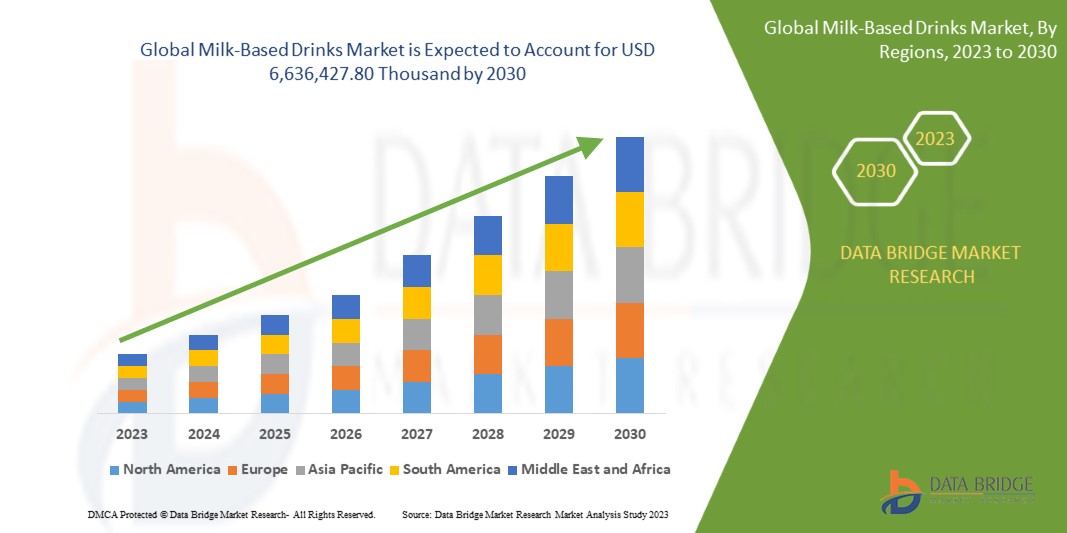

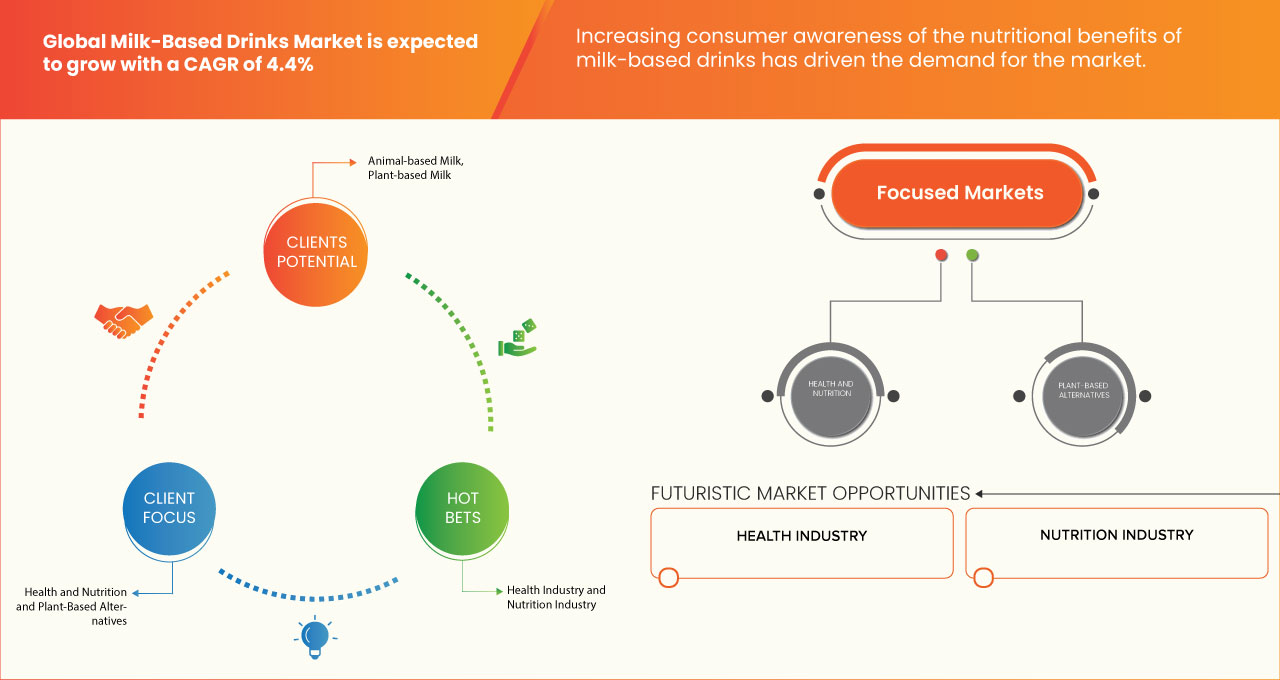

Ожидается, что мировой рынок напитков на основе молока значительно вырастет в прогнозируемый период с 2023 по 2030 год. По данным Data Bridge Market Research, среднегодовой темп роста рынка составит 4,4% в прогнозируемый период с 2023 по 2030 год, и ожидается, что к 2030 году он достигнет 6 636 427,80 тыс. долларов США. Основным фактором, способствующим росту рынка, является растущая осведомленность потребителей в вопросах здоровья и благополучия, а также растущая популярность удобства и быстрого образа жизни.

Отчет о мировом рынке напитков на основе молока содержит подробную информацию о доле рынка, новых разработках и влиянии отечественных и локальных игроков рынка, анализирует возможности с точки зрения новых источников дохода, изменений в рыночных правилах, одобрений продуктов, стратегических решений, запусков продуктов, географических расширений и технологических инноваций на рынке. Чтобы понять анализ и рыночный сценарий, свяжитесь с нами для получения аналитического резюме. Наша команда поможет вам создать решение, влияющее на доход, для достижения желаемой цели.

|

Отчет Метрика |

Подробности |

|

Прогнозируемый период |

2023-2030 |

|

Базовый год |

2022 |

|

Исторические годы |

2021 (Можно настроить на 2015 - 2020) |

|

Количественные единицы |

Доход в тыс. долл. США |

|

Охваченные сегменты |

Продукт (животное молоко и растительное молоко), ароматизатор (ароматизированный и неароматизированный/обычный), природа (органический и традиционный), канал сбыта (розничная торговля в магазине и не в магазине) |

|

Страны, охваченные |

США, Канада, Мексика, Германия, Италия, Великобритания, Испания, Франция, Бельгия, Нидерланды, Швейцария, Россия, Турция и остальные страны Европы, Индия, Китай, Япония, Австралия и Новая Зеландия, Южная Корея, Сингапур, Таиланд, Индонезия, Малайзия, Филиппины, остальные страны Азиатско-Тихоокеанского региона, Бразилия, Аргентина, остальные страны Южной Америки, Объединенные Арабские Эмираты, Саудовская Аравия, Южная Африка, Египет, Израиль и остальные страны Ближнего Востока и Африки |

|

Охваченные участники рынка |

Califia Farms, LLC, MOOALA BRANDS, LLC., Chobani, LLC., Simple FOODS Co., Ltd., TURM-Sahne GmbH, Sanitarium, Arla Foods amba, RUDE HEALTH, Danone SA, Nestlé, THE HERSHEY COMPANY, Oatly Inc, YEO HIAP SENG LTD, Valsoia SpA и GCMMF, среди прочих |

Определение рынка

Рынок напитков на основе молока относится к сегменту отрасли, ориентированному на производство, распространение и потребление напитков, в первую очередь получаемых из молока. Этот рынок охватывает широкий спектр продуктов, включая коровье молоко, растительные заменители молока, ароматизированные молочные коктейли и специальные кофейные и чайные напитки. На него влияют вкусовые предпочтения потребителей, забота о здоровье и выбор диеты, при этом компании конкурируют за инновации и удовлетворение меняющихся потребностей потребителей.

Динамика мирового рынка напитков на основе молока

Драйверы

- Растущая популярность удобства и быстрого образа жизни

В последние годы заметный сдвиг в предпочтениях потребителей в сторону удобства и потребления на ходу стимулировал рост различных отраслей, включая мировой рынок напитков на основе молока. Эта тенденция является ответом на быстрый темп современного образа жизни, когда потребители ищут питательные и богатые белком варианты, которые можно удобно употреблять в любое время. Напитки на основе молока предлагают решение, объединяя питательные преимущества белка, кальция и витаминов с удобством портативных, предварительно упакованных напитков. Урбанизация, более плотный график, более длительные поездки на работу и возросшие требования к работе привели к значительному изменению поведения потребителей. В результате потребители все чаще ищут продукты, которые соответствуют их быстрому темпу жизни, делая удобство главным приоритетом. Более того, нехватка времени побудила потребителей искать быстрые и простые решения для удовлетворения своих потребностей в питании. Традиционные модели питания изменились, и перекусы и потребление на ходу стали более распространенными.

В современном быстро меняющемся мире традиционные завтраки сидя за столом часто заменяются вариантами на ходу. Молочные напитки, особенно обогащенные питательными веществами, рекламируются как быстрая и питательная замена завтраку. Они обеспечивают сбалансированный вариант питания для людей, спешащих на работу или в школу.

Рост электронной коммерции позволил потребителям заказывать напитки на основе молока онлайн, что еще больше повышает удобство. Подписные сервисы регулярно доставляют эти продукты к порогу дома потребителя, экономя им время и усилия при покупке продуктов

Напитки на основе молока часто обогащены другими необходимыми питательными веществами, витаминами и минералами, что делает их полноценным вариантом замены приема пищи или перекуса на ходу.

Глобальный рынок напитков на основе молока переживает устойчивый рост из-за растущей распространенности ориентированного на удобство и подвижного образа жизни. Напитки на основе молока стали удобным и питательным решением, поскольку потребители отдают предпочтение богатым питательными веществами портативным вариантам, которые соответствуют их плотному графику. Ожидается, что рост потребления напитков на основе молока будет стимулировать рост рынка во всем мире.

- Повышение осведомленности потребителей в вопросах здоровья и благополучия

В последние годы наблюдается значительный сдвиг в предпочтениях потребителей в сторону более здорового образа жизни и осознанности в вопросах питания. Этот сдвиг подстегнул тенденцию к росту потребления богатых белком диет, что впоследствии привело к росту рынка. Белок является ключевым компонентом напитков на основе молока, и он соответствует диетам, ориентированным на белок, которые предпочитают многие заботящиеся о своем здоровье потребители.

Высокобелковые напитки на основе молока, часто рекламируемые как варианты восстановления мышц или замены приема пищи, предназначены для людей, стремящихся увеличить потребление белка по различным причинам, связанным со здоровьем и фитнесом. Растущее внимание к здоровью и благополучию привело к тому, что потребители стали искать диетические варианты, которые поддерживают их фитнес-цели и общее благополучие. Белок является важнейшим макроэлементом, который играет решающую роль в восстановлении мышц, поддержании их здоровья и общих функциях организма. Люди включают богатые белком диеты в свою повседневную жизнь, поскольку они становятся более активными в управлении своим здоровьем. Напитки на основе молока адаптируются к различным диетам образа жизни, таким как вегетарианство, флекситарианство и кето-диеты. Бренды предлагают альтернативы, такие как миндальное молоко , соевое молоко и безлактозные варианты, чтобы удовлетворить эти диетические предпочтения.

Потребители все больше осознают питательную ценность потребляемых ими напитков, в том числе напитков на основе молока. Многие потребители воспринимают молоко как источник необходимых питательных веществ, таких как кальций, витамин D , белок и различные витамины и минералы. Это осознание стимулирует спрос на напитки на основе молока как на удобный и питательный вариант.

По мере старения населения мира все больше внимания уделяется поддержанию здоровья и благополучия на протяжении всей жизни. Молочные напитки, обогащенные питательными веществами, важными для старения, такими как витамин B12 и кальций, могут понравиться этой демографической группе.

Растущее внимание потребителей к здоровью и благополучию в сочетании с удобством и разнообразием, предлагаемыми этими напитками, привело к их широкому принятию. Чтобы извлечь выгоду из этих тенденций в области здоровья и благополучия, производителям и маркетологам молочных напитков необходимо согласовывать свои предложения, маркетинговые стратегии и сообщения с меняющимися предпочтениями потребителей в отношении здоровья. Таким образом, ожидается, что растущая тенденция здорового и богатого белком питания будет стимулировать рост рынка.

Возможность

- Растущая популярность веганского и растительно-ориентированного питания

Наблюдается заметный сдвиг в диетических предпочтениях в сторону альтернатив на растительной основе, поскольку потребители становятся все более сознательными в отношении здоровья и окружающей среды. Этот сдвиг создает благоприятную среду для роста рынка, поскольку эти продукты удовлетворяют потребности и предпочтения этой развивающейся потребительской базы.

Растущий спрос на веганские и растительные диеты стимулирует инновации в сегменте напитков на основе молока. Производители разрабатывают широкий спектр источников растительного белка, таких как гороховый белок , соевый белок и рисовый белок , чтобы удовлетворить различные предпочтения потребителей. На рынке наблюдается появление специализированных напитков на основе молока, ориентированных на определенные сегменты потребителей, такие как спортсмены, любители фитнеса и люди с ограничениями в питании. Растительные варианты набирают популярность среди этих сегментов благодаря своим питательным преимуществам.

Производители реагируют на изменение предпочтений потребителей, внедряя инновации и диверсифицируя свои предложения, расширяя свое присутствие в розничной торговле и обучая потребителей преимуществам растительного питания. Глобальный рынок напитков на основе молока имеет все возможности для процветания и внесения вклада в меняющийся ландшафт пищевой и безалкогольной промышленности, поскольку тенденция к растительным диетам продолжает расти. Ожидается, что растущий спрос на веганские и растительные диеты предоставит значительные возможности для роста рынка.

Ограничения/Проблемы

- Строгие правила и положения в отношении напитков на основе молока

Строгие правила и нормы в отношении напитков на основе молока могут создать серьезные проблемы для роста рынка, влияя на различные аспекты производства, маркировки, маркетинга и дистрибуции.

Во многих странах действуют строгие правила, регулирующие состав и маркировку напитков на основе молока. Эти правила часто требуют точного и полного списка ингредиентов, информации о пищевой ценности и деклараций об аллергенах. Обеспечение соответствия может быть сложным, особенно при разработке напитков на основе молока с добавлением ароматизаторов, обогащением или альтернативными ингредиентами, такими как компоненты без лактозы.

Для обеспечения безопасности напитков на основе молока необходимо соблюдать строгие стандарты качества. Это включает микробиологические и химические критерии, ограничения на загрязняющие вещества и особые требования к пастеризации или термической обработке. Соблюдение этих стандартов может быть дорогостоящим, поскольку может потребовать инвестиций в меры контроля качества и испытательные лаборатории.

Правила часто предписывают строгие правила безопасности и гигиены на предприятиях по переработке молока. Поддержание этих стандартов требует постоянных инвестиций в инфраструктуру, оборудование, обучение сотрудников и протоколы санитарии. Невыполнение этих требований может привести к дорогостоящим штрафам или отзыву продукции.

Все большее влияние на отрасль молочных напитков оказывают экологические нормы. Нормы, связанные с упаковочными материалами, утилизацией отходов и выбросами углерода, могут потребовать изменений в производственных процессах и стратегиях снабжения.

В заключение следует отметить, что строгие правила и положения на мировом рынке напитков на основе молока создают сложные проблемы соответствия, которые могут повлиять на формулу продукта, контроль качества и маркировку, маркетинг и международную торговлю. Компании, работающие в этой отрасли, должны инвестировать в юридическую и нормативную экспертизу. Эти усилия по обеспечению соответствия могут привести к увеличению эксплуатационных расходов и повлиять на рыночные стратегии, что делает соблюдение нормативных требований существенной проблемой в этом секторе.

- Рост непереносимости лактозы и аллергии на молочные продукты

Рост непереносимости лактозы и аллергии на молочные продукты существенно сдерживает рост рынка. Эти состояния становятся все более распространенными и могут выступать в качестве сдерживающих факторов несколькими способами.

Потребители становятся более осторожными в потреблении молочных продуктов, поскольку растет осведомленность о непереносимости лактозы и аллергии на молочные продукты. Многие люди с такими состояниями испытывают дискомфорт в пищеварительном тракте, аллергические реакции или другие проблемы со здоровьем при употреблении молочных продуктов. Это привело к снижению спроса на традиционные напитки на основе молока.

Люди с непереносимостью лактозы и аллергией на молочные продукты ищут молочные альтернативы, такие как миндальное молоко, соевое молоко и овсяное молоко , которые не вызывают побочных реакций. Этот сдвиг в предпочтениях потребителей подстегнул рост индустрии растительного молока, отвлекая долю рынка от традиционных молочных напитков.

Производители напитков на основе молока должны инвестировать в разработку безлактозных или безмолочных альтернатив, чтобы удовлетворить потребности потребителей с непереносимостью лактозы и аллергией на молочные продукты. Создание продуктов, которые имитируют вкус и текстуру молочных продуктов, сохраняя при этом чистую этикетку, может быть сложной и дорогостоящей задачей, что препятствует расширению рынка.

Строгие правила маркировки введены для защиты потребителей с аллергией. Производители должны точно маркировать свою продукцию, а риски перекрестного загрязнения вызывают беспокойство. Соблюдение этих нормативных требований может повысить сложность и стоимость производства, что может повлиять на ценообразование и конкурентоспособность.

Повышение осведомленности о непереносимости лактозы и аллергии на молочные продукты — это непрерывный процесс. Производителям, возможно, придется инвестировать в образовательные кампании, чтобы информировать потребителей о своих вариантах без лактозы или без молочных продуктов, что может быть дорогостоящим и отнимать много времени.

В заключение следует отметить, что рост числа случаев непереносимости лактозы и аллергии на молочные продукты является существенным сдерживающим фактором на мировом рынке напитков на основе молока. Компании должны адаптироваться, разрабатывая подходящие альтернативы, соблюдая правила маркировки и обучая потребителей, чтобы преуспеть в этой меняющейся обстановке.

Последние события

- В августе 2023 года Chobani, LLC, компания по производству продуктов питания и напитков нового поколения, известная своим греческим йогуртом , представила Chobani Oatmilk Pumpkin Spice — насыщенный, кремовый овсяный напиток со вкусом тыквы и специй, приготовленный из цельного зерна овса. Последнее дополнение к тыквенной продукции бренда подходит для веганов, является хорошим источником кальция и идеально подходит для любителей тыквенных специй, которые ищут осенние напитки, не идущие на компромисс по качеству или вкусу.

- В январе 2023 года Oatly Inc, оригинальная и крупнейшая в мире компания по производству овсяных напитков, и Ya YA Foods Corporation, ведущий контрактный производитель широкого спектра асептических продуктов питания и напитков, объявили о долгосрочном стратегическом гибридном партнерстве в Северной Америке. В рамках этого гибридного партнерства Oatly продолжит производить свою фирменную овсяную основу на заводах в Огдене, штат Юта, и Форт-Уэрте, штат Техас, которая затем будет передаваться в Ya YA Foods для совместной упаковки в продукты Oatly на каждом предприятии.

- В ноябре 2021 года Arla Foods amba представила свою новую пятилетнюю стратегию, подчеркивающую ее твердую приверженность устойчивому производству молочных продуктов и ответственному расширению бизнеса. В течение следующих пяти лет компания готова увеличить свои инвестиции более чем на 40%, превысив 4 миллиарда евро. Эти инвестиции будут направлены на инициативы в области устойчивого развития, цифровизацию, внедрение инновационных производственных технологий и разработку продукции. Кроме того, компания планирует увеличить свои дивиденды до 1+ миллиарда евро, продемонстрировав свою приверженность поддержке своих фермеров-владельцев на пути к устойчивому развитию.

- В сентябре 2021 года компания Valsoia SpA подписала соглашение с Green Pro International BV, владеющей 100% акций Swedish Green Food Company AB, о приобретении 100% акционерного капитала шведской компании, специализирующейся на импорте и дистрибуции 100% овощной продукции на территории Европы.

- В марте 2021 года компания Hershey India Pvt Ltd, часть THE HERSHEY COMPANY, разработала Sofit Plus, обогащенный растительным белком напиток эксклюзивно для своей социальной инициативы «Nourishing Minds». Он предназначен для удовлетворения потребностей в питании детей из неблагополучных семей, напиток был разработан компанией Hershey India в сотрудничестве с IIT-Bombay, Sion Hospital и НПО Annamrita.

Масштаб мирового рынка напитков на основе молока

Глобальный рынок напитков на основе молока сегментирован на четыре заметных сегмента на основе продукта, вкуса, природы и канала сбыта. Рост среди этих сегментов поможет вам проанализировать основные сегменты роста в отраслях и предоставить пользователям ценный обзор рынка и рыночные идеи для принятия стратегических решений по определению основных рыночных приложений.

Продукт

- Молоко животного происхождения

- Растительное молоко

По видам продукции рынок сегментируется на молоко животного происхождения и молоко растительного происхождения.

Вкус

- Ароматный

- Без вкуса/Обычный

По вкусу рынок сегментируется на ароматизированный и неароматизированный/обычный.

Природа

- Органический

- Общепринятый

On the basis of nature, the market is segmented into organic and conventional.

Distribution Channel

- Store Based Retailer

- Non-Store Retailer

On the basis of distribution channel, the market is segmented into store based retailer and non-store retailer.

Global Milk-Based Drinks Market Regional Analysis/Insights

The global milk-based drinks market is segmented into four notable segments based on product, flavor, nature, and distribution channel.

The countries covered in the global milk-based drinks market report are U.S., Canada, Mexico, Germany, Italy, U.K., Spain, France, Belgium, Netherlands, Switzerland, Russia, Turkey, and Rest of Europe, India, China, Japan, Australia & New Zealand, South Korea, Singapore, Thailand, Indonesia, Malaysia, Philippines, Rest of Asia-Pacific, Brazil, Argentina, Rest of South America, United Arab Emirates, Saudi Arabia, South Africa, Egypt, Israel, and Rest of Middle East and Africa.

Asia-Pacific is expected to dominate the global milk-based drinks market due to the presence of a large production and consumption base in the region. India is expected to dominate the Asia-Pacific region in terms of market share and market revenue due to the ongoing product innovation and the emergence of distinctive and exotic flavors. The U.S. is expected to dominate the North America region due to the growing popularity of convenience and fast-paced lifestyles. Germany is expected to dominate the Europe region due to the increasing consumer consciousness regarding health and well-being.

The country section of the report also provides individual market-impacting factors and changes in market regulation that impact the current and future trends of the market. Data point downstream and upstream value chain analysis, technical trends, Porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Global Milk-Based Drinks Market Share Analysis

The global milk-based drinks market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, and technology lifeline curve. The above data points provided are only related to the companies’ focus related to the market.

Некоторые из видных участников мирового рынка напитков на основе молока включают Califia Farms, LLC, MOOALA BRANDS, LLC., Chobani, LLC., Simple FOODS Co., Ltd., TURM-Sahne GmbH, Sanitarium, Arla Foods amba, RUDE HEALTH, Danone SA, Nestlé, THE HERSHEY COMPANY, Oatly Inc, YEO HIAP SENG LTD, Valsoia SpA и GCMMF, а также другие.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Содержание

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING POPULARITY OF CONVENIENCE AND FAST-PACED LIFESTYLES

5.1.2 INCREASING CONSUMER CONSCIOUSNESS REGARDING HEALTH AND WELL-BEING

5.1.3 ONGOING PRODUCT INNOVATION AND THE EMERGENCE OF DISTINCTIVE AND EXOTIC FLAVORS

5.2 RESTRAINTS

5.2.1 RISING LACTOSE INTOLERANCE AND DAIRY ALLERGIES

5.2.2 SUPPLY CHAIN DISRUPTIONS DUE TO VARIOUS FACTORS

5.3 OPPORTUNITIES

5.3.1 INCREASING FAVORABILITY OF VEGAN AND PLANT-BASED DIETARY CHOICES

5.4 CHALLENGE

5.4.1 STRINGENT RULES AND REGULATIONS

6 GLOBAL MILK-BASED DRINKS MARKET BY GEOGRAPHY

6.1 OVERVIEW

6.2 ASIA PACIFIC

6.3 NORTH AMERICA

6.4 EUROPE

6.5 SOUTH AMERICA

6.6 MIDDLE EAST & AFRICA

7 GLOBAL MILK-BASED DRINKS MARKET: COMPANY LANDSCAPE

7.1 COMPANY SHARE ANALYSIS: GLOBAL

7.2 COMPANY SHARE ANALYSIS: EUROPE

7.3 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

7.4 COMPANY SHARE ANALYSIS: NORTH AMERICA

7.5 PARTNERSHIPS AND ACQUISITION

7.6 BUSINESS EXPANSION

7.7 NEW PRODUCT LAUNCH

8 SWOT ANALYSIS

9 COMPANY PROFILES

9.1 OATLY INC

9.1.1 COMPANY SNAPSHOT

9.1.2 REVENUE ANALYSIS

9.1.3 COMPANY SHARE ANALYSIS

9.1.4 PRODUCT PORTFOLIO

9.1.5 RECENT DEVELOPMENT

9.2 DANONE S.A.

9.2.1 COMPANY SNAPSHOT

9.2.2 REVENUE ANALYSIS

9.2.3 COMPANY SHARE ANALYSIS

9.2.4 PRODUCT PORTFOLIO

9.2.5 RECENT DEVELOPMENTS

9.3 ARLA FOODS AMBA

9.3.1 COMPANY SNAPSHOT

9.3.2 COMPANY SHARE ANALYSIS

9.3.3 PRODUCT PORTFOLIO

9.3.4 RECENT DEVELOPMENT

9.4 NESTLÉ

9.4.1 COMPANY SNAPSHOT

9.4.2 REVENUE ANALYSIS

9.4.3 COMPANY SHARE ANALYSIS

9.4.4 PRODUCT PORTFOLIO

9.4.5 RECENT DEVELOPMENTS

9.5 GCMMF

9.5.1 COMPANY SNAPSHOT

9.5.2 COMPANY SHARE ANALYSIS

9.5.3 PRODUCT PORTFOLIO

9.5.4 RECENT DEVELOPMENTS

9.6 CALIFIA FARMS, LLC

9.6.1 COMPANY SNAPSHOT

9.6.2 PRODUCT PORTFOLIO

9.6.3 RECENT DEVELOPMENTS

9.7 CHOBANI, LLC

9.7.1 COMPANY SNAPSHOT

9.7.2 PRODUCT PORTFOLIO

9.7.3 RECENT DEVELOPMENTS

9.8 MOOALA BRANDS, LLC.

9.8.1 COMPANY SNAPSHOT

9.8.2 PRODUCT PORTFOLIO

9.8.3 RECENT DEVELOPMENTS

9.9 RUDE HEALTH

9.9.1 COMPANY SNAPSHOT

9.9.2 PRODUCT PORTFOLIO

9.9.3 RECENT DEVELOPMENTS

9.1 SANITARIUM

9.10.1 COMPANY SNAPSHOT

9.10.2 PRODUCT PORTFOLIO

9.10.3 RECENT DEVELOPMENTS

9.11 SIMPLE FOODS CO., LTD.

9.11.1 COMPANY SNAPSHOT

9.11.2 PRODUCT PORTFOLIO

9.11.3 RECENT DEVELOPMENTS

9.12 THE HERSHEY COMPANY

9.12.1 COMPANY SNAPSHOT

9.12.2 REVENUE ANALYSIS

9.12.3 PRODUCT PORTFOLIO

9.12.4 RECENT DEVELOPMENT

9.13 TURM-SAHNE GMBH

9.13.1 COMPANY SNAPSHOT

9.13.2 PRODUCT PORTFOLIO

9.13.3 RECENT DEVELOPMENTS

9.14 VALSOIA S.P.A.

9.14.1 COMPANY SNAPSHOT

9.14.2 REVENUE ANALYSIS

9.14.3 PRODUCT PORTFOLIO

9.14.4 RECENT DEVELOPMENT

9.15 YEO HIAP SENG LTD

9.15.1 COMPANY SNAPSHOT

9.15.2 REVENUE ANALYSIS

9.15.3 PRODUCT PORTFOLIO

9.15.4 RECENT DEVELOPMENTS

10 QUESTIONNAIRE

11 RELATED REPORTS

Список таблиц

TABLE 1 GLOBAL MILK-BASED DRINKS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 2 GLOBAL MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 3 GLOBAL PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 4 GLOBAL MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 5 GLOBAL FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 6 GLOBAL MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 7 GLOBAL MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 8 GLOBAL STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 9 GLOBAL NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 10 GLOBAL ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 11 ASIA-PACIFIC MILK-BASED DRINKS MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 12 ASIA-PACIFIC MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 13 ASIA-PACIFIC PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 14 ASIA-PACIFIC MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 15 ASIA-PACIFIC FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 16 ASIA-PACIFIC MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 17 ASIA-PACIFIC MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 18 ASIA-PACIFIC STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 19 ASIA-PACIFIC NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 20 ASIA-PACIFIC ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 21 INDIA MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 22 INDIA PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 23 INDIA MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 24 INDIA FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 25 INDIA MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 26 INDIA MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 27 INDIA STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 28 INDIA NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 29 INDIA ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 30 CHINA MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 31 CHINA PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 32 CHINA MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 33 CHINA FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 34 CHINA MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 35 CHINA MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 36 CHINA STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 37 CHINA NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 38 CHINA ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 39 JAPAN MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 40 JAPAN PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 41 JAPAN MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 42 JAPAN FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 43 JAPAN MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 44 JAPAN MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 45 JAPAN STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 46 JAPAN NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 47 JAPAN ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 48 AUSTRALIA & NEW ZEALAND MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 49 AUSTRALIA & NEW ZEALAND PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 50 AUSTRALIA & NEW ZEALAND MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 51 AUSTRALIA & NEW ZEALAND FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 52 AUSTRALIA & NEW ZEALAND MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 53 AUSTRALIA & NEW ZEALAND MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 54 AUSTRALIA & NEW ZEALAND STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 55 AUSTRALIA & NEW ZEALAND NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 56 AUSTRALIA & NEW ZEALAND ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 57 SOUTH KOREA MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 58 SOUTH KOREA PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 59 SOUTH KOREA MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 60 SOUTH KOREA FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 61 SOUTH KOREA MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 62 SOUTH KOREA MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 63 SOUTH KOREA STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 64 SOUTH KOREA NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 65 SOUTH KOREA ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 66 SINGAPORE MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 67 SINGAPORE PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 68 SINGAPORE MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 69 SINGAPORE FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 70 SINGAPORE MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 71 SINGAPORE MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 72 SINGAPORE STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 73 SINGAPORE NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 74 SINGAPORE ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 75 THAILAND MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 76 THAILAND PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 77 THAILAND MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 78 THAILAND FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 79 THAILAND MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 80 THAILAND MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 81 THAILAND STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 82 THAILAND NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 83 THAILAND ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 84 INDONESIA MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 85 INDONESIA PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 86 INDONESIA MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 87 INDONESIA FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 88 INDONESIA MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 89 INDONESIA MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 90 INDONESIA STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 91 INDONESIA NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 92 INDONESIA ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 93 MALAYSIA MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 94 MALAYSIA PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 95 MALAYSIA MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 96 MALAYSIA FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 97 MALAYSIA MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 98 MALAYSIA MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 99 MALAYSIA STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 100 MALAYSIA NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 101 MALAYSIA ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 102 PHILIPPINES MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 103 PHILIPPINES PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 104 PHILIPPINES MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 105 PHILIPPINES FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 106 PHILIPPINES MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 107 PHILIPPINES MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 108 PHILIPPINES STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 109 PHILIPPINES NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 110 PHILIPPINES ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 111 REST OF ASIA-PACIFIC MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 112 NORTH AMERICA MILK-BASED DRINKS MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 113 NORTH AMERICA MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 114 NORTH AMERICA PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 115 NORTH AMERICA MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 116 NORTH AMERICA FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 117 NORTH AMERICA MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 118 NORTH AMERICA MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 119 NORTH AMERICA STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 120 NORTH AMERICA NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 121 NORTH AMERICA ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 122 U.S. MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 123 U.S. PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 124 U.S. MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 125 U.S. FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 126 U.S. MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 127 U.S. MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 128 U.S. STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 129 U.S. NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 130 U.S. ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 131 CANADA MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 132 CANADA PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 133 CANADA MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 134 CANADA FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 135 CANADA MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 136 CANADA MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 137 CANADA STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 138 CANADA NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 139 CANADA ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 140 MEXICO MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 141 MEXICO PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 142 MEXICO MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 143 MEXICO FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 144 MEXICO MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 145 MEXICO MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 146 MEXICO STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 147 MEXICO NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 148 MEXICO ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 149 EUROPE MILK-BASED DRINKS MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 150 EUROPE MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 151 EUROPE PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 152 EUROPE MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 153 EUROPE FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 154 EUROPE MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 155 EUROPE MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 156 EUROPE STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 157 EUROPE NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 158 EUROPE ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 159 GERMANY MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 160 GERMANY PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 161 GERMANY MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 162 GERMANY FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 163 GERMANY MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 164 GERMANY MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 165 GERMANY STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 166 GERMANY NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 167 GERMANY ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 168 ITALY MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 169 ITALY PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 170 ITALY MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 171 ITALY FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 172 ITALY MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 173 ITALY MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 174 ITALY STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 175 ITALY NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 176 ITALY ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 177 U.K. MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 178 U.K. PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 179 U.K. MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 180 U.K. FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 181 U.K. MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 182 U.K. MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 183 U.K. STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 184 U.K. NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 185 U.K. ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 186 SPAIN MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 187 SPAIN PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 188 SPAIN MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 189 SPAIN FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 190 SPAIN MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 191 SPAIN MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 192 SPAIN STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 193 SPAIN NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 194 SPAIN ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 195 FRANCE MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 196 FRANCE PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 197 FRANCE MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 198 FRANCE FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 199 FRANCE MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 200 FRANCE MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 201 FRANCE STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 202 FRANCE NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 203 FRANCE ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 204 BELGIUM MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 205 BELGIUM PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 206 BELGIUM MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 207 BELGIUM FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 208 BELGIUM MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 209 BELGIUM MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 210 BELGIUM STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 211 BELGIUM NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 212 BELGIUM ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 213 NETHERLANDS MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 214 NETHERLANDS PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 215 NETHERLANDS MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 216 NETHERLANDS FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 217 NETHERLANDS MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 218 NETHERLANDS MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 219 NETHERLANDS STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 220 NETHERLANDS NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 221 NETHERLANDS ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 222 SWITZERLAND MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 223 SWITZERLAND PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 224 SWITZERLAND MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 225 SWITZERLAND FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 226 SWITZERLAND MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 227 SWITZERLAND MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 228 SWITZERLAND STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 229 SWITZERLAND NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 230 SWITZERLAND ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 231 RUSSIA MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 232 RUSSIA PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 233 RUSSIA MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 234 RUSSIA FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 235 RUSSIA MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 236 RUSSIA MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 237 RUSSIA STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 238 RUSSIA NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 239 RUSSIA ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 240 TURKEY MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 241 TURKEY PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 242 TURKEY MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 243 TURKEY FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 244 TURKEY MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 245 TURKEY MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 246 TURKEY STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 247 TURKEY NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 248 TURKEY ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 249 REST OF EUROPE MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 250 SOUTH AMERICA MILK-BASED DRINKS MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 251 SOUTH AMERICA MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 252 SOUTH AMERICA PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 253 SOUTH AMERICA MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 254 SOUTH AMERICA FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 255 SOUTH AMERICA MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 256 SOUTH AMERICA MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 257 SOUTH AMERICA STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 258 SOUTH AMERICA NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 259 SOUTH AMERICA ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 260 BRAZIL MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 261 BRAZIL PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 262 BRAZIL MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 263 BRAZIL FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 264 BRAZIL MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 265 BRAZIL MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 266 BRAZIL STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 267 BRAZIL NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 268 BRAZIL ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 269 ARGENTINA MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 270 ARGENTINA PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 271 ARGENTINA MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 272 ARGENTINA FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 273 ARGENTINA MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 274 ARGENTINA MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 275 ARGENTINA STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 276 ARGENTINA NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 277 ARGENTINA ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 278 REST OF SOUTH AMERICA MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 279 MIDDLE EAST AND AFRICA MILK-BASED DRINKS MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 280 MIDDLE EAST AND AFRICA MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 281 MIDDLE EAST AND AFRICA PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 282 MIDDLE EAST AND AFRICA MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 283 MIDDLE EAST AND AFRICA FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 284 MIDDLE EAST AND AFRICA MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 285 MIDDLE EAST AND AFRICA MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 286 MIDDLE EAST AND AFRICA STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 287 MIDDLE EAST AND AFRICA NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 288 MIDDLE EAST AND AFRICA ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 289 UNITED ARAB EMIRATES MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 290 UNITED ARAB EMIRATES PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 291 UNITED ARAB EMIRATES MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 292 UNITED ARAB EMIRATES FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 293 UNITED ARAB EMIRATES MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 294 UNITED ARAB EMIRATES MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 295 UNITED ARAB EMIRATES STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 296 UNITED ARAB EMIRATES NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 297 UNITED ARAB EMIRATES ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 298 SAUDI ARABIA MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 299 SAUDI ARABIA PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 300 SAUDI ARABIA MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 301 SAUDI ARABIA FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 302 SAUDI ARABIA MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 303 SAUDI ARABIA MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 304 SAUDI ARABIA STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 305 SAUDI ARABIA NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 306 SAUDI ARABIA ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 307 SOUTH AFRICA MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 308 SOUTH AFRICA PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 309 SOUTH AFRICA MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 310 SOUTH AFRICA FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 311 SOUTH AFRICA MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 312 SOUTH AFRICA MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 313 SOUTH AFRICA STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 314 SOUTH AFRICA NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 315 SOUTH AFRICA ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 316 EGYPT MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 317 EGYPT PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 318 EGYPT MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 319 EGYPT FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 320 EGYPT MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 321 EGYPT MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 322 EGYPT STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 323 EGYPT NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 324 EGYPT ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 325 ISRAEL MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 326 ISRAEL PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 327 ISRAEL MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 328 ISRAEL FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 329 ISRAEL MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 330 ISRAEL MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 331 ISRAEL STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 332 ISRAEL NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 333 ISRAEL ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 334 REST OF MIDDLE EAST AND AFRICA MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

Список рисунков

FIGURE 1 GLOBAL MILK-BASED DRINKS MARKET: SEGMENTATION

FIGURE 2 GLOBAL MILK-BASED DRINKS MARKET: DATA TRIANGULATION

FIGURE 3 GLOBAL MILK-BASED DRINKS MARKET: DROC ANALYSIS

FIGURE 4 GLOBAL MILK-BASED DRINKS MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 GLOBAL MILK-BASED DRINKS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 GLOBAL MILK-BASED DRINKS MARKET: MULTIVARIATE MODELLING

FIGURE 7 GLOBAL MILK-BASED DRINKS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 GLOBAL MILK-BASED DRINKS MARKET: DBMR MARKET POSITION GRID

FIGURE 9 GLOBAL MILK-BASED DRINKS MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 GLOBAL MILK-BASED DRINKS MARKET: SEGMENTATION

FIGURE 11 GROWING CONSUMER AWARENESS AND FOCUS ON HEALTH AND WELLNESS IS EXPECTED TO DRIVE THE GROWTH OF THE GLOBAL MILK-BASED DRINKS MARKET IN THE FORECAST PERIOD

FIGURE 12 THE ANIMAL-BASED MILK SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST MARKET SHARE OF THE GLOBAL MILK-BASED DRINKS MARKET IN 2023 AND 2030

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE GLOBAL MILK-BASED DRINKS MARKET

FIGURE 14 GLOBAL MILK-BASED DRINKS MARKET: SNAPSHOT ( 2022)

FIGURE 15 ASIA-PACIFIC MILK-BASED DRINKS MARKET: SNAPSHOT (2022)

FIGURE 16 NORTH AMERICA MILK-BASED DRINKS MARKET: SNAPSHOT (2022)

FIGURE 17 EUROPE MILK-BASED DRINKS MARKET: SNAPSHOT (2022)

FIGURE 18 SOUTH AMERICA MILK-BASED DRINKS MARKET: SNAPSHOT (2022)

FIGURE 19 MIDDLE EAST AND AFRICA MILK-BASED DRINKS MARKET: SNAPSHOT (2022)

FIGURE 20 GLOBAL MILK-BASED DRINKS MARKET: COMPANY SHARE 2022 (%)

FIGURE 21 EUROPE MILK-BASED DRINKS MARKET: COMPANY SHARE 2022 (%)

FIGURE 22 ASIA-PACIFC MILK-BASED DRINKS MARKET: COMPANY SHARE 2022 (%)

FIGURE 23 NORTH AMERICA MILK-BASED DRINKS MARKET: COMPANY SHARE 2022 (%)

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.