Global Medical Device Connectivity Market

Размер рынка в млрд долларов США

CAGR :

%

USD

4.20 Billion

USD

25.84 Billion

2025

2033

USD

4.20 Billion

USD

25.84 Billion

2025

2033

| 2026 –2033 | |

| USD 4.20 Billion | |

| USD 25.84 Billion | |

|

|

|

|

Сегментация мирового рынка подключения медицинских устройств по продуктам и услугам (решения по подключению медицинских устройств и услуги по подключению медицинских устройств), технологиям (проводные технологии, беспроводные технологии и гибридные технологии), области применения (системы мониторинга жизненно важных функций и мониторы пациентов, наркозные аппараты и аппараты ИВЛ, инфузионные насосы и другие), конечным пользователям (больницы, центры домашнего медицинского обслуживания, диагностические центры и центры амбулаторной помощи) — тенденции отрасли и прогноз до 2033 года

Размер рынка подключения медицинских устройств

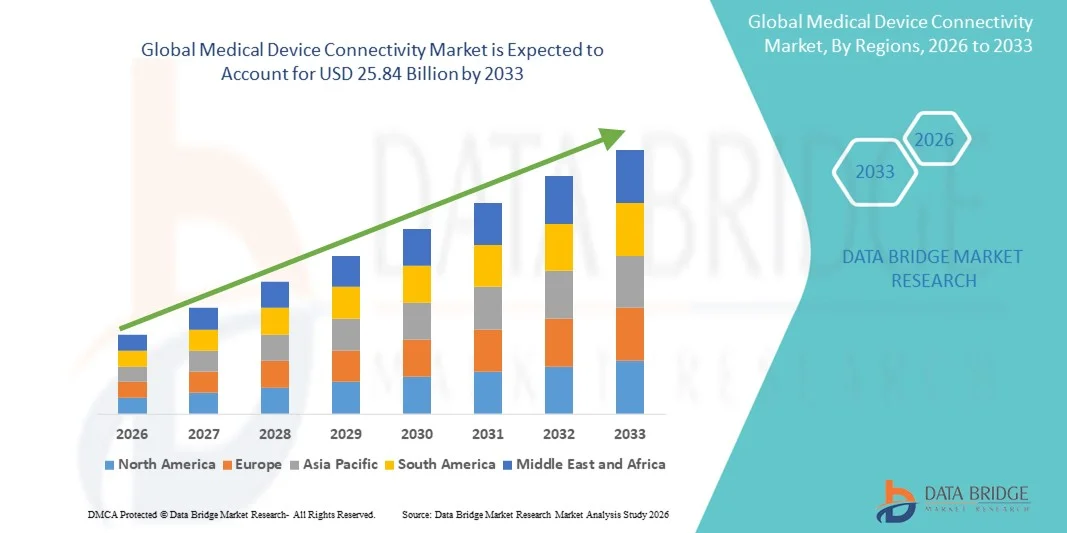

- Объем мирового рынка подключения медицинских устройств в 2025 году оценивался в 4,20 млрд долларов США , а к 2033 году , как ожидается, он достигнет 25,84 млрд долларов США при среднегодовом темпе роста 25,50% в течение прогнозируемого периода.

- Рост рынка во многом обусловлен растущим внедрением передовых медицинских технологий и растущей потребностью в бесперебойной интеграции медицинских устройств в больницах, клиниках и диагностических центрах.

- Кроме того, растущий спрос на мониторинг состояния пациентов в режиме реального времени, эффективное управление данными и оптимизацию клинических рабочих процессов стимулирует внедрение решений для подключенного здравоохранения. Эти факторы ускоряют внедрение решений для подключения медицинских устройств, тем самым значительно стимулируя рост отрасли.

Анализ рынка подключения медицинских устройств

- Решения по подключению медицинских устройств, обеспечивающие бесперебойную интеграцию и взаимодействие между медицинскими устройствами, больничными информационными системами и ИТ-платформами здравоохранения, становятся все более важными компонентами современной инфраструктуры здравоохранения как в больницах, так и в амбулаторных отделениях благодаря своей повышенной эффективности, возможностям мониторинга в режиме реального времени и поддержке принятия решений на основе данных.

- Растущий спрос на подключение медицинских устройств обусловлен, прежде всего, широким распространением электронных медицинских карт (ЭМК), растущим вниманием к безопасности пациентов и оптимизации рабочих процессов, а также растущим спросом на удаленный мониторинг и решения для подключенного здравоохранения.

- Северная Америка доминировала на рынке подключения медицинских устройств, завоевав наибольшую долю выручки в 42% в 2025 году благодаря хорошо развитой инфраструктуре здравоохранения, высоким расходам на НИОКР и присутствию ключевых игроков отрасли. В США наблюдался значительный рост числа установок подключения медицинских устройств в больницах, клиниках и диагностических центрах благодаря инновациям в области интеграции беспроводных устройств, облачных платформ и решений для мониторинга на базе искусственного интеллекта.

- Ожидается, что Азиатско-Тихоокеанский регион станет самым быстрорастущим регионом на рынке подключенных медицинских устройств в прогнозируемый период благодаря развитию инфраструктуры здравоохранения, более широкому внедрению цифровых медицинских решений, растущему спросу на удаленный мониторинг состояния пациентов и увеличению располагаемых доходов в таких странах, как Китай, Индия и Япония. Технологические достижения и государственные инициативы, продвигающие подключенное здравоохранение, дополнительно стимулируют внедрение на рынке в регионе.

- Сегмент решений для подключения медицинских устройств занял самую большую долю рынка в 55,6% в 2025 году, что обусловлено растущей потребностью в интегрированных платформах, обеспечивающих бесперебойный обмен данными между медицинскими устройствами и ИТ-системами больниц.

Область применения отчета и сегментация рынка подключения медицинских устройств

|

Атрибуты |

Ключевые аспекты рынка подключения медицинских устройств |

|

Охваченные сегменты |

|

|

Охваченные страны |

Северная Америка

Европа

Азиатско-Тихоокеанский регион

Ближний Восток и Африка

Южная Америка

|

|

Ключевые игроки рынка |

• Oracle (США) |

|

Рыночные возможности |

|

|

Информационные наборы данных с добавленной стоимостью |

Помимо информации о рыночных сценариях, таких как рыночная стоимость, темпы роста, сегментация, географический охват и основные игроки, рыночные отчеты, подготовленные Data Bridge Market Research, также включают в себя углубленный экспертный анализ, эпидемиологию пациентов, анализ воронки продаж, анализ ценообразования и нормативную базу. |

Тенденции рынка подключения медицинских устройств

Улучшенная связь и взаимодействие медицинских устройств

- Важной и быстрорастущей тенденцией на мировом рынке подключения медицинских устройств является растущее внимание к совместимости различных медицинских устройств, что обеспечивает бесперебойный обмен данными между больничными сетями, лабораториями и диагностическими центрами. Эта тенденция способствует интегрированному мониторингу состояния пациентов, аналитике в реальном времени и более эффективному принятию клинических решений.

- Например, в 2024 году компания Philips Healthcare объявила об усовершенствовании своей платформы IntelliBridge Enterprise, позволяющей интегрировать мониторы жизненно важных показателей, инфузионные насосы и лабораторное оборудование в системы электронных медицинских карт больниц в режиме реального времени. Эти разработки позволяют врачам получать доступ к полным данным о пациентах через единый интерфейс, сокращая количество ошибок ручного ввода и повышая эффективность работы.

- Интеграция медицинских устройств с больничными ИТ-системами обеспечивает автоматизированные оповещения, удаленный мониторинг и аналитическую помощь пациентам. Больницы все чаще используют эти системы для управления данными пациентов, поддержки телемедицины и обеспечения соблюдения протоколов лечения.

- Тенденция к использованию стандартизированных протоколов связи, таких как HL7 и FHIR, еще больше облегчает взаимодействие устройств, упрощая интеграцию новых устройств в существующую инфраструктуру больницы.

- Медицинские учреждения инвестируют в платформы, которые поддерживают многовендорные среды, обеспечивая бесперебойную координацию между устаревшими устройствами и подключенными устройствами нового поколения.

- Эта тенденция формирует ИТ-стратегии больниц и побуждает поставщиков предлагать более гибкие и масштабируемые решения для подключения. Такие компании, как GE Healthcare и Cerner, концентрируются на решениях, объединяющих мониторинг пациентов, визуализацию и результаты лабораторных исследований на единой платформе.

Динамика рынка подключения медицинских устройств

Водитель

Растущая потребность в данных в реальном времени и оптимизации рабочих процессов

- Растущий спрос на данные о пациентах в режиме реального времени в больницах и диагностических центрах является ключевым фактором роста рынка. Доступ к оперативной и достоверной информации помогает врачам принимать более быстрые и точные решения.

- Например, Hillrom (компания Baxter) в 2023 году внедрила свои решения для сетевого ухода за пациентами в нескольких больницах США, чтобы оптимизировать мониторинг и сократить объем ручной документации, повысив эффективность работы персонала.

- Поставщики медицинских услуг все больше внимания уделяют принятию решений на основе данных, для чего им требуются интегрированные решения для подключения, обеспечивающие комплексную аналитику на всех устройствах.

- Мониторинг устройства в режиме реального времени также снижает риск ошибок, повышает безопасность пациентов и способствует лучшему соблюдению протоколов лечения.

- Повышение эффективности работы за счет подключенных медицинских устройств помогает больницам сократить расходы, улучшить управление рабочими процессами и оптимизировать распределение ресурсов.

Сдержанность/Вызов

Опасения по поводу безопасности данных и высоких первоначальных затрат

- Проблемы кибербезопасности и конфиденциальности данных остаются серьёзным сдерживающим фактором на рынке подключения медицинских устройств. Подключённые устройства подвержены кибератакам, утечкам данных и несанкционированному доступу, что вызывает обеспокоенность у поставщиков медицинских услуг.

- Например, в 2022 году несколько больниц в США сообщили о незначительных нарушениях безопасности в сетевых инфузионных насосах, что подчеркивает необходимость надежного шифрования и безопасной аутентификации.

- Высокие первоначальные затраты на внедрение решений по подключению к сети в масштабах всей больницы также могут стать препятствием, особенно для небольших больниц или клиник в развивающихся регионах.

- Обслуживание и обновление подключенных систем требуют постоянных инвестиций в ИТ-инфраструктуру и обучение персонала, что увеличивает эксплуатационные расходы.

- Решение этих проблем посредством усовершенствованных мер безопасности, стандартизированных протоколов и экономически эффективных решений имеет решающее значение для долгосрочного роста рынка.

Рынок подключения медицинских устройств

Рынок сегментирован по признаку продукта и услуги, технологии, области применения и конечного пользователя.

- По продуктам и услугам

По видам продукции и услуг рынок сегментируется на решения для подключения медицинских устройств и услуги по подключению медицинских устройств. Сегмент решений для подключения медицинских устройств занял наибольшую долю рынка – 55,6% – в 2025 году, что обусловлено растущей потребностью в интегрированных платформах, обеспечивающих бесперебойный обмен данными между медицинскими устройствами и ИТ-системами больниц. Больницы и диагностические центры все чаще отдают предпочтение решениям, позволяющим осуществлять мониторинг здоровья пациентов в режиме реального времени, автоматически отправлять оповещения и безопасно хранить данные. Лидерство сегмента поддерживается широким внедрением электронных медицинских карт (ЭМК) и инициативами по модернизации инфраструктуры здравоохранения. Эти решения обеспечивают совместимость между устаревшими и новыми медицинскими устройствами, поддерживая клинические рабочие процессы и повышая эффективность работы. Возможности интеграции с мониторами жизненно важных показателей, инфузионными насосами, аппаратами ИВЛ и наркозными аппаратами делают этот сегмент особенно привлекательным. Ведущие поставщики концентрируются на разработке комплексных решений со стандартизированными протоколами связи для обеспечения совместимости с различными типами устройств. Больницы также получают выгоду от сокращения объема ручной документации, повышения безопасности пациентов и более строгого соблюдения протоколов лечения. Научно-исследовательские и академические институты используют эти решения для сбора данных в режиме реального времени в ходе клинических испытаний и экспериментальных исследований. Значимость сегмента дополнительно усиливается растущими инвестициями в цифровое здравоохранение и инициативами по подключению больниц по всему миру. Постоянное развитие технологий, включая облачные решения и масштабируемость платформ, продолжает укреплять доминирующее положение сегмента решений для подключения медицинских устройств.

Ожидается, что сегмент услуг по подключению медицинских устройств продемонстрирует самые быстрые темпы роста в прогнозируемый период, достигнув среднегодового темпа роста 12,4% с 2026 по 2033 год. Это обусловлено ростом спроса на управляемые услуги, системное обслуживание и поддержку интеграции. Поставщики медицинских услуг ищут услуги, обеспечивающие непрерывную работу подключенных устройств, упрощающие обновление программного обеспечения и предоставляющие возможность устранения неполадок в режиме реального времени. Поставщики услуг предлагают удаленный мониторинг, поддержку установки и консультации для оптимизации подключения устройств в больницах, клиниках и диагностических лабораториях. По мере внедрения больницами более сложных и разнородных сетей медицинских устройств растет спрос на услуги по управлению совместимостью и обеспечению соответствия требованиям. Предлагаемые услуги также включают обучение персонала больниц, поддержку в области кибербезопасности и помощь в анализе данных, обеспечивая безопасное и эффективное использование подключенных устройств. Расширение телемедицины и домашнего мониторинга пациентов еще больше стимулирует внедрение этих услуг. Поставщики услуг предлагают модели на основе подписки, что делает передовые решения по подключению более доступными для небольших клиник и центров домашнего медицинского обслуживания. Акцент на сокращение времени простоя и улучшение управления жизненным циклом устройств повышает привлекательность сервисно-ориентированных решений. Кроме того, соблюдение нормативных требований, таких как HIPAA и MDR, побуждает поставщиков медицинских услуг полагаться на экспертные услуги для внедрения подключения. Рост сегмента подкрепляется растущей осведомленностью о преимуществах профессиональной поддержки в управлении сложными сетями устройств.

- По технологии

В технологическом отношении рынок сегментируется на проводные, беспроводные и гибридные технологии. Сегмент беспроводных технологий занимал наибольшую долю рынка – 48,9% – в 2025 году благодаря своей гибкости, простоте установки и возможности поддержки удалённого мониторинга в режиме реального времени. Больницы и медицинские центры на дому предпочитают беспроводное подключение для снижения затрат на инфраструктуру, интеграции мобильных устройств и повышения мобильности пациентов. Беспроводные системы обеспечивают бесперебойную интеграцию нескольких устройств без прокладки большого количества кабелей, что позволяет быстрее внедрять их в отделения больницы. Они поддерживают подключение мониторов жизненно важных показателей, инфузионных насосов, аппаратов ИВЛ и наркозных аппаратов, предоставляя врачам мгновенный доступ к данным пациентов. Рост сегмента подкрепляется внедрением стандартизированных протоколов связи, обеспечивающих совместимость устройств разных производителей. Беспроводные технологии также повышают масштабируемость, позволяя больницам добавлять устройства в сеть без серьёзных обновлений. Эта технология обеспечивает расширенную аналитику, автоматизированные оповещения и интеграцию с электронными медицинскими картами, повышая операционную эффективность и качество ухода за пациентами. Больницы получают выгоду от снижения риска сбоев, связанных с проводкой, и ускорения поиска и устранения неисправностей. Сегмент также поддерживает телемедицину и инициативы по удаленному мониторингу пациентов, которые становятся все более важными. Широкое внедрение медицинских устройств с поддержкой Интернета вещей еще больше укрепляет позиции беспроводных технологий. Поставщики постоянно модернизируют беспроводные протоколы для повышения безопасности, надежности и точности данных.

Ожидается, что сегмент гибридных технологий продемонстрирует самый быстрый рост, среднегодовой темп роста составит 13,1% в период с 2026 по 2033 год. Гибридные системы предпочтительны в крупных больничных сетях, где критически важные устройства требуют проводного подключения для обеспечения надежности, в то время как мобильные и прикроватные устройства выигрывают от беспроводной интеграции. Эти технологии позволяют поставщикам медицинских услуг поддерживать высокую продолжительность безотказной работы, обеспечивать безопасную передачу данных и расширять возможности мониторинга без капитального ремонта существующей инфраструктуры. Гибридные системы обеспечивают доступ к данным в режиме реального времени как для стационарных, так и для портативных устройств. Рост гибридных решений обусловлен стремлением больниц и диагностических центров оптимизировать затраты, упростить установку и улучшить результаты лечения пациентов. Поставщики предоставляют настраиваемые гибридные платформы для обеспечения совместимости, соответствия нормативным требованиям и безопасного обмена данными. Гибкость сочетания проводных и беспроводных подключений позволяет медицинским учреждениям постепенно внедрять решения для подключения. Гибридные технологии также поддерживают удаленный мониторинг и телемедицинские услуги, удовлетворяя растущую потребность в децентрализованном уходе за пациентами. Благодаря сочетанию надежности, масштабируемости и гибкости гибридные решения по подключению позиционируются как предпочтительный выбор для сложных больничных экосистем.

- По применению

По области применения рынок сегментируется на системы мониторинга жизненно важных показателей и мониторы пациентов, наркозные аппараты и аппараты ИВЛ, инфузионные насосы и другие. Сегмент систем мониторинга жизненно важных показателей и мониторов пациентов занял наибольшую долю рынка – 46,5% в 2025 году, что обусловлено острой необходимостью непрерывного мониторинга пациентов в больницах и учреждениях по уходу на дому. Эти устройства предоставляют данные в режиме реального времени о частоте сердечных сокращений, артериальном давлении, сатурации кислорода и других жизненно важных параметрах, что крайне важно для своевременного проведения клинических вмешательств. Интеграция с больничными ИТ-системами обеспечивает автоматизированную регистрацию данных, снижая количество ошибок, связанных с ручным документированием. Больницы и диагностические центры используют подключенные мониторы для улучшения результатов лечения пациентов, повышения эффективности рабочих процессов и обеспечения возможности удаленных консультаций. Лидерство сегмента также поддерживается растущей распространенностью хронических заболеваний и старением населения, что обуславливает потребность в постоянном наблюдении за пациентами. Программы удаленного мониторинга пациентов и инициативы телемедицины еще больше подчеркивают важность сегмента. Поставщики услуг делают акцент на устройствах, которые являются совместимыми с системами электронных медицинских карт, масштабируемыми и совместимыми с ними, что обеспечивает бесперебойную интеграцию в различные сферы здравоохранения. Расширенная аналитика, автоматические оповещения и прогнозная информация — дополнительные функции, способствующие внедрению этих технологий в условиях стационаров и учреждений домашнего ухода. Научно-исследовательские институты также используют подключенные мониторы жизненно важных показателей для клинических испытаний и исследований в области здравоохранения. Значимость этого сегмента дополнительно усиливается технологическими достижениями, включая портативные и носимые решения для мониторинга.

Ожидается, что сегмент инфузионных насосов будет демонстрировать самые быстрые темпы роста, среднегодовой темп роста составит 12,9% в период с 2026 по 2033 год, что обусловлено растущим использованием подключенных насосов в больницах, амбулаторных центрах и в учреждениях здравоохранения на дому. Подключенные инфузионные насосы позволяют точно контролировать подачу лекарств, автоматически оповещать об окклюзиях или ошибках дозировки, а также интегрироваться с электронными медицинскими картами пациентов для мониторинга в режиме реального времени. Больницы предпочитают подключенные насосы для снижения ошибок при приеме лекарств, повышения эффективности рабочего процесса и повышения безопасности пациентов. Внедрение интеллектуальных инфузионных насосов растет в связи с нормативными требованиями, стремлением к автоматизированному управлению приемом лекарств и ростом распространенности хронических заболеваний. Поставщики услуг все чаще предлагают удаленный мониторинг, обслуживание и обновление программного обеспечения для сетей инфузионных насосов. Рост телемедицины и здравоохранения на дому дополнительно подпитывает спрос, поскольку пациенты могут получать автоматизированное лечение с минимальным клиническим наблюдением. Поставщики сосредоточены на решениях для подключения, которые обеспечивают совместимость, безопасную передачу данных и предиктивную аналитику для управления инфузионной терапией.

- Конечным пользователем

На основе конечного пользователя рынок сегментируется на больницы, центры домашнего медицинского обслуживания, диагностические центры и центры амбулаторной помощи. Сегмент больниц занимал наибольшую долю рынка в 52,8% в 2025 году, поскольку крупные больничные сети требуют передовых возможностей подключения устройств для мониторинга пациентов, оптимизации клинических рабочих процессов и соблюдения нормативных требований. Больницы все чаще внедряют централизованные системы для управления несколькими устройствами, включая мониторы, аппараты ИВЛ, инфузионные насосы и наркозные аппараты, через единый интерфейс. Это позволяет отслеживать состояние пациентов в режиме реального времени, автоматически отправлять оповещения и оптимизировать процесс принятия решений. Сегмент укрепляется благодаря внедрению электронных медицинских карт, программ телемедицины и инициатив в области цифрового здравоохранения. Ведущие больницы уделяют особое внимание совместимости, кибербезопасности и масштабируемым решениям для подключения для улучшения ухода за пациентами и операционной эффективности. Инвестиции в ИТ-инфраструктуру больниц, программы цифровой трансформации и удаленный мониторинг пациентов способствуют доминированию на рынке. Больницы также получают выгоду от предиктивной аналитики, оптимизации рабочих процессов и улучшения клинических результатов, которые обеспечиваются подключенными устройствами.

Ожидается, что сегмент центров домашнего медицинского обслуживания будет демонстрировать самый быстрый рост, среднегодовой темп роста составит 13,3% в период с 2026 по 2033 год, что обусловлено ростом спроса на удаленный мониторинг, лечение хронических заболеваний и услуги телемедицины. Подключенные устройства в домашнем медицинском обслуживании позволяют пациентам контролировать жизненно важные параметры, получать лекарства через подключенные инфузионные системы и передавать данные врачам в режиме реального времени. Эта тенденция подпитывается старением населения, ростом распространенности хронических заболеваний и растущим внедрением телемедицины. Центры домашнего медицинского обслуживания используют подключение устройств для снижения повторных госпитализаций, улучшения соблюдения пациентами предписаний и повышения общего качества ухода. Поставщики разрабатывают решения специально для домашнего использования, уделяя особое внимание простоте установки, надежности и безопасной передаче данных. Расширение услуг домашнего ухода, государственные инициативы и страховое возмещение за удаленный мониторинг дополнительно стимулируют внедрение подключенных медицинских устройств в этом сегменте.

Региональный анализ рынка подключения медицинских устройств

- Северная Америка доминировала на рынке решений для подключения медицинских устройств, достигнув наибольшей доли выручки в 42% в 2025 году благодаря хорошо развитой инфраструктуре здравоохранения, высоким расходам на НИОКР и присутствию ключевых игроков отрасли. Развитая медицинская экосистема региона в сочетании с активным внедрением решений для подключенного здравоохранения создали благоприятную среду для роста рынка.

- Потребители и поставщики медицинских услуг в Северной Америке высоко ценят удобство, возможности мониторинга в реальном времени и бесперебойную интеграцию, которые обеспечивают подключенные медицинские устройства с больничными информационными системами, электронными медицинскими картами и облачными платформами.

- Широкое распространение этой технологии подкрепляется растущим спросом на удаленный мониторинг состояния пациентов, услуги телемедицины и диагностические инструменты на базе искусственного интеллекта, что делает возможность подключения медицинских устройств важнейшим компонентом современной системы оказания медицинских услуг.

Обзор рынка подключения медицинских устройств в США.

Рынок подключения медицинских устройств в США в 2025 году занял наибольшую долю выручки в Северной Америке благодаря значительному росту числа установок в больницах, клиниках и диагностических центрах. Инновации в области интеграции беспроводных устройств, облачных платформ и решений для мониторинга на базе искусственного интеллекта способствуют их внедрению. Поставщики медицинских услуг всё чаще отдают предпочтение подключенным системам, которые улучшают результаты лечения пациентов, обеспечивают эффективный рабочий процесс и доступ к жизненно важным данным в режиме реального времени. Более того, государственные инициативы, стимулирующие внедрение цифрового здравоохранения и интеграцию устройств Интернета медицинских вещей (IoMT), ускоряют расширение рынка.

Обзор европейского рынка подключения медицинских устройств.

Прогнозируется, что европейский рынок подключения медицинских устройств будет расти значительными среднегодовыми темпами в течение всего прогнозируемого периода благодаря широкому внедрению технологий подключенного здравоохранения, строгим нормативным стандартам и повышению осведомленности о безопасности пациентов и эффективности работы. Европейские больницы и диагностические центры интегрируют медицинские устройства с электронными медицинскими картами и платформами телемедицины, тем самым повышая качество ухода за пациентами и эффективность рабочих процессов.

Обзор рынка подключения медицинских устройств в Великобритании.

Ожидается, что рынок подключения медицинских устройств в Великобритании будет устойчиво расти в течение прогнозируемого периода, чему будут способствовать инвестиции в инфраструктуру цифрового здравоохранения, внедрение решений для удаленного мониторинга пациентов и растущее внимание к профилактической помощи. Медицинские учреждения Великобритании все чаще внедряют совместимые медицинские устройства для повышения точности данных, безопасности пациентов и качества принятия клинических решений.

Обзор рынка подключения медицинских устройств в Германии.

Ожидается, что рынок подключения медицинских устройств в Германии будет демонстрировать значительный рост, обусловленный широким внедрением цифровых медицинских решений, развитой медицинской инфраструктурой и растущей интеграцией устройств Интернета вещей (IoMT). Немецкие больницы и научно-исследовательские институты используют подключенные решения для оптимизации рабочих процессов, снижения количества ошибок и поддержки передовых клинических исследований.

Обзор рынка подключенных медицинских устройств в Азиатско-Тихоокеанском регионе.

Ожидается, что рынок подключенных медицинских устройств в Азиатско-Тихоокеанском регионе станет самым быстрорастущим регионом в прогнозируемый период, что обусловлено развитием инфраструктуры здравоохранения, растущим внедрением цифровых медицинских решений, растущим спросом на удаленный мониторинг состояния пациентов и ростом располагаемых доходов в таких странах, как Китай, Индия и Япония. Государственные инициативы, продвигающие подключенное здравоохранение, в сочетании с технологическим прогрессом и доступностью современных устройств способствуют его внедрению в больницах, клиниках и учреждениях по уходу на дому.

Обзор рынка подключения медицинских устройств в Японии.

Рынок подключения медицинских устройств в Японии набирает обороты благодаря акценту на высокотехнологичные решения для здравоохранения, старению населения и растущему спросу на удалённый мониторинг и уход на дому. Интеграция устройств Интернета вещей (IoMT) с системами управления больницами и мобильными медицинскими приложениями способствует эффективному лечению пациентов и проактивному оказанию медицинской помощи.

Обзор рынка подключения медицинских устройств в Китае.

В 2025 году на долю рынка подключения медицинских устройств в Китае пришлась наибольшая доля выручки в Азиатско-Тихоокеанском регионе. Рост обусловлен быстрой урбанизацией, расширением инфраструктуры здравоохранения, государственными инициативами в области цифрового здравоохранения и растущим внедрением подключенных медицинских устройств в больницах и клиниках. Стремление к развитию «умных» больниц и доступность экономически эффективных подключенных медицинских устройств являются основными факторами, стимулирующими развитие рынка.

Доля рынка подключения медицинских устройств

Лидерами отрасли подключения медицинских устройств являются, в первую очередь, хорошо зарекомендовавшие себя компании, в том числе:

• Oracle (США)

• Philips Healthcare (Нидерланды)

• GE Healthcare (США)

• Siemens Healthineers (Германия)

• Medtronic (Ирландия)

• BD (США)

• Tyler Technologies (США)

• Cardinal Health (США)

• Drägerwerk (Германия)

• Spacelabs Healthcare (США)

• Carestream Health (США)

• Hill-Rom Holdings (США)

• Welch Allyn (США)

• Connexall (Франция)

• McKesson Corporation (США)

• Haemonetics (США)

• Stryker Corporation (США)

• Teladoc Health (США)

• Medicomp Systems (США)

Последние разработки на мировом рынке подключения медицинских устройств

- В июле 2025 года компания Philips заключила стратегическое партнерство с ведущими производителями медицинского оборудования, включая Dräger, Hamilton Medical, Getinge и B. Braun, для развития взаимодействия сервисно-ориентированных устройств (SDC) в отделениях интенсивной терапии. Эта инициатива направлена на создание единой медицинской среды, в которой устройства могут беспрепятственно обмениваться данными, обеспечивая мониторинг в режиме реального времени, повышение эффективности рабочих процессов и безопасности пациентов в больничных сетях.

- В мае 2025 года Ассоциация стандартов IEEE опубликовала серию стандартов IEEE 2621 по кибербезопасности медицинских устройств. Эти стандарты предоставляют производителям основу для разработки безопасных и совместимых устройств, обеспечивающих безопасную передачу данных пациентов между ИТ-системами больниц. Цель этой инициативы – снижение киберрисков и повышение уровня интеграции подключенных медицинских устройств в больницах.

- В марте 2023 года Управление по санитарному надзору за качеством пищевых продуктов и медикаментов США (FDA) запустило «Программу диагностических данных» в рамках своей инициативы SHIELD. Эта программа предназначена для стандартизации и улучшения сбора, гармонизации и совместимости данных с медицинских устройств и диагностических лабораторий. Она поддерживает обмен данными в режиме реального времени, раннее выявление клинических проблем и более эффективную интеграцию медицинских устройств в больничные сети.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.