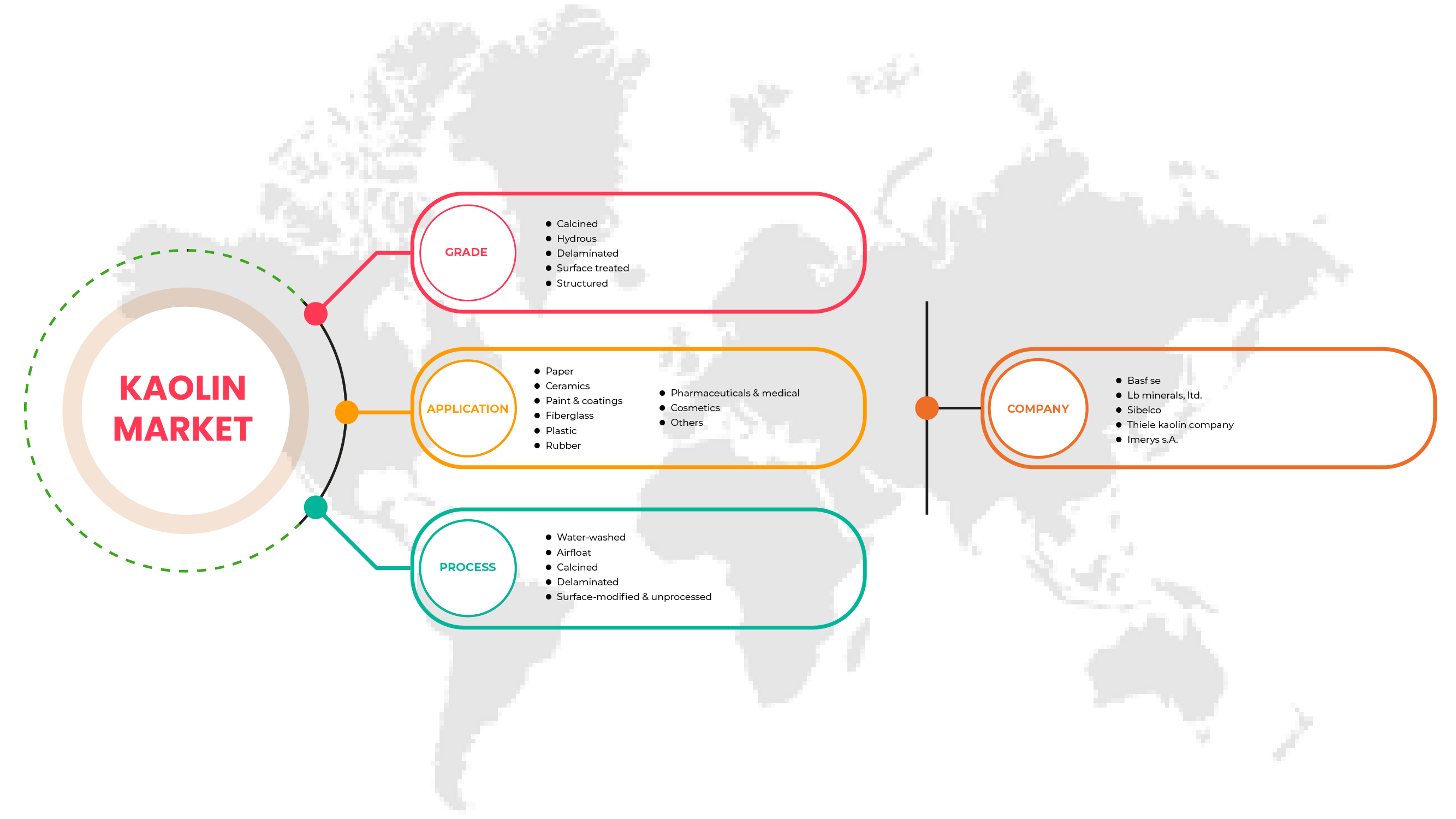

Global Kaolin Market, By Grade (Calcined, Hydrous, Delaminated, Surface Treated, and Structured), Process (Water-Washed, Airfloat, Calcined, Delaminated, and Surface-Modified & Unprocessed), Application (Paper, Ceramics, Paint & Coatings, Fiberglass, Plastic, Rubber, Pharmaceuticals & Medical, Cosmetics, and Others) Industry Trends and Forecast to 2029

Kaolin Market Analysis and Insights

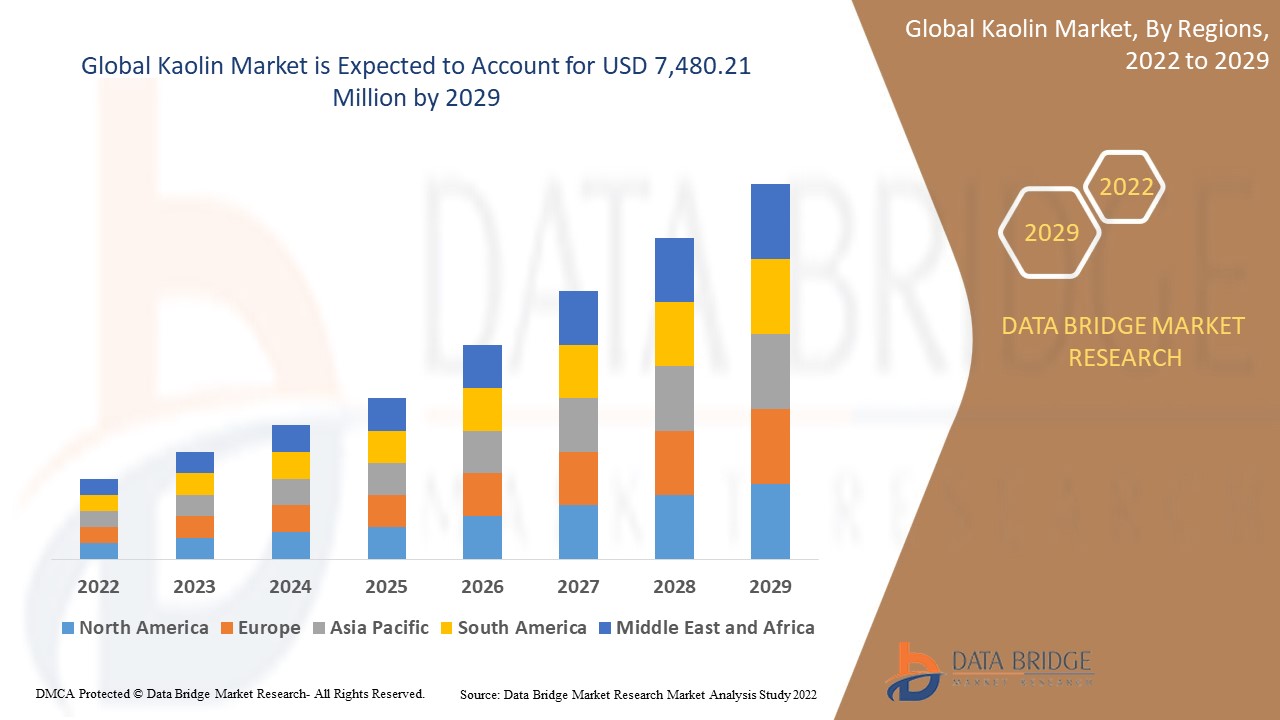

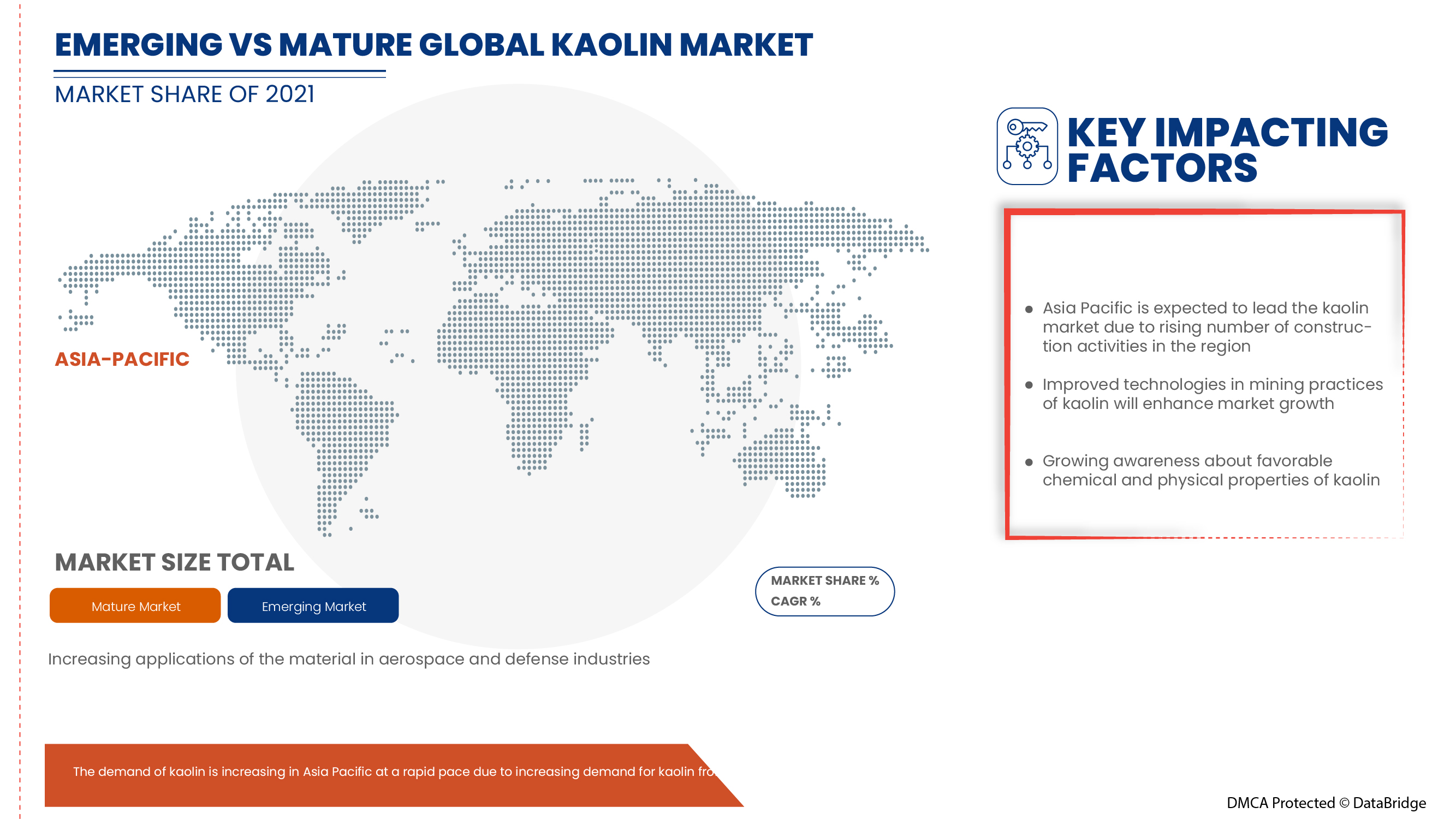

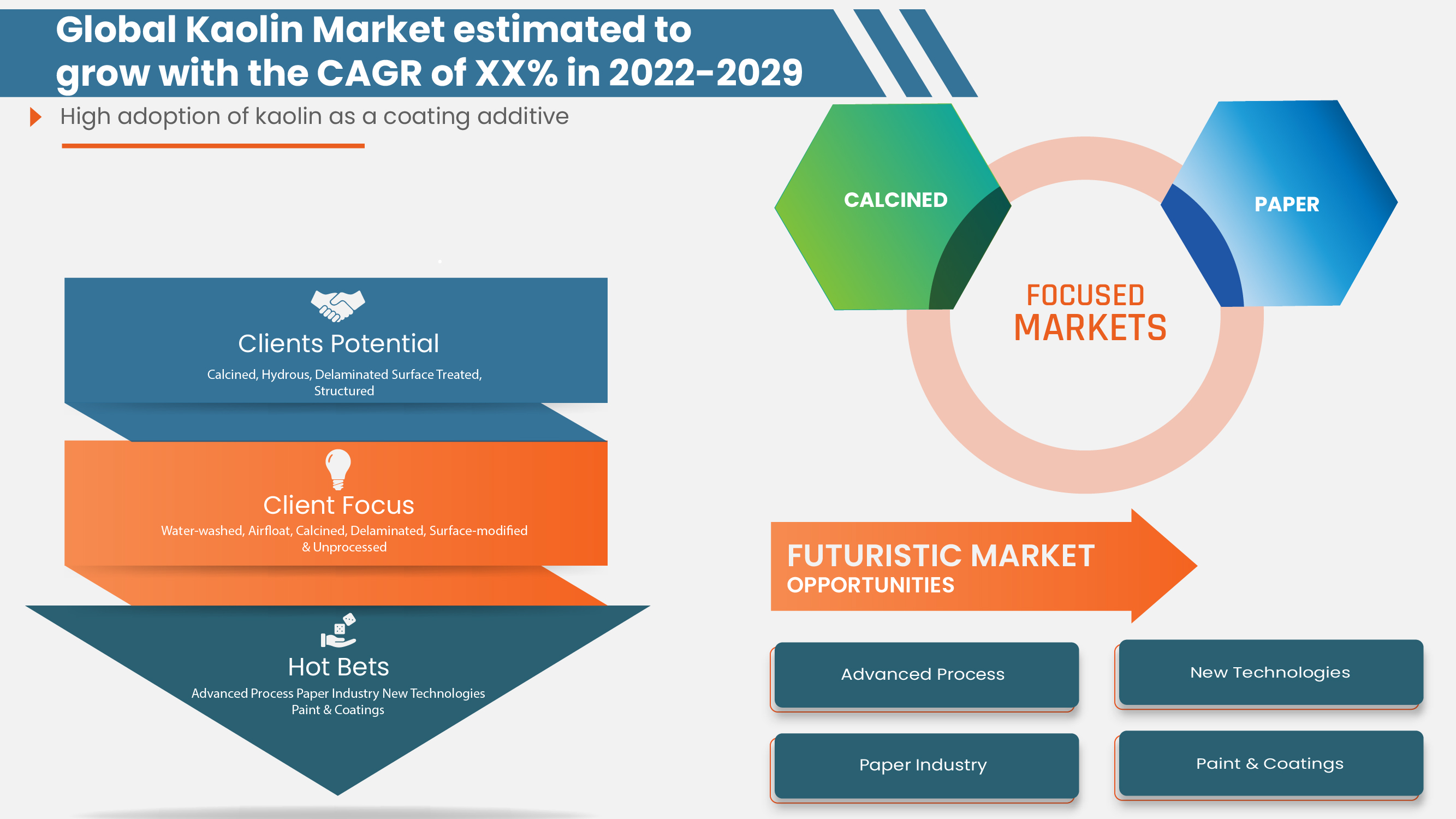

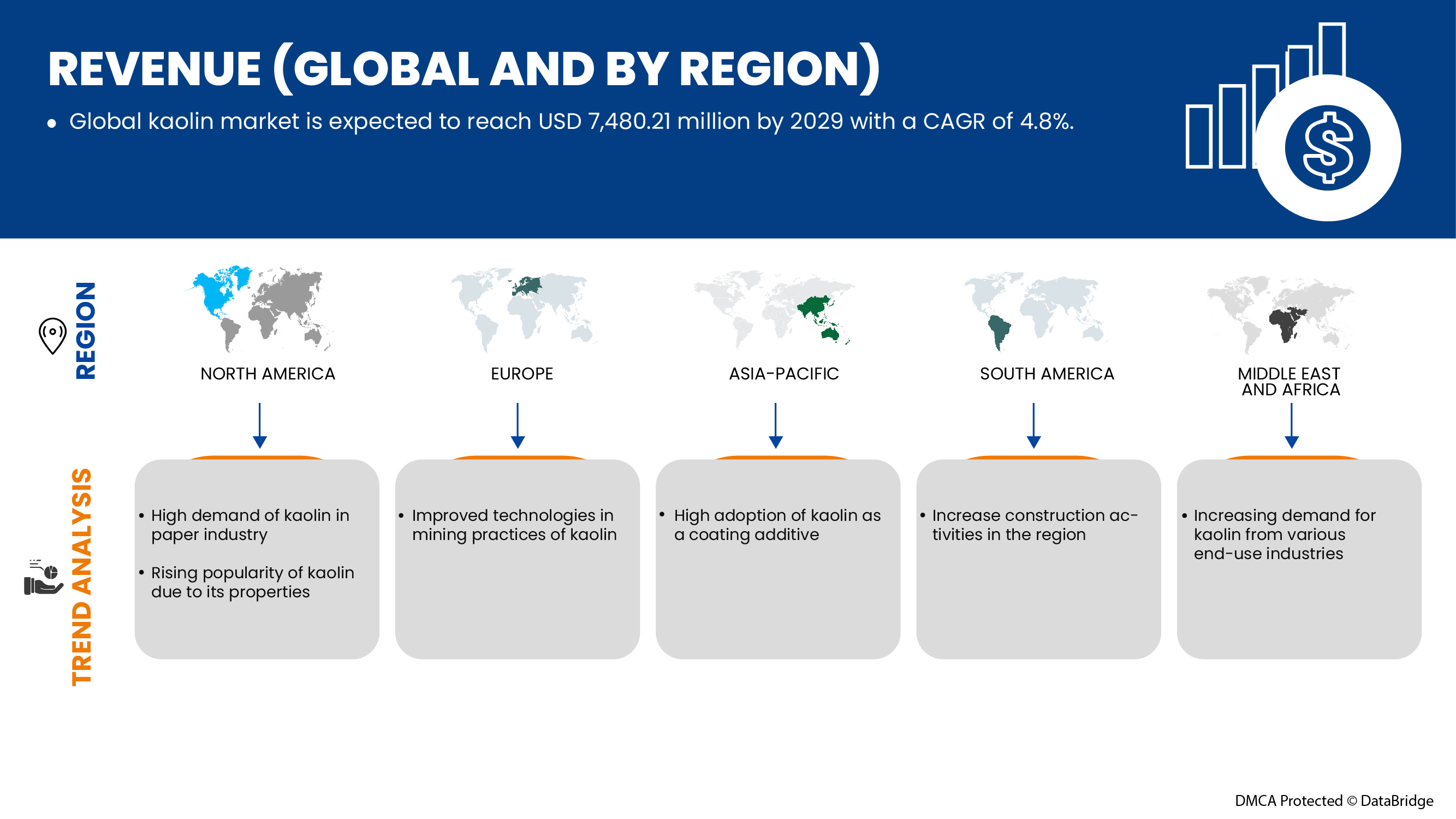

The global kaolin market is expected to grow significantly in the forecast period of 2022 to 2029. Data Bridge Market Research analyses that the market is growing with a CAGR of 4.8% in the forecast period of 2022 to 2029 and is expected to reach USD 7,480.21 million by 2029. The major factor driving the growth of the Kaolin market is the rise in construction activities across the globe, favorable chemical and physical properties of kaolin, increase in demand for kaolin from various end-use industries, and high adoption of kaolin as a coating additive.

Industries are increasingly adopting kaolin as a raw material for the production of commercially important medicinal and cosmetic products. In addition, chemical property such as adsorbing proteins, lipids, and oils has increased the use of kaolin to produce face washes, facial masks, mud packs, body scrubs, and other cosmetic products. Medicinal products, such as mouthwashes, surgical pads, drying agents, and temporary protectants against diaper rash, use kaolin as a key ingredient due to its favorable chemical properties. Therefore, extensive use of kaolin in varied applications and industries may drive the growth of the global kaolin market.

The global kaolin market report provides details of market share, new developments, and the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, products approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario, contact us for an analyst brief. Our team will help you create a revenue impact solution to achieve your desired goal.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Million |

|

Segments Covered |

By Grade (Calcined, Hydrous, Delaminated, Surface Treated, and Structured), Process (Water-Washed, Airfloat, Calcined, Delaminated, and Surface-Modified & Unprocessed), Application (Paper, Ceramics, Paint & Coatings, Fiberglass, Plastic, Rubber, Pharmaceuticals & Medical, Cosmetics, and Others) |

|

Countries Covered |

U.S., Canada, Mexico, U.K., Russia, France, Spain, Italy, Germany, Turkey, Netherlands, Switzerland, Belgium, Rest of Europe, Japan, China, South Korea, India, Singapore, Thailand, Indonesia, Malaysia, Philippines, Australia & New Zealand, and the Rest of Asia-Pacific, Brazil, Argentina, Rest of South America, Egypt, Saudi Arabia, United Arab Emirates, South Africa, Israel and Rest of the Middle East and Africa |

|

Market Players Covered |

BASF SE, LB MINERALS, Ltd., Thiele Kaolin Company, Quartz Works GmbH, KaMin LLC. / CADAM, Ashapura Group, Imerys S.A., SIBELCO, I-Minerals Inc., EICL |

Market Definition

Kaolin, also called china clay, is a soft white clay used as a necessary ingredient in manufacturing paper, rubber, cosmetics, and others. Kaolin is used as a filler agent in the paper industry with adhesive, which improves the paper's appearance, giving it varied gloss, smoothness, brightness, opacity, and printability. In addition, the product enhances paper's printability by providing added ink absorption, ink pigment holdout, and increased roughness. It is highly used in the ceramic industry for manufacturing porcelain and refractory. Kaolin improves mechanical strength and abrasion resistance in the rubber industry.

Global Kaolin Market Dynamics

This section deals with understanding the market drivers, restraints, opportunities, and challenges. All of this is discussed in detail below:

Drivers

- Rise in construction activities across the globe

Increasing construction activities in developing economies have been supported by greater migration of the rural population to urban centers and rising investment in infrastructure development. Growing product demand due to the increasing residential remodeling practices in various countries, such as the U.S. drifting consumer focus towards replacing wood floors with ceramic tiles, drives the kaolin market growth. Moreover, Europe is also expected to witness a rapid pace due to growing ceramic production and consumption in its countries.

- Favorable chemical and physical properties of kaolin

Kaolin is preferred as a metal of choice in various application and end-use industries owing to its desired and favorable chemical and physical properties it executes when used. There is a growing demand for kaolin clay in the plastics industry as its use enhances its electrical performance, durability, and strength. Moreover, the increasing adoption of ceramics is due to the opacity, chemical inertness, non-abrasive texture, and flat shape of kaolin clay. In addition, the use of kaolin in concretes and mortar is rising due to its thermal stability. Some grades of kaolin have fine particle sizes, high adsorption, and suspension properties.

- Increase in demand for kaolin from various end-use industries

Many significant variables and properties that act in favor of kaolin and rising demand for kaolin-made products have kept the kaolin market growing steadily worldwide. The most common application of kaolin is in the paper sector, allowing it to be utilized as a paper coating with a smooth texture and appropriate opacity. The increase is attributable to increased demand for paper from various end-use industries, such as packaging and printing. Furthermore, this material is widely used to fill and coat pieces as it reduces particle size and enhances strength. Kaolin is frequently used in the paper industry because it offers a variety of qualities, including good ink receptivity, paper smoothness, and the optimum opacity for paper making.

- High adoption of kaolin as a coating additive

The paper and paints & coatings industry are among the major users of kaolin in its products. Kaolin is used to enhance the performance of paints in the form of better suspension properties, rapid dispersion, corrosion resistance, superior water resistance, and reduced viscosities. In addition, kaolin is employed as a coating and filling agent when combined with adhesives in paper coating to provide its opacity, color, and printability. Kaolin is the most extensively used particulate mineral in the filling and coating paper. It improves paper appearance, characterized by gloss, smoothness, brightness, and opacity, and of greatest significance, it improves printability. Paper is also filled with kaolin to extend fiber.

Opportunity

- Key strategic initiatives implemented by leading companies

The global kaolin market has seen an unexpected negative effect due to the emergence of COVID-10 and nationwide lockdowns and movement restrictions. Therefore, the manufacturers mostly focus on keeping the liquidity flow to avoid further losses. Moreover, key players in the kaolin market have been implementing various strategic initiatives and developments to gain a major and dominant market share and enhance their operations.

Restraints/Challenges

- Negative effect on paper industry due to the emergence of covid-19

The COVID-19 outbreak has disrupted kaolin market manufacture and supply, delaying the worldwide industry's expansion. Many kaolin enterprises are employing ways to avoid downtime losses, which are increasingly concerning as the pandemic's effects endure. The performance of kaolin in paper filling applications has been eroded by competition from alternative materials, particularly calcium carbonates. Slow growth in coated paper production will limit advances for kaolin in the future, thus, restraining the development of the global kaolin market.

- Easy availability of substitutes

Some other easily available substitutes in the market are bentonite clay. Bentonite clay has powerful oil absorption properties and can absorb more than its body mass in water. This makes it an excellent ingredient for people with extremely oily skin and drives its use in cosmetic products. Bentonite clay is composed of montmorillonite, a type of smectite clay. It has high water content and swells when it comes into contact with water. This makes it effective at drawing out impurities from the skin. Another alternative is fuller's earth, which is also used for skin care and detoxification. In addition, rhassoul clay is a clay that is mined in the Atlas Mountains in Morocco. It is rich in minerals, has cleansing and conditioning properties, and is a great alternative to kaolin clay.

- Rise in the price of kaolin

The companies and players operating in the global kaolin market are focused on increasing kaolin prices to ensure the business's long-term sustainability. These players announced an increase in prices in 2021 for different applications, in which paper was among the key applications. Most companies experienced inflation in various aspects of the business, including inflation in chemicals and freight costs. In addition, the downgrade caused due to the breakout of the pandemic from key application sectors directly impacted the revenue earnings of major market participants.

Recent Development

- In July 2022, Thiele Kaolin Company announced a price increase of 9% for all product categories owing to the current global economic climate, which has resulted in increased costs to manufacturing operations worldwide. For the company, these cost increases have impacted energy, chemicals, labor, mining, maintenance, and other inputs needed to produce quality products

- In November 2021, KaMin LLC and CADAM S.A. agreed to acquire the kaolin mineral business of BASF SE. The kaolin minerals business is part of BASF's Performance Chemicals division. This greatly strengthens the company's kaolin business across the globe

Global Kaolin Market Scope

The global kaolin market is categorized based on grade, process, and application. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Grade

- Calcined

- Hydrous

- Delaminated

- Surface treated

- Structured

Based on grade, the global kaolin market is classified into five segments, namely calcined, hydrous, delaminated, surface treated, and structured.

Process

- Water-Washed

- Airfloat

- Calcined

- Delaminated

- Surface-Modified & Unprocessed

Based on process, the global kaolin market is classified into five segments water-washed, airfloat, calcined, delaminated, and surface-modified & unprocessed.

Application

- Paper

- Ceramics

- Paint & Coatings

- Fiberglass

- Plastic

- Rubber

- Pharmaceuticals & Medical

- Cosmetics

- Others

Based on the application, the global kaolin market is classified into nine segments paper, ceramics, paint & coatings, fiberglass, plastic, rubber, pharmaceuticals & medical, cosmetics, and others.

Global Kaolin Market Regional Analysis/Insights

The global kaolin market is segmented based on grade, process, and application.

The countries in the global kaolin market are the U.S., Canada, Mexico, U.K., Russia, France, Spain, Italy, Germany, Turkey, Netherlands, Switzerland, Belgium, and the Rest of Europe, Japan, China, South Korea, India, Singapore, Thailand, Indonesia, Malaysia, Philippines, Australia & New Zealand, and the rest of Asia-Pacific, Brazil, Argentina, rest of South America, Egypt, Saudi Arabia, United Arab Emirates, South Africa, Israel and rest of the Middle East and Africa.

The U.S. dominates in the North American region due to the region's high adoption of kaolin as a coating additive. Germany dominated expected to dominate the Europe Kaolin market due to growing awareness of the excellent characteristics and properties of kaolin in the region. Saudi Arabia dominated the Kaolin market in the Middle East and Africa, increasing the use of paints & coatings in the region.

The country section of the report also provides individual market-impacting factors and market regulation changes that impact the market's current and future trends. Data point downstream and upstream value chain analysis, technological trends, porter's five forces analysis, and case studies are some pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Global Kaolin Market Share Analysis

Global kaolin market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the companies focus on the global kaolin market.

Some prominent participants operating in the global kaolin market are BASF SE, LB MINERALS, Ltd., Thiele Kaolin Company, Quartz Works GmbH, KaMin LLC. / CADAM, Ashapura Group, Imerys S.A., SIBELCO, I-MineralsInc., and EICL.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. In addition, market share analysis and key trend analysis are the major success factors in the market report. The key research methodology used by the DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Data models include Vendor Positioning grids, Market Time Line Analysis, Market Overview and Guide, Company Positioning grids, Company Market Share Analysis, Standards of Measurement, Global Vs. Regional, and Vendor Share Analysis. Please request an analyst call in case of further inquiry.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Содержание

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL KAOLIN MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 LEGAL FACTORS

4.1.6 ENVIRONMENTAL FACTORS

4.2 PORTER’S FIVE FORCES:

4.2.1 THREAT OF NEW ENTRANTS:

4.2.2 THREAT OF SUBSTITUTES:

4.2.3 CUSTOMER BARGAINING POWER:

4.2.4 SUPPLIER BARGAINING POWER:

4.2.5 INTERNAL COMPETITION (RIVALRY):

4.3 CRITICAL SELECTION CRITERIA FOR BUSINESS DECISION

4.4 IMPORT EXPORT SCENARIO

4.5 MANUFACTURING PROCESS: GLOBAL KAOLIN MARKET

4.6 MARKET CHANGES / CURRENT EVENTS

4.7 PRODUCTION CAPACITY BY MANUFACTURERS: GLOBAL KAOLIN MARKET

4.8 SUPPLY CHAIN ANALYSIS- GLOBAL KAOLIN MARKET

4.8.1 OVERVIEW

4.8.2 LOGISTIC COST SCENARIO

4.8.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.9 TECHNOLOGIES OVERVIEW

4.1 VENDOR SELECTION CRITERIA

4.11 PRICE ANALYSIS SCENARIO

4.11.1 RAW MATERIALS PRICE ANALYSIS

4.11.2 CURRENT PRICE STATISTICS

4.11.3 PRICE FORECASTS

4.12 PRODUCTION CONSUMPTION ANALYSIS

4.13 REGULATION COVERAGE

4.14 MANUFACTURING COST SCENARIO AND FUTURE IMPACT

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISE IN CONSTRUCTION ACTIVITIES ACROSS THE GLOBE

5.1.2 FAVOURABLE CHEMICAL AND PHYSICAL PROPERTIES OF KAOLIN

5.1.3 INCREASE IN DEMAND FOR KAOLIN FROM VARIOUS END-USE INDUSTRIES

5.1.4 HIGH ADOPTION OF KAOLIN AS A COATING ADDITIVE

5.2 RESTRAINTS

5.2.1 NEGATIVE EFFECT ON PAPER INDUSTRY DUE TO EMERGENCE OF COVID-19

5.2.2 KAOLIN MINING CAUSES NUMEROUS ENVIRONMENTAL AND HEALTH HAZARDS

5.3 OPPORTUNITIES

5.3.1 KEY STRATEGIC INITIATIVES IMPLEMENTED BY LEADING COMPANIES

5.3.2 IMPROVED TECHNOLOGIES IN MINING PRACTICES OF KAOLIN

5.4 CHALLENGES

5.4.1 EASY AVAILABILITY OF SUBSTITUTES

5.4.2 RISE IN THE PRICE OF KAOLIN

6 GLOBAL KAOLIN MARKET, BY GRADE

6.1 OVERVIEW

6.2 CALCINED

6.3 HYDROUS

6.4 DELAMINATED

6.5 SURFACE TREATED

6.6 STRUCTURED

7 GLOBAL KAOLIN MARKET, BY PROCESS

7.1 OVERVIEW

7.2 WATER-WASHED

7.3 AIRFLOAT

7.4 CALCINED

7.5 DELAMINATED

7.6 SURFACE-MODIFIED & UNPROCESSED

8 GLOBAL KAOLIN MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 PAPER

8.3 CERAMICS

8.4 PAINT & COATINGS

8.5 FIBERGLASS

8.6 PLASTIC

8.7 RUBBER

8.8 PHARMACEUTICALS & MEDICAL

8.9 COSMETICS

8.1 OTHERS

9 GLOBAL KAOLIN MARKET, BY REGION

9.1 OVERVIEW

9.2 ASIA-PACIFIC

9.2.1 CHINA

9.2.2 INDIA

9.2.3 JAPAN

9.2.4 SOUTH KOREA

9.2.5 THAILAND

9.2.6 SINGAPORE

9.2.7 INDONESIA

9.2.8 AUSTRALIA & NEW ZEALAND

9.2.9 PHILIPPINES

9.2.10 MALAYSIA

9.2.11 REST OF ASIA-PACIFIC

9.3 EUROPE

9.3.1 GERMANY

9.3.2 U.K.

9.3.3 FRANCE

9.3.4 ITALY

9.3.5 SPAIN

9.3.6 RUSSIA

9.3.7 SWITZERLAND

9.3.8 TURKEY

9.3.9 BELGIUM

9.3.10 NETHERLANDS

9.3.11 REST OF EUROPE

9.4 NORTH AMERICA

9.4.1 U.S.

9.4.2 CANADA

9.4.3 MEXICO

9.5 MIDDLE EAST AND AFRICA

9.5.1 SAUDI ARABIA

9.5.2 U.A.E.

9.5.3 SOUTH AFRICA

9.5.4 EGYPT

9.5.5 ISRAEL

9.5.6 REST OF MIDDLE EAST AND AFRICA

9.6 SOUTH AMERICA

9.6.1 BRAZIL

9.6.2 ARGENTINA

9.6.3 REST OF SOUTH AMERICA

10 GLOBAL KAOLIN MARKET: COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: GLOBAL

10.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

10.3 COMPANY SHARE ANALYSIS: EUROPE

10.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

10.5 DISINVESTMENT

10.6 PRICE INCREASE

10.7 ACQUISITION

10.8 FACILITY EXPANSION

11 SWOT ANALYSIS

12 COMPANY PROFILES

12.1 IMERYS S.A.

12.1.1 COMPANY SNAPSHOT

12.1.2 REVENUE ANALYSIS

12.1.3 COMPANY SHARE ANALYSIS

12.1.4 PRODUCT PORTFOLIO

12.1.5 RECENT DEVELOPMENT

12.2 SIBELCO

12.2.1 COMPANY SNAPSHOT

12.2.2 REVENUE ANALYSIS

12.2.3 COMPANY SHARE ANALYSIS

12.2.4 PRODUCT PORTFOLIO

12.2.5 RECENT DEVELOPMENT

12.3 BASF SE

12.3.1 COMPANY SNAPSHOT

12.3.2 REVENUE ANALYSIS

12.3.3 COMPANY SHARE ANALYSIS

12.3.4 PRODUCT PORTFOLIO

12.3.5 RECENT DEVELOPMENT

12.4 KAMIN LLC. / CADAM

12.4.1 COMPANY SNAPSHOT

12.4.2 COMPANY SHARE ANALYSIS

12.4.3 PRODUCT PORTFOLIO

12.4.4 RECENT DEVELOPMENTS

12.5 THIELE KAOLIN COMPANY

12.5.1 COMPANY SNAPSHOT

12.5.2 COMPANY SHARE ANALYSIS

12.5.3 PRODUCT PORTFOLIO

12.5.4 RECENT DEVELOPMENTS

12.6 ASHAPURA GROUP

12.6.1 COMPANY SNAPSHOT

12.6.2 REVENUE ANALYSIS

12.6.3 PRODUCT PORTFOLIO

12.6.4 RECENT DEVELOPMENTS

12.7 EICL

12.7.1 COMPANY SNAPSHOT

12.7.2 REVENUE ANALYSIS

12.7.3 PRODUCT PORTFOLIO

12.7.4 RECENT DEVELOPMENTS

12.8 I-MINERALSINC.

12.8.1 COMPANY SNAPSHOT

12.8.2 REVENUE ANALYSIS

12.8.3 PRODUCT PORTFOLIO

12.8.4 RECENT DEVELOPMENTS

12.9 LB MINERALS, LTD.

12.9.1 COMPANY SNAPSHOT

12.9.2 PRODUCT PORTFOLIO

12.9.3 RECENT DEVELOPMENTS

12.1 QUARTZ WORKS GMBH

12.10.1 COMPANY SNAPSHOT

12.10.2 PRODUCT PORTFOLIO

12.10.3 RECENT DEVELOPMENTS

13 QUESTIONNAIRE

14 RELATED REPORTS

Список таблиц

TABLE 1 IMPORT DATA OF KAOLIN AND OTHER KAOLINIC CLAYS, WHETHER OR NOT CALCINED; HS CODE – 2507 (USD THOUSAND)

TABLE 2 EXPORT DATA OF KAOLIN AND OTHER KAOLINIC CLAYS, WHETHER OR NOT CALCINED; HS CODE – 2507 (USD THOUSAND)

TABLE 3 THE FOLLOWING TABLE SHOWS THE PRODUCTION CAPACITIES OF VARIOUS COMPANIES OPERATING IN THE GLOBAL KAOLIN MARKET.

TABLE 4 REGULATORY FRAMEWORK

TABLE 5 GLOBAL KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 6 GLOBAL KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 7 GLOBAL CALCINED IN KAOLIN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 GLOBAL CALCINED IN KAOLIN MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 9 GLOBAL HYDROUS IN GLOBAL KAOLIN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 GLOBAL HYDROUS IN GLOBAL KAOLIN MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 11 GLOBAL DELAMINATED IN GLOBAL KAOLIN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 GLOBAL DELAMINATED IN GLOBAL KAOLIN MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 13 GLOBAL SURFACE TREATED IN GLOBAL KAOLIN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 GLOBAL SURFACE TREATED IN GLOBAL KAOLIN MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 15 GLOBAL STRUCTURED IN GLOBAL KAOLIN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 GLOBAL STRUCTURED IN GLOBAL KAOLIN MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 17 GLOBAL KAOLIN MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 18 GLOBAL KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 19 GLOBAL WATER-WASHED IN KAOLIN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 GLOBAL WATER-WASHED IN KAOLIN MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 21 GLOBAL AIRFLOAT IN GLOBAL KAOLIN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 GLOBAL AIRFLOAT IN GLOBAL KAOLIN MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 23 GLOBAL CALCINED IN GLOBAL KAOLIN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 GLOBAL CALCINED IN GLOBAL KAOLIN MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 25 GLOBAL DELAMINATED IN GLOBAL KAOLIN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 GLOBAL DELAMINATED IN GLOBAL KAOLIN MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 27 GLOBAL SURFACE-MODIFIED & UNPROCESSED IN GLOBAL KAOLIN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 GLOBAL SURFACE-MODIFIED & UNPROCESSED IN GLOBAL KAOLIN MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 29 GLOBAL KAOLIN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 30 GLOBAL KAOLIN MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 31 GLOBAL PAPER IN KAOLIN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 GLOBAL PAPER IN KAOLIN MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 33 GLOBAL CERAMICS IN GLOBAL KAOLIN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 GLOBAL CERAMICS IN GLOBAL KAOLIN MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 35 GLOBAL PAINT & COATINGS IN GLOBAL KAOLIN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 GLOBAL PAINT & COATINGS IN GLOBAL KAOLIN MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 37 GLOBAL FIBERGLASS IN GLOBAL KAOLIN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 GLOBAL FIBERGLASS IN GLOBAL KAOLIN MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 39 GLOBAL PLASTIC IN GLOBAL KAOLIN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 GLOBAL PLASTIC IN GLOBAL KAOLIN MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 41 GLOBAL RUBBER IN GLOBAL KAOLIN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 42 GLOBAL RUBBER IN GLOBAL KAOLIN MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 43 GLOBAL PHARMACEUTICALS & MEDICAL IN GLOBAL KAOLIN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 44 GLOBAL PHARMACEUTICALS & MEDICAL IN GLOBAL KAOLIN MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 45 GLOBAL COSMETICS IN GLOBAL KAOLIN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 46 GLOBAL COSMETICS IN GLOBAL KAOLIN MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 47 GLOBAL OTHERS IN GLOBAL KAOLIN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 48 GLOBAL OTHERS IN GLOBAL KAOLIN MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 49 GLOBAL KAOLIN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 50 GLOBAL KAOLIN MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 51 ASIA-PACIFIC KAOLIN MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 52 ASIA-PACIFIC KAOLIN MARKET, BY COUNTRY, 2020-2029 (KILO TONS)

TABLE 53 ASIA-PACIFIC KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 54 ASIA-PACIFIC KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 55 ASIA-PACIFIC KAOLIN MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 56 ASIA-PACIFIC KAOLIN MARKET, BY PROCESS, 2020-2029 (KILO TONS)

TABLE 57 ASIA-PACIFIC KAOLIN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 58 ASIA-PACIFIC KAOLIN MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 59 CHINA KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 60 CHINA KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 61 CHINA KAOLIN MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 62 CHINA KAOLIN MARKET, BY PROCESS, 2020-2029 (KILO TONS)

TABLE 63 CHINA KAOLIN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 64 CHINA KAOLIN MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 65 INDIA KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 66 INDIA KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 67 INDIA KAOLIN MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 68 INDIA KAOLIN MARKET, BY PROCESS, 2020-2029 (KILO TONS)

TABLE 69 INDIA KAOLIN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 70 INDIA KAOLIN MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 71 JAPAN KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 72 JAPAN KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 73 JAPAN KAOLIN MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 74 JAPAN KAOLIN MARKET, BY PROCESS, 2020-2029 (KILO TONS)

TABLE 75 JAPAN KAOLIN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 76 JAPAN KAOLIN MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 77 SOUTH KOREA KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 78 SOUTH KOREA KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 79 SOUTH KOREA KAOLIN MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 80 SOUTH KOREA KAOLIN MARKET, BY PROCESS, 2020-2029 (KILO TONS)

TABLE 81 SOUTH KOREA KAOLIN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 82 SOUTH KOREA KAOLIN MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 83 THAILAND KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 84 THAILAND KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 85 THAILAND KAOLIN MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 86 THAILAND KAOLIN MARKET, BY PROCESS, 2020-2029 (KILO TONS)

TABLE 87 THAILAND KAOLIN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 88 THAILAND KAOLIN MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 89 SINGAPORE KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 90 SINGAPORE KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 91 SINGAPORE KAOLIN MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 92 SINGAPORE KAOLIN MARKET, BY PROCESS, 2020-2029 (KILO TONS)

TABLE 93 SINGAPORE KAOLIN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 94 SINGAPORE KAOLIN MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 95 INDONESIA KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 96 INDONESIA KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 97 INDONESIA KAOLIN MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 98 INDONESIA KAOLIN MARKET, BY PROCESS, 2020-2029 (KILO TONS)

TABLE 99 INDONESIA KAOLIN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 100 INDONESIA KAOLIN MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 101 AUSTRALIA & NEW ZEALAND KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 102 AUSTRALIA & NEW ZEALAND KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 103 AUSTRALIA & NEW ZEALAND KAOLIN MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 104 AUSTRALIA & NEW ZEALAND KAOLIN MARKET, BY PROCESS, 2020-2029 (KILO TONS)

TABLE 105 AUSTRALIA & NEW ZEALAND KAOLIN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 106 AUSTRALIA & NEW ZEALAND KAOLIN MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 107 PHILIPPINES KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 108 PHILIPPINES KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 109 PHILIPPINES KAOLIN MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 110 PHILIPPINES KAOLIN MARKET, BY PROCESS, 2020-2029 (KILO TONS)

TABLE 111 PHILIPPINES KAOLIN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 112 PHILIPPINES KAOLIN MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 113 MALAYSIA KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 114 MALAYSIA KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 115 MALAYSIA KAOLIN MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 116 MALAYSIA KAOLIN MARKET, BY PROCESS, 2020-2029 (KILO TONS)

TABLE 117 MALAYSIA KAOLIN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 118 MALAYSIA KAOLIN MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 119 REST OF ASIA-PACIFIC KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 120 REST OF ASIA-PACIFIC KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 121 EUROPE KAOLIN MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 122 EUROPE KAOLIN MARKET, BY COUNTRY, 2020-2029 (KILO TONS)

TABLE 123 EUROPE KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 124 EUROPE KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 125 EUROPE KAOLIN MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 126 EUROPE KAOLIN MARKET, BY PROCESS, 2020-2029 (KILO TONS)

TABLE 127 EUROPE KAOLIN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 128 EUROPE KAOLIN MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 129 GERMANY KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 130 GERMANY KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 131 GERMANY KAOLIN MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 132 GERMANY KAOLIN MARKET, BY PROCESS, 2020-2029 (KILO TONS)

TABLE 133 GERMANY KAOLIN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 134 GERMANY KAOLIN MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 135 U.K. KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 136 U.K. KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 137 U.K. KAOLIN MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 138 U.K. KAOLIN MARKET, BY PROCESS, 2020-2029 (KILO TONS)

TABLE 139 U.K. KAOLIN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 140 U.K. KAOLIN MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 141 FRANCE KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 142 FRANCE KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 143 FRANCE KAOLIN MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 144 FRANCE KAOLIN MARKET, BY PROCESS, 2020-2029 (KILO TONS)

TABLE 145 FRANCE KAOLIN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 146 FRANCE KAOLIN MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 147 ITALY KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 148 ITALY KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 149 ITALY KAOLIN MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 150 ITALY KAOLIN MARKET, BY PROCESS, 2020-2029 (KILO TONS)

TABLE 151 ITALY KAOLIN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 152 ITALY KAOLIN MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 153 SPAIN KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 154 SPAIN KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 155 SPAIN KAOLIN MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 156 SPAIN KAOLIN MARKET, BY PROCESS, 2020-2029 (KILO TONS)

TABLE 157 SPAIN KAOLIN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 158 SPAIN KAOLIN MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 159 RUSSIA KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 160 RUSSIA KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 161 RUSSIA KAOLIN MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 162 RUSSIA KAOLIN MARKET, BY PROCESS, 2020-2029 (KILO TONS)

TABLE 163 RUSSIA KAOLIN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 164 RUSSIA KAOLIN MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 165 SWITZERLAND KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 166 SWITZERLAND KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 167 SWITZERLAND KAOLIN MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 168 SWITZERLAND KAOLIN MARKET, BY PROCESS, 2020-2029 (KILO TONS)

TABLE 169 SWITZERLAND KAOLIN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 170 SWITZERLAND KAOLIN MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 171 TURKEY KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 172 TURKEY KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 173 TURKEY KAOLIN MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 174 TURKEY KAOLIN MARKET, BY PROCESS, 2020-2029 (KILO TONS)

TABLE 175 TURKEY KAOLIN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 176 TURKEY KAOLIN MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 177 BELGIUM KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 178 BELGIUM KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 179 BELGIUM KAOLIN MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 180 BELGIUM KAOLIN MARKET, BY PROCESS, 2020-2029 (KILO TONS)

TABLE 181 BELGIUM KAOLIN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 182 BELGIUM KAOLIN MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 183 NETHERLANDS KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 184 NETHERLANDS KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 185 NETHERLANDS KAOLIN MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 186 NETHERLANDS KAOLIN MARKET, BY PROCESS, 2020-2029 (KILO TONS)

TABLE 187 NETHERLANDS KAOLIN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 188 NETHERLANDS KAOLIN MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 189 REST OF EUROPE KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 190 REST OF EUROPE KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 191 NORTH AMERICA KAOLIN MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 192 NORTH AMERICA KAOLIN MARKET, BY COUNTRY, 2020-2029 (KILO TONS)

TABLE 193 NORTH AMERICA KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 194 NORTH AMERICA KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 195 NORTH AMERICA KAOLIN MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 196 NORTH AMERICA KAOLIN MARKET, BY PROCESS, 2020-2029 (KILO TONS)

TABLE 197 NORTH AMERICA KAOLIN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 198 NORTH AMERICA KAOLIN MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 199 U.S. KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 200 U.S. KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 201 U.S. KAOLIN MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 202 U.S. KAOLIN MARKET, BY PROCESS, 2020-2029 (KILO TONS)

TABLE 203 U.S. KAOLIN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 204 U.S. KAOLIN MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 205 CANADA KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 206 CANADA KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 207 CANADA KAOLIN MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 208 CANADA KAOLIN MARKET, BY PROCESS, 2020-2029 (KILO TONS)

TABLE 209 CANADA KAOLIN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 210 CANADA KAOLIN MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 211 MEXICO KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 212 MEXICO KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 213 MEXICO KAOLIN MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 214 MEXICO KAOLIN MARKET, BY PROCESS, 2020-2029 (KILO TONS)

TABLE 215 MEXICO KAOLIN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 216 MEXICO KAOLIN MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 217 MIDDLE EAST AND AFRICA KAOLIN MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 218 MIDDLE EAST AND AFRICA KAOLIN MARKET, BY COUNTRY, 2020-2029 (KILO TONS)

TABLE 219 MIDDLE EAST AND AFRICA KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 220 MIDDLE EAST AND AFRICA KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 221 MIDDLE EAST AND AFRICA KAOLIN MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 222 MIDDLE EAST AND AFRICA KAOLIN MARKET, BY PROCESS, 2020-2029 (KILO TONS)

TABLE 223 MIDDLE EAST AND AFRICA KAOLIN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 224 MIDDLE EAST AND AFRICA KAOLIN MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 225 SAUDI ARABIA KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 226 SAUDI ARABIA KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 227 SAUDI ARABIA KAOLIN MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 228 SAUDI ARABIA KAOLIN MARKET, BY PROCESS, 2020-2029 (KILO TONS)

TABLE 229 SAUDI ARABIA KAOLIN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 230 SAUDI ARABIA KAOLIN MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 231 U.A.E. KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 232 U.A.E. KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 233 U.A.E. KAOLIN MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 234 U.A.E. KAOLIN MARKET, BY PROCESS, 2020-2029 (KILO TONS)

TABLE 235 U.A.E. KAOLIN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 236 U.A.E. KAOLIN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 237 SOUTH AFRICA KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 238 SOUTH AFRICA KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 239 SOUTH AFRICA KAOLIN MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 240 SOUTH AFRICA KAOLIN MARKET, BY PROCESS, 2020-2029 (KILO TONS)

TABLE 241 SOUTH AFRICA KAOLIN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 242 SOUTH AFRICA KAOLIN MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 243 EGYPT KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 244 EGYPT KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 245 EGYPT KAOLIN MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 246 EGYPT KAOLIN MARKET, BY PROCESS, 2020-2029 (KILO TONS)

TABLE 247 EGYPT KAOLIN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 248 EGYPT KAOLIN MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 249 ISRAEL KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 250 ISRAEL KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 251 ISRAEL KAOLIN MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 252 ISRAEL KAOLIN MARKET, BY PROCESS, 2020-2029 (KILO TONS)

TABLE 253 ISRAEL KAOLIN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 254 ISRAEL KAOLIN MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 255 REST OF MIDDLE EAST AND AFRICA KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 256 REST OF MIDDLE EAST AND AFRICA KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 257 SOUTH AMERICA KAOLIN MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 258 SOUTH AMERICA KAOLIN MARKET, BY COUNTRY, 2020-2029 (KILO TONS)

TABLE 259 SOUTH AMERICA KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 260 SOUTH AMERICA KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 261 SOUTH AMERICA KAOLIN MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 262 SOUTH AMERICA KAOLIN MARKET, BY PROCESS, 2020-2029 (KILO TONS)

TABLE 263 SOUTH AMERICA KAOLIN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 264 SOUTH AMERICA KAOLIN MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 265 BRAZIL KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 266 BRAZIL KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 267 BRAZIL KAOLIN MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 268 BRAZIL KAOLIN MARKET, BY PROCESS, 2020-2029 (KILO TONS)

TABLE 269 BRAZIL KAOLIN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 270 BRAZIL KAOLIN MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 271 ARGENTINA KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 272 ARGENTINA KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 273 ARGENTINA KAOLIN MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 274 ARGENTINA KAOLIN MARKET, BY PROCESS, 2020-2029 (KILO TONS)

TABLE 275 ARGENTINA KAOLIN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 276 ARGENTINA KAOLIN MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 277 REST OF SOUTH AMERICA KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 278 REST OF SOUTH AMERICA KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

Список рисунков

FIGURE 1 GLOBAL KAOLIN MARKET

FIGURE 2 GLOBAL KAOLIN MARKET: DATA TRIANGULATION

FIGURE 3 GLOBAL KAOLIN MARKET: DROC ANALYSIS

FIGURE 4 GLOBAL KAOLIN MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 GLOBAL KAOLIN MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 GLOBAL KAOLIN MARKET: THE PRODUCT LIFE LINE CURVE

FIGURE 7 GLOBAL KAOLIN MARKET: MULTIVARIATE MODELLING

FIGURE 8 GLOBAL KAOLIN MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 GLOBAL KAOLIN MARKET: DBMR MARKET POSITION GRID

FIGURE 10 GLOBAL KAOLIN MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 GLOBAL KAOLIN MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 GLOBAL KAOLIN MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 GLOBAL KAOLIN MARKET: SEGMENTATION

FIGURE 14 ASIA PACIFIC IS EXPECTED TO DOMINATE THE GLOBAL KAOLIN MARKET, WHILE NORTH AMERICA IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD

FIGURE 15 RISE IN CONSTRUCTION ACTIVITIES ACROSS THE GLOBE IS EXPECTED TO DRIVE THE GLOBAL KAOLIN MARKET IN THE FORECAST PERIOD

FIGURE 16 CALCINED SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE GLOBAL KAOLIN MARKET IN 2022 & 2029

FIGURE 17 ASIA-PACIFIC IS THE FASTEST-GROWING MARKET FOR KAOLIN MARKET MANUFACTURERS IN THE FORECAST PERIOD

FIGURE 18 IMPORT-EXPORT SCENARIO (USD THOUSAND)

FIGURE 19 CURRENT PRICE STATISTICS (PER KG)

FIGURE 20 PRICE FORECASTS (PER KG)

FIGURE 21 PRODUCTION CONSUMPTION ANALYSIS

FIGURE 22 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE GLOBAL KAOLIN MARKET

FIGURE 23 GLOBAL KAOLIN MARKET: BY GRADE, 2021

FIGURE 24 GLOBAL KAOLIN MARKET: BY PROCESS, 2021

FIGURE 25 GLOBAL KAOLIN MARKET: BY APPLICATION, 2021

FIGURE 26 GLOBAL KAOLIN MARKET: SNAPSHOT (2021)

FIGURE 27 GLOBAL KAOLIN MARKET: BY REGION (2021)

FIGURE 28 GLOBAL KAOLIN MARKET: BY REGION (2022 & 2029)

FIGURE 29 GLOBAL KAOLIN MARKET: BY REGION (2021 & 2029)

FIGURE 30 GLOBAL KAOLIN MARKET: BY GRADE (2022-2029)

FIGURE 31 ASIA-PACIFIC KAOLIN MARKET: SNAPSHOT (2021)

FIGURE 32 ASIA-PACIFIC KAOLIN MARKET: BY COUNTRY (2021)

FIGURE 33 ASIA-PACIFIC KAOLIN MARKET: BY COUNTRY (2022 & 2029)

FIGURE 34 ASIA-PACIFIC KAOLIN MARKET: BY COUNTRY (2021 & 2029)

FIGURE 35 ASIA-PACIFIC KAOLIN MARKET: BY GRADE (2022-2029)

FIGURE 36 EUROPE KAOLIN MARKET: SNAPSHOT (2021)

FIGURE 37 EUROPE KAOLIN MARKET: BY COUNTRY (2021)

FIGURE 38 EUROPE KAOLIN MARKET: BY COUNTRY (2022 & 2029)

FIGURE 39 EUROPE KAOLIN MARKET: BY COUNTRY (2021 & 2029)

FIGURE 40 EUROPE KAOLIN MARKET: BY GRADE (2022-2029)

FIGURE 41 NORTH AMERICA KAOLIN MARKET: SNAPSHOT (2021)

FIGURE 42 NORTH AMERICA KAOLIN MARKET: BY COUNTRY (2021)

FIGURE 43 NORTH AMERICA KAOLIN MARKET: BY COUNTRY (2022 & 2029)

FIGURE 44 NORTH AMERICA KAOLIN MARKET: BY COUNTRY (2021 & 2029)

FIGURE 45 NORTH AMERICA KAOLIN MARKET: BY GRADE (2022-2029)

FIGURE 46 MIDDLE EAST AND AFRICA KAOLIN MARKET: SNAPSHOT (2021)

FIGURE 47 MIDDLE EAST AND AFRICA KAOLIN MARKET: BY COUNTRY (2021)

FIGURE 48 MIDDLE EAST AND AFRICA KAOLIN MARKET: BY COUNTRY (2022 & 2029)

FIGURE 49 MIDDLE EAST AND AFRICA KAOLIN MARKET: BY COUNTRY (2021 & 2029)

FIGURE 50 MIDDLE EAST AND AFRICA KAOLIN MARKET: BY GRADE (2022 & 2029)

FIGURE 51 SOUTH AMERICA KAOLIN MARKET: SNAPSHOT (2021)

FIGURE 52 SOUTH AMERICA KAOLIN MARKET: BY COUNTRY (2021)

FIGURE 53 SOUTH AMERICA KAOLIN MARKET: BY COUNTRY (2022 & 2029)

FIGURE 54 SOUTH AMERICA KAOLIN MARKET: BY COUNTRY (2021 & 2029)

FIGURE 55 SOUTH AMERICA KAOLIN MARKET: BY GRADE (2022-2029)

FIGURE 56 GLOBAL KAOLIN MARKET: COMPANY SHARE 2021 (%)

FIGURE 57 NORTH AMERICA KAOLIN MARKET: COMPANY SHARE 2021 (%)

FIGURE 58 EUROPE KAOLIN MARKET: COMPANY SHARE 2021 (%)

FIGURE 59 ASIA-PACIFIC KAOLIN MARKET: COMPANY SHARE 2021 (%)

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.