Global Industrial Metrology Market

Размер рынка в млрд долларов США

CAGR :

%

USD

11.76 Billion

USD

19.19 Billion

2024

2032

USD

11.76 Billion

USD

19.19 Billion

2024

2032

| 2025 –2032 | |

| USD 11.76 Billion | |

| USD 19.19 Billion | |

|

|

|

|

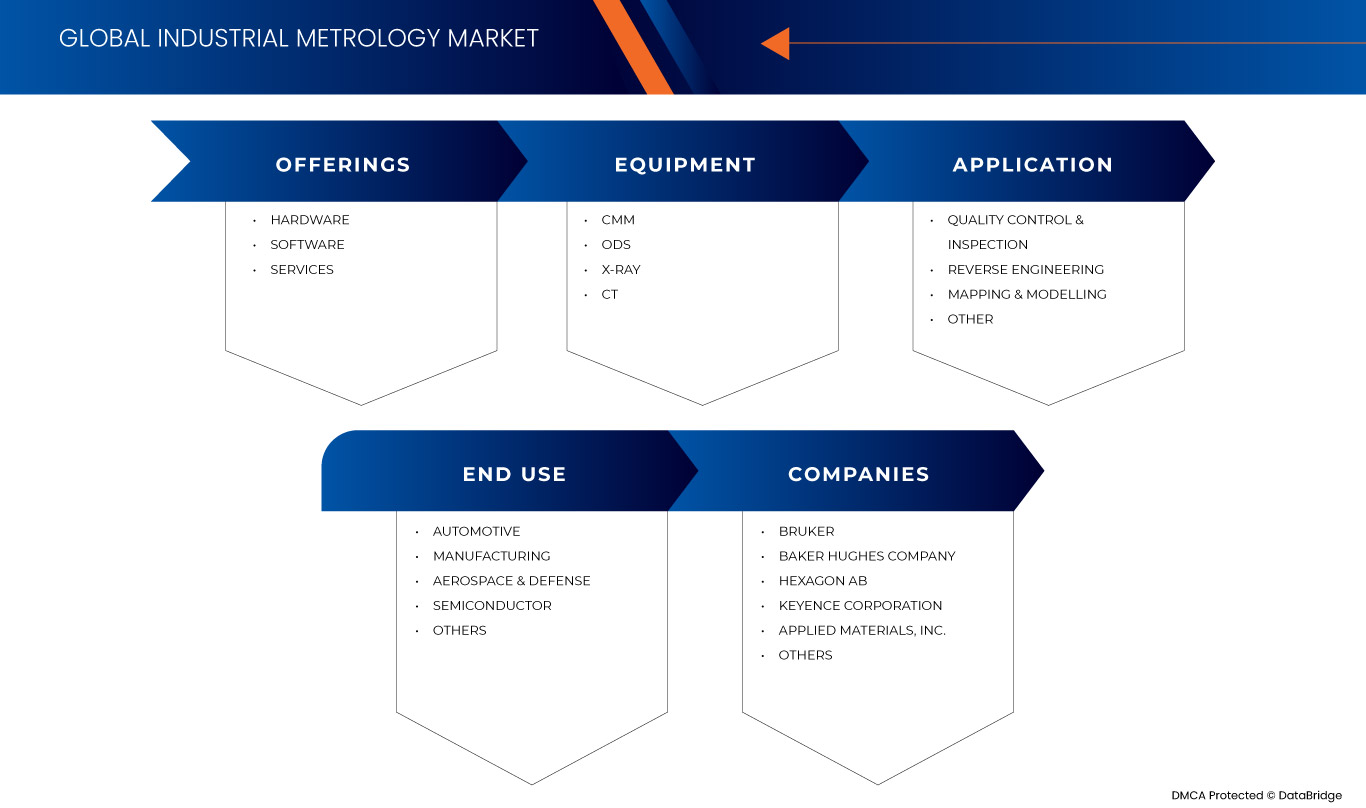

Global Industrial Metrology Market Segmentation, By Offering (Hardware, Software, and Services), Equipment (CMM, ODS, X-ray, and CT), Application (Quality Control & Inspection, Reverse Engineering, Mapping & Modelling, and Others), End User (Automotive, Manufacturing, Aerospace & Defense, Semiconductor, and Others) - Industry Trends and Forecast to 2031

Industrial Metrology Market Analysis

The global industrial metrology market is significantly driven by the increasing demand for high-precision measurement solutions. As industries seek to enhance efficiency and accuracy, advanced metrology technologies, such as 3D scanning and laser measurement systems, are being adopted to ensure precise component production. In addition, the rising demand for quality control across various sectors, including automotive, aerospace, and electronics, further fuels this market. Stringent regulatory requirements and the necessity for compliance with international quality standards compel manufacturers to invest in reliable measurement systems. This focus on quality assurance not only minimizes defects and production costs but also enhances product reliability and customer satisfaction, solidifying the market's growth trajectory.

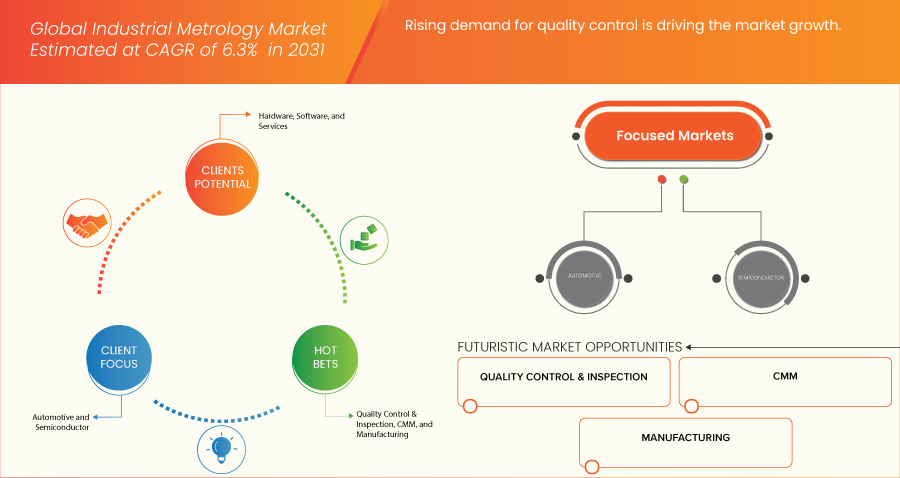

Industrial Metrology Market Size

Global industrial metrology market is expected to reach a value of USD 18.05 billion by 2031 from USD 11.23 billion in 2023, growing at a CAGR of 6.3% during the forecast period 2024 to 2031. In addition to the Market insights such as Market value, growth rate, Market segments, geographical coverage, Market players, and Market scenario, the Market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and PESTLE analysis.

Industrial Metrology Market Trends

"Stringent Regulatory Requirements and Standards Compliance"

Stringent regulatory requirements across various industries present a significant opportunity for the global industrial metrology market. Industries such as aerospace, automotive, and pharmaceuticals are governed by strict standards that dictate the accuracy and reliability of measurement processes. As these regulations evolve and become more rigorous, manufacturers are compelled to invest in advanced metrology solutions to ensure compliance and avoid penalties associated with non-compliance

Furthermore, adhering to international standards, such as ISO 9001 and AS9100, requires consistent quality checks throughout the production process. Metrology tools that facilitate precise measurements and documentation are crucial for meeting these standards. This need for compliance drives demand for sophisticated measurement systems, creating a growing market for providers of metrology solutions that can help manufacturers navigate complex regulatory landscapes. This trend not only boosts market demand but also emphasizes the importance of precision measurement in regulated industries.

Report Scope and Industrial Metrology Market segmentation

|

Attributes |

Industrial Metrology Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada, Mexico, Germany, U.K., France, Italy, Spain, Russia, Turkey, Netherlands, Norway, Finland, Denmark, Sweden, Poland, Switzerland, Belgium, rest of Europe, China, Japan, India, South Korea, Australia, New Zealand, Indonesia, Thailand, Malaysia, Singapore, Philippines, Taiwan, Vietnam, rest of Asia-Pacific, Brazil, Argentina, rest of South America, U.A.E., Saudi Arabia, South Africa, Egypt, Israel, Bahrain, Oman, Qatar, Kuwait, and rest of Middle East and Africa |

|

Key Market Players |

Bruker (U.S.), Baker Hughes Company (U.S.), Hexagon AB (Sweden), KEYENCE CORPORATION (Japan), Applied Materials, Inc. (U.S.), SGS Société Générale de Surveillance (Switzerland), FARO (U.S.), TriMet (U.S.), Intertek Group plc (U.K.), CREAFORM (Canada), Automated Precision Inc (API) (U.S.), CyberOptics Corporation (U.S.), Cairnhill (Singapore), Metrologic Group (France), and ATT Metrology Solutions (U.S.), among others |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the Market insights such as Market value, growth rate, Market segments, geographical coverage, Market players, and Market scenario, the Market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and PESTLE analysis. |

Industrial Metrology Market Definition

The global industrial metrology market encompasses the development, manufacturing, and utilization of measurement and inspection technologies designed to ensure precision and accuracy in industrial processes. This market includes a wide range of equipment and solutions such as Coordinate Measuring Machines (CMMs), optical and laser measurement systems, and software for data analysis and quality control. Industrial metrology plays a critical role across various sectors, including automotive, aerospace, electronics, and healthcare, by enabling manufacturers to maintain high standards of quality, reduce errors, and enhance productivity. As industries increasingly adopt automation and advanced manufacturing technologies, the demand for precise measurement solutions is expected to grow, driven by the need for compliance with stringent quality regulations and the pursuit of operational efficiency. The market is characterized by continuous technological advancements and an expanding application landscape, contributing to its overall growth and evolution.

Industrial Metrology Market Dynamics

Drivers

- Increasing Demand for High-Precision Measurement Solutions

The industrial landscape is increasingly characterized by the need for high-precision measurement solutions across various sectors, including aerospace, automotive, and electronics. As products become more sophisticated and tolerances tighten, manufacturers must rely on advanced metrology tools to ensure that components meet stringent specifications. High-precision measurement is essential not only for quality assurance but also for regulatory compliance, making it a top priority for industries aiming to maintain safety and reliability in their products.

For instance,

- In October 2024, ZEISS introduced the ZEISS VersaXRM 730, a groundbreaking 3D X-ray microscopy system that addresses the increasing demand for precision technology in various industries. This innovative system offers enhanced resolution and faster throughput, enabling manufacturers to conduct efficient scanning and precise quality control of components. With features such as the award-winning ZEN navx software and FAST Mode for rapid imaging, the VersaXRM 730 significantly improves productivity, supporting the rising need for high-precision measurement solutions in sectors such as automotive, aerospace, and medical devices.

Rising Demand for Quality Control

Quality control has become a non-negotiable aspect of manufacturing, significantly influencing the global industrial metrology market. With consumers expecting high-quality products and increased scrutiny from regulatory bodies, manufacturers are compelled to implement rigorous quality control measures. Advanced metrology solutions provide the necessary capabilities to monitor and ensure product quality throughout the production process, reducing the likelihood of defects and ensuring compliance with industry standards.

For instance,

In October 2024, according to the E-Zine Media the integration of Augmented Reality (AR) significantly transformed quality control processes in advanced manufacturing. By overlaying digital information onto physical components, AR enabled real-time data visualization and enhanced precision in inspections. This technology streamlined operations, improved accuracy, and facilitated collaboration between on-site operators and remote experts.

Opportunities

- Customization of Solutions in Metrology

The ability to customize metrology solutions to meet the unique needs of different industries offers a valuable opportunity in the global industrial metrology market. Various sectors, including automotive, electronics, and medical devices, have specific measurement requirements that standard solutions may not adequately address. By providing tailored metrology systems, companies can better serve the diverse needs of their customers, enhancing customer satisfaction and loyalty.

For instance,

In August 2023, Bowers Group successfully supported Virtue Aerospace with a custom measurement solution that accelerated inspection speed by 92%. The bespoke system helped Virtue Aerospace meet stringent compliance requirements for aviation fuel pump impellers. Ian Smith, Quality & Environmental Manager, praised the system for its ease of use and significant improvements in workflow.

- Rising Adoption of Digital Twin Technology

The rising adoption of digital twin technology in manufacturing processes presents a substantial opportunity for the industrial metrology market. Digital twins create virtual replicas of physical assets, allowing manufacturers to simulate, analyze, and optimize operations in real time. Accurate metrology data is crucial for developing and maintaining effective digital twins, as it ensures that the virtual models reflect the actual conditions and performance of the physical assets.

For instance,

According to the Siemens white paper the digital twin technology enabled manufacturers to develop virtual replicas of physical assets, improving operational simulations. Accurate metrology data proved essential for ensuring these digital models accurately reflected real-world conditions. This rises adoption of digital twin technology in global industrial metrology market.

Restraints/Challenges

- High Initial Investment Hinders Market Growth

The high initial investment required for advanced metrology solutions presents a significant restraint in the global industrial metrology market. Sophisticated measurement systems, such as laser scanners, Coordinate Measuring Machines (CMMs), and automated inspection technologies, often come with substantial costs that can be prohibitive, especially for Small to Medium-Sized Enterprises (SMEs). These companies may struggle to allocate budgets for such capital expenditures, leading to delayed adoption of essential metrology tools.

For instance,

In June 2024, the article highlighted that the high initial investment required for advanced metrology solutions poses a significant restraint on the industrial metrology market. Many Small to Medium-Sized Enterprises (SMEs) face budget constraints, delaying the adoption of essential measurement technologies. In addition, ongoing expenses for maintenance and software updates further complicate their ability to invest, limiting market growth potential.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Industrial Metrology Market Scope

The market is segmented into four notable segments, which are based on the basis of offering, equipment, application, and end user. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Offering

- Hardware

- Software

- Services

Equipment

- CMM

- ODS

- X-Ray

- CT

Application

- Quality Control & Inspection

- Reverse Engineering

- Mapping & Modelling

- Other

End User

- Automotive

- Manufacturing

- Aerospace & Defense

- Semiconductor

- Others

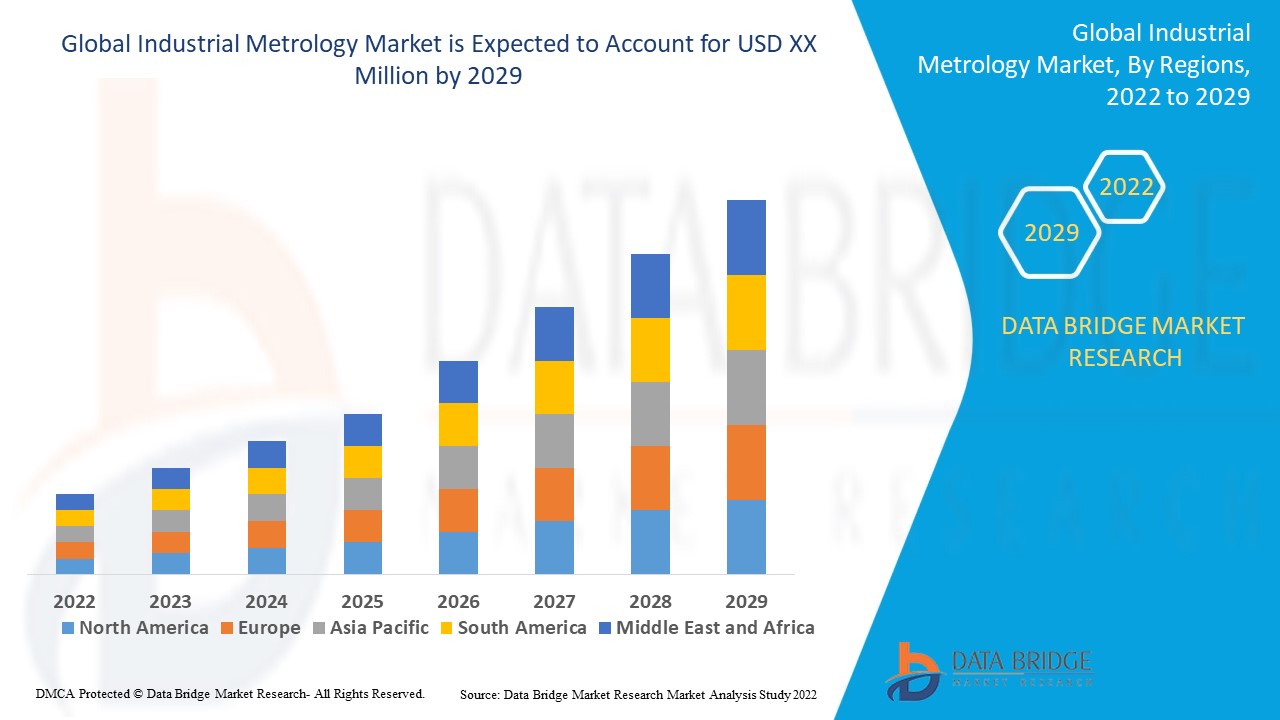

Industrial Metrology Market Regional Analysis

The global industrial metrology market is segmented into four notable segments, which are based on the basis of offering, equipment, application, and end user

The countries covered in the industrial metrology market report as U.S., Canada, Mexico, Germany, U.K., France, Italy, Spain, Russia, Turkey, Netherlands, Norway, Finland, Denmark, Sweden, Poland, Switzerland, Belgium, rest of Europe, China, Japan, India, South Korea, Australia, New Zealand, Indonesia, Thailand, Malaysia, Singapore, Philippines, Taiwan, Vietnam, rest of Asia-Pacific, Brazil, Argentina, rest of South America, U.A.E., Saudi Arabia, South Africa, Egypt, Israel, Bahrain, Oman, Qatar, Kuwait, and rest of Middle East and Africa.

North America region dominates the global industrial metrology market due to its advanced manufacturing capabilities, strong investments in technology, a focus on quality control, and the presence of key industry players.

Asia-Pacific region is expected to be the fastest-growing region due to the presence of key manufacturers further solidifies the region's market leadership and stringent regulatory standards drive demand for precise measurement solutions across various sectors.

The country section of the report also provides individual Market impacting factors and changes in Market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the Market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Industrial Metrology Market Share

Global industrial metrology market competitive landscape provides details of the competitor. Details included are company overview, company financials, revenue generated, Market potential, investment in research and development, new Market initiatives, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to global industrial metrology market.

Industrial Metrology Market Leaders Operating in the Market are:

- Bruker (U.S.)

- Baker Hughes Company (U.S.)

- Hexagon AB (Sweden)

- KEYENCE CORPORATION (Japan)

- Applied Materials, Inc. (U.S.)

- SGS Société Générale de Surveillance (Switzerland)

- FARO (U.S.)

- TriMet (U.S.)

- Intertek Group plc (U.K.)

- CREAFORM (Canada)

- Automated Precision Inc (API) (U.S.)

- CyberOptics Corporation (U.S.)

- Cairnhill (Singapore)

- Metrologic Group (France)

- ATT Metrology Solutions (U.S.)

Latest Developments in Industrial Metrology Market

- In July 2024, Professors Andrew Webb and Bernhard Blumich received the Richard R. Ernst Prize at EUROMAR 2024, recognizing their significant contributions to NMR and magnetic resonance research, advancing scientific understanding in these fields

- In February 2021, Baker Hughes Company has acquired ARMS Reliability to bolster its Asset Performance Management (APM) portfolio, advancing its digital solutions across industries such as mining, power, and utilities. This acquisition enhances Baker Hughes’ industrial asset management capabilities by integrating ARMS Reliability’s solutions into its Bently Nevada platform, providing more precise asset monitoring and lifecycle management, and supporting the company’s commitment to improving productivity in Industrial Metrology

- In September 2024, Hexagon AB introduced a new technology to reduce quality inspection delays in large-scale manufacturing. The Leica Absolute Tracker ATS800 combined laser tracking and radar functionality, allowing manufacturers to measure detailed features from a distance and meet tight assembly tolerances. This system improved productivity by minimizing bottlenecks in aerospace and automotive sectors. The launch strengthened Hexagon AB’s market position, showcasing its commitment to addressing core industry needs and enhancing automated inspection capabilities

- In March 2023, KEYENCE CORPORATION launched the high-precision LM-X multisensor measuring system, combining optical, laser, and touch-probe measurements in one unit. This system enabled easy, high-accuracy measurements without time-consuming positioning, allowing users to obtain reliable inspection reports efficiently and accurately

- In June 2022, the Applied Materials, Inc. announced its acquisition of Picosun Oy, enhancing its ICAPS group's capabilities with Picosun’s atomic layer deposition technology. This move aimed to address the growing demand for specialty semiconductors across various markets

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.