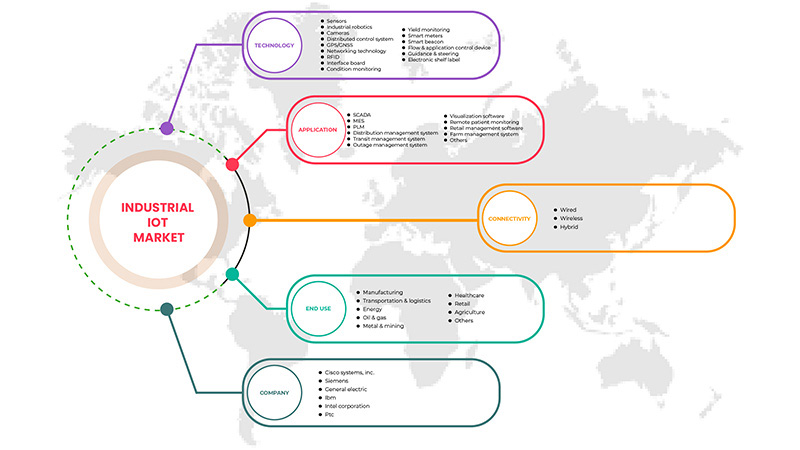

Глобальный рынок промышленного Интернета вещей по технологиям (датчики, промышленная робототехника, камеры, распределенная система управления, GPS/GNSS, сетевые технологии, RFID, интерфейсная плата, мониторинг состояния, мониторинг урожайности, интеллектуальные счетчики, интеллектуальные маяки, потоки и приложения, устройства управления, навигация и рулевое управление, электронные ценники ), применение (SCADA, MES, PLM, система управления дистрибуцией, система управления транзитом, система управления отключениями, программное обеспечение для визуализации, удаленный мониторинг пациентов, программное обеспечение для управления розничной торговлей, система управления фермерским хозяйством и другие), подключение (проводное, беспроводное и гибридное), конечное использование (производство, транспорт и логистика, энергетика, нефть и газ, металлургия и горнодобывающая промышленность, здравоохранение, розничная торговля, сельское хозяйство и другие). Отраслевые тенденции и прогноз до 2029 года.

Анализ и размер рынка промышленного Интернета вещей

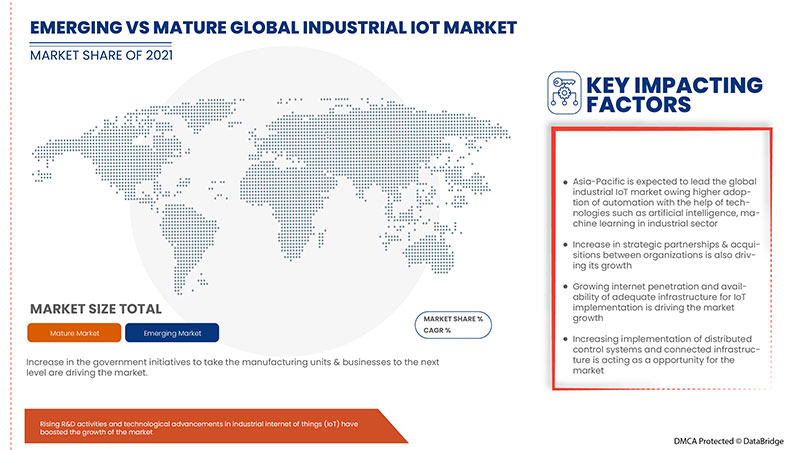

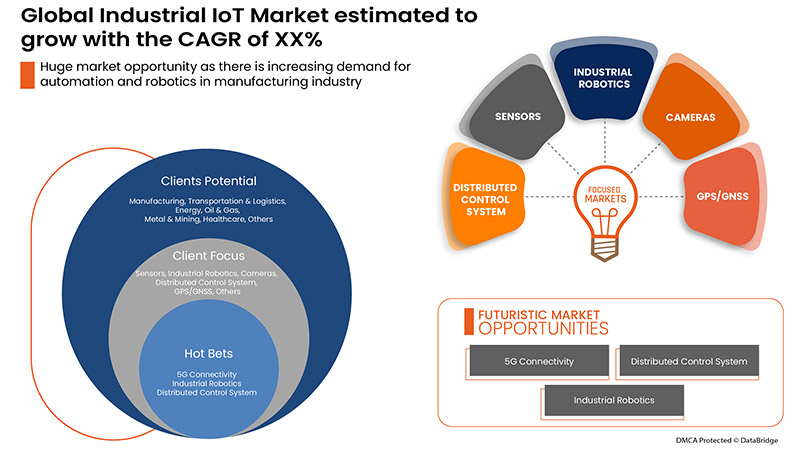

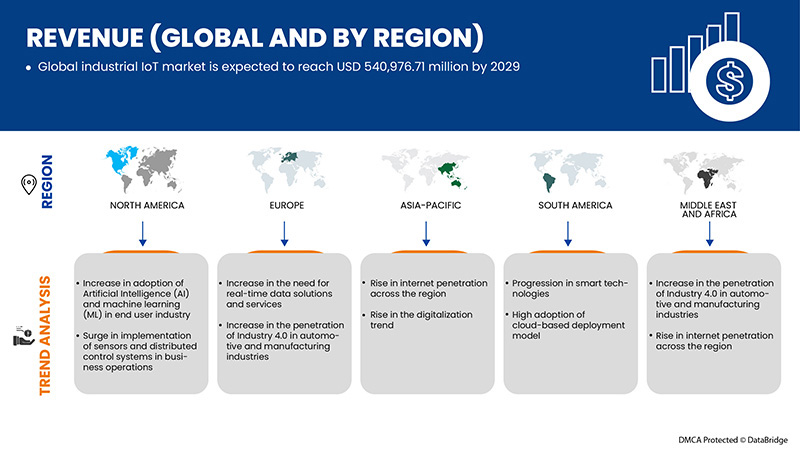

Рост использования промышленного рынка Интернета вещей в связи с внедрением искусственного интеллекта (ИИ) и машинного обучения (МО) в отрасли конечного пользователя также является движущей силой роста рынка. Ожидается, что более высокая вероятность кражи устройств и утечки данных будет сдерживать рынок промышленного Интернета вещей. Растущее проникновение Интернета и цифровизация по всему миру открывают возможности для рынка промышленного Интернета вещей. Высокие затраты на установку и трудности в интеграции устройств Интернета вещей бросают вызов мировому рынку промышленного Интернета вещей.

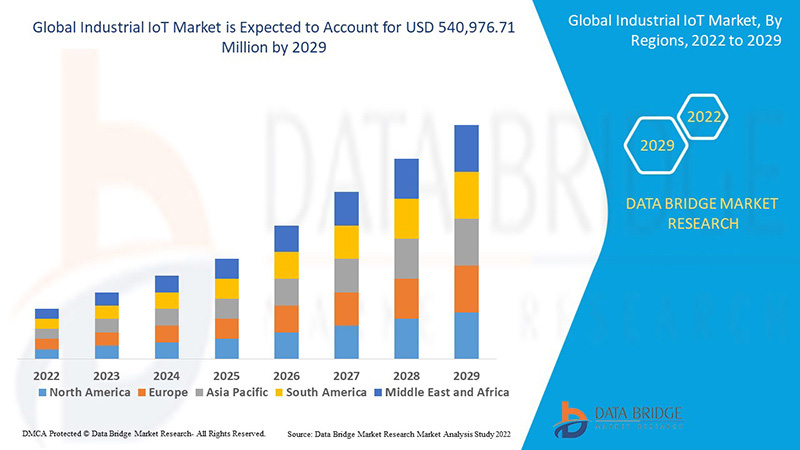

Data Bridge Market Research анализирует, что ожидается, что глобальный рынок промышленного Интернета вещей достигнет значения 540 976,71 млн долларов США к 2029 году при среднегодовом темпе роста 10,1% в течение прогнозируемого периода. « Датчики » составляют наиболее заметный технологический сегмент, поскольку этот тип технологий пользуется спросом и является наилучшим вариантом для извлечения информации из промышленных компонентов. Отчет о рынке промышленного Интернета вещей также подробно охватывает анализ цен, патентный анализ и технологические достижения.

|

Отчет Метрика |

Подробности |

|

Прогнозируемый период |

2022-2029 |

|

Базовый год |

2021 |

|

Исторические годы |

2020 (Можно настроить на 2019-2014) |

|

Количественные единицы |

Доход в млн. долл. США, объемы в единицах, цены в долл. США |

|

Охваченные сегменты |

По технологии (датчики, промышленная робототехника, камеры, распределенная система управления, GPS/GNSS, сетевые технологии, RFID, интерфейсная плата, мониторинг состояния, мониторинг урожайности, интеллектуальные счетчики, интеллектуальный маяк, устройство управления потоками и приложениями, навигация и рулевое управление, электронная маркировка полок), применение (SCADA, MES, PLM, система управления дистрибуцией, система управления транзитом, система управления отключениями, программное обеспечение для визуализации, удаленный мониторинг пациентов, программное обеспечение для управления розничной торговлей, система управления фермерским хозяйством и другие), подключение (проводное, беспроводное и гибридное), конечное использование (производство, транспорт и логистика, энергетика, нефть и газ, металлургия и горнодобывающая промышленность, здравоохранение, розничная торговля, сельское хозяйство и другие) — отраслевые тенденции и прогноз до 2029 года |

|

Страны, охваченные |

США, Канада и Мексика в Северной Америке, Германия, Франция, Великобритания, Нидерланды, Швейцария, Бельгия, Россия, Италия, Испания, Турция, Остальная Европа в Европе, Китай, Япония, Индия, Южная Корея, Сингапур, Малайзия, Австралия, Таиланд, Индонезия, Филиппины, Остальная часть Азиатско-Тихоокеанского региона (APAC) в Азиатско-Тихоокеанском регионе (APAC), Саудовская Аравия, ОАЭ, Южная Африка, Египет, Израиль, Остальной Ближний Восток и Африка, Бразилия, Аргентина и Остальная часть Южной Америки |

|

Охваченные участники рынка |

Cisco Systems, Inc., Siemens. General Electric, IBM Corporation, Intel Corporation, PTC, Honeywell International Inc., NEC Corporation, Rockwell Automation, ABB, SAP SE, Texas Instruments Incorporated, Robert Bosch GmbH, Emerson Electric Co., Microsoft, KUKA AG, Sigfox Network Limited (дочерняя компания UnaBiz), Wipro, Arm Limited (дочерняя компания Softbank Group Corp.) и Huawei Technologies Co., Ltd., среди прочих |

Определение рынка

Расширение и применение Интернета вещей (IoT) в промышленных секторах и приложениях называется промышленным Интернетом вещей (IIoT). Машинно-машинный (M2M) Интернет вещей (IIoT) позволяет предприятиям и отраслям работать более эффективно и надежно благодаря сильному акценту на подключении M2M, больших данных и машинном обучении. Промышленные приложения, такие как робототехника, медицинские технологии и программно-определяемые производственные процессы, включены в IIoT.

Динамика рынка промышленного Интернета вещей

В этом разделе рассматривается понимание движущих сил рынка, преимуществ, возможностей, ограничений и проблем. Все это подробно обсуждается ниже:

Драйверы

- Рост внедрения искусственного интеллекта (ИИ) и машинного обучения (МО) в сфере конечных пользователей

Популярность ИИ и МО растет из года в год в различных отраслях, таких как производство, здравоохранение, энергетика, нефть и газ и многих других. Большинство этих отраслей внедряют технологию для повышения эффективности работы, автоматизации процесса предоставления услуг и модернизации предложений, что приобрело важную роль в конкуренции с конкурентами на рынке. Таким образом, растущая тенденция внедрения ИИ и МО является основным драйвером роста мирового рынка промышленного Интернета вещей.

- Резкий рост внедрения датчиков и распределенных систем управления в бизнес-операциях

Внедрение датчиков и распределенной системы управления поможет контролировать и управлять рабочим процессом и автоматизировать процесс управления для всех промышленных процессов. Таким образом, спрос на внедрение датчиков и DCS в различные бизнес-операции будет увеличиваться с каждым годом. Таким образом, в глобальном масштабе потребность в датчиках и DCS увеличивается из-за многочисленных преимуществ, связанных с внедрением, что способствует росту мирового рынка промышленного IoT и выступает в качестве драйвера развития рынка.

- Рост потребности в решениях и услугах по обработке данных в режиме реального времени

Решения по обработке данных в реальном времени требуют широкого спектра электронных устройств, и в основном ожидается рост спроса на устройства IoT, поскольку они поддерживают анализ данных в реальном времени в бизнес-операциях, поддерживают быстрое понимание данных и направляют решения по доставке продуктов или услуг клиентам. Таким образом, существует высокий спрос на принятие решений в реальном времени, которые напрямую связаны с использованием устройств IoT для отраслей. Поэтому ожидается, что это станет основным драйвером роста рынка.

Ограничения/Проблемы

- Нехватка квалифицированной рабочей силы и учебных занятий

Внедрение решений IoT для отраслей не является быстрым и простым; оно включает в себя детальную визуализацию и адекватный метод автоматизации сектора. Поэтому конечным пользователям требуется больше времени и труда для внедрения решений и обучения сотрудников пониманию процесса и обслуживания.

- Более высокая вероятность кражи устройств и утечки данных

Надежность ИТ-климата предполагает получение ресурсов, организации и информации завода, созданных этими связанными гаджетами. Надежность в большей степени отвечает за принятие цифровизации в бизнес-операциях; однако существует высокая вероятность недостатков безопасности.

- Рост технической сложности из-за ежедневного технологического прогресса

Гибкая безопасность — это одна из идей предоставления медицинской помощи, обучения и помощи с жильем, независимо от того, используется ли кто-то официально. Кроме того, записи действий могут поддерживать глубоко укоренившееся обучение и переподготовку рабочих. Независимо от того, как люди решают вкладывать энергию, должны быть способы, чтобы люди жили удовлетворительной жизнью, независимо от того, нужно ли обществу меньше специалистов. Таким образом, непрерывное технологическое развитие приведет к постоянному обучению сотрудников и будет препятствовать росту рынка.

Влияние COVID-19 на рынок промышленного Интернета вещей

COVID-19 существенно повлиял на рынок промышленного Интернета вещей, поскольку почти каждая страна решила закрыть все производственные мощности, за исключением тех, которые производят товары первой необходимости. Правительство приняло строгие меры, такие как закрытие производства и продажи неосновных товаров, блокировка международной торговли и многое другое, чтобы предотвратить распространение COVID-19. Единственный бизнес, работающий в этой пандемической ситуации, — это основные службы, которым разрешено открыться и запустить процессы.

Рост промышленного рынка Интернета вещей происходит из-за цифровизации производственного процесса и цепочек поставок в сельском хозяйстве, электроэнергетике, горнодобывающей промышленности, нефтегазовой отрасли и транспорте. Более того, внедрение Интернета вещей в промышленности имело огромный прогресс с 2020 по 2021 год, поскольку пандемия продемонстрировала важность Интернета вещей во всех типах бизнеса. Всплеск спроса на автоматизацию для избежания вовлечения максимальной рабочей силы привел к внедрению Интернета вещей в промышленности. Это повторяет положительное влияние COVID-19 на рынок IIoT, который еще больше стимулировал бизнес за счет внедрения технологий промышленности 4.0.

Производители принимают различные стратегические решения, чтобы восстановиться после COVID-19. Игроки проводят многочисленные исследования и разработки для улучшения технологий на рынке промышленного Интернета вещей. Компании будут предлагать рынку передовые и точные решения.

Недавнее развитие

- В марте 2022 года Cisco Systems, Inc. разработала усовершенствованную платформу IoT Control Center, которая поможет повысить надежность обслуживания и сократить эксплуатационные расходы. Эта разработка поможет компании диверсифицировать свой портфель решений и предложить более качественные решения

- В апреле 2022 года Arm Limited представила два новых решения: Arm Cortex-M85 и Cortex-A. Эти новые продукты и решения помогут компании предлагать клиентам лучшие решения, привлекая новых клиентов и ускоряя рост доходов.

Масштаб мирового рынка промышленного Интернета вещей

Промышленный рынок IoT сегментирован на основе технологий, приложений, подключений и конечного использования. Рост среди этих сегментов поможет вам проанализировать сегменты с незначительным ростом в отраслях и предоставить пользователям ценный обзор рынка и рыночные идеи, которые помогут им принимать стратегические решения для определения основных рыночных приложений.

По технологии

- Датчики

- Промышленная робототехника

- Камеры

- Распределенная система управления

- GPS/ГНСС

- Сетевые технологии

- RFID

- Интерфейсная плата

- Мониторинг состояния

- Мониторинг урожайности

- Умные счетчики

- Умный маяк

- Устройство управления потоком и применением

- Руководство и управление

- Электронная этикетка на полке

На основе технологий глобальный рынок промышленного Интернета вещей сегментирован на датчики, промышленную робототехнику, камеры, распределенные системы управления, GPS/GNSS, сетевые технологии, RFID, интерфейсные платы, мониторинг состояния, мониторинг урожайности, интеллектуальные счетчики, интеллектуальные маяки, устройства управления потоками и приложениями, навигацию и рулевое управление, а также электронные ценники.

По применению

- СКАДА

- МЧС

- ПЛМ

- Система управления дистрибуцией

- Система управления транзитом

- Система управления отключениями

- Программное обеспечение для визуализации

- Удаленный мониторинг пациентов

- Программное обеспечение для управления розничной торговлей

- Система управления фермой

- Другие

На основе сферы применения глобальный рынок промышленного Интернета вещей был сегментирован на SCADA, MES, PLM, систему управления дистрибуцией, систему управления транзитом, систему управления отключениями, программное обеспечение для визуализации, удаленный мониторинг пациентов, программное обеспечение для управления розничной торговлей, систему управления фермерским хозяйством и другие.

По подключению

- Проводной

- Беспроводной

- Гибридный

По признаку связности глобальный рынок промышленного Интернета вещей сегментирован на проводной, беспроводной и гибридный.

По конечному использованию

- Производство

- Транспорт и логистика

- Энергия

- Нефть и газ

- Металлургия и горнодобывающая промышленность

- Здравоохранение

- Розничная торговля

- Сельское хозяйство

- Другие

На основе конечного использования глобальный рынок промышленного Интернета вещей был сегментирован на производство, транспорт и логистику, энергетику, нефть и газ, металлургию и горнодобычу, здравоохранение, розничную торговлю, сельское хозяйство и другие.

Региональный анализ/информация о рынке промышленного Интернета вещей

Проведен анализ рынка промышленного Интернета вещей, а также предоставлены сведения о размерах рынка и тенденциях по странам, технологиям, сферам применения, возможностям подключения и конечному использованию, как указано выше.

Страны, охваченные отчетом о рынке промышленного Интернета вещей: США, Канада и Мексика в Северной Америке, Германия, Франция, Великобритания, Нидерланды, Швейцария, Бельгия, Россия, Италия, Испания, Турция, остальные страны Европы в Европе, Китай, Япония, Индия, Южная Корея, Сингапур, Малайзия, Австралия, Таиланд, Индонезия, Филиппины, остальные страны Азиатско-Тихоокеанского региона (APAC) в Азиатско-Тихоокеанском регионе (APAC), Саудовская Аравия, ОАЭ, Южная Африка, Египет, Израиль, остальные страны Ближнего Востока и Африки (MEA) как часть Ближнего Востока и Африки (MEA), Бразилия, Аргентина и остальные страны Южной Америки как часть Южной Америки.

Азиатско-Тихоокеанский регион доминирует на рынке промышленного Интернета вещей. Азиатско-Тихоокеанский регион, вероятно, станет самым быстрорастущим мировым рынком промышленного Интернета вещей. Ожидается, что Азиатско-Тихоокеанский рынок промышленного Интернета вещей станет самым быстрорастущим в мире. Растущее развитие числа производственных компаний в стране и растущий спрос на автоматизацию будут стимулировать спрос на продукты промышленного рынка Интернета вещей в Азиатско-Тихоокеанском регионе.

Раздел отчета по странам также содержит отдельные факторы, влияющие на рынок, и изменения в регулировании рынка, которые влияют на текущие и будущие тенденции рынка. Такие данные, как анализ цепочки создания стоимости вверх и вниз по течению, технические тенденции, анализ пяти сил Портера и тематические исследования, являются некоторыми из указателей, используемых для прогнозирования рыночного сценария для отдельных стран. Кроме того, при предоставлении прогнозного анализа данных по странам учитываются наличие и доступность глобальных брендов и их проблемы, связанные с большой или малой конкуренцией со стороны местных и отечественных брендов, влияние внутренних тарифов и торговые пути.

Анализ конкурентной среды и доли рынка промышленного Интернета вещей

Конкурентная среда промышленного рынка IoT содержит сведения по конкурентам. Включены сведения о компании, ее финансах, полученном доходе, рыночном потенциале, инвестициях в исследования и разработки, новых рыночных инициативах, глобальном присутствии, производственных площадках и объектах, производственных мощностях, сильных и слабых сторонах компании, запуске продукта, широте и широте продукта, доминировании приложений. Приведенные выше данные относятся только к фокусу компаний, связанному с рынком промышленного IoT.

Некоторые из основных игроков, работающих на рынке промышленного Интернета вещей:

- Cisco Systems, Inc.

- Сименс

- Дженерал Электрик

- Корпорация IBM

- Корпорация Intel

- ПТК

- Honeywell International Inc.

- Корпорация NEC

- Rockwell Automation, Inc.

- АББ

- SAP SE

- Техас Инструментс Инкорпорейтед

- Роберт Бош ГмбХ

- Эмерсон Электрик Ко.

- Майкрософт

- КУКА АГ

- Партнерская сеть Sigfox (дочерняя компания UnaBiz)

- Wipro

- Arm Limited (дочерняя компания Softbank Group Corp.)

- Huawei Technologies Co., Ltd.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Содержание

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL INDUSTRIAL IOT MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 TECHNOLOGY TIMELINE CURVE

2.1 MARKET END USE COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 USE CASE ANALYSIS

4.1.1 OVERVIEW

4.1.2 PREDICTIVE MAINTENANCE

4.1.3 LOCATION TRACKING

4.1.4 WORKPLACE ANALYTICS

4.1.5 REMOTE QUALITY MONITORING

4.1.6 ENERGY OPTIMIZATION

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASE IN ADOPTION OF ARTIFICIAL INTELLIGENCE (AI) AND MACHINE LEARNING (ML) IN END USER INDUSTRY

5.1.2 SURGE IN IMPLEMENTATION OF SENSORS AND DISTRIBUTED CONTROL SYSTEMS IN BUSINESS OPERATIONS

5.1.3 INCREASE IN THE NEED FOR REAL-TIME DATA SOLUTIONS AND SERVICES

5.1.4 INCREASE IN THE PENETRATION OF INDUSTRY 4.0 IN AUTOMOTIVE AND MANUFACTURING INDUSTRIES

5.2 RESTRAINTS

5.2.1 LACK OF SKILLED LABOR AND TRAINING SESSIONS

5.2.2 HIGHER PROBABILITY OF DEVICE THEFT AND DATA BREACHES

5.2.3 RISE IN THE TECHNICAL COMPLEXITIES DUE TO DAY-BY-DAY TECHNOLOGICAL ADVANCEMENT

5.3 OPPORTUNITIES

5.3.1 RISE IN INTERNET PENETRATION ACROSS THE GLOBE

5.3.2 RISE IN THE DIGITALIZATION TREND

5.3.3 PROGRESSION IN SMART TECHNOLOGIES

5.3.4 HIGH ADOPTION OF CLOUD-BASED DEPLOYMENT MODEL

5.4 CHALLENGES

5.4.1 HIGH INSTALLATION COST

5.4.2 DIFFICULTIES IN INTEGRATION OF IOT DEVICES

6 GLOBAL INDUSTRIAL IOT MARKET, BY TECHNOLOGY

6.1 OVERVIEW

6.2 SENSORS

6.3 INDUSTRIAL ROBOTICS

6.4 CAMERAS

6.5 DISTRIBUTED CONTROL SYSTEM

6.6 GPS/GNSS

6.7 NETWORKING TECHNOLOGY

6.8 RFID

6.9 INTERFACE BOARD

6.1 CONDITION MONITORING

6.11 YIELD MONITORING

6.12 SMART METERS

6.13 SMART BEACON

6.14 FLOW & APPLICATION CONTROL DEVICE

6.15 GUIDANCE & STEERING

6.16 ELECTRONIC SHELF LABEL

7 GLOBAL INDUSTRIAL IOT MARKET, BY APPLICATION

7.1 OVERVIEW

7.2 SCADA

7.3 MES

7.4 PLM

7.5 DISTRIBUTED CONTROL SYSTEM

7.6 TRANSIT MANAGEMENT SYSTEM

7.7 OUTAGE MANAGEMENT SYSTEM

7.8 VISUALIZATION SOFTWARE

7.9 REMOTE PATIENT MONITORING

7.1 RETAIL MANAGEMENT SOFTWARE

7.11 FARM MANAGEMENT SYSTEM

7.12 OTHERS

8 GLOBAL INDUSTRIAL IOT MARKET, BY CONNECTIVITY

8.1 OVERVIEW

8.2 WIRED

8.3 WIRELESS

8.4 HYBRID

9 GLOBAL INDUSTRIAL IOT MARKET, BY END USE

9.1 OVERVIEW

9.2 MANUFACTURING

9.3 TRANSPORTATION & LOGISTICS

9.4 ENERGY

9.5 OIL & GAS

9.6 METAL & MINING

9.7 HEALTHCARE

9.8 RETAIL

9.9 AGRICULTURE

9.1 OTHERS

10 GLOBAL INDUSTRIAL IOT MARKET, BY REGION

10.1 OVERVIEW

10.2 ASIA-PACIFIC

10.2.1 CHINA

10.2.2 JAPAN

10.2.3 SOUTH KOREA

10.2.4 INDIA

10.2.5 AUSTRALIA

10.2.6 INDONESIA

10.2.7 THAILAND

10.2.8 SINGAPORE

10.2.9 MALAYSIA

10.2.10 PHILIPPINES

10.2.11 REST OF ASIA-PACIFIC

10.3 NORTH AMERICA

10.3.1 U.S.

10.3.2 CANADA

10.3.3 MEXICO

10.4 EUROPE

10.4.1 GERMANY

10.4.2 U.K.

10.4.3 FRANCE

10.4.4 ITALY

10.4.5 SPAIN

10.4.6 SWITZERLAND

10.4.7 NETHERLANDS

10.4.8 TURKEY

10.4.9 RUSSIA

10.4.10 BELGIUM

10.4.11 REST OF EUROPE

10.5 MIDDLE EAST AND AFRICA

10.5.1 SAUDI ARABIA

10.5.2 SOUTH AFRICA

10.5.3 EGYPT

10.5.4 ISRAEL

10.5.5 REST OF MIDDLE EAST AND AFRICA

10.6 SOUTH AMERICA

10.6.1 BRAZIL

10.6.2 ARGENTINA

10.6.3 REST OF SOUTH AMERICA

11 GLOBAL INDUSTRIAL IOT MARKET, COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: GLOBAL

11.2 COMPANY SHARE ANALYSIS: ASIA PACIFIC

11.3 COMPANY SHARE ANALYSIS: NORTH AMERICA

11.4 COMPANY SHARE ANALYSIS: EUROPE

12 SWOT ANALYSIS

13 COMPANY PROFILE

13.1 CISCO SYSTEMS, INC.

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 COMPANY SHARE ANALYSIS

13.1.4 PRODUCT PORTFOLIO

13.1.5 RECENT DEVELOPMENTS

13.2 SIEMENS

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 COMPANY SHARE ANALYSIS

13.2.4 PRODUCT PORTFOLIO

13.2.5 RECENT DEVELOPMENTS

13.3 GENERAL ELECTRIC

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 COMPANY SHARE ANALYSIS

13.3.4 PRODUCT PORTFOLIO

13.3.5 RECENT DEVELOPMENTS

13.4 IBM CORPORATION

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 COMPANY SHARE ANALYSIS

13.4.4 PRODUCT PORTFOLIO

13.4.5 RECENT DEVELOPMENTS

13.5 INTEL CORPORATION

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 COMPANY SHARE ANALYSIS

13.5.4 PRODUCT PORTFOLIO

13.5.5 RECENT DEVELOPMENTS

13.6 ABB

13.6.1 COMPANY SNAPSHOT

13.6.2 REVENUE ANALYSIS

13.6.3 PRODUCT PORTFOLIO

13.6.4 RECENT DEVELOPMENT

13.7 ARM LIMITED (A SUBSIDIAIRY OF SOFTBANK GROUP)

13.7.1 COMPANY SNAPSHOT

13.7.2 REVENUE ANALYSIS

13.7.3 PRODUCT PORTFOLIO

13.7.4 RECENT DEVELOPMENTS

13.8 EMERSON ELECTRIC CO.

13.8.1 COMPANY SNAPSHOT

13.8.2 REVENUE ANALYSIS

13.8.3 PRODUCT PORTFOLIO

13.8.4 RECENT DEVELOPMENTS

13.9 HONEYWELL INTERNATIONAL INC.

13.9.1 COMPANY SNAPSHOT

13.9.2 REVENUE ANALYSIS

13.9.3 PRODUCT PORTFOLIO

13.9.4 RECENT DEVELOPMENTS

13.1 HUAWEI TECHNOLOGIES CO., LTD.

13.10.1 COMPANY SNAPSHOT

13.10.2 PRODUCT PORTFOLIO

13.10.3 RECENT DEVELOPMENTS

13.11 KUKA AG

13.11.1 COMPANY SNAPSHOT

13.11.2 REVENUE ANALYSIS

13.11.3 PRODUCT PORTFOLIO

13.11.4 RECENT DEVELOPMENTS

13.12 MICROSOFT

13.12.1 COMPANY SNAPSHOT

13.12.2 REVENUE ANALYSIS

13.12.3 PRODUCT PORTFOLIO

13.12.4 RECENT DEVELOPMENTS

13.13 NEC CORPORATION

13.13.1 COMPANY SNAPSHOT

13.13.2 REVENUE ANALYSIS

13.13.3 PRODUCT PORTFOLIO

13.13.4 RECENT DEVELOPMENTS

13.14 PTC

13.14.1 COMPANY SNAPSHOT

13.14.2 REVENUE ANALYSIS

13.14.3 PRODUCT PORTFOLIO

13.14.4 RECENT DEVELOPMENTS

13.15 ROBERT BOSCH GMBH

13.15.1 COMPANY SNAPSHOT

13.15.2 REVENUE ANALYSIS

13.15.3 PRODUCT PORTFOLIO

13.15.4 RECENT DEVELOPMENTS

13.16 ROCKWELL AUTOMATION, INC.

13.16.1 COMPANY SNAPSHOT

13.16.2 REVENUE ANALYSIS

13.16.3 PRODUCT PORTFOLIO

13.16.4 RECENT DEVELOPMENTS

13.17 SAP SE

13.17.1 COMPANY SNAPSHOT

13.17.2 REVENUE ANALYSIS

13.17.3 PRODUCT PORTFOLIO

13.17.4 RECENT DEVELOPMENTS

13.18 SIGFOX PARTNER NETWORK

13.18.1 COMPANY SNAPSHOT

13.18.2 PRODUCT PORTFOLIO

13.18.3 RECENT DEVELOPMENTS

13.19 TEXAS INSTRUMENTS INCORPORATED

13.19.1 COMPANY SNAPSHOT

13.19.2 REVENUE ANALYSIS

13.19.3 PRODUCT PORTFOLIO

13.19.4 RECENT DEVELOPMENTS

13.2 WIPRO

13.20.1 COMPANY SNAPSHOT

13.20.2 REVENUE ANALYSIS

13.20.3 PRODUCT PORTFOLIO

13.20.4 RECENT DEVELOPMENTS

14 QUESTIONNAIRE

15 RELATED REPORTS

Список таблиц

TABLE 1 GLOBAL INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 2 GLOBAL SENSORS IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 GLOBAL INDUSTRIAL ROBOTICS IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 GLOBAL CAMERAS IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 GLOBAL DISTRIBUTED CONTROL SYSTEM IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 GLOBAL GPS/GNSS IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 GLOBAL NETWORKING TECHNOLOGY IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 GLOBAL RFID IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 GLOBAL INTERFACE BOARD IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 GLOBAL CONDITION MONITORING IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 GLOBAL YIELD MONITORING IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 GLOBAL SMART METERS IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 GLOBAL SMART BEACON IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 GLOBAL FLOW & APPLICATION CONTROL DEVICE IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 GLOBAL GUIDANCE & STEERING IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 GLOBAL ELECTRONIC SHELF LABEL IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 GLOBAL INDUSTRIAL IOT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 18 GLOBAL SCADA IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 GLOBAL MES IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029, (USD MILLION)

TABLE 20 GLOBAL PLM IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 GLOBAL DISTRIBUTED CONTROL SYSTEM IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 GLOBAL TRANSIT MANAGEMENT SYSTEM IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 GLOBAL OUTAGE MANAGEMENT SYSTEM IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 GLOBAL VISUALIZATION SOFTWARE IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 GLOBAL REMOTE PATIENT MONITORING IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 GLOBAL RETAIL MANAGEMENT SOFTWARE IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 GLOBAL FARM MANAGEMENT SYSTEM IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 GLOBAL OTHERS IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 GLOBAL INDUSTRIAL IOT MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 30 GLOBAL WIRED IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 GLOBAL WIRELESS IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 GLOBAL HYBRID IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 GLOBAL INDUSTRIAL IOT MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 34 GLOBAL MANUFACTURING IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 GLOBAL TRANSPORTATION & LOGISTICS IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 GLOBAL ENERGY IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 GLOBAL OIL & GAS IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 GLOBAL METAL & MINING IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 GLOBAL HEALTHCARE IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 GLOBAL RETAIL IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 GLOBAL AGRICULTURE IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 42 GLOBAL OTHERS IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 43 GLOBAL INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 44 ASIA-PACIFIC INDUSTRIAL IOT MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 45 ASIA-PACIFIC INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 46 ASIA-PACIFIC INDUSTRIAL IOT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 47 ASIA-PACIFIC INDUSTRIAL IOT MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 48 ASIA-PACIFIC INDUSTRIAL IOT MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 49 CHINA INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 50 CHINA INDUSTRIAL IOT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 51 CHINA INDUSTRIAL IOT MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 52 CHINA INDUSTRIAL IOT MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 53 JAPAN INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 54 JAPAN INDUSTRIAL IOT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 55 JAPAN INDUSTRIAL IOT MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 56 JAPAN INDUSTRIAL IOT MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 57 SOUTH KOREA INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 58 SOUTH KOREA INDUSTRIAL IOT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 59 SOUTH KOREA INDUSTRIAL IOT MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 60 SOUTH KOREA INDUSTRIAL IOT MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 61 INDIA INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 62 INDIA INDUSTRIAL IOT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 63 INDIA INDUSTRIAL IOT MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 64 INDIA INDUSTRIAL IOT MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 65 AUSTRALIA INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 66 AUSTRALIA INDUSTRIAL IOT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 67 AUSTRALIA INDUSTRIAL IOT MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 68 AUSTRALIA INDUSTRIAL IOT MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 69 INDONESIA INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 70 INDONESIA INDUSTRIAL IOT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 71 INDONESIA INDUSTRIAL IOT MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 72 INDONESIA INDUSTRIAL IOT MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 73 THAILAND INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 74 THAILAND INDUSTRIAL IOT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 75 THAILAND INDUSTRIAL IOT MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 76 THAILAND INDUSTRIAL IOT MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 77 SINGAPORE INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 78 SINGAPORE INDUSTRIAL IOT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 79 SINGAPORE INDUSTRIAL IOT MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 80 SINGAPORE INDUSTRIAL IOT MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 81 MALAYSIA INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 82 MALAYSIA INDUSTRIAL IOT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 83 MALAYSIA INDUSTRIAL IOT MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 84 MALAYSIA INDUSTRIAL IOT MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 85 PHILIPPINES INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 86 PHILIPPINES INDUSTRIAL IOT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 87 PHILIPPINES INDUSTRIAL IOT MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 88 PHILIPPINES INDUSTRIAL IOT MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 89 REST OF ASIA-PACIFIC INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 90 NORTH AMERICA INDUSTRIAL IOT MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 91 NORTH AMERICA INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 92 NORTH AMERICA INDUSTRIAL IOT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 93 NORTH AMERICA INDUSTRIAL IOT MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 94 NORTH AMERICA INDUSTRIAL IOT MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 95 U.S. INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 96 U.S. INDUSTRIAL IOT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 97 U.S. INDUSTRIAL IOT MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 98 U.S. INDUSTRIAL IOT MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 99 CANADA INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 100 CANADA INDUSTRIAL IOT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 101 CANADA INDUSTRIAL IOT MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 102 CANADA INDUSTRIAL IOT MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 103 MEXICO INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 104 MEXICO INDUSTRIAL IOT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 105 MEXICO INDUSTRIAL IOT MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 106 MEXICO INDUSTRIAL IOT MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 107 EUROPE INDUSTRIAL IOT MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 108 EUROPE INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 109 EUROPE INDUSTRIAL IOT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 110 EUROPE INDUSTRIAL IOT MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 111 EUROPE INDUSTRIAL IOT MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 112 GERMANY INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 113 GERMANY INDUSTRIAL IOT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 114 GERMANY INDUSTRIAL IOT MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 115 GERMANY INDUSTRIAL IOT MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 116 U.K. INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 117 U.K. INDUSTRIAL IOT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 118 U.K. INDUSTRIAL IOT MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 119 U.K. INDUSTRIAL IOT MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 120 FRANCE INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 121 FRANCE INDUSTRIAL IOT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 122 FRANCE INDUSTRIAL IOT MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 123 FRANCE INDUSTRIAL IOT MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 124 ITALY INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 125 ITALY INDUSTRIAL IOT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 126 ITALY INDUSTRIAL IOT MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 127 ITALY INDUSTRIAL IOT MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 128 SPAIN INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 129 SPAIN INDUSTRIAL IOT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 130 SPAIN INDUSTRIAL IOT MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 131 SPAIN INDUSTRIAL IOT MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 132 SWITZERLAND INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 133 SWITZERLAND INDUSTRIAL IOT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 134 SWITZERLAND INDUSTRIAL IOT MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 135 SWITZERLAND INDUSTRIAL IOT MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 136 NETHERLANDS INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 137 NETHERLANDS INDUSTRIAL IOT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 138 NETHERLANDS INDUSTRIAL IOT MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 139 NETHERLANDS INDUSTRIAL IOT MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 140 TURKEY INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 141 TURKEY INDUSTRIAL IOT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 142 TURKEY INDUSTRIAL IOT MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 143 TURKEY INDUSTRIAL IOT MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 144 RUSSIA INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 145 RUSSIA INDUSTRIAL IOT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 146 RUSSIA INDUSTRIAL IOT MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 147 RUSSIA INDUSTRIAL IOT MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 148 BELGIUM INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 149 BELGIUM INDUSTRIAL IOT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 150 BELGIUM INDUSTRIAL IOT MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 151 BELGIUM INDUSTRIAL IOT MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 152 REST OF EUROPE INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 153 MIDDLE EAST AND AFRICA INDUSTRIAL IOT MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 154 MIDDLE EAST AND AFRICA INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 155 MIDDLE EAST AND AFRICA INDUSTRIAL IOT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 156 MIDDLE EAST AND AFRICA INDUSTRIAL IOT MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 157 MIDDLE EAST AND AFRICA INDUSTRIAL IOT MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 158 SAUDI ARABIA INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 159 SAUDI ARABIA INDUSTRIAL IOT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 160 SAUDI ARABIA INDUSTRIAL IOT MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 161 SAUDI ARABIA INDUSTRIAL IOT MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 162 SOUTH AFRICA INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 163 SOUTH AFRICA INDUSTRIAL IOT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 164 SOUTH AFRICA INDUSTRIAL IOT MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 165 SOUTH AFRICA INDUSTRIAL IOT MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 166 EGYPT INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 167 EGYPT INDUSTRIAL IOT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 168 EGYPT INDUSTRIAL IOT MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 169 EGYPT INDUSTRIAL IOT MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 170 ISRAEL INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 171 ISRAEL INDUSTRIAL IOT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 172 ISRAEL INDUSTRIAL IOT MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 173 ISRAEL INDUSTRIAL IOT MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 174 REST OF MIDDLE EAST AND AFRICA INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 175 SOUTH AMERICA INDUSTRIAL IOT MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 176 SOUTH AMERICA INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 177 SOUTH AMERICA INDUSTRIAL IOT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 178 SOUTH AMERICA INDUSTRIAL IOT MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 179 SOUTH AMERICA INDUSTRIAL IOT MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 180 BRAZIL INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 181 BRAZIL INDUSTRIAL IOT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 182 BRAZIL INDUSTRIAL IOT MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 183 BRAZIL INDUSTRIAL IOT MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 184 ARGENTINA INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 185 ARGENTINA INDUSTRIAL IOT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 186 ARGENTINA INDUSTRIAL IOT MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 187 ARGENTINA INDUSTRIAL IOT MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 188 REST OF SOUTH AMERICA INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

Список рисунков

FIGURE 1 GLOBAL INDUSTRIAL IOT MARKET: SEGMENTATION

FIGURE 2 GLOBAL INDUSTRIAL IOT MARKET: DATA TRIANGULATION

FIGURE 3 GLOBAL INDUSTRIAL IOT MARKET: DROC ANALYSIS

FIGURE 4 GLOBAL INDUSTRIAL IOT MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 GLOBAL INDUSTRIAL IOT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 GLOBAL INDUSTRIAL IOT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 GLOBAL INDUSTRIAL IOT MARKET: DBMR MARKET POSITION GRID

FIGURE 8 GLOBAL INDUSTRIAL IOT MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 GLOBAL INDUSTRIAL IOT MARKET: MARKET END USE COVERAGE GRID

FIGURE 10 GLOBAL INDUSTRIAL IOT MARKET: SEGMENTATION

FIGURE 11 INCREASE IN ADOPTION OF ARTIFICIAL INTELLIGENCE (AI) AND MACHINE LEARNING (ML) IN END USER INDUSTRY IS EXPECTED TO DRIVE THE GLOBAL INDUSTRIAL IOT MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 SCADA SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE GLOBAL INDUSTRIAL IOT MARKET IN 2022 AND 2029

FIGURE 13 ASIA-PACIFIC IS EXPECTED TO DOMINATE AND THE FASTEST GROWING REGION IN THE GLOBAL INDUSTRIAL IOT MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 ASIA-PACIFIC IS THE FASTEST GROWING MARKET FOR INDUSTRIAL IOT IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE GLOBAL INDUSTRIAL IOT MARKET

FIGURE 16 AI ADOPTION RATES AROUND THE GLOBE

FIGURE 17 COMPANIES GETTING BENEFITS FROM ANALYTICAL SOLUTIONS

FIGURE 18 GROWING INTERNET USERS WORLDWIDE

FIGURE 19 UNEMPLOYMENT RATE IN THE MIDDLE EAST AND NORTH AFRICA REGION

FIGURE 20 RESEARCH AND DEVELOPMENT EXPENDITURE (% OF GDP)

FIGURE 21 WORLDWIDE CLOUD INVESTMENT, 2019 – 2025

FIGURE 22 GLOBAL INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2021

FIGURE 23 GLOBAL INDUSTRIAL IOT MARKET, BY APPLICATION, 2021

FIGURE 24 GLOBAL INDUSTRIAL IOT MARKET, BY CONNECTIVITY, 2021

FIGURE 25 GLOBAL INDUSTRIAL IOT MARKET, BY END USE, 2021

FIGURE 26 GLOBAL INDUSTRIAL IOT MARKET: SNAPSHOT (2021)

FIGURE 27 GLOBAL INDUSTRIAL IOT MARKET: BY REGION (2021)

FIGURE 28 GLOBAL INDUSTRIAL IOT MARKET: BY REGION (2022 & 2029)

FIGURE 29 GLOBAL INDUSTRIAL IOT MARKET: BY REGION (2021 & 2029)

FIGURE 30 GLOBAL INDUSTRIAL IOT MARKET: BY TECHNOLOGY (2022-2029)

FIGURE 31 ASIA-PACIFIC INDUSTRIAL IOT MARKET: SNAPSHOT (2021)

FIGURE 32 ASIA-PACIFIC INDUSTRIAL IOT MARKET: BY COUNTRY (2021)

FIGURE 33 ASIA-PACIFIC INDUSTRIAL IOT MARKET: BY COUNTRY (2022 & 2029)

FIGURE 34 ASIA-PACIFIC INDUSTRIAL IOT MARKET: BY COUNTRY (2021 & 2029)

FIGURE 35 ASIA-PACIFIC INDUSTRIAL IOT MARKET: BY TECHNOLOGY (2022 & 2029)

FIGURE 36 NORTH AMERICA INDUSTRIAL IOT MARKET: SNAPSHOT (2021)

FIGURE 37 NORTH AMERICA INDUSTRIAL IOT MARKET: BY COUNTRY (2021)

FIGURE 38 NORTH AMERICA INDUSTRIAL IOT MARKET: BY COUNTRY (2022 & 2029)

FIGURE 39 NORTH AMERICA INDUSTRIAL IOT MARKET: BY COUNTRY (2021 & 2029)

FIGURE 40 NORTH AMERICA INDUSTRIAL IOT MARKET: BY TECHNOLOGY (2022 & 2029)

FIGURE 41 EUROPE INDUSTRIAL IOT MARKET: SNAPSHOT (2021)

FIGURE 42 EUROPE INDUSTRIAL IOT MARKET: BY COUNTRY (2021)

FIGURE 43 EUROPE INDUSTRIAL IOT MARKET: BY COUNTRY (2022 & 2029)

FIGURE 44 EUROPE INDUSTRIAL IOT MARKET: BY COUNTRY (2021 & 2029)

FIGURE 45 EUROPE INDUSTRIAL IOT MARKET: BY TECHNOLOGY (2022 & 2029)

FIGURE 46 MIDDLE EAST AND AFRICA INDUSTRIAL IOT MARKET: SNAPSHOT (2021)

FIGURE 47 MIDDLE EAST AND AFRICA INDUSTRIAL IOT MARKET: BY COUNTRY (2021)

FIGURE 48 MIDDLE EAST AND AFRICA INDUSTRIAL IOT MARKET: BY COUNTRY (2022 & 2029)

FIGURE 49 MIDDLE EAST AND AFRICA INDUSTRIAL IOT MARKET: BY COUNTRY (2021 & 2029)

FIGURE 50 MIDDLE EAST AND AFRICA INDUSTRIAL IOT MARKET: BY TECHNOLOGY (2022 & 2029)

FIGURE 51 SOUTH AMERICA INDUSTRIAL IOT MARKET: SNAPSHOT (2021)

FIGURE 52 SOUTH AMERICA INDUSTRIAL IOT MARKET: BY COUNTRY (2021)

FIGURE 53 SOUTH AMERICA INDUSTRIAL IOT MARKET: BY COUNTRY (2022 & 2029)

FIGURE 54 SOUTH AMERICA INDUSTRIAL IOT MARKET: BY COUNTRY (2021 & 2029)

FIGURE 55 SOUTH AMERICA INDUSTRIAL IOT MARKET: BY TECHNOLOGY (2022 & 2029)

FIGURE 56 GLOBAL INDUSTRIAL IOT MARKET: COMPANY SHARE 2021 (%)

FIGURE 57 ASIA-PACIFIC INDUSTRIAL IOT MARKET: COMPANY SHARE 2021 (%)

FIGURE 58 NORTH AMERICA INDUSTRIAL IOT MARKET: COMPANY SHARE 2021 (%)

FIGURE 59 EUROPE INDUSTRIAL IOT MARKET: COMPANY SHARE 2021 (%)

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.