Global Identity Verification Market

Размер рынка в млрд долларов США

CAGR :

%

USD

12.89 Billion

USD

40.38 Billion

2024

2032

USD

12.89 Billion

USD

40.38 Billion

2024

2032

| 2025 –2032 | |

| USD 12.89 Billion | |

| USD 40.38 Billion | |

|

|

|

|

Сегментация мирового рынка проверки личности по области применения (мошенничество с кредитными картами, банковское мошенничество, мошенничество с использованием телефонов или коммунальных услуг, а также мошенничество, связанное с трудоустройством или налогообложением), компоненту (решение и услуги), типу (небиометрические и биометрические), способу развертывания (локальные и облачные), размеру организации (крупные предприятия и малые и средние предприятия), вертикали (бухгалтерские и финансовые учреждения, государственный сектор и оборона, энергетика и коммунальные услуги, розничная торговля и электронная коммерция, ИТ и телекоммуникации, здравоохранение, игры и другие) — отраслевые тенденции и прогноз до 2032 года

Размер рынка проверки личности

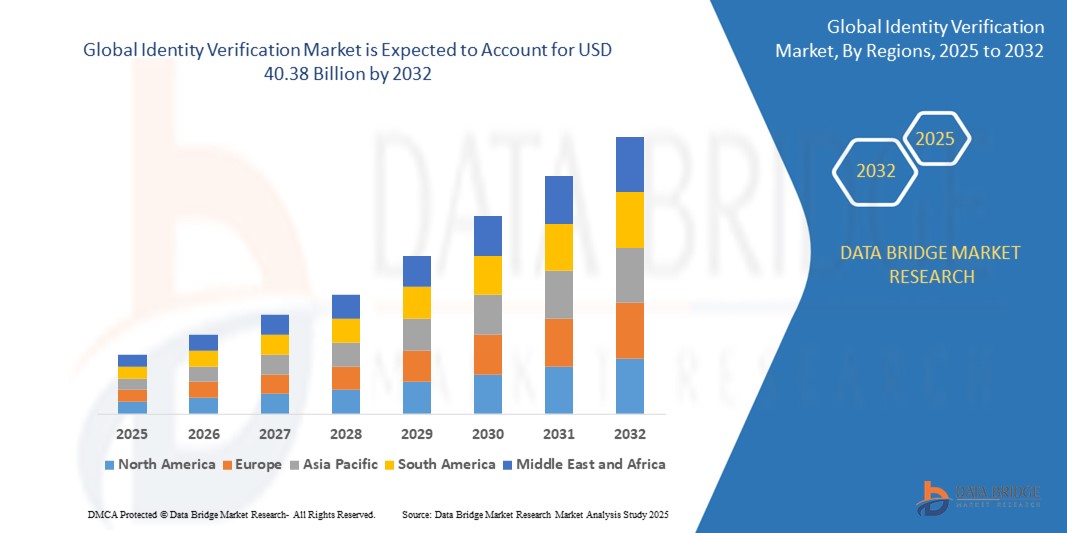

- Объем мирового рынка проверки личности в 2024 году оценивался в 12,89 млрд долларов США , а к 2032 году , как ожидается, он достигнет 40,38 млрд долларов США при среднегодовом темпе роста 15,34% в течение прогнозируемого периода.

- Рост рынка во многом обусловлен растущим внедрением решений цифровой идентификации в банковском секторе, финансовых услугах, здравоохранении и электронной коммерции из-за участившихся случаев мошенничества с использованием персональных данных и необходимости соблюдения нормативных требований.

- Рост популярности удаленной адаптации и цифровой трансформации в различных отраслях ускоряет спрос на решения для проверки личности, поскольку компании ищут безопасные и удобные способы аутентификации пользователей без физического взаимодействия.

Анализ рынка проверки личности

- Рынок проверки личности стремительно растёт из-за растущей цифровизации и необходимости безопасной аутентификации в таких секторах, как банковское дело, здравоохранение и электронная коммерция.

- Компании инвестируют в передовые биометрические и ИИ-технологии для повышения скорости и точности проверки, а также удобства для пользователей.

- Северная Америка доминировала на рынке проверки личности с наибольшей долей выручки в 42,1% в 2024 году, что обусловлено наличием развитой цифровой инфраструктуры, строгими нормативными требованиями, такими как KYC и AML, а также высоким уровнем мошенничества, связанного с идентификацией.

- Ожидается, что Азиатско-Тихоокеанский регион станет свидетелем самых высоких темпов роста мирового рынка проверки личности, чему будет способствовать ускорение цифровой трансформации в развивающихся экономиках, растущее внедрение процессов e-KYC и поддержка государственных инициатив по продвижению цифровой идентификации.

- Сегмент мошенничества с кредитными картами обеспечил наибольшую долю рынка в 2024 году благодаря росту онлайн-транзакций и росту случаев мошенничества без предъявления карты. Финансовые организации всё чаще внедряют технологии многоуровневой верификации для предотвращения мошеннических действий с картами и повышения доверия клиентов.

Область отчета и сегментация рынка проверки личности

|

Атрибуты |

Ключевые аспекты рынка проверки личности |

|

Охваченные сегменты |

|

|

Охваченные страны |

Северная Америка

Европа

Азиатско-Тихоокеанский регион

Ближний Восток и Африка

Южная Америка

|

|

Ключевые игроки рынка |

|

|

Рыночные возможности |

|

|

Информационные наборы данных с добавленной стоимостью |

Помимо таких рыночных данных, как рыночная стоимость, темпы роста, сегменты рынка, географический охват, участники рынка и рыночный сценарий, отчет о рынке, подготовленный командой Data Bridge Market Research, включает в себя углубленный экспертный анализ, анализ импорта/экспорта, анализ цен, анализ потребления продукции и анализ пестицидов. |

Тенденции рынка проверки личности

«Внедрение решений биометрической верификации на базе искусственного интеллекта»

- ИИ повышает точность биометрических данных, обучаясь в процессе взаимодействия, постоянно улучшая результаты проверки и минимизируя количество ложноположительных результатов. Например, биометрическая аутентификация Mastercard на базе ИИ повышает безопасность транзакций в цифровом банкинге.

- Распознавание лиц и сканирование радужной оболочки глаза помогают сократить количество ручных ошибок и вмешательство человека в процесс проверки личности, обеспечивая более быструю и надежную проверку.

- Финансовые учреждения используют ИИ для соблюдения правил KYC, оптимизации регистрации новых клиентов и выявления мошенничества. Например, HSBC использует распознавание лиц в своём мобильном приложении для безопасной проверки личности клиентов.

- Поставщики медицинских услуг используют биометрические инструменты для защиты доступа к данным пациентов, гарантируя, что доступ к конфиденциальной информации будет предоставлен только авторизованному персоналу, и повышая соответствие нормативным требованиям.

- Биометрическая верификация обеспечивает быструю бесконтактную регистрацию, что особенно ценно для удаленных сервисов, таких как цифровые кошельки, онлайн-банкинг и платформы телемедицины.

Динамика рынка проверки личности

Водитель

«Растущие угрозы кибербезопасности и требования к соблюдению нормативных требований»

- Рост кибератак и онлайн-мошенничества обуславливает спрос на безопасную проверку личности, поскольку цифровые платформы становятся все более уязвимыми к утечкам данных и краже личных данных.

- Компании инвестируют в передовые решения аутентификации, чтобы обеспечить безопасную и эффективную проверку пользователей и снизить риск несанкционированного доступа.

- Глобальные правила, такие как KYC, AML и GDPR, требуют проверки личности, вынуждая организации, особенно в сфере финансов и здравоохранения, внедрять строгие меры соответствия.

- Регламент Европейского союза eIDAS способствует развитию надежных цифровых идентификаторов, содействуя безопасному онлайн-взаимодействию и общественному доверию к цифровым услугам.

- Платформы проверки личности помогают повысить доверие потребителей и обеспечить соблюдение требований, предлагая надежные инструменты для защиты конфиденциальной информации и предотвращения неправомерного использования.

Сдержанность/Вызов

«Высокие затраты на реализацию и проблемы с конфиденциальностью»

- Высокие затраты на внедрение препятствуют внедрению технологий проверки личности, особенно среди малых и средних предприятий (МСП) с ограниченным бюджетом.

- Современные системы, такие как распознавание лиц на базе искусственного интеллекта и биометрическая верификация, требуют крупных инвестиций, а также затрат на обновление программного обеспечения, интеграцию и обучение сотрудников.

- Растут опасения по поводу конфиденциальности, связанные с обработкой биометрических и персональных данных, поскольку потребители и регулирующие органы требуют более надежной защиты конфиденциальной информации.

- Юридические риски, связанные с утечками данных, растут, и такие примеры, как коллективные иски в США против компаний, ненадлежащим образом обрабатывающих биометрические данные, подчеркивают потенциальную ответственность.

- Чтобы обеспечить более широкое внедрение, организациям необходимо сосредоточиться на прозрачном управлении данными и экономически эффективных решениях, обеспечивая как соответствие требованиям, так и доверие потребителей во всех секторах.

Сфера применения рынка проверки личности

Глобальный рынок проверки личности сегментирован по принципу применения, компонента, типа, режима развертывания, размера организации и вертикали.

- По применению

По сфере применения рынок верификации личности сегментируется на мошенничество с кредитными картами, банковское мошенничество, телефонное мошенничество или мошенничество в сфере коммунальных услуг, а также мошенничество, связанное с трудоустройством или уплатой налогов. Сегмент мошенничества с кредитными картами обеспечил наибольшую долю рынка в 2024 году благодаря росту онлайн-транзакций и росту числа случаев мошенничества без предъявления карты. Финансовые организации все чаще внедряют технологии многоуровневой верификации для пресечения мошеннических действий с картами и повышения доверия клиентов.

Ожидается, что сегмент мошенничества, связанного с трудоустройством и налогообложением, будет демонстрировать самые высокие темпы роста в период с 2025 по 2032 год, чему будет способствовать рост числа случаев кражи персональных данных для незаконного трудоустройства и подачи налоговых деклараций. Правительства и предприятия в настоящее время инвестируют в эффективные процедуры KYC для снижения рисков.

- По компонентам

По компонентному составу рынок верификации личности сегментируется на решения и услуги. Сегмент решений занимал наибольшую долю рынка в 2024 году благодаря широкому внедрению инструментов цифровой верификации личности, таких как верификация документов, распознавание лиц и валидация баз данных. Эти инструменты обеспечивают аутентификацию в режиме реального времени, масштабируемость и интеграцию с устаревшими системами.

Ожидается, что сегмент услуг будет демонстрировать самые быстрые темпы роста в период с 2025 по 2032 год, поскольку организации будут нуждаться в специализированной поддержке в области услуг по развертыванию, консультированию и обучению для оптимизации рабочих процессов проверки и обеспечения соответствия нормам защиты данных.

- По типу

По типу рынок идентификации личности сегментируется на небиометрические и биометрические методы. В 2024 году биометрический сегмент доминировал на рынке благодаря растущему внедрению сканирования отпечатков пальцев, распознавания лиц и анализа голоса в таких секторах, как финансово-бюджетные и государственные услуги (BFSI) и государственный сектор. Биометрические технологии обеспечивают повышенную точность и удобство для пользователя, что делает их идеальным решением для сред с высоким уровнем безопасности.

Ожидается, что сегмент небиометрических данных продемонстрирует самые быстрые темпы роста в период с 2025 по 2032 год, особенно в приложениях с низким уровнем риска и регионах со строгими законами о конфиденциальности, где по-прежнему широко распространена верификация на основе документов и баз данных.

- По режиму развертывания

В зависимости от способа развертывания рынок верификации личности подразделяется на локальный и облачный. Облачный сегмент занимал доминирующую долю в 2024 году благодаря своей гибкости, масштабируемости и снижению затрат на инфраструктуру. Облачная верификация личности обеспечивает обработку данных в режиме реального времени, обновление системы и удалённый доступ, что делает её весьма популярной среди предприятий малого и среднего бизнеса.

Ожидается, что локальный сегмент будет демонстрировать самые быстрые темпы роста в период с 2025 по 2032 год в связи с его использованием в таких секторах, как оборона и государственное управление, где приоритет отдается безопасности данных и локальному контролю.

- По размеру организации

Рынок верификации личности сегментирован по размеру организаций на крупные предприятия и предприятия малого и среднего бизнеса. Крупные предприятия заняли наибольшую долю рынка в 2024 году благодаря обширной клиентской базе, соблюдению нормативных требований и значительным ИТ-бюджетам, позволяющим инвестировать в сложные решения для верификации личности.

Ожидается, что сегмент МСП продемонстрирует самые высокие темпы роста в период с 2025 по 2032 год, что обусловлено растущей цифровизацией операций и необходимостью борьбы с киберугрозами, обеспечивая при этом бесперебойную адаптацию клиентов.

- По вертикали

По вертикали рынок сегментирован на следующие сферы: BFSI, государственный сектор и оборона, энергетика и коммунальные услуги, розничная торговля и электронная коммерция, ИТ и телекоммуникации, здравоохранение, игры и другие. Сегмент BFSI обеспечил наибольшую долю выручки в 2024 году благодаря строгим нормам KYC и росту числа случаев финансового мошенничества. Банки и финансовые учреждения внедряют верификацию личности с помощью искусственного интеллекта для обеспечения безопасности транзакций и укрепления доверия клиентов.

Ожидается, что в игровом сегменте будут наблюдаться самые быстрые темпы роста в период с 2025 по 2032 год, поскольку отрасль все больше нуждается в надежных системах проверки возраста и личности для обеспечения соблюдения нормативных требований и предотвращения доступа несовершеннолетних и мошенничества в среде онлайн-игр.

Региональный анализ рынка проверки личности

- Северная Америка доминировала на рынке проверки личности с наибольшей долей выручки в 42,1% в 2024 году, что обусловлено наличием развитой цифровой инфраструктуры, строгими нормативными требованиями, такими как KYC и AML, а также высоким уровнем мошенничества, связанного с идентификацией.

- Предприятия региона отдают приоритет надежным технологиям проверки, чтобы обеспечить соответствие требованиям, улучшить взаимодействие с клиентами и снизить киберугрозы.

- Широкое внедрение инструментов биометрической аутентификации на основе искусственного интеллекта в BFSI, здравоохранении и государственном секторе еще больше укрепляет позиции компании на рынке.

Обзор рынка проверки личности в США

Рынок верификации личности в США в 2024 году обеспечил наибольшую долю выручки в Северной Америке, чему способствовала быстрая цифровизация различных отраслей, растущая обеспокоенность по поводу конфиденциальности данных и участившиеся случаи кражи персональных данных. Финансовые учреждения, в частности, инвестируют в многофакторную аутентификацию и биометрические технологии для обеспечения безопасности удалённой регистрации и снижения уровня мошенничества. Наличие крупных игроков на рынке и постоянные инновации также способствуют лидирующим позициям страны.

Обзор рынка проверки личности в Азиатско-Тихоокеанском регионе

Ожидается, что рынок верификации личности в Азиатско-Тихоокеанском регионе будет демонстрировать самые высокие темпы роста в период с 2025 по 2032 год, что обусловлено развитием цифровой экономики, государственными инициативами в области электронных удостоверений личности и ростом проникновения интернета на развивающихся рынках. В таких странах, как Китай, Индия и Япония, наблюдается значительное внедрение в сфере банковской, финансовой и финансовой информации, телекоммуникационном и государственном секторах. Стремление к развитию «умных городов» и безопасному цифровому управлению стимулирует спрос на надежные решения для верификации личности.

Обзор рынка проверки личности в Китае

Китайский рынок верификации личности занимал самую большую долю выручки в Азиатско-Тихоокеанском регионе в 2024 году благодаря мощной государственной поддержке цифровой идентификации, быстрому росту онлайн-сервисов и увеличению инвестиций в технологии видеонаблюдения и искусственного интеллекта. Верификация личности широко применяется в банковской сфере, социальных сетях и системах общественной безопасности при поддержке китайских технологических гигантов и регулирующих органов.

Обзор рынка проверки личности в Японии

Ожидается, что рынок верификации личности в Японии будет демонстрировать самые высокие темпы роста в период с 2025 по 2032 год, чему будут способствовать технологически ориентированное население, высокий спрос на цифровой банкинг и стремление правительства создать национальные системы цифровой идентификации. Внедрение цифровых систем идентификации также растёт в секторах страхования и здравоохранения, где особое внимание уделяется удобным и безопасным решениям для доступа, интегрированным с другими интеллектуальными системами.

Обзор рынка проверки личности в Европе

Ожидается, что европейский рынок верификации личности будет демонстрировать самые высокие темпы роста в период с 2025 по 2032 год, чему будет способствовать внедрение стандартов GDPR и eIDAS, предписывающих безопасную цифровую идентификацию. Растущий спрос на трансграничные цифровые услуги и решения, ориентированные на конфиденциальность, способствует их внедрению, особенно в финансовом, туристическом и государственном секторах.

Обзор рынка проверки личности в Германии

Ожидается, что рынок верификации личности в Германии будет демонстрировать самые высокие темпы роста в период с 2025 по 2032 год благодаря строгому соблюдению нормативных требований, высокому уровню цифровой грамотности и широкому распространению инициатив в области электронного правительства. Внедрение электронных удостоверений личности и защищенных платформ идентификации стимулирует рост рынка как в государственных учреждениях, так и в частных компаниях.

Обзор рынка проверки личности в Великобритании

Ожидается, что рынок верификации личности в Великобритании будет демонстрировать самые высокие темпы роста в период с 2025 по 2032 год, что обусловлено растущей потребностью в предотвращении мошенничества, цифровом внедрении в банковской сфере и финтехе, а также поддерживаемыми государством инициативами, такими как GOV.UK Verify. Стремление страны к обеспечению бесперебойного и безопасного цифрового взаимодействия стимулирует инвестиции в биометрические решения и решения на основе искусственного интеллекта.

Доля рынка проверки личности

Лидерами отрасли проверки личности являются в основном хорошо зарекомендовавшие себя компании, среди которых:

- Experian (Ирландия),

- GB Group plc («GBG») (Великобритания),

- Equifax, Inc. (США),

- Mitek Systems, Inc. (США),

- Фалес (Франция)

- LexisNexis Risk Solutions (США)

- Онфидо (Великобритания)

- Трулио (Канада)

- Acuant, Inc. (США)

- IDEMIA (Франция)

- Хумио (США)

- TransUnion LLC (США)

- AU10TIX (Израиль)

- IDology (США)

- Инноватрикс (Словакия)

- Прикладное признание (Канада)

- Сигникат (Норвегия)

- SecureKey Technologies Inc. (Канада)

- Baldor Technologies Pvt Ltd (Индия)

Последние события на мировом рынке проверки личности

- В феврале 2024 года компания AU10TIX представила новое решение «Знай свой бизнес» (KYB), направленное на улучшение проверки партнёров и снижение рисков. Благодаря интеграции KYB с процессами «Знай своего клиента» (KYC) это решение предлагает комплексные возможности проверки личности, обеспечивая безопасное взаимодействие с клиентами и повышая доверие к финансовым транзакциям.

- В январе 2024 года компания Onfido запустила комплексное решение для проверки личности, призванное помочь компаниям оптимизировать процесс подключения клиентов. Платформа позволяет компаниям соблюдать местные нормативные требования, способствуя плавному выходу на новые рынки и улучшая привлечение пользователей.

- В декабре 2023 года компания HireRight, LLC выпустила «Global ID» — инструмент цифровой идентификации личности, включающий биометрическое сопоставление лиц и цифровое определение личности. Это нововведение повышает эффективность процесса найма, гарантируя подлинность кандидатов, тем самым повышая соответствие требованиям и снижая риск мошенничества с персональными данными.

- В октябре 2023 года компания Veriff представила два инструмента для предотвращения мошенничества, расширяющие её пакет для проверки личности. Используя машинное обучение, поведенческий анализ и биометрическую верификацию, эти инструменты помогают компаниям выявлять и блокировать мошеннические действия, повышая общую безопасность.

- В октябре 2023 года компания IDology, входящая в состав GBG, расширила спектр своих решений по идентификации для игровой индустрии, сосредоточившись на привлечении и удержании игроков, а также на предотвращении мошенничества. Это решение повышает соответствие нормативным требованиям и операционную эффективность, предлагая операторам азартных игр более безопасный и удобный интерфейс.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.