Global High Performance Pigments Market

Размер рынка в млрд долларов США

CAGR :

%

USD

6.50 Billion

USD

9.90 Billion

2024

2032

USD

6.50 Billion

USD

9.90 Billion

2024

2032

| 2025 –2032 | |

| USD 6.50 Billion | |

| USD 9.90 Billion | |

|

|

|

Global High Performance Pigments Market Segmentation, By Type (Organic, Inorganic, Hybrid), Application (Coatings, Plastics, Inks, Cosmetics, Others), End-Use Industry (Automotive and Transportation, Construction and Infrastructure, Printing, Industrial, Others) – Industry Trends and Forecast to 2032

High Performance Pigments Market Analysis

High performance pigments are renowned for their superior performance, high economic value added, and endurance across a range of applications. The end-use cosmetics market is expanding quickly, which in turn is fostering a favorable environment for the market for high performance pigments. For instance, the International Trade Association, USA, estimated the South Korean cosmetics industry at USD 7.1 billion in 2016, while local production and exports climbed by 8.2 percent and 61.6 percent, respectively, over 2015. As a result, the market is projected to accelerate largely over the forecast period.

High Performance Pigments Market Size

Global High Performance Pigments Market size was valued at USD 6.50 billion in 2024 and is projected to reach USD 9.90 billion by 2032, with a CAGR of 5.40% during the forecast period of 2025 to 2032.

Report Scope and Market Segmentation

|

Attributes |

High Performance Pigments Key Market Insights |

|

Segmentation |

|

|

Countries Covered |

U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, France, Italy, U.K., Belgium, Spain, Russia, Turkey, Netherlands, Switzerland, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, U.A.E, Saudi Arabia, Egypt, South Africa, Israel, Rest of Middle East and Africa |

|

Key Market Players |

BASF SE (U.S.), Sun Chemical (U.S.), Sensient Cosmetic Technologies (U.S.), Merck KGaA (Germany), Altana (Germany), Sudarshan Chemical Industries Limited (India), Dayglo Color Corp (U.S.), Elemental SRL (Romania), Kolortek Co., Ltd (China), Clariant (Switzerland), LANXESS (Germany), Venator Materials PLC (U.K.), GEOTECH (Netherlands), Koel Colours Pvt. Ltd. (India), Yipin Pigments (U.S.), NIHON KOKEN KOGYO CO.,LTD. (Japan), Ferro Corporation (U.S.), Sandream Impact LLC (U.S.), VIBFAST PIGMENTS PVT. LTD. (India), Neelikon (Mumbai), Miyoshi Kasei, Inc. (Japan), ECKART (U.K.), Kobo Dynamic Website (U.S.) |

|

Market Opportunities |

|

High Performance Pigments Market Definition

The term "high-performance pigments" (HPPs) refers to both inorganic and organic pigments with exceptional insolubility, color strength, thermal stability, weather and light fastness, bleeding and solvent fastness, and low migration qualities. There are several outdoor applications for HPPs, including decals, signage, and advertising. Additionally, these pigments are employed in indoor applications such floor and wall coverings, printing inks for specialty packaging like retort packaging, decorative metal inks, security inks, electrophotographic toners, and color filters for liquid crystal displays.

High Performance Pigments Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints and challenges. All of this is discussed in detail as below:

Drivers

- High Utilization across Automotive Sector

The automotive industry owned the largest proportion of the market for high-performance pigments due to the usage of HPPs in coatings for luxury cars, high-end hybrid vehicles, traditional plug-in vehicles, ships, and other vehicles. The need for high performance pigments is rising as a result of the automotive industry's rapid growth worldwide; for instance, the automotive motor market's size value was approximately USD 35 billion in 2020. High performance pigments are used in automobile paints and varnishes to provide durability and corrosion protection and shield underlying metals and components from harsh weather conditions.

- Increased Demand from Industries

The demand for long-lasting, highly temperature-resistant, and concentrated pigments has increased in sectors like cosmetics, textiles, pharmaceuticals, and polymers due to favorable regulatory environments. The market is expanding as a result of more high performance pigments being used across various end sue industries across the globe.

Furthermore, the rising income levels and the population growth will further propel the growth rate of high performance pigments market. Additionally, the increasing understanding of the climate and a robust regulatory system will also drive market value growth. The surge in the number of vehicles and construction activities and rapid industrial expansion of various industries such as plastics, textiles, infrastructure and others are projected to bolster the growth of the market.

Opportunities

- Intelligent Technologies and Significant Initiatives

Furthermore, the demand for high-performance pigments is driven by manufacturers' use of intelligent technologies to provide environmentally friendly coatings with improved scratch resistance and abrasion resistance, which offers various profitable opportunities to the market in the forecast period of 2025 to 2032 Additionally, industry participants have taken significant initiatives to create high-performance pigments using only bio-based goods due to consumer satisfaction with bio-based products, which will further expand the future growth of the high performance pigments market.

Restraints/Challenges

- Adverse Impact on Environment

Environmental issues resulting from inorganic pigments' use of petroleum-based materials provide the biggest barrier to the high performance pigments sector. For instance, lung cancer may be brought on by cadmium pigments, chrome yellow, and zinc yellow. Chromate pigments can also result in skin allergies. This ultimately hinders market expansion during the forecast period.

- Regulatory Requirement

However, the use of specific types of pigments in different applications is constrained by a number of regulatory requirements from various agencies. Therefore, this factor will pose as a significant challenge for the high performance pigments market growth rate over the forecast period of 2025 to 2032.

This high performance pigments market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the high performance pigments market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

High Performance Pigments Market Scope

The high performance pigments market is segmented on the basis of type, application and end-use industry. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Organic

- Inorganic

- Hybrid

Application

- Coatings

- Plastics

- Inks

- Cosmetics

- Others

End-Use Industry

- Automotive and Transportation

- Construction and Infrastructure

- Printing

- Industrial

- Others

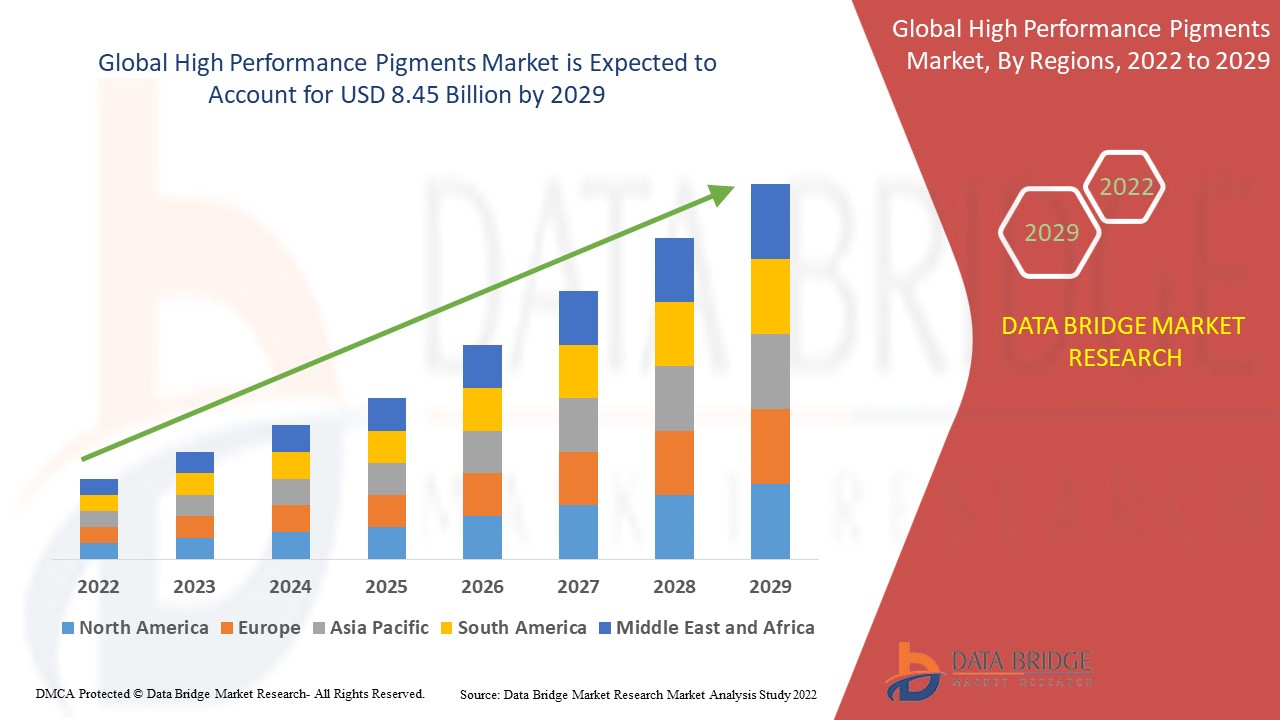

High Performance Pigments Market Regional Analysis

The high performance pigments market is analyzed and market size insights and trends are provided by country, type, application and end-use industry as referenced above.

The countries covered in the high performance pigments market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, Israel, Egypt, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America dominates the market in terms of market share and market revenue and will continue to flourish its dominance during the forecast period of 2025-2032. The market growth over this region is attributed to the high demand from various industries within the region.

Asia-Pacific on the other hand, is estimated to show lucrative growth over the forecast period of 2025-2032, due to the rising use of organic pigments in cosmetics and personal care in the region.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

High Performance Pigments Market Share

The high performance pigments market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to high performance pigments market.

High Performance Pigments Market Leaders Operating in the Market Are:

- BASF SE (U.S.)

- Sun Chemical (U.S.)

- Sensient Cosmetic Technologies (U.S.)

- Merck KGaA (Germany)

- Altana (Germany)

- Sudarshan Chemical Industries Limited (India)

- Dayglo Color Corp (U.S.)), Elemental SRL (Romania)

- Kolortek Co., Ltd (China)

- Clariant (Switzerland)

- LANXESS (Germany)

- Venator Materials PLC (U.K.)

- GEOTECH (Netherlands)

- Koel Colours Pvt. Ltd. (India)

- Yipin Pigments (U.S.)

- NIHON KOKEN KOGYO CO., LTD. (Japan)

- Ferro Corporation (U.S.)

- Sandream Impact LLC (U.S.)

- VIBFAST PIGMENTS PVT. LTD. (India)

- Neelikon (India)

- Miyoshi Kasei, Inc. (Japan)

- ECKART (U.K.)

- Kobo Dynamic Website (U.S.)

Latest Developments in High Performance Pigments Market

- In July 2021, Sun Chemical launched the new cosmetic effect pigments named Reflecks MD Midnight Cherry and Reflecks MD Midnight Sapphire. These two blackened metallic-like effect pigments based on calcium sodium borosilicate have outstanding chroma, colour travel, and sparkle thanks to the cutting-edge multilayer technique utilised in them. Utilizing a novel, patent-pending method, the absorption colourant is embedded inside the coating, simplifying and speeding up formulation while also providing benefits to the end user by barely colouring the skin.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.