Global Gummed Tape Market

Размер рынка в млрд долларов США

CAGR :

%

USD

3,704.16 Million

USD

5,092.46 Million

2021

2029

USD

3,704.16 Million

USD

5,092.46 Million

2021

2029

| 2022 –2029 | |

| USD 3,704.16 Million | |

| USD 5,092.46 Million | |

|

|

|

|

Global Gummed Tape Market, By Product Type (WAT Reinforced Tape, WAT Paper Tape, Gum side In/out), Adhesive Tape (Hot Melt, Rubber, Pressure Sensitive, Starch Adhesive, Water Based Acrylic Adhesive), Backing Material (Paper Gummed Tape, Fiber-reinforced Tape), Type (White Gummed Tapes, Brown Gummed Tapes), Application (Carton Sealing, Masking, Bag Sealing, Auto Packing Machine, Strapping, Wrapping and Decoration, Box Sealing, Splicing, Others) – Industry Trends and Forecast to 2029

Market Analysis and Size

According to the survey, gummed tapes with backing materials such as fiber reinforced tape and paper gummed tape are becoming incredibly popular. In comparison to paper gummed tape, the fiber-reinforced gummed tapes are among the most resilient and simple to use.

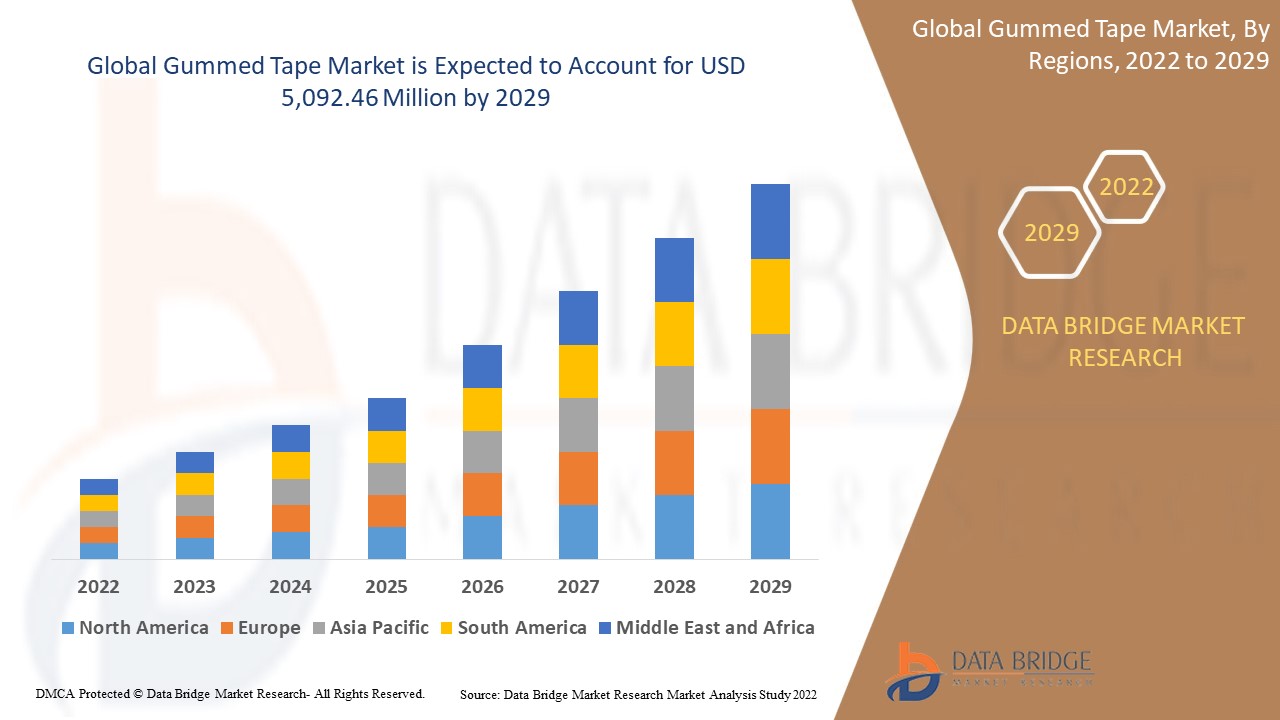

Global Gummed Tape Market was valued at USD 3,704.16 million in 2021 and is expected to reach USD 5,092.46 million by 2029, registering a CAGR of 3.6% during the forecast period of 2022-2029. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, patent analysis and technological advancements.

Report Scope and Market Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2014 - 2019) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Product Type (WAT Reinforced Tape, WAT Paper Tape, Gum side In/out), Adhesive Tape (Hot Melt, Rubber, Pressure Sensitive, Starch Adhesive, Water Based Acrylic Adhesive), Backing Material (Paper Gummed Tape, Fiber-reinforced Tape), Type (White Gummed Tapes, Brown Gummed Tapes), Application (Carton Sealing, Masking, Bag Sealing, Auto Packing Machine, Strapping, Wrapping and Decoration, Box Sealing, Splicing, Others) |

|

Countries Covered |

U.S., Canada, Mexico, Germany, Italy, U.K., France, Spain, Netherlands, Belgium, Switzerland, Turkey, Russia, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia- Pacific, Brazil, Argentina, Rest of South America, South Africa, Saudi Arabia, UAE, Egypt, Israel, Rest of Middle East and Africa |

|

Market Players Covered |

3M (U.S), Nippon Industries (Japan), Gripking Tapes India Pvt. Ltd., (India), PPM Industries SpA (Italy), PIONEER CORPORATION (Japan), Szxinst (China), Ajit Industries Pvt. Ltd. (India), Nitto Denko Corporation (Japan), Tesa Tapes (Germany), AVERY DENNISON CORPORATION (U.S.), Scapa (U.K.), Lohmann GmbH & Co. Kg (Germany), Mactac, LLC (U.S.), JTAPE LTD. (U.K.), Decofix Papers & Tapes (India), LINTEC Corporation (Japan), Shurtape Technologies, LLC (U.S.), Tape India (India) and VITS TECHNOLOGY GMBH (Germany) among others. |

|

Market Opportunities |

|

Market Definition

Gummed tape is heavy-duty paper tape with an impermanent adhesive that doesn't attach to surfaces until it becomes wet. You can moisten it with a sponge or a gummed tape dispenser. Another name for it is water-activated tape (WAT). A form of adhesive tape called gummed paper tape is made from organic materials like paper or potato starch. It comes with a natural glue adhesive that hardens when wet, making it entirely recyclable.

Gummed Tape Market Dynamics

This section deals with understanding the market drivers, opportunities, restraints and challenges. All of this is discussed in detail as below:

Drivers

- High Demand Across End Users

For the packaging of various products and items, these tapes are utilized in a variety of end-use industries, including shipping and logistics, food and beverage, electrical and electronics, automotive, and others. These tapes are frequently used for splicing, sealing, and packaging heavy-duty boxes and cartons due to the aforementioned factors. End users are attempting to expand their product portfolio and manufacturing capacity in order to serve the market and make up for the losses sustained during the pandemic.

- Increased Use of Biodegradable and Sustainable Tapes

Natural adhesives paper and potato starch, which are used to make gummed tapes, strengthen sticky bonds when water activates. It has a natural glue adhesive that hardens into a sticky substance when wet, making it entirely reusable. Brown gummed tapes can be recycled and are produced naturally from plants, which reduces environmental pollution. These tapes are the environmentally friendly substitute for corrugated boxes, or "green boxes," when it comes to packaging. They are a wonderful environmentally friendly alternative to regular packing tape because they are biodegradable and fundamentally 100% recyclable, which further boosts the demand for market across consumers with environmental concerns.

Furthermore, the increasing demand for tamper-evident packaging formats during transportation coupled with the growing e-commerce will further propel the growth rate of gummed tape market. Additionally, the rising popularity of gummed tapes and the tamper-proof backing made of a tear-resistant reinforced fiber boosts the overall market growth. Gummed tapes can also tolerate extremes of heat and cold, driving market value growth. The expansion and growth of various end use industries are projected to bolster the growth of the market.

Opportunities

- Technological Advancements and Research and Development Activities

Furthermore, the ongoing technological advancements, the beginning of new initiatives and upgrades to high-tech water-activated tape dispensers to maximize effectiveness and authenticity further extend profitable opportunities to the market players in the forecast period of 2022 to 2029. Additionally, the increasing research and development activities to meet the increasing demand from food and beverages as well as will further expand the future growth of the gummed tape market.

Restraints/Challenges

- Availability of Gummed Tapes

The expansion of the global gummed tapes market is constrained by substitute materials, including BOPP packaging tapes and heat-activated tapes. For light packing, pressure-sensitive tapes are more affordable than paper gummed tapes.

- High Cost and Other Drawbacks

However, the more expensive initial cost of using gummed tapes, which is mostly made up of the dispenser cost, restrains market growth. These are also less accessible than plastic packaging tape, which restricts market expansion. These factors challenge the gummed tape market growth rate.

This gummed tape market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the gummed tape market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Impact on Gummed Tape Market

The recent outbreak of coronavirus had a negative impact on the gummed tape market. The market largely relies on industries such as electrical and electronics, shipping and logistics, automotive, and others which were severely harmed during the pandemic. The severe disruptions in various manufacturing as well as the supply-chain operations due to the various precautionary lockdowns imposed by governments to curb the spread of disease led to huge financial setback for the market. These aforementioned determinants weighed on the market's revenue trajectory during the pandemic period.

On the brighter side, the market gained a moderate demand from the food and beverages sector even during the pandemic. The suspended and cancelled operations will continue and as a result the market is estimated to expand.

Recent Development

- In September 2021, the launch of a new line of tapes produced from recyclable and biodegradable materials was announced by Ajit Industries Private Limited (AIPL). The product line consists of kraft paper tapes that are water activated and self-adhesive.

- In June 2020, in response to the COVID-19 situation, Irplast created a removable floor-applied cautionary tape that is gummed and PVC-free and is intended to delimit particular spaces in order to ensure social distance.

Global Gummed Tape Market Scope

The gummed tape market is segmented on the basis of product type, adhesive tape, backing material, type, application and oil. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product Type

- WAT Reinforced Tape

- WAT Paper Tape

- Gum side In/out

Adhesive Tape

- Hot Melt

- Rubber

- Pressure Sensitive

- Starch Adhesive

- Water Based Acrylic Adhesive

Backing Material

- Gummed Tape

- Fiber-reinforced Tape

Type

- White Gummed Tapes

- Brown Gummed Tapes

Application

- Carton Sealing

- Masking

- Bag Sealing

- Auto Packing Machine

- Strapping

- Wrapping and Decoration

- Box Sealing

- Splicing

- Others

Gummed Tape Market Regional Analysis/Insights

The gummed tape market is analyzed and market size insights and trends are provided by country, product type, adhesive tape, backing material, type, application and oil as referenced above.

The countries covered in the gummed tape market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America dominates the market in terms of market share and market revenue and will continue to flourish its dominance during the forecast period of 2022-2029. The market growth over this region is attributed to the increasing use across used across various end-use industries such as automotive, healthcare and hygiene, and electricals and electronics coupled with the growing demand from the packaging industry due to the increasing production of food items among others within the region.

On the other hand, Asia-Pacific, is estimated to show lucrative growth over the forecast period of 2022-2029, due to the increasing growth potential observed from emerging countries such as India and China along with developed economies like Japan and South Korea within the region. Over the course of the forecast period, the Asia Pacific gummed tapes market will be driven by rising disposable income as well as a growing inclination for packaged food goods.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Gummed Tape Market Share Analysis

The gummed tape market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to gummed tape market.

Some of the major players operating in the gummed tape market are

- 3M (U.S)

- Nippon Industries (Japan)

- Gripking Tapes India Pvt. Ltd., (India)

- PPM Industries SpA (Italy)

- PIONEER CORPORATION (Japan)

- Szxinst (China)

- Ajit Industries Pvt. Ltd. (India)

- Nitto Denko Corporation (Japan)

- Tesa Tapes (Germany)

- AVERY DENNISON CORPORATION (U.S.)

- Scapa (U.K.)

- Lohmann GmbH & Co. Kg (Germany)

- Mactac, LLC (U.S.)

- JTAPE LTD. (U.K.)

- Decofix Papers & Tapes (India)

- LINTEC Corporation (Japan)

- Shurtape Technologies, LLC (U.S.)

- Tape India (India)

- VITS TECHNOLOGY GMBH (Germany)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.