Global 3d Cell Culture Market

Размер рынка в млрд долларов США

CAGR :

%

USD

2.62 Billion

USD

6.13 Billion

2024

2032

USD

2.62 Billion

USD

6.13 Billion

2024

2032

| 2025 –2032 | |

| USD 2.62 Billion | |

| USD 6.13 Billion | |

|

|

|

|

Сегментация мирового рынка 3D-культур клеток по продукту (на основе матриц, без матриц, на основе микрофлюидики, магнитная левитация и 3D-биопечать), типу (гидрогель, висячая капля, биореактор, микрофлюидика и магнитная левитация), применению (исследования стволовых клеток, поиск лекарств и токсикологические испытания, тканевая инженерия и регенеративная медицина), конечному пользователю (фармацевтические и биотехнологические компании, академические учреждения, институты и исследовательские лаборатории) — тенденции отрасли и прогноз до 2032 г.

Размер рынка 3D-культуры клеток

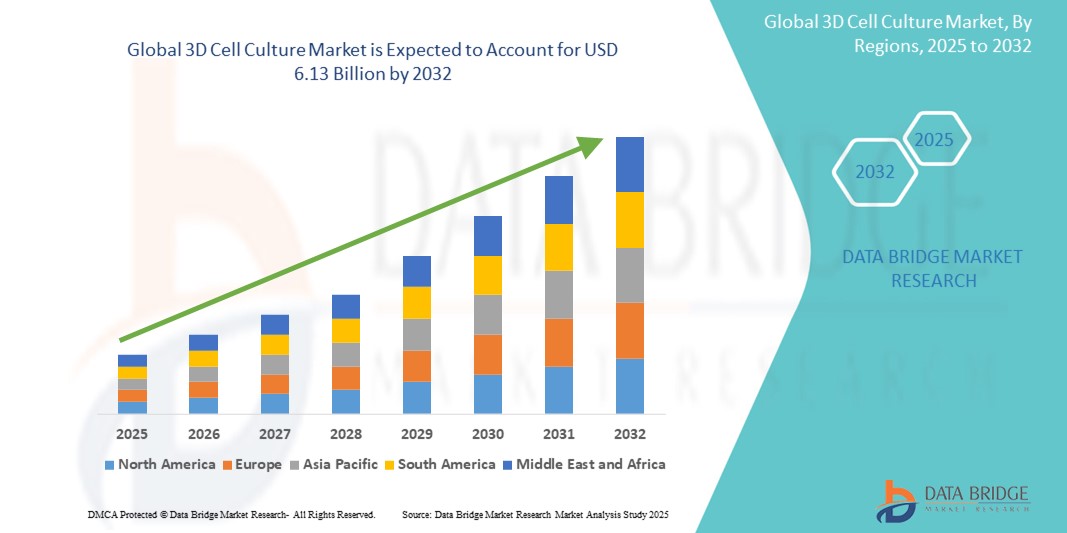

- Объем мирового рынка 3D-культур клеток оценивался в 2,62 млрд долларов США в 2024 году и, как ожидается , достигнет 6,13 млрд долларов США к 2032 году при среднегодовом темпе роста 11,20% в прогнозируемый период.

- Этот рост обусловлен такими факторами, как растущий спрос на более прогностические модели in vitro при разработке лекарственных препаратов, растущее внедрение альтернатив испытаниям на животных, а также достижения в области тканевой инженерии и технологий биопечати.

3D-анализ рынка клеточных культур

- Системы 3D-культивирования клеток — это передовые технологии in vitro, которые позволяют клеткам расти в трехмерной среде, максимально точно имитирующей условия in vivo, что расширяет их применение в разработке лекарственных препаратов, исследовании рака и тканевой инженерии.

- Рост рынка в значительной степени обусловлен ростом спроса на более прогностические клеточные анализы, снижением зависимости от испытаний на животных и растущим применением в регенеративной медицине.

- Ожидается, что Северная Америка будет доминировать на рынке 3D-культур клеток с долей рынка 39,59% благодаря хорошо развитой инфраструктуре здравоохранения, высоким инвестициям в исследования и разработки, а также мощной поддержке передовых биотехнологий.

- Ожидается, что Азиатско-Тихоокеанский регион станет самым быстрорастущим регионом на рынке 3D-культур клеток с долей рынка 24,68% в течение прогнозируемого периода благодаря быстрому развитию биотехнологий, росту инвестиций в здравоохранение и повышению осведомленности о персонализированной медицине.

- Ожидается, что сегмент на основе каркасов будет доминировать на рынке с долей рынка 49,35% благодаря своей способности обеспечивать структурную поддержку, которая точно имитирует внеклеточный матрикс, способствуя реалистичному росту и дифференциации клеток.

Область применения отчета и сегментация рынка 3D-культур клеток

|

Атрибуты |

Ключевые сведения о рынке 3D-культуры клеток |

|

Охваченные сегменты |

|

|

Страны, охваченные |

Северная Америка

Европа

Азиатско-Тихоокеанский регион

Ближний Восток и Африка

Южная Америка

|

|

Ключевые игроки рынка |

|

|

Возможности рынка |

|

|

Информационные наборы данных с добавленной стоимостью |

Помимо информации о рыночных сценариях, таких как рыночная стоимость, темпы роста, сегментация, географический охват и основные игроки, рыночные отчеты, подготовленные Data Bridge Market Research, также включают анализ импорта и экспорта, обзор производственных мощностей, анализ потребления продукции, анализ ценовых тенденций, сценарий изменения климата, анализ цепочки поставок, анализ цепочки создания стоимости, обзор сырья и расходных материалов, критерии выбора поставщиков, анализ PESTLE, анализ Портера и нормативную базу. |

Тенденции рынка 3D-культур клеток

«Растущее внедрение передовых технологий 3D-культуры»

- Одной из основных тенденций на мировом рынке 3D-культур клеток является растущее внедрение передовых технологий 3D-культур, таких как органоиды, сфероиды и модели на основе каркасов, в скрининге лекарственных препаратов и моделировании заболеваний.

- Эти системы лучше воспроизводят физиологические состояния человека по сравнению с традиционными 2D-культурами, повышая надежность доклинических исследований и снижая зависимость от животных моделей.

- Например, технология органоидов все чаще используется в исследованиях рака и персонализированной медицине, предоставляя информацию о реакции пациентов на лекарственные препараты и прогрессировании заболевания.

- Эти достижения кардинально меняют процессы разработки лекарственных препаратов, совершенствуют трансляционные исследования и стимулируют спрос на инновационные платформы для 3D-культивирования клеток в фармацевтическом и биотехнологическом секторах.

Динамика рынка 3D-культур клеток

Водитель

«Растущий спрос на прогностические и релевантные для человека модели тестирования наркотиков»

- Растущая потребность в более физиологически значимых и предсказательных моделях in vitro является основным драйвером рынка 3D-культивирования клеток, особенно в области разработки лекарственных препаратов, токсикологии и исследований рака.

- Традиционные 2D-культуры не в состоянии точно воспроизвести среду in vivo, что часто приводит к неэффективному скринингу лекарственных препаратов и высокому уровню неудач в клинических испытаниях.

- Системы 3D-культуры клеток лучше имитируют сложные взаимодействия между клетками и между клетками и матриксом, обнаруженные в живых тканях, что повышает точность доклинических испытаний и снижает зависимость от животных моделей.

Например,

- Согласно отчету Национального центра развития трансляционных наук (NCATS) за 2023 год, более 90% препаратов, прошедших испытания на животных, терпят неудачу в испытаниях на людях из-за плохой предсказательной способности моделей, что подчеркивает острую необходимость в более релевантных для людей испытательных платформах, таких как 3D-клеточные культуры.

- Поскольку фармацевтические и биотехнологические компании стремятся сократить затраты на разработку и улучшить клинические результаты, спрос на технологии 3D-культивирования клеток продолжает расти на мировых рынках.

Возможность

«Расширение применения в персонализированной медицине и регенеративной терапии»

- Глобальный рынок 3D-культур клеток становится свидетелем значительных возможностей в растущем принятии персонализированной медицины, где 3D-модели, полученные от пациентов, используются для адаптации лечения на основе индивидуальных биологических реакций.

- Эти модели позволяют исследователям воссоздавать специфичные для пациента условия течения заболевания, что позволяет более точно тестировать терапевтические реакции и сокращать количество проб и ошибок при принятии клинических решений.

- В регенеративной медицине 3D-клеточные культуры поддерживают тканевую инженерию, способствуя развитию функциональных тканей и органоидов для трансплантации и восстановления.

Например,

- В отчете Nature Biotechnology за 2024 год исследователи успешно использовали органоиды, полученные от пациентов, для моделирования муковисцидоза, что позволило врачам выбрать наиболее эффективное лечение для каждого человека и значительно улучшить результаты терапии.

- Поскольку системы здравоохранения переходят на персонализированные и регенеративные подходы, интеграция технологий 3D-культивирования клеток открывает новые возможности для инноваций, повышая эффективность лечения и прокладывая путь для биомедицинских приложений следующего поколения.

Сдержанность/Вызов

«Высокая стоимость систем 3D-культивирования и ограниченная стандартизация»

- Высокая стоимость систем 3D-культивирования клеток, включая специализированное оборудование, реагенты и каркасы, является существенным препятствием для их широкого внедрения, особенно в малых и средних исследовательских учреждениях.

- Создание и поддержание 3D-культур требует развитой инфраструктуры и технических знаний, что увеличивает общие расходы лабораторий и фармацевтических компаний.

- Кроме того, отсутствие стандартизированных протоколов для различных методов 3D-культивирования может привести к непоследовательным результатам, что затрудняет воспроизводимость и более широкое принятие в клинических и нормативных условиях.

Например,

- В обзоре 2023 года, опубликованном в журнале Frontiers in Bioengineering and Biotechnology, подчеркивается, что наборы и системы для 3D-культивирования клеток могут стоить в пять раз дороже, чем 2D-аналоги, что делает их недоступными для многих учреждений на развивающихся рынках.

- Эти финансовые и технические проблемы ограничивают проникновение на рынок, особенно в регионах с чувствительными ценами, и создают препятствия для расширения масштабов применения в разработке лекарственных препаратов и персонализированной медицине.

Объем рынка 3D-культуры клеток

Рынок сегментирован по продукту, типу, применению и конечному пользователю.

|

Сегментация |

Субсегментация |

|

По продукту |

|

|

По типу |

|

|

По применению |

|

|

Конечным пользователем |

|

Ожидается, что в 2025 году на рынке будут доминировать строительные леса с наибольшей долей в сегменте продукции.

Ожидается, что сегмент на основе скаффолдов будет доминировать на рынке 3D-культур клеток с наибольшей долей в 49,35% в 2025 году из-за его способности обеспечивать структурную поддержку, которая точно имитирует внеклеточный матрикс, способствуя реалистичному росту и дифференциации клеток. Эти скаффолды облегчают сложные взаимодействия между клетками и между клетками и матриксом, что делает их идеальными для тканевой инженерии, исследований рака и регенеративной медицины. Кроме того, их универсальность и совместимость с различными биоматериалами повышают их применимость в различных областях исследований

Ожидается, что исследования стволовых клеток составят наибольшую долю на рынке приложений в прогнозируемый период.

Ожидается, что в 2025 году сегмент исследований стволовых клеток будет доминировать на рынке с наибольшей долей рынка в 34,73% из-за его растущего использования в регенеративной медицине, моделировании заболеваний и скрининге лекарств. 3D-культура клеток обеспечивает более физиологически релевантную среду для стволовых клеток, повышая их способность к дифференциации и самообновлению. Это поддерживает более точные исследования биологии развития и персонализированной медицины. Растущие мировые инвестиции в терапию стволовыми клетками еще больше подпитывают рост сегмента

Региональный анализ рынка 3D-культуры клеток

«Северная Америка занимает самую большую долю на рынке 3D-культур клеток»

- Северная Америка доминирует на рынке 3D-культур клеток с долей рынка, оцениваемой в 39,59% , что обусловлено хорошо развитой инфраструктурой здравоохранения, высокими инвестициями в исследования и разработки, а также мощной поддержкой передовых биотехнологий.

- Доля США на рынке составляет 36,5% благодаря сильному фармацевтическому сектору, обширной исследовательской деятельности и растущему использованию 3D-моделей культур для разработки лекарств, исследований рака и регенеративной медицины.

- Наличие государственного финансирования, благоприятная регуляторная политика и присутствие ведущих биотехнологических компаний еще больше усиливают рост рынка.

- Кроме того, рост распространенности хронических заболеваний и переход к более точным и надежным доклиническим моделям в тестировании лекарственных средств способствуют расширению рынка по всему региону.

«Прогнозируется, что в Азиатско-Тихоокеанском регионе будет зарегистрирован самый высокий среднегодовой темп роста на рынке 3D-культивирования клеток»

- Ожидается, что Азиатско-Тихоокеанский регион станет свидетелем самых высоких темпов роста рынка 3D-культур клеток с долей рынка 24,68%, что обусловлено быстрым развитием биотехнологий, ростом инвестиций в здравоохранение и повышением осведомленности о персонализированной медицине.

- Такие страны, как Китай, Индия и Япония, становятся ключевыми рынками благодаря развитию фармацевтической и биотехнологической промышленности, а также растущему спросу на более продвинутые модели клеточных культур, применимые к человеку.

- Япония , с ее технологическим опытом и сильным акцентом на регенеративную медицину, остается важнейшим рынком для приложений 3D-культуры клеток, продолжая лидировать в инновационных биотехнологиях.

- Прогнозируется, что Индия зарегистрирует самый высокий среднегодовой темп роста на рынке 3D-культур клеток с долей рынка 7,6%, что обусловлено быстрым улучшением исследовательских возможностей и инфраструктуры.

Доля рынка 3D-культуры клеток

Конкурентная среда рынка содержит сведения о конкурентах. Включены сведения о компании, ее финансах, полученном доходе, рыночном потенциале, инвестициях в исследования и разработки, новых рыночных инициативах, глобальном присутствии, производственных площадках и объектах, производственных мощностях, сильных и слабых сторонах компании, запуске продукта, широте и широте продукта, доминировании приложений. Приведенные выше данные касаются только фокуса компаний на рынке.

Основными лидерами рынка, работающими на рынке, являются:

- SYNTHECON, INCORPORATED (США)

- InSphero ( Швейцария)

- Merck KGaA (Германия)

- VWR International, LLC. (США)

- Лонза (Швейцария)

- Agilent Technologies, Inc. (США)

- Корнинг Инкорпорейтед (США)

- Cell Culture Company, LLC (США)

- Расширенные инструменты (США)

- КОРПОРАЦИЯ SHIBUYA (Япония)

- NanoEntek (Южная Корея)

- Корпорация FUJIFILM (Япония)

- Hitachi, Ltd. (Япония)

- Thermo Fisher Scientific Inc. (США)

- БД (США)

- Ventria Bioscience Inc. (США)

- Greiner Bio-One International GmbH (Австрия)

- 3D Biotek LLC (США)

- Tecan Trading AG (Швейцария)

Последние разработки на мировом рынке 3D-культивирования клеток

- В январе 2025 года компания Inventia Life Science представила RASTRUM Allegro — передовую технологию 3D-культивирования клеток, разработанную для ускорения разработки и открытия лекарств. Эта платформа обеспечивает высокопроизводительный скрининг за счет автоматизации создания сложных 3D-моделей клеток, повышая эффективность и масштабируемость доклинических исследований.

- В ноябре 2024 года компания Emulate Inc. объявила о расширении своей технологии «орган-на-чипе», интегрируя 3D-системы клеточных культур для лучшего воспроизведения физиологии человека. Это достижение направлено на повышение точности прогнозирования in vitro-моделей при тестировании лекарств, снижение зависимости от животных моделей и улучшение результатов трансляционных исследований.

- В сентябре 2024 года Corning Incorporated расширила свою линейку продуктов для 3D-культуры клеток, представив новые платформы на основе скаффолдов, которые обеспечивают улучшенный рост и дифференциацию клеток. Эти инновации разработаны для поддержки приложений в области исследований рака, регенеративной медицины и персонализированной терапии, что отражает приверженность компании развитию технологий культивирования клеток.

- В августе 2024 года компания Thermo Fisher Scientific представила новую линейку усовершенствованных гидрогелей, разработанных для 3D-приложений в области клеточных культур. Эти гидрогели обеспечивают более физиологически релевантную среду для роста клеток, способствуя более точному моделированию архитектуры и функций тканей, тем самым улучшая исследования в области открытия лекарств и моделирования заболеваний.

- В июле 2024 года Lonza Group AG запустила инновационные решения для 3D-биопечати, которые интегрируются с существующими системами 3D-культивирования клеток. Эти решения направлены на создание более сложных моделей тканей, что позволяет исследователям изучать клеточные взаимодействия в среде, более приближенной к in vivo, что имеет решающее значение для развития тканевой инженерии и регенеративной медицины.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.