Europe Yogurt Market

Размер рынка в млрд долларов США

CAGR :

%

USD

28.78 Billion

USD

43.35 Billion

2024

2032

USD

28.78 Billion

USD

43.35 Billion

2024

2032

| 2025 –2032 | |

| USD 28.78 Billion | |

| USD 43.35 Billion | |

|

|

|

|

Европейский рынок йогуртов, тип йогурта (йогурт, скир/йогурт в исландском стиле, концентрированный йогурт, пробиотический йогурт, замороженный йогурт, био-йогурт, перемешанный йогурт и другие), тип продукта (питьевой йогурт, йогурт, который можно есть ложкой, замороженный йогурт и другие), жирность (полный жир, низкий жир и обезжиренный), ароматизатор (обычный и ароматизированный), тип источника (животного происхождения, растительного происхождения и искусственный), рецептура (подслащенный и несладкий), бренд (Yoplait, Chobani, Stonyfield Greek, Corner, Activia, Yeo, Oikos, Arla Skyr, Icelandic Provisions Skyr, Isey Skyr и другие), категория включения (простой и с включениями и топпингами), обогащение (обычный и обогащенный), утверждение (без глютена, Без лактозы, без искусственных консервантов, без молочных продуктов, без сои, без ГМО, без сахара, без калорий, со всеми вышеперечисленными утверждениями, обычные без утверждений и другие), органическая категория (обычные и органические), бренд (фирменные и под частной торговой маркой), упаковка (пакеты, пакеты, банки, стаканчики, бутылки, тетрапаки и другие), размер упаковки (менее 100 граммов, 100–200 граммов, 201–300 граммов и более 300 граммов) и канал сбыта (розничная торговля в магазинах и вне магазинов) — тенденции отрасли и прогноз до 2032 года.

Анализ европейского рынка йогуртов

Йогурт – древний продукт питания, употребляемый народами Азии, Европы и Ближнего Востока на протяжении тысячелетий. Йогурт впервые появился в эпоху неолита, около 5000–10 000 лет назад, вероятно, в результате естественного скисания молока при высоких температурах. Находки древней керамики свидетельствуют о том, что люди неолита использовали горшки для хранения молока. Будучи ферментированным продуктом, йогурт был отличным способом консервации молока, поскольку кислотность замедляет рост вредных бактерий. Йогурт был широко известен в Греческой и Римской империях и играл важную роль в средиземноморской кухне с 800 года до н. э.

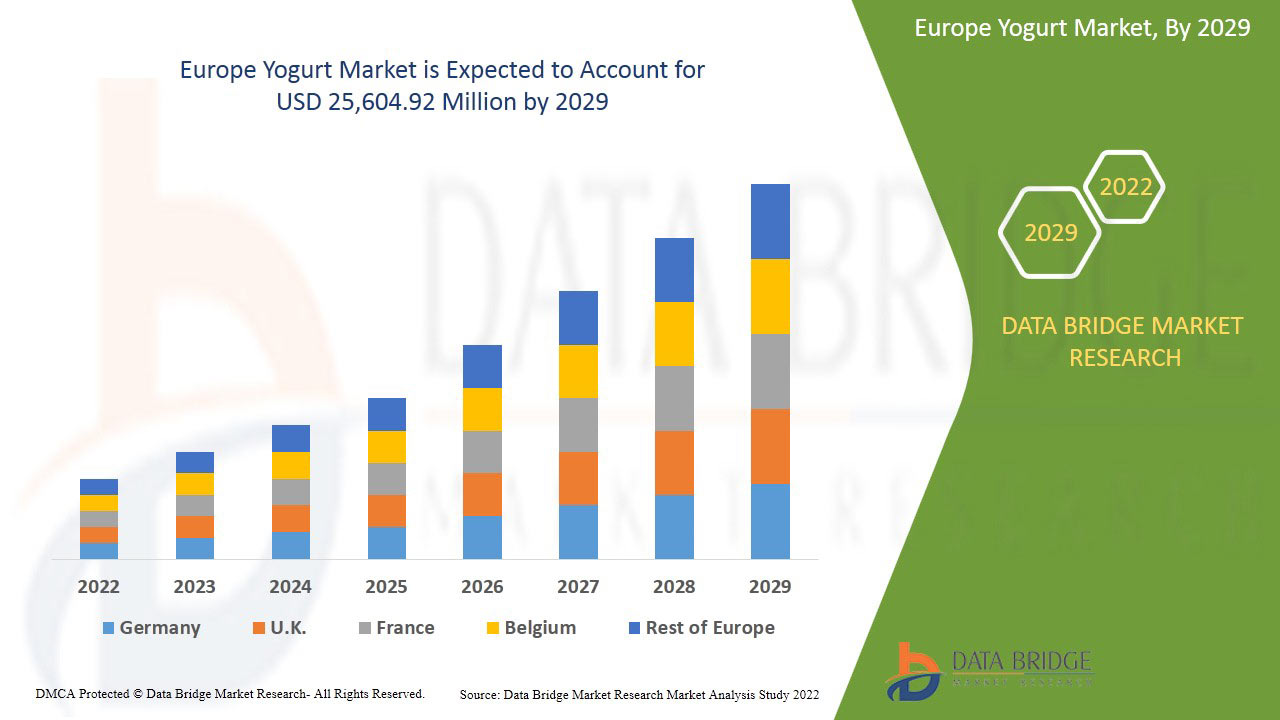

Размер европейского рынка йогурта

Объем европейского рынка йогуртов в 2024 году оценивался в 28,78 млрд долларов США, а к 2032 году, по прогнозам, он достигнет 43,35 млрд долларов США, при среднегодовом темпе роста 5,4% в прогнозируемый период с 2025 по 2032 год. Помимо информации о рыночных сценариях, таких как рыночная стоимость, темпы роста, сегментация, географический охват и основные игроки, отчеты о рынке, подготовленные Data Bridge Market Research, также включают анализ импорта и экспорта, обзор производственных мощностей, анализ потребления продукции, анализ тенденций цен, сценарий изменения климата, анализ цепочки поставок, анализ цепочки создания стоимости, обзор сырья/расходных материалов, критерии выбора поставщиков, анализ PESTLE, анализ Портера и нормативную базу.

Тенденции европейского рынка йогуртов

«Растущий интерес к функциональным продуктам питания»

Растущий интерес к функциональным продуктам питания стремительно меняет европейский рынок йогуртов, поскольку потребители всё чаще ищут продукты, предлагающие больше, чем просто базовые питательные вещества. Йогурт, обогащённый витаминами, минералами и пробиотиками, набирает популярность, поскольку люди ищут продукты, способствующие определённым полезным для здоровья свойствам, таким как улучшение здоровья кишечника, повышение иммунитета и улучшение пищеварения. Этот сдвиг в сторону функциональных продуктов питания отражает более широкую потребительскую тенденцию отдавать приоритет продуктам, которые служат двойной цели: утоляют голод и обеспечивают ощутимую пользу для здоровья. В результате производители йогуртов всё чаще обогащают свою продукцию полезными ингредиентами, такими как витамин D, кальций и живые культуры, удовлетворяя растущий спрос на продукты, ориентированные на здоровый образ жизни. Расширение ассортимента функциональных йогуртовых продуктов, в том числе разработанных для особых потребностей, таких как здоровье костей или укрепление иммунитета, стимулирует рост рынка. Этот всплеск интереса потребителей к функциональным продуктам питания позиционирует йогурт как ключевого игрока в растущем секторе здорового питания, что ещё больше ускоряет его расширение на европейском рынке.

Объем отчета и сегментация европейского рынка йогуртов

|

Атрибуты |

Обзор рынка диагностических тестов в Германии, Швейцарии и Австрии |

|

Охваченные сегменты |

Тип йогурта (йогурт, скир/исландский йогурт, концентрированный йогурт, пробиотический йогурт, застывший йогурт, био-йогурт, перемешанный йогурт и другие), тип продукта (питьевой йогурт, йогурт, который можно есть ложкой, замороженный йогурт и другие), жирность (полное содержание жира, низкое содержание жира и обезжиренный), вкус (обычный и ароматизированный), тип источника (животного происхождения, растительного происхождения и искусственный), рецептура (подслащенный и несладкий), бренд (Yoplait, Chobani, Stonyfield Greek, Corner, Activia, Yeo, Oikos, Arla Skyr, Icelandic Provisions Skyr, Isey Skyr и другие), категория включения (простой и с включениями и топпингами), обогащение (обычный и обогащенный), утверждение (без глютена, без лактозы, Без искусственных консервантов, без молочных продуктов, без сои, без ГМО, без сахара, без калорий, со всеми вышеперечисленными утверждениями, обычный без утверждений и другие), органическая категория (обычный и органический), бренд (фирменный и под собственной торговой маркой), упаковка (пакеты, банки, стаканчики, бутылки, тетра-паки и другие), размер упаковки (менее 100 граммов, 100–200 граммов, 201–300 граммов и более 300 граммов) и канал сбыта (розничная торговля в магазине и вне магазина) |

|

Страны действия |

Германия, Франция, Великобритания, Италия, Испания, Россия, Нидерланды, Бельгия, Швейцария, Турция и остальные страны Европы |

|

Ключевые игроки рынка |

Danone (Франция), Nestlé (Швейцария), EMMY UK LTD (Лондон), Müller UK & Ireland (Англия), FrieslandCampina (Нидерланды), THE CAMPBELL'S COMPANY (США), Arla Foods Amba (Дания), SCHREIBER FOOD INC (США), Sodiaal (Франция), CREMO SA (Швейцария), Fen Farm Dairy (Великобритания), LACTEAS FLOR DE BURGOS SL (Испания), LATTE MAREMMA (Италия), Newlat Food SpA (Италия), The Hain Celestial Group, Inc. (Нью-Йорк) и Yeo Valley Organic Limited (Великобритания) |

|

Рыночные возможности |

|

|

Информационные наборы данных с добавленной стоимостью |

Помимо информации о рыночных сценариях, таких как рыночная стоимость, темпы роста, сегментация, географический охват и основные игроки, рыночные отчеты, подготовленные Data Bridge Market Research, также включают анализ импорта и экспорта, обзор производственных мощностей, анализ потребления продукции, анализ ценовых тенденций, сценарий изменения климата, анализ цепочки поставок, анализ цепочки создания стоимости, обзор сырья/расходных материалов, критерии выбора поставщиков, анализ PESTLE, анализ Портера и нормативную базу. |

Определение европейского рынка йогурта

Йогурт — это высокожирный молочный продукт, обычно содержащий от 30% до 40% молочного жира, специально разработанный для взбивания до лёгкой, воздушной текстуры. Его можно производить из молока коров или других молочных животных. Он отличается насыщенной кремообразной консистенцией, что делает его идеальным для кулинарного применения, например, для украшения десертов, создания начинок и обогащения соусов. Высокое содержание жира позволяет ему насыщаться воздухом при взбивании, образуя устойчивую пену, сохраняющую форму. Это делает его популярным ингредиентом как на домашней, так и на профессиональной кухне для создания разнообразных вкусных и привлекательных блюд.

Динамика европейского рынка йогуртов

Водители

- Польза йогурта для здоровья

Полезные свойства йогурта для здоровья являются одним из основных факторов роста европейского рынка йогуртов, поскольку всё больше потребителей осознают его положительное влияние на общее самочувствие. Йогурт широко известен своим богатым содержанием пробиотиков, которые поддерживают здоровье пищеварительной системы и баланс кишечной микрофлоры. Включение в состав таких необходимых питательных веществ, как кальций, белок и витамин D, ещё больше повышает его привлекательность, особенно для людей, заботящихся о своём здоровье. Помимо укрепления здоровья кишечника, йогурт связан с укреплением иммунитета, прочности костей и даже психического здоровья благодаря своей высокой питательной ценности. По мере роста спроса на функциональные продукты питания, роль йогурта как универсального и богатого питательными веществами продукта выводит его на передовые позиции в диетах, ориентированных на здоровье. Растущее понимание пользы йогурта для здоровья привело к тому, что потребительские предпочтения сместились в сторону продуктов, которые предлагают больше, чем просто вкус, что привело к резкому росту его потребления по всей Европе. Растущее внимание к здоровью и благополучию продолжает стимулировать рост рынка, поскольку всё больше людей включают йогурт в свой ежедневный рацион благодаря его многочисленным полезным свойствам.

Например.

- Согласно статье, опубликованной в апреле 2022 года в Healthline, йогурт содержит практически все необходимые организму питательные вещества, включая высокое содержание кальция, витаминов группы B и микроэлементов. Эти вещества поддерживают здоровье костей, энергетический обмен веществ и общее самочувствие. Поскольку потребители всё чаще отдают предпочтение здоровому питанию, широкий спектр питательных веществ йогурта способствует его популярности. Этот акцент на пользе йогурта для здоровья стимулирует рост и спрос на европейском рынке йогуртов.

- Согласно статье, опубликованной NCBI в декабре 2024 года, употребление йогурта связано со снижением риска ускоренного старения и может также способствовать снижению риска избыточного веса. Эти потенциальные преимущества для здоровья делают йогурт привлекательным выбором для потребителей, стремящихся к долголетию и контролю веса. По мере роста популярности здорового питания роль йогурта в поддержании здорового образа жизни обуславливает его растущий спрос на европейском рынке.

Польза йогурта для здоровья — ключевой фактор его растущей популярности в Европе, поскольку всё больше потребителей осознают его положительное влияние на общее самочувствие. Богатый пробиотиками, кальцием, белком и витамином D, йогурт способствует здоровью пищеварительной системы, иммунитету, укреплению костей и психическому здоровью. В связи с растущим спросом на функциональные продукты питания, питательная ценность йогурта делает его лучшим выбором для людей, заботящихся о своём здоровье, что способствует росту его потребления по всей Европе.

- Инновационные функциональные добавки в йогурте

Инновационные функциональные добавки играют важную роль в росте европейского рынка йогуртов. Потребители всё чаще выбирают продукты, ориентированные на здоровье, и всё чаще в их состав включают такие функциональные ингредиенты, как пробиотики, пребиотики, витамины, минералы и даже суперфуды, такие как семена чиа и куркума. Эти добавки не только повышают пищевую ценность йогурта, но и способствуют достижению конкретных целебных свойств, включая улучшение пищеварения, повышение иммунитета и увеличение энергии. В ответ на растущий спрос на продукты, обеспечивающие больше, чем просто базовые питательные вещества, производители йогуртов постоянно внедряют инновации, внедряя новые вкусы и ингредиенты, укрепляющие здоровье. Эта тенденция к обогащенным и функциональным йогуртам отвечает широкому спектру диетических потребностей и целей в области здоровья, привлекая потребителей, заботящихся о своём здоровье, по всей Европе. Акцент на инновациях и добавлении функциональных добавок создаёт конкурентное преимущество для брендов, что ещё больше способствует расширению рынка йогуртов.

Например,

- Согласно статье, опубликованной NCBI в октябре 2023 года, йогурты с натуральными и модифицированными добавками обладают рядом нутрицевтических преимуществ, включая повышенное содержание биологически активных соединений, антиоксидантные свойства, а также антигипергликемическое и антигипертензивное действие. Эти дополнительные преимущества для здоровья соответствуют растущему потребительскому спросу на функциональные продукты питания. Внедрение таких инновационных добавок стимулирует расширение европейского рынка йогуртов, поскольку потребители всё чаще ищут продукты, которые поддерживают их общее здоровье и благополучие.

- Согласно статье, опубликованной MDPI в июле 2024 года, добавление пребиотических и пробиотических ингредиентов в йогурт улучшает как качество продукта, так и здоровье потребителя. Пробиотики, такие как молочнокислые бактерии, поддерживают здоровье кишечника и работу иммунной системы, а пребиотики питают полезные кишечные бактерии. Эта синергия придает йогурту превосходные функциональные свойства, что повышает его привлекательность. В связи с ростом спроса на полезные для здоровья продукты, эта инновация стимулирует рост европейского рынка йогуртов.

Функциональные добавки стимулируют рост европейского рынка йогуртов в связи с ростом потребительского спроса на продукты, ориентированные на здоровье. В состав йогуртов добавляют такие ингредиенты, как пробиотики, пребиотики, витамины, минералы и суперфуды, например, семена чиа и куркума, для повышения питательной ценности и достижения конкретных полезных для здоровья эффектов, таких как улучшение пищеварения и иммунитета. Эта тенденция обогащения йогуртов функциональными ингредиентами привлекает потребителей, заботящихся о своем здоровье, стимулируя инновации и конкуренцию на рынке.

Возможности

- Внедрение модели самообслуживания

Йогурт пользуется высоким спросом в Европе благодаря своим полезным свойствам по сравнению с другими десертами, такими как мороженое, заварной крем и другими. Чтобы удовлетворить высокий спрос потребителей, некоторые магазины йогуртов открывают свои двери. Эти магазины предлагают модели самообслуживания, которые завоевывают популярность среди покупателей.

Модели самообслуживания предоставляют потребителям полную свободу в выборе вкусов, начинок и количества замороженных йогуртов, позволяя им выбирать и контролировать потребление в соответствии со своими диетическими потребностями. Магазины самообслуживания предлагают широкий выбор начинок, а также более здоровую альтернативу мороженому. Количество магазинов самообслуживания значительно увеличилось по сравнению с магазинами полного цикла.

Например,

Замороженный йогурт Yogurtini предлагает 10–16 фирменных вкусов замороженного йогурта и более 65 начинок. Они учитывают отзывы и предложения клиентов и добавляют в меню больше индивидуальности.

Магазин самообслуживания с замороженным йогуртом в Великобритании, предлагающий покупателям разнообразные вкусы и топпинги для создания идеального десерта. Успех FroYo обусловлен растущим спросом на более полезные и персонализированные варианты десертов.

Таким образом, модель самообслуживания на рынке замороженных йогуртов является одной из прекрасных возможностей для производителей обслуживать своих потребителей в соответствии с их запросами.

- Рост использования рекламных мероприятий и онлайн-платформ

Спрос на йогурт стремительно растёт благодаря различным факторам, таким как польза для здоровья, новые интересные вкусы и другие. На рынке йогуртов работают различные компании. Они внедряют новые методы продвижения своей продукции на рынке, что создаёт новые возможности для производителей йогуртов.

Компании предлагают потребителям интересные вознаграждения, привлекая новых клиентов. Например, Yogurtland запустил программу Real Rewards, основанную на принципе «Чем больше лакомств вы едите, тем больше баллов вы получаете», то есть 2 балла за каждый потраченный доллар. За каждую покупку потребитель зарабатывает баллы, а за каждые 100 баллов автоматически получает вознаграждение в размере 5 долларов США. Таким образом, компании пытаются привлечь новых клиентов с помощью промоакций.

Помимо этого, компании внедряют приложения для онлайн-заказов, чтобы охватить более широкий круг клиентов.

Например,

- В сентябре 2019 года Yogurtland заключила партнерское соглашение с DoorDash, чтобы доставлять персонализированные замороженные йогурты, мороженое и сладости Drinkable Creation клиентам на дом или в офис. Это сотрудничество позволяет любителям замороженных йогуртов наслаждаться любимыми вкусами и добавками, включая сладкие, фруктовые или жевательные, в участвующих заведениях, не покидая их. Таким образом, новые рекламные акции и цифровая трансформация на рынке йогуртов создают новые возможности.

- В 2024 году Menchie's запустил новое партнерство с DoorDash, которое позволит доставлять замороженный йогурт, топпинги и другие блюда из меню клиентам в разных точках сети. Сервис позволяет наслаждаться любимыми замороженными йогуртами, не выходя из дома, что подтверждает ориентацию Menchie's на удобство и персонализацию.

Ограничения/Проблемы

- Наличие заменителей

На рынке представлены альтернативы йогуртам, такие как мороженое, йогурты, джелато, щербеты, мороженое без молочных продуктов, смузи, коктейли и другие десерты. Спрос на йогурт растёт в связи с изменением образа жизни людей, которые выбирают более здоровую пищу. Однако высокая цена йогурта подтолкнула покупателей к переходу на более дешёвое мороженое, коктейли и другие десерты, что затрудняет рост продаж йогурта. Более того, альтернатива йогурту считается самой большой угрозой для рынка йогуртов, поскольку её по-прежнему в основном потребляют люди с аллергией на молоко и непереносимостью лактозы, а также веганы.

Кроме того, другие заведения, торгующие десертами, такие как шоколатье и кондитерские, места встреч местных жителей, такие как кофейни, и даже сети заведений, продающих соки и смузи, создают серьезную проблему для йогуртовой продукции.

1 декабря 2024 года компания Ben & Jerry's представила целый ряд новых интересных вариантов мороженого без молочных ингредиентов. Такие вкусы, как «Карамельный миндаль» и «Чашка с арахисовым маслом», отвечают растущему спросу на растительные десерты без молочных продуктов. Поскольку всё больше потребителей ищут веганские и безлактозные альтернативы, эти инновационные варианты мороженого составляют прямую конкуренцию традиционным йогуртовым продуктам на рынке десертов.

18 января 2024 года издание The New York Times Wirecutter отметило растущий спрос на веганское мороженое. Эти растительные альтернативы, изготовленные из таких ингредиентов, как миндальное, кокосовое и овсяное молоко, становятся популярными среди потребителей с непереносимостью лактозы и веганов. В результате они составляют прямую конкуренцию традиционным йогуртовым продуктам на рынке десертов.

Таким образом, можно сделать вывод, что наличие альтернативы йогурту может стать серьезной проблемой для роста рынка в прогнозируемый период.

- Чувствительность к ценам и рост издержек на европейском рынке йогуртов

По мере роста спроса на премиальные и специализированные йогурты, цены на эти продукты также выросли, что сделало их менее доступными для некоторых потребителей. Высокая стоимость йогурта, особенно органических, пробиотических или безмолочных, побудила многих потребителей перейти на более доступные альтернативы, такие как мороженое, коктейли, смузи и другие десерты. Этот сдвиг усиливается инфляционным давлением и более общими экономическими факторами, которые заставляют потребителей более осознанно подходить к своим расходам.

Производители йогуртов сталкиваются с необходимостью найти баланс между качеством продукции и экономической эффективностью, стремясь поддерживать конкурентоспособные цены и одновременно удовлетворять потребительский спрос на полезные, качественные и функциональные йогурты. В ответ на чувствительность к цене многие производители йогуртов изучают экономически эффективные методы производства, внедряют более дешёвые варианты или предлагают меньшие порции, чтобы сделать свою продукцию более доступной для более широкой аудитории.

Кроме того, рост числа собственных торговых марок йогуртов, которые часто предлагают более низкие цены по сравнению с известными брендами, усиливает конкуренцию. Эти продукты часто предлагают меньше премиальных функций, но привлекают экономных потребителей, которые ищут доступные альтернативы. В результате, известные бренды йогуртов вынуждены искать способы внедрения инноваций, не отпугивая покупателей с ограниченным бюджетом, например, предлагая скидки на упаковки или акции для поддержания лояльности клиентов.

Например,

- Согласно статье, опубликованной Dairy Foods в августе 2024 года, в докладе «Состояние молочной промышленности 2024» отмечены серьёзные проблемы, с которыми сталкиваются производители йогуртов в Европе из-за роста издержек, инфляции и сбоев в цепочках поставок. Аналогично проблемам на рынке косметических услуг в Юго-Восточной Азии (по данным AIA Malaysia), индустрия производства йогуртов сталкивается с финансовыми барьерами, которые могут ограничить её рост. Рост производственных затрат приводит к росту цен на премиальные йогурты, потенциально ограничивая их доступность для более широкого круга потребителей. Эта финансовая проблема может отпугнуть некоторых потребителей от покупки более дорогих йогуртов, что будет препятствовать расширению рынка в регионе.

- Согласно статье Kerry Group «Тенденции роста частных торговых марок», опубликованной в августе 2024 года, растущая популярность продукции под собственными торговыми марками создаёт серьёзные проблемы для производителей йогуртов в Европе, особенно на рынке, характеризующемся возросшей конкуренцией и повышенной ценовой чувствительностью. Аналогично проблемам на рынке косметических услуг Юго-Восточной Азии (о которых сообщает AIA Malaysia), производители йогуртов сталкиваются с финансовыми барьерами, поскольку рост стоимости производства и премиальных продуктов подталкивает потребителей к выбору более доступных вариантов под собственными торговыми марками. Этот сдвиг может ограничить доступность и финансовую доступность брендированных йогуртов, что в конечном итоге сдерживает рост рынка и затрудняет привлечение брендированными производителями потребителей, чувствительных к цене.

Проблема ценовой чувствительности и роста издержек требует от производителей йогуртов внедрения инноваций, сохраняя при этом доступность. Чтобы оставаться конкурентоспособными, брендам необходимо найти способы сбалансировать предложение премиальных продуктов с экономически эффективными стратегиями, исследуя альтернативные варианты, такие как упаковка меньшего размера, акции и разработку продуктов с ориентацией на ценность, которые отвечают потребностям как потребителей, заботящихся о своем здоровье, так и экономных потребителей.

Объем европейского рынка йогуртов

Европейский рынок йогуртов сегментирован на пятнадцать основных сегментов, которые различаются по типу йогурта, типу продукта, содержанию жира, вкусу, источнику, рецептуре, категории включения, обогащению, заявленным характеристикам, ценовому диапазону, категории органического продукта, бренду, упаковке, размеру упаковки и каналу сбыта. Рост в этих сегментах поможет вам проанализировать сегменты с низким ростом в отраслях и предоставит пользователям ценный обзор рынка и аналитику для принятия стратегических решений по определению основных рыночных приложений.

Тип йогурта

- Обычный йогурт

- Пробиотический йогурт

- Био Живой Йогурт

- Набор йогуртов

- Скир/Йогурт в исландском стиле

- Концентрированный йогурт

- Перемешанный йогурт

- Другие

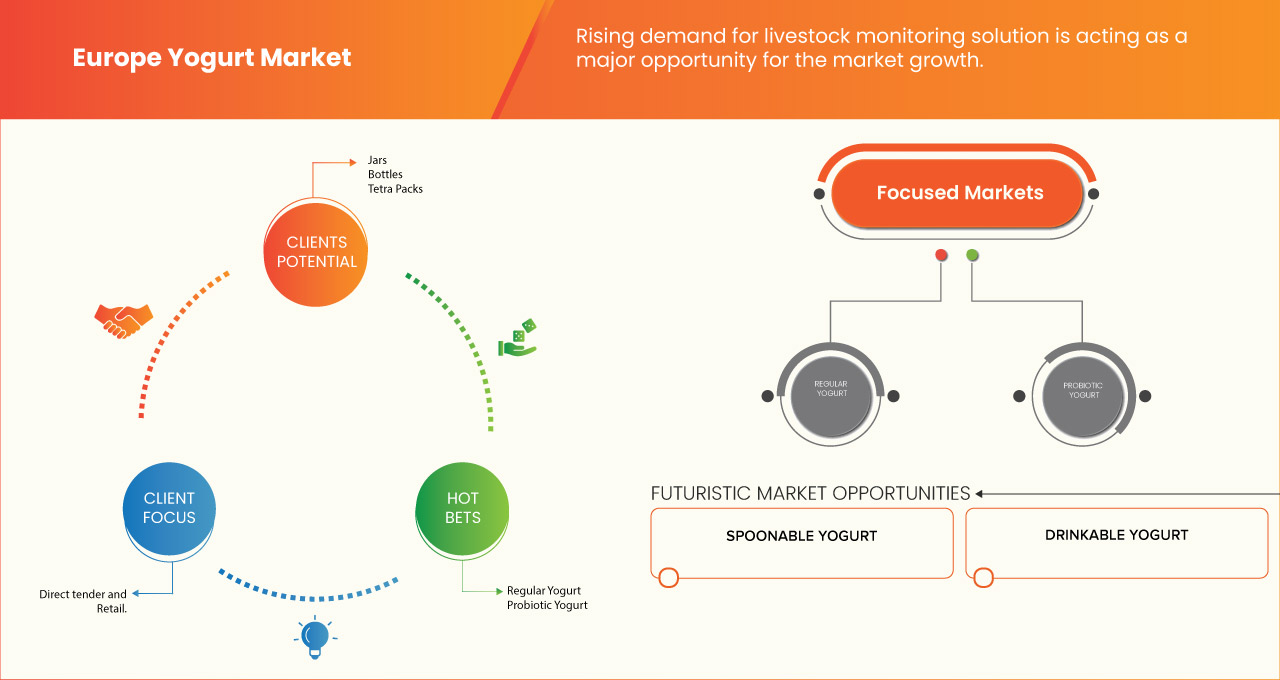

Тип продукта

- Йогурт, который можно положить ложкой

- Питьевой йогурт

- Замороженный йогурт

- Другие

Содержание жира

- С низким содержанием жира

- Без жира

- Полный жир

Вкус

- Простой

- Ароматный

- Клубника

- Ваниль

- Черника

- Банан

- Персик

- Черника

- Ежевика

- Фрукты и орехи

- Лайм

- Кокос

- Орехи

- вишня

- Вишневый сад

- Мед

- Тыква

- Шоколад

- Ириски

- Карамель

- Мокко/Кофе

- Помогранетт

- Мята перечная

- Амаретто

- Другие

Источник

- На основе животных

- На основе животных, по типу

- Коровье молоко

- Буйволиное молоко

- Козье молоко

- Другие

- На растительной основе

- Растительного происхождения, по типу

- Миндальное молоко

- Соевое молоко

- Овсяное молоко

- Кокосовое молоко

- Молоко из кешью

- Другие

Формулировка

- Подслащенный

- Несладкий

Диапазон цен

- Масса

- Премиум

- Роскошь

Категория включения

- Простой

- С добавками и начинками

- Посыпка

- Шоколад

- Куски

- Хлопья

- Сироп

- Другие

- Нонпарель

- Конфетти

- Запеченные кусочки

- Жемчуг

- Драже

- Пралине с пеканом

- Карамельные хрустящие шарики

- Орехи

- Миндаль

- Кешью

- Фисташка

- Фундук

- Изюм

- Орехи Мадамия

- Каштаны

- Другие

Фортификация

- Обычный

- Укрепленный

Требовать

- Обычный

- Не содержит глютен

- Без лактозы

- Без искусственных консервантов

- Без молочных продуктов

- Без сои

- Без ГМО

- Без сахара

- Без калорий

- Со всеми вышеперечисленными утверждениями

- Обычный, без претензий

- Другие

Органическая категория

- Общепринятый

- Органический

Бренд

- Фирменный

- Частная марка

Упаковка

- Мешок-в-коробке

- Мешочки

- Банки

- Стекло

- Пластик

- Чашки

- Бутылки

- Стекло

- Пластик

- Тетра Паки

- Другие

Размер упаковки

- Менее 100 граммов

- 100-200 граммов

- 201-300 граммов

- Более 300 граммов

Канал распространения

- Розничная торговля в магазинах

- Магазины шаговой доступности

- Магазины/кафе по продаже йогуртов

- Супермаркеты/гипермаркеты

- Специализированные магазины

- Продуктовые магазины

- Оптовики

- Другие

- Розничная торговля вне магазина

- Торговля

- Онлайн

Региональный анализ европейского рынка йогуртов

Рынок анализируется, и предоставляются сведения о размере рынка и тенденциях по стране, типу йогурта, типу продукта, содержанию жира, вкусу, типу источника, рецептуре, категории включения, обогащению, заявлению, ценовому диапазону, органической категории, бренду, упаковке, размеру упаковки и каналу сбыта, как указано выше.

Страны, охваченные рынком: Германия, Франция, Великобритания, Италия, Испания, Россия, Нидерланды, Бельгия, Швейцария, Турция и остальные страны Европы.

Ожидается, что Германия будет доминировать на рынке благодаря своей развитой молочной промышленности, высокому спросу как на традиционные, так и на растительные сливочные продукты, а также мощному сектору переработки пищевых продуктов.

Ожидается, что Германия будет демонстрировать самые высокие темпы роста благодаря своей развитой молочной промышленности, высокому спросу как на традиционные, так и на растительные сливочные продукты, сильному сектору переработки пищевых продуктов и предпочтению потребителей к высококачественным молочным ингредиентам, а также центральной роли на европейском рынке общественного питания и розничной торговли.

В разделе отчета, посвященном отдельным странам, также рассматриваются факторы, влияющие на рынок, и изменения в регулировании рынка внутри страны, которые влияют на текущие и будущие тенденции рынка. Такие данные, как анализ цепочек создания стоимости в нисходящей и восходящей цепочке, технические тенденции и анализ пяти сил Портера, а также практические примеры, – вот лишь некоторые из показателей, используемых для прогнозирования рыночного сценария для отдельных стран. Кроме того, при анализе прогнозных данных по странам учитываются наличие и доступность глобальных брендов и их проблемы, связанные с высокой или низкой конкуренцией со стороны местных и отечественных брендов, влияние внутренних тарифов и торговых путей.

Доля европейского рынка йогуртов

В разделе «Конкурентная среда рынка» представлена подробная информация по конкурентам. В неё включены сведения о компании, её финансовые показатели, полученная выручка, рыночный потенциал, инвестиции в исследования и разработки, новые рыночные инициативы, глобальное присутствие, производственные площадки и объекты, производственные мощности, сильные и слабые стороны компании, запуск продукта, широта и разнообразие продуктов, доминирующие области применения. Представленные выше данные относятся только к рыночным интересам компаний.

Лидеры европейского рынка йогуртов:

- Данон (Франция)

- Nestlé (Швейцария)

- EMMY UK LTD (Лондон)

- Мюллер Великобритания и Ирландия (Англия)

- FrieslandCampina (Netherlands)

- Компания Кэмпбелла (США)

- Arla Foods Amba (Дания)

- SCHREIBER FOOD INC (США)

- Sodiaal (Франция)

- CREMO SA (Швейцария)

- Молочная ферма Fen Farm (Великобритания)

- LACTEAS FLOR DE BURGOS SL (Испания)

- ЛАТТЕ МАРЕММА (Италия)

- Newlat Food SpA (Италия)

- Hain Celestial Group, Inc. (Нью-Йорк)

- Yeo Valley Organic Limited (Великобритания)

Последние события на европейском рынке йогуртов

- В мае 2021 года компания Onken совместно с Марвином Хьюмсом запустила кампанию «Семейные рецепты легендарной молочной кухни». Эта увлекательная инициатива направлена на раскрытие самых легендарных семейных рецептов Великобритании, предлагая людям делиться своими кулинарными шедеврами или создавать новые. Известный теле- и радиоведущий Марвин Хьюмс возглавляет эту кампанию, посвященную Дню семейных рецептов.

- В ноябре 2024 года компания Arla Foods Ingredients получила одобрение Управления по конкуренции и рынкам Великобритании на приобретение бизнеса Whey Nutrition компании Volac. Сделка включает в себя приобретение перерабатывающего предприятия в Фелинфахе, Уэльс, и укрепит позиции Arla на растущем рынке сывороточного протеина.

- В сентябре 2023 года компания Nestlé достигла соглашения с Advent International о приобретении контрольного пакета акций Grupo CRM, бразильской компании по производству премиального шоколада. Сделка, закрытие которой ожидается в 2024 году, укрепит позиции Nestlé на бразильском рынке высококачественных кондитерских изделий.

- В ноябре 2022 года компании Nestlé и L Catterton объявили о партнерстве, которое объединит Freshly и Kettle Cuisine, ведущего производителя свежих продуктов питания ручной работы. Новая компания будет предлагать широкий ассортимент свежих продуктов питания по различным каналам сбыта и в различных регионах, а L Catterton станет основным владельцем.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Содержание

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE EUROPE YOGURT MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 GEOGRAPHICAL SCOPE

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 CURRENCY AND PRICING

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 MULTIVARIATE MODELLING

2.6 TREATMENT LIFELINE CURVE

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET APPLICATION COVERAGE GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 BRAND OUTLOOK

4.2 ENVIRONMENTAL CONCERNS

4.2.1 INDUSTRY RESPONSE TO CLIMATE CHANGE

4.2.2 GOVERNMENT’S ROLE IN ADDRESSING CLIMATE CHANGE

4.2.3 ANALYST RECOMMENDATIONS

4.3 MARKETING STRATEGIES ADOPTED BY KEY MARKET PLAYER IN EUROPE YOGURT MARKET

4.3.1 FEN FARM DAIRY

4.3.2 LATTE MAREMMA

4.3.3 NESTLÉ SA

4.3.4 ARLA FOODS AMBA

4.3.5 CAMPBELL SOUP COMPANY

4.3.6 HAIN CELESTIAL GROUP

4.3.7 DIETARY PREFERENCES AND RESTRICTIONS

4.3.8 MARKETING AND ADVERTISING

4.3.9 CONCLUSION

4.4 MARKETING STRATEGIES ADOPTED BY KEY MARKET IN EUROPE YOGURT MARKET

4.4.1 IMPACT ON PRICE

4.4.2 IMPACT ON SUPPLY CHAIN

4.4.3 IMPACT ON SHIPMENT

4.4.4 IMPACT ON COMPANY’S STRATEGIC DECISIONS

4.4.5 CONCLUSION

4.5 IMPORT EXPORT SCENARIO

4.6 MARKETING STRATEGIES ADOPTED BY KEY MARKET PLAYER IN EUROPE YOGURT MARKET

4.6.1 FEN FARM DAIRY

4.6.2 LATTE MAREMMA

4.6.3 NESTLÉ SA

4.6.4 ARLA FOODS AMBA

4.6.5 CAMPBELL SOUP COMPANY

4.6.6 HAIN CELESTIAL GROUP

4.6.7 EMMI UK LTD (ONKEN)

4.6.8 SCHREIBER FOODS

4.6.9 SCHREIBER FOODS

4.6.10 FLOR DE BURGOS

4.6.11 NEWLAT FOOD S.P.A

4.6.12 CONCLUSION

4.7 NEW PRODUCT LAUNCH STRATEGY FOR THE EUROPE YOGURT MARKET

4.7.1 NUMBER OF NEW PRODUCT LAUNCH

4.7.2 DIFFERENTIAL PRODUCT OFFERING

4.7.3 MEETING CONSUMER REQUIREMENTS

4.7.4 PACKAGE DESIGNING

4.7.5 PRICING ANALYSIS

4.7.6 PRODUCT POSITIONING

4.7.7 CONCLUSION

4.8 PRICING ANALYSIS

4.9 PRIVATE LABEL VS BRAND ANAYSIS

4.1 PRODUCTION CAPACITY OF KEY MANUFACTURERS

4.11 PROMOTIONAL ACTIVITIES IN THE EUROPEAN YOGURT MARKET

4.11.1 DIGITAL MARKETING AND SOCIAL MEDIA CAMPAIGNS

4.11.2 CONTENT MARKETING AND EDUCATIONAL INITIATIVES

4.11.3 PRODUCT SAMPLING AND FREE TRIALS

4.11.4 DISCOUNTS, PROMOTIONS, AND LOYALTY PROGRAMS

4.11.5 STRATEGIC PARTNERSHIPS AND SPONSORSHIPS

4.11.6 CELEBRITY ENDORSEMENTS AND MEDIA EXPOSURE

4.11.7 RETAIL AND IN-STORE PROMOTIONS

4.11.8 CONCLUSION

4.12 REGULATION COVERAGE

4.13 SHOPPING BEHAVIOUR AND DYNAMICS

4.13.1 RECOMMENDATION FROM FAMILY & FRIENDS

4.13.2 RESEARCH

4.13.3 IMPULSIVE

4.13.4 ADVERTISEMENT

4.13.4.1 TELEVISION ADVERTISEMENT

4.13.4.2 ONLINE ADVERTISEMENT

4.13.4.3 IN-STORE ADVERTISEMENT

4.13.4.4 OUTDOOR ADVERTISEMENT

4.14 SUPPLY CHAIN ANALYSIS

4.14.1 OVERVIEW

4.14.2 LOGISTIC COST SCENARIO

4.14.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

5 EUROPE YOGURT MARKET: REGULATIONS

5.1 REGULATORY BODIES

5.2 REGULATIONS

5.3 CONCLUSION

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASED FOCUS ON FUNCTIONAL FOODS

6.1.2 HEALTH BENEFITS OF YOGURT

6.1.3 INNOVATIVE FUNCTIONAL ADDITIVES IN YOGURT

6.1.4 TECHNICAL ADVANCEMENT IN PROCESSING OF YOGURT

6.2 RESTRAINTS

6.2.1 HEALTH CONCERNS OVER LACTOSE INTOLERANCE AND MILK ALLERGIES

6.2.2 HEALTH CONCERNS OVER SUGAR CONTENT

6.3 OPPORTUNITIES

6.3.1 INTRODUCTION OF SELF-SERVE MODEL

6.3.2 INCREASE IN ADOPTION OF PROMOTIONAL ACTIVITIES AND ONLINE PLATFORMS

6.3.3 INNOVATIVE RETAIL EXPERIENCES

6.4 CHALLENGES

6.4.1 AVAILABILITY OF SUBSTITUTES

6.4.2 PRICE SENSITIVITY AND RISING COSTS IN THE EUROPEAN YOGURT MARKET

7 EUROPE YOGURT MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 SPOONABLE YOGURT

7.3 DRINKABLE YOGURT

7.4 FROZEN YOGURT

7.5 OTHERS

8 EUROPE YOGURT MARKET, BY FORMULATION

8.1 OVERVIEW

8.2 UNSWEETENED

8.3 SWEETENED

9 EUROPE YOGURT MARKET, BY INCLUSION CATEGORY

9.1 OVERVIEW

9.2 PLAIN

9.3 WITH INCLUSIONS & TOPPINGS

9.3.1 NUTS

9.3.1.1 ALMONDS

9.3.1.2 CASHEWS

9.3.1.3 PISTACHIO

9.3.1.4 HAZELNUTS

9.3.1.5 RAISINS

9.3.1.6 MADAMIA NUTS

9.3.1.7 CHESTNUTS

9.3.1.8 OTHERS

9.3.2 SPRINKLES

9.3.3 CHOCOLATES

9.3.3.1 CHUNKS

9.3.3.2 SYRUP

9.3.3.3 FLAKES

9.3.3.4 OTHERS

9.3.4 CONFETTI

9.3.5 NONPAREILS

9.3.6 BAKED PIECES

9.3.7 PEARLS

9.3.8 DRAGEES

9.3.9 PECAN PRALINES

9.3.10 CARAMEL CRUNCHIES

9.3.11 OTHERS

10 EUROPE YOGURT MARKET, BY SOURCE

10.1 OVERVIEW

10.2 ANIMAL-BASED

10.2.1 COW MILK

10.2.2 BUFFALO MILK

10.2.3 GOAT MILK

10.2.4 OTHERS

10.3 PLANT-BASED

10.3.1 ALMOND MILK

10.3.2 SOY MILK

10.3.3 OAT MILK

10.3.4 COCONUT MILK

10.3.5 CASHEW MILK

10.3.6 OTHERS

10.4 ARTIFICIAL

11 EUROPE YOGURT MARKET, BY FLAVOR

11.1 OVERVIEW

11.2 PLAIN

11.3 FLAVORED

11.3.1 STRAWBERRY

11.3.2 VANILLA

11.3.3 BLUBERRY

11.3.4 BANANA

11.3.5 PEACH

11.3.6 BILBERRY

11.3.7 BLACKBERRY

11.3.8 FRUIT & NUT

11.3.9 LIME

11.3.10 COCONUT

11.3.11 NUTS

11.3.12 CHERRY

11.3.13 ORCHARD CHERRY

11.3.14 HONEY

11.3.15 PUMPKIN

11.3.16 CHOCOLATES

11.3.17 BUTTERSCOTCH

11.3.18 CARAMEL

11.3.19 MOCHA/COFFEE

11.3.20 POMOGRANETT

11.3.21 PEPPERMINT

11.3.22 AMARETTO

11.3.23 OTHERS

12 EUROPE YOGURT MARKET, BY FAT CONTENT

12.1 OVERVIEW

12.2 LOW FAT

12.3 FAT FREE

12.4 FULL FAT

13 EUROPE YOGURT MARKET, BY FORTIFICATION

13.1 OVERVIEW

13.2 REGULAR

13.3 FORTIFIED

14 EUROPE YOGURT MARKET, BY ORGANIC CATEGORY

14.1 OVERVIEW

14.2 CONVENTIONAL

14.3 ORGANIC

15 EUROPE YOGURT MARKET, BY DISTRIBUTION CHANNEL

15.1 OVERVIEW

15.2 STORE-BASED RETAILING

15.2.1 SUPERMARKETS/HYPERMARKETS

15.2.2 YOGURT SHOPS/PARLORS

15.2.3 CONVENIENCE STORES

15.2.4 GROCERY STORES

15.2.5 SPECIALTY STORES

15.2.6 WHOLESALERS

15.2.7 OTHERS

15.3 NON-STORE RETAILING

15.3.1 ONLINE

15.3.2 VENDING

16 EUROPE YOGURT MARKET, BY PACKAGING SIZE

16.1 OVERVIEW

16.2 201-300 GRAMS

16.3 MORE THAN 300 GRAMS

16.4 100-200 GRAMS

16.5 LESS THAN 100 GRAMS

17 EUROPE YOGURT MARKET, BY CLAIM

17.1 OVERVIEW

17.2 SUGAR FREE

17.3 DAIRY FREE

17.4 LACTOSE FREE

17.5 SOY FREE

17.6 GLUTEN FREE

17.7 NON GMO

17.8 CALORIE FREE

17.9 ARTIFICIAL PRESERVATIVES FREE

17.1 WITH ALL OF THE ABOVE CLAIM

17.11 REGULAR WITH NO CLAIMS

17.12 OTHERS

18 EUROPE YOGURT MARKET, BY BRAND

18.1 OVERVIEW

18.2 BRANDED

18.3 PRIVATE LABEL

19 EUROPE YOGURT MARKET, BY PRICE RANGE

19.1 OVERVIEW

19.2 MASS

19.3 PREMIUM

19.4 LUXURY

20 EUROPE YOGURT MARKET, BY PACKAGING TYPE

20.1 OVERVIEW

20.2 JARS

20.2.1 PLASTIC

20.2.2 GLASS

20.3 BOTTLES

20.3.1 PLASTIC

20.3.2 GLASS

20.4 TETRA PACK

20.5 CUPS

20.6 BAG-IN-BOX

20.7 POUCHES

20.8 OTHERS

21 EUROPE YOGURT MARKET, BY COUNTRY

21.1 EUROPE

21.1.1 GERMANY

21.1.2 FRANCE

21.1.3 SPAIN

21.1.4 POLAND

21.1.5 BELGIUM

21.1.6 NETHERLANDS

21.1.7 ITALY

21.1.8 AUSTRIA

21.1.9 SWEDEN

21.1.10 DENMARK

21.1.11 UNITED KINGDOM

21.1.12 PORTUGAL

21.1.13 SWITZERLAND

21.1.14 IRELAND

21.1.15 FINLAND

21.1.16 LUXEMBOURG

21.1.17 REST OF EUROPE

22 EUROPE YOGURT MARKET, COMPANY LANDSCAPE

22.1 COMPANY SHARE ANALYSIS: EUROPE

23 SWOT ANALYSIS

24 COMPANY PROFILES

24.1 DANONE

24.1.1 COMPANY SNAPSHOT

24.1.2 REVENUE ANALYSIS:

24.1.3 PRODUCT PORTFOLIO

24.1.4 RECENT DEVELOPMENT

24.2 NESTLÉ

24.2.1 COMPANY SNAPSHOT

24.2.2 REVENUE ANALYSIS

24.2.3 PRODUCT PORTFOLIO

24.2.4 RECENT DEVELOPMENT

24.3 EMMY UK LTD

24.3.1 COMPANY SNAPSHOT

24.3.2 PRODUCT PORTFOLIO

24.3.3 RECENT DEVELOPMENT

24.4 MÜLLER UK & IRELAND (SUBSIDIARY OF UNTERNEHMENSGRUPPE THEO MÜLLER)

24.4.1 COMPANY SNAPSHOT

24.4.2 PRODUCT PORTFOLIO

24.4.3 RECENT DEVELOPMENT

24.5 FRIESLAND CAMPINA

24.5.1 COMPANY SNAPSHOT

24.5.2 PRODUCT PORTFOLIO

24.5.3 RECENT DEVELOPMENT

24.6 THE CAMPBELL’S COMPANY

24.6.1 COMPANY SNAPSHOT

24.6.2 PRODUCT PORTFOLIO

24.6.3 RECENT DEVELOPMENT

24.7 ARLA FOODS AMBA

24.7.1 COMPANY SNAPSHOT

24.7.2 REVENUE ANALYSIS

24.7.3 PRODUCT PORTFOLIO

24.7.4 RECENT DEVELOPMENT

24.8 SCHREIBER FOOD INC

24.8.1 COMPANY SNAPSHOT

24.8.2 PRODUCT PORTFOLIO

24.8.3 RECENT DEVELOPMENT

24.9 SODIAAL

24.9.1 COMPANY SNAPSHOT

24.9.2 PRODUCT PORTFOLIO

24.9.3 RECENT DEVELOPMENT

24.1 CREMO SA

24.10.1 COMPANY SNAPSHOT

24.10.2 PRODUCT PORTFOLIO

24.11 FEN FARM DAIRY

24.11.1 COMPANY SNAPSHOT

24.11.2 PRODUCT PORTFOLIO

24.11.3 RECENT DEVELOPMENT

24.12 LACTEAS FLOR DE BURGOS

24.12.1 COMPANY SNAPSHOT

24.12.2 PRODUCT PORTFOLIO

24.12.3 RECENT DEVELOPMENT

24.13 LATTE MAREMMA

24.13.1 COMPANY SNAPSHOT

24.13.2 PRODUCT PORTFOLIO

24.13.3 RECENT DEVELOPMENT

24.14 NEWLAT FOOD S.P.A

24.14.1 COMPANY SNAPSHOT

24.14.2 REVENUE ANALYSIS

24.14.3 SEGMENTED REVENUE ANALYSIS

24.14.4 PRODUCT PORTFOLIO

24.15 THE HAIN CELESTIAL GROUP, INC.

24.15.1 COMPANY SNAPSHOT

24.15.2 REVENUE ANALYSIS

24.15.3 SEGMENTED REVENUE ANALYSIS

24.15.4 PRODUCT PORTFOLIO

24.15.5 RECENT DEVELOPMENT

24.16 YEO VALLEY ORGANIC LIMITED

24.16.1 COMPANY SNAPSHOT

24.16.2 PRODUCT PORTFOLIO

24.16.3 RECENT DEVELOPMENT

25 QUESTIONNAIRE

26 RELATED REPORTS

Список таблиц

TABLE 1 PRODUCTION CAPACITY OF KEY MANUFACTURERS

TABLE 2 REGULATIONS ACROSS VARIOUS REGIONS AND COUNTRIES

TABLE 3 EUROPE YOGURT MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 4 EUROPE YOGURT MARKET, BY FORMULATION, 2018-2032 (USD MILLION)

TABLE 5 EUROPE YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 6 EUROPE WITH INCLUSIONS & TOPPINGS IN YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 7 EUROPE NUTS IN YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 8 EUROPE CHOCOLATES IN YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 9 EUROPE YOGURT MARKET, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 10 EUROPE ANIMAL-BASED IN YOGURT MARKET, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 11 EUROPE PLANT-BASED IN YOGURT MARKET, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 12 EUROPE YOGURT MARKET, BY FLAVOR, 2018-2032 (USD MILLION)

TABLE 13 EUROPE FLAVORED IN YOGURT MARKET, BY FLAVOR, 2018-2032 (USD MILLION)

TABLE 14 EUROPE YOGURT MARKET, BY FAT CONTENT, 2018-2032 (USD MILLION)

TABLE 15 EUROPE YOGURT MARKET, BY FORTIFICATION, 2018-2032 (USD MILLION)

TABLE 16 EUROPE YOGURT MARKET, BY ORGANIC CATEGORY, 2018-2032 (USD MILLION)

TABLE 17 EUROPE YOGURT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 18 EUROPE STORE-BASED RETAILING IN YOGURT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 19 EUROPE NON-STORE RETAILING IN YOGURT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 20 EUROPE YOGURT MARKET, BY PACKAGING SIZE, 2018-2032 (USD MILLION)

TABLE 21 EUROPE YOGURT MARKET, BY CLAIM, 2018-2032 (USD MILLION)

TABLE 22 EUROPE YOGURT MARKET, BY BRAND, 2018-2032 (USD MILLION)

TABLE 23 EUROPE YOGURT MARKET, BY PRICE RANGE, 2018-2032 (USD MILLION)

TABLE 24 EUROPE YOGURT MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 25 EUROPE JARS IN YOGURT MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 26 EUROPE BOTTLES IN YOGURT MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 27 EUROPE YOGURT MARKET, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 28 EUROPE YOGURT MARKET, BY COUNTRY, 2018-2032 (KILO TONS)

TABLE 29 GERMANY YOGURT MARKET, BY YOGURT TYPE, 2018-2032 (USD MILLION)

TABLE 30 GERMANY YOGURT MARKET, BY YOGURT TYPE, 2018-2032 (KILO TONS)

TABLE 31 GERMANY YOGURT MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 32 GERMANY YOGURT MARKET, BY FAT CONTENT, 2018-2032 (USD MILLION)

TABLE 33 GERMANY YOGURT MARKET, BY FLAVOR, 2018-2032 (USD MILLION)

TABLE 34 GERMANY FLAVORED IN YOGURT MARKET, BY FLAVOR, 2018-2032 (USD MILLION)

TABLE 35 GERMANY YOGURT MARKET, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 36 GERMANY ANIMAL-BASED IN YOGURT MARKET, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 37 GERMANY PLANT-BASED IN YOGURT MARKET, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 38 GERMANY YOGURT MARKET, BY FORMULATION, 2018-2032 (USD MILLION)

TABLE 39 GERMANY YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 40 GERMANY WITH INCLUSIONS & TOPPINGS IN YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 41 GERMANY NUTS IN YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 42 GERMANY CHOCOLATES IN YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 43 GERMANY YOGURT MARKET, BY FORTIFICATION, 2018-2032 (USD MILLION)

TABLE 44 GERMANY YOGURT MARKET, BY ORGANIC CATEGORY, 2018-2032 (USD MILLION)

TABLE 45 GERMANY YOGURT MARKET, BY BRAND, 2018-2032 (USD MILLION)

TABLE 46 GERMANY YOGURT MARKET, BY PRICE RANGE, 2018-2032 (USD MILLION)

TABLE 47 GERMANY YOGURT MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 48 GERMANY JARS IN YOGURT MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 49 GERMANY BOTTLES IN YOGURT MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 50 GERMANY YOGURT MARKET, BY PACKAGING SIZE, 2018-2032 (USD MILLION)

TABLE 51 GERMANY YOGURT MARKET, BY CLAIM, 2018-2032 (USD MILLION)

TABLE 52 GERMANY YOGURT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 53 GERMANY STORE-BASED RETAILING IN YOGURT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 54 GERMANY NON-STORE RETAILING IN YOGURT MARKET, BY DISTRIBUTION CHANNEL,2018-2032 (USD MILLION)

TABLE 55 FRANCE YOGURT MARKET, BY YOGURT TYPE, 2018-2032 (USD MILLION)

TABLE 56 FRANCE YOGURT MARKET, BY YOGURT TYPE, 2018-2032 (KILO TONS)

TABLE 57 FRANCE YOGURT MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 58 FRANCE YOGURT MARKET, BY FAT CONTENT, 2018-2032 (USD MILLION)

TABLE 59 FRANCE YOGURT MARKET, BY FLAVOR, 2018-2032 (USD MILLION)

TABLE 60 FRANCE FLAVORED IN YOGURT MARKET, BY FLAVOR, 2018-2032 (USD MILLION)

TABLE 61 FRANCE YOGURT MARKET, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 62 FRANCE ANIMAL-BASED IN YOGURT MARKET, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 63 FRANCE PLANT-BASED IN YOGURT MARKET, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 64 FRANCE YOGURT MARKET, BY FORMULATION, 2018-2032 (USD MILLION)

TABLE 65 FRANCE YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 66 FRANCE WITH INCLUSIONS & TOPPINGS IN YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 67 FRANCE NUTS IN YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 68 FRANCE CHOCOLATES IN YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 69 FRANCE YOGURT MARKET, BY FORTIFICATION, 2018-2032 (USD MILLION)

TABLE 70 FRANCE YOGURT MARKET, BY ORGANIC CATEGORY, 2018-2032 (USD MILLION)

TABLE 71 FRANCE YOGURT MARKET, BY BRAND, 2018-2032 (USD MILLION)

TABLE 72 FRANCE YOGURT MARKET, BY PRICE RANGE, 2018-2032 (USD MILLION)

TABLE 73 FRANCE YOGURT MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 74 FRANCE JARS IN YOGURT MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 75 FRANCE BOTTLES IN YOGURT MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 76 FRANCE YOGURT MARKET, BY PACKAGING SIZE, 2018-2032 (USD MILLION)

TABLE 77 FRANCE YOGURT MARKET, BY CLAIM, 2018-2032 (USD MILLION)

TABLE 78 FRANCE YOGURT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 79 FRANCE STORE-BASED RETAILING IN YOGURT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 80 FRANCE NON-STORE RETAILING IN YOGURT MARKET, BY DISTRIBUTION CHANNEL,2018-2032 (USD MILLION)

TABLE 81 SPAIN YOGURT MARKET, BY YOGURT TYPE, 2018-2032 (USD MILLION)

TABLE 82 SPAIN YOGURT MARKET, BY YOGURT TYPE, 2018-2032 (KILO TONS)

TABLE 83 SPAIN YOGURT MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 84 SPAIN YOGURT MARKET, BY FAT CONTENT, 2018-2032 (USD MILLION)

TABLE 85 SPAIN YOGURT MARKET, BY FLAVOR, 2018-2032 (USD MILLION)

TABLE 86 SPAIN FLAVORED IN YOGURT MARKET, BY FLAVOR, 2018-2032 (USD MILLION)

TABLE 87 SPAIN YOGURT MARKET, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 88 SPAIN ANIMAL-BASED IN YOGURT MARKET, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 89 SPAIN PLANT-BASED IN YOGURT MARKET, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 90 SPAIN YOGURT MARKET, BY FORMULATION, 2018-2032 (USD MILLION)

TABLE 91 SPAIN YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 92 SPAIN WITH INCLUSIONS & TOPPINGS IN YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 93 SPAIN NUTS IN YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 94 SPAIN CHOCOLATES IN YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 95 SPAIN YOGURT MARKET, BY FORTIFICATION, 2018-2032 (USD MILLION)

TABLE 96 SPAIN YOGURT MARKET, BY ORGANIC CATEGORY, 2018-2032 (USD MILLION)

TABLE 97 SPAIN YOGURT MARKET, BY BRAND, 2018-2032 (USD MILLION)

TABLE 98 SPAIN YOGURT MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 99 SPAIN JARS IN YOGURT MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 100 SPAIN BOTTLES IN YOGURT MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 101 SPAIN YOGURT MARKET, BY PACKAGING SIZE, 2018-2032 (USD MILLION)

TABLE 102 SPAIN YOGURT MARKET, BY CLAIM, 2018-2032 (USD MILLION)

TABLE 103 SPAIN YOGURT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 104 SPAIN STORE-BASED RETAILING IN YOGURT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 105 SPAIN NON-STORE RETAILING IN YOGURT MARKET, BY DISTRIBUTION CHANNEL,2018-2032 (USD MILLION)

TABLE 106 POLAND YOGURT MARKET, BY YOGURT TYPE, 2018-2032 (USD MILLION)

TABLE 107 POLAND YOGURT MARKET, BY YOGURT TYPE, 2018-2032 (KILO TONS)

TABLE 108 POLAND YOGURT MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 109 POLAND YOGURT MARKET, BY FAT CONTENT, 2018-2032 (USD MILLION)

TABLE 110 POLAND YOGURT MARKET, BY FLAVOR, 2018-2032 (USD MILLION)

TABLE 111 POLAND FLAVORED IN YOGURT MARKET, BY FLAVOR, 2018-2032 (USD MILLION)

TABLE 112 POLAND YOGURT MARKET, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 113 POLAND ANIMAL-BASED IN YOGURT MARKET, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 114 POLAND PLANT-BASED IN YOGURT MARKET, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 115 POLAND YOGURT MARKET, BY FORMULATION, 2018-2032 (USD MILLION)

TABLE 116 POLAND YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 117 POLAND WITH INCLUSIONS & TOPPINGS IN YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 118 POLAND NUTS IN YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 119 POLAND CHOCOLATES IN YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 120 POLAND YOGURT MARKET, BY FORTIFICATION, 2018-2032 (USD MILLION)

TABLE 121 POLAND YOGURT MARKET, BY ORGANIC CATEGORY, 2018-2032 (USD MILLION)

TABLE 122 POLAND YOGURT MARKET, BY BRAND, 2018-2032 (USD MILLION)

TABLE 123 POLAND YOGURT MARKET, BY PRICE RANGE, 2018-2032 (USD MILLION)

TABLE 124 POLAND YOGURT MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 125 POLAND JARS IN YOGURT MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 126 POLAND BOTTLES IN YOGURT MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 127 POLAND YOGURT MARKET, BY PACKAGING SIZE, 2018-2032 (USD MILLION)

TABLE 128 POLAND YOGURT MARKET, BY CLAIM, 2018-2032 (USD MILLION)

TABLE 129 POLAND YOGURT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 130 POLAND STORE-BASED RETAILING IN YOGURT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 131 POLAND NON-STORE RETAILING IN YOGURT MARKET, BY DISTRIBUTION CHANNEL,2018-2032 (USD MILLION)

TABLE 132 BELGIUM YOGURT MARKET, BY YOGURT TYPE, 2018-2032 (USD MILLION)

TABLE 133 BELGIUM YOGURT MARKET, BY YOGURT TYPE, 2018-2032 (KILO TONS)

TABLE 134 BELGIUM YOGURT MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 135 BELGIUM YOGURT MARKET, BY FAT CONTENT, 2018-2032 (USD MILLION)

TABLE 136 BELGIUM YOGURT MARKET, BY FLAVOR, 2018-2032 (USD MILLION)

TABLE 137 BELGIUM FLAVORED IN YOGURT MARKET, BY FLAVOR, 2018-2032 (USD MILLION)

TABLE 138 BELGIUM YOGURT MARKET, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 139 BELGIUM ANIMAL-BASED IN YOGURT MARKET, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 140 BELGIUM PLANT-BASED IN YOGURT MARKET, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 141 BELGIUM YOGURT MARKET, BY FORMULATION, 2018-2032 (USD MILLION)

TABLE 142 BELGIUM YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 143 BELGIUM WITH INCLUSIONS & TOPPINGS IN YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 144 BELGIUM NUTS IN YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 145 BELGIUM CHOCOLATES IN YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 146 BELGIUM YOGURT MARKET, BY FORTIFICATION, 2018-2032 (USD MILLION)

TABLE 147 BELGIUM YOGURT MARKET, BY ORGANIC CATEGORY, 2018-2032 (USD MILLION)

TABLE 148 BELGIUM YOGURT MARKET, BY BRAND, 2018-2032 (USD MILLION)

TABLE 149 BELGIUM YOGURT MARKET, BY PRICE RANGE, 2018-2032 (USD MILLION)

TABLE 150 BELGIUM YOGURT MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 151 BELGIUM JARS IN YOGURT MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 152 BELGIUM BOTTLES IN YOGURT MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 153 BELGIUM YOGURT MARKET, BY PACKAGING SIZE, 2018-2032 (USD MILLION)

TABLE 154 BELGIUM YOGURT MARKET, BY CLAIM, 2018-2032 (USD MILLION)

TABLE 155 BELGIUM YOGURT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 156 BELGIUM STORE-BASED RETAILING IN YOGURT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 157 BELGIUM NON-STORE RETAILING IN YOGURT MARKET, BY DISTRIBUTION CHANNEL,2018-2032 (USD MILLION)

TABLE 158 NETHERLANDS YOGURT MARKET, BY YOGURT TYPE, 2018-2032 (USD MILLION)

TABLE 159 NETHERLANDS YOGURT MARKET, BY YOGURT TYPE, 2018-2032 (KILO TONS)

TABLE 160 NETHERLANDS YOGURT MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 161 NETHERLANDS YOGURT MARKET, BY FAT CONTENT, 2018-2032 (USD MILLION)

TABLE 162 NETHERLANDS YOGURT MARKET, BY FLAVOR, 2018-2032 (USD MILLION)

TABLE 163 NETHERLANDS FLAVORED IN YOGURT MARKET, BY FLAVOR, 2018-2032 (USD MILLION)

TABLE 164 NETHERLANDS YOGURT MARKET, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 165 NETHERLANDS ANIMAL-BASED IN YOGURT MARKET, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 166 NETHERLANDS PLANT-BASED IN YOGURT MARKET, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 167 NETHERLANDS YOGURT MARKET, BY FORMULATION, 2018-2032 (USD MILLION)

TABLE 168 NETHERLANDS YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 169 NETHERLANDS WITH INCLUSIONS & TOPPINGS IN YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 170 NETHERLANDS NUTS IN YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 171 NETHERLANDS CHOCOLATES IN YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 172 NETHERLANDS YOGURT MARKET, BY FORTIFICATION, 2018-2032 (USD MILLION)

TABLE 173 NETHERLANDS YOGURT MARKET, BY ORGANIC CATEGORY, 2018-2032 (USD MILLION)

TABLE 174 NETHERLANDS YOGURT MARKET, BY BRAND, 2018-2032 (USD MILLION)

TABLE 175 NETHERLANDS YOGURT MARKET, BY PRICE RANGE, 2018-2032 (USD MILLION)

TABLE 176 NETHERLANDS YOGURT MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 177 NETHERLANDS JARS IN YOGURT MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 178 NETHERLANDS BOTTLES IN YOGURT MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 179 NETHERLANDS YOGURT MARKET, BY PACKAGING SIZE, 2018-2032 (USD MILLION)

TABLE 180 NETHERLANDS YOGURT MARKET, BY CLAIM, 2018-2032 (USD MILLION)

TABLE 181 NETHERLANDS YOGURT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 182 NETHERLANDS STORE-BASED RETAILING IN YOGURT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 183 NETHERLANDS NON-STORE RETAILING IN YOGURT MARKET, BY DISTRIBUTION CHANNEL,2018-2032 (USD MILLION)

TABLE 184 ITALY YOGURT MARKET, BY YOGURT TYPE, 2018-2032 (USD MILLION)

TABLE 185 ITALY YOGURT MARKET, BY YOGURT TYPE, 2018-2032 (KILO TONS)

TABLE 186 ITALY YOGURT MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 187 ITALY YOGURT MARKET, BY FAT CONTENT, 2018-2032 (USD MILLION)

TABLE 188 ITALY YOGURT MARKET, BY FLAVOR, 2018-2032 (USD MILLION)

TABLE 189 ITALY FLAVORED IN YOGURT MARKET, BY FLAVOR, 2018-2032 (USD MILLION)

TABLE 190 ITALY YOGURT MARKET, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 191 ITALY ANIMAL-BASED IN YOGURT MARKET, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 192 ITALY PLANT-BASED IN YOGURT MARKET, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 193 ITALY YOGURT MARKET, BY FORMULATION, 2018-2032 (USD MILLION)

TABLE 194 ITALY YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 195 ITALY WITH INCLUSIONS & TOPPINGS IN YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 196 ITALY NUTS IN YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 197 ITALY CHOCOLATES IN YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 198 ITALY YOGURT MARKET, BY FORTIFICATION, 2018-2032 (USD MILLION)

TABLE 199 ITALY YOGURT MARKET, BY ORGANIC CATEGORY, 2018-2032 (USD MILLION)

TABLE 200 ITALY YOGURT MARKET, BY BRAND, 2018-2032 (USD MILLION)

TABLE 201 ITALY YOGURT MARKET, BY PRICE RANGE, 2018-2032 (USD MILLION)

TABLE 202 ITALY YOGURT MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 203 ITALY JARS IN YOGURT MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 204 ITALY BOTTLES IN YOGURT MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 205 ITALY YOGURT MARKET, BY PACKAGING SIZE, 2018-2032 (USD MILLION)

TABLE 206 ITALY YOGURT MARKET, BY CLAIM, 2018-2032 (USD MILLION)

TABLE 207 ITALY YOGURT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 208 ITALY STORE-BASED RETAILING IN YOGURT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 209 ITALY NON-STORE RETAILING IN YOGURT MARKET, BY DISTRIBUTION CHANNEL,2018-2032 (USD MILLION)

TABLE 210 AUSTRIA YOGURT MARKET, BY YOGURT TYPE, 2018-2032 (USD MILLION)

TABLE 211 AUSTRIA YOGURT MARKET, BY YOGURT TYPE, 2018-2032 (KILO TONS)

TABLE 212 AUSTRIA YOGURT MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 213 AUSTRIA YOGURT MARKET, BY FAT CONTENT, 2018-2032 (USD MILLION)

TABLE 214 AUSTRIA YOGURT MARKET, BY FLAVOR, 2018-2032 (USD MILLION)

TABLE 215 AUSTRIA FLAVORED IN YOGURT MARKET, BY FLAVOR, 2018-2032 (USD MILLION)

TABLE 216 AUSTRIA YOGURT MARKET, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 217 AUSTRIA ANIMAL-BASED IN YOGURT MARKET, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 218 AUSTRIA PLANT-BASED IN YOGURT MARKET, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 219 AUSTRIA YOGURT MARKET, BY FORMULATION, 2018-2032 (USD MILLION)

TABLE 220 AUSTRIA YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 221 AUSTRIA WITH INCLUSIONS & TOPPINGS IN YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 222 AUSTRIA NUTS IN YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 223 AUSTRIA CHOCOLATES IN YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 224 AUSTRIA YOGURT MARKET, BY FORTIFICATION, 2018-2032 (USD MILLION)

TABLE 225 AUSTRIA YOGURT MARKET, BY ORGANIC CATEGORY, 2018-2032 (USD MILLION)

TABLE 226 AUSTRIA YOGURT MARKET, BY BRAND, 2018-2032 (USD MILLION)

TABLE 227 AUSTRIA YOGURT MARKET, BY PRICE RANGE, 2018-2032 (USD MILLION)

TABLE 228 AUSTRIA YOGURT MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 229 AUSTRIA JARS IN YOGURT MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 230 AUSTRIA BOTTLES IN YOGURT MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 231 AUSTRIA YOGURT MARKET, BY PACKAGING SIZE, 2018-2032 (USD MILLION)

TABLE 232 AUSTRIA YOGURT MARKET, BY CLAIM, 2018-2032 (USD MILLION)

TABLE 233 AUSTRIA YOGURT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 234 AUSTRIA STORE-BASED RETAILING IN YOGURT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 235 AUSTRIA NON-STORE RETAILING IN YOGURT MARKET, BY DISTRIBUTION CHANNEL,2018-2032 (USD MILLION)

TABLE 236 SWEDEN YOGURT MARKET, BY YOGURT TYPE, 2018-2032 (USD MILLION)

TABLE 237 SWEDEN YOGURT MARKET, BY YOGURT TYPE, 2018-2032 (KILO TONS)

TABLE 238 SWEDEN YOGURT MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 239 SWEDEN YOGURT MARKET, BY FAT CONTENT, 2018-2032 (USD MILLION)

TABLE 240 SWEDEN YOGURT MARKET, BY FLAVOR, 2018-2032 (USD MILLION)

TABLE 241 SWEDEN FLAVORED IN YOGURT MARKET, BY FLAVOR, 2018-2032 (USD MILLION)

TABLE 242 SWEDEN YOGURT MARKET, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 243 SWEDEN ANIMAL-BASED IN YOGURT MARKET, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 244 SWEDEN PLANT-BASED IN YOGURT MARKET, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 245 SWEDEN YOGURT MARKET, BY FORMULATION, 2018-2032 (USD MILLION)

TABLE 246 SWEDEN YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 247 SWEDEN WITH INCLUSIONS & TOPPINGS IN YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 248 SWEDEN NUTS IN YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 249 SWEDEN CHOCOLATES IN YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 250 SWEDEN YOGURT MARKET, BY FORTIFICATION, 2018-2032 (USD MILLION)

TABLE 251 SWEDEN YOGURT MARKET, BY ORGANIC CATEGORY, 2018-2032 (USD MILLION)

TABLE 252 SWEDEN YOGURT MARKET, BY BRAND, 2018-2032 (USD MILLION)

TABLE 253 SWEDEN YOGURT MARKET, BY PRICE RANGE, 2018-2032 (USD MILLION)

TABLE 254 SWEDEN YOGURT MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 255 SWEDEN JARS IN YOGURT MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 256 SWEDEN BOTTLES IN YOGURT MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 257 SWEDEN YOGURT MARKET, BY PACKAGING SIZE, 2018-2032 (USD MILLION)

TABLE 258 SWEDEN YOGURT MARKET, BY CLAIM, 2018-2032 (USD MILLION)

TABLE 259 SWEDEN YOGURT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 260 SWEDEN STORE-BASED RETAILING IN YOGURT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 261 SWEDEN NON-STORE RETAILING IN YOGURT MARKET, BY DISTRIBUTION CHANNEL,2018-2032 (USD MILLION)

TABLE 262 DENMARK YOGURT MARKET, BY YOGURT TYPE, 2018-2032 (USD MILLION)

TABLE 263 DENMARK YOGURT MARKET, BY YOGURT TYPE, 2018-2032 (KILO TONS)

TABLE 264 DENMARK YOGURT MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 265 DENMARK YOGURT MARKET, BY FAT CONTENT, 2018-2032 (USD MILLION)

TABLE 266 DENMARK YOGURT MARKET, BY FLAVOR, 2018-2032 (USD MILLION)

TABLE 267 DENMARK FLAVORED IN YOGURT MARKET, BY FLAVOR, 2018-2032 (USD MILLION)

TABLE 268 DENMARK YOGURT MARKET, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 269 DENMARK ANIMAL-BASED IN YOGURT MARKET, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 270 DENMARK PLANT-BASED IN YOGURT MARKET, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 271 DENMARK YOGURT MARKET, BY FORMULATION, 2018-2032 (USD MILLION)

TABLE 272 DENMARK YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 273 DENMARK WITH INCLUSIONS & TOPPINGS IN YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 274 DENMARK NUTS IN YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 275 DENMARK CHOCOLATES IN YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 276 DENMARK YOGURT MARKET, BY FORTIFICATION, 2018-2032 (USD MILLION)

TABLE 277 DENMARK YOGURT MARKET, BY ORGANIC CATEGORY, 2018-2032 (USD MILLION)

TABLE 278 DENMARK YOGURT MARKET, BY BRAND, 2018-2032 (USD MILLION)

TABLE 279 DENMARK YOGURT MARKET, BY PRICE RANGE, 2018-2032 (USD MILLION)

TABLE 280 DENMARK YOGURT MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 281 DENMARK JARS IN YOGURT MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 282 DENMARK BOTTLES IN YOGURT MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 283 DENMARK YOGURT MARKET, BY PACKAGING SIZE, 2018-2032 (USD MILLION)

TABLE 284 DENMARK YOGURT MARKET, BY CLAIM, 2018-2032 (USD MILLION)

TABLE 285 DENMARK YOGURT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 286 DENMARK STORE-BASED RETAILING IN YOGURT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 287 DENMARK NON-STORE RETAILING IN YOGURT MARKET, BY DISTRIBUTION CHANNEL,2018-2032 (USD MILLION)

TABLE 288 UNITED KINGDOM YOGURT MARKET, BY YOGURT TYPE, 2018-2032 (USD MILLION)

TABLE 289 UNITED KINGDOM YOGURT MARKET, BY YOGURT TYPE, 2018-2032 (KILO TONS)

TABLE 290 UNITED KINGDOM YOGURT MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 291 UNITED KINGDOM YOGURT MARKET, BY FAT CONTENT, 2018-2032 (USD MILLION)

TABLE 292 UNITED KINGDOM YOGURT MARKET, BY FLAVOR, 2018-2032 (USD MILLION)

TABLE 293 UNITED KINGDOM FLAVORED IN YOGURT MARKET, BY FLAVOR, 2018-2032 (USD MILLION)

TABLE 294 UNITED KINGDOM YOGURT MARKET, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 295 UNITED KINGDOM ANIMAL-BASED IN YOGURT MARKET, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 296 UNITED KINGDOM PLANT-BASED IN YOGURT MARKET, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 297 UNITED KINGDOM YOGURT MARKET, BY FORMULATION, 2018-2032 (USD MILLION)

TABLE 298 UNITED KINGDOM YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 299 UNITED KINGDOM WITH INCLUSIONS & TOPPINGS IN YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 300 UNITED KINGDOM NUTS IN YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 301 UNITED KINGDOM CHOCOLATES IN YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 302 UNITED KINGDOM YOGURT MARKET, BY FORTIFICATION, 2018-2032 (USD MILLION)

TABLE 303 UNITED KINGDOM YOGURT MARKET, BY ORGANIC CATEGORY, 2018-2032 (USD MILLION)

TABLE 304 UNITED KINGDOM YOGURT MARKET, BY BRAND, 2018-2032 (USD MILLION)

TABLE 305 UNITED KINGDOM YOGURT MARKET, BY PRICE RANGE, 2018-2032 (USD MILLION)

TABLE 306 UNITED KINGDOM YOGURT MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 307 UNITED KINGDOM JARS IN YOGURT MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 308 UNITED KINGDOM BOTTLES IN YOGURT MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 309 UNITED KINGDOM YOGURT MARKET, BY PACKAGING SIZE, 2018-2032 (USD MILLION)

TABLE 310 UNITED KINGDOM YOGURT MARKET, BY CLAIM, 2018-2032 (USD MILLION)

TABLE 311 UNITED KINGDOM YOGURT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 312 UNITED KINGDOM STORE-BASED RETAILING IN YOGURT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 313 UNITED KINGDOM NON-STORE RETAILING IN YOGURT MARKET, BY DISTRIBUTION CHANNEL,2018-2032 (USD MILLION)

TABLE 314 PORTUGAL YOGURT MARKET, BY YOGURT TYPE, 2018-2032 (USD MILLION)

TABLE 315 PORTUGAL YOGURT MARKET, BY YOGURT TYPE, 2018-2032 (KILO TONS)

TABLE 316 PORTUGAL YOGURT MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 317 PORTUGAL YOGURT MARKET, BY FAT CONTENT, 2018-2032 (USD MILLION)

TABLE 318 PORTUGAL YOGURT MARKET, BY FLAVOR, 2018-2032 (USD MILLION)

TABLE 319 PORTUGAL FLAVORED IN YOGURT MARKET, BY FLAVOR, 2018-2032 (USD MILLION)

TABLE 320 PORTUGAL YOGURT MARKET, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 321 PORTUGAL ANIMAL-BASED IN YOGURT MARKET, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 322 PORTUGAL PLANT-BASED IN YOGURT MARKET, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 323 PORTUGAL YOGURT MARKET, BY FORMULATION, 2018-2032 (USD MILLION)

TABLE 324 PORTUGAL YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 325 PORTUGAL WITH INCLUSIONS & TOPPINGS IN YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 326 PORTUGAL NUTS IN YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 327 PORTUGAL CHOCOLATES IN YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 328 PORTUGAL YOGURT MARKET, BY FORTIFICATION, 2018-2032 (USD MILLION)

TABLE 329 PORTUGAL YOGURT MARKET, BY ORGANIC CATEGORY, 2018-2032 (USD MILLION)

TABLE 330 PORTUGAL YOGURT MARKET, BY BRAND, 2018-2032 (USD MILLION)

TABLE 331 PORTUGAL YOGURT MARKET, BY PRICE RANGE, 2018-2032 (USD MILLION)

TABLE 332 PORTUGAL YOGURT MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 333 PORTUGAL JARS IN YOGURT MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 334 PORTUGAL BOTTLES IN YOGURT MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 335 PORTUGAL YOGURT MARKET, BY PACKAGING SIZE, 2018-2032 (USD MILLION)

TABLE 336 PORTUGAL YOGURT MARKET, BY CLAIM, 2018-2032 (USD MILLION)

TABLE 337 PORTUGAL YOGURT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 338 PORTUGAL STORE-BASED RETAILING IN YOGURT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 339 PORTUGAL NON-STORE RETAILING IN YOGURT MARKET, BY DISTRIBUTION CHANNEL,2018-2032 (USD MILLION)

TABLE 340 SWITZERLAND YOGURT MARKET, BY YOGURT TYPE, 2018-2032 (USD MILLION)

TABLE 341 SWITZERLAND YOGURT MARKET, BY YOGURT TYPE, 2018-2032 (KILO TONS)

TABLE 342 SWITZERLAND YOGURT MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 343 SWITZERLAND YOGURT MARKET, BY FAT CONTENT, 2018-2032 (USD MILLION)

TABLE 344 SWITZERLAND YOGURT MARKET, BY FLAVOR, 2018-2032 (USD MILLION)

TABLE 345 SWITZERLAND FLAVORED IN YOGURT MARKET, BY FLAVOR, 2018-2032 (USD MILLION)

TABLE 346 SWITZERLAND YOGURT MARKET, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 347 SWITZERLAND ANIMAL-BASED IN YOGURT MARKET, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 348 SWITZERLAND PLANT-BASED IN YOGURT MARKET, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 349 SWITZERLAND YOGURT MARKET, BY FORMULATION, 2018-2032 (USD MILLION)

TABLE 350 SWITZERLAND YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 351 SWITZERLAND WITH INCLUSIONS & TOPPINGS IN YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 352 SWITZERLAND NUTS IN YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 353 SWITZERLAND CHOCOLATES IN YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 354 SWITZERLAND YOGURT MARKET, BY FORTIFICATION, 2018-2032 (USD MILLION)

TABLE 355 SWITZERLAND YOGURT MARKET, BY ORGANIC CATEGORY, 2018-2032 (USD MILLION)

TABLE 356 SWITZERLAND YOGURT MARKET, BY BRAND, 2018-2032 (USD MILLION)

TABLE 357 SWITZERLAND YOGURT MARKET, BY PRICE RANGE, 2018-2032 (USD MILLION)

TABLE 358 SWITZERLAND YOGURT MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 359 SWITZERLAND JARS IN YOGURT MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 360 SWITZERLAND BOTTLES IN YOGURT MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 361 SWITZERLAND YOGURT MARKET, BY PACKAGING SIZE, 2018-2032 (USD MILLION)

TABLE 362 SWITZERLAND YOGURT MARKET, BY CLAIM, 2018-2032 (USD MILLION)

TABLE 363 SWITZERLAND YOGURT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 364 SWITZERLAND STORE-BASED RETAILING IN YOGURT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 365 SWITZERLAND NON-STORE RETAILING IN YOGURT MARKET, BY DISTRIBUTION CHANNEL,2018-2032 (USD MILLION)

TABLE 366 IRELAND YOGURT MARKET, BY YOGURT TYPE, 2018-2032 (USD MILLION)

TABLE 367 IRELAND YOGURT MARKET, BY YOGURT TYPE, 2018-2032 (KILO TONS)

TABLE 368 IRELAND YOGURT MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 369 IRELAND YOGURT MARKET, BY FAT CONTENT, 2018-2032 (USD MILLION)

TABLE 370 IRELAND YOGURT MARKET, BY FLAVOR, 2018-2032 (USD MILLION)

TABLE 371 IRELAND FLAVORED IN YOGURT MARKET, BY FLAVOR, 2018-2032 (USD MILLION)

TABLE 372 IRELAND YOGURT MARKET, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 373 IRELAND ANIMAL-BASED IN YOGURT MARKET, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 374 IRELAND PLANT-BASED IN YOGURT MARKET, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 375 IRELAND YOGURT MARKET, BY FORMULATION, 2018-2032 (USD MILLION)

TABLE 376 IRELAND YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 377 IRELAND WITH INCLUSIONS & TOPPINGS IN YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 378 IRELAND NUTS IN YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 379 IRELAND CHOCOLATES IN YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 380 IRELAND YOGURT MARKET, BY FORTIFICATION, 2018-2032 (USD MILLION)

TABLE 381 IRELAND YOGURT MARKET, BY ORGANIC CATEGORY, 2018-2032 (USD MILLION)

TABLE 382 IRELAND YOGURT MARKET, BY BRAND, 2018-2032 (USD MILLION)

TABLE 383 IRELAND YOGURT MARKET, BY PRICE RANGE, 2018-2032 (USD MILLION)

TABLE 384 IRELAND YOGURT MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 385 IRELAND JARS IN YOGURT MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 386 IRELAND BOTTLES IN YOGURT MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 387 IRELAND YOGURT MARKET, BY PACKAGING SIZE, 2018-2032 (USD MILLION)

TABLE 388 IRELAND YOGURT MARKET, BY CLAIM, 2018-2032 (USD MILLION)

TABLE 389 IRELAND YOGURT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 390 IRELAND STORE-BASED RETAILING IN YOGURT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 391 IRELAND NON-STORE RETAILING IN YOGURT MARKET, BY DISTRIBUTION CHANNEL,2018-2032 (USD MILLION)

TABLE 392 FINLAND YOGURT MARKET, BY YOGURT TYPE, 2018-2032 (USD MILLION)

TABLE 393 FINLAND YOGURT MARKET, BY YOGURT TYPE, 2018-2032 (KILO TONS)

TABLE 394 FINLAND YOGURT MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 395 FINLAND YOGURT MARKET, BY FAT CONTENT, 2018-2032 (USD MILLION)

TABLE 396 FINLAND YOGURT MARKET, BY FLAVOR, 2018-2032 (USD MILLION)

TABLE 397 FINLAND FLAVORED IN YOGURT MARKET, BY FLAVOR, 2018-2032 (USD MILLION)

TABLE 398 FINLAND YOGURT MARKET, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 399 FINLAND ANIMAL-BASED IN YOGURT MARKET, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 400 FINLAND PLANT-BASED IN YOGURT MARKET, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 401 FINLAND YOGURT MARKET, BY FORMULATION, 2018-2032 (USD MILLION)

TABLE 402 FINLAND YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 403 FINLAND WITH INCLUSIONS & TOPPINGS IN YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 404 FINLAND NUTS IN YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 405 FINLAND CHOCOLATES IN YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 406 FINLAND YOGURT MARKET, BY FORTIFICATION, 2018-2032 (USD MILLION)

TABLE 407 FINLAND YOGURT MARKET, BY ORGANIC CATEGORY, 2018-2032 (USD MILLION)

TABLE 408 FINLAND YOGURT MARKET, BY BRAND, 2018-2032 (USD MILLION)

TABLE 409 FINLAND YOGURT MARKET, BY PRICE RANGE, 2018-2032 (USD MILLION)

TABLE 410 FINLAND YOGURT MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 411 FINLAND JARS IN YOGURT MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 412 FINLAND BOTTLES IN YOGURT MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 413 FINLAND YOGURT MARKET, BY PACKAGING SIZE, 2018-2032 (USD MILLION)

TABLE 414 FINLAND YOGURT MARKET, BY CLAIM, 2018-2032 (USD MILLION)

TABLE 415 FINLAND YOGURT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 416 FINLAND STORE-BASED RETAILING IN YOGURT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 417 FINLAND NON-STORE RETAILING IN YOGURT MARKET, BY DISTRIBUTION CHANNEL,2018-2032 (USD MILLION)

TABLE 418 LUXEMBOURG YOGURT MARKET, BY YOGURT TYPE, 2018-2032 (USD MILLION)

TABLE 419 LUXEMBOURG YOGURT MARKET, BY YOGURT TYPE, 2018-2032 (KILO TONS)

TABLE 420 LUXEMBOURG YOGURT MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 421 LUXEMBOURG YOGURT MARKET, BY FAT CONTENT, 2018-2032 (USD MILLION)

TABLE 422 LUXEMBOURG YOGURT MARKET, BY FLAVOR, 2018-2032 (USD MILLION)

TABLE 423 LUXEMBOURG FLAVORED IN YOGURT MARKET, BY FLAVOR, 2018-2032 (USD MILLION)

TABLE 424 LUXEMBOURG YOGURT MARKET, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 425 LUXEMBOURG ANIMAL-BASED IN YOGURT MARKET, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 426 LUXEMBOURG PLANT-BASED IN YOGURT MARKET, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 427 LUXEMBOURG YOGURT MARKET, BY FORMULATION, 2018-2032 (USD MILLION)

TABLE 428 LUXEMBOURG YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 429 LUXEMBOURG WITH INCLUSIONS & TOPPINGS IN YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)

TABLE 430 LUXEMBOURG NUTS IN YOGURT MARKET, BY INCLUSION CATEGORY, 2018-2032 (USD MILLION)