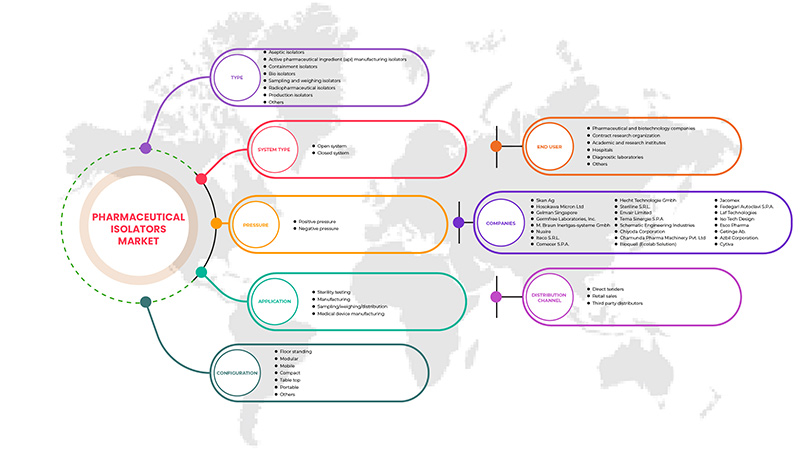

>Европейский рынок фармацевтических изоляторов по типу (асептические изоляторы, изоляторы сдерживания, биоизоляторы, изоляторы для отбора проб и взвешивания, изоляторы для производства активных фармацевтических ингредиентов (API), радиофармацевтические изоляторы, производственные изоляторы и другие), тип системы (закрытая система, открытая система), давление (положительное давление, отрицательное давление), конфигурация (напольные, модульные, мобильные, компактные, настольные, портативные и другие), применение (испытания на стерильность, производство, отбор проб/взвешивание/распределение, производство медицинских приборов ), конечный пользователь (больницы, диагностические лаборатории, академические и научно-исследовательские институты, фармацевтические и биотехнологические компании, контрактные исследовательские организации и другие), канал сбыта (прямые тендеры, розничные продажи, сторонние дистрибьюторы). Тенденции отрасли и прогноз до 2029 года.

Анализ и информация о рынке фармацевтических изоляторов в Европе

Фармацевтические изоляторы используются в фармацевтической промышленности в качестве барьерной системы, не допускающей загрязнения. Микробиологическое тестирование, обработка клеточной терапии, передовое фармацевтическое (ATMP) производство, а также взвешивание, упаковка и распределение стерильных инъекционных продуктов — вот лишь некоторые из применений фармацевтических изоляторов. Использование фармацевтических изоляторов обусловлено непрерывным ростом фармацевтического рынка в развивающихся и развитых странах и увеличением расходов на НИОКР для производства инновационных методов лечения. Передовые медицинские изоляторы и требования фармацевтической промышленности побудили крупных производителей развивать отрасль медицинских изоляторов. Рост использования опасных соединений, увеличение стоимости несоблюдения требований и рост исследовательских лабораторий являются важными факторами, определяющими рынок фармацевтических изоляторов в прогнозируемый период.

Однако большинство экспертов не согласны с тем, что регулирующие органы больше не препятствуют таким прорывам, как разработка фармацевтических изоляторов.

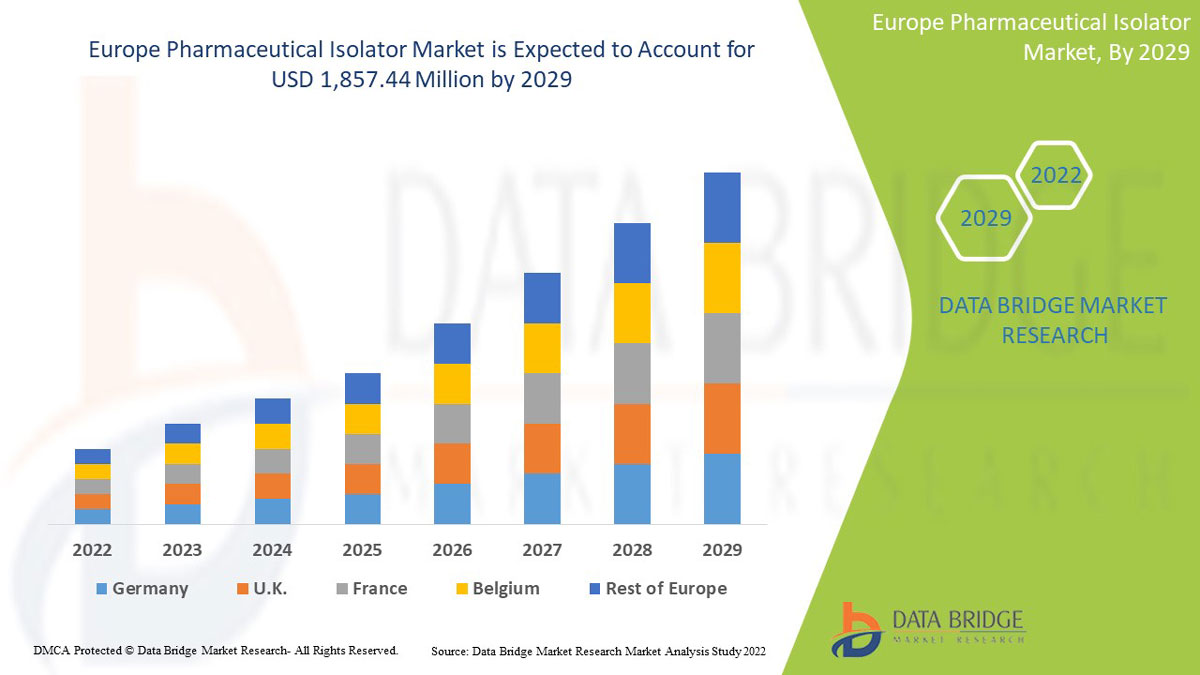

Data Bridge Market Research анализирует, что рынок фармацевтических изоляторов в Европе, как ожидается, достигнет значения 1 857,44 млн долларов США к 2029 году, при среднегодовом темпе роста 13,8% в течение прогнозируемого периода. Тип составляет самый большой сегмент типа на рынке из-за быстрого спроса на фармацевтические изоляторы в регионе. Этот отчет о рынке также подробно охватывает анализ цен, патентный анализ и технологические достижения.

|

Отчет Метрика |

Подробности |

|

Прогнозируемый период |

2022-2029 |

|

Базовый год |

2021 |

|

Исторические годы |

2020 (Можно настроить на 2019 - 2014) |

|

Количественные единицы |

Доход в млн. долл. США, объемы в единицах, цены в долл. США |

|

Охваченные сегменты |

By Type (Aseptic Isolators, Containment Isolators, Bio Isolators, Sampling And Weighing Isolators, Active Pharmaceutical Ingredient (API) Manufacturing Isolators, Radiopharmaceutical Isolators, Production Isolators, Others), System Type (Closed System, Open System), Pressure (Positive Pressure, Negative Pressure), Configuration (Floor Standing, Modular, Mobile, Compact, Table Top, Portable, Others), Application (Sterility Testing, Manufacturing, Sampling/ Weighing/ Distribution, Medical Device Manufacturing), End User (Hospitals, Diagnostic Laboratories, Academic And Research Institutes, Pharmaceutical And Biotechnology Companies, Contract Research Organizations, Others), Distribution Channel (Direct Tender, Retail Sales, Third Party Distributors). |

|

Countries Covered |

Germany, France, U.K., Italy, Spain, Russia, Turkey, Belgium, Netherlands, Switzerland and the rest of Europe, |

|

Market Players Covered |

Getinge, SKAN AG, Hosokawa micron ltd, Gelman Singapore, Azbil Corporation, Germfree Laboratories, Inc., M. Braun Inertgas-Systeme Gmbh, Nuaire, Iteco S.R.L., Comecer S.P.A., Hecht Technologie Gmbh, Steriline S.R.L., Envair Limited, Tema Sinergie S.P.A, Schematic Engineering Industries, Chiyoda Corporation, Chamunda Pharma Machinery Pvt. Ltd, Bioquell (Ecolab Solution), Jacomex, Fedegari Autoclavi S.p.A., LAF Technologies, ISO Tech Design, Cytiva, Esco Pharma among others. |

Europe Pharmaceutical Isolator Market Definition

The isolation concept protects the process from the Operator and or the operator from the process, while protecting the environment. The key to containment, is minimal exposure. By controlling the exposure range below the hazard level set for the compound, the Operator and the environment are properly protected. Hence, the product is protected and therefore a key regulatory issue is addressed. A pharmaceutical isolator is a sealed bacterial enclosure used in the pharmaceutical surrounding for aseptic filling and toxic process. It is made of a perfectly sterile main isolator where the products are handled, stored or packaged using shoulder-high gloves placed on one of the walls. The pharmaceutical isolator enables the control and containment of pharmaceutical processes. The conditions required for working of a pharmaceutical isolator are sterile environment and free of viable microorganisms. A pharmaceutical isolator ensures that production area and aseptic environment are placed in separate positions. A pharmaceutical industry isolator is cost effective and efficient, in comparison to cleanrooms for the pharmaceutical industry in an aseptic environment. It creates a controlled atmosphere during the microbial and drug production process by adjusting with the different standards certification standard required for isolators and restricted access barriers. It ensures the protection of the product, the operators and the environment at the same time.

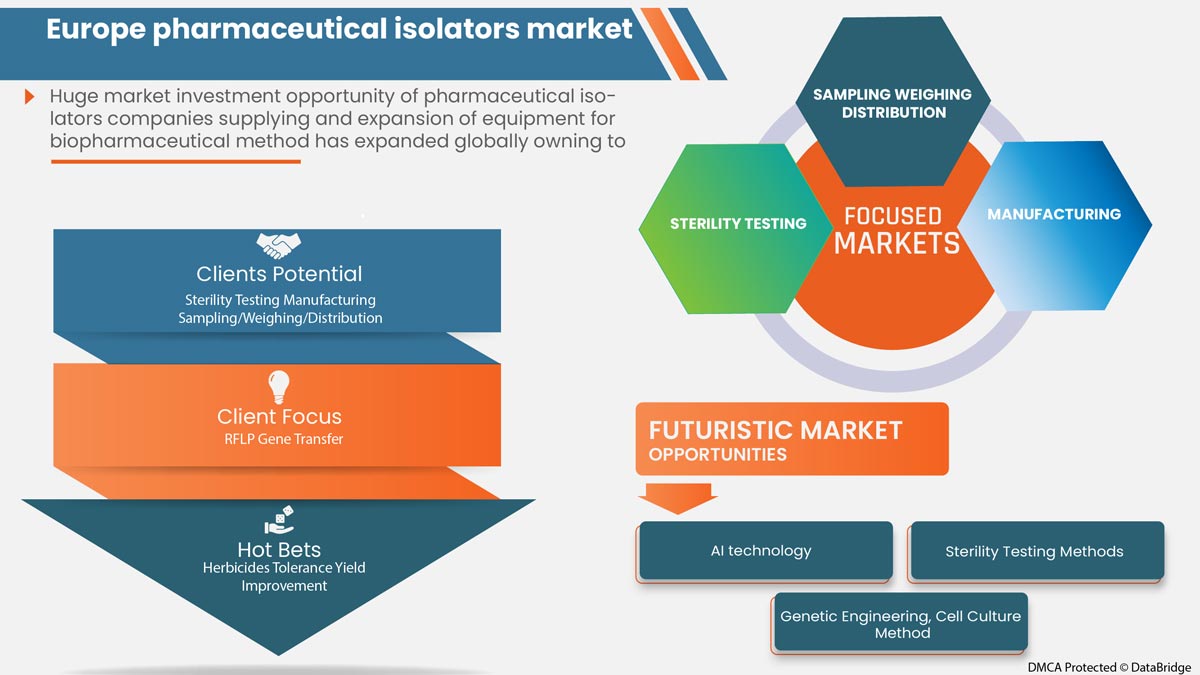

The abundant applications of pharmaceutical isolators, vary for production and control purposes. It is used while handling, transferring or packing solid semi-solid or powder pharma drugs, handling and filing solutions and infusions. The pharmaceutical isolators are applied in sterility testing, aseptic handling of tissues or biological production systems or pathogenic samples, etc. It can be used for the production and control of drugs and pharmaceutical products. The surge in demand for the isolators across pharmaceutical and biotechnology industry, along with low operational cost, high maintenance of aseptic condition in the production of pharmaceutical products and growing demand of biopharmaceutical industry are the factors expected to drive the market growth, in the forecast period.

Also, strategic initiative by market players, technological progressions in pharmaceutical isolators, high sterility assurance and increasing investment for healthcare infrastructure. These factors increase in the demand for pharmaceutical isolators market.

Europe Pharmaceutical Isolator Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail below:

Drivers

Growing demand for the pharmaceutical isolators across booming pharmaceutical

Pharmaceutical isolator is a separative device that divides a pharmaceutical procedure or activity from the operator and the adjacent environment. It is used for various purposes such as:

- Providing a categorized aseptic environment for an activity or procedure and guarding it from microbial and non-microbial contamination rising from the operator and adjacent environment which is referred to product protection.

- Protective product from contamination produced by other product and procedure, moreover at the same time or during earlier operations. This is referred to as safeguard against method generated contamination or cross- contamination.

The Increasing contamination problems in the manufacturing unit in which comes isolator that create a demand for Pharmaceutical isolator that helps in contamination and de-contamination.

- Low operational cost of pharmaceutical isolators

Enclosures that are sealed to some standard of leak tightness that comprises inside qualified controlled environment, at modification with the surrounding conditions isolator application reaches from R&D by the production of pharmaceuticals to laboratory use, especially for the microbiological quality control. Whereas pharmaceutical aseptic production has extremely high standards of cleanness almost completely particle free and germ free environments for the aseptic production.

Due to growth in the pharma industry and the widening product range more and more manufacturers and suppliers needs to think about investments in latest added technologies of the clean room technology.

Aseptic processing of the pharmaceutical drugs is the major factor need to be included in good manufacturing practices meeting the government regulations. The high cost of the maintenance of the aseptic condition by clean room technology which is around 62% higher than the pharmaceutical isolators, shifting the manufacturers to acquire isolator’s technology and constraining the overall manufacturing cost of the pharmaceutical products.

Restraint

Stringent governmental regulations

Active Pharmaceutical Ingredients (API) and intermediates for pharmaceutical use (for instance biological, radiopharmaceutical, and pharmaceutical) and those used to production drugs for clinical trials are regulated under the Divisions 1A and 2, Part C of the Food and Drug Regulations.

- Division 1A, Part C of the Food and Drug Regulations describes activities for which Good Manufacturing Practices (GMP) compliance is required and must be demonstrated prior to the issuance of an API establishment license (EL).

- Division 2, Part C of the Food and Drug Regulations defines the requirements for the GMP of APIs and API intermediates, which are interpreted in the present guidance document.

Due to this strict regulation by the government that has to be followed for the production by the Good Manufacturing Practices (GMP) Guidelines for Active Pharmaceutical Ingredients (API) - (GUI-0104) which constraining the market growth rate.

Opportunity

- Strategic initiatives by market players

The rise in the pharmaceutical isolators market increases the need for strategic business ideas. It includes a partnership, business expansion, and other development. The rising demand for pharmaceuticals is significantly increasing the demand for excipient and to cope with this demand companies are building new manufacturing sites among other strategic initiatives.

These strategic initiatives such as product launches, agreement and business expansion by the major market player will boost the pharmaceutical isolator market growth and is expected to act as an opportunity for the Europe medical display market.

Challenge

Lack of skilled expertise

The shortage of skilled expertise would challenge the pace of recovery and growth in one place. Often, the people who are unemployed in one place have skills that are in short supply elsewhere. Moreover, rapid technological advancement in this field also leads to lack of expertise.

Lack of skilled professionals while handling the pharmaceutical isolators poses a major challenge while selecting and developing the pharmaceutical isolators. The data by the Phys.org 2003 mentions the medical display industries are facing a shortage of workers due to increase demand of pharmaceutical isolators in Asia-Pacific region and severe scarcity of micro chips used in LED and LCD display, which increases the price lead times of LCD production.

As skill demands are too high, it has manifested as a challenge to retain and manage skill-specified professionals. Moreover, technological advancement is another aspect that leads to the increased demand for skilled professionals. Neurologists report significant unmet supportive care needs and barriers in their centers with only a small minority rating themselves as competently providing supportive care. There is an urgent need for education of neurologists and professionals for treatment of dementia and procuring available supportive care resources. Lack of trained and experienced professionals and persistent skill gaps limit the employability prospects and access to quality jobs. It is therefore apparent that availability of professionals equipped with adequate skills is expected to challenge the market growth.

Post-COVID-19 Impact on Europe Pharmaceutical Isolator Market

The COVID-19 pandemic has become the world's most serious threat. It wreaked havoc in many stores and businesses around the world. The pandemic, on the other hand, has provided many opportunities for pharmaceutical and biopharmaceutical companies to expand their research and development activities to develop new vaccines against the new coronavirus. Companies are conducting clinical trials to try to stop the spread of the COVID-19 virus. Pharmaceutical insulator suppliers to biopharmaceutical organizations have more opportunities as the number of clinical trials increases.

Manufacturers are making various strategic decisions to bounce back post-COVID-19. The players are conducting multiple R&D activities and product launch and strategic partnerships to improve the technology and test results involved in the pharmaceutical medical display market.

Recent Developments

- In June 2022, the company announced a partnership with Medical Supply Company (MSC) to market and service Jacomex equipment to the pharmaceutical and pharmaceutical industries in Ireland. MSC has many years of recognized expertise in the market with field teams closest to customers and company’s commercial team currently working abroad had the pleasure of welcoming Cian Murphy and finalizing the agreement between Jacomex and MSC. The beginning of a long and fruitful collaboration. This has helped the company to expand their business.

- In January 2022, Clario partnered with XingImaging, a radiopharmaceutical production and positron emission tomography (PET) acquisition company, to deliver PET imaging clinical trials for testing novel therapeutics in China. The partnership offers to share the joint resources and neuroscience experts of Clario and XingImaging to expedite the startup of clinical trials and drug discovery in China.

Europe Pharmaceutical isolator market Scope

Европейский рынок фармацевтических изоляторов сегментирован по типу, давлению, применению, конфигурации, типу системы, конечному пользователю и каналу сбыта. Рост среди сегментов помогает вам анализировать нишевые карманы роста и стратегии подхода к рынку и определять ваши основные области применения и разницу в ваших целевых рынках.

ЕВРОПЕЙСКИЙ РЫНОК ФАРМАЦЕВТИЧЕСКИХ ИЗОЛЯТОРОВ, ПО ТИПУ

- АСЕПТИЧЕСКИЕ ИЗОЛЯТОРЫ

- ИЗОЛЯТОРЫ СОДЕРЖАНИЯ

- БИОИЗОЛЯТОРЫ

- ИЗОЛЯТОРЫ ДЛЯ ОТБОРА ПРОБ И ВЗВЕШИВАНИЯ

- ИЗОЛЯТОРЫ ДЛЯ ПРОИЗВОДСТВА АКТИВНЫХ ФАРМАЦЕВТИЧЕСКИХ ИНГРЕДИЕНТОВ (АФИ)

- РАДИОФАРМАЦЕВТИЧЕСКИЕ ИЗОЛЯТОРЫ

- ПРОИЗВОДСТВЕННЫЕ ИЗОЛЯТОРЫ

- ДРУГИЕ

По типу рынок фармацевтических изоляторов в Европе сегментируется на асептические изоляторы, изоляторы с изоляцией, биоизоляторы, изоляторы для отбора проб и взвешивания, изоляторы для производства активных фармацевтических ингредиентов (АФИ), радиофармацевтические изоляторы, производственные изоляторы и другие.

ЕВРОПЕЙСКИЙ РЫНОК ФАРМАЦЕВТИЧЕСКИХ ИЗОЛЯТОРОВ ПО ТИПУ СИСТЕМЫ

- ЗАКРЫТАЯ СИСТЕМА

- ОТКРЫТАЯ СИСТЕМА

В зависимости от типа системы европейский рынок фармацевтических изоляторов подразделяется на закрытые системы и открытые системы.

ЕВРОПЕЙСКИЙ РЫНОК ФАРМАЦЕВТИЧЕСКИХ ИЗОЛЯТОРОВ ПО ДАВЛЕНИЮ

- ПОЛОЖИТЕЛЬНОЕ ДАВЛЕНИЕ

- ОТРИЦАТЕЛЬНОЕ ДАВЛЕНИЕ

По типу давления европейский рынок фармацевтических изоляторов подразделяется на изоляторы с положительным и отрицательным давлением.

ЕВРОПЕЙСКИЙ РЫНОК ФАРМАЦЕВТИЧЕСКИХ ИЗОЛЯТОРОВ ПО КОНФИГУРАЦИИ

- НАПОЛЬНЫЙ

- МОДУЛЬНЫЙ

- МОБИЛЬНЫЙ

- КОМПАКТНЫЙ

- СТОЛЕШНИЦА

- ПОРТАТИВНЫЙ

- ДРУГИЕ

По конфигурации рынок фармацевтических изоляторов в Европе сегментируется на напольные, модульные, мобильные, компактные, настольные, переносные и другие.

ЕВРОПЕЙСКИЙ РЫНОК ФАРМАЦЕВТИЧЕСКИХ ИЗОЛЯТОРОВ ПО ОБЛАСТИ ПРИМЕНЕНИЯ

- ИСПЫТАНИЕ НА СТЕРИЛЬНОСТЬ

- ПРОИЗВОДСТВО

- ОТБОР ПРОБ/ВЗВЕШИВАНИЕ/РАСПРЕДЕЛЕНИЕ

- ПРОИЗВОДСТВО МЕДИЦИНСКИХ ИЗДЕЛИЙ

- ДРУГИЕ

В зависимости от сферы применения европейский рынок фармацевтических изоляторов подразделяется на испытания на стерильность, производство, отбор проб/взвешивание/распределение, производство медицинских приборов и другие.

ЕВРОПЕЙСКИЙ РЫНОК ФАРМАЦЕВТИЧЕСКИХ ИЗОЛЯТОРОВ ПО КОНЕЧНОМУ ПОЛЬЗОВАТЕЛЮ

- БОЛЬНИЦЫ

- ДИАГНОСТИЧЕСКИЕ ЛАБОРАТОРИИ

- АКАДЕМИЧЕСКИЕ И НАУЧНО-ИССЛЕДОВАТЕЛЬСКИЕ ИНСТИТУТЫ

- ФАРМАЦЕВТИЧЕСКИЕ И БИОТЕХНОЛОГИЧЕСКИЕ КОМПАНИИ

- КОНТРАКТНЫЕ ИССЛЕДОВАТЕЛЬСКИЕ ОРГАНИЗАЦИИ

- ДРУГИЕ

По признаку конечного пользователя рынок фармацевтических изоляторов в Европе сегментирован на больницы, диагностические лаборатории, академические и научно-исследовательские институты, фармацевтические и биотехнологические компании, контрактные исследовательские организации и т. д.

ЕВРОПЕЙСКИЙ РЫНОК ФАРМАЦЕВТИЧЕСКИХ ИЗОЛЯТОРОВ ПО КАНАЛАМ РАСПРОСТРАНЕНИЯ

- ПРЯМОЙ ТЕНДЕР

- РОЗНИЧНЫЕ ПРОДАЖИ

- СТОРОННИЕ ДИСТРИБЬЮТОРЫ

По каналам сбыта рынок фармацевтических изоляторов в Европе сегментируется на прямые торги, розничные продажи и сторонних дистрибьюторов.

Региональный анализ/информация о рынке фармацевтических изоляторов в Европе

Проведен анализ европейского рынка фармацевтических изоляторов и предоставлена информация о его размере, типе, давлении, применении, конфигурации, типе системы, конечном пользователе и канале сбыта.

Страны, охваченные данным отчетом о рынке: Германия, Франция, Великобритания, Италия, Испания, Россия, Турция, Бельгия, Нидерланды, Швейцария и остальные страны Европы.

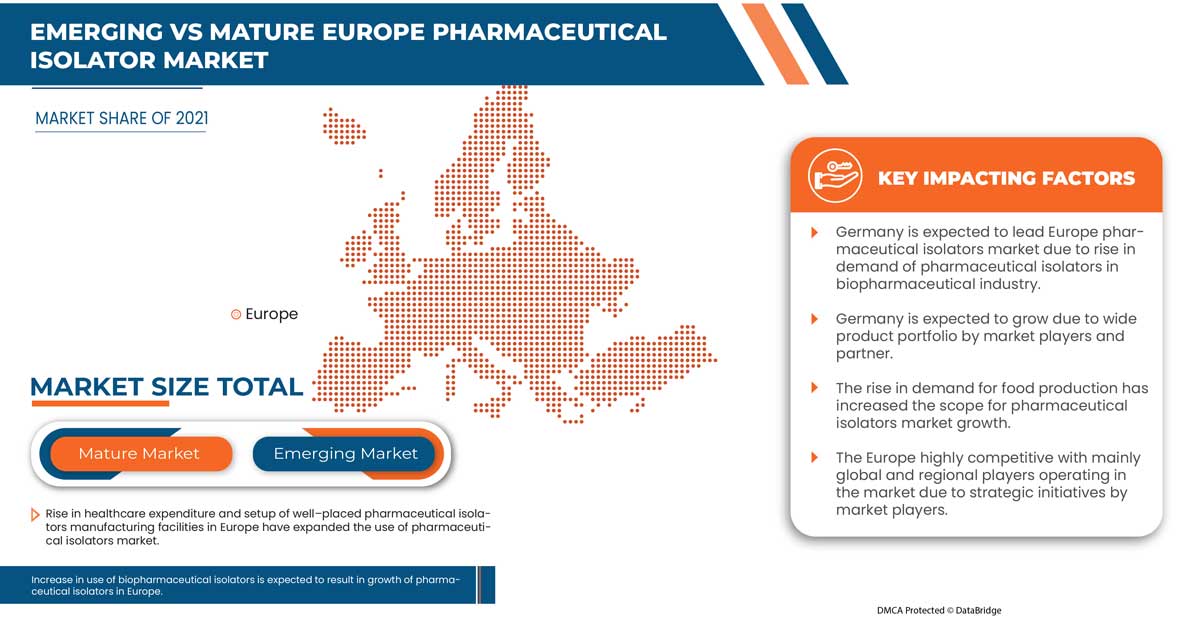

В 2022 году Германия будет доминировать благодаря быстрорастущему фармацевтическому рынку в сочетании с ростом производства фармацевтического оборудования и растущим спросом со стороны развивающихся рынков, а также расширением отраслей здравоохранения.

Раздел отчета по странам также содержит отдельные факторы, влияющие на рынок, и изменения в регулировании на внутреннем рынке, которые влияют на текущие и будущие тенденции рынка. Такие данные, как новые продажи, заменяющие продажи, демографические данные страны, нормативные акты и импортно-экспортные пошлины, являются одними из основных указателей, используемых для прогнозирования рыночного сценария для отдельных стран. Кроме того, при предоставлении прогнозного анализа данных по странам учитываются наличие и доступность европейских брендов и их проблемы из-за большой или малой конкуренции со стороны местных и отечественных брендов, а также влияние каналов продаж.

Конкурентная среда и анализ доли европейского рынка фармацевтических изоляторов

Конкурентная среда европейского фармацевтического рынка изоляторов содержит сведения по конкурентам. Включены сведения о компании, финансы компании, полученный доход, рыночный потенциал, инвестиции в НИОКР, новые рыночные инициативы, производственные площадки и объекты, сильные и слабые стороны компании, запуск продукта, испытания продуктов, одобрения продуктов, патенты, ширина и дыхание продукта, доминирование приложений, кривая жизненной линии технологий. Приведенные выше данные относятся только к фокусу компании на европейском рынке фармацевтических изоляторов.

Некоторые из основных игроков, работающих на европейском рынке фармацевтических изоляторов: Getinge, SKAN AG, Hosokawa micron ltd, Gelman Singapore, Azbil Corporation, Germfree Laboratories, Inc., M. Braun Inertgas-Systeme Gmbh, Nuaire, Iteco SRL, Comecer SPA, Hecht Technologie Gmbh, Steriline SRL, Envair Limited, Tema Sinergie SPA, Schematic Engineering Industries, Chiyoda Corporation, Chamunda Pharma Machinery Pvt. Ltd, Bioquell (Ecolab Solution), Jacomex, Fedegari Autoclavi SpA, LAF Technologies, ISO Tech Design, Cytiva, Esco Pharma.

Методология исследования: Европейский рынок фармацевтических изоляторов

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Рыночные данные анализируются и оцениваются с использованием рыночных статистических и когерентных моделей. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в рыночном отчете. Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Помимо этого, модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, анализ доли рынка компании, стандарты измерения, Европа против региона и анализ доли поставщиков. Пожалуйста, запросите звонок аналитика в случае дальнейшего запроса.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Содержание

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE EUROPE PHARMACEUTICAL ISOLATOR MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET APPLICATION COVERAGE GRID

2.8 SOURCE LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHT

4.1 PESTEL ANALYSIS

4.2 PORTER’S FIVE FORCES

4.3 INDUSTRIAL INSIGHTS:

5 EUROPE PHARMACEUTICAL ISOLATORS MARKET: REGULATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING DEMAND FOR THE PHARMACEUTICAL ISOLATORS ACROSS BOOMING PHARMACEUTICAL

6.1.2 LOW OPERATIONAL COST OF PHARMACEUTICAL ISOLATORS

6.1.3 HIGH MAINTENANCE OF ASEPTIC CONDITIONS IN THE PRODUCTION OF PHARMACEUTICAL PRODUCTS

6.1.4 LOW OPERATING COST OF PHARMACEUTICAL ISOLATORS & GROWING DEMAND IN THE BIOPHARMACEUTICAL INDUSTRY

6.2 RESTRAINTS

6.2.1 STRINGENT GOVERNMENTAL REGULATIONS

6.2.2 HIGH COST OF INSTALLATION & LIMITED ADOPTION OF RABS

6.3 OPPORTUNITIES

6.3.1 STRATEGIC INITIATIVES BY MARKET PLAYERS

6.3.2 TECHNOLOGICAL ADVANCEMENTS IN PHARMACEUTICAL ISOLATORS

6.3.3 HIGH STERILITY ASSURANCE

6.4 CHALLENGES

6.4.1 LACK OF SKILLED EXPERTISE

6.4.2 ENGINEERING CHALLENGES FACED WHILE DESIGNING THE PHARMACEUTICAL ISOLATORS

7 EUROPE PHARMACEUTICAL ISOLATOR MARKET, BY TYPE

7.1 OVERVIEW

7.2 ASEPTIC ISOLATOR

7.3 ACTIVE PHARMACEUTICAL INGREDIENT (API) MANUFACTURING ISOLATORS

7.4 CONTAINMENT ISOLATORS

7.5 BIO ISOLATORS

7.6 SAMPLING AND WEIGHING ISOLATORS

7.7 RADIOPHARMACEUTICAL ISOLATORS

7.8 PRODUCTION ISOLATORS

7.9 OTHERS

8 EUROPE PHARMACEUTICAL ISOLATOR MARKET, BY SYSTEM TYPE

8.1 OVERVIEW

8.2 OPEN SYSTEM

8.3 CLOSED SYSTEM

9 EUROPE PHARMACEUTICAL ISOLATOR MARKET, BY PRESSURE

9.1 OVERVIEW

9.2 POSITIVE PRESSURE

9.3 NEGATIVE PRESSURE

10 EUROPE PHARMACEUTICAL ISOLATOR MARKET, BY CONFIGURATION

10.1 OVERVIEW

10.2 FLOOR STANDING

10.3 MODULAR

10.4 MOBILE

10.5 COMPACT

10.6 TABLE TOP

10.7 PORTABLE

10.8 OTHERS

11 EUROPE PHARMACEUTICAL ISOLATOR MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 STERILITY TESTING

11.3 MANUFACTURING

11.4 SAMPLING/WEIGHING/DISTRIBUTION

11.5 MEDICAL DEVICE MANUFACTURING

12 EUROPE PHARMACEUTICAL ISOLATOR MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 DIRECT TENDER

12.3 RETAIL SALES

12.4 THIRD PARTY DISTRIBUTORS

13 EUROPE PHARMACEUTICAL ISOLATOR MARKET, BY END USER

13.1 OVERVIEW

13.2 PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES

13.2.1 STERILE FILTERING

13.2.2 AMPULE FILLING

13.2.3 SYRINGE FILLING

13.2.4 SAMPLING

13.2.5 SAMPLE TESTING

13.2.6 STERILITY TESTING

13.2.7 PACKAGING

13.2.8 OTHERS

13.3 CONTRACT RESEARCH ORGANIZATION

13.3.1 STERILE FILTERING

13.3.2 AMPULE FILLING

13.3.3 SYRINGE FILLING

13.3.4 SAMPLING

13.3.5 SAMPLE TESTING

13.3.6 STERILITY TESTING

13.3.7 PACKAGING

13.3.8 OTHERS

13.4 ACADEMIC AND RESEARCH INSTITUTES

13.4.1 STERILE FILTERING

13.4.2 AMPULE FILLING

13.4.3 SYRINGE FILLING

13.4.4 SAMPLING

13.4.5 SAMPLE TESTING

13.4.6 STERILITY TESTING

13.4.7 PACKAGING

13.4.8 OTHERS

13.5 HOSPITALS

13.5.1 STERILE FILTERING

13.5.2 AMPULE FILLING

13.5.3 SYRINGE FILLING

13.5.4 SAMPLING

13.5.5 SAMPLE TESTING

13.5.6 STERILITY TESTING

13.5.7 PACKAGING

13.5.8 OTHERS

13.6 DIAGNOSTIC LABORATORIES

13.6.1 STERILE FILTERING

13.6.2 AMPULE FILLING

13.6.3 SYRINGE FILLING

13.6.4 SAMPLING

13.6.5 SAMPLE TESTING

13.6.6 STERILITY TESTING

13.6.7 PACKAGING

13.6.8 OTHERS

13.7 OTHERS

14 EUROPE PHARMACEUTICAL ISOLATOR MARKET, BY REGION

14.1 EUROPE

14.1.1 GERMANY

14.1.2 FRANCE

14.1.3 U.K.

14.1.4 ITALY

14.1.5 RUSSIA

14.1.6 SPAIN

14.1.7 TURKEY

14.1.8 NETHERLANDS

14.1.9 SWITZERLAND

14.1.10 BELGIUM

14.1.11 REST OF EUROPE

15 EUROPE PHARMACEUTICAL ISOLATORS MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: EUROPE

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 GETINGE AB

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 COMPANY SHARE ANALYSIS

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENT

17.2 CYTIVA (A SUBSIDIARY OF DANAHER CORPORATION)

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENT

17.3 AZBIL CORPORATION

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 COMPANY SHARE ANALYSIS

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENTS

17.4 CHIYODA CORPORATION

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 COMPANY SHARE ANALYSIS

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENT

17.5 HOSOKAWA MICRON LTD

17.5.1 COMPANY SNAPSHOT

17.5.2 COMPANY SHARE ANALYSIS

17.5.3 PRODUCT PORTFOLIO

17.5.4 RECENT DEVELOPMENTS

17.6 BIOQUELL, AN ECOLAB SOLUTION (A SUBSIDIARY OF ECOLAB)

17.6.1 COMPANY SNAPSHOT

17.6.2 REVENUE ANALYSIS

17.6.3 PRODUCT PORTFOLIO

17.6.4 RECENT DEVELOPMENT

17.7 CHAMUNDA PHARMA MACHNIERY

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT DEVELOPMENTS

17.8 COMECER S.P.A. (A SUBSIDIARY OF ATS AUTOMATION TOOLS) (2021)

17.8.1 COMPANY SNAPSHOT

17.8.2 REVENUE ANALYSIS

17.8.3 PRODUCT PORTFOLIO

17.8.4 RECENT DEVELOPMENT

17.9 ENVAIR TECHNOLOGY

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENTS

17.1 ESCO MICRO PTE. LTD

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENT

17.11 FEDEGARI AUTOCLAVI S.P.A

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENTS

17.12 GERMFREE LABORATORIES, INC.

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENT

17.13 GELMAN SINGAPORE

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENTS

17.14 HECT TECHNOLOGIE GMBH (2021)

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENT

17.15 ISO TECH DESIGN

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENTS

17.16 ITECO SRL

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENT

17.17 JACOMEX

17.17.1 COMPANY SNAPSHOT

17.17.2 PRODUCT PORTFOLIO

17.17.3 RECENT DEVELOPMENT

17.18 LAF TECHNOLOGIES

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENTS

17.19 MBRAUN.(2021)

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT DEVELOPMENT

17.2 NUAIRE (A SUBSIDIARY OF GENUIT GROUP PLC)

17.20.1 COMPANY SNAPSHOT

17.20.2 REVENUE ANALYSIS

17.20.3 PRODUCT PORTFOLIO

17.20.4 RECENT DEVELOPMENTS

17.21 STERILINE (2021)

17.21.1 COMPANY SNAPSHOT

17.21.2 PRODUCT PORTFOLIO

17.21.3 RECENT DEVELOPMENTS

17.22 SCHEMATIC ENGINEERING INDUSTRY

17.22.1 COMPANY SNAPSHOT

17.22.2 PRODUCT PORTFOLIO

17.22.3 RECENT DEVELOPMENTS

17.23 SKAN AG

17.23.1 COMPANY SNAPSHOT

17.23.2 REVENUE ANALYSIS

17.23.3 PRODUCT PORTFOLIO

17.23.4 RECENT DEVELOPMENT

17.24 TEMA SINERGIE S.P.A

17.24.1 COMPANY SNAPSHOT

17.24.2 PRODUCT PORTFOLIO

17.24.3 RECENT DEVELOPMENTS

18 QUESTIONNAIRE

19 RELATED REPORTS

Список таблиц

TABLE 1 OPERATING COSTS FOR ASEPTIC PRODUCTION UNDER RABS OR ISOLATOR

TABLE 2 APPLICATION OF GUI-0104 TO API MANUFACTURING

TABLE 3 EUROPE PHARMACEUTICAL ISOLATOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 EUROPE ASEPTIC ISOLATOR IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 EUROPE ACTIVE PHARMACEUTICAL INGREDIENT (API) MANUFACTURING ISOLATORS IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 EUROPE CONTAINMENT ISOLATORS IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 EUROPE BIO ISOLATORS IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 EUROPE SAMPLING AND WEIGHING ISOLATORS IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 EUROPE RADIOPHARMACEUTICAL ISOLATORS IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 EUROPE PRODUCTION ISOLATORS IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 EUROPE OTHERS IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 EUROPE PHARMACEUTICAL ISOLATOR MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 13 EUROPE OPEN SYSTEM IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 EUROPE CLOSED SYSTEM IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 EUROPE PHARMACEUTICAL ISOLATOR MARKET, BY PRESSURE, 2020-2029 (USD MILLION)

TABLE 16 EUROPE POSITIVE PRESSURE IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 EUROPE NEGATIVE PRESSURE IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 EUROPE PHARMACEUTICAL ISOLATOR MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 19 EUROPE FLOOR STANDING IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 EUROPE MODULAR IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 EUROPE MOBILE IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 EUROPE COMPACT IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 EUROPE TABLE TOP IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 EUROPE PORTABLE IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 EUROPE OTHERS IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 EUROPE PHARMACEUTICAL ISOLATOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 27 EUROPE STERILITY TESTING IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 EUROPE MANUFACTURING IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 EUROPE SAMPLING/WEIGHING/DISTRIBUTION IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 EUROPE MEDICAL DEVICE MANUFACTURING IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 EUROPE PHARMACEUTICAL ISOLATOR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 32 EUROPE DIRECT TENDER IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 EUROPE RETAIL SALES INPHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 EUROPE THIRD PARTY DISTRIBUTORS IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 EUROPE PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 36 EUROPE PHARMACEUTICAL AND BIOTECHNOLOGICAL COMPANIES IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 EUROPE PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 38 EUROPE CONTRACT RESEARCH ORGANIZATIONS IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 EUROPE CONTRACT RESEARCH ORGANIZATIONS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 40 EUROPE ACADEMIC AND RESEARCH INSTITUTES IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 EUROPE ACADEMIC RESEARCH & INSTITUTES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 42 EUROPE HOSPITALS IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 43 EUROPE HOSPITALS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 44 EUROPE DIAGNOSTIC LABARATORIES IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 45 EUROPE DIAGNOSTICS LABORATORIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 46 EUROPE OTHERS IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 47 EUROPE PHARMACEUTICAL ISOLATOR MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 48 EUROPE PHARMACEUTICAL ISOLATOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 49 EUROPE PHARMACEUTICAL ISOLATOR MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 50 EUROPE PHARMACEUTICAL ISOLATOR MARKET, BY PRESSURE, 2020-2029 (USD MILLION)

TABLE 51 EUROPE PHARMACEUTICAL ISOLATOR MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 52 EUROPE PHARMACEUTICAL ISOLATOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 53 EUROPE PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 54 EUROPE PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 55 EUROPE CONTRACT RESEARCH ORGANIZATIONS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 56 EUROPE ACADEMIC RESEARCH & INSTITUTES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 57 EUROPE HOSPITALS LABORATORIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 58 EUROPE DIAGNOSTICS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 59 EUROPE PHARMACEUTICAL ISOLATOR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 60 GERMANY PHARMACEUTICAL ISOLATOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 61 GERMANY PHARMACEUTICAL ISOLATOR MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 62 GERMANY PHARMACEUTICAL ISOLATOR MARKET, BY PRESSURE, 2020-2029 (USD MILLION)

TABLE 63 GERMANY PHARMACEUTICAL ISOLATOR MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 64 GERMANY PHARMACEUTICAL ISOLATOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 65 GERMANY PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 66 GERMANY PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 67 GERMANY CONTRACT RESEARCH ORGANIZATIONS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 68 GERMANY ACADEMIC RESEARCH & INSTITUTES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 69 GERMANY HOSPITALS LABORATORIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 70 GERMANY DIAGNOSTICS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 71 GERMANY PHARMACEUTICAL ISOLATOR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 72 FRANCE PHARMACEUTICAL ISOLATOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 73 FRANCE PHARMACEUTICAL ISOLATOR MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 74 FRANCE PHARMACEUTICAL ISOLATOR MARKET, BY PRESSURE, 2020-2029 (USD MILLION)

TABLE 75 FRANCE PHARMACEUTICAL ISOLATOR MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 76 FRANCE PHARMACEUTICAL ISOLATOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 77 FRANCE PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 78 FRANCE PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 79 FRANCE CONTRACT RESEARCH ORGANIZATIONS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 80 FRANCE ACADEMIC RESEARCH & INSTITUTES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 81 FRANCE HOSPITALS LABORATORIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 82 FRANCE DIAGNOSTICS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 83 FRANCE PHARMACEUTICAL ISOLATOR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 84 U.K. PHARMACEUTICAL ISOLATOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 85 U.K. PHARMACEUTICAL ISOLATOR MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 86 U.K. PHARMACEUTICAL ISOLATOR MARKET, BY PRESSURE, 2020-2029 (USD MILLION)

TABLE 87 U.K. PHARMACEUTICAL ISOLATOR MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 88 U.K. PHARMACEUTICAL ISOLATOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 89 U.K. PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 90 U.K. PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 91 U.K. CONTRACT RESEARCH ORGANIZATIONS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 92 U.K. ACADEMIC RESEARCH & INSTITUTES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 93 U.K. HOSPITALS LABORATORIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 94 U.K. DIAGNOSTICS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 95 U.K. PHARMACEUTICAL ISOLATOR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 96 ITALY PHARMACEUTICAL ISOLATOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 97 ITALY PHARMACEUTICAL ISOLATOR MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 98 ITALY PHARMACEUTICAL ISOLATOR MARKET, BY PRESSURE, 2020-2029 (USD MILLION)

TABLE 99 ITALY PHARMACEUTICAL ISOLATOR MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 100 ITALY PHARMACEUTICAL ISOLATOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 101 ITALY PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 102 ITALY PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 103 ITALY CONTRACT RESEARCH ORGANIZATIONS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 104 ITALY ACADEMIC RESEARCH & INSTITUTES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 105 ITALY HOSPITALS LABORATORIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 106 ITALY DIAGNOSTICS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 107 ITALY PHARMACEUTICAL ISOLATOR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 108 RUSSIA PHARMACEUTICAL ISOLATOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 109 RUSSIA PHARMACEUTICAL ISOLATOR MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 110 RUSSIA PHARMACEUTICAL ISOLATOR MARKET, BY PRESSURE, 2020-2029 (USD MILLION)

TABLE 111 RUSSIA PHARMACEUTICAL ISOLATOR MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 112 RUSSIA PHARMACEUTICAL ISOLATOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 113 RUSSIA PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 114 RUSSIA PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 115 RUSSIA CONTRACT RESEARCH ORGANIZATIONS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 116 RUSSIA ACADEMIC RESEARCH & INSTITUTES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 117 RUSSIA HOSPITALS LABORATORIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 118 RUSSIA DIAGNOSTICS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 119 RUSSIA PHARMACEUTICAL ISOLATOR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 120 SPAIN PHARMACEUTICAL ISOLATOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 121 SPAIN PHARMACEUTICAL ISOLATOR MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 122 SPAIN PHARMACEUTICAL ISOLATOR MARKET, BY PRESSURE, 2020-2029 (USD MILLION)

TABLE 123 SPAIN PHARMACEUTICAL ISOLATOR MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 124 SPAIN PHARMACEUTICAL ISOLATOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 125 SPAIN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 126 SPAIN PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 127 SPAIN CONTRACT RESEARCH ORGANIZATIONS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 128 SPAIN ACADEMIC RESEARCH & INSTITUTES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 129 SPAIN HOSPITALS LABORATORIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 130 SPAIN DIAGNOSTICS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 131 SPAIN PHARMACEUTICAL ISOLATOR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 132 TURKEY PHARMACEUTICAL ISOLATOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 133 TURKEY PHARMACEUTICAL ISOLATOR MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 134 TURKEY PHARMACEUTICAL ISOLATOR MARKET, BY PRESSURE, 2020-2029 (USD MILLION)

TABLE 135 TURKEY PHARMACEUTICAL ISOLATOR MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 136 TURKEY PHARMACEUTICAL ISOLATOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 137 TURKEY PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 138 TURKEY PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 139 TURKEY CONTRACT RESEARCH ORGANIZATIONS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 140 TURKEY ACADEMIC RESEARCH & INSTITUTES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 141 TURKEY HOSPITALS LABORATORIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 142 TURKEY DIAGNOSTICS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 143 TURKEY PHARMACEUTICAL ISOLATOR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 144 NETHERLAND PHARMACEUTICAL ISOLATOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 145 NETHERLAND PHARMACEUTICAL ISOLATOR MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 146 NETHERLAND PHARMACEUTICAL ISOLATOR MARKET, BY PRESSURE, 2020-2029 (USD MILLION)

TABLE 147 NETHERLAND PHARMACEUTICAL ISOLATOR MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 148 NETHERLAND PHARMACEUTICAL ISOLATOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 149 NETHERLAND PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 150 NETHERLAND PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 151 NETHERLAND CONTRACT RESEARCH ORGANIZATIONS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 152 NETHERLAND ACADEMIC RESEARCH & INSTITUTES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 153 NETHERLAND HOSPITALS LABORATORIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 154 NETHERLAND DIAGNOSTICS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 155 NETHERLAND PHARMACEUTICAL ISOLATOR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 156 SWITZERLAND PHARMACEUTICAL ISOLATOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 157 SWITZERLAND PHARMACEUTICAL ISOLATOR MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 158 SWITZERLAND PHARMACEUTICAL ISOLATOR MARKET, BY PRESSURE, 2020-2029 (USD MILLION)

TABLE 159 SWITZERLAND PHARMACEUTICAL ISOLATOR MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 160 SWITZERLAND PHARMACEUTICAL ISOLATOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 161 SWITZERLAND PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 162 SWITZERLAND PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 163 SWITZERLAND CONTRACT RESEARCH ORGANIZATIONS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 164 SWITZERLAND ACADEMIC RESEARCH & INSTITUTES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 165 SWITZERLAND HOSPITALS LABORATORIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 166 SWITZERLAND DIAGNOSTICS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 167 SWITZERLAND PHARMACEUTICAL ISOLATOR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 168 BELGIUM PHARMACEUTICAL ISOLATOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 169 BELGIUM PHARMACEUTICAL ISOLATOR MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 170 BELGIUM PHARMACEUTICAL ISOLATOR MARKET, BY PRESSURE, 2020-2029 (USD MILLION)

TABLE 171 BELGIUM PHARMACEUTICAL ISOLATOR MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 172 BELGIUM PHARMACEUTICAL ISOLATOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 173 BELGIUM PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 174 BELGIUM PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 175 BELGIUM CONTRACT RESEARCH ORGANIZATIONS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 176 BELGIUM ACADEMIC RESEARCH & INSTITUTES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 177 BELGIUM HOSPITALS LABORATORIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 178 BELGIUM DIAGNOSTICS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 179 BELGIUM PHARMACEUTICAL ISOLATOR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 180 REST OF EUROPE PHARMACEUTICAL ISOLATOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

Список рисунков

FIGURE 1 EUROPE PHARMACEUTICAL ISOLATOR MARKET: SEGMENTATION

FIGURE 2 EUROPE PHARMACEUTICAL ISOLATOR MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE PHARMACEUTICAL ISOLATOR MARKET: DROC ANALYSIS

FIGURE 4 EUROPE PHARMACEUTICAL ISOLATOR MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 EUROPE PHARMACEUTICAL ISOLATOR MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE PHARMACEUTICAL ISOLATOR MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE PHARMACEUTICAL ISOLATOR MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 8 EUROPE PHARMACEUTICAL ISOLATOR MARKET: DBMR MARKET POSITION GRID

FIGURE 9 EUROPE PHARMACEUTICAL ISOLATOR MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 EUROPE PHARMACEUTICAL ISOLATOR MARKET: SEGMENTATION

FIGURE 11 INCREASING USE OF PHARMACEUTICAL ISOLATORS IS EXPECTED TO DRIVE THE EUROPE PHARMACEUTICAL ISOLATOR MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 ASEPTIC ISOLATORS IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE PHARMACEUTICAL ISOLATOR MARKET IN 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE EUROPE PHARMACEUTICAL ISOLATOR MARKET

FIGURE 14 EUROPE PHARMACEUTICAL ISOLATOR MARKET: BY TYPE, 2021

FIGURE 15 EUROPE PHARMACEUTICAL ISOLATOR MARKET: BY TYPE, 2022-2029 (USD MILLION)

FIGURE 16 EUROPE PHARMACEUTICAL ISOLATOR MARKET: BY TYPE, CAGR (2022-2029)

FIGURE 17 EUROPE PHARMACEUTICAL ISOLATOR MARKET: BY TYPE, LIFELINE CURVE

FIGURE 18 EUROPE PHARMACEUTICAL ISOLATOR MARKET: BY SYSTEM TYPE, 2021

FIGURE 19 EUROPE PHARMACEUTICAL ISOLATOR MARKET: BY SYSTEM TYPE, 2022-2029 (USD MILLION)

FIGURE 20 EUROPE PHARMACEUTICAL ISOLATOR MARKET: BY SYSTEM TYPE, CAGR (2022-2029)

FIGURE 21 EUROPE PHARMACEUTICAL ISOLATOR MARKET: BY SYSTEM TYPE, LIFELINE CURVE

FIGURE 22 EUROPE PHARMACEUTICAL ISOLATOR MARKET: BY PRESSURE, 2021

FIGURE 23 EUROPE PHARMACEUTICAL ISOLATOR MARKET: BY PRESSURE, 2022-2029 (USD MILLION)

FIGURE 24 EUROPE PHARMACEUTICAL ISOLATOR MARKET: BY PRESSURE, CAGR (2022-2029)

FIGURE 25 EUROPE PHARMACEUTICAL ISOLATOR MARKET: BY PRESSURE, LIFELINE CURVE

FIGURE 26 EUROPE PHARMACEUTICAL ISOLATOR MARKET: BY CONFIGURATION, 2021

FIGURE 27 EUROPE PHARMACEUTICAL ISOLATOR MARKET: BY CONFIGURATION, 2022-2029 (USD MILLION)

FIGURE 28 EUROPE PHARMACEUTICAL ISOLATOR MARKET: BY CONFIGURATION, CAGR (2022-2029)

FIGURE 29 EUROPE PHARMACEUTICAL ISOLATOR MARKET: BY CONFIGURATION, LIFELINE CURVE

FIGURE 30 EUROPE PHARMACEUTICAL ISOLATOR MARKET: BY APPLICATION, 2021

FIGURE 31 EUROPEPHARMACEUTICAL ISOLATOR MARKET: BY APPLICATION, 2022-2029 (USD MILLION)

FIGURE 32 EUROPE PHARMACEUTICAL ISOLATOR MARKET: BY APPLICATION, CAGR (2022-2029)

FIGURE 33 EUROPE PHARMACEUTICAL ISOLATOR MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 34 EUROPE PHARMACEUTICAL ISOLATOR MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 35 EUROPEPHARMACEUTICAL ISOLATOR MARKET: BY DISTRIBUTION CHANNEL, 2022-2029 (USD MILLION)

FIGURE 36 EUROPEPHARMACEUTICAL ISOLATOR MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 37 EUROPEPHARMACEUTICAL ISOLATOR MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 38 EUROPE PHARMACEUTICAL ISOLATOR MARKET : BY END USER, 2021

FIGURE 39 EUROPE PHARMACEUTICAL ISOLATOR MARKET : BY END USER, 2022-2029 (USD MILLION)

FIGURE 40 EUROPE PHARMACEUTICAL ISOLATOR MARKET : BY END USER, CAGR (2022-2029)

FIGURE 41 EUROPE PHARMACEUTICAL ISOLATOR MARKET : BY END USER, LIFELINE CURVE

FIGURE 42 EUROPE PHARMACEUTICAL ISOLATOR MARKET: SNAPSHOT (2021)

FIGURE 43 EUROPE PHARMACEUTICAL ISOLATOR MARKET: BY COUNTRY (2021)

FIGURE 44 EUROPE PHARMACEUTICAL ISOLATOR MARKET: BY COUNTRY (2022 & 2029)

FIGURE 45 EUROPE PHARMACEUTICAL ISOLATOR MARKET: BY COUNTRY (2021 & 2029)

FIGURE 46 EUROPE PHARMACEUTICAL ISOLATOR MARKET: TYPE (2022-2029)

FIGURE 47 EUROPE PHARMACEUTICAL ISOLATORS MARKET: COMPANY SHARE 2021 (%)

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.