Europe Microgrid Market, By Connectivity (Off-Grid/Island/Remote, Grid Connected), Offering (Hardware, Software, Services), Pattern (Urban, Semi-Urban, Remote Island), Source (Diesel Generators, CHP, Solar Pv, Natural Gas, Others), Storage (Lithium-Ion, Lead Acid, Solar Batteries, Flywheel, Others), Grid Type (AC Microgrid, DC Microgrid, Hybrid Microgrid), Capacity (Less Than 5,000 MW, 5,001 – 10,000 MW, 10,001 – 15,000 MW, More Than 15,000 MW), Control (Primary (Local Control), Secondary, Tertiary (Optimization) Control), Application (Remote Location, Utility, Industrial, Campus, Military, Smart City, Data Center, Hospital, School, Others) - Industry Trends And Forecast to 2029.

Market Definition

A microgrid is a distinct energy system that consists of interconnected loads and distributed energy resources that are capable of operating in parallel with, or independently from the main power grid. Microgrids, in general, are smaller versions of power networks that transport electricity from generators to consumers. They help to lower overall costs and provide grid backup in the event of an outage. Microgrids are more efficient than regular electrical grids and can be integrated with a variety of renewable energy sources such as solar, wind, small hydro, geothermal, waste-to-energy, and combined heat and power (CHP) systems. batteries, distributed generators, and solar panels can also be used to power them. Furthermore, they are also a reliable source of electricity because they operate continuously during power outages.

Market Analysis and Size

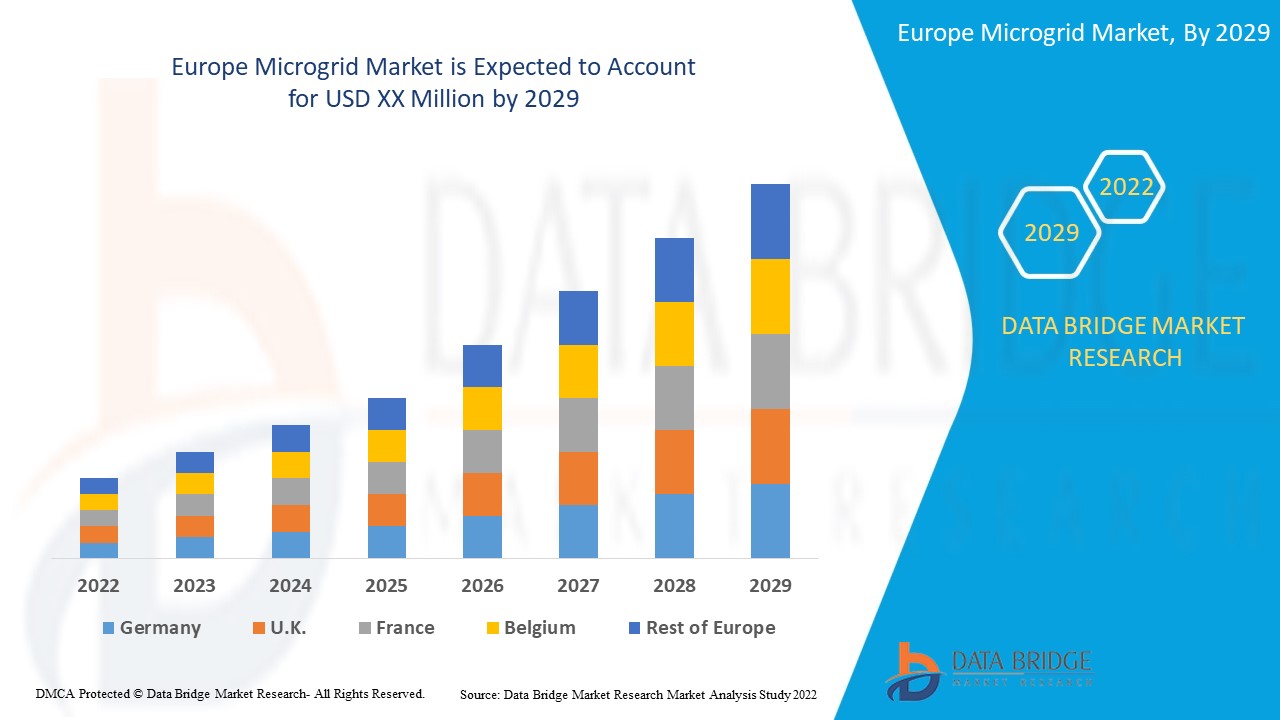

Data Bridge Market Research analyses that the Europe microgrid market is expected to reach the value of USD 7,295.30 million by 2029, at a CAGR of 15.6% during the forecast period. The microgrid market report also covers pricing analysis, patent analysis, and technological advancements in depth.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customisable to 2019-2014) |

|

Quantitative Units |

Revenue in USD Million, Pricing in USD |

|

Segments Covered |

By Connectivity (Off-Grid/Island/Remote, Grid Connected), Offering (Hardware, Software, Services), Pattern (Urban, Semi-Urban, Remote Island), Source (Diesel Generators, CHP, Solar Pv, Natural Gas, Others), Storage (Lithium-Ion, Lead Acid, Solar Batteries, Flywheel, Others), Grid Type (AC Microgrid, DC Microgrid, Hybrid Microgrid), Capacity (Less Than 5,000 MW, 5,001 – 10,000 MW, 10,001 – 15,000 MW, More Than 15,000 MW), Control (Primary (Local Control), Secondary, Tertiary (Optimization) Control), Application (Remote Location, Utility, Industrial, Campus, Military, Smart City, Data Center, Hospital, School, Others) |

|

Countries Covered |

Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey and Rest of Europe in Europe |

|

Market Players Covered |

ABB, Rolls-Royce plc, Schneider Electric, Cummins Inc., Siemens, Caterpillar, General Electric, Tesla, Black & Veatch Holding Company, Honeywell International Inc., Eaton, Norvento Enerxía, InnoVentum, and Hitachi Energy Ltd. |

Microgrid Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints and challenges. All of this is discussed in detail as below:

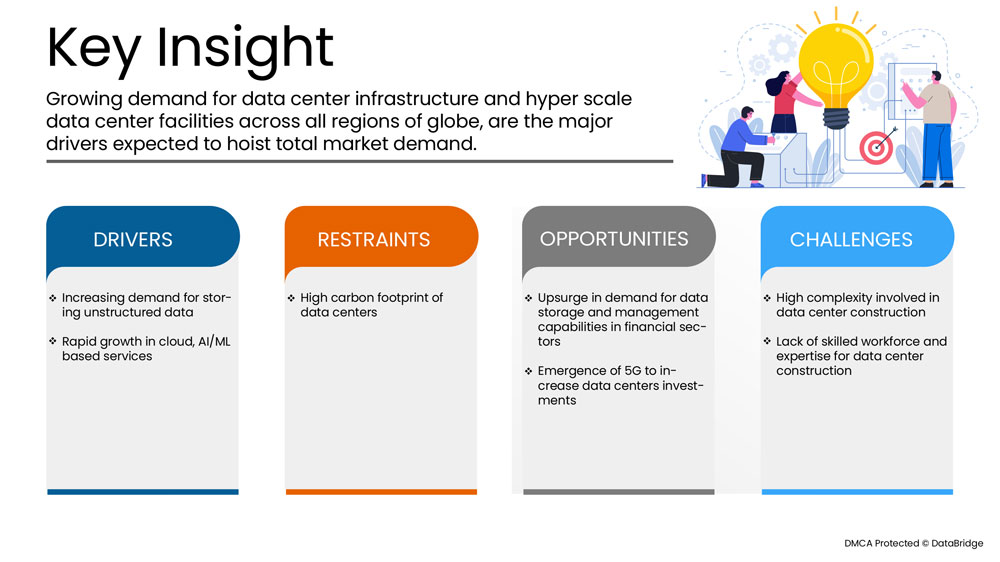

Drivers

- The shift in trends toward gas-based power generation will fuel the natural gas-based microgrid industry

The energy sector is undergoing substantial changes to promote efficiency, reduce emissions, and effectively deploy technologies to trade-off costs and benefits. One emerging solution is applying power-to-gas technology, which can be used for different purposes in electrical systems. Furthermore, favorable government norms and policies toward integrating sustainable and efficient power generation sources have boosted the microgrid infrastructure across the region.

- Increase in demand for uninterrupted and reliable power supply for various applications

In recent years, the global energy demand has increased, further fuelled by the demand in emerging economies and the growth in the overall global economy. Nowadays, massive grids are built across the region, connecting power plants to homes and businesses through the wires. Electricity generated by large, remote power plants are now connected to centralized power grids and use fossil fuels to transmit power across different regions and countries. However, the shortcomings of these power plants in terms of inefficient power transmission have become increasingly evident. Therefore, installing microgrids can improve local power supply and demand management, which can further help to defer costly investments by utilities in new power generation. Also, microgrids can deploy more zero-emission electricity sources, thereby reducing greenhouse gas emissions.

Opportunity

- Increase in demand for renewable energy across the region

The demand for clean and green energy across urban and remote areas is increasing daily. Especially microgrid projects in remote/island areas majorly operate on renewable energy sources like solar, wind, hydro, and others. Lesser availability of conventional fossil fuels in such areas contributes to the rising need for renewable energy. Governments are also working on increasing renewable energy production to reduce the carbon footprint. The growth in the renewable energy industry will therefore create new opportunities for the growth of the Europe microgrid market.

Restraints/Challenges

- Uncertainty in-laws and regulations related to distributed energy generation

Despite the rising interest in distributed energy generation, there are no clear laws, policies, or regulatory instruments associated with the repercussions of distributed generation (DG) integration into electric power systems. Clearly defined policies and regulatory instruments associated with DG grid penetration are required for these systems to thrive. The European Union doesn't have any laws and regulations for smart grids or microgrids. They have only provided directives for the implementation of microgrid solutions. Regulatory and policy uncertainty barriers, which relate to bad policy design, discontinuity, and insufficient transparency of policies and legislation, act as a restraining factor for the growth of the microgrid market in Europe.

- Lack of operating experience with microgrid configurations

There are currently several potential barriers to implementing microgrids, for which solutions are still evolving. Power and frequency control in a small, isolated system is difficult because changes in local demand and distributed generation output have a much greater relative impact on the system than large conventional systems. This makes maintaining stability a significant challenge. Protection is also a major concern because traditionally, protection systems in low voltage networks were designed for unidirectional power flows. In addition, any connected distributed generation is required to disconnect upon detection of a system fault to avoid excessive reverse power flows.

Post COVID-19 Impact on Microgrid Market

COVID-19 created a major impact on the microgrid market as almost every country has opted for the shutdown for every production facility except the ones dealing in producing the essential goods.

The COVID-19 pandemic has impacted the microgrid market to an extent in negative manner. So, the market has resulted in a lower estimated year-on-year growth rate as compared with 2019 because of the fewer amounts of activities of the sectors associated with the microgrid market. However, the growth has been high after the market has opened after COVID-19, and it is expected that there would be considerable growth in the sector owing to higher demand of distributed energy. And this factor is further expected to drive the overall growth of the market.

Manufacturers & solution providers are making various strategic decisions to bounce back post-COVID-19. The players are conducting multiple research and development activities to improve the technology involved in the microgrid. With this, the companies will bring advanced technologies to the market. In addition, government initiatives for usage of electric vehicle has led to the market's growth

Recent Developments

- In March 2022, Siemens had deployed the Middle East's first microgrid designed for industrial use, enabling Qatar Solar Energy (QSE) to reduce electricity costs, curb carbon emissions and benefit from a more stable power supply

- In January 2021, ABB had driven the deployment of microgrids on a global scale to provide smart and sustainable solutions for a world that needs a major shift toward renewables to achieve global annual greenhouse gas reduction

Europe Microgrid Market Scope

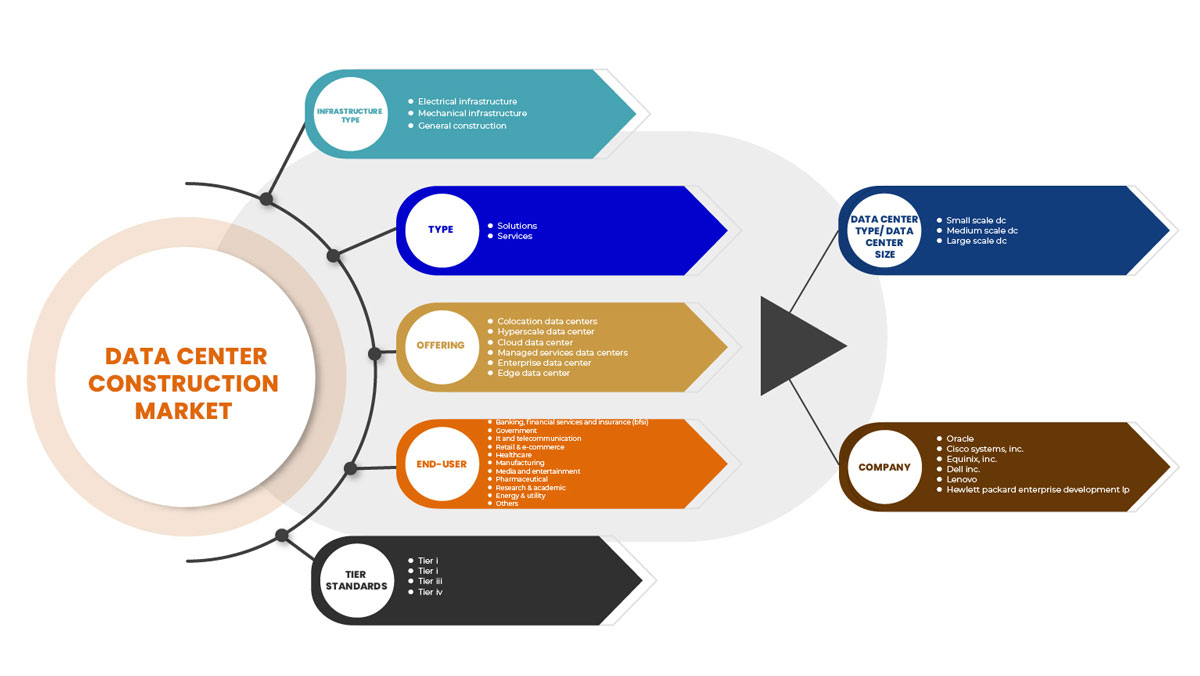

The microgrid market is segmented on the basis of connectivity, offering, pattern, source, storage, grid type, capacity, control and application.

The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Connectivity

- Off-Grid/Island/Remote

- Grid Connected

On the basis of connectivity, the Europe microgrid market is segmented into off-grid/island/remote and grid connected.

Offering

- Hardware

- Software

- Services

On the basis of offering, the Europe microgrid market has been segmented into hardware, software and services.

Pattern

- Urban

- Semi-Urban

- Remote Island

On the basis of pattern, the Europe microgrid market is segmented into urban, semi-urban and remote island.

Source

- Diesel Generators

- CHP

- Solar PV

- Natural Gas

- Others

On the basis of source, the Europe microgrid market has been segmented into diesel generators, CHP, solar PV, natural gas and others.

Storage

- Lithium-Ion

- Lead Acid

- Solar Batteries

- Flywheel

- Flow Batteries

- Others

On the basis of storage, the Europe microgrid market has been segmented into lithium-ion, lead acid, solar batteries, flywheel, flow batteries and others.

Grid Type

- AC Microgrid

- DC Microgrid

- Hybrid Microgrid

On the basis of grid type, the Europe microgrid market has been segmented into AC microgrid, DC microgrid and hybrid microgrid.

Capacity

- Less Than 5,000 MW

- 5,001 – 10,000 MW

- 10,001 – 15,000 MW

- More Than 15,000 MW

On the basis of capacity, the Europe microgrid market has been segmented into less than 5,000 MW, 5,001 – 10,000 MW, 10,001 – 15,000 MW, more than 15,000 MW.

Control

- Primary (Local Control)

- Secondary

- Tertiary (Optimization) Control

On the basis of control, the Europe microgrid market has been segmented into primary (local control), secondary and tertiary (optimization) control.

Application

- Remote Location

- Utility

- Industrial

- Campus

- Military

- Smart City

- Data Center

- Hospital

- School

- Others

On the basis of control, the Europe microgrid market has been segmented into remote location, utility, industrial, campus, military, smart city, data center, hospital, school and others.

Microgrid Market Regional Analysis/Insights

The microgrid market is analysed and market size insights and trends are provided by country, connectivity, offering, pattern, source, storage, grid type, capacity, control, application as referenced above.

The countries covered in the microgrid market report are Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey and Rest of Europe. Germany dominates the Europe region due to increasing reliance for wood has gained momentum.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Europe brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Microgrid Market Share Analysis

The microgrid market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Europe presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to microgrid market.

Some of the major players operating in the microgrid market are ABB, Rolls-Royce plc, Schneider Electric, Cummins Inc., Siemens, Caterpillar, General Electric, Tesla, Black & Veatch Holding Company, Honeywell International Inc., Eaton, Norvento Enerxía, InnoVentum, Hitachi Energy Ltd. among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Содержание

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE MICROGRID MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 MULTIVARIATE MODELING

2.8 CONNECTIVITY TIMELINE CURVE

2.9 MARKET CHALLENGE MATRIX

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 REGULATORY LANDSCAPE:

4.2 PORTER'S FIVE FORCES MODEL

4.3 ADOPTION RATES AND HEADWINDS IN TECHNOLOGY

4.4 COST ANALYSIS BREAKDOWN OF MICROGRIDS

4.5 LIST OF MICROGRIDS PROJECTS

4.6 EUROPEAN GRANTS FOR MICROGRID PROJECTS

4.7 CASE STUDY

4.7.1 PROBLEM STATEMENT & SOLUTION:

4.7.2 PROBLEM STATEMENT & SOLUTION:

4.8 EXAMPLES OF TYPICAL MICROGRID PROJECTS IN EUROPE

4.8.1 PACE PROJECT

4.8.2 KYTHNOS MICROGRID PROJECT

4.8.3 ISLE OF EIGG MICROGRID PROJECT

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 THE SHIFT IN TRENDS TOWARD GAS-BASED POWER GENERATION WILL FUEL THE NATURAL GAS-BASED MICROGRID INDUSTRY

5.1.2 INCREASE IN DEMAND FOR UNINTERRUPTED AND RELIABLE POWER SUPPLY FOR VARIOUS APPLICATIONS

5.1.3 RISE IN ENERGY- AS- A -SERVICE (EAAS) MODEL TO MINIMIZE COST IN THE ENERGY SECTOR

5.2 RESTRAINTS

5.2.1 UNCERTAINTY IN-LAWS AND REGULATIONS RELATED TO DISTRIBUTED ENERGY GENERATION

5.2.2 INCREASE IN ENERGY PRICES IN EUROPE

5.3 OPPORTUNITIES

5.3.1 RISE IN ACQUISITIONS & PARTNERSHIPS AMONG VARIOUS ORGANIZATIONS

5.3.2 INCREASE IN DEMAND FOR RENEWABLE ENERGY ACROSS THE REGION

5.3.3 GOVERNMENT FUNDING IN MICROGRID PROJECTS

5.4 CHALLENGES

5.4.1 LACK OF OPERATING EXPERIENCE WITH MICROGRID CONFIGURATIONS

5.4.2 RESTRICTIONS FROM UTILITY FRANCHISE RIGHTS AND LIMITED RETAIL MARKET ACCESS

5.4.3 INCREASE IN CYBER SECURITY CONCERNS AND REGULATORY BARRIERS

6 EUROPE MICROGRID MARKET, BY CONNECTIVITY

6.1 OVERVIEW

6.2 GRID CONNECTED

6.3 OFF-GRID/ISLAND/REMOTE

7 EUROPE MICROGRID MARKET, BY OFFERING

7.1 OVERVIEW

7.2 HARDWARE

7.2.1 POWER GENERATORS

7.2.1.1 PV MODULES

7.2.1.2 WIND GENERATORS

7.2.1.3 SMALL HYDRO

7.2.1.4 FUEL CELLS

7.2.1.5 BIOMASS PLANT

7.2.1.6 MICROTURBINES

7.2.1.7 OTHERS

7.2.2 ENERGY STORAGE & DISTRIBUTORS

7.2.2.1 BATTERIES

7.2.2.2 FLYWHEELS

7.2.2.3 ULTRACAPACITORS

7.2.3 CONTROLLERS

7.2.4 OTHERS

7.3 SOFTWARE

7.4 SERVICES

7.4.1 SUPPORT & MAINTENANCE

7.4.2 IMPLEMENTATION

7.4.3 TESTING

7.4.4 TRAINING

8 EUROPE MICROGRID MARKET, BY PATTERN

8.1 OVERVIEW

8.2 URBAN

8.3 REMOTE ISLAND

8.4 SEMI-URBAN

9 EUROPE MICROGRID MARKET, BY SOURCE

9.1 OVERVIEW

9.2 DIESEL GENERATORS

9.3 CHP

9.4 SOLAR PV

9.5 NATURAL GAS

9.6 OTHERS

10 EUROPE MICROGRID MARKET, BY STORAGE

10.1 OVERVIEW

10.2 LITHIUM-ION

10.3 LEAD ACID

10.4 FLYWHEEL

10.5 FLOW BATTERIES

10.6 OTHERS

11 EUROPE MICROGRID MARKET, BY GRID TYPE

11.1 OVERVIEW

11.2 AC MICROGRID

11.3 DC MICROGRID

11.4 HYBRID MICROGRID

12 EUROPE MICROGRID MARKET, BY CAPACITY

12.1 OVERVIEW

12.2 LESS THAN 5,000 MW

12.3 5,001 MW - 10,000 MW

12.4 10,001 MW - 15,000 MW

12.5 MORE THAN 15,000 MW

13 EUROPE MICROGRID MARKET, BY CONTROL

13.1 OVERVIEW

13.2 PRIMARY (LOCAL CONTROL)

13.3 SECONDARY

13.3.1 DECENTRALIZED

13.3.2 CENTRALIZED

13.4 TERTIARY (OPTIMIZATION) CONTROL

14 EUROPE MICROGRID MARKET, BY APPLICATION

14.1 OVERVIEW

14.2 REMOTE LOCATION

14.2.1 HARDWARE

14.2.2 SOFTWARE

14.2.3 SERVICES

14.3 UTILITY

14.3.1 HARDWARE

14.3.2 SOFTWARE

14.3.3 SERVICES

14.4 INDUSTRIAL

14.4.1 HARDWARE

14.4.2 SOFTWARE

14.4.3 SERVICES

14.5 CAMPUS

14.5.1 HARDWARE

14.5.2 SOFTWARE

14.5.3 SERVICES

14.6 MILITARY

14.6.1 HARDWARE

14.6.2 SOFTWARE

14.6.3 SERVICES

14.7 SMART CITY

14.7.1 HARDWARE

14.7.2 SOFTWARE

14.7.3 SERVICES

14.8 DATA CENTER

14.8.1 HARDWARE

14.8.2 SOFTWARE

14.8.3 SERVICES

14.9 HOSPITAL

14.9.1 HARDWARE

14.9.2 SOFTWARE

14.9.3 SERVICES

14.1 SCHOOL

14.10.1 HARDWARE

14.10.2 SOFTWARE

14.10.3 SERVICES

14.11 OTHERS

15 EUROPE

15.1 GERMANY

15.2 U.K.

15.3 FRANCE

15.4 SPAIN

15.5 ITALY

15.6 RUSSIA

15.7 NETHERLANDS

15.8 SWITZERLAND

15.9 BELGIUM

15.1 TURKEY

15.11 REST OF EUROPE

16 EUROPE MICROGRID MARKET, COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: EUROPE

17 SWOT ANALYSIS

18 COMPANY PROFILE

18.1 ABB

18.1.1 COMPANY SNAPSHOT

18.1.2 REVENUE ANALYSIS

18.1.3 SERVICE PORTFOLIO

18.1.4 RECENT DEVELOPMENT

18.2 ROLLS-ROYCE PLC

18.2.1 COMPANY SNAPSHOT

18.2.2 REVENUE ANALYSIS

18.2.3 PRODUCT PORTFOLIO

18.2.4 RECENT DEVELOPMENT

18.3 SCHINDER ELECTRIC

18.3.1 COMPANY SNAPSHOT

18.3.2 REVENUE ANALYSIS

18.3.3 PRODUCT PORTFOLIO

18.3.4 RECENT DEVELOPMENTS

18.4 CUMMINS INC.

18.4.1 COMPANY SNAPSHOT

18.4.2 REVENUE ANALYSIS

18.4.3 PRODUCT PORTFOLIO

18.4.4 RECENT DEVELOPMENT

18.5 SIEMENS

18.5.1 COMPANY SNPASHOT

18.5.2 REVENUE ANALYSIS

18.5.3 PRODUCT PORTFOLIO

18.5.4 RECENT DEVELOPMENTS

18.6 BLACK & VEATCH HOLDING COMPANY

18.6.1 COMPANY SNAPSHOT

18.6.2 SERVICE PORTFOLIO

18.6.3 RECENT DEVELOPMENT

18.7 CATERPILLAR

18.7.1 COMPANY SNAPSHOT

18.7.2 REVENUE ANALYSIS

18.7.3 SERVICE PORTFOLIO

18.7.4 RECENT DEVELOPMENT

18.8 EATON

18.8.1 COMPANY SNAPSHOT

18.8.2 REVENUE ANALYSIS

18.8.3 PRODUCT PORTFOLIO

18.8.4 RECENT DEVELOPMENTS

18.9 GENERAL ELECTRIC

18.9.1 COMPANY SNAPSHOT

18.9.2 REVENUE ANALYSIS

18.9.3 PRODUCT PORTFOLIO

18.9.4 RECENT DEVELOPMENTS

18.1 HITACHI ENERGY LTD

18.10.1 COMPANY SNAPSHOT

18.10.2 REVENUE ANALYSIS

18.10.3 SOLUTION PORTFOLIO

18.10.4 RECENT DEVELOPMENT

18.11 HONEYWELL INTERNATIONAL INC.

18.11.1 COMPANY SNAPSHOT

18.11.2 REVENUE ANALYSIS

18.11.3 PRODUCT PORTFOLIO

18.11.4 RECENT DEVELOPMENT

18.12 INNOVENTUM

18.12.1 COMPANY SNAPSHOT

18.12.2 PRODUCT PORTFOLIO

18.12.3 RECENT DEVELOPMENT

18.13 NORVENTO ENERXÍA

18.13.1 COMPANY SNAPSHOT

18.13.2 PRODUCT PORTFOLIO

18.13.3 RECENT DEVELOPMENT

18.14 TESLA

18.14.1 COMPANY SNAPSHOT

18.14.2 REVENUE ANALYSIS

18.14.3 PRODUCT PORTFOLIO

18.14.4 RECENT DEVELOPMENTS

19 QUESTIONNAIRE

20 RELATED REPORTS

Список таблиц

TABLE 1 EUROPE MICROGRID MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 2 EUROPE MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 3 EUROPE HARDWARE IN MICROGRID MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 EUROPE POWER GENERATORS IN MICROGRID MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 5 EUROPE ENERGY STORAGE & DISTRIBUTORS IN MICROGRID MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 6 EUROPE SERVICES IN MICROGRID MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 7 EUROPE MICROGRID MARKET, BY PATTERN, 2020-2029 (USD MILLION)

TABLE 8 EUROPE MICROGRID MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 9 EUROPE MICROGRID MARKET, BY STORAGE, 2020-2029 (USD MILLION)

TABLE 10 EUROPE MICROGRID MARKET, BY GRID TYPE, 2020-2029 (USD MILLION)

TABLE 11 EUROPE MICROGRID MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 12 EUROPE MICROGRID MARKET, BY CONTROL, 2020-2029 (USD MILLION)

TABLE 13 EUROPE SECONDARY IN MICROGRID MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 14 EUROPE MICROGRID MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 15 EUROPE REMOTE LOCATION IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 16 EUROPE UTILITY IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 17 EUROPE INDUSTRIAL IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 18 EUROPE CAMPUS IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 19 EUROPE MILITARY IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 20 EUROPE SMART CITY IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 21 EUROPE DATA CENTER IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 22 EUROPE HOSPITAL IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 23 EUROPE SCHOOL IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 24 EUROPE MICROGRID MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 25 GERMANY MICROGRID MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 26 GERMANY MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 27 GERMANY HARDWARE IN MICROGRID MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 28 GERMANY POWER GENERATORS IN MICROGRID MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 29 GERMANY ENERGY STORAGE & DISTRIBUTORS MICROGRID MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 30 GERMANY SERVICES IN MICROGRID MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 31 GERMANY MICROGRID MARKET, BY PATTERN, 2020-2029 (USD MILLION)

TABLE 32 GERMANY MICROGRID MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 33 GERMANY MICROGRID MARKET, BY STORAGE, 2020-2029 (USD MILLION)

TABLE 34 GERMANY MICROGRID MARKET, BY GRID TYPE, 2020-2029 (USD MILLION)

TABLE 35 GERMANY MICROGRID MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 36 GERMANY MICROGRID MARKET, BY CONTROL, 2020-2029 (USD MILLION)

TABLE 37 GERMANY SECONDARY IN MICROGRID MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 38 GERMANY MICROGRID MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 39 GERMANY REMOTE LOCATION IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 40 GERMANY UTILITY IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 41 GERMANY INDUSTRIAL IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 42 GERMANY CAMPUS IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 43 GERMANY MILITARY IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 44 GERMANY SMART CITY IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 45 GERMANY DATA CENTER IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 46 GERMANY HOSPITAL IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 47 GERMANY SCHOOL IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 48 U.K. MICROGRID MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 49 U.K. MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 50 U.K. HARDWARE IN MICROGRID MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 51 U.K. POWER GENERATORS IN MICROGRID MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 52 U.K. ENERGY STORAGE & DISTRIBUTORS MICROGRID MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 53 U.K. SERVICES IN MICROGRID MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 54 U.K. MICROGRID MARKET, BY PATTERN, 2020-2029 (USD MILLION)

TABLE 55 U.K. MICROGRID MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 56 U.K. MICROGRID MARKET, BY STORAGE, 2020-2029 (USD MILLION)

TABLE 57 U.K. MICROGRID MARKET, BY GRID TYPE, 2020-2029 (USD MILLION)

TABLE 58 U.K. MICROGRID MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 59 U.K. MICROGRID MARKET, BY CONTROL, 2020-2029 (USD MILLION)

TABLE 60 U.K. SECONDARY IN MICROGRID MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 61 U.K. MICROGRID MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 62 U.K. REMOTE LOCATION IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 63 U.K. UTILITY IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 64 U.K. INDUSTRIAL IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 65 U.K. CAMPUS IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 66 U.K. MILITARY IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 67 U.K. SMART CITY IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 68 U.K. DATA CENTER IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 69 U.K. HOSPITAL IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 70 U.K. SCHOOL IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 71 FRANCE MICROGRID MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 72 FRANCE MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 73 FRANCE HARDWARE IN MICROGRID MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 74 FRANCE POWER GENERATORS IN MICROGRID MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 75 FRANCE ENERGY STORAGE & DISTRIBUTORS MICROGRID MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 76 FRANCE SERVICES IN MICROGRID MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 77 FRANCE MICROGRID MARKET, BY PATTERN, 2020-2029 (USD MILLION)

TABLE 78 FRANCE MICROGRID MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 79 FRANCE MICROGRID MARKET, BY STORAGE, 2020-2029 (USD MILLION)

TABLE 80 FRANCE MICROGRID MARKET, BY GRID TYPE, 2020-2029 (USD MILLION)

TABLE 81 FRANCE MICROGRID MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 82 FRANCE MICROGRID MARKET, BY CONTROL, 2020-2029 (USD MILLION)

TABLE 83 FRANCE SECONDARY IN MICROGRID MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 84 FRANCE MICROGRID MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 85 FRANCE REMOTE LOCATION IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 86 FRANCE UTILITY IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 87 FRANCE INDUSTRIAL IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 88 FRANCE CAMPUS IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 89 FRANCE MILITARY IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 90 FRANCE SMART CITY IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 91 FRANCE DATA CENTER IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 92 FRANCE HOSPITAL IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 93 FRANCE SCHOOL IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 94 SPAIN MICROGRID MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 95 SPAIN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 96 SPAIN HARDWARE IN MICROGRID MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 97 SPAIN POWER GENERATORS IN MICROGRID MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 98 SPAIN ENERGY STORAGE & DISTRIBUTORS MICROGRID MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 99 SPAIN SERVICES IN MICROGRID MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 100 SPAIN MICROGRID MARKET, BY PATTERN, 2020-2029 (USD MILLION)

TABLE 101 SPAIN MICROGRID MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 102 SPAIN MICROGRID MARKET, BY STORAGE, 2020-2029 (USD MILLION)

TABLE 103 SPAIN MICROGRID MARKET, BY GRID TYPE, 2020-2029 (USD MILLION)

TABLE 104 SPAIN MICROGRID MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 105 SPAIN MICROGRID MARKET, BY CONTROL, 2020-2029 (USD MILLION)

TABLE 106 SPAIN SECONDARY IN MICROGRID MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 107 SPAIN MICROGRID MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 108 SPAIN REMOTE LOCATION IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 109 SPAIN UTILITY IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 110 SPAIN INDUSTRIAL IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 111 SPAIN CAMPUS IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 112 SPAIN MILITARY IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 113 SPAIN SMART CITY IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 114 SPAIN DATA CENTER IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 115 SPAIN HOSPITAL IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 116 SPAIN SCHOOL IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 117 ITALY MICROGRID MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 118 ITALY MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 119 ITALY HARDWARE IN MICROGRID MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 120 ITALY POWER GENERATORS IN MICROGRID MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 121 ITALY ENERGY STORAGE & DISTRIBUTORS MICROGRID MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 122 ITALY SERVICES IN MICROGRID MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 123 ITALY MICROGRID MARKET, BY PATTERN, 2020-2029 (USD MILLION)

TABLE 124 ITALY MICROGRID MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 125 ITALY MICROGRID MARKET, BY STORAGE, 2020-2029 (USD MILLION)

TABLE 126 ITALY MICROGRID MARKET, BY GRID TYPE, 2020-2029 (USD MILLION)

TABLE 127 ITALY MICROGRID MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 128 ITALY MICROGRID MARKET, BY CONTROL, 2020-2029 (USD MILLION)

TABLE 129 ITALY SECONDARY IN MICROGRID MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 130 ITALY MICROGRID MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 131 ITALY REMOTE LOCATION IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 132 ITALY UTILITY IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 133 ITALY INDUSTRIAL IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 134 ITALY CAMPUS IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 135 ITALY MILITARY IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 136 ITALY SMART CITY IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 137 ITALY DATA CENTER IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 138 ITALY HOSPITAL IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 139 ITALY SCHOOL IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 140 RUSSIA MICROGRID MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 141 RUSSIA MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 142 RUSSIA HARDWARE IN MICROGRID MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 143 RUSSIA POWER GENERATORS IN MICROGRID MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 144 RUSSIA ENERGY STORAGE & DISTRIBUTORS MICROGRID MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 145 RUSSIA SERVICES IN MICROGRID MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 146 RUSSIA MICROGRID MARKET, BY PATTERN, 2020-2029 (USD MILLION)

TABLE 147 RUSSIA MICROGRID MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 148 RUSSIA MICROGRID MARKET, BY STORAGE, 2020-2029 (USD MILLION)

TABLE 149 RUSSIA MICROGRID MARKET, BY GRID TYPE, 2020-2029 (USD MILLION)

TABLE 150 RUSSIA MICROGRID MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 151 RUSSIA MICROGRID MARKET, BY CONTROL, 2020-2029 (USD MILLION)

TABLE 152 RUSSIA SECONDARY IN MICROGRID MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 153 RUSSIA MICROGRID MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 154 RUSSIA REMOTE LOCATION IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 155 RUSSIA UTILITY IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 156 RUSSIA INDUSTRIAL IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 157 RUSSIA CAMPUS IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 158 RUSSIA MILITARY IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 159 RUSSIA SMART CITY IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 160 RUSSIA DATA CENTER IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 161 RUSSIA HOSPITAL IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 162 RUSSIA SCHOOL IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 163 NETHERLANDS MICROGRID MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 164 NETHERLANDS MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 165 NETHERLANDS HARDWARE IN MICROGRID MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 166 NETHERLANDS POWER GENERATORS IN MICROGRID MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 167 NETHERLANDS ENERGY STORAGE & DISTRIBUTORS MICROGRID MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 168 NETHERLANDS SERVICES IN MICROGRID MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 169 NETHERLANDS MICROGRID MARKET, BY PATTERN, 2020-2029 (USD MILLION)

TABLE 170 NETHERLANDS MICROGRID MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 171 NETHERLANDS MICROGRID MARKET, BY STORAGE, 2020-2029 (USD MILLION)

TABLE 172 NETHERLANDS MICROGRID MARKET, BY GRID TYPE, 2020-2029 (USD MILLION)

TABLE 173 NETHERLANDS MICROGRID MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 174 NETHERLANDS MICROGRID MARKET, BY CONTROL, 2020-2029 (USD MILLION)

TABLE 175 NETHERLANDS SECONDARY IN MICROGRID MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 176 NETHERLANDS MICROGRID MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 177 NETHERLANDS REMOTE LOCATION IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 178 NETHERLANDS UTILITY IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 179 NETHERLANDS INDUSTRIAL IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 180 NETHERLANDS CAMPUS IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 181 NETHERLANDS MILITARY IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 182 NETHERLANDS SMART CITY IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 183 NETHERLANDS DATA CENTER IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 184 NETHERLANDS HOSPITAL IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 185 NETHERLANDS SCHOOL IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 186 SWITZERLAND MICROGRID MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 187 SWITZERLAND MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 188 SWITZERLAND HARDWARE IN MICROGRID MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 189 SWITZERLAND POWER GENERATORS IN MICROGRID MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 190 SWITZERLAND ENERGY STORAGE & DISTRIBUTORS MICROGRID MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 191 SWITZERLAND SERVICES IN MICROGRID MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 192 SWITZERLAND MICROGRID MARKET, BY PATTERN, 2020-2029 (USD MILLION)

TABLE 193 SWITZERLAND MICROGRID MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 194 SWITZERLAND MICROGRID MARKET, BY STORAGE, 2020-2029 (USD MILLION)

TABLE 195 SWITZERLAND MICROGRID MARKET, BY GRID TYPE, 2020-2029 (USD MILLION)

TABLE 196 SWITZERLAND MICROGRID MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 197 SWITZERLAND MICROGRID MARKET, BY CONTROL, 2020-2029 (USD MILLION)

TABLE 198 SWITZERLAND SECONDARY IN MICROGRID MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 199 SWITZERLAND MICROGRID MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 200 SWITZERLAND REMOTE LOCATION IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 201 SWITZERLAND UTILITY IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 202 SWITZERLAND INDUSTRIAL IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 203 SWITZERLAND CAMPUS IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 204 SWITZERLAND MILITARY IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 205 SWITZERLAND SMART CITY IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 206 SWITZERLAND DATA CENTER IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 207 SWITZERLAND HOSPITAL IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 208 SWITZERLAND SCHOOL IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 209 BELGIUM MICROGRID MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 210 BELGIUM MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 211 BELGIUM HARDWARE IN MICROGRID MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 212 BELGIUM POWER GENERATORS IN MICROGRID MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 213 BELGIUM ENERGY STORAGE & DISTRIBUTORS MICROGRID MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 214 BELGIUM SERVICES IN MICROGRID MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 215 BELGIUM MICROGRID MARKET, BY PATTERN, 2020-2029 (USD MILLION)

TABLE 216 BELGIUM MICROGRID MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 217 BELGIUM MICROGRID MARKET, BY STORAGE, 2020-2029 (USD MILLION)

TABLE 218 BELGIUM MICROGRID MARKET, BY GRID TYPE, 2020-2029 (USD MILLION)

TABLE 219 BELGIUM MICROGRID MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 220 BELGIUM MICROGRID MARKET, BY CONTROL, 2020-2029 (USD MILLION)

TABLE 221 BELGIUM SECONDARY IN MICROGRID MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 222 BELGIUM MICROGRID MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 223 BELGIUM REMOTE LOCATION IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 224 BELGIUM UTILITY IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 225 BELGIUM INDUSTRIAL IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 226 BELGIUM CAMPUS IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 227 BELGIUM MILITARY IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 228 BELGIUM SMART CITY IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 229 BELGIUM DATA CENTER IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 230 BELGIUM HOSPITAL IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 231 BELGIUM SCHOOL IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 232 TURKEY MICROGRID MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 233 TURKEY MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 234 TURKEY HARDWARE IN MICROGRID MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 235 TURKEY POWER GENERATORS IN MICROGRID MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 236 TURKEY ENERGY STORAGE & DISTRIBUTORS MICROGRID MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 237 TURKEY SERVICES IN MICROGRID MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 238 TURKEY MICROGRID MARKET, BY PATTERN, 2020-2029 (USD MILLION)

TABLE 239 TURKEY MICROGRID MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 240 TURKEY MICROGRID MARKET, BY STORAGE, 2020-2029 (USD MILLION)

TABLE 241 TURKEY MICROGRID MARKET, BY GRID TYPE, 2020-2029 (USD MILLION)

TABLE 242 TURKEY MICROGRID MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 243 TURKEY MICROGRID MARKET, BY CONTROL, 2020-2029 (USD MILLION)

TABLE 244 TURKEY SECONDARY IN MICROGRID MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 245 TURKEY MICROGRID MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 246 TURKEY REMOTE LOCATION IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 247 TURKEY UTILITY IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 248 TURKEY INDUSTRIAL IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 249 TURKEY CAMPUS IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 250 TURKEY MILITARY IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 251 TURKEY SMART CITY IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 252 TURKEY DATA CENTER IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 253 TURKEY HOSPITAL IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 254 TURKEY SCHOOL IN MICROGRID MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 255 REST OF EUROPE MICROGRID MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

Список рисунков

FIGURE 1 EUROPE MICROGRID MARKET: SEGMENTATION

FIGURE 2 EUROPE MICROGRID MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE MICROGRID MARKET: DROC ANALYSIS

FIGURE 4 EUROPE MICROGRID MARKET: COUNTRY VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE MICROGRID MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE MICROGRID MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE MICROGRID MARKET: DBMR MARKET POSITION GRID

FIGURE 8 EUROPE MICROGRID MARKET: SEGMENTATION

FIGURE 9 SHIFTING TRENDS TOWARDS GAS BASED POWER GENERATION IS EXPECTED TO DRIVE THE EUROPE MICROGRID MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 10 GRID CONNECTED SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF EUROPE MICROGRID MARKET IN 2022 & 2029

FIGURE 11 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE EUROPE MICROGRID MARKET

FIGURE 12 NON-HOUSEHOLD ENERGY PRICES IN EUROPEAN UNION

FIGURE 13 EUROPE MICROGRID MARKET: BY CONNECTIVITY, 2021

FIGURE 14 EUROPE MICROGRID MARKET: BY OFFERING, 2021

FIGURE 15 EUROPE MICROGRID MARKET: BY PATTERN, 2021

FIGURE 16 EUROPE MICROGRID MARKET: BY SOURCE, 2021

FIGURE 17 EUROPE MICROGRID MARKET: BY STORAGE, 2021

FIGURE 18 EUROPE MICROGRID MARKET: BY GRID TYPE, 2021

FIGURE 19 EUROPE MICROGRID MARKET: BY CAPACITY, 2021

FIGURE 20 EUROPE MICROGRID MARKET: BY CONTROL, 2021

FIGURE 21 EUROPE MICROGRID MARKET: BY APPLICATION, 2021

FIGURE 22 EUROPE MICROGRID MARKET: SNAPSHOT (2021)

FIGURE 23 EUROPE MICROGRID MARKET: BY COUNTRY (2021)

FIGURE 24 EUROPE MICROGRID MARKET: BY COUNTRY (2022 & 2029)

FIGURE 25 EUROPE MICROGRID MARKET: BY COUNTRY (2021 & 2029)

FIGURE 26 EUROPE MICROGRID MARKET: BY CONNECTIVITY (2022-2029)

FIGURE 27 EUROPE MICROGRID MARKET: COMPANY SHARE 2021 (%)

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.