Europe Major Domestic Cooking Appliances Market

Размер рынка в млрд долларов США

CAGR :

%

USD

20.97 Billion

USD

36.58 Billion

2025

2033

USD

20.97 Billion

USD

36.58 Billion

2025

2033

| 2026 –2033 | |

| USD 20.97 Billion | |

| USD 36.58 Billion | |

|

|

|

|

Сегментация рынка бытовой кухонной техники в Европе по типу (встраиваемые варочные панели, плиты, микроволновые печи, конфорки, электрические плиты и другие), типу питания (электрические и газовые), типу конструкции (встраиваемые и отдельно стоящие), каналам сбыта (супермаркеты, специализированные магазины, электронная коммерция и другие) — тенденции отрасли и прогноз до 2033 года.

Каковы объем и темпы роста рынка бытовой кухонной техники в Европе?

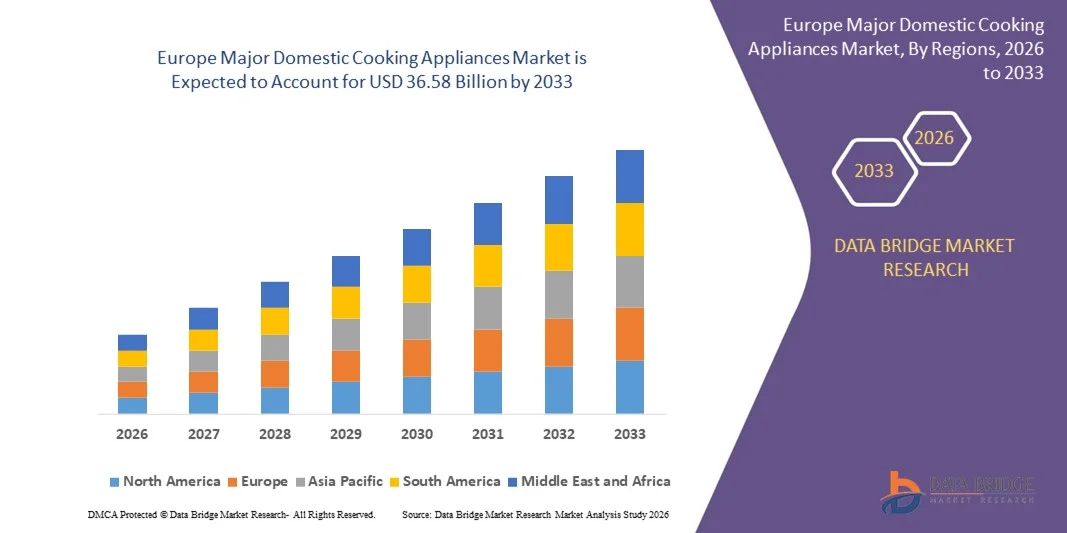

- Объем европейского рынка бытовой кухонной техники в 2025 году оценивался в 20,97 млрд долларов США и, как ожидается, достигнет 36,58 млрд долларов США к 2033 году , демонстрируя среднегодовой темп роста в 7,20% в течение прогнозируемого периода.

- Рынок бытовой кухонной техники демонстрирует значительный рост, обусловленный урбанизацией, ростом располагаемых доходов и увеличением спроса на удобные и эффективные решения для кухни. Потребители все чаще ищут современные кухонные приборы с инновационными функциями, такими как сенсорные экраны, интеллектуальные датчики и подключение к Wi-Fi, для повышения функциональности и удобства.

- Технологический прогресс стимулирует инновации на рынке основных бытовых кухонных приборов, повышая их функциональность и удобство. Платформы электронной коммерции играют решающую роль в расширении рынка, обеспечивая легкий доступ к широкому ассортименту товаров, отвечающих предпочтениям технически подкованных потребителей.

Основные выводы из анализа рынка бытовой кухонной техники:

- Внедрение технологий «умного дома» также способствует росту рынка бытовой кухонной техники. Интеграция с голосовыми помощниками, мобильными приложениями и системами домашней автоматизации позволяет пользователям дистанционно управлять электрическими кухонными приборами и получать уведомления.

- Интеллектуальные функции, такие как предварительно запрограммированные режимы приготовления и подсказки по рецептам, еще больше упрощают процесс приготовления пищи, повышая удобство и эффективность. Эта тенденция подчеркивает растущий интерес потребителей к «умным» жилым пространствам, что стимулирует спрос на технологически продвинутую кухонную технику.

- Германия доминировала на европейском рынке бытовой кухонной техники, занимая наибольшую долю выручки в 43,26% в 2024 году. Это стало возможным благодаря высокой распространенности кухонной техники премиум-класса в домохозяйствах, сильной потребительской ориентации на энергоэффективные и интеллектуальные решения для кухни, а также присутствию ведущих производителей бытовой техники с передовыми производственными возможностями.

- Рынок бытовой кухонной техники во Франции демонстрирует самый быстрый рост со среднегодовым темпом 9,41%, чему способствуют растущий спрос на модернизацию современных кухонь, увеличение использования «умной» и энергоэффективной техники, а также рост активности в сфере ремонта жилых помещений.

- Сегмент кухонных плит доминировал на рынке, занимая наибольшую долю выручки в 31,8% в 2024 году, благодаря широкому распространению в жилых домах из-за удобства, многофункциональности и доступной цены.

Обзор отчета и основные сегменты рынка бытовой кухонной техники.

|

Атрибуты |

Основные бытовые кухонные приборы: ключевые рыночные тенденции. |

|

Охваченные сегменты |

|

|

Охваченные страны |

Европа

|

|

Ключевые игроки рынка |

|

|

Рыночные возможности |

|

|

Информационные наборы данных, представляющие добавленную стоимость |

Помимо анализа рыночных сценариев, таких как рыночная стоимость, темпы роста, сегментация, географический охват и основные игроки, отчеты о рынке, подготовленные Data Bridge Market Research, также включают углубленный экспертный анализ, анализ ценообразования, анализ доли брендов, опросы потребителей, демографический анализ, анализ цепочки поставок, анализ цепочки создания стоимости, обзор сырья/расходных материалов, критерии выбора поставщиков, PESTLE-анализ, анализ Портера и нормативно-правовую базу. |

Какова ключевая тенденция на рынке основных бытовых кухонных приборов?

Повышенное удобство благодаря интеграции ИИ и голосового управления.

- Одной из заметных и быстро развивающихся тенденций на рынке бытовой кухонной техники является интеграция искусственного интеллекта (ИИ) и голосовых систем управления, таких как Amazon Alexa, Google Assistant и Apple HomeKit. Эти технологии повышают удобство для пользователей, обеспечивая интеллектуальное приготовление пищи, дистанционное управление и энергоэффективную работу.

- Например, платформа Samsung SmartThings Cooking использует искусственный интеллект для рекомендации рецептов на основе диетических предпочтений и автоматизирует настройки приготовления пищи в подключенных духовых шкафах и микроволновых печах, а бытовая техника LG ThinQ может управляться голосом и синхронизироваться с другими устройствами умного дома.

- Кухонные приборы с поддержкой искусственного интеллекта могут изучать поведение пользователя, автоматизировать контроль температуры и предоставлять оповещения в режиме реального времени о пережаривании или оптимизации энергопотребления. Такие бренды, как Whirlpool, представили «умные» духовки с датчиками на основе ИИ, которые автоматически регулируют время приготовления и уровень мощности в зависимости от приготавливаемого блюда.

- Интеграция с голосовым управлением позволяет пользователям предварительно разогревать духовки, устанавливать таймеры или проверять состояние приготовления с помощью голосовых команд, обеспечивая работу без использования рук в занятых домах.

- Такое слияние интеллектуальных технологий и кулинарного удобства меняет ожидания пользователей, особенно на премиум-сегменте и в городских районах, где потребители ценят скорость, автоматизацию и минимальные усилия в управлении кухней.

- В результате компании сосредоточились на выпуске кухонной техники с поддержкой искусственного интеллекта и голосового управления, которая соответствует растущему спросу на подключенные кухонные экосистемы и улучшает общее впечатление от использования «умного дома».

Каковы основные факторы, определяющие рынок бытовой кухонной техники?

- Растущая урбанизация, увеличение располагаемых доходов и спрос на современные кухонные решения являются ключевыми факторами, стимулирующими рост мирового рынка основных бытовых кухонных приборов.

- Например, в феврале 2024 года компания Electrolux выпустила новую линейку «умных» духовок и варочных панелей со встроенными помощниками по приготовлению пищи на основе искусственного интеллекта и энергосберегающими функциями, ориентированную на потребителей премиум-класса в Европе и Северной Америке.

- Потребители все чаще отдают предпочтение бытовой технике, сочетающей в себе эффективность, многофункциональность и интеллектуальные функции, особенно в компактных городских кухнях.

- Рост числа семей с двумя работающими супругами и ограниченность времени в повседневной жизни стимулируют спрос на кухонную технику, которая сокращает время приготовления пищи и автоматизирует процессы готовки.

- Кроме того, расширение платформ электронной коммерции и онлайн-обзоров продукции сделало современную бытовую технику более доступной, а такие инновации, как индукционные плиты, сенсорное управление и самоочищающиеся духовки, открывают новые возможности для производителей.

- Экологическая осведомленность также влияет на решения о покупке, что приводит к увеличению продаж энергоэффективной и экологически сертифицированной бытовой техники, еще больше стимулируя рост рынка как в развитых, так и в развивающихся регионах.

Какой фактор препятствует росту рынка основных бытовых кухонных приборов?

- Одной из главных проблем, стоящих перед рынком бытовой кухонной техники, является высокая стоимость «умных» и премиальных приборов, что может препятствовать их внедрению на рынках, чувствительных к ценам.

- Например, хотя духовые шкафы и индукционные плиты с искусственным интеллектом обладают расширенными возможностями, их первоначальные инвестиции значительно выше по сравнению с традиционными газовыми или электрическими моделями, что ограничивает спрос в домохозяйствах с низким и средним уровнем дохода.

- Кроме того, технические сложности, связанные с подключенными к сети кухонными приборами, такие как настройка Wi-Fi, обновления программного обеспечения или совместимость устройств, могут отпугивать потребителей, не разбирающихся в технике, особенно в старших возрастных группах.

- Вопросы конфиденциальности данных и кибербезопасности также становятся все более актуальными, поскольку все больше устройств подключаются к облачным платформам и мобильным приложениям.

- Сообщения об утечках данных в устройствах для умного дома вызывают скептицизм в отношении конфиденциальности и надежности системы. Производители должны обеспечить надежное шифрование, безопасное подключение и прозрачные методы обработки данных, чтобы завоевать доверие потребителей.

- Наконец, ограниченная осведомленность в сельских регионах и зависимость от традиционных методов приготовления пищи на развивающихся рынках также ограничивают проникновение на рынок. Преодоление этого разрыва посредством просвещения потребителей, локализованного маркетинга и доступных по цене товарных линий будет иметь важное значение для долгосрочного и инклюзивного расширения рынка.

Как сегментируется рынок основных бытовых кухонных приборов?

Рынок сегментирован по типу, мощности, структуре и каналам сбыта .

- По типу

По типу, рынок основных бытовых кухонных приборов сегментирован на встраиваемые варочные панели, плиты, микроволновые печи, варочные поверхности, электрические плиты и другие. Сегмент плит доминировал на рынке с наибольшей долей выручки в 31,8% в 2024 году, что обусловлено их широким распространением в жилых домах благодаря удобству, многофункциональности и доступности. Плиты считаются необходимыми кухонными приборами, предлагая как скороварки, так и электрические варианты приготовления пищи, которые удовлетворяют различные потребности потребителей.

Ожидается, что сегмент встраиваемых варочных панелей продемонстрирует самый быстрый среднегодовой темп роста в период с 2025 по 2032 год, чему способствует рост числа модульных кухонных установок, особенно в городах. Эти варочные панели отличаются элегантным дизайном, компактностью и передовыми функциями безопасности, что делает их очень востребованными в современных домах премиум-класса.

- Силой

По типу мощности рынок сегментируется на электроприборы и газовые приборы. На долю сегмента электроприборов приходилась наибольшая доля выручки рынка в 2024 году – 56,3%, что обусловлено растущим распространением индукционных плит, электрических духовок и микроволновых печей. Электроприборы ценятся за простоту использования, точный контроль температуры и совместимость с интеллектуальными технологиями.

Прогнозируется, что сегмент газовых плит будет расти самыми быстрыми темпами в период с 2025 по 2032 год, особенно в регионах со стабильной газовой инфраструктурой и предпочтениями потребителей в отношении приготовления пищи на открытом огне, которое обеспечивает визуальный контроль и традиционные вкусовые преимущества.

- По структуре

По своей структуре рынок основных бытовых кухонных приборов сегментирован на встраиваемые и отдельно стоящие модели. Сегмент отдельно стоящих приборов доминировал на рынке, занимая наибольшую долю в 63,5% в 2024 году, благодаря гибкости размещения, более низким затратам на установку и сильному присутствию как в развивающихся, так и в развитых регионах. Эти приборы популярны среди арендаторов и потребителей с ограниченным бюджетом.

Однако ожидается, что сегмент встроенной мебели продемонстрирует самый быстрый среднегодовой темп роста в период с 2025 по 2032 год, поскольку спрос на интегрированные, эстетически привлекательные кухонные дизайны растет среди городских потребителей и застройщиков.

- По каналам сбыта

По каналам сбыта рынок сегментируется на супермаркеты, специализированные магазины, электронную коммерцию и другие. В 2024 году наибольшую долю рынка (37,6%) занимал сегмент супермаркетов, чему способствовали предпочтение физического осмотра бытовой техники перед покупкой, наличие множества брендов под одной крышей и привлекательные рекламные предложения.

Ожидается, что сегмент электронной коммерции продемонстрирует самый быстрый среднегодовой темп роста в период с 2025 по 2032 год, поскольку потребители все чаще переходят на онлайн-платформы из-за удобства, более широкого ассортимента товаров и доступа к отзывам. Онлайн-платформы также позволяют брендам выходить на рынки городов второго и третьего уровня без разветвленной сети физических розничных магазинов.

Какой регион занимает наибольшую долю на рынке основных бытовых кухонных приборов?

- Германия доминировала на европейском рынке бытовой кухонной техники, занимая наибольшую долю выручки в 43,26% в 2024 году. Это стало возможным благодаря высокой распространенности кухонной техники премиум-класса в домохозяйствах, сильной потребительской ориентации на энергоэффективные и интеллектуальные решения для кухни, а также присутствию ведущих производителей бытовой техники с передовыми производственными возможностями.

- Широкое распространение встраиваемых духовок, индукционных варочных панелей, «умных» плит и подключенных к сети кухонных приборов в городских домохозяйствах укрепляет региональное лидерство на рынке.

- Жесткие нормы энергоэффективности, сильный акцент на устойчивое производство и интеграция интеллектуальных устройств с поддержкой Интернета вещей и искусственного интеллекта позиционируют Европу как один из наиболее технологически развитых региональных рынков.

Анализ рынка крупной бытовой кухонной техники во Франции

Рынок бытовой кухонной техники во Франции демонстрирует самый быстрый рост со среднегодовым темпом 9,41%, чему способствуют растущий спрос на модернизацию современных кухонь, все более широкое внедрение «умной» и энергоэффективной техники, а также рост объемов ремонта жилых помещений. Расширение использования встраиваемых кухонных приборов и многофункциональных духовок повышает удобство и энергосбережение. Жесткие нормативные стандарты, государственные стимулы для энергоэффективной техники и инновации отечественных и зарубежных брендов укрепляют роль Франции как быстрорастущего рынка в европейском ландшафте.

Анализ рынка крупной бытовой кухонной техники в Италии

Рынок бытовой кухонной техники в Италии демонстрирует уверенный рост, обусловленный развитой кулинарной культурой, растущим спросом на высококачественную и дизайнерскую кухонную технику, а также урбанизацией. Все более широкое распространение индукционных варочных панелей, современных вытяжек и интегрированных кухонных решений повышает эффективность и эстетику бытовой техники. Акцент на дизайне продукции, энергоэффективности и непрерывных технологических инновациях позиционирует Италию как важного игрока на европейском рынке бытовой кухонной техники.

Какие компании занимают лидирующие позиции на рынке бытовой кухонной техники?

В основном, отрасль производства крупной бытовой кухонной техники возглавляют хорошо зарекомендовавшие себя компании, в том числе:

- AB Electrolux (Швеция)

- Корпорация Whirlpool (США)

- Samsung Electronics (Южная Корея)

- LG Electronics (Южная Корея)

- Корпорация Panasonic (Япония)

- Конинклийке Philips NV (Нидерланды)

- Морфи Ричардс (Великобритания)

- TTK Prestige Ltd (Индия)

- GE Appliances (США)

- Dacor, Inc. (США)

- Компания «Сычуань Чанхун Электрок» (Китай)

- GREE ELECTRIC APPLIANCES, INC. (Китай)

- Hitachi, Ltd. (Япония)

- BSH Hausgeräte GmbH (Германия)

- Balaji Home Shop (Индия)

- Lords Home Solutions (Индия)

Какие последние тенденции наблюдаются на мировом рынке основных бытовых кухонных приборов?

- В марте 2023 года компания Butterfly Gandhimathi Appliances объединилась с Crompton Greaves Consumer Electricals Ltd. (CGCEL) для укрепления своих позиций на рынке бытовой кухонной техники. Цель этого стратегического слияния — использовать синергию, стимулировать инновации в разработке продукции и внедрить эффективные маркетинговые стратегии для повышения конкурентоспособности компании в отрасли.

- В мае 2021 года корпорация Whirlpool объявила об инвестициях в размере 15 миллионов долларов США в свой завод в Оклахоме с целью расширения производственных мощностей и стимулирования инноваций. Эта инициатива отражает стремление Whirlpool к выпуску высококачественной потребительской продукции, стимулированию роста занятости и укреплению своего лидерства на рынке основных бытовых кухонных приборов за счет передовых производственных возможностей.

- В апреле 2021 года компания Electrolux была удостоена четырех наград Red Dot Design Awards за свои бренды Electrolux и AEG, которые отмечают превосходство в инновациях, функциональности, качестве и эргономике. Эта награда подчеркивает приверженность Electrolux к совершенству дизайна и инновациям, укрепляя ее конкурентное преимущество на рынке основных бытовых кухонных приборов.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.