Europe Leak Detection Market

Размер рынка в млрд долларов США

CAGR :

%

USD

611.26 Million

USD

1,082.09 Million

2025

2033

USD

611.26 Million

USD

1,082.09 Million

2025

2033

| 2026 –2033 | |

| USD 611.26 Million | |

| USD 1,082.09 Million | |

|

|

|

|

Рынок обнаружения утечек в Европе по типу (вверх по течению, в середине и вниз по течению), тип продукта (ручные газоанализаторы, детекторы на базе БПЛА, пилотируемые летательные аппараты и детекторы на базе транспортных средств), технология (акустика/ультразвук, методы отклонения давления-потока, расширенная модель переходных процессов в реальном времени (E-RTTM), тепловидение , баланс массы/объема, зондирование паров, лазерное поглощение и лидар, обнаружение утечек в гидравлической системе, клапаны отрицательного давления и другие), конечный пользователь (нефть и газ, химический завод, водоочистные сооружения, теплоэлектростанции, горнодобывающая промышленность и шламовые заводы и другие), страна (Германия, Франция, Великобритания, Италия, Испания, Россия, Турция, Бельгия, Нидерланды, Швейцария, остальная Европа) Отраслевые тенденции и прогноз до 2028 года

Анализ рынка и идеи : Европейский рынок обнаружения утечек

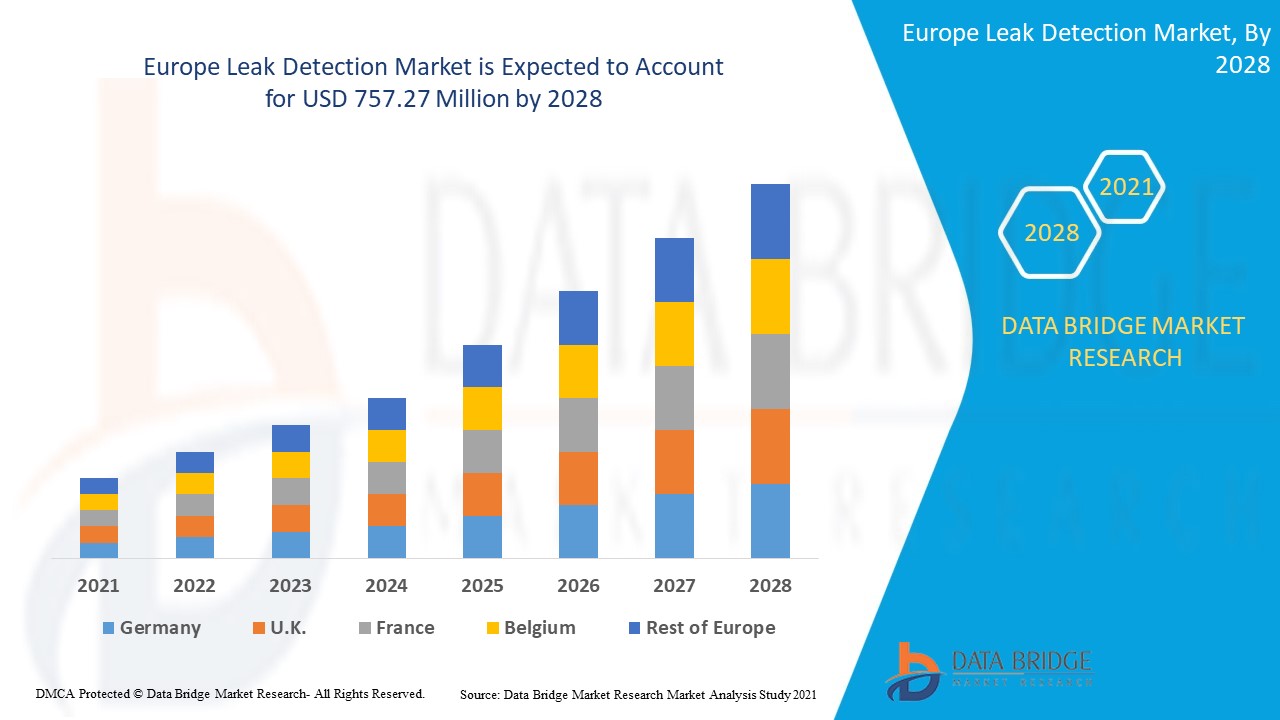

Ожидается, что рынок обнаружения утечек в Европе будет расти в прогнозируемый период с 2021 по 2028 год. По данным Data Bridge Market Research, среднегодовой темп роста рынка составит 7,4% в прогнозируемый период с 2021 по 2028 год, а к 2028 году он, как ожидается, достигнет 757,27 млн долларов США. Основными факторами, способствующими росту рынка, являются рост инфраструктуры нефте- и газопроводов и хранилищ.

Термин «утечка» или «протечка» означает непреднамеренную трещину, отверстие или пористость в ограждающей стенке или стыке труб, батарей, герметичных изделий, камер или контейнеров для хранения, которые должны содержать/передавать различные жидкости и газы. Эти трещины или отверстия позволяют жидкостям и газам выходить из закрытой среды. Утечки должны быть обнаружены как можно скорее, чтобы уменьшить потери и вред, причиняемый окружающей среде, для чего используются различные датчики и приборы обнаружения утечек. Основной функцией системы обнаружения утечек является локализация и измерение размера утечек в герметичных изделиях.

Большое количество инцидентов с утечками в трубопроводах и растущая интеграция передовых технологий в детекторы утечек расширяют рынок обнаружения утечек. Например, в январе 2020 года компания FLIR Systems Inc. выпустила FLIR GF77a, свою первую неохлаждаемую, стационарную, подключенную тепловизионную камеру для обнаружения метана и других промышленных газов. С этим новым запуском серии продуктов оптической газовой визуализации (OGI) компания расширила свой ассортимент продукции и увеличит свою клиентскую базу.

В этом отчете о рынке обнаружения утечек содержатся сведения о доле рынка, новых разработках и анализе продуктового портфеля, влиянии внутренних и локальных игроков рынка, анализируются возможности с точки зрения новых источников дохода, изменений в рыночных правилах, одобрений продуктов, стратегических решений, запусков продуктов, географических расширений и технологических инноваций на рынке. Чтобы понять анализ и рыночный сценарий, свяжитесь с нами для получения аналитического обзора, наша команда поможет вам создать решение по влиянию на доход для достижения желаемой цели.

Объем и размер европейского рынка обнаружения утечек

Рынок обнаружения утечек сегментирован на основе типа, типа продукта, технологии и конечного пользователя. Рост среди сегментов помогает вам анализировать нишевые карманы роста и стратегии подхода к рынку и определять ваши основные области применения и разницу в ваших целевых рынках.

- На основе типа рынок обнаружения утечек сегментируется на upstream, midstream и downstream. В 2021 году сегмент midstream занимал наибольшую долю рынка, поскольку сегмент midstream в основном занимается транспортировкой сырой нефти и природного газа различными способами транспортировки, такими как трубопроводы. Эти трубопроводы необходимо защищать от утечек, чтобы избежать инцидентов с утечками и не привести к гибели людей и имуществу. Таким образом, midstream доминирует в сегменте типов.

- По типу продукта рынок обнаружения утечек сегментируется на портативные газовые детекторы, детекторы на базе БПЛА, пилотируемые летательные аппараты и детекторы на базе транспортных средств. В 2021 году детекторы на базе транспортных средств заняли наибольшую долю рынка, поскольку их можно легко установить на транспортное средство и использовать для мониторинга трубопроводов через движущееся транспортное средство. Это наиболее экономичный и быстрый способ обнаружения утечек, и поэтому он доминирует в сегменте типа продукта.

- На основе технологий рынок обнаружения утечек сегментирован на акустические/ультразвуковые, волоконно-оптические, методы отклонения давления-потока, расширенную модель переходных процессов в реальном времени (E-RTTM), тепловизионные, баланс массы/объема, зондирование паров, лазерное поглощение и LIDAR, обнаружение гидравлических утечек, волны отрицательного давления и другие. В 2021 году акустические/ультразвуковые методы заняли наибольшую долю рынка, поскольку они предлагают более быстрое обнаружение утечек и являются недорогим решением, кроме того, они обеспечивают раннее обнаружение, и потерю можно предотвратить на ранней стадии, эти факторы приводят к самому высокому росту акустических/ультразвуковых методов в технологическом сегменте.

- На основе конечного пользователя рынок обнаружения утечек сегментирован на нефтегазовую отрасль, химические заводы, водоочистные сооружения, теплоэлектростанции, горнодобывающую промышленность и шламовую промышленность и другие. В 2021 году на нефтегазовую отрасль пришлась наибольшая доля рынка, поскольку эта отрасль является основным пользователем систем обнаружения утечек для предотвращения утечек сырой нефти и газа и выбросов метана. Утечка может привести к серьезным потерям жизни и имущества. Более того, несколько государственных постановлений по предотвращению инцидентов с утечками увеличили спрос на обнаружение утечек в нефтегазовой отрасли.

Анализ рынка обнаружения утечек в Европе на уровне страны

Проведен анализ рынка обнаружения утечек и предоставлена информация о его размере по странам, типам, типам продукции, технологиям и конечным пользователям.

В отчете о европейском рынке обнаружения утечек рассматриваются следующие страны: Германия, Великобритания, Франция, Швейцария, Италия, Испания, Нидерланды, Россия, Бельгия, Турция и остальные страны Европы.

Россия заняла самую большую долю рынка благодаря большому количеству проектов по добыче нефти и газа и транспортировке нефти и газа по трубопроводам в регионе.

Раздел отчета по странам также содержит отдельные факторы, влияющие на рынок, и изменения в регулировании на внутреннем рынке, которые влияют на текущие и будущие тенденции рынка. Такие данные, как новые продажи, заменяющие продажи, демографические данные страны, нормативные акты и импортно-экспортные тарифы, являются одними из основных указателей, используемых для прогнозирования рыночного сценария для отдельных стран. Кроме того, при предоставлении прогнозного анализа данных по странам учитываются наличие и доступность европейских брендов и их проблемы из-за большой или малой конкуренции со стороны местных и отечественных брендов, влияние каналов продаж.

Большое количество инцидентов с утечками из трубопроводов

Рынок обнаружения утечек также предоставляет вам подробный анализ рынка для каждой страны, рост в отрасли с продажами, продажами компонентов, влиянием технологического развития в обнаружении утечек и изменениями в нормативных сценариях с их поддержкой рынка обнаружения утечек. Данные доступны за исторический период с 2011 по 2019 год.

Анализ конкурентной среды и доли рынка обнаружения утечек

Конкурентная среда рынка обнаружения утечек содержит сведения по конкурентам. Включены сведения о компании, финансы компании, полученный доход, рыночный потенциал, инвестиции в исследования и разработки, новые рыночные инициативы, присутствие в Европе, производственные площадки и объекты, сильные и слабые стороны компании, запуск продукта, испытания продуктов, одобрения продуктов, патенты, широта и широта продукта, доминирование приложений, кривая жизненного цикла технологии. Приведенные выше данные относятся только к фокусу компаний, связанному с рынком обнаружения утечек.

Основными игроками, охваченными отчетом, являются FLIR SYSTEMS, Inc., ABB, Honeywell International Inc., Siemens Energy, Pentair, ClampOn AS, Schneider Electric, Atmos International, Xylem, Emerson Electric Co., KROHNE Messtechnik GmbH, PERMA-PIPE International Holdings, Inc., TTK, PSI Software AG, MSA, HIMA, AVEVA Group plc, Yokogawa Electric Corporation, INFICON, Fotech Group Ltd., Asel-Tech Inc., MAGNUM Pirex AG / MAGNUM LEO-Pipe GmbH и OptaSense Ltd. и другие. Аналитики DBMR понимают конкурентные преимущества и предоставляют конкурентный анализ для каждого конкурента отдельно.

Многие разработки продуктов также инициируются компаниями по всему миру, что также ускоряет рост рынка обнаружения утечек.

Например,

- В октябре 2020 года компания ABB запустила новую систему ABB MicroGuard — первое комплексное решение для обнаружения утечек газа в коммунальной отрасли, призванное защитить население городов. MicroGuard будет работать вместе с MobileGuard от ABB, чтобы быстрее и проще определять опасные утечки газа. Благодаря запуску этого нового продукта компания расширила свою линейку продукции.

- В декабре 2019 года Honeywell International Inc. объявила о приобретении Rebellion Photonics, поставщика инновационных, интеллектуальных, визуальных решений для мониторинга газа, которые помогают максимизировать безопасность, эксплуатационные характеристики и сокращение выбросов в нефтегазовой, нефтехимической и энергетической отраслях. Это приобретение поможет компании расширить свой продуктовый портфель.

Расширение производства, разработка новых продуктов и другие стратегии увеличивают долю рынка компании за счет увеличения охвата и присутствия. Это также дает преимущество организации в улучшении своего предложения по обнаружению утечек.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.