Europe Hepatitis B Infection Market

Размер рынка в млрд долларов США

CAGR :

%

USD

3.27 Billion

USD

4.73 Billion

2024

2032

USD

3.27 Billion

USD

4.73 Billion

2024

2032

| 2025 –2032 | |

| USD 3.27 Billion | |

| USD 4.73 Billion | |

|

|

|

|

Сегментация рынка инфекции гепатита В в Европе по типу (хроническая и острая), по лечению (вакцина, противовирусные препараты, иммуномодуляторы и хирургия) — тенденции отрасли и прогноз до 2032 г.

Объем рынка инфекции гепатита В в Европе

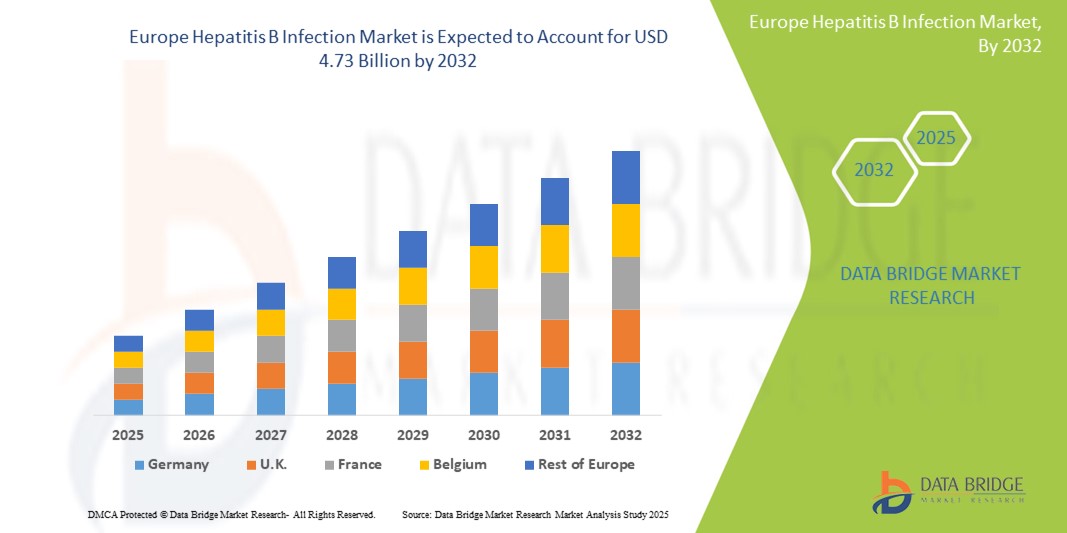

- Объем европейского рынка инфекции гепатита В оценивался в 3,27 млрд долларов США в 2024 году и, как ожидается, достигнет 4,73 млрд долларов США к 2032 году при среднегодовом темпе роста 4,70% в течение прогнозируемого периода .

- Рост рынка во многом обусловлен растущим внедрением передовых диагностических технологий и терапевтических инноваций для лечения гепатита B, а также растущей цифровизацией и интеграцией электронных систем здравоохранения по всей Европе.

- Кроме того, растущий спрос потребителей и общественного здравоохранения на точные, доступные и профилактические решения делает протоколы лечения гепатита B центральным направлением политики здравоохранения. Эти сходящиеся факторы ускоряют принятие вакцинации, скрининга и противовирусной терапии, тем самым значительно стимулируя рост рынка инфекций гепатита B в регионе.

Анализ рынка инфекций гепатита В в Европе

- Лечение и диагностика гепатита В становятся все более важными компонентами инфраструктуры общественного здравоохранения в Европе, особенно в больницах и амбулаторных условиях, в связи с ростом осведомленности об инфекции, улучшением доступности тестирования и достижениями в области противовирусной терапии.

- Растущий спрос на эффективное лечение гепатита B обусловлен в первую очередь государственными программами вакцинации, увеличением скрининга на коинфекцию HBV-HDV и растущим бременем хронических заболеваний печени среди стареющего населения.

- Германия доминировала на европейском рынке инфекций гепатита B с самой большой долей дохода в 34,7% в 2024 году, характеризуясь сильной политикой общественного здравоохранения, ранним внедрением передовых диагностических инструментов и высокими показателями тестирования на HBV. В стране также наблюдался значительный рост охвата лечением, особенно среди групп высокого риска и иммигрантов, что было обусловлено кампаниями по повышению осведомленности и улучшением схем возмещения расходов

- Ожидается, что Великобритания станет самым быстрорастущим регионом на рынке инфекций гепатита В в Европе, что обусловлено интеграцией тестирования на ВГВ в учреждения первичной медико-санитарной помощи и сильными национальными стратегиями иммунизации. Акцент NHS на программах иммунизации взрослых и детей остается ключевым фактором расширения рынка

- Хронический сегмент доминировал на европейском рынке инфекции гепатита В с долей рынка 62,4% в 2024 году, что обусловлено его устойчивым характером, необходимостью долгосрочного мониторинга и терапии, а также растущими показателями выявления в результате расширенных инициатив по скринингу.

Область применения отчета и сегментация европейского рынка инфекции гепатита В

|

Атрибуты |

Основные сведения о рынке инфекции гепатита В в Европе |

|

Охваченные сегменты |

|

|

Страны, охваченные |

Европа

|

|

Ключевые игроки рынка |

|

|

Возможности рынка |

|

|

Информационные наборы данных с добавленной стоимостью |

Помимо аналитических данных о рыночных сценариях, таких как рыночная стоимость, темпы роста, сегментация, географический охват и основные игроки, рыночные отчеты, подготовленные Data Bridge Market Research, также включают в себя углубленный экспертный анализ, анализ цен, анализ доли бренда, опрос потребителей, демографический анализ, анализ цепочки поставок, анализ цепочки создания стоимости, обзор сырья/расходных материалов, критерии выбора поставщиков, анализ PESTLE, анализ Портера и нормативную базу. |

Тенденции рынка инфекций гепатита В в Европе

« Повышенное удобство за счет комплексного ухода и расширенного доступа к лечению »

- Значительная и ускоряющаяся тенденция на европейском рынке инфекции гепатита В — это растущая интеграция многопрофильных моделей ухода и расширенный доступ к лечению через централизованные системы здравоохранения. Эта тенденция значительно улучшает результаты лечения пациентов и соблюдение режима лечения, обеспечивая бесперебойную коммуникацию между врачами общей практики, гепатологами и учреждениями общественного здравоохранения.

- Например, несколько стран Западной Европы внедрили национальные планы действий по гепатиту, которые позволяют пациентам получать раннюю диагностику, противовирусное лечение и регулярный последующий уход в рамках одной скоординированной структуры. Например, интегрированная модель ухода Германии обеспечивает эффективную связь от диагностики до лечения, снижая темпы прогрессирования заболевания

- Такие усилия, как централизованные регистры пациентов, системы цифровых медицинских карт и оптимизированные пути направления, оптимизируют управление инфекцией гепатита B, обеспечивая своевременное вмешательство и мониторинг. Эти системы позволяют поставщикам медицинских услуг отслеживать функцию печени, реакцию на лечение и сопутствующие инфекции, такие как гепатит D, в режиме реального времени

- Интеграция передовой диагностики с рутинными услугами первичной медицинской помощи облегчает раннее выявление как острых, так и хронических случаев. Этот централизованный подход в сочетании с доступным доступом к новым противовирусным методам лечения улучшает как индивидуальный уход за пациентами, так и более широкий надзор за общественным здоровьем

- Эта тенденция к более упорядоченному, скоординированному и технологически поддерживаемому лечению гепатита B в корне меняет ожидания в национальных системах здравоохранения. В результате многие европейские правительства расширяют доступ к скринингу на вирусный гепатит, особенно среди уязвимых и высокорисковых групп населения, таких как мигранты, потребители инъекционных наркотиков и пожилые люди.

- Спрос на доступные, эффективные и комплексные модели лечения гепатита В стремительно растет как в государственном, так и в частном секторе здравоохранения, поскольку заинтересованные стороны все больше внимания уделяют долгосрочному контролю заболевания и достижению целей Всемирной организации здравоохранения по ликвидации гепатита к 2030 году.

Динамика рынка инфекций гепатита В в Европе

Водитель

«Растущая потребность в связи с ростом заболеваемости и внедрением профилактической медицинской помощи»

- Растущая распространенность инфекции гепатита В в Европе, а также возросшая осведомленность о заболеваниях печени существенно повышают спрос на раннюю диагностику, вакцинацию и методы лечения.

- Например, в апреле 2024 года GlaxoSmithKline plc (GSK) расширила поставки вакцины против гепатита B в Европе посредством стратегического партнерства с региональными системами здравоохранения, стремясь улучшить показатели иммунизации среди групп высокого риска. Ожидается, что такие инициативы ключевых игроков рынка будут способствовать росту рынка вакцин против гепатита B в Европе в течение прогнозируемого периода

- Поскольку органы общественного здравоохранения и потребители все больше осознают долгосрочные осложнения, связанные с хроническим гепатитом В, такие как цирроз и рак печени, принятие профилактических стратегий, таких как вакцинация и раннее обследование, продолжает расти.

- Кроме того, интеграция тестирования на гепатит В в регулярные медицинские осмотры и растущая популярность диагностических технологий по месту оказания медицинской помощи делают лечение гепатита В более доступным и эффективным по всей Европе.

- Наличие эффективных вакцин, пероральных противовирусных препаратов и разработка современных иммуномодуляторов позволяют лучше контролировать заболевания. Государственное финансирование, политика возмещения расходов и цели ВОЗ по ликвидации гепатита также повышают уровень внедрения как в государственных, так и в частных медицинских учреждениях

Сдержанность/Вызов

« Опасения относительно доступности лечения и высокой стоимости современных методов лечения »

- Несмотря на достижения в области медицины, ограниченный доступ к современным противовирусным препаратам и иммуномодуляторам в некоторых частях Европы остается проблемой, особенно в Восточной и Южной Европе, где сохраняются различия в здравоохранении.

- Например, исследования, опубликованные в начале 2024 года, показали, что некоторые государства-члены ЕС по-прежнему сталкиваются с нехваткой вакцин против гепатита В и ограниченным доступом к новым схемам лечения из-за проблем с закупками и возмещением расходов.

- Для устранения этого разрыва необходимы усилия на политическом уровне по гармонизации стандартов лечения гепатита В во всех европейских странах, в частности, посредством финансовой поддержки на уровне ЕС, переговоров по ценам и упрощения процесса одобрения регулирующих органов.

- Более того, в то время как противовирусные препараты первой линии становятся более доступными, методы лечения нового поколения с повышенной эффективностью часто обходятся дороже, что потенциально ограничивает их использование среди незастрахованных или малообеспеченных слоев населения.

- Общественное недоверие или нежелание вакцинироваться, особенно в Европе после пандемии, является еще одним препятствием, которое необходимо устранить с помощью кампаний по повышению осведомленности и взаимодействия с поставщиками медицинских услуг.

- Преодоление этих проблем посредством расширения страхового покрытия, государственно-частного партнерства и увеличения инвестиций в региональную инфраструктуру здравоохранения будет иметь решающее значение для поддержания долгосрочного роста на европейском рынке борьбы с инфекцией гепатита В.

Объем рынка инфекции гепатита В в Европе

Рынок сегментирован по типу и способу обработки.

• По типу

На основе типа рынок инфекции гепатита В в Европе сегментирован на хронический и острый. Хронический сегмент доминировал в самой большой доле выручки рынка в 62,4% в 2024 году, в первую очередь из-за высокой распространенности хронических случаев HBV и необходимости пожизненного управления заболеванием с помощью противовирусной терапии и мониторинга.

Ожидается, что сегмент острых заболеваний продемонстрирует самые быстрые темпы роста со среднегодовым темпом роста 6,4% в период с 2025 по 2032 год, что будет обусловлено усилением мер раннего скрининга, инициативами в области общественного здравоохранения и растущей осведомленностью, что приведет к своевременной диагностике и лечению.

• По лечению

На основе лечения рынок инфекции гепатита В в Европе сегментируется на вакцины, противовирусные препараты, иммуномодуляторы и хирургию. Сегмент вакцины имел наибольшую долю выручки в 41,2% в 2024 году, поддержанную национальными кампаниями по вакцинации, увеличением иммунизации при рождении и высоким уровнем охвата среди взрослого населения с высоким риском.

Прогнозируется, что сегмент противовирусных препаратов продемонстрирует самые высокие среднегодовые темпы роста в 7,1% в период с 2025 по 2032 год, что будет обусловлено расширением пула пациентов с хроническим гепатитом В, достижениями в области пероральной терапии и благоприятной политикой возмещения расходов.

Региональный анализ рынка инфекции гепатита В в Европе

- Европа доминировала на рынке инфекции гепатита В с наибольшей долей выручки в 33,27% в 2024 году, что обусловлено сильной инфраструктурой общественного здравоохранения, высоким уровнем охвата вакцинацией и растущей осведомленностью о путях передачи и профилактике гепатита В.

- Регион характеризуется передовыми диагностическими возможностями, хорошо налаженными программами иммунизации и активными инициативами по надзору за гепатитом под руководством правительства.

- Широкое внедрение профилактических и терапевтических мер дополнительно поддерживается всеобщим доступом к здравоохранению, постоянными инвестициями в НИОКР и растущим вниманием к раннему скринингу и контролю заболеваний, что позиционирует Европу как ключевого участника мирового рынка борьбы с инфекцией гепатита В.

Обзор рынка инфекций гепатита В в Германии

Рынок инфекции гепатита В в Германии доминировал в Европе с самой большой долей выручки в 34,7% в 2024 году, что обусловлено ее надежной инфраструктурой здравоохранения, сильными программами общественного здравоохранения и ранним принятием инициатив по вакцинации и скринингу гепатита В. Страна выигрывает от передовой диагностической сети, высокой осведомленности среди медицинских работников и широкого доступа к противовирусной терапии, что поддерживает высокий рыночный спрос. Национальная стратегия иммунизации Германии в сочетании с постоянным финансированием исследований и лечения гепатита В продолжает улучшать результаты контроля заболевания.

Обзор рынка инфекций гепатита В во Франции

На долю рынка инфекции гепатита В во Франции пришлось 14,2% доли регионального дохода в 2024 году. Рост поддерживается государственными программами надзора за гепатитом и высоким охватом вакцинацией. Эффективный дородовой скрининг и вакцинация новорожденных способствуют ранней профилактике. Ожидается, что инвестиции в НИОКР в области противовирусной терапии и кампании по повышению осведомленности будут способствовать дальнейшему расширению рынка.

Обзор рынка инфекций гепатита В в Великобритании

Рынок инфекции гепатита В в Великобритании занимал 13,5% доли выручки на европейском рынке инфекции гепатита В в 2024 году. Ожидается, что рынок будет расти со среднегодовым темпом роста 6,8% в течение прогнозируемого периода, что обусловлено интегрированным тестированием на ВГВ в первичную медицинскую помощь и сильными национальными стратегиями иммунизации. Сосредоточение внимания NHS на иммунизации взрослых и детей является ключевым фактором роста.

Обзор рынка инфекций гепатита В в Нидерландах

Рынок инфекции гепатита В в Нидерландах составил 6,8% от выручки европейского рынка инфекции гепатита В в 2024 году. Рынок выигрывает от комплексных кампаний вакцинации и целевых инициатив скрининга, особенно для групп высокого риска. Сотрудничество правительства и академических кругов способствует инновациям в диагностике и стратегиях раннего лечения.

Доля рынка инфекций гепатита В в Европе

Индустрию борьбы с инфекцией гепатита В в Европе возглавляют в основном хорошо зарекомендовавшие себя компании, в том числе:

- Gilead Sciences, Inc. (США)

- GSK plc (Великобритания)

- Dynavax Technologies (США)

- F. Hoffmann-La Roche Ltd (Швейцария)

- Компания Bristol-Myers Squibb (США)

- Merck & Co., Inc. (США)

- Новартис АГ (Швейцария)

- Arrowhead Pharmaceuticals Inc. (США)

- Arbutus Biopharma (Канада)

- Teva Pharmaceuticals, Inc. (Израиль)

- Zydus Pharmaceuticals (Индия)

- Ауробиндо Фарма (Индия)

- Lupin Pharmaceuticals, Inc. (Индия)

Последние события на европейском рынке инфекций гепатита В

- В сентябре 2024 года Gilead Sciences и Genesis Therapeutics объявили о стратегическом сотрудничестве с целью открытия и разработки новых методов лечения малыми молекулами с использованием платформы Genesis GEMS AI. Gilead получила эксклюзивные права на разработку и коммерциализацию продуктов в рамках этого партнерства

- В июле 2024 года компания Gilead Sciences, Inc. представила данные исследований, демонстрирующие долгосрочную эффективность и безопасность Biktarvy в различных группах населения с ВИЧ, включая испаноязычных/латиноамериканских лиц и пожилых людей с сопутствующими заболеваниями. Также были освещены исследовательские режимы дозирования один раз в день и еженедельно

- В феврале 2024 года GSK завершила приобретение Aiolos Bio, включая перспективное моноклональное антитело AIO-001 для лечения тяжелой астмы. GSK выплатила 1000 миллионов долларов США авансом и до 400 миллионов долларов США поэтапными платежами, расширив свой портфель респираторных биопрепаратов

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Содержание

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE HEPATITIS B INFECTION MARKET

1.4 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 THERAPEUTICS LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHT

4.1 PESTAL ANALYSIS

4.2 PORTER FIVE FORCES

5 EUROPE HEPATITIS B INFECTION MARKET: REGULATIONS

5.1 REGULATORY AUTHORITIES IN THE ASIA-PACIFIC REGION

5.2 NORTH AMERICA REGULATORY SCENARIO

5.3 EUROPE REGULATORY SCENARIO

5.4 MIDDLE EAST AND AFRICA REGULATORY SCENARIO

5.5 SOUTH AMERICA REGULATORY SCENARIO

6 PIPELINE ANALYSIS

7 EPIDEMILIOGY

8 MARKET OVERVIEW

8.1 DRIVERS

8.1.1 INCREASING PREVALENCE OF HEPATITIS B INFECTIONS

8.1.2 TECHNOLOGICAL ADVANCEMENTS IN DIAGNOSTICS

8.1.3 DEVELOPMENT OF COMBINATION THERAPIES FOR HEPATITIS B

8.1.4 STRATEGIC INITIATIVES BY COMPANIES FOR HEPATITIS B INFECTION

8.2 RESTRAINTS

8.2.1 SIDE EFFECTS AND DRUG RESISTANCE

8.2.2 INSUFFICIENT VACCINE COVERAGE FOR HEPATITIS B INFECTION

8.3 OPPORTUNITY

8.3.1 RISING NEW DRUG RELEASES AND INCREASING NEW DRUG PERMITS FOR HEPATITIS B

8.3.2 GOVERNMENT PROGRAMS TO RAISE AWARENESS OF HEPATITIS B INFECTION

8.3.3 ADVANCED RESEARCH AND DEVELOPMENT FOR CLINICAL TRIALS

8.4 CHALLENGES

8.4.1 THE COST OF HEPATITIS B TREATMENTS IS HIGH

8.4.2 STRINGENT REGULATORY POLICIES AND REGIONAL DISPARITIES IN TREATMENT ACCESS

9 EUROPE HEPATITIS B INFECTION MARKET, BY TYPE

9.1 OVERVIEW

9.2 CHRONIC

9.3 ACUTE

10 EUROPE HEPATITIS B INFECTION MARKET, BY TREATMENT

10.1 OVERVIEW

10.2 VACCINE

10.2.1 HOSPITAL PHARMACIES

10.2.2 DRUGS STORES AND RETAIL PHARMACIES

10.2.3 ONLINE PHARMACIES

10.3 ANTIVIRAL DRUGS

10.3.1 TENOFOVIR ALAFENAMIDE FUMARATE (TAF)

10.3.2 TENOFOVIR DISOPROXIL FUMARATE (TDF)

10.3.3 ENTECAVIR

10.3.4 OTHERS

10.4 IMMUNE MODULATOR DRUGS

10.4.1 PEGYLATED INTERFERON

10.4.2 INTERFERON ALPHA

10.5 SURGERY

11 EUROPE HEPATITIS B INFECTION MARKET, BY REGION

11.1 EUROPE

11.1.1 GERMANY

11.1.2 U.K

11.1.3 TURKEY

11.1.4 RUSSIA

11.1.5 SPAIN

11.1.6 ITALY

11.1.7 SWEDEN

11.1.8 BELGIUM

11.1.9 POLAND

11.1.10 FRANCE

11.1.11 SWITZERLAND

11.1.12 NETHERLANDS

11.1.13 NORWAY

11.1.14 DENMARK

11.1.15 FINLAND

11.1.16 REST OF EUROPE

12 EUROPE HEPATITIS B TREATMENT MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: EUROPE

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 GILEAD SCIENCES, INC.

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENT

14.2 GLAXOSMITHKLINE PLC

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENT

14.3 DYNAVAX TECHNOLOGIES CORPORATION

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENTS

14.4 F. HOFFMAN-LA ROCHE LTD.

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT DEVELOPMENTS

14.5 BRISTOL-MYERS SQUIBB COMPANY

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT DEVELOPMENTS

14.6 ARROWHEAD PHARMACEUTICALS, INC.

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 PRODUCT PORTFOLIO

14.6.4 RECENT DEVELOPMENTS

14.7 ARBUTUS BIOPHARMA

14.7.1 COMPANY SNAPSHOT

14.7.2 REVENUE ANALYSIS

14.7.3 PRODUCT PORTFOLIO

14.7.4 RECENT UPDATES

14.8 AUROBINDO PHARMA

14.8.1 COMPANY SNAPSHOT

14.8.2 REVENUE ANALYSIS

14.8.3 PRODUCT PORTFOLIO

14.8.4 RECENT UPDATES

14.9 LUPIN PHARMACEUTICALS, INC.

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT UPDATES

14.1 MERCK & CO., INC.,

14.10.1 COMPANY SNAPSHOT

14.10.2 REVENUE ANALYSIS

14.10.3 PRODUCT PORTFOLIO

14.10.4 RECENT DEVELOPMENTS

14.11 NOVARTIS AG

14.11.1 COMPANY SNAPSHOT

14.11.2 REVENUE

14.11.3 PRODUCT PORTFOLIO

14.11.4 RECENT DEVELOPMENT

14.12 TEVA PHARMACEUTICAL INDUSTRIES

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENTS

14.13 ZYDUS PHARMACEUTICALS, INC.

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 REVENUE

14.13.4 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

Список таблиц

TABLE 1 EUROPE CLINICAL TRIAL AND PIPELINE A-LYSIS AS PER THE COMPANY

TABLE 2 DISTRIBUTION OF PRODUCTS OR PROJECTS BY PHASE

TABLE 3 COUNTRY WISE EPIDEMIOLOGY FOR HEPATITIS B

TABLE 4 COST OF HEPATITIS B MEDICATIONS: BRAND VS. GENERIC PRICES

TABLE 5 EUROPE HEPATITIS B INFECTION MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 6 EUROPE CHRONIC IN HEPATITIS B INFECTION MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 7 EUROPE ACUTE IN HEPATITIS B INFECTION MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 8 EUROPE HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 9 EUROPE VACCINE IN HEPATITIS B INFECTION MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 10 EUROPE VACCINE, ANTIVIRAL DRUGS, IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 11 EUROPE ANTIVIRAL DRUGS IN HEPATITIS B INFECTION MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 12 EUROPE ANTIVIRAL DRUGS IN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 13 EUROPE IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 14 EUROPE IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 15 EUROPE SURGERY IN HEPATITIS B INFECTION MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 16 EUROPE HEPATITIS B INFECTION MARKET, BY COUNTRY, 2022-2031 (USD MILLION)

TABLE 17 EUROPE HEPATITIS B INFECTION MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 18 EUROPE HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 19 EUROPE ANTIVIRAL DRUGS IN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 20 EUROPE IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 21 EUROPE VACCINE, ANTIVIRAL DRUGS, IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 22 GERMANY HEPATITIS B INFECTION MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 23 GERMANY HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 24 GERMANY ANTIVIRAL DRUGS IN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 25 GERMANY IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 26 GERMANY VACCINE, ANTIVIRAL DRUGS, IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 27 U.K. HEPATITIS B INFECTION MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 28 U.K. HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 29 U.K. ANTIVIRAL DRUGS IN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 30 U.K. IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 31 U.K. IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 32 TURKEY HEPATITIS B INFECTION MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 33 TURKEY HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 34 TURKEY ANTIVIRAL DRUGS IN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 35 TURKEY IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 36 TURKEY VACCINE, ANTIVIRAL DRUGS, IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 37 RUSSIA HEPATITIS B INFECTION MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 38 RUSSIA HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 39 RUSSIA ANTIVIRAL DRUGS IN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 40 RUSSIA IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 41 RUSSIA VACCINE, ANTIVIRAL DRUGS, IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 42 SPAIN HEPATITIS B INFECTION MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 43 SPAIN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 44 SPAIN ANTIVIRAL DRUGS IN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 45 SPAIN IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 46 SPAIN VACCINE, ANTIVIRAL DRUGS, IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 47 ITALY HEPATITIS B INFECTION MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 48 ITALY HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 49 ITALY ANTIVIRAL DRUGS IN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 50 ITALY IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 51 ITALY VACCINE, ANTIVIRAL DRUGS, IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 52 SWEDEN HEPATITIS B INFECTION MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 53 SWEDEN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 54 SWEDEN ANTIVIRAL DRUGS IN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 55 SWEDEN IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 56 SWEDEN VACCINE, ANTIVIRAL DRUGS, IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 57 BELGIUM HEPATITIS B INFECTION MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 58 BELGIUM HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 59 BELGIUM ANTIVIRAL DRUGS IN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 60 BELGIUM IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 61 BELGIUM VACCINE, ANTIVIRAL DRUGS, IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 62 POLAND HEPATITIS B INFECTION MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 63 POLAND HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 64 POLAND ANTIVIRAL DRUGS IN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 65 POLAND IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 66 POLAND VACCINE, ANTIVIRAL DRUGS, IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 67 FRANCE HEPATITIS B INFECTION MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 68 FRANCE HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 69 FRANCE ANTIVIRAL DRUGS IN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 70 FRANCE IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 71 FRANCE VACCINE, ANTIVIRAL DRUGS, IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 72 SWITZERLAND HEPATITIS B INFECTION MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 73 SWITZERLAND HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 74 SWITZERLAND ANTIVIRAL DRUGS IN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 75 SWITZERLAND IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 76 SWITZERLAND VACCINE, ANTIVIRAL DRUGS, IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 77 NETHERLANDS HEPATITIS B INFECTION MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 78 NETHERLANDS HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 79 NETHERLANDS ANTIVIRAL DRUGS IN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 80 NETHERLANDS IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 81 NETHERLANDS VACCINE, ANTIVIRAL DRUGS, IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 82 NORWAY HEPATITIS B INFECTION MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 83 NORWAY HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 84 NORWAY HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 85 NORWAY IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 86 NORWAY VACCINE, ANTIVIRAL DRUGS, IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 87 DENMARK HEPATITIS B INFECTION MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 88 DENMARK HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 89 DENMARK ANTIVIRAL DRUGS IN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 90 DENMARK IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 91 DENMARK VACCINE, ANTIVIRAL DRUGS, IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 92 FINLAND HEPATITIS B INFECTION MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 93 FINLAND HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 94 FINLAND ANTIVIRAL DRUGS IN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 95 FINLAND IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY TREATMENT, 2022-2031 (USD MILLION)

TABLE 96 FINLAND VACCINE, ANTIVIRAL DRUGS, IMMUNE MODULATOR DRUGS IN HEPATITIS B INFECTION MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 97 REST OF EUROPE HEPATITIS B INFECTION MARKET, BY TYPE, 2022-2031 (USD MILLION)

Список рисунков

FIGURE 1 EUROPE HEPATITIS B INFECTION MARKET: SEGMENTATION

FIGURE 2 EUROPE HEPATITIS B INFECTION MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE HEPATITIS B INFECTION MARKET: DROC ANALYSIS

FIGURE 4 EUROPE HEPATITIS B INFECTION MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE HEPATITIS B INFECTION MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE HEPATITIS B INFECTION MARKET: MULTIVARIATE MODELLING

FIGURE 7 EUROPE HEPATITIS B INFECTION MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 EUROPE HEPATITIS B INFECTION MARKET: DBMR MARKET POSITION GRID

FIGURE 9 EUROPE HEPATITIS B INFECTION MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 EUROPE HEPATITIS B INFECTION MARKET: SEGMENTATION

FIGURE 11 TWO SEGMENTS COMPRISE THE EUROPE HEPATITIS B INFECTION MARKET, BY TYPE

FIGURE 12 EXECUTIVE SUMMARY

FIGURE 13 STRATEGIC DECISIONS

FIGURE 14 EUROPE HEPATITIS B INFECTION MARKET

FIGURE 15 CHRONIC SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE HEPATITIS B INFECTION MARKET IN 2024 & 2031

FIGURE 16 DROC ANALYSIS

FIGURE 17 BURDEN OF HBV INFECTION IN THE GENERAL POPULATION BY WHO REGION, 2019

FIGURE 18 EUROPE HEPATITIS B INFECTION MARKET: BY TYPE, 2023

FIGURE 19 EUROPE HEPATITIS B INFECTION MARKET: BY TYPE, 2024-2031 (USD MILLION)

FIGURE 20 EUROPE HEPATITIS B INFECTION MARKET: BY TYPE, CAGR (2024-2031)

FIGURE 21 EUROPE HEPATITIS B INFECTION MARKET: BY TYPE, LIFELINE CURVE

FIGURE 22 EUROPE HEPATITIS B INFECTION MARKET: BY TREATMENT, 2023

FIGURE 23 EUROPE HEPATITIS B INFECTION MARKET: BY TREATMENT, 2024-2031 (USD MILLION)

FIGURE 24 EUROPE HEPATITIS B INFECTION MARKET: BY TREATMENT, CAGR (2024-2031)

FIGURE 25 EUROPE HEPATITIS B INFECTION MARKET BY TREATMENT, LIFELINE CURVE

FIGURE 26 EUROPE HEPATITIS B INFECTION MARKET, SNAPSHOT

FIGURE 27 EUROPE HEPATITIS B TREATMENT MARKET: COMPANY SHARE 2023 (%)

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.