Европейский рынок кормовых ароматизаторов и подсластителей по типу (кормовые ароматизаторы, кормовые подсластители), (натуральные и традиционные), форме (порошок, жидкость), животным (жвачные, свиньи, птица, домашние животные) – тенденции отрасли и прогноз до 2029 г.

Анализ и размер рынка

Вкусовые добавки и подсластители корма стали объектом пристального внимания владельцев скота в связи с ростом значимости вкусовых качеств корма. Вкусовые добавки и подсластители корма используются для улучшения вкусовых качеств корма и повышения его потребления. Различные отчеты показывают, что животные используют обоняние и зрение для обнаружения тонких различий в кормах и делают соответствующий выбор.

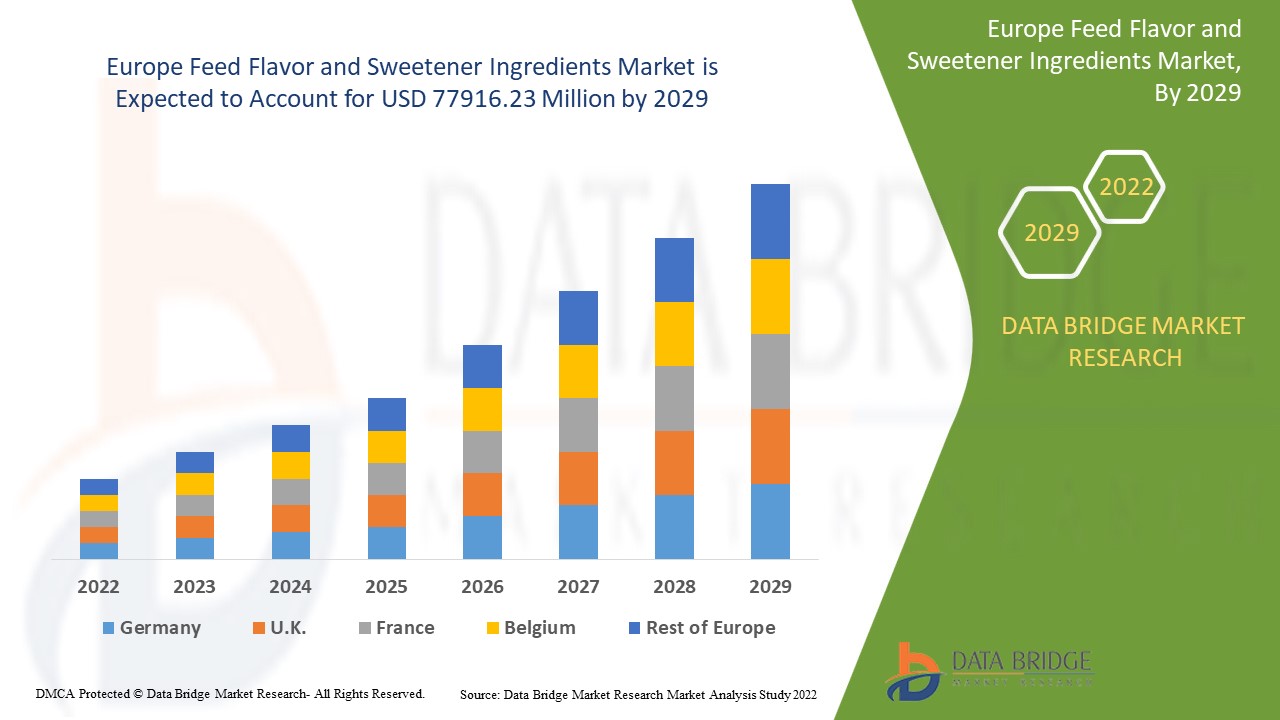

Европейский рынок кормовых ароматизаторов и подсластителей оценивался в 48 897,42 млн долларов США в 2021 году и, как ожидается, достигнет 77 916,23 млн долларов США к 2029 году, регистрируя среднегодовой темп роста 5,10% в прогнозируемый период 2022-2029 годов. Жвачные животные составляют крупнейший сегмент животных на соответствующем рынке из-за высокого использования этих ингредиентов для улучшения потребления ими корма. Помимо рыночных данных, таких как рыночная стоимость, темпы роста, сегменты рынка, географический охват, участники рынка и рыночный сценарий, рыночный отчет, подготовленный командой Data Bridge Market Research, также включает в себя углубленный экспертный анализ, анализ импорта/экспорта, анализ цен, анализ потребления продукции, патентный анализ и поведение потребителей.

Определение рынка

Ингредиенты кормовых ароматизаторов и подсластителей относятся к типу веществ, которые добавляются в корм для животных для придания вкуса и сладости. Они добавляются в корм для животных в основном для двух целей: улучшения вкуса и запаха и улучшения потребления корма животными.

Область отчета и сегментация рынка

|

Отчет Метрика |

Подробности |

|

Прогнозируемый период |

2022-2029 |

|

Базовый год |

2021 |

|

Исторические годы |

2020 (Можно настроить на 2019 - 2014) |

|

Количественные единицы |

Выручка в млрд долл. США, объемы в единицах, цены в долл. США |

|

Охваченные сегменты |

Тип (ароматизаторы корма, подсластители корма), (натуральные и обычные), форма (порошок, жидкость), животное (жвачные животные, свиньи, птица, домашние животные) |

|

Страны, охваченные |

Германия, Швеция, Польша, Дания, Италия, Великобритания, Франция, Испания, Нидерланды, Бельгия, Швейцария, Турция, Россия, Остальная Европа в Европе |

|

Охваченные участники рынка |

pancosma (Швейцария), Palital Feed Additives BV (Нидерланды), Lucta (Испания), PHODE (Франция), Innov Ad NV/SA (Бельгия), Kemin Industries, Inc. (США), Phytobiotics Futterzusatzstoffe GmbH (Германия), Kaesler Nutrition (Германия), INROADS INTERNATIONAL (Великобритания), Adisseo (Китай), FeedStimulants (Нидерланды), DDC Biotech Corp. (Индия), Alltech (США), Orbitec International SL (Испания) и Layn Corp. (Китай) и другие. |

|

Возможности рынка |

|

Динамика рынка кормовых ароматизаторов и подсластителей в Европе

В этом разделе рассматривается понимание движущих сил рынка, преимуществ, возможностей, ограничений и проблем. Все это подробно обсуждается ниже:

Драйверы

- Высокое потребление продуктов животного происхождения

Рост потребления продуктов животного происхождения в регионе выступает в качестве одного из основных факторов, стимулирующих рост рынка ингредиентов для кормовых ароматизаторов и подсластителей. Рост спроса на высококачественные продукты животного происхождения, такие как мясо, среди растущего населения оказывает положительное влияние на рынок.

- Случаи вспышек заболеваний

Рост числа вспышек заболеваний среди скота, а также сильное воздействие животных на окружающую среду ускоряют рост рынка. Рост осознания здоровья животных среди населения и широкое использование кормовых ароматизаторов и подсластителей для снижения дефицита питательных веществ стимулируют рынок.

- Строгие требования

Необходимость соответствия требованиям качества и импорта в регионе дополнительно влияет на рынок. Экспорт в Европейский Союз в основном представляет собой высококачественную продукцию, обслуживающую. Согласно Австралийской комиссии по конкуренции и потребителям (ACCC). Таким образом, производители крупного рогатого скота специализируются на подготовке животных для европейского рынка.

Кроме того, изменение образа жизни, увеличение располагаемого дохода и повышение осведомленности о преимуществах кормовых ароматизаторов положительно влияют на рынок кормовых ароматизаторов и подсластителей.

Возможности

Кроме того, внедрение стандартизированных и коммерческих методов ведения хозяйства с целью повышения качества векселей расширяет возможности получения прибыли для участников рынка в прогнозируемый период с 2022 по 2029 год. Кроме того, сотрудничество с поставщиками сырья будет способствовать дальнейшему расширению рынка.

Ограничения/Проблемы

С другой стороны, ожидается, что колебания цен на сырье будут препятствовать росту рынка. Недостаточная осведомленность, как ожидается, бросит вызов рынку кормовых ароматизаторов и подсластителей в прогнозируемый период 2022-2029 гг.

В этом отчете о рынке кормовых ароматизаторов и подсластителей содержатся сведения о последних разработках, правилах торговли, анализе импорта-экспорта, анализе производства, оптимизации цепочки создания стоимости, доле рынка, влиянии отечественных и локальных игроков рынка, анализируются возможности с точки зрения новых источников дохода, изменений в правилах рынка, анализ стратегического роста рынка, размер рынка, рост рынка категорий, ниши применения и доминирование, одобрение продуктов, запуск продуктов, географическое расширение, технологические инновации на рынке. Чтобы получить больше информации о рынке кормовых ароматизаторов и подсластителей, свяжитесь с Data Bridge Market Research для получения аналитического обзора, наша команда поможет вам принять обоснованное рыночное решение для достижения роста рынка.

Влияние COVID-19 на рынок кормовых ароматизаторов и подсластителей в Европе

COVID-19 оказал негативное влияние на несколько отраслей. Однако рынок кормовых ароматизаторов и подсластителей в этот период значительно вырос. Во время карантина, введенного правительством для ограничения распространения коронавирусной инфекции, большинство владельцев скота проявили большой интерес к использованию кормовых добавок из-за роста осознанности в отношении вспышек заболеваний. Производители сосредоточены на разработке кормовых добавок для повышения потребления корма, производительности и качества конечных продуктов в постковидном сценарии.

Объем и размер европейского рынка кормовых ароматизаторов и подсластителей

Рынок ингредиентов для кормовых ароматизаторов и подсластителей сегментирован на основе типа, типа источника, формы и животного. Рост среди этих сегментов поможет вам проанализировать сегменты с незначительным ростом в отраслях и предоставить пользователям ценный обзор рынка и рыночные идеи, которые помогут им принимать стратегические решения для определения основных рыночных приложений.

Тип

- Кормовые ароматизаторы

- Подсластители для корма

Тип источника

- Естественный

- Общепринятый

Форма

- Пудра

- Жидкость

Животное

- Жвачные животные

- Свинья

- Птица

- Домашние животные

Региональный анализ/информация о рынке ароматизаторов и подсластителей в Европе

Проведен анализ рынка ингредиентов для кормовых ароматизаторов и подсластителей, а также предоставлены сведения о размерах рынка и тенденциях по странам, типам, типам источников, формам и животным, как указано выше.

В отчете о рынке кормовых ароматизаторов и подсластителей рассматриваются следующие страны: Германия, Швеция, Польша, Дания, Италия, Великобритания, Франция, Испания, Нидерланды, Бельгия, Швейцария, Турция, Россия и остальные страны Европы.

На европейском рынке кормовых ароматизаторов и подсластителей Франция доминировала на рынке, поскольку в Европе осведомленность о здоровье животных и потреблении ими корма была усилена усилиями лабораторий по контролю кормов (CL), национальных референтных лабораторий (NRL) и ассоциаций по охране здоровья животных ЕС. Германия и Великобритания также, как ожидается, будут доминировать на рынке и расти со значительными темпами роста. Эти страны известны как популярный центр производства кормов. Растущий спрос на кормовые ароматизаторы также подтолкнул производителей кормовых добавок и кормовых ингредиентов к расширению своего бизнеса в сегменте натуральных и обычных продуктов.

Раздел отчета по странам также содержит отдельные факторы, влияющие на рынок, и изменения в регулировании на внутреннем рынке, которые влияют на текущие и будущие тенденции рынка. Такие данные, как анализ цепочки создания стоимости вверх и вниз по течению, технические тенденции и анализ пяти сил Портера, тематические исследования, являются некоторыми из указателей, используемых для прогнозирования рыночного сценария для отдельных стран. Кроме того, при предоставлении прогнозного анализа данных по странам учитываются наличие и доступность глобальных брендов и их проблемы, связанные с большой или малой конкуренцией со стороны местных и внутренних брендов, влияние внутренних тарифов и торговых путей.

Конкурентная среда и анализ доли европейского рынка кормовых ароматизаторов и подсластителей

Конкурентная среда рынка кормовых ароматизаторов и подсластителей содержит подробную информацию по конкурентам. Включены следующие сведения: обзор компании, финансовые показатели компании, полученный доход, рыночный потенциал, инвестиции в исследования и разработки, новые рыночные инициативы, глобальное присутствие, производственные площадки и объекты, производственные мощности, сильные и слабые стороны компании, запуск продукта, широта и широта продукта, доминирование в применении. Приведенные выше данные касаются только фокуса компаний, связанного с рынком кормовых ароматизаторов и подсластителей.

Некоторые из основных игроков, работающих на рынке ингредиентов для кормовых ароматизаторов и подсластителей, включают:

- панкосма (Швейцария)

- Palital Feed Additives BV (Нидерланды)

- Лукта (Испания)

- ФОД (Франция)

- Innov Ad NV/SA (Бельгия)

- Kemin Industries, Inc. (США)

- Фитобиотики Futterzusatzstoffe GmbH (Германия)

- Kaesler Nutrition (Германия)

- INROADS INTERNATIONAL (Великобритания)

- Адисео (Китай)

- FeedStimulants (Нидерланды)

- DDC Biotech Corp. (Индия)

- Оллтек (США)

- Orbitec International SL (Испания)

- Layn Corp. (Китай)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Содержание

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE FEED FLAVOR AND SWEETENER INGREDIENTS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 SOURCE TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 EUROPE FEED FLAVOR AND SWEETENER INGREDIENTS MARKET: REGULATORY FRAMEWORK

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 HIGH OLFACTORY AND TASTE SENSATION IN ANIMALS

6.1.2 RISING AWARENESS REGARDING BETTER FEED INTAKE OF ANIMALS

6.1.3 HIGH DEMAND OF FLAVORED FEED PRODUCTS

6.1.4 AVAILABILITY OF WIDE RANGE OF TYPES OF FEED FLAVORS

6.1.5 INCREASED POULTRY FARMING

6.2 RESTRAINTS

6.2.1 LACK OF AWARENESS IN EMERGING COUNTRIES REGARDING FEED CONTENT

6.2.2 VARIATION IN PREFERENCE OF FEED FLAVORS BY ANIMALS

6.2.3 LACK OF AWARENESS ABOUT PALATABILITY BOOSTING INGREDIENTS

6.3 OPPORTUNITIES

6.3.1 BUSINESS EXPANSION FOR FUTURE GROWTH

6.3.2 GROWING ADVANCEMENT IN FLAVOR PRESERVATION TECHNOLOGIES

6.3.3 IMPLEMENTATION OF STANDARDIZED AND COMMERCIAL HUSBANDRY PRACTICES

6.4 CHALLENGES

6.4.1 CONTINUOUS FLUCTUATION IN PRICES OF RAW MATERIAL

6.4.2 HIGH PRESENCE OF SUBSTITUTES

6.4.3 SIDE EFFECTS ASSOCIATED WITH CONVENTIONAL FEED FLAVORS

7 COVID-19 IMPACT ON FEED FLAVOR AND SWEETENER INGREDIENTS MARKET

7.1 INITIATIVES

7.2 CONCLUSION

8 EUROPE FEED FLAVOR AND SWEETENER INGREDIENTS MARKET, BY SOURCE TYPE

8.1 OVERVIEW

8.2 NATURAL

8.3 CONVENTIONAL

9 EUROPE FEED FLAVOR AND SWEETENER INGREDIENTS MARKET, BY FORM

9.1 OVERVIEW

9.2 LIQUID

9.3 POWDER

10 EUROPE FEED FLAVOR AND SWEETENER INGREDIENTS MARKET, BY ANIMAL

10.1 OVERVIEW

10.2 RUMINANTS

10.2.1 CALVES

10.2.2 DAIRY CATTLE

10.2.3 BEEF CATTLE

10.2.4 OTHER

10.3 SWINE

10.3.1 STARTER

10.3.2 1.3.2 GROWER

10.3.3 SOW

10.4 POULTRY

10.4.1 BROILERS

10.4.2 LAYERS

10.4.3 OTHERS

10.5 PET

10.5.1 CATS

10.5.2 DOGS

10.5.3 OTHER

10.6 OVERVIEW

11 EUROPE FEED FLAVOR AND SWEETENER INGREDIENTS MARKET BY COUNTRY

11.1 EUROPE

11.1.1 FRANCE

11.1.2 GERMANY

11.1.3 SPAIN

11.1.4 ITALY

11.1.5 U.K.

11.1.6 POLAND

11.1.7 NETHERLANDS

11.1.8 RUSSIA

11.1.9 TURKEY

11.1.10 BELGIUM

11.1.11 DENMARK

11.1.12 SWITZERLAND

11.1.13 SWEDEN

11.1.14 REST OF EUROPE

12 EUROPE FEED FLAVORS AND SWEETENERS MARKET, COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: EUROPE

13 SWOT ANALYSIS

14 COMPANY PROFILES

14.1 LUCTA.

14.1.1 COMPANY SNAPSHOT

14.1.2 COMPANY SHARE ANALYSIS

14.1.3 PRODUCT PORTFOLIO

14.1.4 RECENT DEVELOPMENTS

14.2 PANCOSMA (A SUBSIDIARY OF ADM)

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENTS

14.3 ADISSEO

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENTS

14.4 KAESLER NUTRITION

14.4.1 COMPANY SNAPSHOT

14.4.2 PRODUCT PORTFOLIO

14.4.3 RECENT DEVELOPMENTS

14.5 DDC BIOTECH CORP.

14.5.1 COMPANY SNAPSHOT

14.5.2 PRODUCT PORTFOLIO

14.5.3 RECENT DEVELOPMENTS

14.6 LAYN CORP.

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT DEVELOPMENTS

14.7 PALITAL FEED ADDITIVES B.V.

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENT

14.8 ALLTECH

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENTS

14.9 PHODE

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENT

14.1 KEMIN INDUSTRIES, INC.

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENTS

14.11 FEEDSTIMULANTS

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENT

14.12 PHYTOBIOTICS FUTTERZUSATZSTOFFE GMBH

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENT

14.13 INROADS INTERNATIONAL

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT DEVELOPMENT

14.14 INNOV AD NV/SA

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT DEVELOPMENT

14.15 ORBITEC INTERNATIONAL S.L.

14.15.1 COMPANY SNAPSHOT

14.15.2 1.5.2 PRODUCT PORTFOLIO

14.15.3 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

Список таблиц

LIST OF TABLES

TABLE 1 EUROPE FEED FLAVOR AND SWEETENER INGREDIENTS MARKET: REGULATORY FRAMEWORK 33

TABLE 2 EUROPE FEED FLAVORS AND SWEETENER INGREDIENTS MARKET,BY SOURCE TYPE, 2018-2027 (USD THOUSAND) 51

TABLE 3 EUROPE FEED FLAVORS AND SWEETENER INGREDIENTS MARKET,BY FORM, 2018-2027 (USD THOUSAND) 54

TABLE 4 EUROPE FEED FLAVORS AND SWEETENER INGREDIENTS MARKET,BY ANIMAL, 2018-2027 (USD THOUSAND) 57

TABLE 5 EUROPE RUMINANTS IN FEED FLAVORS AND SWEETENER INGREDIENTS MARKET, BY ANIMAL 2018-2027 (USD THOUSAND) 58

TABLE 6 EUROPE SWINE IN FEED FLAVORS AND SWEETENER INGREDIENTS MARKET, BY ANIMAL 2018-2027 (USD THOUSAND) 59

TABLE 7 EUROPE POULTRY IN FEED FLAVORS AND SWEETENERS INGREDIENTS MARKET, BY ANIMAL, 2018-2027 (USD THOUSAND) 60

TABLE 8 EUROPE PET IN FEED FLAVORS AND SWEETENER INGREDIENTS MARKET, BY ANIMAL 2018-2027 (USD THOUSAND) 61

TABLE 9 EUROPE FEED FLAVORS AND SWEETENERS INGREDIENTS MARKET,BY COUNTRY, 2018-2027 (USD THOUSAND) 66

TABLE 10 EUROPE FEED FLAVORS AND SWEETENERS INGREDIENTS MARKET, BY NATURE, 2018-2027 (USD THOUSAND) 66

TABLE 11 EUROPE FEED FLAVORS AND SWEETENERS INGREDIENTS MARKET, BY FORM, 2018-2027 (USD THOUSAND) 66

TABLE 12 EUROPE FEED FLAVORS AND SWEETENERS INGREDIENTS MARKET, BY ANIMAL, 2018-2027 (USD THOUSAND) 67

TABLE 13 EUROPE RUMINANTS IN FEED FLAVORS AND SWEETENERS INGREDIENTS MARKET, BY ANIMAL, 2018-2027 (USD THOUSAND) 67

TABLE 14 EUROPE SWINE IN FEED FLAVORS AND SWEETENERS INGREDIENTS MARKET, BY ANIMAL, 2018-2027 (USD THOUSAND) 67

TABLE 15 EUROPE POULTRY IN FEED FLAVORS AND SWEETENERS INGREDIENTS MARKET, BY ANIMAL, 2018-2027 (USD THOUSAND) 67

TABLE 16 EUROPE PETS IN FEED FLAVORS AND SWEETENERS INGREDIENTS MARKET, BY ANIMAL, 2018-2027 (USD THOUSAND) 68

TABLE 17 FRANCE FEED FLAVORS AND SWEETENERS INGREDIENTS MARKET, BY NATURE, 2018-2027 (USD THOUSAND) 69

TABLE 18 FRANCE FEED FLAVORS AND SWEETENERS INGREDIENTS MARKET, BY FORM, 2018-2027 (USD THOUSAND) 69

TABLE 19 FRANCE FEED FLAVORS AND SWEETENERS INGREDIENTS MARKET, BY ANIMAL, 2018-2027 (USD THOUSAND) 69

TABLE 20 FRANCE RUMINANTS IN FEED FLAVORS AND SWEETENERS INGREDIENTS MARKET, BY ANIMAL, 2018-2027 (USD THOUSAND) 70

TABLE 21 FRANCE SWINE IN FEED FLAVORS AND SWEETENERS INGREDIENTS MARKET, BY ANIMAL, 2018-2027 (USD THOUSAND) 70

TABLE 22 FRANCE POULTRY IN FEED FLAVORS AND SWEETENERS INGREDIENTS MARKET, BY ANIMAL, 2018-2027 (USD THOUSAND) 70

TABLE 23 FRANCE PETS IN FEED FLAVORS AND SWEETENERS INGREDIENTS MARKET, BY ANIMAL, 2018-2027 (USD THOUSAND) 70

TABLE 24 GERMANY FEED FLAVORS AND SWEETENERS INGREDIENTS MARKET, BY NATURE, 2018-2027 (USD THOUSAND) 71

TABLE 25 GERMANY FEED FLAVORS AND SWEETENERS INGREDIENTS MARKET, BY FORM, 2018-2027 (USD THOUSAND) 71

TABLE 26 GERMANY FEED FLAVORS AND SWEETENERS INGREDIENTS MARKET, BY ANIMAL, 2018-2027 (USD THOUSAND) 71

TABLE 27 GERMANY RUMINANTS IN FEED FLAVORS AND SWEETENERS INGREDIENTS MARKET, BY ANIMAL, 2018-2027 (USD THOUSAND) 72

TABLE 28 GERMANY SWINE IN FEED FLAVORS AND SWEETENERS INGREDIENTS MARKET, BY ANIMAL, 2018-2027 (USD THOUSAND) 72

TABLE 29 GERMANY POULTRY IN FEED FLAVORS AND SWEETENERS INGREDIENTS MARKET, BY ANIMAL, 2018-2027 (USD THOUSAND) 72

TABLE 30 GERMANY PETS IN FEED FLAVORS AND SWEETENERS INGREDIENTS MARKET, BY ANIMAL, 2018-2027 (USD THOUSAND) 72

TABLE 31 SPAIN FEED FLAVORS AND SWEETENERS INGREDIENTS MARKET, BY NATURE, 2018-2027 (USD THOUSAND) 73

TABLE 32 SPAIN FEED FLAVORS AND SWEETENERS INGREDIENTS MARKET, BY FORM, 2018-2027 (USD THOUSAND) 73

TABLE 33 SPAIN FEED FLAVORS AND SWEETENERS INGREDIENTS MARKET, BY ANIMAL, 2018-2027 (USD THOUSAND) 73

TABLE 34 SPAIN RUMINANTS IN FEED FLAVORS AND SWEETENERS INGREDIENTS MARKET, BY ANIMAL, 2018-2027 (USD THOUSAND) 74

TABLE 35 SPAIN SWINE IN FEED FLAVORS AND SWEETENERS INGREDIENTS MARKET, BY ANIMAL, 2018-2027 (USD THOUSAND) 74

TABLE 36 SPAIN POULTRY IN FEED FLAVORS AND SWEETENERS INGREDIENTS MARKET, BY ANIMAL, 2018-2027 (USD THOUSAND) 74

TABLE 37 SPAIN PETS IN FEED FLAVORS AND SWEETENERS INGREDIENTS MARKET, BY ANIMAL, 2018-2027 (USD THOUSAND) 74

TABLE 38 ITALY FEED FLAVORS AND SWEETENERS INGREDIENTS MARKET, BY NATURE, 2018-2027 (USD THOUSAND) 75

TABLE 39 ITALY FEED FLAVORS AND SWEETENERS INGREDIENTS MARKET, BY FORM, 2018-2027 (USD THOUSAND) 75

TABLE 40 ITALY FEED FLAVORS AND SWEETENERS INGREDIENTS MARKET, BY ANIMAL, 2018-2027 (USD THOUSAND) 75

TABLE 41 ITALY RUMINANTS IN FEED FLAVORS AND SWEETENERS INGREDIENTS MARKET, BY ANIMAL, 2018-2027 (USD THOUSAND) 76

TABLE 42 ITALY SWINE IN FEED FLAVORS AND SWEETENERS INGREDIENTS MARKET, BY ANIMAL, 2018-2027 (USD THOUSAND) 76

TABLE 43 ITALY POULTRY IN FEED FLAVORS AND SWEETENERS INGREDIENTS MARKET, BY ANIMAL, 2018-2027 (USD THOUSAND) 76

TABLE 44 ITALY PETS IN FEED FLAVORS AND SWEETENERS INGREDIENTS MARKET, BY ANIMAL, 2018-2027 (USD THOUSAND) 76

TABLE 45 U.K. FEED FLAVORS AND SWEETENERS INGREDIENTS MARKET, BY NATURE, 2018-2027 (USD THOUSAND) 77

TABLE 46 U.K. FEED FLAVORS AND SWEETENERS INGREDIENTS MARKET, BY FORM, 2018-2027 (USD THOUSAND) 77

TABLE 47 U.K. FEED FLAVORS AND SWEETENERS INGREDIENTS MARKET, BY ANIMAL, 2018-2027 (USD THOUSAND) 77

TABLE 48 U.K. RUMINANTS IN FEED FLAVORS AND SWEETENERS INGREDIENTS MARKET, BY ANIMAL, 2018-2027 (USD THOUSAND) 78

TABLE 49 U.K. SWINE IN FEED FLAVORS AND SWEETENERS INGREDIENTS MARKET, BY ANIMAL, 2018-2027 (USD THOUSAND) 78

TABLE 50 U.K. POULTRY IN FEED FLAVORS AND SWEETENERS INGREDIENTS MARKET, BY ANIMAL, 2018-2027 (USD THOUSAND) 78

TABLE 51 U.K. PETS IN FEED FLAVORS AND SWEETENERS INGREDIENTS MARKET, BY ANIMAL, 2018-2027 (USD THOUSAND) 78

TABLE 52 POLAND FEED FLAVORS AND SWEETENERS INGREDIENTS MARKET, BY NATURE, 2018-2027 (USD THOUSAND) 79

TABLE 53 POLAND FEED FLAVORS AND SWEETENERS INGREDIENTS MARKET, BY FORM, 2018-2027 (USD THOUSAND) 79

TABLE 54 POLAND FEED FLAVORS AND SWEETENERS INGREDIENTS MARKET, BY ANIMAL, 2018-2027 (USD THOUSAND) 79

TABLE 55 POLAND RUMINANTS IN FEED FLAVORS AND SWEETENERS INGREDIENTS MARKET, BY ANIMAL, 2018-2027 (USD THOUSAND) 80

TABLE 56 POLAND SWINE IN FEED FLAVORS AND SWEETENERS INGREDIENTS MARKET, BY ANIMAL, 2018-2027 (USD THOUSAND) 80

TABLE 57 POLAND POULTRY IN FEED FLAVORS AND SWEETENERS INGREDIENTS MARKET, BY ANIMAL, 2018-2027 (USD THOUSAND) 80

TABLE 58 POLAND PETS IN FEED FLAVORS AND SWEETENERS INGREDIENTS MARKET, BY ANIMAL, 2018-2027 (USD THOUSAND) 80

TABLE 59 NETHERLANDS FEED FLAVORS AND SWEETENERS INGREDIENTS MARKET, BY NATURE, 2018-2027 (USD THOUSAND) 81

TABLE 60 NETHERLANDS FEED FLAVORS AND SWEETENERS INGREDIENTS MARKET, BY FORM, 2018-2027 (USD THOUSAND) 81

TABLE 61 NETHERLANDS FEED FLAVORS AND SWEETENERS INGREDIENTS MARKET, BY ANIMAL, 2018-2027 (USD THOUSAND) 81

TABLE 62 NETHERLANDS RUMINANTS IN FEED FLAVORS AND SWEETENERS INGREDIENTS MARKET, BY ANIMAL, 2018-2027 (USD THOUSAND) 82

TABLE 63 NETHERLANDS SWINE IN FEED FLAVORS AND SWEETENERS INGREDIENTS MARKET, BY ANIMAL, 2018-2027 (USD THOUSAND) 82

TABLE 64 NETHERLANDS POULTRY IN FEED FLAVORS AND SWEETENERS INGREDIENTS MARKET, BY ANIMAL, 2018-2027 (USD THOUSAND) 82

TABLE 65 NETHERLANDS PETS IN FEED FLAVORS AND SWEETENERS INGREDIENTS MARKET, BY ANIMAL, 2018-2027 (USD THOUSAND) 82

TABLE 66 RUSSIA FEED FLAVORS AND SWEETENERS INGREDIENTS MARKET, BY NATURE, 2018-2027 (USD THOUSAND) 83

TABLE 67 RUSSIA FEED FLAVORS AND SWEETENERS INGREDIENTS MARKET, BY FORM, 2018-2027 (USD THOUSAND) 83

TABLE 68 RUSSIA FEED FLAVORS AND SWEETENERS INGREDIENTS MARKET, BY ANIMAL, 2018-2027 (USD THOUSAND) 83

TABLE 69 RUSSIA RUMINANTS IN FEED FLAVORS AND SWEETENERS INGREDIENTS MARKET, BY ANIMAL, 2018-2027 (USD THOUSAND) 84

TABLE 70 RUSSIA SWINE IN FEED FLAVORS AND SWEETENERS INGREDIENTS MARKET, BY ANIMAL, 2018-2027 (USD THOUSAND) 84

TABLE 71 RUSSIA POULTRY IN FEED FLAVORS AND SWEETENERS INGREDIENTS MARKET, BY ANIMAL, 2018-2027 (USD THOUSAND) 84

TABLE 72 RUSSIA PETS IN FEED FLAVORS AND SWEETENERS INGREDIENTS MARKET, BY ANIMAL, 2018-2027 (USD THOUSAND) 84

TABLE 73 TURKEY FEED FLAVORS AND SWEETENERS INGREDIENTS MARKET, BY NATURE, 2018-2027 (USD THOUSAND) 85

TABLE 74 TURKEY FEED FLAVORS AND SWEETENERS INGREDIENTS MARKET, BY FORM, 2018-2027 (USD THOUSAND) 85

TABLE 75 TURKEY FEED FLAVORS AND SWEETENERS INGREDIENTS MARKET, BY ANIMAL, 2018-2027 (USD THOUSAND) 85

TABLE 76 TURKEY RUMINANTS IN FEED FLAVORS AND SWEETENERS INGREDIENTS MARKET, BY ANIMAL, 2018-2027 (USD THOUSAND) 86

TABLE 77 TURKEY SWINE IN FEED FLAVORS AND SWEETENERS INGREDIENTS MARKET, BY ANIMAL, 2018-2027 (USD THOUSAND) 86

TABLE 78 TURKEY POULTRY IN FEED FLAVORS AND SWEETENERS INGREDIENTS MARKET, BY ANIMAL, 2018-2027 (USD THOUSAND) 86

TABLE 79 TURKEY PETS IN FEED FLAVORS AND SWEETENERS INGREDIENTS MARKET, BY ANIMAL, 2018-2027 (USD THOUSAND) 86

TABLE 80 BELGIUM FEED FLAVORS AND SWEETENERS INGREDIENTS MARKET, BY NATURE, 2018-2027 (USD THOUSAND) 87

TABLE 81 BELGIUM FEED FLAVORS AND SWEETENERS INGREDIENTS MARKET, BY FORM, 2018-2027 (USD THOUSAND) 87

TABLE 82 BELGIUM FEED FLAVORS AND SWEETENERS INGREDIENTS MARKET, BY ANIMAL, 2018-2027 (USD THOUSAND) 87

TABLE 83 BELGIUM RUMINANTS IN FEED FLAVORS AND SWEETENERS INGREDIENTS MARKET, BY ANIMAL, 2018-2027 (USD THOUSAND) 88

TABLE 84 BELGIUM SWINE IN FEED FLAVORS AND SWEETENERS INGREDIENTS MARKET, BY ANIMAL, 2018-2027 (USD THOUSAND) 88

TABLE 85 BELGIUM POULTRY IN FEED FLAVORS AND SWEETENERS INGREDIENTS MARKET, BY ANIMAL, 2018-2027 (USD THOUSAND) 88

TABLE 86 BELGIUM PETS IN FEED FLAVORS AND SWEETENERS INGREDIENTS MARKET, BY ANIMAL, 2018-2027 (USD THOUSAND) 88

TABLE 87 DENMARK FEED FLAVORS AND SWEETENERS INGREDIENTS MARKET, BY NATURE, 2018-2027 (USD THOUSAND) 89

TABLE 88 DENMARK FEED FLAVORS AND SWEETENERS INGREDIENTS MARKET, BY FORM, 2018-2027 (USD THOUSAND) 89

TABLE 89 DENMARK FEED FLAVORS AND SWEETENERS INGREDIENTS MARKET, BY ANIMAL, 2018-2027 (USD THOUSAND) 89

TABLE 90 DENMARK RUMINANTS IN FEED FLAVORS AND SWEETENERS INGREDIENTS MARKET, BY ANIMAL, 2018-2027 (USD THOUSAND) 90

TABLE 91 DENMARK SWINE IN FEED FLAVORS AND SWEETENERS INGREDIENTS MARKET, BY ANIMAL, 2018-2027 (USD THOUSAND) 90

TABLE 92 DENMARK POULTRY IN FEED FLAVORS AND SWEETENERS INGREDIENTS MARKET, BY ANIMAL, 2018-2027 (USD THOUSAND) 90

TABLE 93 DENMARK PETS IN FEED FLAVORS AND SWEETENERS INGREDIENTS MARKET, BY ANIMAL, 2018-2027 (USD THOUSAND) 90

TABLE 94 SWITZERLAND FEED FLAVORS AND SWEETENERS INGREDIENTS MARKET, BY NATURE, 2018-2027 (USD THOUSAND) 91

TABLE 95 SWITZERLAND FEED FLAVORS AND SWEETENERS INGREDIENTS MARKET, BY FORM, 2018-2027 (USD THOUSAND) 91

TABLE 96 SWITZERLAND FEED FLAVORS AND SWEETENERS INGREDIENTS MARKET, BY ANIMAL, 2018-2027 (USD THOUSAND) 91

TABLE 97 SWITZERLAND RUMINANTS IN FEED FLAVORS AND SWEETENERS INGREDIENTS MARKET, BY ANIMAL, 2018-2027 (USD THOUSAND) 92

TABLE 98 SWITZERLAND SWINE IN FEED FLAVORS AND SWEETENERS INGREDIENTS MARKET, BY ANIMAL, 2018-2027 (USD THOUSAND) 92

TABLE 99 SWITZERLAND POULTRY IN FEED FLAVORS AND SWEETENERS INGREDIENTS MARKET, BY ANIMAL, 2018-2027 (USD THOUSAND) 92

TABLE 100 SWITZERLAND PETS IN FEED FLAVORS AND SWEETENERS INGREDIENTS MARKET, BY ANIMAL, 2018-2027 (USD THOUSAND) 92

TABLE 101 SWEDEN FEED FLAVORS AND SWEETENERS INGREDIENTS MARKET, BY NATURE, 2018-2027 (USD THOUSAND) 93

TABLE 102 SWEDEN FEED FLAVORS AND SWEETENERS INGREDIENTS MARKET, BY FORM, 2018-2027 (USD THOUSAND) 93

TABLE 103 SWEDEN FEED FLAVORS AND SWEETENERS INGREDIENTS MARKET, BY ANIMAL, 2018-2027 (USD THOUSAND) 93

TABLE 104 SWEDEN RUMINANTS IN FEED FLAVORS AND SWEETENERS INGREDIENTS MARKET, BY ANIMAL, 2018-2027 (USD THOUSAND) 94

TABLE 105 SWEDEN SWINE IN FEED FLAVORS AND SWEETENERS INGREDIENTS MARKET, BY ANIMAL, 2018-2027 (USD THOUSAND) 94

TABLE 106 SWEDEN POULTRY IN FEED FLAVORS AND SWEETENERS INGREDIENTS MARKET, BY ANIMAL, 2018-2027 (USD THOUSAND) 94

TABLE 107 SWEDEN PETS IN FEED FLAVORS AND SWEETENERS INGREDIENTS MARKET, BY ANIMAL, 2018-2027 (USD THOUSAND) 94

TABLE 108 SWEDEN FEED FLAVORS AND SWEETENERS INGREDIENTS MARKET, BY NATURE, 2018-2027 (USD THOUSAND) 95

Список рисунков

LIST OF FIGURES

FIGURE 1 EUROPE FEED FLAVOR AND SWEETENER INGREDIENTS MARKET: SEGMENTATION 19

FIGURE 2 EUROPE FEED FLAVOR AND SWEETENER INGREDIENTS MARKET: DATA TRIANGULATION 21

FIGURE 3 EUROPE FEED FLAVOR AND SWEETENER INGREDIENTS MARKET: DROC ANALYSIS 22

FIGURE 4 EUROPE FEED FLAVOR AND SWEETENER INGREDIENTS MARKET: EUROPE VS REGIONAL MARKET ANALYSIS 23

FIGURE 5 EUROPE FEED FLAVOR AND SWEETENER INGREDIENTS MARKET: COMPANY RESEARCH ANALYSIS 23

FIGURE 6 EUROPE FEED FLAVOR AND SWEETENER INGREDIENTS MARKET: INTERVIEW DEMOGRAPHICS 25

FIGURE 7 EUROPE FEED FLAVOR AND SWEETENER INGREDIENTS MARKET: DBMR MARKET POSITION GRID 26

FIGURE 8 EUROPE FEED FLAVOR AND SWEETENER INGREDIENTS MARKET: VENDOR SHARE ANALYSIS 27

FIGURE 9 EUROPE FEED FLAVOR AND SWEETENER INGREDIENTS MARKET: SEGMENTATION 30

FIGURE 10 HIGH OLFACTORY AND TASTE SENSATION IN ANIMALS AND RISING AWARENESS REGARDING BETTER FEED INTAKE OF ANIMALS ARE DRIVING THE EUROPE FEED FLAVOR AND SWEETENER INGREDIENTS MARKET IN THE FORECAST PERIOD OF 2020 TO 2027 31

FIGURE 11 POWDER SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE FEED FLAVOR AND SWEETENER INGREDIENTS MARKET IN 2020 & 2027 31

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF EUROPE FEED FLAVOR AND SWEETENER INGREDIENTS MARKET 35

FIGURE 13 TOTAL STACK OF CATTLE IN APRIL, 2019-2020 (1000 PER HEAD) EUROPEAN UNION 46

FIGURE 14 SWINE PRODUCTION IN APRIL, 2019-2020 (1000 PER HEAD) EUROPEAN UNION 47

FIGURE 15 BEEF PRODUCTION IN APRIL, 2019-2020 (1000 PER HEAD) EUROPEAN UNION, MEXICO, CHINA 47

FIGURE 16 EUROPE FEED FLAVORS AND SWEETENERS INGREDIENTS MARKET,BY SOURCE TYPE 50

FIGURE 17 EUROPE FEED FLAVOR AND SWEETENER INGREDIENTS MAKRET, BY FORM 53

FIGURE 18 EUROPE FEED FLAVOR AND SWEETENER INGREDIENTS MARKET, BY ANIMAL 56

FIGURE 19 EUROPE FEED FLAVORS AND SWEETENERS INGREDIENTS MARKET: SNAPSHOT (2019) 63

FIGURE 20 EUROPE FEED FLAVORS AND SWEETENERS INGREDIENTS MARKET: BY COUNTRY(2019) 64

FIGURE 21 EUROPE FEED FLAVORS AND SWEETENERS INGREDIENTS MARKET: BY COUNTRY(2020& 2027) 64

FIGURE 22 EUROPE FEED FLAVORS AND SWEETENERS INGREDIENTS MARKET: BY COUNTRY (2019& 2027) 65

FIGURE 23 EUROPE FEED FLAVORS AND SWEETENERS INGREDIENTS MARKET: BY PRODUCT TYPE (2020-2027) 65

FIGURE 24 EUROPE FEED FLAVORS AND SWEETNERS MARKET: COMPANY SHARE 2019 (%) 96

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.