>Европейский рынок биоразлагаемой бумажной и пластиковой упаковки по типу упаковки (пластик и бумага), продукту (пакеты, противни, бумажные тарелки, контейнеры для сэндвичей-ракушки, порционные стаканчики, подносы, столовые приборы, миски, пакеты и саше, с крышкой и другие), использованию (одноразовые и многоразовые), каналу сбыта (электронная коммерция, супермаркеты/гипермаркеты, магазины шаговой доступности, специализированные магазины и другие), применению (упаковка пищевых продуктов, упаковка напитков, упаковка фармацевтических препаратов, упаковка средств личной гигиены и ухода за домом, упаковка электронных приборов и другие), уровню упаковки (первичная упаковка, вторичная упаковка и третичная упаковка), конечному пользователю (рестораны, отели, чайные и кофейные магазины, магазины сладостей и закусок, кафе и другие), стране (Германия, Великобритания, Италия, Франция, Испания, Швейцария, Россия, Турция, Бельгия, Нидерланды и остальная Европа), отрасли Тенденции и прогноз до 2029 года.

Анализ рынка и аналитика : Европейский рынок биоразлагаемой бумажной и пластиковой упаковки

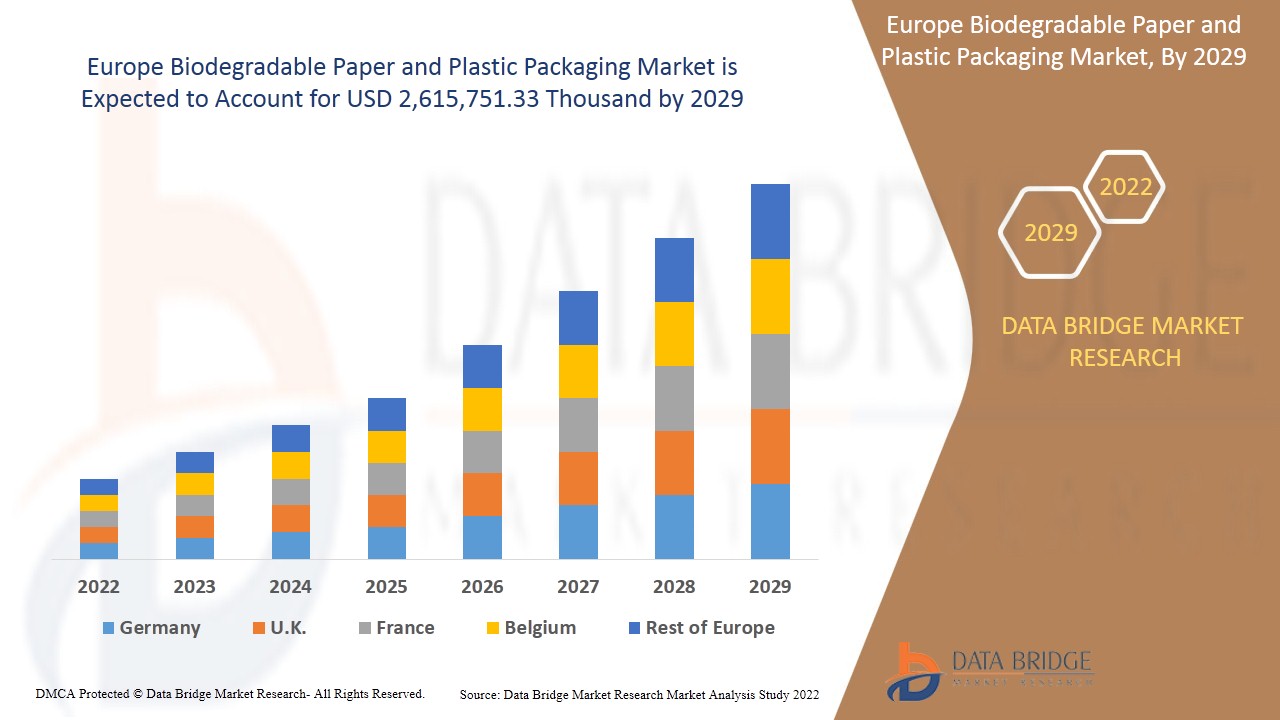

Ожидается, что европейский рынок биоразлагаемой бумажной и пластиковой упаковки будет расти в прогнозируемый период с 2022 по 2029 год. По данным Data Bridge Market Research, среднегодовой темп роста рынка составит 7,8% в прогнозируемый период с 2022 по 2029 год, и ожидается, что к 2029 году он достигнет 2 615 751,33 тыс. долларов США. Одним из существенных факторов, связанных с европейским рынком биоразлагаемой бумажной и пластиковой упаковки, может стать ужесточение государственного регулирования в отношении упаковки.

Биоразлагаемая бумажная и пластиковая упаковка — это экологически чистый товар, который не выделяет углерод в процессе производства. В связи с растущей осведомленностью населения об экологичной упаковке, спрос на биоразлагаемую бумажную и пластиковую упаковку увеличился. Это касается нескольких отраслей промышленности, таких как фармацевтическая, пищевая, здравоохранительная и экологическая. С различными типами пластика пищевая и питьевая промышленность сильно зависит от упаковочных материалов.

Ожидается, что растущая осведомленность потребителей об экологичной упаковке будет способствовать росту рынка. Потребность в материалах с низким углеродным следом может стать потенциальным рыночным драйвером для рынка. Также, поэтапный отказ от одноразового пластика увеличит продажи и прибыль игроков, работающих на рынке.

The major restraint impacting the Europe biodegradable paper and plastic packaging market is the limited investment in biodegradable plastic production. Further, a high focus on recyclable and bio-based non-biodegradable plastic production can also restrain the market growth. The production of polylactic acid (PLA) from sugarcane and corn is expected to create opportunities for the Europe biodegradable paper and plastic packaging market. Limited availability of machines and equipment for bio-based materials is likely to act as a challenge for the market growth.

This Europe biodegradable paper and plastic packaging market report provide details of market share, new developments, and product pipeline analysis, the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, product approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario, contact us for an Analyst Brief; our team will help you create a revenue impact solution to achieve your desired goal.

Europe Biodegradable Paper and Plastic Packaging Market Scope and Market Size

Europe biodegradable paper and plastic packaging market is segmented based on packaging type, product, usage, distribution channel, application, packaging layer and end-user. The growth among segments helps you analyse niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

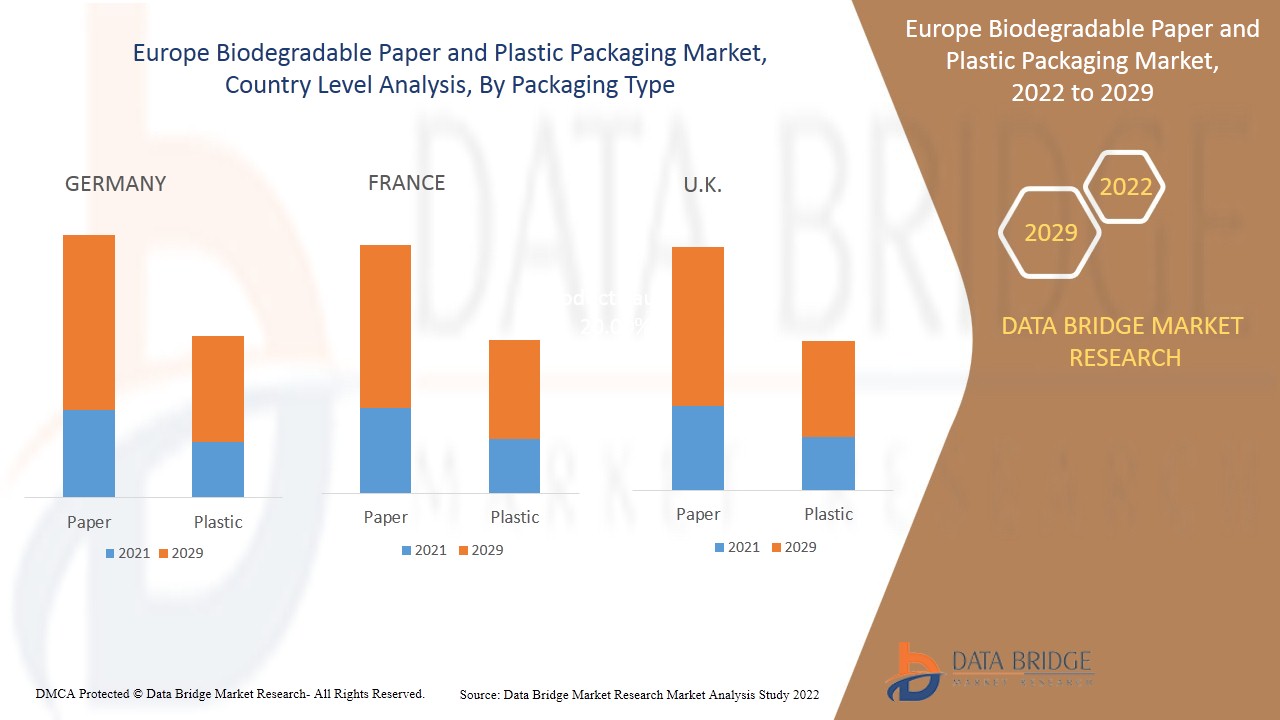

- On the basis of packaging type, the Europe biodegradable paper and plastic packaging market is segmented into paper and plastics. In 2022, the paper segment is expected to dominate the Europe biodegradable paper and plastic packaging market as the manufacturing process of paper requires less skilled laborers with easy availability of resources or raw material, which increases its demand.

- On the basis of product, the Europe biodegradable paper and plastic packaging market is segmented into straws, bags, baking sheets, paper plates, clamshell sandwich containers, portion cups, trays, cutlery, bowls, pouches and sachets, lidded, and others. In 2022, the bags segment is expected to dominate the Europe biodegradable paper and plastic packaging market as it is durable and can be used for multipurpose, which increases its demand.

- On the basis of usage, the Europe biodegradable paper and plastic packaging market is segmented into single-use and reusable. In 2022, the reusable segment is expected to dominate the Europe biodegradable paper and plastic packaging market as it prevents unnecessary exploitation of resources and prevents littering, thus increasing its demand in the forecast period.

- На основе канала сбыта европейский рынок биоразлагаемой бумажной и пластиковой упаковки сегментируется на электронную коммерцию , супермаркеты/гипермаркеты, магазины у дома, специализированные магазины и т. д. Ожидается, что в 2022 году сегмент супермаркетов/гипермаркетов будет доминировать на европейском рынке биоразлагаемой бумажной и пластиковой упаковки, поскольку клиенты смогут пользоваться полной свободой выбора, что увеличит спрос в прогнозируемый период.

- В зависимости от сферы применения европейский рынок биоразлагаемой бумажной и пластиковой упаковки сегментируется на упаковку для пищевых продуктов, упаковку для напитков, упаковку для фармацевтических препаратов, упаковку для средств личной гигиены и ухода за домом, упаковку для электронных приборов и т. д. Ожидается, что в 2022 году сегмент пищевой упаковки будет доминировать на европейском рынке биоразлагаемой бумажной и пластиковой упаковки, поскольку он делает продукты питания более безопасными и менее уязвимыми к загрязнению, что увеличивает спрос на них.

- На основе упаковочного слоя европейский рынок биоразлагаемой бумажной и пластиковой упаковки сегментируется на первичную упаковку, вторичную упаковку и третичную упаковку. Ожидается, что в 2022 году сегмент первичной упаковки будет доминировать на европейском рынке биоразлагаемой бумажной и пластиковой упаковки, поскольку он имеет низкую стоимость и предназначен для конечных пользователей, которые распечатали информацию о продукте, тем самым увеличивая его спрос в прогнозируемый период.

- На основе конечного пользователя европейский рынок биоразлагаемой бумажной и пластиковой упаковки сегментируется на рестораны, гостиницы, чайные и кофейни, магазины сладостей и закусок, кафе и т. д. Ожидается, что в 2022 году сегмент ресторанов будет доминировать на европейском рынке биоразлагаемой бумажной и пластиковой упаковки, поскольку он знакомит посетителей с различными культурами через продукты питания и их упаковку, что увеличивает спрос на нее в прогнозируемый период.

Европейский рынок биоразлагаемой бумажной и пластиковой упаковки, анализ на уровне стран

Европейский рынок биоразлагаемой бумажной и пластиковой упаковки сегментирован по типу упаковки, продукту, использованию, каналу сбыта, области применения, упаковочному слою и конечному пользователю.

В отчете о европейском рынке биоразлагаемой бумажной и пластиковой упаковки рассматриваются следующие страны: Германия, Великобритания, Италия, Франция, Испания, Швейцария, Россия, Турция, Бельгия, Нидерланды и остальные страны Европы.

Ожидается, что Германия будет доминировать на европейском рынке биоразлагаемой бумажной и пластиковой упаковки из-за растущей потребности в материалах с низким углеродным следом. Во Франции растущая осведомленность потребителей об экологичной упаковке, как доказано, повышает спрос на биоразлагаемую бумажную и пластиковую упаковку в каждом секторе. В то время как в Великобритании ожидается, что ужесточение государственного регулирования в отношении упаковки повысит спрос на биоразлагаемую бумажную и пластиковую упаковку среди конечных пользователей.

Раздел отчета по странам также содержит отдельные факторы, влияющие на рынок, и изменения в регулировании рынка, которые влияют на текущие и будущие тенденции рынка. Такие данные, как новые продажи, заменяющие продажи, демографические данные страны, нормативные акты и импортно-экспортные пошлины, являются одними из основных указателей, используемых для прогнозирования рыночного сценария для отдельных стран. Кроме того, при предоставлении прогнозного анализа данных по странам учитываются наличие и доступность европейских брендов и их проблемы из-за большой или малой конкуренции со стороны местных и отечественных брендов, влияние каналов продаж.

Рост в отрасли биоразлагаемой бумажной и пластиковой упаковки

Европейский рынок биоразлагаемой бумажной и пластиковой упаковки также предоставляет вам подробный анализ рынка для каждой страны, рост установленной базы различных видов продукции для рынка биоразлагаемой бумажной и пластиковой упаковки, влияние технологии с использованием кривых жизненного цикла, а также изменения в сценариях регулирования детских смесей и их влияние на европейский рынок биоразлагаемой бумажной и пластиковой упаковки. Данные доступны за исторический период с 2012 по 2020 год.

Конкурентная среда и анализ доли европейского рынка биоразлагаемой бумажной и пластиковой упаковки

Конкурентная среда европейского рынка биоразлагаемой бумажной и пластиковой упаковки содержит данные по конкурентам. Включены сведения о компании, ее финансах, полученном доходе, рыночном потенциале, инвестициях в исследования и разработки, новых рыночных инициативах, глобальном присутствии, производственных площадках и объектах, сильных и слабых сторонах компании, запуске продукта, клинических испытаниях, анализе бренда, одобрении продукта, патентах, широте и широте продукта, доминировании приложений, жизненно важной кривой технологий. Вышеуказанные пункты данных связаны только с фокусом компании на европейском рынке биоразлагаемой бумажной и пластиковой упаковки.

Некоторые из основных игроков, рассмотренных в отчете, включают Smurfit Kappa, DS Smith, Tetra Pak, Mondi, International Paper, VPK Group, Sonoco Products Company, STOROPACK HANS REICHENECKER GMBH, WestRock Company, Stora Enso, Eurocell srl, Novamont SpA, OSQ, BIO-LUTIONS International AG, TIPA LTD, Robert Cullen Ltd., BioApply, CPS Paper Products, The Biodegradable Bag Company Ltd., Hosgör Plastik и других игроков на внутреннем и региональном рынках. Аналитики DBMR понимают конкурентные преимущества и предоставляют конкурентный анализ для каждого конкурента отдельно.

Например,

- В октябре 2021 года VPK Group запустила промышленную площадку DA Alizay, расположенную в регионе Нормандия, в центр устойчивого развития в экономике замкнутого цикла. VPK Group объявляет о проведении реконструкции бумагоделательной машины совместно с Valmet Oyj

- В ноябре 2021 года Mondi инвестировала 20 миллионов евро в повышение устойчивости своего производства целлюлозы на заводе Frantschach в Австрии. Это новое заводское оборудование сделает производство целлюлозы Mondi еще более эффективным и устойчивым. Это поможет дополнительно расширить клиентскую базу

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Содержание

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 USAGE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.1.1 THREAT OF NEW ENTRANTS

4.1.2 THREAT OF SUBSTITUTES

4.1.3 CUSTOMER BARGAINING POWER

4.1.4 SUPPLIER BARGAINING POWER

4.1.5 INTERNAL COMPETITION (RIVALRY)

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 NEED FOR LOWER CARBON FOOTPRINT MATERIALS

5.1.2 GROWING CONSUMER AWARENESS RELATED TO ECO-FRIENDLY PACKAGING

5.1.3 STRENGHTHENING OF GOVERNMENT REGULATIONS RELATED TO PACKAGING

5.1.4 PHASE OUT OF SINGLE USE PLASTICS

5.2 RESTRAINTS

5.2.1 HIGH COST OF BIODEGRADABLE PACKAGING PRODUCTS

5.2.2 LOW PRODUCTION OF POLYHYDROXYBUTYRATE ACID (PHB)

5.2.3 LIMITED INVESTMENT IN BIODEGRADABLE PLASTIC PRODUCTION

5.2.4 HIGH FOCUS ON RECYCLABLE AND BIO-BASED NON-BIODEGRADABLE PLASTIC PRODUCTION

5.3 OPPORTUNITIES

5.3.1 PRODUCTION OF COST-EFFECTIVE BIODEGRADABLE PACKAGING PRODUCTS

5.3.2 PRODUCTION OF POLYLACTIC ACID (PLA) FROM SUGARCANE AND CORN

5.3.3 BIODEGRADABLE PACKAGING PRODUCTION FOR HEALTHCARE INDUSTRY

5.4 CHALLENGES

5.4.1 HIGH FLUCTUATION IN RAW MATERIAL PRICES

5.4.2 LIMITED AVAILABILITY OF MACHINES AND EQUIPMENT FOR PRODUCTION OF BIO-BASED MATERIALS

5.4.3 LOW YIELD IN PRODUCTION OF BIO-BASED PLASTIC RESINS

6 IMPACT OF COVID-19 ON EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET

6.1 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE EUROPE BIODEGRADABLE PLASTIC & PAPER PACKAGING MARKET

6.2 STRATERGIC DECISIONS BY MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.3 PRICE IMPACT

6.4 IMPACT ON DEMAND

6.5 IMPACT ON SUPPLY CHAIN

6.6 CONCLUSION

7 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 BAGS

7.2.1 STANDARD CARRY BAGS

7.2.2 STAND UP BAGS

7.2.2.1 ROUND BOTTOM GUSSET TYPE

7.2.2.2 SEAL BOTTOM TYPE

7.2.2.3 PLOW BOTTOM TYPE

7.2.2.4 SIDE GUSSET TYPE

7.2.2.5 THREE SIDE SEALED

7.2.2.6 FOUR SIDE SEALED

7.2.2.7 OTHERS

7.2.3 T-SHIRT PLASTIC BAGS

7.2.4 SELF-OPENING STYLE BAGS

7.2.5 ZIPPER BAGS

7.2.6 FOOD SAFE BARRIER BAGS

7.2.7 SMELL PROOF BAGS

7.2.8 PINCH BOTTOM BAGS

7.2.9 OTHERS

7.3 TRAYS

7.4 PAPER PLATES

7.5 BOWLS

7.6 CLAMSHELL SANDWICH CONTAINERS

7.7 POUCHES AND SACHETS

7.8 PORTION CUPS

7.9 STRAWS

7.1 CUTLERY

7.11 LIDDED

7.12 BAKING SHEETS

7.13 OTHERS

8 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE

8.1 OVERVIEW

8.2 PAPER

8.2.1 CORRUGATED BOARD

8.2.2 BOXBOARD

8.2.3 FLEXIBLE PAPER

8.2.4 OTHERS

8.3 PLASTIC

8.3.1 PLA

8.3.2 STARCH BASED PLASTIC

8.3.3 PBS

8.3.4 PHA

8.3.5 PCL

8.3.6 OTHERS

9 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY USAGE

9.1 OVERVIEW

9.2 REUSABLE

9.3 SINGLE-USE

10 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY DISTRIBUTION CHANNEL

10.1 OVERVIEW

10.2 SUPERMARKETS/HYPERMARKETS

10.3 CONVENIENCE STORES

10.4 SPECIALTY STORES

10.5 E-COMMERCE

10.6 OTHERS

11 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING LAYER

11.1 OVERVIEW

11.2 PRIMARY PACKAGING

11.3 SECONDARY PACKAGING

11.4 TERTIARY PACKAGING

12 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION

12.1 OVERVIEW

12.2 FOOD PACKAGING

12.2.1 FOOD PACKAGING, BY APPLICATION

12.2.1.1 FRUITS

12.2.1.2 VEGETABLE

12.2.1.3 BAKERY PRODUCTS

12.2.1.3.1 CAKES

12.2.1.3.2 PASTRIES

12.2.1.3.3 BISCUITS

12.2.1.3.4 BREAD

12.2.1.3.5 OTHERS

12.2.1.4 COOKED FOOD

12.2.1.4.1 PIZZA

12.2.1.4.2 SANDWICH

12.2.1.4.3 BURGER

12.2.1.4.4 OTHERS

12.2.1.5 MEAT, SEAFOOD AND POULTRY

12.2.1.6 DAIRY PRODUCTS

12.2.1.6.1 EGGS

12.2.1.6.2 CHEESE

12.2.1.6.3 OTHERS

12.2.1.7 OTHERS

12.3 BEVERAGE PACKAGING

12.4 ELECTRONIC APPLIANCE PACKAGING

12.5 PERSONAL & HOME CARE PACKAGING

12.6 PHARMACEUTICALS PACKAGING

12.7 OTHERS

13 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY END-USER

13.1 OVERVIEW

13.2 RESTAURANTS

13.2.1 RESTAURANTS, BY PRODUCT

13.2.1.1 BAGS

13.2.1.2 TRAYS

13.2.1.3 PAPER PLATES

13.2.1.4 BOWLS

13.2.1.5 CLAMSHELL SANDWICH CONTAINERS

13.2.1.6 POUCHES AND SACHETS

13.2.1.7 PORTION CUPS

13.2.1.8 STRAWS

13.2.1.9 CUTLERY

13.2.1.10 LIDDED

13.2.1.11 BAKING SHEETS

13.2.1.12 OTHERS

13.3 SWEETS & SNACKS STORES

13.3.1 SWEETS & SNACKS STORES, BY PRODUCT

13.3.1.1 BAGS

13.3.1.2 TRAYS

13.3.1.3 PAPER PLATES

13.3.1.4 BOWLS

13.3.1.5 CLAMSHELL SANDWICH CONTAINERS

13.3.1.6 POUCHES AND SACHETS

13.3.1.7 PORTION CUPS

13.3.1.8 STRAWS

13.3.1.9 CUTLERY

13.3.1.10 LIDDED

13.3.1.11 BAKING SHEETS

13.3.1.12 OTHERS

13.4 CAFETERIA

13.4.1 CAFETERIA, BY PRODUCT

13.4.1.1 BAGS

13.4.1.2 TRAYS

13.4.1.3 PAPER PLATES

13.4.1.4 BOWLS

13.4.1.5 CLAMSHELL SANDWICH CONTAINERS

13.4.1.6 POUCHES AND SACHETS

13.4.1.7 PORTION CUPS

13.4.1.8 STRAWS

13.4.1.9 CUTLERY

13.4.1.10 LIDDED

13.4.1.11 BAKING SHEETS

13.4.1.12 OTHERS

13.5 TEA AND COFFEE SHOPS

13.5.1 TEA AND COFFEE SHOPS, BY PRODUCT

13.5.1.1 BAGS

13.5.1.2 TRAYS

13.5.1.3 PAPER PLATES

13.5.1.4 BOWLS

13.5.1.5 CLAMSHELL SANDWICH CONTAINERS

13.5.1.6 POUCHES AND SACHETS

13.5.1.7 PORTION CUPS

13.5.1.8 STRAWS

13.5.1.9 CUTLERY

13.5.1.10 LIDDED

13.5.1.11 BAKING SHEETS

13.5.1.12 OTHERS

13.6 HOTELS

13.6.1 HOTELS, BY PRODUCT

13.6.1.1 BAGS

13.6.1.2 TRAYS

13.6.1.3 PAPER PLATES

13.6.1.4 BOWLS

13.6.1.5 CLAMSHELL SANDWICH CONTAINERS

13.6.1.6 POUCHES AND SACHETS

13.6.1.7 PORTION CUPS

13.6.1.8 STRAWS

13.6.1.9 CUTLERY

13.6.1.10 LIDDED

13.6.1.11 BAKING SHEETS

13.6.1.12 OTHERS

13.7 OTHERS

13.7.1 OTHERS, BY PRODUCT

13.7.1.1 BAGS

13.7.1.2 TRAYS

13.7.1.3 PAPER PLATES

13.7.1.4 BOWLS

13.7.1.5 CLAMSHELL SANDWICH CONTAINERS

13.7.1.6 POUCHES AND SACHETS

13.7.1.7 PORTION CUPS

13.7.1.8 STRAWS

13.7.1.9 CUTLERY

13.7.1.10 LIDDED

13.7.1.11 BAKING SHEETS

13.7.1.12 OTHERS

14 EUROPE

14.1 GERMANY

14.2 FRANCE

14.3 U.K.

14.4 ITALY

14.5 SPAIN

14.6 RUSSIA

14.7 BELGIUM

14.8 NETHERLANDS

14.9 SWITZERLAND

14.1 TURKEY

14.11 REST OF EUROPE

15 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: EUROPE

15.2 MERGERS & ACQUISITIONS

15.3 EXPANSIONS

15.4 NEW PRODUCT DEVELOPMENT

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 SMURFIT KAPPA

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 PRODUCT PORTFOLIO

17.1.4 RECENT UPDATES

17.2 DS SMITH

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 PRODUCT PORTFOLIO

17.2.4 RECENT UPDATES

17.3 TETRA PAK

17.3.1 COMPANY SNAPSHOT

17.3.2 PRODUCT PORTFOLIO

17.3.3 RECENT UPDATES

17.4 MONDI

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 PRODUCT PORTFOLIO

17.4.4 RECENT UPDATES

17.5 INTERNATIONAL PAPER

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 PRODUCT PORTFOLIO

17.5.4 RECENT UPDATES

17.6 VPK GROUP

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT UPDATES

17.7 SONOCO PRODUCTS COMPANY

17.7.1 COMPANY SNAPSHOT

17.7.2 REVENUE ANALYSIS

17.7.3 PRODUCT PORTFOLIO

17.7.4 RECENT UPDATE

17.8 STOROPACK HANS REICHENECKER GMBH

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT UPDATES

17.9 BIOAPPLY

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT UPDATE

17.1 BIO-LUTIONS INTERNATIONAL AG

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT UPDATES

17.11 CPS PAPER PRODUCTS

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT UPDATE

17.12 EUROCELL SRL

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT UPDATE

17.13 HOŞGÖR PLASTIK

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT UPDATES

17.14 NOVAMONT S.P.A.

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT UPDATE

17.15 OSQ

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT UPDATE

17.16 ROBERT CULLEN LTD

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT UPDATE

17.17 STORA ENZO

17.17.1 COMPANY SNAPSHOT

17.17.2 REVENUE ANALYSIS

17.17.3 PRODUCT PORTFOLIO

17.17.4 RECENT UPDATE

17.18 THE BIODEGRADABLE BAG COMPANY LTD.

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT UPDATE

17.19 TIPA LTD

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT UPDATES

17.2 WEST ROCK COMPANY

17.20.1 COMPANY SNAPSHOT

17.20.2 REVENUE ANALYSIS

17.20.3 PRODUCT PORTFOLIO

17.20.4 RECENT UPDATES

18 QUESTIONNAIRES

19 RELATED REPORTS

Список таблиц

TABLE 1 IMPORT DATA OF ARTICLES FOR CONVEYANCE OR PACKAGING OF GOODS, OF PLASTICS; STOPPERS, LIDS, CAPS AND OTHER CLOSURE OF PLASTICS.; HS CODE - 3923 (USD THOUSAND)

TABLE 2 EXPORT DATA OF ARTICLES FOR CONVEYANCE OR PACKAGING OF GOODS, OF PLASTICS; STOPPERS, LIDS, CAPS AND OTHER CLOSURE OF PLASTICS .; HS CODE - 3923 (USD THOUSAND)

TABLE 3 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 4 EUROPE BAGS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 5 EUROPE STAND UP BAGS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 6 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 7 EUROPE PAPER IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 8 EUROPE PLASTIC IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 9 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY USAGE, 2020-2029 (USD THOUSAND)

TABLE 10 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 11 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING LAYER, 2020-2029 (USD THOUSAND)

TABLE 12 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND )

TABLE 13 EUROPE FOOD PACKAGING IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 14 EUROPE BAKERY PRODUCTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 15 EUROPE COOKED FOOD IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 16 EUROPE DAIRY PRODUCTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 17 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY END-USER, 2020-2029 (USD THOUSAND)

TABLE 18 EUROPE RESTAURANTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 19 EUROPE SWEETS & SNACKS STORES IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 20 EUROPE CAFETERIA IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 21 EUROPE TEA AND COFFEE SHOPS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 22 EUROPE HOTELS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 23 EUROPE OTHERS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 24 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 25 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY COUNTRY, 2020-2029 (UNITS)

TABLE 26 GERMANY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 27 GERMANY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 28 GERMANY BAGS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 29 GERMANY STAND UP BAGS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 30 GERMANY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 31 GERMANY PAPER IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 32 GERMANY PLASTIC IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 33 GERMANY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY USAGE, 2020-2029 (USD THOUSAND)

TABLE 34 GERMANY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 35 GERMANY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING LAYER, 2020-2029 (USD THOUSAND)

TABLE 36 GERMANY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 37 GERMANY FOOD PACKAGING IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPICATION, 2020-2029 (USD THOUSAND)

TABLE 38 GERMANY BAKERY PRODUCTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 39 GERMANY COOKED FOOD IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 40 GERMANY DIARY PRODUCTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 41 GERMANY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY END-USER, 2020-2029 (USD THOUSAND)

TABLE 42 GERMANY RESTAURANTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 43 GERMANY SWEETS & SNACKS STORES IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 44 GERMANY CAFETERIA IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 45 GERMANY TEA AND COFFEE SHOPS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 46 GERMANY HOTELS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 47 GERMANY OTHERS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 48 FRANCE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 49 FRANCE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 50 FRANCE BAGS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 51 FRANCE STAND UP BAGS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 52 FRANCE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 53 FRANCE PAPER IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 54 FRANCE PLASTIC IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 55 FRANCE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY USAGE, 2020-2029 (USD THOUSAND)

TABLE 56 FRANCE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 57 FRANCE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING LAYER, 2020-2029 (USD THOUSAND)

TABLE 58 FRANCE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 59 FRANCE FOOD PACKAGING IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPICATION, 2020-2029 (USD THOUSAND)

TABLE 60 FRANCE BAKERY PRODUCTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 61 FRANCE COOKED FOOD IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 62 FRANCE DIARY PRODUCTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 63 FRANCE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY END-USER, 2020-2029 (USD THOUSAND)

TABLE 64 FRANCE RESTAURANTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 65 FRANCE SWEETS & SNACKS STORES IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 66 FRANCE CAFETERIA IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 67 FRANCE TEA AND COFFEE SHOPS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 68 FRANCE HOTELS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 69 FRANCE OTHERS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 70 U.K. BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 71 U.K. BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 72 U.K. BAGS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 73 U.K. STAND UP BAGS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 74 U.K. BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 75 U.K. PAPER IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 76 U.K. PLASTIC IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 77 U.K. BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY USAGE, 2020-2029 (USD THOUSAND)

TABLE 78 U.K. BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 79 U.K. BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING LAYER, 2020-2029 (USD THOUSAND)

TABLE 80 U.K. BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 81 U.K. FOOD PACKAGING IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPICATION, 2020-2029 (USD THOUSAND)

TABLE 82 U.K. BAKERY PRODUCTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 83 U.K. COOKED FOOD IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 84 U.K. DIARY PRODUCTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 85 U.K. BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY END-USER, 2020-2029 (USD THOUSAND)

TABLE 86 U.K. RESTAURANTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 87 U.K. SWEETS & SNACKS STORES IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 88 U.K. CAFETERIA IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 89 U.K. TEA AND COFFEE SHOPS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 90 U.K. HOTELS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 91 U.K. OTHERS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 92 ITALY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 93 ITALY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 94 ITALY BAGS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 95 ITALY STAND UP BAGS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 96 ITALY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 97 ITALY PAPER IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 98 ITALY PLASTIC IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 99 ITALY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY USAGE, 2020-2029 (USD THOUSAND)

TABLE 100 ITALY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 101 ITALY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING LAYER, 2020-2029 (USD THOUSAND)

TABLE 102 ITALY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 103 ITALY FOOD PACKAGING IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPICATION, 2020-2029 (USD THOUSAND)

TABLE 104 ITALY BAKERY PRODUCTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 105 ITALY COOKED FOOD IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 106 ITALY DIARY PRODUCTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 107 ITALY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY END-USER, 2020-2029 (USD THOUSAND)

TABLE 108 ITALY RESTAURANTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 109 ITALY SWEETS & SNACKS STORES IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 110 ITALY CAFETERIA IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 111 ITALY TEA AND COFFEE SHOPS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 112 ITALY HOTELS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 113 ITALY OTHERS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 114 SPAIN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 115 SPAIN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 116 SPAIN BAGS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 117 SPAIN STAND UP BAGS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 118 SPAIN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 119 SPAIN PAPER IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 120 SPAIN PLASTIC IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 121 SPAIN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY USAGE, 2020-2029 (USD THOUSAND)

TABLE 122 SPAIN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 123 SPAIN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING LAYER, 2020-2029 (USD THOUSAND)

TABLE 124 SPAIN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 125 SPAIN FOOD PACKAGING IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPICATION, 2020-2029 (USD THOUSAND)

TABLE 126 SPAIN BAKERY PRODUCTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 127 SPAIN COOKED FOOD IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 128 SPAIN DIARY PRODUCTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 129 SPAIN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY END-USER, 2020-2029 (USD THOUSAND)

TABLE 130 SPAIN RESTAURANTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 131 SPAIN SWEETS & SNACKS STORES IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 132 SPAIN CAFETERIA IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 133 SPAIN TEA AND COFFEE SHOPS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 134 SPAIN HOTELS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 135 SPAIN OTHERS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 136 RUSSIA BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 137 RUSSIA BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 138 RUSSIA BAGS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 139 RUSSIA STAND UP BAGS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 140 RUSSIA BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 141 RUSSIA PAPER IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 142 RUSSIA PLASTIC IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 143 RUSSIA BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY USAGE, 2020-2029 (USD THOUSAND)

TABLE 144 RUSSIA BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 145 RUSSIA BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING LAYER, 2020-2029 (USD THOUSAND)

TABLE 146 RUSSIA BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 147 RUSSIA FOOD PACKAGING IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPICATION, 2020-2029 (USD THOUSAND)

TABLE 148 RUSSIA BAKERY PRODUCTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 149 RUSSIA COOKED FOOD IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 150 RUSSIA DIARY PRODUCTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 151 RUSSIA BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY END-USER, 2020-2029 (USD THOUSAND)

TABLE 152 RUSSIA RESTAURANTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 153 RUSSIA SWEETS & SNACKS STORES IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 154 RUSSIA CAFETERIA IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 155 RUSSIA TEA AND COFFEE SHOPS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 156 RUSSIA HOTELS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 157 RUSSIA OTHERS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 158 BELGIUM BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 159 BELGIUM BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 160 BELGIUM BAGS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 161 BELGIUM STAND UP BAGS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 162 BELGIUM BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 163 BELGIUM PAPER IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 164 BELGIUM PLASTIC IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 165 BELGIUM BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY USAGE, 2020-2029 (USD THOUSAND)

TABLE 166 BELGIUM BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 167 BELGIUM BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING LAYER, 2020-2029 (USD THOUSAND)

TABLE 168 BELGIUM BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 169 BELGIUM FOOD PACKAGING IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPICATION, 2020-2029 (USD THOUSAND)

TABLE 170 BELGIUM BAKERY PRODUCTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 171 BELGIUM COOKED FOOD IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 172 BELGIUM DIARY PRODUCTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 173 BELGIUM BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY END-USER, 2020-2029 (USD THOUSAND)

TABLE 174 BELGIUM RESTAURANTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 175 BELGIUM SWEETS & SNACKS STORES IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 176 BELGIUM CAFETERIA IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 177 BELGIUM TEA AND COFFEE SHOPS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 178 BELGIUM HOTELS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 179 BELGIUM OTHERS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 180 NETHERLANDS BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 181 NETHERLANDS BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 182 NETHERLANDS BAGS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 183 NETHERLANDS STAND UP BAGS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 184 NETHERLANDS BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 185 NETHERLANDS PAPER IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 186 NETHERLANDS PLASTIC IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 187 NETHERLANDS BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY USAGE, 2020-2029 (USD THOUSAND)

TABLE 188 NETHERLANDS BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 189 NETHERLANDS BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING LAYER, 2020-2029 (USD THOUSAND)

TABLE 190 NETHERLANDS BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 191 NETHERLANDS FOOD PACKAGING IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPICATION, 2020-2029 (USD THOUSAND)

TABLE 192 NETHERLANDS BAKERY PRODUCTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 193 NETHERLANDS COOKED FOOD IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 194 NETHERLANDS DIARY PRODUCTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 195 NETHERLANDS BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY END-USER, 2020-2029 (USD THOUSAND)

TABLE 196 NETHERLANDS RESTAURANTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 197 NETHERLANDS SWEETS & SNACKS STORES IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 198 NETHERLANDS CAFETERIA IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 199 NETHERLANDS TEA AND COFFEE SHOPS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 200 NETHERLANDS HOTELS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 201 NETHERLANDS OTHERS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 202 SWITZERLAND BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 203 SWITZERLAND BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 204 SWITZERLAND BAGS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 205 SWITZERLAND STAND UP BAGS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 206 SWITZERLAND BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 207 SWITZERLAND PAPER IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 208 SWITZERLAND PLASTIC IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 209 SWITZERLAND BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY USAGE, 2020-2029 (USD THOUSAND)

TABLE 210 SWITZERLAND BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 211 SWITZERLAND BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING LAYER, 2020-2029 (USD THOUSAND)

TABLE 212 SWITZERLAND BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 213 SWITZERLAND FOOD PACKAGING IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPICATION, 2020-2029 (USD THOUSAND)

TABLE 214 SWITZERLAND BAKERY PRODUCTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 215 SWITZERLAND COOKED FOOD IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 216 SWITZERLAND DIARY PRODUCTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 217 SWITZERLAND BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY END-USER, 2020-2029 (USD THOUSAND)

TABLE 218 SWITZERLAND RESTAURANTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 219 SWITZERLAND SWEETS & SNACKS STORES IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 220 SWITZERLAND CAFETERIA IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 221 SWITZERLAND TEA AND COFFEE SHOPS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 222 SWITZERLAND HOTELS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 223 SWITZERLAND OTHERS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 224 TURKEY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 225 TURKEY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 226 TURKEY BAGS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 227 TURKEY STAND UP BAGS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 228 TURKEY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 229 TURKEY PAPER IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 230 TURKEY PLASTIC IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 231 TURKEY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY USAGE, 2020-2029 (USD THOUSAND)

TABLE 232 TURKEY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 233 TURKEY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING LAYER, 2020-2029 (USD THOUSAND)

TABLE 234 TURKEY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 235 TURKEY FOOD PACKAGING IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPICATION, 2020-2029 (USD THOUSAND)

TABLE 236 TURKEY BAKERY PRODUCTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 237 TURKEY COOKED FOOD IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 238 TURKEY DIARY PRODUCTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 239 TURKEY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY END-USER, 2020-2029 (USD THOUSAND)

TABLE 240 TURKEY RESTAURANTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 241 TURKEY SWEETS & SNACKS STORES IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 242 TURKEY CAFETERIA IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 243 TURKEY TEA AND COFFEE SHOPS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 244 TURKEY HOTELS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 245 TURKEY OTHERS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 246 REST OF EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 247 REST OF EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (UNITS)

Список рисунков

FIGURE 1 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET: SEGMENTATION

FIGURE 2 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET: DROC ANALYSIS

FIGURE 4 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET: GLOBAL VS. REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET: THE USAGE LIFE LINE CURVE

FIGURE 7 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET: MULTIVARIATE MODELLING

FIGURE 8 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET: DBMR MARKET POSITION GRID

FIGURE 10 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET: SEGMENTATION

FIGURE 14 GROWING CONSUMER AWARENESS RELATED TO ECOFRIENDLY PACKAGING IS DRIVING THE EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 15 PAPER SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET IN 2022 TO 2029

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET

FIGURE 17 VOLUME OF PLASTIC POLYMERS USE IN THE EUROPEAN UNION (MILLION TONS), 2018

FIGURE 18 EUROPE BIOPLASTICS MARKET, BY TYPE (IN EUROPE), 2018

FIGURE 19 PRODUCTION CAPACITY OF BIOPLASTICS, BY MATERIAL TYPE, 2019

FIGURE 20 TYPES OF NATIONAL RESTRICTIONS OR BANS IN THE WORLD (%)

FIGURE 21 BANS ON SPECIFIC PRODUCTS (N) ASSOCIATED WITH FOOD SERVICE AND DELIVERY

FIGURE 22 PRODUCTION COST OF PLA, BY OPERATING EXPENDITURE (%)

FIGURE 23 FEEDSTOCK EFFICIENCY SCORE, 2016

FIGURE 24 LAND USE PER TON OF BIOBASED PLA, BIOBASED PE AND BIOETHANOL

FIGURE 25 PRODUCER PRICE INDEX BY INDUSTRY: PLASTICS MATERIAL AND RESINS MANUFACTURING

FIGURE 26 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2021

FIGURE 27 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2021

FIGURE 28 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY USAGE, 2021

FIGURE 29 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2021

FIGURE 30 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING LAYER, 2021

FIGURE 31 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2021

FIGURE 32 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY END-USER, 2021

FIGURE 33 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET: SNAPSHOT (2021)

FIGURE 34 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET: BY COUNTRY (2021)

FIGURE 35 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET: BY COUNTRY (2022 & 2029)

FIGURE 36 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET: BY COUNTRY (2021 & 2029)

FIGURE 37 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET: BY PRODUCT (2022-2029)

FIGURE 38 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET: COMPANY SHARE 2021(%)

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.