Рынок частного медицинского страхования в Австралии по типу (страхование на случай критических заболеваний, индивидуальное медицинское страхование, семейное медицинское страхование, страхование от конкретных заболеваний и другие), категория медицинского плана/уровни металла (бронзовый, серебряный, золотой, платиновый и другие), тип поставщика (организации по поддержанию здоровья (HMOS), предпочтительные организации поставщиков (PPOS), эксклюзивные организации поставщиков (EPOS), планы в точках обслуживания (POS), медицинские планы с высокой франшизой (HDHPS) и другие), возрастная группа (молодой возраст (19–44 года), средний возраст (45–64 года) и пожилой возраст (65 лет и старше)), канал распространения (компании прямого страхования, страховые агрегаторы и другие). Тенденции отрасли и прогноз до 2029 года.

Анализ и размер рынка

Полис медицинского страхования состоит из нескольких типов функций и преимуществ. Он обеспечивает финансовое покрытие страхователям определенных видов лечения, полис медицинского страхования предлагает такие преимущества, как безналичная госпитализация, пред- и постгоспитальное покрытие, возмещение и различные дополнения.

В плане медицинского страхования доступны несколько типов покрытия: безналичное или возмещение. Безналичное пособие доступно, когда страхователь проходит лечение в сетевых больницах страховой компании. Если страхователь проходит лечение в больницах, не входящих в список сети, в этом случае страхователь оплачивает все медицинские расходы, а затем подает заявление на возмещение в страховую компанию, предоставив все медицинские счета.

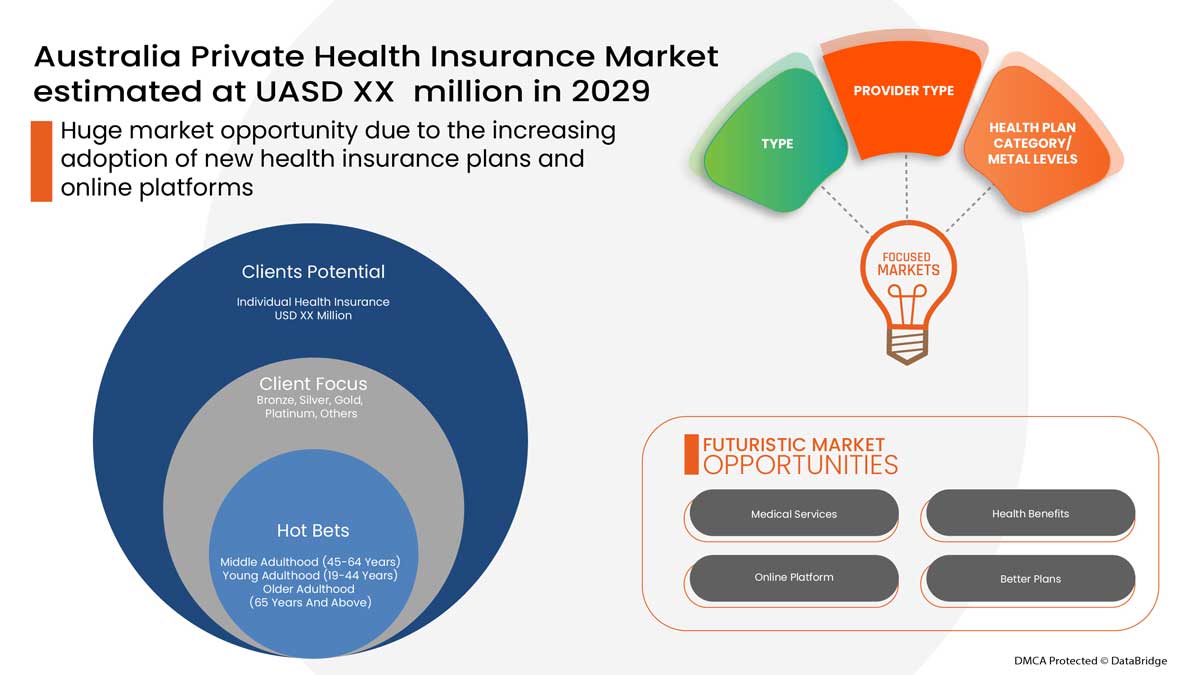

Эти частные медицинские страховки оказывают финансовую поддержку держателю полиса, поскольку покрывают все медицинские расходы, когда держатель полиса госпитализирован для лечения. Data Bridge Market Research анализирует, что рынок частного медицинского страхования, как ожидается, достигнет значения 30 715,92 млн долларов США к 2029 году при среднегодовом темпе роста 2,5% в течение прогнозируемого периода. «Индивидуальное медицинское страхование» составляет наиболее заметный сегмент типа на соответствующем рынке из-за роста частного медицинского страхования. Отчет о рынке, подготовленный командой Data Bridge Market Research, включает в себя углубленный экспертный анализ, анализ импорта/экспорта, анализ цен, анализ производства и потребления, а также сценарий климатической цепочки.

|

Отчет Метрика |

Подробности |

|

Прогнозируемый период |

2022-2029 |

|

Базовый год |

2021 |

|

Исторические годы |

2020 (Можно настроить на 2019 - 2014) |

|

Количественные единицы |

Доход в млн. долл. США |

|

Охваченные сегменты |

По типу (страхование критических заболеваний, индивидуальное медицинское страхование, семейное медицинское страхование, страхование от конкретных заболеваний и другие), категория медицинского плана/уровни металла (бронзовый, серебряный, золотой, платиновый и другие), тип поставщика (организации по поддержанию здоровья (HMOS), предпочтительные организации поставщиков (PPOS), эксклюзивные организации поставщиков (EPOS), планы точек обслуживания (POS), медицинские планы с высокой франшизой (HDHPS) и другие), возрастная группа (молодой возраст (19–44 года), средний возраст (45–64 года) и пожилой возраст (65 лет и старше)), канал распространения (компании прямого страхования, страховые агрегаторы и другие) |

|

Страны, охваченные |

Австралия |

|

Охваченные участники рынка |

AIA Group Limited (Гонконг), HCF (Австралия), Allianz (Германия), Suncorp Group (Австралия), Medibank Private Limited (Австралия), HSBC Group (Гонконг), Tokio Marine (Япония), Great Eastern Holdings Limited (Малайзия), The Royal Automobile Club of WA (Inc.) (Австралия), AXA (Франция), Income (Австралия), Aetna Inc. (дочерняя компания CVS Health), Cigna |

Определение рынка

Медицинское страхование — это вид страхования, который обеспечивает покрытие всех видов хирургических расходов и медицинского лечения, понесенных в результате болезни или травмы. Медицинское страхование распространяется на полный или ограниченный спектр медицинских услуг, которые покрывают полную или частичную стоимость определенных услуг. Медицинское страхование обеспечивает финансовую поддержку страхователю, поскольку покрывает все медицинские расходы, когда страхователь госпитализирован для лечения. Медицинское страхование также покрывает расходы до и после госпитализации.

Нормативная база

Согласно Закону о частном медицинском страховании (пруденциальном надзоре) 2015 г.

Частный медицинский страховщик должен иметь по крайней мере один фонд медицинского страхования. Существуют режимы, регулирующие:

Как работают фонды медицинского страхования; и

Изменение фонда медицинского страхования, к которому относится полис страхования; и

Прекращение выплат по медицинскому страхованию; и

Внешнее управление фондами медицинского страхования.

COVID-19 оказал минимальное влияние на рынок частного медицинского страхования

COVID-19 повлиял на различные отрасли производства и предоставления услуг в 2020-2021 годах, поскольку он привел к закрытию рабочих мест, нарушению цепочек поставок и ограничениям на транспорт. Однако дисбаланс между спросом и предложением и его влияние на ценообразование считаются краткосрочными и, как ожидается, восстановятся по мере окончания этой пандемии. Из-за вспышки covid19 по всему миру спрос на частное медицинское страхование значительно возрос. Кроме того, страх перед пандемией и рост стоимости медицинских услуг способствовали росту рынка медицинского страхования во время пандемии. Кроме того, компании медицинского страхования представили пакеты и решения для покрытия медицинских расходов на лечение страховщиков, инфицированных covid19. Таким образом, несмотря на то, что другие отрасли сильно пострадали во время вспышки covid19, отрасль частного медицинского страхования значительно выросла.

Динамика рынка частного медицинского страхования включает:

Драйверы/Возможности

- Рост стоимости медицинских услуг

Медицинское страхование обеспечивает финансовую поддержку в случае серьезной болезни или несчастного случая. Рост стоимости медицинских услуг на операции и пребывание в больнице создал новую финансовую эпидемию во всем мире. Стоимость медицинских услуг состоит из стоимости операции, гонорара врача, стоимости пребывания в больнице, стоимости отделения неотложной помощи и стоимости диагностических исследований, среди прочего. Таким образом, этот рост стоимости медицинских услуг стимулирует рост рынка.

- Растущее число процедур дневного ухода

Процедуры дневного ухода — это те виды медицинских процедур или операций, которые в первую очередь требуют меньшего времени пребывания в больницах. При процедуре дневного ухода пациенты должны оставаться в больнице в течение короткого периода. Большинство компаний медицинского страхования теперь покрывают процедуры дневного ухода в своих страховых планах, и для таких видов хирургии нет принуждения проводить 24 часа в больнице, что является минимальным сроком пребывания в больнице, подлежащим страхованию. В то время как большинство планов медицинского страхования покрывают пребывание в больнице и серьезные операции, страхователи также могут требовать процедуры дневного ухода в рамках своего полиса медицинского страхования, что стимулирует спрос на рынке.

- Обязательное наличие медицинского страхования в государственном и частном секторе

Покупка полиса медицинского страхования является обязательным условием для сотрудников государственного и частного секторов. Медицинское страхование предлагает основные медицинские льготы, которыми сотрудник может воспользоваться, работая в корпорации. В случае возникновения каких-либо чрезвычайных ситуаций или медицинских проблем медицинское страхование очень полезно для покрытия расходов на лечение. Медицинское страхование сотрудника является расширенным пособием, которое работодатель предоставляет своим сотрудникам . Предоставляемое медицинское страхование покрывает как самого сотрудника, так и членов его семьи в рамках одного и того же полиса. Кроме того, в некоторых случаях работодатель может оплатить часть премии или страхового покрытия полиса медицинского страхования.

- Увеличение численности населения пожилого возраста

Люди пожилого возраста, скорее всего, будут болеть или иметь проблемы со здоровьем из-за старения и слабой иммунной системы, такие как проблемы с зубами, сердечные проблемы, проблемы с раком и неизлечимые болезни. Хорошая медицинская страховка для пожилых граждан может помочь пожилым гражданам выбирать качественные услуги медицинского страхования, чтобы уменьшить будущие финансовые проблемы. Таким образом, увеличение численности населения пожилого возраста может повысить спрос на рынок медицинского страхования.

- Повышение осведомленности о преимуществах медицинского страхования

В случае возникновения чрезвычайной медицинской ситуации медицинская страховка позволяет потребителям отвлечься от стресса, связанного с расходами на здравоохранение, и сосредоточиться на лечении с помощью медицинской страховки. Неотложные медицинские ситуации могут возникнуть в любое время, независимо от нашего текущего хорошего здоровья или дисциплинированного образа жизни. Поэтому важно планировать и защищать наши семьи и себя от любых непредвиденных медицинских ситуаций, особенно когда дома находятся пожилые родители, поскольку они более восприимчивы к инфекциям или другим заболеваниям.

Ограничения/Проблемы, с которыми сталкивается рынок частного медицинского страхования

- Высокая стоимость страховых премий

Медицинское страхование покрывает все виды расходов на лечение. Оно обеспечивает финансовую поддержку страхователю, поскольку покрывает все медицинские расходы, когда страхователь госпитализирован для лечения. Медицинское страхование также покрывает расходы до и после госпитализации. Чтобы приобрести медицинскую страховку, страхователь должен регулярно платить страховые взносы, чтобы поддерживать полис медицинского страхования активным. Стоимость страховой премии высока в большинстве случаев в зависимости от страхового плана, что сдерживает рост рынка.

- Недостаточная осведомленность о медицинском страховании

В сфере здравоохранения большая часть населения мира до сих пор не знает о преимуществах полисов медицинского страхования. Расходы на медицинское обслуживание растут во всем мире с достижениями в этой области. Благодаря развитию технологий сектор здравоохранения является одним из растущих сегментов, однако уровень проникновения полисов медицинского страхования остается низким из-за отсутствия осведомленности о преимуществах, которые они предлагают

В этом отчете о рынке частного медицинского страхования содержатся сведения о последних новых разработках, правилах торговли, анализе импорта-экспорта, анализе производства, оптимизации цепочки создания стоимости, доле рынка, влиянии внутренних и локальных игроков рынка, анализируются возможности с точки зрения новых источников дохода, изменений в правилах рынка, анализ стратегического роста рынка, размер рынка, рост рынка категорий, ниши приложений и доминирование, одобрения продуктов, запуски продуктов, географические расширения, технологические инновации на рынке. Чтобы получить больше информации о рынке частного медицинского страхования, свяжитесь с Data Bridge Market Research для получения аналитического обзора. Наша команда поможет вам принять обоснованное рыночное решение для достижения роста рынка.

Последние события

- В марте 2021 года Medibank Private Limited инвестировала 10 миллионов долларов в компанию Medinet, занимающуюся технологиями в сфере здравоохранения, чтобы поддержать растущую роль виртуального здравоохранения в Австралии — часть своей стратегии по улучшению результатов в области здравоохранения путем поддержки более профилактической и комплексной помощи. Это развитие улучшит имидж компании и поможет расширить ее бизнес.

- В сентябре 2021 года HCF заключил партнерство с Health a Rail, Transport and Energy Health Fund, чтобы предоставить специализированную и персонализированную поддержку, услуги и продукты для работников здравоохранения. Это развитие помогло компании расширить свой бизнес.

Масштаб рынка частного медицинского страхования в Австралии

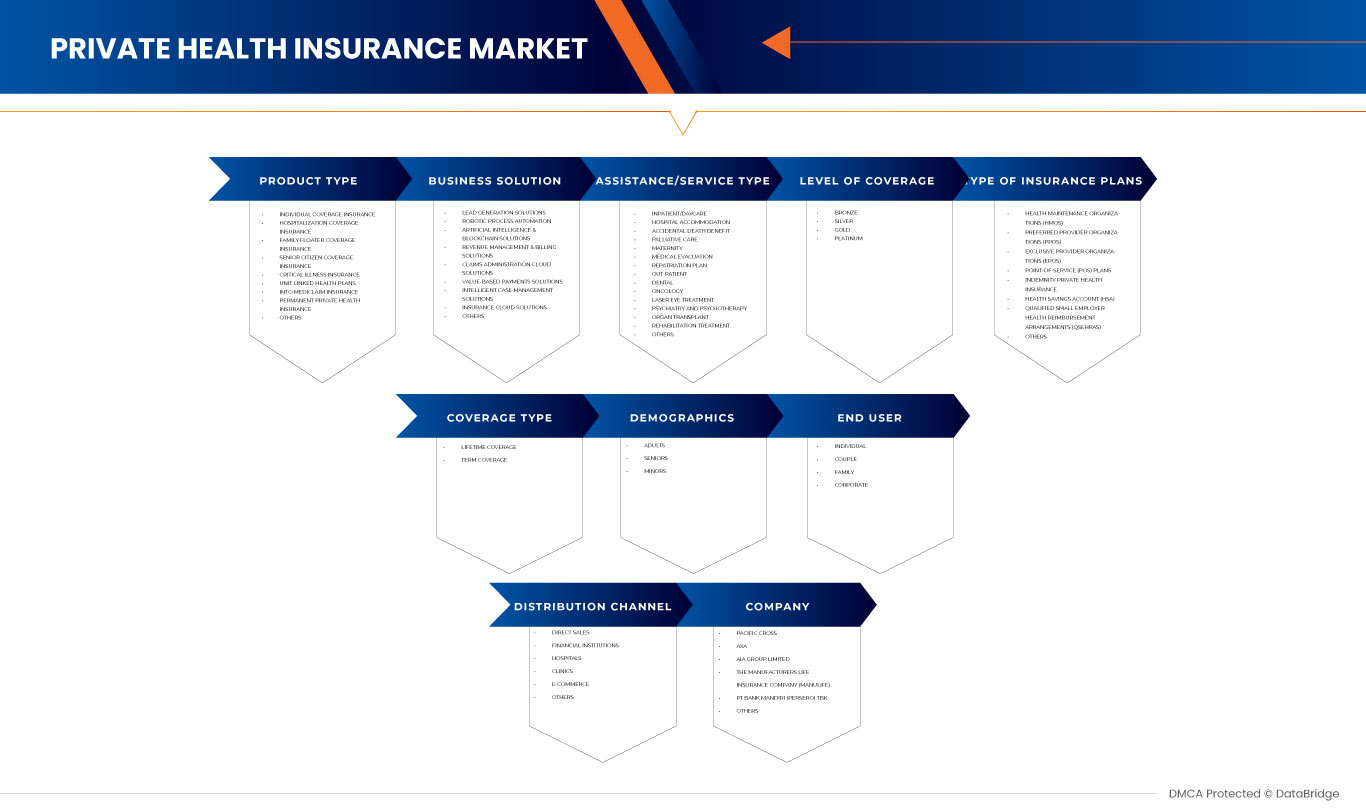

Рынок частного медицинского страхования сегментирован на основе типа, категории/уровня металла медицинского плана, типа поставщика, возрастной группы и канала распространения. Рост среди этих сегментов поможет вам проанализировать сегменты с незначительным ростом в отраслях и предоставить пользователям ценный обзор рынка и рыночные идеи, которые помогут им принимать стратегические решения для определения основных рыночных приложений.

Тип

- Страхование от критических заболеваний

- Индивидуальное медицинское страхование

- Семейное медицинское страхование

- Страхование от конкретных заболеваний

- Другие

По типу рынок сегментируется на страхование от критических заболеваний, индивидуальное медицинское страхование, семейное медицинское страхование, страхование от конкретных заболеваний и другие.

Категория плана здравоохранения/Уровни металлов

- бронза

- Серебро

- Золото

- Платина

- Другие

На основе категории медицинского страхования/уровня металла рынок сегментируется на бронзу, серебро, золото, платину и другие.

Тип провайдера

- Организации по поддержанию здоровья (HMOS)

- Предпочтительные организации поставщиков (PPOS)

- Эксклюзивные организации-поставщики (EPOS)

- Планы точек обслуживания (POS)

- Медицинские планы с высокой франшизой (HDHPS)

- Другие

По типу поставщика рынок сегментируется на организации по поддержанию здоровья (HMOS), организации предпочитаемых поставщиков (PPOS), организации эксклюзивных поставщиков (EPOS), планы в точках обслуживания (POS), медицинские планы с высокой франшизой (HDHPS) и другие.

Возрастная группа

- Молодость (19-44 года)

- Средний возраст (45-64 года)

- Пожилой возраст (65 лет и старше)

По возрастному признаку рынок сегментируется на молодую взрослую группу (19–44 года), среднюю взрослую группу (45–64 года) и пожилую взрослую группу (65 лет и старше).

Канал распространения

- Компании прямого страхования

- Страховые агрегаторы

- Другие

По каналу сбыта рынок сегментируется на компании прямого страхования, страховые агрегаторы и другие.

Анализ конкурентной среды и доли рынка частного медицинского страхования

Конкурентная среда рынка частного медицинского страхования содержит сведения по конкурентам. Включены сведения о компании, финансы компании, полученный доход, рыночный потенциал, инвестиции в исследования и разработки, новые рыночные инициативы, присутствие в Австралии, производственные площадки и объекты, производственные мощности, сильные и слабые стороны компании, запуск продукта, широта и широта продукта, доминирование приложений. Приведенные выше данные относятся только к фокусу компаний, связанному с рынком частного медицинского страхования.

Some of the major players operating in the private health insurance market are AIA Group Limited (Hong Kong), HCF (Australia), Allianz (Germany), Suncorp Group (Australia), Medibank Private Limited (Australia), HSBC Group (Hong Kong), Tokio Marine (Japan), Great Eastern Holdings Limited (Malaysia), The Royal Automobile Club of WA (Inc.). (Australia), AXA (France), Income (Australia), Aetna Inc. (A subsidiary of CVS Health), Cigna among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Содержание

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF AUSTRALIA PRIVATE HEALTH INSURANCE MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 AGE GROUP LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 DBMR MARKET CHALLENGE MATRIX

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 SOUTH EAST ASIA PRIVATE HEALTH INSURANCE MARKET- PESTEL ANALYSIS

4.1.1 OVERVIEW

4.1.2 POLITICAL FACTORS

4.1.3 ENVIRONMENTAL FACTORS

4.1.4 SOCIAL FACTORS

4.1.5 TECHNOLOGICAL FACTORS

4.1.6 ECONOMICAL FACTORS

4.1.7 LEGAL FACTORS

4.1.8 CONCLUSION

4.2 PORTER’S FIVE FORCES:

4.2.1 THREAT OF NEW ENTRANTS:

4.2.2 THREAT OF SUBSTITUTES:

4.2.3 CUSTOMER BARGAINING POWER:

4.2.4 SUPPLIER BARGAINING POWER:

4.2.5 INTERNAL COMPETITION (RIVALRY):

4.3 SOUTH EAST ASIA INSURANCE SCENARIO VS GLOBAL

4.4 CUSTOMIZED DELIVERABLE

4.4.1 HOW ARE INSURANCE CLAIMS EVALUATED (I.E., PROCESS FOR FILING FROM HOSPITALS, PHYSICIAN JUSTIFICATION)

4.4.2 DATA INTERPRETATION

5 INDUSTRY INSIGHTS

5.1 DEMOGRAPHIC TRENDS:-

5.1.1 AGE

5.1.2 GENDER

5.1.3 OCCUPATION

5.1.4 FAMILY SIZE

5.2 NUMBER OF CLAIMS BY TYPE

5.2.1 CASHLESS VS. REIMBURSEMENT CLAIMS

5.3 EXTRA CARE/TOP-UP INSURANCE OFFERINGS BY COMPANIES

5.4 INVESTMENT & FUNDING

5.5 PENETRATION OF PRIVATE INSURANCE & DENSITY

5.6 INTERVIEWS WITH KEY HOSPITALS AND INSURANCE COMPANIES

5.7 POLICY SUPPORT FOR LIFE INSURANCE IN SOUTH EAST ASIA

5.7.1 MALAYSIA

5.7.2 PHILIPPINES

5.7.3 THAILAND

5.7.4 VIETNAM

5.8 PUBLIC VS PRIVATE HEALTH INSURANCE

5.9 OTHER KOL SNAPSHOTS

5.1 PREMIUM/COPAY/COINSURANCE

6 REGULATORY FRAMWORK

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 INCREASING COST FOR MEDICAL SERVICES

7.1.2 GROWING NUMBER OF DAY CARE PROCEDURES

7.1.3 MANDATORY OPTING FOR HEALTH INSURANCE IN PUBLIC AND PRIVATE SECTOR

7.1.4 INCREASING OLD AGE POPULATION

7.2 RESTRAINTS

7.2.1 HIGH COST OF PREMIUM

7.2.2 STRICT DOCUMENTATION PROCESS FOR CLAIM REIMBURSEMENT

7.3 OPPORTUNITIES

7.3.1 INCREASING AWARENESS ABOUT THE BENEFITS OF HEALTH INSURANCE

7.3.2 INCREASING HEALTH CARE EXPENDITURE

7.3.3 GROWING MEDICAL TOURISM AMONG COUNTRIES

7.4 CHALLENGE

7.4.1 LACK OF AWARENESS REGARDING HEALTH INSURANCE

8 AUSTRALIA PRIVATE HEALTH INSURANCE MARKET, BY TYPE

8.1 OVERVIEW

8.2 INDIVIDUAL HEALTH INSURANCE

8.3 FAMILY HEALTH INSURANCE

8.4 CRITICAL ILLNESS INSURANCE

8.5 DISEASE-SPECIFIC INSURANCE

8.6 OTHERS

9 AUSTRALIA PRIVATE HEALTH INSURANCE MARKET, BY HEALTH PLAN CATEGORY/METAL LEVELS

9.1 OVERVIEW

9.2 BRONZE

9.3 SILVER

9.4 GOLD

9.5 PLATINUM

9.6 OTHERS

10 AUSTRALIA PRIVATE HEALTH INSURANCE MARKET, BY PROVIDER TYPE

10.1 OVERVIEW

10.2 HEALTH MAINTENANCE ORGANIZATIONS (HMOS)

10.3 PREFERRED PROVIDER ORGANIZATIONS (PPOS)

10.4 EXCLUSIVE PROVIDER ORGANIZATIONS (EPOS)

10.5 POINT-OF-SERVICE (POS) PLANS

10.6 HIGH-DEDUCTIBLE HEALTH PLANS (HDHPS)

10.7 OTHERS

11 AUSTRALIA PRIVATE HEALTH INSURANCE MARKET, BY AGE GROUP

11.1 OVERVIEW

11.2 MIDDLE ADULTHOOD (45-64 YEARS)

11.3 YOUNG ADULTHOOD (19-44 YEARS)

11.4 OLDER ADULTHOOD (65 YEARS AND ABOVE)

12 AUSTRALIA PRIVATE HEALTH INSURANCE MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 DIRECT INSURANCE COMPANIES

12.3 INSURANCE AGGREGATORS

12.4 OTHERS

13 AUSTRALIA PRIVATE HEALTH INSURANCE MARKET, BY COUNTRY

13.1 AUSTRALIA

14 AUSTRALIA PRIVATE HEALTH INSURANCE THERMAL INSULATION PACKAGING MARKET, COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: AUSTRALIA

14.2 MERGER & ACQUISITION

14.3 EXPANSIONS

14.4 NEW PRODUCT DEVELOPMENT

14.5 PARTNERSHIP

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 AETNA INC. (A SUBSIDIARY OF CVS HEALTH)

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 PRODUCT PORTFOLIO

16.1.4 RECENT DEVELOPMENTS

16.2 CIGNA

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 PRODUCT PORTFOLIO

16.2.4 RECENT DEVELOPMENTS

16.3 AIA GROUP LIMITED

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 PRODUCT PORTFOLIO

16.3.4 RECENT UPDATE

16.4 HCF

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT UPDATES

16.5 ALLIANZ

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 PRODUCT PORTFOLIO

16.5.4 RECENT UPDATES

16.6 SUNCORP GROUP

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 PRODUCT PORTFOLIO

16.6.4 RECENT UPDATES

16.7 MEDIBANK PRIVATE LIMITED

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 PRODUCT PORTFOLIO

16.7.4 RECENT DEVELOPMENTS

16.8 DAI-ICHI LIFE VIETNAM

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT UPDATE

16.9 HSBC GROUP

16.9.1 COMPANY SNAPSHOT

16.9.2 REVENUE ANALYSIS

16.9.3 PRODUCT PORTFOLIO

16.9.4 RECENT UPDATE

16.1 ACCURO HEALTH INSURANCE

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT UPDATE

16.11 AIG ASIA PACIFIC INSURANCE PTE. LTD

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT UPDATE

16.12 ASSICURANZIONI GENERALI S.P.A.

16.12.1 COMPANY SNAPSHOT

16.12.2 FINANCIAL ANALYSIS

16.12.3 PRODUCT PORTFOLIO

16.12.4 RECENT UPDATES

16.13 AXA

16.13.1 COMPANY SNAPSHOT

16.13.2 REVENUE ANALYSIS

16.13.3 PRODUCT PORTFOLIO

16.13.4 RECENT UPDATE

16.14 BNI LIFE

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 PRODUCT PORTFOLIO

16.14.4 RECENT UPDATES

16.15 BUPA GLOBAL

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT UPDATE

16.16 ETIQA

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT UPDATE

16.17 GREAT EASTERN HOLDINGS LIMITED

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT UPDATE

16.18 HONG LEONG ASSURANCE BERHAD

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT UPDATES

16.19 INCOME

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 RECENT UPDATES

16.2 MANULIFE HOLDINGS BERHAD

16.20.1 COMPANY SNAPSHOT

16.20.2 REVENUE ANALYSIS

16.20.3 PRODUCT PORTFOLIO

16.20.4 RECENT UPDATES

16.21 NIB NZ LIMITED

16.21.1 COMPANY SNAPSHOT

16.21.2 PRODUCT PORTFOLIO

16.21.3 RECENT UPDATE

16.22 NOW HEALTH INTERNATIONAL

16.22.1 COMPANY SNAPSHOT

16.22.2 PRODUCT PORTFOLIO

16.22.3 RECENT DEVELOPMENTS

16.23 PACIFIC CROSS

16.23.1 COMPANY SNAPSHOT

16.23.2 PRODUCT PORTFOLIO

16.23.3 RECENT UPDATE

16.24 PARTNERS LIFE

16.24.1 COMPANY SNAPSHOT

16.24.2 PRODUCT PORTFOLIO

16.24.3 RECENT UPDATES

16.25 PRUDENTIAL ASSURANCE MALAYSIA BERHAD

16.25.1 COMPANY SNAPSHOT

16.25.2 PRODUCT PORTFOLIO

16.25.3 RECENT UPDATE

16.26 RAFFLES MEDICAL GROUP

16.26.1 COMPANY SNAPSHOT

16.26.2 REVENUE ANALYSIS

16.26.3 PRODUCT PORTFOLIO

16.26.4 RECENT UPDATE

16.27 SOUTHERN CROSS

16.27.1 COMPANY SNAPSHOT

16.27.2 PRODUCT PORTFOLIO

16.27.3 RECENT UPDATES

16.28 THE ROYAL AUTOMOBILE CLUB OF WA (INC.).

16.28.1 COMPANY SNAPSHOT

16.28.2 PRODUCT PORTFOLIO

16.28.3 RECENT UPDATES

16.29 TOKIO MARINE

16.29.1 COMPANY SNAPSHOT

16.29.2 PRODUCT PORTFOLIO

16.29.3 RECENT UPDATE

16.3 UNIMED

16.30.1 COMPANY SNAPSHOT

16.30.2 PRODUCT PORTFOLIO

16.30.3 RECENT UPDATES

16.31 ZURICH

16.31.1 COMPANY SNAPSHOT

16.31.2 REVENUE ANALYSIS

16.31.3 PRODUCT PORTFOLIO

16.31.4 RECENT UPDATES

17 QUESTIONNAIRES

18 RELATED REPORTS

Список таблиц

TABLE 1 NUMBER OF ADULTS HAVE PRIVATE HEALTH INSURANCE, BY AGE GROUP, MILLION, 2021

TABLE 2 NUMBER OF ADULTS HAVE PRIVATE HEALTH INSURANCE, BY INSURANCE COMPANY, MILLION, 2021

TABLE 3 NUMBER OF ADULTS HAVE PRIVATE HEALTH INSURANCE, BY PROVIDER TYPE, MILLION, 2021

TABLE 4 NEW ZEALAND PRIVATE HEALTH INSURANCE MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 5 DETAILS OF AETNA INC. (A SUBSIDIARY OF CVS HEALTH) OF HEALTH MAINTENANCE ORGANIZATIONS (HMOS), BY TYPE , USD MILLION, 2021

TABLE 6 DETAILS OF AETNA INC. (A SUBSIDIARY OF CVS HEALTH) OF PREFERRED PROVIDER ORGANIZATIONS (PPOS), BY TYPE , USD MILLION, 2021

TABLE 7 DETAILS OF AETNA INC. (A SUBSIDIARY OF CVS HEALTH) OF EXCLUSIVE PROVIDER ORGANIZATIONS (EPOS), BY TYPE , USD MILLION, 2021

TABLE 8 DETAILS OF AETNA INC. (A SUBSIDIARY OF CVS HEALTH) OF POINT-OF-SERVICE (POS) PLANS, BY TYPE , USD MILLION, 2021

TABLE 9 DETAILS OF AETNA INC. (A SUBSIDIARY OF CVS HEALTH) OF HIGH-DEDUCTIBLE HEALTH PLANS (HDHPS), BY TYPE , USD MILLION, 2021

TABLE 10 DETAILS OF AETNA INC. (A SUBSIDIARY OF CVS HEALTH) OF OTHERS, BY TYPE , USD MILLION, 2021

TABLE 11 DETAILS OF CIGNA OF HEALTH MAINTENANCE ORGANIZATIONS (HMOS), BY TYPE , USD MILLION, 2021

TABLE 12 DETAILS OF CIGNA OF PREFERRED PROVIDER ORGANIZATIONS (PPOS), BY TYPE , USD MILLION, 2021

TABLE 13 DETAILS OF CIGNA OF EXCLUSIVE PROVIDER ORGANIZATIONS (EPOS), BY TYPE , USD MILLION, 2021

TABLE 14 DETAILS OF CIGNA OF POINT-OF-SERVICE (POS) PLANS, BY TYPE , USD MILLION, 2021

TABLE 15 DETAILS OF CIGNA OF HIGH-DEDUCTIBLE HEALTH PLANS (HDHPS), BY TYPE , USD MILLION, 2021

TABLE 16 DETAILS OF CIGNA OF OTHERS, BY TYPE , USD MILLION, 2021

TABLE 17 DETAILS OF AIA GROUP LIMITED OF HEALTH MAINTENANCE ORGANIZATIONS (HMOS), BY TYPE , USD MILLION, 2021

TABLE 18 DETAILS OF AIA GROUP LIMITED OF PREFERRED PROVIDER ORGANIZATIONS (PPOS), BY TYPE , USD MILLION, 2021

TABLE 19 DETAILS OF AIA GROUP LIMITED OF EXCLUSIVE PROVIDER ORGANIZATIONS (EPOS), BY TYPE , USD MILLION, 2021

TABLE 20 DETAILS OF AIA GROUP LIMITED OF POINT-OF-SERVICE (POS) PLANS, BY TYPE , USD MILLION, 2021

TABLE 21 DETAILS OF AIA GROUP LIMITED OF HIGH-DEDUCTIBLE HEALTH PLANS (HDHPS), BY TYPE , USD MILLION, 2021

TABLE 22 DETAILS OF AIA GROUP LIMITED OF OTHERS, BY TYPE , USD MILLION, 2021

TABLE 23 CHIEF MEDICAL OFFICER

TABLE 24 LIST OF DAY CARE PROCEDURES

TABLE 25 AUSTRALIA PRIVATE HEALTH INSURANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 26 AUSTRALIA PRIVATE HEALTH INSURANCE MARKET, BY HEALTH PLAN CATEGORY/METAL LEVELS, 2020-2029 (USD MILLION)

TABLE 27 AUSTRALIA PRIVATE HEALTH INSURANCE MARKET, BY PROVIDER TYPE, 2020-2029 (USD MILLION)

TABLE 28 AUSTRALIA PRIVATE HEALTH INSURANCE MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 29 AUSTRALIA PRIVATE HEALTH INSURANCE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 30 AUSTRALIA PRIVATE HEALTH INSURANCE MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 31 AUSTRALIA PRIVATE HEALTH INSURANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 32 AUSTRALIA PRIVATE HEALTH INSURANCE MARKET, BY HEALTH PLAN CATEGORY/METAL LEVELS, 2020-2029 (USD MILLION)

TABLE 33 AUSTRALIA PRIVATE HEALTH INSURANCE MARKET, BY PROVIDER TYPE, 2020-2029 (USD MILLION)

TABLE 34 AUSTRALIA PRIVATE HEALTH INSURANCE MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 35 AUSTRALIA PRIVATE HEALTH INSURANCE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

Список рисунков

FIGURE 1 AUSTRALIA PRIVATE HEALTH INSURANCE MARKET: SEGMENTATION

FIGURE 2 AUSTRALIA PRIVATE HEALTH INSURANCE MARKET: DATA TRIANGULATION

FIGURE 3 AUSTRALIA PRIVATE HEALTH INSURANCE MARKET: DROC ANALYSIS

FIGURE 4 AUSTRALIA PRIVATE HEALTH INSURANCE MARKET: AUSTRALIA VS. REGIONAL MARKET ANALYSIS

FIGURE 5 AUSTRALIA PRIVATE HEALTH INSURANCE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 AUSTRALIA PRIVATE HEALTH INSURANCE MARKET: THE AGE GROUP LIFE LINE CURVE

FIGURE 7 AUSTRALIA PRIVATE HEALTH INSURANCE MARKET: MULTIVARIATE MODELLING

FIGURE 8 AUSTRALIA PRIVATE HEALTH INSURANCE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 AUSTRALIA PRIVATE HEALTH INSURANCE MARKET: DBMR MARKET POSITION GRID

FIGURE 10 AUSTRALIA PRIVATE HEALTH INSURANCE MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 11 AUSTRALIA PRIVATE HEALTH INSURANCE MARKET: VENDOR SHARE ANALYSIS

FIGURE 12 AUSTRALIA PRIVATE HEALTH INSURANCE MARKET: SEGMENTATION

FIGURE 13 MANDATORY OPTING FOR HEALTH INSURANCE IN PUBLIC AND PRIVATE SECTOR IS DRIVING THE AUSTRALIA PRIVATE HEALTH INSURANCE MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 INDIVIDUAL HEALTH INSURANCE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE AUSTRALIA PRIVATE HEALTH INSURANCE MARKET IN 2022 & 2029

FIGURE 15 SOUTH EAST ASIA PRIVATE HEALTH INSURANCE MARKET: PESTEL ANALYSIS

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGE OF AUSTRALIA PRIVATE HEALTH INSURANCE MARKET

FIGURE 17 HEALTHCARE EXPENDITURE IN MALAYSIA, (RM MILLION)

FIGURE 18 MALAYSIA REVENUE TRAVEL INDUSTRY SIZE, BY REVENUE (RM MILLION)

FIGURE 19 AUSTRALIA PRIVATE HEALTH INSURANCE MARKET: BY TYPE, 2021

FIGURE 20 AUSTRALIA PRIVATE HEALTH INSURANCE MARKET: BY HEALTH PLAN CATEGORY/METAL LEVELS, 2021

FIGURE 21 AUSTRALIA PRIVATE HEALTH INSURANCE MARKET: BY PROVIDER TYPE, 2021

FIGURE 22 AUSTRALIA PRIVATE HEALTH INSURANCE MARKET: BY AGE GROUP, 2021

FIGURE 23 AUSTRALIA PRIVATE HEALTH INSURANCE MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 24 AUSTRALIA PRIVATE HEALTH INSURANCE MARKET: SNAPSHOT (2021)

FIGURE 25 AUSTRALIA PRIVATE HEALTH INSURANCE MARKET: BY COUNTRY (2021)

FIGURE 26 AUSTRALIA PRIVATE HEALTH INSURANCE MARKET: BY COUNTRY (2022 & 2029)

FIGURE 27 AUSTRALIA PRIVATE HEALTH INSURANCE MARKET: BY COUNTRY (2021 & 2029)

FIGURE 28 AUSTRALIA PRIVATE HEALTH INSURANCE MARKET: BY TYPE (2022-2029)

FIGURE 29 AUSTRALIA PRIVATE HEALTH INSURANCE MARKET: COMPANY SHARE 2021 (%)

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.