Рынок золы рисовой шелухи в Азиатско-Тихоокеанском регионе по форме (поддоны, порошок, хлопья, узелки/гранулы), содержанию кремния (80-84%, 85-89%, 90-94%, более 95%), дальнейшему применению (бетонные смеси, строительные блоки, огнеупорный кирпич, металлические листы, кровельная черепица, изоляторы, химикаты для гидроизоляции , пестициды и другие). Тенденции отрасли и прогноз до 2029 года.

Анализ рынка и идеи

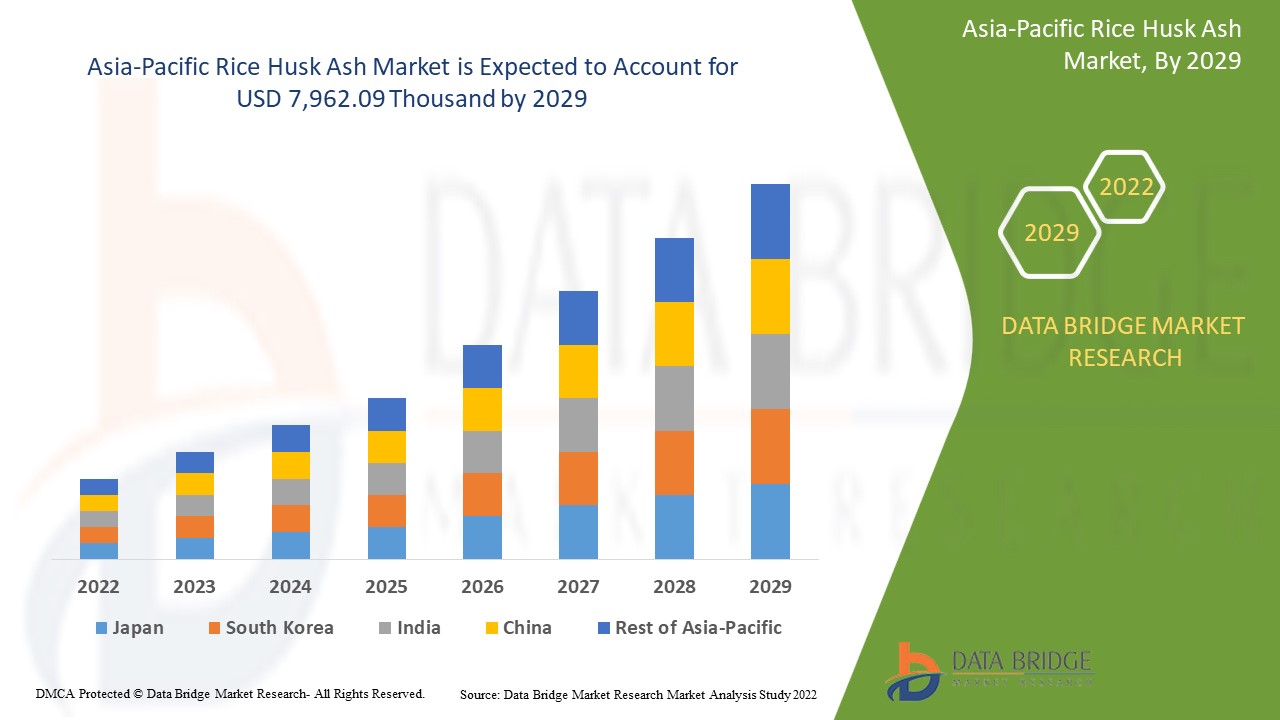

Ожидается, что рынок золы рисовой шелухи в Азиатско-Тихоокеанском регионе значительно вырастет в прогнозируемый период с 2022 по 2029 год. По данным Data Bridge Market Research, среднегодовой темп роста рынка составит 5,9% в прогнозируемый период с 2022 по 2029 год, и ожидается, что к 2029 году он достигнет 7 962,09 тыс. долларов США. Основным фактором, обусловливающим рост рынка золы рисовой шелухи в Азиатско-Тихоокеанском регионе, является обширный ассортимент продукции в строительной отрасли из-за высокого содержания кремнезема.

Ожидается, что обширный ассортимент продукции в строительной отрасли из-за высокого содержания кремния будет стимулировать рынок золы рисовой шелухи в Азиатско-Тихоокеанском регионе. Ожидается, что растущая осведомленность о технических преимуществах использования золы рисовой шелухи будет способствовать росту рынка золы рисовой шелухи в Азиатско-Тихоокеанском регионе.

Основными ограничениями, которые могут оказать негативное влияние на рынок золы рисовой шелухи в Азиатско-Тихоокеанском регионе, являются проблемы, связанные с соотношением воды и цемента при использовании золы рисовой шелухи, а также большой охват рынка заменителями.

Ожидается, что благодаря соблюдению экологических норм, снижению затрат на сырье и производство растущий спрос откроет новые возможности на рынке золы рисовой шелухи в Азиатско-Тихоокеанском регионе.

Однако, как ожидается, проблемы утилизации, связанные с золой рисовой шелухи, и высокая зависимость от производства риса-сырца будут препятствовать росту рынка золы рисовой шелухи в Азиатско-Тихоокеанском регионе.

Отчет о рынке золы рисовой шелухи в Азиатско-Тихоокеанском регионе содержит подробную информацию о доле рынка, новых разработках, влиянии внутренних и локальных игроков рынка, анализирует возможности с точки зрения новых источников дохода, изменений в рыночных правилах, одобрений продуктов, стратегических решений, запусков продуктов, географических расширений и технологических инноваций на рынке. Чтобы понять анализ и рыночный сценарий, свяжитесь с нами для получения аналитического обзора; наша команда поможет вам создать решение по влиянию на доход для достижения желаемой цели.

|

Отчет Метрика |

Подробности |

|

Прогнозируемый период |

2022-2029 |

|

Базовый год |

2021 |

|

Исторические годы |

2020 (Можно настроить на 2019 - 2014) |

|

Количественные единицы |

Доход в тыс. долл. США, объемы в килотоннах, цены в долл. США |

|

Охваченные сегменты |

По форме (поддоны, порошок, чешуйки, узелки/гранулы), содержанию кремния (80-84%, 85-89%, 90-94%, более 95%), дальнейшему применению (бетонные смеси, строительные блоки, огнеупорный кирпич, металлические листы, кровельная черепица, изоляторы, химикаты для гидроизоляции, пестициды и другие) |

|

Страны, охваченные |

Япония, Китай, Южная Корея, Индия, Сингапур, Таиланд, Индонезия, Малайзия, Филиппины, Австралия и Новая Зеландия, а также остальные страны Азиатско-Тихоокеанского региона |

|

Охваченные участники рынка |

Astrra Chemicals, Global Recycling, KV Metachem, Brisil, Rice Husk Ash (Таиланд), Guru Corporation, JASORIYA RICE MILL, PIONEER Carbon и другие. |

Определение рынка

Зола рисовой шелухи — это натуральный побочный продукт, получаемый с рисовых полей после шелушения риса. Оболочка рисовой шелухи обычно состоит из 30% лигнина, 20% кремнезема и 50% целлюлозы, и при сжигании путем контролируемого термического разложения остаток превращается в пепел.

Зола рисовой шелухи получается после контролируемого сжигания рисовой шелухи и обладает высокими пуццолановыми свойствами и реакционной способностью. Она считается подходящим цементирующим материалом в строительной промышленности, либо как заменитель цемента, либо как добавка. В качестве добавки зола рисовой шелухи производит высокопрочный бетон, в то время как замена цемента золой рисовой шелухи дает недорогие строительные блоки. Зола рисовой шелухи используется для производства легких строительных материалов, поскольку добавление RHA делает бетон легче.

Динамика рынка золы рисовой шелухи в Азиатско-Тихоокеанском регионе

Драйверы

- Широкий спектр применения продукции в строительной отрасли благодаря высокому содержанию кремнезема

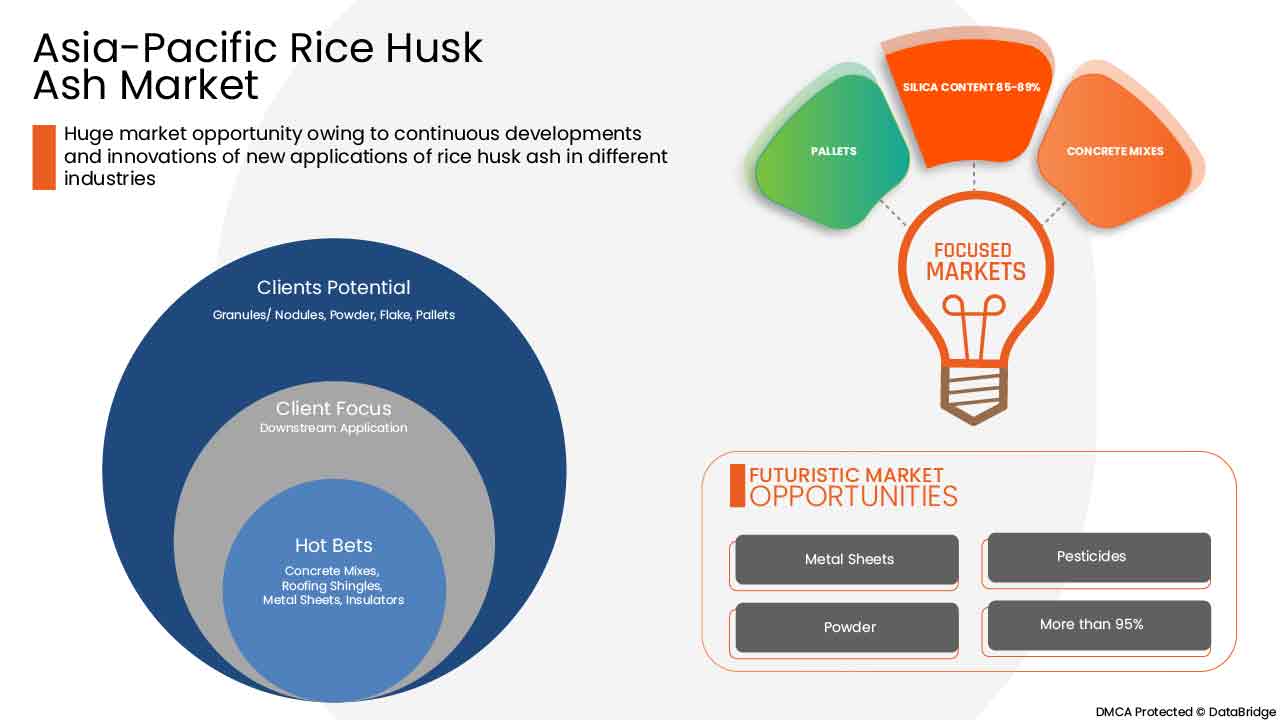

В Азиатско-Тихоокеанском регионе, в связи с ростом строительной отрасли, применение золы рисовой шелухи становится все более распространенным, поскольку она широко используется в качестве пуццолана, наполнителя, добавки, абразивного агента, адсорбента масла, подметающего компонента и суспензионного агента для фарфоровых эмалей. В цементной промышленности зола рисовой шелухи используется из-за ее аморфного кремнезема для производства бетона. Она используется для замены обычного портландцемента (OPC), очень дорогого и основного компонента бетона. Использование золы рисовой шелухи помогает производить недорогие строительные блоки. Недорогие строительные блоки пользуются большим спросом в Азиатско-Тихоокеанском регионе.

Таким образом, ожидается, что растущее использование золы рисовой шелухи в строительной отрасли для производства бетона и бетонных изделий, а также других видов продукции, таких как полы в ванных комнатах, будет стимулировать рынок золы рисовой шелухи в Азиатско-Тихоокеанском регионе.

- Растущая осведомленность о технических преимуществах золы рисовой шелухи

Основное применение золы рисовой шелухи — строительство и строительство в качестве дополнительного вяжущего материала (ВМ) в цементных смесях, поскольку зола рисовой шелухи добавляется в портландцемент для улучшения некоторых характеристик полученной смеси.

Кроме того, бетонная смесь на основе золы рисовой шелухи обеспечивает превосходную устойчивость к проникновению ионов хлора в морскую среду. В результате растет применение этих бетонных смесей для строительных работ в морской среде. Помимо этих применений, зола рисовой шелухи используется в других секторах, таких как кровельная черепица, гидроизоляционные химикаты, абсорбенты для нефтяных разливов, специальные краски, антипирены, инсектициды и биоудобрения, что может способствовать росту рынка золы рисовой шелухи в Азиатско-Тихоокеанском регионе.

- Рост производства высококачественного кремнезема

Растущий спрос на кремнезем со стороны различных отраслей конечного потребления в этом регионе и высокие темпы возделывания рисовых полей в Азиатско-Тихоокеанском регионе увеличивают использование золы рисовой шелухи. Растущее использование высококачественного кремнезема, полученного из золы рисовой шелухи, в строительстве, сталелитейной, керамической и огнеупорной промышленности, среди многих других. Это дает позитивный прогноз относительно роста рынка. Рост предпочтения золы рисовой шелухи вместо кремнеземной пыли и летучей золы в цементной и строительной промышленности повлияет на рынок. В дополнение к экологическим и экономическим преимуществам ожидается, что низкоэнергетические и более простые методы получения чистого кремнезема будут стимулировать рынок, создавая новые возможности для разработки новых промышленных применений золы рисовой шелухи.

Возможности

- Растущий спрос в связи с соблюдением норм экологического регулирования

Рисовая шелуха является органическими отходами и производится в больших количествах. Это основной побочный продукт переработки риса и агропромышленности, основанной на биомассе. Поэтому использование побочного продукта золы рисовой шелухи другими отраслями промышленности помогает сократить отходы, а зола рисовой шелухи используется в качестве добавки во многих материалах и приложениях, таких как огнеупорный кирпич, производство изоляции и материалов для антипиренов. Кроме того, зола рисовой шелухи набирает популярность и получает одобрение от регулирующих органов из-за ее благоприятного воздействия на почву с точки зрения коррекции кислотности. Поэтому ожидается, что использование золы рисовой шелухи для различных других целей обеспечит прибыльные возможности для роста на рынке золы рисовой шелухи в Азиатско-Тихоокеанском регионе.

- Увеличение использования золы рисовой шелухи для производства резиновых шин

Использование кремнезема, извлеченного из золы рисовой шелухи, имеет и другие преимущества. Энергия, потребляемая при извлечении кремнезема из традиционного источника, такого как песок, намного выше. Его необходимо нагреть до 1400 градусов по Цельсию, чтобы извлечь кремнезем из песка. Для сравнения, температура, необходимая для извлечения кремнезема из золы рисовой шелухи, составляет всего 100 градусов по Цельсию. Кроме того, кремнезем из золы рисовой шелухи придает протектору гораздо большую прочность и жесткость и обеспечивает меньшее сопротивление качению. Ожидается, что это предоставит возможность для роста рынка золы рисовой шелухи в Азиатско-Тихоокеанском регионе.

Ограничения/Проблемы

- Проблемы, связанные с соотношением вода/цемент при использовании золы рисовой шелухи

Зола рисовой шелухи улучшает свойства бетона при использовании в определенном количестве, но по мере увеличения количества золы рисовой шелухи прочность цемента и бетона имеет тенденцию к снижению, поскольку зола рисовой шелухи мельче цемента и требует большего количества воды для осаждения. Это сильно влияет на прочность, что, как ожидается, ограничит использование золы рисовой шелухи на рынке золы рисовой шелухи в Азиатско-Тихоокеанском регионе

- Широкий охват рынка заменителей

Потребность в кремнеземе не может быть удовлетворена только за счет производства кремнезема из золы рисовой шелухи. Традиционные методы производства кремнезема по-прежнему предпочтительны и используются для покрытия растущей потребности в сырье в различных отраслях промышленности. Кроме того, сжигание рисовой шелухи для получения золы рисовой шелухи производит много загрязнений, что влияет на ее рост и ограничивает ее использование в прогнозируемый период. Это усилит и сделает рынок заменителей сильнее.

- Проблемы утилизации, связанные с золой рисовой шелухи

Внедрение высокотехнологичных технологий для решения проблемы отходов, таких как зола рисовой шелухи и вода, в то время как некоторые производители риса также используют золу шелухи для хорошего экологического использования, такого как восстановление почвы и повышение плодородия. Кроме того, чтобы решить эту проблему, зола рисовой шелухи используется в различных приложениях для безопасной утилизации. Рассматриваются несколько способов утилизации золы рисовой шелухи, делая ее коммерческое использование более осуществимым и эффективным. Однако неправильная утилизация золы рисовой шелухи и отсутствие объектов на различных рисовых заводах являются серьезной проблемой, которая может помешать росту рынка в прогнозируемый период .

- Высокая зависимость от производства риса-сырца

Процент производства золы рисовой шелухи также зависит от скорости помола риса и того, какой тип риса доступен. Кроме того, рис является харифом или озимой культурой и растет только в определенное время года, зимой. Поэтому он может быть недоступен в больших количествах в течение года, что может повлиять на доступность золы рисовой шелухи для других применений в других отраслях, таких как цементная промышленность, производство кремния, шинная промышленность и многие другие. Это сочетается с другой проблемой, заключающейся в том, что доля Азии составляет более 90% в мире производства риса. Рис-сырец является основной продовольственной зерновой культурой во многих азиатских странах, таких как Индия и Китай. В 2018 году на Индию приходилось всего около 21% мирового производства риса. Поэтому другим странам становится сложно иметь хороший доступ к ресурсам, включая сырье и готовую продукцию. Таким образом, ограниченное географическое присутствие и полная зависимость от рисовой шелухи при производстве риса-сырца являются серьезной проблемой, которую необходимо преодолеть рынку золы рисовой шелухи в Азиатско-Тихоокеанском регионе, чтобы продемонстрировать значительный рост в прогнозируемый период.

COVID-19 оказал минимальное влияние на рынок золы рисовой шелухи в Азиатско-Тихоокеанском регионе

COVID-19 повлиял на различные отрасли обрабатывающей промышленности в 2020-2021 годах, поскольку он привел к закрытию рабочих мест, нарушению цепочек поставок и ограничениям на транспорт. Однако было отмечено значительное влияние на золу рисовой шелухи в глобальных операциях и цепочке поставок, при этом несколько производственных предприятий все еще работали. Поставщики услуг продолжили предлагать золу рисовой шелухи после принятия мер санитарии и безопасности в пост-COVID-сценарии.

Последние события

- Brisil был удостоен различных национальных и международных наград и признаний за свою технологию, которая решает одну из проблем утилизации отходов. Среди них признание от Leaders in Innovation Fellowship, Global Cleantech Innovation Programme и The Economic Times, среди прочих

- Производственные мощности PIONEER Carbon полностью сертифицированы по стандартам ISO 14001 и BS OHSAS 1800. Эти сертификаты гарантируют строгие протоколы проверки качества продукции компании и соблюдение ею систем экологического менеджмента.

- Guru Corporation получила сертификаты ISO 9001: 2008 и ISO 14001: 2004 на процедуры контроля качества и производственный процесс. Это повысило репутацию компании на рынке золы рисовой шелухи в Азиатско-Тихоокеанском регионе

Масштаб рынка золы рисовой шелухи в Азиатско-Тихоокеанском регионе

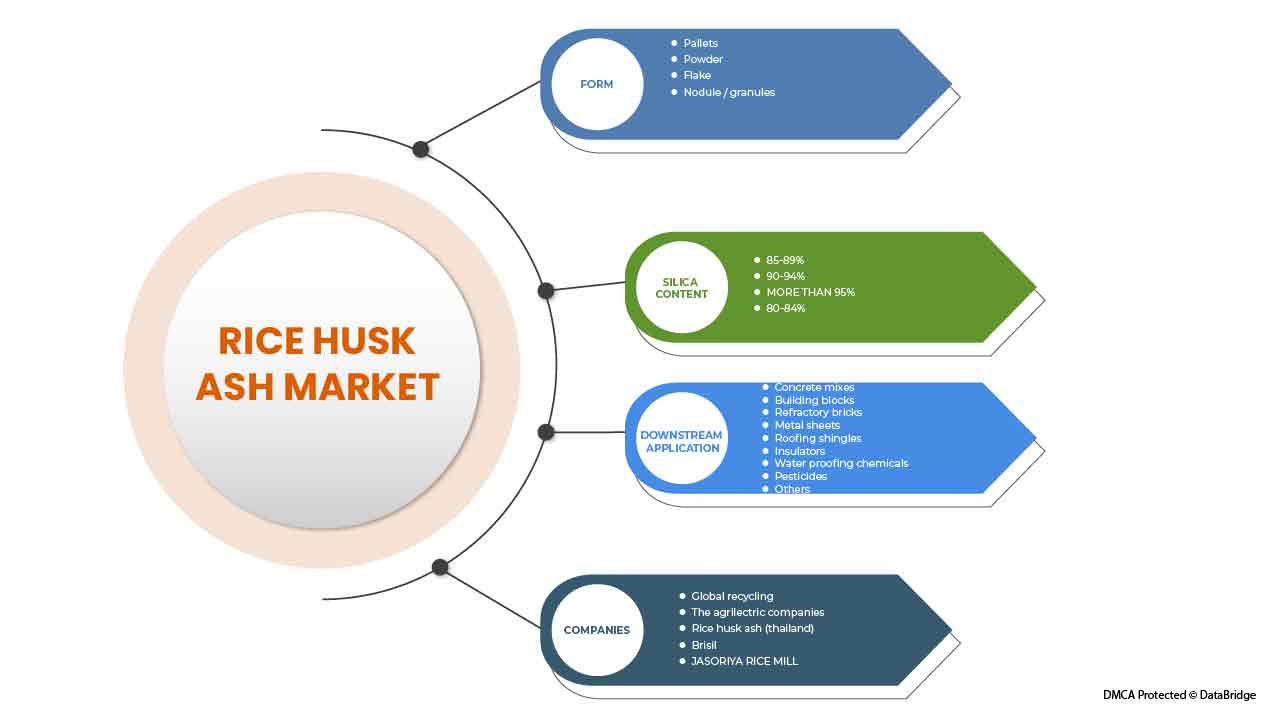

Рынок золы рисовой шелухи в Азиатско-Тихоокеанском регионе классифицируется на основе формы, содержания кремния и последующего применения. Рост среди этих сегментов поможет вам проанализировать основные сегменты роста отрасли и предоставить пользователям ценный обзор рынка и рыночную информацию для принятия стратегических решений по определению основных рыночных приложений.

Форма

- Гранулы/Узелки

- Поддоны

- Хлопья

- Пудра

По форме зола рисовой шелухи на рынке Азиатско-Тихоокеанского региона подразделяется на гранулы/комки, поддоны, хлопья и порошок.

Содержание кремния

- 80-84%

- 85-89%

- 90-94%,

- Более 95%

По содержанию кремния рынок золы рисовой шелухи в Азиатско-Тихоокеанском регионе классифицируется следующим образом: 80–84%, 85–89%, 90–94% и более 95%.

Применение ниже по течению

- Бетонные смеси

- Кровельная черепица

- Строительные блоки

- Огнеупорные кирпичи

- Металлические листы

- Изоляторы

- Химикаты для гидроизоляции

- Пестициды

- Другие

На основе сферы применения зола рисовой шелухи на Азиатско-Тихоокеанском рынке подразделяется на бетонные смеси, кровельную черепицу, строительные блоки, огнеупорный кирпич, металлические листы, изоляторы, гидроизоляционные химикаты, пестициды и другие.

Региональный анализ/идеи золы рисовой шелухи в Азиатско-Тихоокеанском регионе

Рынок золы рисовой шелухи в Азиатско-Тихоокеанском регионе классифицируется по странам, форме, содержанию кремния и последующему применению. Рынок золы рисовой шелухи в Азиатско-Тихоокеанском регионе сегментирован на Японию, Китай, Южную Корею, Индию, Сингапур, Таиланд, Индонезию, Малайзию, Филиппины, Австралию и Новую Зеландию, а также остальную часть Азиатско-Тихоокеанского региона.

Ожидается, что Китай будет доминировать на рынке золы рисовой шелухи в Азиатско-Тихоокеанском регионе благодаря повышению осведомленности о технических преимуществах использования золы рисовой шелухи в регионе.

Раздел отчета по странам также содержит отдельные факторы, влияющие на рынок, и изменения в регулировании рынка, которые влияют на текущие и будущие тенденции рынка. Такие данные, как новые и заменяющие продажи, демографические данные страны и импортно-экспортные тарифы, являются одними из основных указателей, используемых для прогнозирования рыночного сценария для отдельных стран. Кроме того, при предоставлении прогнозного анализа данных по странам учитываются наличие и доступность брендов Азиатско-Тихоокеанского региона и их проблемы, связанные с высокой конкуренцией со стороны местных и отечественных брендов, а также влияние каналов продаж.

Анализ конкурентной среды и доли рынка золы рисовой шелухи в Азиатско-Тихоокеанском регионе

Конкурентная среда рынка золы рисовой шелухи в Азиатско-Тихоокеанском регионе содержит подробную информацию по конкурентам. Включены следующие сведения: обзор компании, финансовые показатели компании, полученный доход, рыночный потенциал, инвестиции в исследования и разработки, новые рыночные инициативы, производственные площадки и объекты, сильные и слабые стороны компании, запуск продукта, линии испытаний продукта, одобрения продукта, патенты, ширина и широта продукта, доминирование применения, кривая жизненной линии технологии. Вышеуказанные пункты данных связаны только с фокусом компаний на рынке золы рисовой шелухи в Азиатско-Тихоокеанском регионе.

Среди крупных участников рынка золы рисовой шелухи в Азиатско-Тихоокеанском регионе можно назвать Astrra Chemicals, Global Recycling, KV Metachem, Brisil, Rice Husk Ash (Таиланд), Guru Corporation, JASORIYA RICE MILL, PIONEER Carbon и другие.

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Рыночные данные анализируются и оцениваются с использованием рыночных статистических и когерентных моделей. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в рыночном отчете. Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Помимо этого, модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, анализ доли рынка компании, стандарты измерения, глобальный и региональный и анализ доли поставщиков. Пожалуйста, запросите звонок аналитика в случае дальнейшего запроса.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Содержание

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA PACIFIC RICE HUSK ASH MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 FORM LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET DOWNSTREAM APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 CLIMATE CHANGE SCENARIO

4.1.1 ENVIRONMENTAL CONCERNS

4.1.2 INDUSTRY RESPONSE

4.1.3 GOVERNMENT’S ROLE

4.1.4 ANALYST RECOMMENDATION

4.2 ASIA PACIFIC IMPORT EXPORT SCENARIO

4.3 LIST OF KEY BUYERS

4.4 PESTLE ANALYSIS

4.4.1 POLITICAL FACTORS

4.4.2 ECONOMIC FACTORS

4.4.3 SOCIAL FACTORS

4.4.4 TECHNOLOGICAL FACTORS

4.4.5 LEGAL FACTORS

4.4.6 ENVIRONMENTAL FACTORS

4.5 PORTER’S FIVE FORCES:

4.6 PRODUCTION CONSUMPTION ANALYSIS- ASIA PACIFIC RICE HUSK ASH MARKET

4.6.1 RICE HUSK ASH PRODUCTION BY INCINERATION OF RICE HUSK

4.7 RAW MATERIAL PRODUCTION COVERAGE – ASIA PACIFIC RICE HUSK ASH MARKET

RICE PADDY/RICE HUSK 59

4.8 SUPPLY CHAIN ANALYSIS

4.8.1 RAW MATERIAL PROCUREMENT

4.8.2 MANUFACTURING AND PACKAGING

4.8.3 MARKETING AND DISTRIBUTION

4.8.4 END USERS

4.9 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.1 VENDOR SELECTION CRITERIA

4.11 REGULATORY COVERAGE

4.11.1 INDIA’S CENTRAL POLLUTION CONTROL BOARD

4.11.2 EUROPEAN COMMISSION (EC)

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 EXTENSIVE PRODUCT SCOPE IN THE CONSTRUCTION INDUSTRY DUE TO HIGH SILICA CONTENT

5.1.2 RISING AWARENESS ABOUT THE TECHNICAL BENEFITS OF RICE HUSK ASH

5.1.3 GROWTH IN PRODUCTION OF HIGH-QUALITY SILICA

5.2 RESTRAINTS

5.2.1 PROBLEMS ASSOCIATED WITH WATER/CEMENT RATIO BY USING RICE HUSK ASH

5.2.2 STRONG MARKET REACH OF SUBSTITUTES

5.3 OPPORTUNITIES

5.3.1 GROWING DEMAND OWING TO ADHERENCE TO ENVIRONMENTAL REGULATORY NORMS

5.3.2 INCREASING USE OF RICE HUSK ASH TO PRODUCE RUBBER TIRES

5.3.3 ABUNDANT AVAILABILITY OF RICE HUSK ASH

5.4 CHALLENGES

5.4.1 DISPOSAL ISSUES ASSOCIATED WITH RICE HUSK ASH

5.4.2 HIGH DEPENDENCY ON THE PRODUCTION OF RICE PADDY

6 ASIA PACIFIC RICE HUSK ASH MARKET, BY FORM

6.1 OVERVIEW

6.2 PALLETS

6.3 POWDER

6.4 FLAKE

6.5 NODULE / GRANULES

7 ASIA PACIFIC RICE HUSK ASH MARKET, BY SILICON CONTENT

7.1 OVERVIEW

7.2 85-89%

7.3 90-94%

7.4 MORE THAN 95%

7.5 80-84%

8 ASIA PACIFIC RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION

8.1 OVERVIEW

8.2 CONCRETE MIXES

8.2.1 CONCRETE MIXES, BY TYPE

8.2.1.1 GREEN CONCRETE

8.2.1.2 HIGH PERFORMANCE CONCRETE

8.2.1.3 OTHERS

8.3 BUILDING BLOCKS

8.4 REFRACTORY BRICKS

8.5 METAL SHEETS

8.6 ROOFING SHINGLES

8.7 INSULATORS

8.8 WATER PROOFING CHEMICALS

8.9 PESTICIDES

8.1 OTHERS

9 ASIA PACIFIC RICE HUSK ASH MARKET, BY GEOGRAPHY

9.1 ASIA-PACIFIC

9.1.1 CHINA

9.1.2 INDIA

9.1.3 JAPAN

9.1.4 SOUTH KOREA

9.1.5 THAILAND

9.1.6 INDONESIA

9.1.7 AUSTRALIA & NEW ZEALAND

9.1.8 PHILIPPINES

9.1.9 MALAYSIA

9.1.10 SINGAPORE

9.1.11 REST OF ASIA-PACIFIC

10 ASIA PACIFIC RICE HUSK ASH MARKET, COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

11 SWOT ANALYSIS

12 COMPANY PROFILES

12.1 ASIA PACIFIC RECYCLING

12.1.1 COMPANY SNAPSHOT

12.1.2 COMPANY SHARE ANALYSIS

12.1.3 PRODUCT PORTFOLIO

12.1.4 RECENT UPDATE

12.2 THE AGRILECTIC COMPANIES

12.2.1 COMPANY SNAPSHOT

12.2.2 COMPANY SHARE ANALYSIS

12.2.3 PRODUCT PORTFOLIO

12.2.4 RECENT UPDATE

12.3 RICE HUSK ASH (THAILAND)

12.3.1 COMPANY SNAPSHOT

12.3.2 COMPANY SHARE ANALYSIS

12.3.3 PRODUCT PORTFOLIO

12.3.4 RECENT UPDATE

12.4 JASORIYA RICE MILL

12.4.1 COMPANY SNAPSHOT

12.4.2 COMPANY SHARE ANALYSIS

12.4.3 PRODUCT PORTFOLIO

12.4.4 RECENT UPDATE

12.5 BRISIL

12.5.1 COMPANY SNAPSHOT

12.5.2 COMPANY SHARE ANALYSIS

12.5.3 PRODUCT PORTFOLIO

12.5.4 RECENT UPDATE

12.6 PIONEER CARBON

12.6.1 COMPANY SNAPSHOT

12.6.2 PRODUCT PORTFOLIO

12.6.3 RECENT UPDATE

12.7 ASTRRA CHEMICALS

12.7.1 COMPANY SNAPSHOT

12.7.2 PRODUCT PORTFOLIO

12.7.3 RECENT UPDATE

12.8 GURU CORPORATION

12.8.1 COMPANY SNAPSHOT

12.8.2 PRODUCT PORTFOLIO

12.8.3 RECENT UPDATE

12.9 K V METACHEM

12.9.1 COMPANY SNAPSHOT

12.9.2 PRODUCT PORTFOLIO

12.9.3 RECENT UPDATE

13 QUESTIONNAIRE

14 RELATED REPORTS

Список таблиц

TABLE 1 IMPORT DATA OF SLAG AND ASH, INCL. SEAWEED ASH ""KELP"" (EXCLUDING SLAG, INCL. GRANULATED, FROM THE MANUFACTURE; HS CODE – 262190 (USD THOUSAND)

TABLE 2 EXPORT DATA OF SLAG AND ASH, INCL. SEAWEED ASH ""KELP"" (EXCLUDING SLAG, INCL. GRANULATED, FROM THE MANUFACTURE; HS CODE – 262190 (USD THOUSAND)

TABLE 3 COMPRESSION STRENGTH OF CONCRETE WITH DIFFERENT PERCENTAGES OF RICE HUSK ASH

TABLE 4 ASIA PACIFIC RICE HUSK ASH MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 5 ASIA PACIFIC RICE HUSK ASH MARKET, BY FORM, 2020-2029 (KILO TONNE)

TABLE 6 ASIA PACIFIC PALLETS IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 7 ASIA PACIFIC PALLETS IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (KILO TONNE)

TABLE 8 ASIA PACIFIC POWDER IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 9 ASIA PACIFIC POWDER IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (KILO TONNE)

TABLE 10 ASIA PACIFIC FLAKE IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 11 ASIA PACIFIC FLAKE IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (KILO TONNE)

TABLE 12 ASIA PACIFIC NODULE / GRANULES IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 13 ASIA PACIFIC NODULE / GRANULES IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (KILO TONNE)

TABLE 14 ASIA PACIFIC RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (USD THOUSAND)

TABLE 15 ASIA PACIFIC RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (KILO TONNE)

TABLE 16 ASIA PACIFIC 85-89% IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 17 ASIA PACIFIC 85-89% IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (KILO TONNE)

TABLE 18 ASIA PACIFIC 90-94% IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 19 ASIA PACIFIC 90-94% IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (KILO TONNE)

TABLE 20 ASIA PACIFIC MORE THAN 95% IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 21 ASIA PACIFIC MORE THAN 95% IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (KILO TONNE)

TABLE 22 ASIA PACIFIC 80-84% IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 23 ASIA PACIFIC 80-84% IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (KILO TONNE)

TABLE 24 ASIA PACIFIC RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 25 ASIA PACIFIC RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (KILO TONNE)

TABLE 26 ASIA PACIFIC CONCRETE MIXES IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 27 ASIA PACIFIC CONCRETE MIXES IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (KILO TONNE)

TABLE 28 ASIA PACIFIC CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 29 ASIA PACIFIC CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (KILO TONNE)

TABLE 30 ASIA PACIFIC BUILDING BLOCKS IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 31 ASIA PACIFIC BUILDING BLOCKS IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (KILO TONNE)

TABLE 32 ASIA PACIFIC REFRACTORY BRICKS IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 33 ASIA PACIFIC REFRACTORY BRICKS IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (KILO TONNE)

TABLE 34 ASIA PACIFIC METAL SHEETS IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 35 ASIA PACIFIC METAL SHEETS IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (KILO TONNE)

TABLE 36 ASIA PACIFIC ROOFING SHINGLES IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 37 ASIA PACIFIC ROOFING SHINGLES IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (KILO TONNE)

TABLE 38 ASIA PACIFIC INSULATORS IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 39 ASIA PACIFIC INSULATORS IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (KILO TONNE)

TABLE 40 ASIA PACIFIC WATER PROOFING CHEMICALS IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 41 ASIA PACIFIC WATER PROOFING CHEMICALS IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (KILO TONNE)

TABLE 42 ASIA PACIFIC PESTICIDES IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 43 ASIA PACIFIC PESTICIDES IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (KILO TONNE)

TABLE 44 ASIA PACIFIC OTHERS IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 45 ASIA PACIFIC OTHERS IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (KILO TONNE)

TABLE 46 ASIA-PACIFIC RICE HUSK ASH MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 47 ASIA-PACIFIC RICE HUSK ASH MARKET, BY COUNTRY, 2020-2029 (KILO TONNE)

TABLE 48 ASIA-PACIFIC RICE HUSK ASH MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 49 ASIA-PACIFIC RICE HUSK ASH MARKET, BY FORM, 2020-2029 (KILO TONNE)

TABLE 50 ASIA-PACIFIC RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (USD THOUSAND)

TABLE 51 ASIA-PACIFIC RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (KILO TONNE)

TABLE 52 ASIA-PACIFIC RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 53 ASIA-PACIFIC RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (KILO TONNE)

TABLE 54 ASIA-PACIFIC CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 55 ASIA-PACIFIC CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (KILO TONNE)

TABLE 56 CHINA RICE HUSK ASH MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 57 CHINA RICE HUSK ASH MARKET, BY FORM, 2020-2029 (KILO TONNE)

TABLE 58 CHINA RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (USD THOUSAND)

TABLE 59 CHINA RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (KILO TONNE)

TABLE 60 CHINA RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 61 CHINA RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (KILO TONNE)

TABLE 62 CHINA CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 63 CHINA CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (KILO TONNE)

TABLE 64 INDIA RICE HUSK ASH MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 65 INDIA RICE HUSK ASH MARKET, BY FORM, 2020-2029 (KILO TONNE)

TABLE 66 INDIA RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (USD THOUSAND)

TABLE 67 INDIA RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (KILO TONNE)

TABLE 68 INDIA RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 69 INDIA RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (KILO TONNE)

TABLE 70 INDIA CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 71 INDIA CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (KILO TONNE)

TABLE 72 JAPAN RICE HUSK ASH MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 73 JAPAN RICE HUSK ASH MARKET, BY FORM, 2020-2029 (KILO TONNE)

TABLE 74 JAPAN RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (USD THOUSAND)

TABLE 75 JAPAN RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (KILO TONNE)

TABLE 76 JAPAN RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 77 JAPAN RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (KILO TONNE)

TABLE 78 JAPAN CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 79 JAPAN CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (KILO TONNE)

TABLE 80 SOUTH KOREA RICE HUSK ASH MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 81 SOUTH KOREA RICE HUSK ASH MARKET, BY FORM, 2020-2029 (KILO TONNE)

TABLE 82 SOUTH KOREA RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (USD THOUSAND)

TABLE 83 SOUTH KOREA RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (KILO TONNE)

TABLE 84 SOUTH KOREA RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 85 SOUTH KOREA RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (KILO TONNE)

TABLE 86 SOUTH KOREA CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 87 SOUTH KOREA CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (KILO TONNE)

TABLE 88 THAILAND RICE HUSK ASH MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 89 THAILAND RICE HUSK ASH MARKET, BY FORM, 2020-2029 (KILO TONNE)

TABLE 90 THAILAND RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (USD THOUSAND)

TABLE 91 THAILAND RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (KILO TONNE)

TABLE 92 THAILAND RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 93 THAILAND RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (KILO TONNE)

TABLE 94 THAILAND CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 95 THAILAND CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (KILO TONNE)

TABLE 96 INDONESIA RICE HUSK ASH MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 97 INDONESIA RICE HUSK ASH MARKET, BY FORM, 2020-2029 (KILO TONNE)

TABLE 98 INDONESIA RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (USD THOUSAND)

TABLE 99 INDONESIA RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (KILO TONNE)

TABLE 100 INDONESIA RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 101 INDONESIA RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (KILO TONNE)

TABLE 102 INDONESIA CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 103 INDONESIA CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (KILO TONNE)

TABLE 104 AUSTRALIA & NEW ZEALAND RICE HUSK ASH MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 105 AUSTRALIA & NEW ZEALAND RICE HUSK ASH MARKET, BY FORM, 2020-2029 (KILO TONNE)

TABLE 106 AUSTRALIA & NEW ZEALAND RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (USD THOUSAND)

TABLE 107 AUSTRALIA & NEW ZEALAND RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (KILO TONNE)

TABLE 108 AUSTRALIA & NEW ZEALAND RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 109 AUSTRALIA & NEW ZEALAND RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (KILO TONNE)

TABLE 110 AUSTRALIA & NEW ZEALAND CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 111 AUSTRALIA & NEW ZEALAND CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (KILO TONNE)

TABLE 112 PHILIPPINES RICE HUSK ASH MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 113 PHILIPPINES RICE HUSK ASH MARKET, BY FORM, 2020-2029 (KILO TONNE)

TABLE 114 PHILIPPINES RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (USD THOUSAND)

TABLE 115 PHILIPPINES RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (KILO TONNE)

TABLE 116 PHILIPPINES RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 117 PHILIPPINES RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (KILO TONNE)

TABLE 118 PHILIPPINES CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 119 PHILIPPINES CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (KILO TONNE)

TABLE 120 MALAYSIA RICE HUSK ASH MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 121 MALAYSIA RICE HUSK ASH MARKET, BY FORM, 2020-2029 (KILO TONNE)

TABLE 122 MALAYSIA RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (USD THOUSAND)

TABLE 123 MALAYSIA RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (KILO TONNE)

TABLE 124 MALAYSIA RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 125 MALAYSIA RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (KILO TONNE)

TABLE 126 MALAYSIA CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 127 MALAYSIA CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (KILO TONNE)

TABLE 128 SINGAPORE RICE HUSK ASH MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 129 SINGAPORE RICE HUSK ASH MARKET, BY FORM, 2020-2029 (KILO TONNE)

TABLE 130 SINGAPORE RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (USD THOUSAND)

TABLE 131 SINGAPORE RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (KILO TONNE)

TABLE 132 SINGAPORE RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 133 SINGAPORE RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (KILO TONNE)

TABLE 134 SINGAPORE CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 135 SINGAPORE CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (KILO TONNE)

TABLE 136 REST OF ASIA-PACIFIC RICE HUSK ASH, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 137 REST OF ASIA-PACIFIC RICE ASH MARKET, BY FORM, 2020-2029 (KILO TONNE)

Список рисунков

FIGURE 1 ASIA PACIFIC RICE HUSK ASH MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC RICE HUSK ASH MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC RICE HUSK ASH MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC RICE HUSK ASH MARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC RICE HUSK ASH MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC RICE HUSK ASH MARKET: THE FORM LIFE LINE CURVE

FIGURE 7 ASIA PACIFIC RICE HUSK ASH MARKET: MULTIVARIATE MODELLING

FIGURE 8 ASIA PACIFIC RICE HUSK ASH MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 ASIA PACIFIC RICE RUSK ASH MARKET: DBMR MARKET POSITION GRID

FIGURE 10 ASIA PACIFIC RICE HUSK ASH MARKET: DOWNSTREAM APPLICATION COVERAGE GRID

FIGURE 11 ASIA PACIFIC RICE HUSK ASH MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 ASIA PACIFIC RICE HUSK ASH MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 ASIA PACIFIC RICE HUSK ASH MARKET: SEGMENTATION

FIGURE 14 ASIA-PACIFIC IS EXPECTED TO DOMINATE THE ASIA PACIFIC RICE HUSK ASH MARKET, WHILE NORTH AMERICA IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD

FIGURE 15 EXTENSIVE PRODUCT SCOPE IN CONSTRUCTION INDUSTRY DUE TO HIGH SILICA CONTENT IS EXPECTED TO DRIVE ASIA PACIFIC RICE HUSK ASH MARKET IN THE FORECAST PERIOD

FIGURE 16 PALLETS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF ASIA PACIFIC RICE HUSK ASH MARKET IN 2022 & 2029

FIGURE 17 IMPORT-EXPORT SCENARIO (USD THOUSAND)

FIGURE 18 SUPPLY CHAIN ANALYSIS- ASIA PACIFIC RICE HUSK ASH MARKET

FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE ASIA PACIFIC RICE HUSK ASH MARKET

FIGURE 20 ASIA PACIFIC RICE HUSK ASH MARKET, BY FORM, 2021

FIGURE 21 ASIA PACIFIC RICE HUSK ASH MARKET, BY SILICON CONTENT, 2021

FIGURE 22 ASIA PACIFIC RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2021

FIGURE 23 ASIA-PACIFIC RICE HUSK ASH MARKET: SNAPSHOT (2021)

FIGURE 24 ASIA-PACIFIC RICE HUSK ASH MARKET: BY COUNTRY (2021)

FIGURE 25 ASIA-PACIFIC RICE HUSK ASH MARKET: BY COUNTRY (2022 & 2029)

FIGURE 26 ASIA-PACIFIC RICE HUSK ASH MARKET: BY COUNTRY (2021 & 2029)

FIGURE 27 ASIA-PACIFIC RICE HUSK ASH MARKET: BY FORM (2022 - 2029)

FIGURE 28 ASIA PACIFIC RICE HUSK ASH MARKET: COMPANY SHARE 2021 (%)

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.